Power-to-gas Market by technology (Electrolysis and Methanation), Capacity (Less than 100 kW, 100–999kW, 1000 kW and Above), End-User (Commercial, Utilities, and Industrial), and Region (North America, Europe, Asia Pacific) - Global Forecast to 2024

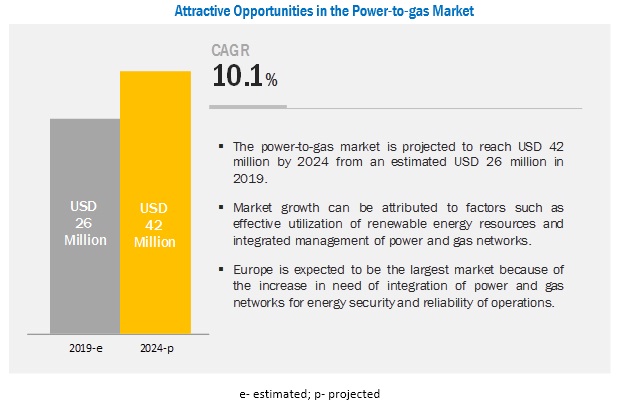

The global power-to-gas market in terms of revenue was estimated to worth $26 million in 2019 and is poised to reach $42 million by 2024 growing at a CAGR of 10.1% during the forecast period.

The growth is attributed to the effective utilization of renewable energy resources and integrated management of power and gas network. The increase in capacity of renewable energy together with the need to reduce carbon emissions has led to a rise in the implementation of power-to-gas technology.

The electrolysis segment is expected to be the largest contributor to the power-to-gas market, by technology, during the forecast period

The power-to-gas market is segmented, by technology, into electrolysis and methanation. The electrolysis segment is projected to hold the largest market share by 2024. This is because of its dynamic operations and the ability to effectively integrate electricity from fluctuating renewable energy sources such as wind and solar.

The 1000 kW and above segment is expected to be the fastest-growing market during the forecast period

The power-to-gas market, by capacity, is segmented into less than 100 kW, 100–999 kW, and 1000 kW and above. 1000 kW and above capacity is highly preferred because of growing commercialization and implementation of several MW size projects of power to gas technologies and demand from utilities and industrial end-users.

The utilities segment is expected to be the fastest-growing market for the power-to-gas market, by end-user, during the forecast period

The power-to-gas market has been categorized, based on end-user, into commercial, utilities, and industrial. The utilities segment is growing as power and gas utilities are looking to effectively produce hydrogen by integrating intermittent renewable power sources and have the flexibility of power system operations.

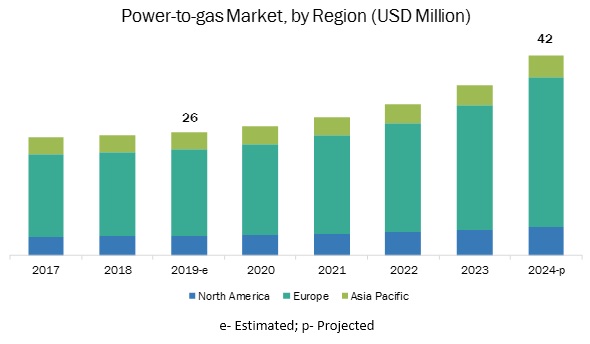

Europe is expected to be the largest market during the forecast period

In this report, the power-to-gas market has been analyzed with respect to three regions, namely, North America, Europe, and Asia Pacific. Europe is estimated to be the largest market from 2019 to 2024. This is because power-to-gas technology is expected to play a significant role in stabilizing the region’s energy supply and offsetting fluctuating power generation from renewable energy sources. Germany has seen a rising demand for power-to-gas technology, with the growing need for hydrogen from chemical, industrial and fuel cell transportation demand in the country.

Key Market Players

The major players in the power-to-gas market are Hydrogenics (Canada), ITM Power (UK), McPhy Energy (France), Siemens (Germany), MAN Energy Solutions (Germany), Nel Hydrogen (Norway), ThyssenKrupp (Germany), Electrochaea (Germany), Exytron (Germany), and GreenHydrogen (Denmark).

Hydrogenics (Canada) is a key player in this segment. The company actively focuses on inorganic strategies to increase its global market share. For instance, in March 2017, Hydrogenics entered into an agreement with Wind to Gas Südermarsch in Germany to deliver a 2.4 MW PEM power-to-gas system for hydrogen production. This 2.4 MW facility would significantly help reduce emissions using renewable hydrogen.

Another major player in the market is the ITM Power(UK). The company opts for partnerships as its inorganic business strategy for increasing its clientele base globally. For instance, in September 2018 ITM Power in partnership with INOVYN, Storengy, Cadent, and Element Energy deployed a 100+ MW power-to-gas energy storage project “Project Centurion” in Runcorn, Cheshire, UK.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Technology, Capacity, End-User, and Region |

|

Geographies covered |

North America, Europe, and Asia Pacific |

|

Companies covered |

Hydrogenics (Canada), ITM Power (UK), McPhy Energy (France), Siemens (Germany), MAN Energy Solutions (Germany), Nel Hydrogen (Norway), Thyssenkrupp (Germany), Electrochaea (Germany), Exytron (Germany), and GreenHydrogen (Denmark) |

This research report categorizes the power-to-gas market by technology, capacity, end-user, and region.

On the basis of technology:

- Electrolysis

- Methanation

On the basis of capacity:

- Less than 100 kW

- 100–999 kW

- 1000 kW and Above

On the basis of end-user:

- Commercial

- Utilities

- Industrial

On the basis of region:

- North America

- Europe

- Asia Pacific

Frequently Asked Questions (FAQ):

What are the revolutionary technology trends that will be seen over the next five years within the global power-to-gas market?

The electrolysis technology is expected to witness a rapid growth rate with a growing demand for hydrogen and massive development in renewable electricity generation. The technology has more than 50% share in the European region, and the number of new power-to-gas projects using electrolysis technology is under development in countries such as Germany and Denmark.

Which of the power-to-gas market elements will lead by 2024?

The utilities segment of power-to-gas is projected to grow at an above-average growth rate with an increasing focus of utilities on natural gas blending and renewable energy integration. Utilities are looking to install power-to-gas technology to reduce greenhouse gas emissions from their operations.

Which capacity type will have the maximum opportunity to grow during the forecast period?

By capacity type, the 1,000 kW and above segment is expected to grow the fastest with an increasing demand for methanation of hydrogen for energy transition. This operational capacity power-to-gas is also driven by the ability to produce a large quantity of green hydrogen as well as methane.

Which will be the leading region with the highest market share by 2024?

Europe dominates the power-to-gas market with an increasing demand for decarbonizing the energy sector operations through hydrogen generation. Countries such as Germany and Denmark are looking to effectively integrate the excess renewable energy production and are looking to ensure the reliability and security of energy sector operations.

How are companies implementing organic and strategies to gain increased market share?

Key players such as Hydrogenics and ITM power focus on strategies such as new contracts for setting power-to-gas technology and are also involved in partnerships to develop, construct and own the facilities. For instance, in 2018, one of the key market leaders, ITM power, entered into a partnership with INOVYN, Storengy, Cadent, and Element Energy to deploy a 100+ MW power-to-gas project in the UK.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Definition

1.2.1 Power-to-gas Market, By Technology: Inclusions & Exclusions

1.2.2 Power-to-gas Market, By End-User: Inclusions & Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Break-Up of Primaries

2.2 Scope

2.3 Market Size Estimation

2.3.1 Demand-Side Analysis

2.3.1.1 Key Assumptions

2.3.1.2 Calculation

2.3.2 Forecast

2.3.3 Supply-Side Analysis

2.3.3.1 Assumptions and Calculations

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Power-to-gas Market

4.2 Market, By Region

4.3 Market, By Technology

4.4 Europe Market, By Capacity & Country

4.5 Market, By End-User

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Effective Utilization of Renewable Energy Resources

5.2.1.2 Integrated Management of Power & Gas Networks

5.2.2 Restraints

5.2.2.1 High Capital Cost of Power-to-gas Systems

5.2.2.2 Low Efficiency and Energy Loss

5.2.3 Opportunities

5.2.3.1 Potential use of Hydrogen in Mobility Solutions

5.2.3.2 Hydrogen Can be Used as a Substitute for Natural Gas

5.2.4 Challenges

5.2.4.1 Regulation Limit for Hydrogen Blending in the Natural Gas Network

5.2.4.2 Availability of Low-Cost Natural Gas and Battery Technologies

6 Power-to-gas Market, By Technology (Page No. - 46)

6.1 Introduction

6.2 Electrolysis

6.2.1 Growing Demand for Green Hydrogen is Driving the Market

6.2.1.1 Alkaline Water Electrolysis

6.2.1.2 Pem

6.2.1.3 Soec

6.3 Methanation

6.3.1 Growing Demand for Sng is Driving the Market

6.3.1.1 Chemical

6.3.1.2 Biological

7 Power-to-gas Market, By Capacity (Page No. - 53)

7.1 Introduction

7.2 1,000 Kw and Above

7.2.1 Methanation of Hydrogen for Energy Transition is Expected to Drive This Segment

7.3 100–999 Kw

7.3.1 Focus on Hydrogen Blending With Natural Gas is Driving This Segment

7.4 Less Than 100 Kw

7.4.1 Majority of the Power-to-gas Pilot Demonstration Projects are Driving This Segment

8 Power-to-gas Market, By End-User (Page No. - 62)

8.1 Introduction

8.2 Utilities

8.2.1 Natural Gas Blending and Renewable Energy Integration are Expected to Drive the Utilities Segment

8.3 Industrial

8.3.1 Hydrogen Used for Feedstock Purpose and in Oil & Gas Refineries is Driving the Industrial Segment

8.4 Commercial

8.4.1 Fuel Cell Based Transport and use of Hydrogen for Commercial Space Heating are Driving the Commercial Segment

9 Power-to-gas Market, By Region (Page No. - 72)

9.1 Introduction

9.2 Europe

9.2.1 By Technology

9.2.2 By Capacity

9.2.3 By End-User

9.2.4 By Country

9.2.4.1 Germany

9.2.4.1.1 Need to Integrate Fluctuating Renewable Energy Sources and Increase Flexibility of Grid Operations is Driving the Market

9.2.4.2 UK

9.2.4.2.1 Growing Demand for Hydrogen as a Substitute for Natural Gas is Driving the Demand for Power-to-gas Technologies

9.2.4.3 France

9.2.4.3.1 Need to Decarbonize Gas and Power Networks is Driving the Demand for Power-to-gas Technology

9.2.4.4 Denmark

9.2.4.4.1 High Share of Wind Power and Well-Developed Subsidies Drive the Power-to-gas Projects

9.2.4.5 the Netherlands

9.2.4.5.1 Need to Reduce Natural Gas Consumption and Produce Green Hydrogen is Driving the Market

9.2.4.6 Switzerland

9.2.4.6.1 Support for Solar Pv Expansion is Driving the Market

9.2.4.7 Rest of Europe

9.2.4.7.1 Need for Large-Scale Energy Storage Projects is Driving the Market

9.3 North America

9.3.1 By Technology

9.3.2 By Capacity

9.3.3 By End-User

9.3.4 By Country

9.3.4.1 US

9.3.4.1.1 Need for Operational Flexibility and Demand for Hydrogen in Commercial Sector are Driving the Market

9.3.4.2 Canada

9.3.4.2.1 Low-Carbon Fuel Standard and Need for Grid Regulation Services are Driving the Market

9.4 Asia Pacific

9.4.1 By Technology

9.4.2 By Capacity

9.4.3 By End-User

9.4.4 By Country

9.4.4.1 China

9.4.4.1.1 Hydrogen Economy Initiatives are Driving the Power-to-gas Market

9.4.4.2 Japan

9.4.4.2.1 Need for Grid Stability and Development of a Hydrogen Economy are Driving the Market

9.4.4.3 Australia

9.4.4.3.1 Hydrogen Export Opportunities are Driving the Market

9.4.4.4 Rest of Asia Pacific

9.4.4.4.1 Support Policies for Renewable Energy Generation are Driving the Power-to-gas Market

10 Competitive Landscape (Page No. - 118)

10.1 Introduction

10.2 Market Share Analysis

10.3 Competitive Scenario

10.3.1 Contracts & Agreements

10.3.2 Mergers & Acquisitions

10.3.3 New Product Developments

10.3.4 Others

10.4 Competitive Leadership Mapping

10.4.1 Visionary Leaders

10.4.2 Innovators

10.4.3 Dynamic

10.4.4 Emerging

11 Company Profile (Page No. - 126)

(Business Overview, Offerings, Recent Developments, SWOT Analysis, and MnM View)*

11.1 Hydrogenics

11.2 ITM Power

11.3 McPhy Energy

11.4 Siemens

11.5 MAN Energy Solutions

11.6 Nel Hydrogen

11.7 ThyssenKrupp

11.8 Electrochaea

11.9 Exytron

11.10 GreenHydrogen

11.11 Hitachi Zosen Inova Etogas

11.12 Ineratec

11.13 Socalgas

11.14 Uniper

11.15 Micropyros

11.16 Carbotech

11.17 Power-to-gas Hungary

11.18 Aquahydrex

11.19 Fuelcell Energy

11.20 Avacon

*Details on Business Overview, Offerings, Recent Developments, SWOT Analysis, and MnM View Might Not be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 166)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (117 Tables)

Table 1 Power-to-gas Market Snapshot

Table 2 Amount of Hydrogen Directly Injected Into the Gas Network According to the Legal Regulations (%)

Table 3 Energy Prices in Countries (USD/Unit) – 2018

Table 4 Power-to-gas Market, By Technology, 2017–2024 (USD Thousand)

Table 5 Electrolysis: Global Market, By Region, 2017–2024 (USD Thousand)

Table 6 Electrolysis: Europe Market, By Country, 2017–2024 (USD Thousand)

Table 7 Electrolysis: North America Market, By Country, 2017–2024 (USD Thousand)

Table 8 Electrolysis: Asia Pacific Market, By Country, 2017–2024 (USD Thousand)

Table 9 Methanation: Global Market, By Region, 2017–2024 (USD Thousand)

Table 10 Methanation: Europe Market, By Country, 2017–2024 (USD Thousand)

Table 11 Methanation: North America Market, By Country, 2017–2024 (USD Thousand)

Table 12 Methanation: Asia Pacific Market, By Country, 2017–2024 (USD Thousand)

Table 13 Power-to-gas Market Size, By Capacity, 2019–2024 (USD Thousand)

Table 14 1,000 Kw and Above: Market Size, By Region, 2017–2024 (USD Thousand)

Table 15 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 16 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 17 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 18 100–999 Kw: Market Size, By Region, 2017–2024 (USD Thousand)

Table 19 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 20 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 21 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 22 Less Than 100 Kw: Market Size, By Region, 2017–2024 (USD Thousand)

Table 23 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 24 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 25 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 26 Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 27 Utilities: Market Size, By Region, 2017–2024 (USD Thousand)

Table 28 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 29 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 30 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 31 Industrial: Market Size, By Region, 2017–2024 (USD Thousand)

Table 32 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 33 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 34 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 35 Commercial: Market Size, By Region, 2017–2024 (USD Thousand)

Table 36 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 37 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 38 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 39 Power-to-gas Market, By Region, 2017–2024 (USD Thousand)

Table 40 Europe: Market Size, By Technology, 2017–2024 (USD Thousand)

Table 41 Europe: Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 42 Europe: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 43 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 44 Germany: Market Size, By Technology, 2017–2024 (USD Thousand)

Table 45 Germany: Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 46 Germany: Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 47 Germany: Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 48 Germany: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 49 The UK: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 50 The UK: Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 51 The UK: Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 52 The UK: Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 53 The UK: Market Size, By End-User, 2017–2024 (USD Thousand)

Table 54 France: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 55 France: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 56 France: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 57 France: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 58 France: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 59 Denmark: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 60 Denmark: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 61 Denmark: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 62 Denmark: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 63 Denmark: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 64 The Netherlands: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 65 The Netherlands: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 66 The Netherlands: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 67 The Netherlands: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 68 The Netherlands: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 69 Switzerland: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 70 Switzerland: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 71 Switzerland: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 72 Switzerland: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 73 Switzerland: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 74 Rest of Europe: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 75 Rest of Europe: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 76 Rest of Europe: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 77 Rest of Europe: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 78 Rest of Europe: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 79 North America: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 80 North America: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 81 North America: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 82 North America: Power-to-gas Market Size, By Country, 2017–2024 (USD Thousand)

Table 83 US: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 84 US: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 85 US: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 86 US: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 87 US: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 88 Canada: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 89 Canada: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 90 Canada: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 91 Canada: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 92 Canada: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 93 Asia Pacific: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 94 Asia Pacific: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 95 Asia Pacific: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 96 Asia Pacific: Power-to-gas Market Size, By Country, 2017–2024 (USD Thousand)

Table 97 China: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 98 China: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 99 China: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 100 China: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 101 China: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 102 Japan: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 103 Japan: Power-to-gas Market Size, By Electrolysis, 2017-2024 (USD Thousand)

Table 104 Japan: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 105 Japan: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 106 Japan: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 107 Australia: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 108 Australia: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 109 Australia: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 110 Australia: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 111 Australia: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 112 Rest of Asia Pacific: Power-to-gas Market Size, By Technology, 2017–2024 (USD Thousand)

Table 113 Rest of Asia Pacific: Power-to-gas Market Size, By Electrolysis, 2017–2024 (USD Thousand)

Table 114 Rest of Asia Pacific: Power-to-gas Market Size, By Methanation, 2017–2024 (USD Thousand)

Table 115 Rest of Asia Pacific: Power-to-gas Market Size, By Capacity, 2017–2024 (USD Thousand)

Table 116 Rest of Asia Pacific: Power-to-gas Market Size, By End-User, 2017–2024 (USD Thousand)

Table 117 Developments By Key Players in the Market, May 2015–August 2019

List of Figures (38 Figures)

Figure 1 Power-to-gas Market: Research Design

Figure 2 Main Metrics Considered While Constructing and Assessing the Demand for the Power-to-gas Market

Figure 3 Year-On-Year Capacity Addition of Power-to-gas Technologies is the Determining Factor for the Global Power-to-gas Market

Figure 4 The Number of New Electrolysis or Methanation Projects is the Determining Factor for the Global Power-to-gas Market

Figure 5 Europe Dominated the Power-to-gas Market in 2018

Figure 6 Electrolysis Segment is Expected to Hold the Largest Share of the Power-to-gas Market, By Technology, During the Forecast Period

Figure 7 1,000 Kw and Above Segment is Expected to Lead the Power-to-gas Market, By Capacity, During the Forecast Period

Figure 8 Utilities Segment is Expected to Lead the Power-to-gas Market, By End-User, During the Forecast Period

Figure 9 Integrated Management of Power and Gas Network is Expected to Drive the Power-to-gas Market, 2019–2024

Figure 10 European Power-to-gas Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 11 Electrolysis Segment is Expected to Dominate the Power-to-gas Market, By Technology, By 2024

Figure 12 1,000 Kw and Above Segment and Germany Dominated the Power-to-gas Market, By Capacity & Country, in 2018

Figure 13 Utilities Segment is Expected to Dominate the Power-to-gas Market, By End-User, By 2024

Figure 14 Drivers, Restraints, Opportunities, and Challenges

Figure 15 Renewable Net Capacity Addition By Resources (In GW), 2011–2018

Figure 16 Excess Production of Renewable Energy, (KTOE) 2011–2018

Figure 17 World Natural Gas Consumption, 2011–2016

Figure 18 World Natural Gas Consumption, 2011–2016

Figure 19 Solar PV Power Generation, (In TWH) 2018

Figure 20 Stock of Fuel Cell Vehicles in 2017

Figure 21 US Natural Gas Consumption By Sector, (Trillion Cubic Feet) 2018

Figure 22 Power-to-gas Market, By Technology, 2019–2024 (USD Thousand)

Figure 23 1,000 Kw and Above Segment is Expected to Dominate the Market During the Forecast Period

Figure 24 Utilities Segment is Expected to Dominate the Market During the Forecast Period

Figure 25 Regional Snapshot: the Market in Europe is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 26 Power-to-gas Market Share (Value), By Region, 2018

Figure 27 Europe Snapshot

Figure 28 North America: Regional Snapshot

Figure 29 Key Developments in the Power-to-gas Market During 2015–2019

Figure 30 Market Share Analysis, 2018

Figure 31 Power-to-gas Market (Global) Competitive Leadership Mapping, 2018

Figure 32 Hydrogenics: Company Snapshot

Figure 33 ITM Power: Company Snapshot

Figure 34 McPhy Energy: Company Snapshot

Figure 35 Siemens: Company Snapshot

Figure 36 Nel.Hydrogen: Company Snapshot

Figure 37 ThyssenKrupp: Company Snapshot

Figure 38 Uniper : Company Snapshot

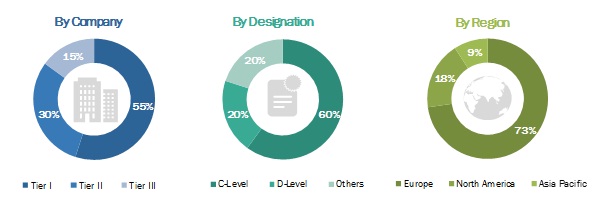

This study involved four major activities in estimating the current size of the power-to-gas market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, Factiva, and power-to-gas journal to identify and collect information useful for a technical, market-oriented, and commercial study of the power-to-gas market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power-to-gas market comprises several stakeholders such as companies related to the industry, consulting companies in the energy and power sector, power generation companies, government & research organizations, organizations, forums, alliances & associations, power-to-gas technology providers, state & national utility authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by the Year-on-Year addition of power-to-gas technologies across the countries and regions considered under the scope. Also, estimation of investments by technology manufacturers in power-to-gas technologies with respect to the new installations across countries and regions were considered. Moreover, the demand is also driven by the effective utilization of renewable energy resources and integrated management of power and gas networks across the globe. The supply side is characterized by the increasing demand for contracts & agreements and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global power-to-gas market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the power-to-gas sector.

Report Objectives

- To define, describe, segment, and forecast the power-to-gas market on the basis technology, capacity, end-user, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and to provide a detailed competitive landscape for market leaders

- To forecast the revenue of the market segments with respect to 3 main regions (along with countries), namely, North America, Europe, and Asia Pacific.

- To strategically profile key players and comprehensively analyze their market ranking and core competencies

- To track and analyze competitive developments such as new product launches, contracts & agreements, expansions, and mergers & acquisitions in the power-to-gas market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Power-to-gas Market