Protective Clothing Market

Protective Clothing Market by Material Type (Aramid & Blends, Polyolefin & Blends), Application (Thermal, Chemical), End-User Type (Personal, Industrial), End-Use Industry (Construction, Manufacturing, Oil & Gas, and Mining) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

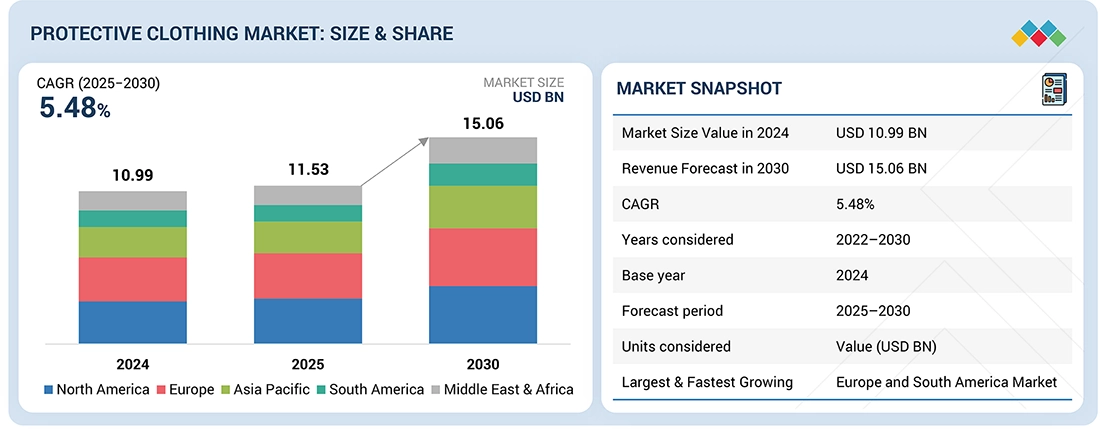

The protective clothing market is projected to reach USD 15.06 billion by 2030 from USD 11.53 billion in 2025, at a CAGR of 5.48% from 2025 to 2030. Protective clothing consists of specialized garments and accessories engineered to protect workers from a wide range of hazards, including fire, extreme heat, chemicals, biological contaminants, and mechanical impacts. It plays a crucial role in industries such as oil & gas, construction, manufacturing, healthcare, and defense, where exposure to hazardous environments is routine. The market’s expansion is strongly driven by increasingly stringent workplace safety regulations, a growing emphasis on worker well-being, and rising industrialization across both developed and emerging economies.

KEY TAKEAWAYS

-

BY MATERIAL TYPEBased on material type, the aramid & blends segment dominated the global protective clothing market in 2024.

-

BY APPLICATIONThe biological/radiation segment is projected to be the fastest-growing application of the protective clothing market with a CAGR of 7.30% during the forecast period.

-

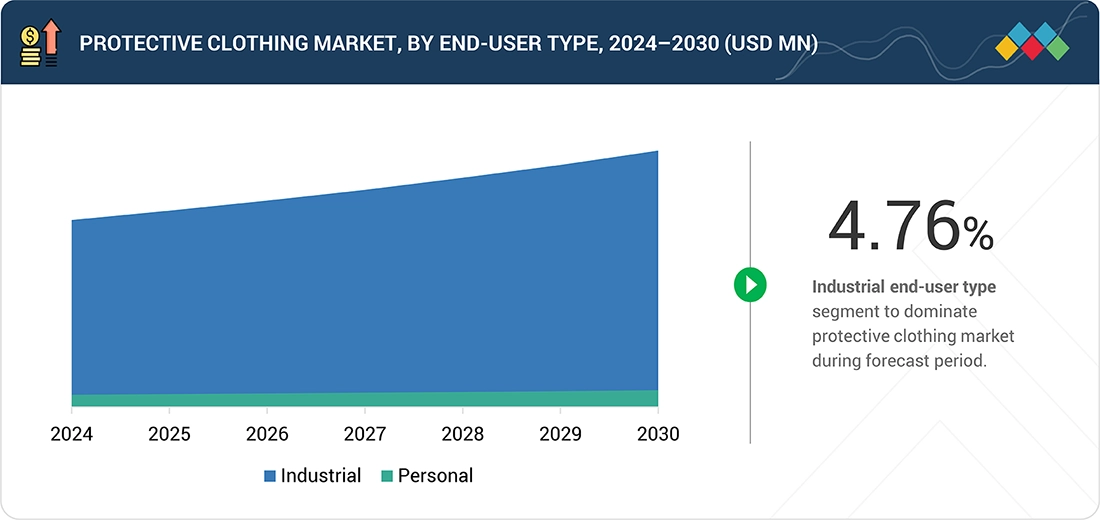

BY END-USER TYPEBased on end-user type, the industrial segment accounted for the largest share of the protective clothing market in 2024.

-

BY END-USE INDUSTRYThe oil & gas industry is projected to grow at the highest CAGR of 6.42% between 2025 and 2030.

-

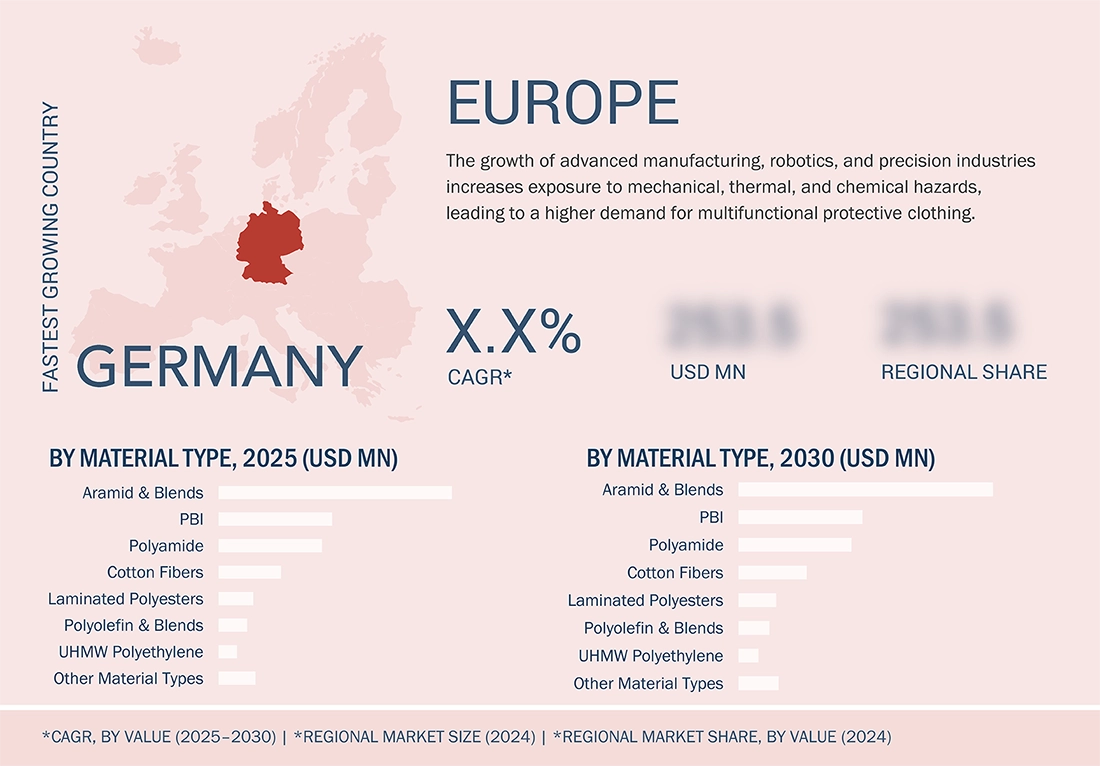

BY REGIONEurope accounted for the largest share of 28.7%, in terms of value, of the global protective clothing market, in 2024

-

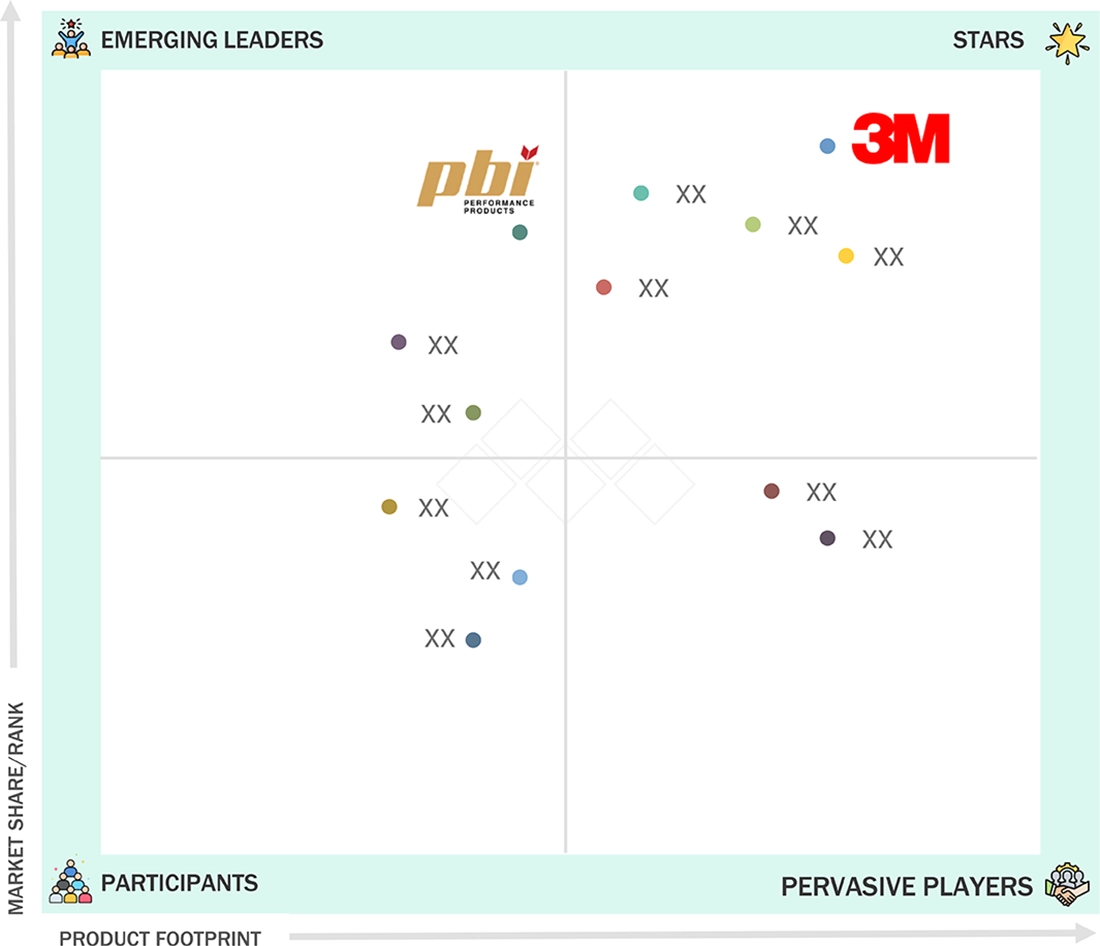

COMPETITIVE LANDSCAPE - KEY PLAYERSCompanies such as 3M Company , DuPont de Nemours, Inc., Ansell Limited, Lakeland Industries, Inc., and TEIJIN LIMITED , were identified as key players in the global protective clothing market, supported by their strong market presence and extensive product portfolios.

-

COMPETITIVE LANDSCAPE - STARTUPSCompanies like Logistik Unicorp Inc., MALLCOM INDIA LIMITED, and Klein Tools, Inc., among other emerging players have carved out solid positions within specialized niche segments, highlighting their potential to evolve into future market leaders.

The protective clothing market is set for sustained growth over the coming years, fueled by the rising industrial safety awareness, regulatory enforcement, and ongoing technological innovation. Increasing automation in manufacturing and expanding industrial bases across emerging economies are creating continuous demand for advanced protective gear. The integration of smart fabrics capable of monitoring physiological parameters, coupled with the industry’s shift toward recyclable and eco-friendly materials, is reshaping the market landscape. As industries prioritize worker safety and sustainability, protective clothing will continue to evolve from a regulatory necessity to a strategic asset that enhances operational efficiency, workforce protection, and brand responsibility worldwide.

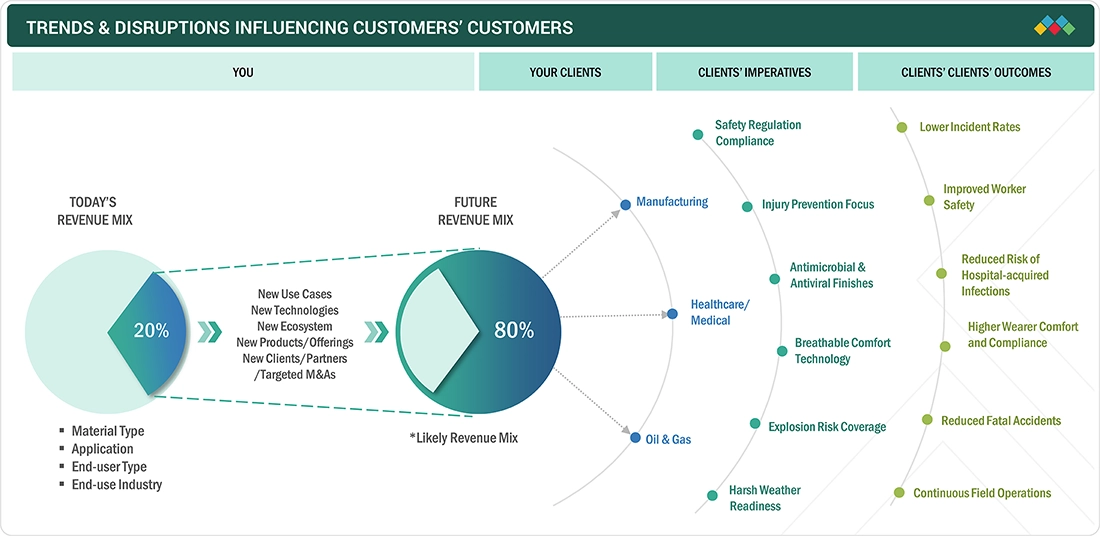

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business in the protective clothing market stems from evolving safety standards and operational demands across major end-use industries such as manufacturing, healthcare, and oil & gas. In manufacturing, automation and stricter workplace safety mandates are driving the need for advanced, durable, and comfortable protective garments. In healthcare, heightened hygiene protocols and infection control requirements continue to influence the adoption of disposable and antimicrobial clothing. Within oil & gas, increased focus on worker safety in high-risk environments is fueling demand for flame-resistant and chemical-protective apparel. These evolving needs directly affect end-user expenditure on safety equipment, thereby shaping the revenue performance of protective clothing manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Workplace safety concerns

-

Rising industrial hazards to fuel demand

Level

-

Regulatory compliance adds complexity

-

High costs of specialized protective clothing

Level

-

Rising demand from emerging economies

-

Eco-friendly protective clothing solutions

Level

-

Customization demands outpace standard production

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Strengthening Global Safety Mandates for Industrial Workforces

The protective clothing market continues to be propelled by strict workplace safety guidelines imposed on companies, nationally and internationally, to reduce occupational risks. Regulatory authorities, such as the United States Occupational Safety and Health Administration (OSHA), the European Agency for Safety and Health at Work (EU-OSHA), and the International Labour Organization (ILO) impose standards for personal safety clothing to protect workers from hazards like heat, chemicals, biological hazards, and mechanical forces. For example, OSHA's 29 CFR 1910 Subpart I (General Industry Standards) is very specific in the needs of employers when providing protective clothing within the manufacturing and construction standards. This is similar to the European Regulation (EU) 2016/425 (General Product Safety), which outlines protective clothing regulations deliberately linking classifications of protection levels and testing protocols. In other exploration industries like oil and gas must have flame resistance and arc rated clothing adhere to respective API and NFPA standards due to the risk of fire and arc light in the workplaces.

Premium Material Expenses Limiting Market Penetration

Advanced protective clothing materials, including aramid fibers, polybenzimidazole (PBI), carbon-based fabrics, and multilayer laminates, increase production costs tremendously. These materials are designed to fend off heat, chemicals, mechanical abrasion, and other potential hazards while on the job, but the complexity of their production methods and sourcing requirements raise the garment's price at the consumer level. Aramid fibers need intricate techniques for spinning and weaving. PBI requires complex polymer chemistry and high-temperature processing to make, all adding to the cost at the unit level. The cost issue is further complicated by the volatility of raw materials, especially when petroleum-based polymers are part of the product line. Manufacturers must also build-in greater labor and business costs when they add smart textiles or breathable membranes, which are important for individual comfort, while maintaining protection.

Accelerating Shift Towards Green and Circular Textile Solutions

The transition towards sustainability in the protective clothing business is clearly accelerating as industries place a greater emphasis on reducing their environmental impact while providing safety to their workers. Manufacturers seeking to develop protective garments are increasingly making use of bio-based fibers with recycled polyester and organic cotton to achieve the apparently impossible relationship between safety and environmental performance. Advances in textile engineering are now allowing the transformation of recycled PET bottles into durable flame-retardant fabrics for industrial applications. The development of biodegradable coatings for water and oil repellency is yet another development replacing harmful PFAS-based treatments taking their toll environmentally.

Surge in Demand for Tailored Protective Apparel

The protective clothing industry is witnessing rising pressure to deliver customized solutions that meet specific safety, comfort, and regulatory needs across diverse sectors. However, standard mass production systems are not equipped to handle such varied requirements efficiently. Manufacturers face challenges in adapting materials, designs, and production timelines while maintaining cost-effectiveness. This growing demand for personalization over uniformity is straining supply capabilities, resulting in slower turnaround times and reduced flexibility in meeting evolving industry expectations.

protective-clothing-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Flame-retardant and chemical-resistant protective clothing for refinery and maintenance workers | Provides superior protection from flash fires and chemical splashes, ensures comfort during long shifts, and supports safety compliance |

|

Arc-flash protective suits for technicians in high-voltage equipment maintenance | Reduces burn risk from electrical arcs, enhances mobility and comfort, and maintains durability under frequent use |

|

Antimicrobial and fluid-resistant protective gowns for healthcare and laboratory personnel | Prevents cross-contamination, provides superior barrier against fluids and pathogens, and supports hygiene and regulatory safety standards |

|

High-visibility and cut-resistant workwear for infrastructure and heavy engineering projects | Improves worker visibility in complex sites, resists wear and tear from sharp tools and materials, and enhances safety compliance and comfort |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The protective clothing ecosystem involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, contractors, and end users. The raw material suppliers provide essential materials such as aramid fibers, polyethylene, and cotton fabrics to the protective clothing manufacturers. The manufacturers use advanced processes like weaving, coating, and lamination to produce garments with properties such as flame resistance, chemical protection, and cut resistance. The distributors and suppliers bridge the gap between manufacturers and end users, ensuring timely delivery, safety compliance, and efficient supply chain coordination across industries like manufacturing, healthcare, and oil & gas.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Protective Clothing Market, By Material Type

The aramid & blends segment dominated the protective clothing market owing to its exceptional resistance to heat, flames, and mechanical stress. These materials offer superior durability while maintaining comfort, making them ideal for high-risk applications in defense, industrial, and firefighting sectors. Manufacturers are increasingly blending aramid fibers with viscose, cotton, or modacrylic to enhance breathability and wearability in long working hours. The segment’s continued dominance is further reinforced by growing compliance requirements and the shift toward lightweight, flexible, and multi-functional protective apparel.

Protective Clothing Market, By Application

The thermal protection application segment accounted for the largest share, in 2024 due to the rising safety requirements in sectors such as metal fabrication, welding, and foundry operations. Continuous exposure to high-temperature environments has driven demand for garments that provide multi-layered insulation and advanced heat-resistant coatings. The integration of phase-change materials and thermal barrier fabrics ensures both protection and mobility. Growing emphasis on worker comfort, along with regulatory mandates for fire safety across industrial zones, continues to propel the adoption of thermal protective clothing.

Protective Clothing Market, By End-user Type

The industrial end-user segment dominated the market, driven by the growing prioritization of worker protection across sectors such as oil & gas, manufacturing, and utilities. Companies are increasingly implementing advanced safety management frameworks that mandate the use of high-performance protective gear for all on-site personnel. The rising frequency of industrial incidents and stricter global compliance standards have pushed employers to invest in next-generation protective clothing featuring enhanced ergonomics and breathability. Furthermore, the integration of smart textiles equipped with sensors to monitor temperature, fatigue, and exposure levels, is reshaping industrial safety, transforming protective wear into an active tool for real-time risk prevention.

Protective Clothing Market, By End-use Industry

The manufacturing end-use industry segment held the largest share of the protective clothing market, driven by the high risk of exposure to heat, sharp tools, chemicals, and machinery. Industrial workers require apparel that provides a balance of safety, comfort, and durability to handle continuous operational hazards. Increasing automation in production lines has heightened the need for antistatic and flame-retardant clothing to protect personnel and sensitive equipment. Moreover, sustainability initiatives within manufacturing facilities are boosting the demand for long-lasting, recyclable protective clothing materials, fueling growth.

REGION

Europe held the largest share in the global protective clothing market in 2024

Europe accounted for the largest regional share in the protective clothing market, supported by its robust regulatory framework, advanced textile innovation, and strong industrial base. Stringent EU worker safety directives, along with REACH and PPE compliance standards, continue to drive demand for high-performance, sustainable protective apparel. European manufacturers are leading the shift toward eco-friendly fibers, circular textile production, and recyclable coatings. Countries such as Germany, France, and Italy are at the forefront, emphasizing safety, functionality, and environmental responsibility in protective clothing design and manufacturing.

protective-clothing-market: COMPANY EVALUATION MATRIX

In the protective clothing market matrix, 3M Company led the market with its robust global presence and an extensive product portfolio, offering advanced protective solutions for industrial, healthcare, and oil & gas applications. Its continuous innovation in lightweight, breathable, and high-performance materials reinforces its dominance in safety and comfort. 3M’s strong focus on research and product integration with emerging technologies such as smart textiles and sustainable materials positions it ahead of competitors, maintaining its leadership in the protective clothing landscape.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- 3M Company (US)

- DuPont de Nemours, Inc. (US)

- Ansell Limited (Australia)

- Lakeland Industries, Inc. (US)

- TEIJIN LIMITED (Japan)

- Protective Industrial Products, Inc. (US)

- TenCate Protective Fabrics (Netherlands)

- PBI Performance Products, Inc. (US)

- Sioen Industries NV (Belgium)

- W. L. Gore & Associates, Inc. (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 10.99 Billion |

| Revenue Forecast in 2030 | USD 15.06 Billion |

| Growth Rate | CAGR of 5.48% from 2025-2030 |

| Actual data | 2022-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | Europe, North America, Asia Pacific, Middle East & Africa, and South America |

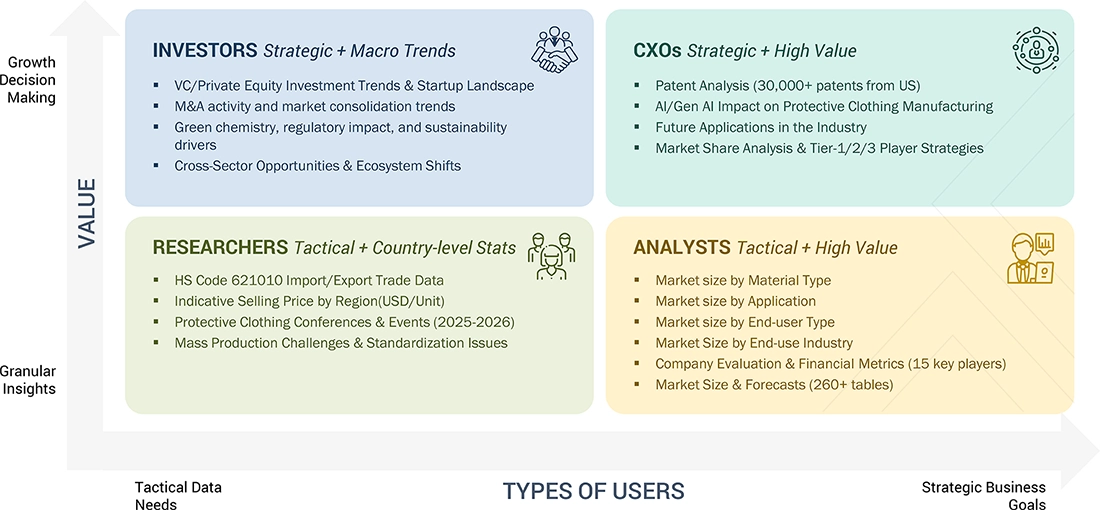

WHAT IS IN IT FOR YOU: protective-clothing-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Protective Clothing Manufacturer |

|

|

| Asia Pacific-based Protective Clothing Manufacturer |

|

|

RECENT DEVELOPMENTS

- December 2022 : Lakeland Industries Inc. acquired Eagle Technical Products. This acquisition enhances Lakeland's fire service protective clothing portfolio and expands its sales presence in the Middle East and Europe.

- June 2022 : DuPont de Nemours, Inc. launched a new, flame-resistant fabric with a bio-based chemical repellent finish that makes protective clothing more sustainable and helps optimize workers’ safety.

- March 2022 : Sioen Industries NV launched the Tormi and the Keibu flame retardant and anti-static protective clothing for female workers.

- Augus 2020 : DuPont de Nemours, Inc. announced a collaboration with Home Depot (US) to donate rolls of Tyvek 1222A (a type of protective clothing) to Kaiser Permanente to manufacture PPE products.

Table of Contents

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

-

6.1 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.2 SUPPLY CHAIN ANALYSISRAW MATERIALMANUFACTURING PROCESSDISTRIBUTIONEND-USER

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 CASE STUDIES

-

6.5 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONSREGULATORY FRAMEWORK

-

6.6 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Multi-layer Fabric Engineering- Membrane and Coating TechnologyCOMPLEMENTARY TECHNOLOGIES- Phase Change Materials (PCMs)ADJACENT TECHNOLOGIES- Advanced Surface Treatment & Coating Technologies

- 6.7 TRENDS DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

-

6.8 TRADE ANALYSISIMPORT DATAEXPORT DATA

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

-

6.10 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGION, 2022-2030AVERAGE SELLING PRICE OF END-USE INDUSTRY, BY KEY PLAYERS, 2024

- 6.11 INVESTMENT AND FUNDING SCENARIO

-

6.12 PATENT ANALYSISAPPROACHDOCUMENT TYPELEGAL STATUS OF THE PATENTSJURISDICTION ANALYSISTOP APPLICANTS

-

6.13 IMPACT OF 2025 US TARIFF – PROTECTIVE CLOTHING MARKETINTRODUCTIONKEY TARIFF RATESPRICE IMPACT ANALYSISIMPACT ON COUNTRY/REGION- US- Europe- Asia PacificIMPACT ON END-USE INDUSTRIES

- 6.14 IMPACT OF AI/GENAI ON PROTECTIVE CLOTHING MARKET

- 7.1 INTRODUCTION

- 7.2 ARAMID & BLENDS

- 7.3 POLYOLEFIN & BLENDS

- 7.4 POLYAMIDE

- 7.5 PBI

- 7.6 UHMW POLYETHYLENE

- 7.7 COTTON FIBRES

- 7.8 LAMINATED POLYESTERS

- 7.9 OTHER MATERIAL TYPES

- 8.1 INTRODUCTION

- 8.2 THERMAL

- 8.3 CHEMICAL

- 8.4 MECHANICAL

- 8.5 BIOLOGICAL/RADIATION

- 8.6 VISIBILITY

- 8.7 OTHER APPLICATIONS

- 9.1 INTRODUCTION

- 9.2 PERSONAL

- 9.3 INDUSTRIAL

- 10.1 INTRODUCTION

- 10.2 OIL & GAS

- 10.3 CONSTRUCTION

- 10.4 MANUFACTURING

- 10.5 HEALTH CARE/MEDICAL

- 10.6 FIREFIGHTING & LAW ENFORCEMENT

- 10.7 MINING

- 10.8 MILITARY

- 10.9 WAREHOUSE & LOGISTICS

- 10.10 OTHER END-USE INDUSTRIES

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICASIA PACIFIC PROTECTIVE CLOTHING MARKET, BY MATERIAL TYPEASIA PACIFIC PROTECTIVE CLOTHING MARKET, BY APPLICATIONASIA PACIFIC PROTECTIVE CLOTHING MARKET, BY END-USER TYPEASIA PACIFIC PROTECTIVE CLOTHING MARKET, BY END-USE INDUSTRYASIA PACIFIC PROTECTIVE CLOTHING MARKET, BY COUNTRY- China- Japan- India- South Korea- Australia- Rest of Asia Pacific

-

11.3 EUROPEEUROPE PROTECTIVE CLOTHING MARKET, BY MATERIAL TYPEEUROPE PROTECTIVE CLOTHING MARKET, BY APPLICATIONEUROPE PROTECTIVE CLOTHING MARKET, BY END-USER TYPEEUROPE PROTECTIVE CLOTHING MARKET, BY END-USE INDUSTRYEUROPE PROTECTIVE CLOTHING MARKET, BY COUNTRY- Germany- UK- France- Spain- Italy- Russia- Rest of Europe

-

11.4 NORTH AMERICANORTH AMERICA PROTECTIVE CLOTHING MARKET, BY MATERIAL TYPENORTH AMERICA PROTECTIVE CLOTHING MARKET, BY APPLICATIONNORTH AMERICA PROTECTIVE CLOTHING MARKET, BY END-USER TYPENORTH AMERICA PROTECTIVE CLOTHING MARKET, BY END-USE INDUSTRYNORTH AMERICA PROTECTIVE CLOTHING MARKET, BY COUNTRY- US- Canada- Mexico

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA PROTECTIVE CLOTHING MARKET, BY MATERIAL TYPEMIDDLE EAST & AFRICA PROTECTIVE CLOTHING MARKET, BY APPLICATIONMIDDLE EAST & AFRICA PROTECTIVE CLOTHING MARKET, BY END-USER TYPEMIDDLE EAST & AFRICA PROTECTIVE CLOTHING MARKET, BY END-USE INDUSTRYMIDDLE EAST & AFRICA PROTECTIVE CLOTHING MARKET, BY COUNTRY- GCC- Iraq- Rest Of Middle East & Africa

-

11.6 SOUTH AMERICASOUTH AMERICA PROTECTIVE CLOTHING MARKET, BY MATERIAL TYPESOUTH AMERICA PROTECTIVE CLOTHING MARKET, BY APPLICATIONSOUTH AMERICA PROTECTIVE CLOTHING MARKET, BY END-USER TYPESOUTH AMERICA PROTECTIVE CLOTHING MARKET, BY END-USE INDUSTRYSOUTH AMERICA PROTECTIVE CLOTHING MARKET, BY COUNTRY- Brazil- Rest Of South America

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/ RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS (2020-2024)

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

-

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- Company Footprint- Region Footprint- Material Type Footprint- Application Footprint- End-user Type Footprint- End-use Industry Footprint

-

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/ SMES, 2024- Detailed List of Key Start-ups/SMEs- Competitive Benchmarking of Key Start-ups/SMEs

-

12.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

-

13.1 MAJOR PLAYERS3M COMPANY- Business Overview- Products Offered- Recent Developments- MnM ViewDUPONT DE NEMOURS, INC.ANSELL LIMITEDLAKELAND INDUSTRIES, INC.TEIJIN LIMITEDPROTECTIVE INDUSTRIAL PRODUCTS, INC.TENCATE PROTECTIVE FABRICSPBI PERFORMANCE PRODUCTS, INC.SIOEN INDUSTRIES NVW. L. GORE & ASSOCIATES, INC.

- 13.2 STARTUPS/SMES

- 15.1 DISCUSSION GUIDE

- 15.2 RELATED REPORTS

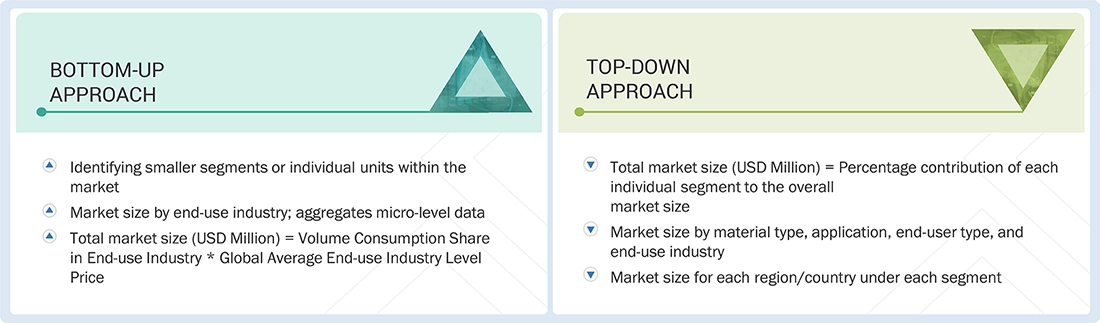

Methodology

The study involved four major activities in estimating the market size for protective clothing market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

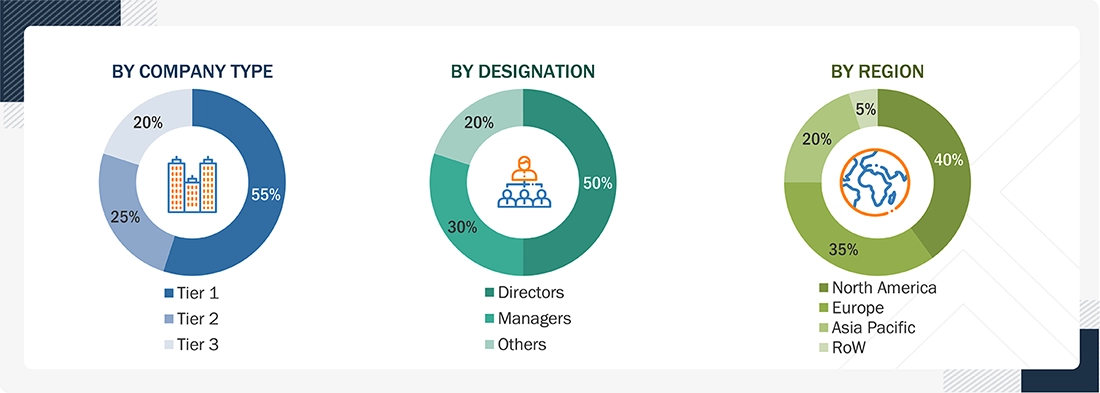

Primary Research

The protective clothing market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the protective clothing market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

3M Company |

Senior Manager |

|

DuPont de Nemours, Inc. |

Innovation Manager |

|

Ansell Limited |

Vice-President |

|

Lakeland Industries, Inc. |

Production Supervisor |

|

TEIJIN LIMITED |

Sales Manager |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the protective clothing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Protective Clothing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the protective clothing industry.

Market Definition

According to the International Safety Equipment Association, protective clothing is designed to shield the body from external hazards such as heat, chemicals, biological agents, and mechanical risks. This includes garments like aprons, coveralls, coats, pants, hoods, sleeves, gloves, and fully encapsulating chemical suits, all intended to protect the wearer from environmental dangers..

Key Stakeholders

- Manufacturers, Dealers, and Suppliers Manufacturers of protective clothing and their raw materials

- Manufacturers in various end-use industries

- Traders, distributors, and suppliers of protective clothing

- Regional manufacturers’ associations and protective clothing associations

- Government and regional agencies and research organizations

Report Objectives

- To analyze and forecast the protective clothing market in terms of value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To define, segment, and project the size of the global protective clothing market based on material type, application, end-user type, and end-use industry.

- To project the market size for six main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America, with their key countries

- To analyze the micromarkets1 concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze R&D and competitive developments such as expansions, product launches, collaborations, investments, partnerships, agreements, developments, collaborations, and mergers & acquisitions in the protective clothing market

Customization Options:

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Protective Clothing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Protective Clothing Market

Raj

Jul, 2022

General information on protective clothing market.