Optic Adhesives Market by Resin Type (Epoxy, Acrylic, Cyanoacrylate, Silicone), Application (Optical Bonding and Assembly, Lens Bonding Cement, and Fiber Optics), and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027

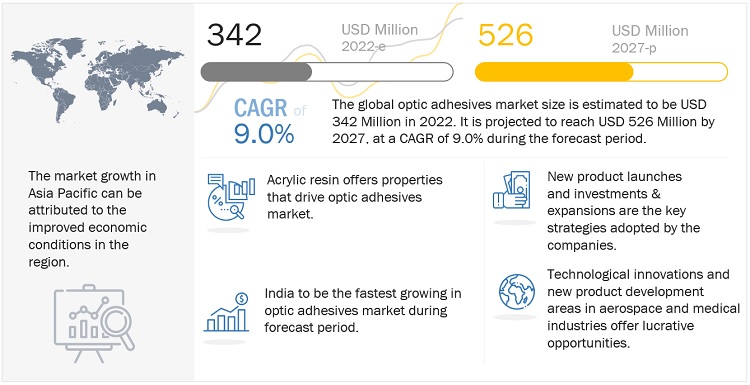

The global optic adhesives market size was valued at USD 342 million in 2022 and is projected to reach USD 526 million by 2027, growing at a cagr 9.0% from 2022 to 2027. The fiber optics, by application segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for optic adhesives.

Attractive Opportunities in the Optic Adhesives Market

Note: e – estimated, p - projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Optic Adhesives Market Dynamics

Drivers: Increasing penetration of smart devices and camera or digital sensors boost the demand for optic adhesives

Rising demand for the latest technology-based smart devices, smartphones, tablets, computers, display screens of medical devices, television sets, and LCD screens is driving the market. According to Statista, smartphone sales in 2021 reached around 1.43 billion units globally. These adhesives are used in mobile phones to bond the digitizer panel to the front bezel of the device. The OCA also acts as an anti-shatter film that holds all the components together if there is any shock or impact on them. In LCDs and televisions, optic adhesives help in their assembly as well as act as a substitute for the vacuum deposition method, which helps in reducing process costs and increasing productivity and production speed. Optic adhesives bind a transparent layer in these devices to protect them from harsh chemicals, damage, and scratches. They also help in improving the mechanical, optical, and electrical performance of the display module and device, as well as its viewability, readability, and contrast in both indoor and outdoor devices.

Restraints: Difficulty in raw material availability and shipping

The raw materials used for manufacturing optic adhesives are petrochemicals and are derived from crude oil. Prices of naturally available raw materials and crude oil are skyrocketing in Europe, leaving chemical producers to suffer from low availability of raw materials to manufacture the desired products. Even countries that do not have trade restrictions are struggling to import from the region due to the disrupted maritime transport sector. 90% of Germany’s petrochemicals-intensive sectors such as adhesives and sealants manufacturers, paints and coatings manufacturers, machinery and equipment, electrical equipment, etc. are reporting logistical troubles and shortages of raw materials.

Opportunities: Technological innovations and new product development areas in aerospace and medical industries

The aerospace and military industries are very rigorous. The equipment used is exposed to extreme environmental conditions. There is a lot of work required for the manufacturers to cater to these industries. Technological innovations and new product requirements have unfastened several opportunities. Adhesives are being used as alternatives to nuts and bolts; they are very popular among space manufacturers because lightweight fasteners and adhesives boost aircraft efficiency. In space, the materials face extreme vacuum and extreme solar radiation without the benefit of atmospheric filtering. Consequently, resistance to gassing, as well as resistance to UV exposure, is crucial for space-based applications of optic adhesives. According to NASA, space-qualified materials should have TML and CVCM < 0.1%.

Furthermore, in the medical industry, it is essential that adhesives are solventless due to concerns about the short-term toxic effects of solvents as well as indications that many of them are carcinogenic. Other requirements include good adhesion to organic and inorganic surfaces, good wetting properties, compatibility with radiation, autoclave sterilization, and fungus- and bacteria-resistance. Not many optic adhesive suppliers have a line of adhesives that are qualified for medical use. Considering all the above-mentioned requirements, it is obvious to have a good scope for research and development in this direction, which could open different opportunities for optic adhesive manufacturers.

Challenges: Toxicity of adhesives causes a possible threat to manufacturers

The chemical industry is facing challenges from the regulatory authorities, such as Control of Substances Hazardous to Health (COSHH), European Union (EU), Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), Globally Harmonized System (GHS), and Environmental Protection Agency (EPA), in Europe and North America. Optic adhesives release solvent into the environment, which, if inhaled, can harm individuals. The toxic byproducts can lead to the deformation of the structure or lens that is adhered to, which may lead to increased production costs for manufacturers.

Fiber Optics accounted for the fastest growing segment of the optic adhesives market between 2022 and 2027.

Fiber optic adhesives perform well on glass, metal, ceramic, and most plastic substrates and provide excellent chemical and solvent resistance. They also provide insulation to electricity and can be used in high-strength optical alignment applications. In addition, they can bond dissimilar materials quickly and efficiently, enabling the production of many optical components.

Adhesive technology always plays a major role in fiber optics assembly. Initially, epoxy technology was the method of choice, primarily in the connector market, but nowadays, adhesives are highly engineered and are available in a wide variety of choices to help fabricate fiber optic assemblies. A correct adhesive offers speed fabrication, lower costs, and improves reliability and performance.

To know about the assumptions considered for the study, download the pdf brochure

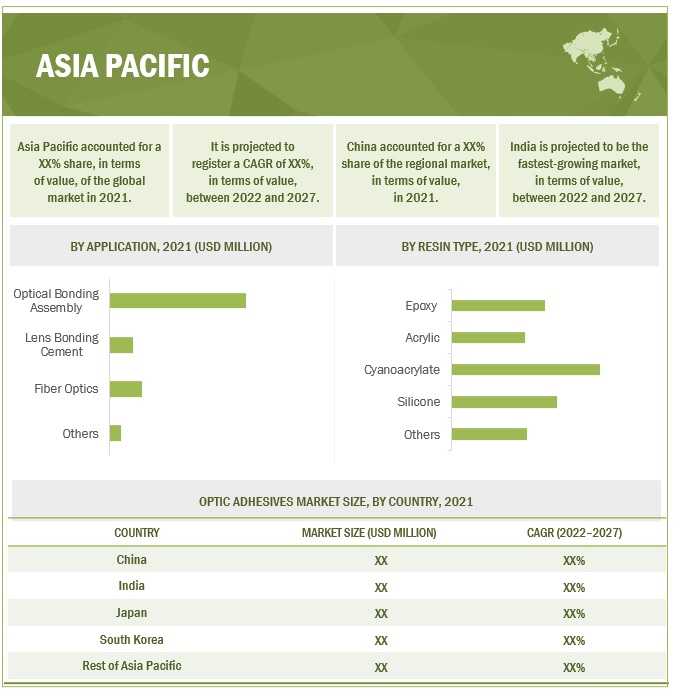

Asia Pacific is the fastest-growing optic adhesives market.

Asia Pacific is the fastest optic adhesives market in terms of value and volume during the forecast period. The development of the market is mainly attributed to the high economic growth rate followed by heavy investment across different manufacturing industries.

Key Market Players

Henkel AG & Co. KGAA (Germany), Dymax Corporation (US), and DELO Adhesives (Germany) are the key players in the global optic adhesives market.

DELO Adhesives is a world-leading manufacturer of industrial adhesives. The company is owner-operated, and for over 50 years, it has developed tailor-made special adhesives and application technologies for high-tech industries such as automotive, aviation, optoelectronics, and electronics. It has subsidiaries in the US, China, Singapore, and Japan, as well as representatives throughout the world.

Scope of the report

|

Report Metric |

Details |

|

Years Considered for the study |

2020-2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD) and Volume (Ton) |

|

Segments |

By Resin Type |

|

Regions covered |

Asia Pacific, Europe, North America, Middle East & Africa, South America |

|

Companies profiled |

Henkel AG & Co. KGAA (Germany), Dymax Corporation (US), and DELO Adhesives (Germany). A total of 15 players have been covered. |

This research report categorizes the OPTIC ADHESIVES market based on resin type, application, and region.

By Resin Type:

- Epoxy

- Acrylic

- Cyanoacrylate

- Silicone

- Others

By Application:

- Optical Bonding & Assembly

- Lens Bonding Cement

- Fiber Optics

- Others

By Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of optic adhesives?

The global optic adhesives market is driven by the growing optical devices, fiber cables, internet services etc.

What are the major applications for optic adhesives?

The major applications of optic adhesives are optical bonding & assembly, lens bonding cement, and fiber optics.

Who are the major manufacturers?

Henkel AG & Co. KGAA (Germany), Dymax Corporation (US), and DELO Adhesives (Germany) are some of the leading players operating in the global optic adhesives market

Why optic adhesives are gaining market share?

The growth of this market is attributed to the growing preference for optic adhesives in optical bonding & assembly application segment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Acrylic resins offer properties that drive optic adhesives market- Increasing penetration of smart devices and camera or digital sensors boost demand for optic adhesivesRESTRAINTS- Difficulty in raw material availability and shipping- Wastage and complications in application process hamper market growthOPPORTUNITIES- Technological innovations and new product development areas in aerospace and medical industries- Rapid development and deployment of different internet services, smart sensors, fiber optic-based military weapon systems, and security and surveillance solutions to provide lucrative opportunitiesCHALLENGES- Toxicity of adhesives causes a possible threat to manufacturers- Changes in stress or other environmental conditions may lead to catastrophic failures

-

5.3 PORTER'S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 MACROECONOMIC INDICATOR ANALYSISINTRODUCTIONTRENDS AND FORECAST OF GDP

-

5.6 INDUSTRY TRENDSTRENDS IN CAMERA INDUSTRYTRENDS IN ELECTRONICS INDUSTRYTRENDS IN OPTICS INDUSTRYTRENDS IN FIBER INDUSTRY

-

5.7 GLOBAL SCENARIOS IMPACTING MARKET GROWTHRUSSIA-UKRAINE WARCHINA- China’s debt problem- Australia-China trade war- Environmental commitmentsEUROPE- Energy crisis in Europe- Manpower issues in UK

- 6.1 INTRODUCTION

-

6.2 EPOXYVAST RANGE OF PROPERTIES OF EPOXIES PROVIDES VERSATILITY TO OPTIC ADHESIVES

-

6.3 CYANOACRYLATEFAST CURING PROPERTY TO DRIVE CYANOACRYLATE-BASED OPTIC ADHESIVES MARKET

-

6.4 ACRYLICECO-FRIENDLY RESIN TO OFFER COMPARABLE PERFORMANCE TO EPOXIES

-

6.5 SILICONEWATER-RESISTANT OPTIC ADHESIVE

- 6.6 OTHERS

- 7.1 INTRODUCTION

-

7.2 OPTICAL BONDING & ASSEMBLYINCREASED SMART DEVICES PENETRATION TO BOOST CONSUMPTION- Camera Lenses- Microscopes- Camera Modules- Others

-

7.3 LENS BONDING CEMENTSUPERIOR PROPERTIES OF LENS BONDING CEMENT TO INCREASE OPTIC ADHESIVES MARKET

-

7.4 FIBER OPTICSDIFFERENT TECHNOLOGIES TO BOOST OPTIC ADHESIVES MARKET IN FIBER OPTICS APPLICATION

- 7.5 OTHERS

-

8.1 INTRODUCTIONRECESSION IMPACT ON GLOBAL ECONOMY

-

8.2 NORTH AMERICAUS- Increasing demand from camera & fiber optics industry to drive optic adhesives marketCANADA- Growing investment in network infrastructure to boost demand for optic adhesivesMEXICO- Increasing penetration of smart screens and internet to drive optic adhesives market

-

8.3 EUROPEGERMANY- Adoption of IoT, especially in manufacturing and automotive industries, to increase demand for optic adhesivesFRANCE- Favorable government initiatives to promote optic adhesives marketUK- Presence of telecom service and fiber optic providers to boost optic adhesives marketITALY- Increasing adoption of FTTH broadband to offer lucrative opportunities for optic adhesive manufacturersSPAIN- Rapid commercialization of 5G services to foster optic adhesives market growthTURKEY- Growing network infrastructure to provide lucrative opportunities for optic adhesives marketIRELAND- Increasing requirement of camera modules to boost optic adhesives marketREST OF EUROPE

-

8.4 ASIA PACIFICCHINA- Substantial investments by telecom operators and government to boost optic adhesives marketINDIA- Government initiatives to increase broadband connectivity across rural areas to support optic adhesives market expansionJAPAN- Presence of well-established fiber optics industry boosts demand for optic adhesivesSOUTH KOREA- Proliferation of smart factories to boost optic adhesives market growthREST OF ASIA PACIFIC

-

8.5 SOUTH AMERICABRAZIL- Rising deployment of fiber optic solutions across Brazil to foster optic adhesives market growthREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICASOUTH AFRICA- Government policies to develop manufacturing industries to drive optic adhesives market in telecommunications industryUAE- Increase in infrastructural spending to drive optic adhesives market growthREST OF MIDDLE EAST & AFRICA

- 9.1 INTRODUCTION

-

9.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2021STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 9.3 STRENGTH OF PRODUCT PORTFOLIO

- 9.4 MARKET SHARE ANALYSIS

- 9.5 MARKET RANKING ANALYSIS

- 9.6 COMPETITIVE SITUATION AND TRENDS

-

10.1 MAJOR PLAYERSHENKEL AG & CO. KGAA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDYMAX CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewDELO ADHESIVES- Business overview- Products/Services/Solutions offered- MnM viewH.B. FULLER COMPANY- Business overview- Products/Solutions/Services offered- MnM viewPARSON ADHESIVES INDIA PRIVATE LIMITED- Business overview- Products/Solutions/Services offered- MnM viewTHE DOW CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered3M COMPANY- Business overview- Products/Solutions/Services offeredPANACOL-ELOSOL GMBH- Business overview- Products/Solutions/Services offeredDIC CORPORATION- Business overview- Products/Solutions/Services offeredMASTER BOND INC.- Business overview- Products/Solutions/Services offeredTHREEBOND INTERNATIONAL, INC.- Business overview- Products/Solutions/Services offeredCHEMITECH, INC.- Business overview- Products/Solutions/Services offeredDENKA COMPANY LIMITED- Business overview- Products/Solutions/Services offeredSUNRISE CO., LTD.- Business overview- Products/Solutions/Services offeredKYORITSU CHEMICAL & CO., LTD.- Business overview- Products/Solutions/Services offered

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHORS DETAILS

- TABLE 1 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH LIMITATIONS

- TABLE 3 RISK ANALYSIS

- TABLE 4 OPTIC ADHESIVES MARKET SNAPSHOT, 2021 VS. 2027

- TABLE 5 OPTIC ADHESIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 TRENDS AND FORECAST OF GDP, PERCENTAGE (%) CHANGE, 2019–2027

- TABLE 7 OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (USD MILLION)

- TABLE 8 OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (TON)

- TABLE 9 EPOXY OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 10 EPOXY OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 11 CYANOACRYLATE OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 12 CYANOACRYLATE OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 13 ACRYLIC OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 14 ACRYLIC OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 15 SILICONE OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 16 SILICONE OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 17 OTHER OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 18 OTHER OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 19 OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 20 OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (TON)

- TABLE 21 OPTIC ADHESIVES MARKET SIZE IN OPTICAL BONDING & ASSEMBLY APPLICATION, BY REGION, 2020–2027 (USD MILLION)

- TABLE 22 OPTIC ADHESIVES MARKET SIZE IN OPTICAL BONDING & ASSEMBLY APPLICATION, BY REGION, 2020–2027 (TON)

- TABLE 23 OPTICAL BONDING & ASSEMBLY MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (USD MILLION)

- TABLE 24 OPTICAL BONDING & ASSEMBLY MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (TON)

- TABLE 25 CAMERA LENSES: OPTICAL BONDING & ASSEMBLY SUB-APPLICATION MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 26 CAMERA LENSES: OPTICAL BONDING & ASSEMBLY SUB-APPLICATION MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 27 MICROSCOPES: OPTICAL BONDING & ASSEMBLY SUB-APPLICATION MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 28 MICROSCOPES: OPTICAL BONDING & ASSEMBLY SUB-APPLICATION MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 29 CAMERA MODULES: OPTICAL BONDING & ASSEMBLY SUB-APPLICATION MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 30 CAMERA MODULES: OPTICAL BONDING & ASSEMBLY SUB-APPLICATION MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 31 OTHERS: OPTICAL BONDING & ASSEMBLY SUB-APPLICATION MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 32 OTHERS: OPTICAL BONDING & ASSEMBLY SUB-APPLICATION MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 33 OPTIC ADHESIVES MARKET SIZE IN LENS BONDING CEMENT APPLICATION, BY REGION, 2020–2027 (USD MILLION)

- TABLE 34 OPTIC ADHESIVES MARKET SIZE IN LENS BONDING CEMENT APPLICATION, BY REGION, 2020–2027 (TON)

- TABLE 35 OPTIC ADHESIVES MARKET SIZE IN FIBER OPTICS APPLICATION, BY REGION, 2020–2027 (USD MILLION)

- TABLE 36 OPTIC ADHESIVES MARKET SIZE IN FIBER OPTICS APPLICATION, BY REGION, 2020–2027 (TON)

- TABLE 37 OPTIC ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 38 OPTIC ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (TON)

- TABLE 39 OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

- TABLE 40 OPTIC ADHESIVES MARKET SIZE, BY REGION, 2020–2027 (TON)

- TABLE 41 NORTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (USD MILLION)

- TABLE 42 NORTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (TON)

- TABLE 43 NORTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 44 NORTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (TON)

- TABLE 45 NORTH AMERICA: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (TON)

- TABLE 47 NORTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

- TABLE 49 EUROPE: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (USD MILLION)

- TABLE 50 EUROPE: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (TON)

- TABLE 51 EUROPE: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 52 EUROPE: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (TON)

- TABLE 53 EUROPE: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (USD MILLION)

- TABLE 54 EUROPE: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (TON)

- TABLE 55 EUROPE: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 56 EUROPE: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

- TABLE 57 ASIA PACIFIC: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (USD MILLION)

- TABLE 58 ASIA PACIFIC: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (TON)

- TABLE 59 ASIA PACIFIC: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 60 ASIA PACIFIC: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (TON)

- TABLE 61 ASIA PACIFIC: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (USD MILLION)

- TABLE 62 ASIA PACIFIC: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (TON)

- TABLE 63 ASIA PACIFIC: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 64 ASIA PACIFIC: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

- TABLE 65 SOUTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (USD MILLION)

- TABLE 66 SOUTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (TON)

- TABLE 67 SOUTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 68 SOUTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (TON)

- TABLE 69 SOUTH AMERICA: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (USD MILLION)

- TABLE 70 SOUTH AMERICA: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (TON)

- TABLE 71 SOUTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 72 SOUTH AMERICA: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

- TABLE 73 MIDDLE EAST & AFRICA: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (USD MILLION)

- TABLE 74 MIDDLE EAST & AFRICA: OPTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2020–2027 (TON)

- TABLE 75 MIDDLE EAST & AFRICA: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 76 MIDDLE EAST & AFRICA: OPTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2020–2027 (TON)

- TABLE 77 MIDDLE EAST & AFRICA: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (USD MILLION)

- TABLE 78 MIDDLE EAST & AFRICA: OPTICAL BONDING & ASSEMBLY APPLICATION MARKET SIZE, BY SUB-APPLICATION, 2020–2027 (TON)

- TABLE 79 MIDDLE EAST & AFRICA: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 80 MIDDLE EAST & AFRICA: OPTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

- TABLE 81 OVERVIEW OF STRATEGIES ADOPTED BY KEY OPTIC ADHESIVE PLAYERS

- TABLE 82 MARKET RANKING ANALYSIS, 2021

- TABLE 83 OPTIC ADHESIVES MARKET: PRODUCT LAUNCHES, 2017–2022

- TABLE 84 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 85 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

- TABLE 86 DYMAX CORPORATION: COMPANY OVERVIEW

- TABLE 87 DELO ADHESIVES: COMPANY OVERVIEW

- TABLE 88 H.B. FULLER COMPANY: COMPANY OVERVIEW

- TABLE 89 PARSON ADHESIVES INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 90 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 91 3M COMPANY: COMPANY OVERVIEW

- TABLE 92 PANACOL-ELOSOL GMBH: COMPANY OVERVIEW

- TABLE 93 DIC CORPORATION: COMPANY OVERVIEW

- TABLE 94 MASTER BOND INC.: COMPANY OVERVIEW

- TABLE 95 THREEBOND INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 96 CHEMITECH, INC.: COMPANY OVERVIEW

- TABLE 97 DENKA COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 98 SUNRISE CO., LTD.: COMPANY OVERVIEW

- TABLE 99 KYORITSU CHEMICAL & CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 OPTIC ADHESIVES MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION

- FIGURE 5 OPTIC ADHESIVES MARKET: DATA TRIANGULATION

- FIGURE 6 CYANOACRYLATE TO BE LARGEST RESIN TYPE SEGMENT OF OPTIC ADHESIVES MARKET, 2022–2027

- FIGURE 7 OPTICAL BONDING & ASSEMBLY TO DOMINATE GLOBAL OPTIC ADHESIVES MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF OPTIC ADHESIVES MARKET

- FIGURE 9 ACRYLIC RESIN OFFERS PROPERTIES THAT DRIVE OPTIC ADHESIVES MARKET

- FIGURE 10 CYANOACRYLATE TO REMAIN LARGEST RESIN SEGMENT OF OPTIC ADHESIVES MARKET

- FIGURE 11 DEVELOPING COUNTRIES TO GROW FASTER THAN DEVELOPED COUNTRIES

- FIGURE 12 OPTICAL BONDING & ASSEMBLY AND CHINA ACCOUNTED FOR LARGEST MARKET SHARES IN ASIA PACIFIC IN 2021

- FIGURE 13 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN OPTIC ADHESIVES MARKET

- FIGURE 15 PORTER'S FIVE FORCES ANALYSIS: OPTIC ADHESIVES MARKET

- FIGURE 16 OPTIC ADHESIVES VALUE CHAIN

- FIGURE 17 CYANOACRYLATE TO REMAIN LARGEST RESIN TYPE SEGMENT IN OPTIC ADHESIVES MARKET

- FIGURE 18 OPTICAL BONDING & ASSEMBLY SEGMENT DOMINATED OVERALL OPTIC ADHESIVES MARKET IN 2021 (VALUE)

- FIGURE 19 ASIA PACIFIC TO BE FASTEST-GROWING OPTIC ADHESIVES MARKET

- FIGURE 20 NORTH AMERICA: OPTIC ADHESIVES MARKET SNAPSHOT

- FIGURE 21 EUROPE: OPTIC ADHESIVES MARKET SNAPSHOT

- FIGURE 22 ASIA PACIFIC: OPTIC ADHESIVES MARKET SNAPSHOT

- FIGURE 23 SOUTH AMERICA: OPTIC ADHESIVES MARKET SNAPSHOT

- FIGURE 24 MIDDLE EAST & AFRICA: OPTIC ADHESIVES MARKET SNAPSHOT

- FIGURE 25 OPTIC ADHESIVES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 26 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 27 MARKET SHARE, BY KEY PLAYERS (2021)

- FIGURE 28 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 29 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 30 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 31 3M COMPANY: COMPANY SNAPSHOT

- FIGURE 32 DIC CORPORATION: COMPANY SNAPSHOT

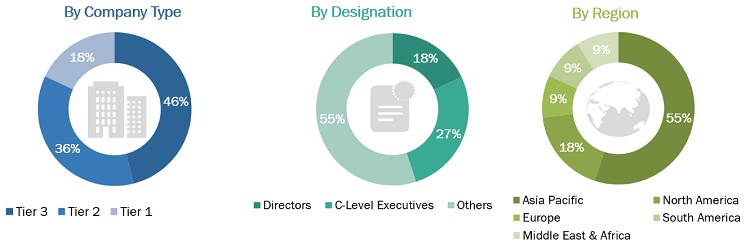

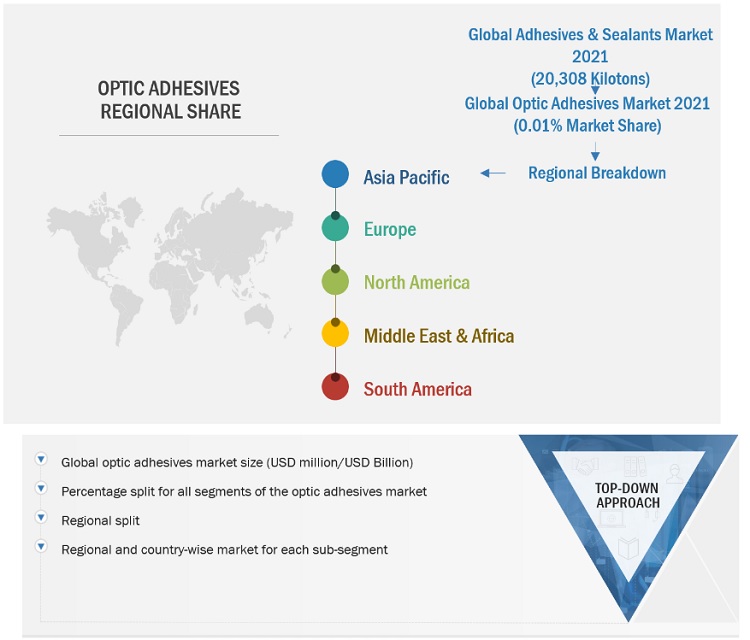

The study involves four major activities in estimating the current market size of optic adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The optic adhesives market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as optical bonding & assembly, lens bonding cement, and fiber optics. The supply side is characterized by advancements in formulations. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Optic adhesives market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Optic adhesives Market Size: Top-down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the optic adhesives market, in terms of value and volume

- To define, describe, and forecast the optic adhesives market by resin type, application, and region

- To forecast the optic adhesives market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments, such as mergers & acquisitions, new product launches, and investments & expansions, in the optic adhesives market

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note: 1. Micromarkets are defined as the sub-segments of the OPTIC ADHESIVES market included in the report.

Note 2: Core competencies of the companies are captured in terms of their key developments and key strategies adopted to sustain their position in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the optic adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Optic Adhesives Market