Specialty Yeast Market by Type (Yeast Extracts, Yeast Autolysates, Yeast Beta-glucan, and Other Yeast Derivatives), Species (Saccharomyces Cerevisiae, Pichia Pastoris, Kluyveromyces), Application and Region – Global Forecast to 2027

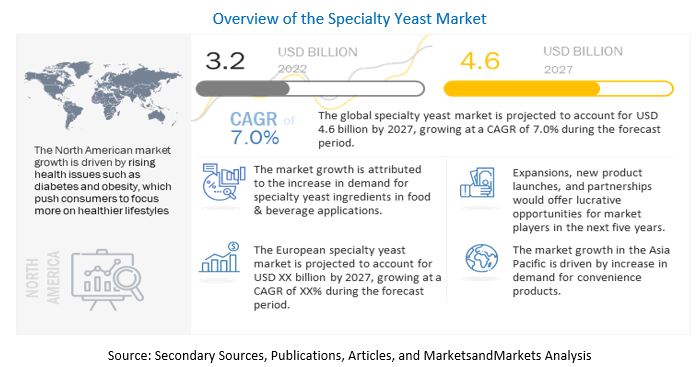

The global specialty yeast market is estimated to be valued at USD 3.2 billion in 2022. It is projected to reach USD 4.6 billion by 2027, with a CAGR of 7.0%, in terms of value between 2022 and 2027. Specialty yeasts are natural ingredients that enhance the nutritional profile of food and feed products and provide a strong taste and flavor profile. They cater to a range of applications across food & beverage industries and are also becoming increasingly popular among the consumers because of their perceived health benefits of nutritive values and antioxidant properties.

- Diverse application range: Specialty yeast has a wide range of applications in various industries such as food and beverage, animal feed, bio-based products, and personal care.

- Growing demand for functional yeast-based food products: The increasing demand for functional food products, such as probiotic yogurt, that can provide health benefits is driving the growth of the specialty yeast market.

- Growing demand for natural ingredients: The increasing demand for natural ingredients in food and beverage products is driving the growth of the specialty yeast market as yeast is a natural ingredient.

- Innovations and advancements in yeast production: The advancements in yeast production technology have led to the development of new and improved yeast strains with improved performance and functionalities.

- Growing demand for plant-based and vegan products: The growing demand for plant-based and vegan food products is driving the growth of the specialty yeast market, as yeast is a key ingredient in many plant-based and vegan food items.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: Increasing demand for specialty yeast ingredients in food & beverage applications

Specialty yeast products such as yeast extracts, yeast autolysates, and other yeast derivatives are used in food & beverage products for their flavor-enhancing properties. The distinctive flavoring quality of yeast extracts differentiates them from other yeast products, leading to an increase in demand for specialty yeast in the industry.

An increase in the consumption of alcoholic beverages is one of the major factors driving the market for specialty yeast. Global consumption of alcoholic beverages, such as wine and beer, has been increasing over the last few years; with yeast being an essential ingredient in the production, the demand for yeast is increasing. Therefore, the growing demand for premium products of wine and beer is fueling the market for specialty yeast.

Restraints: Stringent food safety regulations

In Asian countries, red yeast rice is made by cultivating rice with various strains of Monascus purpureus. This rice product contains a considerable amount of monacolin K, a chemical ingredient similar to the cholesterol-lowering drug, lovastatin. According to the US Food and Drug Administration (FDA), red yeast rice products that contain more than a certain level of monacolin K cannot be sold legally as a dietary supplement. Some red yeast rice products contain the contaminant “citrinin,” which can cause kidney failure. This implies potential adverse effects, about which consumers need to be informed, in case they are supplied in the form of food supplements. The labeling rules, in the case of such products, in European countries, are very stringent.

The American Heart Association warns against using red yeast until the studies regarding their safety are concluded. Therefore, it is challenging for the producers of this type of yeast to market it as a food ingredient.

Opportunities: Growing demand for clean label products in developed countries

Specialty yeasts are considered among the rapidly growing food ingredients, gradually replacing synthetic flavors such as MSG to reduce the glutamic acid and salt content in foodstuffs. An upward trend has been witnessed over the past decade in the demand for low-salt and no-MSG foods, which is eventually driving the yeast ingredients market. These trends have been increasing mainly due to consumer health awareness and growing food security demand, which is also evident from the fact that specialty yeast ingredients can maintain a good flavor under the very low-salt conditions; as the attributes of food flavor substances, yeast extracts are extensively replacing salt and MSG in processed food products.

The increasing aging population, globally, is demanding functional foods that are natural and minimally processed. Natural food ingredients such as yeast extracts play a major role in offering a clean label for various food & beverage products. Also, the increase in demand for ready-to-eat and convenience foods is fueling the market for specialty yeast. The higher nutritional value of the specialty yeast is influencing the market, along with gaining popularity in the pharmaceutical industry. Technology such as encapsulation also creates an opportunity for clean label yeast in the market.

Challenges: Commercialization of duplicate & low-quality products

Lack of transparency in patent protection laws and regulatory compliance in various developing countries leads to duplication of products, in turn hampering the quality of the final product. The growing demand for specialty yeast in the market globally as well as domestically is fueling the market for duplicate products. The growth in the number of adulteration incidences is aided by the difficulty in distinguishing between natural and synthetic yeast is a big concern for specialty yeast producers.

There are many local players, especially in developing countries, producing yeast-based food and feed products that are not recognized brands. These manufacturers sell their products cheaper than the actual specialty yeast product, gaining profits. Manufacturers of specialty yeast-based products are influenced by the low cost, which hinders the overall market growth.

By type, yeast autolysates is projected to witness significant growth rate during the forecast period.

Based on type, yeast autolysates account for the second-fastest growing segment in the specialty yeast market. Yeast autolysates are gaining widespread acceptance with the rise in demand for natural and clean-label ingredients among consumers due to which they have witnessed significant growth in recent years. Yeast autolysates offer a rich source of essential nutrients such as proteins, vitamins, fiber, and other micronutrients are used to enhance the color and flavor across a large number of food products.

By species, Kluyveromyces accounts for the second-largest market share in the market

Based on species, Kluyveromyces accounts for the second-largest segment in the specialty yeast market. Kluyveromyces caters across a range of different industries which drives their market growth and demand. They find extensive applications in fermented dairy industry as they produce â-galactosidase, which helps in utilization of lactase used in dairy products such as cheese, yogurt and kefir. Along with that, they also cater to a range of other industries such as flavor, fragrance and dietary supplement.

By application, the beverages segment accounts for the second-largest market share in the market

By application, the beverages segment accounts for the second-largest segment and is expected to witness significant growth during the forecast period. Specialty yeasts are extensively used in the production and fermentation of alcoholic and non-alcoholic beverages for fermentation due to which they experience significant demand from the beverages industry. A large number of species such as Saccharomyces cerevisiae, Torulaspora delbrueckii, Pichia kluyveri, and Kluyveromyces thermotolerans are used in combination or as an individual strain for fermentation of beverages.

To know about the assumptions considered for the study, download the pdf brochure

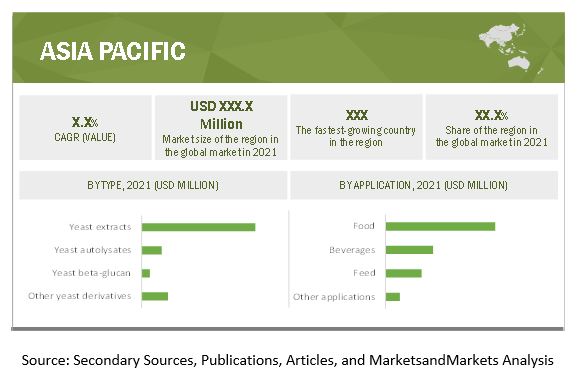

Asia Pacific region accounts for the fastest growing region in the market. The growth in this region is primarily attributed to the rise in awareness regarding natural food ingredients which has led to the acceptance of specialty yeast products in the region. Furthermore, the region has also well-established markets for wine, sauces, dairy, and bakery products in countries such as China, Japan, and India. The popularity of domestic consumption of traditional fermented food in countries such as Thailand and the Philipines have also contributed significantly to the growth of specialty yeast industry in the region.

Key Market Players

Key players in this market include Associated British Foods Plc (UK), ADM (US), Lallemand Inc. (Canada), DSM (Netherlands), Chr. Hansen Holding A/S (Denmark), Kerry Group Plc. (Ireland), Lesaffre (France), AngelYeast Co., Ltd. (China), Biorigin (Brazil), Kemin Industries, Inc. (US).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2017–2027 |

|

Base year considered |

2021 |

|

Forecast period considered |

2022–2027 |

|

Units considered |

Value (USD Million/Billion) and Volume (KT) |

|

Segments covered |

Type, species, application, and region |

|

Regions covered |

Europe, Asia Pacific, North America, and RoW |

|

Companies studied |

|

Target Audience:

- Manufacturers, importers and exporters, traders, distributors, and suppliers of specialty yeast

- Pharmaceutical and nutraceutical manufacturers

- Feed processors and manufacturers

- Government and research organizations

- Trade associations and industry bodies

- Public and commercial research institutions/agencies/laboratories

-

Regulatory bodies and associations, which include the following:

- Food Agriculture Organization (FAO)

- United States Department of Agriculture (USDA)

- European Food Safety Authority (EFSA)

- Food Standards Australia New Zealand (FSANZ)

- European Association for Specialty Yeast Products (EURASYP)

- European Food & Feed Cultures Association (EFFCA)

- American Nutrition Association (ANA)

- The European Federation of National Associations of Measurement, Testing, and Analytical Laboratories (EUROLAB)

This research report categorizes the specialty yeast market based on type, species, application, and region.

By Type

- Yeast extracts

- Yeast autolysates

- Yeast beta-glucan

- Other yeast derivatives (yeast flavor enhancers, yeast saccharides, and yeast pigments)

By species

- Saccharomyces cerevisiae

- Kluyveromyces

- Pichia pastoris

- Other species (Torulaspora delbrueckii, Metschnikowia fructicola, and Candida queretana)

By application

- Food

- Bakery products

- Functional foods

- Savory products

- Other food applications (soups, sauces, snacks, food flavors, and seasonings)

- Beverages

- Feed

- Other applications (healthcare, bioethanol, biotechnology, personal care, and cosmetics)

By Region

- Europe

- Asia Pacific

- North America

- RoW

- South America

- Middle East & Africa

Recent Developments

- In May 2022, Red Star Yeast Co. (US), a joint venture between Lesaffre (France) and ADM (US), announced its expansion plans with the opening of a new manufacturing plant in Cedar Rapids, US. This strategic expansion included a new yeast fermenter and significantly enhanced the production capabilities of the company.

- In January 2022, OHLY (Germany), a subsidiary of Associated British Foods Plc (UK), launched OHLY SAV-R-MEAT PBD yeast-based chicken flavor enhancers in response to the rising demand from consumers for a rich chicken taste and long-lasting umami mouthfeel in food products.

- In December 2021, Lallemand Inc. (Canada) launched three new yeast extracts for plant-based formulations: Savor-Lyfe PH 04, Savor-Lyfe PS 05, and Savor-Lyfe PR 06, in response to the rising demand from consumers for an authentic meat experience along with a sustainable meal option.

- In December 2020, Lallemand Inc. (Canada) through its business unit, Lallemand Bio-Ingredients, acquired Biotec BetaGlucans AS (Norway), a market leader in the area of yeast beta-glucans, catering to the healthcare segment. This strategic acquisition was intended to consolidate the company’s position in the nutritional supplements and health food categories.

Frequently Asked Questions (FAQ):

Which are the major specialty yeast types considered in this study and which segments are projected to have promising growth rates in the future?

All the major specialty yeast types such as yeast extracts, yeast autolysates, yeast beta-glucan and other yeast derivatives such as yeast flavor enhancers, yeast saccharides, and yeast pigments are considered in the scope of the study. Yeast extracts is currently accounting for a dominant share in the specialty yeast market and is also projected to experience the highest growth rate in the next five years, due to its positive perception among consumers about being a natural ingredient.

I am interested in the Asia Pacific market for saccharomyces cerevisiae and kluyveromyces segment. Is the customization available for the same? What all information would be included in the same?

Yes, customization for the Asia Pacific market for various segments can be provided on various aspects including market size, forecast, market dynamics, company profiles & competitive landscape. Exclusive insights on below Asia Pacific countries will be provided:

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

What are some of the drivers fuelling the growth of the specialty yeast market?

Global specialty yeast market is characterized by the following drivers:

Drivers: R&D driving innovations

Research & development is one of the strategic pillars of specialty yeast manufacturing companies for new product development, modifications in the existing products, develop new applications, and various technologies used in order to make the product more enhanced. Companies are innovating new products in order to maintain their presence in the market and to cater to consumer demand for more qualitative products. For instance, in February 2019, Diamond Knot Brewing Company (US) launched three new beers with a fruity aroma coming from specialty yeast with flavors with a resemblance to Caribbean rum, along with Lower Deck Lager.

An increase in demand for healthy & fermented products and the requirement for custom-made yeast extracts is suiting companies to invest more in research & development. Yeast extract manufacturers are also thriving to develop cost-saving yeast ingredients that may enable them and their industrial customers to reduce the use of costly raw materials and other ingredients.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market are Associated British Foods Plc (UK), ADM (US), Lallemand Inc. (Canada), DSM (Netherlands), Chr. Hansen Holding A/S (Denmark), Kerry Group Plc. (Ireland), Lesaffre (France), AngelYeast Co., Ltd. (China), Biorigin (Brazil), Kemin Industries, Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 3 MARKET FOR SPECIALTY YEAST: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

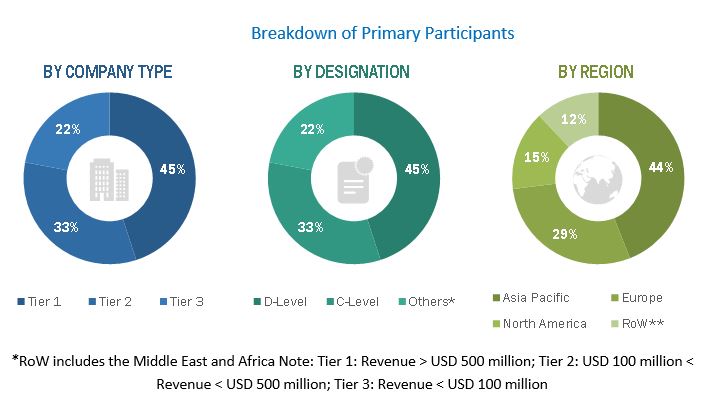

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS

2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 2 MARKET SNAPSHOT, 2022 VS. 2027

FIGURE 8 MARKET FOR SPECIALTY YEAST, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 9 MARKET FOR SPECIALTY YEAST, BY SPECIES, 2022 VS. 2027 (USD MILLION)

FIGURE 10 MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 11 MARKET SHARE (VALUE), BY REGION

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 BRIEF OVERVIEW OF THE MARKET

FIGURE 12 RISING DEMAND FOR CONVENIENCE FOOD PRODUCTS TO FUEL THE MARKET GROWTH

4.2 EUROPE: MARKET FOR SPECIALTY YEAST, BY SPECIES AND COUNTRY

FIGURE 13 SACCHAROMYCES CEREVISIAE ACCOUNTED FOR THE LARGEST SHARE OF THE EUROPEAN SPECIALTY YEAST MARKET IN 2021

4.3 SPECIALTY YEAST MARKET, BY TYPE

FIGURE 14 YEAST EXTRACTS SEGMENT IS PROJECTED TO DOMINATE THE GLOBAL MARKET

4.4 MARKET FOR SPECIALTY YEAST, BY SPECIES

FIGURE 15 SACCHAROMYCES CEREVISIAE IS PROJECTED TO HOLD THE LARGEST SHARE FROM 2022 TO 2027

4.5 MARKET FOR SPECIALTY YEAST, BY APPLICATION

FIGURE 16 FOOD SEGMENT IS ESTIMATED TO DOMINATE THE MARKET IN 2022

4.6 SPECIALTY YEAST MARKET, BY FOOD APPLICATION

FIGURE 17 BAKERY PRODUCTS SEGMENT IS ESTIMATED TO DOMINATE THE MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MACRO INDICATORS

FIGURE 18 TOTAL PER CAPITA ALCOHOL CONSUMPTION AMONG DRINKERS, 2000–2018 (LITER)

FIGURE 19 US: NET PRODUCTION OF FUEL ETHANOL BY BIOFUEL PLANTS, 2015–2021 (THOUSAND BARRELS/DAY)

5.3 MARKET DYNAMICS

FIGURE 20 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 R&D driving innovations

5.3.1.2 Increasing demand for specialty yeast ingredients in food & beverage applications

5.3.1.3 Increasing demand for bio-ethanol as a fuel

5.3.2 RESTRAINTS

5.3.2.1 Stringent food safety regulations

5.3.2.2 Competition for basic raw materials

5.3.3 OPPORTUNITIES

5.3.3.1 Growing demand for clean label products in developed countries

5.3.3.2 New variants of yeast ingredients for improved functionality

5.3.3.3 Yeast is a promising protein source in feed

TABLE 3 AMINO ACID COMPARISON CHART FOR YEAST- AND SOY MEAL-BASED LIVESTOCK DIET

5.3.4 CHALLENGES

5.3.4.1 Commercialization of duplicate & low-quality products

6 REGULATORY FRAMEWORK (Page No. - 51)

6.1 INTRODUCTION

6.2 NORTH AMERICA

6.2.1 US

6.2.2 CANADA

6.3 EUROPE: REGULATORY ENVIRONMENT ANALYSIS

6.3.1 EUROPEAN UNION

6.4 SOUTH AMERICA

6.4.1 ARGENTINA

6.5 ASIA PACIFIC

6.5.1 AUSTRALIA AND NEW ZEALAND

7 INDUSTRY TRENDS (Page No. - 57)

7.1 INTRODUCTION

7.2 VALUE CHAIN

7.2.1 RESEARCH AND PRODUCT DEVELOPMENT

7.2.2 RAW MATERIAL SOURCING

7.2.3 PRODUCTION & PROCESSING

7.2.4 DISTRIBUTION

7.2.5 MARKETING & SALES

FIGURE 21 VALUE CHAIN ANALYSIS OF THE SPECIALTY YEAST MARKET

7.3 SUPPLY CHAIN ANALYSIS

FIGURE 22 STRAIN DEVELOPMENT AND DISTRIBUTION PHASES PLAY A VITAL ROLE IN THE SUPPLY CHAIN

7.4 PRICING ANALYSIS: MARKET FOR SPECIALTY YEAST

TABLE 4 AVERAGE SELLING PRICE OF SPECIALTY YEAST, BY TYPE, 2020-2022 (USD/TONS)

TABLE 5 AVERAGE SELLING PRICE OF SPECIALTY YEAST, BY REGION, 2020-2022 (USD/TONS)

7.5 MARKET DISRUPTION

7.5.1 RISING R&D ACTIVITIES FOR CREATING ALTERNATIVES TO REPLACE SPECIALTY YEAST IN THE FERMENTATION INDUSTRY

7.6 MARKET FOR SPECIALTY YEAST: PATENT ANALYSIS

FIGURE 23 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

FIGURE 24 TOP 10 INVESTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

FIGURE 25 TOP 10 APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

TABLE 6 PATENTS PERTAINING TO YEAST, 2020–APRIL 2022

7.7 TRADE DATA: SPECIALTY YEAST MARKET

7.7.1 ACTIVE YEAST: TRADE DATA

TABLE 7 TOP 10 IMPORTERS AND EXPORTERS OF ACTIVE YEAST, 2021 (KG)

TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF ACTIVE YEAST, 2020 (KG)

TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF ACTIVE YEAST, 2019 (KG)

7.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 10 SPECIALTY YEAST MARKET: PORTER’S FIVE FORCES ANALYSIS

7.8.1 DEGREE OF COMPETITION

7.8.2 BARGAINING POWER OF SUPPLIERS

7.8.3 BARGAINING POWER OF BUYERS

7.8.4 THREAT OF SUBSTITUTES

7.8.5 THREAT OF NEW ENTRANTS

8 SPECIALTY YEAST MARKET, BY TYPE (Page No. - 67)

8.1 INTRODUCTION

FIGURE 26 SPECIALTY YEAST MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

TABLE 11 MARKET FOR SPECIALTY YEAST, BY TYPE, 2017–2021 (USD MILLION)

TABLE 12 MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

TABLE 13 MARKET FOR SPECIALTY YEAST, BY TYPE, 2017–2021 (KT)

TABLE 14 MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (KT)

8.2 YEAST EXTRACTS

8.2.1 YEAST EXTRACTS ARE USED AS A NATURAL AROMATIC INGREDIENT FOR SOUPS, SAUCES, MEAT PREPARATIONS, AND SAVORY MIXES

TABLE 15 YEAST EXTRACTS: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 16 YEAST EXTRACTS: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

8.3 YEAST AUTOLYSATES

8.3.1 YEAST AUTOLYSATE IS A GOOD SOURCE OF PROTEINS, VITAMINS, FIBER, AND MICRONUTRIENTS

TABLE 17 YEAST AUTOLYSATES: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 18 YEAST AUTOLYSATES: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

8.4 YEAST BETA-GLUCAN

8.4.1 PHYSICOCHEMICAL PROPERTIES MAKE IT USEFUL IN FOOD, FEED, CHEMICAL, AND COSMETICS PRODUCTION

TABLE 19 YEAST BETA-GLUCAN: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 20 YEAST BETA-GLUCAN: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

8.5 OTHER YEAST DERIVATIVES

8.5.1 OTHER YEAST DERIVATIVES ARE USUALLY CHARACTERIZED ACCORDING TO THEIR BIOCHEMICAL COMPOSITION

TABLE 21 OTHER YEAST DERIVATIVES: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 22 OTHER YEAST DERIVATIVES: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

9 SPECIALTY YEAST MARKET, BY SPECIES (Page No. - 74)

9.1 INTRODUCTION

FIGURE 27 SPECIALTY YEAST MARKET, BY SPECIES, 2022 VS. 2027 (USD MILLION)

TABLE 23 MARKET FOR SPECIALTY YEAST, BY SPECIES, 2017–2021 (USD MILLION)

TABLE 24 MARKET FOR SPECIALTY YEAST, BY SPECIES, 2022–2027 (USD MILLION)

9.2 SACCHAROMYCES CEREVISIAE

9.2.1 SACCHAROMYCES CEREVISIAE IS USED FOR THE PREPARATION OF PEPPERY AND SPICY FLAVORS

FIGURE 28 ROLE OF SACCHAROMYCES CEREVISIAE IN THE PRODUCTION OF FERMENTED BEVERAGES

TABLE 25 SACCHAROMYCES CEREVISIAE: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 26 SACCHAROMYCES CEREVISIAE: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

9.3 KLUYVEROMYCES

9.3.1 KLUYVEROMYCES IS USED IN THE PREPARATION OF FRUIT-FLAVORED DAIRY PRODUCTS

TABLE 27 KLUYVEROMYCES: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 28 KLUYVEROMYCES: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

9.4 PICHIA PASTORIS

9.4.1 ACTS AS TASTE MODULATOR DUE TO FLAVOR ESTER SYNTHESIS

TABLE 29 PICHIA PASTORIS: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 30 PICHIA PASTORIS: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

9.5 OTHER SPECIES

9.5.1 TORULA DELBRUECKII IS AMONG THE MOST WIDELY USED NON-SACCHAROMYCES YEAST FOR WINE-MAKING

TABLE 31 OTHER SPECIES: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 32 OTHER SPECIES: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

10 SPECIALTY YEAST MARKET, BY APPLICATION (Page No. - 81)

10.1 INTRODUCTION

FIGURE 29 SPECIALTY YEAST MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

TABLE 33 MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 34 MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 FOOD

TABLE 35 MARKET FOR SPECIALTY YEAST, BY FOOD SUBSEGMENT, 2017–2021 (USD MILLION)

TABLE 36 MARKET FOR SPECIALTY YEAST, BY FOOD SUBSEGMENT, 2022–2027 (USD MILLION)

TABLE 37 FOOD: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 38 FOOD: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

10.2.1 BAKERY PRODUCTS

10.2.1.1 Changing consumer preferences and tastes and the increasing health consciousness have significantly contributed to the growth of the baker’s yeast market

TABLE 39 BAKERY PRODUCTS: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 40 BAKERY PRODUCTS: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

10.2.2 FUNCTIONAL FOODS

10.2.2.1 Functional foods are gaining significant demand among consumers to improve health and wellness

TABLE 41 FUNCTIONAL FOODS: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 42 FUNCTIONAL FOODS: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

10.2.3 SAVORY PRODUCTS

10.2.3.1 Specialty yeast is commonly used in savory products to enhance their taste and flavor

TABLE 43 SAVORY PRODUCTS: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 44 SAVORY PRODUCTS: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

10.2.4 OTHER FOOD APPLICATIONS

10.2.4.1 Nutritional yeast is strong in taste but can be topped onto many snack products for an authentic taste

TABLE 45 OTHER FOOD APPLICATIONS: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 46 OTHER FOOD APPLICATIONS: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

10.3 BEVERAGES

10.3.1 NON-SACCHAROMYCES YEASTS ARE USED TO PRODUCE WINE AND BEER

TABLE 47 BEVERAGES: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 48 BEVERAGES: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

10.4 FEED

10.4.1 SPECIALTY YEAST ENHANCES THE NUTRITIONAL VALUE OF FEED

TABLE 49 FEED: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 50 FEED: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

10.5 OTHER APPLICATIONS

10.5.1 MULTIFUNCTIONAL BENEFITS OF SPECIALTY YEAST TO DRIVE THE MARKET FOR OTHER APPLICATIONS

TABLE 51 OTHER APPLICATIONS: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 52 OTHER APPLICATIONS: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

11 SPECIALTY YEAST MARKET, BY REGION (Page No. - 92)

11.1 INTRODUCTION

FIGURE 30 CHINA AND JAPAN TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 53 SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 54 MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION)

TABLE 55 MARKET FOR SPECIALTY YEAST, BY REGION, 2017–2021 (KT)

TABLE 56 MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (KT)

11.2 NORTH AMERICA

TABLE 57 NORTH AMERICA: SPECIALTY YEAST MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY TYPE, 2017–2021 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY SPECIES, 2017–2021 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY SPECIES, 2022–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY FOOD APPLICATION, 2017–2021 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET FOR SPECIALTY YEAST, BY FOOD APPLICATION, 2022–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Adoption of bio-fuel and increasing consumption of prepared and functional foods to fuel the market growth

TABLE 67 US: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 68 US: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Rising awareness of animal health demands more natural additives

TABLE 69 CANADA: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 70 CANADA: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Mexican food industry is well supported by government initiatives

TABLE 71 MEXICO: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 72 MEXICO: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.3 EUROPE

FIGURE 31 EUROPE: SPECIALTY YEAST MARKET SNAPSHOT

TABLE 73 EUROPE: MARKET FOR SPECIALTY YEAST, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 74 EUROPE: MARKET FOR SPECIALTY YEAST, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 75 EUROPE: MARKET FOR SPECIALTY YEAST, BY TYPE, 2017–2021 (USD MILLION)

TABLE 76 EUROPE: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET FOR SPECIALTY YEAST, BY SPECIES, 2017–2021 (USD MILLION)

TABLE 78 EUROPE: MARKET FOR SPECIALTY YEAST, BY SPECIES, 2022–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET FOR SPECIALTY YEAST, BY FOOD APPLICATION, 2017–2021 (USD MILLION)

TABLE 82 EUROPE: MARKET FOR SPECIALTY YEAST, BY FOOD APPLICATION, 2022–2027 (USD MILLION)

11.3.1 FRANCE

11.3.1.1 High livestock production in France to drive the market for specialty yeast in the feed industry

TABLE 83 FRANCE: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 84 FRANCE: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.3.2 UK

11.3.2.1 Rising consumer demand for natural and safe products to drive the market for specialty yeast

TABLE 85 UK: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 86 UK: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Growing demand from food, beverage, and pharmaceutical industries to drive the market in the country

TABLE 87 GERMANY: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 88 GERMANY: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Growing baking industry is demanding more specialty yeast

TABLE 89 ITALY: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 90 ITALY: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Increase in the potential of the food processing sector to fuel the demand for specialty yeast

TABLE 91 SPAIN: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 92 SPAIN: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 93 REST OF EUROPE: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: SPECIALTY YEAST MARKET SNAPSHOT

TABLE 95 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 96 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY TYPE, 2017–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY SPECIES, 2017–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY SPECIES, 2022–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY FOOD APPLICATION, 2017–2021 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY FOOD APPLICATION, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Berry-like flavors and floral aromas in whiskey are projected to drive the market growth

FIGURE 33 SHARE OF WINE IMPORTS IN CHINA, 2021

TABLE 105 CHINA: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 106 CHINA: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.4.2 JAPAN

11.4.2.1 Rising demand for bakery & confectionery products in the country is projected to drive the demand for specialty yeast

TABLE 107 JAPAN: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 108 JAPAN: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Growing demand for fermented dairy products is driving the market for specialty yeast

TABLE 109 INDIA: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 110 INDIA: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.4.4 AUSTRALIA & NEW ZEALAND

11.4.4.1 Plant-based meat alternatives offer growth opportunities for specialty yeast manufacturers in the Australian market

FIGURE 34 NEW ZEALAND: CHEESE AND CURD EXPORTS, 2019

TABLE 111 AUSTRALIA & NEW ZEALAND: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 112 AUSTRALIA & NEW ZEALAND: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.4.5 REST OF ASIA PACIFIC

11.4.5.1 Traditionally fermented products in Vietnam and Thailand to drive the growth of the market

TABLE 113 REST OF ASIA PACIFIC: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 114 REST OF ASIA PACIFIC: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.5 REST OF THE WORLD (ROW)

TABLE 115 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 116 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY REGION, 2022–2027 (USD MILLION

TABLE 117 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY TYPE, 2017–2021 (USD MILLION)

TABLE 118 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

TABLE 119 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY SPECIES, 2017–2021 (USD MILLION)

TABLE 120 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY SPECIES, 2022–2027 (USD MILLION)

TABLE 121 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2017–2021 (USD MILLION)

TABLE 122 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 123 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY FOOD APPLICATION, 2017–2021 (USD MILLION)

TABLE 124 REST OF THE WORLD: MARKET FOR SPECIALTY YEAST, BY FOOD APPLICATION, 2022–2027 (USD MILLION)

11.5.1 SOUTH AMERICA

11.5.1.1 Rising demand for traditional fermented beverages to drive the market in South America

FIGURE 35 WINE PRODUCTION IN SOUTH AMERICA, BY COUNTRY, 2021

TABLE 125 CATALOG OF TRADITIONAL FERMENTED BEVERAGES IN SOUTH AMERICA

TABLE 126 SOUTH AMERICA: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 127 SOUTH AMERICA: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

11.5.2 MIDDLE EAST & AFRICA

11.5.2.1 Growing demand for clean-label ingredients to drive the growth of the market in the Middle East

TABLE 128 MIDDLE EAST & AFRICA: SPECIALTY YEAST MARKET, BY TYPE, 2017–2021 (USD MILLION)

TABLE 129 MIDDLE EAST & AFRICA: MARKET FOR SPECIALTY YEAST, BY TYPE, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 127)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2021

TABLE 130 SPECIALTY YEAST MARKET SHARE ANALYSIS, 2021

12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

FIGURE 36 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2017–2021 (USD BILLION)

12.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.4.1 STARS

12.4.2 PERVASIVE PLAYERS

12.4.3 EMERGING LEADERS

12.4.4 PARTICIPANTS

FIGURE 37 SPECIALTY YEAST MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

12.4.5 MARKET FOR SPECIALTY YEAST: PRODUCT FOOTPRINT (KEY PLAYERS)

TABLE 131 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

TABLE 132 COMPANY FOOTPRINT, BY SPECIES (KEY PLAYERS)

TABLE 133 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

TABLE 134 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

TABLE 135 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

12.5 SPECIALTY YEAST MARKET, EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

12.5.1 PROGRESSIVE COMPANIES

12.5.2 STARTING BLOCKS

12.5.3 RESPONSIVE COMPANIES

12.5.4 DYNAMIC COMPANIES

FIGURE 38 SPECIALTY YEAST MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

FIGURE 39 MARKET FOR SPECIALTY YEAST: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

12.6 COMPETITIVE SCENARIO

12.6.1 NEW PRODUCT LAUNCHES

TABLE 136 MARKET FOR SPECIALTY YEAST: NEW PRODUCT LAUNCHES, 2018-2022

12.6.2 DEALS

TABLE 137 MARKET FOR SPECIALTY YEAST: DEALS, 2018-2022

12.6.3 OTHERS

TABLE 138 MARKET FOR SPECIALTY YEAST : OTHERS, 2022

13 COMPANY PROFILES (Page No. - 137)

13.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)*

13.1.1 ASSOCIATED BRITISH FOODS PLC

TABLE 139 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

FIGURE 40 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

TABLE 140 ASSOCIATED BRITISH FOODS PLC: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

TABLE 141 ASSOCIATED BRITISH FOODS PLC: DEALS

TABLE 142 ASSOCIATED BRITISH FOODS PLC: NEW PRODUCT LAUNCHES

TABLE 143 ASSOCIATED BRITISH FOODS PLC: OTHERS

13.1.2 ADM

TABLE 144 ADM: BUSINESS OVERVIEW

FIGURE 41 ADM: COMPANY SNAPSHOT

TABLE 145 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 146 ADM: OTHERS

13.1.3 LALLEMAND INC.

TABLE 147 LALLEMAND INC.: BUSINESS OVERVIEW

TABLE 148 LALLEMAND INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 149 LALLEMAND INC.: DEALS

TABLE 150 LALLEMAND INC.: NEW PRODUCT LAUNCHES

TABLE 151 LALLEMAND INC.: OTHERS

13.1.4 DSM

TABLE 152 DSM: BUSINESS OVERVIEW

FIGURE 42 DSM: COMPANY SNAPSHOT

TABLE 153 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 DSM: OTHERS

13.1.5 CHR. HANSEN HOLDING A/S

TABLE 155 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

FIGURE 43 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

TABLE 156 CHR. HANSEN HOLDING A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 157 CHR. HANSEN HOLDING A/S: OTHERS

13.1.6 KERRY GROUP PLC.

TABLE 158 KERRY GROUP PLC.: BUSINESS OVERVIEW

FIGURE 44 KERRY GROUP PLC.: COMPANY SNAPSHOT

TABLE 159 KERRY GROUP PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 160 KERRY GROUP PLC.: NEW PRODUCT LAUNCHES

TABLE 161 KERRY GROUP PLC.: OTHERS

13.1.7 LESAFFRE

TABLE 162 LESAFFRE: BUSINESS OVERVIEW

TABLE 163 LESAFFRE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 164 LESAFFRE: OTHERS

13.1.8 ANGELYEAST CO., LTD.

TABLE 165 ANGELYEAST CO., LTD.: BUSINESS OVERVIEW

TABLE 166 ANGELYEAST CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 167 ANGELYEAST CO., LTD.: DEALS

TABLE 168 ANGELYEAST CO., LTD.: OTHERS

13.1.9 BIORIGIN

TABLE 169 BIORIGIN: BUSINESS OVERVIEW

TABLE 170 BIORIGIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 171 BIORIGIN: DEALS

13.1.10 KEMIN INDUSTRIES, INC.

TABLE 172 KEMIN INDUSTRIES, INC.: BUSINESS OVERVIEW

TABLE 173 KEMIN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 174 KEMIN INDUSTRIES, INC.: OTHERS

13.2 OTHER PLAYERS

13.2.1 LEIBER

TABLE 175 LEIBER: BUSINESS OVERVIEW

TABLE 176 LEIBER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 177 LEIBER: DEALS

TABLE 178 LEIBER: OTHERS

13.2.2 FOODCHEM INTERNATIONAL CORPORATION

TABLE 179 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

TABLE 180 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

13.2.3 KOHJIN LIFE SCIENCES CO., LTD.

TABLE 181 KOHJIN LIFE SCIENCES CO., LTD.: BUSINESS OVERVIEW

TABLE 182 KOHJIN LIFE SCIENCES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.4 LEVEX

TABLE 183 LEVEX: BUSINESS OVERVIEW

TABLE 184 LEVEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.5 ARIA INGREDIENTS

TABLE 185 ARIA INGREDIENTS: BUSINESS OVERVIEW

TABLE 186 ARIA INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.6 HALCYON PROTEINS PTY. LTD.

13.2.7 JEEVAN BIOTECH

13.2.8 AGRANO GMBH & CO. KG

13.2.9 AEB GROUP SPA

13.2.10 TITAN BIOTECH

*Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS (Page No. - 183)

14.1 INTRODUCTION

TABLE 187 ADJACENT MARKETS

14.2 LIMITATIONS

14.3 FEED YEAST MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

TABLE 188 FEED YEAST MARKET, BY GENUS, 2020–2025 (USD MILLION)

14.4 YEAST MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

TABLE 189 YEAST MARKET, BY GENUS, 2018–2025 (USD MILLION)

15 APPENDIX (Page No. - 186)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities in estimating specialty yeast market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to, to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the market.

After the complete market engineering (which included calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and to verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, key players, competitive landscape of specialty yeast supplied by different market players, and key market dynamics such as drivers, restraints, opportunities, industry trends, and key player strategies.

In the complete market engineering process, top-down and bottom-up approaches were extensively used along with several data triangulation methods to conduct market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the specialty yeast market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall specialty yeast market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To describe and forecast the specialty yeast market, in terms of type, species, application, and region.

- To describe and forecast the specialty yeast market, in terms of value, by region–Europe, Asia Pacific, North America, and the Rest of the World—along with their respective countries.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market.

- To study the complete value chain of the market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market.

- To strategically profile the key players and comprehensively analyze their market positions, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders.

- To analyze strategic approaches, such as expansions & investments, product launches & approvals, mergers & acquisitions, and agreements in the specialty yeast market.

Available Customizations:

MarketsandMarkets offers customizations according to client-specific scientific needs with the given market data.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of the European specialty yeast market into key EU and non-EU countries

- Further breakdown of the Rest of Asia Pacific specialty yeast market into Indonesia, the Philippines, Vietnam, Thailand, and South Korea

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Specialty Yeast Market