Land Mobile Radio Market Size, Share, Trends and Growth

Land Mobile Radio Market by Type (Hand Portable, In-Vehicle), Technology (Analog, Digital (Terrestrial Trunked Radio (TETRA), Digital Mobile Radio (DMR), Project 25 (P25)); Frequency (25-174 MHz, 200-512 MHz, 700 MHZ & above) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The land mobile radio market is projected to reach USD 32.24 billion by 2030, growing from USD 19.41 billion in 2025 at a CAGR of 10.7% from 2025 to 2030. Market growth is driven by the increasing demand for reliable and secure communication systems across critical sectors, such as public safety, defense, transportation, and utilities. The transition from analog to digital technologies, including TETRA, DMR, and P25, is enhancing voice clarity, data transmission, and interoperability among agencies. At the same time, the integration of broadband and LTE capabilities with traditional LMR systems is expanding operational efficiency, thereby fueling market expansion.

KEY TAKEAWAYS

-

By RegionBy region, North America accounted for a market share of 38.6% in 2024.

-

By TechnologyBy technology, the digital segment is projected to register a higher CAGR (13.7%) than the analog segment during the forecast period.

-

By TypeBy type, the hand-portable segment is projected to grow at a higher rate than the in-vehicle (mobile) segment from 2025 to 2030.

-

By FrequencyBy frequency, the 200–512 MHz (UHF) segment is projected to grow at the highest rate during the forecast period.

-

By ApplicationBy application, the commercial segment is projected to dominate the land mobile radio market during the forecast period. It is projected to grow at the highest CAGR of 12.3% in the same period.

-

Competitive LandscapeCompanies Relay, Inc.; Zetron; goTenna; and Weavix have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The land mobile radio market is witnessing steady growth, driven by the rising need for reliable, mission-critical communication across sectors, such as public safety, defense, transportation, and utilities. Additionally, the shift from analog to digital LMR technologies—including TETRA, DMR, and P25—is enhancing communication efficiency through better voice clarity, data transfer, and encryption capabilities. Moreover, market dynamics are being reshaped by strategic developments, such as Motorola Solutions’ continued expansion of its ASTRO P25 portfolio, Hytera’s launch of next-generation DMR terminals, and JVCKENWOOD’s partnerships for LTE-integrated LMR solutions. These factors are further propelling growth in the market. Moreover, the convergence of LMR with broadband and LTE networks is paving the way for hybrid communication ecosystems, ensuring seamless connectivity and interoperability for field operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Current revenue streams in the land mobile radio market, traditionally driven by voice-centric communication and analog systems, are evolving toward data-enabled, broadband-integrated, and software-driven solutions. As a result, the market is transitioning as organizations seek interoperable, secure, and intelligent communication platforms that combine digital LMR, LTE, and 5G capabilities. Additionally, emerging opportunities are centered around hybrid LMR-LTE systems, AI-assisted dispatch and analytics, cloud-based radio management, and network virtualization, which are redefining how mission-critical communication is deployed and managed. These advancements are enabling transformative applications in public safety networks, utility, transportation, and defense, supporting capabilities, such as real-time situational awareness, IoT-based asset monitoring, and seamless voice-data integration. As the ecosystem matures, revenue is gradually shifting toward software, broadband services, and managed communication platforms, reflecting the growing importance of intelligent, connected, and resilient communication infrastructure.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Transition from analog to digital LMR technologies

-

Rising adoption of hybrid LMR–LTE/5G systems for seamless communication

Level

-

High deployment and maintenance costs for large-scale LMR infrastructure

-

Limited spectrum availability and regulatory constraints

Level

-

Integration of LMR with IoT, GPS, and data analytics for advanced field operations

-

Expansion in emerging markets driven by smart city and infrastructure projects

Level

-

Interoperability issues between multi-vendor and multi-technology systems

-

Cybersecurity risks in digital and hybrid communication environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Transition from analog to digital LMR technologies

The ongoing transition from analog to digital land mobile radio (LMR) systems is a key driver of growth. Digital technologies, such as TETRA, DMR, and P25, offer superior audio clarity, enhanced data capabilities, improved spectrum efficiency, and advanced features like encryption and GPS integration. This shift enables more reliable and secure communication, especially in mission-critical environments, such as public safety, utilities, and transportation. As end users seek systems that support both voice and data transmission, digital LMR adoption continues to accelerate globally, replacing legacy analog networks and driving overall market modernization.

Restraint: High deployment and maintenance costs for large-scale LMR infrastructure

Large-scale LMR deployments involve substantial initial capital investment and ongoing maintenance expenses. The costs associated with network infrastructure, base stations, repeaters, and spectrum licensing can be prohibitive, particularly for smaller agencies or emerging economies. Moreover, maintaining system interoperability and ensuring regular upgrades add to the financial burden. These high costs often delay modernization initiatives and limit adoption in cost-sensitive markets, posing a significant restraint on widespread LMR deployment.

Opportunity: Integration of LMR with IoT, GPS, and data analytics for advanced field operations

The integration of LMR systems with emerging technologies, such as IoT, GPS, and data analytics, presents a strong growth opportunity for the market. By connecting radios to IoT sensors and analytics platforms, organizations can achieve real-time situational awareness, predictive maintenance, and optimized asset tracking. GPS-enabled LMRs enhance field visibility and coordination, particularly in emergency response and logistics operations. Such convergence of communication and data intelligence is enabling next-generation, connected ecosystems that improve efficiency, safety, and decision-making across industries.

Challenge: Interoperability issues between multi-vendor and multi-technology systems

Interoperability remains a critical challenge in the land mobile radio market, particularly as networks expand across regions and incorporate diverse technologies and vendors. Differences in communication protocols, frequency bands, and standards often hinder seamless communication between systems, complicating coordination among agencies or departments using different platforms. Although digital standards like P25 and TETRA have improved compatibility, achieving full cross-technology interoperability remains difficult. Addressing these issues requires collaborative standardization efforts and increased investment in unified communication frameworks to ensure consistent, mission-critical connectivity.

land-professional-mobile-radio-market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Deployment of a next-generation digital LMR communication system in Oakland County to establish a unified, interoperable platform for public safety agencies | Enable seamless voice and data communication |real-time coordination; and secure information exchange during emergencies | Enhanced emergency response efficiency, faster incident resolution, and improved situational awareness across agencies | The solution strengthens network reliability, expands coverage in remote areas, and supports future scalability for advanced communication applications such as GPS tracking and data-driven dispatch. |

|

Implementation of the NEXEDGE digital radio system to enable secure, high-quality, and real-time communication across all operational and construction teams at Istanbul New Airport | Improved coordination and safety across airport operations, enhanced communication reliability over large distances, secure and interference-free voice transmission, and optimized management of large-scale airport activities through seamless team connectivity. |

|

Deployment of Codan’s HF-based communication solution to ensure reliable, long-range connectivity and seamless coordination for the Royal Malaysia Police across challenging and remote regions | Enhanced coverage and network reliability, improved real-time coordination and emergency response, greater communication security, and strengthened operational readiness for law enforcement missions across Malaysia |

|

Implementation of Sepura’s SINE RAKEL system to establish a reliable, interoperable, and wide-coverage communication network connecting Finland’s emergency service agencies for seamless coordination and rapid response | Improved interoperability and network reliability across emergency services, enhanced coverage in remote areas, faster and more coordinated response during crises, and a strengthened national emergency communication infrastructure supporting mission-critical operations |

|

Implementation of Thales software-defined radios to enable flexible, secure, and interoperable communication for the Irish Defence Forces across diverse operational environments and mission requirements | Enhanced operational effectiveness through secure and adaptive communication, improved interoperability across joint and allied forces, reduced hardware obsolescence through software-based upgrades, and strengthened readiness for modern digital defense operations |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The land mobile radio market ecosystem comprises a diverse network of players that collectively enable the design, production, testing, deployment, and distribution of mission-critical communication systems. Manufacturers such as Sepura, Kenwood, L3Harris, Motorola Solutions, Tait Communications, and BK Technologies develop and produce advanced LMR equipment, including TETRA, DMR, and P25 radios, used across public safety, transportation, and defense sectors. Testing & verification service providers like Anritsu and Viavi Solutions ensure that these systems meet stringent performance, interoperability, and reliability standards before deployment. Deployment & installation service providers, including Motorola Solutions, Kenwood, Tait Communications, and Hytera, handle system integration, installation, and maintenance, ensuring seamless operation across large communication networks. Finally, distributors such as IndiaMART, Pulse, and Digi-Key supply LMR devices, components, and accessories to end users and integrators worldwide. Together, these stakeholders form a robust ecosystem that drives reliability, scalability, and innovation in professional and mission-critical radio communications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Land Mobile Radio Market, By Technology

The digital segment is projected to achieve significant growth during the forecast period. The availability of data services within digital technology doubles the capacity in existing licensed channels, due to which the market for the digital technology is projected to witness a higher growth than the analog segment during the forecast period. Moreover, the advanced functionalities offered by digital technologies, such as enhanced voice quality, integration of 4G/LTE, call recording, and group chats, is further expected to drive the growth of the digital technology segment.

Land Mobile Radio Market, By Type

The hand-portable segment is projected to witness a higher growth than the in-vehicle (mobile) segment during the forecast period. An increase in the need for compact sized, featherweight, and portable means of communication particularly in the public safety and business sector has led to the growth of this segment. Additionally, their growing adoption is further aided by battery life improvements as well as their durable nature.

Land Mobile Radio Market, By Frequency

The 700 MHz & above segment is projected to account for the largest share during the forecast period, primarily due to the long-range capability of this frequency band, which enables operators to broadcast over extended distances.

Land Mobile Radio, By Application

The public safety segment is projected to achieve a large market share throughout the forecast period. LMR systems are adopted across applications. These systems help establish interoperability between applications and dispatch centers. Additionally, LMR systems have a wide range that extends over long distance. They may be utilized in areas devoid of any mobile phone signal or those with an erratic pattern of cell connectivity. Public safety departments are progressively employing these systems on the most essential lines of communication.

REGION

Asia Pacific to be fastest-growing region in land mobile radio market during forecast period

The Asia Pacific land mobile radio industry is growing quickly due to urbanization and rising public safety concerns in countries like China, Japan, and South Korea. The growth of this market is also driven by the increased usage of land mobile radios in industries, such as construction, manufacturing, mining and public safety. In China and Japan, a great demand for LMR solutions is being witnessed, especially in the transportation, energy, and public security sectors. The growth of this regional market can also be attributed to the presence of emerging players accompanied by the onset of new technologies. Some of the major players operating in Asia Pacific land mobile radio market are Hytera Communications Corporation Limited (China), Simoco Wireless Solutions (UK), and Tait Communications (New Zealand).

land-professional-mobile-radio-market: COMPANY EVALUATION MATRIX

In the land mobile radio market matrix, Motorola Solutions (Star) holds a leading position with a dominant market share, extensive product portfolio, and strong global presence across public safety, defense, and commercial sectors. The company’s success is driven by its advanced ASTRO P25, TETRA, and MOTOTRBO digital radio systems, complemented by integrated command center software, broadband solutions, and lifecycle management services. Motorola's long-standing relationships with government and emergency service agencies, coupled with its continuous innovation in hybrid LMR-LTE and AI-enabled communication platforms, reinforce its market leadership. On the other hand, L3Harris Technologies (Emerging Leader) is rapidly expanding its footprint with cutting-edge P25 and software-defined radio (SDR) solutions, offering high levels of interoperability, encryption, and field adaptability. The company's growing involvement in defense and tactical communication programs positions it as a strong challenger. It is steadily advancing toward the leaders’ quadrant as global demand rises for secure, interoperable, and broadband-integrated mission-critical communication systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 17,890.3 Million |

| Market Forecast in 2030 (Value) | USD 32,236.0 Million |

| Growth Rate | CAGR of 10.7% from 2025–2030 |

| Years Considered | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Rest of the World |

WHAT IS IN IT FOR YOU: land-professional-mobile-radio-market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| LMR Manufacturer | Competitive profiling of leading LMR vendors, including Motorola Solutions, L3Harris Technologies, Hytera, Sepura, Kenwood, and Tait Communications | Benchmarking technology portfolios across analog, DMR, TETRA, and P25 standards |

| System Integrator/Deployment Service Provider | Benchmarking deployment and installation strategies for large-scale LMR systems | Evaluating performance optimization for multi-agency networks and regional coverage expansion |

| Public Safety Agency/Defense Organization | Comparative evaluation of LMR technologies based on reliability, encryption, and interoperability standards | Assessment of broadband and LMR network convergence for mission-critical communication |

| Component Supplier/Semiconductor Vendor | Mapping demand for RF components, semiconductors, power amplifiers, and encryption modules in digital LMR systems | Forecasting technology trends in SDR-based LMR platforms |

| Distributor/Channel Partner | Market mapping of authorized distributors, dealers, and value-added resellers across North America, Europe, and Asia Pacific | Tracking sales performance, regional coverage, and customer engagement models |

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

| LMR Manufacturer | Competitive profiling of leading LMR vendors including Motorola Solutions, L3Harris Technologies, Hytera, Sepura, Kenwood, and Tait Communications | Benchmarking technology portfolios across analog, DMR, TETRA, and P25 standards |

| System Integrator / Deployment Service Provider | Benchmarking deployment and installation strategies for large-scale LMR systems | Evaluating performance optimization for multi-agency networks and regional coverage expansion |

| Public Safety Agency / Defense Organization | Comparative evaluation of LMR technologies based on reliability, encryption, and interoperability standards | Assessment of broadband and LMR network convergence for mission-critical communication |

| Component Supplier / Semiconductor Vendor | Mapping demand for RF components, semiconductors, power amplifiers, and encryption modules in digital LMR systems | Forecasting technology trends in SDR-based LMR platforms |

| Distributor / Channel Partner | Market mapping of authorized distributors, dealers, and value-added resellers across North America, Europe, and Asia Pacific | Tracking sales performance, regional coverage, and customer engagement models |

RECENT DEVELOPMENTS

- April 2025 : Motorola Solutions announced the launch of SVX, a video remote speaker microphone integrating secure voice, video, and AI for its APX NEXT radio, a new AI collaboration tool designed to provide contextual and actionable information to first responders.

- August 2025 : Motorola Solutions completed the acquisition of Silvus Technologies Holdings Inc., a leader in mobile ad-hoc networks (MANET), for a total consideration of up to USD 5 billion, including an upfront payment and potential earnout, to extend its technology into the rapidly growing drone and unmanned systems market for defense and public safety.

- October 2024 : L3Harris and Palantir established a partnership to rapidly develop user solutions for the Joint Force by integrating L3Harris's resilient communications and software-defined radios with Palantir's AI/ML data integration and decision-aid software platform, Foundry. The solutions would focus on the 'Radio-as-a-Sensor' concept.

Table of Contents

Methodology

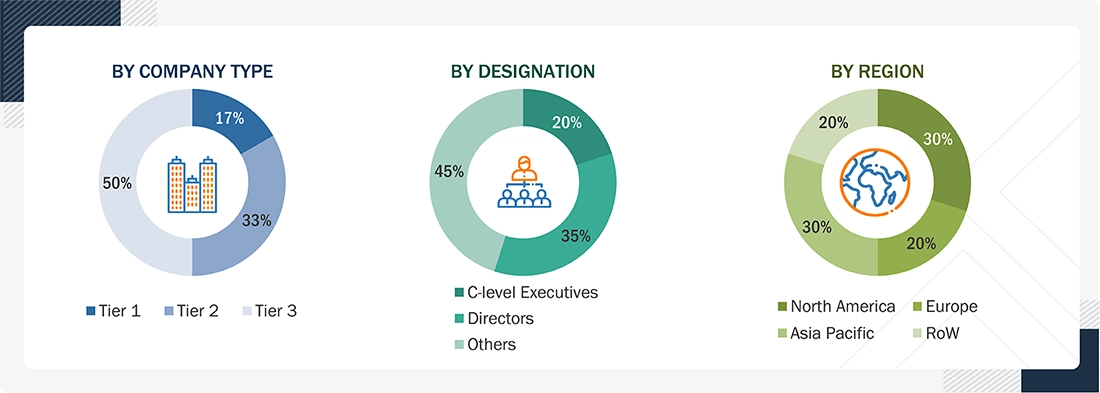

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the land mobile radio market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the land mobile radio market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the land mobile radio market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts, such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various sources were used to identify and collect information important for this study. These included annual reports, press releases & investor presentations of companies, white papers, technology journals, certified publications, articles by recognized authors, directories, and databases. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of market players, the classification of the market according to industry trends to the bottom-most level, regional markets, and key developments from the market and technology-oriented perspectives.

Primary Research

Primary research was conducted to identify segmentation types, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, and industry trends. It was also used to identify key strategies adopted by players operating in the land mobile radio market. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information and insights throughout the report.

Extensive primary research was conducted after acquiring knowledge about the land mobile radio market scenario through secondary research. Several primary interviews were conducted with experts from the demand side (application and region) and supply side (type, technology, and frequency) across four major geographic regions, namely North America, Europe, Asia Pacific, and RoW. Approximately 80% and 20% of primary interviews were conducted from the supply and demand sides, respectively. Data was collected through questionnaires, emails, and telephonic interviews.

Others included Technology Heads, Media Analysts, Sales Managers, Marketing Managers, and Product Managers.

The three tiers of the companies were based on their total revenues as of 2024. Given below is the classification: Tier 1: > USD 1 billion; Tier 2: USD 500 million–1 billion; and Tier 3: USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

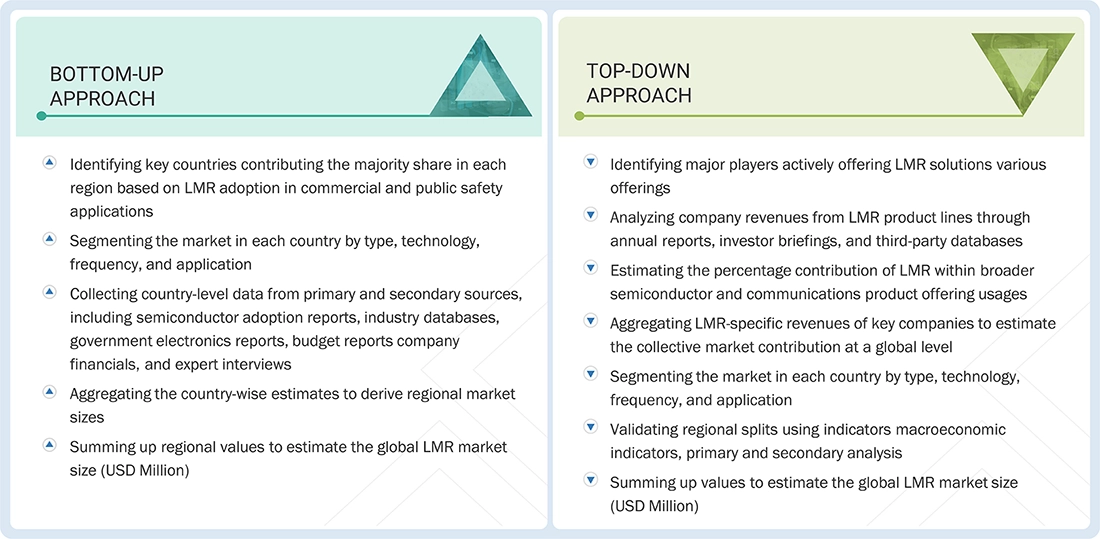

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the land mobile radio market and various other dependent submarkets. Key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire research methodology included the study of annual and financial reports of the top players, as well as interviews with experts (such as CEOs, VPs, directors, and marketing executives) for key insights (quantitative and qualitative).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The following steps were involved in market size estimation using the bottom-up approach:

- Identifying key countries contributing the majority share in each region based on LMR adoption in commercial and public safety applications

- Segmenting the market in each country by type, technology, frequency, and application

- Collecting country-level data from primary and secondary sources, including semiconductor adoption reports, industry databases, government electronics reports, budget reports, company financials, and expert interviews

- Aggregating the country-wise estimates to derive regional market sizes

- Summing up regional values to estimate the global LMR market size (in USD Million).

- Verifying and cross-checking the estimate at every level, from discussions with key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

The following steps were involved in market size estimation using the top-down approach:

- Identifying major players actively offering LMR solutions, various offerings

- Analyzing company revenues from LMR product lines through annual reports, investor briefings, and third-party databases

- Estimating the percentage contribution of LMR within broader semiconductor and communications product offerings usages

- Aggregating LMR-specific revenues of key companies to estimate the collective market contribution at a global level

- Segmenting the market in each country by type, technology, frequency, and application

- Validating regional splits using macroeconomic indicators, primary and secondary analysis

- Conducting interviews with stakeholders, including LMR product managers, solution architects, sales directors, and regional heads, to validate product-level revenue contribution toward LMR

- Triangulating data using company reports, third-party databases, and expert insights to extrapolate the global LMR market size and forecast

- Cross-verifying estimates at every level with key opinion leaders, semiconductor consultants, and industry analysts

Land Mobile Radio Market: Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments using the market size estimation processes explained above. Data triangulation and market breakdown procedures were employed to complete the entire market engineering process and determine each market segment’s and subsegment's exact statistics. The data collected was triangulated by studying various factors and trends from the demand and supply sides in the land mobile radio market.

Market Definition

Land mobile radio (LMR) is a wireless communication system applied by organizations in public safety, government agencies, and enterprises for two-way voice communication. LMR systems serve in mobile use by users in cars or on foot and offer dependable, safe, and frequently mission-critical messages over distances that can be short or long. These systems use specific frequency bands through which they coordinate various activities in many sectors, such as public safety, transportation, utilities, and manufacturing, where immediate and effective communication is essential.

Key Stakeholders

- Suppliers of raw material and manufacturing equipment

- OEMs providing land mobile radio instruments

- Asset management consultants specializing in physical asset management

- Research institutes and organizations

- Associations and regulatory authorities related to plant maintenance

- Government bodies, venture capitalists, and private equity firms

Report Objectives

- To define, describe, and forecast the land mobile radio market, in terms of value and volume, by type, technology, frequency, application, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. To provide ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market

- To give a detailed overview of the value chain of the land mobile radio market ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To study competitive developments, such as collaborations, partnerships, product developments, and acquisitions, in the market

- To understand the impact of AI on the land mobile radio market

- To understand and analyze the impact of the 2025 US trump tariff on the land mobile radio market

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Land Mobile Radio Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Land Mobile Radio Market

Marc

Jan, 2019

I am interested in using the report as part of my research in order to fulfil my undergraduate degree..

Vladislav

Jan, 2016

My specific interest is in market size and trends in handheld radio, especially multiband with data transmission functionality, so is this a part of your report?.

Erica

Mar, 2019

We are interested in locating research analyzing the customers who purchase Digital Mobile Radio (DMR) and portable radio products and industry reports which include customer profiles (industry, size, location, technology use, etc.) for DMRs, two-way radios and other such push-to-talk communication devices..

User

Feb, 2020

Who is the leading supplier of this technology? .

Sam

Jul, 2019

Hello, I'm a student doing market research on the mobile land radio industry and I'm looking for data and information to learn about the industry..

Christopher

Jul, 2017

Could you kindly provide a table of contents for this report? Also, does this report provide the size and growth rate of the MANET (mobile ad hoc network) market? If so, what data relating to this does this report provide?.

Anton

Jun, 2019

Need to estimate 2018 LMR size for public safety (PPDR), Transport (Trains, Metro, LiteRail, Ports and Airports), the size of Utility and Industrial market and the size of Consumer/Personal Radio market..

Conor

Apr, 2018

What are the new trends for Land Mobile Radio Market in North America. It would be good to get a sense of what detail you go into for market tables.