Rugged Servers Market by Offering (Hardware, Software & Services), Type (Dedicated, Standard), Memory Size, Application (Military & Aerospace, Telecommunication, Industrial, Energy & Power, Marine) and Region

Updated on : October 22, 2025

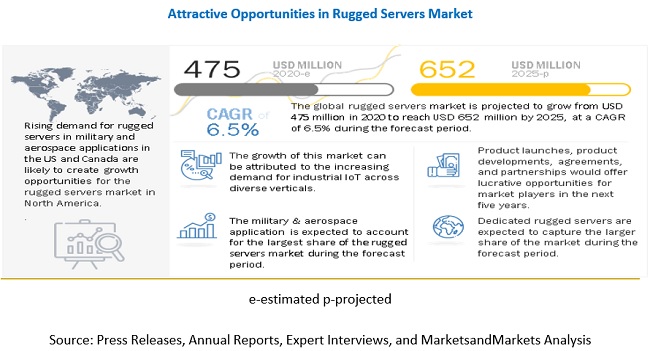

The global rugged servers market size was estimated to be worth USD 475 million in 2020 and is expected to reach USD 652 million by 2025; growing at a CAGR of 6.5% between 2020 to 2025, and expected to grow at a highest CAGR by 2032.

The rugged servers market is experiencing significant growth, driven by increasing demand for reliable and durable computing solutions in harsh environments, such as military, aerospace, manufacturing, and outdoor applications. Rugged servers are specifically designed to withstand extreme temperatures, vibrations, dust, and moisture, making them essential for industries that require continuous operation under challenging conditions. Key trends influencing the market include the rising adoption of Internet of Things (IoT) technology, which necessitates robust data processing at the edge, and the growing need for real-time analytics in remote and mobile operations. Additionally, advancements in rugged computing technology, including enhanced processing power and energy efficiency, are expanding the application scope of rugged servers. The increasing focus on digital transformation and automation in sectors like transportation and logistics further drives demand, as organizations seek reliable solutions to improve operational efficiency and safety. As industries continue to prioritize durability and performance in their computing infrastructure, the rugged servers market is poised for sustained growth.

The growth of the rugged servers market is majorly driven by rising demand for industrial IoT, stringent regulatory requirements across various industries, and growing demand for rugged servers in the military, industrial, and power sectors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the rugged servers market

COVID-19 is an infectious disease caused by the novel coronavirus. Largely unknown before this outbreak across the world, COVID-19 has moved from a regional crisis to a global pandemic in just a matter of a few weeks. The World Health Organization (WHO) declared COVID-19 as a pandemic on March 11, 2020.

COVID-19 has impacted almost all the industries across the world by disrupting supply chains and hindering various industrial operations. Most companies have halted their manufacturing activities or have reduced it to the bare minimum. COVID-19-responsive measures undertaken by governments, such as lockdown and social distancing, led to the closure of manufacturing plants in the initial stage of the pandemic.

With very few industrial operations allowed, the demand for various input products in the industrial sector has declined significantly. The aforementioned factors seem imperative to affect the market for rugged servers as very less new rugged servers market are expected to be used by these industries during the ongoing crisis.

Market Dynamics

Driver: Stringent regulatory requirements across various industries

Several industries, such as military, aerospace, marine, and power, are using rugged servers to increase plant productivity and meet stringent regulations pertaining to product quality and safety. Rugged servers market are well-suited for managing processes across several manufacturing industries; thereby, they help to balance product costs and quality and ensure compliance with regulatory requirements. In process industries, such as food & beverages and pharmaceuticals, certain processes are required to be operated at extreme pressures or temperatures.

However, conventional servers cannot operate efficiently in manufacturing processes under such harsh conditions, and it would be challenging for humans to work in these conditions as well. Thus, several stringent regulations call for the deployment of rugged servers in such situations to ensure safety and security in these industries.

Restraint: Data privacy and security concerns associated with rugged servers deployed at remote locations

The safety and security of data play a vital role in the overall operation of any business. Since rugged servers are used in harsh environments and are majorly deployed in remote locations, automated safety mechanisms are required to counteract the threat of theft, malfunction, accidents, or malicious attacks. Rugged servers, much like any other system, are not fully immune to incidences such as hacking and virus attacks that majorly result in the loss and misuse of valuable information and adversely affect industrial operations by disrupting the overall security mechanism. With increasing digitalization, security has become a major concern for the processing and manufacturing industries. Hence, increasing data privacy and security concerns are expected to restrain the growth of rugged servers market in the coming years.

Opportunity: Steady shift of manufacturing industries towards digitization

Due to the transforming manufacturing landscape, manufacturers worldwide are shifting from traditional manufacturing processes toward digitalized manufacturing methods. In this regard, several manufacturing companies are steadily increasing their R&D investments, adopting emerging technologies in the field of information and communication, and developing innovative products to meet the evolving consumer demands. Increasing use of enabling technologies in manufacturing, rising adoption of industrial robots in the manufacturing sector driven by the development of collaborative robots, and connected enterprise largely support digitization in the manufacturing and processing industries.

In the digitalized manufacturing landscape, rugged servers industry are expected to play an important role in enabling efficient process control and monitoring, as well as effective data transfer. These servers are majorly used for data transfer among devices in industries operating in challenging environments. As a result, the steady shift toward digitalized manufacturing is expected to drive the demand for rugged servers in several end-user industries.

Challenge: High initial costs of rugged servers

Rugged servers aid in the real-time data transfer between client devices to increase the productivity and efficiency of industrial operations. These servers are different from conventional servers as they can operate efficiently in harsh environmental conditions, such as extreme temperature, dust, shocks, and vibrations. Therefore, they are designed and manufactured with advanced components, such as motherboard, hard drive, central processing unit (CPU), hard drives, ports, and random access memory (RAM), which can sustain in such harsh conditions. As a result, the price of a rugged server is higher than a traditional server.

Dedicated segment expected to lead the rugged servers market in 2020

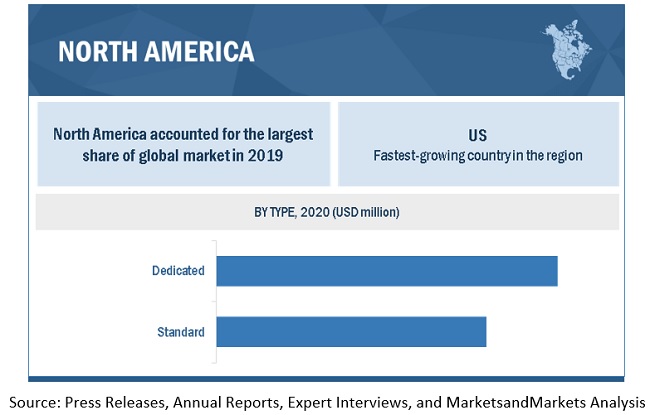

Dedicated rugged servers are expected to account for the larger share of the rugged servers market in 2020. As rugged servers are majorly used in mission-critical applications, military & aerospace, and industrial sectors are the major end users of these servers. These sectors operate under critical temepratures, vibrations, or dusty conditions; hence, access and transfer of data become difficult. Dedicated rugged servers prove to be the most suitable servers for operating in such conditions and are designed and manufactured as per the specific requirements related to these applications.

To know about the assumptions considered for the study, download the pdf brochure

Rugged servers market in North America contributed the largest share in 2019.

Military & aerospace, telecommunication, and power—key end users of rugged servers—are highly established in the North American countries majorly the US and Canada, owing to high-end advancements and research & development activities. Furthermore, the growing demand for improved process flexibility and enhanced efficiency, harmonized production processes for effective supply-chain management, and minimizing the maintenance and operation costs in discrete industries are expected to boost the adoption of rugged servers in industrial applications of the country during the forecast period.

Key Market Players

The rugged servers players have implemented various types of organic as well as inorganic growth strategies, such as product launches, product developments, parnerships, and agreements to strengthen their offerings in the market. The major players in rugged servers companies are Dell Technologies, Mercury Systems, Siemens, Core Systems, and Crystal Group.

The study includes an in-depth competitive analysis of these key players in the rugged servers market with their company profiles, recent developments, and key market strategies.

Rugged Servers Market Report Scope:

|

Report Metric |

Details |

| Estimated Value | USD 475 Million |

| Expected Value | USD 652 Million |

| Growth Rate | CAGR of 6.5% |

|

Years considered |

2016–2025 |

|

On Demand Data Available |

2030 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD million), Volume (Units) |

|

Segments covered |

|

|

Regions covered |

|

| Key Market Driver | Stringent regulatory requirements across various industries |

| Key Market Opportunity | Steady shift of manufacturing industries towards digitization |

| Largest Growing Region | North America |

| Largest Market Share Segment | Dedicated Segment |

|

Companies covered |

Dell Technologies, Mercury Systems, Siemens, Core Systems, Crystal Group, Systel, Symmetrix, and Trenton Systems. A total of 25 players covered. |

In this report, the overall rugged servers market has been segmented based on Offering, Type, Memory Size, Application, and Region

Rugged Servers Market, by Offering

- Hardware

- Software & Services

Rugged Servers Market, by Type

- Dedicated

- Standard

Rugged Servers Market, by Memory Size

- <256 GB

- 256 GB−512 GB

- >512 GB−1 TB

- >1TB

Rugged Servers Market, by Application

- Military and Aerospace

- Telecommunication

- Industrial

- Energy & Power

- Marine

- Others

Geographic Analysis

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, and Rest of Europe)

- Asia Pacific (China, Japan, South Korea, and Rest of APAC)

- Rest of the World (Middle East & Africa and South America)

Recent Developments

- In September 2020, Crystal Group launched RS4105L22 4U GPU server, RS1.532L21X2F twin server, and Crystal Group FORCE RS2606. These servers are particularly designed to offer ultra-high Intelligence, Surveillance, and Reconnaissance (ISR) performance.

- In February 2020, Dell Technologies introduced a new Dell EMC PowerEdge XE2420 server. It is a compact, high-performance, and short-depth server designed to be used in space-constrained and challenging operating conditions.

- In February 2020, Mercury Systems signed an OEM agreement with Hewlett Packard Enterprise (HPE). Under this partnership, Mercury Systems will develop new rugged rackmount servers based on the ProLiant server technology of HPE.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 RUGGED SERVERS MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up approach (demand side)

FIGURE 3 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size by top-down analysis (supply side)

FIGURE 4 MARKET: TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR RUGGED SERVERS MARKET THROUGH SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 7 ASSUMPTIONS OF RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 RUGGED SERVERS MARKET SIZE, 2016–2025

TABLE 1 MARKET, IN TERMS OF VALUE AND VOLUME, 2016–2019

TABLE 2 MARKET, IN TERMS OF VALUE AND VOLUME, 2020–2025

FIGURE 9 MARKET: POST-COVID-19 SCENARIO

3.1 REALISTIC SCENARIO

TABLE 3 MARKET, POST-COVID-19 REALISTIC SCENARIO, 2020–2025

3.2 OPTIMISTIC SCENARIO

TABLE 4 MARKET, POST-COVID-19 OPTIMISTIC SCENARIO, 2020–2025

3.3 PESSIMISTIC SCENARIO

TABLE 5 MARKET, POST-COVID-19 PESSIMISTIC SCENARIO, 2020–2025

FIGURE 10 DEDICATED RUGGED SERVERS TO HOLD LARGER MARKET SIZE IN 2020

FIGURE 11 >1 TB SEGMENT TO CAPTURE LARGEST SHARE OF MARKET IN 2020

FIGURE 12 MILITARY & AEROSPACE APPLICATION TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 13 APAC EXPECTED TO GROW AT HIGHEST CAGR DURING 2020-2025

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 NORTH AMERICA TO PROVIDE LUCRATIVE OPPORTUNITIES FOR MARKET GROWTH IN COMING YEARS

FIGURE 14 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

4.2 RUGGED SERVERS MARKET, BY TYPE (2016–2025)

FIGURE 15 DEDICATED RUGGED SERVERS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

4.3 MARKET, BY OFFERING

FIGURE 16 HARDWARE TO ACCOUNT FOR HIGHER MARKET SHARE IN 2020

4.4 MARKET, BY MEMORY SIZE

FIGURE 17 >1TB SEGMENT TO CONTINUE TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

4.5 MARKET, BY REGION

FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN MARKET DURING 2020–2025

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 RUGGED SERVERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising demand for industrial IoT

5.2.1.2 Stringent regulatory requirements across various industries

5.2.1.3 Growing requirement for rugged servers in military, industrial, and power sectors

FIGURE 20 MARKET: IMPACT ANALYSIS OF DRIVERS AND OPPORTUNITIES

5.2.2 RESTRAINTS

5.2.2.1 Decline in demand due to economic downturn caused by COVID-19 outbreak

5.2.2.2 Data privacy and security concerns associated with rugged servers deployed at remote locations

FIGURE 21 MARKET: IMPACT ANALYSIS OF RESTRAINTS AND CHALLENGES

5.2.3 OPPORTUNITIES

5.2.3.1 Steady shift of manufacturing industries towards digitization

5.2.3.2 Rising demand for smart energy solutions

5.2.4 CHALLENGES

5.2.4.1 High initial costs of rugged servers

5.3 VALUE CHAIN ANALYSIS

FIGURE 22 MARKET: MAJOR VALUE ADDED BY COMPONENT PROVIDERS AND MANUFACTURERS

5.4 ECOSYSTEM

FIGURE 23 SERVERS ECOSYSTEM

TABLE 6 RUGGED SERVERS MARKET: ECOSYSTEM

5.5 PORTER’S 5 FORCES ANALYSIS

TABLE 7 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6 CASE STUDY ANALYSIS

TABLE 8 MARKET ASSESSMENT OF ADVANCED RUGGED SERVERS

TABLE 9 MARKET ASSESSMENT OF RUGGED STORAGE SERVER

5.7 TECHNOLOGY ANALYSIS

5.7.1 IOT

5.7.2 CLOUD COMPUTING

5.7.3 5G

5.8 PRICING ANALYSIS

FIGURE 24 AVERAGE SELLING PRICE (ASP) TREND OF RUGGED SERVERS

5.9 TRADE ANALYSIS

5.9.1 IMPORT SCENARIO

TABLE 10 IMPORT, BY KEY COUNTRY, 2015-2019 (USD BILLION)

5.9.2 EXPORT SCENARIO

TABLE 11 EXPORT, BY KEY COUNTRY, 2015-2019 (USD BILLION)

5.10 PATENT ANALYSIS

TABLE 12 PATENTS IN RUGGED SERVERS MARKET

5.11 MARKET STANDARDS AND REGULATIONS

TABLE 13 MAJOR AMERICAN STANDARDS FOR RUGGED SERVERS

TABLE 14 MAJOR EUROPEAN STANDARDS FOR RUGGED SERVERS

TABLE 15 MAJOR ASIAN STANDARDS FOR RUGGED SERVERS

6 RUGGED SERVERS MARKET, BY OFFERING (Page No. - 60)

6.1 INTRODUCTION

FIGURE 25 MARKET, BY OFFERING

FIGURE 26 HARDWARE SEGMENT TO HOLD LARGER SIZE OF MARKET IN 2020

TABLE 16 MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 17 MARKET, BY OFFERING, 2020–2025 (USD MILLION)

6.2 HARDWARE

6.2.1 HARDWARE COMPONENTS ARE CORE TO RUGGED SERVERS

TABLE 18 MARKET FOR HARDWARE, BY TYPE, 2016-2019 (USD MILLION)

TABLE 19 MARKET FOR HARDWARE, BY TYPE, 2020-2025 (USD MILLION)

TABLE 20 MARKET FOR HARDWARE, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 21 MARKET FOR HARDWARE, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 22 MARKET FOR HARDWARE, BY REGION, 2016-2019 (USD MILLION)

TABLE 23 MARKET FOR HARDWARE, BY REGION, 2020-2025 (USD MILLION)

6.3 SOFTWARE & SERVICES

6.3.1 DATA INTEGRATION AND PROCESSING ARE KEY FUNCTIONS OF SOFTWARE

TABLE 24 MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2016-2019 (USD MILLION)

TABLE 25 MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2020-2025 (USD MILLION)

TABLE 26 MARKET FOR SOFTWARE & SERVICES, BY APPLICATION, 2016-2019 (USD MILLION)

TABLE 27 MARKET FOR SOFTWARE & SERVICES, BY APPLICATION, 2020-2025 (USD MILLION)

TABLE 28 MARKET FOR SOFTWARE & SERVICES, BY REGION, 2016-2019 (USD MILLION)

TABLE 29 MARKET FOR SOFTWARE & SERVICES, BY REGION, 2020-2025 (USD MILLION)

7 RUGGED SERVERS MARKET, BY TYPE (Page No. - 67)

7.1 INTRODUCTION

FIGURE 27 MARKET, BY TYPE

FIGURE 28 MARKET FOR DEDICATED RUGGED SERVERS TO GROW AT HIGHER CAGR FROM 2020 TO 2025

TABLE 30 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 31 MARKET, BY TYPE, 2020–2025 (USD MILLION)

7.2 DEDICATED

7.2.1 DEDICATED RUGGED SERVERS ARE MAINLY PREFERRED IN CRITICAL APPLICATIONS

TABLE 32 DEDICATED RUGGED SERVERS MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 33 DEDICATED MARKET, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 34 DEDICATED MARKET, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 35 DEDICATED MARKET, BY MEMORY SIZE, 2020–2025 (USD MILLION)

TABLE 36 DEDICATED MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 37 DEDICATED MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 38 DEDICATED MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 DEDICATED MARKET, BY REGION, 2020–2025 (USD MILLION)

7.3 STANDARD

7.3.1 STANDARD RUGGED SERVERS ARE PREDOMINANTLY DEPLOYED IN TELECOMMUNICATION APPLICATIONS

TABLE 40 STANDARD RUGGED SERVERS MARKET, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 41 STANDARD MARKET, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 42 STANDARD MARKET, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 43 STANDARD MARKET, BY MEMORY SIZE, 2020–2025 (USD MILLION)

TABLE 44 STANDARD MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 45 STANDARD MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 46 STANDARD MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 STANDARD MARKET, BY REGION, 2020–2025 (USD MILLION)

8 RUGGED SERVERS MARKET, BY MEMORY SIZE (Page No. - 75)

8.1 INTRODUCTION

FIGURE 29 MARKET, BY MEMORY SIZE

FIGURE 30 RUGGED SERVERS OF >1 TB MEMORY SIZE EXPECTED TO CAPTURE LARGEST SIZE OF MARKET IN 2020

TABLE 48 MARKET, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 49 MARKET, BY MEMORY SIZE, 2020–2025 (USD MILLION)

8.2 <256 GB

8.2.1 <256 GB RUGGED SERVERS ARE MAJORLY USED IN APPLICATIONS THAT REQUIRE LOW MEMORY SIZE

TABLE 50 MARKET FOR <256 GB MEMORY SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 51 MARKET FOR <256 GB MEMORY SIZE, BY TYPE, 2020–2025 (USD MILLION)

8.3 256 GB-512 GB

8.3.1 256 GB-512 GB RUGGED SERVERS ARE MAJORLY DEPLOYED IN INDUSTRIAL APPLICATIONS

TABLE 52 MARKET FOR 256 GB-512 GB MEMORY SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 53 MARKET FOR 256 GB-512 GB MEMORY SIZE, BY TYPE, 2020–2025 (USD MILLION)

8.4 >512 GB-1 TB

8.4.1 >512 GB-1 TB RUGGED SERVERS ARE DEPLOYED IN APPLICATIONS WHERE LARGE MEMORY SIZE IS ESSENTIAL

TABLE 54 MARKET FOR >512 GB-1 TB MEMORY SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 55 MARKET FOR >512 GB-1 TB MEMORY SIZE, BY TYPE, 2020–2025 (USD MILLION)

8.5 >1 TB

8.5.1 >1 TB RUGGED SERVERS ARE USED IN CRITICAL MILITARY APPLICATIONS

TABLE 56 MARKET FOR >1 TB MEMORY SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 57 MARKET FOR >1 TB MEMORY SIZE, BY TYPE, 2020–2025 (USD MILLION)

9 RUGGED SERVERS MARKET, BY APPLICATION (Page No. - 81)

9.1 INTRODUCTION

FIGURE 31 MARKET, BY APPLICATION

FIGURE 32 MILITARY & AEROSPACE APPLICATION TO CONTINUE TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 58 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 59 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

9.2 MILITARY & AEROSPACE

9.2.1 MILITARY & AEROSPACE APPLICATIONS CONTRIBUTE MAJORLY TO MARKET

FIGURE 33 DEDICATED RUGGED SERVERS TO DOMINATE MARKET FOR MILITARY & AEROSPACE APPLICATION DURING FORECAST PERIOD

TABLE 60 MARKET FOR MILITARY & AEROSPACE APPLICATION, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 61 MARKET FOR MILITARY & AEROSPACE APPLICATION, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 62 MARKET FOR MILITARY & AEROSPACE APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 63 MARKET FOR MILITARY & AEROSPACE APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 64 MARKET FOR MILITARY & AEROSPACE APPLICATION, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 65 MARKET FOR MILITARY & AEROSPACE APPLICATION, BY MEMORY SIZE, 2020–2025 (USD MILLION)

TABLE 66 MARKET FOR MILITARY & AEROSPACE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 MARKET FOR MILITARY & AEROSPACE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

9.3 INDUSTRIAL

9.3.1 INDUSTRIAL APPLICATION HAS BEEN NEGATIVELY IMPACTED BY COVID-19 TO LARGE EXTENT

TABLE 68 RUGGED SERVERS MARKET FOR INDUSTRIAL APPLICATION, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 69 MARKET FOR INDUSTRIAL APPLICATION, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 70 MARKET FOR INDUSTRIAL APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 71 MARKET FOR INDUSTRIAL APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 72 MARKET FOR INDUSTRIAL APPLICATION, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 73 MARKET FOR INDUSTRIAL APPLICATION, BY MEMORY SIZE, 2020–2025 (USD MILLION)

TABLE 74 MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 75 MARKET FOR INDUSTRIAL APPLICATION, BY REGION, 2020–2025 (USD MILLION)

9.4 TELECOMMUNICATION

9.4.1 ADVENT OF ADVANCED WIRELESS TECHNOLOGIES TO TRIGGER ADOPTION OF RUGGED SERVERS IN TELECOMMUNICATION APPLICATION

FIGURE 34 APAC TO HOLD LARGEST SIZE OF MARKET FOR TELECOMMUNICATION APPLICATION DURING FORECAST PERIOD

TABLE 76 MARKET FOR TELECOMMUNICATION APPLICATION, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 77 MARKET FOR TELECOMMUNICATION APPLICATION, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 78 MARKET FOR TELECOMMUNICATION APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 79 MARKET FOR TELECOMMUNICATION APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 80 MARKET FOR TELECOMMUNICATION APPLICATION, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 81 MARKET FOR TELECOMMUNICATION APPLICATION, BY MEMORY SIZE, 2020–2025 (USD MILLION)

TABLE 82 MARKET FOR TELECOMMUNICATION APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 83 MARKET FOR TELECOMMUNICATION APPLICATION , BY REGION, 2020–2025 (USD MILLION)

9.5 ENERGY & POWER

9.5.1 RENEWABLE ENERGY INFRASTRUCTURE DEVELOPMENT TO FUEL DEMAND FOR RUGGED SERVERS

TABLE 84 MARKET FOR ENERGY & POWER APPLICATION, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 85 MARKET FOR ENERGY & POWER APPLICATION, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 86 MARKET FOR ENERGY & POWER APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 87 MARKET FOR ENERGY & POWER APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 88 MARKET FOR ENERGY & POWER APPLICATION, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 89 MARKET FOR ENERGY & POWER APPLICATION, BY MEMORY SIZE, 2020–2025 (USD MILLION)

TABLE 90 MARKET FOR ENERGY & POWER APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 91 MARKET FOR ENERGY & POWER APPLICATION, BY REGION, 2020–2025 (USD MILLION)

9.6 MARINE

9.6.1 RUGGED SERVERS ARE IDEAL FOR MARINE ENVIRONMENTS OWING TO THEIR RUGGEDNESS

FIGURE 35 HARDWARE SEGMENT TO CONTINUE TO HOLD LARGER SIZE OF MARKET FOR MARINE APPLICATION DURING FORECAST PERIOD

TABLE 92 RUGGED SERVERS MARKET FOR MARINE APPLICATION, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 93 MARKET FOR MARINE APPLICATION, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 94 MARKET FOR MARINE APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 95 MARKET FOR MARINE APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 96 MARKET FOR MARINE APPLICATION, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 97 MARKET FOR MARINE APPLICATION, BY MEMORY SIZE, 2020–2025 (USD MILLION)

TABLE 98 MARKET FOR MARINE APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 99 MARKET FOR MARINE APPLICATION, BY REGION, 2020–2025 (USD MILLION)

9.7 OTHERS

9.7.1 DEMAND FOR RUGGED SERVERS USED IN RAILWAYS IS EXPECTED TO DECLINE OWING TO COVID-19 OUTBREAK

TABLE 100 MARKET FOR OTHER APPLICATIONS, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 101 MARKET FOR OTHER APPLICATIONS, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 102 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2016–2019 (USD MILLION)

TABLE 103 MARKET FOR OTHER APPLICATIONS, BY TYPE, 2020–2025 (USD MILLION)

TABLE 104 MARKET FOR OTHER APPLICATIONS, BY MEMORY SIZE, 2016–2019 (USD MILLION)

TABLE 105 MARKET FOR OTHER APPLICATIONS, BY MEMORY SIZE, 2020–2025 (USD MILLION)

TABLE 106 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 107 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

10 RUGGED SERVERS MARKET, BY REGION (Page No. - 102)

10.1 INTRODUCTION

FIGURE 36 CHINA TO CAPTURE HIGHEST CAGR IN MARKET FROM 2020 TO 2025

TABLE 108 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 109 MARKET, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 37 SNAPSHOT OF MARKET IN NORTH AMERICA

TABLE 110 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 111 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 112 MARKET IN NORTH AMERICA, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 113 MARKET IN NORTH AMERICA, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 114 MARKET IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 115 MARKET IN NORTH AMERICA, BY TYPE, 2020–2025 (USD MILLION)

TABLE 116 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 117 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Market growth in US to be hampered by COVID-19 outbreak

10.2.2 CANADA

10.2.2.1 Growing demand for telecom network services to support market growth in Canada

10.2.3 MEXICO

10.2.3.1 Rising manufacturing activities to favor growth of market in Mexico

10.3 EUROPE

FIGURE 38 SNAPSHOT OF RUGGED SERVERS MARKET IN EUROPE

TABLE 118 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 119 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 120 MARKET IN EUROPE, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 121 MARKET IN EUROPE, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 122 MARKET IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 123 MARKET IN EUROPE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 124 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 125 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Growing focus of manufacturing industries on automation to foster growth of market

10.3.2 UK

10.3.2.1 Shift of manufacturing sector to automated operations unfolding growth avenues for rugged servers

10.3.3 FRANCE

10.3.3.1 Growing demand from aerospace sector to fuel growth of market in France

10.3.4 REST OF EUROPE

10.4 APAC

FIGURE 39 SNAPSHOT OF RUGGED SERVERS MARKET IN APAC

TABLE 126 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 127 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 128 MARKET IN APAC, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 129 MARKET IN APAC, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 130 MARKET IN APAC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 131 MARKET IN APAC, BY TYPE, 2020–2025 (USD MILLION)

TABLE 132 MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 133 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 China is expected to experience plunge in demand for rugged servers due to COVID-19

10.4.2 JAPAN

10.4.2.1 Growing manufacturing sector to support growth of market

10.4.3 SOUTH KOREA

10.4.3.1 Heightened demand from military, aerospace, and industrial applications to foster growth of rugged servers market in South Korea

10.4.4 REST OF APAC

10.5 REST OF THE WORLD (ROW)

TABLE 134 MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 135 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 136 MARKET IN ROW, BY OFFERING, 2016–2019 (USD MILLION)

TABLE 137 MARKET IN ROW, BY OFFERING, 2020–2025 (USD MILLION)

TABLE 138 MARKET IN ROW, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 MARKET IN ROW, BY TYPE, 2020–2025 (USD MILLION)

TABLE 140 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 141 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Industrial applications to propel demand for rugged servers in Middle East & Africa

10.5.2 SOUTH AMERICA

10.5.2.1 Industrial virility in South America to support market growth

11 COMPETITIVE LANDSCAPE (Page No. - 122)

11.1 OVERVIEW

11.2 TOP 3 COMPANY REVENUE ANALYSIS

FIGURE 40 5 YEARS REVENUE ANALYSIS OF TOP 3 PLAYERS IN MARKET

11.3 MARKET SHARE ANALYSIS (2019)

TABLE 142 RUGGED SERVERS MARKET: MARKET SHARE ANALYSIS (2019)

11.4 COMPANY EVALUATION QUADRANT, 2019

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 41 MARKET (GLOBAL) COMPANY EVALUATION QUADRANT, 2019

11.5 MARKET: PRODUCT FOOTPRINT

TABLE 143 COMPANY PRODUCT FOOTPRINT

TABLE 144 COMPANY APPLICATION FOOTPRINT

TABLE 145 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 146 COMPANY REGIONAL FOOTPRINT

11.6 SMALL AND MEDIUM ENTERPRISES (SME) EVALUATION QUADRANT, 2019

11.6.1 PROGRESSIVE COMPANY

11.6.2 RESPONSIVE COMPANY

11.6.3 DYNAMIC COMPANY

11.6.4 STARTING BLOCK

FIGURE 42 RUGGED SERVERS MARKET (GLOBAL),SME EVALUATION QUADRANT, 2019

11.7 COMPETITIVE SCENARIO

TABLE 147 MARKET: PRODUCT LAUNCHES, SEPTEMBER 2019-SEPTEMBER 2020

TABLE 148 MARKET: DEALS, SEPTEMBER 2019-SEPTEMBER 2020

12 COMPANY PROFILES (Page No. - 132)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats, MnM View)*

12.1.1 DELL TECHNOLOGIES

FIGURE 43 DELL TECHNOLOGIES: COMPANY SNAPSHOT

12.1.2 MERCURY SYSTEMS

FIGURE 44 MERCURY SYSTEMS: COMPANY SNAPSHOT

12.1.3 SIEMENS

FIGURE 45 SIEMENS: COMPANY SNAPSHOT

12.1.4 CORE SYSTEMS

TABLE 149 CORE SYSTEMS: BUSINESS OVERVIEW

12.1.5 CRYSTAL GROUP

TABLE 150 CRYSTAL GROUP: BUSINESS OVERVIEW

12.1.6 CP TECHNOLOGIES

TABLE 151 CP TECHNOLOGIES: BUSINESS OVERVIEW

12.1.7 STEALTH

TABLE 152 STEALTH: BUSINESS OVERVIEW

12.1.8 SYMMATRIX

TABLE 153 SYMMATRIX: BUSINESS OVERVIEW

12.1.9 SYSTEL

TABLE 154 SYSTEL: BUSINESS OVERVIEW

12.1.10 TRENTON SYSTEMS

TABLE 155 TRENTON SYSTEMS: BUSINESS OVERVIEW

12.2 OTHER PLAYERS

12.2.1 ACME PORTABLE MACHINES

12.2.2 AMITY TECHNOLOGIES

12.2.3 BELTRONIC IPC

12.2.4 ELMA ELECTRONIC

12.2.5 GENERAL MICRO SYSTEMS

12.2.6 GETAC

12.2.7 KONTRON S&T

12.2.8 MPL

12.2.9 NCS TECHNOLOGIES

12.2.10 ONE STOP SYSTEMS

12.2.11 PORTWELL

12.2.12 SUPERLOGICS

12.2.13 TP GROUP

12.2.14 TRANS PACIFIC TECHNOLOGIES

12.2.15 ZMICRO

*Details on Business Overview, Products Offered, Recent Developments, Key strengths/right to win, Strategic choices made, Weaknesses and competitive threats, MnM View might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKET (Page No. - 163)

13.1 INDUSTRIAL PC MARKET

13.1.1 INTRODUCTION

TABLE 156 KEY POINTS: HDD AND SSD

FIGURE 46 HDD SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2020

TABLE 157 INDUSTRIAL PC MARKET, BY DATA STORAGE, 2017–2025 (USD MILLION)

13.1.2 HDD

13.1.2.1 Adoption of HDD estimated to decline in coming years

TABLE 158 INDUSTRIAL PC MARKET FOR HDD, BY TYPE, 2017–2025 (USD MILLION)

13.1.3 SSD

13.1.3.1 SSD segment to witness higher growth during forecast period

TABLE 159 INDUSTRIAL PC MARKET FOR SSD, BY TYPE, 2017–2025 (USD MILLION)

14 APPENDIX (Page No. - 166)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

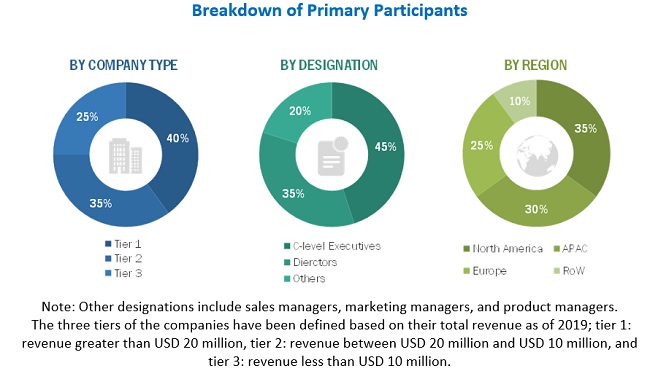

The study involves four major activities for estimating the size of the rugged servers market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the Rugged servers market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size estimations, which have been further validated by primary research.

Primary Research

In the primary research process, a number of primary sources from both supply and demand sides have been interviewed to obtain the qualitative and quantitative information pertaining to this report. Several primary interviews have been conducted with market experts from both demand and supply sides (Rugged servers manufacturers and distributors). This primary data has been collected through questionnaires, emails, and telephonic interviews. Approximately 20% of the primary interviews have been conducted with the demand side and 80% with the supply side. This primary data has been collected mainly through telephonic interviews, which accounted for 80% of the total primary interviews. Additionally, questionnaires and emails were used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the rugged servers market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value and volume, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. To complete the overall market engineering process and arrive at exact statistics for all segments, the market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To define, describe, and forecast the global rugged servers market size, by offering, type, memory size, application, and region, in terms of value

- To forecast the market size, in terms of value, for various segments with regard to 4 main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To study and analyze the influence of COVID-19 on the rugged servers market during the forecast period

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the total market

- To study the complete value chain of the ecosystem for rugged servers, along with market trends and use cases

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global rugged servers market

- To strategically profile key players and comprehensively analyze their core competencies along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as product launches, product developments, agreements, and partnerships, in the global rugged servers market

- To benchmark market players using the company evaluation quadrant, which analyzes players based on various parameters within broad business categories, product strategies, and their market ranks/shares

- To analyze and provide the pricing trend of rugged servers along with import and export trade data, patents related to the product, regulatory landscape of market, and emerging technologies impacting the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Rugged Servers Market