Optoelectronics Market for Automotive by Devices (LED, Image Sensor, Infrared, Laser Diode, Optocoupler), Application (Position Sensor, Convenience & Climate, Safety, Lighting), Vehicle (PC, CV), EV Type, Aftermarket, and Region - Global Forecast to 2025

The global automotive optoelectronics market size was valued at USD 3.50 billion in 2017 and is expected to reach USD 9.80 billion by 2025, at a CAGR of 14.13% during the forecast period.

Objectives

- To define, describe, and project the market (2018–2025), in terms of value (USD million)

- To provide detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and industry-specific challenges

- To analyze and forecast the market and estimate the market size, by value, based on devices, application, EV type, vehicle type, market channel type, and region

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and expansions

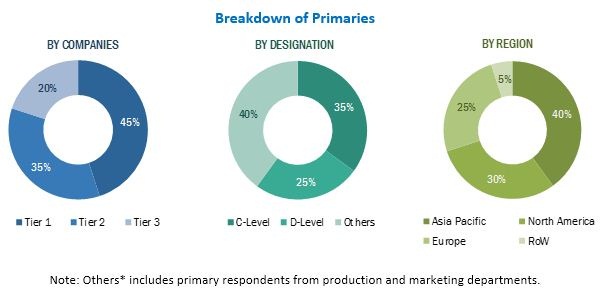

The research methodology used in the report involves data collection from various secondary sources such as International Optoelectronics Association, Optoelectronics Industry Development Association, Automotive Component Manufacturers Association (ACMA), China Association of Automobile Manufacturers (CAAM), Japan Automobile Manufacturers Association (JAMA), European Automobile Manufacturers Association (ACEA), and Canadian Automobile Association (CAA). Experts from related industries and suppliers have been interviewed to understand the future trends of this market. The bottom-up approach has been used to estimate and validate the size of the global market. The global market is derived based on multiple primary inputs and secondary research. Further, regional penetration is identified to derive the regional market sizing of the automotive optoelectronics.

The figure given below illustrates the break-up of the profiles of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the automotive optoelectronics industry consists of manufacturers such as Texas Instruments (US), Hella (Germany), Osram (Germany), Vishay (US), and Broadcom (US).

Target Audience

- Automotive optoelectronics manufacturers

- Raw material suppliers

- Component manufacturers

- Distributors and suppliers of automotive optoelectronics components/parts

Scope of the Report

Automotive Optoelectronics Market, By Devices

- Image Sensor

- IR Component

- Laser Diode

- LED

- Optocoupler

Automotive Optoelectronics Market, By Application

- Position Sensor

- Convenience & Climate

- Safety

- Lighting

- Backlight Control

Automotive Optoelectronics Market, By Vehicle Type

- Passenger Car

- LCV

- Buses

- Trucks

Automotive Optoelectronics Market, By EV

- BEV

- FCEV

- HEV

- PHEV

Automotive Optoelectronics Market, By Market Channel

- OEM

- Aftermarket

Automotive Optoelectronics Market, By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country level analysis of the market

- Profiling of additional market players (up to 3)

- Competitive Leadership Mapping (Micro-quadrant)

Drivers

High demand and increasing sales of luxury and ultra-luxury vehicles

The improving global economic conditions have changed the overall lifestyle of consumers. With increasing disposable income, the demands of consumers have changed in line with new lifestyles, leading to a change in their preferences. This has positively affected the sales of luxury and ultra-luxury cars across the globe. The difference in lifestyle is noticeable, especially in developing countries such as China and India.

The sales of Mercedes-Benz increased from 155.9 thousand units in 2016 to 442.9 thousand units in 2017. Based on the 2017 sales figures, BMW China plans to double its production capacity by 2020. Optoelectronics devices such as LED lights, OLED and LED displays, and ambient lighting are the key highlights of the luxury vehicle segment. These devices increase comfort and convenience of the vehicle. Along with improving visibility, they also provide a congenial atmosphere in the cabin, thus reducing driver fatigue and increasing vehicle safety.

Increase in awareness about vehicle safety

The safety of the passengers and vehicle has become the prime concern for vehicle buyers. Regulatory authorities around the world are aiming to improve vehicle safety. The Global status report on road safety 2015 estimated that more than 1.2 million road traffic deaths occur each year globally. Studies suggest that road traffic injuries will become the fifth leading cause of death globally by 2030. Driver fatigue, driver distraction, and limited visibility of the road are the major causes of these accidents.

In a vehicle, optoelectronics devices can be used for occupant detection, drowsy driver detection, night vision, optical immobilizer, and remote keyless entry. Due to the increasing awareness about vehicle safety and government mandates regarding safety features, OEMs are providing many safety features as a standard fit in vehicles. These features have helped to reduce the number of road fatalities. For instance, there has been a 3% decrease in road accident deaths in India in 2017 as compared to 2016. The positive result will further boost the installation of safety features in vehicles.

Restraints

Easily available and affordable substitutes for the technology

Various substitutes are available as an alternative for optoelectronic components. For instance, halogen bulbs are widely used in headlights and interior lighting. Halogen bulbs are easy to manufacture and cheaper than LEDs and OLEDs. Xenon HID bulbs, which are brighter than halogen, can also be used in headlights. On the other hand, LEDs are both expensive and difficult to make. Also, Yellow phosphorous is widely used in LED lighting. New materials from cadmium selenide and zinc selenide nanoparticles can be illuminated using the blue LED chip. However, they undergo quality and performance degradation over time and at higher operating temperatures compared to phosphors. The color of the light emitted by nanoparticles can be precisely tuned by varying the size of the particle. Hence, the growth of market can be hampered by the easy availability of affordable substitutes.

New Product Developments, 2015–2018

|

Company |

Date |

Description |

|

Texas Instruments |

March 2018 |

Expanding on its industry-leading gallium nitride (GaN) power portfolio, Texas Instruments announced two high-speed GaN field-effect transistor (FET) drivers to create more efficient, higher-performing designs in speed-critical applications such as light detection and ranging (LIDAR) and 5G radio-frequency (RF) envelope tracking. The LMG1020 and LMG1210 can deliver switching frequencies of 50 MHz while improving efficiency and enabling five times smaller solution sizes previously not possible with silicon MOSFETs. |

|

Hella |

May 2018 |

Audi (Germany) and HELLA developed a striking lighting technology for the new Audi A7 Sportback. The headlamps of the four-door coupé are available as LED, Matrix LED, and HD Matrix LED with laser high beam variants. The system uses a new control unit, which takes care of all lighting functions. Audi and HELLA have additionally developed a new interior lighting concept together. |

Expansions

|

Company |

Date |

Description |

|

Hella |

October 2017 |

HELLA expanded its development and production footprint in India. To this end, it is building its second electronics plant near the city of Mehsana in the state of Gujarat |

|

Osram |

November 2017 |

OSRAM’s new LED chip factory in Kulim (Malaysia) began operations. The factory was planned in November 2015. An investment of USD 435 million was made in the first stage of completion |

The optoelectronics market for automotive is estimated to be USD 3.88 billion in 2018 and is projected to reach USD 9.80 billion by 2025, at a CAGR of 14.13% from 2018 to 2025. The key growth drivers for the market are the increasing awareness regarding vehicle safety and rising demand for luxury and ultra-luxury vehicles.

The passenger car segment is estimated to hold the largest market share during the forecast period. The increasing sales of passenger cars globally are leading to the exponential growth of this market. Also, the growing trend of integrating high-end electronics for in-vehicle features is inflating the demand for automotive optoelectronics.

The LED devices segment is projected to register the fastest growth, in terms of value, in the global market during the forecast period. The growth of the LED segment can be attributed to the increasing demand for ambient lighting to enhance the comfort & convenience in the vehicle.

By application, the safety segment is expected to register the fastest growth, by value, in this market during the forecast period. The increasing number of safety mandates by several governments across the globe along with the high consumer preference for safety applications is driving the growth of the market.

By market channel, OE market segment is estimated to be the largest segment of the market during the forecast period. The growth of this segment can be attributed to the offering of features such as ambient lighting, convenience & climate features, and safety features as standard fitment by the automakers. OE is expected to remain an attractive market in the near future due to the increase in demand for such features by the consumers.

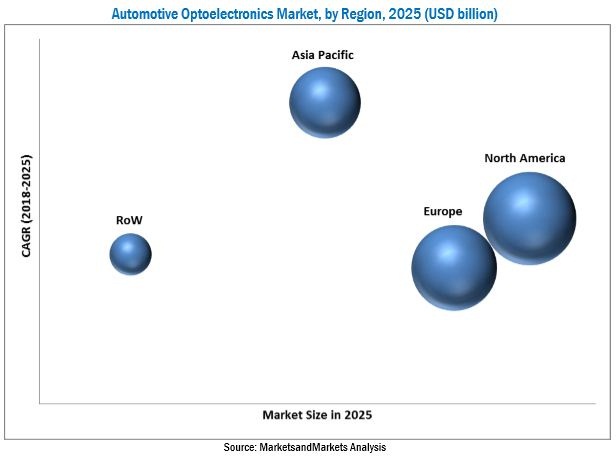

The North American region is projected to be the largest market for automotive optoelectronics by 2025. The increasing production of automobiles and a significant rise in demand for premium segment passenger cars are driving the market growth in this region. The Asia Pacific region is anticipated to register the fastest growth in automotive optoelectronics by 2025. The adoption rate of applications such as safety and lighting in vehicles is expected to show incremental growth in the region in the coming years. The increased adoption rate makes the Asia Pacific region the fastest growing market during the forecast period.

The key factor restraining the growth of this market is the easy availability of affordable substitutes for the optoelectronics technology for automotive applications.

The automotive optoelectronics market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Osram (Germany), Hella (Germany), Texas (US), Broadcom (US), and Vishay (US).

Leading automotive optoelectronics manufacturers/software providers are focused onto develop innovative solutions for existing and new applications of automobiles to drive the industry forward.

Lighting

Automotive lighting has witnessed substantial growth in the recent past due to high demand in comfort and convenience features in the vehicles. Osram is one of the companies that is at the forefront of developing advanced lighting application for automobiles. The company has added the Oslon Compact PL to its portfolio of lighting products for the automotive sector. Designed primarily for vehicle headlights, the LED can be used in adaptive, glare-free high beam, daytime running lights. low beam, and standard high beam lighting. This comprehensive LED combines improved design with low system costs, making it suitable for a wide variety of vehicle classes and a broad spectrum of customers.

LED

LED light is a recent innovation in automotive lighting technology. Compared to xenon/HID lights, LEDs offer a better reflection in terms of light returns from road signs. In vehicles, LEDs can be used for lighting, safety, and convenience & climate applications. LEDs are primarily used in headlights, daytime running light (DRL), side indicators, and ambient lighting. Continuous innovations in the lighting sector are leading to the adoption of new technologies like adaptive LED lighting.

Audi (Germany) and HELLA developed a striking lighting technology. The headlamps of the four-door coupé are available as LED, Matrix LED, and HD Matrix LED with laser high beam variants. The system uses a new control unit, which takes care of all lighting functions. Audi and HELLA have additionally developed a new interior lighting concept together.

Optocoupler

Increased in the electrification inside the vehicles has paved the way for integrating advance electronics components for smooth functioning of technology. Optocoupler is one such component integrated in the electronics architecture of the vehicles which prevents high voltages from affecting the system receiving the electrical signal. Thus, key market players are developing advanced optocouplers to gain traction in the global market.

For instance, Vishay launched its first Automotive Grade phototransistor optocoupler. The new device combines a high current transfer ratio (CTR) with a low forward current. The phototransistor optocoupler is designed for battery management, signal transmission, and system control in automotive applications, including hybrid and electric vehicles.

Opportunities

Increasing R&D in the field of optoelectronics technology

The research and development programs in the optoelectronic components market are focused more on the development of technology to meet the growing consumer demand and enabling integration of these devices into various automotive components. Various R&D communities are investigating optical and optoelectronic approaches for high-speed optical computing and next-generation communication networks. These research divisions are also trying to obtain the optimal combination of materials and devices to make functional elements that perform advanced optoelectronic functions, which will ultimately be used in photonic systems.

Rising demand for electric vehicles

According to the US Environmental Protection Agency, the transportation sector was responsible for nearly 28% of the total greenhouse gas emissions in 2016, becoming one of the leading causes of the increase in global temperature. Hence, various governments are promoting the use of electric vehicles for transportation as they significantly reduce automotive emissions.

Challenges

Aftermarket Installation

As Original Equipment Manufacturers (OEMs) do not provide optoelectronics devices for all vehicles, consumers generally get them installed from the aftermarket. OEMs provide LED lighting, digital display, and LED ambiance lighting in the top variants only. Consumers prefer to install LED display and ambiance lighting in the aftermarket as these are not provided as a standard feature by OEMs. Thus, the aftermarket for automotive optoelectronics is significantly large. OEMs generally have specifications for the production of optoelectronic devices; this aspect cannot be regulated when they are manufactured as an aftermarket accessory. The aftermarket installation is thus a major challenge for the growth of the OEM automotive optoelectronics market.

High raw material cost

The high cost of raw materials used in automotive optoelectronic devices is a major challenge for manufacturers. The high cost of raw materials increases the production cost as well as that of the final product. For instance, a crystal mineral host lattice doped with rare earth ions is a necessary ingredient for the manufacturing of LEDs. These crystal hosts, when illuminated, vibrate and emit energy in the form of light of different wavelengths. The mining of such rare earth materials increases pollution and environmental degradation.

Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements

|

Company |

Date |

Description |

|

Hella |

April 2018 |

The lighting and electronics expert HELLA expanded its presence on the Chinese market by launching a new joint venture dealing in electronic components with the company Beijing HAINACHUAN Automotive Parts (China), which is part of the BAIC automotive group. The contract was signed to launch the joint venture that would be known as HELLA BHAP Electronics (Jiangsu) Co., Ltd |

|

Osram |

April 2018 |

OSRAM and Continental have successfully completed negotiations on their joint venture, which is expected to begin operations in the second half of 2018. The joint venture, in which each of the partners has a 50 percent stake, aims to combine Continental’s and OSRAM’s respective expertise in lighting, light control, and electronics |

Mergers & Acquisitions

|

Company |

Date |

Description |

|

Osram |

May 2018 |

OSRAM Licht has added to its expertise in semiconductor-based optical security technology by acquiring Vixar. Already a technology leader in infrared LEDs and infrared laser diodes, Osram will have a unique breadth of technological expertise and an expanded product portfolio after bringing on board Vixar’s specialist capabilities in the field of VCSEL. |

|

Broadcom |

November 2017 |

Broadcom announced that it has completed its acquisition of Brocade Communications Systems. It will operate as an indirect subsidiary of Broadcom. |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Optoelectronics Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Optoelectronics Market for Automotive

4.2 Optoelectronics Market Share, By Country

4.3 Optoelectronics Market, By Devices

4.4 Optoelectronics Market, By Application

4.5 Optoelectronics Market, By Vehicle Type

4.6 Optoelectronics Market, By Ev Type

4.7 Optoelectronics Market, By Market Channel

4.8 Optoelectronics Market, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand and Increasing Sales of Luxury and Ultra-Luxury Vehicles

5.2.1.2 Increase in Awareness About Vehicle Safety

5.2.1.3 Long Life and Low Power Consumption of Optoelectronics Devices

5.2.2 Restraints

5.2.2.1 Easily Available and Affordable Substitutes for the Technology

5.2.3 Opportunities

5.2.3.1 Increasing R&D in the Field of Optoelectronics Technology

5.2.3.2 Rising Demand for Electric Vehicles

5.2.3.3 Advent of Semi-Autonomous and Autonomous Vehicles

5.2.4 Challenges

5.2.4.1 Aftermarket Installation

5.2.4.2 High Raw Material Cost

6 Automotive Optoelectronics Market, By Application (Page No. - 42)

6.1 Introduction

6.2 Backlight Control

6.3 Convenience & Climate

6.4 Lighting

6.5 Position Sensors

6.6 Safety

7 Automotive Optoelectronics Market, By Devices (Page No. - 50)

7.1 Introduction

7.2 LED

7.3 Image Sensor

7.4 Infrared Components

7.5 Laser Diode

7.6 Optocoupler

8 Automotive Optoelectronics Market, By Vehicle Type (Page No. - 58)

8.1 Introduction

8.2 Passenger Car

8.3 Light Commercial Vehicle

8.4 Trucks

8.5 Buses

9 Automotive Optoelectronics Market, By Market Channel (Page No. - 67)

9.1 Introduction

9.2 Original Equipment Manufacturer (OEM)

9.3 Aftermarket

10 Automotive Optoelectronics Market, By Electric Vehicle (Page No. - 69)

10.1 Introduction

10.2 Battery Electric Vehicle (BEV)

10.3 Hybrid Electric Vehicle (HEV)

10.4 Plug-In Hybrid Electric Vehicle (PHEV)

10.5 Fuel Cell Electric Vehicle (FCEV)

11 Automotive Optoelectronics Market, By Region (Page No. - 77)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Thailand

11.2.6 Rest of the Asia Pacific

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Russia

11.3.4 Spain

11.3.5 Turkey

11.3.6 UK

11.3.7 Rest of Europe

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 US

11.5 RoW

11.5.1 Brazil

11.5.2 Iran

11.5.3 Others

12 Competitive Landscape (Page No. - 103)

12.1 Overview

12.2 Market Ranking

12.3 Competitive Senario

12.3.1 New Product Developments

12.3.2 Expansions

12.3.3 Collaborations/Joint Ventures/Supply Contracts/ Partnerships/Agreements

12.3.4 Mergers & Acquisitions

13 Company Profiles (Page No. - 108)

13.1 Texas Instruments

13.2 Hella

13.3 Osram

13.4 Vishay

13.5 Broadcom

13.6 Grupo Antolin

13.7 Koito Manufacturing

13.8 Koninklijke Philips

13.9 Stanley Electric

13.10 Magneti Marelli

13.11 Renesas

13.12 Excellence Optoelectronics

13.13 Other Key Regional Players

13.13.1 Asia Pacific

13.13.1.1 FOSP Optoelectronics

13.13.1.2 San’an Optoelectronics

13.13.1.3 Foryard Optoelectronics

13.13.1.4 Sharp Corporation

13.13.1.5 Sony Corporation

13.13.2 Europe

13.13.2.1 Selectronic

13.13.2.2 Zizala Lichtsysteme

13.13.2.3 Isocom Components

13.13.2.4 Merck

13.13.2.5 Jenoptik

13.13.3 North America

13.13.3.1 Varroc Lighting

13.13.3.2 Endicott Research

13.13.3.3 Osi Optoelectronics

13.13.4 RoW

13.13.4.1 Proton-Orel

14 Appendix (Page No. - 140)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowladge Store: Marketsandmarkets’ Subscription Portal

14.4 Available Customizations

14.4.1 Automotive Optoelectronics Market, Additional Countries

14.4.2 Profiles of Additional Market Players (Up to 3)

14.4.3 Competitive Leadership Mapping (Micro-Quadrant) Companies

14.5 Related Reports

14.6 Author Details

List of Tables (53 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Global Optoelectronics Market, By Application, 2016-2025 (USD Million)

Table 3 Backlight Control: Market, By Region, 2016-2025 (USD Million)

Table 4 Convenience & Climate: Market, By Region, 2016-2025 (USD Million)

Table 5 Lighting: Market, By Region, 2016-2025 (USD Million)

Table 6 Position Sensors: Market, By Region, 2016-2025 (USD Million)

Table 7 Safety: Market, By Region, 2016-2025 (USD Million)

Table 8 Global Optoelectronics Market, By Devices, 2016-2025 (USD Million)

Table 9 LED: Market, By Region, 2016-2025 (USD Million)

Table 10 Image Sensor: Market, By Devices, 2016-2025 (USD Million)

Table 11 Infrared Sensor: Market, By Devices, 2016-2025 (USD Million)

Table 12 Laser Diode: Market, By Devices, 2016-2025 (USD Million)

Table 13 Optocoupler: Market, By Devices, 2016-2025 (USD Million)

Table 14 Global Optoelectronics Market, By Vehicle Type, 2016 - 2025 (USD Billion)

Table 15 Passenger Car: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 16 Light Commercial Vehicle: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 17 Trucks: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 18 Buses: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 19 Global Optoelectronics Market, By Market Channel, 2016–2025 (USD Million)

Table 20 Taxation Scheme for Alternate Fuel Vehicles, By Key Countries

Table 21 EV: Optoelectronics Market, By Region, 2016–2025 (USD Million)

Table 22 Asia Pacific: Market for EV, By Devices, 2016–2025 (USD Million)

Table 23 Europe: Market for Ev, By Devices, 2016–2025 (USD Million)

Table 24 North America: Market for Ev, By Devices, 2016–2025 (USD Million)

Table 25 Global Optoelectronics Market, By Region, 2016 - 2025 (USD Million)

Table 26 Asia Pacific: Optoelectronics Market, By Country, 2016 - 2025 (USD Million)

Table 27 China: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 28 India: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 29 Japan: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 30 South Korea: Electric Vehicles Subsidies Since 1st January 2015

Table 31 South Korea: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 32 Thailand: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 33 Rest of the Asia Pacific: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 34 Europe: Market, By Country, 2016 - 2025 (USD Million)

Table 35 France: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 36 Germany: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 37 Russia: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 38 Spain: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 39 Turkey: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 40 UK: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 41 Rest of Europe: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 42 North America: Market, By Country, 2016 - 2025 (USD Million)

Table 43 Canada: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 44 Mexico: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 45 US: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 46 RoW: Market, By Country, 2016 - 2025 (USD Million)

Table 47 Brazil: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 48 Iran: Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 49 Others Market, By Vehicle Type, 2016 - 2025 (USD Million)

Table 50 New Product Developments, 2015–2018

Table 51 Expansions

Table 52 Collaborations/Joint Ventures/Supply Contracts/Partnerships/ Agreements

Table 53 Mergers & Acquisitions

List of Figures (53 Figures)

Figure 1 Automotive Optoelectronics: Markets Covered

Figure 2 Optoelectronics Market: Research Design

Figure 3 Optoelectronics Market: Research Methodology Model

Figure 4 Breakdown of Primary Interviews:

Figure 5 Global Market Size: Bottom-Up Approach

Figure 6 Global Market Size, By Component: Top-Down Approach

Figure 7 Market: Data Triangulation

Figure 8 Market Dynamics

Figure 9 LED is Estimated to Hold the Largest Share of this Market, By Devices, 2018 vs 2025 (USD Million)

Figure 10 North America is Estimated to Hold the Largest Share of this Market, 2018 vs 2025 (USD Million)

Figure 11 Rising Demand for Optoelectronics Components is Expected to Drive the Global Market From 2018 to 2025

Figure 12 India is Estimated to Be the Fastest-Growing Market for Automotive Optoelectronics, 2018–2025

Figure 13 LED is Expected to Have the Largest Market Size During the Forecast Period, 2018 vs. 2025

Figure 14 Safety Application is Expected to Have the Largest Share of the Market, 2018 vs. 2025 (USD Million)

Figure 15 Passenger Car Segment is Expected to Hold the Largest Market Share, 2018 vs. 2025 (USD Million)

Figure 16 North America is Expected to Hold the Largest Share of this Market for EV, 2018 vs. 2025

Figure 17 OEM Market is Expected to Have the Largest Share of this Market, 2018 vs. 2025

Figure 18 Asia Pacific is Expected to Be the Fastest Growing Market for Automotive Optoelectronics, 2018 vs. 2025

Figure 19 Automotive Optoelectronics: Market Dynamics

Figure 20 Road Accident Deaths (Per Million), 1994–2016

Figure 21 Electric Vehicle Sales, 2012–2017

Figure 22 Optoelectronics Market, By Application, 2018 vs 2025 (USD Million)

Figure 23 Optoelectronics Market, By Devices, 2018 vs 2025 (USD Million)

Figure 24 Optoelectronics Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 25 Passenger Car: Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 26 Light Commercial Vehicle:Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 27 Trucks: Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 28 Buses: Market, By Vehicle Type, 2018 vs 2025 (USD Million)

Figure 29 Optoelectronics Market for Automotive, By Market Channel, 2018 vs 2025 (USD Million)

Figure 30 Optoelectronics Market for Electric Vehicle, By Region, 2018 vs 2025 (USD Million)

Figure 31 Optoelectronics Market, By Region, 2018 vs 2025 (USD Million)

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Europe: Market Snapshot

Figure 34 North America: Market, By Country, 2018 vs 2025 (USD Million)

Figure 35 RoW: Market, By Country, 2018 vs 2025 (USD Million)

Figure 36 Key Developments By Leading Players in the Market, 2015-2018

Figure 37 Texas Instruments: Company Snapshot

Figure 38 Texas Instruments: SWOT Analysis

Figure 39 Hella: Company Snapshot

Figure 40 Hella: SWOT Analysis

Figure 41 Osram: Company Snapshot

Figure 42 Osram: SWOT Analysis

Figure 43 Vishay: Company Snapshot

Figure 44 Vishay: SWOT Analysis

Figure 45 Broadcom: Company Snapshot

Figure 46 Broadcom: SWOT Analysis

Figure 47 Grupo Antolin: Company Snapshot

Figure 48 Koito Manufacturing: Company Snapshot

Figure 49 Koninklijke Philips: Company Snapshot

Figure 50 Stanley Electric: Company Snapshot

Figure 51 Magneti Marelli: Company Snapshot

Figure 52 Renesas: Company Snapshot

Figure 53 Excellence Optoelectronics: Company Snapshot

Growth opportunities and latent adjacency in Optoelectronics Market