Protein Crystallization Market by Technology (NMR, X-Ray Crystallography), Product & Service (Instrument (Liquid Handling (Automated)), Consumable (Reagent, Microplate) End User, and Region - Global Forecast to 2025

Market Growth Outlook Summary

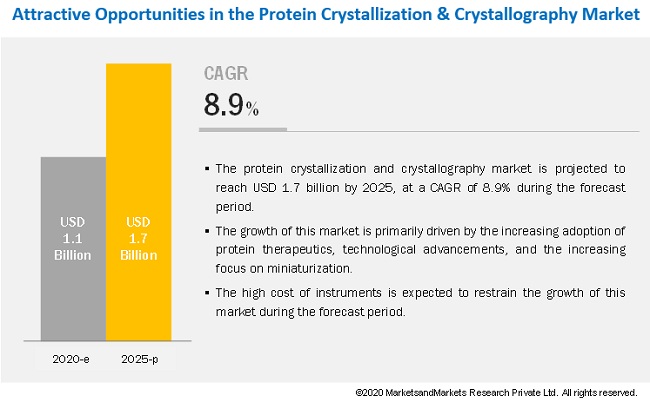

The global protein crystallization market growth forecasted to transform from $1.1 billion in 2020 to $1.7 billion by 2025, driven by a CAGR of 8.9%. The growth in this market is attributed to the increasing adoption of protein therapeutics, technological advancements in protein crystallization instruments and consumables, and the increasing focus on miniaturization. However, the high cost of instruments is expected to restrain the growth of this market during the forecast period.

By product and service, the consumables segment accounted for the largest share of the protein crystallization industry in 2019.

The consumables segment accounted for the largest share of the protein crystallization market in 2019. This can be attributed to the large number of reagent kits and microplates used in proteomics research. The consumables segment is further divided into reagents kits/screens, microplates, crystal mounts and loops, and other consumables.

By end user, the pharmaceutical companies segment accounted for the largest market share of the protein crystallization industry in 2019.

The pharmaceutical companies segment accounted for the largest share of the protein crystallization market in 2019. The large share of this segment can be attributed to the increasing demand for protein-based drugs.

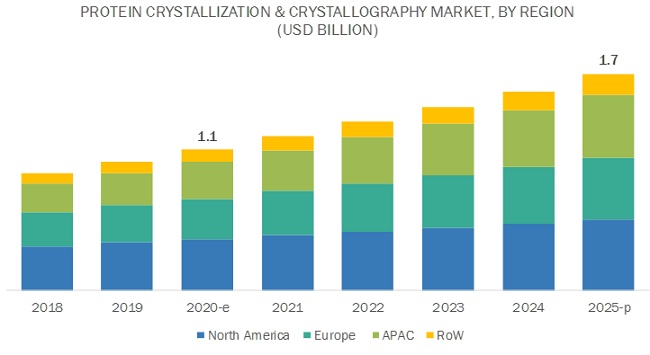

North America dominates the protein crystallization industry.

The protein crystallization market is divided into five major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW). In 2019, North America accounted for the largest share of the global protein crystallization and crystallography market, followed by Europe. The growth in this market can be attributed to the increasing investments in the development of structure-based drug designs, growing academic and government investments in genomics and proteomics research, and rising focus of stakeholders on research projects involving proteins.

The major companies in the protein crystallization market are Rigaku Corporation (Japan), Hampton Research (US), Jena Bioscience GmbH (Germany), and Bruker Corporation (US).

Rigaku Corporation (Japan) is the leading player in the global protein crystallization market. Due to its wide portfolio of protein crystallization instruments, software, and accessories, the company has a strong presence in the APAC and distribution networks and subsidiaries in Europe and the US. To maintain its leadership position, the company has adopted inorganic strategies such as partnerships with firms such as Merck to develop lab consumables based on the crystalline sponge technology.

Scope of the Protein Crystallization Industry:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$1.1 billion |

|

Estimated Value by 2025 |

$1.7 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 8.9% |

|

Market Driver |

Increasing demand for protein therapeutics |

|

Market Opportunity |

Emerging markets |

This report categorizes the global protein crystallization market to forecast revenue and analyze trends in each of the following submarkets:

By Technology

- X-ray Crystallography

- NMR Spectroscopy

- Cryo-electron Microscopy

- Small-angle X-ray Scattering (SAXS)

By Product and Service

-

Consumables

-

Microplates

- 96 well-plates

- 48-well plates

- 24-well plates

- Crystal Mounts and Loops

- Other Consumables

-

Microplates

- Reagents Kits/Screens

-

Instruments

-

Liquid Handling Instruments

- Automated

- Manual

- Crystal Imaging Instruments

-

Liquid Handling Instruments

- Software & Services

By End User

- Pharmaceutical Companies

- Research & Government Institutes

- Biotechnology Companies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

-

Asia Pacific

- China

- Japan

- India

- RoAPAC

- Latin America

- Middle East & Africa

Recent Developments of Protein Crystallization Industry

- In 2020, Calibre Scientific (US) acquired NeXtal Biotechnologies (Product Line of QIAGEN) (Netherlands) to strengthen its portfolio of structural biology solutions.

- In 2019, Charles River Laboratories (US) collaborated with CHDI Foundation (US) for the drug discovery and development of therapies for Huntington’s disease.

- In 2018, Bruker Corporation launched a new product, D8 DISCOVER Plus X-ray Diffraction (XRD).

Key questions addressed by the report:

- Who are the major players in the protein crystallization and crystallography market?

- What are the regional growth trends and the largest revenue-generating regions in the protein crystallization and crystallography market?

- What are the major drivers and challenges in the protein crystallization and crystallography market?

- What are the major technology segments in the protein crystallization and crystallography market?

- What are the major end users in the protein crystallization and crystallography market?

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global protein crystallization market?

The global protein crystallization market boasts a total revenue value of $1.7 billion by 2025.

What is the estimated growth rate (CAGR) of the global protein crystallization market?

The global protein crystallization market has an estimated compound annual growth rate (CAGR) of 8.9% and a revenue size in the region of $1.1 billion in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.2 MARKET DATA ESTIMATION & TRIANGULATION

2.2.1 DATA TRIANGULATION

2.2.2 MARKET ESTIMATION METHODOLOGY

2.3 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 PROTEIN CRYSTALLIZATION MARKET OVERVIEW

4.2 ASIA PACIFIC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET SHARE, BY END USER & COUNTRY (2019)

4.3 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY PRODUCT & SERVICE (2020–2025)

4.4 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET SHARE, BY TYPE, 2020 VS. 2025

4.5 PROTEIN CRYSTALLIZATION INDUSTRY, BY TECHNOLOGY, 2020 VS. 2025 (USD MILLION)

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 MARKET DRIVERS

5.2.1.1 Increasing demand for protein therapeutics

5.2.1.2 Technological advancements

5.2.1.3 Increasing focus on miniaturization

5.2.2 RESTRAINTS

5.2.2.1 High cost of instruments

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets

5.2.4 CHALLENGES

5.2.4.1 Dearth of skilled professionals

5.3 VALUE CHAIN ANALYSIS

5.3.1 RESEARCH

5.3.2 MANUFACTURING

5.3.3 MARKETING & SALES

5.4 TECHNOLOGY ANALYSIS

5.5 IMPACT OF THE COVID-19 OUTBREAK ON THE GROWTH OF THE PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET

6 PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY (Page No. - 41)

6.1 INTRODUCTION

6.2 X-RAY CRYSTALLOGRAPHY

6.2.1 NEED FOR HIGH-RESOLUTION INFORMATION ON PROTEIN STRUCTURES TO DRIVE MARKET GROWTH

6.3 NMR SPECTROSCOPY

6.3.1 NMR SPECTROSCOPY IS PREFERRED IN KINETIC AND DYNAMIC STUDIES

6.4 CRYO-ELECTRON MICROSCOPY

6.4.1 CRYO-ELECTRON MICROSCOPY SEGMENT TO WITNESS HIGH GROWTH IN THE PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET

6.5 SMALL-ANGLE X-RAY SCATTERING (SAXS)

6.5.1 SAXS OFFERS VERY HIGH-RESOLUTION DIFFRACTION IMAGES

7 PROTEIN CRYSTALLIZATION MARKET, BY PRODUCT & SERVICE (Page No. - 49)

7.1 INTRODUCTION

7.2 CONSUMABLES

7.2.1 MICROPLATES

7.2.1.1 96-well plates

7.2.1.1.1 96-well plates are commonly used in automated liquid handling systems

7.2.1.2 48-well plates

7.2.1.2.1 48-well plates are used for hanging drop vapor diffusion crystallization

7.2.1.3 24-well plates

7.2.1.3.1 24-well plates are commonly used in manual liquid handling systems in small laboratories

7.2.1.4 Other microplates

7.2.2 CRYSTAL MOUNTS & LOOPS

7.2.2.1 Crystal mounts and loops avoid cross-contamination and prevent damage to crystals

7.2.3 OTHER CONSUMABLES

7.3 REAGENT KITS/SCREENS

7.3.1 REAGENT KITS IMPROVE THE SENSITIVITY OF PROTEIN STRUCTURES

7.4 INSTRUMENTS

7.4.1 LIQUID HANDLING INSTRUMENTS

7.4.1.1 Automated liquid handling instruments

7.4.1.1.1 Rising preference for automated instruments to support market growth

7.4.1.2 Manual liquid handling instruments

7.4.1.2.1 Manual liquid handling instruments are commonly used in small laboratories

7.4.2 CRYSTAL IMAGING INSTRUMENTS

7.4.2.1 Crystal imaging instruments can differentiate between crystals of protein and salt

7.4.3 OTHER INSTRUMENTS

7.5 SOFTWARE & SERVICES

7.5.1 PROTEIN CRYSTALLIZATION SOFTWARE HELPS IN STREAMLINING THE ENTIRE WORKFLOW IN AUTOMATED LIQUID HANDLING INSTRUMENTS

8 PROTEIN CRYSTALLIZATION MARKET, BY END USER (Page No. - 61)

8.1 INTRODUCTION

8.2 PHARMACEUTICAL COMPANIES

8.2.1 GROWING DEMAND FOR PROTEIN THERAPEUTICS TO DRIVE MARKET GROWTH

8.3 RESEARCH & GOVERNMENT INSTITUTES

8.3.1 GROWING RESEARCH ACTIVITIES BETWEEN ACADEMIC RESEARCH INSTITUTES & PROTEIN DRUG MANUFACTURERS TO SUPPORT MARKET GROWTH

8.4 BIOTECHNOLOGY COMPANIES

8.4.1 INCREASING PRESSURE ON BIOTECHNOLOGY COMPANIES TO DEVELOP NOVEL RECOMBINANT PROTEIN-BASED DRUGS WILL SUPPORT MARKET GROWTH

9 PROTEIN CRYSTALLIZATION MARKET, BY REGION (Page No. - 68)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Government funding for research related to proteins to drive market growth

9.2.2 CANADA

9.2.2.1 Increasing R&D activities in research institutes and universities to drive market growth

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Germany is the largest market for protein crystallization & crystallography in Europe

9.3.2 UK

9.3.2.1 Increasing R&D investments to support market growth

9.3.3 FRANCE

9.3.3.1 Regulatory hurdles and inadequate skilled workforce are expected to restrain market growth in France

9.3.4 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.1.1 Increasing research studies in China to propel market growth

9.4.2 JAPAN

9.4.2.1 Initiatives taken by the Japanese government to support market growth in Japan

9.4.3 INDIA

9.4.3.1 Growing pharma and biotech industries to propel market growth in India

9.4.4 REST OF ASIA PACIFIC (ROAPAC)

9.5 LATIN AMERICA

9.5.1 INCREASING RESEARCH IN VARIOUS DISEASE AREAS WILL PROPEL MARKET GROWTH IN LATIN AMERICA

9.6 MIDDLE EAST & AFRICA

9.6.1 INFRASTRUCTURE DEVELOPMENTS ARE SUPPORTING THE GROWTH OF THE PROTEIN CRYSTALLIZATION INDUSTRY IN THE REGION

10 COMPETITIVE LANDSCAPE (Page No. - 105)

10.1 INTRODUCTION

10.2 MARKET RANKING ANALYSIS

10.3 MARKET EVALUATION FRAMEWORK

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 VISIONARY LEADERS

10.4.2 DYNAMIC DIFFERENTIATORS

10.4.3 INNOVATORS

10.4.4 EMERGING COMPANIES

10.5 COMPETITIVE SCENARIO

10.5.1 KEY PRODUCT LAUNCHES

10.5.2 KEY COLLABORATIONS

10.5.3 KEY ACQUISITIONS

10.5.4 KEY EXPANSIONS

11 COMPANY PROFILES (Page No. - 110)

11.1 BRUKER CORPORATION

(Business Overview, Products Offered, Recent Developments, and MNM View)*

11.2 RIGAKU CORPORATION

11.3 HAMPTON RESEARCH

11.4 AGILENT TECHNOLOGIES

11.5 CORNING INCORPORATED

11.6 TECAN GROUP

11.7 SAROMICS BIOSTRUCTURES

11.8 SPECTRIS PLC

11.9 CHARLES RIVER LABORATORIES

11.10 THERMO FISCHER SCIENTIFIC

11.11 CREATIVE BIOSTRUCTURE

11.12 ANTON PAAR GMBH

11.13 JENA BIOSCIENCE GMBH

11.14 MITEGEN

11.15 CALIBRE SCIENTIFIC, INC.

11.16 ARINAX SCIENTIFIC INSTRUMENTATION

11.17 FORMULATRIX

11.18 HELIX BIOSTRUCTURES, LLC

11.19 GREINER BIO-ONE INTERNATIONAL

11.20 DOUGLAS INSTRUMENTS LIMITED

11.21 ART ROBBINS INSTRUMENTS

*Details on Business Overview, Products Offered, Recent Developments, and MNM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 141)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (142 TABLES)

TABLE 1 PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 2 X-RAY CRYSTALLOGRAPHY MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 3 NORTH AMERICA: X-RAY CRYSTALLOGRAPHY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 4 EUROPE: X-RAY CRYSTALLOGRAPHY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 5 APAC: X-RAY CRYSTALLOGRAPHY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 6 NMR SPECTROSCOPY MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 NORTH AMERICA: NMR SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 8 EUROPE: NMR SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 9 APAC: NMR SPECTROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 10 CRYO-ELECTRON MICROSCOPY MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 NORTH AMERICA: CRY0-ELECTRON MICROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 12 EUROPE: CRYO-ELECTRON MICROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 13 APAC: CRYO-ELECTRON MICROSCOPY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 14 SMALL-ANGLE X-RAY SCATTERING MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 NORTH AMERICA: SMALL-ANGLE X-RAY SCATTERING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 16 EUROPE: SMALL-ANGLE X-RAY SCATTERING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 17 APAC: SMALL-ANGLE X-RAY SCATTERING MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 19 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 20 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 MICROPLATES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 22 MICROPLATES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 96-WELL PLATES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 48-WELL PLATES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 25 24-WELL PLATES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 OTHER MICROPLATES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 27 CRYSTAL MOUNTS & LOOPS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 OTHER CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 REAGENTS KITS/SCREENS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 30 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 31 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (THOUSAND UNITS)

TABLE 32 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 33 LIQUID HANDLING INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 34 LIQUID HANDLING INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 AUTOMATED LIQUID HANDLING INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 MANUAL LIQUID HANDLING INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 37 CRYSTAL IMAGING INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 OTHER INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 39 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY SOFTWARE & SERVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 PROTEIN CRYSTALLIZATION INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

TABLE 41 PROTEIN CRYSTALLIZATION MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 APAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR PHARMACEUTICAL COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR RESEARCH & GOVERNMENT INSTITUTES, BY REGION, 2018–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR RESEARCH & GOVERNMENT INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR RESEARCH & GOVERNMENT INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 APAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR RESEARCH & GOVERNMENT INSTITUTES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR BIOTECHNOLOGY COMPANIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 EUROPE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 APAC: PROTEIN CRYSTALLIZATION INDUSTRY FOR BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 PROTEIN CRYSTALLIZATION MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: PROTEIN CRYSTALLIZATION MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 57 NORTH AMERICA: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 58 NORTH AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: LIQUID HANDLING INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 NORTH AMERICA: MICROPLATES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 US: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 63 US: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 64 US: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 65 US: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 US: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 CANADA: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 68 CANADA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 69 CANADA: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 70 CANADA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 71 CANADA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: PROTEIN CRYSTALLIZATION MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 73 EUROPE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 75 EUROPE: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 76 EUROPE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 77 EUROPE: LIQUID HANDLING INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 EUROPE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 79 EUROPE: MICROPLATES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 80 GERMANY: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 81 GERMANY: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 82 GERMANY: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 83 GERMANY: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 GERMANY: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 UK: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 86 UK: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 87 UK: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 88 UK: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 UK: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 FRANCE: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 91 FRANCE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 92 FRANCE: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 93 FRANCE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 FRANCE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 95 ROE: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 96 ROE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 97 ROE: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 98 ROE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 99 ROE: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 100 APAC: PROTEIN CRYSTALLIZATION MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 APAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 102 APAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 103 APAC: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 104 APAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 APAC: LIQUID HANDLING INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 APAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 107 APAC: MICROPLATES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 CHINA: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 109 CHINA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 110 CHINA: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 111 CHINA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 112 CHINA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 JAPAN: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 114 JAPAN: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 115 JAPAN: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 116 JAPAN: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 117 JAPAN: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 INDIA: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 119 INDIA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 120 INDIA: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 121 INDIA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 122 INDIA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 123 ROAPAC: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 124 ROAPAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 125 ROAPAC: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 126 ROAPAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 127 ROAPAC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 LATIN AMERICA: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 129 LATIN AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 130 LATIN AMERICA: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 131 LATIN AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 132 LATIN AMERICA: LIQUID HANDLING INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 133 LATIN AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 134 LATIN AMERICA: MICROPLATES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: PROTEIN CRYSTALLIZATION MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2018–2025 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: PROTEIN CRYSTALLIZATION INDUSTRY, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: LIQUID HANDLING INSTRUMENTS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MICROPLATES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 142 MARKET EVALUATION FRAMEWORK: PRODUCT LAUNCH WAS THE MAJOR STRATEGY ADOPTED BY MAJOR PLAYERS IN 2017

LIST OF FIGURES (30 FIGURES)

FIGURE 1 BREAKDOWN OF PRIMARIES: PROTEIN CRYSTALLIZATION MARKET

FIGURE 2 DATA TRIANGULATION METHODOLOGY

FIGURE 3 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE-BASED ESTIMATION)

FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 2 (TECHNOLOGY-BASED APPROACH)

FIGURE 5 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET SIZE (USD BILLION)

FIGURE 6 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET: FINAL CAGR PROJECTIONS (2020-2025)

FIGURE 7 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET CAGR PROJECTIONS FROM THE ANALYSIS OF DEMAND-SIDE DRIVERS AND OPPORTUNITIES

FIGURE 8 PROTEIN CRYSTALLIZATION MARKET SHARE, BY PRODUCT & SERVICE, 2019

FIGURE 9 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET SHARE, BY TECHNOLOGY, 2019

FIGURE 10 PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, BY END USER, 2020-2025

FIGURE 11 GEOGRAPHICAL SNAPSHOT OF THE PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET

FIGURE 12 INCREASING ADOPTION OF PROTEIN THERAPEUTICS TO DRIVE MARKET GROWTH

FIGURE 13 PHARMACEUTICAL COMPANIES SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE APAC PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET IN 2019

FIGURE 14 CONSUMABLES IS THE LARGEST SEGMENT OF THE PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET

FIGURE 15 LIQUID HANDLING INSTRUMENTS SEGMENT WILL CONTINUE TO DOMINATE THE PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY INSTRUMENTS MARKET IN 2025

FIGURE 16 X-RAY CRYSTALLOGRAPHY SEGMENT DOMINATES THE PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET

FIGURE 17 PROTEIN CRYSTALLIZATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, & CHALLENGES

FIGURE 18 VALUE CHAIN ANALYSIS OF THE PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET: RESEARCH & MANUFACTURING PHASES CONTRIBUTE TO MAXIMUM VALUE

FIGURE 19 NORTH AMERICA: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET SNAPSHOT

FIGURE 20 ASIA PACIFIC: PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET SNAPSHOT

FIGURE 21 COMPANY RANKING IN THE PROTEIN CRYSTALLIZATION & CRYSTALLOGRAPHY MARKET, 2019

FIGURE 22 GLOBAL PROTEIN CRYSTALLIZATION MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 23 BRUKER CORPORATION: COMPANY SNAPSHOT (2019)

FIGURE 24 AGILENT TECHNOLOGIES: COMPANY SNAPSHOT (2019)

FIGURE 25 CORNING INCORPORATED: COMPANY SNAPSHOT (2019)

FIGURE 26 TECAN GROUP: COMPANY SNAPSHOT (2019)

FIGURE 27 SPECTRIS PLC: COMPANY SNAPSHOT (2019)

FIGURE 28 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT (2019)

FIGURE 29 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT: (2019)

FIGURE 30 GREINER BIO-ONE INTERNATIONAL: COMPANY SNAPSHOT (2019)

The study involved two major activities in estimating the current size of the protein crystallization market. Exhaustive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing estimates with industry experts across the value chain through primary research. Revenue-based estimation approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet were referred to identify and collect information useful for this technical, market-oriented, and commercial study of the protein crystallization and crystallography market. These secondary sources include government sources, such as Advanced Medical Technology Association (AdvaMed), American Association for Clinical Chemistry (AACC), American Public Health Association (APHA), Economist Intelligence Unit, European Proteomics Association, French Society for Electrophoresis and Proteomic Analysis, International Federation of Pharmaceutical Manufacturers & Associations (IFPMA), National Center for Biotechnology Information, Office for National Statistics (ONS), World Health Organization (WHO), Annual Reports, SEC Filings, Investor Presentations, Expert Interviews, and MarketsandMarkets Analysis. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines & research journals; press releases; and trade, business, and professional associations, among others.

Primary Research

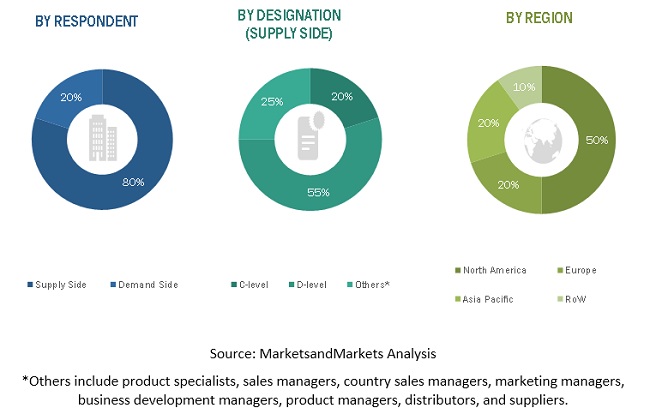

The protein crystallization and crystallography market comprises several stakeholders such as research institutes, protein crystallization and crystallography solution providers, pharmaceutical and biotechnology companies, contract research organizations, government associations and healthcare associations/institutes, protein crystallization and crystallography service and software providing companies, and market research and consulting firms. Several primary interviews were conducted with market experts from both the demand side (such as personnel from managers in healthcare provider organizations) and the supply side (such as C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners, among others) across four major regions, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 80% and 20% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For calculating the global market value, segmental revenues were arrived at based on the revenue mapping of major players active in the protein crystallization and crystallography market. This process involved the following steps:

- Generating a list of the major global players operating in the protein crystallization and crystallography market

- Mapping the annual revenues generated by 1-2 public companies from the protein crystallization and crystallography market (or the nearest reported business unit/product/ service category)

- Estimating the revenue from the related market and extrapolating the global number as of 2019

- Calculating 100% of the global market value of the protein crystallization and crystallography market

- The market was also validated through a technology-based approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the protein crystallization and crystallography market.

Report Objectives

- To define, describe, and forecast the global protein crystallization and crystallography market on the basis of technology, end user, product and service, and region

- To provide detailed information regarding the major factors influencing the growth of the global protein crystallization and crystallography market (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall global protein crystallization and crystallography market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size (by value) of market segments with respect to four main regions (along with countries), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their core competencies in terms of key market developments and growth strategies

- To track and analyze competitive developments such as product and service launches, acquisitions, agreements, partnerships, collaborations, and expansions in the global protein crystallization and crystallography market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Geographic Analysis

- Further breakdown of the European protein crystallization and crystallography market into Spain and Italy

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Protein Crystallization Market