Digital Instrument Cluster Market for Automotive by Display Type (LCD, TFT-LCD, OLED), Display Size (5-8 inch, 9-11 inch, >12 inch), Embedded Technology (AI, Non-AI), Electric Vehicle Type, Vehicle Type (PC and CV), and Region - Global Forecast to 2025

The digital instrument cluster market was valued at USD 1.44 Billion in 2016 and is estimated to reach USD 6.60 Billion by 2025, at a CAGR of 19.15% during the forecast period. The base year considered for the study is 2016 and the forecast period is 2017 to 2025. Factors such as rising demand for electric vehicles, growing demand for advanced cluster technology by OEMs, increasing demand for luxury vehicles, and recent trend of fully reconfigurable instrument cluster in premium vehicles are expected to drive the market.

Objectives of the Study:

- To define, describe, and project the digital instrument cluster market, in terms of volume and value, based on vehicle type (passenger cars and commercial vehicles)

- To analyze and forecast the market, in terms of volume and value, based on display type (LCD, OLED, and TFT-LCD) from 2017 to 2025

- To identify and forecast the market, in terms of volume and value, based on display size (5-8 inch, 9-11 inch, and >12 inch) from 2017 to 2025

- To analyze and forecast the market, in terms of volume and value, based on electric vehicles (BEV, FCEV, HEV, and PHEV) from 2017 to 2025

- To analyze and forecast the market, in terms of value, based on Embedded type (AI and non-AI) during the forecast period from 2017 to 2025

- To identify the market dynamics including drivers, restraints, opportunities, and challenges and analyze their impact on the digital instrument cluster market

- To profile the key digital instrument cluster suppliers and analyze the competitive leadership map for key players based on their business strategies in the past five years

The research methodology uses several secondary sources that include associations such as International Organization of Motor Vehicle Manufacturers (OICA), Emission Controls Manufacturers Association (ECMA), European Automobile Manufacturers Association (ACEA), Environmental Protection Agency (EPA), Automotive Parts Manufacturers' Association (APMA), and Original Equipment Suppliers Association (OESA), automotive electronics hardware suppliers, automotive electronics system integrators, instrument cluster manufacturing companies, automotive associations, and paid databases and directories such as Factiva and Bloomberg. In the primary research stage, experts from related industries, manufacturers, and suppliers have been interviewed to understand the present situation and future trends in the digital instrument cluster market. The market for OE has been derived by forecasting techniques in which the production and sales data for ICE and electric vehicles is multiplied with the penetration of digital instrument cluster in different vehicle types. The penetration is calculated by model mapping in every country considered in the study. A data sanity check is also done by considering the product revenues of leading OEMs in the market.

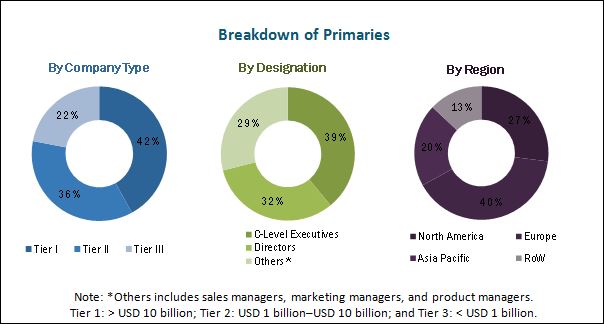

The below figure illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the digital instrument cluster market consists of digital instrument cluster manufacturers such as Bosch (Germany), Continental (Germany), Visteon (US), Delphi (UK), and Denso (Japan). These manufacturers supply digital instrument clusters to major OEMs in the automotive industry including Tesla (US), Audi (Germany), Toyota (Japan), and others.

Target Audience

- Digital instrument cluster manufacturers

- Distributors and suppliers of digital instrument cluster

- Independent and authorized dealers of digital instrument cluster

- Cockpit electronics manufacturers

- Vehicle manufacturers

- Industry associations and experts

Scope of the Report

Market, By region & country

- Asia Pacific

- Europe

- North America

- RoW

Market, By display type

- LCD

- OLED

- TFT-LCD

Market, By electric vehicle type

- BEV

- FCEV

- HEV

- PHEV

Market, By display size

- 5–8 inch

- 9–11 inch

- >12 inch

Market, By embedded type

- AI

- Non-AI

Market, By vehicle type

- Passenger cars

- Commercial vehicles

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

-

Digital instrument cluster market, by vehicle type & country, 2015–2025

- Passenger Car

- Commercial Vehicle

(The countries that will be covered will be the same as covered in this report)

- Detailed analysis and profiling of additional market players (up to 3)

The increasing demand for luxury vehicles is expected to drive the digital instrument cluster market, demand close to USD 6.60 billion by 2025

The demand for digital instrument clusters is growing at a fast rate in developed markets such as the US, Canada, Germany, and the UK. These clusters are fully reconfigurable and enable a user to customize the display content. Digital instrument clusters use TFT-LCD screen technology and feature a human machine interface (HMI) and improvised graphics. Digital instrument clusters have bigger screen panels as they constitute a higher number of electronic features than analog instrument clusters such as speed, map and navigation, communication, media-on-demand updates, system alerts, and other driving information features.

Since the trend in digital instrument clusters is to add more electronic content, the size of these clusters is increasing to accommodate all the desired information. Several OEMs such as Jaguar, Audi, Tesla, Volvo, and others have installed fully reconfigurable digital instrument clusters in their vehicles. The size of these clusters is increasing over time. The available sizes in digital instrument clusters have increased from 4 inches to 12.3 inches and beyond.

The manufacturers of instrument clusters are focusing on merging infotainment with these clusters to gather all electronic information on a single panel using a system-on-chip (SoC) platform. These chips are expected to boost the overall market, as they support the high-quality display of 3D graphics in mid-level cars.

Factors such as rising demand for luxury vehicles, increasing demand for digital instrument clusters in mid-level models from OEMs, and the decrease in the price of digital instrument clusters are expected to drive the growth of the market.

In North America, the digital instrument cluster market is estimated to grow significantly. The majority of the luxury vehicle manufacturers have a strong presence in the region. The US and Canada are expected to dominate the market in North America. However, Mexico is estimated to show the highest growth rate.

Market Dynamics

Drivers

- Rising demand for electric vehicles

- Growing demand for advanced cluster technology by OEMs

- Increasing demand for luxury vehicles

- Intense competition between instrument cluster manufacturers

Restraints

- Cyberthreats

Opportunities

- Increasing acceptance of semi-autonomous and autonomous vehicle technology

- Use of aluminum parts to make digital instrument clusters

- Increasing demand for reconfigurable instrument clusters

Challenges

- Technical challenges

Critical Questions:

- How would you see the evolution of digital instrument cluster after the launch of central 15-inch display?

- How are the industry players addressing the challenge of big screens in cars?

- Is there any upcoming disruptive technology which would impact the market?

- What are the further software developments in the digital instrument cluster?

The digital instrument cluster market is projected to grow at a CAGR of 19.15% during the forecast period and is estimated to grow from USD 1.62 Billion in 2017 to USD 6.60 Billion by 2025. The key factors driving the market are the increasing demand for luxury vehicles and electric vehicles, growing demand for advanced cluster technology by OEMs, and intense competition between manufacturers. The increasing acceptance of semi-autonomous and autonomous vehicle technology and increasing demand for reconfigurable instrument clusters will further boost the demand for market. Owing to these factors, there has been a steady increase in the use of a digital instrument cluster, particularly in electric vehicles and luxury vehicles.

The BEV segment is estimated to be the largest market for the digital instrument cluster, by electric vehicle. Asia Pacific is estimated to be the largest market for BEV. The sales of BEV vehicles is increasing at a rapid pace owing to factors such as strict emission norms, rapid development in charging infrastructure, zero-emission advantage, and government support. For instance, the sales of electric vehicles in Asia Pacific increased by around 6% from 2015 to 2016. As various governments are taking initiatives to stimulate the sales of BEVs, the BEV segment is expected to show significant growth in the future. OEMs are using a digital instrument cluster in BEVs to differentiate themselves from their competitors. For instance, according to the proposed plan of the Chinese Ministry of Industry and Information, each auto manufacturer in China is expected to make and sell 10% of its output as EVs in 2019 and 12% by 2020. Thus, there is a huge growth opportunity for digital instrument cluster in BEV segment.

The >12 inch digital instrument cluster is estimated to be the fastest growing segment of the digital instrument cluster market, by display size. The growth of >12 inch digital instrument cluster can be attributed to the increasing demand for a bigger display, increasing number of features in a digital instrument cluster, and growing demand for vehicle aesthetics. However, vehicles such as entry-level, mid-segment, and light commercial vehicles are equipped with a 5-8 inch digital instrument cluster that helps to decrease the overall cost of the vehicle.

The report classifies the market by display type into LCD, OLED, and TFT-LCD. TFT-LCD is estimated to hold the largest market share of the market, by display type. Models such as Nissan Samsung SM6, Volkswagen Golf, and Range Rover among others are installed with a 9-11 inch or >12 inch TFT-LCD.

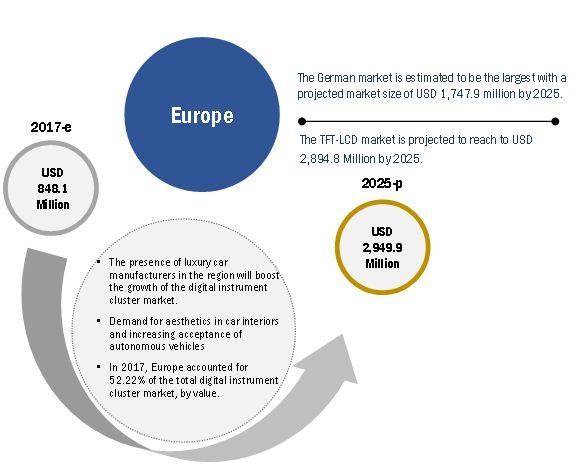

Europe is estimated to be the largest market for digital instrument cluster during the forecast period, followed by North America and the Asia Pacific. Factors such as the high proportion of passenger vehicles in the total vehicle production and growing demand for luxury vehicles and electric vehicles are expected to drive the market in Europe. The penetration of digital instrument cluster in passenger vehicles in Europe is expected to range between 26 and 36% in 2017 and is expected to reach up to 40 to 58% by 2025. The growth can be attributed to the high production capacity of luxury vehicles and demand-supply equilibrium of market.

Cyberthreat can hinder the growth of the digital instrument cluster market. Also, technical challenges such as complexity in the design and advanced graphics requirement pose a challenge for the growth of market. The market is dominated by a few global players and comprises several regional players. Some of the key manufacturers operating in the market are Bosch (Germany), Continental (Germany), Visteon (US), Denso (Japan), Delphi (UK), NVIDIA (US), Panasonic (Japan), Nippon Seiki (Japan), Magneti Marelli (Italy), and IAC Group (Luxembourg).

Rapid development of interior electronics and the rising focus on integrating instrument clusters with telematics and infotainment panels provide opportunities for the growth of the digital instrument cluster market

Liquid Crystal Display (Lcd)

The market for LCD-installed digital instrument clusters is estimated to grow owing to the increase in the sales of premium vehicles, electric vehicles, and decreasing price of LCD display. The European region is the home for premium vehicles and hence, the region is expected to lead the LCD-installed market. Moreover, owing to the stringent emission norms and mandates by governments, the sales of electric vehicles is expected to grow. Hence, the market for LCD-installed digital instrument clusters will grow in direct proportion to the increase in sales of premium and electric vehicles.

Thin Film Transistor-Liquid Crystal Display (Tft-Lcd)

In the recent few years, the trend of photorealistic graphics and the high-resolution display has been observed in instrument clusters. The trend is expected to continue and the application and the integration of HMI and AI systems with instrument clusters are also likely to increase. To integrate these systems, high-quality displays should be installed. Due to TFT-LCD’s low cost and high quality, its market share is expected to grow from 2017 to 2025 at a CAGR of 24.22%, by value.

Organic Light Emitting Diode (Oled)

OLEDs are widely used in consumer electronics applications, such as television displays, smartphones, and others. These advanced display technologies allow flexibility in design and color. They offer superior quality images and brighter displays as compared to LCD and TFT-LCD display panels. With increasing progress and advancements in autonomous and electric vehicles, which are expected to be equipped with larger and advanced displays of flexible designs, the market for advanced display technologies for automotive is expected to grow.

Critical Questions:

- Where will the increasing luxurious features take the car industry in the mid to long term?

- Will the suppliers continue to explore new avenues for digital instrument cluster?

- Which geographical markets have lower penetration of digital instrument cluster where there is a huge growth potential?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Introduction

2.4.2 Demand-Side Analysis

2.4.2.1 Increase in Disposable Income of the Consumers

2.4.2.2 Design Aesthetics

2.4.3 Supply-Side Analysis

2.4.3.1 Increasing Vehicle Sales

2.4.3.2 Integration of Advanced Technologies

2.5 Market Size Estimation

2.6 Data Triangulation

2.7 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Digital Instrument Cluster Market

4.2 Market, By Vehicle Type, 2017 vs 2025

4.3 Market, By Display Type, 2017 vs 2025

4.4 Market, By Display Size, 2017 vs 2025

4.5 Market, By Electric Vehicle, 2017 vs 2025

4.6 Market, By Embedded Technology, 2017 vs 2025

4.7 Market, By Region, 2017 vs 2025

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Electric Vehicles

5.2.1.2 Growing Demand for Advanced Cluster Technology By OEMs

5.2.1.3 Increasing Demand for Luxury Vehicles

5.2.1.4 Intense Competition Between Instrument Cluster Manufacturers

5.2.2 Restraints

5.2.2.1 Cyberthreats

5.2.3 Opportunities

5.2.3.1 Increasing Acceptance of Semi-Autonomous and Autonomous Vehicle Technology

5.2.3.2 Use of Aluminum Parts to Make Digital Instrument Clusters

5.2.3.3 Increasing Demand for Reconfigurable Instrument Clusters

5.2.4 Challenges

5.2.4.1 Technical Challenges

5.3 Macro-Indicator Analysis

5.3.1 Premium Vehicle Sales as A Percentage of Total Sales

5.3.2 GDP (USD Billion)

5.3.3 GNI Per Capita, Atlas Method (USD)

5.3.4 GDP Per Capita PPP (USD)

5.3.5 Macro Indicators Influencing the Digital Instrument Cluster Market, Top 3 Countries

5.3.5.1 US

5.3.5.2 Germany

5.3.5.3 China

5.4 Technological Overview

6 Market, By Display Type (Page No. - 49)

6.1 Introduction

6.2 Liquid Crystal Display (LCD)

6.3 Thin Film Transistor-Liquid Crystal Display (TFT-LCD)

6.4 Organic Light Emitting Diode (OLED)

7 Market, By Display Size (Page No. - 58)

7.1 Introduction

7.2 5–8 Inch

7.3 9–11 Inch

7.4 >12 Inch

8 Market, By Vehicle Type (Page No. - 67)

8.1 Introduction

8.2 Passenger Car

8.3 Commercial Vehicle

9 Market, By Embedded Technology (Page No. - 74)

9.1 Introduction

9.2 AI Based: Digital Instrument Cluster

9.3 Non-AI-Based: Digital Instrument Cluster

10 Market, By Electric Vehicle (Page No. - 80)

10.1 Introduction

10.2 Battery Electric Vehicle (BEV)

10.3 Fuel Cell Electric Vehicle (FCEV)

10.4 Plug-In Hybrid Electric Vehicle (PHEV)

10.5 Hybrid Electric Vehicle (HEV)

11 Market, By Region (Page No. - 90)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Italy

11.3.4 The UK

11.4 North America

11.4.1 Canada

11.4.2 Mexico

11.4.3 The US

11.5 RoW

11.5.1 Brazil

11.5.2 Russia

12 Competitive Landscape (Page No. - 115)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Developments

12.3.2 Expansions

12.3.3 Collaborations/Joint Ventures/Supply Contracts/Partnerships

12.3.4 Mergers & Acquisitions

13 Company Profiles (Page No. - 121)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Bosch

13.2 Continental

13.3 Denso

13.4 Panasonic

13.5 Delphi

13.6 Toshiba

13.7 Yazaki

13.8 Visteon

13.9 Magneti Marelli

13.10 Nippon Seiki

13.11 Nvidia

13.12 IAC Group

13.13 Spark Minda

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 157)

14.1 Key Industry Insights

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (76 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Market, By Display Type, 2015–2025 (‘000 Units)

Table 3 Market, By Display Type, 2015–2025 (USD Million)

Table 4 LCD: Market, By Region, 2015–2025 (‘000 Units)

Table 5 LCD: Market, By Region, 2015–2025 (USD Million)

Table 6 TFT-LCD: Market, By Region, 2015–2025 (‘000 Units)

Table 7 TFT-LCD: Market, By Region, 2015–2025 (USD Million)

Table 8 OLED: Market, By Region, 2015–2025 (‘000 Units)

Table 9 OLED: Market, By Region, 2015–2025 (USD Million)

Table 10 Market Size, By Display Size, 2015–2025 (’000 Units)

Table 11 Market Size, By Display Size, 2015–2025 (USD Million)

Table 12 5–8 Inch: Market, By Region, 2015–2025 (’000 Units)

Table 13 5–8 Inch: Market Size, By Region, 2015–2025 (USD Million)

Table 14 9–11 Inch: Market size, By Region, 2015–2025 (’000 Units)

Table 15 9–11 Inch: Market Size, By Region, 2015–2025 (USD Million)

Table 16 >12 Inch: Market Size, By Region, 2015–2025 (’000 Units)

Table 17 >12 Inch: Market Size, By Region, 2015–2025 (USD Million)

Table 18 Market, By Vehicle Type, 2015–2025 (‘000 Units)

Table 19 Market, By Vehicle Type, 2015–2025 (USD Million)

Table 20 Passenger Car: Market, By Region, 2015–2025 (‘000 Units)

Table 21 Passenger Car: Market, By Region, 2015–2025 (USD Million)

Table 22 Commercial Vehicle: Market, By Region, 2015–2025 (‘000 Units)

Table 23 Commercial Vehicle: Market, By Region, 2015–2025 (USD Million)

Table 24 Market Size, By Embedded Technology, 2015–2025 (Thousand Units)

Table 25 AI Based: Market Size, By Region, 2015–2025 (Thousand Units)

Table 26 Non-AI Based: Market Size, By Region, 2015–2025 (Thousand Units)

Table 27 Market, By EV Type, 2015–2025 (’000 Units)

Table 28 Market, By EV Type, 2015–2025 (USD Thousand)

Table 29 Battery Electric Vehicle: Market, By Region, 2015–2025 (’000 Units)

Table 30 Battery Electric Vehicle: Market, By Region, 2015–2025 (USD Thousand)

Table 31 Fuel Cell Electric Vehicle: Market, By Region, 2015–2025 (’000 Units)

Table 32 Fuel Cell Electric Vehicle: Market, By Region, 2015–2025 (USD Thousand)

Table 33 Plug-In Hybrid Electric Vehicle: Market, By Region, 2015–2025 (’000 Units)

Table 34 Plug-In Hybrid Electric Vehicle: Market, By Region, 2015–2025 (USD Thousand)

Table 35 Hybrid Electric Vehicle: Market, By Region, 2015–2025 (’000 Units)

Table 36 Hybrid Electric Vehicle: Market, By Region, 2015–2025 (USD Thousand)

Table 37 Digital Instrument Cluster, By Region, 2015–2025 (Thousand Units)

Table 38 Market, By Region, 2015–2025 (USD Million)

Table 39 Asia Pacific: Market, By Country, 2015–2025 (Thousand Units)

Table 40 Asia Pacific: Market, By Country, 2015–2025 (USD Million)

Table 41 China: Market, By Display Type, 2015–2025 (Thousand Units)

Table 42 China: Market, By Display Type, 2015–2025 (USD Million)

Table 43 India: Market, By Display Type, 2015–2025 (Thousand Units)

Table 44 India: Market, By Display Type, 2015–2025 (USD Million)

Table 45 Japan: Market, By Display Type, 2015–2025 (Thousand Units)

Table 46 Japan: Market, By Display Type, 2015–2025 (USD Million)

Table 47 South Korea: Market, By Display Type, 2015–2025 (Thousand Units)

Table 48 South Korea: Market, By Display Type, 2015–2025 (USD Million)

Table 49 Europe: Market, By Country, 2015–2025 (Thousand Units)

Table 50 Europe: Market, By Country, 2015–2025 (USD Million)

Table 51 France: Market, By Display Type, 2015–2025 (Thousand Units)

Table 52 France: Market, By Display Type, 2015–2025 (USD Million)

Table 53 Germany: Market, By Display Type, 2015–2025 (Thousand Units)

Table 54 Germany: Market, By Display Type, 2015–2025 (USD Million)

Table 55 Italy: Market, By Display Type, 2015–2025 (Thousand Units)

Table 56 Italy: Market, By Display Type, 2015–2025 (USD Million)

Table 57 UK: Market, By Display Type, 2015–2025 (Thousand Units)

Table 58 UK: Market, By Display Type, 2015–2025 (USD Million)

Table 59 North America: Market, By Country, 2015–2025 (Thousand Units)

Table 60 North America: Market, By Country, 2015–2025 (USD Million)

Table 61 Canada: Market, By Display Type, 2015–2025 (Thousand Units)

Table 62 Canada: Market, By Display Type, 2015–2025 (USD Million)

Table 63 Mexico: Market, By Display Type, 2015–2025 (Thousand Units)

Table 64 Mexico: Market, By Display Type, 2015–2025 (USD Million)

Table 65 US: Market, By Display Type, 2015–2025 (Thousand Units)

Table 66 US: Market, By Display Type, 2015- 2025 (USD Million)

Table 67 RoW: Market, By Country, 2015–2025 (Thousand Units)

Table 68 RoW: Market, By Country, 2015–2025 (USD Million)

Table 69 Brazil: Market, By Display Type, 2015–2025 (Thousand Units)

Table 70 Brazil: Market, By Display Type, 2015–2025 (USD Million)

Table 71 Russia: Market, By Display Type, 2015–2025 (Thousand Units)

Table 72 Russia: Market, By Display Type, 2015–2025 (USD Million)

Table 73 New Product Developments, 2016–2017

Table 74 Expansions, 2015–2017

Table 75 Collaborations/Joint Ventures/Supply Contracts/Partnerships, 2016–2017

Table 76 Mergers & Acquisitions, 2016–2017

List of Figures (65 Figures)

Figure 1 Digital Instrument Cluster Market: Markets Covered

Figure 2 Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Global Passenger Car Sales Data, 2005-2016

Figure 6 Market Size Estimation Methodology for Market: Bottom-Up Approach

Figure 7 Key Countries in the Market: Germany is Estimated to Be the Largest Market By 2025 (USD Billion)

Figure 8 Europe is Estimated to Be the Largest Market for Digital Instrument Cluster, 2017 vs 2025 (USD Million)

Figure 9 TFT-LCD is Estimated to Hold the Largest Share of the Market, 2017 vs 2025 (USD Million)

Figure 10 Passenger Car Segment is Estimated to Hold the Largest Share of the Market, 2017 vs 2025 (USD Million)

Figure 11 9-11 Inch is Estimated to Hold the Largest Share of the Market, 2017 vs 2025 (USD Million)

Figure 12 Artificial Intelligence (AI) is Estimated to Hold the Largest Share of the Market, 2017 vs 2025 (‘000 Units)

Figure 13 HEV is Estimated to Hold the Largest Share of the Market, 2017 vs 2025 (USD Million)

Figure 14 The Increasing Demand for Luxury Vehicles is Expected to Drive the Market

Figure 15 Passenger Cars to Hold the Largest Share, By Value, in the Market, By Vehicle Type

Figure 16 TFT-LCD to Hold the Largest Share, By Value, in the Market, By Display Type

Figure 17 9–11 Inch to Hold the Largest Share, By Value, in the Market, By Display Size

Figure 18 HEV to Hold the Largest Share, By Value, in the Market, By Electric Vehicle

Figure 19 AI to Hold the Largest Size, By Volume, in the Market, By Embedded Technology

Figure 20 Europe to Hold the Largest Market Share in the Market, 2017 vs 2025 (USD Million)

Figure 21 Digital Instrument Cluster Market: Market Dynamics

Figure 22 Electric Vehicle Sales 2010–2016

Figure 23 Global Luxury Vehicle Sales 2014–2016

Figure 24 Autonomous Vehicle Sales, 2023–2030

Figure 25 Semi-Automonous Vehicle Sales, 2015–2022

Figure 26 Tensile Strength of Materials

Figure 27 US: The Rising GNI Per Capita is Expected to Drive the Market During the Forecast Period

Figure 28 Germany: Increasing Luxury Vehicle Production is Expected to Drive the Digital Instrument Cluster Market

Figure 29 China: The Vehicle Production Year on Year Growth Will Be the Primary Macro Indicator Impacting the Market

Figure 30 Market, By Display Type, 2017 vs 2025 (USD Million)

Figure 31 LCD: Market, By Region, 2017 vs 2025 (USD Million)

Figure 32 TFT-LCD: Market, By Region, 2017 vs 2025 (USD Million)

Figure 33 OLED: Market, By Region, 2017 vs 2025 (USD Million)

Figure 34 Market, By Display Size, 2017 vs 2025 (USD Million)

Figure 35 5–8 Inch: Market, By Region, 2017 vs 2025 (USD Million)

Figure 36 9–11 Inch: Market, By Region, 2017 vs 2025 (USD Million)

Figure 37 >12 Inch: Market, By Region, 2017 vs 2025 (USD Million)

Figure 38 Market, By Vehicle Type, 2017 vs 2025 (USD Million)

Figure 39 Passenger Car: European Region to Hold the Largest Market Share, By Value, 2017 vs 2025

Figure 40 Commercial Vehicle: North American Region to Hold the Largest Market Share, By Value, 2017 vs 2022

Figure 41 Market, By Embedded Technology, 2017 vs 2025 (Thousand Units)

Figure 42 AI-Based Market, By Region, 2017 vs 2025 (Thousand Units)

Figure 43 Non-AI Based Market, By Region, 2017 vs 2025 (Thousand Units)

Figure 44 Market, By Electric Vehicle Type, 2017 vs 2025 (USD Thousand)

Figure 45 Battery Electric Vehicle: Market, By Region, 2017 vs 2025 (USD Thousand)

Figure 46 Fuel Cell Electric Vehicle: Market, 2017 vs 2025 (USD Thousand)

Figure 47 Plug-In Hybrid Electric Vehicle: Market, By Region, 2017 vs 2025 (USD Thousand)

Figure 48 Hybrid Electric Vehicle: Market, 2017 vs 2025 (USD Thousand)

Figure 49 Market, By Region, 2017 vs 2025

Figure 50 Asia Pacific: Market, 2017 vs 2025, (USD Million)

Figure 51 Europe: Market Snapshot

Figure 52 North America: Market Snapshot

Figure 53 RoW: Market, 2017 vs 2025 (USD Million)

Figure 54 Key Developments By Leading Players in the Market, 2015–2017

Figure 55 Bosch: Company Snapshot

Figure 56 Continental: Company Snapshot

Figure 57 Denso: Company Snapshot

Figure 58 Panasonic: Company Snapshot

Figure 59 Delphi: Company Snapshot

Figure 60 Toshiba: Company Snapshot

Figure 61 Yazaki: Company Snapshot

Figure 62 Visteon: Company Snapshot

Figure 63 Nippon-Seiki: Company Snapshot

Figure 64 Nvidia: Company Snapshot

Figure 65 Spark Minda: Company Snapshot

Growth opportunities and latent adjacency in Digital Instrument Cluster Market