Data Center Liquid Cooling Market

Data Center Liquid Cooling Market by Component (Solution and Services), End User (Colocation Providers, Enterprises, and Hyperscale Data Centers), Cooling Medium, Data Center Type, Type of Cooling, Enterprise, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

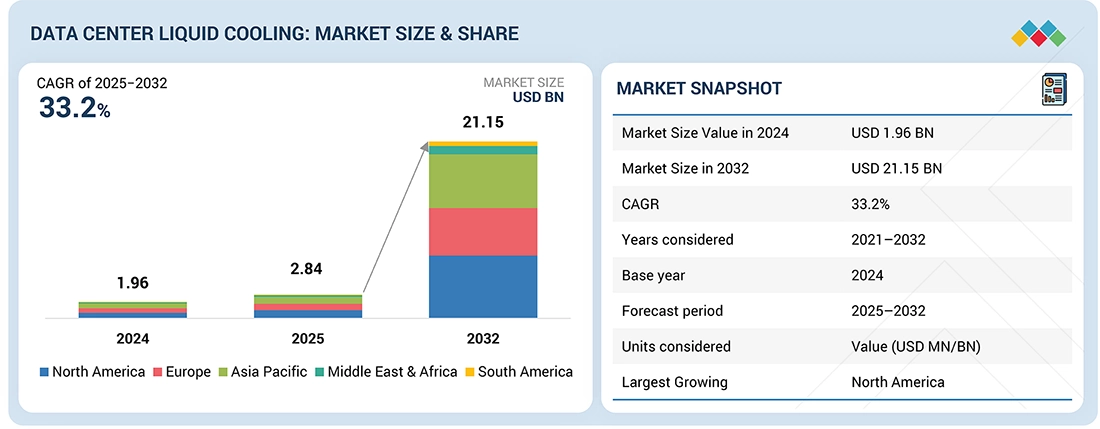

The global data center liquid cooling market is projected to grow from USD 2.84 billion in 2025 to USD 21.15 billion by 2032, at a CAGR of 33.2% from 2025 to 2032. Growth in the global data center liquid cooling market is driven by the exponential growth in data generation through cloud computing, artificial intelligence, and edge computing technologies. As the size and data processing density of data centers increase, conventional air-cooling systems cannot keep up with efficiency in terms of heat. Liquid cooling is energy-efficient, which saves power utilization effectiveness (PUE) and operational expenses by a considerable margin. The change is also being driven by increased demand for green infrastructure as companies and governments work to achieve carbon reduction. High-performance computing (HPC) environments, including scientific computing, financial models, and machine learning, increasingly require efficient and accurate cooling. Liquid cooling is thus no longer an option but a necessity.

KEY TAKEAWAYS

-

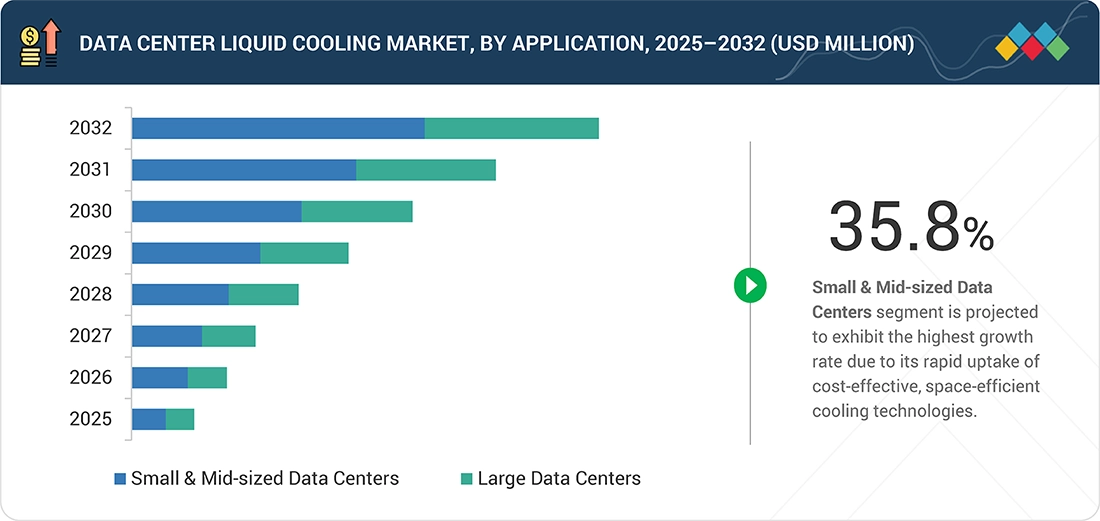

BY DATA CENTER TYPEThe Data Center Liquid Cooling market comprises small & mid-sized data centers. Large data centers are witnessing higher adoption of direct liquid cooling solutions due to their significant cooling requirements of high-density server racks.

-

BY COOLING TYPEThe cooling type includes cold plate liquid cooling, immersion liquid cooling, and spray liquid cooling. Small & mid-sized data center operators are adopting indirect liquid cooling solutions, such as cold plates, as these centers usually have low-density data center servers.

-

BY COMPONENTThe key solutions and services. The growing demand for the maintenance of coolants is expected to propel the growth of the support and maintenance services sub-segment.

-

BY END USERThe end user segment includes colocation providers, enterprises, and hyperscale data centers. The increasing computational demand for hyperscale data centers is fueling the adoption of liquid cooling technologies to enhance efficiency and performance.

-

BY ENTERPRISEThe enterprise segment includes BFSI, IT & telecom, media & entertainment, healthcare, government & defense, retail, research & academia, and other enterprises. The IT & telecom segment’s growth in the data center liquid cooling market is driven by the need for efficient heat management in high-performance computing and densely packed servers.

-

BY COOLING MEDIUMThe cooling medium segment includes water, dielectric fluid, and refrigerants. Dielectric fluid cooling, particularly immersion cooling, has gained traction due to its superior heat dissipation capabilities.

-

BY REGIONData Center Liquid Cooling market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. North America led the Data Center Liquid Cooling market due to US, as rising demand for immersion cooling solutions from cryptocurrency providers to drive the market.

-

COMPETITIVE LANDSCAPEThe major market players have adopted both organic and inorganic strategies including new product launches, acquisitions, partnerships, and expansions. For instance, in December 2024, Vertiv Group Corp. acquired certain assets and technologies from BiXin Energy Technology Co., Ltd. This acquisition, made through Vertiv’s Chinese subsidiary, expands its portfolio and enhances its capabilities in providing liquid cooling solutions for data centers. Integrating BiXin’s technologies aims to improve Vertiv’s offering for managing the thermal demand of high-performance computing and AI workloads, aligning with growing market needs for efficient and scalable cooling solutions in data center environments.

The data center liquid cooling market is anticipated to grow rapidly due to the increasing use of Al workloads and high-performance computing (HPC). As racks become denser, consuming between 30 and 50 kW, traditional air conditioning methods are proving inefficient. As a result, solutions such as direct-to-chip (DTC) cooling, immersion cooling, and cold plate systems are becoming essential.

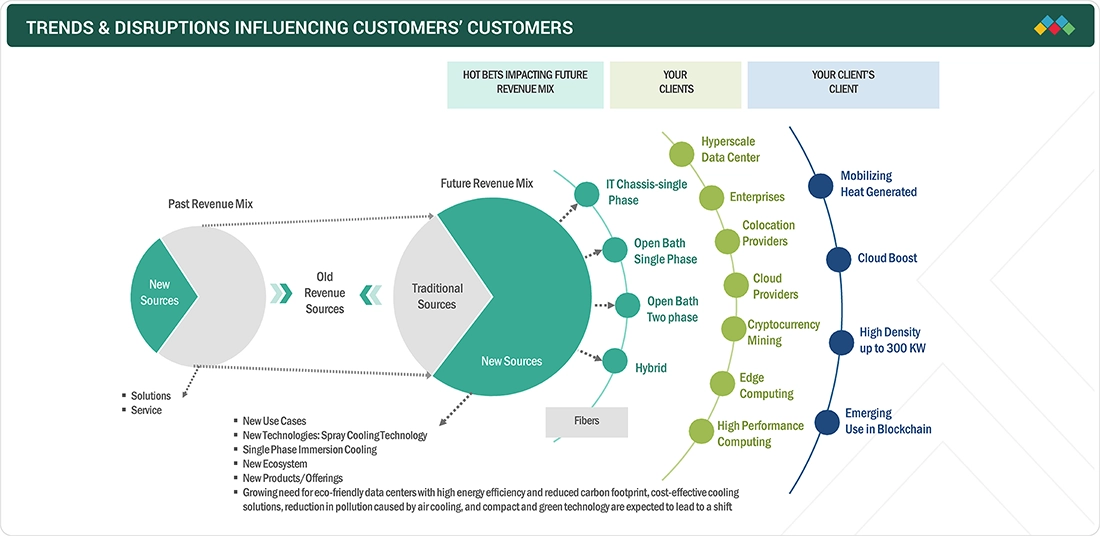

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. The key trends and disruptions set to influence the data center liquid cooling market over the next several years. The significant transformation in the revenue mix, with current market revenues dominated by solutions (80%) and services (20%) projected to undergo a substantial shift in the next four to five years, reversing to 20% solutions and 80% services. This change is driven by the adoption of new use cases, emerging technologies like spray cooling and single-phase immersion, green ecosystem trends, and a broader product portfolio. Suppliers providing technologies such as IT chassis single-phase cooling, open bath single/two-phase cooling, and hybrid systems. End users encompass hyperscale data centers, enterprises, colocation providers, cloud service providers, cryptocurrency miners, edge computing, and high-performance computing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

•Increasing number of data centers and server density

-

•Growing need for energy-efficient cooling solutions

Level

-

•High capital expenditure and maintenance

-

•Slow recognition from end users

Level

-

•Emergence of AI, blockchain, and other advanced technologies

-

•Adoption of immersion cooling solutions in low-density data centers

Level

-

•Lack of standardization

-

•High investments in existing infrastructure

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing number of data centers and server density

With the expanding need for data storage, high computing power, and reliance on digital services, the number of data centers and server density is increasing dramatically. The exponential expansion in digital data from social media and IoT devices, as well as the digitization of numerous industries, has resulted in a surge in the number of data centers for storing and analyzing information. Server density has increased as a result of developments in server technology, such as the usage of efficient CPUs and sophisticated storage technologies, such as solid-state drives, as well as greater memory capacity. Energy efficiency is also being enhanced to meet environmental problems associated with data centers. With liquid cooling, good power distribution, and sophisticated cooling techniques, better server density can be achieved while using less electricity. Data centers are becoming more necessary as the size, complexity, and density of data servers rise in response to increased demand for storage, networking, and computing. According to CloudScene, the top 15 countries with the most data centers as of March 2024 are the US (5,387), Germany (522), the UK (517), China (449), and Canada (336). Other noteworthy countries are France (315), Australia (306), and the Netherlands (300). Russia and Japan have 255 and 219 data centers, respectively. Italy, Mexico, Brazil, India, and Poland complete the list, with India hosting 152 data centers in and around Mumbai. This distribution demonstrates the global demand for advanced cooling solutions to support growing infrastructure.

Restraint: High capital expenditure and maintenance requirements

Compared to standard air-cooling systems, liquid cooling in data centers necessitates a substantial financial commitment. This is due to the additional components, infrastructure, and maintenance requirements associated with liquid cooling systems. Electronic components must be adequately cooled using specialized tools such as heat sinks, cold plates, or immersion cooling systems. These components are more expensive to acquire and install than alternative cooling systems. The components of liquid cooling systems are costly. Improper liquid maintenance causes problems such as excessive sediment buildup, contamination, and bacterial development. The system must be built with rare metals and alloys like bronze, cupronickel, or titanium, which enhances overall costs. Furthermore, the infrastructure required to monitor and send alarms for flow pressure and leak detection increases maintenance costs. The significant initial investment required for data center liquid cooling systems, combined with high infrastructure and maintenance costs, may limit their adoption.

Opportunity: Emergence of artificial intelligence (AI), blockchain, and other advanced technologies

Artificial intelligence (AI), machine learning, and blockchain technologies are rapidly gaining traction. These technologies necessitate the use of more processing units, such as graphics processing units (GPUs) and tensor processing units (TPUs), whose hardware accelerators operate at significantly higher temperatures. Moreover, blockchain applications and high-frequency trading systems generate computationally demanding workloads that demand ultrahigh-performance CPUs and GPUs, thereby generating high heat. Liquid cooling is required for enterprises interested in capitalizing on these technologies, which provide significant performance increases. Liquid cooling technologies lower data centers’ power consumption and PUE.

Challenge: Lack of standardization

Liquid cooling technology is advancing at an exponential rate, with new technologies, solutions, and methods arising. It is challenging for industry participants to keep pace due to the enormous rate of innovation. Liquid cooling has different methods, including direct-to-chip, immersion, and cold plate cooling. Application of common methods to all methodologies is challenging since every methodology has specifications, components, and considerations. Lack of regulation and industry standards for liquid cooling is a significant barrier to the widespread use of this technology. Standardization is beneficial in heterogeneous computing environments as it ensures product compatibility. Incompatible proprietary systems are a market obstacle; thus, it is required to set specifications and standards to enable the global adoption of liquid cooling for data center equipment to function with harmonization.

Data Center Liquid Cooling Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-density GPU clusters for GenAI training and inference in hyperscale clouds. Operators deploy immersion or direct-to-chip to pack many GPUs per rack and keep temperatures under control. | Supports much higher rack power (100s of kW) and GPU density lower footprint and land/space cost per PFLOP. | Improved PUE (energy efficiency) and reduced chillers/CRAC CAPEX & OPEX. | Better sustained performance (fewer thermal throttles) faster model training / higher throughput. |

|

Liquid cooling of dense CPU/GPU HPC clusters solving simulations (climate, physics, biology) | Enables high sustained FLOPS with lower energy consumption. | Simplifies cooling for systems pushing the limits of air cooling.| Facilitates quieter environments and easier thermal management for experimental setups. |

|

Cooling ultra-dense compute and FPGA clusters colocated near exchanges for extremely low latency and 24/7 reliability. Liquid-cooled racks keep temperatures steady under bursty loads. | Reduced failure rates and improved server lifespan. | Stable thermal environment reduces jitter and thermal-induced latency variability. | Compact footprint for colocations where rack space is costly. |

|

Liquid cooling for edge data centers and central offices hosting compute for low-latency 5G workloads and network functions. | Allows dense compute near cell towers or central offices with smaller site footprints. | Lower noise and HVAC requirements at sensitive locations. | Enables efficient remote / modular data centers with less onsite maintenance. |

|

Liquid cooling for GPU clusters conducting large-scale simulation, sensor-data training, and digital twins for autonomous systems. | High throughput for training AI perception stacks. | Smaller compute halls in R&D campuses. | Reduced energy cost for sustained overnight training runs. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

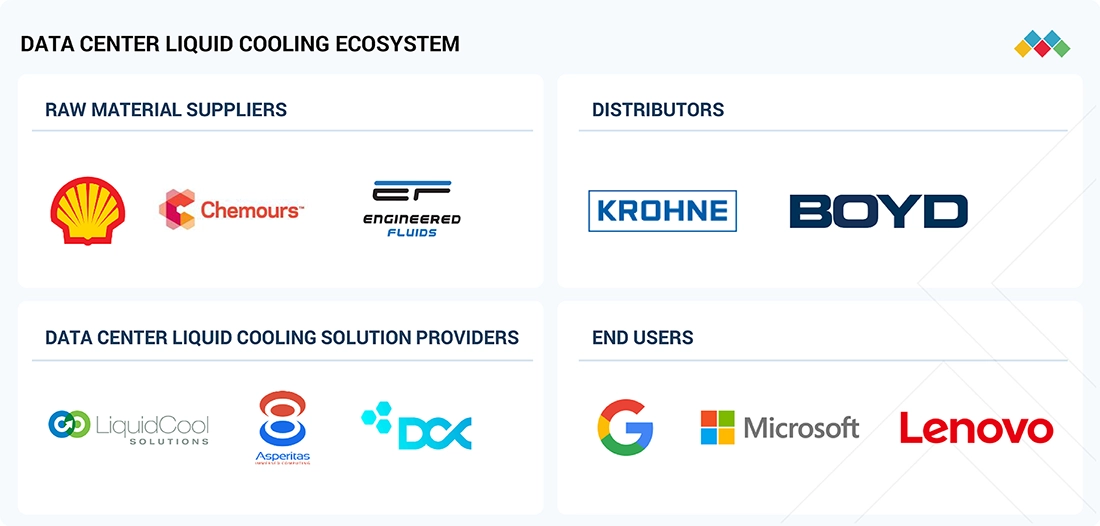

MARKET ECOSYSTEM

The data center liquid cooling market ecosystem is comprised of interconnected players spanning four key segments: raw material suppliers, solution providers, distributors, and end users. Raw material suppliers such as Shell, Chemours, and Engineered Fluids provide the essential fluids and materials needed for liquid cooling systems. Solution providers including LiquidCool Solutions, Asperitas, and DCX innovate and deploy specialized systems that leverage these raw materials to efficiently manage high-density computing loads, critical for modern data centers. Distributors like KROHNE and Boyd serve as the link between product manufacturers and clients, ensuring that high-performance cooling technologies reach data centers globally. Finally, leading end users such as Google, Microsoft, and Lenovo rely on these liquid cooling solutions to maintain optimal thermal conditions, maximize energy efficiency, and support next-generation workloads like cloud computing, AI, and blockchain applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Liquid Cooling Market, By Data Center Type

The small and mid-size data centers segment will register the highest CAGR in the global data center liquid cooling market due to its rapid uptake of cost-effective, space-efficient cooling technologies. As compared to large hyperscale centers that already possess mature cooling infrastructure, smaller facilities are more flexible in embracing newer technologies like direct-to-chip or rear-door liquid cooling. The growing trend of edge computing and localized data processing, particularly in industries such as healthcare, retail, and finance, is pushing the growth of smaller data centers in regional and urban areas. These centers face space and temperature constraints, which liquid cooling easily handles, making it a popular alternative. In addition, government incentives and green technology funding initiatives are more available to small players who want to reduce energy use. The lower upfront investment needed for modular liquid cooling systems also facilitates their deployment. Therefore, the segment is set for aggressive growth in developing and developed economies.

Data Center Liquid Cooling Market, By Type of Cooling

The cold plate liquid cooling segment is expected to witness the highest CAGR in the data center liquid cooling market because it offers higher efficiency and focused thermal management compared to other liquid cooling systems. Unlike immersion cooling, cold plate systems transfer heat directly from high-power devices such as CPUs and GPUs to the liquid coolant using conductive metal plates, enabling precise, localized cooling. This approach cuts down energy use considerably and accommodates increased compute densities, making it suitable for hyperscale and HPC data centers. Its universality with current server architectures and minimum disruption during retrofitting further boosts its adoption. Evolution in materials and compact designs has also improved the affordability and scalability of cold plates. AI, ML, and 5G workloads require efficient chip-level cooling, where cold plate solutions have an advantage. These advantages make it the go-to option for next-generation energy-efficient data center operations.

REGION

North America is the fastest-growing region in the data center liquid cooling market during the forecast period

North America is the fastest-growing region in the global market for data center liquid cooling during the forecast period due to its advanced digital infrastructure, early adoption of cutting-edge technologies, and presence of large hyperscale data center operators such as Google, Amazon Web Services, and Microsoft. High emphasis on energy efficiency and sustainability in the region has fueled the shift to liquid cooling solutions, especially in the high-density computing applications of AI, machine learning, and scientific simulations. Promotion of green data center practices through government incentives and policies has also facilitated the shift. North America also boasts a high number of colocation and cloud service providers retrofitting available buildings to reach performance and thermal efficiency requirements. The availability of skilled technical personnel and a strong culture of research and development has spurred the increased deployment of next-generation cooling technologies. Together, these propel North America’s leadership in the adoption and dissemination of liquid cooling systems for data center operations.

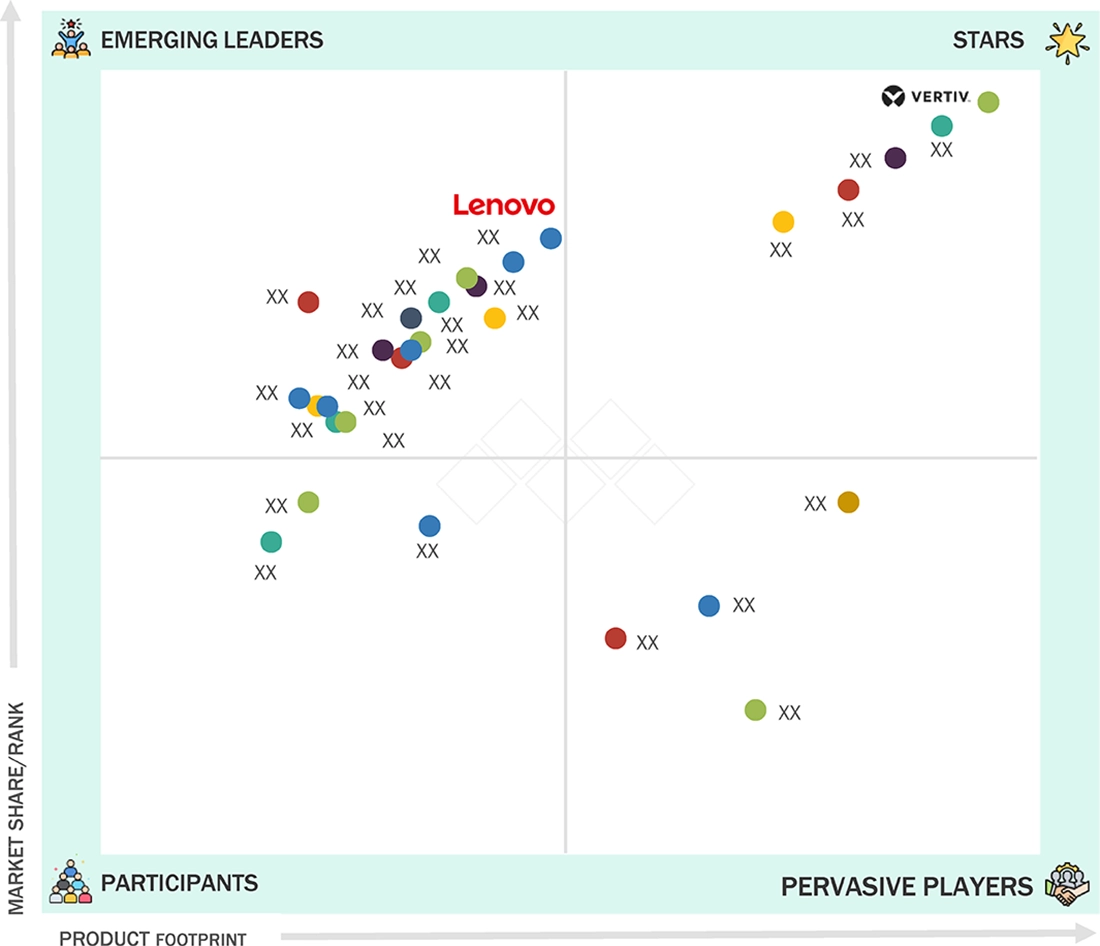

Data Center Liquid Cooling Market: COMPANY EVALUATION MATRIX

In the Data Center Liquid Cooling market matrix, Vertiv (Star) leads with a strong market share and extensive product footprint, driven by its Data Center Liquid Cooling solutions which is adopted by various end users. Lenovo (Emerging Leader) demonstrate substantial product innovations compared to their competitors. While Vertiv dominates through scale and diversified portfolio, Lenovo’s Data Center Liquid Cooling shows significant potential to move toward the leaders’ quadrant as demand for Data Center Liquid Cooling continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.96 BN |

| Market Forecast in 2032 | USD 21.15 BN |

| CAGR (2025–2032) | 33.2% |

| Years considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | The report defines, segments, and projects the Data Center Liquid Cooling market size based on data center type, cooling type, component, end user, enterprise, cooling medium, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as new product development, agreements, acquisitions, and expansions they undertake in the market. |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

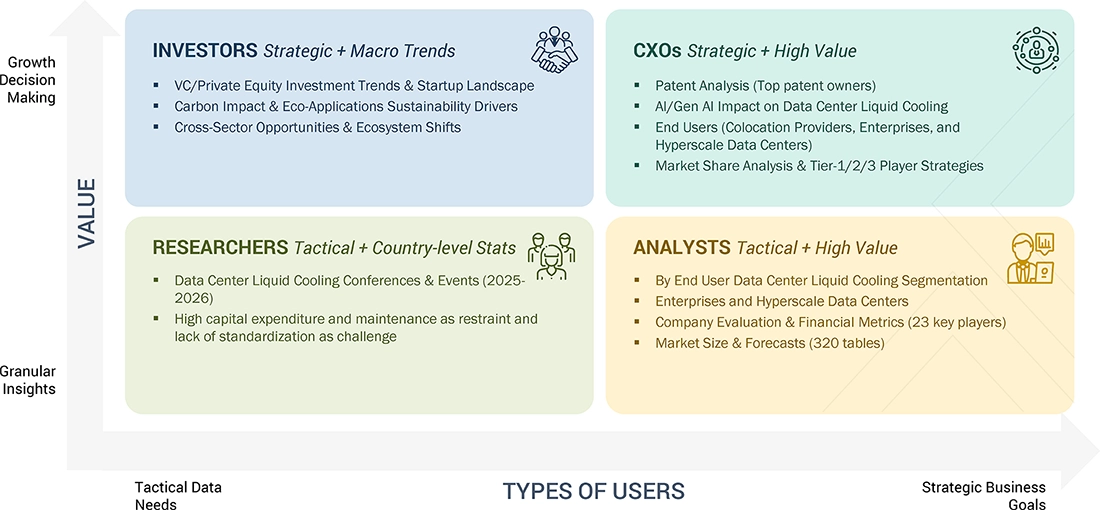

WHAT IS IN IT FOR YOU: Data Center Liquid Cooling Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hyperscale & Enterprise Data Center Operators |

|

|

| Colocation Providers & SMEs |

|

|

| Hybrid Cooling Integration | Integration of liquid cooling with existing air-cooled infrastructures for hybrid environments. | Seamless transition, optimized cooling efficiency, and cost benefits. |

| Coolant Compatibility Testing | Technical testing of coolant materials for thermal efficiency and corrosion resistance. | Increased system reliability and longevity. |

| Sustainability Reporting | Customized reporting on reductions in energy use and water consumption. | Evidence for sustainability goals and regulatory compliance. |

RECENT DEVELOPMENTS

- February 2025 : Asperitas and Cisco collaborated with the Cisco Engineering Alliance partnership program. This partnership integrates Asperitas’ immersion cooling technologies, including Perpetual Natural Convection (PNC) and Direct Forced Convection (DFC), with Cisco’s Unified Compute System (UCS). The aim is to offer pre-validated, scalable cooling solutions for data centers, facilitating smoother adoption of immersed computing technologies from edge facilities to large-scale deployments. This collaboration addresses the growing need for efficient cooling in high-performance computing environments.

- December 2024 : COOLIT SYSTEMS expanded its manufacturing capacity to meet rising demand for liquid cooling technologies geared to artificial intelligence systems. COOLIT has invested in a new building in Calgary, Canada, increasing its production capacity. COOLIT has also appointed Scott Hudson as Vice President of Quality, who will oversee the development of complex quality procedures and systems to ensure the long-term dependability and performance of its liquid cooling technology for data centers.

- October 2024 : Submer and Zero Two formed a strategic partnership to provide sustainable computing solutions that are able to meet the growing demands of AI workloads in the UAE. The partnership combines Zero Two’s instant scalability feature with Submer’s modular AI platforms, focusing on the provision of liquid cooling solutions for data centers. The objective of the partnership is to provide energy efficiency and performance by meeting the specific cooling demands presented by AI workloads, bolstering the region’s emerging AI infrastructure.

- May 2024 : Dell Technologies, Submer, and UNICOM Engineering collaborated to further enhance immersion cooling solutions for data centers. The partnership combines Dell’s PowerEdge servers, which include Intel and NVIDIA processors, with UNICOM Engineering's server design and integration expertise and Submer’s green immersion cooling technology. The partnership provides immersion-ready servers aimed at boosting data center performance and efficiency by providing efficient liquid cooling solutions specially optimized for high-performance workloads.

- May 2024 : Asperitas strategically collaborated with Kiturami Bumyang Air Conditioning Co., Ltd., a prominent South Korean technology corporation. Kiturami Bumyang will act as the sole representative of Asperitas’ immersion cooling technology in the South Korean market, under this reseller partnership. The partnership focuses on growing Asperitas’ footprint in the region and its liquid cooling solution for data centers to meet increasing demand for green and efficient cooling solutions.

Table of Contents

Methodology

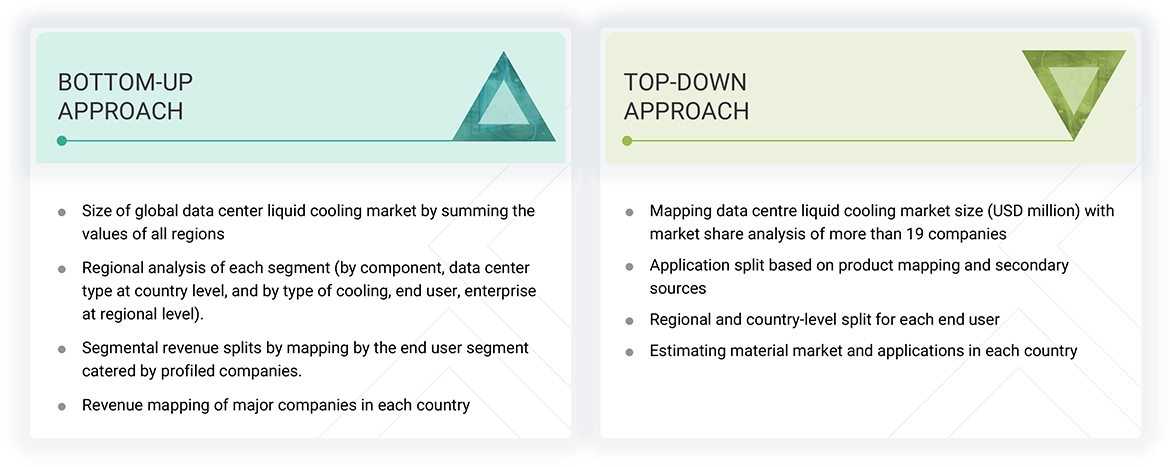

The research entailed four critical steps to assess the present size of the liquid cooling market for data centers. The initial step involved in-depth secondary research to obtain data on the market, allied markets, and the broader parent market. Next, primary research with industry professionals from the data center liquid cooling supply chain validated these findings and the underlying assumptions and projections. Top-down and bottom-up approaches were both used to arrive at the overall market size. The market was then analyzed, and data triangulation was used to approximate the size of different segments and subsegments.

Secondary Research

This research employed secondary sources like Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet to collect and identify the pertinent information. These sources consisted of annual reports, press releases, investor presentations, white papers, credible publications, articles by known authors, validated directories, and databases. The secondary data collected was processed to determine the total market size, later validated through primary research.

Primary Research

The data center liquid cooling market comprises several stakeholders such as raw material suppliers, manufacturers, distributors, traders, data center companies, contract manufacturers, and regulatory agencies engaged in the supply chain. For collecting qualitative and quantitative information for this report, a variety of primary sources from both the demand and supply sides were interviewed. Supply-side information was collected from industry experts such as CEOs, vice presidents, marketing directors, and other significant executives of companies dealing in the liquid cooling industry. The demand side had interviews with directors, marketing managers, and buying managers from various end-use industries.

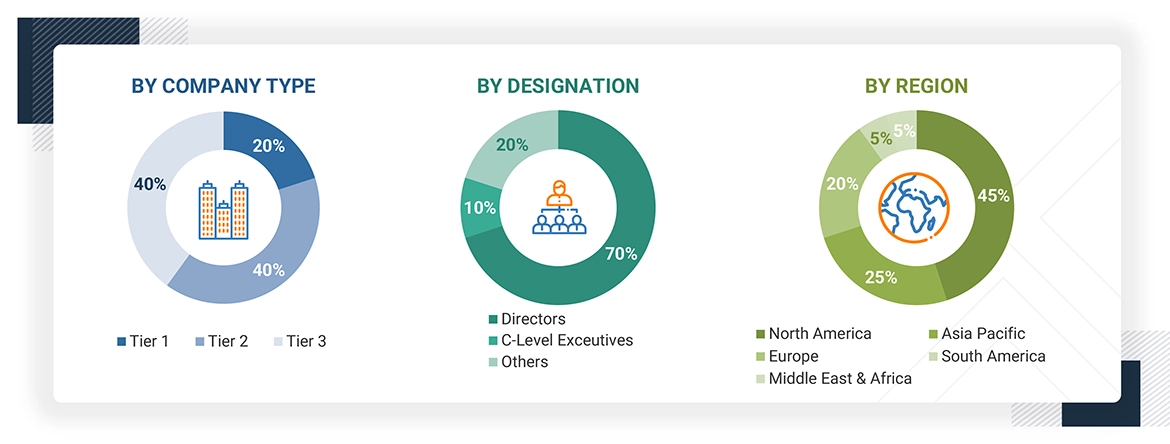

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The estimation and validation of the overall size of the data center liquid cooling market utilized both top-down and bottom-up methodologies. These approaches were also applied to assess various subsegments within the market. The research process for determining market size involved several steps:

- Key industry players were identified through thorough primary and secondary research.

- The market size and value chain for data center liquid cooling were evaluated using primary and secondary sources.

- All percentage shares, distributions, and breakdowns were derived from secondary data and confirmed through primary research.

- The study accounted for all relevant factors influencing the market, which were examined in detail, validated through primary sources, and analyzed to produce comprehensive quantitative and qualitative insights.

- The research also involved reviewing reports, newsletters, and analyses from leading market participants, supplemented by in-depth interviews with influential figures such as CEOs, directors, and marketing executives.

Data Triangulation

The market was divided into multiple segments and subsegments after determining the total market size through the previously described estimation methods. Data triangulation and breakdown methods were utilized as needed to finalize the market analysis and obtain precise figures for each segment. This triangulation involved examining various demand and supply factors and trends. Furthermore, the market size was confirmed using both top-down and bottom-up methodologies.

Market Definition

Liquid cooling of data centers uses liquid immersion technology, immersing servers in tanks containing non-conductive coolants capable of absorbing heat efficiently. This process provides better cooling than the conventional air method, handling efficiently the thermal issues of high-density equipment. The market offers different technologies, such as direct liquid cooling, indirect cooling, immersion cooling, and cold plate cooling, to enterprise, colocation, and hyperscale data centers. Power density growth, energy efficiency requirements, and the emerging high-performance and edge computing uses are major forces behind this market, including all hardware and services associated with liquid cooling solutions.

Stakeholders

- Data center liquid cooling solution providers

- Government and research organizations

- Organizations and industry consortia like the Swedish Data Center Industry Association, China Communications Standards Association, Dutch Data Center Association, European Data Center Association, and Africa Data Centers Association are examples of critical associations and bodies within the data center industry.

- Research and consulting firms

- R&D institutions

- National and regional agencies

- Investment banks and private equity firms

Report Objectives

- The objective is to define, characterize, and project the market size for liquid cooling in data centers, categorized by components, types of data centers, cooling methods, end users, enterprises, and regions.

- It aims to provide in-depth insights into the primary factors that impact market growth, such as drivers, restraints, opportunities, and challenges.

- The forecast will detail the size of different segments within the liquid cooling market across five regions: North America, Asia Pacific, Europe, South America, and the Middle East & Africa, including significant countries within each region.

- Additionally, the analysis will identify stakeholder opportunities and outline a competitive landscape highlighting market leaders.

- Recent trends will be explored, including expansions, agreements, new product launches, partnerships, acquisitions, and collaborations in the liquid cooling sector.

- Finally, the key players in the market will be strategically profiled, thoroughly examining their core strengths and competencies.

Key Questions Addressed by the Report

- Cold Plate Liquid Cooling: Collects and releases heat from components.

- Immersion Liquid Cooling: Electronic components are immersed in a thermally conducting, electrically insulating liquid.

- Spray Liquid Cooling: Uses liquid sprays to remove heat from components' surfaces.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Liquid Cooling Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Liquid Cooling Market