IoT in Smart Cities Market by Offering, Solution (Remote Monitoring, Network Management, and Reporting and Analytics), Service, Application (Smart Transportation, Smart Building, and Smart Utilities) and Region - Global Forecast to 2026

IoT in Smart Cities Market Size, Share, Growth, Report & Analysis

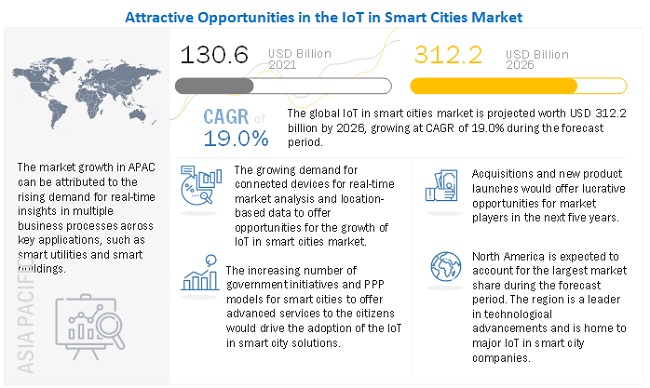

The global IoT in Smart Cities Market size was valued $130.6 billion in 2021 and is anticipated to reach $312.2 billion by 2026. It is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.0% during the forecast period. The base year for estimation is 2020 and the market size available for 2016 to 2026.

Various factors such as increase in adoption of IoT technology for infrastructure management and city monitoring and exponential rise in urban population are expected to drive the adoption of IoT in smart cities solutions and services.

To know about the assumptions considered for the study, Request for Free Sample Report

Innovative IoT-based smart city solutions, which can be effectively coupled with Big Data, analytics, cloud, security, and network connectivity, are witnessing massive demand from various sectors. The adoption of IoT technology in smart city applications, such as smart utilities and smart citizen services, is expected to raise the adoption of IoT in smart cities during the pandemic as regulatory authorities of various countries are majorly focused on monitoring health, safety, and living standards of their citizens. To cater to the need for managing IoT devices across various cities, IoT solutions vendors need to enhance the management capabilities of their platforms.

IoT in Smart Cities Market Growth Dynamics

Driver: Rising adoption of connected and smart technologies in smart cities initiatives

The smart cities environment comprises multiple technologies, such as IoT, cloud, mobility, data communications, and AI, which add to the cities’ infrastructure. The augmented adoption of these technologies in recent years has enabled better connectivity, resulting in the complete remodeling of the smart cities ecosystem. From a technology perspective, there is interest in a range of emerging technologies, with machine learning/data analytics, IoT, and cybersecurity predicted to have the highest impact on smart city projects over the next five years.

The development of 5G Service and NB-IoT technologies is expected to drive the growth of the smart cities market. With advancements in 5G and IoT, the smart government, as well as other sectors, would become highly intelligent and self-governing. Considering smart transportation, the system would collect data from multiple sources and share it with a centralized control center by leveraging the cloud. Such advanced technologies are not only used to enrich the lives of citizens but are also used in other areas, such as security, privacy, and environmental sustainability. For instance, a Mexican city is using AT&T Control Center, an IoT platform, to efficiently manage connected devices in real-time.

Restraint: Privacy and security concerns over the use of IoT

Privacy and security is the primary area of concern for IoT in smart city projects. To solve privacy and security challenges, stakeholders (security professionals and smart city planners) must address issues holistically to ensure the challenges do not continue plaguing the rest of the smart network. IoT would collect much data about personal movements, actions, and purchases.

The technical actions to safeguard privacy include the following:

- Ownership of data and processes

- Access rights and authorization for intercommunication and interoperability

- Ability to neutralize a tag (tag clipping) and context-sensitive tag behavior

There is a need to have a technically suitable solution to guarantee the security and privacy of customers adopting various identification systems. This could be an advanced security mechanism that would add hardware security with key diversification to make attacks significantly impossible. Projects and current cities that simulate a smart network can be used as a point for reference for the same. For instance, the Smart Santander project in Spain is made up of over 2,000 IoT devices for testing solutions and corroborating theories surrounding smart city security and privacy challenges. In January 2020, ZDNet detailed how a hacker published a list of Telnet credentials for 515,000 servers, routers, and IoT devices. In 2021, Mozi, a Mirai-type variant, has been the most active botnet since 2019. As per Security Intelligence and IBM MMS report published on IoT Security issues in April 2021, Japan is the most targeted country, followed by the US.

Opportunity: Increase in smart city initiatives worldwide

The rapid explosion of IoT and smart cities initiatives is enhancing the need for smart security solutions, such as Perimeter Intrusion Detection System (PIDS), to secure boundaries. In addition, there is a high focus on efficient energy management solutions to ensure proper metering and minimize wastage. The transportation infrastructure in smart cities is also inviting the contribution of IoT technology vendors to ensure proper monitoring and control, minimize carbon emissions, and provide better route planning and optimization.

Many countries, nowadays, are investing heavily in technology to upgrade their legacy infrastructure. For example, the Government of India, in 2016, planned to invest USD 7.51 billion for upgrading 100 existing cities across the country into smart cities. Furthermore, in 2016, the US government announced an investment of USD 165 million for smart city solutions. Hence, the initiatives regarding smart cities are expected to help IoT in smart cities market grow. As per an article published by the American Society of Mechanical Engineers in February 2020, the Singapore government has been planning to implement intelligent, energy-efficient lighting for all public roads and have solar panels installed on rooftops of 6,000 buildings by 2022. Norway had announced plans to build a sustainable smart city on 260 acres near Oslo’s airport to develop technology-driven communities.

Challenge: Huge initial investments required for IoT in smart cities

One of the major challenges for the growth of the IoT in smart cities market is project funding for huge initial capital expenditure. It has become the national/local government’s prime responsibility to heavily invest in the transformation process of the city infrastructure. It is easy to understand that even while governments possess the need, vision, and clarity for such transformations, the lack of budgetary allocations for any large-scale implementations hinders the pace of the transformation process, either directly or indirectly. Such heavy investments could also add to the economic burden of debt-ridden governments or local municipal authorities, which adversely affects future general budgets. Government regulatory authorities are forced to monetize these systems and ensure significant RoI before considering new technology deployments, such as IoT. Hence, the cost incurred in transforming the existing infrastructure acts as a deterrent for governments to continue large-scale investments. Though smarter infrastructure helps reduce the operating costs and increase efficiency, the initial costs required pose a major barrier. Smart city projects in cities, such as Amsterdam, Chengdu, and Masdar City, have stood out as exceptions, which have significant government backing for new technology deployment and project funding.

Services segment is expected to account for a higher CAGR during the forecast period

IoT in smart cities market service providers offer various services. IoT in smart city services are segmented into professional services and managed services. These services facilitate smooth implementation, development, and maintenance of ongoing activities in organizations. IoT in Smart city providers assist and support customers, partners, support teams, marketing teams, and employees with individual development and training. Managed services include end-to-end services associated with IoT in smart cities market, which reduce the hassle of managing deployment and performance of the platforms.

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the IoT in smart cities market North America is estimated to capture the largest share of the overall smart city platform market. The US holds a major portion of the market in this region. North America leads the global market in terms of the usage of IoT based smart city solutions and services. The US and Canada have sustainable and well-established economies, which empower them to invest highly in R&D activities, thereby contributing to the development of new technologies. Network operators in this region consistently invest in expanding and upgrading their telecom networks and transitioning toward 5G infrastructure leveraging technologies such as cloud edge computing and network slicing, actuating the adoption of IoT in smart cities for low cost and strategic urban management. Moreover, the startup culture in North America is growing more rapidly as compared to the other regions. The rapid digitalization across diverse verticals, increasing adoption of smart connected devices, and rising technological advancements have further fueled the growth of the market in this region. North America is one of the leading regions in terms of the development of IoT in smart cities market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The IoT in smart cities market companies have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global IoT in smart cities market include IBM (US), Cisco (US), Intel (US), Huawei (China), Microsoft (US), Tech Mahindra (India), Siemens (Germany), Honeywell (US), Bosch (Germany), PTC (US), Schneider Electric (France), ARM (England), Quantela (US), Hitachi (Japan), Sierra Wireless (Canada), Youon (China), SAP (Germany), Deutsche Telekom (Germany), Confidex (Finland), Verizon (US), AGT International (Switzerland), Takadu (Israel), Optibus (Israel), Enevo (US), Signify (Netherlands), FlamencoTech (India), AppyWay (UK). The study includes an in-depth competitive analysis of these key players in the market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2026 |

|

Base year considered |

2021 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By offering, solutions, services, application, and region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

Cisco Systems Inc (Cisco), IBM Corporation (IBM), Huawei Technologies Co.Ltd (Huawei), Intel Corporation (Intel), Microsoft Corporation (Microsoft), Robert Bosch GmbH (Bosch), PTC (PTC), Siemens AG (Siemens), Verizon Communications (Verizon), Honeywell International Inc. (Honeywell), Hitachi Ltd. (Hitachi), Arm Ltd (Arm), Schneider Electric (Schneider), Sierra Wireless (Sierra Wireless), and Quantela (Quantela), Youon Technology Co., Ltd. (Youon), SAP SE (SAP), Deutsche Telekom AG(Deutsche Telekom), Confidex Ltd. (Confidex), AGT Group GmbH (AGT International), Takadu Ltd. (Takadu), Optibus Ltd. (Optibus), Enevo Inc. (Enevo), FlamencoTech Technology Solutions Pvt. Ltd (FlamencoTech), Signify Ltd. (Signify), Tech Mahindra Ltd. (Tech Mahindra), Appyway ( Appyway). |

This research report categorizes the IoT in Smart Cities Market to forecast revenues and analyze trends in each of the following subsegments:

IoT in Smart Cities Market By Offering:

-

Solutions

- Remote Monitoring

- Real-time Location System

- Data Management

- Reporting and analytics

- Security

- Network Management

-

Services

-

Professional Services

- Consulting

- System Integration and Deployment

- Support and Maintenance

- Managed Services

-

Professional Services

IoT in Smart Cities Market By Application:

- Smart Transportation

- Smart Building

- Smart Utilities

-

Smart Citizen Services

- Education

- Healthcare

- Public Safety

IoT in Smart Cities Market By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Singapore

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- Israel

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in IoT in Smart Cities Market:

- In November 2021, Tech Mahindra partnered with TANESCO to drive digital transformation and improve efficiency. The deal would enable TANESCO to support future ready applications, including Geo-Information System, IT Infra/Network, at the same time improving agility and returns on investment through technology-led transformation.

- In October 2021, Siemens Smart Infrastructure acquired French startup, Wattsense, a hardware and software company that offers innovative, plug-and-play IoT management systems for small and mid-size buildings. This would expand Siemens’ building products portfolio.

- In September 2021, HUAWEI parterned with Tatweer Misr. Tatweer Misr, announced plans to launch fully connected smart cities. Both parties merged forces to deliver sustainable and smart technological software solutions throughout Tatweer Misr’s projects to help build a fully connected intelligent world.

- In August 2021, Cisco aquired Epsagon Ltd, Epsagon, a modern observability vendor with leading expertise in distributed tracing solutions for modern application environments and technologies, including containers and serverless environments, provided technology and talent aligned well with Cisco’s vision to enable enterprises to deliver application experiences through industry-leading solutions. By contextualizing and correlating visibility and insights across the full stack, teams could improve collaboration to better understand their systems, solve issues quickly, optimize and secure application experiences and delight their customers.

- In June 2021, IBM acquired Turbonomic to expand AAIOps (the use of AI to automate IT Operations) in application and infrastructure observabilityIn May 2021, Siemens collaborated with Telefónica Tech, this collaboration agreement would enable both companies to present a joint value proposition that included solutions for increasing physical security, monitoring and operational and energy efficiency, as well as user experience and the digitalization of services, where connectivity plays a leading role. Similarly, they would offer an infrastructure that would facilitate data collection and analysis in order to turn data into useful information for making better decisions.

- In June 2021 Cisco acquired Involvio. Involvio offered a suite of education-focused products that would help colleges and universities improve the student experience, engagement, and retention. The Involvio team assisted Cisco in designing Webex Education Connector, an integration that would securely embed Webex collaboration capabilities into learning management systems. As an early adopter of Webex’s open APIs and SDKs, Involvio’s integrations would be among the fastest growing and most used in our ecosystem.

- In March 2021, Hitachi acquired GlobalLogic, the acquisition creates synergies across Hitachi’s five sectors (IT, Energy, Industry, Mobility and Smart Life) and automotive systems business (Hitachi Astemo) by accelerating the advanced digital transformation of social infrastructure such as rail, energy, and healthcare at a global scale.

Frequently Asked Questions (FAQ):

How will shape IoT in Smart Cities Market in next five years?

What is the growth rate (CAGR) of IoT in Smart Cities Market?

What are the key opportunities in the IoT in Smart Cities Market?

Who are the key players in IoT in Smart Cities Market?

Who will be the leading hub for IoT in Smart Cities Market?

What is the IoT in Smart Cities Market Segmentation provided in report?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 INTRODUCTION TO COVID-19

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.2 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.2.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.3 OBJECTIVES OF THE STUDY

1.4 MARKET DEFINITION

1.4.1 INCLUSIONS AND EXCLUSIONS

1.5 MARKET SCOPE

1.5.1 MARKET SEGMENTATION

1.5.2 REGIONAL SCOPE

1.5.3 YEARS CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2020

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

FIGURE 6 IOT IN SMART CITIES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primaries

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN THE MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2 (SUPPLY-SIDE): COLLECTIVE REVENUE OF ALL THE OFFERINGS IN THE Market

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE): IOT IN SMART CITIES MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 STUDY ASSUMPTIONS

2.5.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 63)

FIGURE 10 IOT IN SMART CITIES MARKET, 2019–2026 (USD BILLION)

FIGURE 11 LARGEST SEGMENTS IN THE MARKET SHARE IN 2021

FIGURE 12 MARKET: REGIONAL SNAPSHOT

FIGURE 13 ASIA PACIFIC TO BE THE BEST MARKET TO INVEST BETWEEN 2021 AND 2026

4 PREMIUM INSIGHTS (Page No. - 67)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 14 INCREASING SMART CITY INITIATIVES TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 NORTH AMERICA: MARKET, BY KEY OFFERINGS AND TOP 3 APPLICATIONS

FIGURE 15 SOLUTIONS AND SMART CITIZEN SERVICES SEGMENTS ESTIMATED TO ACCOUNT FOR A LARGER SHARE IN NORTH AMERICA IN 2021

4.3 ASIA PACIFIC: MARKET, BY KEY SERVICES AND TOP 3 SOLUTIONS

FIGURE 16 PROFESSIONAL SERVICES AND REMOTE MONITORING SEGMENTS ESTIMATED TO ACCOUNT FOR A LARGER SHARE IN ASIA PACIFIC IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: IOT IN SMART CITIES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing number of government initiatives and PPP models for smart cities

5.2.1.2 IoT to bring improvements to the communication infrastructure

5.2.1.3 Exponential rise in urban population actuating smart management

FIGURE 18 GLOBAL URBAN POPULATION GROWTH, 2016–2020

5.2.1.4 Rising adoption of connected and smart technologies in smart cities initiatives

FIGURE 19 EMERGING TECHNOLOGY ADOPTION IN DIGITAL TRANSFORMATION, 2020

5.2.2 RESTRAINTS

5.2.2.1 Privacy and security concerns over the use of IoT

5.2.2.2 Lack of advancements in communication technology and poor operational efficiency in developing economies

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in smart city initiatives worldwide

5.2.3.2 Increase in connected devices to drive the growth of IoT

5.2.3.2.1 Smart meters

5.2.3.2.2 Smart appliances

5.2.3.3 Emerging 5G technology to help IoT adoption, globally

5.2.3.4 Drones for the enforcement of compliance

5.2.4 CHALLENGES

5.2.4.1 Lack of knowledge among the people about IoT and smart cities

5.2.4.2 Huge initial investments required for IoT in smart cities

5.2.4.3 Disruption in logistics and supply chain

5.3 INDUSTRY TRENDS

5.3.1 USE CASES

5.3.1.1 Use case 1: CISCO: Wi-Fi paves the way for an IoT platform to make the government more efficient

5.3.1.2 Use case 2: MS Technologies: IoT-Based detection solutions for a safer world

5.3.1.3 Use case 3: IBM: Building citizen-focused public services in Jakarta

5.3.1.4 Use case 4: HUAWEI: Building smart city network (inspired by the nervous system) in Rivas-Vaciamadrid, Spain

5.3.1.5 Use case 5: IoTZA: Powering IoT-enabled smart building innovations

5.3.1.6 Use case 6: Hitachi: Curtin University adopted Hitachi IoT solution to implement a smart campus

5.3.2 ECOSYSTEM ANALYSIS

5.3.2.1 Smart transportation

FIGURE 20 IOT IN SMART CITIES MARKET: SMART TRANSPORTATION ECOSYSTEM ANALYSIS

5.3.2.2 Smart buildings

FIGURE 21 MARKET: SMART BUILDINGS ECOSYSTEM ANALYSIS

5.3.2.3 Smart utilities

FIGURE 22 MARKET: SMART UTILITY ECOSYSTEM ANALYSIS

5.3.2.4 Smart citizen services

FIGURE 23 MARKET: SMART CITIZEN SERVICES ECOSYSTEM ANALYSIS

TABLE 4 MARKET: ECOSYSTEM

5.3.3 SUPPLY CHAIN ANALYSIS

FIGURE 24 MARKET: SUPPLY CHAIN ANALYSIS

5.3.4 PATENT ANALYSIS

5.3.4.1 Methodology

5.3.4.2 Document types of patents

TABLE 5 PATENTS FILED, 2018–2021

5.3.4.3 Innovation and patent applications

FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2018–2021

5.3.4.3.1 Top applicants

FIGURE 26 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

TABLE 6 US: TOP TEN PATENT OWNERS IN THE MARKET, 2018–2021

5.3.5 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN THE MARKET

FIGURE 27 IOT IN SMART CITIES MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3.6 AVERAGE SELLING PRICE TRENDS

TABLE 7 PRICING ANALYSIS

5.3.7 TECHNOLOGY TRENDS

5.3.7.1 Introduction

5.3.7.2 Artificial intelligence and machine learning

5.3.7.3 Internet of Things

5.3.7.4 Big data analytics

5.3.7.5 5G Network

5.3.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES MODEL

5.3.8.1 Threat of new entrants

5.3.8.2 Threat of substitutes

5.3.8.3 Bargaining power of buyers

5.3.8.4 Bargaining power of suppliers

5.3.8.5 Competitive rivalry

5.3.9 REGULATORY IMPACT

5.4 COVID-19 MARKET OUTLOOK FOR IOT IN SMART CITIES NETWORKS

TABLE 9 MARKET: ANALYSIS OF DRIVERS AND OPPORTUNITIES IN COVID-19 ERA

TABLE 10 MARKET: ANALYSIS OF CHALLENGES AND RESTRAINTS IN THE COVID-19 ERA

5.4.1 CUMULATIVE GROWTH ANALYSIS

TABLE 11 MARKET: CUMULATIVE GROWTH ANALYSIS

6 IOT IN SMART CITIES MARKET, BY OFFERING (Page No. - 93)

6.1 INTRODUCTION

6.1.1 OFFERINGS: COVID-19 IMPACT

FIGURE 28 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 MARKET SIZE, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 13 IOT IN SMART CITES MARKET SIZE, BY OFFERING, 2021–2026 (USD BILLION)

6.2 SOLUTIONS

TABLE 14 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 15 SOLUTIONS: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

6.3 SERVICES

TABLE 16 SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 17 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

7 IOT IN SMART CITIES MARKET, BY SOLUTION (Page No. - 98)

7.1 INTRODUCTION

7.1.1 RAPID DIGITALIZATION AND URBANIZATION INCREASING THE DEMAND FOR IOT SOLUTIONS

FIGURE 29 REPORTING AND ANALYTICS SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 18 MARKET SIZE, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 19 MARKET SIZE, BY SOLUTION, 2021–2026 (USD BILLION)

7.2 REMOTE MONITORING

7.2.1 COVID-19 FORCING ORGANIZATIONS TO ADOPT A REMOTE WORKING MODEL, THUS INCREASING THE DEMAND FOR IOT SOLUTIONS

7.2.2 REMOTE MONITORING: MARKET DRIVERS

TABLE 20 REMOTE MONITORING: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 21 REMOTE MONITORING: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

7.2.3 REAL-TIME LOCATION SYSTEM

7.2.3.1 Real-time location-based analysis, visualization, and real-time tracking of equipment and people leading to an increase in real-time location IoT solutions

7.2.4 REAL-TIME LOCATION SYSTEM: MARKET DRIVERS

TABLE 22 REAL-TIME LOCATION SYSTEM: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 23 REAL-TIME LOCATION SYSTEM: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

7.2.5 NETWORK MANAGEMENT

7.2.5.1 Network management solution providing a common platform to manage the entire network of an organization

7.2.6 NETWORK MANAGEMENT: MARKET DRIVERS

TABLE 24 NETWORK MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 25 NETWORK MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

7.2.7 SECURITY

7.2.7.1 IoT devices such as sensors and cameras helping security teams work remotely and detect unwanted intruders

7.2.8 SECURITY: IOT IN SMART CITIES MARKET DRIVERS

TABLE 26 SECURITY: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 27 SECURITY: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

7.2.9 DATA MANAGEMENT

7.2.9.1 IoT data management solutions providing a standardized platform for storing, processing, and managing data analysis

7.2.10 DATA MANAGEMENT: MARKET DRIVERS

TABLE 28 DATA MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 29 DATA MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

7.2.11 REPORTING AND ANALYTICS

7.2.11.1 IoT reporting and analytics solutions enabling existing IoT device data to create immersive, dynamic, and personalized analysis

7.2.12 REPORTING AND ANALYTICS: MARKET DRIVERS

TABLE 30 REPORTING AND ANALYTICS: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 31 REPORTING AND ANALYTICS: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

8 IOT IN SMART CITIES MARKET, BY SERVICE (Page No. - 109)

8.1 INTRODUCTION

8.1.1 SERVICES: MARKET DRIVERS

8.1.2 SERVICES: COVID-19 IMPACT

FIGURE 30 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 32 SERVICES: MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 33 SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

8.2 PROFESSIONAL SERVICES

TABLE 34 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 35 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

TABLE 36 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 37 PROFESSIONAL SERVICES: IOT IN SMART MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

8.2.1 CONSULTING

8.2.1.1 Growing need for implementing IoT-enabled services expected to drive the growth of consulting services

TABLE 38 CONSULTING: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 39 CONSULTING: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

8.2.2 DEPLOYMENT AND SYSTEM INTEGRATION

8.2.2.1 Growing demand for integration with existing infrastructure and deployment of IoT devices driving the growth of deployment and system integration services

TABLE 40 DEPLOYMENT AND SYSTEM INTEGRATION: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 41 DEPLOYMENT AND SYSTEM INTEGRATION MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

8.2.3 SUPPORT AND MAINTENANCE

8.2.3.1 Exponential growth in the usage of IoT-enabled devices driving the need for support and maintenance of these devices

TABLE 42 SUPPORT AND MAINTENANCE: IOT IN SMART CITIES MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 43 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

8.2.4 MANAGED SERVICES

8.2.4.1 Rising need to run the entire citizen services smoothly and improve strategic and tactical significance driving the need for managed services

TABLE 44 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 45 MANAGED SERVICES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 IOT IN SMART CITIES MARKET, BY APPLICATION (Page No. - 118)

9.1 INTRODUCTION

9.1.1 APPLICATION: COVID-19 IMPACT

FIGURE 31 SMART TRANSPORTATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 47 MARKET SIZE, BY APPLICATION, 2021–2026 (USD BILLION)

9.2 SMART TRANSPORTATION

9.2.1 RAPID INCREASE IN TRAFFIC CONGESTION TO CREATE A DEMAND FOR IOT IN SMART CITIES SOLUTIONS AND SERVICES ACROSS THE GLOBE

9.2.2 SMART TRANSPORTATION: MARKET DRIVERS

TABLE 48 SMART TRANSPORTATION: IOT IN SMART CITIES MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 49 SMART TRANSPORTATION: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

9.3 SMART BUILDING

9.3.1 INCREASED NEED FOR THE IOT-ENABLED BUILDING MANAGEMENT SYSTEM DRIVING THE GROWTH OF SMART BUILDING SOLUTIONS

9.3.2 SMART BUILDING: MARKET DRIVERS

TABLE 50 SMART BUILDING: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 51 SMART BUILDING: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

9.4 SMART UTILITIES

9.4.1 GROWING DEMAND FOR ENHANCED GRID RELIABILITY AND EFFICIENT OUTAGE RESPONSE DRIVING THE NEED FOR SMART UTILITIES

9.4.2 SMART UTILITIES: MARKET DRIVERS

TABLE 52 SMART UTILITIES: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 53 SMART UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

9.5 SMART CITIZEN SERVICES

9.5.1 GROWING NEED FOR DIGITALIZATION WITH THE HELP OF IOT DEVICES IN THE EDUCATION, HEALTHCARE, AND PUBLIC SAFETY SECTORS

9.5.2 SMART CITIZEN SERVICES: MARKET DRIVERS

TABLE 54 SMART CITIZEN SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 55 SMART CITIZEN SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

TABLE 56 SMART CITIZEN SERVICES: MARKET SIZE, BY TYPE, 2016–2020 (USD BILLION)

TABLE 57 SMART CITIZEN SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD BILLION)

9.5.3 EDUCATION

9.5.3.1 Exponential increase in the use of mobile devices and IoT devices for education across the globe driving the need for smart education

TABLE 58 EDUCATION: IOT IN SMART CITIES MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 59 EDUCATION: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

9.5.4 HEALTHCARE

9.5.4.1 Growing use of IoT in medical records management, remote monitoring, and telemedicine driving the growth of the smart healthcare segment

TABLE 60 HEALTHCARE: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 61 HEALTHCARE: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

9.5.5 PUBLIC SAFETY

9.5.5.1 Growing security concerns due to the increased adoption of IoT devices across the globe

TABLE 62 PUBLIC SAFETY: MARKET SIZE, BY REGION, 2016–2020 (USD BILLION)

TABLE 63 PUBLIC SAFETY: MARKET SIZE, BY REGION, 2021–2026 (USD BILLION)

10 IOT IN SMART CITIES MARKET, BY REGION (Page No. - 131)

10.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 33 SINGAPORE EXPECTED TO ATTAIN THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 64 MARKET, BY REGION, 2016–2020 (USD BILLION)

TABLE 65 MARKET, BY REGION, 2021–2026 (USD BILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

TABLE 66 NORTH AMERICA: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 67 NORTH AMERICA: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 68 NORTH AMERICA: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 69 NORTH AMERICA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 70 NORTH AMERICA: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 71 NORTH AMERICA: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 72 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 73 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 74 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 75 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 76 NORTH AMERICA: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 77 NORTH AMERICA: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

TABLE 78 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD BILLION)

TABLE 79 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

10.2.3 UNITED STATES

10.2.3.1 Technological advancements and digital readiness responsible for the growth

10.2.3.2 US: Regulatory norms

TABLE 80 UNITED STATES: IOT IN SMART CITIES MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 81 UNITED STATES: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 82 UNITED STATES: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 83 UNITED STATES: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 84 UNITED STATES: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 85 UNITED STATES: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 86 UNITED STATES: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 87 UNITED STATES: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 88 UNITED STATES: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 89 UNITED STATES: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 90 UNITED STATES: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 91 UNITED STATES: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.2.4 CANADA

10.2.4.1 Initiatives for cybersecurity and increasing incidences of cybercrimes and cyber threats

10.2.4.2 Canada: Regulatory norms

TABLE 92 CANADA: IOT IN SMART CITIES MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 93 CANADA: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 94 CANADA: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 95 CANADA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 96 CANADA: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 97 CANADA: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 98 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 99 CANADA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 100 CANADA: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 101 CANADA: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 102 CANADA: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 103 CANADA: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.3 EUROPE

10.3.1 EUROPE: IOT IN SMART CITIES MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 104 EUROPE: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 105 EUROPE: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 106 EUROPE: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 107 EUROPE: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 108 EUROPE: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 109 EUROPE: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 110 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 111 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 112 EUROPE: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 113 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 114 EUROPE: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 115 EUROPE: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

TABLE 116 EUROPE: MARKET, BY COUNTRY, 2016–2020 (USD BILLION)

TABLE 117 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

10.3.3 UNITED KINGDOM

10.3.3.1 Skilled and knowledgeable administration and smart city initiatives by the government

10.3.3.2 UK: Regulatory norms

TABLE 118 UNITED KINGDOM: IOT IN SMART CITIES MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 119 UNITED KINGDOM: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 120 UNITED KINGDOM: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 121 UNITED KINGDOM: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 122 UNITED KINGDOM: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 123 UNITED KINGDOM: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 124 UNITED KINGDOM: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 125 UNITED KINGDOM: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 126 UNITED KINGDOM: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 127 UNITED KINGDOM: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 128 UNITED KINGDOM: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 129 UNITED KINGDOM: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.3.4 GERMANY

10.3.4.1 Government initiatives for the development of smart cities

10.3.4.2 Germany: Regulatory norms

TABLE 130 GERMANY: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 131 GERMANY: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 132 GERMANY: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 133 GERMANY: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 134 GERMANY: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 135 GERMANY: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 136 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 137 GERMANY: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 138 GERMANY: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 139 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 140 GERMANY: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 141 GERMANY: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.3.5 FRANCE

10.3.5.1 High usability of smart devices driving the growth of IoT in smart cities

10.3.5.2 France: Regulatory norms

TABLE 142 FRANCE: IOT IN SMART CITIES MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 143 FRANCE: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 144 FRANCE: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 145 FRANCE: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 146 FRANCE: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 147 FRANCE: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 148 FRANCE: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 149 FRANCE: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 150 FRANCE: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 151 FRANCE: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 152 FRANCE: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 153 FRANCE: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.3.6 REST OF EUROPE

TABLE 154 REST OF EUROPE: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 155 REST OF EUROPE: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 156 REST OF EUROPE: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 157 REST OF EUROPE: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 158 REST OF EUROPE: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 159 REST OF EUROPE: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 160 REST OF EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 161 REST OF EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 162 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 163 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 164 REST OF EUROPE: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 165 REST OF EUROPE: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: IOT IN SMART CITIES MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 166 ASIA PACIFIC: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 167 ASIA PACIFIC: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 168 ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 169 ASIA PACIFIC: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 170 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 171 ASIA PACIFIC: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 172 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 173 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 174 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 176 ASIA PACIFIC: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 177 ASIA PACIFIC: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

TABLE 178 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD BILLION)

TABLE 179 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

10.4.3 CHINA

10.4.3.1 Growing economy and digital transformation driving market growth

10.4.3.2 China: Regulatory norms

TABLE 180 CHINA: IOT IN SMART CITIES MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 181 CHINA: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 182 CHINA: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 183 CHINA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 184 CHINA: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 185 CHINA: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 186 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 187 CHINA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 188 CHINA: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 189 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 190 CHINA: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 191 CHINA: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.4.4 JAPAN

10.4.4.1 Government initiatives and adoption of emerging technologies driving market growth

10.4.4.2 Japan: Regulatory norms

TABLE 192 JAPAN: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 193 JAPAN: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 194 JAPAN: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 195 JAPAN: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 196 JAPAN: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 197 JAPAN: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 198 JAPAN: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 199 JAPAN: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 200 JAPAN: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 201 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 202 JAPAN: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 203 JAPAN: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.4.5 SINGAPORE

10.4.5.1 Rapid adoption of emerging technologies, such as IoT, AI, and big data driving market growth

10.4.5.2 Singapore: Regulatory norms

TABLE 204 SINGAPORE: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 205 SINGAPORE: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 206 SINGAPORE: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 207 SINGAPORE: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 208 SINGAPORE: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 209 SINGAPORE: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 210 SINGAPORE: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 211 SINGAPORE: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 212 SINGAPORE: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 213 SINGAPORE: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 214 SINGAPORE: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 215 SINGAPORE: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.4.6 REST OF ASIA PACIFIC

10.4.6.1 Increased awareness of the government and increased adoption of emerging technologies

TABLE 216 REST OF ASIA PACIFIC: IOT IN SMART CITIES MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 217 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 218 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 219 REST OF ASIA PACIFIC: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 220 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 221 REST OF ASIA PACIFIC: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 222 REST OF ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 223 REST OF ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 224 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 225 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 226 REST OF ASIA PACIFIC: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 227 REST OF ASIA PACIFIC: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: IOT IN SMART CITIES MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 228 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 229 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 230 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 231 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 232 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 233 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 234 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 235 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 236 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 237 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 238 MIDDLE EAST & AFRICA: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 239 MIDDLE EAST & AFRICA: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

TABLE 240 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2020 (USD BILLION)

TABLE 241 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

10.5.3 KINGDOM OF SAUDI ARABIA (KSA)

10.5.3.1 Adoption of industrial use cases expected to drive the growth of IoT

10.5.3.2 Saudi Arabia: Regulatory norms

10.5.4 ISRAEL

10.5.4.1 Israel: Regulatory norms

10.5.5 REST OF MIDDLE EAST & AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: IOT IN SMART CITIES MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 242 LATIN AMERICA: MARKET, BY OFFERING, 2016–2020 (USD BILLION)

TABLE 243 LATIN AMERICA: MARKET, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 244 LATIN AMERICA: MARKET, BY SOLUTION, 2016–2020 (USD BILLION)

TABLE 245 LATIN AMERICA: MARKET, BY SOLUTION, 2021–2026 (USD BILLION)

TABLE 246 LATIN AMERICA: MARKET, BY SERVICE, 2016–2020 (USD BILLION)

TABLE 247 LATIN AMERICA: MARKET, BY SERVICE, 2021–2026 (USD BILLION)

TABLE 248 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2020 (USD BILLION)

TABLE 249 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2021–2026 (USD BILLION)

TABLE 250 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2020 (USD BILLION)

TABLE 251 LATIN AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 252 LATIN AMERICA: MARKET, BY SMART CITIZEN SERVICE, 2016–2020 (USD BILLION)

TABLE 253 LATIN AMERICA: MARKET, BY SMART CITIZEN SERVICE, 2021–2026 (USD BILLION)

TABLE 254 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD BILLION)

TABLE 255 LATIN AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD BILLION)

10.6.3 BRAZIL

10.6.3.1 Government initiatives and collaborations expected to drive market growth

10.6.3.2 Brazil: Regulatory norms

10.6.4 MEXICO

10.6.4.1 Growing adoption of technologies and the collaborative effort of the government and private sector

10.6.4.2 Mexico: Regulatory norms

10.6.5 REST OF LATIN AMERICA

10.6.5.1 Collaboration of public and private organizations toward sustainability in cities

11 COMPETITIVE LANDSCAPE (Page No. - 203)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES

TABLE 256 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN THE IOT IN SMART CITIES MARKET

11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS

TABLE 257 MARKET: DEGREE OF COMPETITION

11.4 HISTORICAL REVENUE ANALYSIS

FIGURE 36 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2018-2020 (USD BILLION)

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 37 KEY MARKET PLAYERS, COMPANY EVALUATION MATRIX, 2021

TABLE 258 PRODUCT FOOTPRINT WEIGHTAGE

11.6 COMPETITIVE BENCHMARKING

TABLE 259 COMPANY FOOTPRINT

TABLE 260 COMPANY APPLICATION FOOTPRINT

TABLE 261 COMPANY SOLUTION FOOTPRINT

TABLE 262 COMPANY REGION FOOTPRINT

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 38 STARTUP/SME IOT IN SMART CITIES MARKET EVALUATION MATRIX, 2021

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 263 PRODUCT LAUNCHES, JANUARY 2019–DECEMBER 2021

11.8.2 DEALS

TABLE 264 DEALS, JANUARY 2019–DECEMBER 2021

11.8.3 OTHERS

TABLE 265 OTHERS, SEPTEMBER 2019

12 COMPANY PROFILES (Page No. - 215)

(Business Overview, Products Offered, Recent Developments, Response to COVID-19, and MnM View)*

12.1 MAJOR PLAYERS

12.1.1 CISCO

TABLE 266 CISCO: BUSINESS OVERVIEW

FIGURE 39 CISCO: FINANCIAL OVERVIEW

TABLE 267 CISCO: PRODUCTS OFFERED

TABLE 268 CISCO: PRODUCT LAUNCHES

TABLE 269 CISCO: DEALS

12.1.2 IBM

TABLE 270 IBM: BUSINESS OVERVIEW

FIGURE 40 IBM: FINANCIAL OVERVIEW

TABLE 271 IBM: PRODUCTS OFFERED

TABLE 272 IBM: PRODUCT LAUNCHES

TABLE 273 IBM: DEALS

12.1.3 MICROSOFT

TABLE 274 MICROSOFT: BUSINESS OVERVIEW

FIGURE 41 MICROSOFT: FINANCIAL OVERVIEW

TABLE 275 MICROSOFT: PRODUCTS OFFERED

TABLE 276 MICROSOFT: PRODUCT LAUNCHES

TABLE 277 MICROSOFT: DEALS

12.1.4 HUAWEI

TABLE 278 HUAWEI: BUSINESS OVERVIEW

FIGURE 42 HUAWEI: FINANCIAL OVERVIEW

TABLE 279 HUAWEI: PRODUCTS OFFERED

TABLE 280 HUAWEI: PRODUCT LAUNCHES

TABLE 281 HUAWEI: DEALS

12.1.5 INTEL

TABLE 282 INTEL: BUSINESS OVERVIEW

FIGURE 43 INTEL: FINANCIAL OVERVIEW

TABLE 283 INTEL: PRODUCTS OFFERED

TABLE 284 INTEL: PRODUCT LAUNCHES

TABLE 285 INTEL: DEALS

12.1.6 SIEMENS

TABLE 286 SIEMENS: BUSINESS OVERVIEW

FIGURE 44 SIEMENS: FINANCIAL OVERVIEW

TABLE 287 SIEMENS: PRODUCTS OFFERED

TABLE 288 SIEMENS: PRODUCT LAUNCHES

TABLE 289 SIEMENS: DEALS

12.1.7 HITACHI

TABLE 290 HITACHI: BUSINESS OVERVIEW

FIGURE 45 HITACHI: FINANCIAL OVERVIEW

TABLE 291 HITACHI: PRODUCTS OFFERED

TABLE 292 HITACHI: PRODUCT LAUNCHES

TABLE 293 HITACHI: DEALS

TABLE 294 HITACHI: OTHERS

12.1.8 SCHNEIDER ELECTRIC

TABLE 295 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 46 SCHNEIDER ELECTRIC: FINANCIAL OVERVIEW

TABLE 296 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

TABLE 297 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

TABLE 298 SCHNEIDER ELECTRIC: DEALS

12.1.9 TECH MAHINDRA

TABLE 299 TECH MAHINDRA: BUSINESS OVERVIEW

FIGURE 47 TECH MAHINDRA: FINANCIAL OVERVIEW

TABLE 300 TECH MAHINDRA: SERVICES OFFERED

TABLE 301 TECH MAHINDRA: SOLUTIONS OFFERED

TABLE 302 TECH MAHINDRA: DEALS

12.1.10 HONEYWELL

TABLE 303 HONEYWELL: BUSINESS OVERVIEW

FIGURE 48 HONEYWELL: FINANCIAL OVERVIEW

TABLE 304 HONEYWELL: PRODUCTS OFFERED

TABLE 305 HONEYWELL: DEALS

12.1.11 SAP

12.1.12 SIERRA WIRELESS

12.1.13 BOSCH

12.1.14 PTC

12.1.15 SIGNIFY

12.1.16 VERIZON

12.1.17 ARM

12.1.18 DEUTSCHE TELEKOM

12.1.19 YOUON

12.2 STARTUP/SMES PLAYERS

12.2.1 QUANTELA

12.2.2 CONFIDEX

12.2.3 AGT INTERNATIONAL

12.2.4 TAKADU

12.2.5 OPTIBUS

12.2.6 ENEVO

12.2.7 FLAMENCOTECH

12.2.8 APPYWAY

* Business Overview, Products Offered, Recent Developments, Response to COVID-19, and MnM View might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS (Page No. - 276)

13.1 INTRODUCTION

TABLE 306 ADJACENT MARKETS AND FORECASTS

13.2 SMART TRANSPORTATION MARKET – GLOBAL FORECAST TO 2025

13.2.1 MARKET DEFINITION

13.2.2 MARKET OVERVIEW

13.2.3 SMART TRANSPORTATION MARKET, BY COMPONENT

TABLE 307 SMART TRANSPORTATION MARKET SIZE, BY TRANSPORTATION MODE, 2016–2019 (USD MILLION)

TABLE 308 SMART TRANSPORTATION MARKET SIZE, BY TRANSPORTATION MODE, 2019–2025 (USD MILLION)

13.2.4 SMART TRANSPORTATION MARKET, BY ROADWAY

TABLE 309 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN ROADWAYS, 2016–2019 (USD MILLION)

TABLE 310 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN ROADWAYS, 2019–2025 (USD MILLION)

TABLE 311 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN ROADWAYS, 2016–2019 (USD MILLION)

TABLE 312 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN ROADWAYS, 2019–2025 (USD MILLION)

13.2.5 SMART TRANSPORTATION MARKET, BY RAILWAY

TABLE 313 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN RAILWAYS, 2016–2019 (USD MILLION)

TABLE 314 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN RAILWAYS, 2019–2025 (USD MILLION)

TABLE 315 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN RAILWAYS, 2016–2019 (USD MILLION)

TABLE 316 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN RAILWAYS, 2019–2025 (USD MILLION)

13.2.6 SMART TRANSPORTATION MARKET, BY AIRWAY

TABLE 317 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN AIRWAYS, 2016–2019 (USD MILLION)

TABLE 318 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN AIRWAYS, 2019–2025 (USD MILLION)

TABLE 319 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN AIRWAYS, 2016–2019 (USD MILLION)

TABLE 320 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN AIRWAYS, 2019–2025 (USD MILLION)

13.2.7 SMART TRANSPORTATION MARKET, BY MARITIME

TABLE 321 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN MARITIME, 2016–2019 (USD MILLION)

TABLE 322 SMART TRANSPORTATION MARKET SIZE, BY SOLUTION IN MARITIME, 2019–2025 (USD MILLION)

TABLE 323 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN MARITIME, 2016–2019 (USD MILLION)

TABLE 324 SMART TRANSPORTATION MARKET SIZE, BY SERVICE IN MARITIME, 2019–2025 (USD MILLION)

13.2.8 SMART TRANSPORTATION MARKET, BY REGION

TABLE 325 SMART TRANSPORTATION MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 326 SMART TRANSPORTATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

13.3 IOT IN RETAIL MARKET – GLOBAL FORECAST TO 2025

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.3.3 IOT IN RETAIL MARKET, BY REGION

TABLE 327 IOT IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.3.4 IOT IN RETAIL MARKET, BY OFFERING

TABLE 328 IOT IN RETAIL MARKET SIZE, BY OFFERING, 2018–2025 (USD MILLION)

13.3.5 IOT IN RETAIL MARKET, BY SERVICE

TABLE 329 SERVICES: IOT IN RETAIL MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 330 SERVICES: IOT IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 331 PROFESSIONAL SERVICES: IOT IN RETAIL MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 332 PROFESSIONAL SERVICES: IOT IN RETAIL MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

13.3.6 IOT IN RETAIL MARKET, BY APPLICATION

TABLE 333 IOT IN RETAIL MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 334 OPERATIONS MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 335 ASSET MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 336 CUSTOMER EXPERIENCE MANAGEMENT: IOT IN RETAIL MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

13.4 IOT IN HEALTHCARE MARKET – GLOBAL FORECAST TO 2025

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.3 IOT IN HEALTHCARE MARKET, BY COMPONENT

TABLE 337 IOT IN HEALTHCARE MARKET SIZE, BY COMPONENT, 2015–2019 (USD BILLION)

TABLE 338 IOT IN HEALTHCARE MARKET SIZE, BY COMPONENT, 2019–2025 (USD BILLION)

TABLE 339 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2015–2019 (USD BILLION)

TABLE 340 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

TABLE 341 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2015–2019 (USD BILLION)

TABLE 342 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

TABLE 343 SERVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2015–2019 (USD BILLION)

TABLE 344 SERVICES: IOT IN HEALTHCARE MARKET SIZE, BY TYPE, 2019–2025 (USD BILLION)

13.4.4 IOT IN HEALTHCARE MARKET, BY APPLICATION

TABLE 345 IOT IN HEALTHCARE MARKET SIZE, BY APPLICATION, 2015–2019 (USD BILLION)

TABLE 346 IOT IN HEALTHCARE MARKET SIZE, BY APPLICATION, 2019–2025 (USD BILLION)

13.4.5 IOT IN HEALTHCARE MARKET, BY END USER

TABLE 347 IOT IN HEALTHCARE MARKET SIZE, BY END USER, 2015–2019 (USD BILLION)

TABLE 348 IOT IN HEALTHCARE MARKET SIZE, BY END USER, 2019–2025 (USD BILLION)

13.4.6 IOT IN HEALTHCARE MARKET, BY REGION

TABLE 349 IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2015–2019 (USD BILLION)

TABLE 350 IOT IN HEALTHCARE MARKET SIZE, BY REGION, 2019–2025 (USD BILLION)

14 APPENDIX (Page No. - 296)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

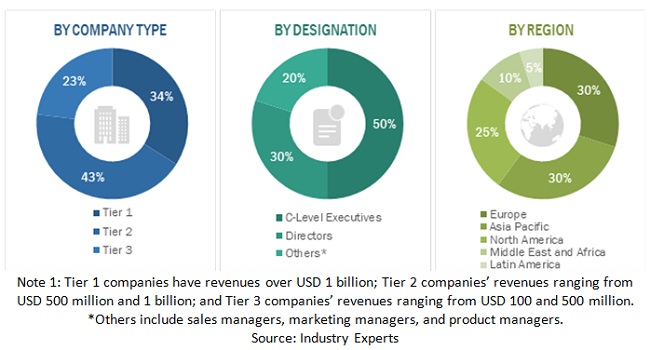

The study involved four major activities in estimating the current size of the IoT in smart cities market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the IoT in smart cities market.

Secondary Research

In the secondary research process, various secondary sources were referred to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation, and key developments in the market. These secondary sources included annual reports, press releases, and investor presentations of companies, white papers, certified publications, and articles from recognized associations and government publishing sources.

Primary Research

Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the IoT in smart cities market. The primary sources from the demand side included IoT in smart cities end users, network administrators/consultants/specialists, Chief Information Officers (CIOs) and subject-matter experts from enterprises and government associations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global IoT in smart cities market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the IoT in smart cities market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (solutions and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

In the bottom-up approach, the key companies offering IoT in smart cities solutions and services were identified. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenue of these companies from Business Units (BUs) that offer IoT in smart cities was identified through similar sources. Then through primaries, the data on revenue generated through specific IoT in smart cities components was collected.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the size of the IoT in smart cities market by offering (solution and services), solutions, services, application, and region during the forecast period.

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To analyze the impact of COVID-19 on the IoT in smart cities market.

- To analyze micro markets with respect to the individual growth trends, prospects, and contributions to the overall IoT in smart cities market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market.

IoT for Sustainable Smart Cities Market & Its impact on IoT in Smart Cities Market

The IoT for sustainable smart cities market and the IoT in smart cities market are closely connected but have different focuses.

IoT in Smart Cities refers to the use of IoT technologies and devices to improve the quality of life for citizens, optimize city operations, and enhance urban services. This includes applications such as smart lighting, traffic management, waste management, air quality monitoring, and more.

IoT for sustainable smart cities focuses specifically on leveraging IoT technologies and solutions to create sustainable and environmentally friendly cities. This includes smart energy management, renewable energy integration, water conservation, waste reduction, and more.

The IoT for sustainable smart cities market is expected to have a significant impact on the IoT in smart cities market, as it represents a key area of growth and innovation in the broader smart cities industry.

One major way in which the IoT for sustainable smart cities market is impacting the IoT in smart cities market is through the development and implementation of sustainable and energy-efficient IoT solutions. This includes the use of IoT devices and sensors to monitor and optimize energy consumption, reduce waste, conserve water, and mitigate the environmental impact of urbanization.

Another major impact is the increased focus on creating more liveable, resilient, and sustainable urban environments, which can be achieved through the deployment of advanced IoT technologies and solutions. This includes the use of IoT-based smart transportation systems to reduce traffic congestion and improve air quality, as well as the integration of renewable energy sources into the grid to reduce greenhouse gas emissions and improve energy security.

Futuristic growth use-cases of IoT for Sustainable Smart Cities Market

- Smart Grids: With the integration of renewable energy sources into the grid, smart grids will become even more intelligent and efficient with IoT sensors and devices that can monitor and optimize energy use, reduce waste, and help cities reach their sustainability targets.

- Waste Management: IoT sensors can be used to monitor waste levels in bins and containers, optimizing collection routes, and minimizing vehicle emissions. This will also help cities to reduce waste and improve recycling rates.

- Smart Lighting: Smart lighting systems can be used to reduce energy consumption and improve safety on streets and roads, with IoT sensors automatically adjusting the lighting levels based on the amount of natural light available, as well as the presence of people or vehicles.

- Water Management: IoT-based water management systems can be used to monitor water usage and detect leaks in real-time, improving water conservation and reducing wastage.

- Environmental Monitoring: IoT sensors can be used to monitor air quality, noise pollution, and other environmental factors, providing real-time data that can be used to manage and mitigate the environmental impact of urbanization.

- Smart Buildings: IoT-based smart building systems can optimize energy use and reduce waste by monitoring and adjusting temperature, lighting, and other factors based on occupancy levels and other data.

Overall, the IoT for sustainable smart cities market is expected to continue to grow as cities seek to become more sustainable and livable, and as IoT technologies and solutions become even more advanced and integrated into urban environments.

Some of the top players in IoT for Sustainable Smart Cities Market are Cisco Systems, Siemens AG, IBM, Schneider Electric, Intel Corporation, Microsoft Corporation, Huawei Technologies, Honeywell International, Johnson Controls International plc, ABB Group.

New Business opportunities in IoT for Sustainable Smart Cities Market:

- Smart Energy Management: With the integration of renewable energy sources and the need to optimize energy usage, there is a growing demand for smart energy management solutions. Companies that can offer innovative solutions in this space, including IoT-based energy management systems and smart grid solutions, are likely to find new business opportunities.

- Environmental Monitoring: Environmental monitoring is becoming increasingly important for cities, as they seek to understand and mitigate the impact of urbanization on the environment. Companies that can offer IoT-based solutions for environmental monitoring, including air quality sensors, water quality sensors, and noise pollution sensors, are likely to find new business opportunities.

- Waste Management: As cities look to reduce waste and improve recycling rates, there is a growing demand for IoT-based waste management solutions. Companies that can offer innovative solutions in this space, including smart waste management systems and waste sorting solutions, are likely to find new business opportunities.

- Smart Lighting: Smart lighting systems are becoming increasingly important for cities, as they seek to reduce energy consumption and improve safety on streets and roads. Companies that can offer innovative solutions in this space, including IoT-based lighting control systems and smart street lighting systems, are likely to find new business opportunities.

- Smart Buildings: Smart building solutions are becoming increasingly popular, as building owners seek to optimize energy usage and reduce waste. Companies that can offer innovative solutions in this space, including IoT-based building automation systems and energy management solutions, are likely to find new business opportunities.

Overall, the IoT for sustainable smart cities market presents many new business opportunities for companies that can offer innovative solutions in key areas such as energy management, environmental monitoring, waste management, smart lighting, and smart buildings.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the European IoT in smart cities market

- Further breakdown of the APAC market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in IoT in Smart Cities Market