Location-based Services (LBS) and Real-time Location Systems (RTLS) Market

Location-based Services (LBS) and Real-time Location Systems (RTLS) Market by Application (Tracking & Navigation, Marketing & Advertising, Location-based Health Monitoring), Technology (UWB, Bluetooth Low Energy, Wi-Fi, RFID) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The location-based services (LBS) and real-time location systems (RTLS) market is projected to grow from USD 33.03 billion in 2025 to USD 51.24 billion by 2030, at a CAGR of 8.8% from 2026 to 2030. Market growth is supported by increasing demand for real-time location visibility across retail, healthcare, logistics, transportation, and industrial environments. Enterprises are deploying LBS and RTLS to enhance asset tracking, improve workforce safety, support navigation, and strengthen customer engagement. Ongoing improvements in positioning technologies such as BLE, UWB, Wi Fi, GNSS, and cellular positioning are increasing accuracy and reliability. These advances also support scalable deployments across both indoor and outdoor use cases.

KEY TAKEAWAYS

-

By RegionNorth America is expected to account for the largest share of 36.45% of the LBS and RTLS market in 2030.

-

By OfferingThe services segment is expected to register the highest CAGR of 12.0% during the forecast period.

-

By Location TypeBy location type, the indoor segment is projected to grow at the highest CAGR of 11.8% from 2026 to 2030.

-

By VerticalBy vertical, the retail segment is expected to dominate the market with a share of 19.5% in 2030.

-

Competitive Landscape - Key PlayersCisco, Google, and IBM were identified as star players in the LBS and RTLS market, given their strong market share and product footprint.

-

Competitive Landscape - Startups/SMEsAiRISTA Flow, Navigine, and Quuppa, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Growth in the LBS and RTLS market stems from standardizing location protocols and improving vendor cooperation. This makes integration easier and encourages companies to adopt the technology. The rising use of autonomous mobile robots and indoor drones creates a strong need for accurate indoor positioning. This is essential for safe navigation and automated logistics. Public-sector investments in smart city projects are opening new opportunities for wayfinding, asset tracking, and urban mobility services. Additionally, greater use of augmented reality for maintenance and training increases the reliance on location data. There is also a growing focus on asset lifecycle sustainability, which boosts the need for location intelligence across various industries.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

As LBS and RTLS providers shift from hardware-focused models to service-oriented and data-driven offerings, their customers' clients notice real improvements in speed, accuracy, and overall experience. The move from one-time software licensing to subscription-based SaaS, partner ecosystem integration, and digital twin services allows for ongoing innovation and scalable deployments. New revenue streams like marketplace participation and data monetization support real-time asset tracking, inventory accuracy, and visibility on the shop floor across logistics, retail, and manufacturing sectors. These features lead to quicker, more reliable deliveries, steady product availability, and smoother journeys for guests and patients. At the same time, better crowd-flow monitoring and critical asset location improve safety and the experience in healthcare settings and large venues. Together, these trends enhance operational transparency for businesses while providing measurable value to end users, promoting adoption across various sectors.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for UWB-based real-time location systems

-

Increasing integration with existing IT systems like BI and ERP to optimize workflows and resource utilization

Level

-

High initial deployment costs for hardware, sensors, and infrastructure, and maintenance costs

-

Lack of interoperability and standardization across RTLS technologies and protocols

Level

-

Expansion in smart cities and infrastructure for real-time asset monitoring and urban applications

-

Advancements in 5G, GPS, and connectivity technologies for real-time positioning and geo-marketing

Level

-

Data privacy, security concerns, and regulatory compliance risks with sensitive location data

-

Environmental interference, signal issues, and a lack of standards in complex settings like indoors

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for UWB-based real-time location systems

The demand for UWB-based real-time location systems is speeding up growth in the LBS and RTLS market. These systems offer centimeter-level positioning and secure ranging for many enterprise and consumer applications. UWB reduces multipath interference and provides reliable time-of-flight measurements. These features are critical for robotics, automated guided vehicles, precise asset tracking, and safety-sensitive healthcare tasks. As semiconductor companies produce lower-power UWB system-on-chips and device makers integrate UWB into smartphones and wearables, solution providers can create more accurate services with lower infrastructure costs and faster returns.

Restraint: Lack of interoperability and standardization across RTLS technologies and protocols

Lack of interoperability and standardization among RTLS technologies constrains market scale-up by complicating integration and increasing implementation risk. Competing approaches such as UWB, BLE, Wi Fi fingerprinting, and passive RFID expose enterprises to disparate data formats, fragmented APIs, and heterogeneous management consoles. These differences raise the total cost of ownership, extend deployment timelines, and increase the risk of vendor lock-in. Addressing this restraint requires industry alignment on common protocols, open APIs, standardized data models, and middleware platforms that simplify multi-vendor orchestration and reduce integration friction.

Opportunity: Expansion in smart cities and infrastructure for real-time asset monitoring and urban applications

The rising demand for UWB-based real-time location systems is driving growth in the LBS and RTLS market by offering centimeter-level positioning and secure ranging across many enterprise and consumer applications. UWB reduces multipath interference and delivers precise time-of-flight measurements, which are crucial for robotics, automated guided vehicles, accurate asset tracking, and safety-sensitive healthcare tasks. As chip manufacturers produce lower-power UWB system-on-chips and device makers incorporate UWB into smartphones and wearables, solution providers can deliver more accurate services at lower infrastructure costs and achieve quicker returns.

Challenge: Data privacy, security concerns, and regulatory compliance risks with sensitive location data

Data privacy, security, and compliance pose a central challenge because location telemetry can reveal personal movement, operational workflows, and commercially sensitive logistics patterns. This makes location data a high-value target for misuse and cyber attacks. Mitigating the challenge requires privacy by design, comprehensive end-to-end encryption, secure device provisioning, and granular access controls, together with rigorous audit trails and breach response procedures. Vendors must also pursue relevant certifications, clear consent mechanisms, and customer training to maintain trust and meet evolving regulatory requirements.

LOCATION-BASED SERVICES (LBS) AND REAL-TIME LOCATION SYSTEMS (RTLS) MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

SimplyDelivery, a German SaaS platform for restaurant delivery, uses Google Maps Platform (Maps Embed, Maps JavaScript, Places Autocomplete, Directions, Distance Matrix, Place Details, Geocoding) to power end-to-end delivery logistics. Drivers receive optimized routes with real-time traffic and detailed visual maps, while customers see accurate delivery destinations and address suggestions | Real-time location data allows SimplyDelivery to propose optimal multi-stop routes, improving on-time delivery and helping restaurants consistently meet a 30-minute target | Distance Matrix data lets kitchens time food preparation to driver arrival, keeping meals hot and fresh | Address autocomplete reduces entry errors, cutting failed or mis-routed deliveries |

|

RWJBarnabas Health, New Jersey’s largest healthcare provider, rolled out Securitas Healthcare’s enterprise RTLS platform across multiple hospitals. The solution tracks more than 16,000 tagged assets and supports use cases, including asset management, staff safety, patient protection and workflow optimization through the MobileView RTLS software and multi-technology tags | RTLS data has driven measurable savings and efficiencies. RWJBarnabas reports saving close to USD 9 million across devices, medications, and food by reducing loss, shrinkage, and over-purchasing | Staff gain rapid access to equipment, improving care delivery and patient safety, while analytics support higher-reliability operations and better use of capital budgets |

|

Transport for London uses Esri real-time GIS to power the Real-Time Origin Destination Tool (RODAT), which analyzes live video and sensor feeds at key locations and along major routes. The system computes journey times and traffic flows between more than 20,000 origin-destination pairs every 15 minutes to support network-wide traffic management | Real-time location intelligence lets TfL monitor congestion patterns, adjust signals and routing strategies, and coordinate multi-agency responses | Shared, map-based situational awareness enables teams to see who is closest to an incident and avoid duplicated responses | The result is smoother traffic flow, faster interventions, and better use of limited transport capacity across London |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The LBS and RTLS ecosystem includes four groups that work together to provide scalable location solutions. Cisco, IBM, Oracle, TomTom, Ericsson, and Zebra Technologies serve as solution providers, integrating software, analytics, and systems for specific use cases. Hardware vendors like Qualcomm, Cisco, Ericsson, and Zebra Technologies supply radios, tags, and certified modules. Platform providers, including Qualcomm, Esri, Alphabet, and Ubisense, offer maps, developer APIs, and spatial analytics. Standard-setting bodies like 3GPP, ISO, FCC, and ITU oversee spectrum, interoperability, and safety. Together, these groups promote product development, certification, and enterprise adoption in various industries.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

LBS and RTLS Market, by Offering

Services dominate the market because businesses are increasingly leaning toward operational support and managed offerings rather than one-time hardware purchases. After the initial setup, organizations need help with installation, system configuration, customization, and continuous platform maintenance. These tasks offer predictable recurring revenue through service contracts and cloud subscriptions. Managed and professional services lower upfront capital costs and shift expenses into operational budgets, increasing purchasing flexibility. The complexity of multi-vendor settings and the need to connect hardware, software, and analysis layers raise demand for systems integration, training, and ongoing support. As a result, service offerings capture a larger share of total market value and remain crucial in customer decision-making.

LBS and RTLS Market, by Location Type

The indoor location segment is the fastest-growing because satellite-based positioning is ineffective indoors, and demand for indoor use cases is expanding rapidly. Warehouses, hospitals, and retail complexes require precise indoor tracking for asset management, staff safety, and customer wayfinding. Improvements in ultra-wideband, Bluetooth low energy, and camera-based positioning have increased indoor accuracy and lowered deployment overhead. Investments in private wireless networks, indoor mapping tools, and edge computing further support scalable implementations. As organizations pursue automation, robotics, and process optimization within buildings, indoor location solutions become essential to achieving operational goals.

LBS and RTLS Market, by Application

Tracking & navigation is the largest application because it addresses core operational and consumer needs across logistics, retail, and public services. Real-time tracking shortens the time spent locating equipment and personnel, improves asset utilization, and reduces idle time, resulting in measurable cost savings. Navigation features improve customer experience by simplifying wayfinding in complex venues and support accessibility services for visually impaired and elderly users. The combined application set also enables analytics for route optimization, fleet management, and demand forecasting. Because these functions directly improve throughput and customer satisfaction, they consistently attract the largest share of deployments and investment.

LBS and RTLS Market, by Technology

Bluetooth low energy is the largest enabling technology because it balances cost, power efficiency, and broad device compatibility for many deployments. BLE tags and beacons are inexpensive to produce and can connect easily to existing Wi-Fi and cellular infrastructure, reducing incremental capital requirements. The technology supports low-power operation, extending tag battery life and reducing ongoing maintenance for large tag populations. A broad ecosystem of chipset vendors, module manufacturers, and developer tools shortens development cycles and encourages third-party integrations. These practical advantages make BLE the default choice for many large-scale LBS and RTLS projects.

LBS and RTLS Market, by Vertical

Healthcare and life sciences are rapidly expanding sectors driven by increasing demand for patient safety, asset visibility, and workflow efficiency across various care settings and clinical operations. Hospitals utilize Real-Time Location Systems (RTLS) to quickly locate critical devices, expedite patient transfers, and improve bed management. Regulatory requirements focused on infection control, traceability, and medication handling are encouraging investment in location-enabled systems. Additionally, clinical research and pharmaceutical manufacturing rely on tracking to manage trial logistics and maintain cold chain integrity. The need for staff safety, lone worker monitoring, and contact tracing further broadens the range of applications. Together, these factors contribute to higher adoption rates and accelerated growth in this sector.

REGION

Asia Pacific is expected to be fastest-growing region in the LBS and RTLS market during forecast period

The Asia Pacific region is growing the fastest for several reasons. Rapid urbanization, the expansion of manufacturing and logistics hubs, and targeted investments in digital infrastructure are driving significant demand for location-based services. Governments and cities are prioritizing smart city initiatives and healthcare modernization, resulting in repeatable, multi-site projects well-suited for LBS and RTLS deployments. High smartphone penetration, competitive pricing for sensors, and a developing local vendor ecosystem are making these solutions more accessible. Regional telecom carriers and cloud providers offer managed platforms and local support, reducing integration risks and speeding deployments across multiple countries. These combined factors contribute to a higher compound annual growth rate for the region.

LOCATION-BASED SERVICES (LBS) AND REAL-TIME LOCATION SYSTEMS (RTLS) MARKET: COMPANY EVALUATION MATRIX

In the LBS and RTLS market, Cisco (Star Player) maintains a commanding position, supported by its comprehensive product portfolio, embedding location intelligence into its widely deployed enterprise networks, enabling scalable deployments, strong partner ecosystems, and seamless integration with existing IT infrastructure. ESRI (Emerging Leader) is gaining momentum by integrating real time location data with GIS analytics and digital mapping platforms, enabling spatial intelligence, decision support and visualization across enterprise and public sector use cases.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Cisco (US)

- Google (US)

- IBM (US)

- Microsoft (US)

- Oracle (US)

- Ericsson (Sweden)

- Qualcomm (US)

- TomTom (Netherlands)

- Zebra Technologies (US)

- ESRI (US)

- Teldio (Canada)

- HERE Technologies (Netherlands)

- Ubisense (UK)

- Apple (US)

- Securitas Healthcare (US)

- GE HealthCare (US)

- CenTrak (US)

- Identec Solutions (Austria)

- Infor (US)

- TeleTracking (US)

- MYSPHERA (Spain)

- HPE Aruba Networking (US)

- KDDI Corporation (Japan)

- NTT DOCOMO (Japan)

- AiRISTA Flow (US)

- Leantegra (Switzerland)

- Sewio (Czech Republic)

- Quuppa (Finland)

- Navigine (US)

- Living Map (UK)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 33.03 Billion |

| Market Forecast in 2030 (Value) | USD 51.24 Billion |

| Growth Rate | CAGR of 8.8% from 2026-2030 |

| Years Considered | 2020–2030 |

| Base Year | 2025 |

| Forecast Period | 2026–2032 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: LOCATION-BASED SERVICES (LBS) AND REAL-TIME LOCATION SYSTEMS (RTLS) MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Multi-site Healthcare Provider |

|

|

| Large Retail Chain (Omnichannel) |

|

|

| Smart City Authority |

|

|

RECENT DEVELOPMENTS

- January 2026 : Ericsson launched 5G Advanced location services that integrate positioning into its dual-mode 5G Core to deliver sub-meter accuracy on commercial networks. The offering targets industrial, automotive, and drone use cases and reduces dependence on overlay sensors, enabling operators to offer scalable location-as-a-service for enterprise LBS and RTLS applications.

- January 2025 : TomTom announced a partnership with Esri to integrate TomTom map and traffic data into ArcGIS. The collaboration enhances spatial analytics, routing and traffic insights within Esri workflows, enabling public sector and enterprise customers to combine high-quality map content with GIS tools for improved transportation analysis and LBS decision making.

- March 2025 : Zebra Technologies launched healthcare-focused RTLS, RFID demos, and hands-free clinical badges, emphasizing asset tracking, specimen management, and workflow automation. The demonstrations reinforced Zebra’s market role in healthcare LBS and helped accelerate customer pilots and partner integrations for hospital asset visibility projects.

Table of Contents

Methodology

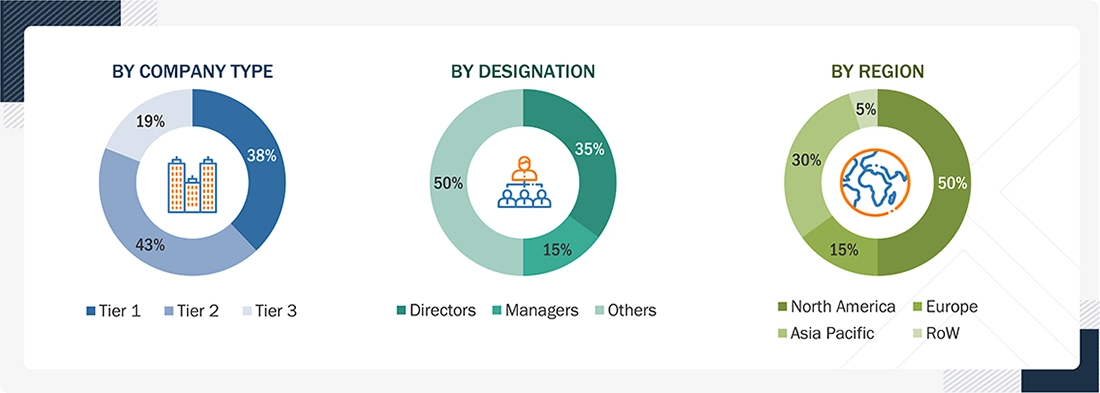

This research study used extensive secondary sources, directories, and databases, including D&B Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for the technical, market-oriented, and commercial study of the LBS and RTLS market. The primary sources were industry experts from core and related industries, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations across all segments of this market's value chain. In-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

In the secondary research process, various sources were consulted to identify and collect information for the study. The secondary sources included annual reports, press releases, company investor presentations, white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and associations, such as the Journal of Telecommunications and Information Technology, and the Journal of Telecommunications and the Digital Economy, were also consulted. Secondary research was used to obtain key information on industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends down to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, interviews were conducted with sources from both the supply and demand sides to gather qualitative and quantitative information for the report. The primary sources on the supply side included industry experts such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and other key executives from leading companies and organizations operating in the LBS and RTLS market. The primary sources on the demand side included LBS and RTLS end users, consultants and specialists, chief information officers (CIOs), and subject-matter experts from enterprises and government associations.

*Others include sales managers, marketing managers, and product managers.

Note: Tier 1 companies have revenues exceeding USD 1 billion, Tier 2 companies have revenues between USD 500 million and 1 billion, and Tier 3 companies have revenues ranging from USD 100 million to USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were used to estimate and forecast the size of the LBS and RTLS market. The first approach estimates market size by summing the revenue generated by companies from the sale of LBS and RTLS solutions.

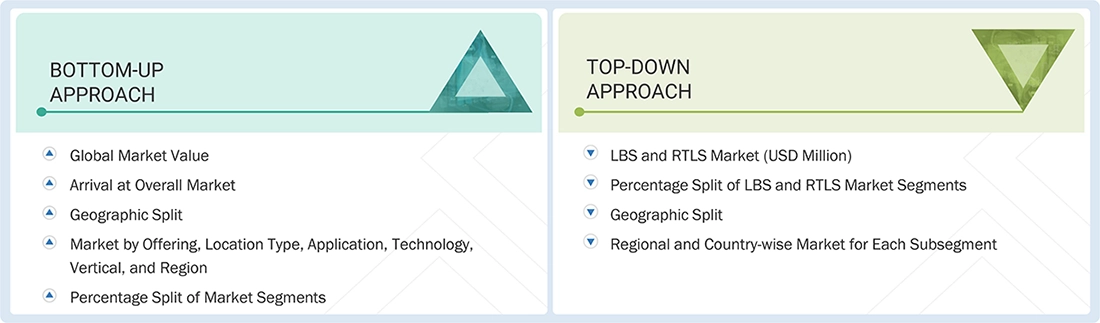

Both top-down and bottom-up approaches were used to estimate and validate the total size of the LBS and RTLS market. These methods were widely used to estimate the sizes of various market segments. The research methodology for estimating the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Location-based Services (LBS) and Real-time Location Systems (RTLS) Market: Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size, the LBS and RTLS market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by analyzing various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated using the top-down and bottom-up approaches.

Market Definition

Location-based Services (LBS) can be defined as an information service provided by a device that delivers and updates information related to the location of the device as and when required. Implementing LBS requires a software application of a service provider, a network, and/or mobile-device-based technology, and a content provider for geo-specific information.

Real-time Location Systems (RTLS) are local positioning and tracking systems that automatically locate and identify objects, people, or targets in real time. RTLS systems are usually used indoors, within buildings, or in other areas. RTLS tags, badges, or sensors attached to objects or worn by people communicate wirelessly with fixed receivers, readers, trackers, exciters, reference points, or access points installed nearby.

Key Stakeholders

- LBS application developers

- LBS and RTLS software/service providers

- Network connectivity providers

- Wireless infrastructure providers

- Mobile content developers and aggregators

- Smart devices and consumer electronics manufacturers

- Venture capitalists, private equity firms, and startups

- Government bodies, such as regulating authorities and policymakers

- LBS and RTLS-related associations, organizations, forums, and alliances

Report Objectives

- To determine and forecast the global LBS and RTLS market based on offering, location type, application, technology, and vertical, from 2026 to 2030, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments concerning five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the LBS and RTLS market

- To analyze each submarket in terms of individual growth trends, prospects, and contributions to the overall LBS and RTLS market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the LBS and RTLS market

- To profile key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape

- To track and analyze competitive developments in the market, such as mergers & acquisitions, product developments, partnerships, collaborations, and research & development (R&D) activities

Customization Options

Based on the given market data, MarketsandMarkets offers customizations tailored to the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Location-based Services (LBS) and Real-time Location Systems (RTLS) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Location-based Services (LBS) and Real-time Location Systems (RTLS) Market