Polymer Blends & Alloys Market by Type (PC, PPE/PPO-Based Blends and Alloys), Application (Automotive, Electrical and Electronics, Consumer Goods), and Region (Europe, North America, Asia Pacific, and RoW) - Global Forecasts to 2028

Updated on : June 27, 2024

Polymer Blends Market and Polymer Alloys Market

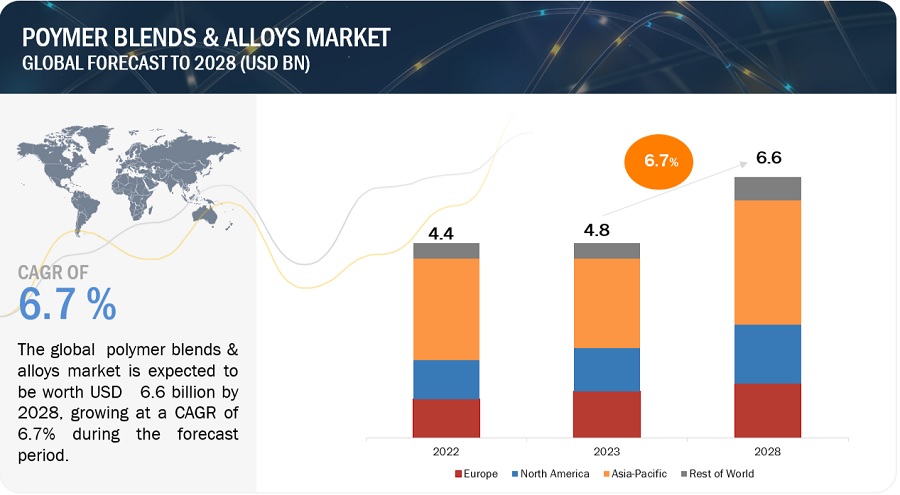

The global polymer blends market and polymer alloys market was valued at USD 4.4 billion in 2022 and is projected to reach USD 6.6 billion by 2028, growing at a cagr 6.7% from 2023 to 2028. Over the world, the polymer blends & alloys market is expanding significantly, and during the forecast period, a similar trend is anticipated.

The demand for polymer blends & alloys has been driven by several factors, They offer versatility, design flexibility, making them ideal for creating durable and attractive products. The major applications of polymer blends & alloys include automotive, electrical and electronics, consumer goods, and others.

In the electrical and electronics industry, polymer blends & alloys are widely used in the manufacturing of electronic devices, connectors, housings, and insulation components. These materials offer excellent electrical insulation, thermal management, and design flexibility required for the fast-paced electronics market. Polymer blends & alloys are used in a variety of packaging applications, including food packaging, beverage packaging, and pharmaceutical packaging. They can provide excellent barrier properties to moisture, gases, and chemicals. Polymer blends & alloys are used in a variety of construction applications, including pipes, window frames, and roofing materials. They can provide excellent strength, durability, and resistance to weather conditions.

Attractive Opportunities in Polymer Blends & Alloys Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Polymer Blends and Alloys Market Dynamics

Driver: High demand for superior and lightweight polymer blends & alloys products

Polymer blends & alloys provide designers and engineers with greater design flexibility compared to traditional materials. They can be molded into complex shapes, allowing for innovative designs and streamlined production processes. Moreover, multiple functions can be integrated into a single component, reducing the number of parts and assembly time, and enhancing overall product performance and efficiency. Thus, this superior characteristics driving the demand for Polymer blends and alloys.

Restraint: High processing and manufacturing cost

High processing and manufacturing cost of polymer blends & alloys is acting as a barrier in the mass-adoption of polymer blends & alloys in various applications. Plastics manufacturers need to provide better and more economic materials with superior combinations of properties as a replacement for traditional metals and polymers. The compatibility testing of two polymers increases the cost of polymer blends. This is most apparent in cost-competitive markets such as consumer products and appliances, especially when product manufacturers have to worry about matching low-cost overseas suppliers. The high cost of polymer blends & alloys is expected to act as an impediment as the applications where high performance characteristics are not required will chose commodity plastics and base polymers owing to their low prices instead of polymer blends and alloys.

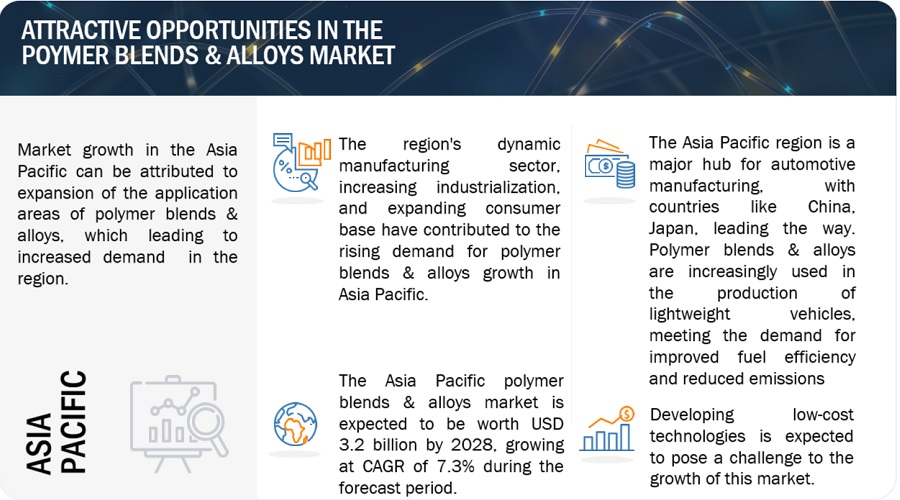

Opportunity: Increasing demand from emerging markets

Asia Pacific economies such as China and India are growing rapidly. South Asian countries such as Thailand and Malaysia also have growth potential along with globalization of economy. The primary driver behind their growth is ever-growing population. With developing economies, per capita income has also been increased in these countries. With growing population, end-use industries such as automotive & transportation, electrical & electronics, consumer appliances, and medical devices are growing. These industries have shown very healthy growth in past five years and this scenario is expected to remain same in the future too. Growth of the automotive sector has resulted in increased demand for polymer blends and alloys.

Challenge: Growing competition and Stringent regulations

The polymer blends & alloys market is in a growing competition phase, with numerous players operating in the market. This makes it challenging for new entrants to establish a foothold in the market. The polymer blends & alloys market is subject to various regulations and standards regarding product quality, safety, and environmental impact. Compliance with these regulations can be a challenge for manufacturers, especially small and medium-sized enterprises.

Based on the application, the consumer goods segment is estimated to account for the fourth largest market share during the forecast period

Based on the application type of consumer goods segment is estimated to account for the fourth largest market share. Polymer blends & alloys are commonly used in the production of appliances such as refrigerators, washing machines, air conditioners, and kitchen appliances. They provide durability, impact resistance, and aesthetic appeal to the appliance components, including housings, handles, knobs, and buttons. Polymer blends & alloys find extensive use in consumer electronics and gadgets such as smartphones, tablets, laptops, televisions, and gaming consoles. They are utilized in casings, bezels, buttons, and other structural components, providing lightweight solutions, design flexibility, and improved impact resistance. These factors will contribute to market growth.

Based on type, the PC based blends & alloys segment is anticipated to register the highest CAGR

Based on type, the market is segmented into PC, PPE/PPO, and others. PC-based blends and alloys offer properties such as ease of processability, toughness, and dimensional stability. PC-based alloys are produced using PC and ABS, due to their characteristics such as impact resistance, stiffness, low temperature impact, ductility, and flame retardance. These blends are used in consumer appliances such as TV & LED frames, electronics, and other digital products. Due to these factors, the PC based blends & alloys type of Polymer blends & alloys is expected to witness the highest CAGR between 2023 and 2028.

Europe to hold the third largest market share during the forecast period

Polymer blends & alloys are extensively used in Europe across industries such as automotive, electrical and electronics, packaging, construction, and consumer goods. Europe's strong manufacturing base, focus on innovation, and commitment to sustainability drive the widespread adoption of these materials. Polymer blends & alloys contribute to lightweight and fuel-efficient automotive components, advanced electronics, sustainable packaging solutions, energy-efficient construction materials, and durable consumer goods. Their versatility, design flexibility, and environmental benefits align with Europe's emphasis on innovation, sustainability, and meeting consumer demands. This factors driving the polymer blends & alloys in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The polymer blends & alloys market is dominated by a few globally established players such as Covestro AG (Germany), BASF SE (Germany), Celanese Corporation (US), LG Chemical (South Korea), INEOS Styrolution Group GmbH (Germany), JSR Corporation (Japan), LyondellBasell Industries Holdings B.V. (US), Mitsubishi Engineering-Plastics Corporation (Japan), SABIC (Saudi Arabia), Daicel Corporation (Japan), Asahi Kasei Corporation (Japan), and CHIMEI (Taiwan) among others, are the key manufacturers that secured major contracts in the last few years. Major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the polymer blends & alloys market. The research includes a detailed competitive analysis of these key players in the polymer blends & alloys market, including company profiles, recent developments, and key market strategies.

Polymer Blends and Alloys Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 4.4 billion |

|

Revenue Forecast in 2028 |

USD 6.6 billion |

|

CAGR |

6.7% |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD billion/million), Volume (Kiloton) |

|

Segments Covered |

By Type, By Application, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, and RoW |

|

Companies covered |

Celanese, Covestro AG, BASF SE, JSR Corporation, LyondellBasel, Mitsubishi Engineering-Plastics Corporation, SABIC, Daicel Polymer Ltd., Asahi Kasei Chemical Corporation, CHIMEI Corporation, INEOS Styrolution Group, LG Chem, Americhem, Foster Corporation, Chemieuro, Axel Polymers Ltd., Arkema, Radici Group, TRINSEO, Bada AG, ROMIRA GmbH, and Polykemi |

The study categorizes the polymer blends & alloys market based on Type, Application, and Region.

By Type:

- PC

- PPO/PPE

- Others

By Application:

- Automotive

- Electrical & Electronics

- Consumer Goods

- Others

By Region:

- North America

- Asia Pacific

- Europe

- RoW

Recent Developments

- In March 2023, SABIC announced a new partnership with Covestro to develop and commercialize new polymer blends & alloys for the automotive industry. The partnership will focus on developing materials with improved performance and sustainability.

- In September 2022, Mitsubishi Engineering-Plastics Corporation acquired the assets of a German company Polymer Alloys GmbH which specialize in the production of polymer alloys for use in electrical and electronic applications.

- In January 2021, Celanese and RTP Company, a global compounder of custom engineered thermoplastics, announced a collaboration to develop new thermoplastic compounds. The partnership aimed to combine Celanese's polymer expertise with RTP Company's compounding capabilities to bring innovative polymer blends & alloys to the market.

Frequently Asked Questions (FAQ):

Which are the major companies in the polymer blends & alloys market? What are their major strategies to strengthen their market presence?

Some of the key players in the polymer blends & alloys market are Covestro AG (Germany), BASF SE (Germany), Celanese Corporation (US), LG Chemical (South Korea), INEOS Styrolution Group GmbH (Germany), JSR Corporation (Japan), LyondellBasell Industries Holdings B.V. (US), Mitsubishi Engineering-Plastics Corporation (Japan), SABIC (Saudi Arabia), Daicel Corporation (Japan), Asahi Kasei Corporation (Japan), and CHIMEI (Taiwan) among others, are the key manufacturers that secured contracts, deals in the last few years. Contracts and deals were the key strategies adopted by these companies to strengthen their position in the polymer blends & alloys market.

What are the drivers and opportunities for the polymer blends & alloys market?

The need for polymer blends & alloys has increased significantly around the world, particularly in Asia Pacific, North America, followed by Europe, where the major polymer blends & alloys manufacturers are present. Rising R&D efforts and growing technological advancement in manufacturing are anticipated to accelerate market expansion globally.

Which region is expected to hold the highest market share?

Asia Pacific dominated the market share in 2022, showcasing strong demand for polymer blends & alloys from this region. Well-established and prominent manufacturers in this region include LG Chemical (South Korea), Daicel Corporation (Japan), Asahi Kasei Corporation (Japan), Mitsubishi Engineering-Plastics Corporation (Japan).

What is the total CAGR expected to be recorded for the polymer blends & alloys market during 2023-2028?

The CAGR is expected to record a CAGR of 6.7% from 2023-2028.

How is the polymer blends & alloys market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Polymer blends replacing traditional materials and base polymers in end use applications- Growth of end use industries- Increasing demand for manufacturing lightweight vehicles- Laws and regulations enforced by governmentsRESTRAINTS- High processing and manufacturing costs- Fluctuations in prices of raw materials- Limited treatment plants and lack of expertise in recycling polymer wasteOPPORTUNITIES- Growing demand for EVs- Increasing penetration of polymer blends & alloys in consumer goodsCHALLENGES- Volatility of crude oil prices- High costs of recycled plastics- Existence of alternate products with identical properties

-

5.3 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE BASED ON APPLICATION, BY KEY PLAYERS

- 5.6 AVERAGE SELLING PRICE, BY REGION

-

5.7 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 KEY CONFERENCES AND EVENTS (2023–2024)

-

5.10 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON POLYMER BLENDS & ALLOYS MARKETREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.11 ECOSYSTEM ANALYSISRAW MATERIAL ANALYSISMANUFACTURING PROCESS ANALYSISFINAL PRODUCT ANALYSIS

- 5.12 VALUE CHAIN ANALYSIS

-

5.13 TRADE ANALYSIS: KEY MARKETS FOR IMPORT/EXPORTUSGERMANYCHINAINDIA

- 5.14 CASE STUDY

- 5.15 TRENDS IMPACTING CUSTOMER BUSINESS

-

5.16 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS’ ANALYSISLIST OF PATENTS

- 6.1 INTRODUCTION

-

6.2 PC-BASED BLENDS & ALLOYSEXCELLENT THERMAL STABILITY, TOUGHNESS, AND DIMENSIONAL STABILITY TO DRIVE MARKET

-

6.3 PPO/PPE-BASED BLENDS & ALLOYSPPO/PPE-BASED POLYMER BLENDS & ALLOYS MOSTLY USED IN STRUCTURAL PARTS OF AUTOMOTIVE AND MOTORCYCLES

- 6.4 OTHER POLYMER BLENDS

- 7.1 INTRODUCTION

-

7.2 AUTOMOTIVEINCREASING DEMAND FOR LIGHTWEIGHT, FUEL-EFFICIENT VEHICLES TO DRIVE DEMANDPOLYMER BLENDS & ALLOYS MARKET IN AUTOMOTIVE APPLICATION, BY REGION

-

7.3 ELECTRICAL & ELECTRONICSRISING DEMAND FOR ELECTRONIC DEVICES TO DRIVE MARKETPOLYMER BLENDS & ALLOYS MARKET IN ELECTRICAL & ELECTRONICS APPLICATION, BY REGION

-

7.4 CONSUMER GOODSINCREASING DEMAND FOR DURABLE AND LIGHTWEIGHT PRODUCTS TO DRIVE GROWTHPOLYMER BLENDS & ALLOYS MARKET IN CONSUMER GOODS APPLICATION, BY REGION

-

7.5 OTHER APPLICATIONSPOLYMER BLENDS & ALLOYS MARKET IN OTHER APPLICATIONS, BY REGION

-

8.1 INTRODUCTIONPOLYMER BLENDS & ALLOYS MARKET, BY REGION

-

8.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICANORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY TYPENORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATIONNORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY- US- Canada

-

8.3 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY TYPEASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATIONASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY- South Korea- China- India- Japan- Rest of Asia Pacific

-

8.4 EUROPEIMPACT OF RECESSION ON EUROPEEUROPE: POLYMER BLENDS & ALLOYS MARKET, BY TYPEEUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATIONEUROPE: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY- Germany- Italy- UK- France- Spain- Russia- Rest of Europe

-

8.5 REST OF THE WORLDIMPACT OF RECESSION ON REST OF THE WORLDREST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY TYPEREST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATIONREST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY- Brazil- Others

- 9.1 INTRODUCTION

- 9.2 MARKET SHARE ANALYSIS

- 9.3 MARKET RANKING

- 9.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

9.5 COMPANY EVALUATION MATRIX

-

9.6 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 9.7 MARKET EVALUATION FRAMEWORK

- 9.8 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

9.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.1 KEY COMPANIESCOVESTRO AG- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewCELANESE CORPORATION- Business overview- Products/Solutions/Services offered- Deals- MnM viewJSR CORPORATION- Business overview- Products/Solutions/Solutions offered- MnM viewLYONDELLBASELL INDUSTRIES N.V.- Business overview- Products/Solutions/Services offered- Deals- MnM viewMITSUBISHI ENGINEERING-PLASTICS CORPORATION- Business overview- Products/Solutions/Services offered- Deals- MnM viewSABIC- Business overview- Products/Solutions/Services offered- Deals- MnM viewDAICEL CORPORATION- Business overview- Products/Solutions/Services offered- Deals- MnM viewASAHI KASEI CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewCHIMEI CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewINEOS STYROLUTION GROUP GMBH- Business overview- Products/Solutions/Services offered- MnM viewLG CHEM- Business overview- Products/Solutions/Services offered- Other developments- MnM view

-

10.2 OTHER PLAYERSAMERICHEMFOSTER CORPORATIONCHEMIEUROAXEL POLYMERS LIMITEDARKEMARADICI PARTECIPAZIONI SPATRINSEOBADA AGROMIRA GMBHPOLYKEMI

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 PORTER'S FIVE FORCES ANALYSIS OF POLYMER BLENDS & ALLOYS MARKET

- TABLE 2 POLYMER BLENDS & ALLOYS MARKET: SUPPLY CHAIN

- TABLE 3 AVERAGE SELLING PRICES OF POLYMER BLENDS & ALLOYS, BY REGION

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 POLYMER BLENDS & ALLOYS MARKET: KEY CONFERENCES AND EVENTS (2023–2024)

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 POLYMER BLENDS & ALLOYS MARKET: GLOBAL PATENTS

- TABLE 11 LIST OF PATENTS

- TABLE 12 POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 13 POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 14 POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 15 POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 16 PC-BASED POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 PC-BASED POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 18 PC-BASED POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 PC-BASED POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 20 PPO/PPE-BASED POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 PPO/PPE-BASED POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 22 PPO/PPE-BASED POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 PPO/PPE-BASED POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 24 SOME MODERN POLYMER ALLOYS AND THEIR MAIN CHARACTERISTICS

- TABLE 25 OTHER POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 OTHER POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 27 OTHER POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 OTHER POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 29 POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 30 POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 31 POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 33 POLYMER BLENDS & ALLOYS MARKET IN AUTOMOTIVE APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 POLYMER BLENDS & ALLOYS MARKET IN AUTOMOTIVE APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 35 POLYMER BLENDS & ALLOYS MARKET IN AUTOMOTIVE APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 POLYMER BLENDS & ALLOYS MARKET IN AUTOMOTIVE APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 37 POLYMER BLENDS & ALLOYS MARKET IN ELECTRICAL & ELECTRONICS APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 POLYMER BLENDS & ALLOYS MARKET IN ELECTRICAL & ELECTRONICS APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 39 POLYMER BLENDS & ALLOYS MARKET IN ELECTRICAL & ELECTRONICS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 POLYMER BLENDS & ALLOYS MARKET IN ELECTRICAL & ELECTRONICS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 41 POLYMER BLENDS & ALLOYS MARKET IN CONSUMER GOODS APPLICATION, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 POLYMER BLENDS & ALLOYS MARKET IN CONSUMER GOODS APPLICATION, BY REGION, 2018–2022 (KILOTON)

- TABLE 43 POLYMER BLENDS & ALLOYS MARKET IN CONSUMER GOODS APPLICATION, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 POLYMER BLENDS & ALLOYS MARKET IN CONSUMER GOODS APPLICATION, BY REGION, 2023–2028 (KILOTON)

- TABLE 45 POLYMER BLENDS & ALLOYS MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 POLYMER BLENDS & ALLOYS MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2022 (KILOTON)

- TABLE 47 POLYMER BLENDS & ALLOYS MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 POLYMER BLENDS & ALLOYS MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (KILOTON)

- TABLE 49 POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2018–2022 (KILOTON)

- TABLE 51 POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 POLYMER BLENDS & ALLOYS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 53 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 54 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 55 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 57 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 59 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 61 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 63 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 65 US: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 66 US: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 67 US: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 US: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 69 CANADA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 70 CANADA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 71 CANADA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 72 CANADA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 73 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 75 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 77 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 79 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 81 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 83 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 85 SOUTH KOREA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 86 SOUTH KOREA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 87 SOUTH KOREA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 88 SOUTH KOREA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 89 CHINA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 90 CHINA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 91 CHINA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 CHINA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 93 INDIA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 94 INDIA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 95 INDIA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 INDIA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 97 JAPAN: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 98 JAPAN: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 99 JAPAN: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 JAPAN: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 101 REST OF ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 103 REST OF ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 105 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 106 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 107 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 109 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 110 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 111 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 113 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 114 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 115 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 117 GERMANY: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 118 GERMANY: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 119 GERMANY: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 GERMANY: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 121 ITALY: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 122 ITALY: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 123 ITALY: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 ITALY: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 125 UK: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 126 UK: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 127 UK: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 UK: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 129 FRANCE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 130 FRANCE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 131 FRANCE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 FRANCE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 133 SPAIN: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 134 SPAIN: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 135 SPAIN: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 136 SPAIN: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 137 RUSSIA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 138 RUSSIA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 139 RUSSIA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 RUSSIA: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 141 REST OF EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 142 REST OF EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 143 REST OF EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 REST OF EUROPE: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 145 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 146 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2018–2022 (KILOTON)

- TABLE 147 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 148 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 149 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 150 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 151 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 153 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 154 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2018–2022 (KILOTON)

- TABLE 155 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 REST OF THE WORLD: POLYMER BLENDS & ALLOYS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 157 BRAZIL: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 158 BRAZIL: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 159 BRAZIL: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 BRAZIL: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 161 OTHERS: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 162 OTHERS: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2018–2022 (KILOTON)

- TABLE 163 OTHERS: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 164 OTHERS: POLYMER BLENDS & ALLOYS MARKET, BY APPLICATION, 2023–2028 (KILOTON)

- TABLE 165 DEGREE OF COMPETITION

- TABLE 166 COMPANY PRODUCT FOOTPRINT

- TABLE 167 COMPANY APPLICATION FOOTPRINT

- TABLE 168 COMPANY REGION FOOTPRINT

- TABLE 169 DEALS, 2018–2023

- TABLE 170 OTHER DEVELOPMENTS, 2018–2023

- TABLE 172 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 173 COVESTRO AG: COMPANY OVERVIEW

- TABLE 174 BASF SE: COMPANY OVERVIEW

- TABLE 175 CELANESE CORPORATION: COMPANY OVERVIEW

- TABLE 176 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 177 LYONDELLBASELL INDUSTRIES N.V.: COMPANY OVERVIEW

- TABLE 178 MITSUBISHI ENGINEERING-PLASTICS CORPORATION: COMPANY OVERVIEW

- TABLE 179 SABIC: COMPANY OVERVIEW

- TABLE 180 DAICEL CORPORATION: COMPANY OVERVIEW

- TABLE 181 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 182 CHIMEI: COMPANY OVERVIEW

- TABLE 183 INEOS STYROLUTION GROUP GMBH: COMPANY OVERVIEW

- TABLE 184 LG CHEM: COMPANY OVERVIEW

- TABLE 185 AMERICHEM: COMPANY OVERVIEW

- TABLE 186 FOSTER CORPORATION: COMPANY OVERVIEW

- TABLE 187 CHEMIEURO: COMPANY OVERVIEW

- TABLE 188 AXEL POLYMERS LIMITED: COMPANY OVERVIEW

- TABLE 189 ARKEMA: COMPANY OVERVIEW

- TABLE 190 RADICI PARTECIPAZIONI SPA: COMPANY OVERVIEW

- TABLE 191 TRINSEO: COMPANY OVERVIEW

- TABLE 192 BADA AG: COMPANY OVERVIEW

- TABLE 193 ROMIRA GMBH: COMPANY OVERVIEW

- TABLE 194 POLYKEMI: COMPANY OVERVIEW

- FIGURE 1 POLYMER BLENDS & ALLOYS MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 POLYMER BLENDS & ALLOYS MARKET: DATA TRIANGULATION

- FIGURE 5 PC-BASED TYPE SEGMENT DOMINATED POLYMER BLENDS & ALLOYS MARKET IN 2022

- FIGURE 6 AUTOMOTIVE APPLICATION SEGMENT LED POLYMER BLENDS & ALLOYS MARKET IN 2022

- FIGURE 7 ASIA PACIFIC LARGEST POLYMER BLENDS & ALLOYS MARKET IN 2022

- FIGURE 8 DEMAND FROM AUTOMOTIVE APPLICATION TO DRIVE MARKET

- FIGURE 9 PC-BASED SEGMENT ACCOUNTED FOR LARGEST SHARE

- FIGURE 10 AUTOMOTIVE SEGMENT LED MARKET IN 2022

- FIGURE 11 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYMER BLENDS & ALLOYS MARKET

- FIGURE 13 PORTER'S FIVE FORCES ANALYSIS OF POLYMER BLENDS & ALLOYS MARKET

- FIGURE 14 AVERAGE SELLING PRICE BY TOP THREE APPLICATIONS, BY KEY PLAYERS (USD/KG)

- FIGURE 15 AVERAGE SELLING PRICE BY TYPE (USD/KG)

- FIGURE 16 AVERAGE SELLING PRICE BY APPLICATION (USD/KG)

- FIGURE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 19 ECOSYSTEM ANALYSIS OF POLYMER BLENDS & ALLOYS MARKET

- FIGURE 20 VALUE CHAIN ANALYSIS OF POLYMER BLENDS & ALLOYS MARKET

- FIGURE 21 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 22 GLOBAL PATENT PUBLICATION TRENDS: 2012–2022

- FIGURE 23 POLYMER BLENDS & ALLOYS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 24 GLOBAL JURISDICTION ANALYSIS

- FIGURE 25 ZHEJIANG UNIVERSITY REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 26 PC-BASED SEGMENT TO DOMINATE POLYMER BLENDS & ALLOYS MARKET

- FIGURE 27 ELECTRICAL & ELECTRONICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 ASIA PACIFIC TO BE LARGEST AUTOMOTIVE POLYMER BLENDS & ALLOYS MARKET

- FIGURE 29 EUROPE TO BE SECOND-LARGEST ELECTRICAL & ELECTRONICS POLYMER BLENDS & ALLOYS MARKET

- FIGURE 30 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR CONSUMER GOODS APPLICATION OF POLYMER BLENDS & ALLOYS

- FIGURE 31 INDIA TO BE FASTEST-GROWING POLYMER BLENDS & ALLOYS MARKET DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA: POLYMER BLENDS & ALLOYS MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: POLYMER BLENDS & ALLOYS MARKET SNAPSHOT

- FIGURE 34 EUROPE: POLYMER BLENDS & ALLOYS MARKET SNAPSHOT

- FIGURE 35 SHARE OF TOP COMPANIES IN POLYMER BLENDS & ALLOYS MARKET

- FIGURE 36 RANKING OF TOP FIVE PLAYERS IN POLYMER BLENDS & ALLOYS MARKET

- FIGURE 37 REVENUE ANALYSIS

- FIGURE 38 POLYMER BLENDS & ALLOYS MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 39 SMALL AND MEDIUM-SIZED ENTERPRISES EVALUATION MATRIX, 2022

- FIGURE 40 COVESTRO AG: COMPANY SNAPSHOT

- FIGURE 41 BASF SE: COMPANY SNAPSHOT

- FIGURE 42 CELANESE CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 JSR CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 LYONDELLBASELL INDUSTRIES N.V.: COMPANY SNAPSHOT

- FIGURE 45 SABIC: COMPANY SNAPSHOT

- FIGURE 46 DAICEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 CHIMEI: COMPANY SNAPSHOT

- FIGURE 49 INEOS STYROLUTION GROUP GMBH: COMPANY SNAPSHOT

- FIGURE 50 LG CHEM: COMPANY SNAPSHOT

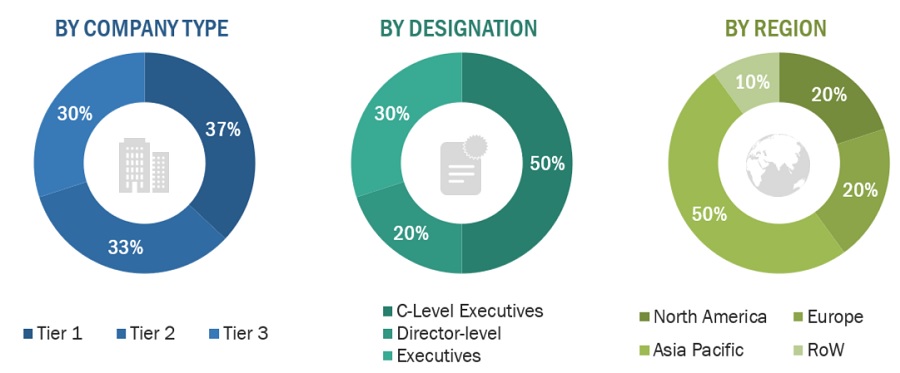

The study involves two major activities in estimating the current market size for the polymer blends & alloys market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. This research involves the extensive use of secondary sources and databases, press releases of companies, Bloomberg, and Factiva to identify and collect information useful for a technical and market-oriented study of the polymer blends & alloys market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The primary sources are mainly industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of the polymer blends & alloys industry. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering polymer blends & alloys and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the polymer blends & alloys market, which was validated by primary respondents.

Secondary research has been used to obtain key information about the supply chain of the polymer blends & alloys industry, the market's monetary chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about the key developments that have taken place from a market-oriented perspective

Primary Research

Extensive primary research was conducted after obtaining information regarding the polymer blends & alloys market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from polymer blends & alloys industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the polymer blends & alloys industry, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of polymer blends & alloys and future outlook of their business which will affect the overall market.

The Breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Kruger Industries |

Product Development Head |

|

BASF SE |

CEO & Founder |

|

Covestro AG |

Polymer Blends & Alloys Consultant |

|

LyondellBasell |

Sales Head |

Market Size Estimation

The research methodology used to estimate the size of the polymer blends & alloys market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in polymer blends & alloys in different applications of the polymer blends & alloys industry at a regional level. Such procurements provide information on the demand aspects of the polymer blends & alloys industry for each application. For each application, all possible segments of the polymer blends & alloys market were integrated and mapped.

Polymer Blends & Alloys Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Polymer Blends & Alloys Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Polymer blends are physical mixtures of polymers and provide a means of combining the useful properties of the constituent components to achieve economic or property advantage polymers are blended to develop a broad range of materials, dilute high-cost engineering resin with a low-cost polymer, and form high performance materials to serve various industries. Properties of polymer blends include tensile strength, flame retardance, impact strength. Compatible polymer blends, miscible polymer blends or multiphase copolymers are termed as polymer alloys, which have same properties as the polymer blends. Polymer alloys are polymeric materials exhibiting macroscopically uniform physical properties throughout their whole volume.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the polymer blends & alloys market based on type, application, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, and RoW, along with major countries in each region

- To provide detailed information about key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the polymer blends & alloys market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Polymer Blends & Alloys Market