Smart Cities Market

Smart Cities Market by Focus Area, Smart Transportation, Smart Buildings, Smart Utilities, Smart Citizen Services (Public Safety, Smart Healthcare, Smart Education, Smart Lighting, and E-Governance) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

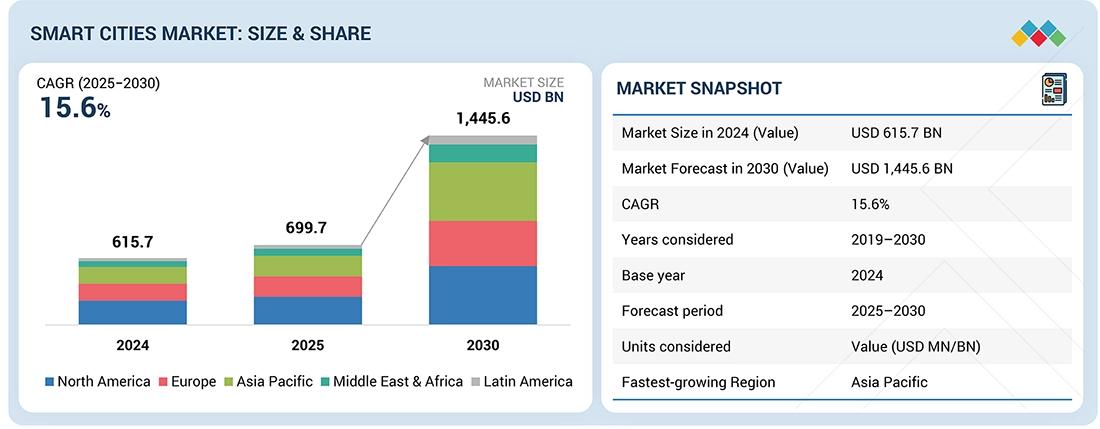

The Smart Cities market is projected to grow from USD 699.7 billion in 2025 to USD 1,445.6 billion by 2030 at a compound annual growth rate (CAGR) of 15.6% from 2025 to 2030. The smart cities market is driven by the integration of digital infrastructure, IoT-enabled connectivity, and artificial intelligence, which enable real-time urban analytics and automated service management for greater efficiency and livability. At the core of Smart Cities, citizen engagement platforms and integrated command centers foster collaborative governance, resilience, and public safety, aligning urban innovation with social and economic needs.

KEY TAKEAWAYS

- The North America smart cities market dominated, with a share of 30.5% in 2024.

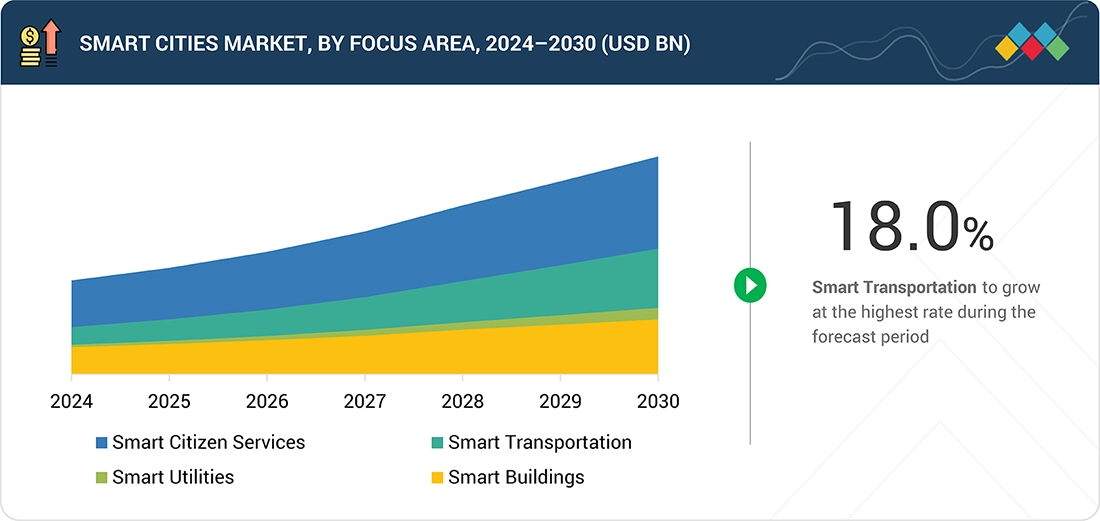

- By focus area, the smart citizen services segment is expected to dominate the market.

- By smart citizen services, the smart healthcare segment is expected to register the highest CAGR of 17.2%.

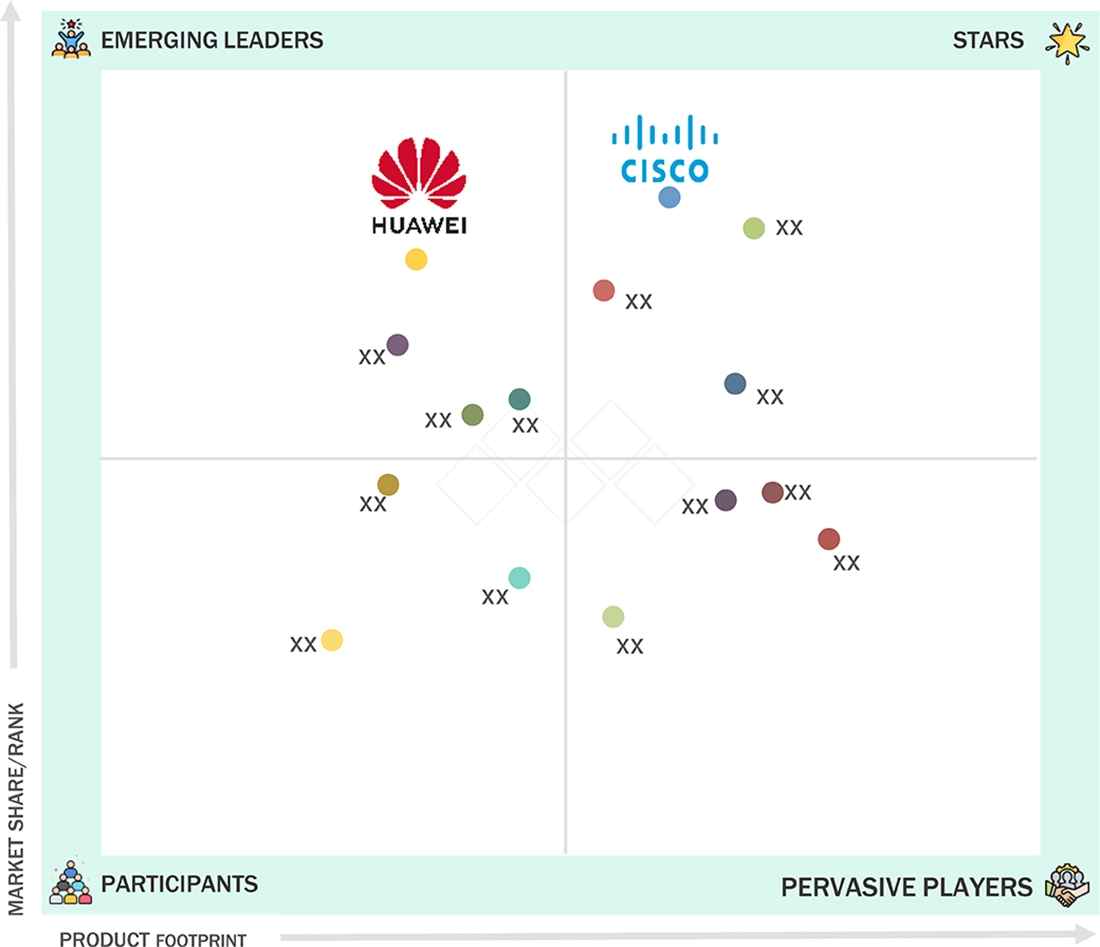

- Siemens, Cisco, and Hitachi were identified as Star players in the smart cities market, as they provide integrated industrial and IT platforms, large-scale IoT and digital-twin capabilities, end-to-end infrastructure, strong systems-integration and cybersecurity expertise, and long-standing public-sector partnerships with global deployments.

- KETOS, AppyWay, and IXDen have have distinguished themselves among startups and SMEs by deploying sensor-driven water and environmental monitoring, smart kerbspace and parking-as-a-service with data-driven policy tools, and edge-to-cloud IoT platforms for real-time urban analytics and citizen services.

- The Europe smart cities market size is projected to grow from USD 202.9 billion in 2025 to USD 408.4 billion by 2030 at a CAGR of 15.0% during the forecast period.

- The Asia Pacific smart cities market size is projected to grow from USD 207.0 billion in 2025 to USD 457.2 billion by 2030 at a CAGR of 17.2% during the forecast period.

- The Saudi Arabia smart cities market size is projected to grow from USD 5.1 billion in 2025 to USD 10.9 billion by 2030 at a CAGR of 16.3% during the forecast period.

Governments and cities are increasingly investing in smart cities as an alternative approach to addressing issues such as traffic congestion, energy consumption, waste management, and public safety. Concurrently, the development of enabling technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and 5G connectivity, enables the real-time collection and analysis of data, helping improve decision-making and efficient delivery of services. Moreover, increased concerns over the environment with regard to international commitments on climate continue to make cities transition towards more efficient, low-carbon solutions. Favorable policies and public-private collaborations further drive the implementation of smart technologies.

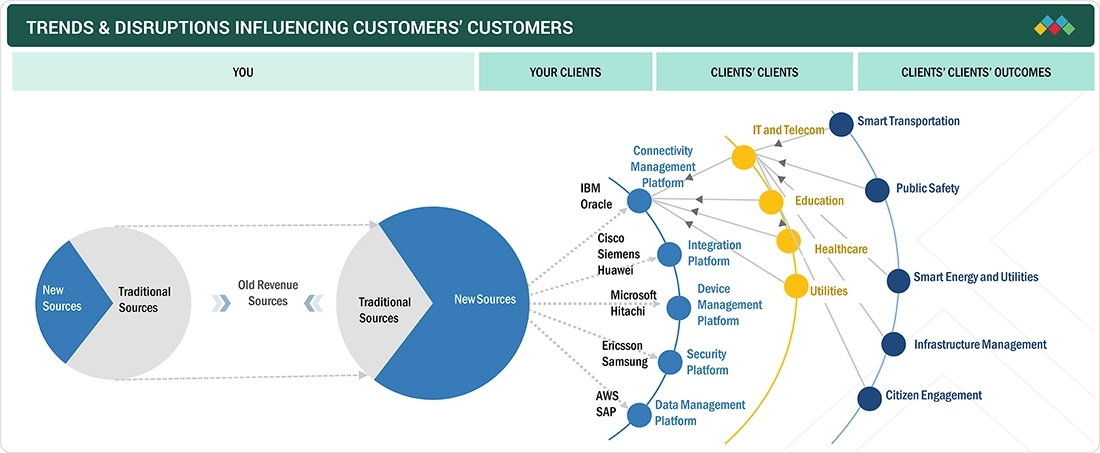

Smart Cities Market TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The smart cities market is influenced by disruptive forces impacting buyers. Concerns about data privacy, trust, and governance lead cities to demand privacy-by-design, transparency, and open standards to prevent vendor lock-in. Focus on climate resilience, cybersecurity, and supply-chain security increases requirements for secure devices and risk transparency. Limited budgets drive phased deployments, outcome-based contracts, and managed services. Adoption of AI and edge analytics emphasizes explainability, low latency, and model validation. Fragmented regulations, higher citizen expectations, and connectivity advances like 5G shape procurement, prioritizing flexibility, outcomes, and future-proofing.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Enhancing public safety in smart cities through technological innovation

-

Use of artificial intelligence and machine learning in urban development

Level

-

High implementation costs

-

Privacy and security concerns

Level

-

Rise of 5G

-

Advancements in AI, cloud, IoT, and analytics technologies

Level

-

Crafting future-ready smart cities for sustainable urban living

-

Absence of suitable infrastructure in emerging economies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Enhancing public safety in smart cities through technological innovation

Smart technologies that enhance monitoring, prevention, and response to incidents include AI-powered surveillance systems, predictive policing software, real-time crime mapping, and integrated response platforms that coordinate multiple agencies. Smart technologies not only enhance the safety of citizens but also foster trust among the public, ensuring social stability that is vital for long-term urban growth. Proactive decision-making and resource allocation that is aided by advanced analytics and infrastructure that is supported by the internet of things, lower response times, and enhances the outcomes of critical situations. The government and municipalities continue to invest in this area as they strive to provide safer living spaces, thus strengthening public safety as a vital pillar of smart city development and a strong rationale for continued market growth.

Restraint: High implementation costs

The high cost of implementation is a major barrier to the growth of the smart cities market. Building smart city infrastructure requires significant initial investments in advanced technologies like IoT networks, AI solutions, data centers, and smart utilities. These costs often include purchasing advanced hardware and software, integrating with legacy systems, hiring skilled labor, and ongoing maintenance. For many municipalities, especially in developing countries, such financial commitments are a barrier, preventing them from starting or expanding smart city projects. Additionally, the uncertainty about return on investment (ROI) and the long wait for substantial benefits discourage both public and private stakeholders. Budget constraints, competing urban priorities, and limited access to financing further slow market adoption and hinder the spread of smart city benefits in different urban areas.

Opportunity: Rise of 5G

The advent of 5G technology is proving to be a crucial driver of the growth of the smart cities market worldwide. With its significantly higher data transmission speeds and ultra-low latencies, 5G represents a fundamental shift from previous network technologies. High-speed capabilities are essential for the smooth operation of key smart city systems, such as intelligent transportation, smart energy networks, automated waste collection, and connected public safety infrastructure. The ability to process data in real time will enable quicker, more efficient decision-making in traffic management, emergency response, and environmental monitoring. Additionally, 5G technology allows cities' governments to expand network capacity and implement network slicing, which helps deploy customized, secure networks tailored to specific urban functions. It also supports the deployment of advanced technologies like self-driving cars and drones, which depend on immediate data sharing for optimal performance. As an enabling technology, 5G is poised to significantly accelerate the development, integration, and operational efficiency of smart city solutions, ultimately fostering long-term market growth.

Challenge: Crafting future-ready smart cities for sustainable urban living

Creating smart cities for sustainable urban living is challenging due to operational, infrastructural, and technological demands. Key challenges include integrating advanced tech like IoT, AI, and 5G into infrastructure lacking a digital base, high initial costs for upgrading systems and building data platforms, operational issues like ensuring interoperability, data privacy, cybersecurity, and processing real-time data. Coordination among government, private sector, and citizens adds complexity. Lack of skilled workforce and regulation delays implementation. These challenges underscore the need for a long-term strategy to address structural and operational barriers to large-scale smart city projects.

Smart Cities Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Fastned is a Dutch provider of fast-charging solutions for electric vehicles. The company provides infrastructure to charge vehicles with renewable energy, such as solar or wind. Fastned wanted to accelerate the adoption of electric vehicles across Europe to reduce CO2 emissions. | ABB offered its ABB Terra 350W chargers, capable of charging 200 km of battery life in just 8 minutes. It also provided its ABB Ability Connected Services Solution to remotely deploy, configure, monitor, and support charging points and with this, Fastned expanded its network to the Netherlands, Germany, Belgium, and the UK, becoming one of the largest EV charging networks in the region. |

|

Bane NOR is the Norwegian national rail administration; it aimed to renew most of the existing signaling systems on the railway network by 2034 to create a seamless European railway system and increase the competitiveness of European railways. Bane NOR needed a proven and scalable TMS solution that could adapt to the growing and evolving network to meet Norway’s increasing needs for the next 25 years. | Thales offered TMS, which is based on Thales’s ARAMIS system. The solution would provide a cybersecure, cloud-ready platform with a fully adapted human-machine interface (HMI). The solution improved train punctuality, passenger safety, and comfort, and facilitated people, goods, and information mobility throughout the country. |

|

Curtin University is an Australian public research university and has one of Australia’s largest international student populations, with more than 60,000 students and 4,000 staff. The University needed an IoT solution to create a smart campus that would enhance the student experience and improve classroom learning. | Hitachi offered Hitachi Visualization Suite, Hitachi Video Analytics, Pentaho, Live Face Matching, and Hitachi Data Systems Infrastructure and Compute. This enabled it to implement a smart campus that improves building utilization, enhances classroom learning, and attracts various industries to collaborate with universities on data-driven research. The solution used IoT data analytics to gain insights into the daily running and utilization of the campus and make informed decisions about their classes, operations, and future requirements. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

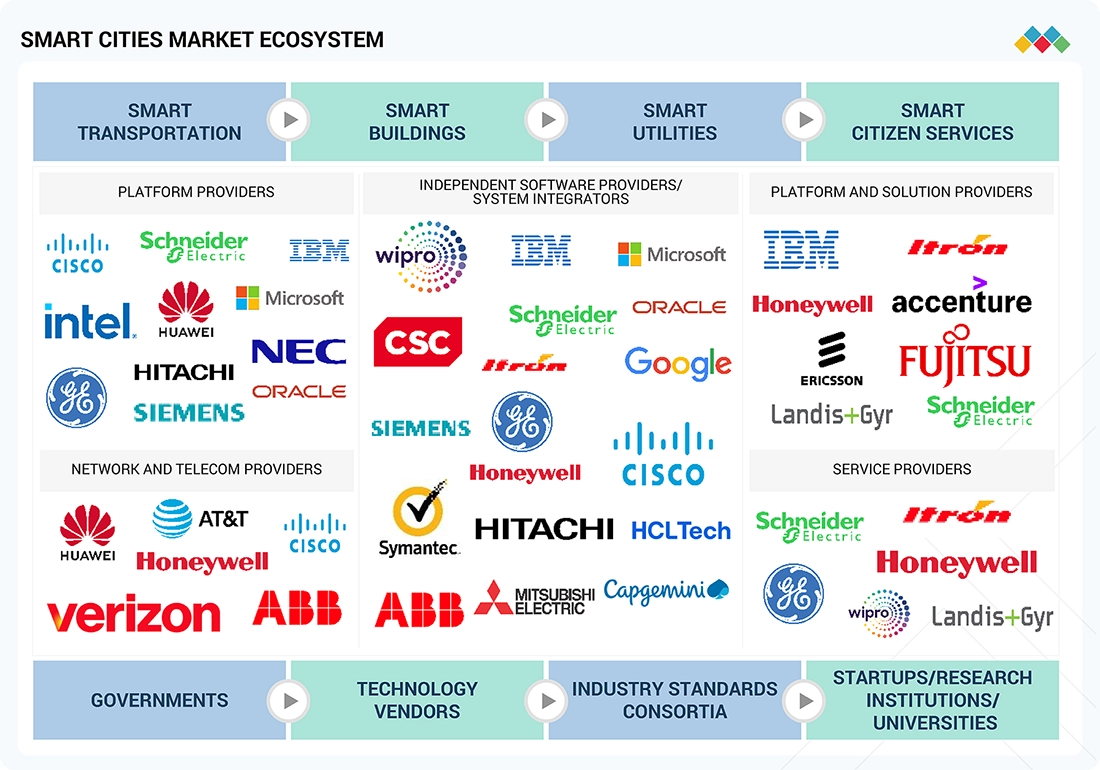

MARKET ECOSYSTEM

The Smart Cities ecosystem comprises various technology solutions and service providers, along with various regulatory bodies. These companies have been operating in the market for several years and possess a diversified product portfolio and state-of-the-art technologies. Prominent companies in this market include Cisco (US), IBM (US), Siemens (Germany), Microsoft (US), Hitachi (Japan), Schneider Electric (France), Huawei (China), NEC (Japan), ABB (Switzerland), and Sutherland (US).

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Smart Cities Market, By Smart Utility

Utilities integrate advanced technologies in providing electricity, gas, water, and waste management. This segment has seen the growing use of IoT, big data analytics, AI, and cloud computing. With smart utilities, cities can enhance efficiency, reduce losses, and enhance engagement. The adoption of next-gen sensors has also driven the demand for smart utility solutions to better manage both the equipment and the data generated.

Smart Cities Market, By Smart Building

Smart buildings refer to technologies and equipment used to enhance functionality and capabilities. Major players in the market have emphasized using IoT sensors, AI, and ML to collect data, drive automation, and design tailored solutions to meet the needs of different applications, including HVAC, lighting, smart appliances, etc. Security & emergency management and energy management are two prominent solutions classified under the smart buildings segment.

Smart Cities Market, by Smart Transportation

Smart transportation is a crucial component of modern smart city initiatives. Cities around the world have increasingly adopted advanced transportation technologies to upgrade infrastructure and support long-term mobility strategies. These technologies have proven effective in reducing urban traffic congestion, especially in large metropolitan areas. The latest generation of smart transportation solutions includes advanced traffic prediction systems, analytics, real-time traveler information, advisory services, ticketing, and fare collection systems. Innovations like Intelligent Transportation Systems (ITS) play a crucial role in improving traffic efficiency, optimizing travel routes, and enhancing the overall passenger experience.

Smart Cities Market, by Smart Citizen Service

Smart citizen services include smart healthcare, smart public safety, eGovernance, smart education, and smart street lighting. Smart healthcare accounts for the largest share of this market. The rising demand for remote monitoring & assistance, simultaneous monitoring & reporting, automation, better alert management, staff & health equipment tracking, and other enhancements to operations are driving market growth.

REGION

North America is estimated to account for the largest market share during the forecast period

North America is poised to maintain its leadership in the smart cities market, with the US leading regional adoption of smart city technology. This is supported by strong financial bases in the US and Canada that enable significant R&D investments necessary for developing and deploying innovative technologies that form the core of smart city infrastructure. Additionally, ongoing investments by North American network providers in expanding and improving telecommunication infrastructure, especially the rollout of 5G networks, further solidify the region’s leadership. The deployment of 5G enhances connectivity and supports the development of emerging technologies such as cloud edge computing and network slicing. These technologies are crucial for maximizing urban services and creating cost-effective, scalable solutions for smart cities.

Smart Cities Market: COMPANY EVALUATION MATRIX

In the Smart Cities market, the competitive landscape is being reshaped by the surging demand for connected infrastructure, secure digital ecosystems, and sustainable urban operations. Cisco (Star) reinforces its leadership by delivering end-to-end smart city platforms that integrate IoT, edge computing, and cybersecurity to enable real-time traffic management, intelligent utilities, and resilient citywide connectivity. Its robust networking backbone and strategic collaborations with municipalities empower large-scale deployments that enhance urban efficiency and citizen experience. Conversely, Huawei (Emerging Leader) is gaining strong momentum by advancing its AI-driven smart city solutions, focusing on integrated command centers, video surveillance, and energy optimization. Leveraging its 5G leadership and AI-enabled IoT innovations, Huawei is positioning itself as a key enabler of hyper-connected, data-driven urban ecosystems that deliver scalable and future-proof smart city transformation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 615.7 Billion |

| Market Forecast in 2030 (Value) | USD 1,445.6 Billion |

| Growth Rate | CAGR of 15.6% from 2025-2030 |

| Years Considered | 2019–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD) Million/Billion |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

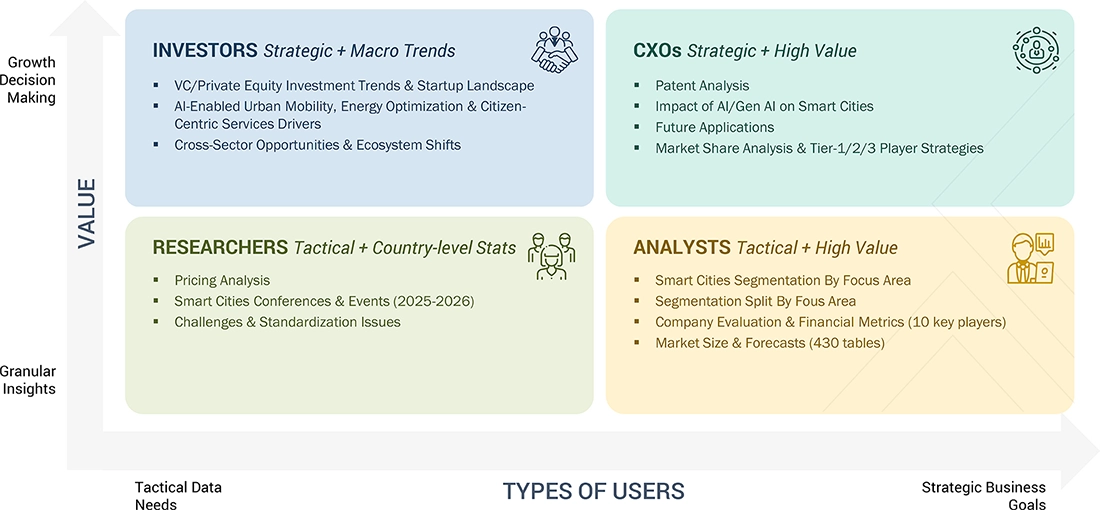

WHAT IS IN IT FOR YOU: Smart Cities Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Service Provider (US) |

|

|

| Company Information | Detailed analysis and profiling of additional market players |

|

RECENT DEVELOPMENTS

- March 2025 : ABB signed an MoU with Canada’s Charbone Hydrogen to supply electrical substations for up to 15 modular green hydrogen plants across North America. ABB will standardize electrical housing and may provide a broader scope of automation. This partnership (renewable energy infrastructure) contributes to smart city/industry decarbonization goals (clean fuel for transportation and industry) in line with ABB’s sustainability focus.

- February 2025 : The King Abdullah Financial District (KAFD) signed an MoU with Huawei at LEAP 2025 to develop advanced Smart City and AI technologies. The collaboration will deploy cutting-edge technologies (WiFi-7, 5G-A, AI/IoT, cloud, smart poles) across KAFD’s 1.6 million m² district. Huawei will support KAFD’s digital infrastructure and smart city platforms (smart lighting, environmental sensing, and sustainable energy), aligning with Saudi Vision 2030. This partnership is a clear Smart Cities initiative: it leverages Huawei’s telecom and AI stack to accelerate urban innovation and digital infrastructure in a major smart district.

- January 2025 : Schneider Electric partnered with The Mobility House Solutions (TMH) to jointly offer smart charging and energy management for electric vehicle fleets. The deal brings together Schneider’s energy management/automation and TMH’s smart-charging tech to simplify deployment of in-depot and on-the-road charging (buses, trucks, etc.). The partnership aims to optimize grid connection and energy use for fleets, accelerating e-mobility adoption. This ties into Schneider’s Smart Cities strategy by expanding EV infrastructure and intelligent energy services in urban transport networks.

- October 2024 : Digital Dubai (a UAE government entity) signed a Memorandum with Microsoft UAE to collaborate on AI-driven digital transformation. Microsoft agreed to launch an AI-skills training initiative for Dubai’s government workforce, supporting Dubai’s “digitized life” vision. This strategic partnership (announced at GITEX 2024) underscores Microsoft’s role in building Smart City capacity (AI upskilling for city services) and institutional integration of cloud/AI in city governance.

- March 2024 : L&T Technology Services (LTTS) partnered with Intel to develop scalable edge-AI solutions aimed at enhancing smart city infrastructure and intelligent transportation systems. The collaboration focuses on deploying Cellular Vehicle-to-Everything (CV2X) applications by leveraging Intel’s Edge Platform, which includes a built-in AI runtime and OpenVINO™ inference for real-time AI optimization. This initiative seeks to improve traffic management and emergency safety measures by enabling low-latency, cost-effective AI analytics at the edge

Table of Contents

Methodology

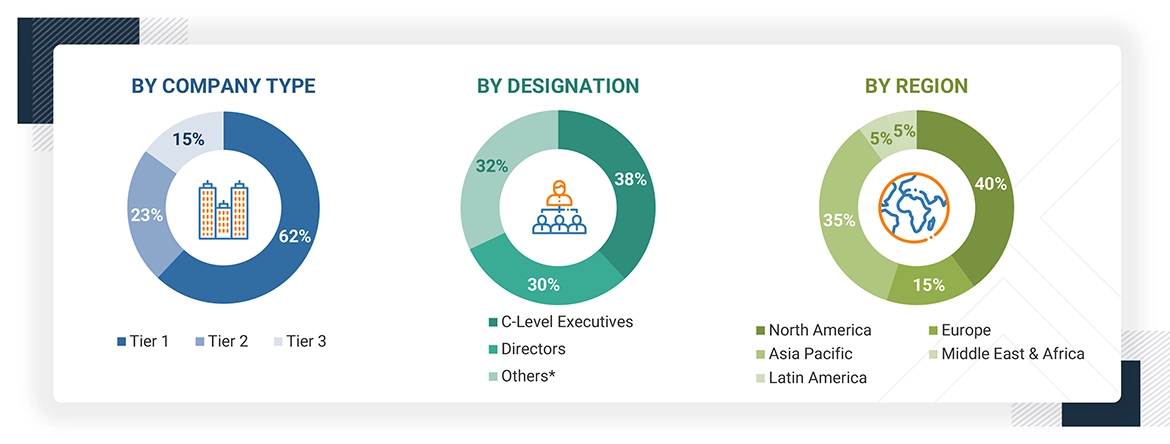

This research study utilized a wide range of secondary sources, including directories and databases such as Dun & Bradstreet (D&B) Hoovers, and Bloomberg BusinessWeek, to gather valuable insights for a technical, market-oriented, and commercial analysis of the smart cities market. Industry experts from core and related sectors, as well as preferred suppliers, manufacturers, distributors, service providers, technology developers, and organizations connected to all segments of the value chain in this market were interviewed as part of the study. To obtain and verify critical qualitative and quantitative information, in-depth interviews were conducted with key industry participants, subject matter experts, C-level executives from leading market players, and industry consultants.

Secondary Research

In the secondary research process, various sources were consulted to gather information for the study. These sources included annual reports, press releases, investor presentations from companies, white papers, certified publications, and articles from recognized associations and governmental publications. Several journals and conferences, such as the 27th IEEE International Conference on Intelligent Transportation Systems (IEEE ITSC 2024) and the Smart Building Conference at Integrated Systems Europe (ISE) 2024, were also referenced. This secondary research aimed to obtain crucial information about industry insights, the monetary flow within the market, the landscape of key players, market classification and segmentation based on current industry trends, regional markets, and significant developments from both, market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to gather qualitative and quantitative information for the report. On the supply side, the primary sources included industry experts such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and other key executives from significant companies and organizations involved in the smart cities market. On the demand side, the primary sources consisted of smart cities end users, consultants, specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

*Others include sales managers, marketing managers, and product managers.

Note: Tier 1 companies: Revenue more than USD 1 billion; Tier 2 companies: Revenue ranges between USD 500 million and 1 billion;

and Tier 3 companies: Revenue ranges between USD 100 million and USD 500 million

To know about the assumptions considered for the study, download the pdf brochure

Smart Cities Market Size Estimation

Several methods were used to estimate and forecast the smart cities market size. The first method involves calculating the market size by adding the revenue generated by companies from the sale of smart city solutions.

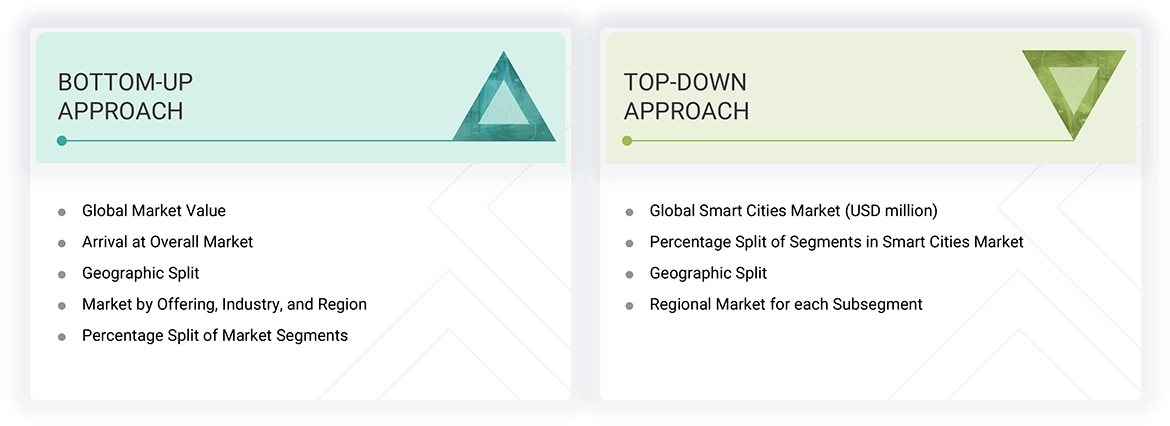

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the smart cities market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following.

- Key players in the market were identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakups were determined using secondary sources and verified through primary sources.

Smart Cities Market : Top-Down and Bottom-Up Approach

Data Triangulation

Upon determining the overall market size, the smart cities market was segmented into various segments and subsegments. A data triangulation process was employed to finalize the overall market engineering and achieve precise statistics for each segment and subsegment, as applicable. This triangulation involved analyzing various factors and trends from both, the demand and supply perspectives. Additionally, the market size was validated using both, the top-down and bottom-up approaches, alongside the data triangulation and market breakdown procedures.

Market Definition

The European Union defines a smart city as a place where traditional networks and services are made more efficient with the use of digital solutions for the benefit of its inhabitants and businesses.

A smart city encompasses more than just the application of digital technologies to enhance resource efficiency and reduce emissions. It includes improved urban transport networks, upgraded water supply and waste disposal systems, and more efficient methods for lighting and heating buildings. Additionally, a smart city features a more interactive and responsive administration, safer public spaces, and addresses the needs of an aging population.

Stakeholders

- National/State Governments

- Municipal Authorities

- Real Estate Developers

- Information Technology (IT) Solution Providers

- Platform Providers

- System Integrators

- Telecom Service Providers

- Networking Solution Providers

- Utility Companies

- Transportation Service Providers

- Independent Software Vendors (ISVs)

- Network Equipment Providers

- Communication Service Providers (CSPs)

Report Objectives

- To determine and forecast the global smart cities market size based on focus areas: smart transportation, smart buildings, smart utilities, smart citizen services, and regions from 2025 to 2030, and analyze the various macroeconomic and microeconomic factors that affect smart cities market growth

- To forecast the size of the market segments concerning five central regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the smart cities market.

- To analyze each submarket concerning individual growth trends, prospects, and contributions to the overall smart cities market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the smart cities market

- To profile key market players, provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and illustrate the market’s competitive landscape.

- To analyze competitive developments in the market, such as mergers & acquisitions, product developments, partnerships, collaborations, and research & development (R&D) activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the smart cities market report.

Geographic Analysis as per Feasibility

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

What is the definition of the smart cities market?

A smart city is a place where traditional networks and services are made more efficient through digital solutions, benefiting its inhabitants and businesses. A smart city goes beyond the use of digital technologies for better resource use and fewer emissions. It means smarter urban transport networks, upgraded water supply and waste disposal facilities, and more efficient ways to light and heat buildings. It also means a more interactive and responsive city administration, safer public spaces, and meeting the needs of an ageing population.

What is the projected size of the global smart cities market by 2030?

According to MarketsandMarkets, the smart cities market is projected to grow from USD 699.7 billion in 2025 to USD 1,445.6 billion by 2030.

What is the expected CAGR of the smart cities market during 2025–2030?

The market is expected to grow at a compound annual growth rate (CAGR) of 15.6%.

What are the major drivers in the smart cities market?

The major drivers of the smart cities market include rapid urbanization, increasing demand for sustainable infrastructure, and the need for efficient resource management. Governments worldwide are investing heavily in smart city initiatives to improve public services, reduce environmental impact, and enhance quality of life. Technological advancements in IoT, AI, and 5G are further accelerating adoption by enabling real-time monitoring and data-driven decision-making. Additionally, rising concerns over traffic congestion, energy consumption, and public safety are pushing cities to implement intelligent solutions that promote operational efficiency and long-term urban resilience.

Which key segments are covered in the smart cities market by focus area?

The market is segmented by focus area into Smart Transportation, Smart Buildings, Smart Utilities, and Smart Citizen Services.

What are the subsegments under the smart transportation focus area?

Subsegments include Smart Ticketing, Traffic Management, Passenger Information Management System, Connected logistics, and other smart transportation solutions.

What are the components considered under smart buildings in this market?

Smart buildings cover Building infrastructure management, Security & emergency management, Energy management, Network management, Integrated workplace management system and Others.

What types of services fall under smart citizen services in the market segmentation?

Services includeSmart Healthcare, Smart Education, Smart Public Safety, Smart Lighting, eGovernance.

Which region is projected to hold the largest market size in the smart cities market?

North America is expected to hold the largest market in the smart cities market

By smart citizen service, Which services will register the highest CAGR in the smart cities market during the forecast period?

According to MarketsandMarkets, by smart citizen service, smart healthcare services will register the highest CAGR in the smart cities market during the forecast period.

Who are the key players operating in the smart cities market?

The key market players profiled in the smart cities market include Cisco (US), IBM (US), Siemens (Germany), Microsoft (US), Hitachi (Japan), Schneider Electric (France), Huawei (China), NEC (Japan), ABB (Switzerland), Sutherland (US), Ericsson (Sweden), Oracle (US), Fujitsu (Japan), Honeywell (US), Accenture (Ireland), Vodafone (UK), AWS (US), Thales (France), Signify (Netherlands), Motorola (US), TCS (India), AT&T (US), Nokia (Finland), Samsung (South Korea), SAP (Germany), TomTom (Netherlands), AppyWay (UK), Ketos (US), Gaia (India), TaKaDu (Israel), Zencity (Israel), Itron (US), IXDen (Israel), Landis+Gyr (Switzerland), and INRIX (US).

What technologies are included in the development of smart city systems as per the report?

According to MarketsandMarkets Research Report, below are the technologies that are included in development of Smart Cities Market

Key Technologies

- AI and ML

- IoT

- Big data analytics

- 5G

Adjacent Technologies

- Robotics

- Augmented intelligence

- Edge computing

Complementary Technologies

- Augmented reality and virtual reality

- Smart grids

- Cybersecurity solutions

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Smart Cities Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Smart Cities Market