Organic Yeast Market by Type (Yeast extracts, Yeast derivatives, Inactive dry yeast, Nutritional yeast), Application (Food, Beverage, Nutrition, Feed),Species (Saccharomyces, Torulaspora, Candida, Kluyveromyces), and Region - Global Forecast to 2025

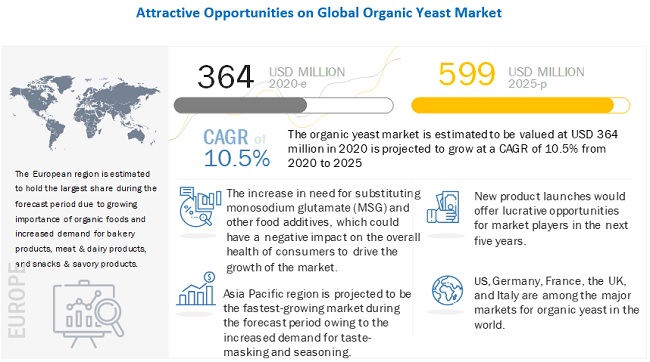

[201 Pages Report] The global organic yeast market size is estimated to be valued at USD 364 million in 2020 and is expected to reach a value of USD 599 million by 2025, growing at a CAGR of 10.5% during the forecast period. Factors such as increasing awareness among consumers about health & wellness, growing need to replace monosodium glutamate (MSG) as an additive in food products, and increased demand for organic food products across the globe is driving the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Organic Yeast Market:

Due to the pandemic, “panic-buying” became more prevalent for grocery and food ingredients. The supermarkets witnessed a surge in demand for yeast products, both active and inactive. In order to meet the demand in the initial phase of the pandemic, several sellers had cut-up the bulk product packaging and sold in smaller sachets. With the increase in time spent at home, the trend is to consume home-cooked foods, which, in turn, has led to an increase in demand for flour and yeast products. With the need for convenience and the requirement to cater to their health concerns, consumers have increased their intake of soups, healthy snacks, and salads, which has also encouraged the demand for organic yeast products. Yeast manufacturers, such as Lallemand Inc. (Canada) and Ohly (Germany), are focusing on catering to the challenges and have increased their production capacities. For instance, due to the increase in demand for dietary supplements during the pandemic, Angel Yeast Co., Ltd (China), has witnessed an expansion of its yeast beta-glucan production capacity. In another instance, Bluebonnet Nutrition Corporation (US) has undertaken stringent measures at the plant level and increased its production capacity to meet the growing demand from consumers who are targeting to improve their immunity.

Market Dynamics:

Driver:

With the increase in awareness among consumers about the benefits of organic food products, the retail sales of organic food products have increased. The US is one of the largest consumers of organic food products in the world, followed by Europe. The largest markets for organic food products in Europe are Germany, France, and Italy.

According to a report by FiBl in 2017, the market for organic food products is growing in countries such as Brazil, Mexico, Chile, and Paraguay. Similarly, the US organic sector is also witnessing an upward trajectory as consumers are witnessing a high demand for organic products, which has enabled them to acquire a larger market share. As per a survey conducted by FiBl on Standards and Legislations, nearly 93 countries had set organic standards in 2018. The number of countries developing regulations and standards for organic products is increasing. Some of the countries that have the largest retail market for organic food products include the US, China, France, Germany, and Italy.

Restraint :

There are regulatory bodies, such as the United States Department of Agriculture (USDA) and European Economic Community Council, which have laid down stringent regulations for the production, labeling, and marketing of organic products. The regulatory bodies in various regions differ and the rules pertaining to each region might vary slightly. This could cause manufacturers to focus on production in a manner, which would cater to the regulatory scenario in the importing region. The interpretation and concepts for each region vary, which could add to the overall production cost of the product. This, in turn, would increase the prices of the end products sold to consumers. The non-compliance with regulations could ban the product from the market or include a penalty. however, certain producers find loopholes within the system due to which a lot of counterfeit products have hit the shelves in European countries and the US.

Opportunity:

Monosodium glutamate (MSG) is the sodium salt of glutamic acid. It is used as an additive to offer “umami” taste in food products to improve palatability. MSG helps in enhancing the presence of other taste-active compounds. However, the use of MSG has been clinically proven to have caused health-related issues such as obesity, oxidative stress, renal, and hepatotoxicity. According to the FDA, MSG is approved to be used in the conditioning of vegetables, tuna, food dressings, and feed. The increased awareness among consumers about the toxic effects of MSG consumption in food and stringent regulations governing the maximum permissible limit (MPL) has led to a rise in demand for substitutes, which could provide similar taste-enhancing properties without any harmful effects.

Organic yeasts, such as yeast extracts, derivatives, and nutritional yeast, are used as alternatives to MSG and provide the “umami” taste. Certain organic yeast manufacturers also claim that the products offered by them can be used as an alternative to MSG. For instance, Koninklijke DSM (Netherlands) claims that their product, Maxarome, can be used in a wide range of food applications instead of MSG.

Challenge :

Although the consumption of organic food products has a positive effect on the overall health of the consumers, one of the major factors discouraging consumers is the high prices associated with organic products. Organic food products are generally costly due to the high costs associated with agricultural production and processing. The need for legal regulations and compliance in a specific country also adds to the pricing of the product.

The prices for organic food products vary from conventional products by a margin of 5%-60% for cereals & grains and 5%-30% for milk and other dairy products. In rare cases, consumers are willing to pay a premium price for these products. For instance, according to a report by the USDA, consumers are willing to pay a premium for organic chicken and eggs. There has been an increase in demand for raw and processed organic foods in developed countries in Europe and the US, where consumers are willing to pay higher, and the awareness about the benefits associated with the consumption of organic foods is also increasing among them. Key companies in various countries have extensive distribution networks, which make organic food products more accessible among consumers.

The yeast extracts segment of the organic yeast market is projected to account for the largest share, by type

Yeast extract is a natural ingredient comprising various amino acids, carbohydrates, minerals, and vitamins. Yeast extracts are used by restaurants and food companies as an aromatic ingredient and for enhancing specific flavor profiles in food and beverages. Most organic yeast extract manufacturers, such as Biospringer (France) and Ohly (Germany) offer yeast extracts for food applications, such as soups & broths, sauces & dressings, snacks & seasonings, meat, fish & analogues, dairy products, sweets, starchy goods, and beverages. With the growing awareness among consumers about nutrition and healthy foods, the need for salt, fat, and sugar reduction in food products has taken precedence. The use of yeast extracts intensifies the salt flavor in the food due to the strong umami taste and allows for specific flavor notes. Since yeast extracts are extracted from fresh yeast, it qualifies as an animal-free ingredient, which can be included in vegan and vegetarian diets. In addition, due to its nutritional characteristics, the use of yeast extracts is growing. A majority of the product lines of companies are also focused on offering yeast extracts and yeast derivatives to its consumers

The market for Saccharomyces species is projected to account for the largest share during the forecast period

Saccharomyces is a genus of fungi that includes many species of yeasts. Many members of this genus are considered important in food production. It is known as the brewer's yeast or baker's yeast. One example is, Saccharomyces cerevisiae, which is popularly known for its role in manufacturing various food and beverage products. It is a critical component in the fermentation process that converts sugar into alcohol, an ingredient shared in beer, wine, and distilled beverages. It used in a variety of snacks and savory products as seasonings to add an umami taste. In addition, it is used in feed for increasing the shelf life and palatability of pet snacks. Companies, such as Lallemand (Canada), Ohly (Germany), Koninklijke DSM N.V. (Netherlands), and Biorigin (Brazil), largely utilizes Saccharomyces. This yeast strain is used to develop various organic yeast extracts and yeast derivatives, which find increased application in the food, beverage, health, and feed industries.

The rising demand for an alternative to monosodium glutamate (MSG) to drive the organic yeast market

Monosodium glutamate (MSG) is the sodium salt of glutamic acid. It is used as an additive to offer “umami” taste in food products to improve the palatability. MSG helps in enhancing the presence of other taste-active compounds. However, the use of MSG has clinically proven to have caused health related issues such as obesity, oxidative stress, renal, and hepatotoxicity. Organic yeasts such as yeast extracts, derivatives, and nutritional yeast are used as alternatives to MSG to provide the “umami” taste. Certain organic yeast manufacturers also claim that the products offered by them can be used as an alternative to MSG.

Asia Pacific is the fastest-growing market during the forecast period in the global market

Asia Pacific is projected to be the fastest growing region due to the rise in demand for natural and organic food ingredients from the major economies such as China, India, Japan and other South east Asian countries are they experience a surged in the increase in number of health conscious consumers. With the increase in disposable income and awareness about nutrient requirement in daily diet amongst consumers have let to the increase in demand for protein rich nutritional food products. In Asia Pacific, trends around healthy lifestyles and prevention among older consumers trying to avoid expensive healthcare costs and extend healthy lifespans are generating growth opportunities dietary supplements. Thus causing organic yeast to flourish as it acts a high quality nutritional supplement as it contain vitamins, minerals and proteins which helps boost immunity.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million), Volume (Tons) |

|

Segments covered |

Type, Application, Species, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, RoW |

|

Companies covered |

Koninklijke DSM N.V (Netherlands), Lallemand (Canada), Biospringer (France), Leiber GmbH (Germany), Ohly (Germany), Levapan (Colombia), Biorigin (Brazil), Agrano Gmbh & Co. KG (Germany), Red Star Yeast Company (US), Angel Yeast Co. Ltd (China), Solgar Inc (US), Imperial Yeast (Portland), Levex (Turkey), and White Labs Copenhagen (US), and Rapunzel Naturkost (Germany) |

This research report categorizes the organic yeast market based on type, application, species, and region.

By Type:

- Yeast extracts

- Yeast derivatives

- Inactive dry yeast

- Nutritional yeast

By Application :

-

Food

- Snacks & savory products

- Soups & broths

- Sauces, seasonings & dressings

- Bakery products

- Meat products

- Other food applications (include dairy and vegan products)

-

Beverage

- Fermented beverages

- Non-fermented beverages

- Nutrition

- Feed

By Species

- Saccharomyces

- Kluyveromyces

- Torulaspora

- Candida

- Other species (include Pichia and Cryptococcus)

By region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of World (RoW)*

*Rest of the World (RoW) includes Africa and the Middle East

Recent Developments

- In April 2020, North American Corporation of Biospringer expanded its production site in Iowa, US. It expanded their yeast extract plant in Cedar Rapids, Iowa, US. This expansion is projected to support its growing market trend for naturally-sourced ingredients derived from fermentation.

- In April 2019, Lallemand Baking introduces Lal^ferm–the new brand for fresh baker’s yeast. This has expanded the organic yeast portfolio of the company.

- In January 2019, Ohly launched Ohly-GO Wall, which is a robust hydrolyzed yeast cell wall, combining the benefits of MOS and ß-glucans. This would help in improving the company’s product portfolio in the feed segment..

- In September, The company introduced ProWean, a complete solution derived from special yeast strains to enhances the health and performance before, during, and after the weaning. This has helped the company widen its animal nutrition portfolio.

Frequently Asked Questions (FAQ):

What are the significant trends that are disrupting the organic yeast market?

The demand for nutritional yeast is growing due to the increased awareness among consumers about the benefits of health and wellness leading to a higher demand for dietary supplements. Nutritonal yeast is rich in vitamins and minerals owing to which it is being increasingly adopted as a functional food.

What are some of the major regulatory challenges and restraints that the industry faces?

In the European Union and the US, only products which have been produced by making use or principles of organic agriculture can be labelled and marketed as “organic yeast”. This poses a challenge for the companies which are not necessarily based out of other regions and want to sell their products in Europe or North America. This would have an adverse effect on the overall production cost.

Which region is projected to emerge as a global leader by 2025?

The Asia Pacific region is projected to be the fastest growing region owing to the growing demand for organic yeast in the masking of meat and dairy products. The trend of convenience products is also growing in the region due to which the demand for organic yeast products in snacks & savory products is also growing.

Is there a standard price for organic yeast products? Does the price differ based on the region in which the product is sold?

Organic products are accompanied by a price premium; hence, organic products are generally 5% -80% costlier than its conventional counterpart. Influencing factors such as the medium on which yeast is grown, regulatory environment influence the price of organic yeast. The report provides the price trend prevalent for different organic yeast products.

Who are the major players in the organic yeast market?

Some of the major players in the market are Ohly (Germany), Biospringer (France), Angel Yeast Co., Ltd (China), Leiber GmbH (Germany), and Agrano GmbH (Germany). The report also covers a market share analysis of the major players in the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 ORGANIC YEAST MARKET: MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2015–2019

1.6 UNITS

1.7 STAKEHOLDERS

1.8 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 7 GLOBAL ORGANIC YEAST MARKET, 2018–2025 (USD MILLION)

FIGURE 8 YEAST EXTRACTS TO HOLD THE LARGEST MARKET SHARE DUE TO ITS WIDE APPLICATIONS IN FOOD PRODUCTS

FIGURE 9 SACCHAROMYCES ACCOUNT FOR THE LARGEST MARKET SHARE DUE TO THE INCREASE IN FOOD AND BEVERAGE APPLICATIONS

FIGURE 10 FOOD TO HOLD THE LARGEST SHARE DUE TO ITS INCREASED USED AS A SUBSTITUTE TO MONOSODIUM GLUTAMATE (MSG)

FIGURE 11 MARKET SNAPSHOT: EUROPE ACCOUNTED FOR THE LARGEST SHARE, 2019 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 OPPORTUNITIES IN THE GLOBAL MARKET

FIGURE 12 INCREASING DEMAND FOR ORGANIC FOOD PRODUCTS TO DRIVE THE GROWTH THE MARKET FOR ORGANIC YEAST

4.2 ORGANIC YEAST MARKET, BY TYPE

FIGURE 13 YEAST EXTRACTS HELD THE LARGEST MARKET SHARE IN THE ORGANIC YEAST MARKET IN 2019

4.3 EUROPE: MARKET, BY APPLICATION AND KEY COUNTRIES

FIGURE 14 EUROPE: GERMANY IS ONE OF THE LARGEST MARKETS FOR ORGANIC YEAST PRODUCTS

4.4 ORGANIC YEAST MARKET, BY SPECIES , 2020 VS 2025

FIGURE 15 SACCHAROMYCES SPECIES HELD THE LARGEST MARKET SHARE IN 2020

4.5 ORGANIC YEAST MARKET, MAJOR REGIONAL SUBMARKETS

FIGURE 16 US ACCOUNTED FOR THE LARGEST SHARE IN THE ORGANIC YEAST MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 41)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INCREASED LAND AREA UNDER ORGANIC AGRICULTURE

FIGURE 17 GLOBAL ORGANIC AGRICULTURE, BY REGION (2017)

FIGURE 18 TOP TEN COUNTRIES WITH LARGE AREAS UNDER ORGANIC FARMING, 2017 (MILLION HECTARES)

5.2.2 INCREASE IN PRODUCTION OF WINE AND FERMENTED BEVERAGES

FIGURE 19 INCREASING WINE PRODUCTION AT A GLOBAL SCALE, 2014 – 2018 (MILLION HL)

5.3 MARKET DYNAMICS

FIGURE 20 INCREASE IN DEMAND FOR CONVENIENCE FOODS DUE TO FAST-PACED LIFESTYLE AMONG CONSUMERS TO DRIVE THE MARKET FOR ORGANIC YEAST

5.3.1 DRIVERS

5.3.1.1 Increase in demand for organic food products across the globe

FIGURE 21 DISTRIBUTION OF RETAIL SALES OF ORGANIC PRODUCTS, 2017

5.3.1.2 Fast-paced lifestyle of consumers and changing consumption patterns

5.3.2 RESTRAINTS

5.3.2.1 Stringent regulations governing the production and marketing of organic products

5.3.3 OPPORTUNITIES

5.3.3.1 Increase in awareness about health & wellness to drive the demand for nutritional yeast

5.3.3.2 Increase in use as an alternative to monosodium glutamate (MSG) to provide “umami” taste in food products

5.3.3.3 Growing trend of veganism and vegetarianism among consumers

FIGURE 22 RETAIL SALES OF PLANT-BASED FOOD PRODUCTS, 2019 (USD MILLION)

5.3.4 CHALLENGES

5.3.4.1 High costs associated with organic products

5.3.4.2 Intense competition and product rivalry due to similar products

5.4 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS

5.5 PATENT ANALYSIS

FIGURE 24 NUMBER OF PATENTS GRANTED FOR YEAST PRODUCTS, 2015–2020

FIGURE 25 REGIONAL ANALYSIS OF PATENTS GRANTED IN THE YEAST MARKET, 2015–2020

TABLE 2 LIST OF A FEW PATENTS IN THE YEAST MARKET, 2015–2020

5.6 MARKET ECOSYSTEM

5.7 AVERAGE PRICE ANALYSIS

FIGURE 26 AVERAGE PRICE TREND FOR ORGANIC YEAST PRODUCTS, 2015–2020 (USD/KG)

5.8 TRADE ANALYSIS

FIGURE 27 KEY COUNTRIES EXPORTING INACTIVE YEAST PRODUCTS, 2019 (USD MILLION)

5.9 YC–YCC SHIFTS IN THE ORGANIC YEAST MARKET

FIGURE 28 DEMAND FOR VEGAN FOODS AND MEAT-BASED SNACKS IS THE NEW HOT BET IN THE MARKET

5.10 REGULATORY FRAMEWORK

5.10.1 NORTH AMERICA

5.10.1.1 US

5.10.1.2 Canada

5.10.2 EUROPE

5.10.3 ASIA PACIFIC

5.10.3.1 India

5.10.3.2 China

5.10.3.3 South Korea

5.10.3.4 Thailand

5.10.3.5 Japan

5.10.4 SOUTH AMERICA

5.10.4.1 Brazil

5.10.5 REST OF THE WORLD

5.11 COVID-19 IMPACT ON THE ORGANIC YEAST MARKET

5.12 CASE STUDY ANALYSIS

5.12.1 SAMPLE: YEAST MARKET – GLOBAL FORECAST TO 2025

6 ORGANIC YEAST MARKET, BY TYPE (Page No. - 66)

6.1 INTRODUCTION

FIGURE 29 MARKET SIZE FOR ORGANIC YEAST, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 3 GLOBAL MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 4 MARKET SIZE FOR ORGANIC YEAST, BY TYPE, 2018–2025 (TON)

6.1.1 NEED FOR IMPROVED AROMA AND FLAVOR PROFILES IN FOOD AND BEVERAGES TO DRIVE THE GROWTH OF THE ORGANIC YEAST EXTRACTS MARKET

TABLE 5 ORGANIC YEAST MARKET SIZE FOR YEAST EXTRACTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 6 MARKET SIZE FOR YEAST EXTRACTS, BY REGION, 2018–2025 (TON)

6.2 YEAST DERIVATIVES

6.2.1 NEED FOR IMPROVING THE NUTRITIONAL PROPERTIES OF FEED PRODUCTS ENCOURAGE THE GROWTH OF THE MARKET

TABLE 7 YEAST DERIVATIVES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 YEAST DERIVATIVES MARKET SIZE, BY REGION, 2018–2025 (TON)

6.3 NUTRITIONAL YEAST

6.3.1 INCREASE IN PREFERENCE OF CONSUMERS FOR DIETARY SUPPLEMENTS TO DRIVE THE GROWTH OF THE MARKET

TABLE 9 NUTRITIONAL YEAST MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 NUTRITIONAL YEAST MARKET SIZE, BY REGION, 2018–2025 (TON)

6.4 INACTIVE DRY YEAST

6.4.1 INCREASE IN CONSUMPTION OF ORGANIC BAKERY PRODUCTS WITH DIFFERENT FLAVOR PROFILES TO DRIVE THE DEMAND FOR INACTIVE DRY YEAST

TABLE 11 INACTIVE DRY YEAST MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 INACTIVE DRY YEAST MARKET SIZE, BY REGION, 2018–2025 (TON)

7 ORGANIC YEAST MARKET, BY APPLICATION (Page No. - 74)

7.1 INTRODUCTION

FIGURE 30 ORGANIC YEAST MARKET SHARE (VALUE), BY APPLICATION, 2020 VS. 2025

TABLE 13 GLOBAL MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 14 GLOBAL MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

7.2 FOOD

7.2.1 INCREASE IN THE NUMBER OF HEALTH-CONSCIOUS PEOPLE OPTING FOR ORGANIC AND CLEAN-LABELED FOOD ITEMS TO DRIVE THE DEMAND FOR ORGANIC YEAST

TABLE 15 MARKET SIZE FOR FOOD, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 MARKET SIZE FOR FOOD, BY REGION, 2018–2025 (TON)

TABLE 17 GLOBAL MARKET SIZE FOR FOOD, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

FIGURE 31 MARKET SHARE (VALUE), BY FOOD SUBAPPLICATION, 2019

7.2.2 SNACKS & SAVORY PRODUCTS

7.2.2.1 Organic yeast to witness an increase in demand as the need to enhance the taste of snacks and savory products without using artificial food additives persist

TABLE 18 ORGANIC YEAST MARKET SIZE FOR SNACKS & SAVORY PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

7.2.3 SOUPS & BROTHS

7.2.3.1 Adding healthy nutrients and increasing the depth of flavor in soups and broth to drive the market of organic yeast

TABLE 19 MARKET SIZE FOR SOUPS & BROTHS, BY REGION, 2018–2025 (USD MILLION)

7.2.4 SAUCES, SEASONINGS & DRESSINGS

7.2.4.1 Increase in consumption of healthy and tasty sauces, seasonings & dressings for improved taste to drive the market growth for organic yeast

TABLE 20 ORGANIC YEAST MARKET SIZE FOR SAUCES, SEASONINGS & DRESSINGS, BY REGION, 2018–2025 (USD MILLION)

7.2.5 BAKERY PRODUCTS

7.2.5.1 Addition of nutritional value in bakery products to drive the growth of the market

TABLE 21 ORGANIC YEAST MARKET SIZE FOR BAKERY, BY REGION, 2018–2025 (USD MILLION)

7.2.6 MEAT PRODUCTS

7.2.6.1 High savory profile of organic yeast extracts that are similar to meat products to drive the market growth

TABLE 22 MARKET SIZE FOR MEAT PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

7.2.7 OTHER FOOD APPLICATIONS

7.2.7.1 Fat reduction and improved taste in dairy products in vegan and vegetarian dishes to increase the use of organic yeast

TABLE 23 MARKET SIZE FOR OTHER FOOD APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

7.3 BEVERAGE

7.3.1 INCREASE IN CONSUMPTION OF ORGANIC WINE TO DRIVE THE MARKET GROWTH OF THE MARKET

TABLE 24 MARKET SIZE FOR BEVERAGES, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 MARKET SIZE FOR BEVERAGE, BY REGION, 2018–2025 (TON)

TABLE 26 GLOBAL MARKET SIZE, BY BEVERAGES, 2018–2025 (USD MILLION)

7.3.2 FERMENTED BEVERAGE

7.3.2.1 Preference for organic products and sustainability concerns to encourage the purchase of organic alcoholic beverages

TABLE 27 ORGANIC YEAST MARKET SIZE FOR FERMENTED BEVERAGES, BY REGION, 2018–2025 (USD MILLION)

7.3.3 NON-FERMENTED BEVERAGES

7.3.3.1 Taste and texture improvement in fruits and vegetable juices to drive the market growth for organic yeast

TABLE 28 MARKET SIZE FOR NON-FERMENTED BEVERAGES, BY REGION, 2018–2025 (USD MILLION)

7.4 NUTRITION

7.4.1 IMMUNITY BOOSTING PROPERTIES OF ORGANIC YEAST TO DRIVE THE DEMAND FOR NUTRITIONAL YEAST

TABLE 29 MARKET SIZE FOR NUTRITION, BY REGION, 2018–2025 (USD MILLION)

TABLE 30 MARKET SIZE FOR NUTRITION, BY REGION, 2018–2025 (TON)

7.5 FEED

7.5.1 RISING PREVALENCE OF DISEASES IN ANIMALS AND INCREASING AWARENESS ON ANIMAL HEALTH TO DRIVE THE GROWTH OF THE MARKET

TABLE 31 MARKET SIZE FOR FEED, BY REGION, 2018–2025 (USD MILLION)

TABLE 32 ORGANIC YEAST MARKET SIZE FOR FEED, BY REGION, 2018–2025 (TON)

8 ORGANIC YEAST MARKET, BY SPECIES (Page No. - 90)

8.1 INTRODUCTION

FIGURE 32 MARKET SHARE (VALUE), BY SPECIES, 2020 VS. 2025

TABLE 33 MARKET SIZE FOR ORGANIC YEAST, BY SPECIES, 2018–2025 (USD MILLION)

8.2 SACCHAROMYCES

8.2.1 RISE IN APPLICATIONS IN THE FOOD, BEVERAGE, HEALTH, AND FEED INDUSTRIES AND ITS INCREASED AVAILABILITY TO DRIVE THE GROWTH OF THE MARKET

TABLE 34 MARKET SIZE IN SACCHAROMYCES, BY REGION, 2018–2025 (USD MILLION)

8.3 CANDIDA

8.3.1 APPLICATION OF CANDIDA IN FEED PRODUCTS PROVIDES NUTRITION TO POULTRY, COWS, FISHES, AND PIGS DRIVING THE DEMAND FOR ORGANIC YEAST

TABLE 35 MARKET SIZE IN CANDIDA, BY REGION, 2018–2025 (USD MILLION)

8.4 KLUYVEROMYCES

8.4.1 NO REQUIREMENT FOR DEBITTERING HAS REDUCED MANUFACTURING COSTS AND INCREASED ITS USE AS A FLAVORING AGENT IN FOOD & BEVERAGE PRODUCTS

TABLE 36 MARKET SIZE IN KLUYVEROMYCES, BY REGION, 2018–2025 (USD MILLION)

8.5 TORULASPORA

8.5.1 INCREASE IN FERMENTATION FOR PRODUCING A DIFFERENT STYLE OF WINE TO DRIVE THE GROWTH OF THE MARKET

TABLE 37 MARKET SIZE IN TORULASPORA, BY REGION, 2018–2025 (USD MILLION)

8.6 OTHER SPECIES

8.6.1 SPECIES SUCH AS PICHIA AND CRYPTOCOCCUS ARE USED AS SUPPLEMENTS IN FEED

TABLE 38 MARKET SIZE IN OTHER SPECIES, BY REGION, 2018–2025 (USD MILLION)

9 ORGANIC YEAST MARKET, BY REGION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 33 ORGANIC RETAIL SALES, 2017 (USD MILLION)

FIGURE 34 INDIA TO GROW AT THE HIGHEST CAGR IN THE GLOBAL MARKET DURING THE FORECAST PERIOD

TABLE 39 GLOBAL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 GLOBAL MARKET SIZE, BY REGION, 2018–2025 (TON)

9.2 NORTH AMERICA

FIGURE 35 THE US DOMINATED THE NORTH AMERICAN ORGANIC YEAST MARKET IN 2019

TABLE 41 NORTH AMERICA: ORGANIC YEAST MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY TYPE, 2018–2025 (TON)

TABLE 44 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (TON)

TABLE 46 NORTH AMERICA: MARKET FOR FOOD, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET FOR BEVERAGE, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY SPECIES, 2018–2025 (USD MILLION)

9.2.1 US

9.2.1.1 Increase in production of beef, pork, and dairy products has led to a rise in the use of healthy feed additives driving the growth of the organic yeast market in the US

TABLE 49 US: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.2.2 CANADA

9.2.2.1 The well-established food processing industry and an increase in production and export of organic food products to drive the demand for organic yeasts

TABLE 50 CANADA: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.2.3 MEXICO

9.2.3.1 Increase in retail sales of organic foods products in Mexico to drive the growth of the market

TABLE 51 MEXICO: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3 EUROPE

FIGURE 36 TOP WINE PRODUCING COUNTRIES IN EUROPE, 2018

FIGURE 37 EUROPE: ORGANIC YEAST MARKET SNAPSHOT

TABLE 52 EUROPE: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 EUROPE: MARKET, BY TYPE, 2018–2025 (TON)

TABLE 55 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 EUROPE: MARKET, BY APPLICATION, 2018–2025 (TON)

TABLE 57 EUROPE: MARKET FOR FOOD, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 58 EUROPE: MARKET FOR BEVERAGES, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY SPECIES, 2018–2025 (USD MILLION)

9.3.1 FRANCE

9.3.1.1 Increase in consumption of organic snacks and baked products in France to drive the growth of the market

TABLE 60 FRANCE: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.2 GERMANY

9.3.2.1 High production and export of meat products encourage the demand for high-quality feed products driving the growth of the market

TABLE 61 GERMANY: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.3 ITALY

9.3.3.1 Increase in consumption of organic food and beverage products to drive the growth of the market in Italy

FIGURE 38 ITALY: ORGANIC FOOD RETAIL SALES

TABLE 62 ITALY: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.4 SPAIN

9.3.4.1 Increase in production of poultry meat and demand for organic chicken to encourage the application of organic yeast in the feed nutrition industry

TABLE 63 SPAIN: MARKET SIZE FOR ORGANIC YEAST, BY TYPE, 2018–2025 (USD MILLION)

9.3.5 UK

9.3.5.1 Growth in the nutritional supplement market and increase in consumption of organic food products to drive the growth of the organic yeast market in the UK

TABLE 64 INCREASE IN FEED PRODUCTION, BY LIVESTOCK (2016-2017)

TABLE 65 UK: MARKET SIZE FOR ORGANIC YEAST, BY TYPE, 2018–2025 (USD MILLION)

9.3.6 RUSSIA

9.3.6.1 Increase in export of meat products to encourage the demand for nutritional feed to drive the growth of the market in Russia

FIGURE 39 RUSSIA: MEAT EXPORT 2018–2019 (TON)

TABLE 66 RUSSIA: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.3.7 SWEDEN

9.3.7.1 Growing popularity of organic wine to increase the use of organic yeasts in alcoholic fermentation

TABLE 67 SWEDEN: MARKET SIZE FOR ORGANIC YEAST, BY TYPE, 2018–2025 (USD THOUSAND)

9.3.8 REST OF EUROPE

9.3.8.1 The increase in awareness about health benefits accrued to consumption of organic products is driving the growth of the market

TABLE 68 REST OF EUROPE: MARKET SIZE FOR ORGANIC YEAST, BY TYPE, 2018–2025 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 40 CHINA DOMINATED THE ASIA PACIFIC ORGANIC YEAST MARKET

TABLE 69 ASIA PACIFIC: ORGANIC YEAST MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 70 ASIA PACIFIC: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET, BY TYPE, 2018–2025 (TON)

TABLE 72 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 74 ASIA PACIFIC: MARKET SIZE FOR FOOD, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 75 ASIA PACIFIC: MARKET FOR BEVERAGE, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET, BY SPECIES, 2018–2025 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Increase in focus on effective feed nutrition for improved animal productivity to increase the use of organic yeast in China

TABLE 77 CHINA: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.2 INDIA

9.4.2.1 Government regulations encourage breweries to use yeast in high amount for the production of alcoholic beverages, which increases the demand for yeast products

TABLE 78 INDIA: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.3 JAPAN

9.4.3.1 Increase in preference for natural wine and sports nutrition in Japan to drive the market growth of organic yeast

FIGURE 41 JAPAN T0TAL WINE IMPORTS, 2017–2018

TABLE 79 JAPAN: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.4 THAILAND

9.4.4.1 Increase in consumption of sweet and savory snacks and rise in demand for healthy functional beverages to drive the growth of the market.

TABLE 80 THAILAND: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.5 SOUTH KOREA

9.4.5.1 Need for high-quality feed products for enhanced productivity of animals to drive the demand for organic yeast

TABLE 81 SOUTH KOREA: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.6 MALAYSIA

9.4.6.1 Need for high-quality feed products for lowering agricultural imports of feed products to create growth opportunities for organic yeast manufacturers in Malaysia

TABLE 82 MALAYSIA: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.4.7 REST OF ASIA PACIFIC

9.4.7.1 Increase in livestock production has led to a rise in demand for high-quality feed products driving the growth of the market of organic yeast

TABLE 83 REST OF ASIA PACIFIC: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5 SOUTH AMERICA

TABLE 84 SOUTH AMERICA: ORGANIC YEAST MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 85 SOUTH AMERICA: MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 SOUTH AMERICA: MARKET, BY TYPE, 2018–2025 (TON)

TABLE 87 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 88 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018-2025 (TON)

TABLE 89 SOUTH AMERICA: MARKET SIZE FOR FOOD, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 90 SOUTH AMERICA: MARKET SIZE FOR BEVERAGES, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 91 SOUTH AMERICA: MARKET SIZE, BY SPECIES, 2018–2025 (USD THOUSAND)

9.5.1 BRAZIL

9.5.1.1 Increase in production and consumption of beer in the country to drive the growth of the market in Brazil

TABLE 92 BRAZIL: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.2 ARGENTINA

9.5.2.1 High production and export of beef and dairy products to drive the demand for organic yeasts to improve animal performance

TABLE 93 ARGENTINA: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.5.3 REST OF SOUTH AMERICA

9.5.3.1 Increase in consumption of processed foods and dairy products to drive the demand for organic yeast

TABLE 94 REST OF SOUTH AMERICA: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD THOUSAND)

9.6 ROW

TABLE 95 ROW: ORGANIC YEAST MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 96 ROW: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 ROW: MARKET SIZE , BY TYPE, 2018–2025 (TON)

TABLE 98 ROW: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 99 ROW: MARKET SIZE , BY APPLICATION, 2018–2025 (TON)

TABLE 100 ROW: MARKET SIZE FOR FOOD, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 101 ROW: MARKET FOR BEVERAGES, BY SUBAPPLICATION, 2018–2025 (USD MILLION)

TABLE 102 ROW: ORGANIC YEAST MARKET, BY SPECIES, 2018–2025 (USD MILLION)

9.6.1 MIDDLE EAST

9.6.1.1 Rise in sales of organic food products and wide application of organic yeast to drive the growth of the market in the Middle East.

TABLE 103 MIDDLE EAST: ORGANIC YEAST MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

9.6.2 AFRICA

9.6.2.1 Increase in production and export or organic wine to drive the growth of the market in Africa.

TABLE 104 AFRICA: ORGANIC YEAST MARKET SIZE , BY TYPE, 2018–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 148)

10.1 OVERVIEW

10.2 COMPETITIVE LEADERSHIP MAPPING

10.2.1 STAR

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

FIGURE 42 ORGANIC YEAST MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 43 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE ORGANIC YEAST MARKET, 2016–2019

10.3 MARKET SHARE AND RANKING ANALYSIS, 2019

FIGURE 44 KEY PLAYERS, SUCH AS LALLEMAND, OHLY, AND DSM, LED THE ORGANIC YEAST MARKET IN 2019

10.4 COMPETITIVE SCENARIO

FIGURE 45 MARKET EVALUATION FRAMEWORK

10.4.1 NEW PRODUCT LAUNCHES

TABLE 105 NEW PRODUCT LAUNCHES, 2018–2020

10.4.2 EXPANSIONS & INVESTMENTS

TABLE 106 EXPANSIONS, 2017

10.4.3 ACQUISITIONS

TABLE 107 ACQUISITIONS, 2017–2019

10.4.4 PARTNERSHIPS, MERGERS, AND COLLABORATIONS

TABLE 108 PARTNERSHIPS, MERGERS, AND COLLABORATIONS, 2017–2019

11 COMPANY PROFILES (Page No. - 156)

11.1 INTRODUCTION

(Business overview, Products offered, Recent developments, SWOT analysis & Right to win)*

11.2 MANUFACTURERS

11.2.1 KONINKLIJKE DSM N.V.

FIGURE 46 KONINKLIJKE DSM N.V.: COMPANY SNAPSHOT

11.2.2 LALLEMAND INC.

11.2.3 OHLY

FIGURE 47 OHLY: COMPANY SNAPSHOT

11.2.4 BIOSPRINGER (LESAFFRE)

11.2.5 ANGEL YEAST CO., LTD

11.2.6 RED STAR YEAST COMPANY LLC

11.2.7 SOLGAR INC

11.2.8 IMPERIAL YEAST

11.2.9 LEVAPAN S.A.

11.2.10 LEIBER GMBH

11.2.11 WHITE LABS COPENHAGEN

11.2.12 BIORIGIN

11.2.13 LEVEX

11.2.14 AGRANO GMBH & CO. KG

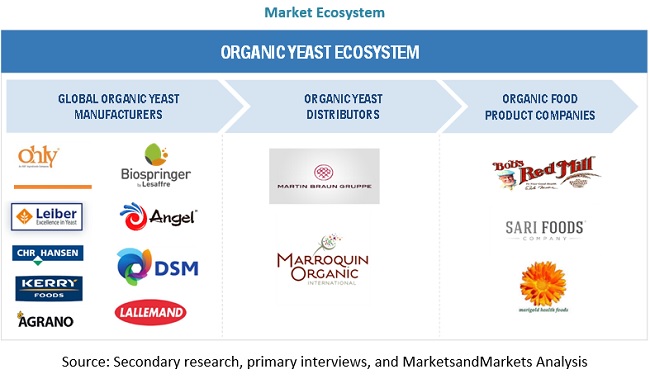

11.3 DISTRIBUTORS

11.3.1 MARTIN BRAUN GRUPPE

11.3.2 MARR0QUIN ORGANIC

11.4 END-PRODUCT MANUFACTURERS

11.4.1 MARIGOLD HEALTH FOODS LTD.

11.4.2 FRONTIER CO-OP

11.4.3 SARI FOODS CO.

11.4.4 NOW FOODS

11.4.5 RAPUNZEL NATURKOST

11.4.6 BOB’S RED MILL NATURAL FOODS

11.4.7 DOVES FARMS FOODS LTD

11.4.8 BLUEBONNET NUTRITION CORPORATION

11.4.9 CAMPBELL’S SOUP COMPANY

FIGURE 48 CAMPBELL’S FOOD COMPANY: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent developments, SWOT analysis & Right to win might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 194)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

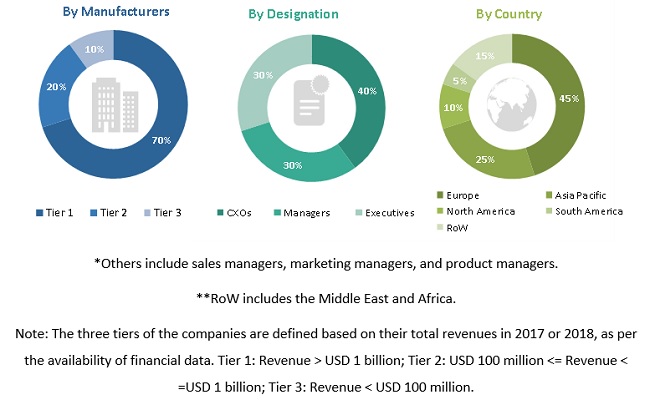

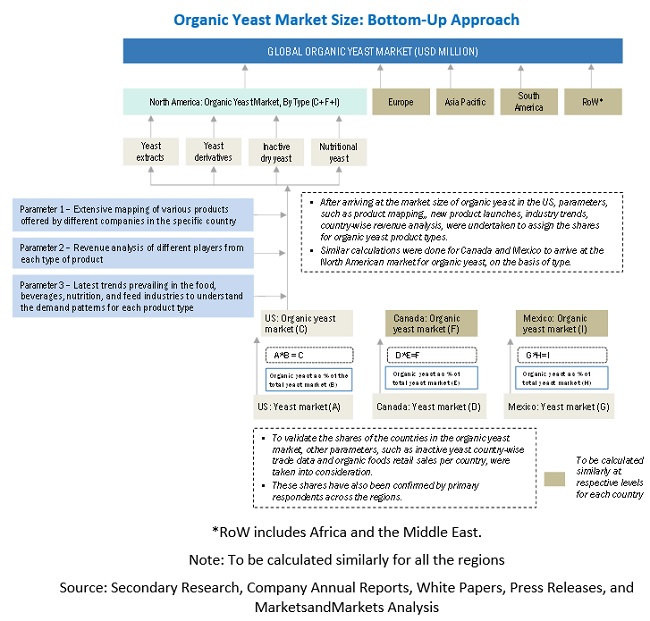

The study involves four major activities to estimate the current market size of the organic yeast market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The market comprises several stakeholders such food and feed manufacturers,, commercial research organisations/agencies/laboratories, and regulatory bodies such as the intermediary suppliers, wholesalers, traders, research institutes and organization, and regulatory bodies such as United States Department of Agriculture (USDA), Confederation of Yeast Producers in the European Union (COFALEC) , European Commission (EU), European Association for Specialty Yeast Products (EURASYP), European Food & Feed Cultures Association (EFFCA), and American Nutrition Association (ANA)

The demand side is comprised of strong demand from the various food, beverage, nutritional supplements, and feed manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the organic yeast market.

Report Objectives

- To define, segment, and estimate the size of the market with respect to its type, application, species, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

Geographic Analysis

- Further breakdown of the Rest of Europe market for organic yeast which includes countries such as Norway, Austria, Switzerland, and Hungary

- Further breakdown of the Rest of Asia Pacific market for organic yeast , which includes countries such as Philippines, Indonesia, and Vietnam.

- Further breakdown of the Rest of South America market for organic yeast which includes countries such as Peru, Uruguay, Chile, and Venezuela

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Organic Yeast Market