Polyvinyl Butyral Market

Polyvinyl Butyral Market by Application (Films & Sheets, Paints & Coatings, Adhesives, Other Applications), Thickness (Ultra-thin Films, Standard Films, Mid-range Films, Thick & Composite Interlayers and Above), Resin Type (Higher Molecular Weight Grade PVB Resin, Medium Molecular Weight Grade PVB Resin, Lower Molecular Weight Grade PVB Resin, Modified PVB Resin), Product Type (Powder & Granulated, Other Product Types), End-use Industry (Automotive, Constructions, Electrical & Electronics, Other End-use Industries), and Region - Global Forecast to 2030

POLYVINYL BUTYRAL MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global polyvinyl butyral market is projected to grow from USD 1.4 billion in 2025 to USD 1.9 billion by 2030, registering a CAGR of 5.0% during the forecast period. The polyvinyl butyral (PVB) market is growing steadily, driven by its ongoing usage in numerous vital industries, primarily automotive, construction, and renewable energy.

KEY TAKEAWAYS

-

BY THICKNESSPVB films are available in ultra-thin films, standard films, mid-range films, and thick & composite interlayers and above. Ultra-thin and standard films are favored in electronics and consumer applications, whereas mid-range and thick interlayers are extensively used in automotive windshields and construction glazing for safety and acoustic performance.

-

BY RESIN TYPEThe market is segmented into higher molecular weight grade PVB resin, medium molecular weight grade PVB resin, lower molecular weight grade PVB resin, and modified PVB resin. High molecular weight grades provide superior strength and durability, while medium and low grades cater to flexibility and cost-effectiveness. Modified PVB resins are gaining traction for enhanced performance in specialty applications.

-

BY PRODUCT TYPEPVB is available in powder and granulated forms, along with other specialty product types. Granulated PVB is commonly used in large-scale industrial processes, while powdered forms are preferred for precise coatings and adhesive applications, offering manufacturers flexibility in processing.

-

BY END-USE INDUSTRYThe automotive industry is the leading consumer of PVB, particularly for laminated safety glass in windshields. Construction follows closely, with PVB interlayers enhancing building safety and aesthetics. The electrical & electronics industries adopt PVB films for insulation and encapsulation, while other industries explore its use in specialty coatings and adhesives.

-

BY REGIONThe global PVB market is growing steadily, with significant adoption in North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads due to rapid industrialization and strong automotive & construction demand, while in Europe and North America, the market is driven by regulatory standards for safety glass and sustainable construction materials.

-

COMPETITIVE LANDSCAPEThe PVB market is driven by product innovation, capacity expansions, and strategic collaborations among global leaders such as Kuraray Co., Ltd., Eastman Chemical Company, Sekisui Chemical Co., Ltd., and Everlam. These companies are focusing on developing advanced PVB films with improved acoustic, safety, and UV-resistance properties to cater to the growing demand from the automotive and construction industries.

The polyvinyl butyral (PVB) market is growing steadily, driven by its ongoing usage in numerous vital industries, primarily automotive, construction, and renewable energy. Across the automotive industry, PVB is used in laminated safety glass in windshields and side windows, which is now standard practice due to the increasing production of vehicles and stringent regulations in safety performance in countries such as China, India, and Japan in Asia Pacific.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Changes in customer trends or disruptions impact consumers’ businesses. These shifts impact the revenue of end users. Consequently, the revenue impact on end users is expected to affect the revenue of polyvinyl butyral suppliers, which, in turn, impacts the revenue of polyvinyl butyral manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Mandatory use of laminated safety glass in architectural and automotive applications

-

Rising demand for EVs and advanced driver-assistance systems (ADAS)

Level

-

Limited UV and moisture resistance in outdoor exposed PVB applications

Level

-

Expanding Recycled PVB (rPVB) Adoption in Industrial and Infrastructure Materials

-

Smart Glass & Dynamic Glazing Integration

Level

-

Regulatory Pressure on Plasticizer Formulations and VOC Emissions in PVB Manufacturing

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Drivers: Mandatory use of laminated safety glass in architectural and automotive applications

As an interlayer in laminated glass, PVB is widely used for this application due to its excellent adhesion, impact resistance, and sound-dampening properties. With globally shifting roadsafety regulations and vehicle design consistently striving towards lighter and safer design, laminated glass with PVB interlayers has now become the standard for windshields and side windows.

Restraints: Limited UV and moisture resistance in outdoor exposed PVB applications

One of the key restraints for the PVB market is its limited resistance to UV radiation and moisture when exposed to outdoor environments. While PVB interlayers excel in providing adhesion and impact resistance, their long-term durability can be compromised under harsh weather conditions, leading to delamination, discoloration, or reduced performance. This restricts the widespread outdoor use of PVB in certain architectural and industrial applications where prolonged exposure to sunlight and humidity is unavoidable. Consequently, manufacturers and end users often have to rely on additional protective coatings, advanced formulations, or alternative interlayers, thereby limiting the straightforward adoption of PVB in such applications.

Opportunities: Expanding Recycled PVB (rPVB) Adoption in Industrial and Infrastructure Materials

Expanding the use of recycled PVB offers significant opportunities for sustainable growth in the market. With increasing emphasis on circular economy practices and stricter environmental regulations, the recycling of end-of-life laminated glass from automotive and architectural sectors into high-quality recycled PVB (rPVB) is gaining traction. Recycled PVB is being adopted in various industrial and infrastructure materials, supporting both cost efficiency and sustainability goals. Moreover, the integration of PVB into smart glass and dynamic glazing technologies represents a strong opportunity. Smart glass applications, including electrochromic, photochromic, and thermochromic systems, benefit from PVB interlayers that enhance durability, energy efficiency, and performance. As buildings and vehicles move toward intelligent, energy-saving solutions, the role of PVB in enabling these advanced glazing systems is expected to expand significantly.

Challenges: Regulatory Pressure on Plasticizer Formulations and VOC Emissions in PVB Manufacturing

The PVB market faces ongoing challenges from regulatory pressures related to plasticizer formulations and volatile organic compound (VOC) emissions during manufacturing. Traditional PVB formulations rely on plasticizers to improve flexibility and processability, but many of these additives face scrutiny due to health, safety, and environmental concerns. Regulatory authorities worldwide are enforcing stricter limits on the use of certain plasticizers, compelling manufacturers to invest in the development of alternative, eco-friendly formulations. Similarly, the production process for PVB can involve VOC emissions, which are increasingly regulated due to their contribution to air pollution and health risks. Compliance with these evolving regulations not only increases production costs but also demands continuous innovation and process optimization from manufacturers to remain competitive.

Polyvinyl Butyral Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

PVB interlayers in laminated automotive windshields and panoramic roofs | Enhanced passenger safety, noise reduction, UV protection, compliance with automotive safety standards |

|

PVB films in architectural glazing for commercial & residential buildings | Improved acoustic insulation, energy efficiency, shatter resistance, and support for green building certification |

|

Development of high-clarity and acoustic PVB resins for laminated glass | Superior optical quality, premium design appeal, better noise control, higher value-added product offering |

|

Solar encapsulation and advanced glazing applications using modified PVB | Improved durability, UV stability, contribution to renewable energy adoption, long-term performance |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The polyvinyl butyral ecosystem analysis involves identifying and analyzing interconnected relationships among various stakeholders, including raw material suppliers, manufacturers, distributors, and end users. The raw material suppliers provide ethylene and polypropylene to polyvinyl butyral manufacturers. The distributors and suppliers establish contact between manufacturing companies and end users to streamline the supply chain, increasing operational efficiency and profitability.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Polyvinyl butyral Market, By Product Type

Powder & granules is the largest product type segment in the polyvinyl butyral (PVB) market, and continues to grow due to the multifunctional capabilities of PVB, ease of processing, as well as compatibility with a large range of applications. An important benefit when it comes to PVB powder and granules is excellent thermal stability and solubility, giving the user the ability to blend precisely and mold PVB. Powder and granules are used in the manufacturing of laminated safety glass, such as automotive windshields and building facades, where consistent quality is necessary and specific shape and film are required.

Polyvinyl butyral Market, By Resin Type

Higher molecular weight PVB resin accounts for the largest proportion of the PVB market because of its notable mechanical strength, durability and performance characteristics which allow it to satisfy high performance requirements. This resin grade has excellent adherence to glass, high tensile strength and enhanced impact resistance, which are important factors in the manufacturing of laminated safety glass, especially in automobile windshields and architectural glazing.

Polyvinyl butyral Market, By Thickness

Standard film thickness dominates the global PVB market, mainly because it strikes the best balance of mechanical properties, cost and versatility of applications. Normal PVB films – whose thickness falls between 0.38 mm and 0.76 mm – are best suited to produce laminated safety glass used for both automotive and architectural applications. Standard PVB films are well-known for offering high impact resistance, superior optical clarity and sound insulation; they, therefore, remain the material of choice for windshield and window glass in the automotive sector and a range of glass applications in high-rise commercial and residential buildings.

Polyvinyl butyral market, By Application

Films & sheets dominate the PVB market, by application, due to their major role in the use of laminated safety glass in many industries such as automotive, construction, and solar energy. PVB films are critical interlayers to sandwich between layers of glass for laminated glass. Safety, sound, and UV shielding are all properties of PVB films.

REGION

Asia Pacific to be fastest-growing region in global Polyvinyl butyral market during forecast period

The Asia Pacific region holds the largest share of the global PVB market, supported by the automotive, building & construction, and solar industries. Countries in the region such as China, India, Japan, and South Korea add to the regional demand for PVB with China being the largest producer and consumer of PVB products. As the middle-class population and urbanization grow, there has also been a rise in the sale of automobiles, particularly passenger vehicles, throughout Asia Pacific. In the automotive segment, PVB is commonly seen in laminated glass applications and even used for safety and acoustic reasons, which is a major contributor to the need for PVB in relation to the automotive market. Investment in commercial, residential, and institutional buildings is also a large contributor to the increased demand for PVB from the construction industry, specifically in India and Southeast Asia.

Polyvinyl Butyral Market: COMPANY EVALUATION MATRIX

In the polyvinyl butyral market matrix, Kuraray (Star) leads with a dominant market share and a strong global footprint, backed by its wide range of PVB interlayers used extensively in automotive safety glass and building & construction applications. Sekisui Chemical (Stars) leverages its advanced resin technologies and consistent product innovations to strengthen its competitive positioning, particularly in Asia and Europe. Meanwhile, Eastman Chemical Company (Emerging Leader) is expanding visibility through its diversified specialty materials portfolio, emphasizing PVB applications in energy-efficient glazing and solar encapsulation. While Kuraray maintains leadership through scale and technological depth, Sekisui and Eastman demonstrate rising potential to capture greater market share as demand for laminated safety glass and sustainable construction materials continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Kuraray Co. Ltd. (Japan)

- Sekisui Chemical Co. Ltd. (Japan)

- Eastman Chemical Company (US)

- Hubergroup (US)

- Chang Chun Group (China)

- Anhui WanWei Bisheng New Material Co., Ltd. (China)

- Kingboard Fogang Specialty Resin Co., Ltd (China)

- Qingdao Jinuo New Materials Co., Ltd. (China)

- Huakai Plastic Co. Ltd., (China)

- Everlam (Belgium)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 1.4 Billion |

| Revenue Forecast in 2030 | USD 1.9 Billion |

| Growth Rate | CAGR of 5.0% from 2025-2030 |

| Actual Data | 2021–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Kilotons) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, Middle East & Africa |

WHAT IS IN IT FOR YOU: Polyvinyl Butyral Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Country-Level Breakdown | Instead of merely regional coverage, the report can provide country-specific market data (e.g., India, Brazil, Saudi Arabia, South Africa, Mexico). This includes demand drivers, production capacities, import/export trends, and regulatory outlooks. | Helps companies identify high-growth national markets and plan market entry strategies with greater accuracy |

| Application-Specific Deep Dive | Customized focus on specific PVB applications such as automotive laminated glass, solar encapsulants, or architectural glazing films; includes end-user adoption rates, OEM partnerships, and future demand projections for each application. | Supports clients targeting niche segments, enabling them to design product portfolios or allocate R&D spending more effectively |

| Resin Type Customization | Comparative analysis of high, medium, and low molecular weight PVB resins, as well as modified PVB grades; covers performance benchmarks, technical advantages, pricing, and suitability for different industries | Enables manufacturers and buyers to optimize resin selection, align pricing with performance, and explore premium-grade opportunities |

| Competitive Benchmarking | Extended profiling of regional and niche players alongside global leaders (Kuraray, Eastman, Sekisui, Everlam); includes SWOT analysis, product differentiation, technology focus, and market positioning | Provides a clear competitive landscape, helping clients identify potential partners, acquisition targets, or competitive threats |

RECENT DEVELOPMENTS

- November 2024 : Eastman announced a significant investment to upgrade and expand extrusion capabilities for Saflex™ interlayers at its Ghent (Belgium) facility, reinforcing its strategy to meet rising demand in Europe.

- October 2024 : Kuraray secured ISCC PLUS certification for its vinyl acetate monomer (VAM), PVOH, and PVB resins across sites in the US and Europe, enabling sales of certified sustainable PVB materials under mass-balance methodology.

- August 2021 : Everlam received Miami-Dade County approval for its SUPER TOUGH PVB interlayer, meeting stringent standards for structural glazing in high-velocity hurricane zones—underscoring PVB’s critical role in building safety and resilience.

Table of Contents

Methodology

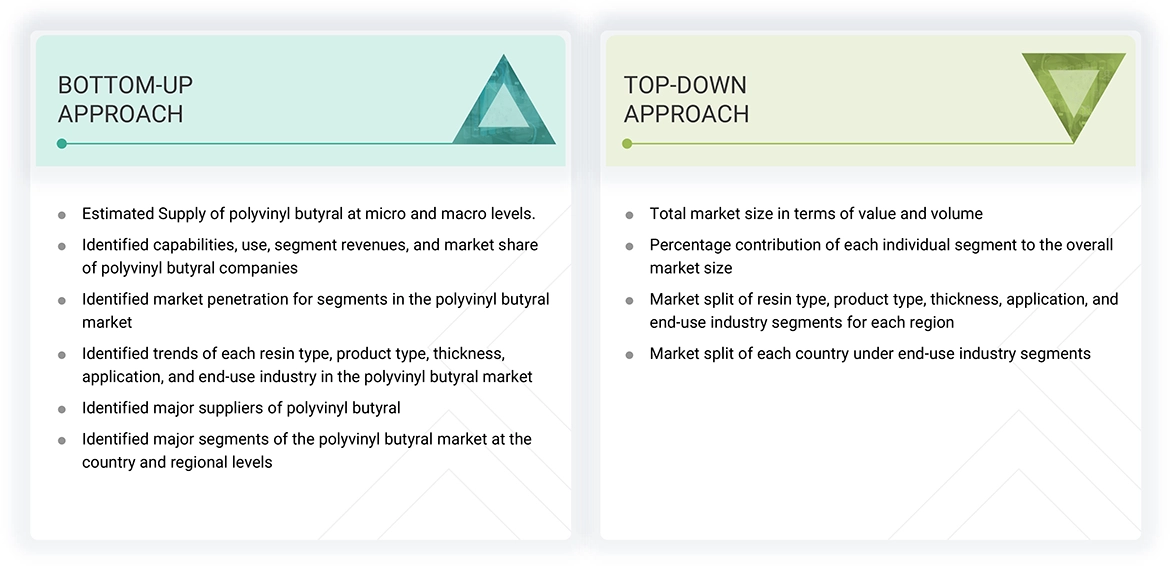

The study involved four key activities in estimating the market size of polyvinyl butyral. Extensive secondary research was conducted to gather information on the market, related markets, and the broader industry. The next step was to validate these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to determine the total market size. Afterward, market segmentation and data triangulation techniques were applied to estimate the sizes of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. These sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research was used to gather essential information about the industry’s value chain, the market’s monetary flow, the overall pool of key polyvinyl butyral market classifications, and segmentation based on industry trends down to the most detailed level, and regional markets. It was also employed to collect information on key developments from a market-oriented perspective.

Primary Research

The polyvinyl butyral market consists of several stakeholders in the value chain, including raw material suppliers, manufacturers, and end users. Various primary sources from both supply and demand sides of the polyvinyl butyral market have been interviewed to gather qualitative and quantitative information. Key opinion leaders in end-use sectors are the primary interviewees from the demand side. Manufacturers, associations, and institutions involved in the polyvinyl butyral industry are the main sources from the supply side.

Primary interviews were conducted to gather insights such as market statistics, revenue data from products and services, market breakdowns, market size estimates, market forecasts, and data triangulation. Primary research also helped us understand various trends related to resin type, thickness, product type, end-use industry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyers’ perspectives on the suppliers, products, component providers, and their current use of the polyvinyl butyral market, as well as the future outlook of their business, which will influence the overall market.

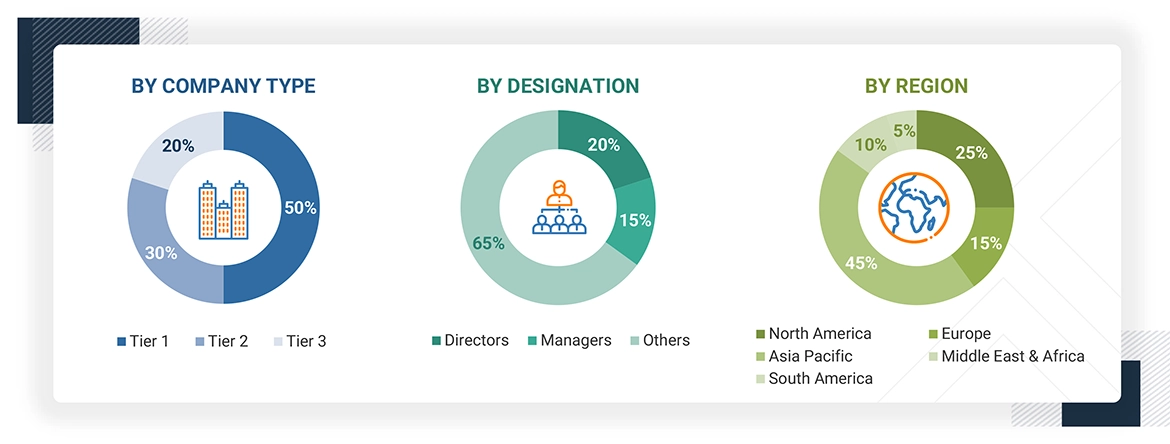

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2024 available in the public domain, product portfolios, and geographic presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for the polyvinyl butyral market in the region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns based on type, electrode material, application and end-use industries, region were determined using secondary sources and verified through primary sources.

- All possible parameters that impact the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis, and presented in this report.

Data Triangulation

After determining the total market size from the estimation process for the polyvinyl butyral market above, the overall market has been divided into several segments and sub-segments. Data triangulation and market breakdown methods have been used, where applicable, to complete the overall market analysis and obtain accurate statistics for all segments and sub-segments. The data was triangulated by examining various factors and trends from both demand and supply sides. Additionally, the market size was confirmed using both top-down and bottom-up approaches, along with primary interviews. For each data segment, three sources were used—top-down approach, bottom-up approach, and expert interviews. The data was considered accurate when the values from these three sources matched.

Market Definition

Polyvinyl butyral (PVB) is a resin formed through the chemical reaction of polyvinyl alcohol (PVA) with butyraldehyde under acidic conditions, resulting in a polymer rich in acetal linkages. This reaction produces a material that exhibits excellent transparency, flexibility, strong adhesion to glass and metal surfaces, and notable impact resistance. PVB is primarily used in the production of laminated safety glass, where it functions as an interlayer between two sheets of glass to hold them together upon impact. This not only enhances the safety of the glass by preventing shattering but also improves its acoustic insulation and UV resistance properties. The global PVB market includes various product types such as films & sheets, powders & granules, and aqueous dispersions, catering to various industries. Key application sectors include automotive (windshields, side, and rear windows), construction (architectural glazing and glass facades), solar energy (photovoltaic panels), and paints & coatings. With growing emphasis on energy-efficient buildings and rising vehicle safety standards, the demand for laminated glass and, thus, PVB is increasing worldwide. Moreover, advancements in solar technology and the integration of PVB in flexible solar panels are opening new avenues for growth. Innovation, regional capacity expansions, and evolving safety and sustainability regulations drive the market.

Stakeholders

- Polyvinyl butyral manufacturers

- Polyvinyl butyral traders, distributors, and suppliers

- Raw material suppliers

- Government and private research organizations

- Associations and industrial bodies

- R&D institutions

- Environmental support agencies

Report Objectives

- To define, describe, and forecast the size of the polyvinyl butyral market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on resin type, product type, thickness, application, end-use industry, and region

- To forecast the size of the market with respect to major regions, namely, North America, Asia Pacific, Europe, the Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as partnerships, agreements, joint ventures, collaborations, announcements, awards, and expansions in the market

- To strategically profile key market players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Which factors influence the growth of the PVB market?

The PVB market grows due to demand from the automotive, construction, and solar industries. Laminated safety glass use in vehicles, energy-efficient glazing in buildings, and photovoltaic modules in solar energy are key drivers. Emerging economies, especially in Asia Pacific, contribute significantly. Sustainability trends like recycled and bio-based PVB also support growth.

Which country is expected to hold the largest share of the polyvinyl butyral market?

China leads the PVB market, driven by its large automotive sector, rapid construction growth, and dominance in solar energy. Urbanization, infrastructure development, and supportive government policies also contribute, along with its strong domestic production and low manufacturing costs.

Who are the major manufacturers of PVB?

Key manufacturers include Sekisui Chemical Co. Ltd. (Japan), Kuraray Co. Ltd. (Japan), Eastman Chemical Company (US), Hubergroup (US), Chang Chun Group (China), Anhui WanWei Bisheng (China), Kingboard Fogang (China), Qingdao Jinuo (China), Huakai Plastic (China), Tridev Resins Pvt. Ltd. (China), and Everlam (Belgium).

What are the opportunities in the polyvinyl butyral market?

Opportunities lie in EV production, solar energy expansion, green buildings, smart glazing solutions, and advanced resin technologies. Growth in emerging markets and stricter global safety regulations also open new avenues for PVB use.

Which application is expected to hold the largest share of the polyvinyl butyral market?

Films & sheets applications hold the largest market share.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Polyvinyl Butyral Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Polyvinyl Butyral Market

Colin

Jan, 2015

PVB non-sheet and film market information.

Satish

Jan, 2015

Liquid Electrical Insulation market insights.