Privileged Identity Management Market by Solution (Identity Management, Access Management, Session Monitoring and Management), Service, Installation Type (Appliance-Based & Agent-Based), Deployment Mode, Vertical, and Region - Global Forecast to 2021

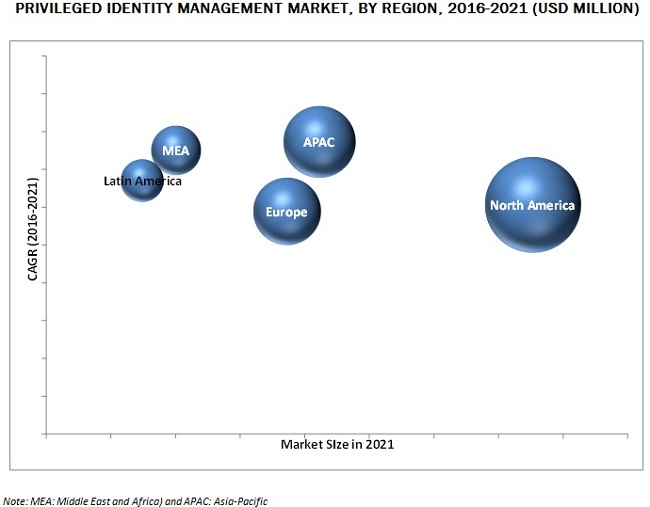

[345 Pages Report] The privileged identity management market estimated to grow from USD 922.0 million in 2016 to USD 3,792.5 million by 2021, at a Compound Annual Growth Rate (CAGR) of 32.7%.

The report aims at estimating the market size and future growth potential of privileged identity management across different segments, such as solutions, services, installation types, deployment modes, organization size, verticals, and regions. Privileged identity management market comprises various solutions, such as identity management, access management, and session monitoring and management. These solutions are rapidly adopted by enterprises and government agencies, as there has been a rise in the number and frequency of attacks on privileged user accounts. The base year for the study is 2015 and the market size is considered to be 2016 to 2021.

Market Dynamics

Drivers

- Increasing threat of data breach due to insider attacks

- Need to optimize organization efficiency

- Government regulatory compliances and adoption of best practices for identity management

Restraints

- High cost of innovation and implementation

Opportunities

- Increased digitization and adoption of IDaaS

- Emergence of intelligence-based privileged identity management solutions

Challenges

- Lack of awareness about emerging security threats

Increasing threat of data breach due to insider attacks is driving the global privileged identity management market

The insider to an organization is the one who can access organization's assets, either physically or from a remote place. The insider can be an employee, vendor, business partner, or maintenance contractor who can access the physical data such as hard copies of documents, electronic devices in the organization, and the digital assets such as digital media, data in transit, and other information resources. Insider attacks are rapidly increasing and causing data breach in the organizations. Due to this threat landscape of insider attacks, there is huge adoption of privileged identity management. The superuser accounts have access to a huge database inside an organization and the protection of this data is the prime objective of companies. The privileged identity management is expected to witness huge market demand.

To know about the assumptions considered for the study, download the pdf brochure

The following are the major objectives of the study

- To define, describe, and forecast the global privileged identity management market on the basis of solutions, services, installation types, deployment modes, organization size, verticals, and regions

- To provide detailed information regarding the major factors influencing the growth of the privileged identity management market (drivers, restraints, opportunities, and challenges)

-

To strategically analyze each subsegment with respect to individual growth trends, future prospects, and contribution to the total privileged identity management market

To forecast the market size of segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America - To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the privileged identity management market

- To strategically profile the key players of the privileged identity management market and comprehensively analyze their core competencies1 in the market

-

To track and analyze competitive developments, such as new product launches, mergers & acquisitions, partnerships, agreements, and collaborations in the global privileged identity management market

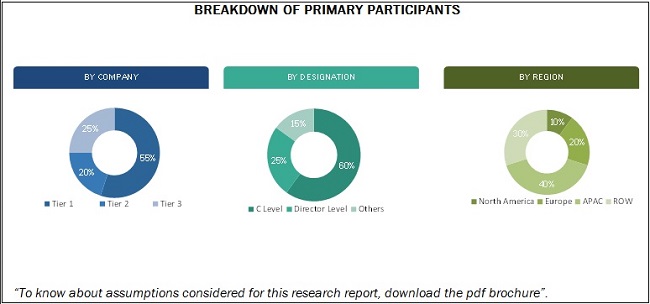

The research methodology used to estimate and forecast the privileged identity management market begins with collection and analysis of data on key vendor revenues through secondary sources such as company website, press releases, annual reports, TechTarget reports, Cloud Security Alliance reports, SC magazine, and SANS Institute studies. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the total market size of the global privileged identity management market from the revenue of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of the primary is depicted in the below figure:

The privileged identity management ecosystem comprises key vendors such as ARCON (India), Balabit (Hungary), BeyondTrust (U.S.), Bomgar Corporation (U.S.), CA, Inc. (U.S.), Centrify (U.S.), Core Security (U.S.), Cyberark (U.S.), Hitachi-ID (Canada), IBM Corporation (U.S.), Iraje (U.S.), Lieberman Software (U.S.), MANAGEENGINE (U.S.), MICROFOCUS(U.K.), NRI SecureTechnologies (U.S.), ObserveIT (U.S.), Onion ID (U.S.), Oracle Corporation (U.S.), Osirium (U.K.), Quest Software (U.S.), Silverlake Mastersam (Singapore), Simeio Solutions (U.S.), Thycotic (U.S.), Wallix (France), and Wheel Systems (U.S.) sell these privileged identity management solutions to end users to cater to their unique business requirements and security needs.

Major Market Developments

- In September 201, Centrify added support for hybrid IT environments (on-premises and cloud) to its cloud-based privileged access security solution, Centrify Privilege Service.

- In December 2016, Lieberman Software formed strategic OEM alliance with Core Security where the former integrates its privileged identity management technology with Core Security’s products for identity, access, authentication, and vulnerability management.

- In October 2016, Balabit partnered with CyberSec Oy, a cybersecurity solution provider, where CyberSec helps Balabit to offer its PAM and user behavior analytics solutions in the Nordics region, particularly finance, telco, and governmental sectors.

Key Target audience

- Government agencies

- Privileged identity management vendors

- Identity and access management solution providers

- Independent software vendors

- Consulting firms

- System integrators

- Value-Added Resellers (VARs)

- Information Technology (IT) security agencies

- Managed Security Service Providers (MSSPs)

“Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments”.

Scope of the Report

The research report segments the privileged identity management market into the following submarkets:

By Component:

Solution

Service

-

- Identity Management

- Access Management

- Session Monitoring and Management

- Professional Services

- Implementation and Integration

- Consulting

- Education and Training

-

Support and Maintenance

Managed Services

By Installation Type:

- Agent-based

- Appliance-based

By Deployment Mode:

- On-Premises

- Cloud

By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Vertical:

- BFSI

- Government & Defense

- Healthcare

- Manufacturing

- Energy and Utilities

- Telecom and IT

- Retail

- Others

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Critical questions which the report answers

- What are new industry verticals which the privileged identity management companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North America privileged identity management market

- Further breakdown of the Europe market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin America market

Company Information

- Detailed analysis and profiling of additional market players

The overall Privileged identity management market is expected to grow from USD 922.0 million in 2016 to USD 3,792.5 million by 2021, at a Compound Annual Growth Rate (CAGR) of 32.7%. The constant pressure of managing data breaches along with the need to improve productivity and reduce costs has led enterprises of all sizes to adopt privileged identity management solutions for critical credentials management.

Privileged identity management is a software solution used to manage the identity and access rights of privileged users and outsourced IT vendors to prevent internal cyber threats. The solution has also been enhanced in recent times to provide privileged access rights to regular employees, termed as privilege elevation, as and when the situation demands. The privileged users can be IT staff and managers who have administrative access to critical systems in an organization. The solutions help protect, manage, and monitor privileged accounts and access & help meet regulations and compliance needs. With proper privileged identity management, an organization can prevent insider and outsider security threats, cut down business cost, and enhance its information security posture.

The privileged identity management market by component has been segmented, on the basis of solution and service. The market for services segment is expected to grow at the highest CAGR between 2017 and 2022. The high adoption of privileged identity management solutions and services by the global organizations contribute to the rapid growth of the market.

Privileged identity management solutions combine the capabilities of managing identity content such as usernames, passwords, and other privileged information associated with privileged accounts within the enterprises. The identity management solution is expected to dominate the privileged identity management market, contributing the largest market share during the forecast period. Session monitoring and management is expected to play a key role in changing the identity management landscape and grow at the highest growth rate during the forecast period as Bring Your Own Device (BYOD) adoption in enterprises will continue to grow.

Cloud deployment is the fastest-growing deployment mode in the privileged identity management market as it benefits organizations with increased scalability, speed, 24/7 services, and enhanced management capabilities. Small and Medium Enterprises (SMEs), in particular, have opted for cloud deployment as it can help them avoid costs pertaining to hardware, software, storage, and technical staff.

Increasing threat of data breach due to insider attacks

Banking, Financial Services, and Insurance (BFSI)

Banking and financial industries are the sectors that mainly deal with the national and international regulations such as Basel-III, GLBA, and SOX. In the banking sector, privileged identity management solutions deal with the identification of individuals associated with banks and controlling and managing their access privileges. Privileged identity management has become one of the most important issues for financial institutions and requires high-level security. For this, many financial firms are developing better IT infrastructure to secure customer data and assets from cyber breaches. Identity management solutions are also being utilized to address complex compliance processes and manage access changes with adherence to firm policies.

Government

Privileged identity management has become one of the most important aspects of the government and defense sector. The concept of e-governance has led the government to focus more on identity thefts. Moreover, as organizations are shifting toward real-time communication, thefts from web browsing email correspondence, peer-to-peer traffic, and file exchange have considerably increased. Almost 90% of IT leaders believe government needs to be involved in setting up the cyber defense strategies to protect their own IT infrastructure and that of the private sector. Privileged identity management solutions must be developed and implemented to protect the electronic identities from attacks by hackers, as well as to strengthen their flexibility against natural corrosion and unplanned threats such as equipment shut downs and user errors.

Healthcare and Pharmaceuticals

Some of the major hacking cases in the healthcare industry have led to increased security against cyber threat in this sector. Financial data has always been the prime target for attackers, but these days medical data is also becoming one of the lucrative targets. Individual’s identity could be stolen directly from hospitals, health insurance companies, and any system that manages medical record. Social security numbers, insurance IDs, addresses, and medical detail are some of the factors for cyber threats, because they usually contain valuable data, including personal information such as social security numbers and addresses and credit card information. These issues are increasing the requirement for identity management solutions in the healthcare and life sciences department.

Manufacturing

Manufacturers are harnessing a new generation of machine-to-machine systems, mobile apps, and cloud-based services. Moreover, manufacturers cannot make or sell their products without close relation with their suppliers which leads to sharing of data back and forth. Therefore, manufacturing companies increasingly rely on software to automate processes, manage supply chains, and facilitate Research and Development (R&D), and the digitization of processes and products. This has also increased the threat of cybercrime within the industry. Challenges of information security, compliance issues, and supply chain management are some of the factors that are pushing big manufacturing companies to approach identity management vendors to smoothen the functioning of their organizations. Further, the operators working in the manufacturing enterprise require system access and efficient automated processes. These issues can be resolved using privileged identity management solutions that can help in better handling and management of external identities and access using SSO of their partners and stakeholders.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the different solutions for privileged identity management?

The lack of awareness about emerging security threats is one of the major challenges affecting the security posture of the organizations. The high cost of innovation and implementation for privileged identity management market is acting as a barrier to the growth of the privileged identity management market. The investments are becoming a matter of concern for many organizations including SMEs. Furthermore, the development cost for robust security solutions is high, which in turn leads to increased implementation cost for customers.

The key players in this market are ARCON (India), Balabit (Hungary), BeyondTrust (U.S.), Bomgar Corporation (U.S.), CA, Inc. (U.S.), Centrify (U.S.), Core Security (U.S.), Cyberark (U.S.), Hitachi-ID (Canada), IBM Corporation (U.S.), Iraje (U.S.), Lieberman Software (U.S.), MANAGEENGINE (U.S.), MICROFOCUS(U.K.), NRI SecureTechnologies (U.S.), ObserveIT (U.S.), Onion ID (U.S.), Oracle Corporation (U.S.), Osirium (U.K.), Quest Software (U.S.), Silverlake Mastersam (Singapore), Simeio Solutions (U.S.), Thycotic (U.S.), Wallix (France), and Wheel Systems (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Privileged Identity Management Market

4.2 Market: Components

4.3 Market, By Region and Vertical

4.4 Privileged Identity Management Market Potential

4.5 Lifecycle Analysis, By Region, 2016

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Solution

5.2.2 By Service

5.2.3 By Installation Type

5.2.4 By Deployment Mode

5.2.5 By Organization Size

5.2.6 By Vertical

5.2.7 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Threat of Data Breach Due to Insider Attacks

5.3.1.2 Need to Optimize Organization Efficiency

5.3.1.3 Government Regulatory Compliances and Adoption of Best Practices for Identity Management

5.3.2 Restraints

5.3.2.1 High Cost of Innovation and Implementation

5.3.3 Opportunities

5.3.3.1 Increased Digitization and Adoption of Identity as A Service (IDaaS)

5.3.3.2 Emergence of Intelligence-Based Privileged Identity Management Solutions

5.3.4 Challenges

5.3.4.1 Lack of Awareness About Emerging Security Threats

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Key Trends in Privileged Identity Management

6.3.1 Emergence of Cloud-Based Privileged Identity Management

6.3.2 Rise in Cloud Computing

6.3.3 The Development of Adaptable and Intelligence-Based Privileged Identity Management Solutions

6.4 Regulatory Implications

6.4.1 Payment Card Industry Data Security Standard (PCI–DSS)

6.4.2 Health Insurance Portability and Accountability Act (HIPAA)

6.4.3 Federal Information Security Management Act (FISMA)

6.4.4 Gramm-Leach-Bliley Act (GLB Act)

6.4.5 Sarbanes-Oxley Act (SOX)

6.4.6 The International Organization for Standardization (ISO) Standard 27001

7 Privileged Identity Management Market Analysis, By Component (Page No. - 45)

7.1 Introduction

7.2 Solutions

7.2.1 Identity Management

7.2.2 Access Management

7.2.3 Session Monitoring and Management

7.3 Services

7.3.1 Professional Services

7.3.1.1 Implementation and Integration

7.3.1.2 Consulting

7.3.1.3 Education and Training

7.3.1.4 Support and Maintenance

7.3.2 Managed Services

8 Privileged Identity Management Market Analysis, By Installation Type (Page No. - 57)

8.1 Introduction

8.2 Appliance-Based

8.3 Agent-Based

9 Market By Deployment Mode (Page No. - 61)

9.1 Introduction

9.2 Cloud

9.3 On-Premises

10 Market Analysis, By Organization Size (Page No. - 65)

10.1 Introduction

10.2 Large Enterprises

10.3 Small and Medium Enterprises

11 Privileged Identity Management Market Analysis, By Industry Vertical (Page No. - 69)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Government and Defense

11.4 Healthcare and Pharmaceuticals

11.5 Manufacturing

11.6 Energy and Utilities

11.7 It and Telecom

11.8 Retail

11.9 Others

12 Geographic Analysis (Page No. - 78)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Vendor Dive Analysis (Page No. - 100)

13.1 Introduction

13.2 Vendor Inclusion Criteria

13.3 Vendor Dive

13.3.1 Vanguard

13.3.2 Innovator

13.3.3 Dynamic

13.3.4 Emerging

13.4 Overview

13.5 Product Offerings (For All 25 Players)

13.6 Business Strategy (For All 25 Players)

14 Company Synopsis (Page No. - 105)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

14.1 Centrify Corporation

14.2 Lieberman Software Corporation

14.3 Balabit Corp.

14.4 Beyondtrust, Inc.

14.5 Bomgar Corporation

14.6 Thycotic

14.7 CA, Inc.

14.8 Quest Software Inc.

14.9 Cyberark Software Ltd.

14.10 Observeit

14.11 Zoho Corp (Manageengine)

14.12 Simeio Solutions

14.13 Micro Focus Netiq

14.14 Hitachi Id Systems, Inc.

14.15 Wallix

14.16 Core Security

14.17 IBM Corporation

14.18 Oracle Corporation

14.19 Silverlake Mastersam Limited

14.20 Onion Id, Inc.

14.21 Arcon

14.22 Iraje

14.23 Osirium Ltd

14.24 Wheel Systems

14.25 NRI Securetechnologies

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 123)

15.1 Industry Excerpts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introduction RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (76 Tables)

Table 1 Privileged Identity Management Market Size and Growth Rate, 2014–2021 (USD Million)

Table 2 Market Size, By Component, 2014–2021 (USD Million)

Table 3 Market Size, By Component, 2016–2021 (USD Million)

Table 4 Market Size, By Solution, 2016–2021 (USD Million)

Table 5 Solutions: Market Size, By Region, 2016–2021 (USD Million)

Table 6 Identity Management: Market Size, By Region, 2016–2021 (USD Million)

Table 7 Access Management: Market Size, By Region, 2016–2021 (USD Million)

Table 8 Session Monitoring and Management: Market Size, By Region, 2016–2021 (USD Million)

Table 9 Privileged Identity Management Market Size, By Service, 2016–2021 (USD Million)

Table 10 Services: Market Size, By Region, 2016–2021 (USD Million)

Table 11 Market Size, By Professional Service, 2016–2021 (USD Million)

Table 12 Professional Services: Market Size, By Region, 2016–2021 (USD Million)

Table 13 Implementation and Integration: Market Size, By Region, 2016–2021 (USD Million)

Table 14 Consulting: Market Size, By Region, 2016–2021 (USD Million)

Table 15 Education and Training: Market Size, By Region, 2016–2021 (USD Million)

Table 16 Support and Maintenance: Market Size, By Region, 2016–2021 (USD Million)

Table 17 Managed Services: Market Size, By Region, 2016–2021 (USD Million)

Table 18 Privileged Identity Management Market Size, By Installation Type, 2016–2021 (USD Million)

Table 19 Appliance-Based: Market Size, By Region, 2016–2021 (USD Million)

Table 20 Agent-Based: Market Size, By Region, 2016–2021 (USD Million)

Table 21 Market Size, By Deployment Mode, 2016–2021 (USD Million)

Table 22 Cloud: Market Size, By Region, 2016–2021 (USD Million)

Table 23 On-Premises: Market Size, By Region, 2016–2021 (USD Million)

Table 24 Market Size, By Organization Size, 2016–2021 (USD Million)

Table 25 Large Enterprises: Market Size, By Region, 2016–2021 (USD Million)

Table 26 Small and Medium Enterprises: Market Size, By Region, 2016–2021 (USD Million)

Table 27 Privileged Identity Management Market Size, By Industry Vertical, 2016–2021 (USD Million)

Table 28 Banking, Financial Services, and Insurance: Market Size, By Region, 2016–2021 (USD Million)

Table 29 Government and Defense: Market Size, By Region, 2016–2021 (USD Million)

Table 30 Healthcare and Pharmaceuticals: Market Size, By Region, 2016–2021 (USD Million)

Table 31 Manufacturing: Market Size, By Region, 2016–2021 (USD Million)

Table 32 Energy and Utilities: Market Size, By Region, 2016–2021 (USD Million)

Table 33 It and Telecom: Market Size, By Region, 2016–2021 (USD Million)

Table 34 Retail: Market Size, By Region, 2016–2021 (USD Million)

Table 35 Others: Market Size, By Region, 2016–2021 (USD Million)

Table 36 Privileged Identity Management Market Size, By Region, 2014-2021 (USD Million)

Table 37 North America: Market Size, By Component, 2016–2021 (USD Million)

Table 38 North America: Market Size, By Solution, 2016–2021 (USD Million)

Table 39 North America: Market Size, By Service, 2014–2021 (USD Million)

Table 40 North America: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 41 North America: Market Size, By Installation Type, 2014–2021 (USD Million)

Table 42 North America: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 43 North America: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 44 North America: Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 45 Europe: Privileged Identity Management Market Size, By Component, 2016–2021 (USD Million)

Table 46 Europe: Market Size, By Solution, 2016–2021 (USD Million)

Table 47 Europe: Market Size, By Service, 2014–2021 (USD Million)

Table 48 Europe: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 49 Europe: Market Size, By Installation Type, 2014–2021 (USD Million)

Table 50 Europe: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 51 Europe: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 52 Europe: Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 53 Asia-Pacific: Market Size, By Component, 2016–2021 (USD Million)

Table 54 Asia-Pacific: Market Size, By Solution, 2016–2021 (USD Million)

Table 55 Asia-Pacific: Market Size, By Service, 2014–2021 (USD Million)

Table 56 Asia-Pacific: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 57 Asia-Pacific: Market Size, By Installation Type, 2014–2021 (USD Million)

Table 58 Asia-Pacific: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 59 Asia-Pacific: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 60 Asia-Pacific: Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 61 Middle East and Africa: Privileged Identity Management Market Size, By Component, 2016–2021 (USD Million)

Table 62 Middle East and Africa: Market Size, By Solution, 2016–2021 (USD Million)

Table 63 Middle East and Africa: Market Size, By Service, 2014–2021 (USD Million)

Table 64 Middle East and Africa: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 65 Middle East and Africa: Market Size, By Installation Type, 2014–2021 (USD Million)

Table 66 Middle East and Africa: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 67 Middle East and Africa: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 68 Middle East and Africa: Market Size, By Industry Vertical, 2014–2021 (USD Million)

Table 69 Latin America: Market Size, By Component, 2016–2021 (USD Million)

Table 70 Latin America: Market Size, By Solution, 2016–2021 (USD Million)

Table 71 Latin America: Market Size, By Service, 2014–2021 (USD Million)

Table 72 Latin America: Market Size, By Professional Service, 2014–2021 (USD Million)

Table 73 Latin America: Market Size, By Installation Type, 2014–2021 (USD Million)

Table 74 Latin America: Market Size, By Deployment Mode, 2014–2021 (USD Million)

Table 75 Latin America: Market Size, By Organization Size, 2014–2021 (USD Million)

Table 76 Latin America: Market Size, By Industry Vertical, 2014–2021 (USD Million)

List of Figures (36 Figures)

Figure 1 Global Privileged Identity Management Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 North America is Expected to Hold the Largest Market Share in 2016

Figure 7 Services Segment is Expected to Grow at A Higher CAGR Than Solutions During the Forecast Period (2016–2021)

Figure 8 Cloud-Based Deployment Mode is Expected to Grow at A Higher CAGR Than On-Premises During the Forecast Period

Figure 9 Healthcare and Pharmaceutical Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 10 Privileged Identity Management Market is Expected to Witness Remarkable Growth Opportunities Due to the Need to Meet Compliance Requirements and Protect From Internal Cyber Threats in the Forecast Period

Figure 11 Appliance-Based Installation Type is Expected to Grow at A Higher CAGR Than Agent-Based Installation Type During the Forecast Period

Figure 12 North America is Expected to Hold the Largest Market Share in the Privileged Identity Management Market in 2016

Figure 13 Asia-Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 14 Regional Lifecycle: Asia-Pacific is Expected to Be in the Growth Phase in 2016

Figure 15 Market Segmentation: By Solution

Figure 16 Market Segmentation: By Service

Figure 17 Market Segmentation: By Installation Type

Figure 18 Market Segmentation: By Deployment Mode

Figure 19 Market Segmentation: By Organization Size

Figure 20 Market Segmentation: By Vertical

Figure 21 Market Segmentation: By Region

Figure 22 Privileged Identity Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Market: Value Chain

Figure 24 Among the Solutions, Identity Management is Expected to Contribute the Largest Market Size During the Forecast Period

Figure 25 Professional Services Segment is Expected to Have A Larger Market Size Than Managed Services During the Forecast Period

Figure 26 Appliance-Based Installation Type is Expected to Grow at A Higher CAGR Than Agent-Based Installation Type During the Forecast Period

Figure 27 Cloud-Based Deployment Mode is Expected to Grow at A Higher CAGR Than On-Premises During the Forecast Period

Figure 28 SME Segment is Expected to Grow at A Higher CAGR Than Large Enterprises Segment During the Forecast Period

Figure 29 Healthcare and Pharmaceuticals Industry Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 30 Asia-Pacific is Expected to Witness the Highest Growth Rate From 2016 to 2021

Figure 31 North America is Expected to Be the Leader in Terms of Market Size During the Period 2016–2021

Figure 32 North America Market Snapshot

Figure 33 Asia-Pacific: Market Snapshot

Figure 34 Dive Chart

Figure 35 Dive Chart

Figure 36 Dive Chart

Growth opportunities and latent adjacency in Privileged Identity Management Market