Ophthalmology PACS (Picture Archiving and Communication System) Market by Type (Standalone, Integrated), Delivery (On-premise, Cloud), End User (Hospitals, Specialty Clinic, ASC), Region (North America (US, Canada) Europe, Asia) - Global Forecasts to 2023

The ophthalmology PACS market is projected to reach USD 160.2 million by 2023, at a CAGR of 8.5% during the forecast period. The growth of the ophthalmology market is driven by the rapid growth in the geriatric population, rising prevalence of eye diseases, limited number of ophthalmologists, government initiatives to encourage the adoption of EHR/EMR, and the increasing adoption of teleophthalmology.

The Objectives of this Study are as follows:

- To define, describe, and forecast the ophthalmology PACS market by type, delivery model, end user, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market size of market segments in North America, Europe, Asia, Pacific countries, and the Rest of the World (RoW)

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies3

- To track and analyze competitive developments such as partnerships, agreements, and collaborations; mergers & acquisitions; product launches and enhancements; and expansions in the ophthalmology PACS market

Drivers

Rapid growth in the geriatric population

Over the years, there has been a significant increase in the geriatric population and, subsequently, the prevalence of age-related disorders, including a number of eye disorders. This is a key factor driving the demand for innovative technologies for the diagnosis and treatment of ophthalmic conditions. The tear layer loses stability and degrades faster in the elderly; consequently, the risk of getting severe eye disorders increases significantly with age, particularly after 60 years. One in three elderly people suffers from some form of eye diseases and is at risk of severe eye problems. These conditions include age-related macular degeneration, cataract, low vision, glaucoma, and diabetic eye disease.

Rising prevalence of eye diseases

The number of people with major eye diseases is increasing across the globe, and vision loss is becoming a major public health concern. The growth in aging population and the increasing prevalence of chronic disorders such as diabetes and hypertension have also served to boost the prevalence of eye diseases such as diabetic retinopathy and ocular hypertension (glaucoma). The number of blind individuals or those affected with low vision is expected to increase substantially.

According to the Royal National Institute of Blind People (RNIB), in 2013, around 2 million people in the UK were living with sight loss, which is expected to increase to 4.1 million by 2050. According to the WHO, an estimated 20 million cataract surgeries were performed in 2010 across the globe; this is expected to reach 32 million by 2020.

Research Methodology

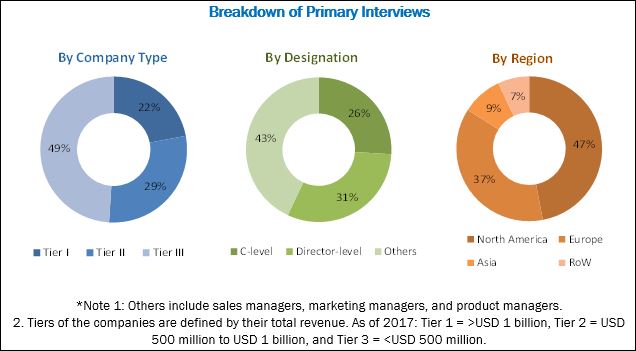

The study estimates the ophthalmology PACS industry size for 2018 and projects its demand till 2023. In the primary research process, various sources from both demand side and supply side were interviewed to obtain qualitative and quantitative information for the report. Primary sources from the demand side include various industry CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from the various players in the ophthalmology PACS market. For the market estimation process, both top-down and bottom-up approaches were used to estimate and validate the market size of the ophthalmology PACS market as well as to estimate the market size of various other dependent submarkets. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report. Some of the secondary sources include International Council of Ophthalmology (ICO), American Academy of Ophthalmology (AAO), National Eye Institute (NEI), American Optometric Association (AOA), Association for Medical Imaging Management (AHRA), Australian Diagnostic Imaging Association (ADIA), National Health Service (NHS), European Society of Ophthalmology (ESO), German Ophthalmological Society (DOG), and All India Ophthalmological Society (AIOS).

To know about the assumptions considered for the study, download the pdf brochure

The ophthalmology PACS market is marked by the presence of several big and small players. Prominent players offering ophthalmology PACS products include Carl Zeiss Meditec AG (Germany), Topcon Corporation (Japan), Heidelberg Engineering (Germany), Sonomed Escalon (US), Visbion (UK), EyePACS (US), and IBM Corporation (Merge Healthcare) (US).

Target Audience for this Report:

- Healthcare institutions (hospitals, specialty clinics, laboratories, and medical schools)

- EHR/EMR vendors

- Healthcare IT companies

- Research institutes

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

Expansions (2015–2018)

|

Month & Year |

Company |

Country |

Description |

|

February 2018 |

Carl Zeiss Meditec AG |

Asunción, |

ZEISS and Christoffel-Blindenmission (CBM) along with local partner Fundación Visión established a training center for ophthalmologists. This center utilizes all the equipment and solutions developed by ZEISS for ophthalmology diagnosis and treatment. |

|

September 2017 |

Carl Zeiss Meditec AG |

Germany |

The company invested USD 36.1 million (EURO 30 million) in an innovation hub at the Karlsruhe Institute of Technology (KIT), Germany, to build new technologies in the ophthalmic industry. |

Mergers and Acquisitions (2015–2018)

|

Month & Year |

Strategy |

Acquirer |

Acquiree |

Description |

|

April 2018 |

Acquisition |

Topcon Corporation |

KIDE Clinical Systems Oy (Finland) |

This acquisition enabled the company to enhance its ophthalmology product segment by adding KIDE’s optical and ophthalmology cloud solutions to its product portfolio. |

|

August 2017 |

Acquisition |

Carl Zeiss Meditec AG |

Veracity Innovations, LLC (US) |

To focus on advancing digitalization in medical technology by expanding its market-leading digital solutions for eye care with the acquisition of an intelligent cloud-based platform offered by Veracity, which provides doctors fast and easy access to relevant clinical data at each step in the care and treatment of patients. |

Product Launches and Enhancements (2015–2018)

|

Year |

Company |

Segment |

Product |

|

November 2017 |

Carl Zeiss Meditec AG |

Ophthalmology and Optometry |

The company launched its VERACITY Surgical, Clarus 500, and HFA3. |

|

October 2016 |

Topcon Corporation |

Eye Care |

IMAGEnet Connect |

Partnerships, Collaborations, and Agreements (2015–2018)

|

Year |

Deal Type |

Company 1 |

Company 2 |

Description |

|

Jan-18 |

Agreement |

Agfa HealthCare |

Premier Inc. (US) |

Signed a group purchasing agreement through which Primer could take advantage of special pricing and terms pre-negotiated for the Agfa HealthCare Enterprise Imaging IT solutions, including PACS, universal image viewer, workflow, and VNA for various medical applications |

|

Jun-16 |

Partnership |

IBM Watson Health |

16 medical providers and imaging technology companies |

IBM partnered with 16 medical providers and imaging technology companies to develop new ways to use medical imaging to predict various health conditions. These companies include Agfa HealthCare (Belgium), Anne Arundel Medical Center (US), Baptist Health South Florida (US), Eastern Virginia Medical School (US), Hologic (US), ifa systems AG (Germany), inoveon (US), Radiology Associates of South Florida (US), Sentara Healthcare (US), Sheridan Healthcare (US), Topcon (Japan), UC Sand Diego Health (US), University of Miami Health System (US), University of Vermont Health Network (US), and vRad (US). |

Ophthalmology PACS Market Scope

This report categorizes the ophthalmology PACS market into the following segments and subsegments:

By Type

- Integrated PACS

- Standalone PACS

By Delivery Model

- On-premise

- Web/cloud-based

By End User

- Hospitals

- Specialty Clinics & Ambulatory Surgery Centers

- Other End Users (Medical Education Centers, Eye Research Institutes, and Laboratories)

By Region

- North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe (RoE)

-

Asia

- Japan

- China

- India

- Singapore

- Rest of Asia (RoA)

- Pacific Countries

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for this report.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

The report segments the ophthalmology market by type, delivery model, end user, and region.

Based on type, the ophthalmology PACS market is segmented into standalone and integrated PACS. The integrated PACS segment is expected to command the largest share of the ophthalmology PACS market in 2018. Integrated PACS offer advantages like ease of deployment and use, easy interoperability, data security, portability, and cost-effectiveness. These advantages are encouraging their adoption and thus driving the growth of this segment.

On the basis of delivery model, the ophthalmology PACS market is segmented into on-premise and web/cloud-based models. In 2018, the on-premise models segment is expected to account for the largest share of the ophthalmology PACS market. This can be attributed to the fact that on-premise models are more customizable than web/cloud-based models.

Based on end user, the ophthalmology PACS market is segmented into hospitals, specialty clinics & ambulatory surgery centers, and other end users. In 2018, the specialty clinics & ambulatory surgical centers segment is expected to command the largest share of the ophthalmology PACS market. The growing patient pool for the diagnosis and treatment of cataracts in specialty clinics & ASCs due to cost-effective treatments is expected to propel the growth of the ophthalmology PACS market in this end-user segment.

The market is dominated by North America, followed by Europe. The dominance of the North American market is attributed to factors such as growing aging population and increasing incidence of age-related eye diseases. Additionally, government initiatives towards digitization and increasing adoption of EHR/EMR and data storage & exchange solutions are additional factors driving the adoption of ophthalmology PACS in this region.

While the ophthalmology market represents significant growth opportunities, market growth may be hindered due to the high implementation and maintenance costs of these solutions.

The ophthalmology market is marked by the presence of several big and small players. IBM Corporation (Merge Healthcare) (US), Carl Zeiss Meditec AG (Germany), Topcon Corporation (Japan), Heidelberg Engineering (Germany), Sonomed Escalon (US), Visbion (UK), EyePACS (US), VersaSuite (US), Medical Standard (South Korea), ScImage (US), Agfa-Gevaert Group (Belgium), and Canon USA Inc. (US) are some of the prominent players offering ophthalmology products.

Frequently Asked Questions (FAQs):

What is the size of Ophthalmology PACS Market?

The ophthalmology PACS market is projected to reach USD 160.2 million by 2023, at a CAGR of 8.5%.

What are the major growth factors of Ophthalmology PACS Market?

The growth of the ophthalmology market is driven by the rapid growth in the geriatric population, rising prevalence of eye diseases, limited number of ophthalmologists, government initiatives to encourage the adoption of EHR/EMR, and the increasing adoption of teleophthalmology.

Who all are the prominent players of Ophthalmology PACS Market?

The ophthalmology PACS market is marked by the presence of several big and small players. Prominent players offering ophthalmology PACS products include Carl Zeiss Meditec AG (Germany), Topcon Corporation (Japan), Heidelberg Engineering (Germany), Sonomed Escalon (US), Visbion (UK), EyePACS (US), and IBM Corporation (Merge Healthcare) (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.3.2 Markets Covered

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Ophthalmology PACS: Market Overview

4.2 Ophthalmology PACS Market, By Type, 2018–2023

4.3 Ophthalmology PACS Market, By Delivery Model, 2018 vs 2023 (USD Million)

4.4 Ophthalmology PACS Market, By End User (2018)

4.5 Geographical Snapshot of the Ophthalmology PACS Market

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rapid Growth in the Geriatric Population

5.2.1.2 Rising Prevalence of Eye Diseases

5.2.1.3 Limited Number of Ophthalmologists

5.2.1.4 Government Initiatives to Encourage Adoption of EHR/EMR

5.2.1.5 Expansion of Teleophthalmology

5.2.2 Restraints

5.2.2.1 High Implementation and Maintenance Costs

5.2.3 Opportunities

5.2.3.1 Untapped Emerging Markets

5.2.3.2 Integration With EHR/EMR

5.2.3.3 High-Growth Opportunities Represented By Cloud-Based Platforms

5.2.4 Challenges

5.2.4.1 Poor Compatibility With Informatics Standards

6 Industry Insights (Page No. - 37)

6.1 New vs Replacement Market

6.2 PACS vs Vendor Neutral PACS

6.3 Ophthalmologists vs Optometrists

6.4 Market Entry Strategy

6.4.1 Key Functionalities Required:

6.5 List of Ophthalmology/Optometry Practices, By Region

7 Ophthalmology PACS Market, By Delivery Model (Page No. - 45)

7.1 Introduction

7.2 On-Premise Model

7.3 Web/Cloud-Based Models

8 Ophthalmology PACS Market, By Type (Page No. - 52)

8.1 Introduction

8.2 Integrated PACS

8.3 Standalone PACS

9 Ophthalmology PACS Market, By End User (Page No. - 58)

9.1 Introduction

9.2 Specialty Clinics & Ambulatory Surgical Centers (ASCS)

9.3 Hospitals

9.4 Other End Users

10 Ophthalmology PACS Market, By Region (Page No. - 67)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 UK

10.3.4 RoE

10.4 Asia

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Singapore

10.4.5 Rest of Asia (RoA)

10.5 Pacific Countries

10.6 Rest of the World

11 Competitive Landscape (Page No. - 100)

11.1 Overview

11.2 Market Share Analysis

11.3 Competitive Scenario

11.3.1 Expansions (2015–2018)

11.3.2 Mergers and Acquisitions (2015–2018)

11.3.3 Product Launches and Enhancements (2015–2018)

11.3.4 Partnerships, Collaborations, and Agreements (2015–2018)

12 Company Profiles (Page No. - 106)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 IBM Corporation (Merge Healthcare Incorporated)

12.2 Carl Zeiss Meditec AG

12.3 Topcon Corporation

12.4 Heidelberg Engineering

12.5 Sonomed Escalon

12.6 Visbion

12.7 Eyepacs

12.8 Versasuite

12.9 Medical Standard

12.10 Scimage

12.11 Agfa-Gevaert Group

12.12 Canon Usa, Inc.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 128)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (86 Tables)

Table 1 Projected Increase in Geriatric Population, 2000 to 2050

Table 2 Prevalence of Leading Eye Diseases Among Adults Above 40 Years of Age) in the Us

Table 3 Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 4 On-Premise Ophthalmology PACS Market, By Region, 2016–2023 (USD Million)

Table 5 North America: On-Premise Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 6 Europe: On-Premise Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 7 Asia: On-Premise Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 8 Web/Cloud-Based Ophthalmology PACS Market, By Region, 2016–2023 (USD Million)

Table 9 North America: Web/Cloud-Based Ophthalmology PACS Market, 2016–2023 (USD Million)

Table 10 Europe: Web/Cloud-Based Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 11 Asia: Web/Cloud-Based Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 12 Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 13 Integrated Ophthalmology PACS Market, By Region, 2016–2023 (USD Million)

Table 14 North America: Integrated Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 15 Europe: Integrated Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 16 Asia: Integrated Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 17 Standalone Ophthalmology PACS Market, By Region, 2016–2023 (USD Million)

Table 18 North America: Standalone Ophthalmology PACS Market, 2016–2023 (USD Million)

Table 19 Europe: Standalone Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 20 Asia: Standalone Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 21 Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 22 Ophthalmology PACS Market for Specialty Clinics & Ambulatory Surgical Centers, By Region, 2016–2023 (USD Million)

Table 23 North America: Ophthalmology PACS Market for Specialty Clinics & Ambulatory Surgical Centers, By Country, 2016–2023 (USD Million)

Table 24 Europe: Ophthalmology PACS Market for Specialty Clinics & Ambulatory Surgical Centers, By Country, 2016–2023 (USD Million)

Table 25 Asia: Ophthalmology PACS Market for Specialty Clinics & Ambulatory Surgical Centers, By Country, 2016–2023 (USD Million)

Table 26 Ophthalmology PACS Market for Hospitals, By Region, 2016–2023 (USD Million)

Table 27 North America: Ophthalmology PACS Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 28 Europe: Ophthalmology PACS Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 29 Asia: Ophthalmology PACS Market for Hospitals, By Country, 2016–2023 (USD Million)

Table 30 Ophthalmology PACS Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 31 North America: Ophthalmology PACS Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 32 Europe: Ophthalmology PACS Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 33 Asia: Ophthalmology PACS Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 34 Ophthalmology PACS Market, By Region, 2016–2023 (USD Million)

Table 35 North America: Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 36 North America: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 37 North America: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 38 North America: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 39 Increase in Disease Prevalence, 2013 vs 2030 (Million Patients)

Table 40 US: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 41 US: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 42 US: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 43 Canada: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 44 Canada: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 45 Canada: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 46 Europe: Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 47 Europe: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 48 Europe: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 49 Europe: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 50 Germany: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 51 Germany: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 52 Germany: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 53 France: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 54 France: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 55 France: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 56 UK: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 57 UK: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 58 UK: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 59 RoE: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 60 RoE: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 61 RoE: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 62 Asia: Ophthalmology PACS Market, By Country, 2016–2023 (USD Million)

Table 63 Asia: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 64 Asia: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 65 Asia: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 66 Japan: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 67 Japan: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 68 Japan: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 69 China: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 70 China: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 71 China: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 72 India: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 73 India: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 74 India: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 75 Singapore: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 76 Singapore: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 77 Singapore: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 78 RoA: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 79 RoA: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 80 RoA: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 81 Pacific Countries: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 82 Pacific Countries: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 83 Pacific Countries: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

Table 84 RoW: Ophthalmology PACS Market, By Type, 2016–2023 (USD Million)

Table 85 RoW: Ophthalmology PACS Market, By Delivery Model, 2016–2023 (USD Million)

Table 86 RoW: Ophthalmology PACS Market, By End User, 2016–2023 (USD Million)

List of Figures (33 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Integrated PACS to Dominate the Ophthalmology PACS Market During the Forecast Period

Figure 6 On-Premise Models to Account for the Largest Share of the Ophthalmology PACS Market in 2018

Figure 7 Specialty Clinics & Ambulatory Surgery Centers to Register the Highest Growth During the Forecast Period

Figure 8 Geographical Snapshot of the Ophthalmology PACS Market

Figure 9 Rapid Growth in the Geriatric Population and Rising Prevalence of Eye Diseases—Key Drivers for Market Growth

Figure 10 Integrated PACS to Register the Highest Growth Rate in the Ophthalmology PACS Market Between 2018 and 2023

Figure 11 Web/Cloud-Based Models to Offer Significant Growth Opportunities for Market Players

Figure 12 Specialty Clinics & Ambulatory Surgical Centers Segment to Hold the Largest Share of the Ophthalmology PACS Market in 2018

Figure 13 Market in Asia Projected to Witness the Highest Growth During the Forecast Period (2018–2023)

Figure 14 Ophthalmology PACS Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Ophthalmology PACS: New vs Replacement Market for Ophthalmologists and Optometrists - 2017

Figure 16 PACS vs Vendor Neutral PACS - 2018 vs 2023

Figure 17 Ophthalmologists vs Optometrists - 2017

Figure 18 Web/Cloud-Based Models to Register the Highest Growth During the Forecast Period

Figure 19 Integrated PACS to Register the Highest Growth During the Forecast Period

Figure 20 Specialty Clinics & Ambulatory Surgery Centers to Register the Highest Growth During the Forecast Period

Figure 21 North America to Dominate the Ophthalmology PACS Market in 2018

Figure 22 North America: Ophthalmology PACS Market Snapshot

Figure 23 Europe: Ophthalmology PACS Market Snapshot

Figure 24 Asia: Ophthalmology PACS Market Snapshot

Figure 25 Key Developments in the Ophthalmology PACS Market Between 2015 and 2018

Figure 26 Market Evolution Framework

Figure 27 Ophthalmology PACS Market Share Analysis, 2017

Figure 28 IBM: Company Snapshot (2017)

Figure 29 Carl Zeiss Meditec AG: Company Snapshot (2017)

Figure 30 Topcon Corporation: Company Snapshot (2017)

Figure 31 Sonomed Escalon: Company Snapshot (2017)

Figure 32 Agfa-Gevaert Group: Company Snapshot (2017)

Figure 33 Canon Inc.: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ophthalmology PACS (Picture Archiving and Communication System) Market