Residential Air Purifiers Market by Technology (High Efficiency Particulate Air (HEPA), Electrostatic Precipitators, Activated Carbon, Ultraviolet), Type (Portable Air Purifiers, In-duct Air Purifiers) & Region - Global Forecast to 2026

Market Growth Outlook Summary

The global residential air purifiers market growth forecasted to transform from $9.6 billion in 2021 to $14.1 billion by 2026, driven by a CAGR of 8.1%. The growth of this market is majorly driven by the growing popularity of smart homes, supportive government regulations for effective air pollution monitoring and control, and increasing public awareness related to the healthcare and environmental implications of air pollution. Also, the need for an energy-efficient air purifier and R&D being undertaken to bring innovative products to the market is aiding the market growth. However, the high cost of these products and technical limitations associated with air quality monitoring products are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Residential Air Purifiers Market Dynamics

Driver: Supportive government regulations for effective air pollution monitoring & control

The adverse effects of air pollution on health and the environment have compelled governments of several countries across the globe to implement and propose stringent regulations for effective air pollution monitoring and control. Major countries (such as the US, Germany, France, Japan, China, India, and Canada) have enacted various policies and legislation to monitor air pollution and regularly assess ambient air quality in urban areas. With the increasing implementation and adoption of stringent government regulations for effective air pollution monitoring and control across major sectors, the demand for residential air purifiers is expected to increase during the forecast period.

Restraint: High product cost

A typical air quality monitoring sensor is used to assess specific indoor air quality parameters, such as temperature, particulate matter concentration, the presence of gaseous compounds, and concentration of toxic chemicals or biological agents (such as bacteria, viruses, and fungi). The detection of gaseous and biological components requires advanced technologies such as nephelometers, gas sensors, radio-frequency identification detectors (RFID), and PCR-based biosensors. Most of the current indoor air quality monitors are equipped with these advanced technologies for detecting and purifying complex pollutants. For example, Dyson's Pure Cool Air series are air purifiers that come with an inbuilt LCD screen that gives a real-time air quality reading, plus temperature and humidity sensors. However, most of these advanced technologies are high-priced, which further increases the cost of indoor air purifiers.

Opportunity: Rising technological advancements

Technologically advanced indoor air quality monitors (such as real-time monitors and remote-sensing devices) are beneficial for assessing air quality parameters for residents. The development and commercialization of advanced air quality monitoring systems (such as miniaturized devices, nanotechnology-based systems, infrared spectroscopy, and remote sensing instruments) offer significant growth opportunities for prominent and emerging players in the market. To leverage enormous opportunities, leading players in the global air purifiers market focus on carrying out R&D activities to develop new and advanced air monitoring equipment.

Challenge: Complex nature of indoor pollutants

Indoor air is more polluted than outdoor air and can be classified into biological and chemical. There are several sources of indoor air pollution, including combustion sources such as oil, gas, kerosene, coal, wood, and tobacco products; building materials and furnishing; asbestos-containing insulation; wet or damp carpets; cabinetry or furniture made of certain pressed wood products; products for household cleaning and maintenance; central heating and cooling systems and humidification devices; and outdoor sources such as radon, pesticides, and outdoor air pollutants. These indoor pollutants can release gases like carbon monoxide and nitrogen dioxide, which are difficult to break down with conventional air filters. Fine mesh sizes are required to trap these gases and break them down into less harmful particles. Manufacturing such filters can be extremely challenging for manufacturers as these filters have to remove such complex pollutants and other indoor pollutants. Integrating one or more technologies into a single air purifier requires further research and additional costs, thereby affecting the entire manufacturing process.

The HEPA segment of the global residential air purifiers industry is expected to grow at the highest CAGR during the forecast period

Based on technology, the residential air purifiers market is segmented into HEPA filters (high-efficiency particulate arrestence or high-efficiency particulate air) and other technologies. The other technologies segment comprises electrostatic precipitators, activated carbon, UV filters, and ionic filters. The HEPA segment is expected to grow at the highest CAGR in forecast period. This is due to the growing concern for environmental sustainability, increasing public awareness pertaining to the healthcare implications of air pollution, and the growing popularity of smart homes/ambient-assisted living.

The portable/stand-alone purifiers segment accounted for the largest share of the residential air purifiers industry

Based on type, the global residential air purifiers market is segmented into portable/stand-alone purifiers and in-duct purifiers. The portable/stand-alone purifiers accounted for the highest share of the market. This is mainly due to the need to remove sources of pollutants or allergens from indoor air, growing popularity of smart homes/ambient-assisted living, and increasing public awareness pertaining to the healthcare implications of air pollution.

Asia Pacific region is expected to register the highest CAGR in the residential air purifiers industry

The Asia Pacific residential air purifiers market is expected to grow at the highest CAGR from 2021 to 2026. This can be attributed to factors such as the increasing investments by major players in the region, the presence of less stringent regulations for product approval, and growing demand for quality lifestyles are expected to drive the growth of this market during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the residential air purifiers market include Daikin Industries, Ltd. (Japan), Sharp Corporation (Japan), Honeywell International Inc. (US), Samsung Electronics Co., Ltd. (South Korea), LG Electronics Inc. (South Korea), Koninklijke Philips N.V. (Netherlands), Dyson (UK), Unilever Group (UK), Panasonic Corporation (Japan), Whirlpool Corporation (US), AllerAir Industries Inc. (US), IQAir (Switzerland), Winix Co., Ltd. (South Korea), Xiaomi Corporation (China), Camfil AB (Sweden), Airpura Industries Inc. (Canada), Airgle Corporation (US), Hunter Pure Air (US), Kent RO Systems Ltd. (India), SHIL Limited (India), IDEAL Krug & Priester GMBH & Co. KG (Germany), Havells India Ltd. (India), Molekule (US), Carrier Global (US), and Coway CO., Ltd. (South Korea).

Scope of the Residential Air Purifiers Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2021 |

$9.6 billion |

|

Projected Revenue Size by 2026 |

$14.1 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 8.1% |

|

Market Driver |

Supportive government regulations for effective air pollution monitoring & control |

|

Market Opportunity |

Rising technological advancements |

The study categorizes the global residential air purifiers market to forecast revenue and analyze trends in each of the following submarkets

By Technology

- High Efficiency Particulate Air (HEPA)

- Other Technologies

By Type

- Portable /Stand Alone Air Purifiers

- In-Duct Air Purifiers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- South Korea

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Residential Air Purifiers Industry

- In 2021, Panasonic Corporation (Japan) has developed a new nanoe X device that generates 100 times more Hydroxyl (OH) radicals than the conventional nanoe device. As a result, the latest nanoe X device delivers increased effectiveness in air purification and deodorization in indoor spaces.

- In 2021, Panasonic Ecology Systems Co., Ltd. (PES) and Panasonic Ecology Systems Guangdong Co., Ltd. built the First Shunde Branch Plant in China, a new factory for IAQ devices such as energy recovery ventilator systems and air purifiers.

- In 2021, Dyson (UK) opened its fourth Dyson Demo store in France, located in the iconic shopping district of Terrasses du Port in Marseille. The new space will showcase Dyson’s latest technology in home cleaning, air purification, lighting, and hair care.

- In 2020, Molekule (US) partnered with Sourcenext (Japan). The partnership is aimed at helping Molekule move into the next phase of growth, which includes global expansion. In a commitment to Molekule's innovation, Sourcenext has also invested USD 10.1 million into the company. The funds will be used for growth initiatives as the company prepares to meet strong global demand for an air purification solution.

- In 2020, Molekule (US) launched its India operations by introducing its air purifiers on Amazon for the Indian consumers.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global residential air purifiers market?

The global residential air purifiers market boasts a total revenue value of $14.1 billion by 2026.

What is the estimated growth rate (CAGR) of the global residential air purifiers market?

The global residential air purifiers market has an estimated compound annual growth rate (CAGR) of 8.1% and a revenue size in the region of $9.6 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 RESIDENTIAL AIR PURIFIERS INDUSTRY DEFINITION & SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKET SEGMENTATION

FIGURE 1 RESIDENTIAL AIR PURIFIERS MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY DESIGN

FIGURE 2 GLOBAL MARKET: RESEARCH DESIGN

2.2.1 SECONDARY RESEARCH

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.2.2.1 Key data from primary sources

2.2.2.2 Insights from primary experts

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND OTHER PARTICIPANTS

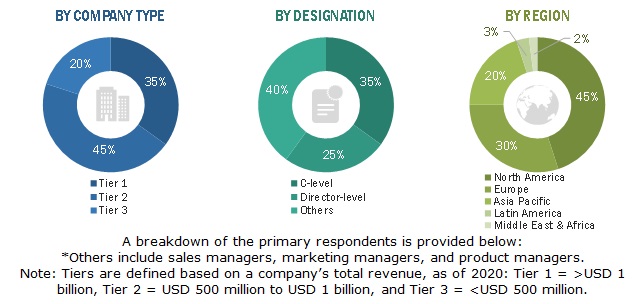

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 8 CHINA MARKET ANALYSIS APPROACH

FIGURE 9 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 10 CAGR PROJECTIONS

FIGURE 11 TOP-DOWN APPROACH

2.4 DATA TRIANGULATION APPROACH

FIGURE 12 DATA TRIANGULATION METHODOLOGY

2.5 MARKET SHARE ESTIMATION

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 40)

FIGURE 13 RESIDENTIAL AIR PURIFIERS MARKET, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

FIGURE 14 GLOBAL RESIDENTIAL AIR PURIFIERS INDUSTRY, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 GEOGRAPHIC ANALYSIS: GLOBAL RESIDENTIAL AIR PURIFIERS MARKET

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 16 RISING LEVELS OF AIR POLLUTION AND THE GROWING TREND FOR SMART HOMES ARE EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL MARKET

4.2 NORTH AMERICA: MARKET, BY TECHNOLOGY

FIGURE 17 HEPA SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICA MARKET IN 2020

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 18 INDIA IS EXPECTED TO PROJECT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.4 GLOBAL MARKET, BY REGION (2019-2026)

FIGURE 19 ASIA PACIFIC TO DOMINATE THE GLOBAL MARKET UNTIL 2026

4.5 GLOBAL MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 20 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

TABLE 3 MARKET DYNAMICS: GLOBAL MARKET

5.2.1 MARKET DRIVERS

5.2.1.1 The rising prevalence of COVID-19

TABLE 4 TOTAL NUMBER OF CONFIRMED COVID-19 CASES, BY REGION, (AS OF SEPTEMBER 13, 2021)

5.2.1.2 Increasing urbanization and indoor air pollution levels

5.2.1.3 Supportive government regulations for effective air pollution monitoring & control

TABLE 5 GOVERNMENT INITIATIVES TO COMBAT AIR POLLUTION ACROSS REGIONS

5.2.1.4 Increasing public awareness pertaining to the healthcare implications of air pollution

TABLE 6 AWARENESS PROGRAM INITIATIVES

5.2.2 MARKET RESTRAINTS

5.2.2.1 High product costs

TABLE 7 PRICE RANGE OF AIR PURIFIERS WITH ADVANCED TECHNOLOGIES

5.2.2.2 Technical limitations associated with air quality monitoring products

5.2.3 MARKET OPPORTUNITIES

5.2.3.1 Emerging markets to offer high growth opportunities

TABLE 8 COMPANY EXPANSIONS IN EMERGING MARKETS

5.2.3.2 Rising technological advancements

5.2.4 MARKET CHALLENGES

5.2.4.1 Complex nature of indoor pollutants

5.2.4.2 High R&D expenses for new product launches

5.3 INDUSTRY TRENDS

5.3.1 MULTI-FUNCTIONAL/SMART AIR PURIFIERS

FIGURE 21 SMART AIR PURIFIER MARKET INSIGHTS

5.3.2 GROWING TREND FOR SMART HOMES

5.4 REGULATORY ANALYSIS

5.4.1 NORTH AMERICA

5.4.2 EUROPE

5.4.3 ASIA PACIFIC

TABLE 9 TEST STANDARDS (AND RATING MATRICS) FOR AIR PURIFICATION TECHNOLOGIES

TABLE 10 KEY REGULATIONS & STANDARDS GOVERNING GLOBAL MARKET

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 11 PORTERS’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 INTENSITY OF COMPETITIVE RIVALRY

5.6 TECHNOLOGY ANALYSIS

TABLE 12 TECHNOLOGY INNOVATION IN RESIDENTIAL AIR PURIFIERS

5.7 PRICING ANALYSIS

TABLE 13 AVERAGE PRICE OF RESIDENTIAL AIR PURIFIERS, BY REGION (USD)

5.8 ECOSYSTEM ANALYSIS

5.8.1 GLOBAL MARKET: ECOSYSTEM ANALYSIS

5.9 PATENT ANALYSIS

5.9.1 PATENT PUBLICATION TRENDS FOR RESIDENTIAL AIR PURIFIERS

FIGURE 22 PATENT PUBLICATION TRENDS (JANUARY 2011–SEPTEMBER 2021)

5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 23 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR RESIDENTIAL AIR PURIFIERS PATENTS (JANUARY 2011–SEPTEMBER 2021)

FIGURE 24 TOP APPLICANT COUNTRIES/REGIONS FOR RESIDENTIAL AIR PURIFIERS PATENTS (JANUARY 2011–SEPTEMBER 2021)

TABLE 14 LIST OF PATENTS/PATENT APPLICATIONS IN THE GLOBAL MARKET, 2020–2021

5.10 IMPACT OF COVID-19 ON THE GLOBAL MARKET

6 GLOBAL RESIDENTIAL AIR PURIFIERS MARKET, BY TECHNOLOGY (Page No. - 71)

6.1 INTRODUCTION

TABLE 15 GLOBAL RESIDENTIAL AIR PURIFIERS INDUSTRY, BY TECHNOLOGY, 2019–2026 (USD MILLION)

6.2 HIGH-EFFICIENCY PARTICULATE AIR (HEPA)

6.2.1 HEPA TECHNOLOGY IS THE MOST EFFICIENT METHOD FOR AIR PURIFICATION, THUS LEADING TO ITS INCREASED ADOPTION

TABLE 16 GLOBAL MARKET FOR HEPA, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 OTHER TECHNOLOGIES

TABLE 17 GLOBAL MARKET FOR OTHER TECHNOLOGIES, BY COUNTRY, 2019–2026 (USD MILLION)

7 GLOBAL RESIDENTIAL AIR PURIFIERS MARKET, BY TYPE (Page No. - 76)

7.1 INTRODUCTION

TABLE 18 GLOBAL RESIDENTIAL AIR PURIFIERS INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

7.2 PORTABLE/STAND-ALONE AIR PURIFIERS

7.2.1 HEPA FILTERS ARE MOST COMMONLY USED IN PORTABLE AIR PURIFIER SYSTEMS

TABLE 19 PORTABLE AIR CLEANER SIZING FOR 80% STEADY-STATE PARTICLE REMOVAL

TABLE 20 PORTABLE/STAND-ALONE MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 IN-DUCT AIR PURIFIERS

7.3.1 DUCT-BASED SYSTEMS REQUIRE FORCED-AIR HVAC SYSTEMS FOR EFFICIENT AIR PURIFICATION

TABLE 21 IN-DUCT MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 GLOBAL RESIDENTIAL AIR PURIFIERS MARKET, BY REGION (Page No. - 81)

8.1 INTRODUCTION

FIGURE 25 RESIDENTIAL AIR PURIFIERS MARKET: GEOGRAPHIC SNAPSHOT (2020)

TABLE 22 GLOBAL MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2 IMPACT OF COVID-19 ON THE GLOBAL MARKET, BY COUNTRY/REGION

8.3 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 23 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 24 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 25 ASIA PACIFIC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.3.1 CHINA

8.3.1.1 Increasing efforts and focus towards preventing and minimizing air pollution to drive the market growth in China

TABLE 26 CHINA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 27 CHINA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.3.2 JAPAN

8.3.2.1 Presence of prominent residential air purifier market players in the region to drive the market growth in Japan

TABLE 28 JAPAN: RESIDENTIAL AIR PURIFIERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 29 JAPAN: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.3.3 INDIA

8.3.3.1 Increasing awareness programs by the government to curb air pollution to drive the adoption of residential air purifiers in India

TABLE 30 INDIA: RESIDENTIAL AIR PURIFIERS INDUSTRY, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 31 INDIA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.3.4 SOUTH KOREA

8.3.4.1 Growing air pollution due to fine dust to drive market growth

TABLE 32 SOUTH KOREA: RESIDENTIAL AIR PURIFIERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 33 SOUTH KOREA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.3.5 REST OF ASIA PACIFIC (ROAPAC)

TABLE 34 ROAPAC: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 35 ROAPAC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.4 NORTH AMERICA

FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

TABLE 36 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: RESIDENTIAL AIR PURIFIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.4.1 US

8.4.1.1 Presence of major market players and the growing demand for smart technologies in the US to drive the market growth

TABLE 39 US: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 40 US: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.4.2 CANADA

8.4.2.1 Increasing government investments in technology and infrastructure to drive the growth of the market

TABLE 41 CANADA RESIDENTIAL AIR PURIFIERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 42 CANADA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.5 EUROPE

TABLE 43 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 EUROPE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 45 EUROPE: RESIDENTIAL AIR PURIFIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.5.1 GERMANY

8.5.1.1 Excessive level of air pollution in Germany to drive the growth of the market

TABLE 46 GERMANY: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 47 GERMANY: RESIDENTIAL AIR PURIFIERS INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

8.5.2 FRANCE

8.5.2.1 Focused government initiatives towards curbing energy & greenhouse emissions to drive the market growth in France

TABLE 48 FRANCE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 49 FRANCE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.5.3 UK

8.5.3.1 Government initiatives towards the support of energy-efficient products and green infrastructure to drive the market growth

TABLE 50 UK: RESIDENTIAL AIR PURIFIERS MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 51 UK: RESIDENTIAL AIR PURIFIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.5.4 ITALY

8.5.4.1 Growing focus on curbing air pollution and fine dust particle levels to drive the growth of the market

TABLE 52 ITALY: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 53 ITALY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.5.5 SPAIN

8.5.5.1 Increasing focus on personal health and the growing number of COVID-19 cases to support the market growth in Spain

TABLE 54 SPAIN: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 55 SPAIN: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.5.6 REST OF EUROPE

TABLE 56 ROE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 57 ROE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.6 LATIN AMERICA

TABLE 58 LATIN AMERICA: RESIDENTIAL AIR PURIFIERS MARKET, BY COUNTRY/REGION, 2019–2026 (USD MILLION)

TABLE 59 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 60 LATIN AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.6.1 BRAZIL

8.6.1.1 The rising concern regarding air pollution in the major cities of Brazil to support the market growth for residential air purifiers

TABLE 61 BRAZIL: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 62 BRAZIL: RESIDENTIAL AIR PURIFIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.6.2 MEXICO

8.6.2.1 Green building initiatives and rising carbon emissions to drive the market growth for air purifiers in Mexico

TABLE 63 MEXICO: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 64 MEXICO: RESIDENTIAL AIR PURIFIERS INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

8.6.3 REST OF LATIN AMERICA

TABLE 65 ROLATAM: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 66 ROLATAM: MARKET, BY TYPE, 2019–2026 (USD MILLION)

8.7 MIDDLE EAST & AFRICA

8.7.1 RISING CONCERNS OF ENVIRONMENTAL DEGRADATION WILL DRIVE THE MARKET GROWTH IN THE COMING YEARS

TABLE 67 MIDDLE EAST & AFRICA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA: RESIDENTIAL AIR PURIFIERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 114)

9.1 OVERVIEW

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN THE RESIDENTIAL AIR PURIFIERS MARKET

9.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 28 REVENUE ANALYSIS OF KEY PLAYERS IN THE GLOBAL RESIDENTIAL AIR PURIFIERS INDUSTRY

9.4 MARKET SHARE ANALYSIS

FIGURE 29 GLOBAL MARKET SHARE, BY KEY PLAYER, 2020

TABLE 69 GLOBAL MARKET: DEGREE OF COMPETITION

9.5 COMPETITIVE BENCHMARKING

TABLE 70 FOOTPRINT OF COMPANIES IN THE GLOBAL MARKET

TABLE 71 PRODUCT FOOTPRINT OF COMPANIES (20 COMPANIES)

TABLE 72 REGIONAL FOOTPRINT OF COMPANIES (20 COMPANIES)

9.6 COMPETITIVE LEADERSHIP MAPPING

9.6.1 STARS

9.6.2 EMERGING LEADERS

9.6.3 PERVASIVE PLAYERS

9.6.4 PARTICIPANTS

FIGURE 30 RESIDENTIAL AIR PURIFIERS MARKET: COMPETITIVE LEADERSHIP MAPPING (2020)

9.7 COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES

9.7.1 PROGRESSIVE COMPANIES

9.7.2 DYNAMIC COMPANIES

9.7.3 STARTING BLOCKS

9.7.4 RESPONSIVE COMPANIES

FIGURE 31 GLOBAL RESIDENTIAL AIR PURIFIERS INDUSTRY: COMPETITIVE LEADERSHIP MAPPING FOR OTHER COMPANIES (2020)

9.8 COMPETITIVE SCENARIO

9.8.1 PRODUCT/APPROVALS/ENHANCEMENTS

TABLE 73 PRODUCT APPROVALS/ENHANCEMENTS, 2018–2021

9.8.2 DEALS

TABLE 74 DEALS, 2018–2021

9.8.3 OTHER DEVELOPMENTS

TABLE 75 OTHER DEVELOPMENTS, 2018–2021

10 COMPANY PROFILES (Page No. - 130)

10.1 KEY PLAYERS

10.2.5 COWAY CO., LTD.: COMPANY OVERVIEW

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

10.1.1 DAIKIN INDUSTRIES, LTD.

TABLE 76 DAIKIN INDUSTRIES, LTD.: BUSINESS OVERVIEW

FIGURE 32 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT (2020)

10.1.2 SHARP CORPORATION

TABLE 77 SHARP CORPORATION: BUSINESS OVERVIEW

FIGURE 33 SHARP CORPORATION: COMPANY SNAPSHOT (2020)

10.1.3 HONEYWELL INTERNATIONAL INC.

TABLE 78 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 34 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT (2020)

10.1.4 PANASONIC CORPORATION

TABLE 79 PANASONIC CORPORATION: BUSINESS OVERVIEW

FIGURE 35 PANASONIC CORPORATION: COMPANY SNAPSHOT (2020)

10.1.5 LG ELECTRONICS, INC.

TABLE 80 LG ELECTRONICS, INC.: BUSINESS OVERVIEW

FIGURE 36 LG ELECTRONICS, INC.: COMPANY SNAPSHOT (2020)

10.1.6 KONINKLIJKE PHILIPS N.V

TABLE 81 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

FIGURE 37 KONINKLIJKE PHILIPS N.V: COMPANY SNAPSHOT (2020)

10.1.7 DYSON LTD.

TABLE 82 DYSON LTD.: BUSINESS OVERVIEW

10.1.8 SAMSUNG ELECTRONICS LTD.

TABLE 83 SAMSUNG ELECTRONICS LTD.: BUSINESS OVERVIEW

FIGURE 38 SAMSUNG ELECTRONICS LTD.: COMPANY SNAPSHOT (2020)

TABLE 84 UNILEVER GROUP: BUSINESS OVERVIEW

FIGURE 39 UNILEVER GROUP: COMPANY SNAPSHOT (2020)

10.1.10 WHIRLPOOL CORPORATION

TABLE 85 WHIRLPOOL CORPORATION: BUSINESS OVERVIEW

FIGURE 40 WHIRLPOOL CORPORATION: COMPANY SNAPSHOT (2020)

10.1.11 ALLERAIR INDUSTRIES, INC.

TABLE 86 ALLERAIR INDUSTRIES, INC.: BUSINESS OVERVIEW

10.1.12 IQAIR

TABLE 87 IQAIR: BUSINESS OVERVIEW

10.1.13 WINIX CO., LTD.

TABLE 88 WINIX CO. LTD.: BUSINESS OVERVIEW

10.1.14 XIAOMI CORPORATION

TABLE 89 XIAOMI CORPORATION: BUSINESS OVERVIEW

FIGURE 41 XIAOMI CORPORATION: COMPANY SNAPSHOT (2020)

10.1.15 CAMFIL AB

TABLE 90 CAMFIL AB: BUSINESS OVERVIEW

10.1.16 AIRPURA INDUSTRIES INC.

TABLE 91 AIRPURA INDUSTRIES INC.: BUSINESS OVERVIEW

10.1.17 AIRGLE CORPORATION

TABLE 92 AIRGLE CORPORATION: BUSINESS OVERVIEW

10.1.18 HUNTER PURE AIR

TABLE 93 HUNTER PURE AIR: BUSINESS OVERVIEW

10.1.19 KENT RO SYSTEMS LTD.

TABLE 94 KENT RO SYSTEMS LTD.: BUSINESS OVERVIEW

10.1.20 SOMANY HOME INNOVATION LIMITED (WHOLLY OWNED SUBSIDIARY OF HSIL)

TABLE 95 SOMANY HOME INNOVATION LIMITED: BUSINESS OVERVIEW

FIGURE 42 SOMANY HOMEINNOVATION LIMITED: COMPANY SNAPSHOT (2020)

10.2 OTHER PLAYERS

10.2.1 IDEAL KRUG & PRIESTER GMBH & CO. KG: COMPANY OVERVIEW

10.2.2 HAVELLS INDIA LTD.: COMPANY OVERVIEW

10.2.3 MOLEKULE: COMPANY OVERVIEW

10.2.4 CARRIER GLOBAL: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 181)

11.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global residential air purifiers market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply side and other participants were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the global market. The primary sources from the other participants group include private consultants, product development Engineers and Research & Development team.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by technology, type, and region).

Data Triangulation

After arriving at the market size, the total residential air purifiers market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, segment, and forecast the residential air purifiers market by technology, type and by region.

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the global market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the global market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, and R&D activities of the leading players in the residential air purifiers market

- To benchmark players within the global market using the Competitive Leadership Mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Geographic Analysis

- Further breakdown of the Europe market into Switzerland, Netherlands, and RoE

- Further breakdown of the MEA (the Middle East & Africa) market into the UAE, Saudi Arabia, and other MEA countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Residential Air Purifiers Market