Palm Vein Scanner Market with COVID-19 Impact Analysis by Offering (Hardware, Software & Services), Product (Palm Vein Biometrics, Finger Vein Biometrics), Authentication, Functionality, End-User Vertical, Application, and Region - Global Forecast to 2025

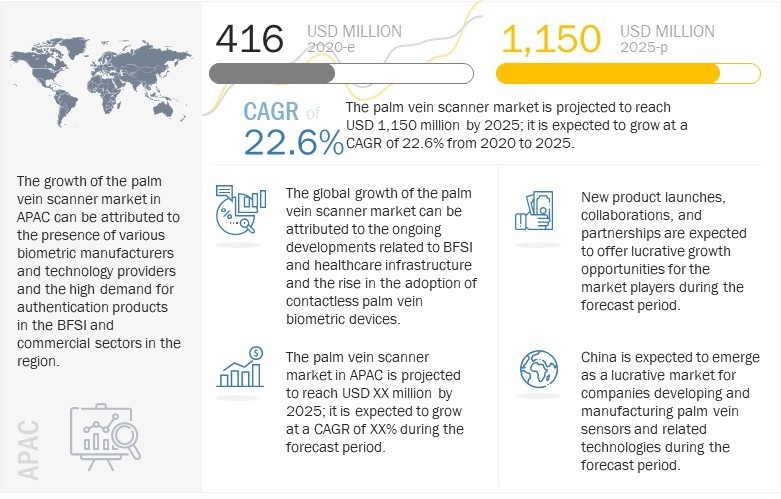

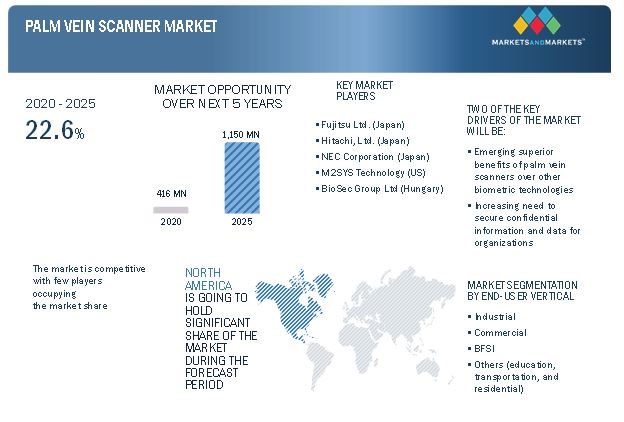

The palm vein scanner market report share is estimated to be USD 416 million in 2020 and expected to reach USD 1,150 million by 2025, at a CAGR of 22.6% from 2020 to 2025

A palm vein scanner is a biometric scanner or device which works on the palm vein pattern recognition or authentication technology. A palm vein authentication works by comparing the pattern of veins in the palm (which appear as blue lines) of a person being authenticated with a pattern stored in a database. As vascular patterns are unique to each individual and exist inside the body, it is not possible to steal these patterns, making palm vein authentication scanners the most secure of all biometric identification methods. Finger vein pattern recognition is based on the same principle as palm vein pattern recognition.

Palm vein recognition technology works by pairing a biometric scanner with a database server or smart card, which stores user data and matches this data with the scanned data. The palm vein recognition technology provides a high level of accuracy and offers an intuitive, non-intrusive, stigma-free, and easy-to-use interface that users are very comfortable with.

Palm Vein Scanner Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

The global palm vein scanner market has been expanding and developing into a strong, well-connected value chain; moreover, robust development is expected to occur over the next few years. The palm vein scanner is a biometric authentication device that uses near-infrared light to scan the vein patterns inside the palm and uses the pattern to match against the stored user data present on a smart card or online server database in order to authenticate a user. The biometrics industry has witnessed a significant increase in the number of vendors that supply palm vein and finger vein biometric technology because of the increasing adoption of highly accurate and highly secure biometric solutions. Moreover, many palm vein biometric systems supplied today are contactless, matching the hygiene requirements of various industries resulting in their increasing adoption.

The palm vein biometric scanner value chain has grown on a vast network of players involved in various segments across different applications. The increasing number of collaborations, along with the emergence of various high-tech startups in different regions of the world, has caused tremendous changes in the landscape of the palm vein scanner industry value chain.

The major drivers for the palm vein scanner market include emerging superior benefits of palm vein scanners over other biometric technologies, increasing need to secure confidential information and data for organizations, surging adoption of biometric identification systems in BFSI, healthcare, and commercial sectors, expanding government support in Europe for internal biometric techniques owing to GDPR compliance, and growing partnerships and collaborations between vendors in the ecosystem boosting market proliferation.

Palm Vein Scanner Market Dynamics :

Driver : Emerging superior benefits of palm vein scanners over other biometric technologies

Palm vein patterns are unique to every individual, even identical twins. Palm vein biometric technology captures an image of the vein pattern beneath the skin and uses that image as the basis for individual identification. It uses near-infrared light to capture a palm vein pattern, so it does not require high-quality skin integrity for accurate identification. Since palm vein biometrics rely on scanning the vein pattern under the skin, it is one of the most secure and reliable biometric modalities. Unlike fingerprint biometric technology, which relies on the integrity of the skin on the fingertip for accurate identification and can be negatively impacted by age, environment, cuts, scrapes, bruises, scars, dirt, grime, and grease, the integrity of the skin is not an issue with palm vein biometrics. Facial recognition technology works by mapping the unique geometry of a person’s face, such as the distance from the chin to the forehead, the distance between the eyes, and the length of the jawline, whereas palm vein technology works by using infrared light to map the unique vein pattern of a person’s palm, measuring over 5 million data points in their vein structure. Because a user’s face is exposed everywhere they go, face recognition cameras can easily identify them from a distance, making it possible to be tracked in public and creating serious privacy risks. Palm vein, on the other hand, is privacy-by-design as the palm vein pattern is concealed inside the hand—it requires a combination of infrared light and a close-up ultra-HD camera to capture it. So, unlike with face recognition, it is impossible for palm vein patterns to be captured from a distance. To be identified, a user must deliberately scan their palm over the palm vein scanner—it cannot be captured without consent. This is what makes palm vein a consent-based biometric, giving it clear advantages over facial recognition in terms of privacy.

Restraint: High convenience of use in alternative biometric methods such as facial, iris, and voice recognition

Palm vein biometrics offer various benefits, including a high level of security, privacy, and accuracy, when compared to alternative technologies such as facial, iris, and voice-based biometric systems. However, one of the potential restraints to the adoption of the palm vein scanner technology is that this technology does not offer the same amount of convenience as that offered by the various alternative biometric systems. In order to use a palm vein biometric system, a user must be close to the palm scanner so that the scanner is able to identify the palm veins. However, in the case of alternative biometrics systems such as facial recognition or iris recognition, the end user can stay at a certain distance from the biometric identification system and still be able to use the biometric platform for access control and other functions. Since palm vein scanner-based biometric systems do not offer long-range identification capabilities, their use has been potentially limited in the personal devices segment as compared to other alternative biometric systems.

Opportunity : Rising demand for all-in-one biometric solutions

Unlike the use of other forms of authentication, such as passwords or tokens, biometric recognition provides a strong link between an individual and a claimed identity. CrucialTrak (US) has been working on improving issued constraints of biometric recognition technology. By combining different biometric technologies into one solution, the company has developed a multi-biometric terminal. These multi-biometric terminals are an integration of different biometric technologies such as fingerprints, facial features, iris patterns, and vein patterns used in the identification and verification process. The use of multi-biometrics takes advantage of the capabilities of each biometric technology while overcoming the limitations of a single technology. Most biometric market players expect that multi-biometric products will become more prevalent in the near future.

Challenge: Data security concerns related to biometric systems

For maintaining a high security level while using palm security, only a high-end palm vein ID with a low False Rejection Rate (FRR) and a low False Acceptance Rate (FAR) will be helpful. Plenty of products that have clearly never been tested with high numbers of users and that can cause problems exist. Another important warning that applies to all forms of biometric identification is that a reliable scanner and registration device are not enough to create a trustworthy system. It is vital to thoroughly secure what is behind them—the database. It is important that all the information saved in the palm vein identification system is encrypted, and images made during the control are not saved. Palm vein biometric systems are exposed to privacy concerns since there is an intrinsic link between the stored biometric template and the person it originates from. The advantages offered by biometric authentication are inverted when the stored data is stolen. The biometric characteristics cannot be changed like a key or a password. Revocation and reissuing of a specific biometric characteristic are not feasible in palm vein biometric systems. Another privacy-related aspect is cross-matching—if the same modality is used in different application contexts (access control, financial services, eCommerce services, etc.), a profile can be constructed linking the stored data in different databases. Furthermore, biometric data can contain important information related to the physical traits of a human. Therefore, the risk of storing medical health-related information is always present in the case of palm vein scanner biometric systems. Thus, data security poses a major challenge to the market growth of palm vein biometrics systems.

Palm Vein Scanner Market Segment Insights :

Based on Offering, the palm vein scanner market has been segmented into hardware and software & services. The software & services segment held the largest share of the palm vein scanner market in 2020. The high growth of the segment can be attributed to the growing compatibility of biometric software with various biometric authentication and verification products and platforms. The software component of a palm vein biometric system can be considered as the backbone of the complete biometric device. Software including SDKs, APIs, OS, integration software, data management software, and other middleware are essential in integrating a palm vein sensor or sensor technology into an end device based on user requirements. The services component is equally important as the software component to the overall growth of the palm vein scanner market as it involves training and post-deployment maintenance.

Based on functionality, physical access control & biometric identification segment accounted for highest market share

By functionality, the palm vein scanner market has been segmented into physical access control & biometric identification, embedded system, and logical access control & biometric identification. Palm vein scanners are largely used for physical access control. They also enhance the level of security of places that need security against an unauthorized person’s entry and maintain the access log. A growing number of organizations have replaced their more traditional security systems, such as keycard readers, with systems that can allow access-based palm vein patterns. Cards can potentially fall into the wrong hands, whereas palm vein biometrics deliver enhanced security by ensuring that it is the actual, authorized individual who is seeking access.

Based on end-user vertical, commercial segment accounted for highest market share

By end-user vertical, the palm vein scanner market has been segmented into commercial, BFSI, industrial, and others. Palm vein scanners are widely used across the commercial vertical, which typically includes retail, sports, hospitality, IT, and healthcare industries. Enterprises that are looking for secure solutions to allow, control, and monitor the access of authorized individuals to secure areas in buildings, facilities, data centers, and control centers are adopting palm vein biometric technology to meet their needs. Companies in retail, sports, hospitality, IT, and healthcare sectors are also deploying palm vein biometric technology for physical access control.

Regional Insights:

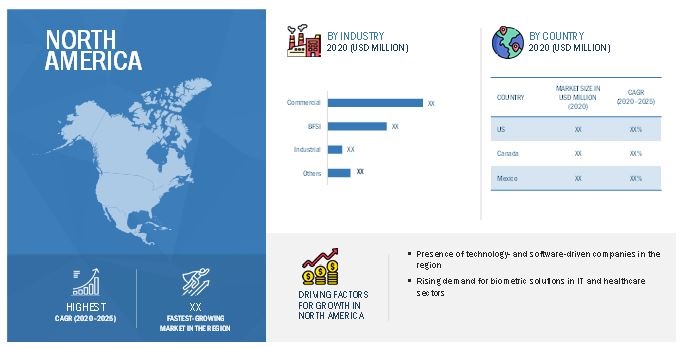

The North America region is projected to Grow at significant CAGR during the forecast period

The emergence of various government regulations and standards in the region by different governments for the protection and security of personal data and to regulate its collection and use of biometric data has led to the promotion of biometric technologies for authentication and verification purposes. Such developments are expected to offer an opportunity for the market growth of palm vein scanners in the region. Amazon (US) and Fingopay (Canada) are some of the major companies which manufacture finger vein and palm vein biometric device in North America. The region has rich exposure to biometric technologies, which are being deployed in various application areas, including government, defense, BFSI, healthcare, IT, home security, and other commercial applications.

Palm Vein Scanner Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The increasing digitalization and adoption of smart technologies have led to the rising demand for finger vein and palm vein biometric products. Several departmental governments in the North America are adopting biometric technologies, including palm vein scanner and finger vein scanner biometric systems, to enhance and ensure the security of their departments, facilitate physical and logical access, and combat security issues. Various districts in the US have released their own set of laws related to data privacy in the past few years, which could contribute to the demand for palm vein biometric systems in the future. Governments in the US have also been deploying biometric solutions on a pilot basis in recent years for controlling immigration movement at borders by using palm vein and finger vein based biometric authentication systems.

Key Market Players in Palm Vein Scanner Market :

Some of the Major players in the palm vein scanner market are Fujitsu Ltd. (Japan), Hitachi, Ltd. (Japan), NEC Corporation (Germany), M2SYS Technology (US), and BioSec Group (Hungary). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the palm vein scanner market.

Fujitsu Ltd. or Fujitsu is a leading Japanese global information and communication technology (ICT) company offering a full range of technology products, solutions, and services. Fujitsu offers PalmSecure, a market-proven biometric authentication technology based on palm vein pattern recognition. PalmSecure provides a high level of accuracy, is easy to implement, and uses a non-intrusive and contactless reader. The company has developed innovative products to cater to the palm vein scanning market. In November 2019, Fujitsu launched “FUJITSU Security Solution AuthConductor V2,” which uses palm vein authentication to deliver comprehensive biometric authentication support for customers. The adoption of advanced technologies, concentrated R&D efforts, and diversified segments have helped the company transform itself from one of the early pioneers into technology leaders of biometric technologies.

Hitachi is the parent company of the Hitachi Group and was a part of the Nissan zaibatsu and later DKB Group of companies before DKB merged into the Mizuho Financial Group. Hitachi’s business segments include IT, Energy, Industry, Mobility, Smart Life, and businesses from its major subsidiaries. The finger vein scanning products offered by the company offer logical as well as physical access control. Hitachi has been leading the biometric authentication business for many years. Its finger vein biometrics is used by banks to replace passwords for authorizing transactions. Hitachi initiated a 3-year 2021 Mid-term management plan in 2019 to become a global leader through its innovative social business. This plan has helped the company to launch and develop innovative solutions in the area of biometric identification technology.

NEC Corporation is one of the global leaders in the integration of IT and network technologies that benefit businesses and people across the world. By providing a combination of products and solutions that cross utilize the company’s experience and global resources, NEC’s advanced technologies meet the complex and ever-changing needs of its customers. Major business segments of the company include public solutions, public infrastructure, enterprise, network services, system platform, and global. NEC offers face recognition, iris recognition, fingerprint/palmprint recognition, voice recognition, and ear acoustic authentication biometric technologies. NEC focuses on offering innovative solutions that can be differentiated from its competitors. NEC offers biometric technologies under the “Bio-IDiom” brand for various applications and in effective combinations. NEC has implemented over 1,000 systems equipped with fingerprint and face recognition technologies in more than 70 countries in the world.

M2SYS provides enterprise multi-modal biometric solutions that enable users to utilize or integrate the right form of biometric technology for their needs. The company majorly focuses on offering identity management solutions for workforce management, healthcare, and large government projects. Various products offered by the company include fingerprint readers, smart fingerprint readers, finger vein readers, dual iris cameras, dual fingerprint live scanners, ten-fingerprint live scanners, and portable biometric readers. M2SYS has laid special emphasis on nurturing its partnership with different technology providers such as Fujitsu and Hitachi in order to offer best in class efficient and accurate biometric products and solutions. Additionally, the company has focused on contracts and partnerships to increase its market visibility. For instance, in March 2019, M2SYS partnered with American Green (US), a technology company that deals in medical cannabis, to sign a contract. The contract involved the integration of M2SYS finger vein reader with American Green Machine (AGM) supplied by American Green to use as a custom vending solution for dispensaries.

BioSec Group Ltd. is a company involved in the design, development, and manufacture of biometric solutions. The company is a dedicated developer of innovative security solutions based on palm vein recognition. BioSec primarily specializes in biometric and non-biometric mass authentication, logical and physical access control solutions and the integration of palm vein recognition in third-party solutions. BioSec Group Ltd. specializes in developing biometric access control and IT security solutions based on palm vein recognition. In February 2020, BioSec’s BS LifePass biometric authentication solution was integrated with Assa Abloy (Sweden) SEAWING Seawing Integrated Solution (SIS) radio frequency identification (RFID) access control system for external verification.

Palm Vein Scanner Market Report Scope :

|

Report Metric |

Details |

| Estimated Value | USD 416 Million |

| Expected Value | USD 1,150 Million |

| Growth Rate | 22.6% |

|

Base Year Considered |

2019 |

|

Forecast Period |

2020–2025 |

|

Historical Data Available for Years |

2016–2025 |

|

Segments Covered |

|

|

Regions Covered |

|

|

Market Leaders |

|

| Key Market Driver | Emerging superior benefits of palm vein scanners over other biometric technologies |

| Key Market Opportunity | Rising demand for all-in-one biometric solutions |

| Largest Growing Region | North America |

| Largest Market Share Segment | Commercial segment |

This report categorizes the palm vein scanner market based on offering, product, authentication, functionality, end-user vertical, application, and region available at the regional and global level

By Offering

- Hardware

- Software & Services

By Product

- Finger vein biometrics

- Palm vein biometrics

By Authentication

- Unimodal biometric system

- Multimodal biometric system

By Functionality

- Physical access control & biometric authentication

- Logical access control & biometric authentication

- Embedded System

By End-user Vertical

- BFSI

- Commercial

- Industrial

By Application

- Access control & biometric identification

- User authentication

- OEM terminal devices

By Region

- APAC

- North America

- Europe

- Middle East, Africa, and South America

Palm Vein Scanner Market Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts.

Emerging superior benefits of palm vein scanners over other biometric technologies, increasing need to secure confidential information and data for organizations, surging adoption of biometric identification systems in BFSI, healthcare, and commercial sectors, expanding government support in Europe for internal biometric techniques owing to GDPR compliance, and growing partnerships and collaborations between vendors in the ecosystem boosting market proliferation.

- Addition/refinement in segmentation–Increase in depth or width of segmentation of the market.

- Hardware

- Software & Services

- Finger Vein Biometrics

- Palm Vein Biometrics

- Unimodal Biometric System

- Multimodal Biometric System

- Physical Access Control & Biometric Authentication

- Logical Access Control & Biometric Authentication

- Embedded Systems

- Access Control & Biometric Identification

- User Authentication

- OEM Terminal Devices

- Others

- Industrial

- Commercial

- BFSI

- Others

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- Central Europe

- Rest of Europe

- Asia Pacific

- China

- Japan

- Southeast Asia

- Rest of Asia Pacific

- RoW

- South America

- Middle East

- Africa

- Coverage of new market players and change in the market share of existing players of the palm vein scanner market.

Company profiles: Company profiles give a glimpse of the key players in the market with respect to their business overviews, financials, product offerings, recent developments undertaken by them, and MnM view. In the new edition of the report, we have total 25 players (15 major, 10 Startups/SME). Moreover, the share of companies operating in the palm vein scanner market and start-up matrix have also been provided in the report.

- Updated financial information and product portfolios of players operating in the palm vein scanner market.

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the context of the palm vein scanner market till 2021/2022 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, business segment focus in terms of the highest revenue-generating segment and investment on research and development activities.

- Updated market developments of the profiled players.

Recent Developments: Updated market developments such as contracts, joint ventures, partnerships & agreements, acquisitions, new service launches, new product launches, investments, funding, and certification have been mapped for the years 2019 to 2022.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

- Competitive benchmarking of startups /SME which covers details about employees, financial status, latest funding round and total funding.

- Inclusion of impact of megatrends on the palm vein scanner market that includes a shift in global climate change, rapid urbanization, greater customization, and disruptive technologies

- Technology analysis and case studies are added in this edition of the report to give the technological perspective and the significance of the advancements in palm vein scanner market

- Inclusion of patent registrations to have an overview of R&D activities in the palm vein scanner market.

- The startup evaluation matrix is added in this edition of the report, covering palm vein scanner startups.

- The new edition of the report consists of trends/disruptions on customer’s business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to enable a better understanding of the market dynamics for palm vein scanner.

Recent Developments

- In May 2020, NEC Corporation announced the development of a multimodal biometric authentication terminal that has been recognized as the world's No.1 in benchmark tests for identification technologies conducted by the US National Institute of Standards and Technology (NIST) and is the core technology of NEC's multimodal biometric authentication brand "Bio-Idiom.

- In December 2019, Recogtech partnered with Nedap (Netherlands), a leading technology company specializing in RFID and access solutions, to develop highly secured palm vein recognition technology. Palm ID and palm ID Card developed by Recogtech were integrated with Nedap’s AEOS access control system to offer customers access to both the technologies worldwide.

- In November 2019, Fujitsu launched the Fujitsu Security Solution AuthConductor V2 that uses various authentication methods, including palm vein authentication, to deliver comprehensive biometric authentication support for customers. In addition to providing a unified palm vein authentication office environment, this product features facial authentication, fingerprint authentication, and IC card authentication for PC logons and is fully scalable to support use by anywhere from several people to organizations with multiple users.

- In November 2019, Barclays (UK) and Hitachi released an improved version of the Barclays Biometric Reader (BBR), a finger vein scanner that allows companies to securely access their banking platforms. The scanner uses infra-red technology to scan finger vein patterns and identify users based on these unique features.

- In July 2019, BioSec signed an OEM contract with Fujitsu (Japan), as a result of which a new PalmSecure product portfolio was launched under the name of Fujitsu BioSec. The new product portfolio includes the ID LifePass, ID GateKeeper, and ID Login V2 solutions and is available in the EMEIA region.

Key Benefits of the Report/Reason to Buy:

Target Audience:

Frequently Asked Questions (FAQ’s)

What is the current size of the palm vein scanner market?

The palm vein scanner market is projected to grow from USD 416 million in 2020 to USD 1,150 million by 2025, at a CAGR of 22.6% from 2020 to 2025.

Who are the winners in the palm vein scanner market?

Fujitsu Ltd. (Japan), Hitachi, Ltd. (Japan), NEC Corporation (Japan), M2SYS Technology (US), and BioSec Group Ltd (Hungary).

What are some of the technological advancements in the market?

Contactless biometric palm vein scanners can be considered as one of the major commercial innovations in the field of biometric technologies in the past 2 decades. Today, several companies offer biometric devices based on contactless palm vein authentication technology for use in different applications, including healthcare, government, border control, BFSI, IT, residential, education, hospitality, and other commercial sectors. Various advancements related to biometric technology have made it possible to integrate 2 different biometric technologies into a single biometric device.

What are the factors driving the growth of the market?

Emerging superior benefits of palm vein scanners over other biometric technologies, increasing need to secure confidential information and data for organizations, surging adoption of biometric identification systems in BFSI, healthcare, and commercial sectors, expanding government support in Europe for internal biometric techniques owing to GDPR compliance, and growing partnerships and collaborations between vendors in the ecosystem boosting market proliferation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 GENERAL INCLUSIONS & EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT OFFERING LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT PRODUCT LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT AUTHENTICATION LEVEL

1.2.6 INCLUSIONS AND EXCLUSIONS AT END-USER VERTICAL LEVEL

1.2.7 INCLUSIONS AND EXCLUSIONS AT APPLICATION LEVEL

1.3 SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 PALM VEIN SCANNER MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 PALM VEIN SCANNER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUE GENERATED BASED ON SALES

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM–UP (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION OF COMPANIES BASED ON SALES

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for estimating market size using bottom-up approach (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for estimating market size using top-down approach (supply-side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 8 COMPARISON CHART FOR PMARKET WITH RESPECT TO IMPACT OF COVID-19

3.1 PRE-COVID-19

3.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

3.4 REALISTIC SCENARIO (POST-COVID-19)

FIGURE 9 SOFTWARE & SERVICES SEGMENT TO GROW AT HIGHER CAGR FROM 2020 TO 2025

FIGURE 10 EMBEDDED SYSTEM SEGMENT TO GROW AT HIGHER CAGR FROM 2020 TO 2025

FIGURE 11 MARKET FOR ACCESS CONTROL & BIOMETRIC IDENTIFICATION TO HOLD LARGEST MARKET SHARE BY 2025

FIGURE 12 MULTIMODAL BIOMETRIC SYSTEM TO GROW AT HIGHER CAGR FROM 2020 TO 2025

FIGURE 13 BFSI TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 14 APAC PALM VEIN SCANNER MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN PALM VEIN SCANNER MARKET

FIGURE 15 INCREASING GLOBAL DEMAND IN BFSI AND COMMERCIAL SECTORS SUPPLEMENTED BY ADOPTION OF CONTACTLESS PALM VEIN SCANNER TO SPUR MARKET GROWTH

4.2 PALM VEIN SCANNER MARKET, BY PRODUCT

FIGURE 16 FINGER VEIN BIOMETRICS TO ACCOUNT FOR LARGEST SHARE OF MARKET BY 2025

4.3 APAC: MARKET, BY INDUSTRY & COUNTRY

FIGURE 17 COMMERCIAL VERTICAL AND SOUTHEAST ASIA TO ACCOUNT FOR LARGEST SHARES OF MARKET IN APAC BY 2025

4.4 MARKET, BY COUNTRY

FIGURE 18 MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

5.2.1 DRIVERS

5.2.1.1 Emerging superior benefits of palm vein scanners over other biometric technologies

TABLE 1 COMPARISON OF MAJOR BIOMETRICS METHODS

5.2.1.2 Increasing need to secure confidential information and data for organizations

5.2.1.3 Surging adoption of biometric identification systems in BFSI, healthcare, and commercial sectors

5.2.1.4 Expanding government support in Europe for internal biometric techniques owing to GDPR compliance

5.2.1.5 Growing partnerships and collaborations between vendors in the ecosystem boosting market proliferation

FIGURE 20 MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High convenience of use in alternative biometric methods such as facial, iris, and voice recognition

FIGURE 21 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Ongoing technological advancements such as palm biometric smart cards

5.2.3.2 Increasing adoption of mobile devices

5.2.3.3 Growing demand for touchless biometric systems due to COVID-19

5.2.3.4 Emerging initiatives taken by governments to provide unique identity cards to citizens

5.2.3.5 Rising demand for all-in-one biometric solutions

FIGURE 22 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Availability of alternative biometric systems

5.2.4.2 Data security concerns related to biometric systems

FIGURE 23 MARET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS OF MARKET

5.4 AVERAGE SELLING PRICE TREND

FIGURE 25 AVERAGE SELLING PRICE TREND FOR PALM VEIN SCANNER

5.5 MARKET MAP

FIGURE 26 KEY PLAYERS IN MARKET ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

5.5.1 CUMULATIVE SHIPMENT OF FUJITSU PALM VEIN SENSORS’

FIGURE 27 CUMULATIVE SHIPMENT OF FUJITSU PALM VEIN SENSORS BETWEEN 2015 AND 2018

5.6 CASE STUDY ANALYSIS

5.6.1 SOCIAL SECURITY INSTITUTION (SSI) – TURKISH NATIONAL HEALTH SYSTEM CHOOSE FUJITSU PALMSECURE PALM VEIN AUTHENTICATION

5.6.2 COMMUNICATION SERVICE CREDIT UNION SELECTS FISERV VERIFAST FOR SECURE AUTHENTICATION AND IDENTIFICATION OF EMPLOYEES

5.7 REGULATIONS LANDSCAPE

5.8 PATENT LANDSCAPE

5.9 TECHNOLOGY ANALYSIS

6 PALM VEIN SCANNER MARKET, BY OFFERING (Page No. - 75)

6.1 INTRODUCTION

FIGURE 28 SOFTWARE & SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 3 MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 4 MARKET, BY OFFERING, 2020–2025 (USD MILLION)

6.2 HARDWARE

6.2.1 MOST PALM VEIN BIOMETRIC DEVICES USE REFLECTION METHOD TO RECOGNIZE VEIN PATTERN

TABLE 5 MARKET FOR HARDWARE, BY REGION, 2016–2019 (USD MILLION)

TABLE 6 MARKET FOR HARDWARE, BY REGION, 2020–2025 (USD MILLION)

6.3 SOFTWARE & SERVICES

6.3.1 SDKS IMPORTANT FOR ENSURING TIMELY DELIVERY OF IMPORTANT UPDATES TO BIOMETRIC DEVICE OVER CLOUD

TABLE 7 MARKET FOR SOFTWARE & SERVICES, BY REGION, 2016–2019 (USD MILLION)

TABLE 8 MARKET FOR SOFTWARE & SERVICES, BY REGION, 2020–2025 (USD MILLION)

7 PALM VEIN SCANNER MARKET, BY PRODUCT (Page No. - 80)

7.1 INTRODUCTION

FIGURE 29 PALM VEIN BIOMETRICS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 9 MARKET, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 10 MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

7.2 FINGER VEIN BIOMETRICS

7.2.1 FINGER VEIN BIOMETRIC SYSTEMS DO NOT LEAVE ANY TRACE DURING AUTHENTICATION PROCESS AND THUS CANNOT BE DUPLICATED

TABLE 11 FINGER VEIN BIOMETRIC MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 FINGER VEIN BIOMETRIC MARKET, BY REGION, 2020–2025 (USD MILLION)

7.3 PALM VEIN BIOMETRICS

7.3.1 DEVELOPMENT OF CONTACTLESS PALM VEIN BIOMETRICS BOOSTED ADOPTION OF PALM VEIN BIOMETRICS

TABLE 13 PALM VEIN BIOMETRIC MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 14 PALM VEIN BIOMETRIC MARKET, BY REGION, 2020–2025 (USD MILLION)

8 PALM VEIN SCANNER MARKET, BY AUTHENTICATION (Page No. - 85)

8.1 INTRODUCTION

FIGURE 30 MULTIMODAL BIOMETRIC SYSTEM TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY AUTHENTICATION, 2016–2019 (USD MILLION)

TABLE 16 MARKET, BY AUTHENTICATION, 2020–2025 (USD MILLION)

8.2 UNIMODAL BIOMETRIC SYSTEM

8.2.1 INCREASING ADOPTION OF MULTI-FACTOR AUTHENTICATION IN LOW SECURITY APPLICATIONS LED TO CONTINUOUS ADOPTION OF UNIMODAL BIOMETRICS

TABLE 17 UNIMODAL BIOMETRIC SYSTEM-BASED MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 UNIMODAL BIOMETRIC SYSTEM-BASED MARKET, BY REGION, 2020–2025 (USD MILLION)

8.3 MULTIMODAL BIOMETRIC SYSTEM

8.3.1 MULTIMODAL BIOMETRIC SYSTEM BENEFITS FROM ABILITY TO ELIMINATE SPOOFING THROUGH LIVENESS DETECTION

TABLE 19 MULTIMODAL BIOMETRIC SYSTEM-BASED MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 20 MULTIMODAL BIOMETRIC SYSTEM-BASED MARKET, BY REGION, 2020–2025 (USD MILLION)

9 PALM VEIN SCANNER MARKET, BY FUNCTIONALITY (Page No. - 90)

9.1 INTRODUCTION

FIGURE 31 PHYSICAL ACCESS CONTROL & BIOMETRIC IDENTIFICATION TO HOLD LARGEST SHARE 0F MARKET IN 2025

TABLE 21 MARKET, BY FUNCTIONALITY, 2016–2019 (USD MILLION)

TABLE 22 MARKET, BY FUNCTIONALITY, 2020–2025 (USD MILLION)

9.2 PHYSICAL ACCESS CONTROL & BIOMETRIC IDENTIFICATION

9.2.1 SUPERIOR SECURITY AND CONVENIENCE LEADING PALM VEIN SCANNERS TO MAKE BIG DIFFERENCE IN PHYSICAL ACCESS CONTROL & BIOMETRIC IDENTIFICATION

TABLE 23 MARKET FOR PHYSICAL ACCESS CONTROL & BIOMETRIC IDENTIFICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 MARKET FOR PHYSICAL ACCESS CONTROL & BIOMETRIC IDENTIFICATION, BY REGION, 2020–2025 (USD MILLION)

9.3 LOGICAL ACCESS CONTROL & BIOMETRIC IDENTIFICATION

9.3.1 PALM VEIN SCANNERS CAN IMPROVE IT SECURITY AGAINST ILLEGITIMATE ACCESS AND INFORMATION LEAKAGE ON BUSINESS SYSTEMS

TABLE 25 MARKET FOR LOGICAL ACCESS CONTROL & BIOMETRIC IDENTIFICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 MARKET FOR LOGICAL ACCESS CONTROL & BIOMETRIC IDENTIFICATION, BY REGION, 2020–2025 (USD MILLION)

9.4 EMBEDDED SYSTEM

9.4.1 PALM VEIN AUTHENTICATION UNITS INCREASINGLY BEING DEPLOYED AT VARIOUS POS TERMINALS, PRINTERS/COPYING MACHINES, AND PCS

TABLE 27 MARKET FOR EMBEDDED SYSTEM, BY REGION, 2016–2019 (USD MILLION)

TABLE 28 MARKET FOR EMBEDDED SYSTEM, BY REGION, 2020–2025 (USD MILLION)

10 PALM VEIN SCANNER MARKET, BY END-USER VERTICAL (Page No. - 96)

10.1 INTRODUCTION

FIGURE 32 COMMERCIAL SEGMENT TO HOLD LARGEST SHARE OF PALM VEIN SCANNER MARKET IN 2025

TABLE 29 MARKET, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 30 MARKET, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

10.2.1 BANKS AND FINANCIAL INSTITUTIONS IN DEVELOPING COUNTRIES ADOPTING VEIN RECOGNITION BIOMETRICS TO VERIFY CUSTOMERS’ IDENTITIES

TABLE 31MARKET FOR BFSI, BY REGION, 2016–2019 (USD MILLION)

TABLE 32 MARKET FOR BFSI, BY REGION, 2020–2025 (USD MILLION)

10.3 COMMERCIAL

10.3.1 COMPANIES IN RETAIL, SPORTS, HOSPITALITY, IT, AND HEALTHCARE SECTORS DEPLOYING PALM VEIN BIOMETRIC TECHNOLOGY FOR PHYSICAL ACCESS CONTROL

TABLE 33 MARKET FOR COMMERCIAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 MARKET FOR COMMERCIAL, BY REGION, 2020–2025 (USD MILLION)

10.4 INDUSTRIAL

10.4.1 PALM VEIN SCANNERS LARGELY USED IN INDUSTRIAL VERTICAL FOR PHYSICAL ACCESS CONTROL

TABLE 35MARKET FOR INDUSTRIAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 36MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (USD MILLION)

10.5 OTHERS

10.5.1 PALM VEIN SCANNERS BEING DEPLOYED IN RESIDENTIAL PREMISES TO IMPROVE HOME SECURITY

TABLE 37MARKET FOR OTHERS (END-USER VERTICAL), BY REGION, 2016–2019 (USD MILLION)

TABLE 38 MARKET FOR OTHERS (END-USER VERTICAL), BY REGION, 2020–2025 (USD MILLION)

11 PALM VEIN SCANNER MARKET, BY APPLICATION (Page No. - 103)

11.1 INTRODUCTION

FIGURE 33 ACCESS CONTROL & BIOMETRIC IDENTIFICATION SEGMENT TO HOLD LARGEST SHARE OF PALM VEIN SCANNER MARKET IN 2025

TABLE 39 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 40 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

11.2 ACCESS CONTROL AND BIOMETRIC IDENTIFICATION

11.2.1 RESIDENTIAL HOUSES INSTALLING DOOR ACCESS CONTROL SYSTEM TO ADD EXTRA LAYER OF SECURITY TO THEIR HOME PREMISES

TABLE 41 MARKET FOR ACCESS CONTROL AND BIOMETRIC IDENTIFICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 MARKET FOR ACCESS CONTROL AND BIOMETRIC IDENTIFICATION, BY REGION, 2020–2025 (USD MILLION)

11.3 OEM TERMINAL DEVICES

11.3.1 CONTACTLESS PALM VEIN AND FINGER VEIN BIOMETRIC SCANNERS EXPERIENCED HIGH ADOPTION IN PAYMENT SYSTEMS

TABLE 43 MARKET FOR OEM TERMINAL DEVICES, BY REGION, 2016–2019 (USD MILLION)

TABLE 44 MARKET FOR OEM TERMINAL DEVICES, BY REGION, 2020–2025 (USD MILLION)

11.4 USER AUTHENTICATION

11.4.1 FINGER VEIN AND PALM VEIN BIOMETRIC TECHNOLOGIES OFFER ADDITIONAL LAYER OF SECURITY TO HOME COMPUTERS AND WORKSTATIONS

TABLE 45 MARKET FOR USER AUTHENTICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 46 MARKET FOR USER AUTHENTICATION, BY REGION, 2020–2025 (USD MILLION)

11.5 OTHERS

TABLE 47 MARKET FOR OTHERS (APPLICATION), BY REGION, 2016–2019 (USD MILLION)

TABLE 48 MARKET FOR OTHERS (APPLICATION), BY REGION, 2020–2025 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 110)

12.1 INTRODUCTION

FIGURE 34 MARKET IN APAC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 49 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 50 PALM VEIN SCANNER MARKET, BY REGION, 2020–2025 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 35 SNAPSHOT: MARKET IN NORTH AMERICA

TABLE 51 MARKET IN NORTH AMERICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 52 MARKET IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 53 MARKET IN NORTH AMERICA, BY FUNCTIONALITY, 2016–2019 (USD MILLION)

TABLE 54 MARKET IN NORTH AMERICA, BY FUNCTIONALITY, 2020–2025 (USD MILLION)

TABLE 55 MARKET IN NORTH AMERICA, BY AUTHENTICATION, 2016–2019 (USD MILLION)

TABLE 56 MARKET IN NORTH AMERICA, BY AUTHENTICATION, 2020–2025 (USD MILLION)

TABLE 57 MARKET IN NORTH AMERICA, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 58 MARKET IN NORTH AMERICA, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 59 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 60 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 61 MARKET IN NORTH AMERICA, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 62 MARKET IN NORTH AMERICA, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

TABLE 63 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 64 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

12.2.1 US

12.2.1.1 Increasing digitalization and adoption of smart technologies have led to rising demand for finger vein and palm vein biometric products

TABLE 65 MARKET IN US, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 66 MARKET IN US, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 67 MARKET IN US, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 68 MARKET IN US, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Canada has made several amendments related to biometrics and privacy laws to promote use of biometric technologies

TABLE 69 MARKET IN CANADA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 70 MARKET IN CANADA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 71 MARKET IN CANADA, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 72 MARKET IN CANADA, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Mexico deployed biometric solutions at airports and country borders to improve national security and strengthen border control

TABLE 73 MARKET IN MEXICO, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 74 MARKET IN MEXICO, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 75 MARKET IN MEXICO, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 76 MARKET IN MEXICO, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.2.4 IMPACT OF COVID-19 ON THE NORTH AMERICA

12.2.4.1 Falling demand for high-cost multimodal biometric solutions in US to affect growing demand for palm vein scanners and solutions

FIGURE 36 NORTH AMERICA: COMPARISON OF PRE- & POST-COVID-19 SCENARIOS FOR PALM VEIN SCANNER MARKET, 2016–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: COMPARISON OF PRE- & POST-COVID-19 SCENARIOS FOR MARKET, 2016–2025 (USD MILLION)

12.2.4.2 COVID-19 impact on US

12.2.4.3 COVID-19 impact on Canada

12.2.4.4 COVID-19 impact on Mexico

12.3 EUROPE

FIGURE 37 SNAPSHOT: PALM VEIN SCANNER MARKET IN EUROPE

TABLE 78 MARKET IN EUROPE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 79 MARKET IN EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 80 MARKET IN EUROPE, BY FUNCTIONALITY, 2016–2019 (USD MILLION)

TABLE 81 MARKET IN EUROPE, BY FUNCTIONALITY, 2020–2025 (USD MILLION)

TABLE 82 MARKET IN EUROPE, BY AUTHENTICATION, 2016–2019 (USD MILLION)

TABLE 83 MARKET IN EUROPE, BY AUTHENTICATION, 2020–2025 (USD MILLION)

TABLE 84 MARKET IN EUROPE, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 85 MARKET IN EUROPE, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 86 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 88 MARKET IN EUROPE, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 89 MARKET IN EUROPE, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

TABLE 90 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 91 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Growing adoption of biometric access control systems in construction and ICT sectors to spur market growth

TABLE 92 MARKET IN GERMANY, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 93 MARKET IN GERMANY, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 94 MARKET IN GERMANY, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 95 MARKET IN GERMANY, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.3.2 UK

12.3.2.1 UK to register largest market size of palm vein scanner market

TABLE 96 MARKET IN UK, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 97 MARKET IN UK, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 98 MARKET IN UK, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 99 MARKET IN UK, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.3.3 CENTRAL EUROPE

12.3.3.1 Implementation of GDPR further accelerated adoption of palm vein and finger vein authentication systems in Central Europe

TABLE 100 PALM VEIN SCANNER MARKET IN CENTRAL EUROPE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 101 MARKET IN CENTRAL EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 102 MARKET IN CENTRAL EUROPE, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 103 MARKET IN CENTRAL EUROPE, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.3.4 REST OF EUROPE

TABLE 104 MARKET IN REST OF EUROPE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 105 MARKET IN REST OF EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 106 MARKET IN REST OF EUROPE, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 107 MARKET IN REST OF EUROPE, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.3.5 IMPACT OF COVID-19 ON EUROPE

12.3.5.1 Revival and progression of healthcare industry to increase demand for advanced contactless biometric solutions such as palm vein and finger vein scanners

FIGURE 38 EUROPE: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR MARKET, 2016–2025 (USD MILLION)

&nbnbsp; TABLE 108 EUROPE: COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR PALM VEIN SCANNER MARKET, 2016–2025 (USD MILLION)

12.3.5.2 COVID-19 impact on Germany

12.3.5.3 COVID-19 impact on UK

12.3.5.4 COVID-19 impact on Central Europe

12.3.5.5 COVID-19 impact on Rest of Europe

12.4 APAC

FIGURE 39 SNAPSHOT: MARKET IN APAC

TABLE 109 MARKET IN APAC, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 110 MARKET IN APAC, BY OFFERING,2020–2025 (USD MILLION)

TABLE 111 MARKET IN APAC, BY FUNCTIONALITY, 2016–2019 (USD MILLION)

TABLE 112 MARKET IN APAC, BY FUNCTIONALITY, 2020–2025 (USD MILLION)

TABLE 113 MARKET IN APAC, BY AUTHENTICATION, 2016–2019 (USD MILLION)

TABLE 114 PALM VEIN SCANNER MARKET IN APAC, BY AUTHENTICATION, 2020–2025 (USD MILLION)

TABLE 115 MARKET IN APAC, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 116 MARKET IN APAC, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 117 MARKET IN APAC, BY APPLICATION,2016–2019 (USD MILLION)

TABLE 118 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 119 MARKET IN APAC, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 120 MARKET IN APAC, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

TABLE 121 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 122 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

12.4.1 JAPAN

12.4.1.1 Presence of several biometric market pioneers, including Fujitsu, Hitachi, and NEC Corporation, to drive market growth

TABLE 123 MARKET IN JAPAN, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 124 MARKET IN JAPAN, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 125 MARKET IN JAPAN, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 126MARKET IN JAPAN, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.4.2 CHINA

12.4.2.1 China to hold largest market share in APAC

TABLE 127 MARKET IN CHINA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 128 MARKET IN CHINA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 129 MARKET IN CHINA, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 130 MARKET IN CHINA, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.4.3 SOUTHEAST ASIA

12.4.3.1 Improving economic infrastructure in Southeast Asia has led to increasing adoption and widespread implementation of biometric solutions in government and public sectors

TABLE 131MARKET IN SOUTHEAST ASIA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 132 MARKET IN SOUTHEAST ASIA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 133 MARKET IN SOUTHEAST ASIA, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 134 MARKET IN SOUTHEAST ASIA, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.4.4 REST OF APAC

12.4.4.1 Several credit card companies in South Korea launched finger vein payment systems to offer added convenience in making payments

TABLE 135 MARKET IN REST OF APAC, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 136 MARKET IN REST OF APAC, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 137 MARKET IN REST OF APAC, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 138MARKET IN REST OF APAC, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.4.5 IMPACT OF COVID-19 ON APAC

12.4.5.1 Bounce back of palm vein scanner market in APAC could be driven by improving demand in BFSI, hospitality, healthcare, and public sectors

FIGURE 40 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR MARKET IN APAC, 2016–2025 (USD MILLION)

TABLE 139 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR MARKET IN APAC, 2016–2025 (USD MILLION)

12.4.5.2 COVID-19 impact on China

12.4.5.3 COVID-19 impact on Japan

12.4.5.4 COVID-19 impact on Southeast Asia

12.4.5.5 COVID-19 impact on Rest of APAC

12.5 REST OF THE WORLD (ROW)

TABLE 140 MARKET IN ROW, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 141 MARKET IN ROW, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 142 MARKET IN ROW, BY FUNCTIONALITY, 2016–2019 (USD MILLION)

TABLE 143 MARKET IN ROW, BY FUNCTIONALITY, 2020–2025 (USD MILLION)

TABLE 144 MARKET IN ROW, BY AUTHENTICATION, 2016–2019 (USD MILLION)

TABLE 145 PALM VEIN SCANNER MARKET IN ROW, BY AUTHENTICATION, 2020–2025 (USD MILLION)

TABLE 146 MARKET IN ROW, BY PRODUCT, 2016–2019 (USD MILLION)

TABLE 147 MARKET IN ROW, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 148 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 149 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 150 MARKET IN ROW, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 151 MARKET IN ROW, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

TABLE 152 MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 153 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

12.5.1 MIDDLE EAST

12.5.1.1 Governments in UAE and Saudi Arabia implementing contactless biometric solutions for biometric registration of travelers and for border control

TABLE 154 MARKET IN MIDDLE EAST, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 155 MARKET IN MIDDLE EAST, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 156 MARKET IN MIDDLE EAST, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 157 MARKET IN MIDDLE EAST, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.5.2 AFRICA

12.5.2.1 Rising outside investments helped South Africa and Egypt to improve their overall economic infrastructure

TABLE 158MARKET IN AFRICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 159 PMARKET IN AFRICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 160 MARKET IN AFRICA, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 161 MARKET IN AFRICA, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.5.3 SOUTH AMERICA

12.5.3.1 Brazil—largest adopter of advanced biometric solutions among South American countries

TABLE 162 MARKET IN SOUTH AMERICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 163MARKET IN SOUTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 164 MARKET IN SOUTH AMERICA, BY END-USER VERTICAL, 2016–2019 (USD MILLION)

TABLE 165 MARKET IN SOUTH AMERICA, BY END-USER VERTICAL, 2020–2025 (USD MILLION)

12.5.4 IMPACT OF COVID-19 ON REST OF THE WORLD (ROW)

12.5.4.1 Government spending on improving economic infrastructure, including promoting contactless biometric solutions, to decline

FIGURE 41 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR MARKET IN ROW, 2016–2025 (USD MILLION)

TABLE 166 COMPARISON OF PRE- AND POST-COVID-19 SCENARIOS FOR MARKET IN ROW, 2016–2025 (USD MILLION)

12.5.4.2 COVID-19 impact on Middle East

12.5.4.3 COVID-19 impact on Africa

12.5.4.4 COVID-19 impact on South America

13 COMPETITIVE LANDSCAPE (Page No. - 167)

13.1 OVERVIEW

FIGURE 42 COMPANIES ADOPTED PARTNERSHIPS AND CONTRACTS AS KEY GROWTH STRATEGIES FROM JANUARY 2016 TO SEPTEMBER 2020

13.2 MARKET SHARE AND RANKING ANALYSIS

FIGURE 43 MARKET: MARKET SHARE ANALYSIS

TABLE 167 MARKET: MARKET SHARE ANALYSIS

TABLE 168 MARKET: MARKET RANKING ANALYSIS

13.3 COMPANY EVALUATION QUADRANT

FIGURE 44 PALM VEIN SCANNER MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2019

13.3.1 STAR

13.3.2 PERVASIVE

13.3.3 EMERGING LEADER

13.3.4 PARTICIPANT

13.4 COMPETITIVE BENCHMARKING

13.4.1 STRENGTH OF PRODUCT PORTFOLIO (FOR 18 COMPANIES)

FIGURE 45 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN PALM VEIN SCANNER MARKET

13.4.2 BUSINESS STRATEGY EXCELLENCE (FOR 18 COMPANIES)

FIGURE 46 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN PALM VEIN SCANNER MARKET

13.5 STARTUP/SME EVALUATION MATRIX, 2019

FIGURE 47 PALM VEIN SCANNER MARKET (GLOBAL) STARTUP/SME EVALUATION MATRIX, 2019

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

13.6 COMPETITIVE SCENARIO AND TRENDS

13.6.1 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 169 PALM VEIN SCANNER MARKET: KEY PRODUCT LAUNCHES AND DEVELOPMENTS (JANUARY 2016–SEPTEMBER 2020)

13.6.2 DEALS

TABLE 170 KEY DEALS (JANUARY 2016–SEPTEMBER 2020)

14 COMPANY PROFILE (Page No. - 181)

14.1 INTRODUCTION

(Business Overview, Products/Solutions/Services Offered, Recent Developments, COVID-19 impact, and MnM View (Key strengths/ Right to win/ Strategic choices made/ Weaknesses and competitive threats))*

14.2 KEY PLAYERS

14.2.1 FUJITSU LTD.

FIGURE 48 FUJITSU LTD.: COMPANY SNAPSHOT

14.2.2 HITACHI, LTD.

FIGURE 49 HITACHI, LTD.: COMPANY SNAPSHOT

14.2.3 NEC CORPORATION

FIGURE 50 NEC CORPORATION: COMPANY SNAPSHOT

14.2.4 M2SYS TECHNOLOGY

14.2.5 BIOSEC GROUP LTD.

14.2.6 EPORTATION, INC.

14.2.7 IDLINK SYSTEMS PTE LTD.

14.2.8 BIOENABLE TECHNOLOGIES PVT. LTD.

14.2.9 MOFIRIA CORPORATION

14.2.10 DAKAR SOFTWARE SYSTEMS

14.2.11 RECOGTECH B.V.

14.3 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 51 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

14.4 OTHER IMPORTANT PLAYERS

14.4.1 IPROOV

14.4.2 REDROCK BIOMETRICS

14.4.3 FISERV, INC.

14.4.4 RAVIRAJ TECHNOLOGIES

14.4.5 IMPRIVATA, INC.

14.4.6 TIME SYSTEMS (UK) LTD

14.4.7 GLOBAL ID SA

14.4.8 XCELTECH INTERNATIONAL PTE LTD.

14.4.9 IDENTYTECH SOLUTIONS LTD.

14.4.10 CRUCIALTRAK, INC.

14.4.11 MANTRA SOFTECH (INDIA) PVT. LTD.

14.4.12 MATRIX COMSEC PVT. LTD.

14.4.13 FINGOPAY (A STHALER COMPANY)

14.4.14 IDEMIA

14.4.15 NEUROTECHNOLOGY

14.4.16 NORMEE LIMITED.

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, COVID-19 impact, and MnM View (Key strengths/ Right to win/ Strategic choices made/ Weaknesses and competitive threats)might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 213)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 QUESTIONNAIRE FOR MARKET

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

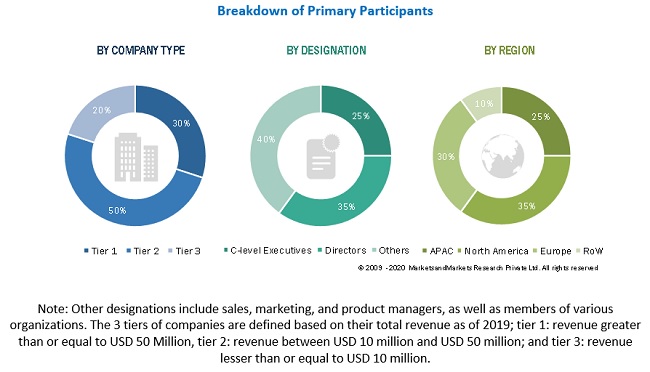

The study involved four major activities for estimating the size of the palm vein scanner market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with industry experts across the palm vein scanner market's value chain. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the palm vein scanner market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the palm vein scanner market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the palm vein scanner market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across key regions, namely, North America, Europe, APAC, and the Middle East, Africa & South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the palm vein scanner market's size and segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain and the size of the palm vein scanner market, in terms of value, have been determined through primary and secondary research processes

- Several primary interviews have been conducted with key opinion leaders related to the palm vein scanner market, including key OEMs, IDMs, and Tier I suppliers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been considered while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from the palm vein scanner market's demand and supply sides.

Report Objectives

- To describe, segment, and forecast the overall size of the palm vein scanner market based on offering, product, authentication, functionality, end-user vertical, application, and region

- To describe, analyze, and forecast the market size for various segments with regard to 3 main regions—Asia Pacific (APAC), North America, Europe, Middle East Africa, and South America

- To analyze and forecast the market size, in terms of value (USD million/billion), for the palm vein scanner market

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To briefly describe the palm vein scanner value chain

- To segment and forecast the palm vein scanner market size by offering (hardware and software & services)

- To segment and forecast the palm vein scanner market size by product (palm vein biometrics and finger vein biometrics)

- To segment and forecast the palm vein scanner market size by authentication (unimodal biometric system and multimodal biometric system)

- To segment and forecast the palm vein scanner market size by functionality (physical access control & biometric authentication, logical access control & biometric authentication, and embedded system)

- To segment and forecast the palm vein scanner market size by end-user vertical (BFSI, commercial, and industrial)

- To segment and forecast the palm vein scanner market size by application (access control & biometric identification, user authentication, and OEM terminal devices)

- To forecast the palm vein scanner market size in key regions, namely, North America, Asia Pacific (APAC), Europe, and the Middle East, Africa (MEA), and South America

- To analyze competitive developments such as product launches and developments, partnerships, acquisitions, contracts, expansions, and research and development (R&D) activities in the palm vein scanner market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the palm vein scanner market

- Estimation of the market size of the segments of the palm vein scanner market based on different subsegments

Growth opportunities and latent adjacency in Palm Vein Scanner Market

I see you show M2Sys as a player in the palm vein market. You should know that they are no longer offering it as a product and indeed Fujitsu has severed their relationship with M2SYS