Remote Weapon Station Market by Weapon Type (Lethal, Non-lethal), Mobility (Moving, Stationary), Application (Military, Homeland Security), Platform (Land, Airborne, Naval), Technology, Component and Region- Global Forecast to 2027

Updated on : Nov 25, 2024

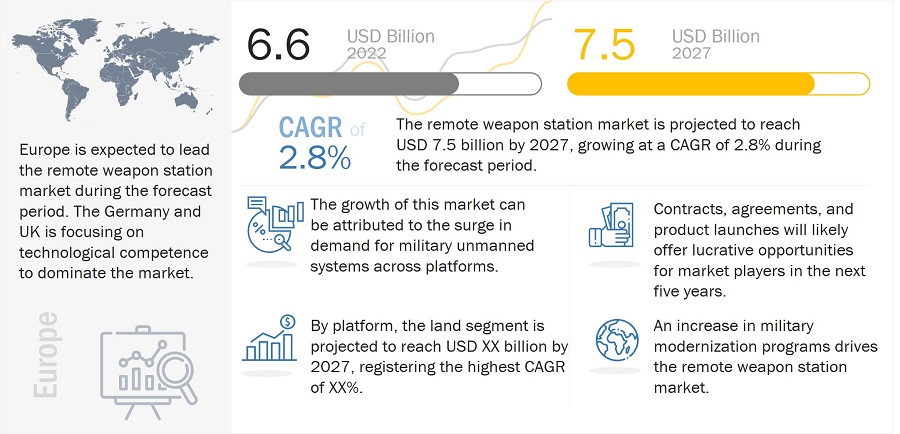

[288 Pages Report] The remote weapon station market is projected to grow from USD 6.6 billion in 2022 to USD 7.5 billion by 2027, at a CAGR of 2.8% during the forecast period. The development of new ground warfare systems, ongoing improvements to current combat platforms, and linked warfare are among the factors predicted to propel the remote weapon station market throughout the course of the research period.

Remote Weapon Station Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Remote Weapon Station Market Dynamics

Driver: Modernization of border surveillance systems

Border surveillance systems have evolved with time and continue to undergo enhancements with advancements, such as autonomous fighter drones and remote weapon system. Portable ground remote weapon station like containerized based remote weapon systems (CBRWS) have enabled various countries to secure their borders more efficiently. These remote weapon stations are deployed in strategic locations on borders to increase detection rates of possible intrusions. State-of-the-art non-lethal and lethal remote weapon station with low false alarms have helped countries with border disputes, drug trafficking problems, and illegal immigration to prevent these problems. According to an article published by CNET in February 2019, the US government considered a bill worth USD 100 million to fund the installation of border security & surveillance systems, such as fixed towers, remote weapon systems, and mobile surveillance systems on its northern border. Such modernization of border security and surveillance systems drives the remote weapon station industry.

Restraint: Survivability issues

Remote weapon system is used by defense forces for several reasons. The primary reason, however, is the protection of onboard personnel against Improvised Explosive Devices (IEDs), mines, and ballistic attacks, among others. However, the use of advanced weapon systems, powerful IEDs, and various advanced counter-countermeasure systems by enemy forces often lead to survivability issues for personnel onboard armored vehicles. These vehicles are facing issues in safeguarding the lives of onboard personnel from the above threats.

Opportunity: Ongoing military modernization programs in various countries across the globe

The world economy has recently experienced several armed confrontations and disputes, both intrastate and interstate. The struggle against the Islamic State in Iraq, the civil war in Syria, the situation in North Korea, the conflict with the Taliban in Afghanistan, and other continuing crises have all had a substantial impact on the world economy. Military and law enforcement organizations from major economies throughout the world, including the US, UK, and France, among others, have been mobilized because of these disputes. Countries are making significant efforts to improve their military prowess by swapping out outdated technologies and weaponry for more advanced ones. The demand for remote weapon stations is rising as armored vehicle modernisation investments increase. For instance, in March 2018, Kongsberg and Qatar agreed to a deal for USD 1.9 billion whereby the Swedish company will provide 490 Nexter-produced VCBI 88 armored infantry fighting vehicles with its Medium-Caliber Turret and Protector Remote Weapon Station (France).

Challenges: Complexity involved in the integration of remote weapon stations with a wide range of platforms

Integrating a weapon system with standalone solutions to the desired level has always been a complex task. Remote weapon stations can be equipped with laser weapon gun systems, and their integration requires significant investments and power sources. The level of complexity increases with the decrease in the amount of space available on platforms. Thus, combat helicopters have the highest complexity in integration, followed by armored vehicles and ships.

Manufacturers of remote weapon stations in North America adhere to US standards and policies, which, however, are not followed by several countries that use defense systems sourced from other countries, such as Russia, France, and Germany, or use indigenous systems. The integration of US standard weapons with these systems is a difficult process and needs massive alterations and modernization. It is difficult to cost-effectively provide upgraded munition control units, precision strike packages, and related training, and simulation of weapons and their incorporated systems. This is expected to pose a major challenge for countries willing to upgrade their remote weapon arsenal.

Land segment to lead remote weapon station market by platform during forecast period

The market for remote weapon stations has been divided into three categories based on platform: land, naval, and airborne. During the forecast period, the land segment is anticipated to develop at the greatest CAGR. Numerous factors, such as the growing emphasis on close combat systems, the upgrading of current armored platforms, the requirement for connected warfare systems, and the safety of soldiers in combat-like circumstances, among others, can be used to explain the increase in demand for remote weapon stations. In recent years, the employment of remote weapon stations has grown significantly in defense, largely due to an increase in the number of warfare platforms being produced globally. Remotely controllable and secure weapon systems are necessary for these warfare platforms.

Lethal weapon segment to lead remote weapon station market by weapon type during forecast period

The lethal weapon category dominates the remote weapon station market in terms of weapon type. Modularity, quick reconfigurability, ease of integration, simplicity of operation, and ease of training are all features of lethal weapons installed on remote weapon stations in multi-weapon configurations. During the projection period, the lethal weapon segment is anticipated to increase at the greatest CAGR. This is explained by the rise in demand for effective long-range weaponry.

Europe segment to lead remote weapon station market by region during forecast period

The biggest market share is anticipated to be held by Europe throughout the forecasted period. The constant replacement of outdated technology with newer ones is one of the main drivers propelling the European remote weapon station industry. The main nations making significant investments in remote weapon stations and related technology are Russia, Italy, France, and the UK.

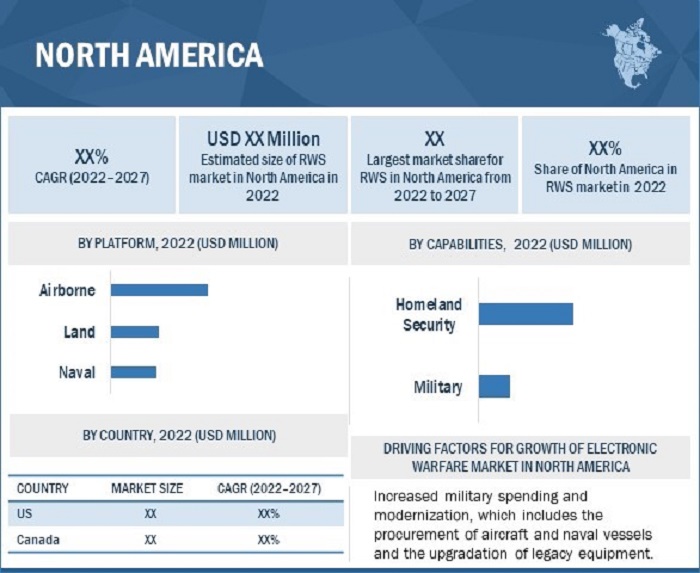

North America to acquire largest share during forecast period

Remote Weapon Station Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Remote Weapon Station Companies - Key players

The remote weapon station companies are dominated by globally established players such as Kongsberg (Norway), Elbit Systems (Israel), Rafael Advanced Defense Systems (Israel), Raytheon Technologies Corporation (US), Saab AB (Sweden), Leonardo S.p.A. (Italy), Electro Optic Systems (Australia), ASELSAN A.S. (Turkey), Thales Group (France) Rheinmetall AG (Germany), among others. Contracts is the major growth strategy adopted by the top players to strengthen their positions in the remote weapon station market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Application, By Mobility, By Platform, By Component, By Technology, By Weapon Type |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World |

|

Companies covered |

Kongsberg (Norway), Elbit systems (Israel), BAE Systems (UK), Northrop Grumman Corporation (US), Raytheon Technologies Corporation (US), Thales Group (US), Israel Aerospace Industries (Israel), and Saab AB (Sweden) are some of the major suppliers of Electronic Warfare. (25 Companies) |

Ecosystem

The ecosystem of the remote weapon station market comprises OEMs, integrators, and end users. Key end users of the remote weapon station market are defense forces. Major players in the remote weapon station marketare Kongsberg Gruppen (Norway), Raytheon Company (US), Elbit Systems (Israel), Saab AB (Sweden), Leonardo S.p.A. (Italy), Electro Optic Systems (Australia), BAE Systems (UK), Rheinmetall AG (Germany), ASELSAN A.S (Turkey), FN Herstal (Belgium), Rafael Advanced Defense Systems (Israel), and Rheinmetall AG (Germany), among others.

Target Audiences

- Original Equipment Manufacturers (OEMs)

- Component Suppliers

- Military

- Upgradation Service Providers

Remote Weapon Station Market Highlights

This research report categorizes the global remote weapon station market into the following segments and subsegments:

|

Aspect |

Details |

|

By Platform |

|

|

By Application |

|

|

By Component |

|

|

By Weapon Type |

|

|

By Technology |

|

|

By Mobility |

|

|

By Region |

|

Recent developments

- In September 2022, Elbit Systems was awarded a contract valued at USD 80 million to supply unmanned turrets for Armoured Fighting Vehicles of an Asian-Pacific country. The contract will be performed over three years. Elbit Systems will supply 30mm-gun unmanned light turrets that integrate sensors and display systems for enhanced situational awareness, target acquisition capabilities, fire control systems, and weapon systems of various types, enabling significant mission performance upgrades for the AFVs.

- In October 2020, ASELSAN signed a new sales contract with the Indonesian Navy for Indonesia’s naval platforms. In the contract, ASELSAN will provide the 30mm SMASH Remote Controlled Stabilized Gun System to the Indonesian Navy.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the remote weapon station market?

Response: The remote weapon station is expected to grow substantially owing to the technological development in designing various armoured vehicles and related components for several military applications.

What are the key sustainability strategies adopted by leading players operating in the remote weapon station market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the remote weapon station market. Major players, including Kongsberg (Norway), Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Leonardo S.p.A. (Italy), Elbit System (Israel), and Rheinmetall AG (US), have adopted strategies, such as contracts and agreements, to expand their presence in the market further.

What new emerging technologies and use cases disrupt the remote weapon station market?

Response: Some of the major emerging technologies and use cases disrupting the market include the development of land compact vehicles, unmanned systems across the platform, and others.

Who are the key players and innovators in the ecosystem of the remote weapon station market?

Response: Key players include Moog Inc. (US), Rafael Advanced Defense System Ltd. (Israel), Northrop Grumman Corporation (US), Electro optic system (Australia), Sharpshooter (Israel) and Elbit System (Israel).

Which region is expected to hold the highest market share in the remote weapon station market?

Response: Europe accounted for the largest share of 47.9% of the market in 2022, while Europe is expected to grow at the highest CAGR of 4.4% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Significant investments in remote weapon stations by governments- Rise in military expenditure on advanced equipment- Deployment of remote weapon system capabilities on unmanned platforms- Increased adoption of asymmetric warfare techniques- Rising requirement for high-precision remote weapon stations- Improving ISR and target acquisition capabilities of defense forcesRESTRAINTS- Survivability challenges- Hardware and software malfunctions- High investments in early phasesOPPORTUNITIES- Ongoing military modernization programs in various countries across globe- Surging adoption of unmanned systems across platforms- Development of next-generation and scalable remote weapon systemsCHALLENGES- Complexity involved in integration of remote weapon stations with wide range of platforms- Stringent cross-border trading policies- Advanced RWS deployment costs more than conventional systems

-

5.3 TRENDS IMPACTING CUSTOMER BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR REMOTE WEAPON STATION MANUFACTURERS

-

5.4 RECESSION IMPACT ANALYSISIMPACT OF RECESSION ON REMOTE WEAPON STATION MARKET

-

5.5 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE TREND, LAND PLATFORM

-

5.6 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 USE CASE ANALYSISUSE CASE 1: DEFENDER-INNOVATION DRIVEN SOLUTION TO COUNTER THREATUSE CASE 2: HOMELAND SECURITY USING REMOTE WEAPON STATIONUSE CASE 3: NORINCO NAVAL REMOTE WEAPON STATIONUSE CASE 4: SMASH DRAGON UAV BY ISRAEL COMPANY SMART SHOOTER

-

5.9 TRADE ANALYSISIMPORT DATA FOR LAND VEHICLES PLATFORM, BY REGION, 2017−2020

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.13 KEY CONFERENCES AND EVENTS FROM OCTOBER 2022 TO SEPTEMBER 2023

- 6.1 INTRODUCTION

-

6.2 KEY TECHNOLOGICAL TRENDS IN REMOTE WEAPON STATION MARKETNEXT-GEN UNMANNED PLATFORM DEVELOPMENTSADVANCED DIRECTED ENERGY WEAPONSCOUNTER-DIRECTED ENERGY WEAPON SYSTEMSUNIFIED REMOTE WEAPON SYSTEMSSMART AND PROGRAMMABLE AMMUNITIONSNEXT-GENERATION SENSORS DEVELOPMENTSADVANCED GUN SYSTEMSREACTIVE ARMOR TECHNOLOGYIMPROVED AMMUNITION-CARRYING CAPABILITYADVANCED AUTOLOADERS

-

6.3 IMPACT OF MEGATRENDSDIGITALIZATION AND INTRODUCTION OF INTERNET OF THINGSOPERATIONS ON INTEGRATED BATTLEFIELDS WITH COLLABORATIVE COMBATSHIFT IN GLOBAL ECONOMIC POWER

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATION AND PATENT REGISTRATIONS

- 7.1 INTRODUCTION

-

7.2 MILITARYINCREASING DEMAND FOR MODERN AND ADVANCED SYSTEMS FOR OFFENSIVE CROSS-COUNTRY OPERATIONS

-

7.3 HOMELAND SECURITYINCREASING USE OF LAVS FOR BORDER PATROLLING, ISR ACTIVITIES, AND DEFENSE PERSONNEL TRANSPORTATION

- 8.1 INTRODUCTION

-

8.2 LANDCOMBAT VEHICLES- Increasing demand for combat vehicles for offensive cross-country and security operations- Main Battle Tanks (MBTs)- Infantry Fighting Vehicles (IFVs)- Light Armored Vehicles (LAVs)- Air Defense Vehicles- Armored Amphibious Vehicles (AAVs)- Armored Mortar Carriers (AMCs)- Unmanned Ground Vehicles (UGVs)GROUND STATIONS- Increasing demand for advanced ground-based remote weapon stations for border security

-

8.3 NAVALFRIGATES- Increasing use of autonomous systems on frigatesCORVETTES- Increasing procurement of corvettes across militaries to increase remote weapon station demandOFFSHORE SUPPORT VESSELS (OSV)- Technological advancement in OSVs to fuel remote weapon station requirementDESTROYERS- Protect large vessels against small, powerful short-range attackersPATROL AND MINE COUNTERMEASURE VESSELS- Increasing demand for patrol and mine countermeasure vessels for cross-border protectionAMPHIBIOUS VESSELS- Increasing demand for amphibious warfare ships by various countriesUNMANNED SURFACE VEHICLES (USV)- Operate on water surface without human support

-

8.4 AIRBORNEFIGHTER AIRCRAFT- Increasing modernization programs by militariesATTACK HELICOPTERS- Play crucial role in sea, land, and air operationsUNMANNED AERIAL VEHICLES (UAV)- Wide range of combat UAVs for military applications to drive segment

- 9.1 INTRODUCTION

- 9.2 HUMAN MACHINE INTERFACES (HMIS)

-

9.3 STABILIZATION UNITDEVELOPMENT OF MODERNIZED STABILIZATION UNIT TO CREATE MORE DEMAND

-

9.4 CONTROL SYSTEMDEMAND FOR HIGHLY ADVANCED TURRET CONTROL UNITS TO DRIVE MARKETMOTOR CONTROLLERPOWER UNIT

-

9.5 SENSORSDETECTS SOUND, PRESSURE, HEAT, LIGHT, OR MOTIONDAY IMAGING SYSTEMSTHERMAL IMAGERSLASER RANGEFINDERS (LRF)LASER DESIGNATORLASER MARKER

-

9.6 WEAPONS & ARMAMENTSGUNS- Rising demand for small-caliber gunsLAUNCHERS- Discharges medium-caliber projectile and has explosive, smoke, or gas warheadDIRECT ENERGY WEAPONS- Used in anti-personnel weapon systems and missile defense systems, and to destroy electronic platforms

- 10.1 INTRODUCTION

-

10.2 LETHAL WEAPONSREDUCE SAFETY CONCERNS OF MILITARIES AND THOROUGHNESS OF OPERATIONSSMALL CALIBER- Used for short-range fires and close combat operations- 5.56MM- 7.62MM- 12.7MMMEDIUM CALIBER- Increasing use in counter-rocket, artillery, and mortar weapon systems- 20MM- 25MM- 30MM- 40MM

-

10.3 NON-LETHAL WEAPONSINCREASING DEVELOPMENT OF NEW VARIETIES OF NON-LETHAL WEAPONS

- 11.1 INTRODUCTION

-

11.2 MOVINGHIGH ADOPTION IN MOVING REMOTE WEAPON STATIONS TO DRIVE DEMAND

-

11.3 STATIONARYSTATIONARY REMOTE WEAPON STATION FOR BORDER SECURITY TO DRIVE DEMAND

- 12.1 INTRODUCTION

-

12.2 CLOSE-IN WEAPON SYSTEMS (CIWS)CONSISTS OF RADARS, MULTI-BARREL GUNS, RAPID-FIRE CANNONS, AND SHORT-RANGE MISSILES

- 12.3 COMMON REMOTELY OPERATED WEAPON STATIONS (CROWS)

- 13.1 INTRODUCTION

- 13.2 REGIONAL RECESSION IMPACT ANALYSIS

-

13.3 NORTH AMERICAREGIONAL RECESSION IMPACT ANALYSIS-NORTH AMERICAPESTEL ANALYSIS: NORTH AMERICAUS- Modernization programs and defense policiesCANADA- Increased R&D investments

-

13.4 EUROPEREGIONAL RECESSION IMPACT ANALYSIS –EUROPEPESTLE ANALYSIS: EUROPEUK- Rapid market expansion through advanced upgrading programsFRANCE- Procurement of new-generation combat vehicles for defense forcesGERMANY- Major global exporter of armored vehiclesPOLAND- Procurement of light tanks with ceramic-aramid armor-equipped vehiclesITALY- Robust presence of major defense playersREST OF EUROPE- Significant improvement and strengthening of military power

-

13.5 ASIA PACIFICREGIONAL RECESSION IMPACT ANALYSIS: ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increasing investment to strengthen military fuels demand for remote weapon stationINDIA- Increasing procurement of armored vehicles to tackle border disputesAUSTRALIA- Manufacturing and modernization of RWS and combat fleetJAPAN- High-end indigenous military technologiesSOUTH KOREA- Robotics technologies to raise demand for RWS in unmanned ground vehiclesSINGAPORE- Deployment of technologically advanced armored vehicles on battlefieldsREST OF ASIA PACIFIC- Unmanned armored vehicles to fuel market for RWS Market

-

13.6 REST OF THE WORLDREGIONAL RECESSION IMPACT ANALYSIS: REST OF THE WORLDMIDDLE EAST- Social unrest and market instability to drive demand in Middle EastLATIN AMERICA & AFRICA- Increased demand for unmanned military ground vehicles

- 14.1 INTRODUCTION

- 14.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 14.3 SHARE OF KEY MARKET PLAYERS, 2022

- 14.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2022

- 14.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

14.6 COMPETITIVE EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

14.7 REMOTE WEAPON STATION MARKET COMPETITIVE LEADERSHIP MAPPING (SME)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

14.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHES/DEVELOPMENTSDEALS

- 15.1 INTRODUCTION

-

15.2 KEY PLAYERSKONGSBERG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- Deals- MnM ViewELBIT SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewLEONARDO S.P.A.- Business overview- Products/Solutions/Services offered- Recent developments- MnM ViewTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewELECTRO OPTIC SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsNORTHROP GRUMMAN CORPORATION- Business overview- Products/Solutions/Services offered- DealsBAE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developmentsRHEINMETALL AG- Business overview- Products/Solutions/Services offered- DealsGENERAL DYNAMICS CORPORATION- Business overview- Products/Solutions/Services offered- DealsST ENGINEERING- Business overview- Products/Solutions/Services offeredASELSAN A.S.- Business overview- Products/Solutions/Services offered- DealsSAAB AB- Business overview- Products/Solutions/Services offeredMOOG INC.- Business overview- Products/Solutions/Services offered- DealsISRAEL AEROSPACE INDUSTRIES LTD.- Business overview- Products/Solutions/Services offered

-

15.3 OTHER PLAYERSNEXTER GROUP- Business overviewESCRIBANO MECHANICAL & ENGINEERING- Business overviewDENEL SOC LTD.- Business overviewFN HERSTAL- Business overviewNORINCO GROUP- Business overviewRAFAEL ADVANCED DEFENSE SYSTEMS LTD.- Business overviewMERRILL TECHNOLOGIES GROUP- Business overviewEVPU DEFENCE- Business overviewKRAUSS MAFFEI WEGMANN- Business overviewSMART SHOOTER LTD.- Business overview

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN REMOTE WEAPON STATION MARKET

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 SEGMENTS AND SUBSEGMENTS

- TABLE 4 REMOTE WEAPON STATION MARKET ESTIMATION PROCEDURE

- TABLE 5 TABLE 1: DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

- TABLE 6 REMOTE WEAPON STATION FOR UNMANNED PLATFORMS

- TABLE 7 AVERAGE SELLING PRICE OF MAIN BATTLE TANKS (USD MILLION)

- TABLE 8 AVERAGE SELLING PRICE OF INFANTRY FIGHTING VEHICLES (USD MILLION)

- TABLE 9 AVERAGE SELLING PRICE OF ARMORED PERSONNEL CARRIERS (USD MILLION)

- TABLE 10 AVERAGE SELLING PRICE OF MINE-RESISTANT AMBUSH-PROTECTED VEHICLES (USD MILLION)

- TABLE 11 AVERAGE SELLING PRICE OF LIGHT PROTECTED VEHICLES (USD MILLION)

- TABLE 12 REMOTE WEAPON STATION MARKET ECOSYSTEM

- TABLE 13 DEFENDER-INNOVATION-DRIVEN SOLUTION TO COUNTER THREAT

- TABLE 14 HOMELAND SECURITY USING REMOTE WEAPON STATION

- TABLE 15 NORINCO NAVAL REMOTE WEAPON STATION

- TABLE 16 SMASH DRAGON UAV BY ISRAEL COMPANY SMART SHOOTER

- TABLE 17 ARMORED VEHICLES REGION-WISE IMPORT DATA (USD), 2017−2020

- TABLE 18 TANKS AND OTHER ARMORED FIGHTING VEHICLES, MOTORIZED, FITTED WITH WEAPONS: COUNTRY-WISE EXPORTS, 2020−2021 (USD THOUSAND)

- TABLE 19 TANKS AND OTHER ARMORED FIGHTING VEHICLES, MOTORIZED, FITTED WITH WEAPONS: COUNTRY-WISE IMPORTS, 2020−2021 (USD THOUSAND)

- TABLE 20 REMOTE WEAPON STATION MARKET: PORTER’S FIVE FORCE ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF THREE PLATFORMS (%)

- TABLE 22 KEY BUYING CRITERIA FOR THREE PLATFORMS

- TABLE 23 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 24 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 25 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 26 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 27 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 28 REMOTE WEAPON STATION MARKET: CONFERENCES & EVENTS, 2022−2023

- TABLE 29 REMOTE WEAPON STATION: KEY PATENTS, 2017−2022

- TABLE 30 REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 31 REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 32 REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 33 REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 34 REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 35 REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 36 REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 37 REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 38 REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 39 REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 40 REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2018−2021 (USD BILLION)

- TABLE 41 REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2022−2027 (USD BILLION)

- TABLE 42 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 43 REMOTE WEAPON STATION MARKET, BY REGION, 2018−2021 (USD BILLION)

- TABLE 44 REMOTE WEAPON STATION MARKET, BY REGION, 2022−2027 (USD BILLION)

- TABLE 45 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 46 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 47 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 48 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 49 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 50 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 51 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 52 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 53 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 54 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 55 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2018−2021 (USD BILLION)

- TABLE 56 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2022−2027 (USD BILLION)

- TABLE 57 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY COUNTRY, 2018−2021 (USD BILLION)

- TABLE 58 NORTH AMERICA: REMOTE WEAPON STATION MARKET, BY COUNTRY, 2022−2027 (USD BILLION)

- TABLE 59 US: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 60 US: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 61 US: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 62 US: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027(USD BILLION)

- TABLE 63 US: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 64 US: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027(USD BILLION)

- TABLE 65 US: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 66 US: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027(USD BILLION)

- TABLE 67 US: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 68 US: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027(USD BILLION)

- TABLE 69 CANADA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 70 CANADA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 71 CANADA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 72 CANADA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 73 CANADA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 74 CANADA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 75 CANADA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 76 CANADA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 77 CANADA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 78 CANADA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 79 EUROPE: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 80 EUROPE: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 81 EUROPE: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 82 EUROPE: REMOTE WEAPON STATION MARKET SIZE, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 83 EUROPE: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 84 EUROPE: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 85 EUROPE: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 86 EUROPE: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 87 EUROPE: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 88 EUROPE: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 89 EUROPE: REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2018−2021 (USD BILLION)

- TABLE 90 EUROPE: REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2022−2027 (USD BILLION)

- TABLE 91 EUROPE: REMOTE WEAPON STATION MARKET, BY COUNTRY, 2018−2021 (USD BILLION)

- TABLE 92 EUROPE: REMOTE WEAPON STATION MARKET, BY COUNTRY, 2022−2027 (USD BILLION)

- TABLE 93 UK: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 94 UK: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 95 UK: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 96 UK: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 97 UK: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 98 UK: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 99 UK: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 100 UK: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 101 UK: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 102 UK: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 103 FRANCE: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 104 FRANCE: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 105 FRANCE: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 106 FRANCE: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 107 FRANCE: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 108 FRANCE: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 109 FRANCE: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 110 FRANCE: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 111 FRANCE: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 112 FRANCE: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 113 GERMANY: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 114 GERMANY: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 115 GERMANY: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018–2021 (USD BILLION)

- TABLE 116 GERMANY: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 117 GERMANY: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 118 GERMANY: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 119 GERMANY: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 120 GERMANY: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 121 GERMANY: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 122 GERMANY: REMOTE WEAPON STATION MARKET SIZE, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 123 POLAND: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 124 POLAND: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 125 POLAND: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 126 POLAND: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 127 POLAND: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 128 POLAND: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 129 POLAND: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 130 POLAND: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 131 POLAND: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 132 POLAND: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 133 ITALY: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 134 ITALY: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 135 ITALY: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 136 ITALY: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 137 ITALY: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018–2021 (USD BILLION)

- TABLE 138 ITALY: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022–2027 (USD BILLION)

- TABLE 139 ITALY: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 140 ITALY: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 141 ITALY: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 142 ITALY: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 143 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 144 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 145 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 146 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 147 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 148 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 149 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 150 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 151 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 152 REST OF EUROPE: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 153 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 154 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 155 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 156 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 157 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 158 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 159 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 160 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 161 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 162 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 163 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2018−2021 (USD BILLION)

- TABLE 164 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2022−2027 (USD BILLION)

- TABLE 165 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY COUNTRY, 2018−2021 (USD BILLION)

- TABLE 166 ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY COUNTRY, 2022−2027 (USD BILLION)

- TABLE 167 CHINA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 168 CHINA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 169 CHINA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 170 CHINA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 171 CHINA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 172 CHINA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 173 CHINA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 174 CHINA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 175 CHINA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 176 CHINA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 177 INDIA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 178 INDIA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 179 INDIA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 180 INDIA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 181 INDIA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 182 INDIA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 183 INDIA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 184 INDIA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 185 INDIA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 186 INDIA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 187 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 188 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 189 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 190 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 191 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 192 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 193 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 194 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 195 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 196 AUSTRALIA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 197 JAPAN: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 198 JAPAN: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 199 JAPAN: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 200 JAPAN: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 201 JAPAN: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 202 JAPAN: REMOTE WEAPON STATION MARKET SIZE, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 203 JAPAN: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 204 JAPAN: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 205 JAPAN: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 206 JAPAN: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027(USD BILLION)

- TABLE 207 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 208 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 209 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 210 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 211 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 212 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 213 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 214 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 215 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 216 SOUTH KOREA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 217 SINGAPORE: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 218 SINGAPORE: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 219 SINGAPORE: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 220 SINGAPORE: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 221 SINGAPORE: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 222 SINGAPORE: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 223 SINGAPORE: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 224 SINGAPORE: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 225 SINGAPORE: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 226 SINGAPORE: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 227 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 228 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 229 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 230 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 231 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 232 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 233 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 234 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 235 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 236 REST OF ASIA PACIFIC: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 237 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 238 REST OF THE WORLD: REMOTE WEAPON STATION MARKET SIZE, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 239 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 240 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 241 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 242 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 243 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 244 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 245 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 246 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 247 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2018−2021 (USD BILLION)

- TABLE 248 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY TECHNOLOGY, 2022−2027 (USD BILLION)

- TABLE 249 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY COUNTRY, 2018–2021 (USD BILLION)

- TABLE 250 REST OF THE WORLD: REMOTE WEAPON STATION MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 251 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 252 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 253 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 254 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 255 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 256 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 257 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 258 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 259 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 260 MIDDLE EAST: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 261 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2018−2021 (USD BILLION)

- TABLE 262 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY APPLICATION, 2022−2027 (USD BILLION)

- TABLE 263 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2018−2021 (USD BILLION)

- TABLE 264 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY PLATFORM, 2022−2027 (USD BILLION)

- TABLE 265 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2018−2021 (USD BILLION)

- TABLE 266 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY WEAPON TYPE, 2022−2027 (USD BILLION)

- TABLE 267 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2018−2021 (USD BILLION)

- TABLE 268 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY MOBILITY, 2022−2027 (USD BILLION)

- TABLE 269 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2018−2021 (USD BILLION)

- TABLE 270 LATIN AMERICA & AFRICA: REMOTE WEAPON STATION MARKET, BY COMPONENT, 2022−2027 (USD BILLION)

- TABLE 271 KEY DEVELOPMENTS BY LEADING PLAYERS IN REMOTE WEAPON STATION MARKET BETWEEN 2019 AND 2022

- TABLE 272 REMOTE WEAPON STATION MARKET: DEGREE OF COMPETITION

- TABLE 273 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 274 COMPANY PLATFORM FOOTPRINT ANALYSIS

- TABLE 275 COMPANY REGION FOOTPRINT ANALYSIS

- TABLE 276 REMOTE WEAPON STATION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JULY 2019−NOVEMBER 2022

- TABLE 277 REMOTE WEAPON STATION MARKET: DEALS, JULY 2019−NOVEMBER 2022

- TABLE 278 REMOTE WEAPON STATION MARKET: OTHER DEALS/DEVELOPMENTS, JULY 2019−NOVEMBER 2022

- TABLE 279 KONGSBERG: BUSINESS OVERVIEW

- TABLE 280 KONGSBERG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 KONGSBERG: PRODUCT LAUNCHES

- TABLE 282 KONGSBERG: DEALS

- TABLE 283 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 284 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 286 ELBIT SYSTEMS: BUSINESS OVERVIEW

- TABLE 287 ELBIT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 ELBIT SYSTEMS: PRODUCT LAUNCHES

- TABLE 289 ELBIT SYSTEMS: DEALS

- TABLE 290 LEONARDO S.P.A.: BUSINESS OVERVIEW

- TABLE 291 LEONARDO S.P.A.: PRODUCTS OFFERED

- TABLE 292 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 293 LEONARDO S.P.A.: DEALS

- TABLE 294 THALES GROUP: BUSINESS OVERVIEW

- TABLE 295 THALES GROUP: PRODUCTS OFFERED

- TABLE 296 THALES GROUP: PRODUCT LAUNCHES

- TABLE 297 THALES GROUP.: DEALS

- TABLE 298 ELECTRO OPTIC SYSTEMS: BUSINESS OVERVIEW

- TABLE 299 ELECTRO OPTIC SYSTEMS: PRODUCTS OFFERED

- TABLE 300 ELECTRO OPTIC SYSTEMS: PRODUCT LAUNCHES

- TABLE 301 ELECTRO OPTIC SYSTEMS: DEALS

- TABLE 302 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 303 NORTHROP GRUMMAN CORPORATION: PRODUCTS OFFERED

- TABLE 304 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 305 BAE SYSTEMS: BUSINESS OVERVIEW

- TABLE 306 BAE SYSTEMS: PRODUCTS OFFERED

- TABLE 307 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 308 BAE SYSTEMS: DEALS

- TABLE 309 RHEINMETALL AG: BUSINESS OVERVIEW

- TABLE 310 RHEINMETALL AG: PRODUCTS OFFERED

- TABLE 311 RHEINMETALL AG: DEALS

- TABLE 312 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

- TABLE 313 GENERAL DYNAMICS CORPORATION: PRODUCTS OFFERED

- TABLE 314 GENERAL DYNAMICS CORPORATION: DEALS

- TABLE 315 ST ENGINEERING: BUSINESS OVERVIEW

- TABLE 316 ST ENGINEERING: PRODUCTS OFFERED

- TABLE 317 ASELSAN A.S.: BUSINESS OVERVIEW

- TABLE 318 ASELSAN A.S.: PRODUCTS OFFERED

- TABLE 319 ASELSAN A.S.: DEALS

- TABLE 320 SAAB AB: BUSINESS OVERVIEW

- TABLE 321 SAAB AB: PRODUCTS OFFERED

- TABLE 322 MOOG INC.: BUSINESS OVERVIEW

- TABLE 323 MOOG INC.: PRODUCTS OFFERED

- TABLE 324 MOOG INC.: DEALS

- TABLE 325 ISRAEL AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 326 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 327 NEXTER GROUP: BUSINESS OVERVIEW

- TABLE 328 ESCRIBANO MECHANICAL & ENGINEERING: BUSINESS OVERVIEW

- TABLE 329 DENEL SOC LTD.: BUSINESS OVERVIEW

- TABLE 330 FN HERSTAL: BUSINESS OVERVIEW

- TABLE 331 NORINCO GROUP: BUSINESS OVERVIEW

- TABLE 332 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 333 MERRILL TECHNOLOGIES GROUP: BUSINESS OVERVIEW

- TABLE 334 EVPU DEFENCE: BUSINESS OVERVIEW

- TABLE 335 KRAUSS MAFFEI WEGMANN: BUSINESS OVERVIEW

- TABLE 336 SMART SHOOTER LTD.: BUSINESS OVERVIEW

- FIGURE 1 REMOTE WEAPON STATION MARKET SEGMENTATION

- FIGURE 2 RESEARCH METHODOLOGY MODEL

- FIGURE 3 REMOTE WEAPON STATION MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 8 RECESSION IMPACT ON REVENUE OF KEY PLAYERS

- FIGURE 9 LAND SEGMENT PROJECTED TO DOMINATE MARKET FROM 2022 TO 2027

- FIGURE 10 MILITARY SEGMENT ANTICIPATED TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 11 HUMAN MACHINE INTERFACES SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 12 LETHAL WEAPONS SEGMENT TO SECURE LARGEST MARKET SHARE FROM 2022 TO 2027

- FIGURE 13 MOVING SEGMENT ANTICIPATED TO DOMINATE MARKET FROM 2022 TO 2027

- FIGURE 14 CLOSE-IN WEAPON SYSTEMS SEGMENT FORECASTED TO COMMAND MARKET FROM 2022 TO 2027

- FIGURE 15 ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 16 SURGE IN ADOPTION OF UNMANNED SYSTEMS TO DRIVE MARKET GROWTH

- FIGURE 17 LAND SEGMENT ESTIMATED TO LEAD MARKET FROM 2018 TO 2027

- FIGURE 18 MILITARY SEGMENT PROJECTED TO DOMINATE MARKET FROM 2018 TO 2027

- FIGURE 19 HUMAN MACHINE INTERFACES SEGMENT ANTICIPATED TO LEAD MARKET FROM 2018 TO 2027

- FIGURE 20 LETHAL WEAPONS SEGMENT PROJECTED TO TOP MARKET FROM 2018 TO 2027

- FIGURE 21 MOVING SEGMENT ESTIMATED TO GROW AT HIGHEST CAGR FROM 2018 TO 2027

- FIGURE 22 COMMON REMOTELY OPERATED WEAPON STATIONS SEGMENT ANTICIPATED TO FLOURISH AT MAXIMUM CAGR FROM 2018 TO 2027

- FIGURE 23 INDIA PROJECTED TO BE FASTEST-GROWING COUNTRY FROM 2022 TO 2027

- FIGURE 24 REMOTE WEAPON STATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 DEFENSE EXPENDITURE OF MAJOR COUNTRIES IN PERCENTAGE

- FIGURE 26 NUMBER OF FATALITIES DUE TO TERRORIST ATTACKS WORLDWIDE, 2010−2020

- FIGURE 27 REVENUE SHIFT IN REMOTE WEAPON STATION MARKET

- FIGURE 28 RECESSION IMPACT ANALYSIS ON REMOTE WEAPON STATION MARKET

- FIGURE 29 FACTORS IMPACTING REMOTE WEAPON STATION MARKET ANALYSIS

- FIGURE 30 REMOTE WEAPON STATION MARKET ECOSYSTEM

- FIGURE 31 VALUE CHAIN ANALYSIS: REMOTE WEAPON STATION MARKET

- FIGURE 32 INTENSITY OF COMPETITIVE RIVALRY TO BE MODERATE IN REMOTE WEAPON STATION MARKET

- FIGURE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF THREE PLATFORMS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP PLATFORMS

- FIGURE 35 TECHNOLOGICAL TRENDS IN REMOTE WEAPON STATION MARKET

- FIGURE 36 SUPPLY CHAIN ANALYSIS

- FIGURE 37 MILITARY SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 38 LAND PLATFORM PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 39 HUMAN MACHINE INTERFACE SEGMENT PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 LETHAL WEAPONS SEGMENT ANTICIPATED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 41 MOVING SEGMENT TO RECORD HIGHEST GROWTH FROM 2022 AND 2027

- FIGURE 42 COMMON REMOTELY OPERATED WEAPON STATIONS TECHNOLOGY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA CLAIMED LARGEST SHARE OF REMOTE WEAPON STATION MARKET IN 2022

- FIGURE 44 NORTH AMERICA REMOTE WEAPON STATION MARKET SNAPSHOT

- FIGURE 45 US: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2021

- FIGURE 46 CANADA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2021

- FIGURE 47 EUROPE REMOTE WEAPON STATION MARKET SNAPSHOT

- FIGURE 48 UK: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 49 FRANCE: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 50 GERMANY: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 51 ITALY: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016–2020

- FIGURE 52 ASIA PACIFIC: REMOTE WEAPON STATION MARKET SNAPSHOT

- FIGURE 53 CHINA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2021

- FIGURE 54 INDIA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2021

- FIGURE 55 AUSTRALIA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 56 JAPAN: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 57 SOUTH KOREA: MILITARY SPENDING (USD BILLION) VS. GDP (%), 2016−2020

- FIGURE 58 RANKING ANALYSIS OF TOP FIVE PLAYERS IN REMOTE WEAPON STATION MARKET, 2022

- FIGURE 59 SHARE OF TOP PLAYERS IN REMOTE WEAPON STATION MARKET, 2022 (%)

- FIGURE 60 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2022

- FIGURE 61 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 62 REMOTE WEAPON STATION MARKET (SME) COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 63 KONGSBERG: COMPANY SNAPSHOT

- FIGURE 64 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 ELBIT SYSTEMS: COMPANY SNAPSHOT

- FIGURE 66 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 67 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 68 ELECTRO OPTIC SYSTEMS: COMPANY SNAPSHOT

- FIGURE 69 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 71 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 72 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 ST ENGINEERING: COMPANY SNAPSHOT

- FIGURE 74 ASELSAN A.S.: COMPANY SNAPSHOT

- FIGURE 75 SAAB AB: COMPANY SNAPSHOT

- FIGURE 76 MOOG INC.: COMPANY SNAPSHOT

- FIGURE 77 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for the Remote Weapon Station market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

The share of companies in the remote weapon station market was determined using secondary data made available through paid and unpaid sources, and by analyzing the product portfolio of major companies operating in the market. These companies were rated based on the performance and quality of their products. Data points were further validated by primary sources.

Secondary sources referred to for this research study on the electronic warfare market included government sources such as the US Department of Defense (DoD), Trade Statistics for International Business Development, the US Department of Army (DoA), UN DATABASE, World Bank Database, and defense budgets of various countries; corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the remote weapon station market, which was further validated by primary respondents.

Primary Research

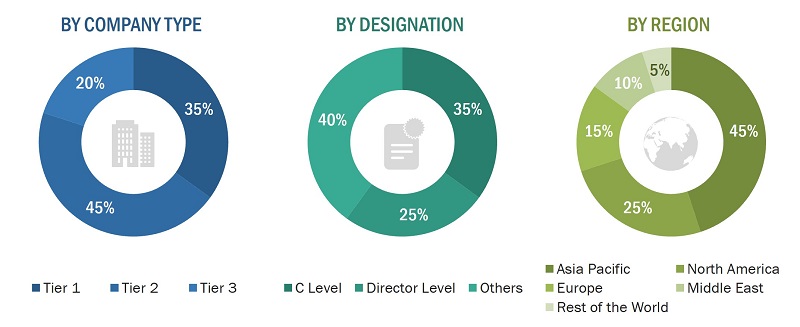

Extensive primary research was conducted after obtaining information about the current scenario of the remote weapon station market through secondary research. Several primary interviews were conducted with market experts from both, demand- and supply-side across 6 major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The supply side is characterized by suppliers, manufacturers, solution providers, technology developers, alliances, and organizations. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the remote weapon station Market.

This report covers the forecast of the remote weapon station market and its dynamics over the next 5 years, while also recognizing market application gaps, recent developments in the market, and high potential countries. The remote weapon station market has been analyzed primarily on the basis of platform (land, naval, airborne), mobility (stationary, moving), weapon type (lethal, non-lethal), component (control system, stabilization unit, sensors, human machine interface, weapons & armaments), application (military, homeland security), technology (close-in weapon system, common remotely operated weapon station (CROWS)), and region through the period, 2022 to 2027, considering 2021 as the base year.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The top-down and bottom-up approaches were used to estimate and validate the size of the electronic warfare market. The figure in the section below is a representation of the overall market size estimation process employed for the purpose of this study.

- The research methodology used to estimate the market size also includes the following details.

- Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews of CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides. Along with this, the market size was validated using both, the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used in this report.

Report Objectives

- To analyze the remote weapon station market and provide projections for it from 2022 to 2027

- To define, describe, and forecast the size of remote weapon station market based on end use, capability, product, and platform, along with a regional analysis

- To understand the market structure by identifying its various subsegments

- To provide in-depth market intelligence regarding the dynamics and major factors that influence the growth of the remote weapon station market (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the market for stakeholders by identifying key trends

- To analyze competitive developments such as new product launches, contracts, partnerships, collaborations, expansions, acquisitions, and new product development in the remote weapon station market

- To provide a detailed competitive landscape of the electronic warfare market, along with an analysis of the business and corporate strategies adopted by key market players

- To strategically profile key market players and comprehensively analyze their core competencies

Customizations Available for the Report

With the given market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Country-level Analysis

- Comprehensive market projections for countries categorized under North America, Europe, Asia Pacific, and Rest of the World

- Country-level analysis of the market based on weapon type, technology, and mobility can be provided

- Number of units (volume data) can be provided on regional and country level

- Market share analysis of top players in the remote weapon station market

Company Information

- Detailed analysis and profiles of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Remote Weapon Station Market