Autonomous Vehicle Sensor Market by Component (Hardware, Software), Offering, Software, Level of Autonomy (L2+, L3, L4), Propulsion (ICE, Electric), Vehicle Type, Sensor Platform Approach, Sensor Fusion Process and Region - Global Forecast to 2030

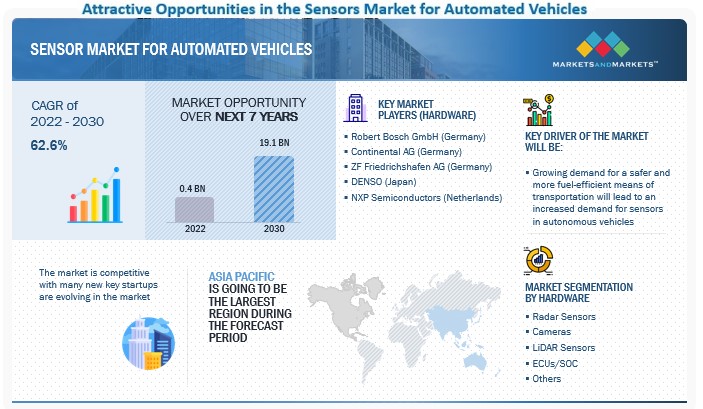

[310 Pages Report] The global sensor market for automated vehicles size was valued at USD 0.4 billion in 2022 and is expected to reach USD 19.1 billion by 2030, at a CAGR of 62.6%, during the forecast period 2022-2030. Component providers provide automated driving software and hardware to leading automotive OEMs. Global OEMs leverage cameras, LiDAR, radars and sensing platforms from these providers to be integrated in their autonomous vehicles. Factors such as increased demand for safer vehicles and strong government support have caused leading original equipment manufacturers (OEMs) and component manufacturers to invest in autonomous vehicles technologies. OEMs and solution providers have set up R&D centers and are working on meeting the rising demand of autonomous vehicles in the global automotive market. With advances in technologies such as connected mobility, ADAS and safety features, new age battery technologies, among others, the sensors market for automated vehicles is likely to grow.

To know about the assumptions considered for the study, Request for Free Sample Report

Sensor Market for Automated Vehicles Dynamics:

Driver: Growing penetration of ADAS safety features

The demand for reliable safety measures has grown along with the development efforts for automated vehicles. For the autonomous car to travel securely, autonomous vehicle sensors are a crucial part of these cutting-edge safety measures. Due to this, there is now an increased demand for autonomous vehicle sensors, which is propelling the sensor market for automated vehicles expansion. These sensors are used to convey information about the position and speed of the vehicle as well as to identify obstacles including pedestrians, other cars, and road conditions. There are already several groups active in different aspects of automobile safety throughout the world. The fact that ADAS (advanced driver assistance systems) are being included in more and more vehicles, trucks, and buses has led to a steady increase in the standards and norms linked to ADAS. A fully autonomous car can reduce the risk of drivers with illnesses, alcohol, or drug problems gripping the steering wheel of traditional vehicles, thus reducing the chance of driving problems, which currently account for a major portion of the total deaths caused by road traffic injuries. Autonomous vehicles use a system that finds the fastest route to their destination, resulting in better fuel economy and lower emissions and costs. Many of the global automotive OEMs, such as Audi, BMW, Volkswagen, and Hyundai, provide various types of safety features, such as autonomous emergency braking (AEB), blind spot detection, adaptive cruise control (ACC), lane keeping assist (LKA), autonomous parking, self-diagnostics, autonomous valet parking, and automated highway pilot, in their vehicles.

Restraint: Insufficient infrastructure for vehicle connectivity

Autonomous vehicles need basic infrastructures, such as well-organized roads, lane marking, and GPS connectivity for the effective functioning of various sensors. V2V and V2X communications also leverage various sensors and sensor platforms which require adequate connectivity infrastructure. On highways, information such as lane change, object detection, distances between vehicles, traffic, and services, such as navigation and connectivity, is critical in semi-autonomous and autonomous trucks. However, due to the limited network connectivity on highways, vehicles are not connected to each other or to cloud data. In developing countries like Mexico, Brazil, and India, the development of IT infrastructure on highways is slow as compared to developed economies. 3G and 4G-LTE communication networks, which are needed for connectivity, are limited to urban and semi-urban areas. While several third-party logistics companies operate in semi-urban and rural areas, issues of low connectivity persist. Developing countries also need government support for the adoption of sensors and sensor platforms in autonomous and semi-autonomous vehicles. Therefore, the lack of information technology communication infrastructure and lenient government regulations are major restraints to the growth of autonomous vehicle sensors in developing regions. In most developing countries, basic amenities required for automated vehicles, like improved roads, high-speed internet connectivity, dedicated lanes, and improved charging stations, are not present. Autonomous vehicles rely on reliable and accurate mapping data. ADAS technologies depend on high-speed internet connectivity for a variety of functions, such as real-time traffic updates, route planning and navigation, and remote vehicle diagnostics.

Opportunity: Rising popularity of electric vehicles

Electric vehicles (EVs) are becoming increasingly popular due to their environmental and economic benefits. These vehicles are propelled by electricity rather than gasoline, which lowers both pollution and energy costs. Additionally, through tax credits, subsidies, and other incentives, governments and automakers are encouraging the use of EVs. The use of EVs is expected to increase in the upcoming years due to ongoing technological advancements and growing public awareness of their benefits. OEMs such as Tesla, NIO, Rivian, Xpeng, Volkswagen, and Daimler have developed autonomous EVs and other ADAS features. An autonomous EV includes sensors and controllers such as battery management systems (BMS), electric motor controllers, wheel speed sensors, accelerometer sensors, brake pedal position sensors, and vehicle range sensors. With increasing demand for autonomous and environment-friendly electric vehicles globally, the demand for sensors and sensor platforms is expected to increase. The shift to EVs will drive the demand for automated vehicles. An electric autonomous vehicle offers various benefits, such as improved safety, increased mobility, reduced impact on the environment, and increased efficiency. An electric autonomous vehicle can reduce the dependency on non-renewable sources of energy, such as fossil fuels. Electric autonomous vehicles are also much more efficient in terms of fuel consumption, as they can be programmed to drive in the most efficient way possible. With the added potential of lowering overall greenhouse gas emissions, these battery-powered, energy-efficient vehicles provide cleaner and faster transportation. With the rapidly growing demand for EVs, and targets for greener and safer transportation across many countries in the world, both these technologies will grow simultaneously. Countries like China, Germany, and the US, among others, have made stringent safety and environmental regulations.

Challenge: Hard to trade-off between price and overall quality

Safety regulations, among other factors, have led to several advancements in automotive technology. However, this has resulted in high compliance costs, as regulatory bodies such as the NHTSA and Euro NCAP are promoting the use of ADAS in vehicles to reduce road accidents. This is the first step towards complete autonomous vehicles. The increasing demand for safety, comfort, and convenience is reflected in the overall price of autonomous vehicles. In general, higher-priced autonomous vehicles are of higher quality, with more features and advanced technology. Cheaper self-driving cars may lack certain features or have less advanced technology, but they may still provide some automated features such as lane-keeping and parking assistance. While the key criteria for buying a car previously were power, speed, and design, buyers now demand energy efficiency, safety, and comfort. It is challenging for manufacturers to provide these features at a low cost. OEMs are struggling to offer new features with minimum cost impact and to keep a balance between cost and performance to sustain in the sensor market for automated vehicles. OEMs are expected to negotiate with Tier 1 manufacturers to keep component prices low and incorporate more features in upcoming vehicles at lower prices. Hence, Tier 1 manufacturers will find it difficult to provide advanced safety systems at a low cost and maintain superior quality at the same time.

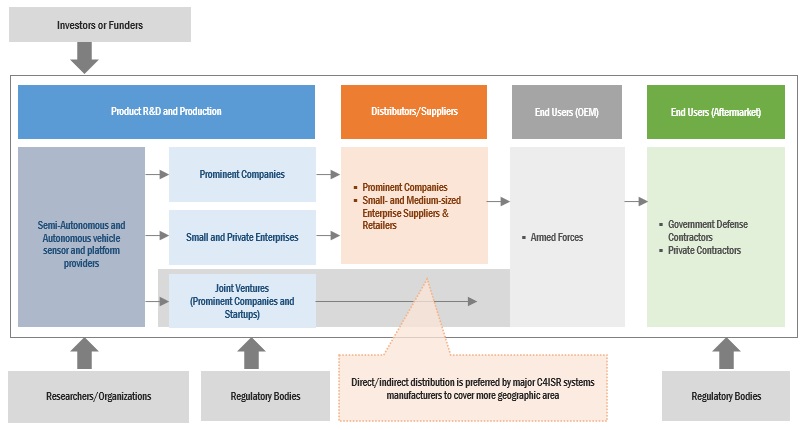

Sensor Market for Automated Vehicles Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Semi-Autonomous and Autonomous vehicle sensor and platform provider. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Robert Bosch GmbH (Germany), Continental AG (Germany), ZF Friedrichshafen AG (Germany), DENSO (Japan), and NXP Semiconductors (Netherlands).

To know about the assumptions considered for the study, download the pdf brochure

High-level Fusion is to be the largest market during forecast period

The high-level fusion segment is estimated to hold the largest sensor market for automated vehicles size during the forecast period. High-level fusion in autonomous vehicles typically involves the integration of data from various sensors, such as cameras, LiDAR, and radars, to provide a comprehensive understanding of the vehicle's surroundings. This information is then processed using advanced algorithms and machine learning techniques to identify objects and make predictions about their behavior. The resulting information is used to make decisions about the vehicle's path, speed, and other control inputs. One important aspect of high-level fusion is to handle uncertainty in the data from individual sensors, such as measurement errors and false detections, and to ensure that the final decisions made by the vehicle are reliable and safe. High-level fusion can also be used to improve the overall performance of autonomous vehicles. For example, it can be used to optimize the vehicle's energy efficiency and extend its range. High-level fusion can also be used to provide additional safety features, such as object detection and avoidance, to prevent collisions and other hazardous situations. With an increasing demand for automated vehicles, the demand for high-level sensor fusion solutions is also growing. As more and more companies enter the AV market, the demand for advanced sensor fusion technology is expected to increase. With the AV market maturing, more companies are investing in the development of advanced sensor fusion technology to stay competitive. This is expected to drive the growth of the market. Government regulations and standards for automated vehicles are becoming more stringent, which is driving the demand for high-level sensor fusion solutions that can meet these standards. Advances in technology such as 5G, edge computing, and artificial intelligence is also expected to drive the growth of the market.

Feature Level Fusion to be the largest and the fastest growing segment during the forecast period

Feature-level sensor fusion is a process in autonomous vehicles (AVs) where information from multiple sensors is combined and processed to extract specific features of the vehicle's environment. The features can include road markings, traffic signals, lane boundaries, and other objects such as other vehicles and pedestrians. The extracted features are then used by the vehicle's decision-making systems to make real-time driving decisions and navigate the vehicle safely. Feature-level sensor fusion is important in ensuring the safety and reliability of AVs, as it helps to accurately detect and track objects and road features and make informed driving decisions in real time. By combining data from multiple sensors, the vehicle can create a more accurate and robust representation of the environment, enabling it to operate in challenging environmental conditions, such as darkness, rain, or snow.

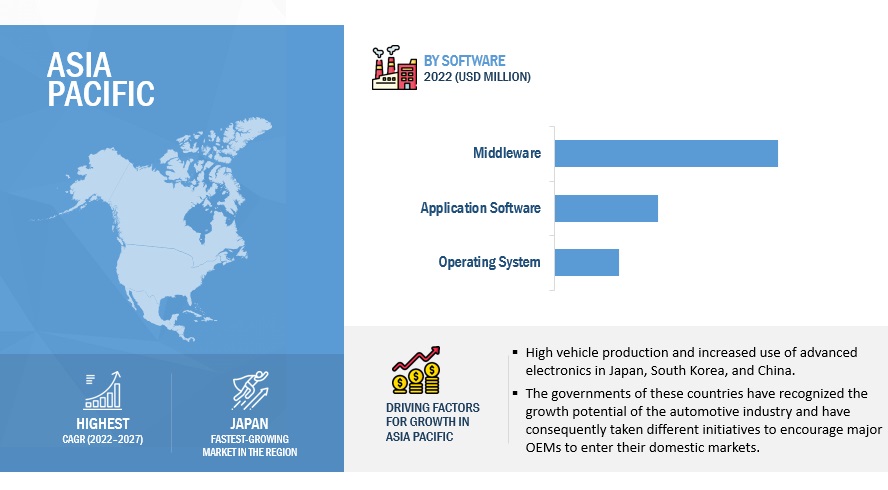

Asia Pacific to be the largest market by volume during the forecast period

Asia Pacific is estimated to account for the largest sensor market for automated vehicles share by 2030, followed by Europe and North America, whereas the Rest of the World (RoW) region is projected to register the highest CAGR during the forecast period. Increasing demand for a safe, efficient, and convenient driving experience; rising disposable income in emerging economies; and stringent safety regulations worldwide drive the sensors market for automated vehicles. The market growth in the North American and European regions is expected to be driven by stringent safety regulations. For instance, in 2016, the US National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) made automatic emergency braking (AEB) a standard for vehicles by 2022. The market in the RoW region is expected to grow at a significant rate as OEMs are increasingly focusing on emerging economies to expand and attract consumers with feature-rich vehicles. Other factors, such as changing preferences of buyers, improved standard of living, and enhanced infrastructure, are also expected to drive the sensors market for automated vehicles. China, South Korea, and Japan account for the largest share of the sensors market for automated vehicles in the Asia Pacific region. The market growth in this region can be attributed to the high vehicle production and increased use of advanced electronics in Japan, South Korea, and China.

The governments of these countries have recognized the growth potential of the automotive industry and have consequently taken different initiatives to encourage major OEMs to enter their domestic sensor market for automated vehicles. Several European and American automobile manufacturers, such as Volkswagen (Germany), Mercedes-Benz (Germany), and General Motors (US), have shifted their production plants to developing countries. Major sensor component providers such as Robert Bosch (Germany), Continental (Germany), and DENSO (Japan) have production facilities across the region. The Asia Pacific region is home to established OEMs such as Hyundai (South Korea), Toyota (Japan), and Honda (Japan), which are investing in autonomous vehicle technology. These OEMs have collaborated with various global software and hardware providers to develop autonomous vehicles. They also have plans to invest heavily in the development of autonomous vehicle sensor technologies in the coming years. The region is also home to various tech start-ups that are engaged in the development of autonomous vehicle technologies. Countries in the region are also establishing infrastructure for the implementation of electric vehicles, which could aid in the rise of autonomous vehicles as well. For instance, in October 2021, Honda signed an agreement with Cruise, a subsidiary of General Motors, under which Honda will invest USD 2 billion over a span of 12 years to develop autonomous vehicle technologies.

Key Market Players

The sensor market for automated vehicles is dominated by Robert Bosch GmbH (Germany), Continental AG (Germany), ZF Friedrichshafen AG (Germany), DENSO (Japan), and NXP Semiconductors (Netherlands), among others. These companies provide hardware and software solutions to global OEMs and component manufacturers. These companies have set up R&D infrastructure and offer best-in-class solutions to their customers.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2022–2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2022–2030 |

|

Forecast Units |

Value (USD Million/Billion) and Volume (USD Thousand) |

|

Segments Covered |

Component, Offering, Software, Propulsion, Level of Autonomy, Vehicle Type, Sensor Platform Approach, Sensor Fusion Process |

|

Geographies Covered |

North America, Europe, Asia Pacific and Rest of the World |

|

Companies Covered |

Robert Bosch GmbH (Germany), Continental AG (Germany), ZF Friedrichshafen AG (Germany), DENSO (Japan), and NXP Semiconductors (Netherlands), among others. |

This research report categorizes the sensor market for automated vehicles based on component, offering, software, propulsion, level of autonomy, vehicle type, sensor platform approach, sensor fusion process, and region.

Based on Component:

- Hardware

- Software

Based on Offering:

- Cameras

- Chips/Semiconductors

- Radar Sensors

- Lidar Sensors

- Others

Based on Software:

- Operating System

- Middleware

- Application Software

Based on Propulsion:

- ICE

- Electric

Based on Level of Autonomy:

- L2+

- L3

- L4

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on Sensor Platform Approach:

- High-Level Fusion

- Mid-Level Fusion

- Low-Level Fusion

Based on Sensor Fusion Process:

- Signal-Level Fusion

- Object-Level Fusion

- Feature-Level Fusion

- Decision-Level Fusion

Based on Region:

-

Asia Pacific

- China

- Japan

- India

- South Korea

-

North America (NA)

- US

- Canada

-

Europe

- France

- Germany

- Italy

- UK

- Rest of Europe

Recent Developments

- In January 2023, ZF Friedrichshafen AG launched Smart Camera 4.8. It enables autonomous cars to have a wider field of view, in turn enabling the vehicle to identify pedestrians, cyclists, and other vehicles.

- In December 2022, Robert Bosch GmbH launched the 6G-ICAS4Mobility project, which is aimed at integrating communication and radar systems into a single 6G system.

- In October 2022, DENSO launched its new 4mm Wave Radar PCU. According to DENSO's vision of future mobility, the power device in the power control unit (PCU) is essential. The SiC MOSFET will displace silicon-based power devices, and 4mm Wave radar will be widely used.

- In September 2022, NXP Semiconductors started the production of its second-generation RFCMOS radar transceiver. The RFCMOS chip accommodates 3 transmitters, 4 receivers, ADC conversion, phase rotators, and low-phase noise VCOs. It supports short-, medium-, and long-range radar applications, including cascaded high-resolution imaging radar. Moreover, it will facilitate 360-degree sensing for critical safety applications, automated emergency braking, automated parking, and blind-spot monitoring, among others.

- In June 2022, Under a joint project, Continental AG announced the development of an intelligent solution for automated driving in the city. In this project, it collaborated with 15 companies, universities, and research institutes, supported by the German Federal Ministry of Economics and Climate Protection.

- In January 2022, DENSO created the Global Safety Package 3, an active safety system intended to increase vehicles’ safety by enhancing their environment-sensing abilities. The Global Safety Package helps the driver operate the car securely by combining the capabilities of a millimeter-wave radar sensor and vision sensor. The vision sensor makes use of a camera to detect the surroundings in front of the car, while the millimeter-wave radar sensor makes use of radar to detect the forms of road objects, such as vehicles and guardrails.

Frequently Asked Questions (FAQ):

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

The sensor market for automated vehicles is dominated by Robert Bosch GmbH (Germany), Continental AG (Germany), ZF Friedrichshafen AG (Germany), DENSO (Japan), and NXP Semiconductors (Netherlands), among others. These companies provide hardware and software solutions to global OEMs and component manufacturers. These companies have set up R&D infrastructure and offer best-in-class solutions to their customers.

Which region is expected to grow at fastest rate during the forecast period?

Rest of the world will be the fastest-growing region in the sensor market for automated vehicles due to the huge volume of investments in the region and the high demand for safer and convenient commercial and passenger transport vehicles.

Which are the key technology trends prevailing in the sensor market for automated vehicles market?

The key technologies affecting the sensor market for automated vehicles are the ADAS and safety, EVs, connected mobility, and sensor platform technologies.

What is the total CAGR expected to be recorded for the sensor market for automated vehicles during 2022-2027?

The market is expected to record a CAGR of 62.6% from 2022-2027.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing penetration of ADAS safety features- Advancements in automotive sensor technology- Development of autonomous commercial vehicles- Government initiatives for road safetyRESTRAINTS- Lack of standardization in software architecture/hardware platforms- Insufficient infrastructure for vehicle connectivity- Increase in cybersecurity threats due to advancements in connectivity technologyOPPORTUNITIES- Growing development in autonomous space- Rising popularity of electric vehicles- Increasing adoption of 5G and connectivityCHALLENGES- Security and safety concerns- Environmental constraints in using LiDAR- Hard to trade-off between price and overall qualityIMPACT OF MARKET DYNAMICS

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN ANALYSISVALUE CHAIN ANALYSIS: SENSOR MARKET FOR AUTOMATED VEHICLES

-

5.5 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- 5.6 PRICING ANALYSIS

-

5.7 SENSOR MARKET FOR AUTOMATED VEHICLES ECOSYSTEMSENSORSPROCESSORSSOFTWARE AND SYSTEMSOEMS

-

5.8 KEY STAKEHOLDERS AND BUYING CRITERIAPASSENGER CARSCOMMERCIAL VEHICLESKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.9 TECHNOLOGY ANALYSISSOLID-STATE LIDARTERRAIN SENSING SYSTEM FOR AUTONOMOUS VEHICLESV2X CONNECTED AUTONOMOUS VEHICLESAUTOMATED VALET PARKING (AVP)NIGHT VISION AND THERMAL IMAGING

-

5.10 PATENT ANALYSIS

-

5.11 CASE STUDY ANALYSISCASE STUDY 1: DATASPEED AUTONOMOUS VEHICLE SOLUTIONCASE STUDY 2: RENESAS BOOSTS DEEP LEARNING DEVELOPMENT FOR ADAS AND AUTOMATED DRIVING APPLICATIONSCASE STUDY 3: DEVELOPING AUTONOMOUS DRIVING FOR GLOBAL OEMCASE STUDY 4: AUTOMATED PARKING FOR STUTTGART AIRPORTCASE STUDY 5: ZF’S NEW AI-BASED SERVICE FOR ADAS DEVELOPMENTCASE STUDY 6: OPEN AUTONOMY PILOT FOR US STATECASE STUDY 7: TRANSPORTATION FOR THE IMPAIRED

-

5.12 REGULATORY OVERVIEWREGULATIONS ON AUTONOMOUS VEHICLES USAGE BY COUNTRYLIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.14 RECESSION IMPACTINTRODUCTIONREGIONAL MACROECONOMIC OVERVIEWANALYSIS OF KEY ECONOMIC INDICATORSECONOMIC STAGFLATION (SLOWDOWN) VS. ECONOMIC RECESSION- Europe- Asia Pacific- AmericasECONOMIC PROJECTIONS

-

5.15 RECESSION IMPACT ON AUTOMOTIVE SECTORANALYSIS OF AUTOMOTIVE VEHICLE SALES- Europe- Asia Pacific- AmericasAUTOMOTIVE SALES OUTLOOK

- 5.16 KEY CONFERENCES AND EVENTS, 2022–2023

-

5.17 SENSOR MARKET FOR AUTOMATED VEHICLES, SCENARIOS (2022–2030)MOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

-

6.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

6.2 HARDWAREGROWING DEMAND FOR ADAS SAFETY SYSTEMS TO DRIVE SEGMENT

-

6.3 SOFTWAREGROWING DEMAND FOR AUTONOMOUS VEHICLE PLATFORMS AND RELATED SOFTWARE TO DRIVE SEGMENT

- 6.4 KEY INDUSTRY INSIGHTS

-

7.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

7.2 CAMERASGROWING DEMAND FOR NIGHT VISION SYSTEMS AND INTELLIGENT PARKING SYSTEMS TO INCREASE DEMAND

-

7.3 ECU/ SOCGROWING DEMAND FOR ADVANCED AUTOMOTIVE FEATURES TO DRIVE SEGMENT

-

7.4 RADAR SENSORSGROWING DEVELOPMENT OF AUTONOMOUS TECHNOLOGY TO INCREASE DEMAND FOR RADAR SYSTEMS IN VEHICLES

-

7.5 LIDAR SENSORSINCREASING COST-EFFECTIVENESS OF LIDAR SYSTEMS TO INCREASE THEIR DEMAND IN AUTONOMOUS VEHICLES

- 7.6 OTHERS

- 7.7 KEY INDUSTRY INSIGHTS

-

8.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

8.2 OPERATING SYSTEMNEED FOR EFFICIENT DATA MANAGEMENT TO INCREASE OPERATING SYSTEM APPLICATION IN AUTONOMOUS VEHICLES

-

8.3 MIDDLEWAREINCREASED USE OF SENSOR FUSION IN AUTONOMOUS VEHICLE APPLICATIONS TO INCREASE MIDDLEWARE USE

-

8.4 APPLICATION SOFTWAREGROWING LEVEL OF AUTOMATION TO INCREASE DEMAND FOR APPLICATION SOFTWARE

- 8.5 KEY INDUSTRY INSIGHTS

-

9.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

9.2 L2+INCREASING SAFETY MANDATES TO FUEL DEMAND FOR L2+ AUTONOMOUS VEHICLES

-

9.3 L3INCREASING SAFETY MANDATES TO FUEL DEMAND FOR L3 AUTONOMOUS VEHICLES

-

9.4 L4GROWING SHIFT TOWARD FULL AUTOMATION TO INCREASE DEMAND FOR SENSORS FOR L4 AUTONOMOUS VEHICLES

- 9.5 KEY INDUSTRY INSIGHTS

-

10.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

10.2 ICEINCREASING SAFETY REGULATIONS TO FUEL DEMAND FOR SENSORS IN ICE AUTONOMOUS VEHICLES

-

10.3 ELECTRICELECTRIFICATION TARGETS BY COUNTRIES TO DRIVE OEMS TOWARD DEVELOPING L4 AND ABOVE FEATURES MAINLY FOR EVS

- 10.4 KEY INDUSTRY INSIGHTS

-

11.1 INTRODUCTIONOPERATIONAL DATAASSUMPTIONSRESEARCH METHODOLOGY

-

11.2 PASSENGER CARSMANDATES FOR LDW, DMS, AND FCW FEATURES TO INCREASE ADAS AND AUTONOMOUS VEHICLE DEMAND IN PASSENGER CARS SEGMENT

-

11.3 COMMERCIAL VEHICLESPLANS BY COUNTRIES TO MANDATE ADAS FEATURES TO INCREASE DEMAND FOR AUTONOMOUS COMMERCIAL VEHICLES

- 11.4 KEY INDUSTRY INSIGHTS

-

12.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

12.2 LOW-LEVEL FUSIONRAPID DEVELOPMENT OF ADVANCED SENSORS AND NEED FOR ACCURATE OBJECT DETECTION TO DRIVE SEGMENT

-

12.3 MID-LEVEL FUSIONDEMAND FOR SAFETY FEATURES IN VEHICLES TO DRIVE SEGMENT

-

12.4 HIGH-LEVEL FUSIONINCREASING DEVELOPMENT OF BASIC SENSOR FUSION IN AUTOMOBILES TO DRIVE SEGMENT

- 12.5 KEY INDUSTRY INSIGHTS

-

13.1 INTRODUCTIONASSUMPTIONSRESEARCH METHODOLOGY

-

13.2 SIGNAL-LEVEL FUSIONDEVELOPMENT OF NEW SENSORS WITH HIGHER ACCURACY AND LOWER COST TO INCREASE DEMAND FOR SIGNAL-LEVEL SENSOR FUSION

-

13.3 OBJECT-LEVEL FUSIONADVANCEMENTS IN AI TECHNOLOGIES TO DRIVE DEMAND FOR OBJECT-LEVEL SENSOR FUSION

-

13.4 FEATURE-LEVEL FUSIONNEED FOR MORE ACCURATE AND RELIABLE DATA FOR DECISION-MAKING IN COMPLEX AND DYNAMIC DRIVING ENVIRONMENTS TO DRIVE SEGMENT

-

13.5 DECISION-LEVEL FUSIONGOVERNMENT REGULATIONS FOR SAFER DRIVING SYSTEMS AND INCREASING DEMAND FOR AUTONOMOUS TRANSPORTATION TO DRIVE SEGMENT

- 13.6 KEY INDUSTRY INSIGHTS

- 14.1 INTRODUCTION

-

14.2 ASIA PACIFICCHINA- Increasing deployment of autonomous vehicles for testing by ride-hailing aggregators to increase demand for sensorsJAPAN- Government initiatives for road safety and push for autonomous vehicles to drive marketSOUTH KOREA- Government focus on autonomous vehicle deployment to drive marketINDIA- Increasing prices of petrol and diesel to drive market

-

14.3 EUROPEGERMANY- Strong autonomous vehicle development ecosystem to drive marketFRANCE- Government mandates for road safety to increase demand for autonomous vehicle sensing systemsITALY- Growing consumer demand for luxury automobiles with advanced safety features to drive marketUK- Increasing demand for advanced safety and leisure features on luxury vehicles to drive marketREST OF EUROPE

-

14.4 NORTH AMERICAUS- Government support for developing and testing autonomous vehicles to drive marketCANADA- Strong start-up ecosystem and presence of leading tier 1 component manufacturers to drive market

-

14.5 REST OF THE WORLDBRAZIL- Expansion of R&D centers for autonomous vehicle development due to export demand to drive marketUAE- Increasing development in autonomous driving to boost marketOTHERS

- 15.1 OVERVIEW

- 15.2 MARKET RANKING ANALYSIS

- 15.3 MARKET EVALUATION FRAMEWORK: REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

-

15.4 COMPETITIVE SCENARIODEALSPRODUCT DEVELOPMENTSEXPANSIONS, 2020–2023

-

15.5 COMPETITIVE LEADERSHIP MAPPING FOR SENSOR MARKET FOR AUTOMATED VEHICLESSTARSEMERGING LEADERSPERVASIVE PLAYERSEMERGING COMPANIES

-

15.6 COMPANY EVALUATION QUADRANT: SENSOR MARKET FOR AUTOMATED VEHICLES

- 15.7 SENSOR MARKET FOR AUTOMATED VEHICLES: COMPANY APPLICATION FOOTPRINT FOR MANUFACTURERS, 2022

- 15.8 SENSOR MARKET FOR AUTOMATED VEHICLES: REGIONAL FOOTPRINT FOR MANUFACTURERS, 2022

-

15.9 COMPETITIVE EVALUATION QUADRANT: SMES AND START-UPSPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

16.1 KEY PLAYERSROBERT BOSCH GMBH- Business overview- Recent developments- MnM viewCONTINENTAL AG- Business overview- Recent developments- MnM viewZF FRIEDRICHSHAFEN AG- Business overview- Recent developments- MnM viewDENSO- Business overview- Recent developments- MnM viewNXP SEMICONDUCTORS- Business overview- Recent developments- MnM viewALLEGRO MICROSYSTEMS- Business overview- Recent developmentsSTMICROELECTRONICS- Business overview- Recent developmentsAPTIV PLC- Business overview- Recent developmentsINFINEON TECHNOLOGIES- Business overview- Recent developments

-

16.2 KEY AUTONOMOUS VEHICLE PLATFORM PROVIDERSMOBILEYE- Business Overview- Recent developmentsNVIDIA- Business overview- Recent developmentsQUALCOMM- Business overview- Recent developmentsWAYMO- Business overview- Recent developmentsTESLA- Business overviewDATASPEED INC.- Business overview- Recent developmentsLEDDARTECH- Business overview- Recent developmentsVELODYNE LIDAR- Business overview- Recent developmentsBASELABS- Business overview- Recent developments

-

16.3 OTHER PLAYERSZOOXAURORABAIDUCTS CORPORATIONMEMSIC SEMICONDUCTOR (TIANJIN) CO., LTD.KIONIX, INC.TDK CORPORATIONMICROCHIP TECHNOLOGY INC.MONOLITHIC POWER SYSTEMS, INC.IBEO AUTOMOTIVE SYSTEMS GMBHRENESAS ELECTRONICS CORPORATIONMAGNA INTERNATIONALANALOG DEVICESVISTEON CORPORATIONPHANTOM AINEOUSYS TECHNOLOGYTE CONNECTIVITY LTD.MICRON TECHNOLOGYXILINX, INC.

- 17.1 ASIA PACIFIC TO BE MOST LUCRATIVE REGION FOR SENSOR MARKET FOR AUTOMATED VEHICLES

- 17.2 TECHNOLOGICAL ADVANCEMENTS TO HELP DEVELOP MARKET FOR AUTONOMOUS VEHICLES

- 17.3 SOFTWARE SEGMENT TO WITNESS SIGNIFICANT OPPORTUNITIES IN COMING YEARS WITH INCREASED VIABILITY OF LOW AND MID-LEVEL SENSOR FUSION

- 17.4 CONCLUSION

- 18.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

- TABLE 1 MARKET DEFINITION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COMPONENT

- TABLE 2 MARKET DEFINITION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY OFFERING

- TABLE 3 MARKET DEFINITION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY SOFTWARE

- TABLE 4 MARKET DEFINITION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY

- TABLE 5 MARKET DEFINITION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY PROPULSION

- TABLE 6 MARKET DEFINITION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY VEHICLE TYPE

- TABLE 7 MARKET DEFINITION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY SENSOR PLATFORM APPROACH

- TABLE 8 MARKET DEFINITION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY SENSOR FUSION PROCESS

- TABLE 9 INCLUSIONS AND EXCLUSIONS

- TABLE 10 CURRENCY EXCHANGE RATES

- TABLE 11 SAFETY FEATURES UNDER DEVELOPMENT

- TABLE 12 GLOBAL REGULATIONS AND INITIATIVES FOR DRIVER ASSISTANCE SYSTEMS

- TABLE 13 PORTER’S 5 FORCES IMPACT ON THE SENSOR MARKET FOR AUTOMATED VEHICLES

- TABLE 14 GDP TRENDS AND FORECAST, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

- TABLE 15 SENSOR MARKET FOR AUTOMATED VEHICLES: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 APPLICATIONS (%)

- TABLE 17 TYPES OF NIGHT VISION/THERMAL IMAGING

- TABLE 18 IMPORTANT PATENT REGISTRATIONS RELATED TO SENSOR MARKET FOR AUTOMATED VEHICLES

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 KEY ECONOMIC INDICATORS FOR SELECT COUNTRIES, 2021–2022

- TABLE 23 EUROPE: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 24 EUROPE: KEY INFLATION INDICATORS, 2021–2023

- TABLE 25 ASIA PACIFIC: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 26 ASIA PACIFIC: KEY INFLATION INDICATORS, 2021–2023

- TABLE 27 AMERICAS: KEY ECONOMIC INDICATORS, 2021–2023

- TABLE 28 AMERICAS: KEY INFLATION INDICATORS, 2021–2023

- TABLE 29 GDP GROWTH PROJECTIONS FOR KEY COUNTRIES, 2024–2027 (% GROWTH)

- TABLE 30 EUROPE: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- TABLE 31 ASIA PACIFIC: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- TABLE 32 AMERICAS: PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE SALES, BY COUNTRY, 2021–2022

- TABLE 33 PASSENGER CAR AND LIGHT COMMERCIAL VEHICLE PRODUCTION FORECAST, 2022 VS. 2030 (UNITS)

- TABLE 34 SENSOR MARKET FOR AUTOMATED VEHICLES: LIST OF CONFERENCES AND EVENTS

- TABLE 35 SENSOR MARKET FOR AUTOMATED VEHICLES (MOST LIKELY), BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 36 SENSOR MARKET FOR AUTOMATED VEHICLES (OPTIMISTIC), BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 37 SENSOR MARKET FOR AUTOMATED VEHICLES (PESSIMISTIC), BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 38 TOP HARDWARE COMPANIES PROVIDING AUTOMATED DRIVING SYSTEMS TO OEMS

- TABLE 39 SENSOR MARKET FOR AUTOMATED VEHICLES, BY COMPONENT, 2018–2021 (USD MILLION)

- TABLE 40 SENSOR MARKET FOR AUTOMATED VEHICLES, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 41 TOP HARDWARE PROVIDERS, 2021

- TABLE 42 HARDWARE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 43 HARDWARE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 44 SOFTWARE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 45 SOFTWARE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 46 SENSOR MARKET FOR AUTOMATED VEHICLES, BY OFFERING, 2018–2021 (THOUSAND UNITS)

- TABLE 47 SENSOR MARKET FOR AUTOMATED VEHICLES, BY OFFERING, 2022–2030 (THOUSAND UNITS)

- TABLE 48 SENSOR MARKET FOR AUTOMATED VEHICLES, BY OFFERING, 2018–2021 (USD MILLION)

- TABLE 49 SENSOR MARKET FOR AUTOMATED VEHICLES, BY OFFERING, 2022–2030 (USD MILLION)

- TABLE 50 CAMERAS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 51 CAMERAS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 52 CAMERAS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 53 CAMERAS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 54 ECU/ SOC: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 55 ECU/ SOC: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 56 ECU/ SOC: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 57 ECU/ SOC: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 58 RADAR SENSORS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 59 RADAR SENSORS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 60 RADAR SENSORS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 61 RADAR SENSORS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 62 LIDAR SENSORS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 63 LIDAR SENSORS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 64 OTHERS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 65 OTHERS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 66 OTHERS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 67 OTHERS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 68 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SOFTWARE, 2018–2021 (USD MILLION)

- TABLE 69 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SOFTWARE, 2022–2030 (USD MILLION)

- TABLE 70 OPERATING SYSTEM: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 71 OPERATING SYSTEM: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 72 MIDDLEWARE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 73 MIDDLEWARE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 74 APPLICATION SOFTWARE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 75 APPLICATION SOFTWARE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 76 SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 77 SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 78 OEMS DEVELOPMENT IN SENSOR HARDWARE SPACE

- TABLE 79 OEMS DEVELOPMENT IN SENSOR SOFTWARE SPACE

- TABLE 80 L2+: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 81 L2+: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 82 L3: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 83 L3: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 84 L4: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 85 SENSOR MARKET FOR AUTOMATED VEHICLES, BY PROPULSION, 2018–2021 (THOUSAND UNITS)

- TABLE 86 SENSOR MARKET FOR AUTOMATED VEHICLES, BY PROPULSION, 2022–2030 (THOUSAND UNITS)

- TABLE 87 ICE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 88 ICE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 89 ELECTRIC: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 90 ELECTRIC: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 91 SENSOR MARKET FOR AUTOMATED VEHICLES, BY VEHICLE TYPE, 2018–2021 (THOUSAND UNITS)

- TABLE 92 SENSOR MARKET FOR AUTOMATED VEHICLES, BY VEHICLE TYPE, 2022–2030 (THOUSAND UNITS)

- TABLE 93 UPCOMING AND OPERATIONAL AUTONOMOUS CAR MODELS

- TABLE 94 PASSENGER CARS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 95 PASSENGER CARS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 96 COMMERCIAL VEHICLES: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 97 COMMERCIAL VEHICLES: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 98 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SENSOR PLATFORM APPROACH, 2018–2021 (USD MILLION)

- TABLE 99 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SENSOR PLATFORM APPROACH, 2022–2030 (USD MILLION)

- TABLE 100 SENSOR FUSION LEVEL COMPARISON

- TABLE 101 ASSUMPTIONS: BY SENSOR PLATFORM APPROACH

- TABLE 102 LOW-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 103 LOW-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 104 MID-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 105 MID-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 106 HIGH-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 107 HIGH-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 108 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SENSOR FUSION PROCESS, 2018–2021 (USD MILLION)

- TABLE 109 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SENSOR FUSION PROCESS, 2022–2030 (USD MILLION)

- TABLE 110 ASSUMPTIONS: BY SENSOR FUSION PROCESS

- TABLE 111 SIGNAL-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 112 SIGNAL-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 113 OBJECT-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 114 OBJECT-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 115 FEATURE LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 116 FEATURE LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 117 DECISION-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (USD MILLION)

- TABLE 118 DECISION-LEVEL FUSION: SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (USD MILLION)

- TABLE 119 PHASES IN AUTONOMOUS VEHICLE DEVELOPMENT AND IMPACTS

- TABLE 120 SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2018–2021 (THOUSAND UNITS)

- TABLE 121 SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- TABLE 122 ASIA PACIFIC: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 123 ASIA PACIFIC: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2022–2030 (THOUSAND UNITS)

- TABLE 124 KEY COMPANIES IN AUTONOMOUS VEHICLE TECHNOLOGY AND THEIR KNOWN PARTNERS IN CHINA

- TABLE 125 LIST OF KEY START-UPS IN CHINA

- TABLE 126 CHINA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 127 CHINA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 128 LIST OF KEY START-UPS IN JAPAN

- TABLE 129 JAPAN: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 130 JAPAN: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 131 LIST OF KEY START-UPS IN SOUTH KOREA

- TABLE 132 SOUTH KOREA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 133 SOUTH KOREA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 134 LIST OF KEY START-UPS IN INDIA

- TABLE 135 INDIA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 136 INDIA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 137 EUROPE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 138 EUROPE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2022–2030 (THOUSAND UNITS)

- TABLE 139 AUTONOMOUS VEHICLE SENSOR AND SENSING PLATFORM START-UPS IN GERMANY

- TABLE 140 GERMANY: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 141 GERMANY: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 142 AUTONOMOUS VEHICLE SENSOR AND SENSING PLATFORM START-UPS IN FRANCE

- TABLE 143 FRANCE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 144 FRANCE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 145 ITALY: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 146 ITALY: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 147 AUTONOMOUS VEHICLE SENSOR AND SENSING PLATFORM START-UPS IN UK

- TABLE 148 UK: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 149 UK: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 150 REST OF EUROPE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 151 REST OF EUROPE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 152 NORTH AMERICA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 153 NORTH AMERICA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2022–2030 (THOUSAND UNITS)

- TABLE 154 AUTONOMOUS VEHICLE SENSOR AND SENSING PLATFORM START-UPS IN US

- TABLE 155 US: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 156 US: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 157 AUTONOMOUS VEHICLE SENSOR AND SENSING PLATFORM START-UPS IN CANADA

- TABLE 158 CANADA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2018–2021 (THOUSAND UNITS)

- TABLE 159 CANADA: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 160 REST OF THE WORLD: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2018–2021 (THOUSAND UNITS)

- TABLE 161 REST OF THE WORLD: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2022–2030 (THOUSAND UNITS)

- TABLE 162 BRAZIL: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 163 UAE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 164 OTHERS: SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- TABLE 165 SENSOR MARKET FOR AUTOMATED VEHICLES: DEALS, 2022

- TABLE 166 SENSOR MARKET FOR AUTOMATED VEHICLES: PRODUCT DEVELOPMENTS, 2020–2023

- TABLE 167 SENSOR MARKET FOR AUTOMATED VEHICLES: EXPANSIONS, 2020–2023

- TABLE 168 COMPANY PRODUCT FOOTPRINT

- TABLE 169 SENSOR MARKET FOR AUTOMATED VEHICLES: DETAILED LIST OF KEY START-UPS

- TABLE 170 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- TABLE 171 ROBERT BOSCH GMBH: PRODUCTS OFFERED

- TABLE 172 ROBERT BOSCH GMBH: NEW PRODUCT DEVELOPMENTS

- TABLE 173 ROBERT BOSCH GMBH: DEALS

- TABLE 174 CONTINENTAL AG: BUSINESS OVERVIEW

- TABLE 175 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 176 CONTINENTAL AG: NEW PRODUCT DEVELOPMENTS

- TABLE 177 CONTINENTAL AG: DEALS

- TABLE 178 CONTINENTAL AG: OTHERS

- TABLE 179 ZF FRIEDRICHSHAFEN AG: BUSINESS OVERVIEW

- TABLE 180 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED

- TABLE 181 ZF FRIEDRICHSHAFEN AG: NEW PRODUCT DEVELOPMENTS

- TABLE 182 ZF FRIEDRICHSHAFEN AG: DEALS

- TABLE 183 DENSO: BUSINESS OVERVIEW

- TABLE 184 DENSO: PRODUCTS OFFERED

- TABLE 185 DENSO: NEW PRODUCT DEVELOPMENTS

- TABLE 186 DENSO: DEALS

- TABLE 187 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

- TABLE 188 NXP SEMICONDUCTORS: PRODUCTS OFFERED

- TABLE 189 NXP SEMICONDUCTORS: NEW PRODUCT DEVELOPMENTS

- TABLE 190 NXP SEMICONDUCTORS: DEALS

- TABLE 191 ALLEGRO MICROSYSTEMS: BUSINESS OVERVIEW

- TABLE 192 ALLEGRO MICROSYSTEMS: PRODUCTS OFFERED

- TABLE 193 ALLEGRO MICROSYSTEMS: NEW PRODUCT DEVELOPMENTS

- TABLE 194 ALLEGRO MICROSYSTEMS: DEALS

- TABLE 195 STMICROELECTRONICS: BUSINESS OVERVIEW

- TABLE 196 STMICROELECTRONICS: PRODUCTS OFFERED

- TABLE 197 STMICROELECTRONICS: NEW PRODUCT DEVELOPMENTS

- TABLE 198 STMICROELECTRONICS: DEALS

- TABLE 199 APTIV PLC: BUSINESS OVERVIEW

- TABLE 200 APTIV PLC: PRODUCTS OFFERED

- TABLE 201 APTIV PLC: NEW PRODUCT DEVELOPMENTS

- TABLE 202 APTIV PLC: DEALS

- TABLE 203 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 204 INFINEON TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 205 INFINEON TECHNOLOGIES: NEW PRODUCT DEVELOPMENTS

- TABLE 206 INFINEON TECHNOLOGIES: DEALS

- TABLE 207 MOBILEYE: BUSINESS OVERVIEW

- TABLE 208 MOBILEYE: PRODUCTS OFFERED

- TABLE 209 MOBILEYE: NEW PRODUCT DEVELOPMENTS

- TABLE 210 MOBILEYE: DEALS

- TABLE 211 NVIDIA: BUSINESS OVERVIEW

- TABLE 212 NVIDIA: PRODUCTS OFFERED

- TABLE 213 NVIDIA: NEW PRODUCT DEVELOPMENTS

- TABLE 214 NVIDIA: DEALS

- TABLE 215 QUALCOMM: BUSINESS OVERVIEW

- TABLE 216 QUALCOMM: PRODUCTS OFFERED

- TABLE 217 QUALCOMM: NEW PRODUCT DEVELOPMENTS

- TABLE 218 QUALCOMM: DEALS

- TABLE 219 WAYMO: BUSINESS OVERVIEW

- TABLE 220 WAYMO: PRODUCTS OFFERED

- TABLE 221 WAYMO: NEW PRODUCT DEVELOPMENTS

- TABLE 222 WAYMO: DEALS

- TABLE 223 TESLA: BUSINESS OVERVIEW

- TABLE 224 TESLA: PRODUCTS OFFERED

- TABLE 225 TESLA: DEALS

- TABLE 226 TESLA: OTHERS

- TABLE 227 DATASPEED INC.: BUSINESS OVERVIEW

- TABLE 228 DATASPEED INC.: PRODUCTS OFFERED

- TABLE 229 DATASPEED INC.: NEW PRODUCT DEVELOPMENTS

- TABLE 230 DATASPEED INC.: DEALS

- TABLE 231 LEDDARTECH: BUSINESS OVERVIEW

- TABLE 232 LEDDARTECH: PRODUCTS OFFERED

- TABLE 233 LEDDARTECH: NEW PRODUCT DEVELOPMENTS

- TABLE 234 LEDDARTECH: DEALS

- TABLE 235 LEDDARTECH: OTHERS

- TABLE 236 VELODYNE LIDAR: BUSINESS OVERVIEW

- TABLE 237 VELODYNE LIDAR: PRODUCTS OFFERED

- TABLE 238 VELODYNE LIDAR: NEW PRODUCT DEVELOPMENTS

- TABLE 239 VELODYNE LIDAR: DEALS

- TABLE 240 BASELABS: BUSINESS OVERVIEW

- TABLE 241 BASELABS: PRODUCTS OFFERED

- TABLE 242 BASELABS: NEW PRODUCT DEVELOPMENTS

- TABLE 243 BASELABS: DEALS

- TABLE 244 ZOOX: BUSINESS OVERVIEW

- TABLE 245 AURORA: BUSINESS OVERVIEW

- TABLE 246 BAIDU: BUSINESS OVERVIEW

- TABLE 247 KIONIX, INC.: BUSINESS OVERVIEW

- TABLE 248 TDK CORPORATION: BUSINESS OVERVIEW

- TABLE 249 MICROCHIP TECHNOLOGY INC.: BUSINESS OVERVIEW

- TABLE 250 MONOLITHIC POWER SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 251 IBEO AUTOMOTIVE SYSTEMS GMBH: BUSINESS OVERVIEW

- TABLE 252 RENESAS ELECTRONICS CORPORATION: BUSINESS OVERVIEW

- TABLE 253 MAGNA INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 254 ANALOG DEVICES: BUSINESS OVERVIEW

- TABLE 255 VISTEON CORPORATION: BUSINESS OVERVIEW

- TABLE 256 PHANTOM AI: BUSINESS OVERVIEW

- TABLE 257 NEOUSYS TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 258 TE CONNECTIVITY LTD.: BUSINESS OVERVIEW

- TABLE 259 MICRON TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 260 XILINX, INC.: BUSINESS OVERVIEW

- FIGURE 1 MARKETS COVERED

- FIGURE 2 SENSOR MARKET FOR AUTOMATED VEHICLES: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 7 BOTTOM-UP APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 SENSOR MARKET FOR AUTOMATED VEHICLES: RESEARCH DESIGN & METHODOLOGY

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- FIGURE 12 SENSOR MARKET FOR AUTOMATED VEHICLES: MARKET OVERVIEW

- FIGURE 13 SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- FIGURE 14 SENSOR MARKET FOR AUTOMATED VEHICLES: UPCOMING MARKET TRENDS

- FIGURE 15 SENSOR MARKET FOR AUTOMATED VEHICLES, BY HARDWARE, 2022−2030

- FIGURE 16 INCREASING FOCUS ON SAFER VEHICLES AND ADVANCEMENTS IN VEHICLE TECHNOLOGY TO DRIVE MARKET

- FIGURE 17 SOFTWARE SEGMENT TO REGISTER HIGHER CAGR THAN HARDWARE SEGMENT DURING FORECAST PERIOD

- FIGURE 18 RADAR SENSORS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 MIDDLEWARE SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 20 L2+ SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 ELECTRIC SEGMENT TO GROW AT HIGHER RATE THAN ICE SEGMENT DURING FORECAST PERIOD

- FIGURE 22 PASSENGER CARS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 23 MID-LEVEL FUSION SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 24 FEATURE-LEVEL FUSION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 25 EUROPE ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 26 SENSOR MARKET FOR AUTOMATED VEHICLES: MARKET DYNAMICS

- FIGURE 27 ADAS FEATURE OFFERING BY VEHICLE HARDWARE

- FIGURE 28 VAYYAR 4D IMAGING RADAR SYSTEM

- FIGURE 29 DAIMLER L4 TRUCK ARCHITECTURE

- FIGURE 30 SENSOR INTERFACE STANDARDIZATION AT DIFFERENT STANDARDIZATION LEVELS

- FIGURE 31 EV SALES (2010–2021)

- FIGURE 32 5G NETWORK SERVICES IN DIFFERENT COUNTRIES

- FIGURE 33 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 34 SENSOR MARKET FOR AUTOMATED VEHICLES: AVERAGE PRICE OF ADAS COMPONENTS

- FIGURE 35 SENSOR MARKET FOR AUTOMATED VEHICLES: ECOSYSTEM ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP 2 APPLICATIONS

- FIGURE 38 TERRAIN SENSING SYSTEM IN JAGUAR LAND ROVER

- FIGURE 39 NUMBER OF PUBLISHED PATENTS (2012–2024)

- FIGURE 40 NUMBER OF DOCUMENTS

- FIGURE 41 REVENUE SHIFT FOR SENSOR MARKET FOR AUTOMATED VEHICLES

- FIGURE 42 SENSOR MARKET FOR AUTOMATED VEHICLES – FUTURE TRENDS & SCENARIO, 2022–2030 (THOUSAND UNITS)

- FIGURE 43 SENSOR MARKET FOR AUTOMATED VEHICLES, BY COMPONENT, 2022–2030

- FIGURE 44 SENSOR MARKET FOR AUTOMATED VEHICLES, BY OFFERING, 2022–2030

- FIGURE 45 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SOFTWARE, 2022–2030 (USD MILLION)

- FIGURE 46 SENSOR MARKET FOR AUTOMATED VEHICLES, BY LEVEL OF AUTONOMY, 2022–2030 (THOUSAND UNITS)

- FIGURE 47 SENSOR MARKET FOR AUTOMATED VEHICLES, BY PROPULSION, 2022–2030 (THOUSAND UNITS)

- FIGURE 48 SENSOR MARKET FOR AUTOMATED VEHICLES, BY VEHICLE TYPE, 2022–2030 (THOUSAND UNITS)

- FIGURE 49 APPLICATIONS OF DIFFERENT SENSOR FUSION LEVELS

- FIGURE 50 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SENSOR PLATFORM APPROACH, 2022–2030 (USD MILLION)

- FIGURE 51 APPLICATIONS OF DIFFERENT TYPES OF SENSOR FUSION PROCESSES IN VEHICLE

- FIGURE 52 SENSOR MARKET FOR AUTOMATED VEHICLES, BY SENSOR FUSION PROCESS, 2022–2030 (USD MILLION)

- FIGURE 53 SENSOR MARKET FOR AUTOMATED VEHICLES, BY REGION, 2022–2030 (THOUSAND UNITS)

- FIGURE 54 ASIA PACIFIC: SENSOR MARKET FOR AUTOMATED VEHICLES SNAPSHOT

- FIGURE 55 EUROPE: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2022–2030 (THOUSAND UNITS)

- FIGURE 56 NORTH AMERICA: SENSOR MARKET FOR AUTOMATED VEHICLES SNAPSHOT

- FIGURE 57 REST OF THE WORLD: SENSOR MARKET FOR AUTOMATED VEHICLES, BY COUNTRY, 2022–2030

- FIGURE 58 MARKET RANKING ANALYSIS FOR SENSOR MARKET FOR AUTOMATED VEHICLES, 2022

- FIGURE 59 TOP PUBLIC/LISTED PLAYERS DOMINATING SENSOR MARKET FOR AUTOMATED VEHICLES

- FIGURE 60 SENSOR MARKET FOR AUTOMATED VEHICLES: COMPETITIVE LEADERSHIP MAPPING FOR TOP HARDWARE PLAYERS, 2022

- FIGURE 61 SENSOR MARKET FOR AUTOMATED VEHICLES: COMPETITIVE LEADERSHIP MAPPING FOR AUTOMATED DRIVING PLATFORM PROVIDERS, 2022

- FIGURE 62 SENSOR MARKET FOR AUTOMATED VEHICLES: COMPETITIVE LEADERSHIP MAPPING FOR OTHER PLAYERS, 2022

- FIGURE 63 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 64 BOSCH ADAS SYSTEMS

- FIGURE 65 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 66 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

- FIGURE 67 ZF FRIEDRICHSHAFEN AG’S ADAS SYSTEMS FOR AUTONOMOUS VEHICLES

- FIGURE 68 DENSO: COMPANY SNAPSHOT

- FIGURE 69 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 70 ALLEGRO MICROSYSTEMS: COMPANY SNAPSHOT

- FIGURE 71 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 72 APTIV PLC: COMPANY SNAPSHOT

- FIGURE 73 APTIV PLC AV ARCHITECTURE

- FIGURE 74 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 75 MOBILEYE: COMPANY SNAPSHOT

- FIGURE 76 MOBILEYE IMAGING RADAR

- FIGURE 77 NVIDIA: COMPANY SNAPSHOT

- FIGURE 78 NVIDIA DRIVE PLATFORM

- FIGURE 79 QUALCOMM: COMPANY SNAPSHOT

- FIGURE 80 QUALCOMM’S SNAPDRAGON RIDE SOFTWARE PLATFORM FOR AV

- FIGURE 81 WAYMO DRIVER SETUP

- FIGURE 82 TESLA: COMPANY SNAPSHOT

- FIGURE 83 LEDDARVISION’S ENVIRONMENTAL PERCEPTION FRAMEWORK FOR AV

- FIGURE 84 VELODYNE LIDAR: COMPANY SNAPSHOT

- FIGURE 85 BASELABS DATA FUSION TECHNOLOGY

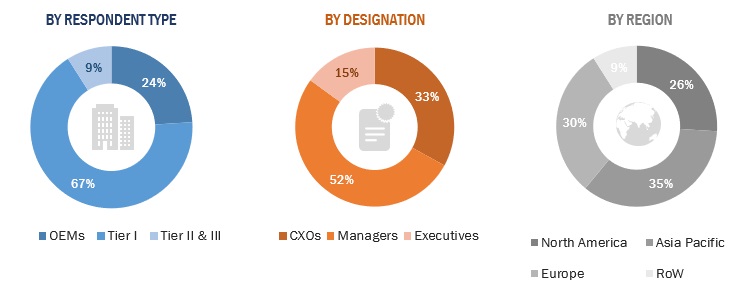

The study involved four major activities in estimating the current size of the sensor market for automated vehicles. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down approach was employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, industry association publications (for example, publications of automobile OEMs), automotive component associations, American Automobile Association (AAA), European Alternative Fuels Observatory (EAFO), International Energy Agency (IEA), country-level automotive associations, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (for example, Marklines and Factiva) were used to identify and collect information for an extensive commercial study of the sensor market for automated vehicles.

Primary Research

Extensive primary research was conducted after acquiring an understanding of the sensor market for automated vehicles scenario through secondary research. Several primary interviews were conducted with market experts from both the demand (country-level government associations, trade associations, institutes, R&D centers, OEMs/vehicle manufacturers) and supply (component manufacturers, software providers) sides across four major regions, namely North America, Europe, Asia Pacific, and Rest of the World. 52% of the experts involved in primary interviews were from the demand side, while the remaining 48% were from the supply side.

Primary data was collected through questionnaires, emails, and telephonic interviews. Primary interviews were conducted from various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint of the report. After interacting with industry participants, brief sessions were conducted with experienced independent consultants to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the findings delineated in the rest of this report. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to determine the size of the sensors market for automated vehicles for the component, offering, software, propulsion, vehicle type, sensor platform approach, and sensor fusion process. The total market size in value (USD million) was derived using the top-down approach. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s future supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the supply side.

Report Objectives

- To segment and forecast the sensor market for automated vehicles size in terms of volume (Thousand Units) and value (USD Million/Billion)

- To define, describe, and forecast the market based on component, offering, software, propulsion, level of autonomy, vehicle type, sensor platform approach and sensor fusion process

- To segment the market and forecast its size, by volume, based on region (North America, Europe, Asia Pacific and Rest of the World)

- To segment and forecast the market based on component (hardware, software)

- To segment and forecast the market based on offering (cameras, chips/semiconductors, radar sensors, lidar sensors, others)

- To segment and forecast the market based on software (operating system, middleware, application software)

- To segment and forecast the market based on propulsion (ICE, electric)

- To segment and forecast the market based on level of autonomy (L2+, L3, L4)

- To segment and forecast the market based on vehicle type (passenger cars, commercial vehicles)

- To segment and forecast the market based on sensor platform approach (high-level fusion, mid-level fusion, low-level fusion)

- To segment and forecast the market based on sensor fusion process (signal-level fusion, object-level fusion, feature-level fusion, decision-level fusion)

- To analyze the technological developments impacting the market

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, challenges, and opportunities)

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market

-

To study the following with respect to the market

- Market Dynamics

- Porter’s Five Forces Analysis

- Value Chain Analysis

- Ecosystem Analysis

- Case Study Analysis

- Trade Analysis

- Patent Analysis

- Regulatory Analysis

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as deals (joint ventures, mergers & acquisitions, partnerships, collaborations), new product development, and other activities carried out by key industry participants

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with company-specific needs.

- Additional country-level breakdown for the sensor market for automated vehicles by propulsion

- Additional country-level breakdown for the sensor market for automated vehicles by battery type

Company Information

- Profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Autonomous Vehicle Sensor Market