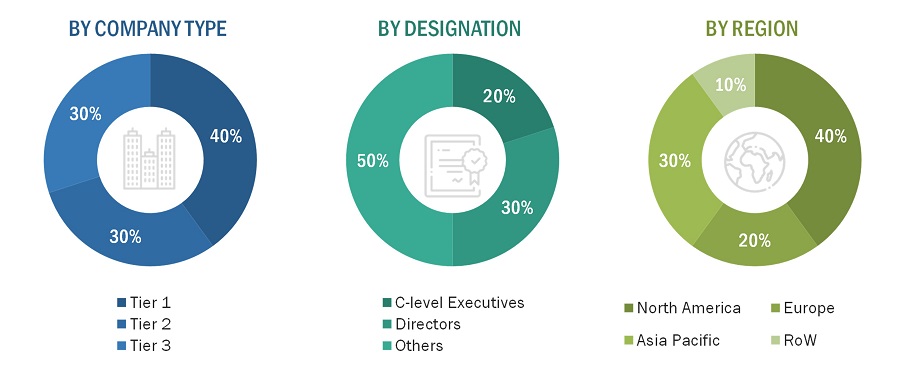

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the fingerprint sensor market size. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the fingerprint sensor market size. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the fingerprint sensor market share were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These include annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry's value chain, the total pool of market players, the classification of the industry according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Primary research was also conducted to identify the segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends, along with key strategies adopted by players operating in the fingerprint sensor industry share . Extensive qualitative and quantitative analyses were performed on the complete industry engineering process to list key information and insights throughout the report.

Extensive primary research has been conducted after acquiring knowledge about the fingerprint sensor industry scenario through secondary research. Several primary interviews have been conducted with experts from both demand (end-use application, and region) and supply side (technology, sensor technology, type) across four major geographic regions: North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of the primary interviews were conducted from the supply and demand side, respectively. These primary data have been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

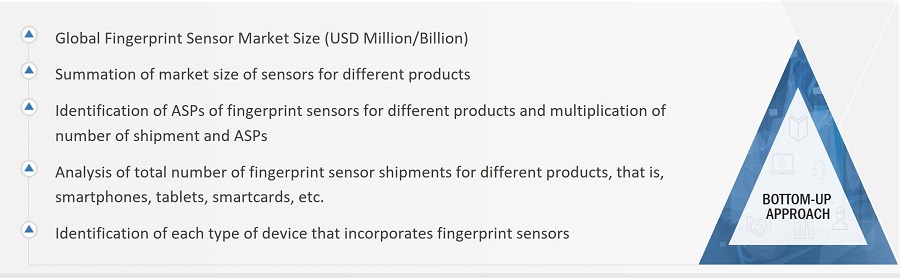

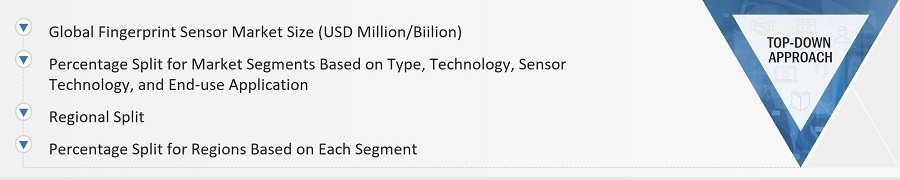

In the complete market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the fingerprint sensor market size and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Fingerprint Sensor Market: Bottom-Up Approach

Fingerprint Sensor Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the industry size estimation process, as explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using top-down and bottom-up approaches.

Market Definition

A fingerprint sensor is an electronic component used to capture a digital image of the fingerprint pattern of a person, i.e., the ridges and valleys (minutiae) found on the surface tips of a human finger to identify an individual. The captured image is called a live scan, and live scans are digitally processed to create a biometric template stored and used for matching the patterns. Since every person’s fingerprint is unique and different from any other in the world, it has become an ideal and popular identification method.

Key Stakeholders

-

Smartphone OEMs, access control system providers, fingerprint scanner providers, IoT device manufacturers

-

Sensor manufacturers

-

Smartcard providers

-

Integrated device manufacturers

-

Research organizations and consulting companies

-

Subcomponent manufacturers

-

Technology providers

-

Sensor chip traders and distributors

-

Electronic hardware equipment manufacturers

-

Research institutes and organizations

Report Objectives

-

To define, describe, and forecast the fingerprint sensor market size , in terms of value, by technology, sensor technology, type, end-use application, and region.

-

To describe and forecast the fingerprint sensor market Share , by end-use application, in terms of volume.

-

To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW).

-

To explain the different materials used in fingerprint sensors, key standards for fingerprint sensors, and various products that use fingerprint sensors

-

To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

-

To offer an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market.

-

To give a detailed overview of the value chain of the fingerprint sensor market ecosystem

-

To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

-

To strategically profile the key players and comprehensively analyze their market shares and core competencies

-

To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

-

To study competitive developments such as collaborations, partnerships, product developments, and acquisitions in the market

-

To understand the impact of the recession on the fingerprint sensor industry

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Alexandra

Jan, 2019

I would be very grateful if you could provide me more detailed information about technology of fingerprint sensors, technical parameters of sensors, prices of sensors, number of sales, main vendors and types of sensors, features of sensors, common problems of production and statistics on sensors' byers. .

jk

Dec, 2018

Currently, I am searching the finger print sensor tech and market trends. Can you provide us with the major market trends and opportunities for the fingerprint sensor market?.

naresh

Oct, 2019

In India day by day touch sensing market increased. I want to know, how much future potential available in India. .

anges.hsu

Sep, 2021

We focus on NB and peripheral devices, which have fingerprint devices with the next 5-year attach rate trend.wanted to know which type sensor attach rate trend in next 5 years..

jason

Sep, 2014

We are the leading providers of capacitive fingerprint sensors. I would like to understand the potential threats of these in the next 4-5 years. Also would like to understand the opportunities for this market. .

Ziyun

Aug, 2019

We're seeking for market reports about biometrics, fingerprint sensors, and palm print sensors. The contents including security and government applications would be preferred..