Silica Flour Market by Type (Quartz, Cristobalite), End Use (Fiberglass, Foundry, Glass & Clay, Ceramic & Refractory, Oil Well Cement) and Region (North America, APAC, Europe, South America, Middle East & Africa) - Global Forecast to 2026

Updated on : September 03, 2025

Silica Flour Market

The global silica flour market was valued at USD 563 million in 2021 and is projected to reach USD 684 million by 2026, growing at 3.94% cagr from 2021 to 2026. The market is expected to witness moderate growth in the coming years due to its increased demand across the construction, fiberglass, foundry, oil well cementing, and cosmetics industries.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 impact on global silica flour market

With the rise in cases of COVID-19, implementation of emergency protocols and shutdown of various operations and facilities have been observed during 2020. The silica flour market has observed a minimal or nominal impact of the pandemic on its demand in 2020-2021. However, the silica flour market faced several difficulties with material supply chain disruptions, and labor shortages, in 2020. In the first quarter of 2021, the market for silica flour has experienced an increase in the demand for silica flour chemicals worldwide, compared to that in 2020.

Silica Flour Market Dynamics

Driver: Increase in demand for silica flour for oil well cementing

Oil well cementing is one of the key applications of silica flour, and the growth of the oil industry coupled with the increase in crude oil prices has contributed to the growth of the silica flour market. Silica flour is commercially used in oil well cementing owing to its mechanical strength and permeability. Throughout the Western Canadian Sedimentary Basin, wellbore temperatures can exceed 110°C due to well depth or physical treatment. In these environments, silica flour is required as an additive to standard cement (Oilwell Class G) to meet permeability and compressive strength requirements. This creates a significant demand for silica flour for oil well cementing.

Restraint: Stringent government regulations on the usage of silica flour

Silica is classified as a hazardous substance and is therefore regulated under Chapter 4 of the Hazardous Substances of the 2017 Occupational Health and Safety Regulations. This means that an employer has a legal duty to identify hazards and eliminate or control any risk, provide information and training, undertake atmospheric monitoring, maintain records and, in the case of crystalline silica, carry out health surveillance. The National Occupational Health and Safety Commission (NOHSC - now SafeWork Australia) has revised the exposure standards for the three forms of crystalline silica, quartz, cristobalite, and tridymite. These regulations and mandates have prompted manufacturers to employ new techniques to maintain a safe working environment. This, in turn, can lead to reduced profit margins and may hamper the growth of the silica flour market to some extent.

Opportunity: Growth in the cosmetic industry to drive the demand for silica flour

Silica flour is used in cosmetics as a natural absorbent. Skin products have gained the attention of the masses in recent times, and people of all age groups use them. Since most skin products are manufactured using silica flour, the demand for silica flour has increased globally in recent years. According to Cosmetics Europe (The Personal Care Association), the cosmetic industry was valued at EUR 79.8 billion at a retail sales price in 2019, and the European cosmetics and personal care market is the largest in the world. Globally, the economic development in emerging countries has further increased the utilization of cosmetic products, as consumers have more disposable income. This growth in demand for cosmetic products will, in turn, drive the demand for silica flour for application in skincare products.

Challenge: Adverse effect of silica flour on human health

One of the major effects of silica flour on human health is silicosis, which is a long-term lung disease caused by inhaling large amounts of crystalline silica dust, usually over many years. The handling or processing of silica flour can create a risk for the workers, as silica flour has a very fine dust-like structure that can be easily inhaled, causing adverse effects on human health. The National Institute for Occupational Safety and Health (NIOSH) has also warned the manufacturers and users of silica flour that the risk of developing silicosis may be very high for workers exposed to silica flour. NIOSH stated that workers exposed to silica flour are at serious risk of developing silicosis. Therefore, the adverse effects of silica flour on human health act as a major challenge for the market’s growth.

Quartz widely preferred type of silica flour

Based on type, quartz is projected to be the largest segment in the silica flour market. Quartz silica, often called quartz sand, white sand, industrial sand, and silica sand includes sand with high silicon dioxide (SiO2) content. It is a hard, crystalline mineral that consists of silicon and oxygen atoms. Quartz is estimated to be the largest segment in the silica flour market in 2020. Quartz is extensively used in the production of paints, cosmetics, fiberglass, silicone rubber, and ceramic and in oil well cementing. The hardness, high density, and high chemical resistance offered by quartz flour are likely to contribute to the higher demand of this segment.

Significant increase in the demand for silica flour for fiberglass production

By End use, the fiberglass segment is projected to be the largest segment in the silica flour market.. Properties such as high strength and low weight make fiberglass preferable for use in composite and insulation applications in the construction, automotive, and wind energy industries. The growth of this segment can be attributed to the keen interest of contractors and builders to use silica flour to produce fiberglass for construction activities (as a construction and insulation material), especially in the emerging economies of APAC and South America.

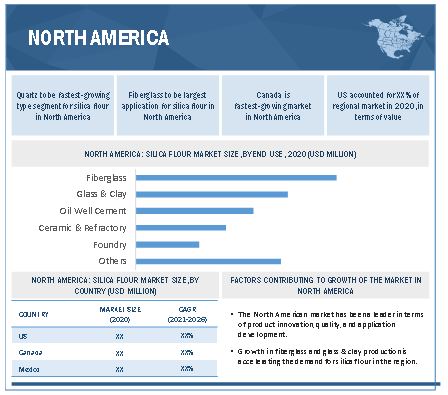

North American region to lead the global silica flour market by 2026

The North American region accounted for the largest market share in 2020. North America has witnessed a substantial upsurge in the tire industry due to the presence of automobile giants, such as General Motors and Ford Company. The growing tire industry has increased the consumption of silica flour as a reinforcing filler in this region. Additionally, the use of glass and silica flour for renewable energy resource applications such as solar cells and wind turbines has accelerated the growth of the silica flour market in the region.

Silica Flour Market Players

The silica flour market is dominated by a few established players, such as U.S. Silica Holdings, Inc. (US), Sibelco Group (Belgium), Adwan Chemical Industries Company (Saudi Arabia), Sil Industrial Minerals (Canada), and AGSCO Corporation (US), amongst others.

Frequently Asked Questions (FAQ):

What is the current size of global silica flour market?

The global silica flour market size is projected to grow USD 563.8 million in 2021 to USD 684.0 billion by 2025, at a CAGR of 3.94% from 2021 to 2026.

How is the silica flour market aligned?

The silica flour market is highly competitive, and has a large number of global, regional and domestic players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key players in the global silica flour market?

The key players operating in the silica flour market are U.S. Silica Holdings, Inc. (US), Sibelco Group (Belgium), Adwan Chemical Industries Company (Saudi Arabia), Sil Industrial Minerals (Canada), and AGSCO Corporation (US), amongst others.

What are the factors driving the growth of the silica flour market?

The growth of the silica flour market is attributed to the increase in demand for silica flour for numerous applications, particularly for fiberglass and glass & clay production. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 SILICA FLOUR MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

FIGURE 2 SILICA FLOUR MARKET, BY REGION

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.2 MARKET SIZE ESTIMATION

FIGURE 3 APPROACH 1: TOP-DOWN

FIGURE 4 APPROACH 2: SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 5 SILICA FLOUR MARKET: DATA TRIANGULATION

FIGURE 6 KEY MARKET INSIGHTS

FIGURE 7 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 27)

FIGURE 8 QUARTZ SEGMENT TO DOMINATE SILICA FLOUR MARKET BY 2026

FIGURE 9 FIBERGLASS TO BE LARGEST END USE OF SILICA FLOUR DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA DOMINATED SILICA FLOUR MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 30)

4.1 EMERGING ECONOMIES TO WITNESS A RELATIVELY HIGHER DEMAND FOR SILICA FLOUR

FIGURE 11 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN SILICA FLOUR MARKET DURING THE FORECAST PERIOD

4.2 NORTH AMERICA: SILICA FLOUR MARKET, BY END USE AND COUNTRY

FIGURE 12 US WAS LARGEST MARKET FOR SILICA FLOUR IN NORTH AMERICA IN 2020

4.3 SILICA FLOUR MARKET, BY TYPE

FIGURE 13 QUARTZ TO LEAD SILICA FLOUR MARKET DURING FORECAST PERIOD

4.4 SILICA FLOUR MARKET, BY END USE

FIGURE 14 FIBERGLASS PROJECTED TO BE DOMINANT END USE OF SILICA FLOUR MARKET BY 2026

4.5 SILICA FLOUR MARKET, BY COUNTRY

FIGURE 15 MARKET IN INDIA PROJECTED GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 33)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 SILICA FLOUR MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for silica flour for oil well cementing

FIGURE 17 CRUDE OIL PRICE TREND, 2015–2021

5.2.1.2 Silica flour preferred as a good refractory material

5.2.2 RESTRAINTS

5.2.2.1 Stringent government regulations on the usage of silica flour

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in construction and infrastructural activities

TABLE 1 ASIA PACIFIC URBANIZATION TREND, 1990–2050

5.2.3.2 Growth in the cosmetic industry to drive demand for silica flour

5.2.4 CHALLENGES

5.2.4.1 Adverse effects of silica flour on human health

5.3 YC-YCC DRIVERS

FIGURE 18 YC-YCC DRIVERS

5.4 TARIFF AND REGULATORY ANALYSIS

5.5 MARKET MAPPING/ ECOSYSTEM MAP

FIGURE 19 ECOSYSTEM MAP

5.6 PRICING ANALYSIS

5.6.1 SILICA FLOUR - PRICE

5.7 TRADE ANALYSIS

5.7.1 HS CODE USED FOR SILICA FLOUR - IMPORT

5.7.2 HS CODE USED FOR SILICA FLOUR - EXPORT

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 METHODOLOGY

5.8.3 DOCUMENT TYPE

TABLE 2 NUMBER OF PATENTS FOR SILICA FLOUR

FIGURE 20 SILICA FLOUR MARKET: GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

FIGURE 21 PUBLICATION TRENDS - LAST 10 YEARS

5.8.4 INSIGHTS

FIGURE 22 JURISDICTION ANALYSIS

5.8.5 TOP COMPANIES/APPLICANTS

FIGURE 23 TOP APPLICANTS OF SILICA FLOUR

5.8.6 LIST OF PATENTS BY ELKEM AS

5.8.7 LIST OF PATENTS BY UNITED STATES GYPSUM CORPORATION

5.8.8 LIST OF PATENTS BY SAUDI ARABIAN OIL COMPANY

5.8.9 LIST OF PATENTS BY US ARMY

5.8.10 LIST OF TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 INDUSTRY TRENDS (Page No. - 47)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 24 SILICA FLOUR MARKET: SUPPLY CHAIN

TABLE 3 SILICA FLOUR MARKET: ECOSYSTEM

6.2.1 PROMINENT COMPANIES

6.2.2 SMALL & MEDIUM ENTERPRISES

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 SILICA FLOUR MARKET: PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

7 IMPACT OF COVID-19 ON SILICA FLOUR MARKET (Page No. - 53)

7.1 INTRODUCTION

7.2 IMPACT OF COVID-19 ON SILICA FLOUR MARKET

8 SILICA FLOUR MARKET, BY TYPE (Page No. - 55)

8.1 INTRODUCTION

FIGURE 26 QUARTZ SEGMENT TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 5 SILICA FLOUR MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 6 SILICA FLOUR MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

8.2 QUARTZ

8.2.1 QUARTZ LED SILICA FLOUR MARKET IN 2020

8.3 CRISTOBALITE

8.3.1 EXCELLENT OPTICAL PROPERTIES OFFERED BY CRISTOBALITE FLOUR BOOST SEGMENT GROWTH

9 SILICA FLOUR MARKET, BY END USE (Page No. - 58)

9.1 INTRODUCTION

FIGURE 27 FIBERGLASS TO REMAIN LARGEST SEGMENT FOR SILICA FLOUR MARKET UNTIL 2026

TABLE 7 MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 8 MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

9.2 FIBERGLASS

9.2.1 FIBERGLASS TO DOMINATE GLOBAL SILICA FLOUR MARKET

9.3 OIL WELL CEMENT

9.3.1 STRENGTH AND PERMEABILITY OF SILICA FLOUR IN OIL WELL CEMENTING DRIVE SEGMENT GROWTH

9.4 GLASS & CLAY

9.4.1 GLASS & CLAY TO BE SECOND-FASTEST GROWING SEGMENT FOR SILICA FLOUR

9.5 CERAMIC & REFRACTORY

9.5.1 RESISTANCE TO HEAT AND STRESS MAKES SILICA FLOUR SUITABLE REFRACTORY MATERIAL

9.6 FOUNDRY

9.6.1 HIGH TEMPERATURE STRENGTH AND HIGH DENSITY DRIVES FOUNDRY SEGMENT

9.7 OTHERS

10 SILICA FLOUR MARKET, BY REGION (Page No. - 63)

10.1 INTRODUCTION

FIGURE 28 REGIONAL SNAPSHOT: INDIA PROJECTED TO BE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2021 TO 2026

TABLE 9 SILICA FLOUR MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 10 MARKET SIZE, BY REGION, 2019–2026 (MILLION KG)

TABLE 11 MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 12 MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 13 MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 14 MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: SILICA FLOUR MARKET SNAPSHOT

TABLE 15 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 16 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 17 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 18 NORTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 19 NORTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 20 NORTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.2.1 US

10.2.1.1 US to dominate market for silica flour in North America

TABLE 21 US: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 22 US: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 23 US: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 24 US: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.2.2 CANADA

10.2.2.1 Growing construction projects to drive market for silica flour in Canada

TABLE 25 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 26 CANADA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 27 CANADA: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 28 CANADA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.2.3 MEXICO

10.2.3.1 Increasing glass production to boost market for silica flour in Mexico

TABLE 29 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 30 MEXICO: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 31 MEXICO: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 32 MEXICO: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.3 APAC

FIGURE 30 APAC: MARKET SNAPSHOT

TABLE 33 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 34 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 35 APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 36 APAC: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 37 APAC: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 38 APAC: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.3.1 CHINA

10.3.1.1 Increasing use of fiberglass for construction applications to boost demand for silica flour in China

TABLE 39 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 40 CHINA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 41 CHINA: SILICA FLOUR MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 42 CHINA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.3.2 JAPAN

10.3.2.1 Significant demand for silica flour for fiberglass from automobile manufacturers in Japan

TABLE 43 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 44 JAPAN: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 45 JAPAN: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 46 JAPAN: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.3.3 INDIA

10.3.3.1 India to be fastest-growing silica flour market globally

TABLE 47 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 48 INDIA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 49 INDIA: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 50 INDIA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.3.4 AUSTRALIA

10.3.4.1 Increasing applicability of paint & costings creates demand for silica flour in Australia

TABLE 51 AUSTRALIA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 52 AUSTRALIA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 53 AUSTRALIA: SILICA FLOUR MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 54 AUSTRALIA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.3.5 REST OF APAC

TABLE 55 REST OF APAC: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 56 REST OF APAC: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 57 REST OF APAC: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 58 REST OF APAC: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.4 EUROPE

TABLE 59 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 60 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 61 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 62 EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 63 EUROPE: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 64 EUROPE: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.4.1 GERMANY

10.4.1.1 Germany to dominate silica flour market in Europe

TABLE 65 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 66 GERMANY: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 67 GERMANY: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 68 GERMANY: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.4.2 UK

10.4.2.1 Growing construction industry to offer opportunities for silica flour market in UK

TABLE 69 UK: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 70 UK: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 71 UK: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 72 UK: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.4.3 FRANCE

10.4.3.1 Increasing demand for fiberglass to accelerate demand for silica flour in France

TABLE 73 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 74 FRANCE: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 75 FRANCE: SILICA FLOUR MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 76 FRANCE: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.4.4 RUSSIA

10.4.4.1 Rising steel production capacity to boost demand for silica flour for refractory in Russia

TABLE 77 RUSSIA: SILICA FLOUR MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 78 RUSSIA: SILICA FLOUR MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 79 RUSSIA: SILICA FLOUR MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 80 RUSSIA: SILICA FLOUR MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.4.5 ITALY

10.4.5.1 Increasing demand for refractory applications boost demand for silica flour in Italy

TABLE 81 ITALY: SILICA FLOUR MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 82 ITALY: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 83 ITALY: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 84 ITALY: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.4.6 REST OF EUROPE

TABLE 85 REST OF EUROPE: SILICA FLOUR MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 86 REST OF EUROPE: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 87 REST OF EUROPE: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 88 REST OF EUROPE: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.5 MIDDLE EAST & AFRICA

TABLE 89 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 90 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 91 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 92 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 93 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 94 MIDDLE EAST & AFRICA: SILICA FLOUR MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.5.1 UAE

10.5.1.1 Rising demand for fiberglass for construction projects boosts demand for silica flour in UAE

TABLE 95 UAE: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 96 UAE: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 97 UAE: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 98 UAE: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.5.2 SAUDI ARABIA

10.5.2.1 Increasing oil well construction to drive growth of silica flour market in Saudi Arabia

TABLE 99 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 100 SAUDI ARABIA:MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 101 SAUDI ARABIA:MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 102 SAUDI ARABIA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.5.3 TURKEY

10.5.3.1 Significant infrastructural investments to accelerate demand for silica flour in Turkey

TABLE 103 TURKEY: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 104 TURKEY: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 105 TURKEY: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 106 TURKEY: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.5.4 EGYPT

10.5.4.1 Increasing glass production to drive demand for silica flour in Egypt

TABLE 107 EGYPT: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 108 EGYPT: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 109 EGYPT: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 110 EGYPT: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.5.5 KUWAIT

10.5.5.1 Boost in demand for silica flour for oil well cementing in Kuwait

TABLE 111 KUWAIT: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 112 KUWAIT: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 113 KUWAIT: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 114 KUWAIT: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 115 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 116 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 117 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 118 REST OF MIDDLE EAST & AFRICA: SILICA FLOUR MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.6 SOUTH AMERICA

TABLE 119 SOUTH AMERICA: SILICA FLOUR MARKET SIZE, BY COUNTRY, 2019–2026 (USD THOUSAND)

TABLE 120 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION KG)

TABLE 121 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 122 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 123 SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 124 SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.6.1 BRAZIL

10.6.1.1 Brazil to dominate silica flour market in South America

TABLE 125 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 126 BRAZIL: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 127 BRAZIL: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 128 BRAZIL: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

10.6.2 ARGENTINA

10.6.2.1 Increasing demand for fiberglass to boost silica flour market in Argentina

TABLE 129 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 130 ARGENTINA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 131 ARGENTINA: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 132 ARGENTINA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

TABLE 133 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (USD THOUSAND)

TABLE 134 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2019–2026 (MILLION KG)

TABLE 135 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (USD THOUSAND)

TABLE 136 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION KG)

11 COMPETITIVE LANDSCAPE (Page No. - 114)

11.1 OVERVIEW

11.2 MARKET RANKING

FIGURE 31 MARKET RANKING OF KEY PLAYERS, 2020

11.2.1 SIBELCO GROUP

11.2.2 U.S. SILICA HOLDINGS, INC.

11.2.3 SIL INDUSTRIAL MINERALS

11.2.4 ADWAN CHEMICAL INDUSTRIES COMPANY

11.2.5 AGSCO CORPORATION

11.3 MARKET SHARE ANALYSIS

TABLE 137 SILICA FLOUR MARKET: DEGREE OF COMPETITION

FIGURE 32 SILICA FLOUR MARKET: MARKET SHARE ANALYSIS, 2020

11.4 COMPETITIVE LEADERSHIP MAPPING

11.4.1 STAR

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 EMERGING COMPANIES

FIGURE 33 SILICA FLOUR MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN SILICA FLOUR MARKET

11.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN SILICA FLOUR MARKET

TABLE 138 COMPANY INDUSTRY FOOTPRINT

TABLE 139 COMPANY REGION FOOTPRINT

12 COMPANY PROFILES (Page No. - 124)

(Business overview, Products offered, Operational Assessment, Recent developments, SWOT analysis, MnM View, & Right to win)*

12.1 U.S. SILICA HOLDINGS, INC.

TABLE 140 U.S. SILICA HOLDINGS, INC.: BUSINESS OVERVIEW

FIGURE 36 U.S. SILICA HOLDINGS, INC.: COMPANY SNAPSHOT

FIGURE 37 U.S. SILICA HOLDINGS, INC.: SWOT ANALYSIS

12.2 SIBELCO GROUP

TABLE 141 SIBELCO GROUP: BUSINESS OVERVIEW

FIGURE 38 SIBELCO GROUP: COMPANY SNAPSHOT

FIGURE 39 SIBELCO GROUP: SWOT ANALYSIS

12.3 ADWAN CHEMICAL INDUSTRIES COMPANY

TABLE 142 ADWAN CHEMICAL INDUSTRIES COMPANY: BUSINESS OVERVIEW

FIGURE 40 ADWAN CHEMICAL INDUSTRIES COMPANY: SWOT ANALYSIS

12.4 AGSCO CORPORATION

TABLE 143 AGSCO CORPORATION: BUSINESS OVERVIEW

FIGURE 41 AGSCO CORPORATION: SWOT ANALYSIS

12.5 SIL INDUSTRIAL MINERALS

TABLE 144 SIL INDUSTRIAL MINERALS: BUSINESS OVERVIEW

12.6 INTERNATIONAL SILICA INDUSTRIES CO.

TABLE 145 INTERNATIONAL SILICA INDUSTRIES CO.: BUSINESS OVERVIEW

12.7 HOBEN INTERNATIONAL LIMITED

TABLE 146 HOBEN INTERNATIONAL LIMITED: BUSINESS OVERVIEW

12.8 PREMIER SILICA LLC

TABLE 147 PREMIER SILICA LLC: BUSINESS OVERVIEW

12.9 MS INDUSTRIES II, LLC

TABLE 148 MS INDUSTRIES II, LLC: BUSINESS OVERVIEW

12.10 KNOUZ

TABLE 149 KNOUZ: BUSINESS OVERVIEW

12.11 ADDITIONAL PLAYERS

12.11.1 GULF MINERALS & CHEMICALS LLC

12.11.2 MICAMIN EXPORTS

12.11.3 FINETON INDUSTRIAL MINERALS LIMITED

12.11.4 B.R.K. MINERALS

12.11.5 TASMANIAN ADVANCED MINERALS

12.11.6 ADINATH INDUSTRIES

12.11.7 TIANJIN BINHAI NEW AREA DAGANG FARWING DRILLING TECHNICAL SERVICE CO., LTD.

12.11.8 BMS FACTORIES

12.11.9 QUARZWERKE GMBH

12.11.10 TANVI MINES & MINERALS

12.11.11 SAC CORPORATION

12.11.12 THRRAT FACTORY FOR THE INDUSTRY

12.11.13 SHRI VINAYAK INDUSTRIES

12.11.14 LIANYUNGANG CHANGTONG SILICA POWDER CO., LTD.

12.11.15 TERENGGANU SILICA CONSORTIUM SDN BHD

12.11.16 RP ENTERPRISE

12.12 EGYPT-BASED PLAYERS

12.12.1 KNOUZ

TABLE 150 KNOUZ: BUSINESS OVERVIEW

12.12.2 GREEN EGYPT GROUP

TABLE 151 GREEN EGYPT GROUP: BUSINESS OVERVIEW

12.12.3 SUEZ COMPANY FOR MINERALS

TABLE 152 SUEZ COMPANY FOR MINERALS: BUSINESS OVERVIEW

12.12.4 CAIRO FRESH FOR MINERALS & QUARRIES MATERIALS

TABLE 153 CAIRO FRESH FOR MINERALS & QUARRIES MATERIALS: BUSINESS OVERVIEW

12.12.5 EL FAYROUZ FOUNDATION

TABLE 154 EL FAYROUZ FOUNDATION: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Operational Assessment, Recent developments, SWOT analysis, MnM View, & Right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 160)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

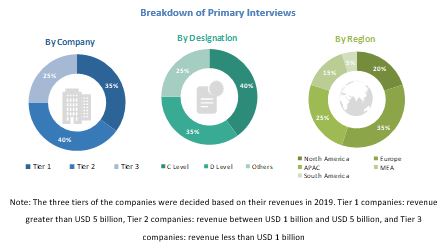

The study involved four major activities for estimating the current global size of the silica flour market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of silica flour through primary research. The top-down approach was employed to estimate the overall size of the silica flour market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the silica flour market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the silica flour market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the silica flour industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the global size of the silica flour market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the silica flour market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the silica flour market in terms of value and volume based on type, end use, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the silica flour report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the silica flour market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Silica Flour Market