Self-Checkout Systems Market by Offering (Hardware, Software, and Services), Mounting Type (Standalone and Wall Mounted & Countertop), Model Type (Cash Model and Cashless Model), End User, and Geography - Global Forecast to 2022

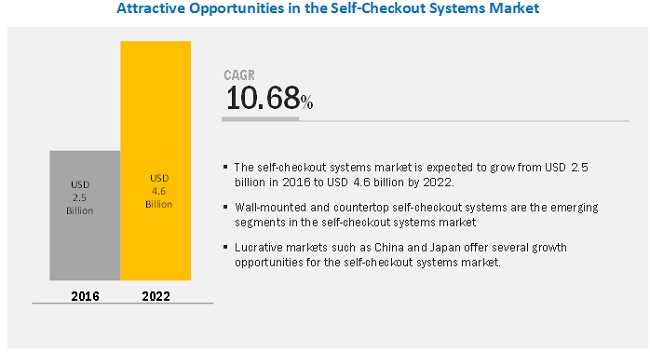

[124 Pages Report] The self-checkout systems market is expected to be valued at USD 2.5 billion in 2016 and is likely to reach USD 4.6 billion by 2022, at a CAGR of 10.68% during the forecast period. The study involved four major activities to estimate the current market size for self-checkout systems. Exhaustive secondary research was done to collect information on market, peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

The self-checkout systems market is expected to be valued at USD 2.5 billion in 2016 and is likely to reach USD 4.6 billion by 2022, at a CAGR of 10.68% during the forecast period. The growth of this market is being propelled by the growing deployment of these systems in various formats of retail stores such as supermarkets, hypermarkets, department stores, and convenience stores. The major reason behind this increase in demand is the ability of these systems to help retailers in reducing the checkout time, providing more personalized services at the store, and reducing the operational cost of the stores.

By model type, cash model type is expected to account for the largest market size during the forecast period

The cash model type dominated the self-checkout systems market because of their high popularity among the retailers and customers, as compared to the cashless model type. Most customers like to have option of making payment through cash or through the card, or both. The cash model type systems give the payment flexibility to the customers, thus increasing the popularity of these systems.

By mounting type, wall-mounted and countertop mounting type is expected to grow at the highest CAGR during the forecast period

The wall-mounted and countertop mounting type self-checkout systems market is expected to witness significant growth during the forecast period. The space required for installing the countertop or wall-mounted systems is usually less than that of stand-alone systems; this has led to the increased demand for the wall-mounted and countertop self-checkout systems from retail stores having space constraints.

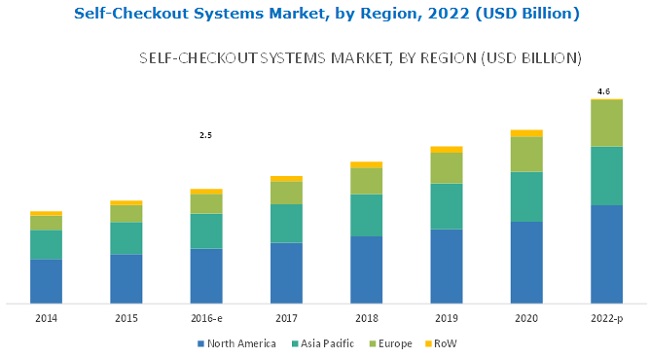

North America is expected to account for the largest market size during the forecast period

North America is expected to account for the largest share of self-checkout systems market during the forecast period. The market in this region is also expected to witness a significant growth between 2016 and 2022. The leading position of North America can be attributed to the high demand for these systems in this region due to the presence of a large number of retail stores such as supermarkets, hypermarkets, department stores, and convenience stores, among others.

Key players in the self-checkout systems market include NCR Corporation (US), Diebold Nixdorf (US), Fujitsu (Japan), Toshiba TEC (Japan), and ITAB ScanFlow (Sweden). NCR Corporation is a well-known name in the global market for self-checkout systems. The company offers a number of products, software, and services related to self-checkout and is further trying to expand its product portfolio with the help of new product launches. To maintain a leading position in the market, NCR focuses on investing a substantial portion of its annual revenues in R&D activities. Apart from strong product portfolio, the company also has a very strong customer base. A range of self-checkout systems offered by the company is one of the most deployed self-checkout systems in the retail industry. PJSC Magnit (Russia), REWE Group (Germany), SPAR International (Netherlands), Ryohin Keikaku (Japan), and X5 Retail Group (Russia) are some of the customers of NCR who have implemented self-checkout systems in their retail stores.

Recent Developments

- In May 2016, NCR expanded its self-checkout solutions product portfolio with the launch of “NCR FastLane SelfServ self-checkout release 6”. This product has an integrated convertible option due to which it can be easily switched from self-checkout mode to cashier-assisted mode.

- In August 2015, Fujitsu launched Fujitsu Impulse, which is an automated assistant self-checkout system designed especially for convenience stores. This system is just 14.84-inch wide and 20.3-inch high, and provides cashless payment option.

- In April 2015, ITAB Scanflow (Sweden) and Toshiba Global Commerce Solutions (US) entered into a global cooperation agreement. Under this agreement, Toshiba would be selling and integrating ITAB’s self-checkout systems in the market in the US as well as in the markets in which ITAB is currently not active.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the emerging application areas of self-checkout systems?

- How advancements in retail industry is influencing the self-checkout systems market?

- Which model type self-checkout system is expected to penetrate significantly in market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Year Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Self-Checkout Systems Expected to Have A Huge Growth Opportunity in APAC

4.2 Self-Checkout Systems, By Mounting Type (2016–2022)

4.3 Self-Checkout Systems, By Region and End User

4.4 Self-Checkout Systems, By Model Type

4.5 Self-Checkout Systems, By Region (2016)

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Self-Checkout Systems, By Offering

5.2.2 Self-Checkout Systems, By Mounting Type

5.2.3 Self-Checkout Systems, By Model Type

5.2.4 Self-Checkout Systems, By End User

5.2.5 Self-Checkout Systems, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Checkout Speed

5.3.1.2 Reduces Operational Cost

5.3.1.3 Caters to the Labor Shortage Issues Across the Developed Countries

5.3.2 Restraints

5.3.2.1 Reluctance to Use Self-Checkout Systems

5.3.2.2 Increased Risk of Loss of Inventory

5.3.3 Opportunities

5.3.3.1 Growing Demand From Retail Stores Such as Convenience Stores and Specialty Stores

5.3.4 Challenges

5.3.4.1 Successful Implementation of Self-Checkout Systems

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Model

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Market, By Offering (Page No. - 47)

7.1 Introduction

7.2 Hardware

7.2.1 Display Devices

7.2.2 Price Readers

7.2.3 Payment-Related Hardware

7.2.4 Weighing Scales

7.2.5 Others

7.3 Software

7.4 Services

8 Market, By Model Type (Page No. - 52)

8.1 Introduction

8.2 Cash Model Type

8.3 Cashless Model Type

9 Market, By Mounting Type (Page No. - 56)

9.1 Introduction

9.2 Stand-Alone Mounting Type

9.3 Wall-Mounted and Countertop Mounting Type

10 Market, By End User (Page No. - 60)

10.1 Introduction

10.2 Supermarkets

10.3 Hypermarkets and DEPArtment Stores

10.4 Convenience Stores

10.5 Others

11 Market, By Geography (Page No. - 64)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 U.K.

11.3.2 Germany

11.3.3 France

11.3.4 Rest of Europe

11.4 Asia-Pacific (APAC)

11.4.1 Japan

11.4.2 China

11.4.3 Australia

11.4.4 Rest of Apac

11.5 Rest of the World (RoW)

11.5.1 South America

11.5.2 Middle East and Africa

12 Competitive Landscape (Page No. - 86)

12.1 Overview

12.2 Market Ranking Analysis: Market

12.3 Competitive Situation

12.3.1 New Product Launches and Developments

12.3.2 Partnerships, Agreements, and Collaborations

12.3.3 Acquisitions, Contracts, and Joint Ventures

13 Company Profiles (Page No. - 92)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

13.2 NCR Corporation

13.3 Diebold Nixdorf, Inc.

13.4 Fujitsu Limited

13.5 Toshiba Tec Corporation

13.6 ITAB Scanflow AB

13.7 ECR Software Corporation

13.8 Pan-Oston Co.

13.9 IER

13.10 Computer Hardware Design, Ltd.

13.11 PCMS Group PLC

13.12 Slabb Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 116)

14.1 Insights of Industry Experts

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (35 Tables)

Table 1 Self-Checkout Systems Market in Terms of Value and Volume, 2013–2022

Table 2 Self-Checkout Systems, By Offering, 2013–2022 (USD Million)

Table 3 Self-Checkout Systems, By Model Type, 2013–2022 (USD Million)

Table 4 Self-Checkout Systems for Cash Model Type, By Region, 2013–2022 (USD Million)

Table 5 Self-Checkout Systems for Cashless Model Type, By Region, 2013–2022 (USD Million)

Table 6 Self-Checkout Systems, By Mounting Type, 2013–2022 (USD Million)

Table 7 Self-Checkout Systems, By End User, 2013–2022 (USD Million)

Table 8 Self-Checkout Systems, By Region, 2013–2022 (USD Million)

Table 9 Market in North America, By Country, 2013–2022 (USD Million)

Table 10 Self-Checkout Systems in North America, By End User, 2013–2022 (USD Million)

Table 11 Self-Checkout Systems in North America, By Model Type, 2013–2022 (USD Million)

Table 12 Self-Checkout Systems in the U.S., By End User, 2013–2022 (USD Million)

Table 13 Self-Checkout Systems in Canada, By End User, 2013–2022 (USD Million)

Table 14 Self-Checkout Systems in Mexico, By End User, 2013–2022 (USD Million)

Table 15 Self-Checkout Systems in Europe, By Country, 2013–2022 (USD Million)

Table 16 Self-Checkout Systems in Europe, By End User, 2013–2022 (USD Million)

Table 17 Self-Checkout Systems in Europe, By Model Type, 2013–2022 (USD Million)

Table 18 Self-Checkout Systems in the U.K., By End User, 2013–2022 (USD Million)

Table 19 Self-Checkout Systems in Germany, By End User, 2013–2022 (USD Million)

Table 20 Self-Checkout Systems in France, By End User, 2013–2022 (USD Million)

Table 21 Self-Checkout Systems in Rest of Europe, By End User, 2013–2022 (USD Million)

Table 22 Self-Checkout Systems in Apac, By Country, 2013–2022 (USD Million)

Table 23 Self-Checkout Systems in Apac, By End User, 2013–2022 (USD Million)

Table 24 Self-Checkout Systems in Apac, By Model Type, 2013–2022 (USD Million)

Table 25 Self-Checkout Systems in Japan, By End User, 2013–2022 (USD Million)

Table 26 Self-Checkout Systems in China, By End User, 2013–2022 (USD Million)

Table 27 Self-Checkout Systems in Australia, By End User, 2013–2022 (USD Million)

Table 28 Self-Checkout Systems in Rest of Apac, By End User, 2013–2022 (USD Million)

Table 29 Self-Checkout Systems in RoW, By Region, 2013–2022 (USD Million)

Table 30 Self-Checkout Systems in South America, By End User, 2013–2022 (USD Million)

Table 31 Self-Checkout Systems in Middle East and Africa, By End User, 2013–2022 (USD Million)

Table 32 Ranking Analysis: Self-Checkout Systems Market

Table 33 New Product Launches and Developments, 2014–2016

Table 34 Partnerships, Agreements, and Collaborations, 2014–2016

Table 35 Acquisitions, Contracts, and Joint Ventures, 2014–2016

List of Figures (48 Figures)

Figure 1 Market Segmentation: Self-Checkout Systems

Figure 2 Self-Checkout Systems : Process Flow of Market Size Estimation

Figure 3 Self-Checkout Systems : Research Design

Figure 4 Bottom-Up Approach for Market Size Estimation: Self-Checkout Systems Market

Figure 5 Top-Down Approach for Market Size Estimation: Self-Checkout Systems

Figure 6 Data Triangulation

Figure 7 Market: Market Size Analysis (2013–2022)

Figure 8 Market for Supermarkets Expected to Dominate During the Forecast Period

Figure 9 North America Accounted for the Largest Share of the Self-Checkout Systems in 2015

Figure 10 Attractive Growth Opportunities in the Self-Checkout Systems Market

Figure 11 Market for Wall-Mounted and Countertop Systems Expected to Grow at A Higher CAGR Between 2016 and 2022

Figure 12 North America Expected to Hold the Largest Share of the Self-Checkout Systems in 2016

Figure 13 Market for Cashless Type Systems Expected to Grow at A Higher Rate During the Forecast Period

Figure 14 U.S. Expected to Hold the Largest Share of Self-Checkout Systems in 2016

Figure 15 Market, By Region

Figure 16 Drivers, Restraints, Opportunities, and Challenges for the Market

Figure 17 Value Chain Analysis: Major Value Addition Takes Place During the Manufacturing and Assembly, and Software Development Phases

Figure 18 Porter’s Five Forces Analysis

Figure 19 Porter’s Analysis: Market

Figure 20 Impact Analysis of Threat of New Entrants

Figure 21 Impact Analysis of Threat of Substitutes

Figure 22 Impact Analysis of Bargaining Power of Suppliers

Figure 23 Impact Analysis of Bargaining Power of Buyers

Figure 24 Impact Analysis of Intensity of Competitive Rivalry

Figure 25 Hardware Offerings Expected to Hold the Largest Size of the Self-Checkout Systems Market During the Forecast Period

Figure 26 Self-Checkout Systems Market, By Model Type

Figure 27 Cash Model Type Expected to Hold A Larger Size of the Self-Checkout Systems During the Forecast Period

Figure 28 Market, By Mounting Type

Figure 29 Stand-Alone Mounting Type Expected to Hold the Largest Size of the Self-Checkout Systems During the Forecast Period

Figure 30 Market, By End User

Figure 31 Market for Convenience Stores Expected to Grow at the Highest Rate During the Forecast Period

Figure 32 Geographic Snapshot (2015): APAC Countries Such as China and Japan Expected to Witness Significant Growth During the Forecast Period

Figure 33 Snapshot of the Self-Checkout Systems in North America: Convenience Stores Expected to Grow at A High Rate Between 2016 and 2022

Figure 34 Snapshot of the Self-Checkout Systems in Europe: Supermarkets Expected to Hold the Largest Size of the Market During the Forecast Period

Figure 35 Snapshot of the Self-Checkout Systems in Apac: Japan Expected to Hold the Largest Size of the Market During the Forecast Period

Figure 36 New Product Launches and Developments as the Key Growth Strategy Adopted By the Company (2014–2016)

Figure 37 Battle for Market Share: New Product Launches and Developments: Key Strategies Adopted By Major Players in the Market

Figure 38 Market Evaluation Framework: New Product Launches and Developments Fueled Innovation and Growth of the Companies Between 2014 and 2016

Figure 39 Geographic Revenue Mix of Top Market Players

Figure 40 NCR Corp.: Company Snapshot

Figure 41 NCR Corp.: SWOT Analysis

Figure 42 Wincor Nixdorf AG: Company Snapshot

Figure 43 Wincor Nixdorf AG: SWOT Analysis

Figure 44 Fujitsu Ltd.: Company Snapshot

Figure 45 Fujitsu Ltd.: SWOT Analysis

Figure 46 Toshiba Tec Corp.: Company Snapshot

Figure 47 Toshiba Tec Corp.: SWOT Analysis

Figure 48 ITAB Scanflow AB: SWOT Analysis

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include retail journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles from recognized authors, directories, and databases such as Factiva, Hoovers, and OneSource.

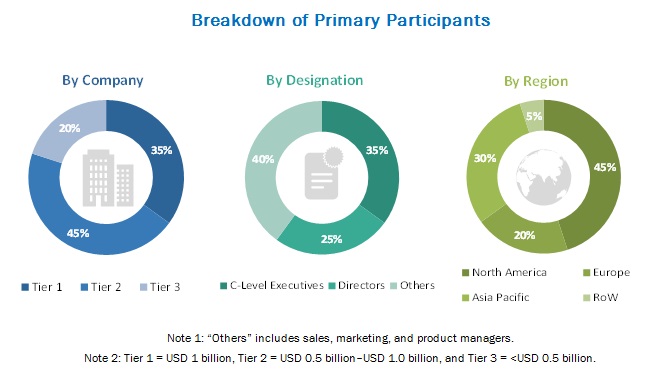

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the self-checkout systems market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information as well as verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the self-checkout systems market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends identified from both demand and supply sides, in retail industry.

Report Objectives

The following are the major objectives of the study.

- To define, describe, and forecast the self-checkout systems market, segmented on the basis of offering, mounting type, model type, end user, and geography

- To define, describe, and forecast the global market in terms of volume

- To forecast the size of the market, in terms of value, and its market segments with respect to four main regions, namely, North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To identify the major market trends and factors driving or inhibiting the growth of the market and its submarkets

- To provide value chain analysis as well as the impact of the Porter’s five forces on the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To strategically profile the key players operating in the self-checkout systems market and comprehensively analyze their market ranking and core competencies

- To analyze the strategic developments such as new product launches, alliances, joint ventures, and mergers and acquisitions in the market

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2013-2022 |

|

Base year considered |

2015 |

|

Forecast period |

2016-2022 |

|

Forecast units |

Value (USD) and Volume (Thousand Units) |

|

Segments covered |

Offering, Model Type, Mounting Type, End User, and Region |

|

Geographies covered |

North America, APAC, Europe and RoW |

|

Companies covered |

NCR Corporation (US), Diebold Nixdorf (US), Fujitsu (Japan), Toshiba TEC (Japan), ITAB ScanFlow (Sweden) |

This research report categorizes the market based on offering, model type, mounting type, end user, and region.

Self-Checkout Systems Market, by Offering

- Hardware

- Software

- Services

Self-Checkout Systems Market, by Model Type

- Cash Model Type

- Cashless Model Type

Self-Checkout Systems Market, by Mounting Type

- Stand-alone Mounting Type

- Wall-mounted and countertop Mounting Type

Self-Checkout Systems Market, by End User

- Supermarkets

- Hypermarkets and Department Stores

- Convenience Stores

- Others

Self-Checkout Systems Market, by Geography

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, and Rest of Europe)

- APAC (Japan, China, Australia, and Rest of APAC)

- RoW (South America, and the Middle East and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Self-Checkout Systems Market