Feed Acidulants Market by Type (Propionic Acid, Formic Acid, Citric Acid, Lactic Acid, Sorbic Acid, Malic Acid, and Acetic Acid), Animal Type (Poultry, Ruminants, Swine, Aquaculture, Pets, and Equine), Compound, Form and Region - Global Forecast to 2028

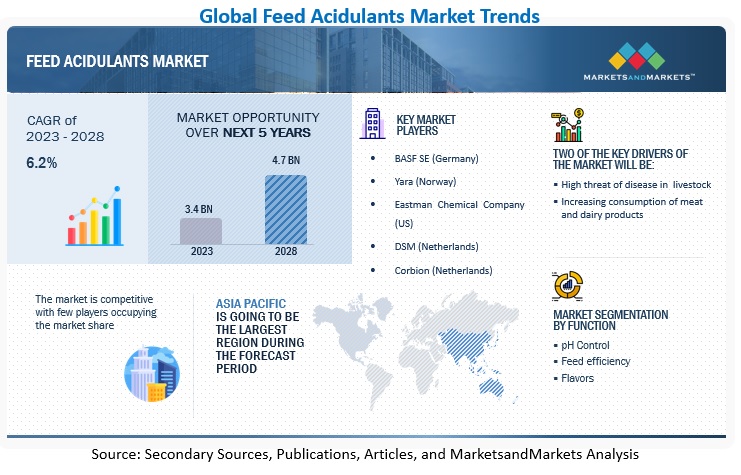

[269 Pages Report] The global feed acidulants market is estimated to be valued at USD 3.4 billion in 2023. It is projected to reach USD 4.7 billion by 2028, recording a CAGR of 6.2% during the forecast period. Feed acidulants have gained immense popularity in recent years due to their numerous benefits for animal health and productivity. These acidulants are added to animal feed to reduce the pH level and create a more acidic environment in the gut. This, in turn, improves nutrient absorption, enhances digestive efficiency, and prevents the growth of harmful bacteria, resulting in better animal health and performance. The global feed acidulants market is expected to grow at a significant pace in the coming years, owing to several factors that are driving the demand for these additives.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Drivers: High threat of disease in livestock

The high threat of disease in livestock has been a major driving force behind the growth of the feed acidulants market. Livestock are susceptible to a range of diseases, including bacterial infections, viral infections, and parasitic infestations, which can result in significant economic losses for farmers and the wider agricultural industry. Feed acidulants are effective in reducing the risk of disease in livestock by creating a more acidic environment in the gut, which can inhibit the growth of harmful microorganisms. This has led to increased demand for feed acidulants as a preventative measure to protect livestock health and improve productivity. The feed acidulants market is expected to continue to grow as farmers seek new ways to improve animal health and welfare and ensure the safety and quality of animal products for consumers.

Restraints: Increasing prices of feed acidulants

The feed acidulants market has been experiencing steady growth over the past few years, driven by the increasing demand for animal protein and the need to improve feed efficiency and animal health. However, one major factor that is limiting the growth of this market is the rising prices of feed acidulants. Feed acidulants are widely used in animal feed to promote digestion and prevent the growth of harmful bacteria in the gut. They are typically made from organic acids such as formic acid, propionic acid, and lactic acid. However, the prices of these acids have been steadily increasing due to several factors, including raw material costs, transportation costs, and regulatory pressures. As a result, the cost of feed acidulants has risen significantly, which has made it more difficult for farmers to afford them. This has led to a slowdown in the growth of the feed acidulants market, as many farmers are now looking for alternative solutions that are more cost-effective.

Opportunities: Innovation in encapsulation used in feed acidulants

The encapsulation process presents significant opportunities for the feed acidulants market, as it offers several benefits such as improved stability, controlled release, and targeted delivery. Encapsulation is the process of enclosing a substance within a protective shell or coating, which can protect the substance from degradation or damage and control its release. In the feed acidulants market, encapsulation can be used to protect organic acids from degradation in the feed or gut and to deliver them more effectively to the target site. This can improve the efficacy of the acidulants, reduce dosage requirements, and lower overall costs.

Challenges: Efficacy maintenance in feed acidulants

The major challenge in maintaining the efficacy of feed acidulants is their susceptibility to degradation in the feed or gut. Organic acids such as formic acid, propionic acid, and lactic acid can be rapidly degraded by microbial activity in the gut, which can reduce their effectiveness in controlling bacterial growth and promoting digestion. This can result in reduced animal performance and increased susceptibility to disease. To maintain the efficacy of feed acidulants, it is important to optimize their dosage and delivery methods and to ensure that they are protected from degradation in the feed or gut. Overall, addressing the challenge of maintaining the efficacy of feed acidulants is crucial for ensuring their continued use in animal feed and improving animal health and performance.

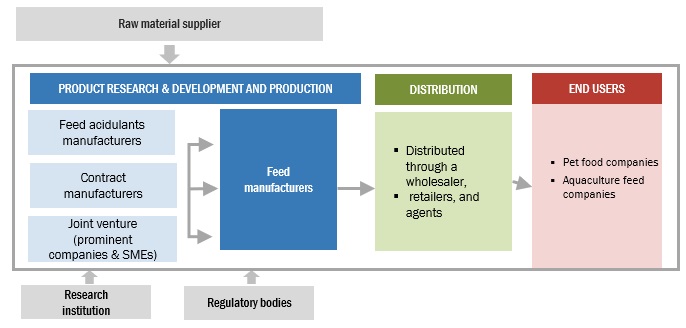

Feed Acidulants Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of feed acidulants. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market are Yara (Norway), Eastman Chemical Company(US), Corbion (Netherlands), BASF (Germany), and DSM (Netherlands).

To know about the assumptions considered for the study, download the pdf brochure

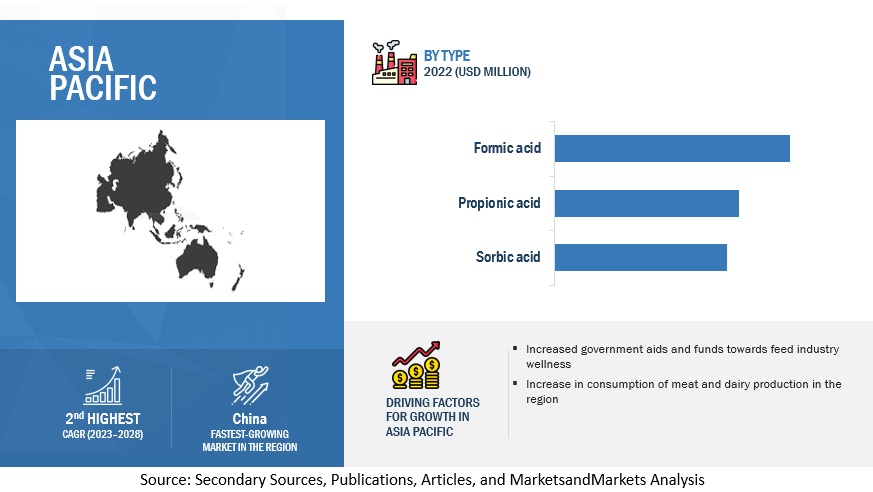

Formic acid by type in the feed acidulants market is projected to grow at the highest CAGR during the forecast period

The market growth of formic acids used as feed acidulants has been increasing in recent years. Formic acid is a widely used feed acidulant that has been shown to have a positive effect on animal health and performance. It is a strong acid that can reduce the pH in the gut, inhibiting the growth of harmful bacteria and improving feed digestion. Formic acid can also enhance nutrient absorption, reduce the incidence of diarrhea and respiratory diseases, and improve feed conversion efficiency. Factors influencing the market growth of formic acid in the feed acidulants market include its increasing demand from the poultry industry, as well as its proven efficacy and cost-effectiveness.

Feed efficiency by function segment is estimated to be the second largest segment over the forecasted period

The feed efficiency function of feed acidulants is a key factor driving the growth of the feed acidulants market. Feed acidulants can help improve feed efficiency by promoting digestion and nutrient absorption, reducing the incidence of gastrointestinal disorders, and enhancing the microbial balance in the gut. This can lead to improved animal performance, higher growth rates, and better feed conversion ratios. Improved feed efficiency is particularly important in the livestock industry, as it can help reduce feed costs and increase profitability.

Asia Pacific is projected to be the largest region in the feed acidulants market, in 2022; it is anticipated to grow at a significant CAGR

Government funds and initiatives are playing a significant role in driving the growth of the feed acidulants market in the Asia Pacific. Governments in the region are investing in research and development programs to improve the efficacy and safety of feed acidulants and to promote their use in animal feed. The aim is to improve animal health and welfare, reduce the environmental impact of livestock production, and enhance the sustainability of the industry.

In China, the Ministry of Agriculture and Rural Affairs has established research centers to promote the development of new feed additives, while in India, the government has set up a task force to study the use of feed additives in animal feed. In addition, regulations and standards have been introduced in many countries to ensure the safety and efficacy of feed acidulants, and to promote their use in animal feed. Overall, government funds and initiatives are expected to continue to support the growth of the feed acidulants market in Asia Pacific, by promoting research and development, encouraging innovation, and improving the sustainability and competitiveness of the industry.

Key Market Players

The key players in this market include BASF SE (Germany), Yara (Norway), Eastman Chemical Company (US), DSM (Netherlands), Corbion (Netherlands), and Perstorp (Sweden).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (KT) |

|

Segments covered |

By type, compound, form, function, animal type, and region |

|

Regions covered |

North America, Asia Pacific, Europe, South America, and RoW |

|

Companies studied |

|

This research report categorizes the feed acidulants market, based on type, form, compound, function, animal type, and region

By Type

- Propionic acid

- Formic acid

- Citric acid

- Lactic acid

- Sorbic acid

- Malic acid

- Acetic acid

- Other Types

By Compound

- Blended Compound

- Single Compound

By Form

- Dry

- Liquid

By Function

- pH Control

- Feed efficiency

- Flavor

By Animal Type

-

Poultry

- Broilers

- Layers

- Breeders

-

Swine

- Starters

- Growers

- Sows

-

Ruminants

- Dairy Cattle

- Beef Cattle

- Other ruminants

-

Pets

- Dogs

- Cats

- Other pets

- Aquaculture

- Equine

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In May 2022, Kemin Industries, Inc. (US) expanded the company’s presence in Mexico and Central American regions by opening new offices and a distribution center in Mexico based in Guadalajara, Jalisco.

- In November 2020, DSM (Netherlands) strengthened its geographical footprint in the South Asian market by opening a new facility in China. The expansion was done to promote and sell their animal nutrition & health products.

- In October 2020, ADDCON GmbH (Germany) launched AQUAFORM 3G in Ecuador. This helped the company to further strengthen its acidifier portfolio in aquaculture and gain more market share in Ecuador.

Frequently Asked Questions (FAQ):

Which region is projected to have the fastest growth in the feed acidulants market?

South America is projected to be the fastest-growing region in the feed acidulants market with a significant CAGR during the forecast period; it is also estimated to have a significant value in 2023.

What is the current size of the global feed acidulants market? What are the market drivers?

The global feed acidulants market is estimated to be valued at USD 3.49 Billion in 2023. It is projected to reach USD 4.72 Billion by 2028, recording a CAGR of 6.2% during the forecast period.

Increase in consumption of meat and dairy products.

Which are the key players in the market, and how intense is the competition?

Key players in this market include BASF SE (Germany), Yara (Norway), Eastman Chemical Company (US), DSM (Netherlands), Corbion (Netherlands), and Perstorp (Sweden). Since feed acidulants are a fast-growing market, with a lot of unexplored potentials, the existing players are fixated on expanding their production capacities, while startups are being established rapidly. The feed acidulants market can be classified as a competitive market as it has a mix of both large and small number players and none of them account for a major part of the market share. The large players are present at the global level, and unorganized players are present at the local level in several countries.

What are the restraining factors limiting growth in the feed acidulants market?

The continuously rising prices of feed acidulants are limiting the growth in the market.

Which acid type is projected to dominate the feed acidulants market?

Propionic acid type is projected to dominate the feed acidulants market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- High threat of diseases in livestock- Increasing consumption of meat and dairy products- Ban on antibiotics in US and European Union (EU)- Growing government aids or funds to promote wellness of feed industryRESTRAINTS- Rising prices of feed acidulantsOPPORTUNITIES- Encapsulation processes used for feed acidulantsCHALLENGES- Maintaining efficacy of feed acidulants

- 6.1 INTRODUCTION

-

6.2 VALUE CHAINRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCING AND MANUFACTURINGASSEMBLINGDISTRIBUTIONMARKETING & SALES

-

6.3 TECHNOLOGY ANALYSISAGGLOMERATION (PELLETIZING)DOSING SYSTEMS

- 6.4 PRICING ANALYSIS: FEED ACIDULANTS MARKET

-

6.5 MARKET MAP AND ECOSYSTEM: FEED ACIDULANTS MARKETDEMAND SIDESUPPLY SIDEFEED & ANIMAL NUTRITION: ECOSYSTEM VIEWFEED ACIDULANTS: MARKET MAP

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.7 PATENT ANALYSIS

- 6.8 TRADE ANALYSIS

-

6.9 CASE STUDIES

-

6.10 REGULATORY FRAMEWORKREGULATIONS- Feed acidulants regulatory approval from European union- Time duration for feed acidulants to register- Registration of feed acidulants- Packaging of feed acidulants- Labeling of feed acidulants- Manufacture and sale of feed acidulants- Import of feed acidulants

-

6.11 COUNTRY-WISE REGULATORY FRAMEWORKUS- Labeling- Association of American feed control officials (AAFCO)CANADA- Legal authoritiesBRAZILCHINAEUROPEAN UNIONJAPANSOUTH AFRICA

- 7.1 INTRODUCTION

-

7.2 PROPIONIC ACIDSAFETY PROPERTIES OF PROPIONIC ACID FOR ANIMALS AND ENVIRONMENT TO DRIVE MARKET GROWTH

-

7.3 FORMIC ACIDANTIBACTERIAL EFFECTS OF FORMIC ACID TO PRESERVE FEED AND TO DRIVE MARKET

-

7.4 CITRIC ACIDINCREASING DEMAND TO IMPROVE FEED EFFECTIVENESS AND LIVESTOCK PERFORMANCE

-

7.5 LACTIC ACIDCONCENTRATED EFFICACY TOWARD MAINTENANCE OF FEED SAFETY TO DRIVE DEMAND

-

7.6 SORBIC ACIDGROWING NUMBER OF LIVESTOCK DISEASES TO ENCOURAGE ANIMAL BREEDERS TO ADOPT SORBIC ACID AS FEED PRESERVATIVE

-

7.7 MALIC ACIDBREAKDOWN OF FEED INTO NUTRIENTS ABSORBED BY RUMINANTS TO DRIVE MARKET

-

7.8 ACETIC ACIDPROVIDING LIVESTOCK BREEDERS WITH EFFECTIVE AND COST-EFFICIENT FEED FORMULATIONS TO DRIVE MARKET

- 7.9 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 BLENDEDGROWING DEMAND TO IMPROVE LIVESTOCK HEALTH

-

8.3 SINGLE COMPOUNDSINGLE COMPOUNDS TO RESTRICT AND CONTROL GROWTH OF PATHOGENIC BACTERIA IN FEED TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 DRYEASY STORAGE AND TRANSPORTABILITY OF DRY FEED ACIDULANTS TO DRIVE MARKET

-

9.3 LIQUIDINCREASE IN DEMAND FOR FEED PRESERVATIVES TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 PH CONTROLGROWING AWARENESS TOWARD ANIMAL HEALTH TO DRIVE MARKET

-

10.3 FEEDINCREASING DEMAND FOR FEED CONVERSION RATE AND FEED PRESERVATION TO DRIVE MARKET GROWTH

-

10.4 FLAVORGROWING DEMAND FOR FEED ADDITIVES TO DRIVE MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 POULTRYRAPID GROWTH IN POULTRY MEAT PRODUCTION TO INCREASE DEMAND FOR SUPERIOR QUALITY FEEDBROILERSLAYERSBREEDERS

-

11.3 SWINEHIGHER CONSUMPTION OF PROTEIN-RICH MEAT SUCH AS PORK TO DRIVE MARKETSOWSGROWERSSTARTERS

-

11.4 RUMINANTSGROWTH IN DEMAND FOR QUALITY MILK AND BEEF PRODUCTS TO BE USED IN RUMINANT DIETSDAIRY CATTLEBEEF CATTLEOTHER RUMINANTS

-

11.5 AQUACULTURERAPID GROWTH IN AQUACULTURE INDUSTRY TO DRIVE MARKET

-

11.6 PETSINCREASE IN PET POPULATION AND HIGH INVESTMENT IN QUALITY AND PREMIUM PET FOOD TO DRIVE MARKETDOGSCATSOTHER PETS

-

11.7 EQUINEUSAGE OF FEED ACIDULANTS AS EFFICIENT ENABLERS OF ANIMAL FEED FOR EQUINE TO DRIVE MARKET

- 12.1 INTRODUCTION

-

12.2 RECESSION IMPACT: FEED ACIDULANTS MARKETMACRO INDICATORS OF RECESSION

-

12.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increased demand for protein-rich diet to drive marketMEXICO- Increasing population of livestock to drive marketCANADA- Significant growth in livestock industry along with modernization of dairy industry to drive market

-

12.4 EUROPEEUROPE: RECESSION IMPACT ANALYSIS- Europe recession impact analysisSPAIN- Increasing livestock rearing and growing feed industry to drive marketFRANCE- Rise in domestic demand for meat products and natural growth promoters for livestock to drive marketGERMANY- Growth of cattle and swine meat consumption and adoption of safe and healthier feed additives to boost marketUK- High regulatory framework and increasing demand for nutritious feed products to drive marketITALY- Increase in usage of naturally sourced additives to drive marketREST OF EUROPE

-

12.5 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- High adoption rate of organic feed additives by livestock rearers to drive marketINDIA- Growing investment in meat-protein-based diet to drive marketJAPAN- Willingness of livestock rearers to add organically sourced feed additives to drive marketTHAILAND- High competition and feed additive diversification to drive marketVIETNAM- Increasing consumption of meat, beef, and pork together with growth in livestock population to drive marketREST OF ASIA PACIFIC

-

12.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Growing health awareness about technical and clinical benefits of feed acidulants to drive growthARGENTINA- Significant rise in production of meat to drive growthREST OF SOUTH AMERICA

-

12.7 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISAFRICA- Growing livestock population and rising demand for better quality meat and dairy products to drive marketMIDDLE EAST- Rising demand to improve feed efficiency to meet growing meat consumption

- 13.1 OVERVIEW

- 13.2 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- 13.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.4 MARKET SHARE ANALYSIS, 2022

-

13.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

13.6 STARTUPS/SMES EVALUATION QUADRANT (OTHER PLAYERS)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

13.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYARA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDSM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCORBION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPERSTORP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKEMIN INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPETERLABS HOLDINGS BERHAD- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewANPARIO PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewTITAN BIOTECH- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewPANCOSMA- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewJEFO- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewADDCON GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewNOVUS INTERNATIONAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewIMPEXTRACO NV- Business overview- Products/Solutions/Services offered- Recent developments- MnM View

-

14.2 OTHER PLAYERSBENTOLI- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewHAMBURG FRUCTOSE GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewMOSSELMAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewNUTREX- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewOXIRIS CHEMICALS S.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewPRATHISTA INDUSTRIES LIMITEDTROUW NUTRITIONPRAKASH CHEMICALS AGENCIES PRIVATE LIMITEDVIZAG CHEMICALH K ENZYMES AND BIOCHEMICALS PVT LTD.

- 15.1 INTRODUCTION

- 15.2 RESEARCH LIMITATIONS

-

15.3 PHYTOGENIC FEED ADDITIVES MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 FEED ENZYMES MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018–2021

- TABLE 2 FEED ACIDULANTS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 AVERAGE SELLING PRICE OF FEED ACIDULANTS, BY REGION, 2020–2022 (USD/TON)

- TABLE 4 AVERAGE SELLING PRICE OF FEED ACIDULANTS, BY KEY TYPE, 2020–2022 (USD/TON)

- TABLE 5 FEED ACIDULANTS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 6 FEW PATENTS PERTAINING TO FEED ACIDULANTS, 2019–2022

- TABLE 7 IMPORT DATA OF PREPARATION OF KIND USED IN ANIMAL FEEDING FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- TABLE 8 EXPORT DATA OF PREPARATION OF KIND USED IN ANIMAL FEEDING FOR KEY COUNTRIES, 2021 (VALUE AND VOLUME)

- TABLE 9 GROWING INNOVATION IN ANIMAL DIET

- TABLE 10 INCREASE IN CONCERN TO IMPROVE LIVESTOCK HEALTH IN ASIA PACIFIC

- TABLE 11 FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 12 FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 13 FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 14 FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 15 PROPIONIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 16 PROPIONIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 17 PROPIONIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 PROPIONIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 FORMIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 20 FORMIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 21 FORMIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 FORMIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 CITRIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 24 CITRIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 25 CITRIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 CITRIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 LACTIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 28 LACTIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 29 LACTIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 LACTIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 SORBIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 32 SORBIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 33 SORBIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 SORBIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 MALIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 36 MALIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 37 MALIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 MALIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 ACETIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 40 ACETIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 41 ACETIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 ACETIC ACID: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 OTHER TYPES: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 44 OTHER TYPES: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 45 OTHER TYPES: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 OTHER TYPES: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 FEED ACIDULANTS MARKET, BY COMPOUND, 2018–2022 (USD MILLION)

- TABLE 48 FEED ACIDULANTS MARKET, BY COMPOUND, 2023–2028 (USD MILLION)

- TABLE 49 BLENDED COMPOUND FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 BLENDED COMPOUND FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 SINGLE COMPOUND FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 SINGLE COMPOUND FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 FEED ACIDULANTS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 54 FEED ACIDULANTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 55 DRY FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 56 DRY FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 LIQUID FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 LIQUID FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 FEED ACIDULANTS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 60 FEED ACIDULANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 61 PH CONTROL: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 PH CONTROL: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 FEED EFFICIENCY: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 FEED EFFICIENCY: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 FLAVOR: FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 FLAVOR: FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2018–2022 (USD MILLION)

- TABLE 68 FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2023–2028 (USD MILLION)

- TABLE 69 POULTRY FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 POULTRY FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 POULTRY FEED ACIDULANTS MARKET, BY POULTRY TYPE, 2018–2022 (USD MILLION)

- TABLE 72 POULTRY FEED ACIDULANTS MARKET, BY POULTRY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 SWINE FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 74 SWINE FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 SWINE FEED ACIDULANTS MARKET, BY SWINE TYPE, 2018–2022 (USD MILLION)

- TABLE 76 SWINE FEED ACIDULANTS MARKET, BY SWINE TYPE, 2023–2028 (USD MILLION)

- TABLE 77 RUMINANTS FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 78 RUMINANTS FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 RUMINANTS FEED ACIDULANTS MARKET, BY RUMINANTS TYPE, 2018–2022 (USD MILLION)

- TABLE 80 RUMINANTS FEED ACIDULANTS MARKET, BY RUMINANTS TYPE, 2023–2028 (USD MILLION)

- TABLE 81 AQUACULTURE FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 AQUACULTURE FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 PETS FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 PETS FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 PETS FEED ACIDULANTS MARKET, BY PET TYPE, 2018–2022 (USD MILLION)

- TABLE 86 PETS FEED ACIDULANTS MARKET, BY PET TYPE, 2023–2028 (USD MILLION)

- TABLE 87 EQUINE FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 88 EQUINE FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (KT)

- TABLE 90 FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (KT)

- TABLE 91 FEED ACIDULANTS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 92 FEED ACIDULANTS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: FEED ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: FEED ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 96 NORTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 97 NORTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: FEED ACIDULANTS MARKET, BY COMPOUND, 2018–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: FEED ACIDULANTS MARKET, BY COMPOUND, 2023–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: FEED ACIDULANTS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: FEED ACIDULANTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: FEED ACIDULANTS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: FEED ACIDULANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2018–2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2023–2028 (USD MILLION)

- TABLE 107 US: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 108 US: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 MEXICO: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 110 MEXICO: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 111 CANADA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 112 CANADA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: FEED ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 114 EUROPE: FEED ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 EUROPE: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 116 EUROPE: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 117 EUROPE: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 118 EUROPE: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: FEED ACIDULANTS MARKET, BY COMPOUND, 2018–2022 (USD MILLION)

- TABLE 120 EUROPE: FEED ACIDULANTS MARKET, BY COMPOUND, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: FEED ACIDULANTS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 122 EUROPE: FEED ACIDULANTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: FEED ACIDULANTS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 124 EUROPE: FEED ACIDULANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2018–2022 (USD MILLION)

- TABLE 126 EUROPE: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2023–2028 (USD MILLION)

- TABLE 127 SPAIN: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 128 SPAIN: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 129 FRANCE: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 130 FRANCE: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 131 GERMANY: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 132 GERMANY: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 133 UK: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 134 UK: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 ITALY: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 136 ITALY: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 REST OF EUROPE: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 138 REST OF EUROPE: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 142 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 143 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY COMPOUND, 2018–2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY COMPOUND, 2023–2028 (USD MILLION)

- TABLE 147 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 150 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 151 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2018–2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2023–2028 (USD MILLION)

- TABLE 153 CHINA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 154 CHINA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 INDIA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 156 INDIA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 157 JAPAN: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 158 JAPAN: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 159 THAILAND: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 160 THAILAND: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 VIETNAM: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 162 VIETNAM: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 165 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 166 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 167 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 168 SOUTH AMERICA: FEED ACIDULANTS MARKET SIZE, BY TYPE, 2023–2028 (KT)

- TABLE 169 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 170 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 171 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY COMPOUND, 2018–2022 (USD MILLION)

- TABLE 172 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY COMPOUND, 2023–2028 (USD MILLION)

- TABLE 173 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 174 SOUTH AMERICA: FEED ACIDULANTS MARKET SIZE, BY FORM, 2023–2028 (USD MILLION)

- TABLE 175 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 176 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 177 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2018–2022 (USD MILLION)

- TABLE 178 SOUTH AMERICA: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2023–2028 (USD MILLION)

- TABLE 179 BRAZIL: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 180 BRAZIL: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 181 ARGENTINA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 182 ARGENTINA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 183 REST OF SOUTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 184 REST OF SOUTH AMERICA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 ROW: FEED ACIDULANTS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 186 ROW: FEED ACIDULANTS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 187 ROW: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 188 ROW: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 189 ROW: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 190 ROW: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 ROW: FEED ACIDULANTS MARKET, BY COMPOUND, 2018–2022 (USD MILLION)

- TABLE 192 ROW: FEED ACIDULANTS MARKET, BY COMPOUND, 2023–2028 (USD MILLION)

- TABLE 193 ROW: FEED ACIDULANTS MARKET, BY FORM, 2018–2022 (USD MILLION)

- TABLE 194 ROW: FEED ACIDULANTS MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 195 ROW: FEED ACIDULANTS MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 196 ROW: FEED ACIDULANTS MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 197 ROW: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2018–2022 (USD MILLION)

- TABLE 198 ROW: FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2023–2028 (USD MILLION)

- TABLE 199 AFRICA: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 200 AFRICA: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 201 MIDDLE EAST: FEED ACIDULANTS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 202 MIDDLE EAST: FEED ACIDULANTS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 FEED ACIDULANTS MARKET: DEGREE OF COMPETITION (COMPETITIVE), 2021

- TABLE 204 COMPANY TYPE FOOTPRINT

- TABLE 205 COMPANY ANIMAL TYPE FOOTPRINT

- TABLE 206 COMPANY REGIONAL FOOTPRINT

- TABLE 207 OVERALL COMPANY FOOTPRINT

- TABLE 208 FEED ACIDULANTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 209 FEED ACIDULANTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 210 PRODUCT LAUNCHES, OCTOBER 2020-SEPTEMBER 2022

- TABLE 211 DEALS, OCTOBER 2020–JANUARY 2023

- TABLE 212 OTHERS, JANUARY 2020–MAY 2022

- TABLE 213 BASF SE- BUSINESS OVERVIEW

- TABLE 214 BASF SE: PRODUCT LAUNCHES

- TABLE 215 BASF SE: DEALS

- TABLE 216 YARA- BUSINESS OVERVIEW

- TABLE 217 EASTMAN CHEMICAL COMPANY- BUSINESS OVERVIEW

- TABLE 218 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 219 DSM: BUSINESS OVERVIEW

- TABLE 220 DSM: DEALS

- TABLE 221 DSM: OTHERS

- TABLE 222 CORBION: BUSINESS OVERVIEW

- TABLE 223 PERSTORP: BUSINESS OVERVIEW

- TABLE 224 PERSTORP: DEALS

- TABLE 225 KEMIN INDUSTRIES, INC.- BUSINESS OVERVIEW

- TABLE 226 KEMIN INDUSTRIES, INC.: DEALS

- TABLE 227 KEMIN INDUSTRIES, INC.: OTHERS

- TABLE 228 PETERLABS HOLDINGS BERHAD: BUSINESS OVERVIEW

- TABLE 229 ANPARIO PLC.: BUSINESS OVERVIEW

- TABLE 230 TITAN BIOTECH: BUSINESS OVERVIEW

- TABLE 231 PANCOSMA: BUSINESS OVERVIEW

- TABLE 232 JEFO: BUSINESS OVERVIEW

- TABLE 233 JEFO: OTHERS

- TABLE 234 ADDCON GMBH: BUSINESS OVERVIEW

- TABLE 235 ADDCON GMBH: NEW PRODUCT LAUNCHES

- TABLE 236 ADDCON GMBH: DEALS

- TABLE 237 NOVUS INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 238 NOVUS INTERNATIONAL: DEALS

- TABLE 239 IMPEXTRACO NV: BUSINESS OVERVIEW

- TABLE 240 BENTOLI: BUSINESS OVERVIEW

- TABLE 241 HAMBURG FRUCTOSE GMBH: BUSINESS OVERVIEW

- TABLE 242 MOSSELMAN: BUSINESS OVERVIEW

- TABLE 243 NUTREX: BUSINESS OVERVIEW

- TABLE 244 NUTREX: DEALS

- TABLE 245 NUTREX: OTHERS

- TABLE 246 OXIRIS CHEMICALS S.A.: BUSINESS OVERVIEW

- TABLE 247 PRATHISTA INDUSTRIES LIMITED: BUSINESS OVERVIEW

- TABLE 248 TROUW NUTRITION: BUSINESS OVERVIEW

- TABLE 249 PRAKASH CHEMICALS AGENCIES PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 250 VIZAG CHEMICAL: BUSINESS OVERVIEW

- TABLE 251 H K ENZYMES AND BIOCHEMICALS PVT LTD.: BUSINESS OVERVIEW

- TABLE 252 ADJACENT MARKETS

- TABLE 253 PHYTOGENIC FEED ADDITIVES MARKET, BY LIVESTOCK, 2018–2025 (USD MILLION)

- TABLE 254 FEED ENZYMES MARKET, BY LIVESTOCK, 2018–2025 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 FEED ACIDULANTS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 FEED ACIDULANTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 8 FEED ACIDULANTS MARKET, BY COMPOUND, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 FEED ACIDULANTS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 FEED ACIDULANTS MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 11 SOUTH AMERICA TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 12 SPAIN AND PH CONTROL ACCOUNTED FOR LARGEST RESPECTIVE SHARES IN 2022

- FIGURE 13 FORMIC ACID TO DOMINATE ASIA PACIFIC MARKET DURING FORECAST PERIOD

- FIGURE 14 POULTRY TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO DOMINATE ANIMAL TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 16 FEED ACIDULANTS: MARKET DYNAMICS

- FIGURE 17 GLOBAL MEAT CONSUMPTION ESTIMATES, 2022–2031 (KT CARCASS WEIGHT EQUIVALENT)

- FIGURE 18 GLOBAL MILK PRODUCTION, ALL SPECIES, 2015–2019 (MT)

- FIGURE 19 VALUE CHAIN ANALYSIS OF FEED ACIDULANTS MARKET: RAW MATERIAL SOURCING AND KEY MANUFACTURING CONTRIBUTORS

- FIGURE 20 REVENUE SHIFT FOR FEED ACIDULANTS MARKET

- FIGURE 21 PATENTS GRANTED FOR FEED ACIDULANTS MARKET 2011-2021

- FIGURE 22 REGIONAL ANALYSIS OF PATENT GRANTED FOR FEED ACIDULANTS MARKET, 2011-2021

- FIGURE 23 FEED ACIDULANTS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 24 FEED ACIDULANTS MARKET, BY COMPOUND, 2023 VS. 2028 (USD MILLION)

- FIGURE 25 FEED ACIDULANTS MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 26 FEED ACIDULANTS MARKET, BY FUNCTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 27 FEED ACIDULANTS MARKET, BY ANIMAL TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 28 GEOGRAPHIC SNAPSHOT

- FIGURE 29 INDICATORS OF RECESSION

- FIGURE 30 WORLD INFLATION RATE: 2011-2021

- FIGURE 31 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 32 RECESSION INDICATORS AND THEIR IMPACT ON FEED ACIDULANTS MARKET

- FIGURE 33 GLOBAL FEED ACIDULANTS MARKET: EARLIER FORECAST VS RECESSION FORECAST

- FIGURE 34 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 35 EUROPE FEED ACIDULANTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 36 ASIA PACIFIC :FEED ACIDULANTS MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC FEED ACIDULANTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 38 SOUTH AMERICA IS PROJECTED TO GROW AT HIGHEST CAGR

- FIGURE 39 SOUTH AMERICA FEED ACIDULANTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 40 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS IN MARKET, 2017–2021 (USD BILLION)

- FIGURE 41 FEED ACIDULANTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 42 FEED ACIDULANTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (OTHER PLAYERS)

- FIGURE 43 BASF SE: COMPANY SNAPSHOT

- FIGURE 44 YARA: COMPANY SNAPSHOT

- FIGURE 45 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 46 DSM: COMPANY SNAPSHOT

- FIGURE 47 CORBION: COMPANY SNAPSHOT

- FIGURE 48 PERSTORP: COMPANY SNAPSHOT

- FIGURE 49 PETERLABS HOLDINGS BERHAD: COMPANY SNAPSHOT

- FIGURE 50 ANPARIO PLC.: COMPANY SNAPSHOT

- FIGURE 51 TITAN BIOTECH: COMPANY SNAPSHOT

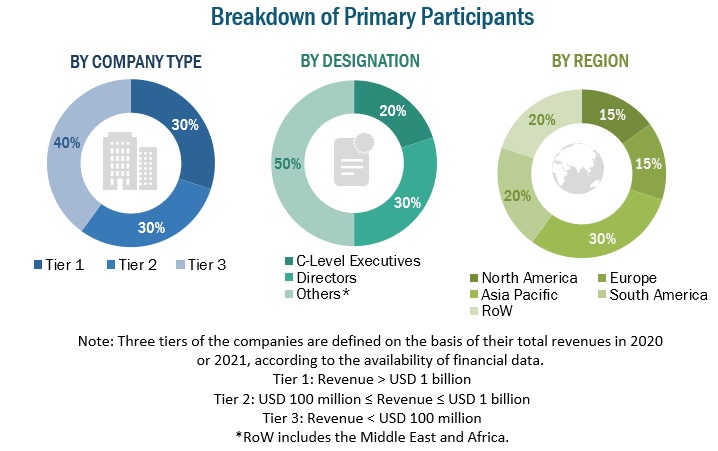

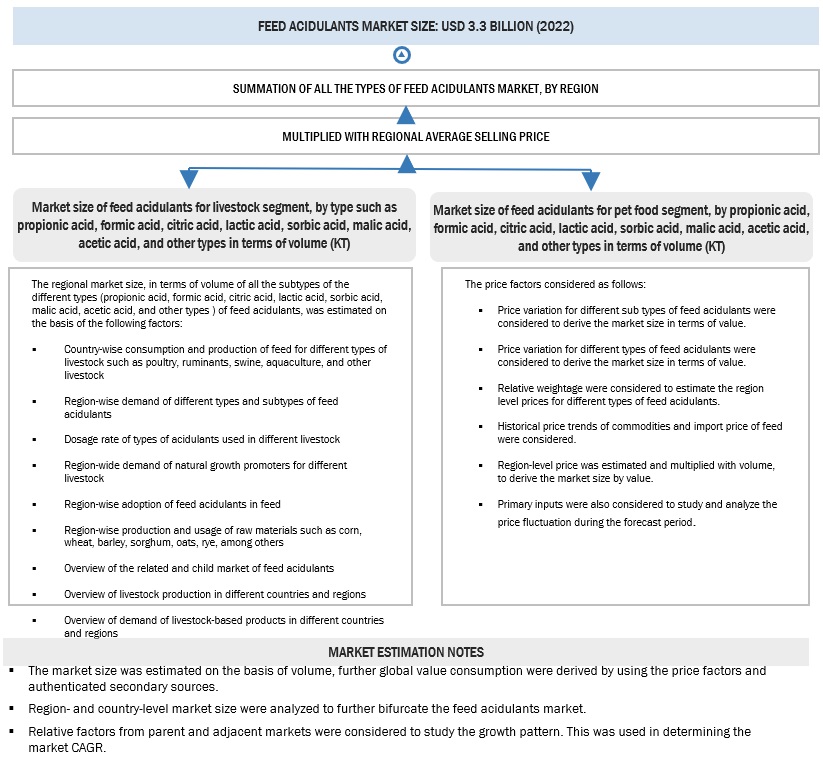

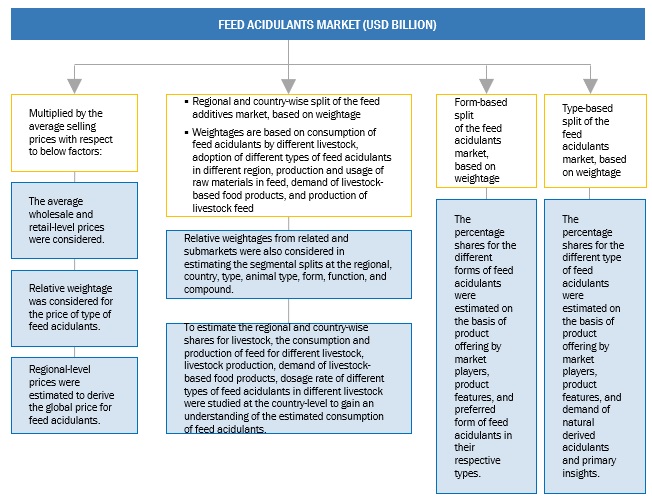

The study involved four major activities in estimating the current size of the feed acidulants market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering feed acidulants and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the feed acidulants market, which was validated by the primary respondent.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the feed acidulants market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- Both the top-down and bottom-up approaches were used to estimate and validate the total size of the feed acidulants market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major feed acidulants-based food and feed manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the feed acidulants market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Market Size Estimation Methodology: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Market Definition

- Feed acidulants are compounds that have acidic properties and are mixed in feed. These acidulants help regulate the pH value of the feed and promote a healthy gut while improving its growth. Feed acidulants are combined with basic feed mix/ration to help with livestock weight gain, improvement in feed digestion, prevention of diseases, and to enable the conversion of feed into nutrients.

Key Stakeholders

- Regulatory bodies

- World Health Organization (WHO)

- American Feed Industry Association (AFIA)

- European Feed Manufacturers' Federation (FEFAC)

- EU Association of Specialty Feed Ingredients and their Mixtures (FEFNA)

- International Feed Industry Federation (IFIF)

- Government agencies

- Intermediary suppliers such as traders, distributors, and suppliers of feed acidulants and feed

- Feed manufacturers & suppliers

- Associations and industry bodies

- Feed acidulant manufacturers and suppliers

- Feed acidulant traders and distributors

- Commercial research & development (R&D) institutions

- Government and research organizations

- Technology providers to feed acidulant companies

Report Objectives

- To define, segment, and project the global market for feed acidulants on the basis of type, form, compound, function, animal type, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the feed acidulants market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe region for feed acidulants market into Russia, Belgium, the Netherlands, and Denmark.

- Further breakdown of the Asia Pacific region for feed acidulants market into Indonesia, Australia, South Korea, Singapore, and Malaysia.

- Further breakdown of other countries in the South American region for feed acidulants market into Colombia, Peru, Chile, and Venezuela.

- Further breakdown of other countries in the RoW market for feed acidulants market into Middle East and Africa.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Feed Acidulants Market

Which pets are considered for this report?