Patient Access Solutions Market by Product & Service (Training, Education, Medical Necessity, Pre-certification), Delivery Mode (Web & Cloud, On premise), End User (Providers, Healthcare BPO Service Providers) - Global Forecast to 2027

Market Growth Outlook Summary

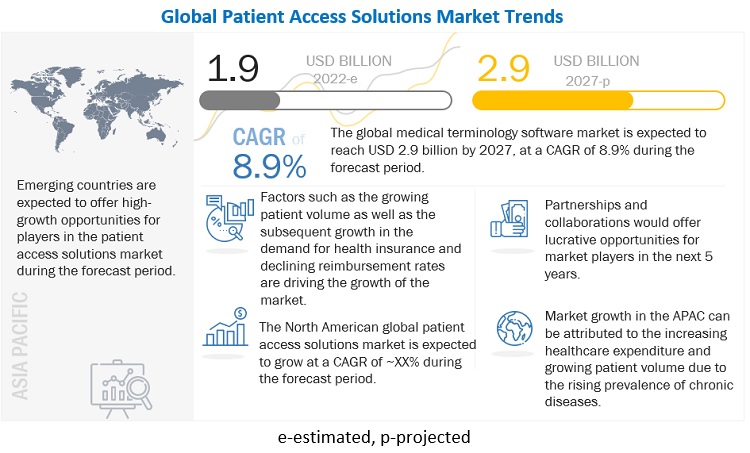

The global patient access solutions market growth forecasted to transform from $1.9 billion in 2022 to $2.9 billion by 2027, driven by a CAGR of 8.9%. The factors driving market growth include the need to maintain regulatory compliance, rising need to curtail healthcare costs, rising importance of denials management. However, dearth of skilled IT professionals, and high deployment costs is challenging the growth of the global patient access solutions market to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Patient access solutions Market Dynamics

Drivers: Growing importance of denials management

To reduce costs and maximize profits, insurance companies are increasingly denying claims as well as coverage to patients treating chronic or persistent illnesses. This puts an extra burden on healthcare providers to manage operating costs. These factors enable healthcare providers to adopt healthcare IT solutions such as patient access solutions to properly analyze denied claims.

Many providers across the globe still use highly manual and paper-oriented approaches to manage denials. This results in errors, delayed follow-ups, and miscommunication between healthcare providers and insurance companies. While providers may have some level of technology to help automate aspects of this process, many of them are not using the technology to its fullest extent due to a lack of integration with workflows. Automated patient access software such as medical necessity, prior authorization, and denials and appeals management solutions help healthcare providers to save significant revenue, as well as identify trends in errors so that future denials may be prevented.

Restraints: Rising Number of Healthcare Data Breaches

Most healthcare data breaches happen as a result of hacking or IT-related incidents. The next most common cause for data breaches was unauthorized access or disclosure. Loss and theft is a less common reasons of data breaches in the healthcare system In the US, the HIPAA Journal recorded 616 healthcare data breaches in its 2020 breach list, an increase of 66% over the total number of breaches tracked in 2018. According to a publication from the HIPAA Journal, HIPAA-covered companies and business associates paid around USD 13.6 million for HIPAA violations in 2020 and around USD 15.3 million in 2019. Thus, creating a secure communication platform is a major challenge faced by IT vendors catering to the healthcare industry.

Opportunities: Growing Potential in emerging healthcare IT markets

The Asia Pacific region is a highly lucrative market for patient access solutions owing to the various government initiatives focused on the adoption of HCIT solutions, rising government spending on healthcare, and technological advancements in the healthcare sector. The Australian market also presents significant potential for the adoption and implementation of patient access solutions, such as necessity and claims denial management solutions. State- and country-wide HCIT initiatives by the Australian government are supporting the adoption of these HCIT solutions. For instance, the State of South Australia developed a fully integrated statewide electronic health record system; this is expected to drive the adoption of patient access solutions. The Indian healthcare industry has also begun exploring the idea of a connected healthcare ecosystem. Changing demographics increased healthcare expenditure, and rising healthcare awareness are the major factors driving this trend.

Challenge: High deployment costs

Patient access solutions are fairly high-priced software solutions. The maintenance and software update costs of these tools may be more than the actual price of the software. Support and maintenance services, which include software upgrades, represent a recurring expenditure amounting to almost 30% of the total cost of ownership. Moreover, a lack of internal IT expertise necessitates training end users, thereby adding to the cost of ownership.

Hospitals often prefer investing in core technologies such as EHR, E-prescribing, and other clinical solutions linked to the quality of care for patients as opposed to investing in technologies for allied departments of the organization. Thus, the high cost of deployment and maintenance restricts smaller healthcare organizations from investing in patient access solutions, especially in emerging markets across Asia and Latin America.

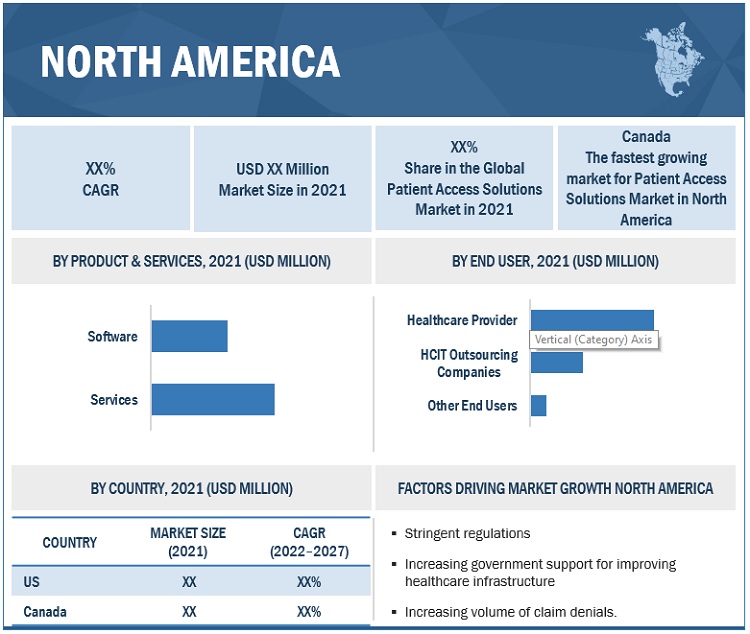

“ Software to register highest growth in the product & service segment of patient access solutions market in 2021”

On the basis of product & service, the software segment to register highest growth. The high growth of this segment can be attributed to the advantages offerd by the software such as error management, wide variety, differentiated functions.

“Healthcare providers is the largest end user segment by healthcare providers in the patient access solutions market in 2021”

Based on end user, the healthcare providers segment accounted for the largest share in the patient access solutions market during the forecast period. The large share of this segment can be attributed to the growing adoption of HCIT solutions, rise in healthcare spending, and increasing healthcare costs are the major factors supporting the adoption of patient access solutions among healthcare providers.

“North America accounted for the largest share of the patient access solutions market during the forecast period.”

North America holds the largest share of the patient access solutions market in 2021. Growth in the North American patient access solutions market can be attributed to factors such as stringent regulations, increasing government support for improving healthcare infrastructure, and the presence of leading market players in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The products and services market is dominated by a few globally established players such as Cognizant (US), McKesson Corporation (US), Cerner Corporation (US), Experian Plc (Ireland), 3M (US), Conifer Health Solutions (US), Waystar (US), Epic Systems Corporation (US), The SSI Group, LLC (US), Optum, Inc. (US), Cirius Group, Inc. (US), Craneware, Inc. (Scotland), Allscripts Healthcare Solutions, Inc. (US), Genentech, Inc. (US).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Product & Service, Delivery mode, End user, and region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Cognizant (US), McKesson Corporation (US), Cerner Corporation (US), Experian Plc (Ireland), 3M (US), Conifer Health Solutions (US), Waystar (US), Epic Systems Corporation (US), The SSI Group, LLC (US), Optum, Inc. (US), Cirius Group, Inc. (US), Craneware, Inc. (Scotland), Allscripts Healthcare Solutions, Inc. (US), Genentech, Inc. (Germany), AccuReg Software (US), Patient Access Solutions, Inc. (Canada), Kyruus (US), AccessOne, Inc. (US), Vee Technologies (India), Exela Technologies, Inc. (US), Conduent, Inc. (US), FinThrive (US), PLEXIS Healthcare Systems (US), HealthAsyst (US), and Virtusa Corporation (US) Availity, LLC (US), Access Healthcare (US), Qway Healthcare, Inc. (US), Clearwave, Inc. (US), Promantra (US), Kareo, Inc. (US). |

The study categorizes the patient access solutions market based on product & services, delivery mode, end user at regional and global level.

Patient access solutions Market, By Product & Service

- Introduction

-

Services

- Support & maintenance services

- Implementation services

- Training & education services

-

Software

- Eligibility verification software

- Medical necessity management software

- Precertification & authorization software

- Claims denial & appeal management

- Payment estimation software

- Claims payment assessment & processing software

- Other software

Patient access solutions Market, By Product & Service

- Introduction

- Web & Cloud-based solutions

- On-premise solutions

Patient access solutions Market, By End User

- Introduction

- Healthcare Providers

- HCIT Outsourcing Companies

- Others

Global Patient access solutions Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

- Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In July, 2021, Cerner and Baystate collaborated to introduce a digital health platform to integrate care delivery and financing systems for a more consumer-focused approach to patient care.

- In July 2021, Cognizant and Philips collaborated to develop end-to-end digital health solutions that will enable healthcare organizations and life science companies to improve patient care and accelerate clinical trials.

- In May 2021, Optum (US) collaborated with Bassett Healthcare Network (US) to provide software and data analytics, technology-enabled services and research, as well as advisory and revenue cycle management offerings to advance the delivery of high-quality, convenient, and affordable healthcare for patients across Central New York.

Frequently Asked Questions (FAQ):

Which are the top industry players in the global patient access solutions market?

The top market players in the global patient access solutions market include Cognizant (US), McKesson Corporation (US), Cerner Corporation (US), Experian Plc (Ireland), 3M (US), Conifer Health Solutions (US), Waystar (US), Epic Systems Corporation (US), The SSI Group, LLC (US), Optum, Inc. (US), Cirius Group, Inc. (US), Craneware, Inc. (Scotland), Allscripts Healthcare Solutions, Inc. (US), Genentech, Inc. (US).

Which products & services have been included in the patient access solutions market report?

This report contains the following patient access solutions:

- Services

- Software

Which geographical region is dominating in the global patient access solutions market?

The global patient access solutions market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America holds the largest share and APAC registers the highest growth during the forecast period.

Which end user segments have been included in the patient access solutions market report?

The report contains the following end user segments:

- Healthcare Providers

- HCIT Outsourcing Companies

- Other end users

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKETS COVERED

FIGURE 1 PATIENT ACCESS SOLUTIONS MARKET

FIGURE 2 REGIONAL SEGMENTS COVERED

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.5 STAKEHOLDERS

1.6 LIMITATIONS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 4 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

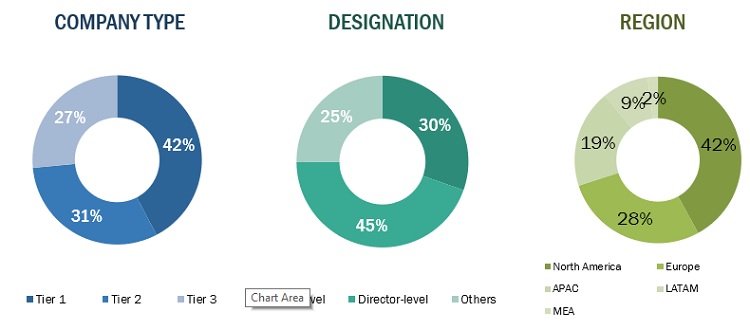

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 8 COUNTRY-LEVEL ANALYSIS OF PATIENT ACCESS SOLUTIONS MARKET

FIGURE 9 TOP-DOWN APPROACH

FIGURE 10 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

FIGURE 11 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022-2027)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 12 MARKET DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 13 PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 PATIENT ACCESS SERVICES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2022 VS. 2027 (USD MILLION)

FIGURE 16 PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 17 GEOGRAPHICAL SNAPSHOT OF PATIENT ACCESS SOLUTIONS MARKET, 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 PATIENT ACCESS SOLUTIONS: MARKET OVERVIEW

FIGURE 18 GROWING IMPORTANCE OF DENIALS MANAGEMENT TO DRIVE MARKET

4.2 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE AND END USER (2021)

FIGURE 19 WEB & CLOUD-BASED SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2021

4.3 PATIENT ACCESS SOLUTIONS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 20 UK TO REGISTER HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

4.4 REGIONAL MIX: PATIENT ACCESS SOLUTIONS MARKET (2022−2027)

FIGURE 21 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 PATIENT ACCESS SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Stringent government regulations for accessing patient data

5.2.1.2 Increasing patient volume and subsequent growth in demand for health insurance

FIGURE 23 GROWTH IN GERIATRIC POPULATION, BY REGION, 2015–2050

FIGURE 24 PROJECTED HEALTHCARE SPENDING IN DIFFERENT REGIONS, 2017–2022 (USD BILLION)

5.2.1.3 Growing importance of denials management

5.2.1.4 Declining reimbursement rates

5.2.1.5 Rising need to curtail healthcare costs

TABLE 2 IMPACT ANALYSIS: MARKET DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Data breaches and loss of confidentiality

TABLE 3 LARGEST HEALTHCARE DATA BREACHES GLOBALLY (2020)

TABLE 4 IMPACT ANALYSIS: MARKET RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 High growth potential in emerging healthcare IT markets

TABLE 5 IMPACT ANALYSIS: MARKET OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Dearth of skilled healthcare IT professionals

5.2.4.2 Reluctance to adopt patient access solutions

5.2.4.3 High deployment costs

TABLE 6 IMPACT ANALYSIS: MARKET CHALLENGES

6 INDUSTRY INSIGHTS (Page No. - 58)

6.1 INTRODUCTION

TABLE 7 ESTIMATED SPENDING ON REGULATORY COMPLIANCE BY HEALTHCARE PROVIDERS IN US

6.2 US: CURRENT SCENARIO OF HEALTHCARE CLAIMS MANAGEMENT

6.2.1 MANUAL VS. ELECTRONIC CLAIMS MANAGEMENT PROCESSES

TABLE 8 AVERAGE COST PER TRANSACTION FOR MANUAL AND ELECTRONIC TRANSACTIONS AND SAVINGS OPPORTUNITY, 2018

TABLE 9 AVERAGE, MINIMUM, AND MAXIMUM TIME SPENT BY PROVIDERS CONDUCTING MANUAL AND ELECTRONIC TRANSACTIONS, 2018

6.2.2 LACK OF STANDARDIZATION BETWEEN PAYER POLICIES

6.3 US: ADOPTION TRENDS FOR PATIENT ACCESS SOLUTIONS

FIGURE 25 US: ADOPTION AND VOLUME OF ELECTRONIC ELIGIBILITY AND BENEFIT VERIFICATIONS FOR COMMERCIAL MEDICAL HEALTH PLANS AND PROVIDERS

6.4 PATIENT ACCESS SOLUTIONS AND VALUE-BASED CARE

FIGURE 26 VALUE-BASED CARE THROUGH EFFICIENT DATA EXCHANGE

6.5 HCIT EXPENDITURE ANALYSIS

6.5.1 NORTH AMERICA

FIGURE 27 US HEALTHCARE SPENDING, 2012–2020 (USD BILLION)

6.5.2 EUROPE

6.5.3 ASIA PACIFIC

6.6 US: HCIT ADOPTION TRENDS

FIGURE 28 US: HOSPITAL EHR ADOPTION, 2007–2018

6.7 REGULATORY ANALYSIS

6.7.1 NORTH AMERICA

6.7.1.1 US

6.7.1.2 Canada

6.7.2 EUROPE

6.7.3 ASIA PACIFIC

6.8 INDUSTRY TRENDS

6.8.1 GROWING FOCUS ON INTEGRATION PLATFORM AS A SERVICE (IPAAS)

6.8.2 BUDGETARY CONSTRAINTS AND COST-CUTTING MEASURES IN EUROPE

6.9 ECOSYSTEM ANALYSIS

FIGURE 29 MARKET ECOSYSTEM: PATIENT ACCESS SOLUTIONS MARKET

6.10 TECHNOLOGY ANALYSIS

FIGURE 30 FOCUS ON USING PATIENT ACCESS SOLUTIONS IN HEALTHCARE SUPPLY CHAIN MANAGEMENT

7 PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE (Page No. - 72)

7.1 INTRODUCTION

TABLE 10 PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

7.2 SERVICES

TABLE 11 PATIENT ACCESS SOLUTIONS MARKET BY SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 12 PATIENT ACCESS SOLUTIONS MARKET BY SERVICES, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.1 SUPPORT & MAINTENANCE SERVICES

7.2.1.1 Rising trend of outsourcing to drive segment

TABLE 13 SUPPORT & MAINTENANCE SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.2 IMPLEMENTATION SERVICES

7.2.2.1 Increasing adoption of software by healthcare providers to fuel segment

FIGURE 31 ADOPTION OF ELECTRONIC ADMINISTRATIVE TRANSACTIONS, 2018–2021

TABLE 14 IMPLEMENTATION SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.2.3 TRAINING & EDUCATION SERVICES

7.2.3.1 Training & education services to increase healthcare providers’ awareness about available patient access solutions

TABLE 15 TRAINING & EDUCATION SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 SOFTWARE

TABLE 16 PATIENT ACCESS SOFTWARE MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 17 PATIENT ACCESS SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1 ELIGIBILITY VERIFICATION SOFTWARE

7.3.1.1 Real-time access to healthcare payers to propel segment

FIGURE 32 ADOPTION OF ELECTRONIC ELIGIBILITY AND BENEFIT VERIFICATION, 2019–2021

TABLE 18 KEY PLAYERS PROVIDING ELIGIBILITY VERIFICATION SOFTWARE

TABLE 19 ELIGIBILITY VERIFICATION SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.2 MEDICAL NECESSITY MANAGEMENT SOFTWARE

7.3.2.1 Accelerated cash flow and net revenue to drive segment

TABLE 20 KEY PLAYERS PROVIDING MEDICAL NECESSITY MANAGEMENT SOFTWARE

TABLE 21 MEDICAL NECESSITY MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.3 PRECERTIFICATION & AUTHORIZATION SOFTWARE

7.3.3.1 Cost efficiency and management of real-time authorization requests to fuel segment

TABLE 22 KEY PLAYERS PROVIDING PRECERTIFICATION & AUTHORIZATION SOFTWARE

TABLE 23 PRECERTIFICATION & AUTHORIZATION SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.4 CLAIMS DENIAL & APPEAL MANAGEMENT SOFTWARE

7.3.4.1 Streamlined productivity tools and claims-related alerts to fuel segment

TABLE 24 KEY PLAYERS PROVIDING CLAIMS DENIAL & APPEAL MANAGEMENT SOFTWARE

TABLE 25 CLAIMS DENIAL & APPEAL MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.5 PAYMENT ESTIMATION SOFTWARE

7.3.5.1 Need to control rising healthcare costs to drive segment

TABLE 26 KEY PLAYERS PROVIDING PAYMENT ESTIMATION SOFTWARE

TABLE 27 PAYMENT ESTIMATION SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.6 CLAIMS PAYMENT ASSESSMENT & PROCESSING SOFTWARE

7.3.6.1 Increasing government initiatives to propel segment

TABLE 28 KEY PLAYERS PROVIDING CLAIMS PAYMENT ASSESSMENT & PROCESSING SOFTWARE

TABLE 29 CLAIMS PAYMENT ASSESSMENT & PROCESSING SOFTWARE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.7 OTHER SOFTWARE

TABLE 30 OTHER SOFTWARE MARKET FOR PATIENT ACCESS SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8 PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE (Page No. - 90)

8.1 INTRODUCTION

TABLE 31 PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

8.2 WEB & CLOUD-BASED SOLUTIONS

8.2.1 COST-EFFECTIVENESS AND LARGE STORAGE CAPACITY TO PROPEL MARKET

TABLE 32 PATIENT ACCESS SOLUTIONS MARKET FOR WEB & CLOUD-BASED SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 ON-PREMISE SOLUTIONS

8.3.1 REDUCED RISK OF DATA BREACHES AND OTHER SECURITY ISSUES TO DRIVE MARKET

TABLE 33 PATIENT ACCESS SOLUTIONS MARKET FOR ON-PREMISE SOLUTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 PATIENT ACCESS SOLUTIONS MARKET, BY END USER (Page No. - 94)

9.1 INTRODUCTION

TABLE 34 PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 HEALTHCARE PROVIDERS

9.2.1 HEALTHCARE PROVIDERS TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 35 PATIENT ACCESS SOLUTIONS MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 HCIT OUTSOURCING COMPANIES

9.3.1 HCIT OUTSOURCING COMPANIES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 36 PATIENT ACCESS SOLUTIONS MARKET FOR HCIT OUTSOURCING COMPANIES, BY COUNTRY, 2020–2027 (USD MILLION)

9.4 OTHER END USERS

TABLE 37 PATIENT ACCESS SOLUTIONS MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

10 PATIENT ACCESS SOLUTIONS MARKET, BY REGION (Page No. - 100)

10.1 INTRODUCTION

TABLE 38 PATIENT ACCESS SOLUTIONS MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET SNAPSHOT, 2021

TABLE 39 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET FOR SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Growing need to curtail healthcare costs to drive market

TABLE 45 US: KEY MACROINDICATORS

TABLE 46 US: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 47 US: PATIENT ACCESS SOLUTIONS MARKET FOR SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 48 US: PATIENT ACCESS SOLUTIONS MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 49 US: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 50 US: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Need for financial management in healthcare organizations to support market

TABLE 51 CANADA: KEY MACROINDICATORS

TABLE 52 CANADA: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 53 CANADA: PATIENT ACCESS SOLUTIONS MARKET FOR SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 54 CANADA: PATIENT ACCESS SOLUTIONS MARKET BY SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 CANADA: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 56 CANADA: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 57 EHEALTH PRIORITIES FOR HEALTHCARE PROVIDERS IN EUROPE, BY COUNTRY (2019)

FIGURE 34 EUROPE: EHEALTH CHALLENGES FACED BY HEALTHCARE PROVIDERS, 2019

TABLE 58 EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 59 EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 60 EUROPE: PATIENT ACCESS SOLUTIONS MARKET BY SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: PATIENT ACCESS SOLUTIONS MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 63 EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing government initiatives to boost market

TABLE 64 GERMANY: KEY MACROINDICATORS

TABLE 65 GERMANY: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 66 GERMANY: PATIENT ACCESS SOLUTIONS MARKET FOR SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 GERMANY: PATIENT ACCESS SOLUTIONS MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 GERMANY: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 69 GERMANY: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.2 FRANCE

10.3.2.1 Upcoming retirement of doctors to drive market

TABLE 70 FRANCE: KEY MACROINDICATORS

TABLE 71 FRANCE: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 72 FRANCE: PATIENT ACCESS SOLUTIONS MARKET BY SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 FRANCE: PATIENT ACCESS SOLUTIONS MARKET BY SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 FRANCE: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 75 FRANCE: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.3 UK

10.3.3.1 Government initiatives for EMR and eHealth solutions to drive market

TABLE 76 UK: KEY MACROINDICATORS

TABLE 77 UK: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 78 UK: PATIENT ACCESS SOLUTIONS MARKET BY SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 UK: PATIENT ACCESS SOLUTIONS MARKET BY SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 UK: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 81 UK: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 82 REST OF EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 83 REST OF EUROPE: PATIENT ACCESS SOLUTIONS MARKET FOR SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 84 REST OF EUROPE: PATIENT ACCESS SOLUTIONS MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 REST OF EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 86 REST OF EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 INCREASING NEED FOR IMPROVED FINANCIAL MANAGEMENT TO DRIVE MARKET

FIGURE 35 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET SNAPSHOT, 2021

TABLE 87 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 88 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET FOR SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 90 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 91 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 DEVELOPMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET

TABLE 92 LATIN AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 93 LATIN AMERICA: PATIENT ACCESS SOLUTIONS MARKET BY SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 LATIN AMERICA: PATIENT ACCESS SOLUTIONS MARKET BY SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 LATIN AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 96 LATIN AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 GROWING MEDICAL TOURISM TO SUPPORT MARKET

TABLE 97 MIDDLE EAST & AFRICA: PATIENT ACCESS SOLUTIONS MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: PATIENT ACCESS SOLUTIONS MARKET FOR SERVICES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 99 MIDDLE EAST & AFRICA: PATIENT ACCESS SOLUTIONS MARKET FOR SOFTWARE, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: PATIENT ACCESS SOLUTIONS MARKET, BY DELIVERY MODE, 2020–2027 (USD MILLION)

TABLE 101 MIDDLE EAST & AFRICA: PATIENT ACCESS SOLUTIONS MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 140)

11.1 INTRODUCTION

TABLE 102 KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS FROM JANUARY 2019 TO JUNE 2022

11.2 PATIENT ACCESS SOLUTIONS MARKET: GEOGRAPHICAL ASSESSMENT

FIGURE 36 GEOGRAPHIC ASSESSMENT OF KEY PLAYERS IN PATIENT ACCESS SOLUTIONS MARKET (2021)

11.3 PATIENT ACCESS SOLUTIONS MARKET: R&D EXPENDITURE

FIGURE 37 R&D EXPENDITURE OF KEY PLAYERS IN PATIENT ACCESS SOLUTIONS MARKET (2021)

11.4 REVENUE ANALYSIS OF MARKET PLAYERS

FIGURE 38 REVENUE ANALYSIS: PATIENT ACCESS SOLUTIONS MARKET, 2021

11.5 MARKET SHARE ANALYSIS

FIGURE 39 PATIENT ACCESS SOLUTIONS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

11.6 COMPETITIVE LEADERSHIP MAPPING

11.6.1 STARS

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE PLAYERS

11.6.4 PARTICIPANTS

FIGURE 40 PATIENT ACCESS SOLUTIONS MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

11.7 COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 41 PATIENT ACCESS SOLUTIONS MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS (2021)

11.8 COMPETITIVE BENCHMARKING

FIGURE 42 ANALYSIS OF PRODUCT & SERVICE PORTFOLIOS OF MAJOR PLAYERS IN PATIENT ACCESS SOLUTIONS MARKET

FIGURE 43 BUSINESS STRATEGIES ADOPTED BY MAJOR PLAYERS IN PATIENT ACCESS SOLUTIONS MARKET

11.9 COMPETITIVE SITUATIONS AND TRENDS

11.9.1 DEALS

TABLE 103 DEALS (2019–2022)

12 COMPANY PROFILES (Page No. - 152)

12.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View)*

12.1.1 MCKESSON CORPORATION

TABLE 104 MCKESSON CORPORATION: COMPANY OVERVIEW

FIGURE 44 MCKESSON CORPORATION: COMPANY SNAPSHOT (2021)

12.1.2 OPTUM, INC.

TABLE 105 OPTUM, INC.: COMPANY OVERVIEW

FIGURE 45 OPTUM, INC.: COMPANY SNAPSHOT (2021)

12.1.3 COGNIZANT

TABLE 106 COGNIZANT: COMPANY OVERVIEW

FIGURE 46 COGNIZANT: COMPANY SNAPSHOT (2021)

12.1.4 CERNER CORPORATION

TABLE 107 CERNER CORPORATION: COMPANY OVERVIEW

FIGURE 47 CERNER CORPORATION: COMPANY SNAPSHOT (2021)

12.1.5 EXPERIAN PLC

TABLE 108 EXPERIAN PLC: COMPANY OVERVIEW

FIGURE 48 EXPERIAN PLC: COMPANY SNAPSHOT (2021)

12.1.6 3M

TABLE 109 3M: COMPANY OVERVIEW

FIGURE 49 3M: COMPANY SNAPSHOT (2021)

12.1.7 CONIFER HEALTH SOLUTIONS

TABLE 110 CONIFER HEALTH SOLUTIONS: COMPANY OVERVIEW

FIGURE 50 CONIFER HEALTH SOLUTIONS: COMPANY SNAPSHOT (2021)

12.1.8 CRANEWARE, INC.

TABLE 111 CRANEWARE, INC.: COMPANY OVERVIEW

FIGURE 51 CRANEWARE, INC.: COMPANY SNAPSHOT (2021)

12.1.9 GENENTECH, INC. (ROCHE)

TABLE 112 GENENTECH, INC.: COMPANY OVERVIEW

FIGURE 52 ROCHE: COMPANY SNAPSHOT (2021)

12.1.10 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.

TABLE 113 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY OVERVIEW

FIGURE 53 ALLSCRIPTS HEALTHCARE SOLUTIONS, INC.: COMPANY SNAPSHOT (2021)

12.1.11 EPIC SYSTEMS CORPORATION

TABLE 114 EPIC SYSTEMS CORPORATION: COMPANY OVERVIEW

12.1.12 WAYSTAR

TABLE 115 WAYSTAR: COMPANY OVERVIEW

12.1.13 THE SSI GROUP, LLC

TABLE 116 THE SSI GROUP, LLC: COMPANY OVERVIEW

12.1.14 CIRIUS GROUP, INC.

TABLE 117 CIRIUS GROUP, INC.: COMPANY OVERVIEW

12.1.15 ACCUREG SOFTWARE

TABLE 118 ACCUREG SOFTWARE: COMPANY OVERVIEW

* Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 PATIENT ACCESS SOLUTIONS, INC.

12.2.2 KYRUUS

12.2.3 EXELA TECHNOLOGIES, INC.

12.2.4 ACCESS ONE, INC.

12.2.5 VEE TECHNOLOGIES

12.2.6 CONDUENT, INC.

12.2.7 FINTHRIVE

12.2.8 PLEXIS HEALTHCARE SYSTEMS

12.2.9 HEALTHASYST

12.2.10 VIRTUSA CORPORATION

13 APPENDIX (Page No. - 191)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, and key player strategies.

Secondary Research

This research study involved secondary sources; directories; databases such as Bloomberg Business, Factiva, and the Wall Street Journal; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for this extensive, technical, market-oriented, and commercial study of the patient access solutions market. It was also used to obtain essential information about key market players, market classification, and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side include CEOs, vice presidents, marketing and sales directors, business development managers, technology and innovation directors of companies, suppliers, and distributors. On the other hand, primary sources from the demand side include industry experts such as directors of hospitals and clinics, hospital and clinic managers, optometrists, professors, research scientists, and related key opinion leaders.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

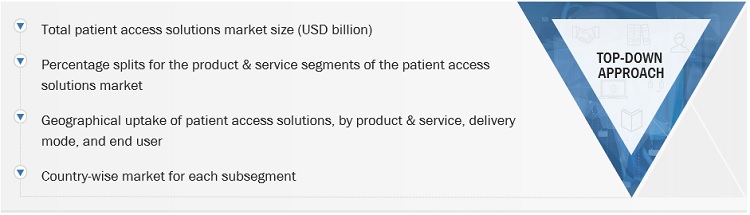

The total size of the patient access solutions market was arrived at after data triangulation from five different approaches, as mentioned below. After each approach, the weighted average of approaches was taken based on the level of assumptions used.

Data Triangulation

After arriving at the market size, the total Patient access solutions Market was divided into several segments and subsegments.

- Approach for products and services as well as delivery mode: Splits for segments were derived by studying the usage and adoption of various product and service segments as well as delivery mode considered in the study.

- Approach for end users: Splits for segments were derived by studying the adoption patterns of products by different end users in the patient access solutions market.

Global Patient access solutions Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Objectives of the Study

- To define, describe, analyze, and forecast the patient access solutions market, by product and service, delivery mode, end user, as well as region

- To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall patient access solutions market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their market shares and core competencies in the patient access solutions market

- To track and analyze competitive developments such as partnerships, collaborations, agreements, acquisitions, and divestitures in the patient access solutions market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- A further breakdown of the European patient access solutions market into Spain, Italy and the Rest of Europe

- A further breakdown of the Asia Pacific patient access solutions market into Japan, Singapore, and Australia

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Access Solutions Market

Need data on CAGR of Patient Engagement Solutions Market during 2021-2028, its Adoption of Mobile Health as well.

What are the benefits of the emerging trends in the global growth of Patient Access Solutions Market?

Which are the different growth strategies adopted by key players of the Patient Access Solutions Market?