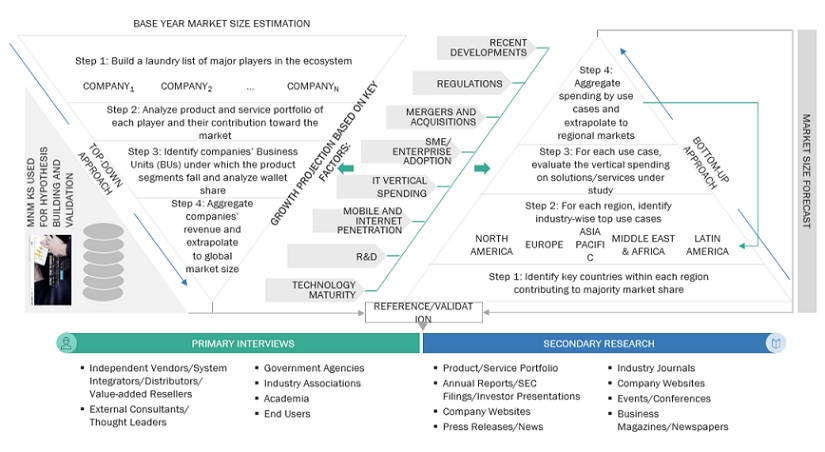

The study covered four main actions to estimate the current market size of the Open Banking solutions market. We conducted significant secondary research to gather data on the market, the competing market, and the parent market. The following stage involved conducting primary research to confirm these conclusions' hypotheses and sizing with industry experts throughout the value chain. A combination of top-down and bottom-up methods was used to assess the overall market size. We then estimated the market sizes of the leading Open Banking solutions segments using the market breakup and data triangulation techniques.

Secondary Research

A wide range of secondary sources, directories, and databases were employed in this research project, including product demos, vendor data sheets, D&B Hoovers, DiscoverOrg, Factiva, Vendor Surveys, Global Findex database, Association for Financial Technology (AFT), and Company Websites/Annual Reports/SEC Filings. We referred to sources to locate and gather important data for this technical, commercial, and market-focused analysis of the Open Banking solutions market.

Primary Research

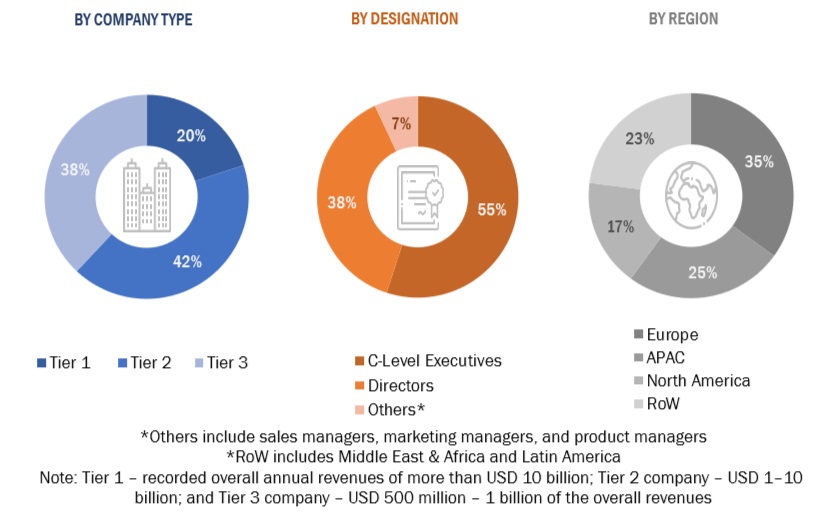

Several industry experts from the core and related industries and providers of preferred software developers, distributors, service providers, technology developers, alliances, and organisations connected to every link in the industry value chain were the primary sources of information. Key industry participants, subject-matter experts, C-level executives of major market players, and industry consultants were among the primary respondents with whom in-depth interviews were conducted to gather and validate crucial qualitative and quantitative data and evaluate the market's potential.

To obtain information, we conducted primary interviews on market statistics, the most recent trends that are upending the industry, newly implemented use cases, data on revenue generated by goods and services, market segmentation, market size estimations, market forecasts, and data triangulation. Understanding different technological developments, segmentation types, industry trends, and geographical areas was also aided by primary research. To understand the buyer's perspective on suppliers, open banking solution providers, and their current use cases, which would affect the overall Open Banking solutions market, demand-side stakeholders, such as Chief Executive Officers (CEOs), Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Vice Presidents (VPs), and Chief Security Officers (CSOs), as well as the installation teams of governments/end users using Open Banking solutions, and digital initiatives project teams, were interviewed.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

We employed top-down and bottom-up methodologies to estimate and forecast the Open Banking solutions market and other associated submarkets. Using the revenues and product offerings of the major market players, the bottom-up approach assisted in determining the overall market size. This research ascertained and validated the precise value of the total parent market size through data triangulation techniques and primary interview validation. Using percentage splits of the market segments, we were able to estimate the size of other specific markets using the overall market size via the top-down approach.

The bottom-up approach identified the trend of Open Banking solutions adoption among industry verticals in critical countries that contribute the most to the market. The adoption trend of Open Banking solutions and varying cases of use concerning their business segments were identified and extrapolated for cross-validation. We gave weightage to the use cases identified in different solution areas for the calculation. We prepared an exhaustive list of all vendors offering Open Banking solutions. Using annual reports, news releases, fundraising, investor presentations, paid databases, and primary interviews, we calculated the revenue contribution of each vendor in the market.. We evaluated each vendor based on its service offerings across verticals. To get the entire market size, we extrapolated the total revenue of all businesses. The market size and geographical penetration of each subsegment were examined and analysed. We determined the region split through primary and secondary sources based on these numbers.

The top-down approach prepared an exhaustive list of all vendors in the Open Banking solutions market. We estimated the revenue contribution of all vendors in the market through their annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. We estimated the market size from revenues generated by vendors from different Open Banking solutions offerings. Using secondary and primary sources, we located additional vendors and the income produced by each service type, which we then aggregated to calculate the market size. Additionally, the procedure included a regional penetration analysis of the Open Banking solutions market. The investigation was utilized to ascertain and validate the precise values of the market sizes for Open Banking solutions and its sectors, using the data triangulation process and primary data validation. The main procedure to gather essential insights was conducting in-depth interviews with CEOs, CTOs, CIOs, VPs, directors, and marketing executives. To confirm, we further triangulated market numbers using the current MarketsandMarkets repository.

Open Banking solutions Market: Top-Down and Bottom-Up approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was divided into several segments and subsegments using the previously described market size estimation procedures once the overall market size was determined. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from government entities' supply and demand sides.

Market Definition

Considering the views of various sources (Software AG company) and associations on Open Banking solutions, MarketsandMarkets defines Open Banking solutions as “a banking practice and regulatory framework that allows customers to grant third-party financial service providers access to their financial data held by traditional banks or financial institutions through secure Application Programming Interfaces (APIs). This sharing of data enables third-party developers to create innovative financial products and services, such as budgeting apps, payment solutions, investment platforms, and lending services, tailored to the individual needs and preferences of customers. Open Banking aims to promote competition, innovation, and transparency in the financial services industry, empowering customers with greater control over their financial data and fostering a more interconnected and dynamic ecosystem of financial services".

Key Stakeholders

-

Banks and Financial Institutions

-

Fintech Companies

-

Investors

-

Regulatory Bodies

-

Technology Providers

-

Third-Party Providers (TPPs)

-

Government Agencies

-

Industry Associations

-

Consulting Firms

-

Customers

Report Objectives

-

To define, describe, and forecast the Open Banking Solutions market based on offering, application, digital channel, deployment model, end user, and region

-

To offer comprehensive details regarding the primary variables impacting the market's growth (drivers, restraints, opportunities, and challenges)

-

To determine the high-growth market sectors in order to assess the opportunities for stakeholders in the market

-

To forecast the market size with respect to five main regions—North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

-

To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

-

To profile the key players of the market and comprehensively analyze their market size and core competencies

-

To track and analyze the competitive developments, such as product enhancements, product launches, acquisitions, partnerships, and collaborations, in the Open Banking Solutions market globally.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Product Analysis

-

The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

-

Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

-

Further breakup of the North American market into countries contributing 75% to the regional market size

-

Further breakup of the Latin American market into countries contributing 75% to the regional market size

-

Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

-

Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Open Banking Solutions Market