PVB Interlayers Market by Type (Standard Polyvinyl Butyral and Structural Polyvinyl Butyral), End-use Industry (Automotive, Building & Construction, and Photovoltaic),Region (North America, Europe, APAC,RoW) - Global Forecast to 2024

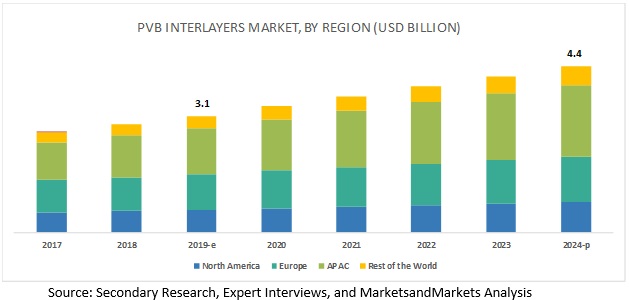

[88 Pages Report] The PVB interlayers market size is projected to grow from the estimated USD 3.1 billion in 2019 to USD 4.4 billion by 2024, at a compound annual growth rate (CAGR) of 7.3%, during the forecast period. PVB interlayers are thin protective films sandwiched between two panels of glass. These interlayers are made from polyvinyl butyral resin, which has properties, such as optical clarity, strong bond, toughness, flexibility, and adhesion to various surfaces. The glasses with interlayers are called laminated glass, which are used in automobile, construction, and photovoltaic industries for various applications, such as protection from projectiles, acoustic insulation, UV insulation, and safety & security. The increasing production of vehicles and mandatory safety glass regulations are the major factors driving the PVB interlayers market.

Photovoltaic to be the fastest-growing end-use segment of the PVB interlayers market.

The demand for PVB interlayers in the photovoltaic industry is expected to grow at a relatively high rate, driven by its advantages over other plastic materials as an encapsulant in the photovoltaic modules. Owing to the growing focus on renewable sources for energy generation, the consumption of PVB interlayers in this end-use industry segment is projected to grow during the forecast period.

Standard to be the largest type segment of the PVB interlayers market.

Standard PVB interlayers are used in more than 70% of laminated glass applications. The major function of these interlayers is to enhance the safety and security performance, and improve the acoustic and UV protection performance of the glass. These interlayers are used in traditional four side supported glass and 1-3 side and minimally supported glass in windows, faηade systems, overhead, floor and balustrade. However, these interlayers have comparatively lower post breakage performance. Hence, these interlayers are been replaced by advanced interlayers, such as PVB structured interlayers and ionoplast interlayers. In additionally, these interlayers have limitations, such lower strength and increased weight in comparison to monolithic glass.

APAC projected to account for the largest market share during the forecast period.

APAC is estimated to dominate the overall PVB interlayers market during the forecast period. The region has emerged as the largest consumer PVB interlayers, owing to the growth in production of electric vehicles, building & construction projects, and solar photovoltaic installations in China, India, Japan, South Korea, among other countries in the region.

Key Market Players

The leading players in the PVB interlayers market are Eastman Chemical Company (US), Kuraray (Germany), Sekisui Chemicals (Japan), Everlam (Belgium), Genau Manufacturing Company (India), KB PVB (China), Chang Chun Group (China), DuLite (China), Huakai Plastic (China), Willing Lamiglass Materials (China), Jiangsu Darui Hengte Technology (China), and Tiantai Kanglai Industrial (China). These players have strong R&D and focus on producing high-performance products to meet the demands of end users.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Unit considered |

Value (USD Billion) and Volume (Square Meter) |

|

Segments |

Type, End-Use Industry, and Region |

|

Regions |

North America, APAC, Europe, and Rest of World |

|

Companies |

Eastman Chemical Company (US), Kuraray (Germany), Sekisui Chemicals (Japan), Everlam (Belgium), Genau Manufacturing Company (India), KB PVB (China), Chang Chun Group (China), DuLite (China), Huakai Plastic (China), Willing Lamiglass Materials (China), Jiangsu Darui Hengte Technology (China), and Tiantai Kanglai Industrial (China) |

This research report categorizes the global PVB interlayers market on the basis of type, end-use industry, and region.

On the basis of Type:

- Standard

- Structural

On the basis of End-use Industry:

- Automotive

- Construction

- Photovoltaic

On the basis of Region:

- North America

- Europe

- APAC

- Rest of the World

The market is further analyzed for the key countries in each of these regions.

Recent Developments

- Kuraray used expansion as its key strategy to increase its geographic presence. In 2017, Kuraray established a PVB films production facility at the Ulsan plant in South Korea with an investment of USD 50 million. This expansion helped the company to cater to the demand for PVB in APAC.

- Sekisui Chemical adopted expansion as their strategy to increase their product offering. In December 2017, the company announced that it has added a third production line at its Mexico plant. The new production line will produce automotive interlayer films due to the growing demand from Central and South America. In January 2018, the company decided to increase the production capacity of interlayer film at Roermond and resin at Geleen, both in the Netherlands. The expansion was done to produce wedge shape interlayer films for head up displays (HUD).

Key Questions Addressed by the Report

- What are the global trends in demand for PVB interlayers? Will the market witness an increase or decline in demand in the near future?

- What were the revenue pockets for PVB interlayers in 2018?

- Who are the key players in the PVB interlayers market, globally?

Frequently Asked Questions (FAQ):

What is importance of PVB Interlayers?

What are the major end-use industries using PVB Interlayers?

What are the factors influencing the growth of PVB Interlayers market?

How PVB Interlayers are better than other alternatives in the market?

What the types of PVB Interlayers available in the market?

Who are the major players in the PVB interlayers market?

Are there any upcoming opportunities of manufacturers in the market?

What are the factors influencing the price of PVB Interlayers?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.1.1 PVB Interlayers Market, By Region

1.3.2 Years Considered For the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.1.3 Market Size Estimation: Bottom-Up Approach

2.1.4 Market Size Estimation: Top-Down Approach

2.2 Data Triangulation

2.3 Limitations of the Study

2.4 Research Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Opportunities in the PVB Interlayers Market

4.2 APAC: PVB Interlayers Market

4.3 PVB Interlayers Market, By Country

5 Market Overview (Page No. - 28)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Large-Scale Demand From the Automotive Industry

5.2.1.2 The Growing Demand From the Building & Construction Industry

5.2.2 Opportunities

5.2.2.1 Growing Photovoltaic Industry

5.2.3 Challenges

5.2.3.1 Replacement With More Optimized Materials

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Threat of New Entrants

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 PVB Interlayers Market, By Type (Page No. - 33)

6.1 Introduction

6.2 Standard

6.2.1 Standard PVB Accounted For the Larger Share of the PVB Interlayers Market

6.3 Structural

6.3.1 The Adoption of Structural PVB is Projected to Witness High Growth During the Forecast Period

7 PVB Interlayers Market, By End-Use (Page No. - 36)

7.1 Introduction

7.2 Building & Construction

7.2.1 Increasing Usage of Laminated Glass is Driving the PVB Interlayers Market in the Building & Construction Industry

7.3 Automotive

7.3.1 Rise in the Manufacturing of Evs to Drive the Demand For PVB Interlayers in the Automotive End-Use Industry Segment

7.4 Photovoltaic

7.4.1 Rising Photovoltaic Installations to Drive the Demand For PVB Interlayers as an Encapsulant

8 PVB Interlayers Market, By Region (Page No. - 41)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 The US is the Largest Market For PVB Interlayers in North America

8.2.2 Canada

8.2.2.1 Automotive to Be the Dominant End-Use Industry of PVB Interlayers in Canada

8.2.3 Mexico

8.2.3.1 Automotive Industry to Lead the PVB Interlayers Market in Mexico

8.3 Europe

8.3.1 Germany

8.3.1.1 Automotive Industry to Be the Largest Market For PVB Interlayers

8.3.2 France

8.3.2.1 Government Initiatives to Drive the Market For PVB Interlayers

8.3.3 UK

8.3.3.1 Uncertainty Over Brexit is Hampering the Growth of the End-Use Industries of PVB Interlayers

8.3.4 Italy

8.3.4.1 Growth of Evs to Drive the Demand For PVB Interlayers in the Automotive Industry

8.3.5 Spain

8.3.5.1 Automotive to Lead the Market For PVB Interlayers

8.3.6 Rest of Europe

8.4 APAC

8.4.1 China

8.4.1.1 China is the Largest Market For PVB Interlayers in APAC

8.4.2 Japan

8.4.2.1 Photovoltaic is Going to Be the Fastest-Growing End-Use Sector

8.4.3 India

8.4.3.1 India is Going to Be the Fastest-Growing Market in APAC

8.4.4 South Korea

8.4.4.1 Photovoltaic is Going to Be the Fastest-Growing End-Use Industry

8.4.5 Rest of APAC

8.4.5.1 The Growing Photovoltaic Industry Will Drive the Market

8.5 Row

8.6 Middle East & Africa

8.6.1 Middle East & Africa

8.6.1.1 Investment to Promote Automotive Manufacturing is One of the Key Factors Driving the Market in the Region

8.6.2 South America

8.6.2.1 The Emerging Solar Energy Sector to Drive the Market Growth

9 Company Profiles (Page No. - 68)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

9.1 Eastman Chemical Company

9.2 Kuraray

9.3 Sekisui Chemicals

9.4 Everlam

9.5 Genau Manufacturing Company

9.6 KB PVB

9.7 Chang Chun Group

9.8 Dulite

9.9 Huakai Plastic

9.10 Willing Lamiglass Materials

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

9.11 Others

9.11.1 Jiangsu Daruihengte Technology & Science

9.11.2 Tiantai Kanglai Industrial

9.11.3 Zhejiang Hehui New Material Co. Ltd

9.11.4 Zhejiang Ruihong Plastic Co., Ltd.

9.11.5 Jiangsu Banda New Materials Co., Ltd

10 Appendix (Page No. - 83)

10.1 Discussion Guide

10.2 Knowledge Store: Marketsandmarkets Subscription Portal

10.3 Related Reports

10.4 Author Details

List of Tables (58 Tables)

Table 1 PVB Interlayers Market Size, By Type, 20172024 (000 Square Meter)

Table 2 Market Size, By Type, 20172024 (USD Million)

Table 3 PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 4 Market Size, By End-Use Industry, 20172024 (USD Million)

Table 5 PVB Interlayers Market Size in Building & Construction Industry, By Region, 20172024 (000 Square Meter)

Table 6 Market Size in Building & Construction Industry, By Region, 20172024 (USD Million)

Table 7 PVB Interlayers Market Size in Automotive Industry, By Region, 20172024 (000 Square Meter)

Table 8 Market Size in Automotive Industry, By Region, 20172024 (USD Million)

Table 9 PVB Interlayers Market Size in Photovoltaic Industry, By Region, 20172024 (000 Square Meter)

Table 10 Market Size in Photovoltaic Industry, By Region, 20172024 (USD Million)

Table 11 PVB Interlayers Market Size, By Region, 20172024 (000 Square Meter)

Table 12 Market Size, By Region, 20172024 (USD Million)

Table 13 North America: PVB Interlayers Market Size, By Country, 20172024 (000 Square Meter)

Table 14 North America: Market Size, By Country, 20172024 (USD Million)

Table 15 North America: Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 16 North America: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 17 US: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 18 US: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 19 Canada: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 20 Canada: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 21 Mexico: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 22 Mexico: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 23 Europe: PVB Interlayers Market Size, By Country, 20172024 (000 Square Meter)

Table 24 Europe: Market Size, By Country, 20172024 (USD Million)

Table 25 Europe: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 26 Europe: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 27 Germany: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 28 Germany: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 29 France: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 30 France: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 31 UK: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 32 UK: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 33 Italy: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 34 Italy: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 35 Spain: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 36 Spain: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 37 Rest of Europe: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 38 Rest of Europe: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 39 APAC: PVB Interlayers Market Size, By Country, 20172024 (000 Square Meter)

Table 40 APAC: Market Size, By Country, 20172024 (USD Million)

Table 41 APAC: Market Size, By End-Use Industry, 20172024 (Square Meter)

Table 42 APAC: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 43 China: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 44 China: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 45 Japan: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000square Meter)

Table 46 Japan: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 47 India: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 48 India: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 49 South Korea: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 50 South Korea: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 51 Rest of APAC: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 52 Rest of APAC: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 53 Row: PVB Interlayers Market Size, By Region, 20172024 (000 Square Meter)

Table 54 Row: Market Size, By Region, 20172024 (USD Million)

Table 55 Middle East & Africa: PVB Interlayers Market Size, By End-Use Industry, 20172024 (000 Square Meter)

Table 56 Middle East & Africa: Market Size, By End-Use Industry, 20172024 (USD Million)

Table 57 South America: PVB Interlayers Market Size, By End-Use Industry, 20172024 (Square Meter)

Table 58 South America: Market Size, By End-Use Industry, 20172024 (USD Million)

List of Figures (26 Figures)

Figure 1 PVB Interlayers: Market Segmentation

Figure 2 PVB Interlayers Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Data Triangulation: PVB Interlayers

Figure 6 Automotive Accounted For the Largest Share in the PVB Interlayers Market in 2018

Figure 7 Structural PVB to Be the Faster-Growing Type of PVB Interlayers Between 2019 and 2024

Figure 8 APAC to Be the Fastest-Growing Market For PVB Interlayers

Figure 9 Increasing Demand From APAC to Drive the PVB Interlayers Market

Figure 10 Automotive End-Use Industry and China Accounted For the Largest Share in the PVB Interlayers Market in APAC in 2018

Figure 11 The Market in India to Grow at the Highest Rate During the Forecast Period

Figure 12 Drivers, Opportunities, and Challenges in the PVB Interlayers Market

Figure 13 Electric Cars Stock, 20092018

Figure 14 Porters Five Forces Analysis

Figure 15 Standard PVB Was the Larger PVB Interlayers Type

Figure 16 Automotive End-Use Industry Segment Led the PVB Interlayers Market in 2018

Figure 17 APAC to Lead the Market Globally

Figure 18 North America: PVB Interlayers Market Snapshot

Figure 19 Europe: Market Snapshot

Figure 20 APAC: Market Snapshot

Figure 21 Eastman Chemical Company: Company Snapshot

Figure 22 SWOT Analysis: Eastman Chemical Company

Figure 23 Kuraray: Company Snapshot

Figure 24 SWOT Analysis: Kuraray

Figure 25 Sekisui: Company Snapshot

Figure 26 SWOT Analysis: Sekisui

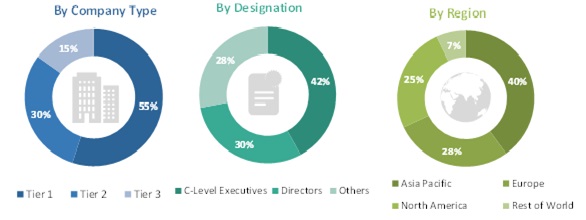

The study involves four major activities in estimating the current market size of PVB interlayers. Exhaustive secondary research was done to collect information related to the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both, top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The PVB interlayers market comprises several stakeholders, such as raw material suppliers, technology developers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the construction and transportation industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global PVB interlayers market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size included the following steps:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage splits and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of the key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process explained above, the overall market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated by using both the top-down and bottom-up approaches. It was then verified through primary interviews. Hence, for every data segment, there are three sourcestop-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the market size of PVB interlayers, in terms of value and volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market size on the basis of type and end-use industry

- To analyze and forecast the market size on the basis of component

- To forecast the market size of different segments with respect to four regions, namely, APAC, Europe, North America, and Rest of the World

- To forecast the market size of different segments with respect to key countries of each region

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze the competitive developments, such as expansion and new product development, in the market

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data. The following customization options are available for the report:

Regional Analysis:

- Further breakdown of a region with respect to a particular country

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Product Analysis

- Product Matrix that gives a detailed comparison of product portfolio of each company

Growth opportunities and latent adjacency in PVB Interlayers Market