Power Tools Market Size, Share & Industry Growth Analysis Report by Tool Type (Drilling and Fastening Tools, Demolition Tools, Sawing and Cutting Tools, Material Removal Tools, Routing Tools), Mode of Operation (Electric, Pneumatic, Hydraulic), Application and Region - Global Forecast to 2029

Updated on : September 01, 2025

Power Tools Market Size & Growth

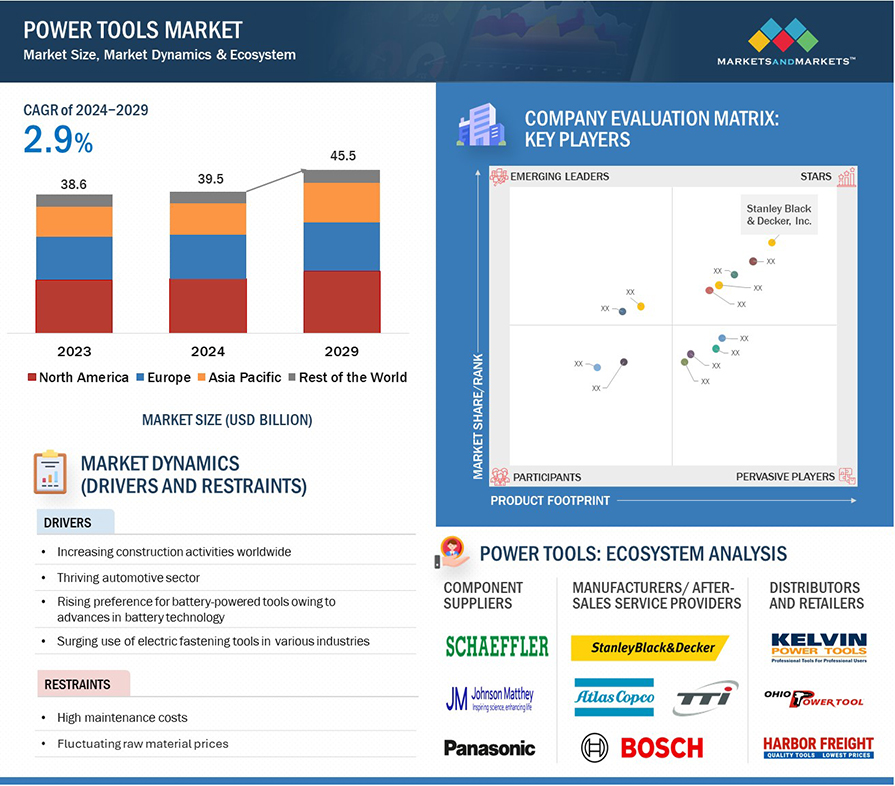

The global Power Tools Market was valued at USD 39.45 billion in 2024 and is projected to grow from USD 40.44 billion in 2025 to USD 45.52 billion by 2029, at a CAGR of 2.9% during the forecast period. This growth is propelled by increasing construction activities worldwide, a thriving automotive sector, and a rising preference for battery-powered tools driven by advances in battery technology. Additionally, the development of smart and connected power tools and the surging use of electric fastening tools in various industries further contribute to the market expansion.

Key Takeaways:

• The global Power Tools Industry was valued at USD 39.45 billion in 2024 and is projected to grow from USD 40.44 billion in 2025 to USD 45.52 billion by 2029, at a CAGR of 2.9% during the forecast period.

• By Product: Battery-powered tools are experiencing increased adoption due to advances in lithium-ion battery technology, providing longer operational durations and greater mobility compared to traditional corded tools.

• By Application: The construction and automotive industries are major drivers of demand, leveraging power tools for tasks such as drilling, fastening, and demolition.

• By Technology: Smart and connected assembly power tools, along with innovations like brushless DC motors, are enhancing tool efficiency and user experience.

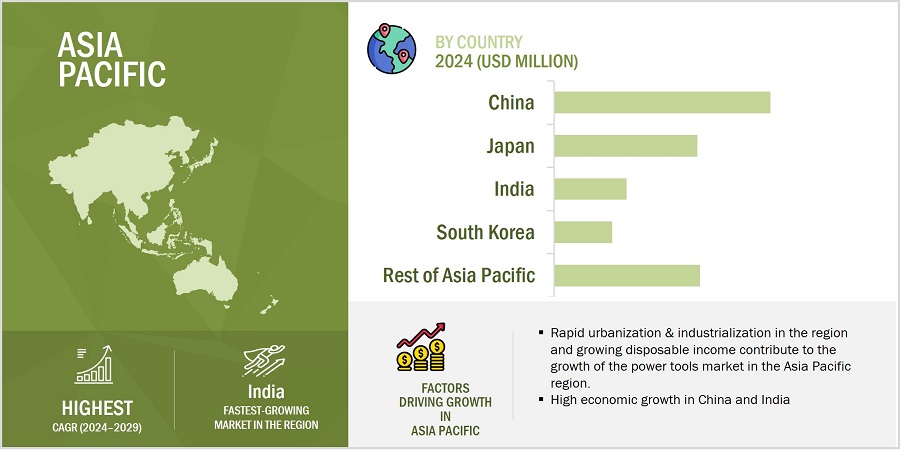

• By Region: ASIA PACIFIC is expected to grow fastest at a 4.7% CAGR, driven by expanding industrial and construction activities.

• Opportunities: There is significant growth potential in the development of smart and connected power tools and the increasing use of power tools in residential applications.

• Challenges: Designing ergonomic and lightweight power tools remains a challenge, as does navigating stringent trade policies and safety standards.

In conclusion, the power tools market is poised for steady growth, underpinned by technological advancements and robust demand from construction and automotive sectors. The increasing shift towards battery-powered tools, coupled with the expansion of smart and connected devices, offers significant opportunities for innovation and market penetration. Long-term projections indicate sustained growth potential, particularly in emerging regions such as Asia Pacific, where industrialization and urbanization are rapidly advancing.

In addition, the development of smart and connected power tools, coupled with the rising demand for fastening tools in the wind energy industry are all factors that generate opportunities within the power tools industry.

Power Tools Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Power Tools Market Trends

DRIVERS: Increased adoption of battery-powered tools globally

Battery-powered tools encompass a variety of cordless equipment, such as hammer drills, impact wrenches, circular saws, and nailers, utilized across different industries and by homeowners. These tools offer users increased flexibility and mobility compared to traditional corded counterparts, as their cordless nature allows for easy maneuvering around the workplace.

They are well-suited for tasks like sanding, welding, cutting, and metalworking. Lithium-ion batteries have replaced conventional nickel-cadmium (Ni-Cd) and nickel-metal hydride (Ni-MH) power sources in these tools. Ongoing advancements in battery technology contribute to the growing popularity of cordless power tools, featuring high-density batteries that offer longer operational durations once charged. Lithium-ion batteries deliver higher energy density and extended operational life, all while being lightweight and exhibiting minimal self-discharge.

Consequently, they have emerged as the preferred choice for powering cordless tools. As consumers are more attracted to cordless tools, manufacturers focus on launching innovative products. For instance, in March 2024, Chicago Pneumatic (a brand of Atlas Copco AB) launched the CP8609 series of eBlueTork battery-operated torque wrenches, ideal for fast and accurate tire changes on large commercial vehicles like trucks and buses. These tools enhance operator safety, traceability, and productivity in nutrunning operations, building on the success of the CP86 series. The demand for more mobile, flexible, and compact tools drives the market for battery-powered/cordless tools.

RESTRAINTS: High maintenance costs

Power tools, including assembly tools, are precise instruments that require regular maintenance. It's important to recalibrate these tools periodically to ensure accurate performance. Components such as motors, batteries, power cords, drive belts, carbon brushes, and bearings naturally wear out over time and may eventually fail. Other parts like power switches, drill bits, and accessories need frequent maintenance for proper function, given their widespread use in nearly every industry.

Regular maintenance involves tasks such as oiling, sharpening, and replacing parts, which can incur significant costs. Consequently, the expense of repairing and replacing parts for power tools tends to be relatively high.

Particularly in developing countries, consumers may hesitate to invest in power tool maintenance due to the availability of low-cost manual labor. The overall cost of owning power tools increases due to maintenance and repair requirements. Therefore, in developing countries, consumers often choose to lease power tools rather than buy them outright, as the high cost of maintenance hampers the market.

OPPORTUNITIES: The advancement of intelligent and connected power tools

With the growing adoption of IoT devices and the increasing popularity of smart and connected systems in assembly line operations, every piece of equipment within the plant becomes interconnected. Technological advancements and the adoption of smart manufacturing practices drive the innovation of smart and connected tools, prompting manufacturers to prioritize the production of such tools.

For example, Milwaukee Tool, a brand of Techtronic Industries Co. Ltd., offers ONE-KEY, a digital platform for tools and equipment. This cloud-based platform enables users to customize torque and speed settings for specific applications. Similarly, Robert Bosch GmbH (Germany) provides the Bosch Toolbox app, tailored for professionals across various industries such as construction, electricians, gardening, metalworking, plumbing, HVAC engineering, carpentry, and masonry. This app allows users to monitor project timelines, track travel, manage tasks, record material usage, and create memos complete with report sheets.

CHALLENGES: Difficulties in designing ergonomic and lightweight power tools

Power tools manufacturers are facing the challenge of designing equipment to fit the operator’s needs. The misuse of electric portable equipment can cause many painful or even fatal injuries. Customers are looking for ergonomic equipment that offers the desired performance and provides better comfort and control to the operator; this allows work to be completed with ease and less fatigue.

However, with the development of cordless equipment, the weight of such equipment has increased due to the addition of batteries. Therefore, designing ergonomic and lightweight equipment is an important concern for power tools manufacturers. To overcome these design-related challenges, manufacturers need to focus more on implementing ergonomic principles and producing user-friendly and comfortable tools than on manufacturing battery-powered equipment with high capacity and longer runtimes.

Power Tools Market Ecosystem

Power Tools Market Segmentation

Drilling and fastening tools segment to hold the largest share of the power tools market during 2024–2029.

The drilling and fastening tools segment is expected to account for the largest share of the power tool market during the forecast period, due to its versatility and widespread utility across various industries, including construction and woodworking. These tools are indispensable for tasks such as drilling holes and fastening components.

Demand for them remains consistently high due to ongoing construction projects and maintenance needs across different sectors. Technological advancements, such as the introduction of cordless options and smart controls, further enhance their performance and appeal.

Additionally, the DIY market significantly contributes to their popularity among homeowners and hobbyists, who rely on them for a multitude of projects. Moreover, innovations such as ergonomic designs and feature-rich functionalities continue to drive the demand for these tools in both professional and personal settings.

Electric mode of operation is expected to grow at the higher CAGR in the power tools market during the forecast period.

The electric mode of operation is expected to grow at the higher CAGR in the power tools market during the forecast period. Electric power tools find widespread use in industries like construction, automotive, aerospace, energy, and shipbuilding due to advancements in battery technology and the rising popularity of cordless options among both corporate and individual users.

Anticipated market expansion is driven by rapid urbanization and industrial growth, offering lucrative prospects for businesses in the years ahead. Moreover, the increasing emphasis on sustainability and energy efficiency in industrial operations contributes to the demand for electric power tools, reinforcing their market dominance.

Industrial/Professional application will dominate the market during the forecast period.

The Industrial/Professional application is expected to account for the largest share of the power tool market during the forecast period. Industries such as construction, manufacturing, automotive, and aerospace heavily depend on power tools for critical functions like cutting, drilling, fastening, and shaping materials, which generates significant demand among professionals.

As projects within these sectors grow in complexity and scale, there arises a heightened requirement for top-tier power tools capable of effectively managing challenging tasks. Moreover, companies are increasingly prioritizing productivity, efficiency, and safety, thereby investing in high-quality power tools to optimize performance and operational workflows.

Asia Pacific is expected to grow at the higher CAGR in the power tools market during the forecast period.

Asia Pacific is expected to grow at the higher CAGR in the power tools industry throughout the forecast period. This surge is fueled by strong economic growth, rapid urbanization trends, and increasing disposable incomes across key markets such as China, India, Japan, and South Korea. Additionally, the rising disposable income and expanding middle-class population in the region are significant drivers of demand for power tools, particularly for residential and DIY purposes.

Moreover, advancements in technology and the availability of innovative power tool solutions tailored to the specific needs of the Asian market are contributing significantly to market growth. Moreover, a growing emphasis on environmental awareness is encouraging the adoption of energy-efficient and environmentally friendly power tools. These combined factors position the Asia-Pacific region as a significant driver of growth in the power tool market.

Power Tools Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Power Tools Companies - Key Market Players

The power tools companies have /implemented various types of organic and inorganic growth strategies, such as product launches, product developments, partnerships, and collaborations, to strengthen their offerings in the market. The major players are

- Stanley Black & Decker, Inc. (US),

- Robert Bosch GmbH (Germany),

- Techtronic Industries Co. Ltd. (Hong Kong),

- Makita Corporation (Japan),

- Hilti Corporation (Liechtenstein),

- ANDREAS STIHL AG & Co. KG (STIHL) (Germany),

- Atlas Copco AB (Sweden),

- Apex Tool Group, LLC (US),

- Ingersoll Rand (US),

- Snap-on Incorporated (US), among others. The study includes an in-depth competitive analysis of these key players in the power tools industry with their company profiles, recent developments, and key market strategies.

Power Tools Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 39.5 billion in 2024 |

| Projected Market Size | USD 45.5 billion by 2029 |

| Power Tools Market Growth rate | CAGR of 2.9% |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Tool Type, Mode of Operation, and Application |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Stanley Black & Decker, Inc. (US), Robert Bosch GmbH (Germany), Techtronic Industries Co. Ltd. (Hong Kong), Makita Corporation (Japan), Hilti Corporation, (Liechtenstein), Andreas Stihl AG & Co. KG (STIHL) (Germany), Atlas Copco AB (Sweden), Apex Tool Group, LLC (US), Ingersoll Rand (US), Snap-on Incorporated (US), among other – Total 25 players have been covered. |

Power Tools Market Highlights

This research report categorizes the global Power Tool Market based on Tool Type, Mode of Operation, Applications, and Region.

|

Segment |

Subsegment |

|

By Tool Type: |

|

|

By Mode of Operations |

|

|

By Application |

|

|

By Region: |

|

Recent Developments in Power Tools Industry

- In February 2024, Robert Bosch GmbH introduced the new AdvancedDrill and AdvancedImpact 18V-80 QuickSnap, enabling powerful screwing and drilling even in tight spots. These cordless tools are part of Bosch's '18V Power for All System', which covers over 70 DIY tools and appliances. With a single 18V lithium-ion battery and charger, users save space and money, while reducing environmental impact. Equipped with Syneon Technology for optimal performance and endurance, Bosch tools maintain full power until the battery is drained, ensuring efficient drilling and screwing throughout the task.

- In February 2024, Makita U.S.A., Inc. has launched the 5" Paddle Switch Angle Grinder with AC/DC Switch (9558HP), providing another choice for professionals in metal fabrication shops, as well as the electrical, mechanical, and plumbing trades. This addition expands Makita’s grinding options, offering users 7.5 AMPs and 10,000 RPM in a compact 4.5 lb grinder.

- In October 2023, Milwaukee, a subsidiary of Techtronic Industries Co. Ltd., introduced the innovative M18 FUEL 4-½" / 5” Dual-Trigger Braking Grinder, offering dual-trigger activation, a fixed side handle, and AUTOSTOP kickback control for enhanced user control and safety on the worksite. Featuring four speed settings (3,500-8,500 RPM), the grinder offers precise control. It's ONE KEY compatible for wireless syncing with devices, enabling tool location tracking and security features

- In August 2023, DEWALT, a Stanley Black & Decker brand and leader in total jobsite solutions, introduced the new 20V MAX XR Brushless Cordless 1/2 in. High Torque Impact Wrench (DCF961), the industry's top-rated cordless 1/2 in. impact wrench, delivering 1200 ft-lbs of max fastening torque and 1750 ft-lbs of max breakaway torque. This wrench automatically boosts power after four seconds of impacting, aiding in loosening stubborn fasteners. It also features 3 Speeds, PRECISION WRENCH technology to prevent overtightening, and BATTERYGUARD for reduced battery wear.

- In April 2023, Milwaukee, a subsidiary of Techtronic Industries Co. Ltd., introduced the new M18 FUEL Drill and Impact Driver featuring ONE-KEY technology. This expansion of their advanced drilling and driving solutions includes the M18 FUEL ½” Hammer Drill and M18 FUEL ¼” Hex Impact Driver, both integrated with ONE-KEY. These tools offer users unparalleled driving speeds, enhanced safety features, and cutting-edge customization options.

Frequently Asked Questions(FAQs):

What is Power Tools?

Power tools are devices that are powered by electricity, compressed air, hydraulic power, or batteries, designed to perform various tasks more efficiently than manual tools. These tools are commonly used in construction, woodworking, metalworking, and other industries for activities such as drilling, cutting, sanding, grinding, and fastening. They offer increased speed, precision, and power compared to traditional hand tools, making them essential in many professional and DIY applications.

What is the total CAGR expected to be recorded for the power tools market during 2024-2029?

The global power tools market is expected to record a CAGR of 2.9% from 2024–2029.

What are the driving factors for the power tools market?

Increased adoption of battery-powered power tools globally and growing construction industry in emerging economies are some of the factors driving the power tools market.

Which are the significant players operating in the power tools market?

Stanley Black & Decker, Inc. (US), Robert Bosch GmbH (Germany), Techtronic Industries Co. Ltd. (Hong Kong), Makita Corporation (Japan), Hilti Corporation, (Liechtenstein), Andreas Stihl AG & Co. KG (STIHL) (Germany), Atlas Copco AB (Sweden), Apex Tool Group, LLC (US), Ingersoll Rand (US), Snap-on Incorporated (US), among others are some of the major companies operating in the power tools market.

Which region will lead the power tools market in the future?

Asia Pacific is expected to lead the power tools market during the forecast period..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing construction activities worldwide- Thriving automotive sector- Rising preference for battery-powered tools owing to advances in battery technology- Surging use of electric fastening tools in various industriesRESTRAINTS- High maintenance costs- Fluctuating raw material pricesOPPORTUNITIES- Increasing use of wind energy- Development of smart and connected power tools- Growing demand for power tools by residential consumersCHALLENGES- Difficulties in designing ergonomic and lightweight power tools- Stringent trade policies and safety standards

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISINDICATIVE PRICING TREND OF POWER TOOLS PROVIDED BY MARKET PLAYERS, BY TOOL TYPE, 2023 (USD)AVERAGE SELLING PRICE TREND OF POWER TOOLS, BY REGION, 2019–2023 (USD)

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 ECOSYSTEM ANALYSIS

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Smart and connected assembly power tools- Brushless DC motorsCOMPLEMENTARY TECHNOLOGIES- 40V MAX and 80V MAX lithium-ion batteries- Wireless chargingADJACENT TECHNOLOGY- Easy start system

-

5.8 PATENT ANALYSISLIST OF MAJOR PATENTS, 2022–2023

-

5.9 TRADE ANALYSISIMPORT DATAEXPORT DATA

- 5.10 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.11 CASE STUDY ANALYSISDI ENVIRONMENT IMPLEMENTED TRELAWNY’S VL303 VIBRO-LO NEEDLE SCALERS TO REDUCE OPERATOR FATIGUE AND DOWNTIMEBIG IMPLEMENTATION ADOPTED CS UNITEC’S MAB 485 PORTABLE MAGNETIC DRILL FOR DRILLING BOEING 747RICHMOND PRIMOID DEPLOYED HILTI CORPORATION’S HIGH-QUALITY TOOLS TO ENHANCE JOB EFFICIENCY AND STREAMLINE OPERATIONS

-

5.12 REGULATIONS AND STANDARDSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

-

5.13 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING CRITERIABUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 BRICKS/BLOCKS

- 6.3 CONCRETES

- 6.4 GLASSES

- 6.5 WOODS/METALS

- 6.6 OTHER MATERIALS

- 7.1 INTRODUCTION

- 7.2 ONLINE

- 7.3 OFFLINE

- 8.1 INTRODUCTION

-

8.2 DRILLING AND FASTENING TOOLSDRILLS- Portability and light weight of corded power drills to boost demandIMPACT DRIVERS- Ability to provide high torque to drive marketIMPACT WRENCHES- Increasing demand from solar industry to offer lucrative growth opportunitiesSCREWDRIVERS AND NUTRUNNERS- Rising use in aerospace and automotive assembly operations to drive market

-

8.3 DEMOLITION TOOLSROTARY HAMMERS/HAMMER DRILLS/DEMOLITION HAMMERS- Rapid demolition of brittle materials with fast drilling and minimum efforts to boost demand

-

8.4 SAWING AND CUTTING TOOLSJIGSAWS- Rising demand for lightweight and high-speed equipment to foster segmental growthRECIPROCATING SAWS- Growing application in construction and demolition to fuel market growthCIRCULAR SAWS- Expansion of construction industry to propel marketBAND SAWS- Increasing use for cutting irregular or curved jigsaws to drive marketSHEARS & NIBBLERS- Ability to cut nonferrous metals and plastics from thin plates and strips to boost demand

-

8.5 MATERIAL REMOVAL TOOLSSANDERS/POLISHERS/BUFFERS- Growing application in industrial and residential sectors to drive marketAIR SCALERS- Efficiency in cleaning and removing old paint from metal surfaces to fuel market growthGRINDERS- Growing utilization in abrasive cutting, grinding, and polishing to foster segmental growth- Angle grinders- Die and straight grinders

-

8.6 ROUTING TOOLSQUICK-ACTING SAFETY BRAKE SYSTEM AND SPINDLE-STOP CUTTER-CHANGING FEATURES TO STIMULATE DEMANDROUTERS/PLANERS/JOINERS- Palm routers and laminate trimmers

- 8.7 OTHER TOOLS

- 9.1 INTRODUCTION

-

9.2 ELECTRICCORDED TOOLS- Growing applications for drilling and mining operations to drive marketCORDLESS TOOLS- Independence from secondary power sources to fuel market growth

-

9.3 PNEUMATICGROWING DEMAND FROM AUTOMOTIVE INDUSTRY TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

-

9.4 HYDRAULICINCREASING USES IN ROAD CONSTRUCTIONS AND TRENCH EXCAVATIONS TO BOOST DEMAND

- 10.1 INTRODUCTION

-

10.2 INDUSTRIAL/PROFESSIONALCONSTRUCTION- Growing demand for impact drills and rotary hammers in construction projects to boost demandAUTOMOTIVE- Ease of maintenance by speeding up repetitive processes to drive demandAEROSPACE- Rising demand for fuel-efficient and quiet aircraft components to accelerate demandENERGY- Increasing number of wind projects in developing countries to drive marketSHIPBUILDING- Growing demand for screwdrivers, electric nutrunners, and impact wrenches to boost demandOTHER INDUSTRIES

-

10.3 RESIDENTIAL/DIYGROWING PREFERENCE FOR REMODELING AND REFURBISHING EXISTING HOMES TO BOOST DEMAND

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAIMPACT OF RECESSION ON POWER TOOLS MARKET IN NORTH AMERICAUS- Thriving automotive and construction industries to boost demandCANADA- Rising demand in residential construction projects to drive marketMEXICO- Implementation of free-trade agreements to drive market

-

11.3 EUROPEIMPACT OF RECESSION ON POWER TOOLS MARKET IN EUROPEGERMANY- Rising focus to upgrade assembly lines for smart manufacturing to boost demandFRANCE- Presence of aircraft manufacturing companies to fuel market growthUK- Increasing construction activities in residential and nonresidential sectors to boost demandITALY- Wind energy sector to offer lucrative growth opportunities for market playersREST OF EUROPE

-

11.4 ASIA PACIFICIMPACT OF RECESSION ON POWER TOOLS MARKET IN ASIA PACIFICCHINA- Low labor and material costs to drive marketJAPAN- Established global exporter of large construction vehicles to accelerate demandINDIA- Government-led initiatives to boost construction industry to drive demandSOUTH KOREA- Growing adoption in shipbuilding industry to accelerate demandREST OF ASIA PACIFIC

-

11.5 ROWIMPACT OF RECESSION ON POWER TOOLS MARKET IN ROWSOUTH AMERICA- Government-led initiatives to develop infrastructure to drive marketGCC COUNTRIES- Growing initiatives of smart city projects to drive marketAFRICA & REST OF MIDDLE EAST- Expanding commercial and residential real estate sectors to fuel market growth

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, MARCH 2023–FEBRUARY 2024

- 12.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2019–2023

- 12.4 MARKET SHARE ANALYSIS, 2023

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 12.6 BRANDS/PRODUCTS COMPARISON

-

12.7 COMPETITIVE EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS- Company overall footprint- Tool type footprint- Mode of operation footprint- Application footprint- Region footprint

-

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING- Detailed list of startups/SMEs- Competitive benchmarking of key startups/SMEs

-

12.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSSTANLEY BLACK & DECKER, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROBERT BOSCH GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTECHTRONIC INDUSTRIES CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMAKITA CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHILTI CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewANDREAS STIHL AG & CO. KG- Business overview- Products/Solutions/Services offeredAPEX TOOL GROUP, LLC- Business overview- Products/Solutions/Services offeredATLAS COPCO AB- Business overview- Products/Solutions/Services offered- Recent developmentsINGERSOLL RAND- Business overview- Products/Solutions/Services offered- Recent developmentsSNAP-ON INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSKOKI HOLDINGS CO., LTD.YAMABIKO CORPORATIONPANASONIC INDUSTRY EUROPE GMBHKEN HOLDING CO., LTDDYNABRADE INC.AMICOC. & E. FEIN GMBHCHERVON (CHINA) TRADING CO., LTD.CS UNITEC, INC.FERM INTERNATIONAL B.V.INTERSKOLPOSITEC TOOL CORPORATIONRIDGIDGREENWORKSTOOLSURYU SEISAKU, LTD.

- 14.1 INTRODUCTION

- 14.2 OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION

-

14.3 COMMERCIALINCREASING CONSTRUCTION ACTIVITIES TO PROPEL MARKET GROWTH

-

14.4 RESIDENTIAL/DIYGROWING POPULARITY OF DIY GARDENING CULTURE TO DRIVE MARKET

- 15.1 INSIGHTS OF INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 INDICATIVE PRICING TREND OF POWER TOOLS PROVIDED BY KEY PLAYERS, BY TOOL TYPE, 2023 (USD)

- TABLE 2 ROLE OF PLAYERS IN POWER TOOLS ECOSYSTEM

- TABLE 3 MAJOR PATENT OWNERS IN POWER TOOLS MARKET

- TABLE 4 POWER TOOLS MARKET: KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 POWER TOOLS MARKET: STANDARDS

- TABLE 10 POWER TOOLS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIAL/PROFESSIONAL APPLICATIONS (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIAL/PROFESSIONAL APPLICATIONS

- TABLE 13 POWER TOOLS MARKET, BY TOOL TYPE, 2020–2023 (USD MILLION)

- TABLE 14 POWER TOOLS MARKET, BY TOOL TYPE, 2024–2029 (USD MILLION)

- TABLE 15 POWER TOOLS MARKET, BY TOOL TYPE, 2020–2023 (MILLION UNITS)

- TABLE 16 POWER TOOLS MARKET, BY TOOL TYPE, 2024–2029 (MILLION UNITS)

- TABLE 17 POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 18 POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 19 ELECTRIC: POWER TOOLS MARKET, BY TOOL TYPE, 2020–2023 (USD MILLION)

- TABLE 20 ELECTRIC: POWER TOOLS MARKET, BY TOOL TYPE, 2024–2029 (USD MILLION)

- TABLE 21 ELECTRIC: POWER TOOLS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 22 ELECTRIC: POWER TOOLS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 23 ELECTRIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020–2023 (USD MILLION)

- TABLE 24 ELECTRIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024–2029 (USD MILLION)

- TABLE 25 ELECTRIC: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 26 ELECTRIC: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 27 ELECTRIC: POWER TOOLS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 28 ELECTRIC: POWER TOOLS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 29 PNEUMATIC: POWER TOOLS MARKET, BY TOOL TYPE, 2020–2023 (USD MILLION)

- TABLE 30 PNEUMATIC: POWER TOOLS MARKET, BY TOOL TYPE, 2024–2029 (USD MILLION)

- TABLE 31 PNEUMATIC: POWER TOOLS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 32 PNEUMATIC: POWER TOOLS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 33 PNEUMATIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020–2023 (USD MILLION)

- TABLE 34 PNEUMATIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024–2029 (USD MILLION)

- TABLE 35 PNEUMATIC: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 36 PNEUMATIC: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 37 HYDRAULIC: POWER TOOLS MARKET, BY TOOL TYPE, 2020–2023 (USD MILLION)

- TABLE 38 HYDRAULIC: POWER TOOLS MARKET, BY TOOL TYPE, 2024–2029 (USD MILLION)

- TABLE 39 HYDRAULIC: POWER TOOLS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 40 HYDRAULIC: POWER TOOLS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 41 HYDRAULIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020–2023 (USD MILLION)

- TABLE 42 HYDRAULIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024–2029 (USD MILLION)

- TABLE 43 HYDRAULIC: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 44 HYDRAULIC: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 45 POWER TOOLS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 46 POWER TOOLS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 47 INDUSTRIAL/PROFESSIONAL: POWER TOOLS MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 48 INDUSTRIAL/PROFESSIONAL: POWER TOOLS MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 49 INDUSTRIAL/PROFESSIONAL: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 50 INDUSTRIAL/PROFESSIONAL: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 51 CONSTRUCTION: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 52 CONSTRUCTION: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 53 CONSTRUCTION: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 54 CONSTRUCTION: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 55 AUTOMOTIVE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 56 AUTOMOTIVE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 57 AUTOMOTIVE: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 58 AUTOMOTIVE: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 59 AEROSPACE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 60 AEROSPACE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 61 AEROSPACE: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 62 AEROSPACE: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 63 ENERGY: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 64 ENERGY: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 65 ENERGY: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 66 ENERGY: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 67 SHIPBUILDING: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 68 SHIPBUILDING: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 69 SHIPBUILDING: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 70 SHIPBUILDING: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 71 OTHER INDUSTRIES: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 72 OTHER INDUSTRIES: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 73 OTHER INDUSTRIES: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 OTHER INDUSTRIES: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 RESIDENTIAL/DIY: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 76 RESIDENTIAL/DIY: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 77 POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 78 POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 81 NORTH AMERICA: POWER TOOLS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 82 NORTH AMERICA: POWER TOOLS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL, 2020–2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL, 2024–2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: POWER TOOLS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: POWER TOOLS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 87 EUROPE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 88 EUROPE: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 89 EUROPE: POWER TOOLS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 90 EUROPE: POWER TOOLS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 91 EUROPE: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL, 2020–2023 (USD MILLION)

- TABLE 92 EUROPE: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL, 2024–2029 (USD MILLION)

- TABLE 93 EUROPE: POWER TOOLS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 94 EUROPE: POWER TOOLS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 95 ASIA PACIFIC: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: POWER TOOLS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: POWER TOOLS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020–2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024–2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: POWER TOOLS MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: POWER TOOLS MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 103 ROW: POWER TOOLS MARKET, BY MODE OF OPERATION, 2020–2023 (USD MILLION)

- TABLE 104 ROW: POWER TOOLS MARKET, BY MODE OF OPERATION, 2024–2029 (USD MILLION)

- TABLE 105 ROW: POWER TOOLS MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 106 ROW: POWER TOOLS MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 107 ROW: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2020–2023 (USD MILLION)

- TABLE 108 ROW: POWER TOOLS MARKET, BY INDUSTRIAL/PROFESSIONAL APPLICATION, 2024–2029 (USD MILLION)

- TABLE 109 ROW: POWER TOOLS MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 110 ROW: POWER TOOLS MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 111 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN POWER TOOLS MARKET, MARCH 2023–FEBRUARY 2024

- TABLE 112 POWER TOOLS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 113 POWER TOOLS MARKET: TOOL TYPE FOOTPRINT

- TABLE 114 POWER TOOLS MARKET: MODE OF OPERATION FOOTPRINT

- TABLE 115 POWER TOOLS MARKET: APPLICATION FOOTPRINT

- TABLE 116 POWER TOOLS MARKET: REGION FOOTPRINT

- TABLE 117 POWER TOOLS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 118 POWER TOOLS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 119 POWER TOOLS MARKET: PRODUCT LAUNCHES, JANUARY 2022–FEBRUARY 2024

- TABLE 120 POWER TOOLS MARKET: DEALS, JANUARY 2022–FEBRUARY 2024

- TABLE 121 STANLEY BLACK & DECKER, INC.: COMPANY OVERVIEW

- TABLE 122 STANLEY BLACK & DECKER, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 123 STANLEY BLACK & DECKER, INC.: PRODUCT LAUNCHES

- TABLE 124 STANLEY BLACK & DECKER, INC.: OTHERS

- TABLE 125 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 126 ROBERT BOSCH GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 127 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 128 TECHTRONIC INDUSTRIES CO. LTD.: COMPANY OVERVIEW

- TABLE 129 TECHTRONIC INDUSTRIES CO. LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 130 TECHTRONIC INDUSTRIES CO. LTD.: PRODUCT LAUNCHES

- TABLE 131 MAKITA CORPORATION: COMPANY OVERVIEW

- TABLE 132 MAKITA CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 133 MAKITA CORPORATION: PRODUCT LAUNCHES

- TABLE 134 HILTI CORPORATION: COMPANY OVERVIEW

- TABLE 135 HILTI CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 136 HILTI CORPORATION: DEALS

- TABLE 137 ANDREAS STIHL AG & CO. KG: COMPANY OVERVIEW

- TABLE 138 ANDREAS STIHL AG & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 APEX TOOL GROUP, LLC: COMPANY OVERVIEW

- TABLE 140 APEX TOOL GROUP, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 ATLAS COPCO AB: COMPANY OVERVIEW

- TABLE 142 ATLAS COPCO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 ATLAS COPCO AB: PRODUCT LAUNCHES

- TABLE 144 INGERSOLL RAND: COMPANY OVERVIEW

- TABLE 145 INGERSOLL RAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 INGERSOLL RAND: DEALS

- TABLE 147 SNAP-ON INCORPORATED: COMPANY OVERVIEW

- TABLE 148 SNAP-ON INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 SNAP-ON INCORPORATED: PRODUCT LAUNCHES

- TABLE 150 SNAP-ON INCORPORATED: DEALS

- TABLE 151 KOKI HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 152 YAMABIKO CORPORATION: COMPANY OVERVIEW

- TABLE 153 PANASONIC INDUSTRY EUROPE GMBH: COMPANY OVERVIEW

- TABLE 154 KEN HOLDING CO., LTD: COMPANY OVERVIEW

- TABLE 155 DYNABRADE INC.: COMPANY OVERVIEW

- TABLE 156 AMICO: COMPANY OVERVIEW

- TABLE 157 C. & E. FEIN GMBH: COMPANY OVERVIEW

- TABLE 158 CHERVON (CHINA) TRADING CO., LTD.: COMPANY OVERVIEW

- TABLE 159 CS UNITEC, INC.: COMPANY OVERVIEW

- TABLE 160 FERM INTERNATIONAL B.V.: COMPANY OVERVIEW

- TABLE 161 INTERSKOL: COMPANY OVERVIEW

- TABLE 162 POSITEC TOOL CORPORATION: COMPANY OVERVIEW

- TABLE 163 RIDGID: COMPANY OVERVIEW

- TABLE 164 GREENWORKSTOOLS: COMPANY OVERVIEW

- TABLE 165 URYU SEISAKU, LTD.: COMPANY OVERVIEW

- TABLE 166 OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 167 OUTDOOR POWER EQUIPMENT MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 168 COMMERCIAL: OUTDOOR POWER EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020–2023 (USD MILLION)

- TABLE 169 COMMERCIAL: OUTDOOR POWER EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024–2029 (USD MILLION)

- TABLE 170 COMMERCIAL: OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 171 COMMERCIAL: OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 172 RESIDENTIAL/DIY: OUTDOOR POWER EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2020–2023 (USD MILLION)

- TABLE 173 RESIDENTIAL/DIY: OUTDOOR POWER EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2024–2029 (USD MILLION)

- TABLE 174 RESIDENTIAL/DIY: OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 175 RESIDENTIAL/DIY: OUTDOOR POWER EQUIPMENT MARKET, BY REGION, 2024–2029 (USD MILLION)

- FIGURE 1 POWER TOOLS MARKET SEGMENTATION

- FIGURE 2 POWER TOOLS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF COMPONENTS AND POWER TOOLS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 DRILLING AND FASTENING SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 8 ELECTRIC SEGMENT TO DOMINATE MARKET FROM 2024 TO 2029

- FIGURE 9 INDUSTRIAL/PROFESSIONAL SEGMENT TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 EXPANDING CONSTRUCTION INDUSTRY IN EMERGING ECONOMIES TO FUEL MARKET GROWTH

- FIGURE 12 DRILLING AND FASTENING TOOLS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 13 ELECTRIC SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 INDUSTRIAL/PROFESSIONAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 INDIA TO RECORD HIGHEST CAGR IN GLOBAL POWER TOOLS MARKET DURING FORECAST PERIOD

- FIGURE 16 POWER TOOLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 POWER TOOLS MARKET: IMPACT OF DRIVERS

- FIGURE 18 POWER TOOLS MARKET: IMPACT OF RESTRAINTS

- FIGURE 19 GLOBAL TREND OF WIND POWER CAPACITY (GW), 2016–2022

- FIGURE 20 POWER TOOLS MARKET: IMPACT OF OPPORTUNITIES

- FIGURE 21 POWER TOOLS MARKET: IMPACT OF CHALLENGES

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 23 INDICATIVE PRICING TREND OF POWER TOOLS OFFERED BY KEY PLAYERS, BY TOOL TYPE, 2023 (USD)

- FIGURE 24 AVERAGE SELLING PRICING TREND OF POWER TOOLS, BY TOOL TYPE, 2019–2023 (USD)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF POWER TOOLS, BY REGION, 2019–2023 (USD)

- FIGURE 26 GLOBAL POWER TOOLS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 27 KEY PLAYERS IN ECOSYSTEM

- FIGURE 28 TOP 10 COMPANIES WITH SIGNIFICANT NUMBER OF PATENT APPLICATIONS FROM 2014 TO 2023

- FIGURE 29 IMPORT DATA FOR HS CODE 8467-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 8467-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 31 POWER TOOLS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIAL/PROFESSIONAL APPLICATIONS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIAL/PROFESSIONAL APPLICATIONS

- FIGURE 34 APPLICATIONS OF POWER TOOLS ON DIFFERENT MATERIALS

- FIGURE 35 DISTRIBUTION CHANNELS OF POWER TOOLS

- FIGURE 36 POWER TOOLS MARKET, BY TOOL TYPE

- FIGURE 37 DRILLING AND FASTENING TOOLS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 POWER TOOLS MARKET, BY MODE OF OPERATION

- FIGURE 39 ELECTRIC SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 40 POWER TOOLS MARKET, BY APPLICATION

- FIGURE 41 RESIDENTIAL/DIY SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 CONSTRUCTION SEGMENT TO DOMINATE POWER TOOLS MARKET FOR INDUSTRIAL/PROFESSIONAL APPLICATIONS IN 2029

- FIGURE 43 POWER TOOLS MARKET, BY REGION

- FIGURE 44 INDIA TO RECORD HIGHEST GROWTH RATE IN GLOBAL POWER TOOLS MARKET DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA TO DOMINATE GLOBAL POWER TOOLS MARKET FROM 2024 TO 2029

- FIGURE 46 NORTH AMERICA: POWER TOOLS MARKET SNAPSHOT

- FIGURE 47 EUROPE: POWER TOOLS MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: POWER TOOLS MARKET SNAPSHOT

- FIGURE 49 FIVE-YEAR REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2019–2023

- FIGURE 50 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- FIGURE 51 VALUATION OF KEY PLAYERS IN POWER TOOLS MARKET, 2024

- FIGURE 52 EV/EBITDA OF KEY PLAYERS, 2023

- FIGURE 53 BRANDS/PRODUCTS COMPARISON

- FIGURE 54 POWER TOOLS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 55 COMPANY OVERALL FOOTPRINT

- FIGURE 56 POWER TOOLS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 STANLEY BLACK & DECKER, INC.: COMPANY SNAPSHOT

- FIGURE 58 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 59 TECHTRONIC INDUSTRIES CO. LTD.: COMPANY SNAPSHOT

- FIGURE 60 MAKITA CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 HILTI CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 ATLAS COPCO AB: COMPANY SNAPSHOT

- FIGURE 63 INGERSOLL RAND: COMPANY SNAPSHOT

- FIGURE 64 SNAP-ON INCORPORATED: COMPANY SNAPSHOT

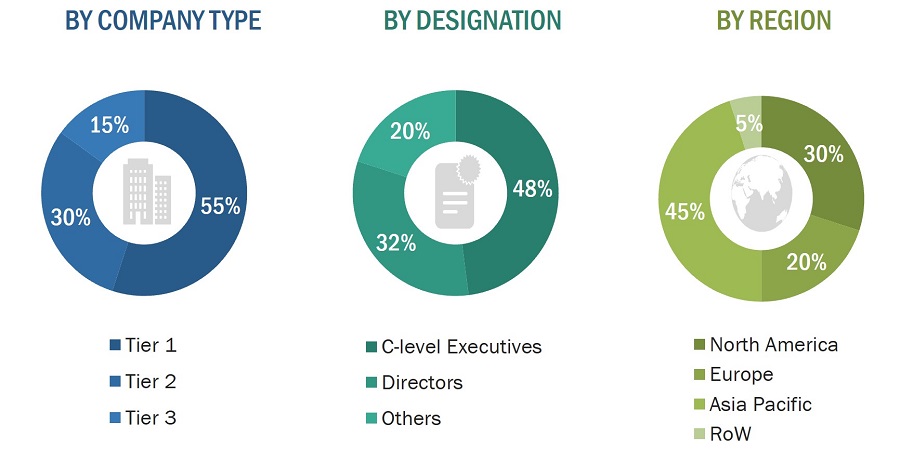

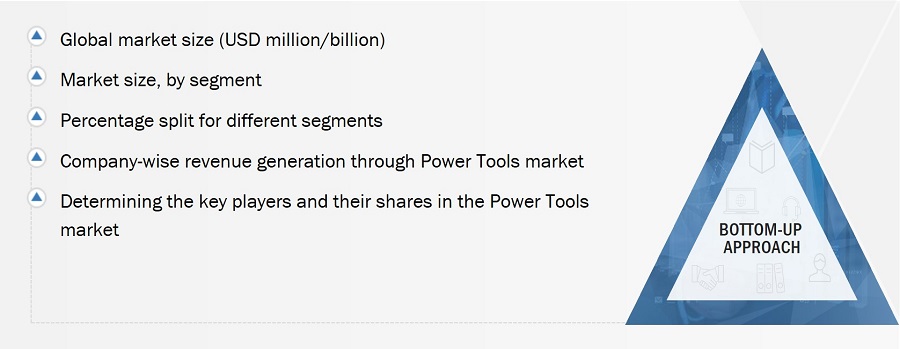

The study involved four major activities in estimating the current size of the power tool market. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Finally, both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information relevant to this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles from recognized authors; directories; and databases. Secondary research was conducted mainly to obtain key information about the industry’s supply chain, value chain of the market, the total pool of key players, market classification and segmentation according to industry trends, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain the qualitative and quantitative information relevant to this report. Primary sources from the supply side include experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the power tools ecosystem. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the overall power tool market and the market based on segments. The research methodology used to estimate the market size was given below:

- Major players operating in the power tools market were identified and considered for the report through extensive secondary research.

- The supply chain and market size of the power tool market, both in terms of value and units, were estimated/determined through secondary and primary research processes.

- All estimations and calculations, including percentage share, revenue mix, splits, and breakdowns, were determined through the use of secondary sources, which were further verified through primary sources.

Global Power Tools market Size: Bottom-Up Approach

Global Power Tools Market Size: Top-Down Approach

Market Definition

Power tools are mechanical devices that rely on an external power source, such as electricity, compressed air, or hydraulic pressure, for operation. They are designed to carry out a wide array of tasks, including cutting, drilling, grinding, fastening, and shaping materials. These tools find extensive use across industries and in households, offering increased efficiency and productivity compared to manual alternatives.

Key Stakeholders

- End Users

- Government Bodies, Venture Capitalists, and Private Equity Firms

- Power Tool Manufacturers

- Power Tool Distributors

- Power Tool Industry Associations

- Professional Service/Solution Providers

- Research Institutions and Organizations

- Standards Organizations and Regulatory Authorities Related to the Power Tools Market

- System Integrators

- Technology Consultants

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objectives:

- To describe and forecast the power tools market, in terms of value, based on tool type, mode of operation, and application

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific, and the Rest of World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain of the Power Tools ecosystem

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and details of the competitive landscape of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies

- To analyze the major growth strategies implemented by key market players, such as contracts, agreements, acquisitions, product launches, expansions, and partnerships

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of 25 key players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Tools Market

Hi, I am currently doing a project about analysis the power tools market. pacifically about the competitors market share, the effect of the covid-19, and the forecast about the industry. if I could received any information or data the will be really useful and helpful. Many thanks!!!

Would the Power Tools Market be considered an oversaturated market? any information regarding this would be useful.