Cellular M2M Market by Service (Connectivity, Professional, and Managed), Application (Asset Tracking and Monitoring, Predictive Maintenance, Telemedicine, and Fleet Management), End User, Organization Size, and Region - Global Forecast to 2025

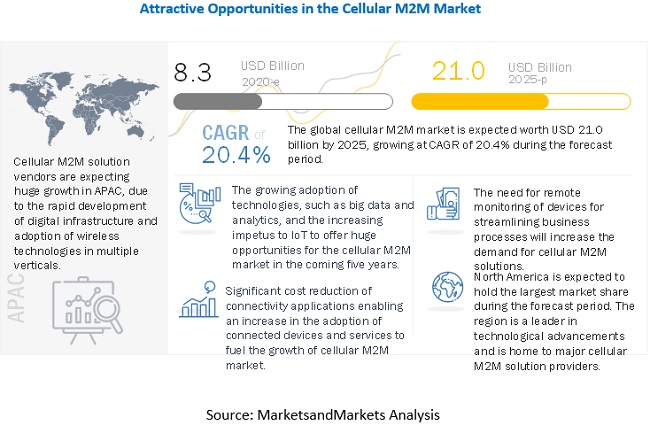

The global Cellular M2M Market size is projected to grow from USD 8.3 billion in 2020 to USD 21.0 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 20.4% during the forecast period. Connectivity plays a crucial role in managing M2M device connections. The adoption of wireless connectivity has been increasing across industries. M2M has enabled a widespread scope of connectivity for enterprises possessing devices across geographically dispersed locations.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global cellular M2M market

The quick spread of the coronavirus has created a health crisis and triggered a massive financial crisis worldwide. Due to the huge economic losses in the majority of the sectors, the investments for the development of cellular M2M solutions by the organizations is reduced. However, technological advancements and digitization in various countries are expected to keep up the demand for cellular M2M solutions in major verticals, such as healthcare and utilities, to reduce human intervention. Moreover, organizations are gradually adopting mobile and cloud technologies, and big data and analytics capabilities combined in cellular M2M solutions to regain operational efficiency and improve their productivity.

Market Dynamics

Driver: Growing adoption of high-speed internet and connectivity technologies, such as 4G and 5G

Internet and wireless technologies have revolutionized the way customers, enterprises, and communication service providers interact with business processes. Huge rise in M2M connections is having a massive impact on the way many organizations do their businesses across industries by improving operational efficiency, quality of products and services, and decision-making. Organizations are moving to adopt next-generation connectivity technologies, such as 4G and 5G, to enable innovation and gain competitive advantage by linking billions of devices, machines, and people in the hyper-connected area.

Restraint: Increasing concerns about data privacy and security

The volume of data collected using M2M technology introduces new risks to security and privacy. The sharing of data through cloud services increases the locations where personal data resides. Most of the cellular-based M2M application providers map, monitor, and store private data of individuals, asset and vehicle information, and remote access to different IT systems and are concerned regarding the disclosure of this vital information to third parties for marketing purposes or disclosure to government officials.

Opportunity: Growing impetus to IoT

M2M is a key component of the evolving IoT revolution. M2M connections form a part of the IoT, along with big data analytics, cloud computing, and sensors and actuators that can together run autonomous machines and intelligent systems. For the recent developments in wireless communications, sensing and actuation have given M2M an impetus to IoT. Further, the number of connected devices is growing exponentially for many years and will continue to grow in the future. As a result, IoT is supporting a wide range of smart applications and services to cope up with many of the challenges people face in their daily lives.

Challenge: Increasing security threats due to cloud and mobile technologies

Cellular M2M applications have been greatly benefitted due to the rise in disruptive technologies, such as cloud and mobile. However, owing to the sensitivity and security associated with insurance data, controlling the flow of sensitive data and digital access rights of digital assets as well as intellectual property protection are the major concerns of cellular M2M application providers. Data privacy and security is a cumbersome bottleneck that needs to be addressed effectively. Setting up proper access and control mechanism is a must to address the issues of data theft.

Connectivity services segment to lead the cellular M2M market in 2020

The demand for connectivity services is increasing with the rise in complicated applications being deployed by customers. Services must ensure networks are secure, reliable, scalable, and offer coverage in remote areas. Hence, providing roaming services and SIMs with global coverage has become a pivotal function in creating end-to-end IoT solutions.

Asset tracking and monitoring segment to lead the cellular M2M market in 2020

Asset tracking has been used to fix problems, such as theft and loss of valuable assets, inefficient processes, and poor operational performance. The M2M asset tracking application helps businesses efficiently track their assets to improve employee safety, drive process automation, and optimize their supply chain. The application is instrumental in maintaining the asset health as well as a vital means of trouble shooting in case of any emergency.

Transportation and logistics segment grow at a higher CAGR during the forecast period

The transformation of transportation and logistics industry is significant with adoption of cellular M2M services and solutions at a global scale. Due to rapid digitalization, there are many key players along the value chain which can exchange information through M2M technology and enhance productivity. With help of cellular M2M solutions, the logistic and transportation processes are being innovated and companies are implementing customizable solutions for efficient functioning of the supply chain and delivery systems.

Large enterprises segment to lead the cellular M2M market in 2020

Cellular M2M service providers help large enterprises in optimizing the network infrastructure, deploy latest applications that help them lower the operational costs, improve operational efficiencies, troubleshooting the IoT device issues, and detecting and mitigating security attacks. They always focus on the adoption of industry solutions that can help them in increasing their operational efficiency.

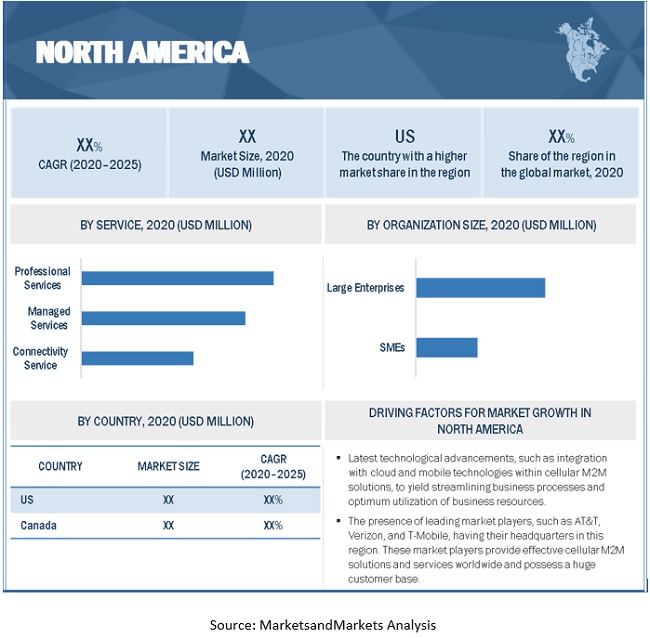

North America to lead the cellular M2M market in 2020

North America has been extremely responsive toward adopting the latest technological advancements, such as integration with cloud and mobile technologies within cellular M2M solutions, to yield streamlining business processes and optimum utilization of business resources. The region is foremost in deploying cellular M2M mobile applications, which are efficient in securing the digital document transfer and collaboration among geographically diverse employees or locations. In addition, North America is home to many technological innovators. Most of the leading market players, such as AT&T, Verizon, and T-Mobile, have their headquarters in this region. These players provide effective cellular M2M solutions and services worldwide and possess a huge customer base.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The cellular M2M market comprises key solution and service providers, such as AT&T (US), Verizon (US), T-Mobile (US), Deutsche Telekom (Germany), Orange S.A. (France), Telefonica (Spain), Vodafone (UK), Ericsson (Sweden), Kore Wireless (US), Aeris (US), Arm holdings (UK), China Mobile (China), Infineon (Germany), Thales Group (France), Orbocomm (US), Telit (UK), Giesecke+Devrient (Germany), Cubic Telecom (Ireland), KPN (Netherlands), A1 Digital (Austria), SK Telecom (South Korea), Rogers Communications (Canada), Telenor Connexion (Sweden), Truphone (UK), and 1oT (Estonia).

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2016-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Service, Application, End User, Organization Size |

|

Regions covered |

North America, Europe, APAC, Middle East and Africa, Latin America |

|

Companies covered |

AT&T (US), Verizon (US), T-Mobile (US), Deutsche Telekom (Germany), Orange S.A. (France), Telefonica (Spain), Vodafone (UK), Ericsson (Sweden), Kore Wireless (US), Aeris (US), Arm holdings (UK), China Mobile (China), Infineon (Germany), Thales Group (France), Orbocomm (US), Telit (UK), Giesecke+Devrient (Germany), Cubic Telecom (Ireland), KPN (Netherlands), A1 Digital (Austria), SK Telecom (South Korea), Rogers Communications (Canada), Telenor Connexion (Sweden), Truphone (UK), 1oT (Estonia) |

This research report categorizes the cellular M2M market to forecast revenues and analyze trends in each of the following subsegments:

Based on services, the cellular M2M market has the following segments:

- Connectivity services

- Professional services

- Managed services

Based on application, the market has the following segments

- Asset tracking and monitoring

- Predictive maintenance

- Telemedicine

- Fleet management

- Warehouse management

- Industrial automation

- Smart meter

- Others (connected cars, Point of Sale (POS), and digital signage)

Based on end user, the cellular M2M market has the following segments

- Healthcare

- Energy and utilities

- Transportation and logistics

- Manufacturing

- Others (automotive and retail)

Based on organization size, the market has the following segments

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Based on region, the cellular M2M market has the following segments

- North America

- United States (US)

- Canada

- Europe

- United Kingdom (UK)

- Germany

- APAC

- China

- Japan

- Rest of APAC

- Middle East and Africa (MEA)

- Latin America

- Brazil

- Mexico

Recent Developments

- In October 2020, Verizon extended the provision of its 5G network services at the innovation hub located at the University of Illinois Research Park. The provision of 5G network will enable innovators, such as students, startups, and large corporations, to be able to create modern applications in all industries that leverage advanced technologies, such as robotics, analytics, ML, and IoT devices.

- In October 2020, T-Mobile, US became the first wireless provider in North America to successfully finish NB-IoT field tests on the live commercial network. Narrowband IoT or NB-IoT is an evolution of LTE technology built on industry standards that uses very small amounts of dedicated spectrum to carry data with incredible efficiency and performance.

- In September 2020, Orange partnered with Ericsson to launch the 5G network in Spain. The partnership will lead Ericsson’s 5G Radio Access Network (RAN) and its range of core products and solutions to power Orange Spain’s 5G services in two cities: Madrid and Barcelona.

- In July 2020, Deutsche Telekom launched LTE-M in Germany, enabling its customers to develop solutions supporting data transfer and analysis. LTE-M is expected to help customers enable applications across a multitude of industry sectors through the 5G-based LTE-M technology.

- In December 2019, AT&T collaborated with Vodafone to enable commercial inter-carrier arrangement for NB-IoT Roaming Across the US and Europe, creating opportunities for customers to efficiently create massive IoT deployments across the region.

Frequently Asked Questions (FAQ):

How is cellular M2M market expected to grow in next five years?

According to MarketsandMarkets, the global cellular M2M market size is projected to grow from USD 8.3 billion in 2020 to USD 21.0 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 20.4% during the forecast period.

What region holds the highest market share in the cellular M2M market?

North America has the highest market share in the cellular M2M market due to early adoption of technology and presence of various solution providers.

What are the major factors driving the growth of cellular M2M market?

The major drivers for the cellular M2M market include growing adoption of high-speed internet and connectivity technologies, such as 4G and 5G; significant cost reduction of connectivity applications enabling an increase in the adoption of connected devices and services; increasing software application integration in devices for improving performance; increasing demand for remote monitoring of the devices for cost-effectiveness; and high growth of government regulations in telecom and communications sector.

Who are the major vendors in the cellular M2M market?

The major vendors in the cellular M2M market include AT&T, Verizon, T-Mobile, Deutsche Telekom, and Orange S.A. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 6 CELLULAR M2M MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 RESEARCH METHODOLOGY: APPROACH 1: SUPPLY SIDE ANALYSIS

FIGURE 9 RESEARCH METHODOLOGY - SUPPLY SIDE ANALYSIS (OVERALL MARKET) ANALYSIS

FIGURE 10 RESEARCH METHODOLOGY - SUPPLY SIDE - COMPANY REVENUE ESTIMATION

FIGURE 11 RESEARCH APPROACH 2: DEMAND SIZE MARKET ESTIMATIONS THROUGH VERTICALS (ENERGY AND UTILITIES)

FIGURE 12 RESEARCH APPROACH 2: DEMAND SIZE MARKET ESTIMATIONS THROUGH VERTICALS (MANUFACTURING)

2.4 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPETITIVE EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.6.1 ASSUMPTIONS FOR THE STUDY

2.6.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 14 CELLULAR M2M MARKET SIZE, 2020–2025

FIGURE 15 CONNECTIVITY SERVICES SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING FORECAST PERIOD

FIGURE 16 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR THE LARGER MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CELLULAR M2M MARKET

FIGURE 17 GROWING ADOPTION OF WIRELESS TECHNOLOGIES AND RISING DEMAND FOR REMOTE MONITORING OF DEVICES TO DRIVE THE MARKET GROWTH

4.2 MARKET IN ASIA PACIFIC, BY SERVICE AND COUNTRY

FIGURE 18 CONNECTIVITY SERVICES AND CHINA TO ACCOUNT FOR LARGER MARKET SIZES IN ASIA PACIFIC IN 2020

4.3 MARKET: MAJOR COUNTRIES

FIGURE 19 JAPAN TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CELLULAR M2M MARKET

5.2.1 DRIVERS

5.2.1.1 Growing adoption of high-speed internet and connectivity technologies, such as 4G and 5G

5.2.1.2 Significant cost reduction of connectivity applications enabling an increase in the adoption of connected devices and services

5.2.1.3 Increasing software application integration in devices for improving performance

5.2.1.4 Increasing demand for remote monitoring of the devices for cost-effectiveness

5.2.1.5 High growth of government regulations in the telecom and communications sector

5.2.2 RESTRAINTS

5.2.2.1 Increasing concerns about data privacy and security

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of technologies, such as big data and analytics

5.2.3.2 Growing impetus to IoT

5.2.4 CHALLENGES

5.2.4.1 Increasing security threats due to cloud and mobile technologies

5.2.4.2 Increasing growth in data traffic

5.3 CASE STUDY ANALYSIS

5.3.1 MANUFACTURING

5.3.1.1 Use case 1: Vodafone helped Atlas Copco boost product development and customer support

5.3.2 FOOD AND BEVERAGES

5.3.2.1 Use case 2: Telefonica helped Nestle offer IoT-controlled coffee machines

5.3.3 HEALTHCARE

5.3.3.1 Use case 3: AT&T helped IrisVision provide ongoing support, updates, and releases to its customers in near-real time

5.3.4 ENERGY AND UTILITIES

5.3.4.1 Use case 4: Aeris helped BlueNRGY empower secure cellular connectivity

5.4 REGULATORY LANDSCAPE

5.4.1 GENERAL DATA PROTECTION REGULATION

5.4.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.4.3 SERVICE ORGANIZATION CONTROL 2

5.4.4 COMMUNICATIONS DECENCY ACT

5.4.5 ANTI-CYBERSQUATTING CONSUMER PROTECTION ACT

5.5 VALUE CHAIN ANALYSIS

5.5.1 INTRODUCTION

FIGURE 21 VALUE CHAIN ANALYSIS

5.5.2 VALUE CHAIN VENDOR ANALYSIS

TABLE 2 M2M ECOSYSTEM PLAYERS VENDORS: OFFERINGS, CELLULAR M2M, FOCUS AREAS, AND PARTNERS

5.5.3 COVID-19 IMPACT ON VALUE CHAIN STAKEHOLDERS

FIGURE 22 CELLULAR M2M MARKET: POST COVID-19 MARKET SCENARIO

TABLE 3 CELLULAR M2M PLAYERS BUSINESS GROWTH RECOVERY POST COVID-19

5.5.3.1 Hardware Providers

5.5.3.2 Machines and Equipment Providers

5.5.3.3 Connectivity Service Providers

5.5.3.4 Software/Platform Providers

5.5.3.5 Solution Designers and Developers

5.5.3.6 System Integrators

5.5.3.7 Managed Service Providers

5.5.3.8 End User

5.6 STATE OF 5G COMMERCIALIZATION

TABLE 4 5G MARKET OUTLOOK ACROSS KEY COUNTRIES

TABLE 5 COUNTRY-WISE 5G LAUNCH

5.7 TECHNOLOGY ANALYSIS

5.7.1 NB-IOT CHIPSET MARKET

TABLE 6 NB-IOT CHIPSET MARKET, BY DEVICE, 2017–2019 (USD MILLION)

TABLE 7 NB-IOT CHIPSET MARKET, BY DEVICE, 2020–2025 (USD MILLION)

TABLE 8 NB-IOT CHIPSET MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 9 NB-IOT CHIPSET MARKET, BY REGION, 2020–2025 (USD MILLION)

5.7.2 ESIM MARKET

FIGURE 23 ESIM BASED DEVICES

TABLE 10 ESIM MARKET IN TERMS OF VALUE AND VOLUME, 2015–2023

TABLE 11 ESIM MARKET IN TERMS OF VALUE AND VOLUME, 2015–2023

TABLE 12 ESIM MARKET, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 13 ESIM MARKET, BY APPLICATION, 2015–2023 (MILLION UNITS)

TABLE 14 ESIM MARKET FOR M2M, BY REGION, 2015–2023 (USD MILLION)

TABLE 15 ESIM MARKET, BY VERTICAL, 2015–2023 (USD MILLION)

6 CELLULAR M2M MARKET, BY APPLICATION (Page No. - 90)

6.1 INTRODUCTION

6.1.1 COVID-19 IMPACT, BY APPLICATION

FIGURE 24 PREDICTIVE MAINTENANCE TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

6.1.2 CHALLENGES/PAIN POINTS OF CELLULAR M2M

TABLE 16 MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 17 MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

6.1.3 M2M CONNECTIVITY TECHNOLOGY, BY APPLICATION

6.2 ASSET TRACKING AND MONITORING

6.2.1 USE CASE: M2M IN ASSET TRACKING AND MONITORING

6.2.2 MARKET DRIVERS FOR ASSET TRACKING AND MONITORING

TABLE 18 MARKET SIZE IN ASSET TRACKING AND MONITORING, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 CELLULAR M2M MARKET SIZE IN ASSET TRACKING AND MONITORING ASSET TRACKING AND MONITORING, BY REGION, 2019–2025 (USD MILLION)

6.3 PREDICTIVE MAINTENANCE

6.3.1 USE CASE: M2M IN PREDICTIVE MAINTENANCE

6.3.2 MARKET DRIVERS FOR PREDICTIVE MAINTENANCE

TABLE 20 MARKET SIZE IN PREDICTIVE MAINTENANCE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 MARKET SIZE IN PREDICTIVE MAINTENANCE, BY REGION, 2019–2025 (USD MILLION)

6.4 TELEMEDICINE

6.4.1 USE CASE: M2M IN TELEMEDICINE

6.4.2 USE CASE: M2M IN TELEMEDICINE

6.4.3 MARKET DRIVERS FOR TELEMEDICINE

TABLE 22 MARKET SIZE IN TELEMEDICINE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 MARKET SIZE IN TELEMEDICINE, BY REGION, 2019–2025 (USD MILLION)

6.5 FLEET MANAGEMENT

6.5.1 USE CASE: M2M IN FLEET MANAGEMENT

6.5.2 MARKET DRIVERS FOR FLEET MANAGEMENT

TABLE 24 MARKET SIZE IN FLEET MANAGEMENT, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 MARKET SIZE IN FLEET MANAGEMENT, BY REGION, 2019–2025 (USD MILLION)

6.6 WAREHOUSE MANAGEMENT

6.6.1 USE CASE: M2M IN WAREHOUSE MANAGEMENT

6.6.2 MARKET DRIVERS FOR WAREHOUSE MANAGEMENT

TABLE 26 MARKET SIZE IN WAREHOUSE MANAGEMENT, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 MARKET SIZE IN WAREHOUSE MANAGEMENT, BY REGION, 2019–2025 (USD MILLION)

6.7 INDUSTRIAL AUTOMATION

6.7.1 USE CASE: M2M IN INDUSTRIAL AUTOMATION

6.7.2 MARKET DRIVERS FOR INDUSTRIAL AUTOMATION

TABLE 28 MARKET SIZE IN INDUSTRIAL AUTOMATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 MARKET SIZE IN INDUSTRIAL AUTOMATION, BY REGION, 2019–2025 (USD MILLION)

6.8 SMART METERS

6.8.1 USE CASE: M2M IN SMART METERING

6.8.2 MARKET DRIVERS FOR SMART METERS

TABLE 30 MARKET SIZE IN SMART METERS, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 MARKET SIZE IN SMART METERS, BY REGION, 2019–2025 (USD MILLION)

6.9 OTHERS

TABLE 32 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2025 (USD MILLION)

7 CELLULAR M2M MARKET, BY SERVICE (Page No. - 111)

7.1 INTRODUCTION

7.1.1 SERVICES: COVID-19 IMPACT

FIGURE 25 PROFESSIONAL SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 35 MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

7.2 CONNECTIVITY SERVICES

TABLE 36 CELLULAR M2M CONNECTION, BY VENDOR, 2017–2019 (MILLION UNITS)

TABLE 37 CELLULAR M2M CONNECTIONS, 2017–2025 (UNIT BILLION)

7.2.1 CONNECTIVITY SERVICES: MARKET DRIVERS

7.2.2 CELLULAR M2M CONNECTIVITY TECHNOLOGY COMPARISON

TABLE 38 CONNECTIVITY SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 CONNECTIVITY SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3 PROFESSIONAL SERVICES

7.3.1 PROFESSIONAL SERVICES: MARKET DRIVERS

TABLE 40 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4 MANAGED SERVICES

7.4.1 MANAGED SERVICES: MARKET DRIVERS

TABLE 42 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 43 MANAGED SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 CELLULAR M2M MARKET, BY END USER (Page No. - 119)

8.1 INTRODUCTION

8.1.1 END USERS: COVID-19 IMPACT

FIGURE 26 TRANSPORTATION AND LOGISTICS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 44 MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 45 MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

8.2 HEALTHCARE

8.2.1 KEY DEVELOPMENTS IN HEALTHCARE

TABLE 46 HEALTHCARE: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 47 HEALTHCARE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 48 HEALTHCARE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 HEALTHCARE: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.2.2 TELEMEDICINE

8.2.3 ASSET TRACKING AND MONITORING

TABLE 50 HEALTHCARE: ASSET TRACKING AND MONITORING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 HEALTHCARE: ASSET TRACKING AND MONITORING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.2.4 PREDICTIVE MAINTENANCE

TABLE 52 HEALTHCARE: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 HEALTHCARE: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 TRANSPORTATION AND LOGISTICS

8.3.1 KEY DEVELOPMENTS IN TRANSPORTATION AND LOGISTICS

TABLE 54 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 55 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 56 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.2 FLEET MANAGEMENT

8.3.3 WAREHOUSE MANAGEMENT

8.3.4 ASSET TRACKING AND MANAGEMENT

TABLE 58 TRANSPORTATION AND LOGISTICS: ASSET TRACKING AND MONITORING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 TRANSPORTATION AND LOGISTICS: ASSET TRACKING AND MONITORING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.5 PREDICTIVE ASSET MAINTENANCE AND MONITORING

TABLE 60 TRANSPORTATION AND LOGISTICS: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 TRANSPORTATION AND LOGISTICS: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4 MANUFACTURING

8.4.1 KEY DEVELOPMENTS IN MANUFACTURING

TABLE 62 MANUFACTURING: CELLULAR M2M MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 63 MANUFACTURING: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 64 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 65 MANUFACTURING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4.2 INDUSTRIAL AUTOMATION

8.4.3 ASSET TRACKING AND MONITORING

TABLE 66 MANUFACTURING: ASSET TRACKING AND MONITORING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 MANUFACTURING: ASSET TRACKING AND MONITORING MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4.4 PREDICTIVE MAINTENANCE

TABLE 68 MANUFACTURING: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 69 MANUFACTURING: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.5 ENERGY AND UTILITIES

TABLE 70 ENERGY AND UTILITIES: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 71 ENERGY AND UTILITIES: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 72 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 73 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.5.1 SMART METERS

8.5.2 ASSET TRACKING AND MONITORING

TABLE 74 ENERGY AND UTILITIES: ASSET TRACKING AND MONITORING MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 75 ENERGY AND UTILITIES: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.5.3 PREDICTIVE MAINTENANCE

TABLE 76 ENERGY AND UTILITIES: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 77 ENERGY AND UTILITIES: PREDICTIVE MAINTENANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.6 OTHERS

TABLE 78 OTHER END USERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 79 OTHER END USERS: MARKET, BY REGION, 2019–2025 (USD MILLION)

9 CELLULAR M2M MARKET, BY ORGANIZATION SIZE (Page No. - 141)

9.1 INTRODUCTION

9.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 27 SMALL AMD MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 80 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 81 MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

9.2 LARGE ENTERPRISES

9.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 82 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 83 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

9.3.1 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET DRIVERS

TABLE 84 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 85 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10 CELLULAR M2M MARKET, BY REGION (Page No. - 146)

10.1 INTRODUCTION

TABLE 86 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 87 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

FIGURE 28 ASIA PACIFIC TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET REGULATIONS

10.2.2 NORTH AMERICA: MARKET DRIVERS

10.2.3 NORTH AMERICA: COVID-19 IMPACT

FIGURE 29 NORTH AMERICA: CELLULAR M2M MARKET SNAPSHOT

TABLE 88 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: HEALTHCARE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 95 NORTH AMERICA: HEALTHCARE MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 97 NORTH AMERICA: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 99 NORTH AMERICA: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 100 NORTH AMERICA: MANUFACTURING MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 101 NORTH AMERICA: MANUFACTURING MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.2.4 UNITED STATES

10.2.4.1 United States: MARKET Regulations

TABLE 106 UNITED STATES: CELLULAR M2M MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 107 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 108 UNITED STATES: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 109 UNITED STATES: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 110 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 111 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.2.5 CANADA

10.2.5.1 Canada: MARKET Regulations

TABLE 112 CANADA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 113 CANADA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 114 CANADA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 115 CANADA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 116 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 117 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET REGULATIONS

10.3.2 EUROPE: MARKET DRIVERS

10.3.3 EUROPE: COVID-19 IMPACT

TABLE 118 EUROPE: CELLULAR M2M MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 124 EUROPE: HEALTHCARE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 125 EUROPE: HEALTHCARE MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 126 EUROPE: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 127 EUROPE: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 128 EUROPE: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 129 EUROPE: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 130 EUROPE: MANUFACTURING MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 131 EUROPE: MANUFACTURING MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 135 EUROPE: MANUFACTURING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.3.4 UNITED KINGDOM

10.3.4.1 United Kingdom: MARKET Regulations

TABLE 136 UNITED KINGDOM: CELLULAR M2M MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 137 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 138 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 139 UNITED KINGDOM: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 140 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 141 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.3.5 GERMANY

10.3.5.1 Germany: MARKET Regulations

TABLE 142 GERMANY: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 143 GERMANY: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 144 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 145 GERMANY: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 146 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 147 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET REGULATIONS

10.4.2 ASIA PACIFIC: MARKET DRIVERS

10.4.3 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 30 ASIA PACIFIC: CELLULAR M2M MARKET SNAPSHOT

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 154 ASIA PACIFIC: HEALTHCARE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 155 ASIA PACIFIC: HEALTHCARE MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 156 ASIA PACIFIC: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 157 ASIA PACIFIC: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 158 ASIA PACIFIC: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 159 ASIA PACIFIC: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 160 ASIA PACIFIC: MANUFACTURING MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 161 ASIA PACIFIC: MANUFACTURING MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 165 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.4.4 CHINA

10.4.4.1 China: MARKET Regulations

TABLE 166 CHINA: CELLULAR M2M MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 167 CHINA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 168 CHINA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 169 CHINA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 170 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 171 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.4.5 JAPAN

10.4.5.1 Japan: MARKET Regulations

TABLE 172 JAPAN: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 173 JAPAN: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 174 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 175 JAPAN: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 176 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 177 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET REGULATIONS

10.5.2 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.3 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 178 MIDDLE EAST AND AFRICA: CELLULAR M2M MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 179 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 180 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 181 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 182 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 183 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 184 MIDDLE EAST AND AFRICA: HEALTHCARE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 185 MIDDLE EAST AND AFRICA: HEALTHCARE MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 186 MIDDLE EAST AND AFRICA: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 187 MIDDLE EAST AND AFRICA: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 188 MIDDLE EAST AND AFRICA: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 189 MIDDLE EAST AND AFRICA: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 190 MIDDLE EAST AND AFRICA: MANUFACTURING MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 191 MIDDLE EAST AND AFRICA: MANUFACTURING MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 192 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 193 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET REGULATIONS

10.6.2 LATIN AMERICA: CELLULAR M2M2 MARKET DRIVERS

10.6.3 LATIN AMERICA: COVID-19 IMPACT

TABLE 194 LATIN AMERICA: CELLULAR M2M MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 195 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY END USER, 2016–2019 (USD MILLION)

TABLE 199 LATIN AMERICA: MARKET SIZE, BY END USER, 2019–2025 (USD MILLION)

TABLE 200 LATIN AMERICA: HEALTHCARE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 201 LATIN AMERICA: HEALTHCARE MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 202 LATIN AMERICA: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 203 LATIN AMERICA: ENERGY AND UTILITIES MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 204 LATIN AMERICA: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 205 LATIN AMERICA: TRANSPORTATION AND LOGISTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 206 LATIN AMERICA: MANUFACTURING MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 207 LATIN AMERICA: MANUFACTURING MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 208 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 209 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

TABLE 210 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 211 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.6.4 BRAZIL

10.6.4.1 Brazil: MARKET Regulations

TABLE 212 BRAZIL: CELLULAR M2M MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 213 BRAZIL: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 214 BRAZIL: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 215 BRAZIL: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 216 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 217 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

10.6.5 MEXICO

10.6.5.1 Mexico: MARKET Regulations

TABLE 218 MEXICO: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 219 MEXICO: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 220 MEXICO: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 221 MEXICO: MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

TABLE 222 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 223 MEXICO: MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 204)

11.1 INTRODUCTION

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 31 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 32 TOP PLAYERS IN THE MARKET

11.4 HISTORICAL REVENUE ANALYSIS

11.4.1 INTRODUCTION

FIGURE 33 HISTORIC FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

11.5 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 34 RANKING OF KEY PLAYERS, 2020

11.6 MARKET: COMPANY EVALUATION MATRIX

11.6.1 STARS

11.6.2 PERVASIVE

11.6.3 PARTICIPANT COMPANIES

11.6.4 EMERGING LEADERS

FIGURE 35 GLOBAL MARKET: COMPANY EVALUATION MATRIX, 2020

11.7 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS

FIGURE 36 STRENGTH OF PRODUCT PORTFOLIO OF TOP PLAYERS IN CELLULAR M2M MARKET

12 COMPANY PROFILES (Page No. - 211)

(Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, MnM View)*

12.1 AT&T

FIGURE 37 AT&T: COMPANY SNAPSHOT

12.2 VERIZON

FIGURE 38 VERIZON: COMPANY SNAPSHOT

12.3 T-MOBILE, US

FIGURE 39 T-MOBILE, US: COMPANY SNAPSHOT

12.4 VODAFONE

FIGURE 40 VODAFONE: COMPANY SNAPSHOT

12.5 ORANGE S.A.

FIGURE 41 ORANGE S.A.: COMPANY SNAPSHOT

12.6 TELEFONICA

FIGURE 42 TELEFONICA: COMPANY SNAPSHOT

12.7 DEUTSCHE TELEKOM

FIGURE 43 DEUTSCHE TELEKOM: COMPANY SNAPSHOT

12.8 ERICSSON

FIGURE 44 ERICSSON: COMPANY SNAPSHOT

12.9 KORE WIRELESS

12.10 AERIS

12.11 TELIT

12.12 GIESECKE+DEVRIENT

12.13 CUBIC TELECOM

12.14 KPN

12.15 A1 DIGITAL

12.16 ARM HOLDINGS

12.17 CHINA MOBILE

12.18 INFINEON

12.19 THALES GROUP

12.20 ORBCOMM

12.21 SK TELECOM

12.22 ROGERS COMMUNICATIONS

12.23 TELENOR CONNEXION

12.24 TRUPHONE

12.25 10T

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 261)

13.1 IOT IN HEALTHCARE MARKET

13.1.1 MARKET DEFINITION

13.1.2 IOT IN HEALTHCARE MARKET, BY COMPONENT

TABLE 224 IOT IN HEALTHCARE MARKET SIZE, BY COMPONENT, 2015–2019 (USD BILLION)

TABLE 225 IOT IN HEALTHCARE MARKET SIZE, BY COMPONENT, 2019–2025 (USD BILLION)

TABLE 226 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2015–2019 (USD BILLION)

TABLE 227 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

TABLE 228 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2015–2019 (USD BILLION)

TABLE 229 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

TABLE 230 MEDICAL DEVICES: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2015–2019 (USD BILLION)

TABLE 231 MEDICAL DEVICES: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2019–2025 (USD BILLION)

TABLE 232 STATIONARY MEDICAL DEVICES MARKET SIZE, BY REGION, 2015–2019 (USD BILLION)

TABLE 233 STATIONARY MEDICAL DEVICES MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

TABLE 234 STATIONARY MEDICAL DEVICES: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2015–2019 (USD BILLION)

TABLE 235 STATIONARY MEDICAL DEVICES: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2019–2025 (USD BILLION)

TABLE 236 IMPLANTED MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2015–2019 (USD BILLION)

TABLE 237 IMPLANTED MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

TABLE 238 IMPLANTED MEDICAL DEVICES: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2015–2019 (USD BILLION)

TABLE 239 IMPLANTED MEDICAL DEVICES: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2019–2025 (USD BILLION)

TABLE 240 WEARABLE EXTERNAL MEDICAL DEVICES MARKET SIZE, BY REGION, 2015–2019 (USD BILLION)

TABLE 241 WEARABLE EXTERNAL MEDICAL DEVICES MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

TABLE 242 WEARABLE EXTERNAL MEDICAL DEVICES: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2015–2019 (USD BILLION)

TABLE 243 WEARABLE EXTERNAL MEDICAL DEVICES: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2019–2025 (USD BILLION)

TABLE 244 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2015–2019 (USD BILLION)

TABLE 245 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

TABLE 246 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2015–2019 (USD BILLION)

TABLE 247 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

TABLE 248 SYSTEMS AND SOFTWARE: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2015–2019 (USD BILLION)

TABLE 249 SYSTEMS AND SOFTWARE: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2019–2025 (USD BILLION)

TABLE 250 REMOTE DEVICE MANAGEMENT MARKET SIZE, BY REGION, 2015–2019 (USD BILLION)

TABLE 251 REMOTE DEVICE MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

TABLE 252 REMOTE DEVICE MANAGEMENT: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2015–2019 (USD BILLION)

TABLE 253 REMOTE DEVICE MANAGEMENT: NORTH AMERICA IOT IN HEALTHCARE MARKET SIZE, BY COUNTRY, 2019–2025 (USD BILLION)

13.2 IOT SECURITY MARKET

13.2.1 MARKET DEFINITION

13.2.2 IOT SECURITY MARKET, BY COMPONENT

TABLE 254 IOT SECURITY MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 255 IOT SECURITY MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

TABLE 256 SOLUTIONS: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 257 SOLUTIONS: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 258 SERVICES: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 259 SERVICES: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.2.3 IOT SECURITY MARKET, BY TYPE

TABLE 260 IOT SECURITY MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 261 IOT SECURITY MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 262 NETWORK SECURITY: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 263 NETWORK SECURITY: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 264 ENDPOINT SECURITY: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 265 ENDPOINT SECURITY: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 266 APPLICATION SECURITY: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 267 APPLICATION SECURITY: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 268 CLOUD SECURITY: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 269 CLOUD SECURITY: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 270 OTHERS: IOT SECURITY MARKET SIZE, BY REGION , 2016–2019 (USD MILLION)

TABLE 271 OTHERS: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.2.4 IOT SECURITY MARKET, BY SOLUTION

TABLE 272 IOT SECURITY MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 273 IOT SECURITY MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 274 IDENTITY AND ACCESS MANAGEMENT: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 275 IDENTITY AND ACCESS MANAGEMENT, IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 276 DATA ENCRYPTION AND TOKENIZATION: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 277 DATA ENCRYPTION AND TOKENIZATION, IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 278 INTRUSION DETECTION SYSTEM AND INTRUSION PREVENTION SYSTEM: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 279 INTRUSION DETECTION SYSTEM AND INTRUSION PREVENTION SYSTEM: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 280 DEVICE AUTHENTICATION AND MANAGEMENT: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 281 DEVICE AUTHENTICATION AND MANAGEMENT, IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 282 SECURE COMMUNICATIONS: IOT SECURITY MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 283 SECURE COMMUNICATIONS: IOT SECURITY MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

14 APPENDIX (Page No. - 283)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

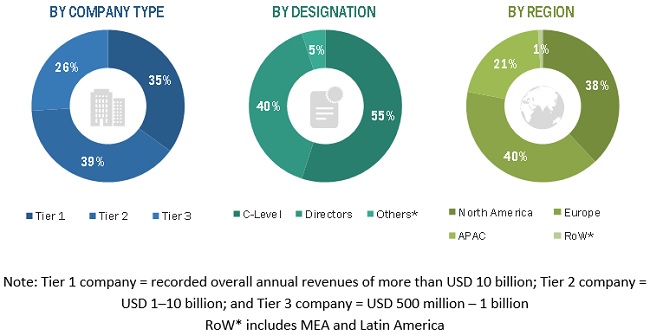

The study involved four major activities in estimating the current market size for the cellular M2M market. Exhaustive secondary research was done to collect information on the Cellular M2M market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the Cellular M2M market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. Journals such as the International Journal of Computer Science and Information Technology and Security (IJCSITS) and Scientific.Net; and various associations, including the European Association of Next Generation Telecommunications Innovators (EANGTI) and International Telecommunication Union (ITU) were referred to, for consolidating the report. Secondary research was mainly used to obtain key information about the industry insights, market’s monetary chain, overall pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Cellular M2Mmarket. The primary sources from the demand side included telecom operators, network administrators/consultants/ specialists, Chief Information Officers (CIOs), and subject matter experts from telecom and government associations.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the Cellular M2M market. The first approach involves the estimation of the market size by summing up companies’ revenue generated through the sale of solutions and services. The top-down and bottom-up approaches were used to estimate and validate the size of the Cellular M2M market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors who offer services in the Cellular M2M market was prepared while using the top-down approach. The market revenue for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The aggregate of all companies’ revenues was extrapolated to reach the overall market size. Further, each subsegment was studied and analyzed for its regional market size and country-level penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global cellular M2M market based on services, application, organization size, end user, and regions from 2020 to 2025, and analyze various macro and microeconomic factors affecting the market growth

- To forecast the size of the market segments for five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To analyze each submarket for individual growth trends, prospects, and contributions to the global market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the global market

- To profile the key market players, such as top vendors and startups; provide a comparative analysis based on their business overviews, regional presence, product offerings, and business strategies; and illustrate the market’s competitive landscape

- To track and analyze competitive developments, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations, in the market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Cellular M2M market

- To profile key market players; provide a comparative analysis based on business overview, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in Cellular M2M Market