Embedded System Market by Hardware (MPU, MCU, Application-specific Integrated Circuits, DSP, FPGA, and Memories), Software (Middleware, Operating Systems), System Size, Functionality, Application, Region - Global Forecast to 2025

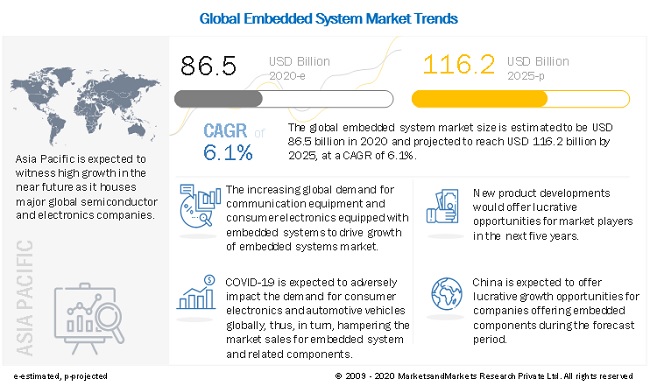

[197 Pages Report] The embedded system market size is expected to reach USD 116.2 billion by 2025 from USD 86.5 billion in 2020, at a CAGR of 6.1% during the forecast period.

Automotive industry segment is expected to grow at highest CAGR in coming years. Key factors fueling the growth of this market include an increase in the number of research and development activities related to embedded systems, rise in demand for advanced driver-assistance systems (ADAS) and electromobility solutions for electric vehicles and hybrid vehicles, increase in demand for portable devices such as wearables, and rise in the use of multicore processors in military applications.

Covid-19 Impact on the Global Embedded System Market

The embedded systems market includes major Tier 1 and 2 manufacturers like Intel Corporation, Texas Instruments, Microchip Technology Inc., Qualcomm Corporation, Renesas Electronics, NXP Semiconductors, STMicroelectronics, Cypress Semiconductor, Marvell Semiconductor, and ON Semiconductor. These companies have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and RoW. The embedded hardware components and software solutions manufactured by these companies are used by consumer device, automotive, aerospace and defense, healthcare, communication, and other industrial manufacturers. COVID-19 not only impacted the operations of the industries offering various embedded component and solutions, but also affected the businesses of the companies using these products and solutions. The low demand for consumer electronic devices due to lockdown had a global impact on the semiconductor market. The continuous fall in the global demand and export shipments for automotive vehicles is also expected to negatively impact the semiconductor market and eventually, slow down the demand for embedded system. The healthcare industry is however, expected to be benefited from the COVID-19 pandemic as the need for ventilator and other advanced medical equipment rises across the world. This is expected to positively impact the embedded systems market as various embedded hardware components are used in the development of advanced ventilators and other medical equipment including medical robots.

Embedded Systems Market Dynamics

Driver: Surge in the demand for ADAS in EV and hybrid vehicles

Embedded systems are playing an important role in the redesigning of the automotive industry. These systems are used in ADAS technology incorporated in the electric and hybrid vehicles. The increase in the demand for electric and hybrid vehicles owing to the growing awareness among masses about the depleting state of environment has led to the growth of the embedded systems market. According to the Bloomberg New Energy Finance report, sales of electric vehicles is estimated to reach 41 million by 2020, thereby leading to a rise in the demand for electronic components including embedded hardware and software used in electric vehicles.

Restraint: Vulnerability of embedded systems to cyber threats and security breaches

One of the major factors that has hampered the growth of the embedded systems market is the security of embedded devices. Embedded devices such as memory contains information which could be critical to military forces, banks, data centers, and healthcare facilities. Thus, it is very critical to protect such devices from cyber threats and security breaches. Irregular security updates, long device lifecycle, remote deployment, and attack replication are some of the factors that make embedded systems vulnerable to cyberattacks. Thus, the vulnerability of embedded systems to cyber threats and security breaches is expected to restrain the growth of the embedded system market.

Opportunity: Advent of 5G and development of 5G based embedded devices

The advent of 5G technology is expected to act as a growth opportunity for the embedded systems market. According to the GSM Association (GSMA), the 5G market is expected to contribute USD 2.2 trillium to the global economy by 2034, comprising 5.3% of the global GDP growth. As a result, the production of embedded devices based on 5G architecture is expected to increase in the future. Embedded devices used in smart camera surveillance system of vehicles deliver fast response rates owing to the integration of 5G in their architecture. Additionally, 5G technology is expected to help tackle the challenges faced during industrial automation and smart farming as it enables fast image processing. Thus, embedded devices supporting 5G infrastructure is expected to fuel the growth of embedded system market.

Challenge: High energy consumption of compact embedded systems

The compactness of embedded system to incorporate various functionalities in them could lead to complexity in their design architectures. This also leads to increased energy consumption in embedded system. High energy consumption often compromises the overall lifecycle of embedded devices. The energy consumption is susceptible to the temperature of embedded device and increases with rise in the temperature of device. This affects the overall performance of the embedded system. Therefore, the high energy consumption of compact embedded systems acts as a severe challenge to the growth of the embedded systems market.

Microcontrollers segment accounted for the largest share of the embedded system market in 2019

In 2019, the microcontrollers segment accounted for the largest share of the embedded system hardware market. The growth of this segment can be attributed to the increased use of microcontrollers in implantable medical devices, automobile engine control systems, microwave ovens, washers and dryers, security systems, office machines, remote controls, power tools, appliances, and toys. The demand for microcontrollers is continuously increasing owing to automation in different industries, adoption of IoT in a number of verticals, rise in the global demand for secured applications, and increase in demand for low energy consumption devices.

Real-time embedded systems segment accounted for a large share of the embedded system market in 2019

The real-time embedded systems segment accounted for a large share of the embedded systems market in 2019. Real-time embedded systems are used in applications that require a high responsiveness rate. Network embedded systems are kind of real-time embedded systems that use LAN, WAN, or the Internet to access the resources and perform given tasks. They can have either wired or wireless connections. The growing incorporation of IoT in various devices, smart environments, and platforms is one of the factors driving the demand for real-time embedded systems. Moreover, ongoing advancements in sensors and actuators used for industrial automation, energy distribution, transportation, telecommunication networks, and healthcare applications are also driving the demand for real-time embedded systems globally.

Among applications, the communication segment accounted for the largest share of the embedded system market in 2019

The communication segment accounted for the largest share of the embedded systems market in 2019. Embedded systems are used in routers, Ethernet devices, wireless infrastructures, and protocol converters for high-speed data transfer to support the expanding communication infrastructures. Embedded hardware such as FPGA and ASIC are being used in various network and telecom applications. Telecom providers often integrate hard IP for interfaces such as peripheral component interconnect (PCI) Express, 100G Ethernet, and DDR3/4 for high-speed data transfer using embedded hardware such as FPGA. Moreover, technologies such as eASIC, which are cost-effective and meet power targets, are increasingly used in radio access network (RAN) equipment.

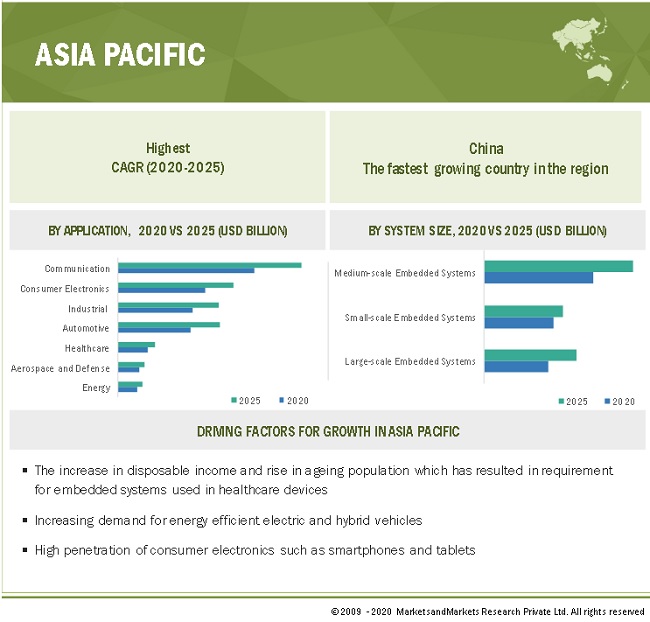

Asia Pacific is the leading embedded systems market, globally, by market share, in 2019

The growing per capita income and ongoing large-scale industrialization and urbanization are factors driving the growth of the embedded systems market in the Asia Pacific (APAC) region. In addition, the availability of low-cost electronic products in APAC is expected to contribute to an increased demand for microprocessors and microcontrollers in the region. The rising use of autonomous robots and embedded vision systems is also projected to lead to an increased demand for embedded system hardware such as microprocessors and controllers for use in industrial applications in APAC.

The recent COVID-19 pandemic is expected to impact the embedded industry. The entire supply chain is disrupted due to limited supply of parts. For instance, the outbreak of COVID-19 in China resulted in lockdown measures which included the shutdown of manufacturing facilities and warehouses and affected the global exports and shipments of various industries. The lockdown also led to a fall in the domestic and export demand for electronics devices, semiconductor, automotive vehicles, and other industrial equipment and devices including HMI, sensors, etc. as the impact of COVID-19 spread to other countries.

Top Key Players in Embedded System Market:

-

Intel (US),

-

STMicroelectronics (Switzerland),

-

Renesas (Japan),

-

Texas Instruments (US),

-

NXP Semiconductors (Netherlands).

-

Intel Corporation (US),

These companies have adopted both organic and inorganic growth strategies such as product launches and developments, agreements, partnerships, joint ventures, collaborations, mergers, and acquisitions to strengthen their position in the market.

Please visit 360Quadrants to see the vendor listing of Embedded Systems

Embedded Systems Market Size and Scope

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

By Hardware, By Software, By Functionality, By System Size, By Application |

|

Base Year considered |

2019 |

This report categorizes the embedded system market based on hardware, software, functionality, system size, application at the regional and global level

By Hardware

- Application-specific Integrated Circuits (ASIC)

- Microcontrollers

- Microprocessors

- Power Management Integrated Circuits (PMIC)

- Field Programmable Gate Arrays (FPGA)

- Digital Signal Processors (DSP)

- Memories

By Software

- Operating Systems

- Middleware

- By Functionality

- Real-time Embedded Systems

- Standalone Embedded Systems

By System Size

- Small-scale Embedded Systems

- Medium-scale Embedded Systems

- Large-scale Embedded Systems

By Application

- Automotive

- Consumer Electronics

- Industrial

- Aerospace and Defense

- Energy

- Healthcare

- Communication

By Region

- North America

- Europe

- APAC

- RoW

Recent Developments

- In December 2019, NXP Semiconductors acquired Wi-Fi and Bluetooth connectivity businesses of Marvell for USD 1.8 billion. The all-cash buyout deal was made to provide complete, scalable processing, as well as improved connectivity solutions to its customers in different end markets.

- In November 2019, Renesas introduced its new 32-bit RA series Arm Cortex M microcontrollers, thereby extending the 32-bit MCU range, which includes the RX series and Renesas Synergy Platform. The RA MCU have been designed to improve the performance, HMI, security, and connectivity of IoT devices used in metering, healthcare, and home-related applications.

- In November 2019, STMicroelectronics launched STM32WB wireless microcontrollers to support Bluetooth 5.0 technology. These MCU are affordable and offer strong security.

- In September 2019, Intel and US-based Oracle collaborated to develop a new shared persistent memory platform optimized for an Oracle database. The partnership aimed at offering customers high-performance latency-sensitive services for IoT data processing, high-frequency stock trading, and financial trading, as well as for use in applications requiring human interaction in real-time.

Frequently Asked Questions (FAQ):

Where are the major opportunities and drivers for growth of embedded system market in next 5 years?

Factors such as rapid adoption of embedded system for smart homes and devices and the increasing demand for IoT based devices present major opportunities of growth for embedded system market. Advancements in multicore processor and surge in demand for ADAS in EV and hybrid vehicles are a few factors driving the market growth of embedded system.

What are the major companies or players operating in the embedded system market? What are the key strategies adopted by these companies to strengthen their market presence?

The major companies driving the embedded system market include Intel, Renesas, STMicroelectronics, NXP Semiconductor, Texas Instruments, Microchip, Cypress Semiconductor, Qualcomm, Analog Devices, and Infineon Technologies. Product launches and developments along with partnerships are the key strategies adopted by the companies for their market growth.

Which embedded hardware is expected to register highest growth in coming years? What are some of the reasons which could impact its growth?

FPGA is expected to register highest growth rate in coming years. The ability of FPGA to reconfigure with different chip architecture and simple design cycles offering parallel architecture capabilities could increase their penetration in industrial automation and communication industry.

Which application and industry segments are expected to grow the most in the coming years in embedded system market?

The automotive industry segment is expected to grow at highest CAGR in coming years. Some of the automotive segments which are expected to experience high growth include ADAS, autonomous driving, electric vehicles, and hybrid vehicles.

What is the COVID-19 impact on embedded system market manufacturers and suppliers?

The manufacturing facilities worldwide witnessed shut down or partial closure of operations in order to curb the spread of COVID-19 virus. Additionally, strict social distancing norms were placed in several countries to keep the pandemic under control. These factors together impacted the operations of embedded component manufacturers during the initial quarter of 2020. The first quarter of 2020 also experienced disruption in global supply chain operations and logistics related services due to limited air and road movement. The slowing penetration of consumer electronics along-with the falling market shipments and demand for automotive vehicles impacted the embedded system industry. However, the short-term high demand for memory devices for server and data center is expected to devise a positive outlook for the embedded system market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size using bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size using top-down analysis (supply side)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 37)

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN EMBEDDED SYSTEM MARKET

4.2 EMBEDDED SYSTEM MARKET, BY SOFTWARE

4.3 EMBEDDED SYSTEM MARKET, BY SYSTEM SIZE

4.4 EMBEDDED SYSTEM MARKET IN APAC, BY APPLICATION AND COUNTRY

4.5 EMBEDDED SYSTEM MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in number of research and development activities related to embedded systems

5.2.1.2 Surge in demand for ADAS in EV and hybrid vehicles

5.2.1.3 Increase in demand for portable devices equipped with embedded systems

5.2.1.4 Rise in demand for multicore processors in military applications

5.2.2 RESTRAINTS

5.2.2.1 Vulnerability of embedded systems to cyber threats and security breaches

5.2.2.2 Short product lifecycle and high production costs associated with development of embedded systems

5.2.3 OPPORTUNITIES

5.2.3.1 Advent of 5G and development of 5G-based embedded devices

5.2.3.2 Rapid adoption of embedded systems in smart homes

5.2.3.3 Increase in demand for IoT-based embedded systems

5.2.3.4 Innovations in advanced packaging systems used for semiconductor products

5.2.4 CHALLENGES

5.2.4.1 Design complexities of embedded products used in different applications

5.2.4.2 High energy consumption of compact embedded systems

6 INDUSTRY TRENDS (Page No. - 54)

6.1 VALUE CHAIN ANALYSIS

6.2 COVID-19 UPDATE

7 EMBEDDED SYSTEM MARKET, BY HARDWARE (Page No. - 56)

7.1 INTRODUCTION

7.2 MICROCONTROLLERS

7.2.1 8-BIT MICROCONTROLLERS

7.2.1.1 8-bit microcontrollers to witness significant demand for use in smartphones

7.2.2 16-BIT MICROCONTROLLERS

7.2.2.1 High precision of 16-bit microcontrollers leads to their increased application in different verticals

7.2.3 32-BIT MICROCONTROLLERS

7.2.3.1 32-bit microcontrollers to hold largest size of embedded system market for microcontrollers from 2020 to 2025

7.3 APPLICATION-SPECIFIC INTEGRATED CIRCUITS (ASIC)

7.3.1 RISE IN USE OF ASIC IN CONSUMER ELECTRONICS TO LEAD TO THEIR INCREASED GLOBAL DEMAND

7.4 POWER MANAGEMENT INTEGRATED CIRCUITS (PMIC)

7.4.1 RISE IN DEMAND FOR PMIC FROM AUTOMOTIVE INDUSTRY

7.5 MICROPROCESSORS

7.5.1 8-BIT MICROPROCESSORS

7.5.1.1 Rise in use of 8-bit microprocessors in applications with low time-bound response requirement

7.5.2 16-BIT MICROPROCESSORS

7.5.2.1 Higher clock speed and wider data paths of 16-bit microprocessors than 8-bit microprocessors to fuel to their increased global demand

7.5.3 32-BIT MICROPROCESSORS

7.5.3.1 32-bit microprocessors offer most secure environment and fast response required in automotive applications

7.6 FIELD-PROGRAMMABLE GATE ARRAYS (FPGA)

7.6.1 INCREASE IN USE OF FPGA IN MEDICAL IMAGING, CRYPTOGRAPHY, DEVICE CONTROLLERS, AND FILTERING APPLICATIONS

7.7 DIGITAL SIGNAL PROCESSORS (DSP)

7.7.1 CAPABILITY OF DSP TO PROCESS DATA IN REAL-TIME TO CONTRIBUTE TO THEIR INCREASED DEMAND IN AUTOMOTIVE APPLICATIONS

7.8 MEMORIES

7.8.1 VOLATILE MEMORIES

7.8.1.1 Fast speed and ease of data transfer contributing to high demand for volatile memories

7.8.2 NON-VOLATILE MEMORIES

7.8.2.1 Low power consumption and high scalability of non-volatile memories fueling their adoption in various applications

8 EMBEDDED SYSTEM MARKET, BY SOFTWARE (Page No. - 76)

8.1 INTRODUCTION

8.2 OPERATING SYSTEMS

8.2.1 REAL-TIME EMBEDDED SYSTEMS SEGMENT TO HOLD LARGE SHARE OF EMBEDDED OPERATING SYSTEM MARKET

8.3 MIDDLEWARE

8.3.1 MIDDLEWARE ACT AS UNIFIED INTERFACE TO SUPPORT VARIOUS EMBEDDED APPLICATIONS

9 EMBEDDED SYSTEM MARKET, BY SYSTEM SIZE (Page No. - 84)

9.1 INTRODUCTION

9.2 SMALL-SCALE EMBEDDED SYSTEMS

9.2.1 MICROCONTROLLERS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF SMALL-SCALE EMBEDDED SYSTEM MARKET FROM 2020 TO 2025

9.3 MEDIUM-SCALE EMBEDDED SYSTEMS

9.3.1 EXCELLENT POWER HANDLING CAPACITIES OF MEDIUM-SCALE EMBEDDED SYSTEMS LEADING TO THEIR INCREASED ADOPTION IN NETWORK AND COMMUNICATION APPLICATIONS

9.4 LARGE-SCALE EMBEDDED SYSTEMS

9.4.1 FPGA SEGMENT OF LARGE-SCALE EMBEDDED SYSTEM MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

10 EMBEDDED SYSTEM MARKET, BY FUNCTIONALITY (Page No. - 89)

10.1 INTRODUCTION

10.2 REAL-TIME EMBEDDED SYSTEMS

10.2.1 ONGOING ADVANCEMENTS IN NETWORKING DEVICES AND RELATED INFRASTRUCTURES CONTRIBUTING TO GROWTH OF REAL-TIME EMBEDDED SYSTEM MARKET

10.3 STANDALONE EMBEDDED SYSTEMS

10.3.1 INCREASING AUTOMATION OF AUTOMOTIVE INDUSTRY TO LEAD TO GLOBAL DEMAND FOR STANDALONE EMBEDDED SYSTEMS

11 AI- AND NON-AI BASED EMBEDDED SYSTEMS (Page No. - 94)

11.1 INTRODUCTION

11.2 AI-BASED EMBEDDED SYSTEMS

11.2.1 DEVELOPMENT OF NEXT-GENERATION WIRELESS TECHNOLOGIES LEADING TO INCREASED DEMAND FOR AI-BASED EMBEDDED SYSTEMS

11.3 NON-AI BASED EMBEDDED SYSTEMS

11.3.1 SIMPLE ARCHITECTURE AND LOW COSTS OF NON-AI BASED EMBEDDED SYSTEM CONTRIBUTING TO THEIR GLOBAL DEMAND

12 EMBEDDED SYSTEM MARKET, BY APPLICATION (Page No. - 95)

12.1 INTRODUCTION

12.2 AUTOMOTIVE

12.2.1 MICROCONTROLLERS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF EMBEDDED SYSTEM MARKET FOR AUTOMOTIVE FROM 2020 TO 2025

12.3 COMMUNICATION

12.3.1 ASIC SEGMENT TO ACCOUNT FOR LARGEST SIZE OF EMBEDDED SYSTEM MARKET FOR COMMUNICATION FROM 2020 TO 2025

12.4 CONSUMER ELECTRONICS

12.4.1 APAC TO LEAD EMBEDDED SYSTEM MARKET FOR CONSUMER ELECTRONICS FROM 2020 TO 2025

12.5 ENERGY

12.5.1 ADVENT OF ENERGY HARVESTING TECHNOLOGY TO LEAD TO DEVELOPMENT OF EMBEDDED SYSTEMS USED IN ENERGY APPLICATIONS

12.6 INDUSTRIAL

12.6.1 RISE IN USE OF EMBEDDED SYSTEMS FOR INDUSTRIAL AUTOMATION AND MACHINE CONTROL TO DRIVE GROWTH OF EMBEDDED SYSTEM MARKET FOR INDUSTRIAL

12.7 HEALTHCARE

12.7.1 INCREASE IN ADOPTION OF IOT-ENABLED HEALTHCARE DEVICES TO FUEL GROWTH OF EMBEDDED SYSTEM MARKET FOR HEALTHCARE

12.8 AEROSPACE AND DEFENSE

12.8.1 INCREASE IN USE OF EMBEDDED SYSTEMS IN COMMERCIAL AND MILITARY AIRCRAFT

13 GEOGRAPHIC ANALYSIS (Page No. - 108)

13.1 INTRODUCTION

13.2 NORTH AMERICA

13.2.1 US

13.2.1.1 Increase in adoption of AI and IoT is expected to drive growth of embedded system market in US

13.2.2 MEXICO

13.2.2.1 Embedded system market in Mexico to grow at highest CAGR from 2020 to 2025 owing to flourishing automotive and consumer electronics industry in country

13.2.3 CANADA

13.2.3.1 Consumer electronics and industrial automation to fuel growth of embedded system market in Canada

13.3 APAC

13.3.1 CHINA

13.3.1.1 Advancements in wireless technologies to drive growth of embedded system market in China

13.3.2 JAPAN

13.3.2.1 Advancements in remote healthcare devices to fuel growth of embedded system market in Japan

13.3.3 TAIWAN

13.3.3.1 Taiwan emerged as one of leading exporters of embedded systems in APAC

13.3.4 SOUTH KOREA

13.3.4.1 Rise in adoption of consumer electronics to fuel growth of embedded system market in South Korea

13.3.5 REST OF APAC

13.4 EUROPE

13.4.1 GERMANY

13.4.1.1 Strong infrastructural support and advancements in automotive industry to contribute to growth of embedded system market in Germany

13.4.2 UK

13.4.2.1 Rise in demand for smart energy solutions to control energy consumption in buildings expected to contribute to growth of embedded system market in UK

13.4.3 FRANCE

13.4.3.1 Government subsidies to promote development and purchase of electric vehicles expected to fuel growth of embedded system market in France

13.4.4 REST OF EUROPE

13.5 REST OF THE WORLD (ROW)

14 COMPETITIVE LANDSCAPE (Page No. - 132)

14.1 OVERVIEW

14.2 KEY PLAYERS IN EMBEDDED SYSTEM MARKET

14.3 COMPETITIVE LEADERSHIP MAPPING

14.3.1 VISIONARY LEADERS

14.3.2 DYNAMIC DIFFERENTIATORS

14.3.3 INNOVATORS

14.3.4 EMERGING COMPANIES

14.4 STRENGTH OF PRODUCT PORTFOLIO

14.5 BUSINESS STRATEGY EXCELLENCE

14.6 COMPETITIVE SCENARIO

14.6.1 PRODUCT LAUNCHES AND DEVELOPMENTS

14.6.2 PARTNERSHIPS, COLLABORATIONS, JOINT VENTURES, AND AGREEMENTS

14.6.3 MERGERS, ACQUISITIONS, AND EXPANSIONS

15 COMPANY PROFILES (Page No. - 143)

15.1 INTRODUCTION

(Business Overview, Products & Solutions Offered, Recent Developments, SWOT Analysis, and MnM View)*

15.2 KEY PLAYERS

15.2.1 INTEL

15.2.2 RENESAS

15.2.3 STMICROELECTRONICS

15.2.4 NXP SEMICONDUCTORS

15.2.5 TEXAS INSTRUMENTS

15.2.6 MICROCHIP

15.2.7 CYPRESS SEMICONDUCTOR

15.2.8 QUALCOMM

15.2.9 ANALOG DEVICES

15.2.10 INFINEON

15.3 RIGHT-TO-WIN

15.4 OTHER COMPANIES

15.4.1 FUJITSU LIMITED

15.4.2 MARVELL

15.4.3 SAMSUNG ELECTRONICS

15.4.4 ON SEMICONDUCTOR

15.4.5 BROADCOM

15.4.6 SILICON LABORATORIES

15.4.7 ADVANCED MICRO DEVICES

15.4.8 MAXIM INTEGRATED

15.4.9 NUVOTON

15.4.10 TOSHIBA

*Details on Business Overview, Products & Solutions Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 190)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORT

16.6 AUTHOR DETAILS

LIST OF TABLES (109 TABLES)

TABLE 1 EMBEDDED SYSTEM MARKET, BY HARDWARE, 2017–2025 (USD BILLION)

TABLE 2 EMBEDDED SYSTEM MARKET FOR HARDWARE, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 3 EMBEDDED SYSTEM MARKET FOR HARDWARE, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 4 EMBEDDED SYSTEM MARKET FOR HARDWARE, BY REGION, 2017–2025 (USD BILLION)

TABLE 5 EMBEDDED SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 6 EMBEDDED SYSTEM MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 7 EMBEDDED SYSTEM MARKET IN APAC, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 8 EMBEDDED SYSTEM MARKET IN ROW, BY REGION, 2017–2025 (USD BILLION)

TABLE 9 EMBEDDED SYSTEM MARKET FOR MICROCONTROLLERS, BY PACKAGING, 2017–2025 (USD BILLION)

TABLE 10 EMBEDDED SYSTEM MARKET FOR MICROCONTROLLERS, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 11 EMBEDDED SYSTEM MARKET FOR MICROCONTROLLERS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 12 EMBEDDED SYSTEM MARKET FOR MICROCONTROLLERS, BY REGION, 2017–2025 (USD BILLION)

TABLE 13 EMBEDDED SYSTEM MARKET FOR ASIC, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 14 EMBEDDED SYSTEM MARKET FOR ASIC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 15 EMBEDDED SYSTEM MARKET FOR ASIC, BY REGION, 2017–2025 (USD BILLION)

TABLE 16 EMBEDDED SYSTEM MARKET FOR PMIC, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 17 EMBEDDED SYSTEM MARKET FOR PMIC, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 18 EMBEDDED SYSTEM MARKET FOR PMIC, BY REGION, 2017–2025 (USD BILLION)

TABLE 19 EMBEDDED SYSTEM MARKET FOR MICROPROCESSORS, BY PACKAGING, 2017–2025 (USD BILLION)

TABLE 20 EMBEDDED SYSTEM MARKET FOR MICROPROCESSORS, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 21 EMBEDDED SYSTEM MARKET FOR MICROPROCESSORS, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 22 EMBEDDED SYSTEM MARKET FOR MICROPROCESSORS, BY REGION, 2017–2025 (USD BILLION)

TABLE 23 EMBEDDED SYSTEM MARKET FOR FPGA, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 24 EMBEDDED SYSTEM MARKET FOR FPGA, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 25 EMBEDDED SYSTEM MARKET FOR FPGA, BY REGION, 2017–2025 (USD MILLION)

TABLE 26 EMBEDDED SYSTEM MARKET FOR DSP, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 27 EMBEDDED SYSTEM MARKET FOR DSP, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 28 EMBEDDED SYSTEM MARKET FOR DSP, BY REGION, 2017–2025 (USD MILLION)

TABLE 29 EMBEDDED SYSTEM MARKET FOR MEMORIES, BY TYPE, 2017–2025 (USD MILLION)

TABLE 30 EMBEDDED SYSTEM MARKET FOR MEMORIES, BY FUNCTIONALITY, 2017–2025 (USD MILLION)

TABLE 31 EMBEDDED SYSTEM MARKET FOR MEMORIES, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 32 EMBEDDED SYSTEM MARKET FOR MEMORIES, BY REGION, 2017–2025 (USD MILLION)

TABLE 33 EMBEDDED SYSTEM MARKET, BY SOFTWARE, 2017–2025 (USD BILLION)

TABLE 34 EMBEDDED SYSTEM SOFTWARE MARKET, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 35 EMBEDDED SYSTEM SOFTWARE MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 36 EMBEDDED SYSTEM SOFTWARE MARKET, BY REGION, 2017–2025 (USD BILLION)

TABLE 37 EMBEDDED SYSTEM SOFTWARE MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 38 EMBEDDED SYSTEM SOFTWARE MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 39 EMBEDDED SYSTEM SOFTWARE MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 40 EMBEDDED SYSTEM SOFTWARE MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 41 EMBEDDED OPERATING SYSTEM MARKET, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 42 EMBEDDED OPERATING SYSTEM MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 43 EMBEDDED OPERATING SYSTEM MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 44 EMBEDDED MIDDLEWARE MARKET, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 45 EMBEDDED MIDDLEWARE MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 46 EMBEDDED MIDDLEWARE MARKET, BY REGION, 2017–2025 (USD MILLION)

TABLE 47 EMBEDDED SYSTEM MARKET, BY SYSTEM SIZE, 2017–2025 (USD BILLION)

TABLE 48 SMALL-SCALE EMBEDDED SYSTEM MARKET, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 49 MEDIUM-SCALE EMBEDDED SYSTEM MARKET, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 50 LARGE-SCALE EMBEDDED SYSTEM MARKET, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 51 EMBEDDED SYSTEM MARKET, BY FUNCTIONALITY, 2017–2025 (USD BILLION)

TABLE 52 REAL-TIME EMBEDDED SYSTEM MARKET, BY HARDWARE, 2017–2025 (USD BILLION)

TABLE 53 REAL-TIME EMBEDDED SYSTEM MARKET, BY SOFTWARE, 2017–2025 (USD BILLION)

TABLE 54 STANDALONE EMBEDDED SYSTEM MARKET, BY HARDWARE, 2017–2025 (USD BILLION)

TABLE 55 STANDALONE EMBEDDED SYSTEM MARKET, BY SOFTWARE, 2017–2025 (USD BILLION)

TABLE 56 EMBEDDED SYSTEM MARKET, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 57 EMBEDDED SYSTEM MARKET FOR AUTOMOTIVE, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 58 EMBEDDED SYSTEM MARKET FOR AUTOMOTIVE, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 59 EMBEDDED SYSTEM MARKET FOR AUTOMOTIVE, BY REGION, 2017–2025 (USD BILLION)

TABLE 60 EMBEDDED SYSTEM MARKET FOR COMMUNICATION, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 61 EMBEDDED SYSTEM MARKET FOR COMMUNICATION, BY SOFTWARE, 2017–2025 (USD BILLION)

TABLE 62 EMBEDDED SYSTEM MARKET FOR COMMUNICATION, BY REGION, 2017–2025 (USD BILLION)

TABLE 63 EMBEDDED SYSTEM MARKET FOR CONSUMER ELECTRONICS, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 64 EMBEDDED SYSTEM MARKET FOR CONSUMER ELECTRONICS, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 65 EMBEDDED SYSTEM MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017–2025 (USD BILLION)

TABLE 66 EMBEDDED SYSTEM MARKET FOR ENERGY, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 67 EMBEDDED SYSTEM MARKET FOR ENERGY, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 68 EMBEDDED SYSTEM MARKET FOR ENERGY, BY REGION, 2017–2025 (USD MILLION)

TABLE 69 EMBEDDED SYSTEM MARKET FOR INDUSTRIAL, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 70 EMBEDDED SYSTEM MARKET FOR INDUSTRIAL, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 71 EMBEDDED SYSTEM MARKET FOR INDUSTRIAL, BY REGION, 2017–2025 (USD BILLION)

TABLE 72 EMBEDDED SYSTEM MARKET FOR HEALTHCARE, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 73 EMBEDDED SYSTEM MARKET FOR HEALTHCARE, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 74 EMBEDDED SYSTEM MARKET FOR HEALTHCARE, BY REGION, 2017–2025 (USD BILLION)

TABLE 75 EMBEDDED SYSTEM MARKET FOR AEROSPACE AND DEFENSE, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 76 EMBEDDED SYSTEM MARKET FOR AEROSPACE AND DEFENSE, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 77 EMBEDDED SYSTEM MARKET FOR AEROSPACE AND DEFENSE, BY REGION, 2017–2025 (USD MILLION)

TABLE 78 EMBEDDED SYSTEM MARKET, BY REGION, 2017–2025 (USD BILLION)

TABLE 79 EMBEDDED SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 80 EMBEDDED SYSTEM MARKET IN NORTH AMERICA, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 81 EMBEDDED SYSTEM MARKET IN NORTH AMERICA, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 82 EMBEDDED SYSTEM MARKET IN NORTH AMERICA, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 83 EMBEDDED SYSTEM MARKET IN US, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 84 EMBEDDED SYSTEM MARKET IN MEXICO, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 85 EMBEDDED SYSTEM MARKET IN CANADA, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 86 EMBEDDED SYSTEM MARKET IN APAC, BY COUNTRY, 2017–2025 (USD BILLION)

TABLE 87 EMBEDDED SYSTEM MARKET IN APAC, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 88 EMBEDDED SYSTEM MARKET IN APAC, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 89 EMBEDDED SYSTEM MARKET IN APAC, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 90 EMBEDDED SYSTEM MARKET IN CHINA, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 91 EMBEDDED SYSTEM MARKET IN JAPAN, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 92 EMBEDDED SYSTEM MARKET IN TAIWAN, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 93 EMBEDDED SYSTEM MARKET IN SOUTH KOREA, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 94 EMBEDDED SYSTEM MARKET IN REST OF APAC, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 95 EMBEDDED SYSTEM MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 96 EMBEDDED SYSTEM MARKET IN EUROPE, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 97 EMBEDDED SYSTEM MARKET IN EUROPE, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 98 EMBEDDED SYSTEM MARKET IN EUROPE, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 99 EMBEDDED SYSTEM MARKET IN GERMANY, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 100 EMBEDDED SYSTEM MARKET IN UK, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 101 EMBEDDED SYSTEM MARKET IN FRANCE, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 102 EMBEDDED SYSTEM MARKET IN REST OF EUROPE, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 103 EMBEDDED SYSTEM MARKET IN ROW, BY REGION, 2017–2025 (USD BILLION)

TABLE 104 EMBEDDED SYSTEM MARKET IN ROW, BY HARDWARE, 2017–2025 (USD MILLION)

TABLE 105 EMBEDDED SYSTEM MARKET IN ROW, BY SOFTWARE, 2017–2025 (USD MILLION)

TABLE 106 EMBEDDED SYSTEM MARKET IN ROW, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 107 TOP 10 PRODUCT LAUNCHES AND DEVELOPMENTS, 2017–2019

TABLE 108 PARTNERSHIPS, COLLABORATIONS, JOINT VENTURES, AND AGREEMENTS, 2017–2019

TABLE 109 MERGERS, ACQUISITIONS, AND EXPANSIONS, 2017–2019

LIST OF FIGURES (55 FIGURES)

FIGURE 1 EMBEDDED SYSTEM MARKET SEGMENTATION

FIGURE 2 EMBEDDED SYSTEM MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF EMBEDDED HARDWARE

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF COMPANY FROM SALES OF EMBEDDED SYSTEM

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 – BOTTOM-UP ESTIMATION OF SIZE OF EMBEDDED SYSTEM MARKET, BY HARDWARE

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 8 DATA TRIANGULATION

FIGURE 9 FPGA SEGMENT OF EMBEDDED SYSTEM MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 10 MIDDLEWARE SEGMENT OF EMBEDDED SYSTEM MARKET TO GROW AT HIGH CAGR FROM 2020 2025

FIGURE 11 REAL-TIME EMBEDDED SYSTEMS SEGMENT TO HOLD LARGE SHARE OF EMBEDDED SYSTEM MARKET IN 2025

FIGURE 12 AUTOMOTIVE SEGMENT OF EMBEDDED SYSTEM MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 13 APAC TO HOLD LARGEST SHARE OF EMBEDDED SYSTEM MARKET IN 2025

FIGURE 14 INCREASING GLOBAL DEMAND FOR COMMUNICATION EQUIPMENT AND CONSUMER ELECTRONICS TO SPUR GROWTH OF EMBEDDED SYSTEM MARKET FROM 2020 TO 2025

FIGURE 15 MIDDLEWARE SEGMENT TO ACCOUNT FOR LARGE SHARE OF EMBEDDED SYSTEM MARKET IN 2025

FIGURE 16 MEDIUM-SCALE EMBEDDED SYSTEMS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF EMBEDDED SYSTEM MARKET IN 2025

FIGURE 17 COMMUNICATION SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF EMBEDDED SYSTEM MARKET IN APAC IN 2025

FIGURE 18 EMBEDDED SYSTEM MARKET IN CHINA PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 19 EMBEDDED SYSTEM MARKET DYNAMICS

FIGURE 20 ELECTRIC VEHICLE SALES, 2013—2018 (MILLION UNITS)

FIGURE 21 EMBEDDED SYSTEM MARKET DRIVERS AND THEIR IMPACT

FIGURE 22 EMBEDDED SYSTEM MARKET RESTRAINTS AND THEIR IMPACT

FIGURE 23 PROJECTED GLOBAL NUMBER OF 5G CONNECTIONS FROM 2021 TO 2025

FIGURE 24 FORECAST FOR IOT MARKET IN 2025

FIGURE 25 EMBEDDED SYSTEM MARKET OPPORTUNITIES AND THEIR IMPACT

FIGURE 26 EMBEDDED SYSTEM MARKET CHALLENGES AND THEIR IMPACT

FIGURE 27 VALUE CHAIN ANALYSIS OF EMBEDDED SYSTEM MARKET

FIGURE 28 FPGA SEGMENT OF EMBEDDED SYSTEM MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 29 32-BIT MICROCONTROLLERS SEGMENT OF EMBEDDED SYSTEM MARKET FOR MICROCONTROLLERS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 30 EMBEDDED SYSTEM MARKET FOR MICROCONTROLLERS, 2019 (BILLION UNITS)

FIGURE 31 REAL-TIME EMBEDDED SYSTEMS SEGMENT OF EMBEDDED SYSTEM MARKET FOR ASIC TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 32 32-BIT MICROPROCESSORS SEGMENT OF EMBEDDED SYSTEM MARKET FOR MICROPROCESSORS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 33 MIDDLEWARE SEGMENT TO LEAD EMBEDDED SYSTEM MARKET FROM 2020 TO 2025

FIGURE 34 LARGE-SCALE EMBEDDED SYSTEM MARKET PROJECTED TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 35 REAL-TIME EMBEDDED SYSTEMS SEGMENT TO LEAD EMBEDDED SYSTEM MARKET FROM 2020 TO 2025

FIGURE 36 AUTOMOTIVE SEGMENT OF EMBEDDED SYSTEM MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 37 EMBEDDED SYSTEM MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 38 SNAPSHOT OF EMBEDDED SYSTEM MARKET IN NORTH AMERICA

FIGURE 39 SNAPSHOT OF EMBEDDED SYSTEM MARKET IN APAC

FIGURE 40 SNAPSHOT OF EMBEDDED SYSTEM MARKET IN EUROPE

FIGURE 41 COMPANIES ADOPTED PRODUCT LAUNCHES AND DEVELOPMENTS AS KEY GROWTH STRATEGIES FROM 2017 TO 2019

FIGURE 42 EMBEDDED SYSTEM MARKET: COMPANY RANKING ANALYSIS (2019)

FIGURE 43 EMBEDDED SYSTEM MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 44 PRODUCT PORTFOLIOS ANALYSIS OF TOP PLAYERS IN EMBEDDED SYSTEMS MARKET

FIGURE 45 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN EMBEDDED SYSTEMS MARKET

FIGURE 46 INTEL: COMPANY SNAPSHOT

FIGURE 47 RENESAS: COMPANY SNAPSHOT

FIGURE 48 STMICROELECTRONICS: COMPANY SNAPSHOT

FIGURE 49 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

FIGURE 50 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

FIGURE 51 MICROCHIP: COMPANY SNAPSHOT

FIGURE 52 CYPRESS SEMICONDUCTOR: COMPANY SNAPSHOT

FIGURE 53 QUALCOMM: COMPANY SNAPSHOT

FIGURE 54 ANALOG DEVICES: COMPANY SNAPSHOT

FIGURE 55 INFINEON: COMPANY SNAPSHOT

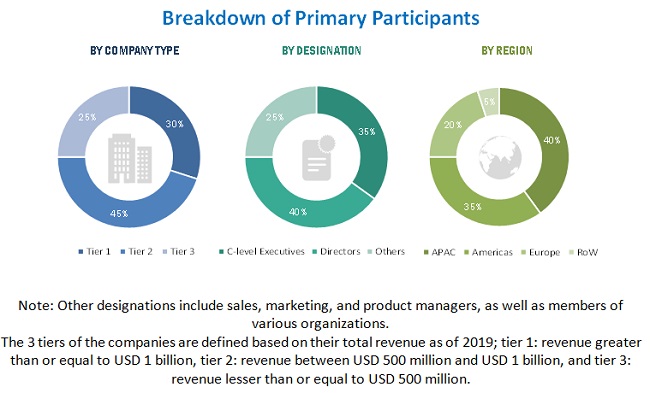

The study involved 4 major activities for estimating the size of the embedded system market. Exhaustive secondary research has been carried out to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with the industry experts across the value chain of the embedded system market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology that has been used to estimate and forecast the size of the embedded system market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. This study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the embedded system market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

The embedded system market comprises several stakeholders, such as suppliers of standard components, equipment manufacturers, and original equipment manufacturers (OEMs). The demand side of this market has been characterized by hardware, software, and service companies. The supply side has been characterized by electronic embedded products and their diverse applications. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the embedded system market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research

- The supply chain of the manufacturing industry and the size of the embedded system market, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both demand and supply sides of the embedded system market.

Research Objectives

- To describe, segment, and forecast the overall size of the embedded system market based on hardware (application-specific integrated circuits (ASIC), microcontrollers, microprocessors, power management integrated circuits (PMIC), field-programmable gate arrays (FPGA), digital signal processors (DSP), and memories), software (operating systems and middleware), functionality, system size, and industry

- To describe and forecast the market size for various segments with regard to 4 main regions—Asia Pacific (APAC), North America, Europe, and the Rest of the World (RoW)

- To provide detailed information regarding major factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To briefly describe the embedded system value chain

- To analyze competitive developments such as product launches and developments, agreements, partnerships, mergers, acquisitions, joint ventures, expansions, and research and development (R&D) activities in the embedded system market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Estimation of the market size of the application segment of the embedded system market based on different subsegments

Critical Questions

- What are new application areas being explored by the providers of embedded systems?

- Who are the key players in the embedded system market, and how intense is the competition in this market?

Growth opportunities and latent adjacency in Embedded System Market