Public Safety and Security Market by Component, Solution (Critical Communication Network, Biometric & Authentication System, Surveillance System, Emergency & Disaster Management, Cyber Security), Service, Vertical and Region - Global Forecast to 2027

Public Safety and Security Market Statistics - Size, Share & Growth

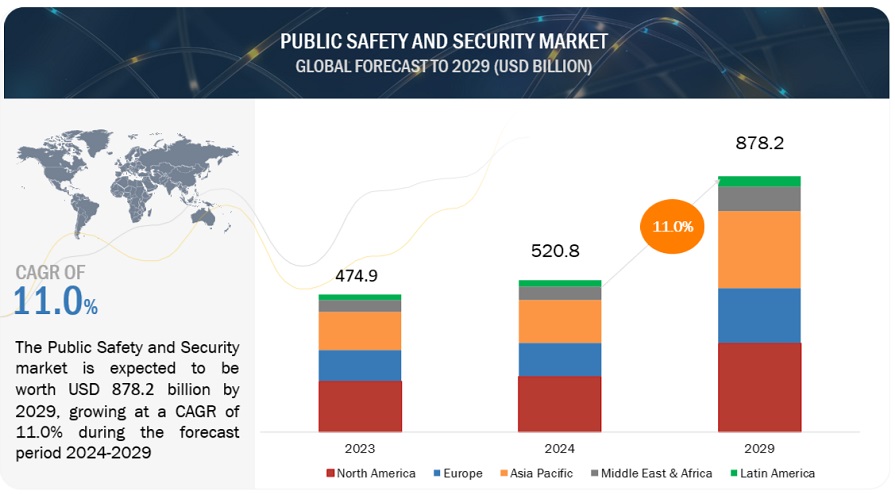

The global Public Safety and Security Market size was surpassed $433.6 billion in 2022 and is poised to increase up to $707.2 billion by the end of 2027, projecting a effective CAGR of 10.3% during the predicted period (2022-2027).

The major factors fueling the Public Safety and Security market include Rising instances of terrorist activities and security, Need for security training and awareness, Increasing law enforcement requirements for public safety amid COVID-19. Moreover, Growing trend of IoT in public safety wil also help the vendor to boost the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Public Safety and Security Market Growth Dynamics

Driver: Rising instances of terrorist activities and security breaches

The growing crime rates and the rising terrorist activities have increased the concerns over the safety and security of assets, people, and processes. These increasing attacks have led to the loss of several human lives and severe damage to infrastructure, highlighting the need for public safety and security solutions. According to the US Department of State, terrorist activities have been rising across the globe. The growth in organized crime has posed a significant threat to national and international security. Criminal networks are expanding and diversifying their activities, resulting in the convergence of threats to public safety, public health, and democratic institutions and affecting economic stability across the globe.

Restraint: High installation and maintenance costs for public safety and security systems

Ensuring public safety and security is a priority for governments around the world. Public safety and security systems feature a huge set of hardware components along with software solutions. Governments spend considerable resources on the installation of critical communication networks, biometric security and authentication systems, surveillance systems, scanning and screening systems, and emergency and disaster management systems. According to the F5 State of Application Delivery survey 2020, small security budgets (38%) are among the top five security challenges for ensuring public safety globally. Effective and regular maintenance of public safety and security solutions are essential to ensure that they remain dependable always. The maintenance costs of public safety solutions account for around 40% of the Total Cost of Ownership (TCO). While government authorities and law enforcement bodies strive to promote the public's safety, health, and welfare, the high-level public safety facilities are not economical.

Opportunity: Emergence of big data analytics in public safety and security

The pace of technological innovation is accelerating year over year. Connected devices generate enormous amounts of information that can provide actionable insights to protect critical infrastructure from attacks. Data analytics is the process of analyzing historical data to gain valuable insights. Big data analytics involves analyzing huge amounts of structured or unstructured data. Such data generated from various security devices is first cleaned and managed so that it supports pattern recognition and anomaly identification; this can help public safety organizations and security officers understand the suspect in a crime and easily prevent further crimes. Advanced big data analytics capabilities are now integrated with various CCTV surveillance systems to improve crime response times.

Challenge: Lack of efficient storage and data management capacities

Public safety and law enforcement agencies incorporate various digital solutions, such as high-quality video surveillance, body-worn cameras, and in-car cameras to provide reliable evidence against criminals. However, while body-worn cameras provide various public safety benefits, they also create public safety challenges, such as data security. For instance, the US-based law enforcement agency, Seattle Police Department, generates more than 360 terabytes of data from dashboard cameras alone. The police department in Duluth (a city in Minnesota, US) was able to spend USD 5,000 on cameras but struggled to produce USD 78,000 toward data storage fees for two years. As per the Motorola 2018 Law Enforcement Survey Report, around 85% of respondents wanted more multimedia capabilities to investigate criminal activities.

By component, services segment to grow at a higher cagr during the forecast period

The component segment of the public safety and security market includes the solutions and services required to safeguard the public and public infrastructure. Service providers offer these components to end users as a combined package of solutions and associated services or individually. The public safety services sector constantly looks for new and better ways to protect cities, infrastructure, businesses, and citizens. The market has been segmented into managed services and professional services based on services. The managed services segment has been further segmented into Managed Security Services (MSS) and managed network services. The professional services segment has been segmented into design and consulting, installation and integration, support and maintenance, and training and education.

To know about the assumptions considered for the study, download the pdf brochure

North America to hold the largest market size during the forecast period

The global public safety and security market is dominated by North America, which has the world’s largest number of public safety and security vendors. The region, comprising the US and Canada, boasts the most advanced infrastructure and has significant cyber technology adoption. The other factors that are expected to push the growth of this market in North America are the massive use of smartphones, the rapidly growing e-commerce industry, and the friction related to technology improvements among the competing nations in different regions.

Public safety and security is identified as the most serious economic and national security challenge for governments in the region. In recent years, the growing need to protect critical infrastructure and sensitive data has increased government intervention. Governments in this region are now focusing on deploying more Intrusion Detection System/Intrusion Prevention System (IDS/IPS) solutions across various departments, especially in the healthcare and training assistance program. Over the years, the increased budget and grants have invited various big players to make significant investments in this region. Various government and law enforcement agencies in the US and Canada are strengthening the security infrastructure. For instance, the Canadian government established the Canadian Cyber Incident Response Center to monitor the cybersecurity incidents in the country and make plans to eliminate them. With terrorist organizations increasingly using the internet to aid their fundraising and propaganda activities agenda, the Canadian Government is undertaking public awareness and outreach activities to educate citizens about the potential dangers of cyberspace. The US and Canadian governments are continuously working with law enforcement agencies to prevent violent extremism and counterterrorism-related activities.

Asia Pacific to grow at the highest CAGR during the forecast period

Asia Pacific countries are highly concerned about increasing security spending due to the ever-growing threat landscape. India, Japan, and Singapore have updated or launched new national cybersecurity policies to deal with the increasingly sophisticated threats. Organizations in the Asia Pacific region are expected to spend large amounts of money to deal with cyber security breaches. The growing terrorist attacks and cyberattacks in the region have caused huge damage, leading India, China, Australia, Japan, Malaysia, and Singapore to adopt the best-in-class public safety and security systems. The Australian Government has appointed the National Counterterrorism Coordinator to assist the Australian Prime Minister in setting up policies. China has made its security policies stricter and sets up surveillance and perimeter security systems and solutions in the Xinjiang Uyghur Autonomous Region. The Asia Pacific region is witnessing a surge in smart city projects, creating a greater demand for public safety and security technologies such as surveillance systems, scanning and screening systems, and critical communication networks. The Indian Government focuses on infrastructure development and enhancing the security systems at airports, ports, and refineries.

Key Market Players

Major vendors in the global Public Safety and Security Market include Cisco (US), Honeywell (US), Motorola Solutions (US), IBM (US), NEC (Japan), Siemens (Germany), Thales (France), Ericsson (Sweden), Huawei (China), Tyco (Johnson Control) (Irland), Atos (France), Hexagon AB (Sweden), Idemia (France), General Dynamics (US), ESRI (US), L3HRRIS Technology (US), Alcatel-Lucent Enterprise (France), BAE systems (UK), Verint Systems (US), Haystacks (US), Elbit systems (Israel), Teltronic (Spain), AGT International (Germany), Rave Mobile Safety (US), NICE (Israel), Fotokite (Switzerland), Scadafence (US), TVIlight (Netherland), Briefcam (US), Openpath (US), SmartCone Technologies (Canada). 3XLogic (US), Cityshob (Israel), SavYU(Israel), Onsolve (US).

Cisco is an American multinational company that develops and sells software, networking hardware, telecom equipment, and high technology services and products. Its technological solutions are Cisco Networking, Cisco Security, Cisco IoT, and Cisco Data Center. The company designs manufactures, verifies, and sells integrated products and services. Cisco Systems offers a wide variety of products related to public safety and security, categorized into two groups: Cybersecurity, and Connected Safety and Security. The Cybersecurity category contains products for network security, email security, secure access, and Advanced Malware Protection (AMP). The Connected Safety and Security category has products required for video surveillance, platforms, IP cameras, access controls, and incident response. Its extensive product offerings for physical security comprises video surveillance software, platforms, IP cameras, access control, and incident response. It is among the top physical security companies due to its constant investment in R&D, enabling innovations in the form of high-quality products and services. Its service offerings include technical support and advanced services. With more than 75,900 employees, Cisco caters to a wide customer base, ranging from SMEs to service providers, across industry verticals, such as automotive, FMCG, energy, education, BFSI, government, healthcare, manufacturing, mining, retail, hospitality, transportation, sports, and entertainment. The company has its presence globally in North America, Europe, Asia Pacific, Middle East, and Latin America.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2015-2027 |

|

Base Year Considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast Unit |

Value(USD) |

|

Segments covered |

Public Safety and Security market: |

|

Geographies covered |

|

|

Companies Covered |

Cisco (US), Honeywell (US), Motorola Solutions (US), IBM (US), NEC (Japan), Siemens (Germany), Thales (France), Ericsson (Sweden), Huawei (China), Tyco (Johnson Control) (Irland), Aros (France), Hexagon AB (Sweden), Idemia (France), General Dynamics (US), ESRI (US), L3HRRIS Technology (US), Alcatel Lucent Enterprise (France), BAE systems (UK), Verint Systems (US), Haystacks (US), Elbit systems (Israel), Teltronic (Spain), AGT International (Germany), Rave Mobile Safety (US), NICE (Israel), Fotokite (Switzerland), Scadafence (US), TVIlight (Netherland), Briefcam (US), Openpath (US), SmartCone Technologies (Canada). 3XLogic (US), Cityshob (Israel), SavYU(Israel), Onsolve (US). |

The research report categorizes the public safety and security market into the following segments and subsegments:

Public Safety and Security Market by Component

- Solution

- Services

Market, By Solution

- Critical Communication Network

- C2/C4ISR Networks

- Biometric Security and Authentication System

- Surveillance System

- Scanning and Screening System

- Emergency and Disaster Management

- Cybersecurity

- Public Address and General Alarm

- Backup and Recovery System

Public Safety and Security Market, By Services

- Professional Service

- Managed Services

Market, By Vertical

- Homeland Security

- Emergency Services

- Critical Infrastructure Security

- Transportation Systems

- Other Verticals

Market, by Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Rest of Europe

-

Asia Pacific

- Australia and New Zealand

- China

- Japan

- Japan

- Singapore

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- Israel

- KSA

- Qatar

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In January 2022, Honeywell Made Strategic Investment in RapidSOS. RapidSOS emergency response data platform will be linked to Honeywell’s Connected Life Safety System (CLSS) to enhance its Public Safety Communications Capabilities.

- In December 2021, Honeywell acquired US Digital Designs to integrate it with Honeywell's Fire and Connected Life Safety systems business to expand Honeywell's line of solutions for public safety communications.

- In February 2021, Cisco partnered with Openpath, one of the leaders in touchless, modern access control and workplace safety automation. The company announced a new Video Management System (VMS) partnership integration with Cisco Meraki. Openpath’s access control capabilities will be paired with Cisco Meraki’s industry-leading cloud-based technology, including smart camera intelligence that delivers data and analytics and provides insights to help users make smarter business decisions

Frequently Asked Questions (FAQ):

What is Public Safety and Security?

public safety refers to the public's safety, security, and welfare. Public safety and security is a top priority of governments all over the world. The role of public safety professionals is to prevent danger and protect the wellbeing of citizens, communities, and organizations against cyber threats, terrorism, frauds, criminal activities, natural calamities, national and international terrorism, and other emergencies disaster situations.

What are the top trends that are impacting Public Safety and Security market?

Trends that are impacting Public Safety and Security market include:

- Rising instances of terrorist activities and security breaches

- Increasing law enforcement requirements for public safety amid COVID-19

- Growing trend of IoT in public safety

- High installation and maintenance costs for public safety and security systems

- Emergence of big data analytics in public safety and security

- Adoption of cloud computing technologies in the public safety industry

- Integration of technologies, such as AI, ML, and analytics, in border and public safety

Which are the leading the Public Safety and Security Market Companies?

Cisco (US), Honeywell (US), Motorola Solutions (US), IBM (US), NEC (Japan), Siemens (Germany), Thales (France), Ericsson (Sweden), Huawei (China), Tyco (Johnson Control) (Irland), Aros (France), Hexagon AB (Sweden), Idemia (France), General Dynamics (US), ESRI (US), L3HRRIS Technology (US), Alcatel Lucent Enterprise (France), BAE systems (UK), Verint Systems (US), Haystacks (US), Elbit systems (Israel), Teltronic (Spain), AGT International (Germany), Rave Mobile Safety (US), NICE (Israel), Fotokite (Switzerland), Scadafence (US), TVIlight (Netherland), Briefcam (US), Openpath (US), SmartCone Technologies (Canada). 3XLogic (US), Cityshob (Israel), SavYU(Israel), Onsolve (US).

What are the major solutions in Public Safety and Security market?

The various solutions in Public Safety and Security market as follows:

- Critical Communication Network

- C2/C4ISR Networks

- Biometric Security and Authentication System

- Surveillance System

- Scanning and Screening System

- Emergency and Disaster Management

- Cybersecurity

- Public Address and General Alarm

- Backup and Recovery System

What is the Public Safety and Security market size?

The global Public Safety and Security market size is expected to grow from USD 433.6 billion in 2022 to USD 707.2 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 10.3% from 2022 to 2027. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.5.1.1 Solution

1.5.1.2 Services

1.5.1.3 Vertical

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 PERIODIZATION CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2021

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 54)

2.1 RESEARCH DATA

FIGURE 6 PUBLIC SAFETY AND SECURITY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 7 MARKET: RESEARCH FLOW

2.3 MARKET SIZE ESTIMATION

2.3.1 REVENUE ESTIMATES

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS/SERVICES OF PUBLIC SAFETY AND SECURITY VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, SUPPLY-SIDE ANALYSIS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF PUBLIC SAFETY AND SECURITY VENDORS

2.3.2 DEMAND-SIDE ANALYSIS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP-DOWN (DEMAND SIDE): SHARE OF PUBLIC SAFETY AND SECURITY THROUGH THE OVERALL INFORMATION TECHNOLOGY MARKET

2.4 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 12 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.5 STARTUPS EVALUATION QUADRANT METHODOLOGY

FIGURE 13 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 68)

FIGURE 14 RISING TERRORIST ATTACKS AND THEIR ECONOMIC IMPACT, 2014 – 2019

TABLE 3 PUBLIC SAFETY AND SECURITY MARKET SIZE AND GROWTH, 2022–2027 (USD MILLION, Y-O-Y GROWTH)

TABLE 4 COVID-19 IMPACT ON VENDOR REVENUE AND ACTION PLAN FOR RECOVERY

FIGURE 15 THE MARKET TO WITNESS A SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

FIGURE 16 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST MARKET SHARE IN 2022

FIGURE 17 FASTEST-GROWING SEGMENTS OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 74)

4.1 BRIEF OVERVIEW OF THE PUBLIC SAFETY AND SECURITY MARKET

FIGURE 18 THE INCREASING INSTANCES OF TERROR CASES AND THEFTS TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET, BY SOLUTIONS, 2022

FIGURE 19 CRITICAL COMMUNICATION NETWORK SEGMENT TO HOLD THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY VERTICALS, 2022

FIGURE 20 HOMELAND SECURITY SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4.4 MARKET INVESTMENT SCENARIO

FIGURE 21 APAC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 77)

5.1 INTRODUCTION

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PUBLIC SAFETY AND SECURITY MARKET

5.1.1 DRIVERS

5.1.1.1 Rising instances of terrorist activities and security breaches

FIGURE 23 NUMBER OF TERRORIST ATTACKS IN THE UNITED STATES FROM 1995–2019

TABLE 5 PATENTS TOP 10 COUNTRIES WITH THEIR GLOBAL TERRORISM INDEX SCORE

FIGURE 24 TERROR ATTACKS WORLDWIDE, 2018

5.1.1.2 Increasing law enforcement requirements for public safety amid COVID-19

TABLE 6 COVID-19 IMPACT: NEW PRODUCT LAUNCHES FOR PANDEMIC PREPAREDNESS AND RESPONSE

5.1.1.3 Need for security training and awareness

5.1.1.4 Increasing investment in public safety measures for smart cities

FIGURE 25 PUBLIC SAFETY INITIATIVES IN 2018–2019

5.1.1.5 Growing trend of IoT in public safety

5.1.2 RESTRAINTS

5.1.2.1 High installation and maintenance costs for public safety and security systems

5.1.2.2 Violation of privacy

5.1.3 OPPORTUNITIES

5.1.3.1 Emergence of big data analytics in public safety and security

5.1.3.2 Adoption of cloud computing technologies in the public safety industry

5.1.3.3 Integration of technologies, such as AI, ML, and analytics, in border and public safety

5.1.3.4 Convergence of multiple public safety and security systems

5.1.4 CHALLENGES

5.1.4.1 Lack of efficient storage and data management capacities

5.1.4.2 Integration of logical and physical components of security systems

5.1.4.3 Device vulnerability and chances of systems being hacked

5.2 COVID-19-DRIVEN MARKET DYNAMICS

TABLE 7 PUBLIC SAFETY AND SECURITY MARKET: DRIVERS AND OPPORTUNITIES

TABLE 8 MARKET: RESTRAINTS AND CHALLENGES

5.2.1 CUMULATIVE GROWTH ANALYSIS

5.3 ECOSYSTEM

FIGURE 26 MARKET: ECOSYSTEM AND ADJACENT MARKETS

FIGURE 27 MARKET: ECOSYSTEM

5.3.1 ECOSYSTEM

TABLE 9 MARKET ECOSYSTEM

5.4 VALUE CHAIN ANALYSIS

FIGURE 28 CURITY MARKET: VALUE CHAIN

5.5 PATENT ANALYSIS

FIGURE 29 PUBLIC SAFETY AND SECURITY MARKET: PATENT ANALYSIS

TABLE 10 PUBLIC SAFETY AND SECURITY PATENTS

5.6 ADJACENT MARKETS

5.7 PRICING ANALYSIS

5.7.1 AVERAGE SELLING PRICES OF KEY PLAYERS

TABLE 11 HD-CVI/TVI CAMERAS

TABLE 12 IP CAMERAS – MEDIUM COMMERCIAL GRADE/ ABOVE AVERAGE QUALITY

TABLE 13 IP CAMERAS – ENTRY LEVEL/ ACCEPTABLE QUALITY

TABLE 14 ACCESS CONTROL SYSTEMS

TABLE 15 ALARM INTRUSION SYSTEMS

5.7.2 BIOMETRIC SECURITY AND AUTHENTICATION SYSTEM

FIGURE 30 BIOMETRIC SECURITY AND AUTHENTICATION SYSTEM ASP TREND

5.7.3 SURVEILLANCE SYSTEM ASP TREND

FIGURE 31 SURVEILLANCE SYSTEM ASP TREND

5.8 TECHNOLOGY ANALYSIS

5.8.1 PUBLIC SAFETY AND SECURITY AND AI/ML

5.8.2 PUBLIC SAFETY AND SECURITY AND CLOUD

5.8.3 PUBLIC SAFETY AND SECURITY AND MOBILE-BASED ACCESS CONTROL

5.8.4 PUBLIC SAFETY AND SECURITY AND BIG DATA AND VIDEO ANALYTICS

5.8.5 PUBLIC SAFETY AND SECURITY AND CONTACTLESS BIOMETRICS

5.8.6 PUBLIC SAFETY AND SECURITY AND DRONES

5.9 USE CASES

5.9.1 CISCO HELPED THE CITY OF SAN LUIS POTOSI TO IMPROVE THE PHYSICAL SECURITY OF CITIZENS

5.9.2 HONEYWELL INTELLIGENTLY SECURED AND TRANSFORMED PRISTINA INTERNATIONAL AIRPORT

5.9.3 GOVERNMENT OF INDIA USES NEC BIOMETRIC IDENTIFICATION SYSTEM FOR OVER ONE BILLION PEOPLE

5.9.4 SECOM ELIMINATED THE NEED FOR MANNED GUARDING AT SPEEDY HIRE

5.9.5 DUBLIN AIRPORT IMPLEMENTED ADT’S VIDEO MANAGEMENT SYSTEM

5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 32 PUBLIC SAFETY AND SECURITY MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 16 PORTER’S FIVE FORCES IMPACT ON THE MARKET

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

5.13 TARIFF AND REGULATORY LANDSCAPE

5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 21 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.13.2 GENERAL DATA PROTECTION REGULATION (GDPR)

5.13.3 SARBANES-OXLEY (SOX) ACT

5.13.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.13.5 HEALTH INFORMATION TECHNOLOGY FOR ECONOMIC AND CLINICAL HEALTH

5.13.6 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.14 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 22 MARKET: LIST OF CONFERENCES & EVENTS

6 PUBLIC SAFETY AND SECURITY MARKET, BY COMPONENT (Page No. - 110)

6.1 INTRODUCTION

FIGURE 34 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 23 COMPONENT: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 24 COMPONENT: MARKET SIZE, 2021–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET DRIVERS

6.2.2 SOLUTIONS: COVID-19 IMPACT

TABLE 25 SOLUTIONS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 26 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

6.3.2 SERVICES: COVID-19 IMPACT

TABLE 27 SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 28 SERVICES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7 PUBLIC SAFETY AND SECURITY MARKET, BY SOLUTION (Page No. - 115)

7.1 INTRODUCTION

FIGURE 35 CRITICAL COMMUNICATION NETWORK SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

TABLE 29 SOLUTION: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 30 SOLUTION: MARKET SIZE, 2021–2027 (USD MILLION)

7.2 CRITICAL COMMUNICATION NETWORK

7.2.1 CRITICAL COMMUNICATION NETWORK: MARKET DRIVERS

7.2.2 CRITICAL COMMUNICATION NETWORK: COVID-19 IMPACT DRIVERS

TABLE 31 CRITICAL COMMUNICATION NETWORK: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 32 CRITICAL COMMUNICATION NETWORK: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.3 C2/ C4ISR SYSTEM

7.3.1 C2/C4ISR SYSTEM: MARKET DRIVERS

7.3.2 C2/C4ISR SYSTEM: COVID-19 IMPACT DRIVERS

TABLE 33 C2/C4ISR SYSTEM: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 34 C2/C4ISR SYSTEM: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.4 BIOMETRIC SECURITY AND AUTHENTICATION SYSTEM

7.4.1 BIOMETRIC SECURITY AND AUTHENTICATION SYSTEM: MARKET DRIVERS

7.4.2 BIOMETRIC SECURITY AND AUTHENTICATION SYSTEM: COVID-19 IMPACT DRIVERS

TABLE 35 BIOMETRIC SECURITY AND AUTHENTICATION SYSTEM: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 36 BIOMETRIC SECURITY AND AUTHENTICATION SYSTEM: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.5 SURVEILLANCE SYSTEM

7.5.1 SURVEILLANCE SYSTEM: MARKET DRIVERS

7.5.2 SURVEILLANCE SYSTEM MANAGEMENT: COVID-19 IMPACT DRIVERS

TABLE 37 SURVEILLANCE SYSTEM MANAGEMENT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 38 SURVEILLANCE SYSTEM MANAGEMENT: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.6 SCANNING AND SCREENING SYSTEM

7.6.1 SCANNING AND SCREENING SYSTEM: PUBLIC SAFETY AND SECURITY MARKET DRIVERS

7.6.2 SCANNING AND SCREENING SYSTEM: COVID-19 IMPACT DRIVERS

TABLE 39 SCANNING AND SCREENING SYSTEM: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 40 SCANNING AND SCREENING SYSTEM: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.7 EMERGENCY AND DISASTER MANAGEMENT

7.7.1 EMERGENCY AND DISASTER MANAGEMENT: MARKET DRIVERS

7.7.2 EMERGENCY AND DISASTER MANAGEMENT: COVID-19 IMPACT DRIVERS

TABLE 41 EMERGENCY AND DISASTER MANAGEMENT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 42 EMERGENCY AND DISASTER MANAGEMENT: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.8 CYBERSECURITY

7.8.1 CYBERSECURITY: MARKET DRIVERS

7.8.2 CYBERSECURITY: COVID-19 IMPACT DRIVERS

TABLE 43 CYBERSECURITY: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 44 CYBERSECURITY: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.9 PUBLIC ADDRESS AND GENERAL ALARM

7.9.1 PUBLIC ADDRESS AND GENERAL ALARM: MARKET DRIVERS

7.9.2 PUBLIC ADDRESS AND GENERAL ALARM: COVID-19 IMPACT

TABLE 45 PUBLIC ADDRESS AND GENERAL ALARM: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 46 PUBLIC ADDRESS AND GENERAL ALARM: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.10 BACKUP AND RECOVERY SYSTEM

7.10.1 BACKUP AND RECOVERY SYSTEM: MARKET DRIVERS

7.10.2 BACKUP AND RECOVERY SYSTEM: COVID-19 IMPACT

TABLE 47 BACKUP AND RECOVERY SYSTEM: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 48 BACKUP AND RECOVERY SYSTEM: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8 PUBLIC SAFETY AND SECURITY MARKET, BY SERVICES (Page No. - 131)

8.1 INTRODUCTION

FIGURE 36 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 49 SERVICES: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 50 SERVICES: MARKET SIZE, 2021–2027 (USD MILLION)

8.2 PROFESSIONAL SERVICES

8.2.1 PROFESSIONAL SERVICES: MARKET DRIVERS

8.2.2 PROFESSIONAL SERVICES: COVID-19 IMPACT

FIGURE 37 TRAINING AND EDUCATION SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 51 PROFESSIONAL SERVICES: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 52 PROFESSIONAL SERVICES: MARKET SIZE, 2021–2027 (USD MILLION)

TABLE 53 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 54 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.2.3 DESIGN AND CONSULTING

TABLE 55 DESIGN AND CONSULTING: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 56 DESIGN AND CONSULTING: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.2.4 INSTALLATION AND INTEGRATION

TABLE 57 INSTALLATION AND INTEGRATION: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 58 INSTALLATION AND INTEGRATION: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.2.5 SUPPORT AND MAINTENANCE

TABLE 59 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 60 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.2.6 TRAINING AND EDUCATION

TABLE 61 TRAINING AND EDUCATION: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 62 TRAINING AND EDUCATION: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.3 MANAGED SERVICES

8.3.1 MANAGED SERVICES: PUBLIC SAFETY AND SECURITY MARKET DRIVERS

8.3.2 MANAGED SERVICES: COVID-19 IMPACT

FIGURE 38 MANAGED SECURITY SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 63 MANAGED SERVICES: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 64 MANAGED SERVICES: MARKET SIZE, 2021–2027 (USD MILLION)

TABLE 65 MANAGED SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 66 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.3.3 MANAGED SECURITY SERVICES

TABLE 67 MANAGED SECURITY SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 68 MANAGED SECURITY SERVICES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.3.4 MANAGED NETWORK SERVICES

TABLE 69 MANAGED NETWORK SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 70 MANAGED NETWORK SERVICES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9 PUBLIC SAFETY AND SECURITY MARKET, BY VERTICAL (Page No. - 145)

9.1 INTRODUCTION

FIGURE 39 TRANSPORTATION SYSTEMS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 71 VERTICAL: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 72 VERTICAL: MARKET SIZE, 2021–2027 (USD MILLION)

9.2 HOMELAND SECURITY

9.2.1 HOMELAND SECURITY: MARKET DRIVERS

9.2.2 HOMELAND SECURITY: COVID-19 IMPACT

FIGURE 40 LAW ENFORCEMENT AND INTELLIGENCE AGENCIES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 73 HOMELAND SECURITY: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 74 HOMELAND SECURITY: MARKET SIZE, SCENARIO, 2021–2027 (USD MILLION)

TABLE 75 HOMELAND SECURITY: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 76 HOMELAND SECURITY: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.2.3 LAW ENFORCEMENT AND INTELLIGENCE AGENCIES

TABLE 77 LAW ENFORCEMENT AND INTELLIGENCE AGENCIES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 78 LAW ENFORCEMENT AND INTELLIGENCE AGENCIES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.2.4 BORDER SECURITY

TABLE 79 BORDER SECURITY: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 80 BORDER SECURITY: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.2.5 OTHERS IN HOMELAND SECURITY

TABLE 81 OTHERS IN HOMELAND SECURITY: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 82 OTHERS IN HOMELAND SECURITY: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.3 EMERGENCY SERVICES

9.3.1 EMERGENCY SERVICES: PUBLIC SAFETY AND SECURITY MARKET DRIVERS

9.3.2 EMERGENCY SERVICES: COVID-19 IMPACT

FIGURE 41 DISASTER MANAGEMENT SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 83 EMERGENCY SERVICES: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 84 EMERGENCY SERVICES: MARKET SIZE, 2021–2027 (USD MILLION)

TABLE 85 EMERGENCY SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 86 EMERGENCY SERVICES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.3.3 MEDICAL SERVICES

TABLE 87 MEDICAL SERVICES: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 88 MEDICAL SERVICES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.3.4 FIREFIGHTING SERVICES

TABLE 89 FIREFIGHTING SERVICES: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 90 FIREFIGHTING SERVICES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.3.5 DISASTER MANAGEMENT

TABLE 91 DISASTER MANAGEMENT: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 92 DISASTER MANAGEMENT: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.4 CRITICAL INFRASTRUCTURE SECURITY

9.4.1 CRITICAL INFRASTRUCTURE SECURITY: MARKET DRIVERS

9.4.2 CRITICAL INFRASTRUCTURE SECURITY: COVID-19 IMPACT

FIGURE 42 ENERGY AND POWER SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 93 CRITICAL INFRASTRUCTURE SECURITY: PUBLIC SAFETY AND SECURITY MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 94 CRITICAL INFRASTRUCTURE SECURITY: MARKET SIZE, 2021–2027 (USD MILLION)

TABLE 95 CRITICAL INFRASTRUCTURE SECURITY: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 96 CRITICAL INFRASTRUCTURE SECURITY: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.4.3 ENERGY AND POWER

TABLE 97 ENERGY AND POWER: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 98 ENERGY AND POWER: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.4.4 CRITICAL MANUFACTURING SECTOR

TABLE 99 CRITICAL MANUFACTURING SECTOR: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 100 CRITICAL MANUFACTURING SECTOR: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.4.5 WATER AND WASTEWATER SYSTEMS SECTOR

TABLE 101 WATER AND WASTEWATER SYSTEMS SECTOR: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 102 WATER AND WASTEWATER SYSTEMS SECTOR: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.5 TRANSPORTATION SYSTEMS

9.5.1 TRANSPORTATION SYSTEMS: PUBLIC SAFETY AND SECURITY MARKET DRIVERS

9.5.2 TRANSPORTATION SYSTEMS: COVID-19 IMPACT

FIGURE 43 RAILWAYS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 103 TRANSPORTATION SYSTEMS: MARKET SIZE, 2015–2020 (USD MILLION)

TABLE 104 TRANSPORTATION SYSTEMS: MARKET SIZE, 2021–2027 (USD MILLION)

TABLE 105 TRANSPORTATION SYSTEMS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 106 TRANSPORTATION SYSTEMS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.5.3 AIRPORTS

TABLE 107 AIRPORTS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 108 AIRPORTS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.5.4 SEAPORTS

TABLE 109 SEAPORTS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 110 SEAPORTS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.5.5 RAILWAYS

TABLE 111 RAILWAYS: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 112 RAILWAYS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.5.6 OTHER TRANSPORTATION SYSTEMS

TABLE 113 OTHER TRANSPORTATION SYSTEMS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 114 OTHER TRANSPORTATION SYSTEMS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.6 OTHER VERTICALS

TABLE 115 OTHER VERTICALS: MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 116 OTHER VERTICALS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

10 PUBLIC SAFETY AND SECURITY MARKET BY REGION (Page No. - 177)

10.1 INTRODUCTION

FIGURE 44 NORTH AMERICA IS ESTIMATED TO HAVE THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 117 MARKET SIZE, BY REGION, 2015–2020 (USD MILLION)

TABLE 118 MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

TABLE 119 NORTH AMERICA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 123 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 125 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2015–2020 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2027 (USD MILLION)

TABLE 127 NORTH AMERICA: MARKET SIZE, BY MANAGED SERVICES, 2015–2020 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET SIZE, BY MANAGED SERVICES, 2021–2027 (USD MILLION)

TABLE 129 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 130 NORTH AMERICA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 131 NORTH AMERICA: MARKET SIZE, BY HOMELAND SECURITY, 2015–2020 (USD MILLION)

TABLE 132 NORTH AMERICA: MARKET SIZE, BY HOMELAND SECURITY, 2021–2027 (USD MILLION)

TABLE 133 NORTH AMERICA: MARKET SIZE, BY EMERGENCY SERVICES, 2015–2020 (USD MILLION)

TABLE 134 NORTH AMERICA: MARKET SIZE, BY EMERGENCY SERVICES, 2021–2027 (USD MILLION)

TABLE 135 NORTH AMERICA: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2015–2020 (USD MILLION)

TABLE 136 NORTH AMERICA: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2021–2027 (USD MILLION)

TABLE 137 NORTH AMERICA: MARKET SIZE, BY TRANSPORTATION SERVICES, 2015–2020 (USD MILLION)

TABLE 138 NORTH AMERICA: MARKET SIZE, BY TRANSPORTATION SERVICES, 2021–2027 (USD MILLION)

TABLE 139 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 140 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.2.4 UNITED STATES

TABLE 141 UNITED STATES: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 142 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 143 UNITED STATES: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 144 UNITED STATES: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 145 UNITED STATES: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 146 UNITED STATES: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 147 UNITED STATES: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 148 UNITED STATES: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.2.5 CANADA

TABLE 149 CANADA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 150 CANADA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 151 CANADA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 152 CANADA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 153 CANADA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 154 CANADA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 155 CANADA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 156 CANADA: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 157 EUROPE: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 158 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 159 EUROPE: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 160 EUROPE: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 161 EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 162 EUROPE: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 163 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICES, 2015–2020 (USD MILLION)

TABLE 164 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2027 (USD MILLION)

TABLE 165 EUROPE: MARKET SIZE, BY MANAGED SERVICES, 2015–2020 (USD MILLION)

TABLE 166 EUROPE: MARKET SIZE, BY MANAGED SERVICES, 2021–2027 (USD MILLION)

TABLE 167 EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 168 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 169 EUROPE: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY HOMELAND SECURITY, 2015–2020 (USD MILLION)

TABLE 170 EUROPE: MARKET SIZE, BY HOMELAND SECURITY, 2021–2027 (USD MILLION)

TABLE 171 EUROPE: MARKET SIZE, BY EMERGENCY SERVICES, 2015–2020 (USD MILLION)

TABLE 172 EUROPE: MARKET SIZE, BY EMERGENCY SERVICES, 2021–2027 (USD MILLION)

TABLE 173 EUROPE: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2015–2020 (USD MILLION)

TABLE 174 EUROPE: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2021–2027 (USD MILLION)

TABLE 175 EUROPE: MARKET SIZE, BY TRANSPORTATION SERVICES, 2015–2020 (USD MILLION)

TABLE 176 EUROPE: MARKET SIZE, BY TRANSPORTATION SERVICES, 2021–2027 (USD MILLION)

TABLE 177 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 178 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 179 UNITED KINGDOM: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 180 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 181 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 182 UNITED KINGDOM: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 183 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 184 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 185 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 186 UNITED KINGDOM: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.3.5 GERMANY

TABLE 187 GERMANY: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 188 GERMANY: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 189 GERMANY: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 190 GERMANY: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 191 GERMANY: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 192 GERMANY: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 193 GERMANY: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 194 GERMANY: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.3.6 FRANCE

TABLE 195 FRANCE: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 196 FRANCE: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 197 FRANCE: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 198 FRANCE: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 199 FRANCE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 200 FRANCE: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 201 FRANCE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 202 FRANCE:MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.3.7 SPAIN

TABLE 203 SPAIN: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 204 SPAIN: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 205 SPAIN: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 206 SPAIN: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 207 SPAIN: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 208 SPAIN: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 209 SPAIN: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 210 SPAIN: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.3.8 REST OF EUROPE

TABLE 211 REST OF EUROPE: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 212 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 213 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 214 REST OF EUROPE: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 215 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 216 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 217 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 218 REST OF EUROPE: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 219 ASIA PACIFIC: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 220 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 221 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 222 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 223 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 224 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 225 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICES, 2015–2020 (USD MILLION)

TABLE 226 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2027 (USD MILLION)

TABLE 227 ASIA PACIFIC: MARKET SIZE, BY MANAGED SERVICES, 2015–2020 (USD MILLION)

TABLE 228 ASIA PACIFIC: MARKET SIZE, BY MANAGED SERVICES, 2021–2027 (USD MILLION)

TABLE 229 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 230 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 231 ASIA PACIFIC: MARKET SIZE, BY HOMELAND SECURITY, 2015–2020 (USD MILLION)

TABLE 232 ASIA PACIFIC: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY HOMELAND SECURITY, 2021–2027 (USD MILLION)

TABLE 233 ASIA PACIFIC: MARKET SIZE, BY EMERGENCY SERVICES, 2015–2020 (USD MILLION)

TABLE 234 ASIA PACIFIC: MARKET SIZE, BY EMERGENCY SERVICES, 2021–2027 (USD MILLION)

TABLE 235 ASIA PACIFIC: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2015–2020 (USD MILLION)

TABLE 236 ASIA PACIFIC: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2021–2027 (USD MILLION)

TABLE 237 ASIA PACIFIC: MARKET SIZE, BY TRANSPORTATION SERVICES, 2015–2020 (USD MILLION)

TABLE 238 ASIA PACIFIC: MARKET SIZE, BY TRANSPORTATION SERVICES, 2021–2027 (USD MILLION)

TABLE 239 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 240 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.4.4 AUSTRALIA AND NEW ZEALAND

TABLE 241 AUSTRALIA AND NEW ZEALAND: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 242 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 243 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 244 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 245 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 246 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 247 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 248 AUSTRALIA AND NEW ZEALAND: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.4.5 CHINA

TABLE 249 CHINA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 250 CHINA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 251 CHINA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 252 CHINA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 253 CHINA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 254 CHINA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 255 CHINA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 256 CHINA: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.4.6 JAPAN

TABLE 257 JAPAN: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 258 JAPAN: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 259 JAPAN: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 260 JAPAN: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 261 JAPAN: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 262 JAPAN: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 263 JAPAN: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 264 JAPAN: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.4.7 SINGAPORE

TABLE 265 SINGAPORE: MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 266 SINGAPORE: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 267 SINGAPORE: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 268 SINGAPORE: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 269 SINGAPORE: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 270 SINGAPORE: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 271 SINGAPORE: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 272 SINGAPORE: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.4.8 REST OF ASIA PACIFIC

TABLE 273 REST OF ASIA PACIFIC: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 274 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 275 REST OF ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 276 REST OF ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 277 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 278 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 279 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 280 REST OF ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 281 MIDDLE EAST AND AFRICA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 282 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 283 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 284 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 285 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 286 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 287 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2015–2020 (USD MILLION)

TABLE 288 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2027 (USD MILLION)

TABLE 289 MIDDLE EAST AND AFRICA: MARKET SIZE, BY MANAGED SERVICES, 2015–2020 (USD MILLION)

TABLE 290 MIDDLE EAST AND AFRICA: MARKET SIZE, BY MANAGED SERVICES, 2021–2027 (USD MILLION)

TABLE 291 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 292 MIDDLE EAST AND AFRICA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 293 MIDDLE EAST AND AFRICA: MARKET SIZE, BY HOMELAND SECURITY, 2015–2020 (USD MILLION)

TABLE 294 MIDDLE EAST AND AFRICA: MARKET SIZE, BY HOMELAND SECURITY, 2021–2027 (USD MILLION)

TABLE 295 MIDDLE EAST AND AFRICA: MARKET SIZE, BY EMERGENCY SERVICES, 2015–2020 (USD MILLION)

TABLE 296 MIDDLE EAST AND AFRICA: MARKET SIZE, BY EMERGENCY SERVICES, 2021–2027 (USD MILLION)

TABLE 297 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2015–2020 (USD MILLION)

TABLE 298 MIDDLE EAST AND AFRICA: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2021–2027 (USD MILLION)

TABLE 299 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TRANSPORTATION SERVICES, 2015–2020 (USD MILLION)

TABLE 300 MIDDLE EAST AND AFRICA: MARKET SIZE, BY TRANSPORTATION SERVICES, 2021–2027 (USD MILLION)

TABLE 301 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 302 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 303 UNITED ARAB EMIRATES: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 304 UNITED ARAB EMIRATES: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 305 UNITED ARAB EMIRATES: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 306 UNITED ARAB EMIRATES: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 307 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 308 UNITED ARAB EMIRATES: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 309 UNITED ARAB EMIRATES: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 310 UNITED ARAB EMIRATES: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.5.5 ISRAEL

TABLE 311 ISRAEL: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 312 ISRAEL: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 313 ISRAEL: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 314 ISRAEL: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 315 ISRAEL: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 316 ISRAEL: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 317 ISRAEL: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 318 ISRAEL: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.5.6 KINGDOM OF SAUDI ARABIA

TABLE 319 KINGDOM OF SAUDI ARABIA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 320 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 321 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 322 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 323 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 324 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 325 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 326 KINGDOM OF SAUDI ARABIA : MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.5.7 QATAR

TABLE 327 QATAR: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 328 QATAR: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 329 QATAR: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 330 QATAR: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 331 QATAR: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 332 QATAR: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 333 QATAR: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 334 QATAR: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.5.8 SOUTH AFRICA

TABLE 335 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 336 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 337 SOUTH AFRICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 338 SOUTH AFRICA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 339 SOUTH AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 340 SOUTH AFRICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 341 SOUTH AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 342 SOUTH AFRICA: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.5.9 REST OF MIDDLE EAST AND AFRICA

TABLE 343 REST OF MIDDLE EAST AND AFRICA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 344 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 345 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 346 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 347 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 348 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 349 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 350 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: PUBLIC SAFETY AND SECURITY MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 351 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 352 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 353 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 354 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 355 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 356 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 357 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2015–2020 (USD MILLION)

TABLE 358 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICES, 2021–2027 (USD MILLION)

TABLE 359 LATIN AMERICA: MARKET SIZE, BY MANAGED SERVICES, 2015–2020 (USD MILLION)

TABLE 360 LATIN AMERICA: MARKET SIZE, BY MANAGED SERVICES, 2021–2027 (USD MILLION)

TABLE 361 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 362 LATIN AMERICA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

TABLE 363 LATIN AMERICA: MARKET SIZE, BY HOMELAND SECURITY, 2015–2020 (USD MILLION)

TABLE 364 LATIN AMERICA: MARKET SIZE, BY HOMELAND SECURITY, 2021–2027 (USD MILLION)

TABLE 365 LATIN AMERICA: MARKET SIZE, BY EMERGENCY SERVICES, 2015–2020 (USD MILLION)

TABLE 366 LATIN AMERICA: MARKET SIZE, BY EMERGENCY SERVICES, 2021–2027 (USD MILLION)

TABLE 367 LATIN AMERICA: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2015–2020 (USD MILLION)

TABLE 368 LATIN AMERICA: MARKET SIZE, BY CRITICAL INFRASTRUCTURE SECURITY, 2021–2027 (USD MILLION)

TABLE 369 LATIN AMERICA: MARKET SIZE, BY TRANSPORTATION SERVICES, 2015–2020 (USD MILLION)

TABLE 370 LATIN AMERICA: MARKET SIZE, BY TRANSPORTATION SERVICES, 2021–2027 (USD MILLION)

TABLE 371 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 372 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

10.6.4 BRAZIL

TABLE 373 BRAZIL: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020(USD MILLION)

TABLE 374 BRAZIL: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 375 BRAZIL: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 376 BRAZIL: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 377 BRAZIL: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 378 BRAZIL: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 379 BRAZIL: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 380 BRAZIL: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.6.5 MEXICO

TABLE 381 MEXICO: MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 382 MEXICO: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 383 MEXICO: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 384 MEXICO: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 385 MEXICO: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 386 MEXICO: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 387 MEXICO: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 388 MEXICO: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

10.6.6 REST OF LATIN AMERICA

TABLE 389 REST OF LATIN AMERICA: PUBLIC SAFETY AND SECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 390 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 391 REST OF LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2015–2020 (USD MILLION)

TABLE 392 REST OF LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2021–2027 (USD MILLION)

TABLE 393 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2015–2020 (USD MILLION)

TABLE 394 REST OF LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 395 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2015–2020 (USD MILLION)

TABLE 396 REST OF LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 291)

11.1 OVERVIEW

11.2 HISTORICAL REVENUE ANALYSIS

FIGURE 47 FIVE-YEAR REVENUE ANALYSIS OF KEY PUBLIC SAFETY AND SECURITY SOLUTION AND SERVICE VENDORS (USD MILLION)

11.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS

FIGURE 48 PUBLIC SAFETY AND SECURITY MARKET: REVENUE ANALYSIS

11.4 COVID-19 IMPACT: REVENUE ANALYSIS

11.4.1 COVID-19 IMPACT AND REVENUE ANALYSIS

11.5 MARKET STRUCTURE

TABLE 397 MARKET: DEGREE OF COMPETITION

11.6 RANKING OF KEY PLAYERS

FIGURE 49 RANKING OF KEY MARKET PLAYERS

11.6.1 RECENT DEVELOPMENTS

TABLE 398 MARKET: PRODUCT LAUNCHES

TABLE 399 MARKET: DEALS

11.7 MARKET EVALUATION FRAMEWORK

FIGURE 50 PUBLIC SAFETY AND SECURITY MARKET EVALUATION FRAMEWORK BETWEEN 2019 AND 2022

11.8 COMPANY EVALUATION QUADRANT

11.8.1 COMPANY EVALUATION QUADRANT DEFINITIONS AND METHODOLOGY

TABLE 400 EVALUATION CRITERIA

11.9 COMPETITIVE BENCHMARKING

11.9.1 COMPANY FOOTPRINT

FIGURE 51 COMPANY FOOTPRINT OF MAJOR PLAYERS IN MARKET

11.10 COMPETITIVE LEADERSHIP MAPPING

11.10.1 STARS

11.10.2 EMERGING LEADERS

11.10.3 PERVASIVE PLAYERS

11.10.4 PARTICIPANTS

FIGURE 52 PUBLIC SAFETY AND SECURITY MARKET, COMPANY EVALUATION QUADRANT

11.11 COMPETITIVE SCENARIO

11.12 STARTUP/SME EVALUATION QUADRANT

11.12.1 PROGRESSIVE COMPANIES

11.12.2 RESPONSIVE COMPANIES

11.12.3 DYNAMIC COMPANIES

11.12.4 STARTING BLOCKS

FIGURE 53 MARKET, STARTUP/SME EVALUATION QUADRANT

11.13 COMPETITIVE BENCHMARKING

TABLE 401 MARKET: LIST OF STARTUP/SMES

TABLE 402 MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

12 COMPANY PROFILES (Page No. - 308)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View)*

12.2.1 CISCO

TABLE 403 CISCO: BUSINESS OVERVIEW

FIGURE 54 CISCO: COMPANY SNAPSHOT

TABLE 404 CISCO: SOLUTIONS OFFERED

TABLE 405 ADT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 406 CISCO: DEALS

12.2.2 HONEYWELL

TABLE 407 HONEYWELL: BUSINESS OVERVIEW

FIGURE 55 HONEYWELL: COMPANY SNAPSHOT

TABLE 408 HONEYWELL: SOLUTIONS OFFERED

TABLE 409 HONEYWELL: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 410 HONEYWELL: DEALS

12.2.3 MOTOROLA SOLUTIONS

TABLE 411 MOTOROLA SOLUTIONS: BUSINESS OVERVIEW

FIGURE 56 MOTOROLA SOLUTIONS: COMPANY SNAPSHOT

TABLE 412 MOTOROLA SOLUTIONS: SOLUTIONS OFFERED

TABLE 413 MOTOROLA SOLUTION: SERVICES OFFERED

TABLE 414 MOTOROLA SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 415 MOTOROLA SOLUTIONS: DEALS

12.2.4 IBM

TABLE 416 IBM: BUSINESS OVERVIEW

FIGURE 57 IBM: COMPANY SNAPSHOT

TABLE 417 IBM: SOLUTIONS OFFERED

TABLE 418 IBM: SERVICES OFFERED

TABLE 419 IBM: PRODUCT LAUNCHES

TABLE 420 IBM: DEALS

12.2.5 NEC

TABLE 421 NEC: BUSINESS OVERVIEW

FIGURE 58 NEC: COMPANY SNAPSHOT

TABLE 422 NEC: SOLUTIONS OFFERED

TABLE 423 NEC: PRODUCT LAUNCHES

TABLE 424 NEC: BUSINESS EXPANSION

TABLE 425 NEC: DEALS

12.2.6 SIEMENS

TABLE 426 SIEMENS: BUSINESS OVERVIEW

FIGURE 59 SIEMENS: COMPANY SNAPSHOT

TABLE 427 SIEMENS: SOLUTIONS OFFERED

TABLE 428 SIEMENS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 429 SIEMENS: DEALS

12.2.7 THALES

TABLE 430 THALES: BUSINESS OVERVIEW

FIGURE 60 THALES: COMPANY SNAPSHOT

TABLE 431 THALES: SOLUTIONS OFFERED

TABLE 432 THALES: PRODUCT LAUNCHES

TABLE 433 THALES: BUSINESS EXPANSION

TABLE 434 THALES: DEALS

12.2.8 ERICSSON

TABLE 435 ERICSSON: BUSINESS OVERVIEW

FIGURE 61 ERICSSON: COMPANY SNAPSHOT

TABLE 436 ERICSSON: SOLUTIONS OFFERED

TABLE 437 ERICSSON: PRODUCT LAUNCHES

TABLE 438 ERICSSON: DEALS

12.2.9 HUAWEI

TABLE 439 HUAWEI: BUSINESS OVERVIEW

FIGURE 62 HUAWEI: COMPANY SNAPSHOT

TABLE 440 HUAWEI: SOLUTIONS OFFERED

TABLE 441 HUAWEI: PRODUCT LAUNCHES

TABLE 442 HUAWEI: DEALS

12.2.10 TYCO (JOHNSON CONTROLS)

TABLE 443 TYCO (JOHNSON CONTROLS): BUSINESS OVERVIEW

FIGURE 63 TYCO (JOHNSON CONTROLS): COMPANY SNAPSHOT

TABLE 444 TYCO: SOLUTIONS OFFERED

TABLE 445 TYCO: PRODUCT LAUNCHES

TABLE 446 TYCO: DEALS

*Details on Business Overview, Solutions & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.3 OTHER PLAYERS

12.3.1 ATOS

12.3.2 HEXAGON AB

12.3.3 IDEMIA

12.3.4 GENERAL DYNAMICS

12.3.5 ESRI

12.3.6 L3HARRIS TECHNOLOGIES

12.3.7 ALCATEL-LUCENT ENTERPRISE

12.3.8 BAE SYSTEMS

12.3.9 VERINT SYSTEMS

12.3.10 HAYSTAX TECHNOLOGY

12.3.11 ELBIT SYSTEMS

12.3.12 TELTRONIC

12.3.13 AGT INTERNATIONAL

12.3.14 RAVE MOBILE SAFETY

12.3.15 NICE

12.4 STARTUP/SME

12.4.1 FOTOKITE

12.4.2 SCADAFENCE

12.4.3 TVILIGHT

12.4.4 BRIEFCAM

12.4.5 OPENPATH

12.4.6 SMARTCONE TECHNOLOGIES

12.4.7 3XLOGIC

12.4.8 CITYSHOB

12.4.9 SAYVU

12.4.10 ONSOLVE

13 ADJACENT MARKETS (Page No. - 374)

13.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 447 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 PHYSICAL SECURITY MARKET

13.3.1 MARKET DEFINITION

13.3.2 PHYSICAL SECURITY MARKET ESTIMATES AND FORECASTS, BY SYSTEM, 2015–2026

TABLE 448 PHYSICAL SECURITY MARKET SIZE, BY SYSTEM, 2015–2020 (USD BILLION)

TABLE 449 PHYSICAL SECURITY MARKET SIZE, BY SYSTEM, 2021–2026 (USD BILLION)

TABLE 450 PHYSICAL ACCESS CONTROL SYSTEMS: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 451 PHYSICAL ACCESS CONTROL SYSTEMS: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

TABLE 452 VIDEO SURVEILLANCE SYSTEMS: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 453 VIDEO SURVEILLANCE SYSTEMS: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

TABLE 454 PERIMETER INTRUSION DETECTION AND PREVENTION: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 455 PERIMETER INTRUSION DETECTION AND PREVENTION: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

TABLE 456 PHYSICAL SECURITY INFORMATION MANAGEMENT: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 457 PHYSICAL SECURITY INFORMATION MANAGEMENT: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

TABLE 458 PHYSICAL IDENTITY ACCESS MANAGEMENT: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 459 PHYSICAL IDENTITY ACCESS MANAGEMENT: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

TABLE 460 SECURITY SCANNING, IMAGING, AND METAL DETECTION: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 461 SECURITY SCANNING, IMAGING, AND METAL DETECTION: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

TABLE 462 FIRE AND LIFE SAFETY: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2015–2020 (USD BILLION)

TABLE 463 FIRE AND LIFE SAFETY: PHYSICAL SECURITY MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

13.4 CYBERSECURITY MARKET

13.4.1 MARKET DEFINITION

13.4.2 CYBERSECURITY MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2015–2026

TABLE 464 CYBERSECURITY MARKET SIZE, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 465 CYBERSECURITY MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 466 CYBERSECURITY MARKET SIZE FOR HARDWARE, BY REGION, 2015–2020 (USD MILLION)

TABLE 467 CYBERSECURITY MARKET SIZE FOR HARDWARE, BY REGION, 2020–2026 (USD MILLION)

TABLE 468 CYBERSECURITY MARKET SIZE FOR SOFTWARE, BY REGION, 2015–2020 (USD MILLION)

TABLE 469 CYBERSECURITY MARKET SIZE FOR SOFTWARE, BY REGION, 2020–2026 (USD MILLION)

TABLE 470 CYBERSECURITY MARKET SIZE FOR SERVICES, BY REGION, 2015–2020 USD MILLION)

TABLE 471 CYBERSECURITY MARKET SIZE FOR SERVICES, BY REGION, 2020–2026 (USD MILLION)

14 APPENDIX (Page No. - 384)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved major activities in estimating the current market size for the Public Safety and Security market. An exhaustive secondary research was done to collect information on the Public Safety and Security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches such as Top-down, bottom-up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Public Safety and Security market.

Secondary Research

The market for the companies offering public safety and security systems and services for various verticals is arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of major companies in the ecosystem and rating them based on their performance and quality. In the secondary research process, various sources were referred to identify and collect this study's information. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases.

Secondary research was used to obtain key information about the industry's value chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the public safety and security market.

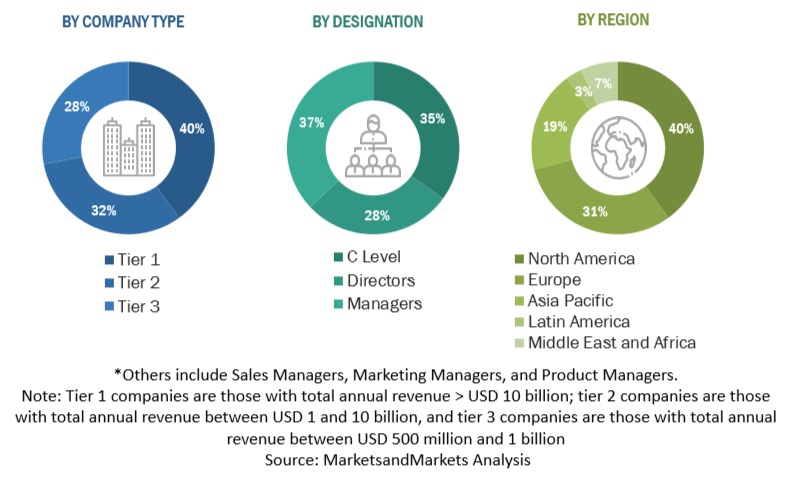

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the public safety and security market. Top-down and bottom-up approaches were used to estimate and validate the size of the global public safety and security market and estimate the size of various other dependent subsegments. The research methodology used to estimate the market size included the following details: the key players in the market were identified through secondary research, and their revenue contributions in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments.

Report Objectives

- To define, describe, and forecast the public safety and security market by component, solution, services (professional services, managed services), vertical (homeland security, emergency services, critical infrastructure security, transportation systems), and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the public safety and security market globally

- To analyze the impact of the COVID-19 outbreak on the growth of the market

Safety and Security Market & Its Impact on the Public Safety and Security Market: