Ozone Generator Market by Technology (Corona Discharge, Ultraviolet Radiation), Application (Water Purification, Air Purification), End-use Industry (Food & Beverages, Pharmaceutical), and Region - Global Forecast to 2026

Updated on : August 25, 2025

Ozone Generator Market

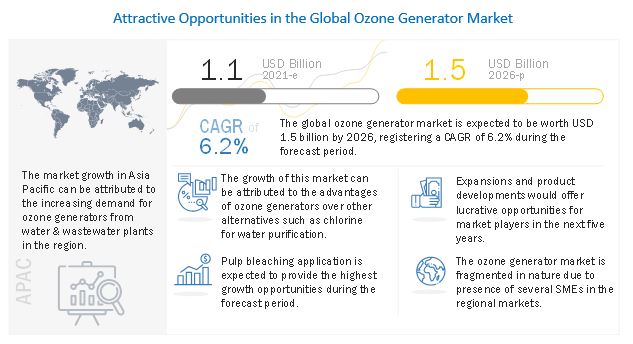

The global ozone generator market was valued at USD 1.1 billion in 2021 and is projected to reach USD 1.5 billion by 2026, growing at 6.2% cagr from 2021 to 2026. The increasing water scarcity across the globe, along with growing demand for ozone generators from municipal water treatment plants is expected to accelerate the growth of the ozone generator market across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Ozone Generator Market

Rapid population growth, urbanization, and a rise in the consumption of goods ranging from food & beverages to textiles have put the wastewater treatment facilities under immense pressure. Wastewater produced from these industries, if discarded without any treatment, can raise serious health concerns as it contains organic and inorganic matter, along with traces of heavy metals. As a result, it is essential to treat this wastewater to reduce its harmful effect and make it suitable for reuse. An ozone generator is a vital cog in this process chain, which is used primarily for disinfection and odor removal in the wastewater treatment plant.

The current COVID-19 pandemic scenario has triggered extreme uncertainty, which may lead to a global economic slowdown. The global economic growth depends on multiple factors, such as the spread of the contagion, the intensity of containment efforts, supply chain disruptions, tightening of financial markets, shifts in spending patterns, behavioral changes, and volatile commodity prices. These domestic disruptions are expected to spill over across the globe through trade and global value chain linkages, compounding the microeconomic effects.

COVID-19 has affected consumer spending as well. The spending on all non-essential products and services has reduced drastically. Ozone generators have their applications in household appliances such as air purifiers, fruit & vegetable washer, surface disinfectant, and laundry. These are comparatively non-essential and slightly expensive appliances. According to McKinsey & Company’s COVID-19 consumer pulse survey, in countries such as India, Brazil, China, and Korea, consumers are not optimistic about their economic outlook.

The COVID-19 pandemic has had a catastrophic effect on the global manufacturing industry as well as the interconnected supply chain systems. Social distancing norms and global lockdowns have had a major influence in the cut down of business operations globally. The ozone generator market is expected to be significantly impacted by these developments in the initial months of 2020. However, the global municipal and industrial sectors are still dependent on this equipment as it used in product processing and water & wastewater treatment. Hence, recovery for this market is projected to be faster as countries reopen borders for trade and incomplete projects and installations resume operations.

Ozone Generator Market Dynamics

Driver: An alternative to chlorine for water disinfection

Chemical methods, such as chlorination, are majorly used for water disinfection. However, the use of such chemicals has posed a number of health and environment-related risks. It is becoming more commonly accepted that water-borne pathogens can exist in chlorinated water. It is also known that many water-borne pathogens are not regulated. Cryptosporidium, Cyclospora, and Microsporidia are some of the nonregulated pathogens that can exist in chlorinated water and have been known to cause human disease. According to the US Council of Environmental Quality, 93% or above people drinking chlorinated water are vulnerable to cancer risks. Chlorination also produces harmful byproducts, such as trihalomethanes. The use of chlorine has other disadvantages as well. It is challenging to maintain the level of chlorine in water and is more expensive than ozone generators.

Ozone can be injected in adequate amounts with proper installation. According to the Water Pollution Control Federation, ozone is considered to be 3,000 times more effective than chlorine in terms of disinfection. Ozone is a cost-effective method of treating water, and it does not require transportation and storage. As a result, the growth in the adoption of ozone generators is expected, owing to the increasing awareness among people about the benefits of ozone over chlorine. The growing regulations by environmental agencies such as EPA to monitor the maximum allowable limit for disinfection byproducts also drive the demand for ozone generators in the coming years.

Restraint: High installation and maintenance costs

High costs are incurred in the pretreatment process of wastewater. High energy requirements for carrying out the wastewater treatment processes increase the operating costs of ozone generators. The installation of ozone generators is a one-time investment for any industry. However, operational and maintenance costs of ozone generators are high.

The cost of ozone disinfection systems is dependent on the system manufacturer, site, and capacity of the plant, and the characteristics of the water to be disinfected for municipal water treatment. Ozonation costs are generally high in comparison with other disinfection techniques. According to EPA, ozone disinfection is the least used method in the US. Ozone treatment has the ability to achieve higher levels of disinfection than either chlorine or UV. However, the capital costs, as well as maintenance expenditures, are not competitive with available alternatives. Ozone is therefore used cautiously in special cases where alternatives are not effective.

Opportunity: Investments by developed countries in emerging economies

According to the World Health Organisation (WHO), 3 in 10 people worldwide are facing a shortage of safe drinking water. This is due to the lack of capital and technology to treat municipal and industrial wastewater. Thus, several countries are adopting the concept of a nation-wide loan business model for more market growth and public benefit. As per this model, developed countries or private investors invest in the installation of wastewater treatment systems such as ozone generators across countries. This is expected to offer an opportunity for the ozone generator market to grow in emerging countries.

Challenge: Lack of awareness

The use of ozone generators is still a new concept in various countries of Asia Pacific, the Middle East & Africa, and South American regions, owing to the use of various traditional methods, including chlorine, and membrane filtration for wastewater treatment. The lack of awareness among masses regarding residential applications of ozone for sanitization and disinfection is a challenge in the growth of the ozone generators market.

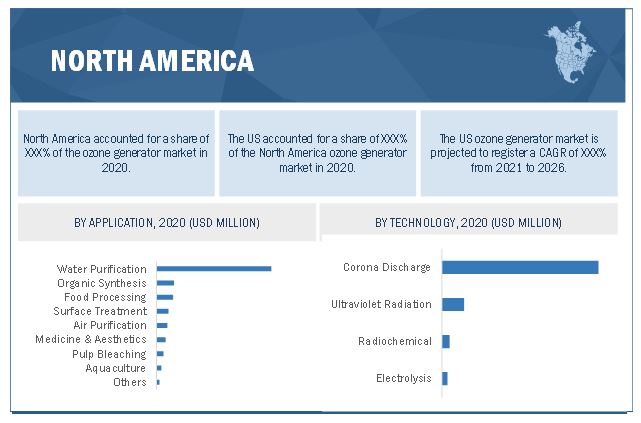

Based on application, the water purification segment accounted for the largest market share in 2020

By application, the water purification segment accounted for the largest market share in 2020. Ozone generators are widely used for water disinfection, purification, and de-colorization in water & wastewater treatment plants, bottling plants, swimming pools, cooling towers, and drinking water. Ozone is a powerful oxidant, leaves no residual harmful product, no sludge disposal problem instead increases the dissolved oxygen (DO) content of wastewater, which helps further in the degradation of residual pollutants. Therefore, ozone finds use in the treatment of municipal wastewater, industrial wastewater, contaminated groundwater, swimming pool water, paper industry wastewater, dye industry wastewater, among others. It also acts as a strong disinfectant in the removal of color, treatment of gaseous effluent, cyanide wastewater, heavy metals, and the elimination of phenolic compounds. Stringent laws & regulations implemented by the environmental bodies and governments for water & wastewater treatment are expected to propel the growth of the water purification segment.

Based on technology, the corona discharge segment accounted for the largest market share in 2020

By technology, the corona discharge segment accounted for the largest share of the ozone generator market in 2020. Corona discharge ozone generator is used for both industrial and commercial applications. The growth can be attributed to the advantages of corona discharge technology over other materials. This technology is cost-effective and has comparatively low maintenance.

Some of the advantages of corona discharge ozone generators are as follows:

- Efficient generation of ozone in large volume

- Cost-effective ozone generation for large-scale high concentration installations

- No byproducts

- Lifespan exceeds ten years

Based on end-use industry, the municipal & industrial water treatment segment accounted for the largest market share in 2020

Based on end-use industry, the municipal & industrial water treatment segment accounted for the largest share of the ozone generator market in 2020. Ozone is a powerful oxidizing agent which is used to destroy all bacteria and viruses when dissolved in water. It is used for the disinfection of municipal wastewater, industrial wastewater, contaminated groundwater, and swimming pool water. Ozone is also used in bottled water production plants for the treatment of bottled water and for disinfecting bottles.

North America accounted for the largest share of the ozone generator market in 2020

North America accounted for the largest share of the ozone generator market in 2020. North America is the leading consumer of ozone generators. The large market share is due to the vast industrial base in the region, especially in the US. The growth of the market in this region can be attributed to the rising population, increasing awareness among people about the advantages and applications of ozone generators, and stringent implementation of various government regulations regarding water & wastewater treatment. The key players operating in the North American ozone generator market are Xylem, Corotec Corporation, and MKS Instruments.

To know about the assumptions considered for the study, download the pdf brochure

Ozone Generator Market Players

SUEZ Water Technologies & Solutions (France), Xylem (US), Mitsubishi Electric Corporation (Japan), Ebara Corporation (Japan), Toshiba Corporation (Japan), METAWATER Co., Ltd. (Japan), Industrie De Nora S.p.A. (Italy), Spartan Environmental Technologies (US), MKS Instruments (US), Teledyne API (US), Creative Oz-Air (I) Pvt Ltd (US), Corotec Corporation (US), Ozonetech Systems OTS AB (Sweden), and Absolute Systems Inc (China) are some of the leading players operating in the ozone generator market.

Ozone Generator Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 1.1 billion |

|

Revenue Forecast in 2026 |

USD 1.5 billion |

|

CAGR |

6.2% |

|

Market Size Available for Years |

2018-2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

Process, Technology, End-use Industry and Application |

|

Geographies Covered |

North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

|

Companies Covered |

SUEZ Water Technologies & Solutions (France), Xylem (US), Mitsubishi Electric Corporation (Japan), Ebara Corporation (Japan), Toshiba Corporation (Japan), METAWATER Co., Ltd. (Japan), Industrie De Nora S.p.A. (Italy), Spartan Environmental Technologies (US), MKS Instruments (US), Teledyne API (US), Creative Oz-Air (I) Pvt Ltd (US), Corotec Corporation (US), Ozonetech Systems OTS AB (Sweden), Absolute Systems Inc (China), Lenntech (Netherlands), Chemtronics Technologies Pvt. Ltd. (India), International Ozone (US), Faraday Ozone (India), Ecozone Technologies Ltd. (Israel), ESCO International Ltd (UK), Taoture International Enterprises Inc. (US), Ozonefac Limited (China), Enaly Ozone Generator (China), Jinan Sankang Envi-tech Co., Ltd (China), Biotek Environmental Science Ltd. (Taiwan), Shandong Nippon Photoelectricity Equipment Co., Ltd (China), Eltech Ozone (India), BiOzone Corporation (US), Dongguan Beelee Electronics Co., Ltd. (China), Fujian Newland EnTech Co. Ltd. (China), Medozons Ltd. (Russia), Ozonetek Limited (India), and Pinnacle Ozone Solutions, LLC (US), among others |

This research report categorizes the ozone generator market based on technology, application, end-use industry, and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Ozone Generator Market based on the Process:

- Odor Control

- Groundwater Remediation

- Disinfection

Ozone Generator Market based on the Application:

- Water Purification

- Air Purification

- Pulp Bleaching

- Organic Synthesis

- Aquaculture

- Food Processing

- Surface Treatment

- Medical & Aesthetics

- Others (effluent treatment, synthetic lubricants, fabric restoration, and agriculture)

Ozone Generator Market based on the Technology:

- Corona Discharge

- Ultraviolet Radiation

- Electrolysis

- Radiochemical

Ozone Generator Market based on the End-use Industry:

- Municipal & Industrial Water Treatment

- Residential & Industrial Air Treatment

- Automotive

- Food & Beverage

- Paper & Pulp

- Pharmaceuticals

- Semiconductors

- Others (textile, healthcare, and aquaculture)

Ozone Generator Market based on the Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In July 2020, Ozonetech Systems OTS AB entered into a partnership with Lohja Municipality (Finland) to implement pharmaceutical treatment. The project is sponsored by the program for efficient water protection by the ELY Centre in South Savo (Centre for Economic Development, Transport, and the Environment) and the Ministry of Environment. Lohja will be the first municipality in Finland to install advanced treatment technology to eliminate micropollutant emissions into the environment.

- In June 2018, Ozonetech Systems OTS AB signed a contract to deliver highly advanced AOP-coupled ozone treatment for a landfill remediation project in Southeast Asia.

- Corotec Corporation introduced a new line of modular ozone generators for use on extrusion coating and laminating lines to improve the adhesion of the laminate and allow increased production speeds. These generators apply ozone to the web at the laminating or coating nip, which can increase bond strengths drastically.

Frequently Asked Questions (FAQ):

What is ozone generator?

Ozone generators are devices that generate ozone gas and are primarily used in the purification, treatment, and disinfection of air and water.

What are the different technologies used in ozone generators?

Corona discharge, ultraviolet radiation, electrolysis, radiochemical are four technologies used in ozone generators.

Which are the key countries expected to fuel the ozone generator market?

The ozone generator market is expected to grow the fastest in China, followed by India

What are the key driving factors for the ozone generator market?

The increasing water scarcity across the globe, along with environmental regulations related to the release of wastewater from industries and municipalities into the environment in emerging economies such as China, Brazil, Russia, and India are expected to drive the ozone generator market.

What are the major challenges which may hinder the growth of the ozone generator market?

High installation & maintenance costs, and adverse health effects associated with ozone are the major challenge that the manufacturers of ozone generator are facing and this can hinder the growth of the overall ozone generator market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 OZONE GENERATOR MARKET, BY TECHNOLOGY: INCLUSIONS & EXCLUSIONS

TABLE 2 OZONE GENERATOR MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

TABLE 3 OZONE GENERATOR MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

TABLE 4 OZONE GENERATOR MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.3 SCOPE OF THE MARKET

1.3.1 MARKETS COVERED

1.3.2 OZONE GENERATOR MARKET: REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 1 OZONE GENERATOR MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION: OZONE GENERATOR MARKET

2.3 MARKET ENGINEERING PROCESS

2.3.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 OZONE GENERATOR MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 5 OZONE GENERATOR MARKET SNAPSHOT, 2021 & 2026

FIGURE 6 CORONA DISCHARGE ACCOUNTED FOR LARGEST SHARE OF OZONE GENERATOR MARKET IN 2020

FIGURE 7 WATER PURIFICATION WAS LARGEST APPLICATION OF OZONE GENERATOR MARKET IN 2020

FIGURE 8 MUNICIPAL & INDUSTRIAL WATER TREATMENT ACCOUNTED FOR LARGEST SHARE OF OZONE GENERATOR MARKET IN 2020

FIGURE 9 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF OZONE GENERATOR MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN OZONE GENERATOR MARKET

FIGURE 10 GROWING INDUSTRIAL APPLICATIONS OF OZONE GENERATORS EXPECTED TO DRIVE THE MARKET

4.2 OZONE GENERATOR MARKET, BY REGION

FIGURE 11 OZONE GENERATOR MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.3 NORTH AMERICA OZONE GENERATOR MARKET, BY APPLICATION & COUNTRY

FIGURE 12 WATER PURIFICATION SEGMENT ACCOUNTS FOR LARGEST SHARE OF NORTH AMERICA OZONE GENERATOR MARKET

4.4 OZONE GENERATOR MARKET, BY MAJOR COUNTRIES

FIGURE 13 OZONE GENERATOR MARKET IN CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 50)

5.1 MARKET DYNAMICS

FIGURE 14 OZONE GENERATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Water scarcity and stringent laws & regulations

5.1.1.2 Growing demand for ozone generators from municipal water treatment plants

FIGURE 15 GLOBAL POPULATION RISE VS WATER DEMAND

5.1.1.3 Increased non-conventional applications of ozone generators

FIGURE 16 GLOBAL USERS OF CONSUMER ELECTRONIC PRODUCTS, 2016–2021

5.1.1.4 An alternative to chlorine for water disinfection

5.1.2 RESTRAINTS

5.1.2.1 High installation and maintenance costs

TABLE 6 COST ESTIMATES OF AN OZONE DISINFECTION

5.1.2.2 Adverse health effects associated with ozone

TABLE 7 OZONE: HEALTH EFFECTS AND STANDARDS

5.1.3 OPPORTUNITIES

5.1.3.1 Technological advancements in wastewater treatment systems

5.1.3.2 Investments by developed countries in emerging economies

5.1.4 CHALLENGES

5.1.4.1 Lack of awareness

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 OZONE GENERATOR MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 8 PORTER’S FIVE FORCES ANALYSIS: OZONE GENERATOR MARKET

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 THREAT OF NEW ENTRANTS

5.2.3 THREAT OF SUBSTITUTES

5.2.4 BARGAINING POWER OF BUYERS

5.2.5 INTENSITY OF RIVALRY

6 INDUSTRY TRENDS (Page No. - 59)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 18 SUPPLY CHAIN ANALYSIS OF OZONE GENERATOR MARKET

6.2 CUSTOMER ANALYSIS & SALES CHANNELS

6.2.1 BUSINESS-TO-BUSINESS (B2B)

TABLE 9 ECOSYSTEM OF OZONE GENERATOR MARKET

6.2.2 BUSINESS-TO-CONSUMER (B2C)

6.3 AVERAGE SELLING PRICE TREND ANALYSIS

TABLE 10 AVERAGE PRICE OF OZONE-BASED HOME & KITCHEN APPLIANCES, BY REGION (2020) (USD)

6.4 COVID-19 IMPACT ANALYSIS

6.4.1 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 20 IMPACT OF COVID-19 ON DIFFERENT COUNTRIES IN 2020 (Q4)

TABLE 11 THREE SCENARIO-BASED ANALYSES OF COVID-19 IMPACT ON GLOBAL ECONOMY

6.4.2 COVID-19 IMPACT ON OZONE GENERATOR MARKET

6.4.2.1 Potential new application due to COVID-19

6.4.2.2 Post COVID-19 scenario

6.5 MACROECONOMIC OVERVIEW AND TRENDS

6.5.1 INTRODUCTION

6.5.2 TRENDS AND FORECAST OF GDP

TABLE 12 TRENDS AND FORECAST OF GDP, BY KEY COUNTRY, 2016-2023 (USD MILLION)

6.5.3 GLOBAL ELECTRONICS INDUSTRY

FIGURE 21 PRODUCTION BY GLOBAL ELECTRONICS AND IT INDUSTRIES (USD MILLION)

6.5.4 MANUFACTURING INDUSTRY

FIGURE 22 ANNUAL GROWTH RATE OF WORLD MANUFACTURING OUTPUT

6.5.5 OIL & GAS INDUSTRY

TABLE 13 GLOBAL OIL & GAS PRICES, USD/BBL (2016–2020)

FIGURE 23 GLOBAL OIL DEMAND GROWTH (2016-2021)

7 OZONE GENERATOR MARKET, BY PROCESS (Page No. - 73)

7.1 INTRODUCTION

7.2 ODOR CONTROL

7.3 GROUNDWATER REMEDIATION

7.3.1 KEY FEATURES OF OZONE FOR SOIL REMEDIATION:

7.3.2 CONTAMINANTS DESTROYED BY OZONE:

7.4 DISINFECTION

7.4.1 ADVANTAGES:

7.4.2 DISADVANTAGES:

8 OZONE GENERATOR MARKET, BY TECHNOLOGY (Page No. - 76)

8.1 INTRODUCTION

FIGURE 24 OZONE GENERATOR MARKET, BY TECHNOLOGY, 2021 & 2026 (USD MILLION)

TABLE 14 OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

8.2 CORONA DISCHARGE

8.2.1 INCREASING INDUSTRIALIZATION TO BOOST DEMAND FOR OZONE GENERATORS

TABLE 15 CORONA DISCHARGE MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.3 ULTRAVIOLET RADIATION

8.3.1 ULTRAVIOLET (UV) RADIATION TECHNOLOGY USED WHERE SMALL CONCENTRATION OF OZONE IS REQUIRED

TABLE 16 ULTRAVIOLET RADIATION MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.4 ELECTROLYSIS

8.4.1 NORTH AMERICA IS LARGEST MARKET FOR OZONE GENERATORS IN ELECTROLYSIS SEGMENT

TABLE 17 ELECTROLYSIS MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.5 RADIOCHEMICAL

8.5.1 ASIA PACIFIC IS FASTEST-GROWING MARKET IN RADIOCHEMICAL SEGMENT

TABLE 18 RADIOCHEMICAL MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

9 OZONE GENERATOR MARKET, BY APPLICATION (Page No. - 81)

9.1 INTRODUCTION

FIGURE 25 OZONE GENERATOR MARKET, BY APPLICATION, 2021 & 2026 (USD MILLION)

TABLE 19 OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

9.2 WATER PURIFICATION

9.2.1 INCREASING FOR DEMAND FOR PURE WATER CONTRIBUTING TO MARKET GROWTH

TABLE 20 OZONE GENERATOR MARKET SIZE IN WATER PURIFICATION, BY REGION, 2018–2026 (USD MILLION)

9.3 AIR PURIFICATION

9.3.1 INCREASED DEMAND FOR CLEAN AIR IN INDUSTRIAL AND RESIDENTIAL SECTORS

TABLE 21 OZONE GENERATOR MARKET SIZE IN AIR PURIFICATION, BY REGION, 2018–2026 (USD MILLION)

9.4 PULP BLEACHING

9.4.1 DEMAND FOR OZONE GENERATOR TO RISE FOR PULP BLEACHING

TABLE 22 OZONE GENERATOR MARKET SIZE IN PULP BLEACHING, BY REGION, 2018–2026 (USD MILLION)

9.5 ORGANIC SYNTHESIS

9.5.1 RISING PHARMACEUTICALS SECTOR TO DRIVE THE OZONE GENERATOR MARKET

TABLE 23 OZONE GENERATOR MARKET SIZE IN ORGANIC SYNTHESIS, BY REGION, 2018–2026 (USD MILLION)

9.6 AQUACULTURE

9.6.1 RISE IN USE OF OZONATED WATER IN AQUACULTURE SECTOR

TABLE 24 OZONE GENERATOR MARKET SIZE IN AQUACULTURE, BY REGION, 2018–2026 (USD MILLION)

9.7 FOOD PROCESSING

9.7.1 INCREASE IN DEMAND FOR OZONE GENERATORS FOR FOOD PROCESSING

TABLE 25 OZONE GENERATOR MARKET SIZE IN FOOD PROCESSING, BY REGION, 2018–2026 (USD MILLION)

9.8 SURFACE TREATMENT

9.8.1 RISE IN USE OF SURFACE TREATMENT APPLICATION IN SEMICONDUCTORS INDUSTRY

TABLE 26 OZONE GENERATOR MARKET SIZE IN SURFACE TREATMENT, BY REGION, 2018–2026 (USD MILLION)

9.9 MEDICINE & AESTHETICS

9.9.1 NEED FOR CLEAN AIR, WATER, AND MEDICAL EQUIPMENT CONTRIBUTING TO GROWTH OF MARKET

TABLE 27 OZONE GENERATOR MARKET SIZE IN MEDICINE & AESTHETICS, BY REGION, 2018–2026 (USD MILLION)

9.10 OTHERS

TABLE 28 OZONE GENERATOR MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2026 (USD MILLION)

10 OZONE GENERATOR MARKET, BY END-USE INDUSTRY (Page No. - 90)

10.1 INTRODUCTION

FIGURE 26 OZONE GENERATOR MARKET, BY END-USE INDUSTRY, 2021 & 2026 (USD MILLION)

TABLE 29 OZONE GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

10.2 MUNICIPAL & INDUSTRIAL WATER TREATMENT

10.2.1 RISING DEMAND FOR WATER CONTRIBUTING TO MARKET GROWTH

TABLE 30 OZONE GENERATOR MARKET SIZE IN MUNICIPAL & INDUSTRIAL WATER TREATMENT, BY REGION, 2018–2026 (USD MILLION)

10.3 RESIDENTIAL & INDUSTRIAL AIR TREATMENT

10.3.1 DEMAND FOR CLEAN AIR IN RESIDENTIAL AND INDUSTRIAL SECTORS

TABLE 31 OZONE GENERATOR MARKET SIZE IN RESIDENTIAL & INDUSTRIAL AIR TREATMENT, BY REGION, 2018–2026 (USD MILLION)

10.4 FOOD & BEVERAGES

10.4.1 NORTH AMERICA IS FASTEST-GROWING MARKET FOR OZONE GENERATORS IN FOOD & BEVERAGES SECTOR

TABLE 32 OZONE GENERATOR MARKET SIZE IN FOOD & BEVERAGE, BY REGION, 2018–2026 (USD MILLION)

10.5 PHARMACEUTICAL

10.5.1 ASIA PACIFIC IS FASTEST-GROWING MARKET FOR OZONE GENERATORS IN PHARMACEUTICAL INDUSTRY

TABLE 33 OZONE GENERATOR MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2018–2026 (USD MILLION)

10.6 PAPER & PULP

10.6.1 OZONE MAINLY USED FOR DECOLORIZATION AND DECONTAMINATION OF PULP

TABLE 34 OZONE GENERATOR MARKET SIZE IN PAPER & PULP, BY REGION, 2018–2026 (USD MILLION)

10.7 SEMICONDUCTORS

10.7.1 RISING DEMAND FOR ELECTRONICS WILL BOOST MARKET GROWTH

TABLE 35 OZONE GENERATOR MARKET SIZE IN SEMICONDUCTORS, BY REGION, 2018–2026 (USD MILLION)

10.8 AUTOMOTIVE

10.8.1 COVID-19 PANDEMIC CONTRIBUTING TO INCREASED NEED FOR AUTOMOTIVE SANITIZATION

TABLE 36 OZONE GENERATOR MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2026 (USD MILLION)

10.9 OTHERS

TABLE 37 OZONE GENERATOR MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2018–2026 (USD MILLION)

11 OZONE GENERATOR MARKET, BY REGION (Page No. - 98)

11.1 INTRODUCTION

FIGURE 27 OZONE GENERATOR MARKET, BY MAJOR COUNTRIES

TABLE 38 OZONE GENERATOR MARKET, BY REGION, 2018–2026 (USD MILLION)

11.2 ASIA PACIFIC

FIGURE 28 ASIA PACIFIC OZONE GENERATOR MARKET SNAPSHOT

TABLE 39 ASIA PACIFIC OZONE GENERATOR MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 40 ASIA PACIFIC OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 41 ASIA PACIFIC OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 42 ASIA PACIFIC OZONE GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

11.2.1 COVID-19 IMPACT ON ASIA PACIFIC OZONE GENERATOR MARKET

11.2.2 CHINA

11.2.2.1 Largest market for ozone generators in Asia Pacific

11.2.2.2 COVID-19 impact on China

TABLE 43 CHINA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 44 CHINA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.2.3 INDIA

11.2.3.1 High growth market in Asia Pacific for ozone generators

11.2.3.2 COVID-19 impact on India

TABLE 45 INDIA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 46 INDIA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.2.4 JAPAN

11.2.4.1 Ozone generator market to witness highest growth in surface treatment applications of semiconductors

11.2.4.2 COVID-19 impact on Japan

TABLE 47 JAPAN OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 48 JAPAN OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.2.5 AUSTRALIA

11.2.5.1 Rising consumption in food processing and disinfection

11.2.5.2 COVID-19 impact on Australia

TABLE 49 AUSTRALIA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 50 AUSTRALIA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.2.6 SOUTH KOREA

11.2.6.1 Rising consumption in food processing and water treatment driving market growth

11.2.6.2 COVID-19 impact on South Korea

TABLE 51 SOUTH KOREA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 52 SOUTH KOREA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.2.7 INDONESIA

11.2.7.1 Growing paper & pulp industry in the country to boost demand for ozone generators

11.2.7.2 COVID-19 impact on Indonesia

TABLE 53 INDONESIA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 54 INDONESIA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.2.8 REST OF ASIA PACIFIC

TABLE 55 REST OF ASIA PACIFIC OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 56 REST OF ASIA PACIFIC OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 29 NORTH AMERICA OZONE GENERATOR MARKET SNAPSHOT

TABLE 57 NORTH AMERICA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 58 NORTH AMERICA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 59 NORTH AMERICA OZONE GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 60 NORTH AMERICA OZONE GENERATOR MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

11.3.1 COVID-19 IMPACT ON NORTH AMERICA OZONE GENERATOR MARKET

11.3.2 US

11.3.2.1 US accounts for largest share of the market in North America

11.3.2.2 COVID-19 impact on US

TABLE 61 US OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 62 US OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.3.3 CANADA

11.3.3.1 Rising manufacturing and service industries to contribute to market growth

11.3.3.2 COVID-19 impact on Canada

TABLE 63 CANADA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 64 CANADA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.3.4 MEXICO

11.3.4.1 Rising demand from agricultural sector to spur the market growth

11.3.4.2 COVID-19 impact on Mexico

TABLE 65 MEXICO OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 66 MEXICO OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.4 EUROPE

FIGURE 30 EUROPE OZONE GENERATOR MARKET SNAPSHOT

TABLE 67 EUROPE OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 68 EUROPE OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 69 EUROPE OZONE GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 70 EUROPE OZONE GENERATOR MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

11.4.1 COVID-19 IMPACT ON EUROPE OZONE GENERATOR MARKET

11.4.2 GERMANY

11.4.2.1 Germany accounts for largest share of ozone generators market in Europe

11.4.2.2 COVID-19 impact on Germany

TABLE 71 GERMANY OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 72 GERMANY OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.4.3 UK

11.4.3.1 Industrialization to fuel the demand for ozone generators

11.4.3.2 COVID-19 impact on the UK

TABLE 73 UK OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 74 UK OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.4.4 FRANCE

11.4.4.1 Environmental regulations to spur the market growth

11.4.4.2 COVID-19 impact on France

TABLE 75 FRANCE OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 76 FRANCE OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.4.5 ITALY

11.4.5.1 Need for water purification to drive the market growth

11.4.5.2 COVID-19 impact on Italy

TABLE 77 ITALY OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 78 ITALY OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.4.6 RUSSIA

11.4.6.1 Rising consumption in food and beverage industry driving market growth

11.4.6.2 COVID-19 impact on Russia

TABLE 79 RUSSIA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 80 RUSSIA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.4.7 SPAIN

11.4.7.1 Growing chemical, food & beverage, and textiles industries to drive the market growth

11.4.7.2 COVID-19 impact on Spain

TABLE 81 SPAIN OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 82 SPAIN OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.4.8 REST OF EUROPE

TABLE 83 REST OF EUROPE OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 84 REST OF EUROPE OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.5 MIDDLE EAST & AFRICA

TABLE 85 MIDDLE EAST & AFRICA OZONE GENERATOR MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 86 MIDDLE EAST & AFRICA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 87 MIDDLE EAST & AFRICA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 88 MIDDLE EAST & AFRICA OZONE GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

11.5.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA OZONE GENERATOR MARKET

11.5.2 SAUDI ARABIA

11.5.2.1 Saudi Arabia accounts for largest market share in Middle East & Africa region

11.5.2.2 COVID-19 impact on Saudi Arabia

TABLE 89 SAUDI ARABIA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 90 SAUDI ARABIA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.5.3 UAE

11.5.3.1 Increasing demand for water and air purification contributing to market growth

11.5.3.2 COVID-19 impact on UAE

TABLE 91 UAE OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 92 UAE OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.5.4 QATAR

11.5.4.1 Increasing investment in water treatment plants to spur market growth

11.5.4.2 COVID-19 impact on Qatar

TABLE 93 QATAR OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 94 QATAR OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.5.5 SOUTH AFRICA

11.5.5.1 Fastest growing market in the Middle East & Africa region

11.5.5.2 COVID-19 impact on South Africa

TABLE 95 SOUTH AFRICA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 96 SOUTH AFRICA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 97 REST OF MIDDLE EAST & AFRICA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 98 REST OF MIDDLE EAST & AFRICA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 99 SOUTH AMERICA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 100 SOUTH AMERICA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 101 SOUTH AMERICA OZONE GENERATOR MARKET SIZE, BY END-USE INDUSTRY, 2018–2026 (USD MILLION)

TABLE 102 SOUTH AMERICA OZONE GENERATOR MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

11.6.1 COVID-19 IMPACT ON SOUTH AMERICA OZONE GENERATOR MARKET

11.6.2 BRAZIL

11.6.2.1 Brazil accounts for largest share of ozone generator market in South America

11.6.2.2 COVID-19 impact on Brazil

TABLE 103 BRAZIL OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 104 BRAZIL OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.6.3 ARGENTINA

11.6.3.1 Increasing demand for water purification contributing to growth of market

11.6.3.2 COVID-19 impact on Argentina

TABLE 105 ARGENTINA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 106 ARGENTINA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

11.6.4 REST OF SOUTH AMERICA

TABLE 107 REST OF SOUTH AMERICA OZONE GENERATOR MARKET SIZE, BY TECHNOLOGY, 2018–2026 (USD MILLION)

TABLE 108 REST OF SOUTH AMERICA OZONE GENERATOR MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 148)

12.1 INTRODUCTION

12.2 COMPETITIVE LANDSCAPE MAPPING

12.2.1 STAR

12.2.2 EMERGING LEADERS

12.2.3 PERVASIVE

12.2.4 PARTICIPANTS

FIGURE 31 COMPETITIVE LANDSCAPE MAPPING: OZONE GENERATOR MARKET

12.3 COMPETITIVE BENCHMARKING

12.3.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 32 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN OZONE GENERATOR MARKET

12.3.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 33 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN OZONE GENERATOR MARKET

12.4 OVERVIEW

FIGURE 34 KEY GROWTH STRATEGIES ADOPTED BY COMPANIES IN THE OZONE GENERATOR MARKET BETWEEN 2017 AND 2021

12.5 COMPETITIVE SITUATION & TRENDS

12.5.1 PARTNERSHIPS

TABLE 109 PARTNERSHIPS, 2017–2021

12.5.2 NEW PRODUCT LAUNCHES

TABLE 110 PRODUCT LAUNCHES, 2017–2021

12.5.3 CONTRACTS

TABLE 111 CONTRACTS, 2017–2021

12.6 MARKET SHARE ANALYSIS

FIGURE 35 RANKING OF COMPANIES OPERATING IN OZONE GENERATOR MARKET, 2020

13 COMPANY PROFILES (Page No. - 156)

13.1 MAJOR PLAYER

(Business Overview, Products Offered, COVID-19 related developments, MnM view, Right to win, Strategic choices made, Weakness/competitive threats)*

13.1.1 MITSUBISHI ELECTRIC CORPORATION

TABLE 112 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

FIGURE 36 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

13.1.2 XYLEM

TABLE 113 XYLEM: COMPANY OVERVIEW

FIGURE 37 XYLEM: COMPANY SNAPSHOT

13.1.3 SUEZ

TABLE 114 SUEZ: COMPANY OVERVIEW

FIGURE 38 SUEZ: COMPANY SNAPSHOT

13.1.4 EBARA CORPORATION

TABLE 115 EBARA CORPORATION: COMPANY OVERVIEW

FIGURE 39 EBARA CORPORATION: COMPANY SNAPSHOT

13.1.5 TOSHIBA CORPORATION

TABLE 116 TOSHIBA CORPORATION: COMPANY OVERVIEW

FIGURE 40 TOSHIBA CORPORATION: COMPANY SNAPSHOT

13.1.6 MKS INSTRUMENTS

TABLE 117 MKS INSTRUMENTS: COMPANY OVERVIEW

FIGURE 41 MKS INSTRUMENTS: COMPANY SNAPSHOT

13.1.7 METAWATER CO., LTD.

TABLE 118 METAWATER CO., LTD.: COMPANY OVERVIEW

FIGURE 42 METAWATER CO., LTD.: COMPANY SNAPSHOT

13.1.8 TELEDYNE TECHNOLOGIES INC.

TABLE 119 TELEDYNE TECHNOLOGIES INC.: COMPANY OVERVIEW

FIGURE 43 TELEDYNE TECHNOLOGIES INC.: COMPANY SNAPSHOT

13.1.9 TMEIC

TABLE 120 TMEIC: COMPANY OVERVIEW

13.1.10 COROTEC CORPORATION

TABLE 121 COROTEC CORPORATION: COMPANY OVERVIEW

13.1.11 OZONETEK LIMITED

TABLE 122 OZONETEK LIMITED: COMPANY OVERVIEW

13.1.12 LENNTECH

TABLE 123 LENNTECH: COMPANY OVERVIEW

13.1.13 BIOTEK ENVIRONMENTAL SCIENCE LTD.

TABLE 124 BIOTEK ENVIRONMENTAL SCIENCE LTD.: COMPANY OVERVIEW

13.1.14 BIOZONE CORPORATION

TABLE 125 BIOZONE CORPORATION: COMPANY OVERVIEW

13.1.15 OZONETECH SYSTEMS OTS AB

TABLE 126 OZONETECH SYSTEMS OTS AB: COMPANY OVERVIEW

13.1.16 ESCO INTERNATIONAL LTD.

TABLE 127 ESCO INTERNATIONAL LTD.: COMPANY OVERVIEW

13.1.17 CHEMTRONICS TECHNOLOGIES (INDIA) PVT. LTD.

TABLE 128 CHEMTRONICS TECHNOLOGIES (INDIA) PVT. LTD.: COMPANY OVERVIEW

13.1.18 FARADAY OZONE

TABLE 129 FARADAY OZONE: COMPANY OVERVIEW

13.1.19 PINNACLE OZONE SOLUTIONS, LLC

TABLE 130 PINNACLE OZONE SOLUTIONS, LLC: COMPANY OVERVIEW

13.1.20 ECOZONE TECHNOLOGIES LTD.

TABLE 131 ECOZONE TECHNOLOGIES LTD.: COMPANY OVERVIEW

13.1.21 ENALY OZONE GENERATOR

TABLE 132 ENALY OZONE GENERATOR: COMPANY OVERVIEW

13.1.22 ABSOLUTE SYSTEMS INC.

TABLE 133 ABSOLUTE SYSTEMS INC.: COMPANY OVERVIEW

13.1.23 INTERNATIONAL OZONE

TABLE 134 INTERNATIONAL OZONE: COMPANY OVERVIEW

13.1.24 INDUSTRIE DE NORA S.P.A

TABLE 135 INDUSTRIE DE NORA S.P.A: COMPANY OVERVIEW

13.1.25 SPARTAN ENVIRONMENTAL TECHNOLOGIES

TABLE 136 SPARTAN ENVIRONMENTAL TECHNOLOGIES: COMPANY OVERVIEW

13.1.26 FUJIAN NEWLAND ENTECH CO. LTD.

TABLE 137 FUJIAN NEWLAND ENTECH CO. LTD.: COMPANY OVERVIEW

13.1.27 SHANDONG NIPPON PHOTOELECTRICITY EQUIPMENT CO., LTD.

TABLE 138 SHANDONG NIPPON PHOTOELECTRICITY EQUIPMENT CO., LTD.: COMPANY OVERVIEW

13.1.28 JINAN SANKANG ENVI-TECH CO., LTD.

TABLE 139 JINAN SANKANG ENVI-TECH CO., LTD.: COMPANY OVERVIEW

13.1.29 TAOTURE INTERNATIONAL ENTERPRISES INC.

TABLE 140 TAOTURE INTERNATIONAL ENTERPRISES INC.: COMPANY OVERVIEW

13.1.30 CREATIVE OZ-AIR (I) PVT. LTD.

TABLE 141 CREATIVE OZ-AIR (I) PVT. LTD.: COMPANY OVERVIEW

13.1.31 ELTECH OZONE

TABLE 142 ELTECH OZONE: COMPANY OVERVIEW

13.1.32 DONGGUAN BEELEE ELECTRONICS CO., LTD.

TABLE 143 DONGGUAN BEELEE ELECTRONICS CO., LTD.: COMPANY OVERVIEW

13.1.33 OZONEFAC LIMITED

TABLE 144 OZONEFAC LIMITED: COMPANY OVERVIEW

13.1.34 MEDOZONS LTD.

TABLE 145 MEDOZONS LTD.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, COVID-19 related developments, MnM view, Right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 227)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

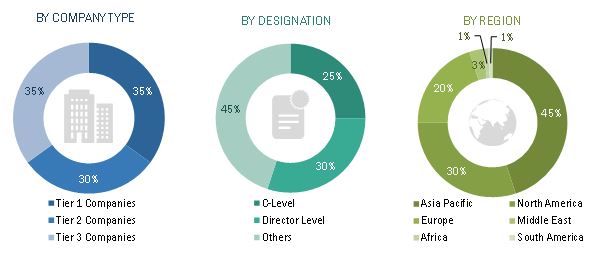

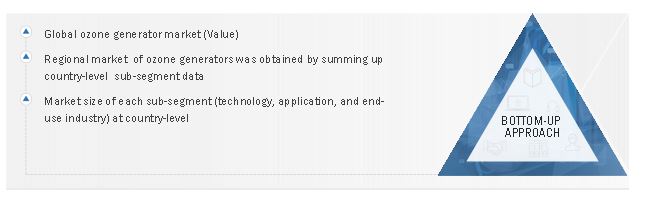

This study involved four major activities in estimating the current size of the ozone generator market. Exhaustive secondary research was undertaken to collect information on the ozone generator market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the ozone generator value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the market. After that, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the ozone generator market.

Ozone Generator Market Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred for identifying and collecting information for this study on the ozone generator market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

Ozone Generator Market Primary Research

As a part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the ozone generator market. Primary sources from the supply side included industry experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the ozone generator market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Ozone Generator Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ozone generator market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research

- The supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players along with extensive interviews for opinions from leaders, such as directors and marketing executives

Ozone Generator Market Data Triangulation:

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Objectives of the Ozone Generator Market Report

- To define, describe, and forecast the global ozone generator market in terms of value based on technology, application, and end-use industry

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the global ozone generator market

- To analyze and forecast the size of various segments of the ozone generator market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa, along with key countries in each of these regions

- To analyze region-specific trends in North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To analyze competitive developments, such as partnerships, contracts, and product launches in the ozone generator market

The Following Customization Options are Available for the Report:

- Further breakdown of the North America, Asia Pacific and Europe ozone generator markets

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ozone Generator Market

I want ozone generator market report for North America region.