RTLS Market for Healthcare by Hardware (Tags/Badges, Readers/Trackers), Technology (RFID, Wi-Fi, UWB, BLE, Infrared, Ultrasound, Zigbee, Rubee), Application (Inventory/Asset Tracking, Personnel Monitoring), Facility Type, Region - Global Forecast to 2029

Updated on : August 28, 2025

RTLS Market for Healthcare Size

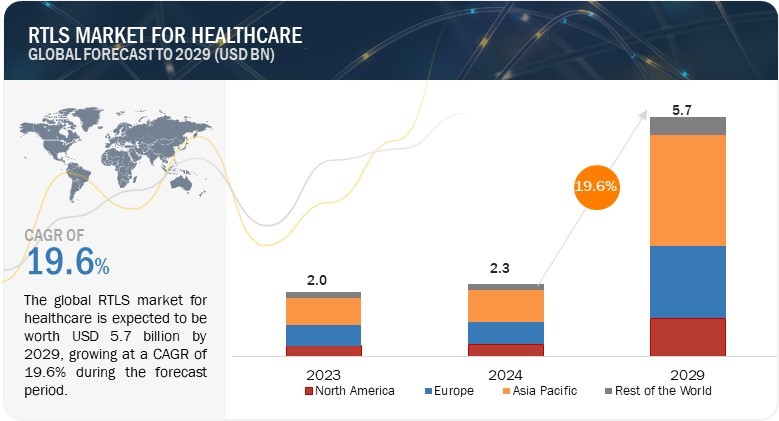

The global RTLS Market for Healthcare Market was valued at USD 2.3 billion in 2024 and is projected to grow from USD 2.7 billion in 2025 to USD 5.7 billion by 2029, at a CAGR of 19.6% during the forecast period. This exceptional growth is primarily driven by the increasing adoption of UWB technology for its unparalleled accuracy and efficiency, the rising demand for IoT integration in healthcare, and the need for improved resource utilization and workflow optimization. The market also benefits from the growing popularity of hybrid RTLS solutions and the expanding use of AI to enhance patient care and operational efficiency.

Key Takeaways:

• The global RTLS Market for Healthcare Market was valued at USD 2.3 billion in 2024 and is projected to grow from USD 2.7 billion in 2025 to USD 5.7 billion by 2029, at a CAGR of 19.6% during the forecast period.

• By Technology: UWB technology is a major growth driver due to its high precision, low power consumption, and superior accuracy, making it the preferred choice over RFID and Wi-Fi in many healthcare applications.

• By Application: Inventory and asset tracking & management is a crucial application, enhancing operational efficiency by reducing errors and improving the inventory turnover ratio, thereby increasing ROI.

• By End User: Hospitals and healthcare facilities are leading adopters of RTLS, using it to gain real-time visibility into equipment and personnel movement, which improves patient care and safety.

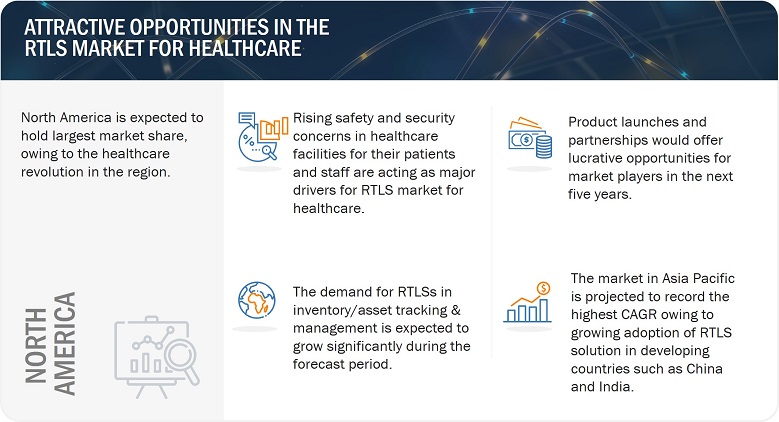

• By Region: ASIA PACIFIC is expected to grow fastest at a CAGR of 25.3% due to increasing IoT adoption, a rising geriatric population, and initiatives to improve healthcare infrastructure.

• Market Dynamics: The demand for RTLS is propelled by the need for efficient resource utilization, cost-effective solutions, and the integration of AI and big data analytics, which enhance predictive capabilities and operational efficiency.

• Challenges: Key challenges include data security concerns and the high costs of installation and maintenance, alongside issues of system compatibility and common standards.

In conclusion, the RTLS Market for Healthcare is poised for robust growth driven by technological advancements, rising demand for efficient healthcare operations, and innovations in AI and IoT integration. Long-term opportunities abound as the industry addresses challenges related to data security and cost, paving the way for more sophisticated and comprehensive RTLS solutions in healthcare settings.

RTLS solutions are increasingly being used in supply chain operations to save time and reduce errors, improving the inventory turnover ratio that saves costs and increases return on investment. RTLS solutions track assets and personnel but also manage enterprise assets, which enables higher productivity by analyzing data captured and provides forecasting for any potential error. There are many big data analytics and RTLS companies that deal with enterprises by providing more Rol and helping them manage their assets and staff in a much better way.

The use of AI in RTLS solutions could revolutionize the healthcare industry by optimizing patient care, staff safety, and operational efficiency. AI-powered predictive analytics allow RTLS data to forecast patient flow, manage resources effectively, and anticipate equipment maintenance needs, thus improving overall hospital management. Combining RTLS with medical wearable technology facilitates continuous monitoring of patient vitals, enabling proactive interventions for patients with chronic conditions and enhancing personalized care. Moreover, AI-driven analysis of patient movement data optimizes surgical outcomes by refining protocols and ensuring efficient patient flow from preoperative preparation to postoperative care.

RTLS Market for Healthcare Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

RTLS Market for Healthcare Market Trends & Dynamics

DRIVERS: Rising adoption of UWB technology-based RTLS solutions due to accuracy

In recent years, UWB technology-based RTLS solutions have witnessed a rise in penetration in the RTLS market for healthcare. The ability of the UWB technology to provide highly accurate positioning data of a person/object is the main driver for the UWB technology-based RTLS industery for healthcare. UWB offers higher accuracy and range with lower power consumption in comparison with most other RTLS technologies. This has led to its high penetration in applications requiring high accuracy. In recent years, several end users of RTLS technology have shifted from other technology-based RTLS solutions, such as RFID and Wi-Fi, to UWB technology-based RTLS solutions for improving efficiency, shortening lead times, and decreasing costs.

RESTRAINTS: Threat of cyberattacks, data security and privacy issues

Data security and privacy are among the major issues faced by personnel/staff in various industries, particularly in the healthcare domain. The threat of cyberattacks in healthcare has never been more prevalent and is a major issue for every organization looking to establish an RTLS entry point into their network and systems. Real-time location tracking systems are revolutionizing various industries where the efficient utilization of resources is critical. RTLS provides the whereabouts of individuals at any time and also offers the visibility required to keep people safe. However, union members in diverse industries complain that an RTLS solution can be used to monitor specific employees unfairly, that is, their break time and working hours. In other cases, people are worried about losing their freedom.

OPPORTUNITIES: Growing need for efficient operations and optimum utilization of existing resources

Several healthcare organizations have faced resource utilization as a significant challenge while increasing their output regarding workflow optimization, production, tracking and monitoring of assets, and reducing costs. RTLS addresses these challenges by effectively tracking and monitoring the assets and personnel. Efficient operations and optimum utilization of existing resources help enterprises to save costs and increase profits. The installation of an RTLS allows an enterprise to utilize resources efficiently and reduce inventory and stock management costs by tracking and managing assets in real-time.

CHALLENGES: Trade-off issue in RTLS solutions designing

Various RTLS solution providers offer different technologies for different applications. These solutions offer various technological advantages, such as high range, low power, and high accuracy. However, RTLS solution providers face the challenge of providing one solution with all benefits. RTLS comprises hardware and software, which are used to continuously track and deliver the real-time location of assets and resources. Tags, readers, or sensors are used to instantly track and monitor assets, people, or any resource of value with very high accuracy and mobility anywhere in the area covered by the network. However, RTLS tags face challenges because of a complicated trade-off between accuracy, power consumption, and range. Narrowband tags do not provide the accuracy required by some applications, while wideband tags provide accuracy but offer a limited capacity; additionally, some wideband tags are large and consume more power.

RTLS Market For Healthcare Ecosystem

Prominent companies in this market include well-established, financially stable RTLS providers such as Securitas Healthcare LLC (US), Zebra Technologies Corp. (US), HPE Aruba Networking (US), Impinj, Inc. (US), and TeleTracking Technologies, Inc. (US). These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Along with the well-established companies, there are a large number of small and medium companies operating in this market, such as Pozyx (Belgium) and Navigine (US).

RTLS Market for Healthcare Share

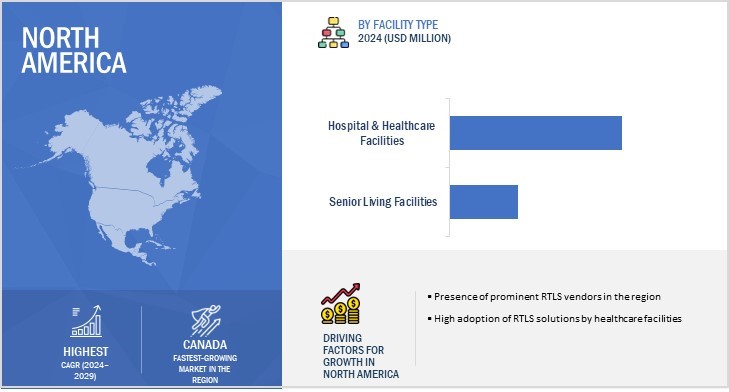

Senior living facilities segment is expected to grow at highest CAGR during the forecast period.

Resident safety and comfort are the top priorities of senior living facilities. Many such facilities adopt RTLS to improve residents' experience and increase operational efficiency. RTLS, combined with wearable sensors or tags/badges, can assist with situations potentially harmful to patients/residents, such as patients wandering and entering unauthorized or sensitive areas. RTLS solutions help locate individuals who have wandered or entered unauthorized areas by immediately and accurately pinpointing their exact location. This provides institutions the confidence they need to discretely keep patients safe without compromising their freedom of movement. It is especially beneficial for those residents showing signs of dementia. RTLS solutions that are built on ultrasound indoor positioning technology that delivers precise and immediate location and event-based information for any tagged object or badged individual are mostly used in senior living facilities.

The market for inventory / asset tracking & management segment is projected to hold largest market share during the forecast period.

With increasing patient volume and expectations of experience and satisfaction, healthcare facilities are under greater pressure. They have to reduce the excess fat in the form of unnecessary steps in their workflow. Asset tracking and management activities thus have prime importance in various organizations. They make sure that the correct equipment or tools are available at the right time. It is particularly critical in the case of emergencies, especially in hospitals. Asset tracking and management is the major application in the healthcare sector as healthcare organizations are usually large and may have thousands of critically important assets, such as patient beds and specialized medical devices.

RTLS Market for Healthcare Regional Analysis

The market in North America is projected to hold the substantial market share in 2029.

RTLS Market for Healthcare by Region

To know about the assumptions considered for the study, download the pdf brochure

North America is currently leading the RTLS market for healthcare in terms of market size, and a similar trend is expected to continue during the forecast period, owing to the healthcare revolution in the region. The reason for the dominance of North America is its well-established economy, which allows for investments in new technologies. The rapid adoption of RTLS solutions for several applications is also contributing to the largest market share of North America in the RTLS market for healthcare. The declining ASPs of UWB tags and long-term high return on investment are expected to be the prominent reasons for the growing adoption of BLE- and UWB technology-based solutions in healthcare facilities in the next few years.

Top RTLS for healthcare Industry Companies - Key Market Manufacture :

- Securitas Healthcare LLC (US),

- Zebra Technologies Corp. (US),

- HPE Aruba Networking (US),

- Impinj, Inc. (US), and

- TeleTracking Technologies, Inc. (US) are among a few top players in the RTLS companies for Healthcare.

RTLS for healthcare Industry Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 2.3 billion in 2024 |

| Projected Market Size | USD 5.7 billion by 2029 |

|

Growth Rate

|

CAGR of 19.6% |

|

Market Size Available for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Offering, Technology, Facility Type, and Application |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Zebra Technologies Corp. (US), HPE Aruba Networking (US), Impinj, Inc. (US), GE HealthCare (US), TeleTracking Technologies, Inc. (US), Securitas Healthcare LLC (US), Savi Technology (US), AiRISTA (US), Advantech Co., Ltd. (Taiwan), Alien Technology, LLC (US), CenTrak, Inc. (US), and Others - (Total 25 players have been covered) |

RTLS Market for Healthcare Highlights

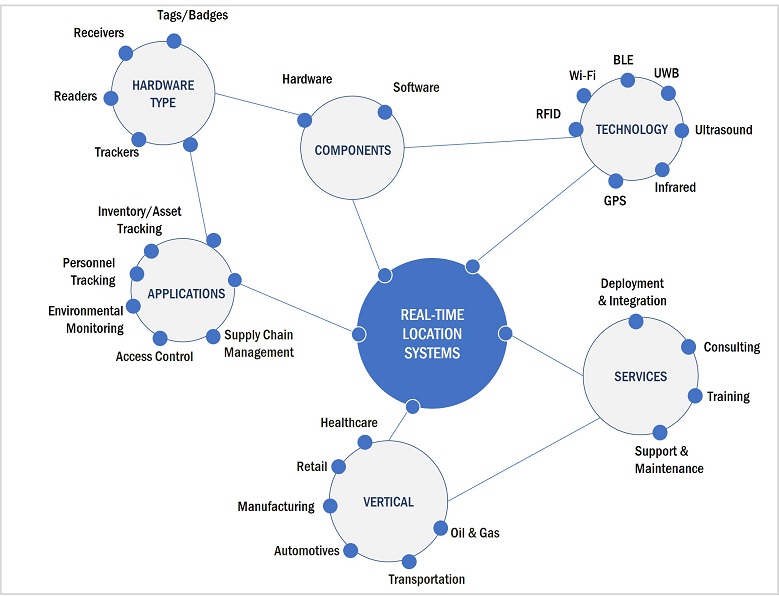

This research report categorizes the RTLS market for healthcare by offering, technology, facility type, application, and region.

|

Segment |

Subsegment |

|

By Offering: |

|

|

By Technology: |

|

|

By Application: |

|

|

By Facility Type: |

|

|

By Region |

|

Recent Developments in RTLS Market for Healthcare

- In November 2023, Impinj, Inc. announced the launch of R720 RAIN RFID reader. It has more processing power and memory than Impinj’s prior-generation reader. It helps to meet the most demanding requirements of large-scale enterprise deployments.

- In November 2022, CenTrak, Inc. announced its new platform with exceptional management capabilities and an emergency call system. Moreover, the call system has passed the safety standards and requirements; hence, it was awarded UL certification.

- In July 2022, BE SWITCHCRAFT, one of the leading manufacturers of electrical switchboards, adopted Zebra's RFID solutions to gain real-time visibility of their manufacturing process to meet customer expectations.

Frequently Asked Questions:

What is the total CAGR expected to be recorded for the RTLS market for healthcare from 2024 to 2029?

The global RTLS market for healthcare market is expected to record a CAGR of 19.6% from 2024–2029.

What are the driving factors for the RTLS market for healthcare?

Rising adoption of UWB technology-based RTLS solutions due to accuracy and rising adoption of RTLS solutions owing to high RoI are some of the driving factors for the RTLS market for healthcare.

Which application will grow at a fast rate in the future?

Supply Chain Management & Automation is expected to grow at the highest CAGR during the forecast period.

Which are the significant players operating in the RTLS market for healthcare?

Securitas Healthcare LLC (US), Zebra Technologies Corp. (US), HPE Aruba Networking (US), Impinj, Inc. (US), and TeleTracking Technologies, Inc. (US) are among a few top players in the RTLS market for healthcare.

Which region will grow at a fast rate in the future?

The RTLS market for healthcare in Asia Pacific is expected to grow at the highest CAGR during the forecast period.

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Easy availability of cost-effective and customized RTLS solutions due to emergence of startups- Rising use of RTLS for asset tracking to maximize return on investment- Increasing demand for UWB technology-based RTLS solutions owing to their greater accuracy- Growing focus of healthcare facilities on improving patient and staff safetyRESTRAINTS- Data privacy and security issues- High ownership costs- Trade-off challenges while designing RTLS solutionsOPPORTUNITIES- Growing need for efficient operations and optimum utilization of existing resources- Increasing interest toward hybrid RTLS solutions- Surging deployment of IoT technology-based solutions in healthcare- Elevating demand for Wi-Fi–enabled RTLS in developing countriesCHALLENGES- Compatibility and interoperability issues, coupled with lack of standard protocols

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF TAGS/BADGESAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERINGAVERAGE SELLING PRICE TREND OF TAGS/BADGES, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Hybrid RTLSCOMPLEMENTARY TECHNOLOGIES- AIADJACENT TECHNOLOGIES- IoT

- 5.9 PATENT ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIO (HS CODE 852352)EXPORT SCENARIO (HS CODE 852352)

- 5.11 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.12 CASE STUDY ANALYSISUNIVERSITY OF FUKUI HOSPITAL DEPLOYS SATO HEALTHCARE AND CARECOM’S RTLS SOLUTIONS TO MONITOR AND IMPROVE HAND HYGIENE HABITS OF STAFFTEXAS HEALTH RESOURCES IMPLEMENTS CENTRAK’S RTLS TO ENHANCE PATIENT SATISFACTION AND MAXIMIZE COST SAVINGSLIFE CARE GAYNES PARK MANOR DEPLOYS SONITOR’S RTLS TO ENSURE PATIENT CARE AND SAFETYORANGE PARK MEDICAL CENTER ADOPTS CENTRAK’S ENTERPRISE LOCATION SERVICES TO DRIVE HIGHER PATIENT SATISFACTIONPIEDMONT HEALTHCARE USES VIZZIA’S RTLS PLATFORM TO TRACK ASSETS AND REDUCE EXPENSESMEDSTAR HARBOR HOSPITAL EMPLOYS COMM-TRONICS AND SONITOR’S RTLS TO ENHANCE STAFF AND PATIENT SAFETYBIOTECH FIRM ADOPTS SAVI'S TRACKING SOLUTION TO GAIN REAL-TIME VISIBILITY OF IN-TRANSIT INVENTORY

-

5.13 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

-

5.14 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.16 IMPACT OF AI/GEN AI ON RTLS MARKET FOR HEALTHCAREINTRODUCTIONMARKET POTENTIAL IN RTLS APPLICATIONSAI USE CASES IN RTLSKEY COMPANIES IMPLEMENTING AIFUTURE OF GENERATIVE AI IN RTLS ECOSYSTEMINTERCONNECT ADJACENT ECOSYSTEM- Impact on IoT market

- 6.1 INTRODUCTION

-

6.2 HARDWARETAGS/BADGES- Rising use of tags to get accurate asset information to accelerate market growthREADERS/TRACKERS/ACCESS POINTS- Growing adoption of readers for asset management to foster market growthOTHER HARDWARE PRODUCTS

-

6.3 SOFTWARETECHNOLOGICAL ADVANCEMENTS TO DRIVE NEED FOR CUSTOMIZED SOFTWARE PLATFORMS

-

6.4 SERVICESDEPLOYMENT & INTEGRATION- Rising collaboration between RTLS vendors and service providers to support segmental growthSUPPORT & MAINTENANCE- Need to customize and enhance system performance to boost demandCONSULTING- Demand for on-site surveys and network designing to create opportunities for consultants

- 7.1 INTRODUCTION

-

7.2 RFIDENHANCED ACCURACY AND COST EFFICIENCY TO DRIVE ADOPTIONACTIVE RFIDPASSIVE RFID

-

7.3 WI-FIEASY AVAILABILITY AND HIGH CONNECTIVITY RANGE TO SPUR DEMAND

-

7.4 UWBHIGH PRECISION AND FAST UPDATE RATES TO FUEL SEGMENTAL GROWTH

-

7.5 BLELONG LIFE AND LOW POWER CONSUMPTION TO ELEVATE DEMAND

-

7.6 ULTRASOUNDRISING DEPLOYMENT IN SENIOR LIVING FACILITIES TO FOSTER MARKET GROWTH

-

7.7 INFRAREDHIGH ACCURACY IN SUB-ROOM LEVEL APPLICATIONS TO BOOST DEPLOYMENT

- 7.8 OTHER TECHNOLOGIES

- 8.1 INTRODUCTION

-

8.2 INVENTORY/ASSET TRACKING & MANAGEMENTPRESSING NEED FOR REAL-TIME TRACKING OF MEDICAL EQUIPMENT IN HOSPITALS TO DRIVE MARKET

-

8.3 PERSONNEL LOCATING & MONITORINGRISING FOCUS ON ENSURING PATIENT AND STAFF SAFETY TO CREATE OPPORTUNITIES

-

8.4 ACCESS CONTROL & SECURITYGROWING ADOPTION OF RTLS SOLUTIONS TO RESTRICT UNAUTHORIZED ACCESS TO SUPPORT MARKET GROWTH

-

8.5 ENVIRONMENTAL MONITORINGSURGING NEED TO MONITOR AIR PRESSURE AND HUMIDITY IN HEALTHCARE FACILITIES TO CONTRIBUTE TO MARKET GROWTH

-

8.6 SUPPLY CHAIN MANAGEMENT & AUTOMATIONELEVATING FOCUS ON MITIGATING SUPPLY CHAIN RISKS TO FUEL MARKET GROWTH

- 8.7 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 HOSPITALS & HEALTHCARE FACILITIESREQUIREMENT FOR REAL-TIME VISIBILITY OF EQUIPMENT AND STAFF TO BOOST SEGMENTAL GROWTHHOSPITALSCLINICSEMERGENCY MEDICAL SERVICE (EMS) RESPONDERSDIAGNOSTIC LABS

-

9.3 SENIOR LIVING FACILITIESGROWING DEMAND TO MAINTAIN COMFORTABLE TEMPERATURE AND HUMIDITY LEVELS TO CREATE OPPORTUNITIES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Strong presence of well-established RTLS solution providers to support market growthCANADA- Significant requirement to track assets, patients, and staff to drive demandMEXICO- Emerging economy with significant focus on infrastructure development to create growth opportunities

-

10.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEUK- Increasing government investment in healthcare infrastructure development to drive marketGERMANY- Growing focus on efficient use of resources and automation to streamline workflow to fuel market growthFRANCE- Rapid development of technologically advanced RTLS solutions to foster market growthITALY- Rising government and private funding in healthcare modernization projects to create opportunitiesSWEDEN- Increasing elderly population to contribute to market growthNORWAY- Implementation of AI in RTLS for better patient care to drive marketNETHERLANDS- Digital transformation in healthcare to spike demandREST OF EUROPE

-

10.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Adoption of IoT and AI in healthcare sector to create opportunitiesJAPAN- Integration of information technology in medical and home nursing care to accelerate market growthAUSTRALIA- Rising aging population to fuel RTLS implementationSOUTH KOREA- Increasing focus of RTLS vendors on expanding their footprint to contribute to market growthREST OF ASIA PACIFIC

-

10.5 ROWMACROECONOMIC OUTLOOK FOR ROWMIDDLE EAST- Rising focus on healthcare infrastructure improvement to support market growth- GCC countries- Rest of Middle EastSOUTH AMERICA- Increasing healthcare expenditure to fuel market growthAFRICA- Untapped markets to offer growth opportunities for RTLS

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020–2024

- 11.3 REVENUE ANALYSIS, 2019–2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

-

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Application footprint- Offering footprint- Technology footprint- Facility type footprint- Region footprint

-

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

-

11.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSSECURITAS HEALTHCARE LLC- Business overview- Products/Solutions/Services offered- MnM viewZEBRA TECHNOLOGIES CORP.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHPE ARUBA NETWORKING- Business overview- Products/Solutions/Services offered- MnM viewIMPINJ, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTELETRACKING TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- MnM viewSAVI TECHNOLOGY- Business overview- Products/Solutions/Services offeredADVANTECH CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsAIRISTA- Business overview- Products/Solutions/Services offeredALIEN TECHNOLOGY, LLC- Business overview- Products/Solutions/Services offeredCENTRAK, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsGE HEALTHCARE- Business overview- Products/Solutions/Services offeredUBISENSE- Business overview- Products/Solutions/Services offered- Recent developmentsSONITOR TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsINFOR- Business overview- Products/Solutions/Services offeredQORVO, INC.- Business overview- Products/Solutions/Services offered

-

12.2 OTHER PLAYERSBLUEIOT (BEIJING) TECHNOLOGY CO., LTD.BORDA TECHNOLOGYLITUMMIDMARK CORPORATIONMYSPHERA S.L.REDPOINT POSITIONING CORP.SECURE CARE PRODUCTS, LLCKONTAKT.IONAVIGINEPOZYX

- 13.1 INTRODUCTION

-

13.2 RFID MARKET, BY APPLICATIONCOMMERCIAL- Surging adoption of RFID in asset tracking and inventory management applications to accelerate segmental growthTRANSPORTATION- Increasing deployment of RFID technology in road tolling and parking management systems to fuel market growth

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 RTLS MARKET FOR HEALTHCARE: RISK ANALYSIS

- TABLE 2 INDICATIVE PRICING TREND OF TAGS/BADGES OFFERED BY MAJOR PLAYERS, 2020–2023

- TABLE 3 INDICATIVE PRICING TREND OF RTLS, BY TECHNOLOGY, 2023

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 LIST OF PATENTS, 2020–2024

- TABLE 6 KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 RTLS MARKET FOR HEALTHCARE MARKET: STANDARDS

- TABLE 12 PORTER’S FIVE FORCES ANALYSIS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 15 RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 16 RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 17 HARDWARE: RTLS MARKET FOR HEALTHCARE, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 18 HARDWARE: RTLS MARKET FOR HEALTHCARE, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 19 RTLS MARKET FOR HEALTHCARE FOR TAGS/BADGES, BY TECHNOLOGY, 2020–2023 (MILLION UNITS)

- TABLE 20 RTLS MARKET FOR HEALTHCARE FOR TAGS/BADGES, BY TECHNOLOGY, 2024–2029 (MILLION UNITS)

- TABLE 21 HARDWARE: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 22 HARDWARE: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 23 SOFTWARE: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 24 SOFTWARE: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 25 SERVICES: RTLS MARKET FOR HEALTHCARE, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 26 SERVICES: RTLS MARKET FOR HEALTHCARE, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 27 SERVICES: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 28 SERVICES: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 29 RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 30 RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 31 RFID: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 32 RFID: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 33 RFID: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 34 RFID: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 35 WI-FI: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 36 WI-FI: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 37 WI-FI: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 38 WI-FI: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 39 UWB: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 40 UWB: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 41 UWB: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 42 UWB: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 43 BLE: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 44 BLE: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 45 BLE: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 46 BLE: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 47 ULTRASOUND: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 48 ULTRASOUND: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 49 ULTRASOUND: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 50 ULTRASOUND: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 51 INFRARED: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 52 INFRARED: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 53 INFRARED: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 54 INFRARED: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 55 OTHER TECHNOLOGIES: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 56 OTHER TECHNOLOGIES: RTLS MARKET FOR HEALTHCARE, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 57 OTHER TECHNOLOGIES: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 58 OTHER TECHNOLOGIES: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 59 RTLS MARKET FOR HEALTHCARE, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 60 RTLS MARKET FOR HEALTHCARE, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 61 RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2020–2023 (USD MILLION)

- TABLE 62 RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2024–2029 (USD MILLION)

- TABLE 63 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 64 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 65 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 66 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 67 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 68 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 69 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 70 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 71 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 72 HOSPITALS & HEALTHCARE FACILITIES: RTLS MARKET FOR HEALTHCARE IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 73 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 76 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE IN NORTH AMERICA, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 77 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 78 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE IN EUROPE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 79 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE IN ASIA PACIFIC, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 80 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE IN ASIA PACIFIC, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 81 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE IN ROW, BY REGION, 2020–2023 (USD MILLION)

- TABLE 82 SENIOR LIVING FACILITIES: RTLS MARKET FOR HEALTHCARE IN ROW, BY REGION, 2024–2029 (USD MILLION)

- TABLE 83 RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 84 RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: RTLS MARKET FOR HEALTHCARE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: RTLS MARKET FOR HEALTHCARE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2020–2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2024–2029 (USD MILLION)

- TABLE 91 EUROPE: RTLS MARKET FOR HEALTHCARE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 92 EUROPE: RTLS MARKET FOR HEALTHCARE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 93 EUROPE: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 94 EUROPE: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 95 EUROPE: RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2020–2023 (USD MILLION)

- TABLE 96 EUROPE: RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2024–2029 (USD MILLION)

- TABLE 97 ASIA PACIFIC: RTLS MARKET FOR HEALTHCARE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 98 ASIA PACIFIC: RTLS MARKET FOR HEALTHCARE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 99 ASIA PACIFIC: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 101 ASIA PACIFIC: RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2020–2023 (USD MILLION)

- TABLE 102 ASIA PACIFIC: RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2024–2029 (USD MILLION)

- TABLE 103 ROW: RTLS MARKET FOR HEALTHCARE, BY REGION, 2020–2023 (USD MILLION)

- TABLE 104 ROW: RTLS MARKET FOR HEALTHCARE, BY REGION, 2024–2029 (USD MILLION)

- TABLE 105 ROW: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 106 ROW: RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 107 ROW: RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2020–2023 (USD MILLION)

- TABLE 108 ROW: RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE, 2024–2029 (USD MILLION)

- TABLE 109 MIDDLE EAST: RTLS MARKET FOR HEALTHCARE, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 110 MIDDLE EAST: RTLS MARKET FOR HEALTHCARE, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 111 RTLS MARKET FOR HEALTHCARE: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020–2024

- TABLE 112 RTLS MARKET FOR HEALTHCARE: DEGREE OF COMPETITION, 2023

- TABLE 113 RTLS MARKET FOR HEALTHCARE: APPLICATION FOOTPRINT

- TABLE 114 RTLS MARKET FOR HEALTHCARE: OFFERING FOOTPRINT

- TABLE 115 RTLS MARKET FOR HEALTHCARE: TECHNOLOGY FOOTPRINT

- TABLE 116 RTLS MARKET FOR HEALTHCARE: FACILITY TYPE FOOTPRINT

- TABLE 117 RTLS MARKET FOR HEALTHCARE: REGION FOOTPRINT

- TABLE 118 RTLS MARKET FOR HEALTHCARE: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 119 RTLS MARKET FOR HEALTHCARE: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 120 RTLS MARKET FOR HEALTHCARE: PRODUCT LAUNCHES, JANUARY 2020–JUNE 2024

- TABLE 121 RTLS MARKET FOR HEALTHCARE: DEALS, JANUARY 2020–JUNE 2024

- TABLE 122 SECURITAS HEALTHCARE LLC: COMPANY OVERVIEW

- TABLE 123 SECURITAS HEALTHCARE LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 125 ZEBRA TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 ZEBRA TECHNOLOGIES CORP.: DEALS

- TABLE 127 HPE ARUBA NETWORKING: COMPANY OVERVIEW

- TABLE 128 HPE ARUBA NETWORKING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 IMPINJ, INC.: COMPANY OVERVIEW

- TABLE 130 IMPINJ, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 IMPINJ, INC.: PRODUCT LAUNCHES

- TABLE 132 IMPINJ, INC.: DEALS

- TABLE 133 TELETRACKING TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 134 TELETRACKING TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 SAVI TECHNOLOGY: COMPANY OVERVIEW

- TABLE 136 SAVI TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 ADVANTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 138 ADVANTECH CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 ADVANTECH CO., LTD.: PRODUCT LAUNCHES

- TABLE 140 AIRISTA: COMPANY OVERVIEW

- TABLE 141 AIRISTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 ALIEN TECHNOLOGY, LLC: COMPANY OVERVIEW

- TABLE 143 ALIEN TECHNOLOGY, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 CENTRAK, INC.: COMPANY OVERVIEW

- TABLE 145 CENTRAK, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 CENTRAK, INC.: PRODUCT LAUNCHES

- TABLE 147 CENTRAK, INC.: DEALS

- TABLE 148 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 149 GE HEALTHCARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 UBISENSE: COMPANY OVERVIEW

- TABLE 151 UBISENSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 UBISENSE: PRODUCT LAUNCHES

- TABLE 153 UBISENSE: DEALS

- TABLE 154 SONITOR TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 155 SONITOR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 SONITOR TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 157 INFOR: COMPANY OVERVIEW

- TABLE 158 INFOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 QORVO, INC.: COMPANY OVERVIEW

- TABLE 160 QORVO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 RFID MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 RFID MARKET, BY APPLICATION, 2023–2032 (USD MILLION)

- TABLE 163 COMMERCIAL: RFID TAGS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 164 COMMERCIAL: RFID TAGS MARKET, BY TYPE, 2023–2032 (USD MILLION)

- TABLE 165 COMMERCIAL: RFID TAGS MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 166 COMMERCIAL: RFID TAGS MARKET, BY FREQUENCY, 2023–2032 (USD MILLION)

- TABLE 167 COMMERCIAL: RFID TAGS MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 168 COMMERCIAL: RFID TAGS MARKET, BY FORM FACTOR, 2023–2032 (USD MILLION)

- TABLE 169 COMMERCIAL: RFID TAGS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 170 COMMERCIAL: RFID TAGS MARKET, BY MATERIAL, 2023–2032 (USD MILLION)

- TABLE 171 COMMERCIAL: RFID TAGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 172 COMMERCIAL: RFID TAGS MARKET, BY REGION, 2023–2032 (USD MILLION)

- TABLE 173 TRANSPORTATION: RFID TAGS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 174 TRANSPORTATION: RFID TAGS MARKET, BY TYPE, 2023–2032 (USD MILLION)

- TABLE 175 TRANSPORTATION: RFID TAGS MARKET, BY FREQUENCY, 2019–2022 (USD MILLION)

- TABLE 176 TRANSPORTATION: RFID TAGS MARKET, BY FREQUENCY, 2023–2032 (USD MILLION)

- TABLE 177 TRANSPORTATION: RFID TAGS MARKET, BY FORM FACTOR, 2019–2022 (USD MILLION)

- TABLE 178 TRANSPORTATION: RFID TAGS MARKET, BY FORM FACTOR, 2023–2032 (USD MILLION)

- TABLE 179 TRANSPORTATION: RFID TAGS MARKET, BY MATERIAL, 2019–2022 (USD MILLION)

- TABLE 180 TRANSPORTATION: RFID TAGS MARKET, BY MATERIAL, 2023–2032 (USD MILLION)

- TABLE 181 TRANSPORTATION: RFID TAGS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 182 TRANSPORTATION: RFID TAGS MARKET, BY REGION, 2023–2032 (USD MILLION)

- FIGURE 1 RTLS MARKET FOR HEALTHCARE SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RTLS MARKET FOR HEALTHCARE: RESEARCH DESIGN

- FIGURE 3 RTLS MARKET FOR HEALTHCARE: RESEARCH APPROACH

- FIGURE 4 RTLS MARKET FOR HEALTHCARE: TOP-DOWN APPROACH

- FIGURE 5 RTLS MARKET FOR HEALTHCARE: BOTTOM-UP APPROACH

- FIGURE 6 RTLS MARKET FOR HEALTHCARE MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 7 RTLS MARKET FOR HEALTHCARE: DATA TRIANGULATION

- FIGURE 8 RTLS MARKET FOR HEALTHCARE: RESEARCH ASSUMPTIONS

- FIGURE 9 SIZE OF RTLS MARKET FOR HEALTHCARE, 2020–2029 (USD MILLION)

- FIGURE 10 HARDWARE SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2024

- FIGURE 11 UWB SEGMENT TO EXHIBIT SECOND-HIGHEST CAGR IN RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY, FROM 2024 TO 2029

- FIGURE 12 HOSPITALS & HEALTHCARE FACILITIES TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 13 NORTH AMERICA DOMINATED RTLS MARKET FOR HEALTHCARE IN 2023

- FIGURE 14 GROWING USE OF RTLS IN INVENTORY/ASSET TRACKING & MANAGEMENT APPLICATIONS IN HEALTHCARE SECTOR TO DRIVE MARKET

- FIGURE 15 HARDWARE SEGMENT TO HOLD LARGEST SHARE OF RTLS MARKET FOR HEALTHCARE IN 2024

- FIGURE 16 INVENTORY/ASSET TRACKING & MANAGEMENT SEGMENT TO DOMINATE MARKET BETWEEN 2024 AND 2029

- FIGURE 17 WI-FI TECHNOLOGY AND US ACCOUNTED FOR LARGEST SHARES OF NORTH AMERICAN RTLS MARKET FOR HEALTHCARE IN 2023

- FIGURE 18 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL RTLS MARKET FOR HEALTHCARE DURING FORECAST PERIOD

- FIGURE 19 RTLS MARKET FOR HEALTHCARE: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 IMPACT ANALYSIS: DRIVERS

- FIGURE 21 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 22 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 23 IMPACT ANALYSIS: CHALLENGES

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF TAGS/BADGES, 2020–2023

- FIGURE 26 AVERAGE SELLING PRICE TREND OF TAGS/BADGES PROVIDED BY KEY PLAYERS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF TAGS/BADGES, BY REGION, 2020−2023

- FIGURE 28 VALUE CHAIN ANALYSIS

- FIGURE 29 RTLS MARKET FOR HEALTHCARE: ECOSYSTEM ANALYSIS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2017–2022

- FIGURE 31 PATENTS APPLIED AND GRANTED, 2014–2023

- FIGURE 32 IMPORT DATA FOR HS CODE 852352-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 33 EXPORT DATA FOR HS CODE 852352-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 37 RTLS MARKET FOR HEALTHCARE, BY OFFERING

- FIGURE 38 SERVICES SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2024 TO 2029

- FIGURE 39 RTLS MARKET FOR HEALTHCARE, BY TECHNOLOGY

- FIGURE 40 UWB SEGMENT TO EXHIBIT SECOND-HIGHEST CAGAR IN RTLS MARKET FOR HEALTHCARE DURING FORECAST PERIOD

- FIGURE 41 RTLS MARKET FOR HEALTHCARE, BY APPLICATION

- FIGURE 42 INVENTORY/ASSET TRACKING & MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 43 RTLS MARKET FOR HEALTHCARE, BY FACILITY TYPE

- FIGURE 44 SENIOR LIVING FACILITIES TO EXHIBIT HIGHER CAGR FROM 2024 TO 2029

- FIGURE 45 RTLS MARKET FOR HEALTHCARE, BY REGION

- FIGURE 46 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL RTLS MARKET FOR HEALTHCARE DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: RTLS MARKET FOR HEALTHCARE SNAPSHOT

- FIGURE 48 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN RTLS MARKET FOR HEALTHCARE THROUGHOUT FORECAST PERIOD

- FIGURE 49 EUROPE: RTLS MARKET FOR HEALTHCARE SNAPSHOT

- FIGURE 50 UK TO WITNESS HIGHEST CAGR IN EUROPEAN RTLS MARKET FOR HEALTHCARE FROM 2023 TO 2028

- FIGURE 51 ASIA PACIFIC: RTLS MARKET FOR HEALTHCARE SNAPSHOT

- FIGURE 52 CHINA TO WITNESS HIGHEST CAGR IN RTLS MARKET FOR HEALTHCARE IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 53 RTLS MARKET FOR HEALTHCARE IN ROW, BY REGION, 2024 VS. 2029

- FIGURE 54 RTLS MARKET FOR HEALTHCARE MARKET: REVENUE ANALYSIS OF THREE KEY PLAYERS, 2019–2023

- FIGURE 55 SHARE ANALYSIS OF RTLS MARKET FOR HEALTHCARE, 2023

- FIGURE 56 COMPANY VALUATION

- FIGURE 57 FINANCIAL METRICS

- FIGURE 58 BRAND/PRODUCT COMPARISON

- FIGURE 59 RTLS MARKET FOR HEALTHCARE: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 60 RTLS MARKET FOR HEALTHCARE: COMPANY FOOTPRINT

- FIGURE 61 RTLS MARKET FOR HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 62 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT

- FIGURE 63 IMPINJ, INC.: COMPANY SNAPSHOT

- FIGURE 64 ADVANTECH CO., LTD.: COMPANY SNAPSHOT

- FIGURE 65 GE HEALTHCARE: COMPANY SNAPSHOT

- FIGURE 66 QORVO, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the RTLS market for healthcare. Exhaustive secondary research has been done to collect information on the market, peer, and parent markets. The next step has been to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods were used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the RTLS market for healthcare.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred RTLS providers, distributors, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

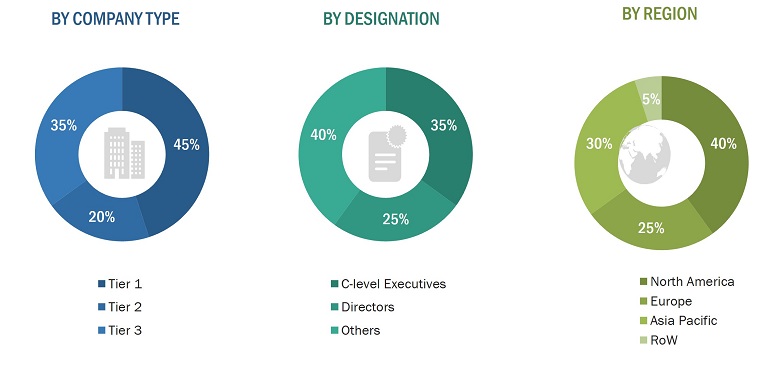

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from RTLS providers, such as Securitas Healthcare LLC (US), Zebra Technologies Corp. (US), HPE Aruba Networking (US), Impinj, Inc. (US), and TeleTracking Technologies, Inc. (US); research organizations, distributors, industry associations, and key opinion leaders. Following is the breakdown of primary respondents.

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

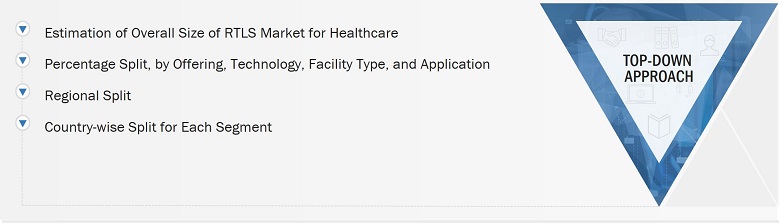

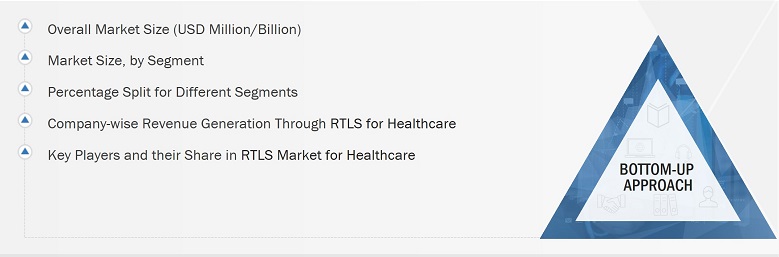

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the RTLS market for healthcare. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Top-down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual market segments (mentioned in market segmentation) through percentage splits from secondary and primary research. For specific market segments, the size of the most appropriate immediate parent market has been used to implement the top-down approach. The bottom-up approach has also been implemented for data obtained from secondary research to validate the market size of various segments.

RTLS Market for Healthcare: Top-down Approach

Bottom-up Approach

The bottom-up approach has been used to arrive at the overall size of the RTLS market for healthcare from the revenues of the key players and their market shares. Calculations based on revenues of key companies identified in the market led to the estimation of their overall Industry size.

RTLS Market for Healthcare: Bottom-up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall Industry engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Market Definition

Real-time location systems (RTLS) are local positioning and tracking systems used to locate and identify objects/people/targets automatically in real-time, usually for indoor applications such as within buildings or other contained areas. RTLS tags/badges/sensors attached to objects or worn by people communicate wirelessly with readers/trackers/access points installed in the vicinity. An RTLS solution may use different technologies for communication between tags and receivers, depending on the application/use case requirement. Various technologies, such as Radio-Frequency Identification (RFID), Wireless Fidelity (Wi-Fi), Ultrasound, Infrared, Ultra-Wideband (UWB), and Bluetooth Low Energy (BLE), are used for precise locating or tracking applications in real-time.

Key Stakeholders

- RTLS hardware providers

- RTLS software providers

- RTLS-related service providers

- RTLS-related associations, organizations, forums, and alliances

- OEM/ODMs, foundries, and semiconductor component suppliers

- RTLS distributors and sales firms

- RTLS end users

- Government bodies, such as regulating authorities and policymakers

- Venture capitalists, private equity firms, and start-up companies

- Research institutes, organizations, and consulting companies

Report Objectives

- To define and forecast the RTLS market for healthcare regarding offering, technology, facility type and application.

- To describe and forecast the RTLS market for healthcare and its value segments for four regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries.

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micro-markets concerning individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the RTLS market for healthcare market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market position regarding ranking and core competencies, along with a detailed market competitive landscape.

- To analyze strategic approaches such as agreements, collaborations, and partnerships in the RTLS market for healthcare

- To provide an analysis of the recession impact on the growth of the market and its segments

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in RTLS Market

Many vendors in RTLS market are combining two or more technologies for making their RTLS system more efficient, for example BLE technology is being combined with Wi-Fi. I would like to in the report the RTLS hybrid technologies are covered under which segment?

We corporate with the Taiwan government “The New Southbound Policy”. So we are seeing if there have possible business opportunities in South Asia countries.Usually, we ask for help from the office of trade negotiations. They will give Taiwan local companies business information on the interesting areas.For the covid-19 pandemic, Avalue’s Renity RTLS solution is suitable for Hospital’s asset tracking and management. That’s why I am looking for “RTLS Market for Healthcare”. I am collecting all kinds of information about Healthcare solutions for South Asia countries.

The hospitals and healthcare facilities are the major demand generators for RTLS. I want to gets insights on this segment. Is the market sizing on hospitals by number of beds covered in the report?

Increased market competitiveness with the emergence of startups providing innovative and customized RTLS solutions based on newer technologies is a major factor fueling the growth of RTLS market for healthcare. We are also interested in entering in this market so would like to get information on the leading players. What parameters were used to rank the players?

RFID and Wi-Fi are the prominent technologies in the RTLS market for healthcare, while UWB and BLE are the emerging ones. We want to explore the market for UWB and BLE technologies and thus want to learn more about these technologies.

Senior living spaces are the emerging application area for RTLS systems. We want to understand opportunities which this segment holds. Let us know if the report includes data on senior living spaces by hardware, technology, and region.