Public Safety-LTE Market by Infrastructure (E-UTRAN, EPC), Services (Consulting and Integration), Deployment Model (Private, Hybrid), Application (Law Enforcement, Firefighting Services), and Region

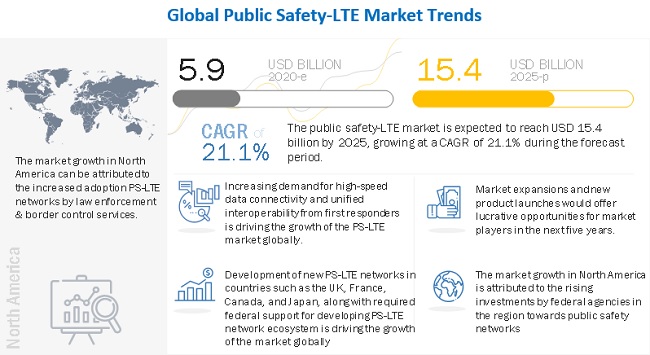

The Public safety LTE market is expected to be valued at USD 5.9 billion in 2020 and is likely to reach USD 15.4 billion by 2025; it is expected to grow at a CAGR of 21.1% during the forecast period. Increase in demand for unmanned vehicles globally and adoption of LTE technology to eliminate the existing interconnectivity issues between different networks seamless data connectivity offered by LTE technology are driving the growth of the PS-LTE market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Public Safety-LTE Market

The market is likely to witness a slight plunge in terms of year-on-year growth in 2020. This is largely attributed to the extended lockdown in countries worldwide, resulting in affected supply chains of OEMs and shutdown of factories. Since the factories were being shut, OEMs found it difficult to find vendors who were willing to supply, mainly due to the disruptions caused by the pandemic and the social distancing norms. This resulted in slowing down the existing and new deployments. For instance, Ericsson (Sweden) reported that the COVID-19 pandemic has affected its sales and service delivery due to the lockdown and travel restrictions imposed by governments to curb the effects of the outbreak. Furthermore, public safety-LTE plays a crucial role during mission-critical services, its adoption as the communication standard is expected to rise and hold a market size larger than the pre-COVID-19 forecast.

Public Safety-LTE Market Dynamics

Driver: Need for efficient and extensive network capacity driven by COVID-19 pandemic

Since the outbreak of the COVID-19 pandemic, every country initiated a nationwide lockdown to control the spread. The organizations responsible for the health and safety consequences of the COVID-19 pandemic are the first responders consisting of paramedics, firefighters, and the police, along with doctors, nurses, and other officials. These responders need more radios and network capacity to work effectively for mitigating this global crisis. The healthcare workers and the police especially need more communication terminals and network capacity to adequately monitor the outbreak.

The pandemic has increased the need for new types of group communications. Public safety operators need to collaborate as well as work in cross-functional teams. LTE technology in public safety communications has benefitted the operators by eliminating the interconnectivity issues, thus providing an added advantage during group communications.

Restraint: Spectrum scarcity

Spectrum is a scarce resource, and hence, it requires to be used efficiently. Each frequency range has a unique band designator, and each frequency range performs a specific function. According to the radio regulations and norms of the International Telecommunications Union (ITU), the available frequency spectrum is shared by different civil, government, and military users. LTE frequencies are divided into paired and unpaired bands. According to ITU, in Europe, over 600 MHz of spectrum is available for mobile operators using 800; 900; 1,800; 2,100; and 2,600 MHz frequency division duplex (FDD) and time division duplex (TDD) bands. In the US, LTE networks are available on 700 and 1,700/2,100 MHz frequencies. In Japan, LTE deployments have started using the 2,100 MHz band, followed by 800; 1,500; and 1,700 MHz bands. The 700 MHz band is an important band of the spectrum available for both, commercial wireless and public safety communication. This 108 MHz band of the spectrum having frequencies ranging from 698 MHz to 806 MHz allows 700 MHz signals to penetrate buildings and walls easily. It can also be used to cover large geographic areas with limited infrastructures (relative to high-frequency bands). The First Responder Network Authority (FirstNet) is an independent authority of the US Department of Commerce, having the responsibility of deploying and operating the nationwide public safety broadband network in the country.

Opportunities: Adoption of LPWA connectivity technologies in LTE

Presently, low-power wide-area (LPWA) technologies such as LoRa and narrowband IoT (NB-IoT) are limited to IoT applications such as smart meters and smart parking. Large-scale adoption of these LPWA technologies in public safety applications is expected to offer growth opportunities for different stakeholders. Frequent broadcast of sizeable payloads and mobility support are the 2 major applications of LPWA technologies in public safety. In February 2019, AT&T started the evaluation of LTE for machines or LTE-M for the public safety networks of the US through FirstNet. The company is evaluating the adoption of LTE-M to ensure the quality of service, priority, and preemption (QPP) on LTE networks. In May 2019, KT and Samsung partnered to deploy NB-IoT in South Korea by 2020 for different public safety applications.

Challenges: High costs of developing and maintaining LTE network infrastructures

The key components of PS-LTE solutions are end-use devices, radio access networks (RANs), backhaul networks, EPC, and application and operation support systems. These solutions are customized according to the applications wherein they are to be used or depending on the requirements of public safety agents and authorities. A dedicated LTE spectrum, cleared of any previous service, is a prerequisite for a public safety model. It requires long planning cycles and high investments. Significant upfront investments are required for developing and maintaining a dedicated network. If the allocated spectrum band is not in use in the commercial sector, costs/CAPEX of the entire system, including that of network elements and devices increase. In some countries, the narrowband spectrum allocated for public safety applications can limit the operating capacity of PSAPs. Thus, public safety authorities are required to establish service level agreements (SLAs) with the mobile network operators to define the trade-off between coverage, availability, and prioritization, and resilience requirements of mission-critical applications. Such SLAs incur a high cost in the form of subscription or setup fee.

PS-LTE infrastructure market is expected to dominate in the Europe region

The growth of the PS-LTE market for infrastructure in Europe can be attributed to the ongoing initiatives in the region to replace the fully functional TETRA network with PS-LTE systems by 2020. Europe launched the emergency services mobile communications program (ESMCP) in 2013 that aims to provide LTE-based communication systems to first responders. Under this program, a new network, known as the emergency services network (ESN), is being developed. In June 2019, the Home Office of the UK allowed US-based Motorola Solutions to provide software for this ESN network while UK-based EE Limited developed the network infrastructure.

Law enforcement & border control application for commercial LTE segment is projected to hold the largest share during forecast period

The growth of the law enforcement & border control segment for commercial LTE can be attributed to the high popularity of commercial LTE deployment model in this application owing to low initial costs and reduced time of deployment. Commercial LTE deployment model uses existing networks of commercial carriers to provide public safety services to first responders. Furthermore, no network CAPEX is required in this deployment model, making it ideal for public safety agencies, which demand quick and low-cost PS-LTE services.

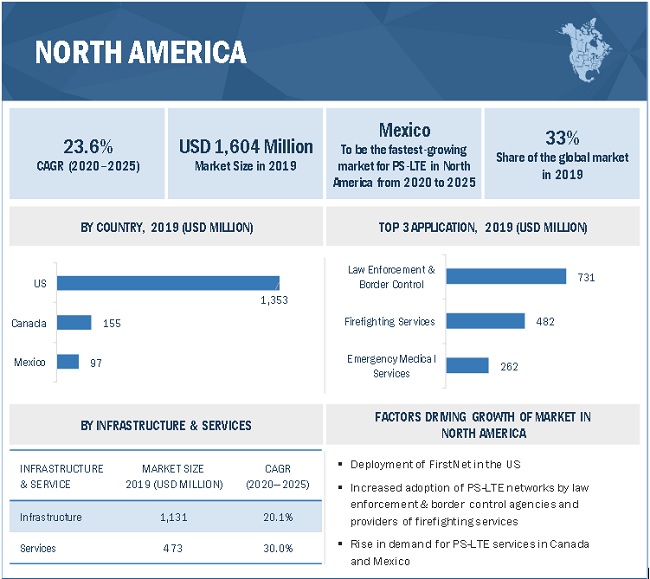

The adoption of public safety-LTE was significant in the North America region

The growth of the PS-LTE market in North America is largely driven by an increase in the number of terrorist attacks; the occurrence of natural calamities such as floods, cyclones, forest fires, and earthquakes; and cyberattacks in the region. For instance, the 9/11 attack in the US triggered the requirement for public safety communication as there were several cases of communication breakdown among different government agencies during this attack.

To know about the assumptions considered for the study, download the pdf brochure

PS-LTE market is dominated by globally established players such as Motorola Solutions (US), Nokia(Finland), Hytera(China), General Dynamics(US), and AT&T (US).

Public Safety-LTE Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2020 |

USD 5.9 Billion |

| Revenue Forecast in 2025 | USD 15.4 Billion |

| Growth Rate | 21.1% |

| Base Year Considered | 2019 |

| Historical Data Available for Years | 2017–2025 |

|

Forecast Period |

2020–2025 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Need for efficient and extensive network capacity driven by COVID-19 pandemic |

| Key Market Opportunity | Adoption of LPWA connectivity technologies in LTE |

| Largest Growing Region | North America |

| Largest Market Share Segment | Infrastructure Segment |

| Highest CAGR Segment | Emergency medical services Segment |

| Largest Application Market Share | Law enforcement & border control Application |

Public Safety-LTE market segmentation: In this report, the PS-LTE market has been segmented into the following categories:

Based on Infrastructure & Services

-

Infrastructure

- Evolved UMTS Terrestrial Radio Access Network (E-UTRAN)

- Evolved Packet Core (EPC)

- End-use Devices

-

Service

- Consulting Services

- Integration Services

- Maintenance Services

- Other Services

Based on Deployment Model

- Private LTE

- Commercial LTE

- Hybrid LTE

Based on Application

- Law Enforcement & Border Control

- Firefighting Services

- Emergency Medical Services

- Disaster Management

Based on End User:

- Public Safety Agencies

- Industrial

- Transport

- Utilities

Based on Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In July 2020, Hytera introduced a carrier-integrated mission-critical version of its Push-to-Talk over Cellular (PoC) broadband solution. Hytera HyTalk MC is an end-to-end solution supporting 3GPP Mission Critical Push-to-Talk (MCPTT), Mission Critical Data (MCData), and Mission Critical Video (MCVideo) services for use by mission- and business-critical communications users. Hytera HyTalk MC provides instantaneous one-to-many and one-to-one MCPTT, MCData, and MCVideo (collectively known as MCPTX) services, including individual, group, broadcast, and emergency call, over public or private LTE networks based on 3GPP Release 14 specifications.

- In June 2020, Bittium launched the Bittium Tough Mobile 2 C smartphone designed for confidential communications for government authorities. The smartphone's unique HW security solutions and multilayered security structure based on the hardened Android 9 operating system are reinforced with the dual-boot functionality, running two completely separate and hardened operating systems on a single platform: Confidential and Personal. The smartphone, intended for government-level security needs, is complemented with Bittium Secure Suite management software, enabling remote management of devices and applications, as well as encrypted IP-based data transfer.

- In March 2020, Nokia and Swiss Federal Railways completed a proof of concept trial to help define radio frequency for the new Future Railway Mobile Communication System (FRMCS) standard. As part of the collaboration, Nokia carried out LTE 1900MHz Time Division Duplex (TDD) radio frequency testing with SBB in the cantons of Fribourg and Neuchâtel, Switzerland. Due to be introduced in 2025, FRMCS will bring a host of benefits to rail operators and passengers. These include cost containment through increased utilization of existing infrastructure, enhanced levels of safety and security, and improved rail network performance and reliability.

Frequently Asked Questions (FAQ):

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

Motorola Solutions, Nokia, Hytera, General Dynamics and AT&T are some of the major players PS-LTE market. Product launches and developments is one of the key strategies adopted by these players. Apart from launches, these players have announced collaborations to provide solutions across a variety of applications and end users.

What are the drivers for the PS-LTE market?

Adoption of LTE technology to eliminate the existing interconnectivity issues between different networks, increase in demand for unmanned vehicles globally, seamless data connectivity offered by LTE technology, and the COVID-19 pandemic are the major drivers of the market.

Which End-users are expected to drive the growth of the market in the next 5 years?

Public safety agencies are expected to drive the growth of the market in the next 5 years mainly due to increasing adoption of LTE infrastructure by the end-user.

Which region is expected to witness significant demand for PS-LTE in the coming years?

The North America region is expected to witness significant demand for PS-LTE systems and infrastructures, mainly due to increase in the number of terrorist attacks; the occurrence of natural calamities such as floods, cyclones, forest fires, and earthquakes; and cyberattacks in the region.

Which PS-LTE application is dominating the global market?

Law enforcement & border control application of the PS-LTE market is dominating around the globe. Increasing demand for high-speed data connectivity from law enforcement & border control agencies to share high-definition audio and video content with command centers during field operations is driving the growth of this segment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION & SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 PS-LTE MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 PS-LTE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.1.1 Key industry insights

2.1.2 SECONDARY DATA

2.1.2.1 Major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Breakdown of primaries

2.1.3.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at the market size using bottom-up analysis (demand side)

FIGURE 3 PS-LTE MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at the market size using top-down analysis (supply side)

FIGURE 4 PS-LTE MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 6 E-UTRAN SEGMENT IS ESTIMATED TO HOLD LARGEST SHARE OF PS-LTE MARKET FOR INFRASTRUCTURE IN 2020

FIGURE 7 COMMERCIAL LTE SEGMENT IS ESTIMATED TO HOLD LARGEST SHARE OF PS-LTE MARKET IN 2020

FIGURE 8 EMERGENCY MEDICAL SERVICES SEGMENT OF PS-LTE MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 9 EUROPE IS ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF PS-LTE MARKET IN 2020

3.1 COVID-19 IMPACT ANALYSIS: PUBLIC SAFETY-LTE MARKET

FIGURE 10 PRE- AND POST-COVID-19 SCENARIO ANALYSIS FOR PUBLIC SAFETY-LTE MARKET

3.1.1 PRE-COVID-19 SCENARIO

3.1.2 POST-COVID-19 SCENARIO

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 ATTRACTIVE OPPORTUNITIES IN PS-LTE MARKET

FIGURE 11 INCREASING DEMAND FOR INTERCONNECTIVITY FROM FIRST RESPONDERS IS EXPECTED TO DRIVE GROWTH OF PS-LTE MARKET FROM 2020 TO 2025

4.2 PS-LTE MARKET, BY END USER

FIGURE 12 PUBLIC SAFETY AGENCIES SEGMENT TO HOLD LARGEST SHARE OF PS-LTE MARKET FROM 2020 TO 2025

4.3 PS-LTE MARKET IN NORTH AMERICA, BY DEPLOYMENT MODE AND COUNTRY

FIGURE 13 LAW ENFORCEMENT & BORDER CONTROL SEGMENT AND US PROJECTED TO HOLD LARGEST SHARE OF PS-LTE MARKET IN NORTH AMERICA IN 2025

4.4 PS-LTE MARKET, BY COUNTRY

FIGURE 14 PS-LTE MARKET IN MEXICO IS PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

FIGURE 15 EVOLUTION OF PUBLIC SAFETY–LTE STANDARDIZATION FROM 2015 TO 2018

5.2 MARKET DYNAMICS

FIGURE 16 DATA CONNECTIVITY OFFERED BY LTE DRIVES GROWTH OF PS-LTE MARKET

5.2.1 DRIVERS

FIGURE 17 PS-LTE MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Use of LTE technology to eliminate existing interconnectivity issues between different networks

5.2.1.2 Increased demand for unmanned vehicles across the globe

5.2.1.3 Seamless data connectivity offered by LTE technology

5.2.1.4 Increased data security and high quality of services offered by LTE technology

5.2.1.5 Need for efficient and extensive network capacity driven by COVID-19 pandemic

5.2.2 RESTRAINTS

FIGURE 18 PS-LTE MARKET RESTRAINTS AND THEIR IMPACT

5.2.2.1 Spectrum scarcity

TABLE 1 LIST OF FREQUENCY BANDS

5.2.3 OPPORTUNITIES

FIGURE 19 PS-LTE MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Implementation of emergency services IP networks

FIGURE 20 PUBLIC SAFETY ANSWERING POINTS

5.2.3.2 Adoption of LPWA connectivity technologies in LTE

5.2.4 CHALLENGES

FIGURE 21 PS-LTE MARKET CHALLENGES AND THEIR IMPACT

5.2.4.1 High costs of developing and maintaining LTE network infrastructures

5.2.4.2 Limited adoption of LTE networks in public safety applications due to reliability concerns

5.2.4.3 Budget constraints for developing and maintaining dedicated PS-LTE networks

5.3 INDUSTRY TRENDS

5.3.1 LTE-U

5.3.2 5G NEW RADIO (NR) FOR SUPPORTING PUBLIC SAFETY COMMUNICATION

5.3.3 LTE-RAILROAD

5.3.3.1 Benefits of LTE-railroad

5.3.4 PUBLIC SAFETY LTE STANDARDIZATION STATUS

FIGURE 22 COMPARISON BETWEEN COMMERCIAL LTE AND LTE FOR PUBLIC SAFETY

5.3.4.1 Release 12 (2015)

5.3.4.1.1 Proximity Services (ProSe):

5.3.4.1.2 Group Communication System Enablers (GCSE_LTE)

5.3.4.2 Release 13 (2016)

5.3.4.2.1 Mission-critical push-to-talk (MCPTT) functionality

5.3.4.3 Release 14 (2017)

5.3.4.4 Release 15 (2018)

TABLE 2 AVERAGE SELLING PRICE OF HANDHELD DEVICES IN PS-LTE

5.4 ADJACENT AND RELATED MARKETS

6 PS-LTE MARKET, BY INFRASTRUCTURE & SERVICES (Page No. - 74)

6.1 INTRODUCTION

FIGURE 23 INFRASTRUCTURE SEGMENT TO ACCOUNT FOR A LARGER SIZE OF PS-LTE MARKET THAN SERVICES SEGMENT FROM 2020 TO 2025

TABLE 3 PS-LTE INFRASTRUCTURE & SERVICES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 4 PS-LTE INFRASTRUCTURE & SERVICES MARKET, BY TYPE, 2020–2025 (USD MILLION)

6.2 INFRASTRUCTURE

FIGURE 24 NETWORK ARCHITECTURE OF LTE

TABLE 5 PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2017–2019 (USD MILLION)

TABLE 6 PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2020–2025 (USD MILLION)

TABLE 7 PS-LTE MARKET FOR INFRASTRUCTURE, BY REGION, 2017–2019 (USD MILLION)

TABLE 8 PS-LTE MARKET FOR INFRASTRUCTURE, BY REGION, 2020–2025 (USD MILLION)

6.2.1 EVOLVED UMTS TERRESTRIAL RADIO ACCESS NETWORK (E-UTRAN)

6.2.1.1 E-UTRAN is air interface of LTE technology

FIGURE 25 ARCHITECTURE OF E-UTRAN

TABLE 9 PS-LTE INFRASTRUCTURE MARKET FOR E-UTRAN, BY REGION, 2017–2019 (USD MILLION)

TABLE 10 PS-LTE INFRASTRUCTURE MARKET FOR E-UTRAN, BY REGION, 2020–2025 (USD MILLION)

6.2.2 EVOLVED PACKET CORE (EPC)

6.2.2.1 EPC is also known as service architecture evolution (SAE) core

TABLE 11 PS-LTE INFRASTRUCTURE MARKET FOR EPC, BY REGION, 2017–2019 (USD MILLION)

TABLE 12 PS-LTE INFRASTRUCTURE MARKET FOR EPC, BY REGION, 2020–2025 (USD MILLION)

6.2.3 END-USE DEVICES

6.2.3.1 End-use devices for public safety-LTE are developed to withstand harsh weather conditions

TABLE 13 PS-LTE INFRASTRUCTURE MARKET FOR END-USE DEVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 14 PS-LTE INFRASTRUCTURE MARKET FOR END-USE DEVICES, BY REGION, 2020–2025 (USD MILLION)

6.2.3.1.1 Handheld devices

6.2.3.1.2 Body-worn cameras

6.2.3.1.3 Routers

6.2.3.1.4 Others

6.3 SERVICES

FIGURE 26 MAINTENANCE SERVICES SEGMENT OF PS-LTE SERVICES MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 15 PS-LTE MARKET FOR SERVICES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 16 PS-LTE MARKET FOR SERVICES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 17 PS-LTE MARKET FOR SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 18 PS-LTE MARKET FOR SERVICES, BY REGION, 2020–2025 (USD MILLION)

TABLE 19 PS-LTE MARKET FOR CONSULTING SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 20 PS-LTE MARKET FOR CONSULTING SERVICES, BY REGION, 2020–2025 (USD MILLION)

TABLE 21 PS-LTE MARKET FOR INTEGRATION SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 22 PS-LTE MARKET FOR INTEGRATION SERVICES, BY REGION, 2020–2025 (USD MILLION)

TABLE 23 PS-LTE MARKET FOR MAINTENANCE SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 24 PS-LTE MARKET FOR MAINTENANCE SERVICES, BY REGION, 2020–2025 (USD MILLION)

TABLE 25 PS-LTE MARKET FOR OTHER SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 26 PS-LTE MARKET FOR OTHER SERVICES, BY REGION, 2020–2025 (USD MILLION)

6.3.1 CONSULTING SERVICES

6.3.1.1 Consulting services are extensively used by telecom operators for business decisions

6.3.2 INTEGRATION SERVICES

6.3.2.1 Integration services expected to hold largest share of PS-LTE market during the forecast period

6.3.3 MAINTENANCE SERVICES

6.3.3.1 Maintenance services is expected to grow the fasted during the forecast period

6.3.4 OTHER SERVICES

7 PS-LTE MARKET, BY DEPLOYMENT MODEL (Page No. - 89)

7.1 INTRODUCTION

FIGURE 27 COMMERCIAL LTE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF PS-LTE MARKET IN 2020

TABLE 27 PS-LTE MARKET, BY DEPLOYMENT MODEL, 2017–2019 (USD MILLION)

TABLE 28 PS-LTE MARKET, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

7.2 PRIVATE LTE

7.2.1 PUBLIC SAFETY AGENCIES MANAGE THEIR NETWORKS IN PRIVATE LTE MODEL

TABLE 29 PS-LTE MARKET FOR PRIVATE LTE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 30 PS-LTE MARKET FOR PRIVATE LTE, BY APPLICATION, 2020–2025 (USD MILLION)

7.3 COMMERCIAL LTE

7.3.1 PUBLIC SAFETY AGENCIES USE EXISTING LTE NETWORKS UNDER COMMERCIAL LTE MODEL

TABLE 31 PS-LTE MARKET FOR COMMERCIAL LTE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 32 PS-LTE MARKET FOR COMMERCIAL LTE, BY APPLICATION, 2020–2025 (USD MILLION)

7.4 HYBRID LTE

7.4.1 HIGHLY RELIABLE SERVICES AT LOW COSTS ARE AMONG KEY ATTRIBUTES OF HYBRID LTE MODEL

TABLE 33 PS-LTE MARKET FOR HYBRID LTE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 34 PS-LTE MARKET FOR HYBRID LTE, BY APPLICATION, 2020–2025 (USD MILLION)

8 PS-LTE MARKET, BY APPLICATION (Page No. - 96)

8.1 INTRODUCTION

FIGURE 28 LAW ENFORCEMENT & BORDER CONTROL SEGMENT IS PROJECTED TO ACCOUNT FOR THE LARGEST SIZE OF PS-LTE MARKET FROM 2020 TO 2025

TABLE 35 PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 36 PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

8.2 LAW ENFORCEMENT & BORDER CONTROL

8.2.1 HIGH-SPEED DATA OFFERED BY PS-LTE NETWORKS IS RESULTING IN THEIR INCREASED ADOPTION IN LAW ENFORCEMENT & BORDER CONTROL APPLICATION

TABLE 37 PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY DEPLOYMENT MODEL, 2017–2019 (USD MILLION)

TABLE 38 PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

TABLE 39 PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY REGION, 2017–2019 (USD MILLION)

TABLE 40 PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY REGION, 2020–2025 (USD MILLION)

FIGURE 29 MEXICO PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

TABLE 41 NORTH AMERICA PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 42 NORTH AMERICA PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 43 EUROPE PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY COUNTRY, 2017–2024 (USD MILLION)

TABLE 44 EUROPE PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 45 APAC PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 46 APAC PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 47 ROW PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY REGION, 2017–2019 (USD MILLION)

TABLE 48 ROW PS-LTE MARKET IN LAW ENFORCEMENT & BORDER CONTROL, BY REGION, 2020–2025 (USD MILLION)

8.3 EMERGENCY MEDICAL SERVICES

8.3.1 PS-LTE ALLOWS REMOTE MONITORING OF PATIENTS DURING EMERGENCY SITUATIONS

TABLE 49 PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY DEPLOYMENT MODEL, 2017–2019 (USD MILLION)

TABLE 50 PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

TABLE 51 PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 52 PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY REGION, 2020–2025 (USD MILLION)

TABLE 53 NORTH AMERICA PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 54 NORTH AMERICA PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 30 UK IS ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF PS-LTE MARKET FOR EMERGENCY MEDICAL SERVICES IN 2020

TABLE 55 EUROPE PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 56 EUROPE PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 57 APAC PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 58 APAC PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 59 ROW PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 60 ROW PS-LTE MARKET IN EMERGENCY MEDICAL SERVICES, BY REGION, 2020–2025 (USD MILLION)

8.4 FIREFIGHTING SERVICES

8.4.1 EFFECTIVE EVALUATION OF GROUND SITUATION WITH REAL-TIME STREAMING OF IMAGES AND VIDEOS LEADING TO ADOPTION OF LTE TECHNOLOGY BY FIREFIGHTERS

TABLE 61 PS-LTE MARKET IN FIREFIGHTING SERVICES, BY DEPLOYMENT MODEL, 2017–2019 (USD MILLION)

TABLE 62 PS-LTE MARKET IN FIREFIGHTING SERVICES, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

TABLE 63 PS-LTE MARKET IN FIREFIGHTING SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 64 PS-LTE MARKET IN FIREFIGHTING SERVICES, BY REGION, 2020–2025 (USD MILLION)

TABLE 65 NORTH AMERICA PS-LTE MARKET IN FIREFIGHTING SERVICES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 66 NORTH AMERICA PS-LTE MARKET IN FIREFIGHTING SERVICES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 67 EUROPE PS-LTE MARKET IN FIREFIGHTING SERVICES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 68 EUROPE PS-LTE MARKET IN FIREFIGHTING SERVICES, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 31 CHINA PROJECTED TO LEAD APAC PS-LTE MARKET FOR FIREFIGHTING SERVICES FROM 2020 TO 2025

TABLE 69 APAC PS-LTE MARKET IN FIREFIGHTING SERVICES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 70 APAC PS-LTE MARKET IN FIREFIGHTING SERVICES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 71 ROW PS-LTE MARKET IN FIREFIGHTING SERVICES, BY REGION, 2017–2019 (USD MILLION)

TABLE 72 ROW PS-LTE MARKET IN FIREFIGHTING SERVICES, BY REGION, 2020–2025 (USD MILLION)

8.5 DISASTER MANAGEMENT

8.5.1 LTE BROADBAND USES MOBILE DATA TO OFFER COORDINATED RESPONSES AMONG DISASTER MANAGEMENT AGENTS DURING EMERGENCY SITUATIONS

TABLE 73 PS-LTE MARKET IN DISASTER MANAGEMENT, BY DEPLOYMENT MODEL, 2017–2019 (USD MILLION)

TABLE 74 PS-LTE MARKET IN DISASTER MANAGEMENT, BY DEPLOYMENT MODEL, 2020–2025 (USD MILLION)

TABLE 75 PS-LTE MARKET IN DISASTER MANAGEMENT, BY REGION, 2017–2019 (USD MILLION)

TABLE 76 PS-LTE MARKET IN DISASTER MANAGEMENT, BY REGION, 2020–2025 (USD MILLION)

TABLE 77 NORTH AMERICA PS-LTE MARKET IN DISASTER MANAGEMENT, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 78 NORTH AMERICA PS-LTE MARKET IN DISASTER MANAGEMENT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 79 EUROPE PS-LTE MARKET IN DISASTER MANAGEMENT, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 80 EUROPE PS-LTE MARKET IN DISASTER MANAGEMENT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 81 APAC PS-LTE MARKET IN DISASTER MANAGEMENT, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 82 APAC PS-LTE MARKET IN DISASTER MANAGEMENT, BY COUNTRY, 2020–2025 (USD MILLION)

FIGURE 32 MIDDLE EAST ACCOUNTED FOR THE LARGEST SHARE OF ROW PS-LTE MARKET FOR DISASTER MANAGEMENT IN 2020

TABLE 83 ROW PS-LTE MARKET IN DISASTER MANAGEMENT, BY REGION, 2017–2019 (USD MILLION)

TABLE 84 ROW PS-LTE MARKET IN DISASTER MANAGEMENT, BY REGION, 2020–2025 (USD MILLION)

8.6 IMPACT OF COVID-19 ON VARIOUS APPLICATIONS OF PUBLIC SAFETY-LTE MARKET

9 PS-LTE MARKET, BY END USER (Page No. - 117)

9.1 INTRODUCTION

FIGURE 33 PS-LTE MARKET FOR UTILITIES IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

TABLE 85 PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 86 PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

9.2 PUBLIC SAFETY AGENCIES

9.2.1 PS-LTE ENABLES EFFECTIVE COMMUNICATION AMONG FIRST RESPONDERS FOR PUBLIC SAFETY APPLICATIONS

TABLE 87 PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 88 PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY REGION, 2020–2025 (USD MILLION)

TABLE 89 NORTH AMERICA PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 90 NORTH AMERICA PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 91 EUROPE PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 92 EUROPE PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 93 APAC PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 94 APAC PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 95 ROW PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 96 ROW PS-LTE MARKET FOR PUBLIC SAFETY AGENCIES, BY REGION, 2020–2025 (USD MILLION)

9.3 INDUSTRIAL

9.3.1 PUBLIC SAFETY-LTE IS NECESSARY TO SECURE CRITICAL ASSETS, NETWORKS, AND SYSTEMS

TABLE 97 PS-LTE MARKET FOR INDUSTRIAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 98 PS-LTE MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (USD MILLION)

TABLE 99 NORTH AMERICA PS-LTE MARKET FOR INDUSTRIAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 100 NORTH AMERICA PS-LTE MARKET FOR INDUSTRIAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 101 EUROPE PS-LTE MARKET FOR INDUSTRIAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 102 EUROPE PS-LTE MARKET FOR INDUSTRIAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 103 APAC PS-LTE MARKET FOR INDUSTRIAL, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 104 APAC PS-LTE MARKET FOR INDUSTRIAL, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 105 ROW PS-LTE MARKET FOR INDUSTRIAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 106 ROW PS-LTE MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (USD MILLION)

9.4 TRANSPORT

9.4.1 RAILWAYS COULD BE KEY BENEFICIARY OF PS-LTE TECHNOLOGY

TABLE 107 PS-LTE MARKET FOR TRANSPORT, BY REGION, 2017–2019 (USD MILLION)

TABLE 108 PS-LTE MARKET FOR TRANSPORT, BY REGION, 2020–2025 (USD MILLION)

TABLE 109 NORTH AMERICA PS-LTE MARKET FOR TRANSPORT, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 110 NORTH AMERICA PS-LTE MARKET FOR TRANSPORT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 111 EUROPE PS-LTE MARKET FOR TRANSPORT, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 112 EUROPE PS-LTE MARKET FOR TRANSPORT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 113 APAC PS-LTE MARKET FOR TRANSPORT, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 114 APAC PS-LTE MARKET FOR TRANSPORT, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 115 ROW PS-LTE MARKET FOR TRANSPORT, BY REGION, 2017–2019 (USD MILLION)

TABLE 116 ROW PS-LTE MARKET FOR TRANSPORT, BY REGION, 2020–2025 (USD MILLION)

9.5 UTILITIES

9.5.1 PS-LTE CHANNELS ARE WIDELY USED TO NOTIFY ABOUT EMERGENCY SITUATIONS IN UTILITIES

TABLE 117 PS-LTE MARKET FOR UTILITIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 118 PS-LTE MARKET FOR UTILITIES, BY REGION, 2020–2025 (USD MILLION)

TABLE 119 NORTH AMERICA PS-LTE MARKET FOR UTILITIES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 120 NORTH AMERICA PS-LTE MARKET FOR UTILITIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 121 EUROPE PS-LTE MARKET FOR UTILITIES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 122 EUROPE PS-LTE MARKET FOR UTILITIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 123 APAC PS-LTE MARKET FOR UTILITIES, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 124 APAC PS-LTE MARKET FOR UTILITIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 125 ROW PS-LTE MARKET FOR UTILITIES, BY REGION, 2017–2019 (USD MILLION)

TABLE 126 ROW PS-LTE MARKET FOR UTILITIES, BY REGION, 2020–2025 (USD MILLION)

9.6 IMPACT OF COVID-19 ON VARIOUS END USERS OF PS-LTE MARKET

10 REGIONAL ANALYSIS (Page No. - 135)

10.1 INTRODUCTION

FIGURE 34 PS-LTE MARKET IN NORTH AMERICA IS PROJECTED TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

TABLE 127 PS-LTE MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 128 PS-LTE MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA PS-LTE MARKET SNAPSHOT

TABLE 129 NORTH AMERICA PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 130 NORTH AMERICA PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 131 NORTH AMERICA PS-LTE MARKET, BY INFRASTRUCTURE & SERVICE, 2017–2019 (USD MILLION)

TABLE 132 NORTH AMERICA PS-LTE MARKET, BY INFRASTRUCTURE & SERVICE, 2020–2025 (USD MILLION)

TABLE 133 NORTH AMERICA PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2017–2019 (USD MILLION)

TABLE 134 NORTH AMERICA PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2020–2025 (USD MILLION)

TABLE 135 NORTH AMERICA PS-LTE MARKET FOR SERVICES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 136 NORTH AMERICA PS-LTE MARKET FOR SERVICES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 137 NORTH AMERICA PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 138 NORTH AMERICA PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 139 NORTH AMERICA PS-LTE MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 140 NORTH AMERICA PS-LTE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 FirstNet is major application of PS-LTE in US

TABLE 141 US PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 142 US PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 143 US PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 144 US PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Deployment of PS-LTE in Canada to enhance its emergency response

TABLE 145 CANADA PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 146 CANADA PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 147 CANADA PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 148 CANADA PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.2.3 MEXICO

10.2.3.1 ALTAN Redes anticipated to drive growth of PS-LTE market in Mexico

TABLE 149 MEXICO PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 150 MEXICO PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 151 MEXICO PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 152 MEXICO PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.3 EUROPE

FIGURE 36 EUROPE PS-LTE MARKET SNAPSHOT

TABLE 153 EUROPE PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 154 EUROPE PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 155 EUROPE PS-LTE MARKET, BY INFRASTRUCTURE & SERVICE, 2017–2019 (USD MILLION)

TABLE 156 EUROPE PS-LTE MARKET, BY INFRASTRUCTURE & SERVICE, 2020–2025 (USD MILLION)

TABLE 157 EUROPE PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2017–2019 (USD MILLION)

TABLE 158 EUROPE PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2020–2025 (USD MILLION)

TABLE 159 EUROPE PS-LTE MARKET FOR SERVICES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 160 EUROPE PS-LTE MARKET FOR SERVICES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 161 EUROPE PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 162 EUROPE PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 163 EUROPE PS-LTE MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 164 EUROPE PS-LTE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

10.3.1 UK

10.3.1.1 Allocation of different bands to roll-out PS-LTE networks in UK

TABLE 165 UK PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 166 UK PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 167 UK PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 168 UK PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 BDBOS is expected to start PS-LTE trials in Germany in near future

TABLE 169 GERMANY PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 170 GERMANY PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 171 GERMANY PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 172 GERMANY PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Project PCSTORM is driving growth of PS-LTE market in France

TABLE 173 FRANCE PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 174 FRANCE PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 175 FRANCE PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 176 FRANCE PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.3.4 REST OF EUROPE

TABLE 177 REST OF EUROPE PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 178 REST OF EUROPE PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 179 REST OF EUROPE PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 180 REST OF EUROPE PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.4 APAC

FIGURE 37 APAC PS-LTE MARKET SNAPSHOT

TABLE 181 APAC PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 182 APAC PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 183 APAC PS-LTE MARKET, BY INFRASTRUCTURE & SERVICE, 2017–2019(USD MILLION)

TABLE 184 APAC PS-LTE MARKET, BY INFRASTRUCTURE & SERVICE, 2020–2025 (USD MILLION)

TABLE 185 APAC PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2017–2019 (USD MILLION)

TABLE 186 APAC PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2020–2025 (USD MILLION)

TABLE 187 APAC PS-LTE MARKET FOR SERVICES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 188 APAC PS-LTE MARKET FOR SERVICES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 189 APAC PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 190 APAC PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 191 APAC PS-LTE MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 192 APAC PS-LTE MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China is among early adopters of PS-LTE technology in APAC

TABLE 193 CHINA PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 194 CHINA PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 195 CHINA PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 196 CHINA PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Ongoing trials of PS-LTE networks are fueling growth of PS-LTE market in Japan

TABLE 197 JAPAN PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 198 JAPAN PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 199 JAPAN PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 200 JAPAN PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.4.3 SOUTH KOREA

10.4.3.1 SafeNet is driving growth of PS-LTE network in South Korea

TABLE 201 SOUTH KOREA PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 202 SOUTH KOREA PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 203 SOUTH KOREA PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 204 SOUTH KOREA PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Project LANES initiated adoption of LTE services for public safety in Australia

TABLE 205 AUSTRALIA PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 206 AUSTRALIA PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 207 AUSTRALIA PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 208 AUSTRALIA PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.4.5 REST OF APAC

TABLE 209 REST OF APAC PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 210 REST OF APAC PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 211 REST OF APAC PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 212 REST OF APAC PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.5 ROW

FIGURE 38 ROW PS-LTE MARKET SNAPSHOT

TABLE 213 ROW PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 214 ROW PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 215 ROW PS-LTE MARKET, BY INFRASTRUCTURE & SERVICE, 2017–2019 (USD MILLION)

TABLE 216 ROW PS-LTE MARKET, BY INFRASTRUCTURE & SERVICE, 2020–2025 (USD MILLION)

TABLE 217 ROW PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2017–2019 (USD MILLION)

TABLE 218 ROW PS-LTE MARKET FOR INFRASTRUCTURE, BY ELEMENT, 2020–2025 (USD MILLION)

TABLE 219 ROW PS-LTE MARKET FOR SERVICES, BY TYPE, 2017–2019 (USD MILLION)

TABLE 220 ROW PS-LTE MARKET FOR SERVICES, BY TYPE, 2020–2025 (USD MILLION)

TABLE 221 ROW PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 222 ROW PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 223 ROW PS-LTE MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 224 ROW PS-LTE MARKET, BY REGION, 2020–2025 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Brazil is among prominent countries in terms of adoption of S-LTE technology in South America

TABLE 225 SOUTH AMERICA PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 226 SOUTH AMERICA PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 227 SOUTH AMERICA PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 228 SOUTH AMERICA PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.5.2 MIDDLE EAST

10.5.2.1 Deployment of PS-LTE networks in Qatar and UAE is fueling growth of PS-LTE market in Middle East

TABLE 229 MIDDLE EAST PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 230 MIDDLE EAST PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 231 MIDDLE EAST PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 232 MIDDLE EAST PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.5.3 AFRICA

10.5.3.1 Kenya and Angola are early adopters of PS-LTE technology in Africa

TABLE 233 AFRICA PS-LTE MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 234 AFRICA PS-LTE MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 235 AFRICA PS-LTE MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 236 AFRICA PS-LTE MARKET, BY END USER, 2020–2025 (USD MILLION)

10.6 IMPACT OF COVID-19 ON VARIOUS REGIONS OF PS-LTE MARKET

11 COMPETITIVE LANDSCAPE (Page No. - 182)

11.1 OVERVIEW

FIGURE 39 KEY DEVELOPMENTS IN PS-LTE MARKET FROM JANUARY 2017 TO JULY 2020

11.2 MARKET PLAYER RANKING ANALYSIS, 2019

FIGURE 40 RANKING OF KEY PLAYERS IN PS-LTE MARKET, 2019

11.3 COMPETITIVE LEADERSHIP MAPPING

11.3.1 VISIONARY LEADERS

11.3.2 DYNAMIC DIFFERENTIATORS

11.3.3 INNOVATORS

11.3.4 EMERGING COMPANIES

FIGURE 41 PS-LTE MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11.4 COMPETITIVE SCENARIO

FIGURE 42 PRODUCT LAUNCHES WAS KEY STRATEGY ADOPTED BY MARKET S-LTE technology in South America PLAYERS FROM JANUARY 2017 TO JULY 2020

11.4.1 PRODUCT LAUNCHES

11.4.2 PRODUCT DEVELOPMENTS

11.4.3 ACQUISITIONS

12 COMPANY PROFILES (Page No. - 191)

(Business Overview, Products, Solutions, and Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

12.1 KEY PLAYERS

12.1.1 GENERAL DYNAMICS

FIGURE 43 GENERAL DYNAMICS: COMPANY SNAPSHOT

12.1.2 AIRBUS

FIGURE 44 AIRBUS: COMPANY SNAPSHOT

12.1.3 MOTOROLA SOLUTIONS

FIGURE 45 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

12.1.4 NOKIA

FIGURE 46 NOKIA: COMPANY SNAPSHOT

12.1.5 HARRIS

FIGURE 47 HARRIS: COMPANY SNAPSHOT

12.1.6 HUAWEI

FIGURE 48 HUAWEI: COMPANY SNAPSHOT

12.1.7 BITTIUM

FIGURE 49 BITTIUM: COMPANY SNAPSHOT

12.1.8 AT&T

FIGURE 50 AT&T: COMPANY SNAPSHOT

12.1.9 HYTERA

12.1.10 COBHAM WIRELESS

12.2 RIGHT TO WIN

12.3 OTHER KEY PLAYERS

12.3.1 SAMSUNG ELECTRONICS

12.3.2 ERICSSON

12.3.3 MENTURA GROUP

12.3.4 SONIM TECHNOLOGIES

12.3.5 KYOCERA

12.3.6 LEONARDO

12.3.7 AIRSPAN

12.3.8 ZTE

12.3.9 KT

12.3.10 SIERRA WIRELESS

*Details on Business Overview, Products, Solutions, and Services Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 228)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 PUSH TO TALK MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.4 PUSH TO TALK MARKET, BY COMPONENT

FIGURE 51 SOLUTIONS SEGMENT TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

TABLE 237 PUSH-TO-TALK MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

13.4.1 HARDWARE

13.4.1.1 Growing number of end-use devices to drive the adoption of PTT hardware

TABLE 238 HARDWARE: PUSH-TO-TALK MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.4.2 SOLUTIONS

13.4.2.1 Push-to-talk solutions enable secured and reliable communication for mission and non-mission critical purposes

TABLE 239 SOLUTIONS: PUSH-TO-TALK MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.4.3 SERVICES

FIGURE 52 SUPPORT AND MAINTENANCE SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 240 SERVICES: PUSH-TO-TALK MARKET SIZE, BY TYPE, 2017–2024 (USD MILLION)

TABLE 241 SERVICES: PUSH-TO-TALK MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.4.3.1 Consulting

13.4.3.1.1 Need for technical expertise in setting up a robust PTT system to drive the demand for consulting services

TABLE 242 CONSULTING MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.4.3.2 Implementation

13.4.3.2.1 Implementation services to have significant revenue growth opportunities in Asia Pacific

TABLE 243 IMPLEMENTATION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.4.3.3 Support and Maintenance

13.4.3.3.1 Need for 24/7 real-time support to fuel the demand for support and maintenance services

TABLE 244 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.5 PUSH TO TALK MARKET, BY VERTICAL

FIGURE 53 PUBLIC SAFETY SEGMENT TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 245 PUSH-TO-TALK MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.5.1 PUBLIC SAFETY

13.5.1.1 Need for a reliable network for mission-critical communication in public safety

TABLE 246 PUBLIC SAFETY: PUSH-TO-TALK MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.5.2 GOVERNMENT AND DEFENSE

13.5.2.1 Use of push-to-talk solutions to augment the existing use of land mobile radios in government and defense vertical

TABLE 247 GOVERNMENT AND DEFENSE: PUSH-TO-TALK MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.5.3 COMMERCIAL

TABLE 248 COMMERCIAL: PUSH-TO-TALK MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

FIGURE 54 TRANSPORTATION AND LOGISTICS TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 249 COMMERCIAL: PUSH-TO-TALK MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.5.3.1 Transportation and logistics

13.5.3.1.1 Push-to-talk solutions are vital tools for fleet dispatchers

TABLE 250 TRANSPORTATION AND LOGISTICS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.5.3.2 Travel and hospitality

13.5.3.2.1 Increasing demand for PoC to improve overall guest and traveler experience

TABLE 251 TRAVEL AND HOSPITALITY MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.5.3.3 Energy and utilities

13.5.3.3.1 Push-to-talk devices enable real-time communication and ensure the safety of large workforces in energy and utilities vertical

TABLE 252 ENERGY AND UTILITIES MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.5.3.4 Construction

13.5.3.4.1 Push-to-talk solutions offer an effective communication tool for construction sites

TABLE 253 CONSTRUCTION MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.5.3.5 Manufacturing

13.5.3.5.1 Push-to-talk solutions help manufacturers improve worker safety and productivity

TABLE 254 MANUFACTURING MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.5.4 OTHERS

TABLE 255 OTHERS MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

13.6 PUSH TO TALK MARKET, BY REGION

13.6.1 NORTH AMERICA

TABLE 256 NORTH AMERICA: PUSH-TO-TALK MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 257 NORTH AMERICA: PUSH-TO-TALK MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.6.2 EUROPE

TABLE 258 EUROPE: PUSH-TO-TALK MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 259 EUROPE: PUSH-TO-TALK MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.6.3 ASIA PACIFIC

TABLE 260 ASIA PACIFIC: PUSH-TO-TALK MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 261 ASIA PACIFIC: PUSH-TO-TALK MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.6.4 LATIN AMERICA

TABLE 262 LATIN AMERICA: PUSH-TO-TALK MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 263 LATIN AMERICA: PUSH-TO-TALK MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.6.5 MIDDLE EAST AND AFRICA

TABLE 264 MIDDLE EAST AND AFRICA: PUSH-TO-TALK MARKET SIZE, BY COMPONENT, 2017–2024 (USD MILLION)

TABLE 265 MIDDLE EAST AND AFRICA: PUSH-TO-TALK MARKET SIZE, BY VERTICAL, 2017–2024 (USD MILLION)

13.7 CRITICAL COMMUNICATIONS MARKET

13.7.1 MARKET DEFINITION

13.7.2 MARKET OVERVIEW

13.8 CRITICAL COMMUNICATIONS MARKET, BY TECHNOLOGY

FIGURE 55 LMR NETWORK TECHNOLOGY TO CAPTURE SIGNIFICANTLY LARGER SIZE OF CRITICAL COMMUNICATION MARKET DURING FORECAST PERIOD

TABLE 266 CRITICAL COMMUNICATION MARKET, BY TECHNOLOGY, 2016–2024 (USD BILLION)

13.8.1 LAND MOBILE RADIO (LMR)

13.8.1.1 Lmr technology-based critical communication solutions to account for larger market share during 2019–2024

TABLE 267 CRITICAL COMMUNICATION MARKET FOR LMR TECHNOLOGY, BY TYPE, 2016–2024 (USD MILLION)

TABLE 268 CRITICAL COMMUNICATION MARKET FOR LMR TECHNOLOGY, BY REGION, 2016–2024 (USD MILLION)

13.8.1.2 Tetra/p25

13.8.1.2.1 TERA/P25 LMR technology to record highest CAGR in critical communication market during forecast period

13.8.1.3 Analog

13.8.1.3.1 Analog technology accounted for largest share of critical communication market for LMR in 2018

13.8.1.4 Others

13.8.2 LONG-TERM EVOLUTION (LTE)

13.8.2.1 LTE technology to witness highest CAGR in critical communication market during forecast period

TABLE 269 CRITICAL COMMUNICATION MARKET FOR LTE TECHNOLOGY, BY REGION, 2016–2024 (USD MILLION)

13.9 CRITICAL COMMUNICATIONS MARKET, BY VERTICAL

FIGURE 56 PUBLIC SAFETY VERTICAL TO ACCOUNT FOR LARGEST SIZE OF CRITICAL COMMUNICATION MARKET DURING FORECAST PERIOD

TABLE 270 CRITICAL COMMUNICATION MARKET, BY VERTICAL, 2016–2024 (USD MILLION)

13.9.1 PUBLIC SAFETY

13.9.1.1 Public safety vertical to witness highest demand for critical communication solutions during forecast period

TABLE 271 CRITICAL COMMUNICATION MARKET FOR PUBLIC SAFETY VERTICAL, BY REGION, 2016–2024 (USD MILLION)

13.9.2 TRANSPORTATION

13.9.2.1 Transportation vertical to witness highest CAGR in critical communication market from 2019 to 2024

TABLE 272 CRITICAL COMMUNICATION MARKET FOR TRANSPORTATION VERTICAL, BY REGION, 2016–2024 (USD MILLION)

13.9.3 UTILITIES

13.9.3.1 Need for robust communication in utilities vertical to propel critical communication market growth during forecast period

TABLE 273 CRITICAL COMMUNICATION MARKET FOR UTILITIES VERTICAL, BY REGION, 2016–2024 (USD MILLION)

13.9.4 MINING

13.9.4.1 APAC to record highest CAGR in critical communication market for mining vertical during forecast period

TABLE 274 CRITICAL COMMUNICATION MARKET FOR MINING VERTICAL, BY REGION, 2016–2024 (USD MILLION)

13.9.5 OTHERS

TABLE 275 CRITICAL COMMUNICATION FOR OTHER VERTICALS, BY REGION, 2016–2024 (USD MILLION)

13.10 LAND MOBILE RADIO MARKET

13.10.1 MARKET DEFINITION

13.10.2 MARKET OVERVIEW

13.11 LAND MOBILE RADIO MARKET, BY TECHNOLOGY

FIGURE 57 LAND MOBILE RADIO MARKET: DIGITAL VS. ANALOG (2016 VS. 2022)

TABLE 276 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2013–2022 (USD BILLION)

13.11.1 ANALOG TECHNOLOGY

TABLE 277 LAND MOBILE RADIO MARKET FOR ANALOG TECHNOLOGY, BY REGION, 2013–2022 (USD BILLION)

13.11.2 DIGITAL TECHNOLOGY

TABLE 278 LAND MOBILE RADIO MARKET FOR DIGITAL TECHNOLOGY, BY TYPE, 2013–2022 (USD BILLION)

TABLE 279 LAND MOBILE RADIO MARKET FOR DIGITAL TECHNOLOGY, BY REGION, 2013–2022 (USD BILLION)

13.11.2.1 Tetra

TABLE 280 LAND MOBILE RADIO MARKET FOR TETRA DIGITAL TECHNOLOGY, BY REGION, 2013–2022 (USD BILLION)

13.11.2.2 Dmr

TABLE 281 LAND MOBILE RADIO MARKET FOR DIGITAL MOBILE RADIO TECHNOLOGY, BY REGION, 2013–2022 (USD BILLION)

13.11.2.3 P25

TABLE 282 LAND MOBILE RADIO MARKET FOR P25 DIGITAL TECHNOLOGY, BY REGION, 2013–2022 (USD BILLION)

13.11.2.4 Others

13.12 LAND MOBILE RADIO MARKET, BY APPLICATION

FIGURE 58 LAND MOBILE RADIO MARKET, BY APPLICATION

TABLE 283 LAND MOBILE RADIO MARKET, BY APPLICATION, 2013–2022 (USD BILLION)

FIGURE 59 LAND MOBILE RADIO MARKET: PUBLIC SAFETY VS. COMMERCIAL APPLICATION (2016 VS. 2022)

13.12.1 COMMERCIAL

FIGURE 60 COMMERCIAL LAND MOBILE RADIO MARKET: TRANSPORTATION APPLICATION TO DOMINATE THE COMMERCIAL LAND MOBILE RADIO MARKET DURING THE FORECAST PERIOD

TABLE 284 LAND MOBILE RADIO MARKET, BY COMMERCIAL APPLICATION, 2013–2022 (USD BILLION)

TABLE 285 LAND MOBILE RADIO MARKET FOR COMMERCIAL APPLICATION, BY REGION, 2013–2022 (USD BILLION)

13.12.1.1 Retail

TABLE 286 LAND MOBILE RADIO MARKET FOR COMMERCIAL RETAIL APPLICATION, BY REGION, 2013–2022 (USD MILLION)

13.12.1.2 Transportation

TABLE 287 LAND MOBILE RADIO MARKET FOR COMMERCIAL TRANSPORTATION APPLICATION, BY REGION, 2013–2022 (USD MILLION)

13.12.1.3 Utility

TABLE 288 LAND MOBILE RADIO MARKET FOR COMMERCIAL UTILITY APPLICATION, BY REGION, 2013–2022 (USD MILLION)

13.12.1.4 Mining

TABLE 289 LAND MOBILE RADIO MARKET FOR COMMERCIAL MINING APPLICATION, BY REGION, 2013–2022 (USD MILLION)

13.12.1.5 Others

TABLE 290 LAND MOBILE RADIO MARKET FOR OTHER COMMERCIAL APPLICATIONS, BY REGION, 2013–2022 (USD MILLION)

13.12.2 PUBLIC SAFETY

FIGURE 61 PUBLIC SAFETY LAND MOBILE RADIO MARKET: MILITARY & DEFENSE TO DOMINATE THE MARKET FOR THE PUBLIC SAFETY APPLICATION

TABLE 291 LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY APPLICATION, BY REGION, 2013–2022 (USD MILLION)

TABLE 292 LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY APPLICATION, 2013–2022 (USD BILLION)

13.12.2.1 Military & defense

TABLE 293 LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY MILITARY & DEFENSE APPLICATION, BY REGION, 2013–2022 (USD MILLION)

13.12.2.2 Home security

TABLE 294 LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY HOME SECURITY APPLICATION, BY REGION, 2013–2022 (USD MILLION)

13.12.2.3 Emergency & medical services

TABLE 295 LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY EMERGENCY & MEDICAL SERVICES APPLICATION, BY REGION, 2013–2022 (USD MILLION)

13.12.2.4 Fire department

TABLE 296 LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY FIRE DEPARTMENT APPLICATION, BY REGION, 2013–2022 (USD MILLION)

13.12.2.5 Others

TABLE 297 LAND MOBILE RADIO MARKET FOR OTHER PUBLIC SAFETY APPLICATIONS, BY REGION, 2013–2022 (USD MILLION)

14 APPENDIX (Page No. - 278)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

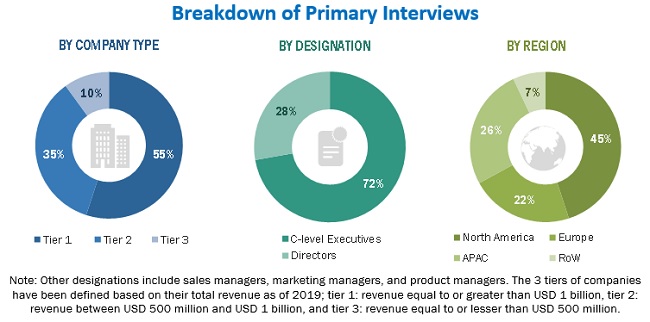

The study involved the estimation of the current size of the public safety-LTE market. Exhaustive secondary research was conducted to collect information on the market, its peer markets, and its parent market. This was followed by the validation of these findings, assumptions, and sizing with the industry experts through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall size of the market. It was followed by the market breakdown and data triangulation procedures, which were used to estimate the size of the market based on different segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information relevant to this study on the PS-LTE market. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases. Secondary research was conducted to obtain key information about the supply chain and the value chain of the critical communication industry, the total pool of key players, the market classification and segmentation according to the industry trends, geographic markets, and key developments from both market and technology perspectives.

Primary Research

Extensive primary research was conducted after understanding and analyzing the PS-LTE market through secondary research. Several primary interviews were conducted (with a key focus on the impact of COVID-19) with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Europe, APAC, and RoW. RoW comprises the Middle East and Africa and South America.

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information relevant to this report on the PS-LTE market. Primary sources from the supply side included experts such as CEOs, VPs, marketing directors, technology and innovation directors, application developers, application users, and related executives from various key companies and organizations operating in the public safety ecosystem.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

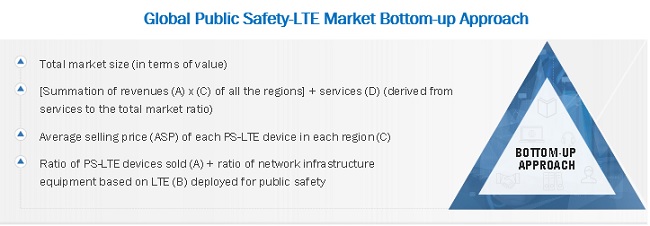

Top-down and bottom-up approaches were implemented to estimate and validate the total size of PS-LTE market.

Bottom-up approach

The bottom-up approach was used to arrive at the overall size of the PS-LTE market from the analyses of revenues of key players and network deployments and infrastructure developments undertaken by them in the market.

- Identifying potential applications and end users of PS-LTE technology

- Analyzing each potential application of PS-LTE, along with the identification of providers of PS-LTE systems and solutions, companies related to PS-LTE, and service providers that carry out the deployment of PS-LTE networks across various regions

- Arriving at the market estimates for deployments at different locations by understanding the demand for PS-LTE across different sectors and by tracking the ongoing and upcoming implementations of PS-LTE networks for both pre- and post-COVID-19 scenarios

- Tracking the ongoing and upcoming PS-LTE projects for various applications, and forecasting the market size based on these projects and other critical parameters, such as government policies related to public safety and the effect of other critical communication technologieson the market along with the anticipated change in demand in the post COVID-19 scenario.

- Understanding the regional markets by analyzing the adoption of PS-LTE by different end users

- Combining the regional markets for each application to arrive at the regional market estimates

- Carrying out multiple discussions with key opinion leaders to understand the different types of products based on LTE technology developed by major companies; this information helped in the analysis of the scope of work carried out by each major company in the PS-LTE market as well as the impact of COVID-19 on the market

- Arriving at the market estimates by analyzing PS-LTE infrastructure and identifying the companies that provide PS-LTE services in different countries; combining this information to arrive at the market estimates for each region for both pre- and post-COVID-19 scenarios

- Verifying and cross-checking estimates at every level through discussions with key opinion leaders, including directors and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid information sources, such as annual reports, press releases, white papers, and databases.

Top-down Approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned under the market segmentation) through percentage splits obtained from secondary and primary research.

To calculate the size of specific market segments, the size of the most appropriate immediate parent market (the critical communications market) was used to implement the top-down approach. The bottom-up approach was implemented for the data extracted from secondary research to validate the market size obtained.

- Focusing on the investments being made in the critical communications ecosystem; additionally, listing down the key market developments undertaken by leading players, analyzing advanced technologies and trends in the competing critical communications marketplace, and evaluating the size of the PS-LTE market by further splitting the data obtained from PS-LTE devices and infrastructures

- Collecting and analyzing information related to the revenue of the key PS-LTE infrastructure developers and service providers

- Conducting multiple discussions with key opinion leaders involved in the development of PS-LTE hardware and solutions

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country or a region, government policies related to PS-LTE, and the number of telecom players deploying PS-LTE solutions globally

- Impact of COVID-19 on the steps mentioned above has also been considered

Data Triangulation

After arriving at the overall size of the PS-LTE market from the market size estimation process explained earlier, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the size of the PS-LTE market was validated using top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the public safety-long term evolution (PS-LTE) market, in terms of value, based on infrastructure & service, deployment model, application, end user, and region

- To forecast the market size for various segments with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the PS-LTE market

- To strategically analyze micromarkets1 with respect to individual growth trends, market prospects, and contribution to the total market

- To analyze opportunities in the PS-LTE market for stakeholders and provide a detailed competitive landscape for the market players

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies2

- To analyze developments such as product launches and developments, acquisitions, partnerships, collaborations, and agreements carried out in the PS-LTE market

Available Customizations

With given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis

- Further regional and country-level breakdown of the PS-LTE market, by infrastructure & service and deployment model

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Public Safety-LTE Market