Biometric-as-a-Service Market by Offering, Solution (Fingerprint Recognition, Iris Recognition, Voice Recognition, Palm & Vein Recognition), Trait (Physiological, Behavioral), Modality, Organization Size, Vertical, Region-Global Forecast to 2025

Biometric as a Service Market Size & Forecast

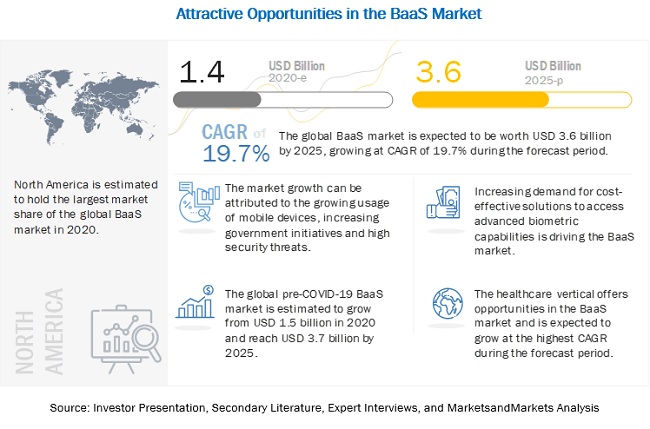

The global Biometric as a Service Market size was valued at USD 1.4 billion in 2020 and is expected to grow at a CAGR of 19.7% from 2020 to 2025. The revenue forecast for 2025 is projected to reach $3.6 billion. The base year for estimation is 2019, and the historical data spans from 2020 to 2025.

The major factors fueling the biometric as a service market include increasing users and data-security initiatives by government, growing usage of mobile devices, and rising demand for robust fraud detection and prevention systems. Moreover, the growing integration of Artificial Intelligence (AI) and blockchain technologies with Biometrics-as-a-Service (BaaS) solutions would provide opportunities for BaaS vendors.

Biometric as a Service Market Growth Dynamics

Driver: Increasing demand for cost-effective solutions to access advanced biometrics capabilities

The integration of biometrics capabilities into business applications, using the traditional biometric technique, is costly and tedious. Biometrics-as-a-service is offered on the cloud-based platform, which integrates cloud capabilities and technologies with the biometrics infrastructure. This delivers biometric onboarding and authentication capabilities on the cloud platform and eliminates the cost associated with the database, network, and storage components. The only hardware component required is the biometric capture device to capture the individual biometric input, which makes it easier for these solutions to be deployed, thus driving their adoption across various industries. Moreover, most of the biometrics-as-a-service providers offer integration services to help customers integrate biometrics capabilities into their existing systems. This further reduces the need for technical resources to integrate the service. Companies are in constant need of such low-cost solutions, thus driving the demand for these solutions across the globe.

Restraint: Security of biometric data stored on the cloud

Consumers and enterprise organizations are reluctant to integrate biometrics-as-a-service systems with their organizations, as the storage of their biometric information is on the cloud. This information, stored on the cloud, can be stolen, lost, or otherwise compromised if the cloud is not secured. According to Gemalto’s Breach Level Index, in 2016, 1,792 data breaches led to almost 1.4 billion data records being compromised worldwide. The company also reported an increase in data breaches of 86% as compared to 2015. If the biometric is intercepted, it can be misused to enable illegitimate authentication. Moreover, unlike passwords or smart cards, biometric information describes a person, and hence it is unlikely to be reset or reproduced once it is compromised. Thus, the security of biometric data acts as a restraint in the adoption of BaaS offerings.

Opportunity: Increasing adoption of cloud-based services

Enterprises are increasingly adopting cloud-based services, for their business functions, due to various advantages, such as lower costs, flexibility, disaster recovery, and agility. Moreover, the cloud provides the advantage of hybrid cloud deployment, which provides the benefit of both the private and public clouds. Owing to cloud deployment, enterprises are also able to avail of the biometric security capabilities without the requirement of any complex infrastructure. These biometrics capabilities can be offered over the cloud and can be quickly integrated into the existing systems. As a result, enterprises are using cloud services to simplify the complexities involved with traditional deployments. Thus, the growing cloud usage is expected to provide excellent opportunities for the biometric-as-a-service market over the coming years.

Challenge:Integration of BaaS into the existing systems

The integration of biometric infrastructure into the existing systems is a major challenge in the adoption of biometrics-as-a-service offerings. The integration of biometric technology into the existing system may require the procurement of new systems or replacement of the existing equipment and software. Moreover, organizations have to bear the costs and efforts of utilizing a Software Development Kit (SDK) to add biometric recognition capability into their existing systems and products. This is a time-consuming process, which can delay or cancel the adoption of biometric technology. However, to overcome such challenges, companies such as BioID and HYPR offer integration services that enable the rapid integration of biometric services by using standard protocols.

Services segment to grow at a higher CAGR during the forecast period

In the biometric as a service market by offerings, the services segment is expected to grow at a higher CAGR during the forecast period. Services mostly support services for upgrading or maintenance, which are either a part of the subscription plan or a standalone service. Additionally, services revenues are mainly derived from integration services with complex enterprise applications.

The unimodal segment to hold a larger market size during the forecast period

Unimodal solutions are easy to deploy and less complex than multimodal technologies. However, unimodal technologies are more vulnerable to threats, such as spoofing, and are not as reliable as multimodal systems. These systems are therefore deployed in industries where high levels of security and reliability are not required.

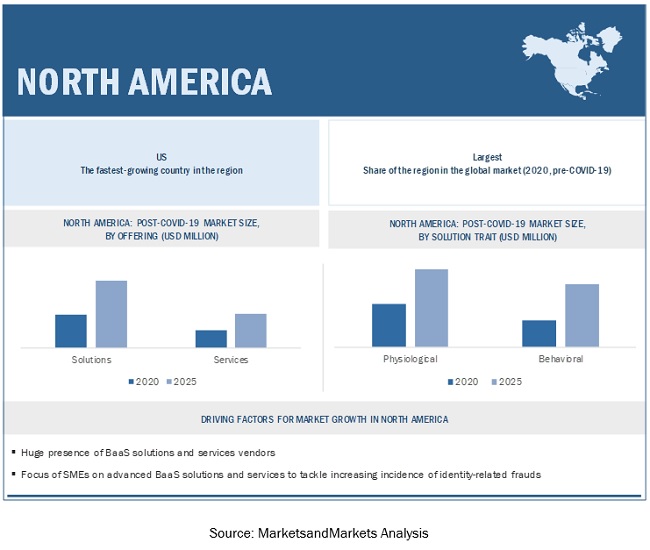

North America to hold the largest market size during the forecast period

North America is expected to contribute the highest market share in terms of revenues during the forecast period as it is a technologically advanced region with a high number of early adopters and the presence of major market players. Factors such as large-scale funded programs and employee access monitoring in buildings are driving the revenue growth in this region.

Asia Pacific is expected to contribute to the fastest-growing region with the highest CAGR during the forecast period as it is getting technologically equipped with the early adoption of new technologies. Factors such as increasing cyber-attacks and inefficiency of large and small businesses in this region to manage and mitigate the risks associated with identity-related cyberattacks are driving the revenue growth in this region.

Key market players

Major vendors in the global biometric as a service market include NEC (Japan), Aware (US), Fujitsu (Japan), Nuance (US), Thales (France), Leidos (US), Idemia (France), M2SYS (US), and HYPR (US).

Nuance is a well-established voice biometrics solution and Natural Language Understanding (NLU) solutions provider with an extensive geographic presence. The company's segments include healthcare, enterprise, automotive, and imaging. Moreover, it caters to multiple verticals, such as financial services, government, healthcare, legal, manufacturing, education, and logistics. The company has expanded its biometrics solution portfolio with the addition of behavioral biometrics solutions by partnering with BioCatch, a leading behavioral biometrics solutions provider. This partnership has enabled Nuance to offer multi-factor authentication solutions to customers.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Offering, solution type, solution trait, modality, organization size, vertical and region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Idemia (France), NEC (Japan), Thales (France), M2SYS (US), Fujitsu (Japan), Aware (US), Leidos (US), Nuance (US), Certisign (Brazil), HYPR (US), BioID (Germany), Ayonix (Japan), Phonexia (US), Lexis Nexis (US), Cognitec Systems (Germany), Iritech (US), Affectiva (US), Nviso (Switzerland), Fingerprints (Sweden), Bayometric (US), Google (US), Microsoft (US), IBM (US), Amazon (US), and Accenture (Ireland) |

The research report categorizes biometric as a service market based on application area, modality, offering, and regions.

Biometric as a Service Market Based on Offering:

- Solutions

- Services

Based on the solution type:

- Fingerprint Recognition

- Face Recognition

- Iris Recognition

- Voice Recognition

- Palm and Vein Recognition

- Others (DNA, Signature, Keystroke)

Biometric as a Service Market Based on solution trait:

- Physiological

- Behavioral

Based on modality:

- Unimodal

- Multimodal

Biometric as a Service Market Based on organization size:

- SMEs

- Large Enterprises

Based on verticals:

- Government (Public Administration)

- Healthcare

- BFSI

- IT and ITES

- Manufacturing

- Education

- Others (entertainment, transportation, energy and utilities, retail, telecommunication, and other professional services)

Biometric as a Service Market Based on Regions:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent developments

- In May 2019, Fujitsu partnered with Kia to build a biometric-enabled police highway patrol vehicle with a critical information system integrated into the car. Under this partnership, Fujitsu would create a single action button for three features, namely, front of the gearstick control, emergency lights, and sirens, by embedding its biometrics (Palm Secure) into the gearstick.

- In April 2019, NEC partnered with Nagasaki University to establish a program on global health and biometric authentication for Nagasaki University’s Graduate School of Tropical Medicine and Global Health Studies.

- In February 2018, Nuance upgraded its biometrics security suite with Artificial Intelligence (AI) to curb frauds across voice and digital channels. It introduced ConversationPrint and Intelligent Detectors to streamline omnichannel customer authentication and stop fraudsters across all points of access.

Frequently Asked Questions (FAQ):

How big is the global biometric as a service market?

What is the definition of biometric as a service?

What is the estimated growth rate (CAGR) of the global biometric as a service market?

Who are the major vendors in the biometric as a service market?

What are the major revenue pockets in the global biometric as a service market currently?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 POSSIBLE SCENARIOS OF THE RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

FIGURE 6 GLOBAL BIOMETRIC AS A SERVICE MARKET: MARKET SEGMENTATION

1.6.1 REGIONS COVERED

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2014–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

FIGURE 7 BIOMETRIC AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key industry insights

FIGURE 8 MARKET: KEY OFFERINGS OF SOME OF THE PRIMARY RESPONDENTS

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

TABLE 2 SUPPLY-SIDE ANALYSIS: PRODUCT MAPPING

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY -SUPPLY SIDE: REVENUE OF SERVICES OF THE BIOMETRICS-AS-A-SERVICE-MARKET

FIGURE 11 BIOMETRIC AS A SERVICE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 12 IMPACT OF COVID19 PANDEMIC ON BIOMETRIC AS A SERVICE MARKET

FIGURE 13 NORTH AMERICA IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE (POST-COVID-19) IN 2020

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE BIOMETRICS-AS-A-SERVICE POST COVID-19 MARKET

FIGURE 14 INCREASING REQUIREMENT FOR EFFICIENT AND COST-EFFECTIVE SECURITY CAPABILITIES IS EXPECTED TO FUEL THE GROWTH OF THE BIOMETRIC AS A SERVICE MARKET

4.2 MARKET: TOP 3 VERTICALS, POST-COVID-19

FIGURE 15 HEALTHCARE TO HAVE THE HIGHEST SHARE DURING THE FORECAST PERIOD

4.3 MARKET SIZE, BY VERTICAL, 2020–2025, POST COVID-19

FIGURE 16 HEALTHCARE TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.4 MARKET, BY REGIONS AND VERTICAL, 2020, POST COVID-19

FIGURE 17 HEALTHCARE VERTICAL AND ASIA PACIFIC IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 BIOMETRIC AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing usage of mobile devices

FIGURE 19 SMARTPHONE ADOPTION RATE, 2018 VS. 2025

5.2.1.2 Increasing demand for cost-effective solutions to access advanced biometrics capabilities

5.2.1.3 High security threats

FIGURE 20 WORLDWIDE SECURITY SPENDING, 2017–2019

5.2.1.4 Increasing government initiatives

5.2.2 RESTRAINTS

5.2.2.1 Security of biometric data stored on the cloud

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing use of digital platforms for transactions

5.2.3.2 Increasing adoption of cloud-based services

5.2.4 CHALLENGES

5.2.4.1 Integration of biometrics-as-a-service into the existing systems

5.2.4.2 Network dependency to access biometrics-as-a-service offerings over the cloud

5.3 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

5.3.1 CUMULATIVE GROWTH ANALYSIS

5.3.2 DRIVERS AND OPPORTUNITIES: IMPACT OF COVID-19 ON FACIAL BIOMETRIC

5.4 TECHNOLOGY TRENDS AND STANDARDS

5.4.1 INTRODUCTION

5.4.2 STANDARDS AND GUIDELINES FOR THE BIOMETRIC AS A SERVICE MARKET

5.4.2.1 Health Insurance Portability and Accountability Act (HIPAA)

5.4.2.2 International Organization for Standardization/International Electrotechnical Commission 27000 family (ISO/IEC 27000)

5.4.2.3 Payment Card Industry Data Security Standard (PCI-DSS)

5.4.2.4 Federal Information Security Management Act (FISMA)

5.4.2.5 International Organization for Standardization/International Electrotechnical Commission 27018 (ISO/IEC 27018)

5.4.2.6 European Association for Biometrics (EAB)

5.4.2.7 International Biometric Society (IBS)

5.4.2.8 Fast Identity Online (FIDO) Alliance

5.5 USE CASES

5.5.1 BIOMETRICS-AS-A-SERVICE: USE CASES

5.5.1.1 USE CASE #1: Securing banking operations

5.5.1.2 USE CASE #2: Registration of 1.2 billion citizens

5.5.1.3 USE CASE #3: Biometrics for patient identification

5.5.1.4 USE CASE #4: Effective voter registration solution for improved accuracy

5.5.1.5 USE CASE #5: Biometrics in jail management

5.5.1.6 USE CASE #6: Enhanced security through palm vein biometric authentication

6 BIOMETRIC AS A SERVICE MARKET ANALYSIS, BY OFFERING (Page No. - 73)

6.1 INTRODUCTION

FIGURE 21 SERVICES SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD (POST-COVID-19)

6.1.1 MARKET ESTIMATES AND FORECAST, 2014–2025

TABLE 4 MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 5 PRE-COVID-19: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 6 POST-COVID-19: MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

6.2 SOLUTIONS

6.3 SERVICES

6.3.1 MARKET ESTIMATES AND FORECAST, BY SERVICE, 2014–2025

TABLE 7 SERVICES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 8 PRE-COVID-19: SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 9 POST-COVID-19: SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7 BIOMETRIC AS A SERVICE MARKET ANALYSIS, BY SOLUTION (Page No. - 77)

7.1 INTRODUCTION

7.1.1 MARKET ESTIMATES AND FORECAST, BY SOLUTION, 2014–2025

TABLE 10 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 11 PRE-COVID-19: SOLUTIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 12 POST-COVID-19: SOLUTIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2 BY TYPE

FIGURE 22 VOICE RECOGNITION SEGMENT IS EXPECTED TO GROW AT THE HIGHER CAGR IN THE POST-COVID-19 MARKET

7.2.1 MARKET ESTIMATES AND FORECAST, BY TYPE, 2014–2025

TABLE 13 SOLUTIONS: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 14 PRE-COVID-19: SOLUTION MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 15 POST-COVID-19: SOLUTION MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

7.2.2 FINGERPRINT SCANNING

7.2.2.1 Fingerprint scanning: biometric as a service market drivers

7.2.2.2 Fingerprint scanning: covid-19 market impact

7.2.3 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 16 FINGERPRINT SCANNING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 17 PRE-COVID-19: FINGERPRINT SCANNING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 18 POST-COVID-19: FINGERPRINT SCANNING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.4 FACIAL RECOGNITION

7.2.4.1 Facial recognition: market drivers

7.2.4.2 Facial recognition: covid-19 market impact

7.2.5 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 19 FACIAL RECOGNITION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 20 PRE-COVID-19: FACIAL RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 21 POST-COVID-19: FACIAL RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.6 IRIS RECOGNITION

7.2.6.1 Iris Recognition: Market Drivers

7.2.6.2 Iris recognition: covid-19 market impact

7.2.7 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 22 IRIS RECOGNITION: BIOMETRIC AS A SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 23 PRE-COVID-19: IRIS RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 24 POST-COVID-19: IRIS RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.8 VOICE RECOGNITION

7.2.8.1 Voice recognition: market drivers

7.2.8.2 Voice recognition: covid-19 market impact

7.2.9 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 25 VOICE RECOGNITION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 26 PRE-COVID-19: VOICE RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 27 POST-COVID-19: VOICE RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.10 PALM AND VEIN RECOGNITION

7.2.10.1 Palm and vein recognition: market drivers

7.2.10.2 Palm and vein recognition: covid-19 market impact

7.2.11 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 28 PALM AND VEIN RECOGNITION: BIOMETRIC AS A SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 29 PRE-COVID-19: PALM AND VEIN RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 30 POST-COVID-19: PALM AND VEIN RECOGNITION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.12 OTHER SOLUTIONS

7.2.13 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 31 OTHER SOLUTIONS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 32 PRE-COVID-19: OTHER SOLUTIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 33 POST-COVID-19: OTHER SOLUTIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 BY TRAIT

FIGURE 23 BEHAVIORAL SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE POST-COVID-19 FORECAST PERIOD

7.3.1 MARKET ESTIMATES AND FORECAST 2014–2025

TABLE 34 BIOMETRIC AS A SERVICE MARKET SIZE, BY TRAIT, 2014–2019 (USD MILLION)

TABLE 35 PRE-COVID-19: MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

TABLE 36 POST-COVID-19: MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

7.3.2 PHYSIOLOGICAL BIOMETRICS

7.3.2.1 Physiological biometrics: covid-19 market impact

7.3.3 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 37 PHYSIOLOGICAL BIOMETRICS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 38 PRE-COVID-19: PHYSIOLOGICAL BIOMETRICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 39 POST-COVID-19: PHYSIOLOGICAL BIOMETRICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.4 BEHAVIORAL BIOMETRICS

7.3.4.1 Behavioral biometrics: covid-19 market impact

7.3.5 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 40 BEHAVIORAL BIOMETRICS: BIOMETRIC AS A SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 41 PRE-COVID-19: BEHAVIORAL BIOMETRICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 42 POST-COVID-19: BEHAVIORAL BIOMETRICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 BIOMETRIC AS A SERVICE MARKET ANALYSIS, BY MODALITY TYPE (Page No. - 97)

8.1 INTRODUCTION

FIGURE 24 MULTIMODAL SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

8.1.1 MARKET ESTIMATES AND FORECAST, BY MODALITY TYPE, 2014–2025

TABLE 43 MARKET SIZE, BY MODALITY TYPE, 2014–2019 (USD MILLION)

TABLE 44 PRE-COVID-19: MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

TABLE 45 POST-COVID-19: MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

8.2 UNIMODAL BIOMETRICS

8.2.1 UNIMODAL BIOMETRICS: MARKET DRIVERS

8.2.2 UNIMODAL BIOMETRICS: COVID-19 MARKET IMPACT

8.2.3 MARKET ESTIMATES AND FORECAST, BY MODALITY, 2014–2025

TABLE 46 UNIMODAL BIOMETRICS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 47 PRE-COVID-19: UNIMODAL BIOMETRIC AS A SERVICE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 48 POST-COVID-19: UNIMODAL MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 MULTIMODAL BIOMETRICS

8.3.1 MULTIMODAL BIOMETRICS: MARKET DRIVERS

8.3.2 MULTIMODAL BIOMETRICS: COVID-19 MARKET IMPACT

8.3.3 MARKET ESTIMATES AND FORECAST, BY REGION, 2014–2025

TABLE 49 MULTIMODAL BIOMETRICS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 50 PRE-COVID-19: MULTIMODAL MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 51 POST-COVID-19: MULTIMODAL MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 BIOMETRIC AS ASERVICE MARKET ANALYSIS, BY ORGANIZATION SIZE (Page No. - 103)

9.1 INTRODUCTION

FIGURE 25 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT IS EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

9.1.1 MARKET ESTIMATES AND FORECAST, BY ORGANIZATION SIZE, 2014–2025

TABLE 52 MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 53 PRE-COVID-19: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 54 POST-COVID-19: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

9.2.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

9.2.2 SMALL AND MEDIUM ENTERPRISES: COVID-19 MARKET IMPACT

9.2.3 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 55 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 56 PRE-COVID-19: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 57 POST-COVID-19: SMALL AND MEDIUM-SIZED ENTERPRISES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 LARGE ENTERPRISES

9.3.1 LARGE ENTERPRISES: MARKET DRIVERS

9.3.2 LARGE ENTERPRISES: COVID-19 MARKET IMPACT

9.3.3 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 58 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 59 PRE-COVID-19: LARGE ENTERPRISES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 60 POST-COVID-19: LARGE ENTERPRISES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 MARKET ANALYSIS, BY VERTICAL (Page No. - 109)

10.1 INTRODUCTION

FIGURE 26 GOVERNMENT AND DEFENSE INDUSTRY IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

10.1.1 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

TABLE 61 MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 62 PRE-COVID-19: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 63 POST-COVID-19: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

10.2 GOVERNMENT

10.2.1 GOVERNMENT: MARKET DRIVERS

10.2.2 GOVERNMENT: COVID-19 MARKET IMPACT

10.2.3 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 64 GOVERNMENT: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 65 PRE-COVID-19: GOVERNMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 66 POST-COVID-19: GOVERNMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.3 HEALTHCARE

10.3.1 HEALTHCARE: BIOMETRIC AS A SERVICE MARKET DRIVERS

10.3.2 HEALTHCARE: COVID-19 MARKET IMPACT

10.3.3 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 67 HEALTHCARE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 68 PRE-COVID-19: HEALTHCARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 69 POST-COVID-19: HEALTHCARE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.4 BANKING, FINANCIAL SERVICES, AND INSURANCE

10.4.1 BFSI: MARKET DRIVERS

10.4.2 BFSI: COVID-19 MARKET IMPACT

10.4.3 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 70 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 71 PRE-COVID-19: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 72 POST-COVID-19: BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.5 IT AND ITES

10.5.1 IT AND ITES: BIOMETRIC AS A SERVICE MARKET DRIVERS

10.5.2 IT AND ITES: COVID-19 MARKET IMPACT

10.5.3 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 73 IT AND ITES: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 74 PRE-COVID-19: IT AND ITES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 75 POST-COVID-19: IT AND ITES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.6 MANUFACTURING

10.6.1 MANUFACTURING: MARKET DRIVER

10.6.2 MANUFACTURING: COVID-19 MARKET IMPACT

10.6.3 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 76 MANUFACTURING: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 77 PRE-COVID-19: MANUFACTURING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 78 POST-COVID-19: MANUFACTURING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.7 EDUCATION

10.7.1 EDUCATION: BIOMETRIC AS A SERVICE MARKET DRIVERS

10.7.2 EDUCATION: COVID-19 MARKET IMPACT

10.7.3 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 79 EDUCATION: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 80 PRE-COVID-19: EDUCATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 81 POST-COVID-19: EDUCATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.8 OTHER VERTICALS

10.8.1 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 82 OTHER VERTICALS: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 83 PRE-COVID-19: OTHER VERTICALS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 84 POST-COVID-19: OTHER VERTICALS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11 GEOGRAPHIC ANALYSIS (Page No. - 124)

11.1 INTRODUCTION

FIGURE 27 REGIONAL SNAPSHOT: NORTH AMERICA IS EXPECTED TO HOLD THE LARGEST MARKET SHARE BY 2022

11.1.1 MARKET ESTIMATES AND FORECAST, BY REGION 2014–2025

TABLE 85 BIOMETRIC AS A SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 86 PRE-COVID-19: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 87 POST-COVID-19: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: COVID-19 MARKET IMPACT

FIGURE 28 NORTH AMERICA: MARKET SNAPSHOT

11.2.3 MARKET ESTIMATES AND FORECAST, BY OFFERING, 2014–2025

TABLE 88 NORTH AMERICA: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 89 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 90 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

11.2.4 MARKET ESTIMATES AND FORECAST, BY SOLUTION TYPE, 2014–2025

TABLE 91 NORTH AMERICA: BIOMETRIC AS A SERVICE MARKET SIZE, BY SOLUTION TYPE, 2014–2019 (USD MILLION)

TABLE 92 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

TABLE 93 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

11.2.5 MARKET ESTIMATES AND FORECAST, BY TRAIT, 2014–2025

TABLE 94 NORTH AMERICA: MARKET SIZE, BY TRAIT, 2014–2019 (USD MILLION)

TABLE 95 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

TABLE 96 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

11.2.6 MARKET ESTIMATES AND FORECAST, BY MODALITY TYPE, 2014–2025

TABLE 97 NORTH AMERICA: MARKET SIZE, BY MODALITY TYPE, 2014–2019 (USD MILLION)

TABLE 98 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

TABLE 99 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

11.2.7 MARKET ESTIMATES AND FORECAST, BY ORGANIZATION SIZE, 2014–2025

TABLE 100 NORTH AMERICA: BIOMETRIC AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 101 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 102 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11.2.8 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

TABLE 103 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 104 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 105 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

11.2.9 MARKET ESTIMATES AND FORECAST, BY COUNTRY, 2014–2025

TABLE 106 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 107 PRE-COVID-19: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 108 POST-COVID-19: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: BIOMETRIC AS A SERVICE MARKET DRIVERS

11.3.2 EUROPE: COVID-19 MARKET IMPACT

FIGURE 29 EUROPE: MARKET SNAPSHOT

11.3.3 MARKET ESTIMATES AND FORECAST, BY OFFERING, 2014–2025

TABLE 109 EUROPE: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 110 PRE-COVID-19: EUROPE MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 111 POST-COVID-19: EUROPE MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

11.3.4 MARKET ESTIMATES AND FORECAST, BY SOLUTION TYPE, 2014–2025

TABLE 112 EUROPE: MARKET SIZE, BY SOLUTION TYPE, 2014–2019 (USD MILLION)

TABLE 113 PRE-COVID-19: EUROPE MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

TABLE 114 POST-COVID-19: EUROPE MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

11.3.5 MARKET ESTIMATES AND FORECAST, BY TRAIT, 2014–2025

TABLE 115 EUROPE: MARKET SIZE, BY TRAIT, 2014–2019 (USD MILLION)

TABLE 116 PRE-COVID-19: EUROPE MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

TABLE 117 POST-COVID-19: EUROPE MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

11.3.6 MARKET ESTIMATES AND FORECAST, BY MODALITY TYPE, 2014–2025

TABLE 118 EUROPE: MARKET SIZE, BY MODALITY TYPE, 2014–2019 (USD MILLION)

TABLE 119 PRE-COVID-19: EUROPE MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

TABLE 120 POST-COVID-19: EUROPE MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

11.3.7 MARKET ESTIMATES AND FORECAST, BY ORGANIZATION SIZE, 2014–2025

TABLE 121 EUROPE: BIOMETRIC AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 122 PRE-COVID-19: EUROPE MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 123 POST-COVID-19: EUROPE MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11.3.8 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

TABLE 124 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 125 PRE-COVID-19: EUROPE MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 126 POST-COVID-19: EUROPE MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

11.3.9 MARKET ESTIMATES AND FORECAST, BY COUNTRY, 2014–2025

TABLE 127 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 128 PRE-COVID-19: EUROPE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 129 POST-COVID-19: EUROPE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: BIOMETRIC AS A SERVICE MARKET DRIVERS

11.4.2 ASIA PACIFIC: COVID-19 MARKET IMPACT

FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

11.4.3 MARKET ESTIMATES AND FORECAST, BY OFFERING, 2014–2025

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 131 PRE-COVID-19: ASIA PACIFIC MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 132 POST-COVID-19: ASIA PACIFIC MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

11.4.4 MARKET ESTIMATES AND FORECAST, BY SOLUTION TYPE, 2014–2025

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY SOLUTION TYPE, 2014–2019 (USD MILLION)

TABLE 134 PRE-COVID-19: ASIA PACIFIC MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

TABLE 135 POST-COVID-19: ASIA PACIFIC MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

11.4.5 MARKET ESTIMATES AND FORECAST, BY TRAIT, 2014–2025

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY TRAIT, 2014–2019 (USD MILLION)

TABLE 137 PRE-COVID-19: ASIA PACIFIC MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

TABLE 138 POST-COVID-19: ASIA PACIFIC MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

11.4.6 MARKET ESTIMATES AND FORECAST, BY MODALITY TYPE, 2014–2025

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY MODALITY TYPE, 2014–2019 (USD MILLION)

TABLE 140 PRE-COVID-19: ASIA PACIFIC MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

TABLE 141 POST-COVID-19: ASIA PACIFIC MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

11.4.7 MARKET ESTIMATES AND FORECAST, BY ORGANIZATION SIZE, 2014–2025

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 143 PRE-COVID-19: ASIA PACIFIC BIOMETRIC AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 144 POST-COVID-19: ASIA PACIFIC MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11.4.8 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 146 PRE-COVID-19: ASIA PACIFIC MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 147 POST-COVID-19: ASIA PACIFIC MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

11.4.9 MARKET ESTIMATES AND FORECAST, BY COUNTRY, 2014–2025

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 149 PRE-COVID-19: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 150 POST-COVID-19: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

11.5 MIDDLE EAST AND AFRICA

11.5.1 MIDDLE EAST AND AFRICA: BIOMETRIC AS A SERVICE MARKET DRIVERS

11.5.2 MIDDLE EAST AND AFRICA: COVID-19 MARKET IMPACT

11.5.3 MARKET ESTIMATES AND FORECAST, BY OFFERING, 2014–2025

TABLE 151 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 152 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 153 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

11.5.4 MARKET ESTIMATES AND FORECAST, BY SOLUTION TYPE, 2014–2025

TABLE 154 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION TYPE, 2014–2019 (USD MILLION)

TABLE 155 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

TABLE 156 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

11.5.5 MARKET ESTIMATES AND FORECAST, BY TRAIT 2014–2025

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TRAIT, 2014–2019 (USD MILLION)

TABLE 158 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

TABLE 159 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

11.5.6 MARKET ESTIMATES AND FORECAST, BY MODALITY TYPE, 2014–2025

TABLE 160 MIDDLE EAST AND AFRICA: BIOMETRIC AS A SERVICE MARKET SIZE, BY MODALITY TYPE, 2014–2019 (USD MILLION)

TABLE 161 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

TABLE 162 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

11.5.7 MARKET ESTIMATES AND FORECAST, BY ORGANIZATION SIZE, 2014–2025

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 164 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 165 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11.5.8 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 167 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 168 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

11.5.9 MARKET ESTIMATES AND FORECAST, BY COUNTRY, 2014–2025

TABLE 169 MIDDLE EAST AND AFRICA: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 170 PRE-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 171 POST-COVID-19: MIDDLE EAST AND AFRICA MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

11.6 LATIN AMERICA

11.6.1 LATIN AMERICA: BIOMETRIC AS A SERVICE MARKET DRIVERS

11.6.2 LATIN AMERICA: COVID-19 MARKET IMPACT

11.6.3 MARKET ESTIMATES AND FORECAST, BY OFFERING, 2014–2025

TABLE 172 LATIN AMERICA: MARKET SIZE, BY OFFERING, 2014–2019 (USD MILLION)

TABLE 173 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

TABLE 174 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY OFFERING, 2019–2025 (USD MILLION)

11.6.4 MARKET ESTIMATES AND FORECAST, BY SOLUTION TYPE, 2014–2025

TABLE 175 LATIN AMERICA: MARKET SIZE, BY SOLUTION TYPE, 2014–2019 (USD MILLION)

TABLE 176 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

TABLE 177 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY SOLUTION TYPE, 2019–2025 (USD MILLION)

11.6.5 MARKET ESTIMATES AND FORECAST, BY TRAIT, 2014–2025

TABLE 178 LATIN AMERICA: MARKET SIZE, BY TRAIT, 2014–2019 (USD MILLION)

TABLE 179 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

TABLE 180 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY TRAIT, 2019–2025 (USD MILLION)

11.6.6 MARKET ESTIMATES AND FORECAST, BY MODALITY TYPE, 2014–2025

TABLE 181 LATIN AMERICA: BIOMETRIC AS A SERVICE MARKET SIZE, BY MODALITY TYPE, 2014–2019 (USD MILLION)

TABLE 182 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

TABLE 183 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY MODALITY TYPE, 2019–2025 (USD MILLION)

11.6.7 MARKET ESTIMATES AND FORECAST, BY ORGANIZATION SIZE, 2014–2025

TABLE 184 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 185 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 186 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11.6.8 MARKET ESTIMATES AND FORECAST, BY VERTICAL, 2014–2025

TABLE 187 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 188 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 189 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

11.6.9 MARKET ESTIMATES AND FORECAST, BY COUNTRY, 2014–2025

TABLE 190 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 191 PRE-COVID-19: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

TABLE 192 POST-COVID-19: LATIN AMERICA MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 169)

12.1 OVERVIEW

12.2 COMPETITIVE LEADERSHIP MAPPING

12.2.1 VISIONARY LEADERS

12.2.2 INNOVATORS

12.2.3 DYNAMIC DIFFERENTIATORS

12.2.4 EMERGING COMPANIES

FIGURE 31 BIOMETRIC AS A SERVICE MARKET (GLOBAL), COMPETITIVE LEADERSHIP MAPPING, 2020

12.3 RANKING OF KEY PLAYERS

FIGURE 32 RANKING OF KEY PLAYERS IN THE MANAGED SECURITY SERVICES MARKET, 2020

13 COMPANY PROFILES (Page No. - 171)

13.1 KEY VENDORS

(Business overview, Solutions offered, and Recent developments)*

13.1.1 IDEMIA

13.1.2 NEC

FIGURE 33 NEC: COMPANY SNAPSHOT

13.1.3 THALES GROUP

FIGURE 34 THALES GROUP: COMPANY SNAPSHOT

13.1.4 M2SYS

13.1.5 FUJITSU

FIGURE 35 FUJITSU: COMPANY SNAPSHOT

13.1.6 AWARE

FIGURE 36 AWARE: COMPANY SNAPSHOT

13.1.7 LEIDOS

FIGURE 37 LEIDOS: COMPANY SNAPSHOT

13.1.8 NUANCE

FIGURE 38 NUANCE: COMPANY SNAPSHOT

13.1.9 CERTIBIO

13.1.10 HYPR

13.2 OTHER KEY PROFILES

13.2.1 BIO ID

13.2.2 AYONIX

13.2.3 PHONEXIA

13.2.4 LEXIS NEXIS

13.2.5 COGNITEC SYSTEMS

13.2.6 IRITECH

*Details on Business overview, Solutions offered, and Recent developments might not be captured in case of unlisted companies.

13.3 OTHER RELEVANT GLOBAL TECHNOLOGY COMPANIES

13.3.1 INTRODUCTION

TABLE 193 OTHER RELEVANT GLOBAL VENDORS

14 ADJACENT MARKETS (Page No. - 197)

14.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 194 ADJACENT MARKETS AND FORECASTS

14.2 LIMITATIONS

14.3 DIGITAL IDENTITY SOLUTIONS MARKET

14.3.1 ADJACENT MARKET: DIGITAL IDENTITY SOLUTIONS MARKET, BY SOLUTION

TABLE 195 SOLUTIONS: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY TYPE, 2017–2024 (USD MILLION)

TABLE 196 BIOMETRICS: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 197 NON-BIOMETRICS: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.3.2 ADJACENT MARKET: DIGITAL IDENTITY SOLUTIONS MARKET, BY AUTHENTICATION TYPE

TABLE 198 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY AUTHENTICATION TYPE, 2017–2024 (USD MILLION)

TABLE 199 SINGLE-FACTOR AUTHENTICATION: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 200 MULTI-FACTOR AUTHENTICATION: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.3.3 ADJACENT MARKET: DIGITAL IDENTITY SOLUTIONS MARKET, BY VERTICAL

TABLE 201 DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

TABLE 202 BANKING, FINANCIAL SERVICES, AND INSURANCE: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 203 RETAIL AND ECOMMERCE: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 204 GOVERNMENT AND DEFENSE: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 205 HEALTHCARE: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2023 (USD MILLION)

TABLE 206 IT AND TELECOM: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 207 ENERGY AND UTILITIES: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 208 OTHER VERTICALS: DIGITAL IDENTITY SOLUTIONS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

14.4 IMPACT OF COVID-19 ON CLOUD COMPUTING MARKET

14.4.1 ADJACENT MARKET: IMPACT OF COVID-19 ON THE CLOUD COMPUTING MARKET

TABLE 209 IMPACT OF COVID-19 ON CLOUD COMPUTING MARKET, 2020–2021 (USD MILLION)

TABLE 210 BANKING, FINANCIAL SERVICES, AND INSURANCE: COVID-19 USE CASES

TABLE 211 HEALTHCARE AND LIFE SCIENCES: COVID-19 USE CASES

TABLE 212 IT AND ITES: COVID-19 USE CASES

TABLE 213 RETAIL AND CONSUMER GOODS: COVID-19 USE CASES

TABLE 214 TELECOM: COVID-19 USE CASES

TABLE 215 ENERGY AND UTILITIES: COVID-19 USE CASES

TABLE 216 GOVERNMENT AND PUBLIC SERVICES: COVID-19 USE CASES

TABLE 217 MANUFACTURING: COVID-19 USE CASES

14.5 VIDEO SURVEILLANCE MARKET

14.5.1 ADJACENT MARKET: GLOBAL VIDEO SURVEILLANCE MARKET, BY OFFERING

TABLE 218 VIDEO SURVEILLANCE MARKET, BY OFFERING, 2017–2025 (USD MILLION)

14.5.2 ADJACENT MARKET: VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE

TABLE 219 VIDEO SURVEILLANCE SOFTWARE MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 220 VIDEO SURVEILLANCE SOFTWARE MARKET, BY VERTICAL, 2017–2025 (USD MILLION)

TABLE 221 VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 222 COMMERCIAL: VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 223 INFRASTRUCTURE: VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 224 MILITARY AND DEFENSE: VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 225 RESIDENTIAL: VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 226 PUBLIC FACILITY: VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 227 INDUSTRIAL: VIDEO SURVEILLANCE SOFTWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

14.5.3 ADJACENT MARKET: VIDEO SURVEILLANCE SERVICE MARKET, BY TYPE

TABLE 228 VIDEO SURVEILLANCE SERVICE MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 229 VIDEO SURVEILLANCE SERVICE MARKET, BY VERTICAL, 2017–2025 (USD MILLION)

TABLE 230 VIDEO SURVEILLANCE SERVICE MARKET, BY REGION, 2017–2025 (USD MILLION)

14.5.4 ADJACENT MARKET: VIDEO SURVEILLANCE MARKET, BY REGION

TABLE 231 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 232 NORTH AMERICA: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2017–2025 (USD MILLION)

TABLE 233 EUROPE: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 234 EUROPE: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2017–2025 (USD MILLION)

TABLE 235 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 236 ASIA PACIFIC: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2017–2025 (USD MILLION)

TABLE 237 REST OF THE WORLD: VIDEO SURVEILLANCE MARKET, BY OFFERING, 2017–2025 (USD MILLION)

TABLE 238 REST OF THE WORLD: VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2017–2025 (USD MILLION)

15 APPENDIX (Page No. - 213)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

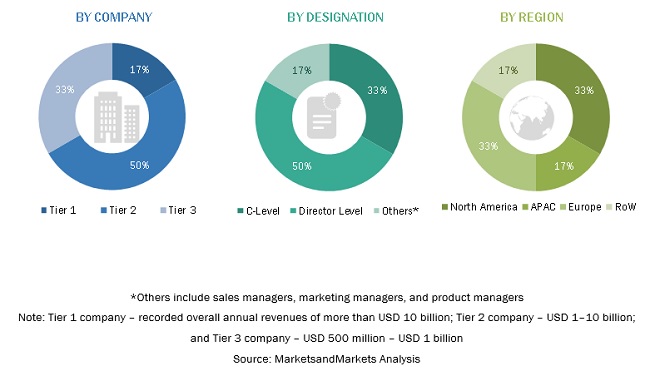

The study consists of seven major activities to estimate the current market size of the biometric as a service market. Extensive secondary research was done to collect information on the market for biometric-as-a-service, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the biometric as a service market.

Secondary research

In the secondary research process, various secondary sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports; press releases; investor presentations of BaaS market vendors; forums; certified publications, such as Biometrics-as-a-Service: Cloud-Based Technology, Systems, and Applications by IEEE, Biometric Authentication: A Review; and whitepapers such as “Biometrics in Government” by Aware, “Banking on Biometrics” by Nuance, the “Biometrics Whitepaper” by SecuGen, etc. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification, and segmentation from both market and technology oriented perspectives.

Primary research

Various primary sources from both the supply and demand sides of the biometric as a service market were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors of biometric-as-a-service solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the profile breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the biometric as a service market. The methods were also used extensively to estimate the size of various subsegments in the market for biometric-as-a-service. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Data triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using the study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report objectives

- To define, describe, and forecast the size of the biometric as a service market by offering, solution type, solution trait, modality, organization size, vertical and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the biometric as a service market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the biometric as a service market

- To analyze opportunities in the market for stakeholders by identifying the high growth segments of the biometric-as-a-service ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze strategic approaches, such as product launches, acquisitions, contracts, agreements, and partnerships, in the biometric as a service market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American biometric as a service market

- Further breakup of the European market

- Further breakup of the APAC market for biometric-as-a-service

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Biometric-as-a-Service Market

Interested in regulatories in the market

What are the potentially exploring opportunities in the Biometric-as-a-Service Market?

Crisp insights with clean infographics

Interested in biometric as a service market

Interested in market estimation of biometric market

Interested in the factors driving adoption of biometric-as-a-service in this COVID-19 crisis

What are the key use cases gaining traction in Europe ?

Interested in understanding the landscape of biometric system integrators by various verticals.