Product Analytics Market by Component, Mode (Tracking Data, Analyzing Data), End User (Sales & Marketing Professionals, Consumer Engagement), Deployment Mode, Organization Size, Vertical, & Region - Global Forecast to 2026

Product Analytics Market Share, Forecast - Growth Analysis

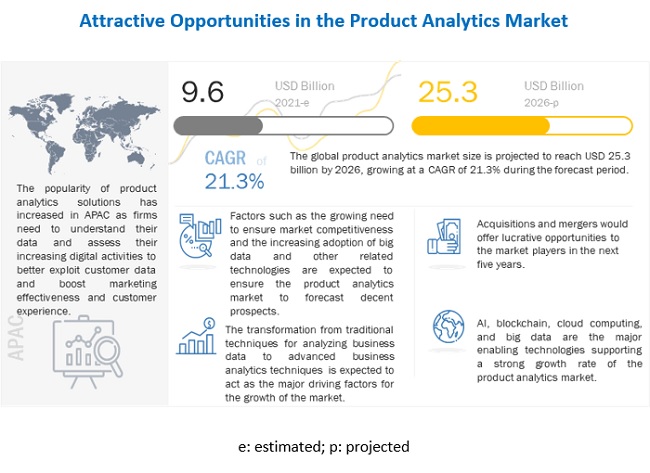

[276 Pages Report] The global Product Analytics Market size was worth around $9.6 billion in 2021 and is anticipated to reach a market valume of $25.3 billion by the end of 2026, records a CAGR of 21.3% during the forecast period 2021-2026. The base year for estimation is 2020 and the data available for the years 2020 to 2026.

Various factors such as growing need to improve customer behavior management to deliver personalized recommendations of products, increasing demand for advanced analytics tools to ensure market competitiveness, and growing adoption of big data and other related technologies are expected to drive the adoption of product analytics solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

Product Analytics Market Growth Dynamics

Driver: Growing need to improve customer behavior management to deliver personalized recommendations of products

Customer service has become the key to success for businesses. Customers make 70% of their buying decisions based on how well they are attended. Today, predicting customer needs has become an important concern for businesses to supply effective solutions and ensure clients are satisfied. Hence, successful businesses rely on product recommendation engines to provide personalized service to every single customer. The right product recommendation tool helps businesses increase the potential RoI of their marketing efforts by utilizing customer behavior and optimizing their customer service efforts. Harvard Business Review report suggests that personalization can deliver five to eight times the RoI on marketing spend and can improve sales by 10% or more. Predictive recommendations help retailers deliver the right offer at the right time to the right shopper. This results in conversion and more money spent per transaction. A study suggests that up to 31% of eCommerce site revenue is generated from personalized product recommendations because intelligent product recommendation offers opportunities for natural, logical upsell and cross-sell. The client’s interest is demonstrated through their behavior and history and the product recommendation tool automatically pairs that behavior with the right suggestions. Small transactions become larger ones, and clients who might not have been on the path to making a purchase suddenly find themselves interested in doing so. Hence, product analytics plays a vital role in analyzing customer behavior.

Restraint: Growing concerns over data privacy and security

Latest technologies such as AI and ML can be the best defensive technologies in a company’s cybersecurity arsenal. However, these technologies are prone to malicious attacks, as attackers are adopting such technologies faster than security leaders. The use of these technologies by cybercriminals can have a pessimistic impact on all businesses seeking to protect their most precious asset and data. This is considered one of the restraining factors for the growth of the product analytics market. Enterprises adopting product analytics solutions face security and privacy issues. Companies have confidential data, which needs to be protected to avoid data breaches and theft, as it may affect the reputation and business of enterprises. The possession of such confidential data with analytical providers is a reason of concern for organizations that their data may be leaked over the internet and can be easily accessed by unauthorized users.

Opportunity: Product analytics and intelligence tools to play a key role in the post-COVID-19 era

Data management and analytics tools have become essential in managing the current disruption and are moving toward the new normal. There is publicly available data related to the status of COVID-19 for each country, region, and even to the local level. Product analytics can help correlate this data with supply chain information for identifying areas of risks and forecasting the regions that are going to resume routine quickly and those regions that may require a longer grace period. All such data can help financial institutions to minimize risks by analyzing the liquidity position of client companies through a real-time cash liquidity view. In the energy industry, companies can implement remote monitoring of equipment with IoT to deliver analytics for preventative and predictive maintenance, eliminating the need to send employees to remote locations. In the post-COVID-19 era, more companies are turning toward cloud for maximizing insights from data and big data analytics, which has now become must for organizations. Product analytics will play a major role in the coming years as it will enable companies to correlate more data, such as health data from governments, with their organization’s data for predicting and forecasting demand.

Challenge: Integration of data from data silos

Extracting value from data has become a key requirement for companies to successfully mitigate risks, target valuable customers, and evaluate business performance. Monetizing these data assets requires the availability of a sufficient amount of data. However, data consolidation from distinct data sources into meaningful information can incite various challenges for organizations, especially centralized business enterprises. Data exchange and data ecosystem deliver tools to analyze the collected data at a centralized location and help extract and cross-check business-critical components. The development of data exchanges and data ecosystem varies based on the assumptions made in the value of the data for each customer segment. Several product analytics providers offer unified data aggregation and data analytics platforms that help users in successfully aggregating and analyzing data from disparate data sources. Data exchange is a major concern for industries, such as banking and financial services and healthcare, which deal with individual’s confidential data. As the need for data exchange increases, it needs to be balanced with risk mitigation capabilities. With companies adopting product analytics software integrated with data security capabilities, data exchange is not expected to be a major issue in the near future.

The solutions segment is expected to account for a larger market size during the forecast period

The component segment has been further divided into solutions and services. The solutions segment is expected to account for a larger market size during the forecast period. Solutions help analyze data generated from IoT devices, sensors, clickstreams, and social media platforms. They provide data results via interactive dashboards. However, services associated with such software form an integral part of the product analytics market, ensuring effective use of product analytics solutions.

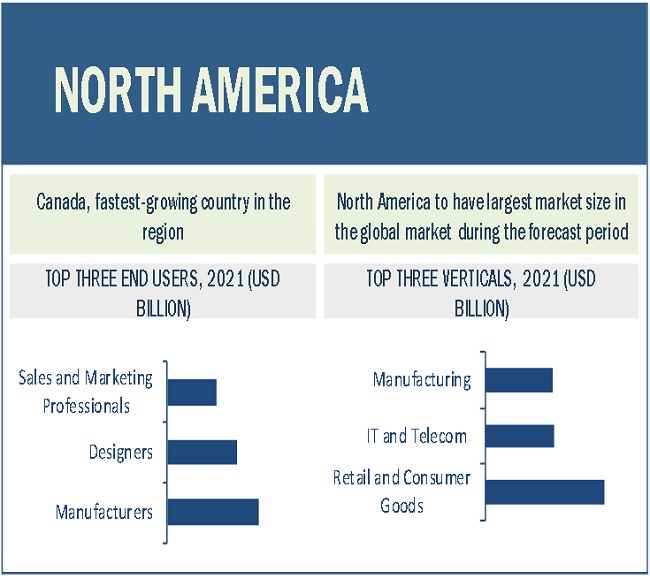

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the product analytics market. Key factors favoring the growth of the product analytics market in North America include the increasing technological advancements in the region. The growing number of product analytics players across regions is expected to further drive the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report

| Report Attributes |

Details |

|

Market size available for years |

2020–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Revenue Forecast in 2026 |

$25.3 billion |

|

Key Market Growth Drivers |

Growing need to improve customer behavior management to deliver personalized recommendations of products |

|

Key Market Opportunities |

Product analytics and intelligence tools to play a key role in the post-COVID-19 era |

|

Market Segmentation |

Component, Mode (Tracking Data, Analyzing Data), End User (Sales & Marketing Professionals, Consumer Engagement), Deployment Mode, Organization Size, Vertical, & Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of Companies in Product Analytics |

Google (US), IBM (US), Oracle (US), Adobe (US), Salesforce (US), Medallia (US), Veritone (US), LatentView Analytics (US), Mixpanel (US), Amplitude (US), Pendo (US), Kissmetrics (US), Gainsight (US), UserIQ (US), Copper CRM (US), Countly (UK), Heap (US), Plytix (Denmark), Risk Edge Solutions (India), Woopra (US), Piwik PRO (Poland), Smartlook (Czech Republic), LogRocket (US), Auryc (US), Quantum Metric (US), cux.io (Germany), Refiner (France), InnerTrends (England), GrowthSimple (US), OmniPanel (US), and Productlift (Canada) |

Product Analytics Companies

The Product analytics vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global product analytics market include Google (US), IBM (US), Oracle (US), Adobe (US), Salesforce (US), Medallia (US), Veritone (US), LatentView Analytics (US), Mixpanel (US), Amplitude (US), Pendo (US), Kissmetrics (US), Gainsight (US), UserIQ (US), Copper CRM (US), Countly (UK), Heap (US), Plytix (Denmark), Risk Edge Solutions (India), Woopra (US), Piwik PRO (Poland), Smartlook (Czech Republic), LogRocket (US), Auryc (US), Quantum Metric (US), cux.io (Germany), Refiner (France), InnerTrends (England), GrowthSimple (US), OmniPanel (US), and Productlift (Canada). The study includes an in-depth competitive analysis of these key players in the Product analytics market with their company profiles, recent developments, and key market strategies.

Recent Developments:

- In May 2021, Veritone has announced Veritone's Interaction Analytics solutions, which are pre-configured AI solutions for conversational intelligence that instantly retrieve insights from customer interactions such as voice calls, texts, emails, chats, social streams, images, and videos in near-real-time, allowing for smarter decision-making while increasing revenues, lowering operational costs, and enhancing customer satisfaction.

- In April 2021, Adobe announced Real-time Customer Data Platform. Users can combine, match, and analyze data at any point in the consumer journey using Adobe Analytics. They can benefit from flexible reporting, predictive intelligence, and other features. The platform combines everything together to provide real-time information based on actual 360-degree customer perspectives. It uses attribution to determine what is driving each conversion and allocate resources accordingly.

- In April 2021, IBM announced additional features for IBM Watson aimed at assisting organizations in developing trustworthy AI. These capabilities add to Watson's suite of tools for governing and explaining AI-driven choices, improving insight accuracy, mitigating risks, and meeting privacy and regulatory needs.

- In January 2021, Google launched Product Discovery Solutions for retail industry. This suite would enhance the retailer’s eCommerce capabilities and it provide enhanced customer experience. Product Discovery Solutions for Retail brings together AI algorithms and search service, Cloud Search for Retail, which leverages Google Search technology to power retailers’ product-finding tools.

- In October 2020, Amplitude announced Journeys, an industry-first solution that uses ML to help teams focus on the most important times during the customer lifecycle. Journeys instantly centers teams on the handful of precise moments that have the largest business effect, such as drop-off or paths that provide the best conversion, by assessing the millions of potential outcomes along a customer path.

- In July 2020, Heap announced Heap Data Engine, which is based on a foundation of comprehensive, auto-captured data, allows teams the freedom to organize that data and respond to questions that value to them. Heap ensures the data is reliable and adaptable, the team is well-organized, and the product remains oriented on providing value to users.

- In April 2020, Google Cloud launched an AI chatbot called Rapid Response Virtual Agent program. It allows Google Cloud customers to respond more quickly to questions from their customers related to the coronavirus. This program is designed for organizations to provide information related to the COVID-19 pandemic to their customers, such as government agencies, healthcare, and public health organizations, travel, financial services, and retail industries.

- In June 2019, Oracle introduced a new feature in Oracle Analytics. The new feature would provide AI-powered self-service capabilities. Oracle Analytics, with data preparation, visualization, and NLP features, would help business analysts get data insights to make business decisions. This product enhancement would provide an opportunity for Oracle to increase its presence in APAC and Latin America.

Frequently Asked Questions (FAQ):

What is the current market size of Product Analytics Market ?

What is the Product Analytics Market Growth?

What are the driving factors gor global Product Analytics Market growth?

Who are the key players in Product Analytics Market?

Which region is the leading hub for Product Analytics Market?

What is the Product Analytics Market segmentation provided in report?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 6 PRODUCT ANALYTICS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 PRODUCT ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE PRODUCT ANALYTICS MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF PRODUCT ANALYTICS THROUGH OVERALL PRODUCT ANALYTICS SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID-19 ON THE MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 4 GLOBAL PRODUCT ANALYTICS MARKET SIZE AND GROWTH RATE, 2015–2020 (USD MILLION, Y-O-Y%)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

FIGURE 16 SOLUTIONS SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 17 PROFESSIONAL SERVICES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 18 TRACKING DATA SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 19 CLOUD SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 20 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 21 MANUFACTURERS SEGMENT TO HOLD THE LARGEST MARKET SIZE IN 2021

FIGURE 22 RETAIL AND CONSUMER GOODS VERTICAL TO HOLD THE LARGEST MARKET SIZE IN 2021

FIGURE 23 NORTH AMERICA TO HOLD THE HIGHEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PRODUCT ANALYTICS MARKET

FIGURE 24 GROWING NEED TO ENSURE MARKET COMPETITIVENESS TO BOOST THE MARKET GROWTH

4.2 MARKET, BY VERTICAL

FIGURE 25 RETAIL AND CONSUMER GOODS VERTICAL TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4.3 MARKET, BY REGION

FIGURE 26 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE BY 2026

4.4 MARKET, TOP THREE END USERS AND VERTICALS

FIGURE 27 DESIGNERS AND RETAIL AND CONSUMER GOODS SEGMENT TO HOLD THE LARGEST MARKET SHARES BY 2026

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PRODUCT ANALYTICS MARKET

5.2.1 DRIVERS

5.2.1.1 Growing need to improve customer behavior management to deliver personalized recommendation of products

5.2.1.2 Increasing demand for advanced analytics tools to ensure market competitiveness

5.2.1.3 Growing adoption of big data and other related technologies

5.2.2 RESTRAINTS

5.2.2.1 Growing concerns over data privacy and security

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for real-time analytics solutions

5.2.3.2 Product analytics and intelligence tools to play a key role in the post-COVID-19 era

5.2.4 CHALLENGES

5.2.4.1 Integration of data from data silos

5.2.4.2 Reluctance to adopt advanced analytical technologies

5.3 INVESTMENTS IN ANALYTICS

TABLE 6 MAJOR INVESTMENTS IN ANALYTICS, 2018–2021

5.4 ACQUISITIONS IN THE PRODUCT ANALYTICS MARKET

TABLE 7 MAJOR ACQUISITIONS IN THE MARKET BETWEEN 2018 AND 2021

5.5 REVENUE SHIFT – YC/YCC SHIFT FOR MARKET

FIGURE 29 MARKET: YC/YCC SHIFT

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 DOCUMENT TYPE

TABLE 8 PATENTS FILED, 2018–2021

5.6.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 30 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.6.3.1 Top applicants

FIGURE 31 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

TABLE 9 TOP TEN PATENT OWNERS (US) IN THE PRODUCT ANALYTICS MARKET, 2018–2021

5.7 CASE STUDY ANALYSIS

5.7.1 HOW LENDINGCLUB SERVES MORE CUSTOMERS WITH DATA INSIGHTS BACKED BY HEAP

5.7.2 HOW ONEBRIDGE SOLUTIONS USED PENDO FEEDBACK TO CREATE THE BEST POSSIBLE PRODUCT

5.7.3 CLOROX USED MIXPANEL FOR BUILDING A PERSONALIZED EXPERIENCE FOR CUSTOMERS TO INCREASE ENGAGEMENT AND BRAND LOYALTY ON THE HIDDEN VALLEY RANCH WEBSITE

5.7.4 WHY HUBSPOT CHOSE AMPLITUDE FOR PRODUCT ANALYTICS OVER A HOMEGROWN SOLUTION

5.7.5 USERIQ PROVIDES BIM ONE WITH AN ALL-IN-ONE SOLUTION AND IMPROVES NPS RESPONSE RATES BY 5X

5.7.6 SPRINT SAW AN 18% AVERAGE LIFT ACROSS KPI’S WITH THE HELP OF ADOBE ANALYTICS AND TARGET

5.7.7 HOW ACROLINX ACHIEVED 14.8% INCREASE IN PRODUCT AND SERVICE QUALITY WITH THE RIGHT DATA BY PIWIKPRO

5.8 PRODUCT ANALYTICS: EVOLUTION

FIGURE 32 EVOLUTION OF PRODUCT ANALYTICS

5.9 PRODUCT ANALYTICS: ECOSYSTEM

FIGURE 33 ECOSYSTEM OF PRODUCT ANALYTICS

5.10 PRODUCT ANALYTICS MARKET: COVID-19 IMPACT

FIGURE 34 MARKET TO WITNESS GROWTH SPIKE BETWEEN 2020 AND 2021

5.11 VALUE/SUPPLY CHAIN ANALYSIS

FIGURE 35 VALUE/SUPPLY CHAIN ANALYSIS

TABLE 10 MARKET: VALUE/SUPPLY CHAIN

5.12 PRICING MODEL ANALYSIS

5.13 TECHNOLOGY ANALYSIS

5.13.1 ARTIFICIAL INTELLIGENCE, MACHINE LEARNING, AND PRODUCT ANALYTICS

5.13.2 CLOUD COMPUTING AND PRODUCT ANALYTICS

5.13.3 BIG DATA AND PRODUCT ANALYTICS

5.13.4 BUSINESS INTELLIGENCE AND PRODUCT ANALYTICS

5.14 PORTER’S FIVE FORCES ANALYSIS

FIGURE 36 PRODUCT ANALYTICS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 11 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF NEW ENTRANTS

5.14.2 THREAT OF SUBSTITUTES

5.14.3 BARGAINING POWER OF SUPPLIERS

5.14.4 BARGAINING POWER OF BUYERS

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

5.15 REGULATORY IMPLICATIONS

5.15.1 INTRODUCTION

5.15.2 SARBANES-OXLEY ACT OF 2002

5.15.3 GENERAL DATA PROTECTION REGULATION

5.15.4 BASEL

6 PRODUCT ANALYTICS MARKET, BY COMPONENT (Page No. - 81)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID-19 IMPACT

FIGURE 37 THE SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 13 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOLUTIONS

6.2.1 GROWING ADOPTION BY ENTERPRISE AND WITH ADVANCEMENTS IN PRODUCT ANALYTICS SOLUTIONS BOOST THE GROWTH RATE OF SOLUTIONS

TABLE 14 PRODUCT ANALYTICS SOLUTIONS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 15 PRODUCT ANALYTICS SOLUTIONS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 38 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 16 PRODUCT ANALYTICS SERVICES MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 17 PRODUCT ANALYTICS SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 PRODUCT ANALYTICS MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 19 MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 Growing requirement for customized solutions to boost the professional services industry

TABLE 20 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 21 PROFESSIONAL SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 Customers with ongoing demands and alterations in the solutions to support managed services

TABLE 22 MANAGED SERVICES MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 23 MANAGED SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 PRODUCT ANALYTICS MARKET, BY DEPLOYMENT MODE (Page No. - 89)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODES: COVID-19 IMPACT

FIGURE 39 CLOUD SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 24 MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 25 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

7.2 CLOUD

7.2.1 REDUCED OPERATIONAL COST AND HIGHER SCALABILITY TO ENABLE GROWTH IN CLOUD-BASED DEPLOYMENTS

TABLE 26 CLOUD: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 27 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 ON-PREMISES

7.3.1 WITH THE GROWING THREAT OF DATA THEFTS, SOME ORGANIZATIONS PREFER PRODUCT ANALYTICS SOLUTIONS TO REMAIN ON-PREMISES

TABLE 28 ON-PREMISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 29 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 PRODUCT ANALYTICS MARKET, BY ORGANIZATION SIZE (Page No. - 94)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 40 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 30 MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 31 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 MANUFACTURING AND AUTOMOTIVE VERTICALS TO DRIVE THE ADOPTION OF PRODUCT ANALYTICS SOLUTIONS ACROSS LARGE ENTERPRISES

TABLE 32 LARGE ENTERPRISES MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 33 LARGE ENTERPRISES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 ROBUST CLOUD-BASED DEPLOYMENTS TO LEAD SMALL AND MEDIUM-SIZED ENTERPRISES TO RECORD A HIGHER GROWTH RATE

TABLE 34 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 35 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 PRODUCT ANALYTICS MARKET, BY MODE (Page No. - 99)

9.1 INTRODUCTION

9.1.1 MODES: COVID-19 IMPACT

FIGURE 41 ANALYZING DATA SEGMENT TO RECORD A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

TABLE 36 MARKET SIZE, BY MODE, 2015–2020 (USD MILLION)

TABLE 37 MARKET SIZE, BY MODE, 2021–2026 (USD MILLION)

9.2 TRACKING DATA

9.2.1 RISING NEED FOR DETAILED INFORMATION AND TRACKING METRICS LED TO THE RAPID ADOPTION OF DATA TRACKING

TABLE 38 TRACKING DATA: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 39 TRACKING DATA: MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 ANALYZING DATA

9.3.1 RISING NEED FOR DATA ANALYSIS OWING TO BUSINESS INTELLIGENCE AND PRODUCT USAGE

TABLE 40 ANALYZING DATA: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 41 ANALYZING DATA: MARKET, BY REGION, 2021–2026 (USD MILLION)

10 PRODUCT ANALYTICS MARKET, BY END USER (Page No. - 104)

10.1 INTRODUCTION

10.1.1 END USER: COVID-19 IMPACT

FIGURE 42 DESIGNERS SEGMENT TO RECORD THE HIGHEST GROWTH RATE IN DEPLOYING PRODUCT ANALYTICS SOLUTIONS

TABLE 42 MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 43 MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

10.2 DESIGNERS

10.2.1 DESIGNERS TO RELY MORE ON PRODUCT ANALYTICS SOLUTIONS FOR OFFERING ENHANCED USER EXPERIENCE

TABLE 44 DESIGNERS IN MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 45 DESIGNERS IN MARKET, BY REGION, 2021–2026 (USD MILLION)

10.3 MANUFACTURERS

10.3.1 MANUFACTURERS RELY ON PRODUCT ANALYTICS SOLUTIONS TO ENABLE COST-EFFECTIVE PRODUCTION PLANS AND BOOST INNOVATION

TABLE 46 MANUFACTURERS: MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 47 MANUFACTURERS: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.4 SALES AND MARKETING PROFESSIONALS

10.4.1 ADVENT OF DIGITALIZATION ACROSS ALL VERTICALS TO BOOST THE DEPLOYMENT AND PERFORMANCE OF PRODUCT ANALYTICS SOLUTIONS IN SALES AND MARKETING PROFESSIONALS

TABLE 48 SALES AND MARKETING PROFESSIONALS: PRODUCT ANALYTICS MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 49 SALES AND MARKETING PROFESSIONALS: MARKET, BY REGION, 2021–2026 (USD MILLION)

10.5 CONSUMER ENGAGEMENT

10.5.1 INCREASING DEMAND FOR ENHANCED USER EXPERIENCE AND INSIGHTS TO DRIVE THE GROWTH OF THE MARKET BY CONSUMER ENGAGEMENT BUSINESSES

TABLE 50 CONSUMER ENGAGEMENT IN MARKET, BY REGION, 2015–2020 (USD MILLION)

TABLE 51 CONSUMER ENGAGEMENT IN MARKET, BY REGION, 2021–2026 (USD MILLION)

11 PRODUCT ANALYTICS MARKET, BY VERTICAL (Page No. - 111)

11.1 INTRODUCTION

11.1.1 VERTICALS: COVID-19 IMPACT

11.1.2 PRODUCT ANALYTICS: ENTERPRISE USE CASES

FIGURE 43 HEALTHCARE AND PHARMACEUTICALS VERTICAL TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 52 MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 53 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE

11.2.1 TO IMPROVE BUSINESS PERFORMANCE, REDUCE COST, AND CHURN WITH THE HELP OF PRODUCT ANALYTICS SOLUTIONS

TABLE 54 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 55 BANKING, FINANCIAL SERVICES AND INSURANCE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 RETAIL AND CONSUMER GOODS

11.3.1 ADOPTION OF PRODUCT ANALYTICS SOLUTIONS TO BOOST BUSINESS DECISION PERFORMANCE AND PROFIT MARGINS

TABLE 56 RETAIL AND CONSUMER GOODS: PRODUCT ANALYTICS MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 57 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4 IT AND TELECOM

11.4.1 USAGE OF SMARTPHONES, COMPLEXITY IN TELECOM INDUSTRY, AND INCREASING SERVICE PROVIDERS MAKING A RAPID GROWTH FOR MARKET

TABLE 58 IT AND TELECOM: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 59 IT AND TELECOM: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.5 AUTOMOTIVE

11.5.1 ADOPTION OF PRODUCT ANALYTICS SOLUTIONS FOR DATA-DRIVEN STRATEGIES, CUTTING COSTS, AVOID RISKS, AND DRIVE REVENUE

TABLE 60 AUTOMOTIVE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 61 AUTOMOTIVE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.6 MEDIA AND ENTERTAINMENT

11.6.1 RISING CONTENT CONSUMPTION AND DIGITAL ENTERTAINMENT ADOPTION IS GENERATING DEMAND FOR PRODUCT ANALYTICS

TABLE 62 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 63 MEDIA AND ENTERTAINMENT: PRODUCT ANALYTICS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.7 MANUFACTURING

11.7.1 ADOPTION OF PRODUCT ANALYTICS TO BOOST PERFORMANCE AND IMPROVE DECISION-MAKING

TABLE 64 MANUFACTURING: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 65 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.8 HEALTHCARE AND PHARMACEUTICALS

11.8.1 REAL-TIME DECISION-MAKING TO PROVIDE NEW INNOVATIVE SOLUTIONS AND DELIVER PROPER INSIGHTS FOR PATIENTS LED TO A RISING NEED FOR PRODUCT ANALYTICS SOLUTIONS

TABLE 66 HEALTHCARE AND PHARMACEUTICALS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 67 HEALTHCARE AND PHARMACEUTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.9 ENERGY AND UTILITIES

11.9.1 GROWING DEMAND FOR INTELLIGENT PRODUCTION, DISTRIBUTION, AND CONSUMPTION OF ENERGY AND UTILITIES LED TO THE GROWTH OF PRODUCT ANALYTICS SOLUTIONS IN THIS VERTICAL

TABLE 68 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 69 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.10 OTHER VERTICALS

TABLE 70 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 71 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 PRODUCT ANALYTICS MARKET, BY REGION (Page No. - 126)

12.1 INTRODUCTION

FIGURE 44 CHINA TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 45 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 72 MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 73 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: PRODUCT ANALYTICS MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

12.2.3 NORTH AMERICA: REGULATIONS

12.2.3.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

12.2.3.2 Gramm–Leach–Bliley Act

12.2.3.3 Health Insurance Portability and Accountability Act of 1996

12.2.3.4 Federal Information Security Management Act

12.2.3.5 Federal Information Processing Standards

12.2.3.6 California Consumer Privacy Act

FIGURE 46 NORTH AMERICA: MARKET SNAPSHOT

TABLE 74 NORTH AMERICA: PRODUCT ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY MODE, 2015–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY MODE, 2021–2026 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.4 UNITED STATES

12.2.4.1 Rapid adoption and use of digitally innovative solutions, the presence of tech-giants, and the growth of social media platforms to drive the product analytics market growth

12.2.5 CANADA

12.2.5.1 Startup ecosystem and the growth in the need for real-time decision-making to drive the growth of product analytics solutions in Canada

12.3 EUROPE

12.3.1 EUROPE: MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

12.3.3 EUROPE: REGULATIONS

12.3.3.1 General Data Protection Regulation

12.3.3.2 European Committee for Standardization

TABLE 90 EUROPE: PRODUCT ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 94 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 95 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 96 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 97 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 98 EUROPE: MARKET SIZE, BY MODE, 2015–2020 (USD MILLION)

TABLE 99 EUROPE: MARKET SIZE, BY MODE, 2021–2026 (USD MILLION)

TABLE 100 EUROPE: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 101 EUROPE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 102 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 103 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.4 UNITED KINGDOM

12.3.4.1 Advanced IT infrastructure and skilled workforce to drive the growth of product analytics solutions in the UK

12.3.5 GERMANY

12.3.5.1 Government initiatives for technological developments in the manufacturing vertical to drive the growth of product analytics solutions in Germany

12.3.6 FRANCE

12.3.6.1 Heavy R&D investments, digitalization and strong hold of retail, aerospace and defense, and manufacturing verticals to drive the growth of the product analytics market in France

12.3.7 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

12.4.3 ASIA PACIFIC: REGULATIONS

12.4.3.1 Personal Data Protection Act

12.4.3.2 International Organization for Standardization 27001

FIGURE 47 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: PRODUCT ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY MODE, 2015–2020 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY MODE, 2021–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.4 CHINA

12.4.4.1 Exponential growth of internet penetration and eCommerce players to drive the growth of product analytics solutions in China

12.4.5 JAPAN

12.4.5.1 Rise of innovative technologies and collaboration between governments and businesses for digital transformation in Japan

12.4.6 SOUTH KOREA

12.4.6.1 Heavy investments in R&D for innovative technologies by the government in South Korea led to the growth of the product analytics solutions

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: PRODUCT ANALYTICS MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

12.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

12.5.3.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

12.5.3.2 GDPR Applicability in KSA

12.5.3.3 Protection of Personal Information Act

TABLE 122 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: PRODUCT ANALYTICS MARKET SIZE, BY MODE, 2015–2020 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET SIZE, BY MODE, 2021–2026 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.5.4 MIDDLE EAST

12.5.4.1 Shift of countries in the Middle East toward digital innovations drives the adoption of product analytics solutions in the region

12.5.5 AFRICA

12.5.5.1 Growing digitalization in African countries to offer opportunities for deploying product analytics solutions in Africa

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: PRODUCT ANALYTICS MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

12.6.3 LATIN AMERICA: REGULATIONS

12.6.3.1 Brazil Data Protection Law

12.6.3.2 Argentina Personal Data Protection Law No. 25.326

TABLE 138 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 140 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 141 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 142 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

TABLE 143 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 144 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 146 LATIN AMERICA: PRODUCT ANALYTICS MARKET SIZE, BY MODE, 2015–2020 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET SIZE, BY MODE, 2021–2026 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET SIZE, BY END USER, 2015–2020 (USD MILLION)

TABLE 149 LATIN AMERICA: PRODUCT ANALYTICS MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.6.4 BRAZIL

12.6.4.1 Increased use of data center services in industries such as media and entertainment, banking and financial services, and government organizations to increase the demand in Brazil

12.6.5 MEXICO

12.6.5.1 SMEs adopt digital analytics platforms to streamline business processes, enhance product offerings, fulfill customer demands, and improve the overall enterprise performance

12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 170)

13.1 OVERVIEW

13.2 REVENUE ANALYSIS

FIGURE 48 REVENUE ANALYSIS FOR KEY COMPANIES IN THE PAST FIVE YEARS

13.3 MARKET SHARE ANALYSIS

FIGURE 49 PRODUCT ANALYTICS MARKET: MARKET SHARE ANALYSIS

TABLE 154 MARKET: DEGREE OF COMPETITION

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STARS

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE PLAYERS

13.4.4 PARTICIPANTS

FIGURE 50 KEY PRODUCT ANALYTICS MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

13.5 COMPETITIVE BENCHMARKING

TABLE 155 COMPANY PRODUCT FOOTPRINT

TABLE 156 COMPANY REGION FOOTPRINT

13.6 STARTUP/SME EVALUATION QUADRANT

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 51 STARTUP/SME PRODUCT ANALYTICS MARKET EVALUATION MATRIX, 2021

13.7 COMPETITIVE SCENARIO

13.7.1 PRODUCT LAUNCHES

TABLE 157 PRODUCT LAUNCHES, JANUARY 2018–MAY 2021

13.7.2 DEALS

TABLE 158 DEALS, JANUARY 2018– MAY 2021

13.7.3 OTHERS

TABLE 159 OTHERS, 2018–2021

14 COMPANY PROFILES (Page No. - 184)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business Overview, Solutions, Key Insights, Recent Developments, MnM View)*

14.2.1 IBM

TABLE 160 IBM: BUSINESS OVERVIEW

FIGURE 52 IBM: FINANCIAL OVERVIEW

TABLE 161 IBM: SOLUTIONS OFFERED

TABLE 162 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 163 IBM: DEALS

14.2.2 ORACLE

TABLE 164 ORACLE: BUSINESS OVERVIEW

FIGURE 53 ORACLE: FINANCIAL OVERVIEW

TABLE 165 ORACLE: SOLUTIONS OFFERED

TABLE 166 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 167 ORACLE: DEALS

14.2.3 GOOGLE

TABLE 168 GOOGLE: BUSINESS AND FINANCIAL OVERVIEW

FIGURE 54 GOOGLE: FINANCIAL OVERVIEW

TABLE 169 GOOGLE: SOLUTION OFFERED

TABLE 170 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 171 GOOGLE: DEALS

14.2.4 SALESFORCE

TABLE 172 SALESFORCE: BUSINESS OVERVIEW

FIGURE 55 SALESFORCE: FINANCIAL OVERVIEW

TABLE 173 SALESFORCE: SOLUTIONS OFFERED

TABLE 174 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 175 SALESFORCE: DEALS

14.2.5 ADOBE

TABLE 176 ADOBE: BUSINESS OVERVIEW

FIGURE 56 ADOBE: FINANCIAL OVERVIEW

TABLE 177 ADOBE: SOLUTION OFFERED

TABLE 178 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 179 ADOBE: DEALS

14.2.6 VERITONE

TABLE 180 VERITONE: BUSINESS OVERVIEW

FIGURE 57 VERITONE: FINANCIAL OVERVIEW

TABLE 181 VERITONE: SOLUTION OFFERED

TABLE 182 VERITONE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 183 VERITONE: DEALS

14.2.7 MEDALLIA

TABLE 184 MEDALLIA: BUSINESS OVERVIEW

FIGURE 58 MEDALLIA: FINANCIAL OVERVIEW

TABLE 185 MEDALLIA: SOLUTIONS OFFERED

TABLE 186 MEDALLIA: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 187 MEDALLIA: DEALS

14.2.8 AMPLITUDE

TABLE 188 AMPLITUDE: BUSINESS OVERVIEW

TABLE 189 AMPLITUDE: SOLUTIONS OFFERED

TABLE 190 AMPLITUDE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 AMPLITUDE: DEALS

TABLE 192 AMPLITUDE: OTHERS

14.2.9 PENDO

TABLE 193 PENDO: BUSINESS OVERVIEW

TABLE 194 PENDO: SOLUTIONS OFFERED

TABLE 195 PENDO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 196 PENDO: DEALS

TABLE 197 PENDO: OTHERS

14.2.10 GAINSIGHT

TABLE 198 GAINSIGHT: BUSINESS OVERVIEW

TABLE 199 GAINSIGHT: SOLUTIONS OFFERED

TABLE 200 GAINSIGHT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 201 GAINSIGHT: DEALS

14.2.11 HEAP

TABLE 202 HEAP: BUSINESS OVERVIEW

TABLE 203 HEAP: SOLUTIONS OFFERED

TABLE 204 HEAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 205 HEAP: DEALS

TABLE 206 HEAP: OTHERS

14.2.12 MIXPANEL

TABLE 207 MIXPANEL: BUSINESS OVERVIEW

TABLE 208 MIXPANEL: SOLUTIONS OFFERED

TABLE 209 MIXPANEL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 210 MIXPANEL: DEALS

TABLE 211 MIXPANEL: OTHERS

14.2.13 COPPER

TABLE 212 COPPER: BUSINESS OVERVIEW

TABLE 213 COPPER: SOLUTIONS OFFERED

TABLE 214 COPPER: DEALS

TABLE 215 COPPER: OTHERS

14.2.14 USERIQ

TABLE 216 USERIQ: BUSINESS OVERVIEW

TABLE 217 USERIQ: SOLUTIONS OFFERED

TABLE 218 USERIQ: DEALS

TABLE 219 USERIQ: OTHERS

14.2.15 LATENTVIEW ANALYTICS

TABLE 220 LATENTVIEW ANALYTICS: BUSINESS OVERVIEW

TABLE 221 LATENTVIEW ANALYTICS: SOLUTIONS OFFERED

TABLE 222 LATENTVIEW ANALYTICS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 223 LATENTVIEW ANALYTICS: DEALS

14.2.16 COUNTLY

14.2.17 PLYTIX

14.2.18 RISKEDGE SOLUTIONS

14.2.19 KISSMETRICS

14.2.20 WOOPRA

14.2.21 PIWIK PRO

*Details on Business Overview, Solutions, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

14.3 START-UP/SME PROFILES

14.3.1 SMARTLOOK

14.3.2 LOGROCKET

14.3.3 AURYC

14.3.4 QUANTUM METRIC

14.3.5 CUX.IO

14.3.6 INNERTRENDS

14.3.7 GROWTHSIMPLE

14.3.8 OMNIPANEL

14.3.9 PRODUCTLIFT

14.3.10 REFINER

15 ADJACENT AND RELATED MARKETS (Page No. - 253)

15.1 INTRODUCTION

15.2 CUSTOMER JOURNEY ANALYTICS MARKET— GLOBAL FORECAST TO 2026

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.2.1 Customer journey analytics market, by component

TABLE 224 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 225 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 226 SERVICES: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 227 SERVICES: CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

15.2.2.2 Customer journey analytics market, by application

TABLE 228 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 229 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

15.2.2.3 Customer journey analytics market, by deployment mode

TABLE 230 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 231 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

15.2.2.4 Customer journey analytics market, by organization size

TABLE 232 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015–2019 (USD MILLION)

TABLE 233 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

15.2.2.5 Customer journey analytics market, by industry vertical

TABLE 234 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 235 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

15.2.2.6 Customer journey analytics market, by region

TABLE 236 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 237 CUSTOMER JOURNEY ANALYTICS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

15.3 MOBILE APPS AND WEB ANALYTICS MARKET - GLOBAL FORECAST TO 2025

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.2.1 Mobile apps and web analytics market, by component

TABLE 238 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 239 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

15.3.2.2 Mobile apps and web analytics market, by application

TABLE 240 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 241 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

15.3.2.3 Mobile apps and web analytics market, by deployment mode

TABLE 242 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 243 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

15.3.2.4 Mobile apps and web analytics market, by organization size

TABLE 244 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 245 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.3.2.5 Mobile apps and web analytics market, by industry vertical

TABLE 246 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 247 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

15.3.2.6 Mobile apps and web analytics market, by region

TABLE 248 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 249 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

16 APPENDIX (Page No. - 267)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of the product analytics market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the product analytics market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

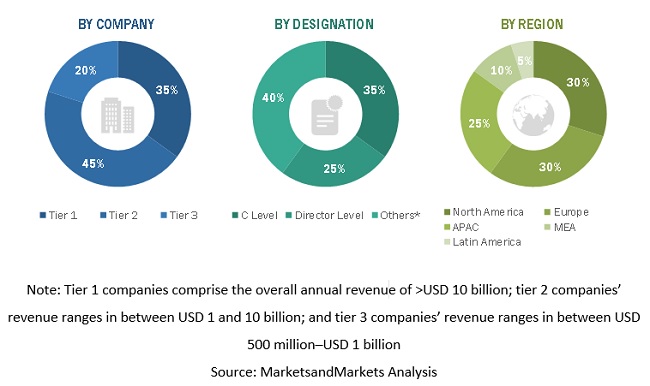

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the product analytics market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from Product analytics solution vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Product analytics market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the market. The bottom-up approach was used to arrive at the overall market size of the global Product analytics market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the product analytics market by component (solutions and services), mode, organization size, deployment mode, end user, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the product analytics market

- To analyze the impact of the COVID-19 pandemic on the product analytics market

COVID-19 impact

COVID-19’s global impact has shown that interconnectedness plays an important role in international cooperation. As a result, several governments started rushing toward identifying, evaluating, and procuring reliable solutions powered by AI. Advanced analytics and AI are invaluable to organizations managing uncertainty in real-time, but most predictive models rely on historical patterns. The use of advanced analytics and AI has accelerated in the COVID-19 pandemic period. This has helped organizations engage customers through digital channels, manage fragile and complex supply chains, and support workers through disruption to their work and lives. At the same time, leaders have identified a major weakness in their analytics strategy: the reliance on historical data for algorithmic models. From customer behavior to supply and demand patterns, historical patterns, and the assumption of continuity are empowering the predictive models. Technology and service providers have been facing significant disruption to their businesses from COVID-19. It has become important for product managers to evaluate the critical ways in which the pandemic affects their teams so they can mitigate the negative effects and plan for recovery. Product managers serve at the intersection of different functions. They glue together product, engineering, and design. However, as the COVID-19 has been changing the product landscape, these relationships have gone remote and that is not the only problem teams are tackling. As many of the world’s major economies work to address the second wave of COVID-19, it would be an appropriate time to look at how the pandemic has changed product management. Hence, the COVID-19 pandemic has disrupted the global financial markets and has created panic, uncertainty, and distraction in the operations of global corporations.

Available customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American Product analytics market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Product Analytics Market