Smart Thermostat Market Size, Share & Industry Growth Analysis Report by Product (Connected, Learning, Standalone), Connectivity Technology (Wireless, Wired), Installation Type (New Installation, Retrofit Installation), Vertical (Residential, Commercial, Industrial), and Region - Global Growth Driver and Industry Forecast to 2030

Updated on : October 22, 2024

Smart Thermostat Market Size & Growth

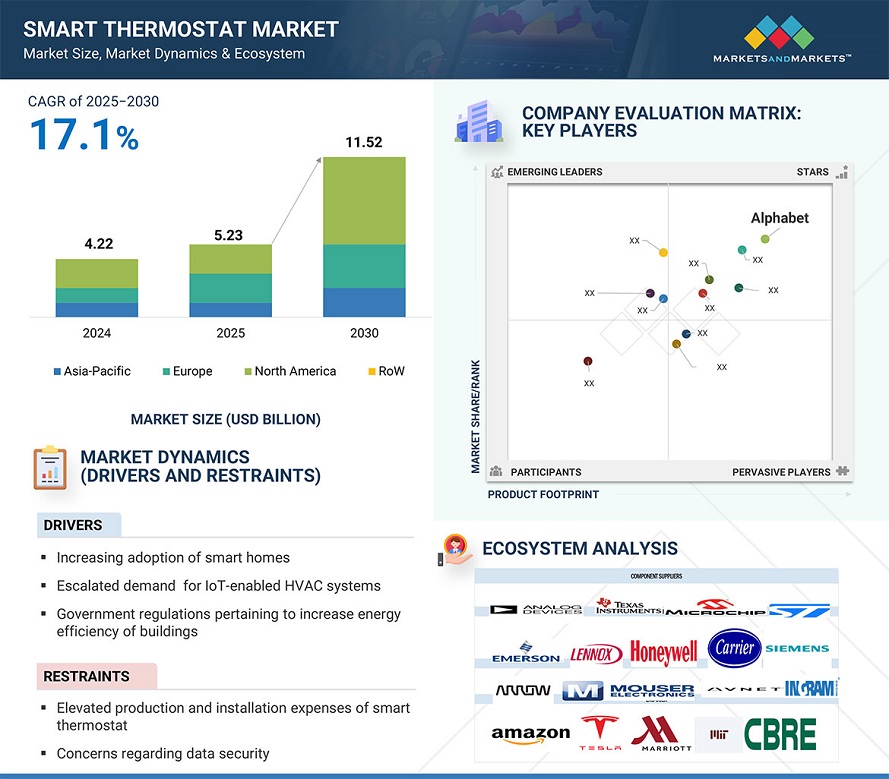

The global smart thermostat market was valued at USD 5.2 billion in 2025 and is estimated to reach USD 11.5 billion by 2040, registering a CAGR of 17.1% during the forecast period. The rising demand for energy efficiency, the adoption of IoT and smart home technologies and the awareness about carbon footprints are the major drivers for smart thermostat usage. The government initiatives related to energy conservation and integration of renewable energy sources further boost the market growth. The consumer preference for convenience, remote control, and personalized temperature settings via mobile apps enhances the demand. Another area of advancement for smart thermostats is AI and machine learning, which provides predictive analytics and adaptive temperature control. High energy costs and penetration of HVAC systems across the world are also boosting the market.

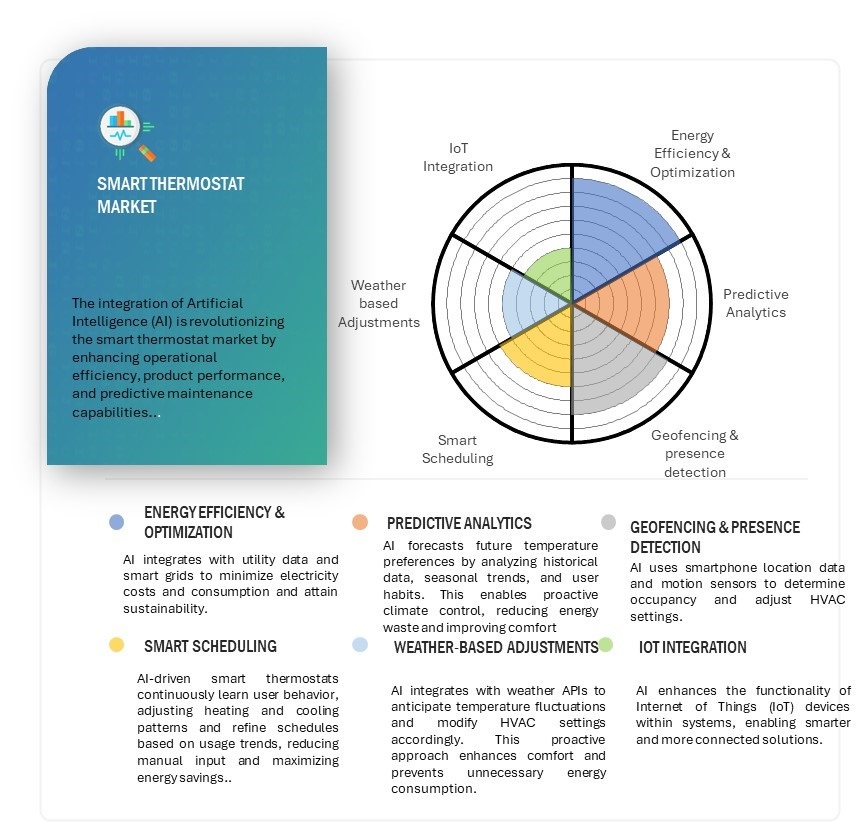

Impact of AI in Smart Thermostat Market

Smart thermostat market is drastically revived by AI with respect to enhancing functionality, efficiency, and user experience. The AI-enabled smart thermostats make efficient use of machine learning algorithms to analyze user behavior, preferences, and environmental conditions for precise, adaptive temperature control. This personalization improves energy efficiency, leading to lower energy costs and reduced environmental impact.AI also supports predictive maintenance, alerting users to potential HVAC issues before they escalate, thus minimizing downtime and repair costs. Integration with other smart home devices and platforms, driven by AI, allows seamless automation and interoperability, increasing the appeal of smart thermostats. Furthermore, the AI-driven voice assistants, including Alexa or Google Assistant, enhance user convenience through voice-controlled temperature adjustments..

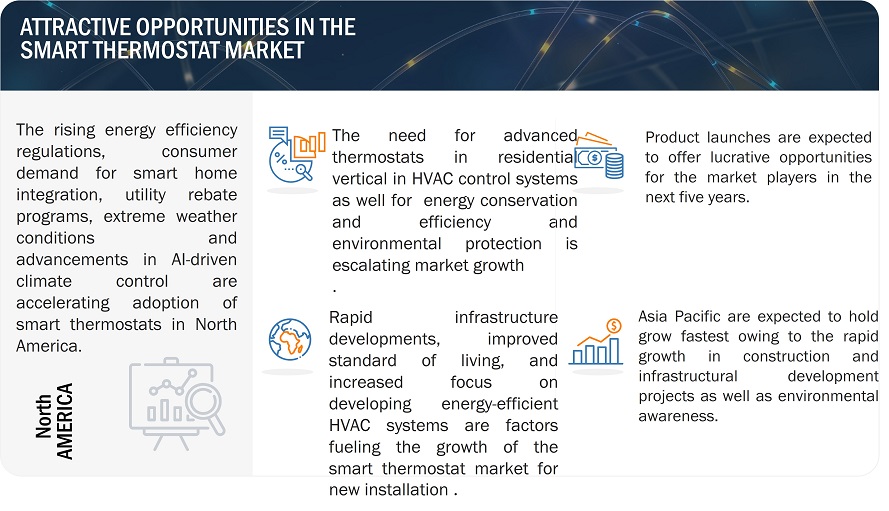

Attractive opportunities in the Smart Thermostat Market size

Smart Thermostat Market Forecast to 2030

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics:

Driver: Escalated demand for IoT-connected HVAC systems.

The principal driver for IoT based thermostat is increasing demand in IoT-enabled HVAC systems. This is escalating need for energy efficiency, better comfort, and greater automation in homes, offices, and industries. This is because monitoring and controlling the HVAC system through smart thermostat with IoT technologies, which is also a part of the energy consciousness and environmental sensitivity by the consumers and industries, offers the most significant advantage. These systems enable users to adjust temperature settings in real-time from smartphones, tablets, or other connected devices, optimizing energy use and minimizing waste.IoT-enabled HVAC systems further offer predictive maintenance. It could collect and analyze data from embedded sensors in the HVAC equipment; it could spot performance issues or likely failures before such events occur and thus enable preventive maintenance, reduce potential downtime and its associated repair cost, and increases system longevity as well as system reliability. Also, the growing integration of smart thermostats with home automation ecosystems, such as Amazon Alexa or Google Home systems, makes it very user-friendly through voice control functions. Internet of Things-enabled smart thermostats are eventually capable of learning user preferences and environmental elements and can thus adapt to these changes, offering personalized comfort levels without compromising optimal energy usage. There is also an adoption of IoT thermostat-based HVAC systems on the part of business organizations to ensure strict regulations on energy efficiency and sustainability.

Additionally, the Nest Thermostat, developed by Google, is a smart thermostat that uses machine learning and IoT technology to optimize heating and cooling based on user behavior and environmental conditions. Adoption of Nest Thermostat have been witnessed with the surge in demand for energy-efficient HVAC solutions, high smart home device integration, and growing consumer awareness about being sustainable. Some of the key features that are enhancing user convenience while reducing costs for smart thermostats or nest thermostats include automated scheduling, voice control, and real-time energy usage.

Restraint: Elevated production and installation expenses of smart thermostats

A major restraint to their widespread adoption is the high manufacturing and installation cost of smart thermostats. In a nutshell, smart thermostats provide energy efficiency and greater customer control, but the upfront costs for these may be out of people’s or businesses’ budgets. These thermostats are made from more sophisticated components, like sensors, connectivity modules, and AI-driven algorithms; the production is more costly than that of traditional thermostats. The necessity for the continued updates and compatibility requirements with increasingly dynamic smart home ecosystems play a role in pushing the pricing further.Installation is also quite complicated, especially for those upgrading from a conventional system. Smart thermostats need professional installation for the proper integration with existing HVAC systems and for maximum utilization of the device’s features. It raises the overall cost of ownership, which does not make it more accessible to the budget-conscious consumer. Although prices are slowly decreasing with the development of technology, the upfront price is still a main barrier to penetration. For most businesses and residential owners who believe in value for money or who do not possess technical know-how, the idea of smart thermostats will not be well justified by the money. This remains a slow-growing area, more so in the regions where affordability is a concern for most when buying.All of this could potentially improve with advancements in manufacturing processes, making these thermostats even cheaper as the years pass by. Currently, however, they remain pricey for a much broader penetration of the market..

Opportunity Rising demand for smart technologies and self-adaptive devices.

Demand in smart technologies and self-adaptive devices is therefore one of the major opportunities presented to the market of smart thermostat. As a result of rising demands for convenience, efficiency, and automation by consumers, this interest in a device that could learn and be aware of the individual preference and routine pattern is growing increasingly. Self-adaptive devices, in this case smart thermostats, use AI and ML algorithms to follow the patterns of behavior of users and adjust accordingly. Such systems not only improve comfort for users but also optimize energy consumption, hence lower utility bills and a reduced carbon footprint.

The further integration of smart homes can also speed the adoption of smart thermostats. Since any household implementation of IoT-enabled devices will more likely include climate control systems, it eventually transcends to be integrated with other technological components of smart homes, including lighting, security, and entertainment systems. This interconnectedness offers consumers seamless and personal experiences with the home environment, managing home conditions with minimal effort.

In addition, self-adaptive devices such as smart thermostats are nowadays being considered tools in achieving goals in energy efficiency and sustainability. There is, however, much awareness about global warming and ever-rising costs of energy use. Consumers need a thermostat that would automatically adjust their energy consumption without compromising comfort. This requires a special manufacturing opportunity to be created in the thermostat that allows advanced automation together with real-time energy management capabilities.

As smart technology continues to evolve, the market for smart thermostats will drive innovation in autonomous optimization of its functions, opening up long-term growth prospects.

Challenge: Complexity of integration with existing systems

Complexity in integrating smart thermostats with existing HVAC systems is a huge challenge in the market. For consumers with older systems, the upgrade to a smart thermostat may be complex with installation processes as wiring adjustments or addition of new components.This therefore comes with an added barrier where users might need to hire professionals to install it hence increasing its cost. In addition, no HVAC system enables advanced connectivity through Wi-Fi and Bluetooth for smart thermostat features. This tends to cause more compatibility issues among users, effectively limiting the whole range of features presented by the product, such as remote control offered by mobile applications or integration within other smart house devices. This may also make integration with other home automation systems difficult, and the experience becomes underwhelming and less convenient.This also means that with technical standards from various brands and models of different HVACs, the challenge is made much more complicated by the inability of manufacturers to assure smooth integration across all systems. Technologically nontech savvy consumers will have difficulty troubleshooting the issue or identifying exactly what they require for successful integration.This complexity deters some potential customers from adopting smart thermostats, especially those who prioritize simplicity and affordability over advanced features. To overcome these integration challenges is key to wide adoption and market growth.

Smart Thermostat Market Ecosystem

The smart thermostat market is consolidated. Major companies, such as Emerson Electric Co (US), Honeywell Technologies Inc (US), Lennox International Inc.(US), Carrier(US), Siemens (Germany), Johnson Controls (Ireland), ecobee (Canada), among others, are the major providers of smart thermostat. The market has numerous small- and medium-sized vital enterprises. Many players offer components and technologies, while other players offer integration services. These integration services are required in various applications.

Connected smart thermostat segment to account for largest market share

The connected smart thermostat segment is likely to lead the market for smart thermostats because of the seamless integration of smart thermostats with various IoT-enabled devices, enhancing convenience, energy efficiency, and cost savings. These thermostats utilize Wi-Fi or other wireless communication protocols to allow users to control and monitor home temperature settings from a distance using smartphones, tablets, or voice assistants like Alexa and Google Assistant.This segment is experiencing a rise in demand because of increasing energy costs and tougher environmental regulations. With these concerns, connected smart thermostats optimize energy consumption by learning intelligent algorithms, geofencing, and advanced scheduling features. It also reduces waste and saves utility bills through control of the precise climate because it learns about user behavior and current environmental real-time data.Increasing smart home adoption worldwide, coupled with the proliferation of connected ecosystems, has made them unavoidable components for modern households. Leading manufacturers have innovated smart models equipped with intelligent apps to control operation, making them compatible with major platforms, easily integratable into existing HVAC systems, and hence getting more in demand. Connected smart thermostat will continue to grow with ongoing technological advancements and consumer awareness, holding the largest market share in the coming years.

Wireless connectivity segment to be largest end user of smart thermostat during forecast period

The largest market share of the smart thermostat market will be taken up by the wireless connectivity segment. It is based on the advantages such as convenience, flexibility, and ease of installation. The key advantage of these technologies, Wi-Fi, Zigbee, Z-Wave, and Bluetooth, is seamless communication between the smart thermostat and other connected devices. It will enable users to control and monitor their home climate systems with the help of their smartphone, tablet, or even voice assistants such as Amazon Alexa and Google Assistant.One of the biggest advantages of wireless connectivity, in this case, is that it easily integrates into existing HVAC systems without requiring any extensive wiring, so appealing for retrofit as well as new installation. This reduces installation costs and increases the simplicity of the process that encourages consumers and businesses to create a more extensive offer. Wireless thermostats also enhance scalability in smart home ecosystems.Wireless-enabled smart thermostats are also driving demand due to increased adoption of smart home technologies and high-speed internet across the world. They use real-time data, geofencing, and machine learning algorithms to increase energy usage, provide added comfort, and diminish utility bills.North America as well as Asia-Pacific experience impressive growth primarily due to the growing awareness of consumers along with supportive government policies which promote energy efficiency. As innovation follows, a trend that is expected to hold on even as the smart thermostat market continues its rapid growth is wireless connectivity.

Smart Thermostat Industry Regional Analysis

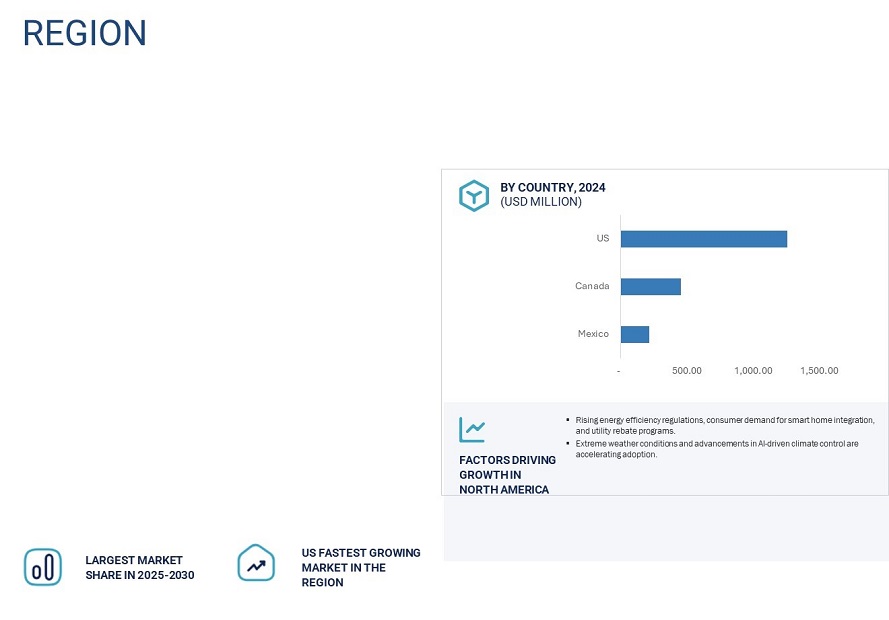

North America to hold largest market share for smart thermostat

North America held the largest share of the smart thermostat market in 2024. Supportive government plans and programs & favorable laws are the major factors driving the growth of the regional market. There are several reasons for this dominance. High consumer awareness and adoption of energy-efficient smart home technologies play a very significant role, particularly in the United States. Government incentives also play a significant role in driving the market. The key players operating in the smart thermostat market are Honeywell International (US), Emerson Electric (US), Carrier (US), ecobee (Canada), and Lennox International (US). They have adopted product launches as the key strategy to expand their business operations, customer base, and geographic reach and provide the best possible solutions to their customers.For instance, newer releases from technological improvements include products such as Honeywell Home X2S Smart Thermostat and Ecobee’s Smart Thermostat Essential. More advanced versions with good quality of integration also support key smart home brands including Amazon Alexa, Google Home, and Apple HomeKit make it an adopted solution. Coupled with a significant distribution network and continuous innovation from key players, these factors solidify North America’s position as the global leader in the smart thermostat market.

Smart Thermostat Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Smart Thermostat Companies - Key Market Players

- Alphabet (Google Nest) (US)

- Emerson Electric (US)

- Honeywell International (US)

- Lennox International (US)

- Carrier Corporation (US)

- Resideo Technologies (US)

- Control4 Corporation (US)

- Nortek Control (US)

- Alarm.com (US)

- Cielo Wigle (US)

- MRCOOL (US)

- Radio Thermostat Company of America (US)

- Vine Connected (US)

- VIvint (US)

- Zen Ecosystems (US)

- Ecobee (Canada)

- Johnson Controls (Ireland)

- Legrand (France)

- Siemens (Germany)

- Trane Technologies (Ireland)

- Tado (Germany)

- Bosch Thermotechnology (Germany)

- Centrica Hive (UK)

- Climote (Ireland)

- Eve Systems (Germany)

- Salus Controls (UK)

Smart Thermostat Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 5.2 Billion in 2025 |

| Projected Market Size | USD 11.5 Billion by 2030 |

| CAGR | CAGR of 17.1% |

|

Years considered to provide market size |

2025–2030 |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Market Leaders |

Ecobee (Canada), Johnson Controls (Lux Products) (Ireland), Legrand (Netatmo) (France), Siemens (Germany), Trane Technologies (Ireland), Tado (Germany), Bosch Thermotechnology (Germany), Centrica Hive (UK), Climote (Ireland), Empowered Homes (MYSA) (Canada), Eve Systems (Germany), Salus Controls (UK) |

|

Top Companies in North America |

Alphabet (Google Nest) (US), Emerson Electric (US), Honeywell International (US), Lennox International (US), Carrier Corporation (US), Resideo Technologies (US), Control4 Corporation (US), Nortek Control (US), Alarm.com (US), Cielo Wigle (US), MRCOOL (US), Radio Thermostat Company of America (US), Vine Connected (US), VIvint (US), Zen Ecosystems (US) |

This research report segments the smart thermostats market trends based on products, connectivity technology, installation type, vertical and geography.

Smart Thermostat Market By Products:

- Connected Smart thermostat

- Learning Smart Thermostat

- Standalone Smart Thermostat

Smart Thermostat Market By Connectivity Technology

-

Wireless Network

- Wi-Fi

- Zigbee

- Z-wave

- Bluetooth

- Wired Network

Smart Thermostats Market By Installation Type

- New Installation

- Retrofit Installation

Smart Thermostats Market By Vertical

- Residential

-

Commercial

- Retail

- Offices

- Educational Institutes

- Hospitality Centers

- Hospitals

- Industrial

Smart Thermostat Market By Region

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Recent Developments in Smart Thermostat Market

- In January 2025, Resideo Technologies, a global leader in home comfort, security, and safety solutions, unveiled Honeywell Home X2S, a smart thermostat. Matter-enabled and ENERGY STAR certified, this smart thermostat comes with unbeatable features at an affordable price, available in spring at retailers selling home improvements.

- In January 2025, Carrier India and Jamia Millia Islamia’s (JMI) University Polytechnic collaborated to create a “Centre of Excellence for Professional Skill Development.” This initiative, driven by Carrier and in collaboration with the United Way of India, is redefining HVAC skill development and empowering a workforce for the future. Carrier India is part of Carrier Global Corporation a global leader in intelligent climate and energy solutions.

- In October 2024, Ecobee-a Generac Power Systems subsidiary-was set to release the ecobee Smart Thermostat Lite, available through channel distribution. Ecobee Smart Thermostat Lite is designed with professional input, such that installation was easy and simple to work, durable, and hardwired, meaning no charging or another source of power would be needed.

- In August 2024, Google announced the update of its flagship thermostat. The company has announced the Nest Learning Thermostat (4th gen). The thermostat has an all-new design, several new features, and support for the smart home standard Matter.

- In October 2023,Universal Electronics Inc. announced the launch of a new thermostat designed for the US market. This thermostat has been developed with input from Mitsubishi Electric Trane HVAC US LLC (METUS), a leading supplier of Ductless and Ducted Mini-split and Variable Refrigerant Flow (VRF) heat pump and air-conditioning systems.

Frequently Asked Questions (FAQs):

Which are the major companies in the smart thermostat market? What are their significant strategies to strengthen their market presence?

The major companies in the smart thermostat market are Alphabet (US), Emerson Electric (US), Honeywell International (US), Lennox International (US), Carrier Corporation (US), Resideo Technologies (US), The significant strategies these players adopt are product launches & developments, contracts, collaborations, acquisitions, and expansions.

Which region has the highest potential in the smart thermostat market?

The North American region is expected to register the fastest growth in the smart thermostat market.

What are the opportunities for new market entrants?

The smart thermostat market offers opportunities for new entrants to target emerging markets, develop affordable and customizable solutions, and leverage advanced technologies like AI and IoT for unique features.

What are the drivers and opportunities for the smart thermostat market?

Drivers and opportunities in the smart thermostat market include focus on energy efficiency, sustainability, and partnerships with HVAC manufacturers or smart home platforms that can help establish a competitive edge. Tailoring products to niche segments like hospitality or commercial buildings further enhances growth potential among others.

Who are the major applications of smart thermostat that are expected to drive the market’s growth in the next five years?

The significant consumers for smart thermostat are residenatial, commercial, retail and others

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

FIGURE 1 SMART THERMOSTAT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM PRODUCTS/SOLUTIONS/SERVICES OF MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up approach

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down approach

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 6 ASSUMPTIONS FOR RESEARCH STUDY

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 7 IMPACT ANALYSIS ON SMART THERMOSTAT MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 8 CONNECTED SMART THERMOSTAT SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

FIGURE 9 WIRELESS CONNECTIVITY SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2020

FIGURE 10 NEW INSTALLATION SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2020

FIGURE 11 RESIDENTIAL VERTICAL TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

FIGURE 12 APAC MARKET TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 13 EXPANDING SMART HOME MARKET IS FUELING DEMAND FOR SMART THERMOSTATS

4.2 MARKET, BY PRODUCT

FIGURE 14 CONNECTED SMART THERMOSTAT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FROM 2021 TO 2026

4.3 MARKET, BY CONNECTIVITY TECHNOLOGY

FIGURE 15 WIRELESS SMART THERMOSTAT SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE FROM 2021 TO 2026

4.4 MARKET, BY INSTALLATION TYPE

FIGURE 16 NEW INSTALLATION SEGMENT TO HOLD LARGER SIZE OF MARKET FROM 2021 TO 2026

4.5 MARKET, BY VERTICAL AND REGION

FIGURE 17 RESIDENTIAL SEGMENT AND NORTH AMERICA ACCOUNTED FOR LARGEST SHARES OF MARKET IN 2020

4.6 MARKET, BY GEOGRAPHY

FIGURE 18 US ACCOUNTED FOR LARGEST MARKET SHARE IN 2020

5 SMART THERMOSTAT MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing adoption of smart homes attributed to situation

5.2.1.2 Emergence of IoT-enabled HVAC systems

5.2.1.3 Government regulations pertaining to increase energy efficiency of buildings

FIGURE 20 PROJECTED ENERGY DEMAND IN INDIA BY 2047

5.2.1.4 Surging adoption of smart home voice assistants

FIGURE 21 DRIVERS OF MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing and installation costs of smart thermostats

5.2.2.2 Concerns regarding data security

FIGURE 22 RESTRAINTS OF SMART THERMOSTAT MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand for self-learning devices

5.2.3.2 Growing demand for cloud computing in HVAC industry

FIGURE 23 OPPORTUNITIES FOR MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 High upgradation cost of existing systems

5.2.4.2 Inability to work offline

5.2.4.3 Disruption in supply chain due to situation

FIGURE 24 CHALLENGES FOR MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

FIGURE 26 SMART THERMOSTAT MARKET: ECOSYSTEM

TABLE 2 MARKET: ECOSYSTEM

5.5 YC-YCC SHIFT: MARKET

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 IMPACT OF EACH FORCE ON MARKET

5.7 CASE STUDY

5.7.1 USE CASE 1: HEATMISER

5.7.2 USE CASE 2: FEDERATION OF CANADIAN MUNICIPALITIES

5.8 TECHNOLOGY ANALYSIS

5.8.1 MACHINE LEARNING AND ENERGY INFRASTRUCTURE

5.8.2 VOICE RECOGNITION TECHNOLOGY

5.8.3 5G

5.8.4 PREDICTIVE MAINTENANCE

5.8.5 VIRTUAL REALITY

5.9 PRICING ANALYSIS

TABLE 4 AVERAGE SELLING PRICE OF SMART THERMOSTAT

TABLE 5 AVERAGE SELLING PRICE OF SMART THERMOSTAT BY APPLICATION

5.10 TRADE ANALYSIS

FIGURE 27 IMPORT DATA FOR THERMOSTATS, 2015–2019 (USD MILLION)

FIGURE 28 EXPORT DATA FOR THERMOSTATS, 2015–2019 (USD MILLION)

TABLE 6 IMPORT OF THERMOSTATS, BY REGION, 2016–2019 (USD MILLION)

5.11 PATENT ANALYSIS

FIGURE 29 PATENT ANALYSIS RELATED TO MARKET

FIGURE 30 TOP SMART THERMOSTAT COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 7 TOP PATENT OWNERS (US) IN LAST 10 YEARS

5.12 REGULATORY LANDSCAPE

5.12.1 REGULATIONS

5.12.2 CODES AND STANDARDS FOR HVAC SYSTEMS

TABLE 8 MANDATORY CODES AND STANDARDS IN HVAC INDUSTRY

6 MARKET, BY CONNECTIVITY TECHNOLOGY (Page No. - 80)

6.1 INTRODUCTION

FIGURE 31 WIRELESS NETWORK SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

TABLE 9 MARKET, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 10 MARKET, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

6.2 WIRELESS NETWORK

6.2.1 WIRELESS NETWORK SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

6.2.2 WI-FI

6.2.3 ZIGBEE

6.2.4 Z-WAVE

6.2.5 BLUETOOTH

FIGURE 32 WI-FI SUB-SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET FOR WIRELESS CONNECTIVITY NETWORK DURING FORECAST PERIOD

TABLE 11 WIRELESS CONNECTIVITY NETWORK: SMART THERMOSTAT MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 12 WIRELESS CONNECTIVITY NETWORK: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 13 WIRELESS CONNECTIVITY NETWORK: MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 14 WIRELESS CONNECTIVITY NETWORK: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 15 WIRELESS CONNECTIVITY NETWORK: MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 16 WIRELESS CONNECTIVITY NETWORK: MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

6.3 WIRED NETWORK

6.3.1 WIRED NETWORK OFFERS MORE RELIABLE CONNECTION AS COMPARED TO WIRELESS NETWORK

TABLE 17 WIRED CONNECTIVITY NETWORK: MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 18 WIRED CONNECTIVITY NETWORK: MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

FIGURE 33 OFFICES APPLICATION SEGMENT OF WIRED CONNECTIVITY MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 19 WIRED CONNECTIVITY NETWORK: MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 20 WIRED CONNECTIVITY NETWORK: MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

7 MARKET, BY SPECIFICATION (Page No. - 89)

7.1 INTRODUCTION

7.2 POWER

7.2.1 BATTERY POWERED

7.2.2 HARD-WIRED

FIGURE 34 HARD-WIRED SMART THERMOSTAT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

7.3 GEO-FENCING

FIGURE 35 GEO-FENCING TO PROVE AS AN EFFICIENT FEATURE FOR SMART THERMOSTATS

7.4 MULTIPLE ZONES

FIGURE 36 MULTIPLE ZONE IS GAINING IMPORTANCE IN MARKET

7.5 MOTION DETECTION

FIGURE 37 ADOPTION OF MOTION DETECTION IN SMART THERMOSTAT IS CURRENTLY A PREMIUM FEATURE

7.6 COMPATIBILITY

7.6.1 TWO-STAGE

7.6.2 MULTI-STAGE

FIGURE 38 MULTI-STAGE SMART THERMOSTAT TO HOLD LARGER MARKET SHARE

8 SMART THERMOSTAT MARKET, BY PRODUCT (Page No. - 93)

8.1 INTRODUCTION

FIGURE 39 CONNECTED PRODUCT SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 21 MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

TABLE 22 SMART THERMOSTAT INDUSTRY, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 23 MARKET, 2017–2020 (THOUSAND UNITS)

TABLE 24 MARKET, 2021–2026 (THOUSAND UNITS)

8.2 STANDALONE SMART THERMOSTAT

8.2.1 EASY INSTALLATION PROCESS TO INCREASE DEMAND FOR STANDALONE SMART THERMOSTAT

8.3 CONNECTED SMART THERMOSTAT

8.3.1 CONNECTED SMART THERMOSTAT SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MARKET

8.4 LEARNING SMART THERMOSTAT

8.4.1 LEARNING THERMOSTAT SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

9 MARKET, BY INSTALLATION TYPE (Page No. - 97)

9.1 INTRODUCTION

FIGURE 40 NEW INSTALLATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 25 SMART THERMOSTAT INDUSTRY, BY INSTALLATION TYPE, 2017–2020 (USD BILLION)

TABLE 26 MARKET, BY INSTALLATION TYPE, 2021–2026 (USD BILLION)

9.2 NEW INSTALLATION

9.2.1 NEW INSTALLATION SEGMENT TO HOLD LARGER SHARE OF SMART THERMOSTAT MARKET

TABLE 27 MARKET FOR NEW INSTALLATION, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 28 MARKET FOR NEW INSTALLATION, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 29 NEW INSTALLATION MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 NEW INSTALLATION MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

9.3 RETROFIT INSTALLATION

9.3.1 HVAC RETROFITS ARE INSTALLED TO ENSURE IMPROVED SYSTEM PERFORMANCE AND ENERGY SAVING

FIGURE 41 RESIDENTIAL VERTICAL TO DOMINATE RETROFIT INSTALLATION SEGMENT OF MARKET DURING FORECAST PERIOD

TABLE 31 SMART THERMOSTAT INDUSTRY FOR RETROFIT INSTALLATION, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 32 MARKET FOR RETROFIT INSTALLATION, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 33 RETROFIT INSTALLATION MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 34 RETROFIT INSTALLATION MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

10 MARKET, BY COMPONENT (Page No. - 104)

10.1 INTRODUCTION

10.2 DISPLAY

10.3 CONTROL UNIT

10.4 TEMPERATURE SENSOR

10.5 HUMIDITY SENSOR

10.6 MOTION SENSOR

10.7 OTHERS

11 MARKET, BY VERTICAL (Page No. - 106)

11.1 INTRODUCTION

FIGURE 42 RESIDENTIAL VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 35 MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 36 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

11.2 RESIDENTIAL

11.2.1 RESIDENTIAL VERTICAL TO HOLD LARGEST SHARE OF SMART THERMOSTAT MARKET

TABLE 37 MARKET FOR RESIDENTIAL VERTICAL, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 38 MARKET FOR RESIDENTIAL VERTICAL, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 39 MARKET FOR RESIDENTIAL VERTICAL, BY INSTALLATION TYPE, 2017–2020 (USD MILLION)

TABLE 40 MARKET FOR RESIDENTIAL VERTICAL, BY INSTALLATION TYPE, 2021–2026 (USD MILLION)

TABLE 41 MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 MARKET FOR RESIDENTIAL VERTICAL, BY REGION, 2021–2026 (USD MILLION)

FIGURE 43 US MARKET FOR RESIDENTIAL VERTICAL IN NORTH AMERICA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 43 SMART THERMOSTAT INDUSTRY FOR RESIDENTIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 44 MARKET FOR RESIDENTIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 45 MARKET FOR RESIDENTIAL VERTICAL IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 46 MARKET FOR RESIDENTIAL VERTICAL IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 47 MARKET FOR RESIDENTIAL VERTICAL IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 48 MARKET FOR RESIDENTIAL VERTICAL IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 49 MARKET FOR RESIDENTIAL VERTICAL IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 SMART THERMOSTAT MARKET FOR RESIDENTIAL VERTICAL IN ROW, BY REGION, 2021–2026 (USD MILLION)

11.3 COMMERCIAL

FIGURE 44 RETAIL APPLICATION TO DOMINATE MARKET FOR COMMERCIAL VERTICAL DURING FORECAST PERIOD

TABLE 51 MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 52 MARKET FOR COMMERCIAL VERTICAL, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 53 MARKET FOR COMMERCIAL VERTICAL, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 54 MARKET FOR COMMERCIAL VERTICAL, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 55 MARKET FOR COMMERCIAL VERTICAL, BY INSTALLATION TYPE, 2017–2020 (USD MILLION)

TABLE 56 MARKET FOR COMMERCIAL VERTICAL, BY INSTALLATION TYPE, 2021–2026 (USD MILLION)

TABLE 57 MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 59 MARKET FOR COMMERCIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 60 MARKET FOR COMMERCIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

FIGURE 45 UK TO DOMINATE MARKET FOR COMMERCIAL VERTICAL IN EUROPE DURING FORECAST PERIOD

TABLE 61 MARKET FOR COMMERCIAL VERTICAL IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 62 MARKET FOR COMMERCIAL VERTICAL IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 63 MARKET FOR COMMERCIAL VERTICAL IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 64 MARKET FOR COMMERCIAL VERTICAL IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 65 MARKET FOR COMMERCIAL VERTICAL IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 MARKET FOR COMMERCIAL VERTICAL IN ROW, BY REGION, 2021–2026 (USD MILLION)

11.3.1 RETAIL

11.3.1.1 Retail application to hold largest share of smart thermostat market for commercial vertical

TABLE 67 MARKET FOR RETAIL APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 46 WIRELESS MARKET TO DOMINATE RETAIL APPLICATION SEGMENT OF COMMERCIAL VERTICAL DURING FORECAST PERIOD

TABLE 68 MARKET FOR RETAIL APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 69 MARKET FOR RETAIL APPLICATION, BY INSTALLATION TYPE, 2017–2020 (USD MILLION)

TABLE 70 MARKET FOR RETAIL APPLICATION, BY INSTALLATION TYPE, 2021–2026 (USD MILLION)

TABLE 71 MARKET FOR RETAIL APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 MARKET FOR RETAIL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

11.3.2 OFFICES

11.3.2.1 Application of smart thermostats in offices to increase at highest rate during forecast period

TABLE 73 SMART THERMOSTAT INDUSTRY FOR OFFICES APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 74 MARKET FOR OFFICES APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 75 MARKET FOR OFFICES APPLICATION, BY INSTALLATION TYPE, 2017–2020 (USD MILLION)

TABLE 76 MARKET FOR OFFICES APPLICATION, BY INSTALLATION TYPE, 2021–2026 (USD MILLION)

FIGURE 47 NORTH AMERICA TO DOMINATE OFFICES APPLICATION OF MARKET DURING FORECAST PERIOD

TABLE 77 MARKET FOR OFFICES APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 MARKET FOR OFFICES APPLICATION, BY REGION, 2021–2026 (USD MILLION)

11.3.3 EDUCATIONAL INSTITUTES

11.3.3.1 Growing need for achieving energy efficiency in educational institutes to fuel growth of application segment

TABLE 79 MARKET FOR EDUCATIONAL INSTITUTES APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 80 MARKET FOR EDUCATIONAL INSTITUTES APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 81 MARKET FOR EDUCATIONAL INSTITUTES APPLICATION, BY INSTALLATION TYPE, 2017–2020 (USD MILLION)

TABLE 82 MARKET FOR EDUCATIONAL INSTITUTES APPLICATION, BY INSTALLATION TYPE, 2021–2026 (USD MILLION)

TABLE 83 MARKET FOR EDUCATIONAL INSTITUTES APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 84 MARKET FOR EDUCATIONAL INSTITUTES APPLICATION, BY REGION, 2021–2026 (USD MILLION)

11.3.4 HOSPITALITY CENTERS

11.3.4.1 Government regulations for increasing energy efficiency of hospitality centers to drive demand for smart thermostats

FIGURE 48 WIRELESS NETWORK SEGMENT TO DOMINATE SMART THERMOSTAT MARKET FOR HOSPITALITY CENTERS DURING FORECAST PERIOD

TABLE 85 MARKET FOR HOSPITALITY CENTERS APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 86 MARKET FOR HOSPITALITY CENTERS APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 87 MARKET FOR HOSPITALITY CENTERS APPLICATION, BY INSTALLATION TYPE, 2017–2020 (USD MILLION)

TABLE 88 MARKET FOR HOSPITALITY CENTERS APPLICATION, BY INSTALLATION TYPE, 2021–2026 (USD MILLION)

TABLE 89 MARKET FOR HOSPITALITY CENTERS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 90 MARKET FOR HOSPITALITY CENTERS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

11.3.5 HOSPITALS

11.3.5.1 Growing need to achieve optimum efficiency in hospitals owing to global fuel demand for smart thermostats

TABLE 91 MARKET FOR HOSPITALS APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 92 MARKET FOR HOSPITALS APPLICATION, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 93 MARKET FOR HOSPITALS APPLICATION, BY INSTALLATION TYPE, 2017–2020 (USD MILLION)

TABLE 94 MARKET FOR HOSPITALS APPLICATION, BY INSTALLATION TYPE, 2021–2026 (USD MILLION)

FIGURE 49 APAC MARKET FOR HOSPITALS APPLICATIONS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 95 MARKET FOR HOSPITALS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 MARKET FOR HOSPITALS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

11.4 INDUSTRIAL

11.4.1 INCREASING NUMBER OF SMART WAREHOUSES TO FUEL GROWTH OF MARKET FOR INDUSTRIAL VERTICAL

TABLE 97 MARKET FOR INDUSTRIAL VERTICAL, BY CONNECTIVITY TECHNOLOGY, 2017–2020 (USD MILLION)

TABLE 98 MARKET FOR INDUSTRIAL VERTICAL, BY CONNECTIVITY TECHNOLOGY, 2021–2026 (USD MILLION)

TABLE 99 MARKET FOR INDUSTRIAL VERTICAL, BY INSTALLATION TYPE, 2017–2020 (USD MILLION)

TABLE 100 MARKET FOR INDUSTRIAL VERTICAL, BY INSTALLATION TYPE, 2021–2026 (USD MILLION)

TABLE 101 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 102 MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2021–2026 (USD MILLION)

FIGURE 50 US TO DOMINATE NORTH AMERICAN MARKET FOR INDUSTRIAL VERTICAL

TABLE 103 MARKET FOR INDUSTRIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 104 MARKET FOR INDUSTRIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 105 MARKET FOR INDUSTRIAL VERTICAL IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 106 MARKET FOR INDUSTRIAL VERTICAL IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 107 MARKET FOR INDUSTRIAL VERTICAL IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 108 MARKET FOR INDUSTRIAL VERTICAL IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 109 MARKET FOR INDUSTRIAL VERTICAL IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 110 MARKET FOR INDUSTRIAL VERTICAL IN ROW, BY REGION, 2021–2026 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 137)

12.1 INTRODUCTION

FIGURE 51 MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

TABLE 111 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 112 MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 52 NORTH AMERICA: SMART THERMOSTAT MARKET SNAPSHOT

12.2.1 US

12.2.1.1 US to hold largest share of North American market

12.2.2 CANADA

12.2.2.1 Growing environmental awareness among consumers of energy-efficient technologies is increasing adoption of smart thermostats in Canada

12.2.3 MEXICO

12.2.3.1 High focus on Mexican companies and associations to boost manufacturing and warehousing sectors to fuel market growth

TABLE 113 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 114 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 115 MARKET IN US, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 116 MARKET IN US, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 117 MARKET IN CANADA, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 118 MARKET IN CANADA, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 119 MARKET IN MEXICO, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 120 MARKET IN MEXICO, BY VERTICAL, 2021–2026 (USD MILLION)

12.3 EUROPE

FIGURE 53 EUROPE: SMART THERMOSTAT MARKET SNAPSHOT

12.3.1 UK

12.3.1.1 UK to hold largest market size in Europe

12.3.2 GERMANY

12.3.2.1 Growing adoption of smart HVAC devices in smart cities to propel the demand for smart thermostats

TABLE 121 GAS EMISSION REDUCTION TARGETS BASED ON SECTORS, 2030

12.3.3 FRANCE

12.3.3.1 Rising demand for smart homes in France to fuel growth of smart market

TABLE 122 NATIONAL TARGETS AND CONTRIBUTIONS OF FRANCE

12.3.4 REST OF EUROPE (ROE)

TABLE 123 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 124 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 125 MARKET IN UK, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 126 MARKET IN UK, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 127 MARKET IN FRANCE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 128 MARKET IN FRANCE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 129 MARKET IN GERMANY, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 130 MARKET IN GERMANY, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 131 MARKET IN REST OF EUROPE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 132 MARKET IN REST OF EUROPE, BY VERTICAL, 2021–2026 (USD MILLION)

12.4 APAC

FIGURE 54 APAC: SMART THERMOSTAT MARKET SNAPSHOT

12.4.1 CHINA

12.4.1.1 China to hold largest share of APAC market

12.4.2 JAPAN

12.4.2.1 Growing need for energy efficiency is fueling demand for smart thermostats

12.4.3 SOUTH KOREA

12.4.3.1 Expanding smart home market to fuel market growth

12.4.4 REST OF APAC (ROAPAC)

TABLE 133 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 134 MARKET IN CHINA, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 136 MARKET IN CHINA, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 137 MARKET IN JAPAN, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 138 MARKET IN JAPAN, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 139 MARKET IN SOUTH KOREA, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 140 MARKET IN SOUTH KOREA, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 141 MARKET IN REST OF APAC, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 142 MARKET IN REST OF APAC, BY VERTICAL, 2021–2026 (USD MILLION)

12.5 REST OF THE WORLD (ROW)

FIGURE 55 ROW: MARKET SNAPSHOT

12.5.1 MIDDLE EAST & AFRICA

12.5.1.1 Middle East & Africa to witness significant growth

12.5.2 SOUTH AMERICA

12.5.2.1 Growing retail industry to fuel regional market growth

TABLE 143 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 144 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 145 MARKET IN MIDDLE EAST & AFRICA, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 146 MARKET IN MIDDLE EAST & AFRICA, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 147 MARKET IN SOUTH AMERICA, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 148 MARKET IN SOUTH AMERICA, BY VERTICAL, 2021–2026 (USD THOUSAND)

13 COMPETITIVE LANDSCAPE (Page No. - 161)

13.1 INTRODUCTION

13.1.1 TOP 5 COMPANY REVENUE ANALYSIS

FIGURE 56 TOP PLAYERS IN MARKET, 2016–2020

13.2 MARKET EVALUATION FRAMEWORK

TABLE 149 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS OF MARKET

13.3 SMART THERMOSTAT MARKET ANALYSIS OF PLAYERS, 2019

TABLE 150 MARKET: CONSOLIDATED

13.4 COMPETITIVE EVALUATION QUADRANT

13.4.1 STAR

13.4.2 EMERGING LEADER

13.4.3 PERVASIVE

13.4.4 PARTICIPANT

FIGURE 57 GLOBAL SMART THERMOSTAT MARKET COMPETITIVE LEADERSHIP MAPPING, 2019

13.5 STARTUP/SME EVALUATION QUADRANT

13.5.1 PROGRESSIVE COMPANY

13.5.2 RESPONSIVE COMPANY

13.5.3 DYNAMIC COMPANY

13.5.4 STARTING BLOCK

FIGURE 58 STARTUP/SME EVALUATION MATRIX

TABLE 151 COMPANY APPLICATION FOOTPRINT

TABLE 152 COMPANY REGION FOOTPRINT

TABLE 153 COMPANY FOOTPRINT

13.6 COMPETITIVE SITUATIONS AND TRENDS

13.6.1 PRODUCT LAUNCHES

TABLE 154 MARKET: PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2020

13.6.2 DEALS

TABLE 155 MARKET: DEALS, JANUARY 2018–JANUARY 2021

13.6.3 OTHERS

TABLE 156 MARKET: OTHERS, JANUARY 2018–JANUARY 2021

14 COMPANY PROFILES (Page No. - 173)

14.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View)*

14.1.1 ALPHABET (GOOGLE NEST)

TABLE 157 ALPHABET: BUSINESS OVERVIEW

FIGURE 59 ALPHABET: COMPANY SNAPSHOT

14.1.2 EMERSON ELECTRIC

TABLE 158 EMERSON ELECTRIC: BUSINESS OVERVIEW

FIGURE 60 EMERSON ELECTRIC: COMPANY SNAPSHOT

14.1.3 HONEYWELL INTERNATIONAL

TABLE 159 HONEYWELL INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 61 HONEYWELL INTERNATIONAL: COMPANY SNAPSHOT

14.1.4 LENNOX INTERNATIONAL

TABLE 160 LENNOX CORPORATION: BUSINESS OVERVIEW

FIGURE 62 LENNOX INTERNATIONAL: COMPANY SNAPSHOT

14.1.5 ECOBEE

TABLE 161 ECOBEE: BUSINESS OVERVIEW

14.1.6 CARRIER CORPORATION

TABLE 162 CARRIER CORPORATION: BUSINESS OVERVIEW

14.1.7 JOHNSON CONTROLS (LUX PRODUCTS)

TABLE 163 JOHNSON CONTROLS: BUSINESS OVERVIEW

FIGURE 63 JOHNSON CONTROLS: COMPANY SNAPSHOT

14.1.8 LEGRAND (NETATMO)

TABLE 164 LEGRAND: BUSINESS OVERVIEW

FIGURE 64 LEGRAND: COMPANY SNAPSHOT

14.1.9 RESIDEO TECHNOLOGIES

TABLE 165 RESIDEO TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 65 RESIDEO TECHNOLOGIES: COMPANY SNAPSHOT

14.1.10 SIEMENS

TABLE 166 SIEMENS: BUSINESS OVERVIEW

FIGURE 66 SIEMENS: COMPANY SNAPSHOT

14.1.11 TRANE TECHNOLOGIES

TABLE 167 TRANE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 67 TRANE TECHNOLOGIES: COMPANY SNAPSHOT

14.1.12 CONTROL4 CORPORATION

TABLE 168 CONTROL4 CORPORATION: BUSINESS OVERVIEW

14.1.13 NORTEK CONTROL

TABLE 169 NORTEK CONTROL: BUSINESS OVERVIEW

14.1.14 TADO

TABLE 170 TADO: BUSINESS OVERVIEW

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

14.2 OTHER KEY PLAYERS

14.2.1 ALARM.COM

14.2.2 BOSCH THERMOTECHNOLOGY

14.2.3 CENTRICA HIVE

14.2.4 CIELO WIGLE

14.2.5 CLIMOTE

14.2.6 EMPOWERED HOMES (MYSA)

14.2.7 EVE SYSTEMS

14.2.8 MRCOOL

14.2.9 RADIO THERMOSTAT COMPANY OF AMERICA

14.2.10 SALUS CONTROLS

14.2.11 VINE CONNECTED

14.2.12 VIVINT

14.2.13 ZEN ECOSYSTEMS

15 ADJACENT & RELATED MARKET (Page No. - 215)

15.1 INTRODUCTION

15.2 LIMITATIONS

15.3 BUILDING AUTOMATION SYSTEM MARKET

15.3.1 DEFINITION

15.3.2 MARKET OVERVIEW

15.3.3 BUILDING AUTOMATION SYSTEM MARKET, BY REGION

TABLE 171 BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2015–2020 (USD BILLION)

TABLE 172 BUILDING AUTOMATION SYSTEM MARKET, BY REGION, 2021–2026 (USD BILLION)

15.3.3.1 North America

TABLE 173 BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2015–2020 (USD BILLION)

TABLE 174 SMART THERMOSTAT MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD BILLION)

TABLE 175 MARKET IN NORTH AMERICA, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 176 MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 177 BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA, BY APPLICATION, 2015–2020 (USD BILLION)

TABLE 178 MARKET IN NORTH AMERICA, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 179 MARKET IN NORTH AMERICA FOR RESIDENTIAL APPLICATION, BY COUNTRY 2015–2020 (USD MILLION)

TABLE 180 MARKET IN NORTH AMERICA FOR RESIDENTIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 181 MARKET IN NORTH AMERICA FOR COMMERCIAL APPLICATION, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 182 MARKET IN NORTH AMERICA FOR COMMERCIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 183 BUILDING AUTOMATION SYSTEM MARKET IN NORTH AMERICA FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 184 MARKET IN NORTH AMERICA FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 185 MARKET IN US, BY APPLICATION, 2015–2020 (USD BILLION)

TABLE 186 MARKET IN US, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 187 MARKET IN CANADA, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 188 MARKET IN CANADA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 189 MARKET IN MEXICO, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 190 BUILDING AUTOMATION SYSTEM MARKET IN MEXICO, BY APPLICATION, 2021–2026 (USD MILLION)

15.3.3.2 Europe

TABLE 191 BUILDING AUTOMATION SYSTEM MARKET IN EUROPE, BY COUNTRY, 2015–2020 (USD BILLION)

TABLE 192 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD BILLION)

TABLE 193 MARKET IN EUROPE, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 194 MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 195 MARKET IN EUROPE, BY APPLICATION, 2015–2020 (USD BILLION)

TABLE 196 MARKET IN EUROPE, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 197 MARKET IN EUROPE FOR RESIDENTIAL APPLICATION, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 198 MARKET IN EUROPE FOR RESIDENTIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 199 BUILDING AUTOMATION SYSTEM MARKET IN EUROPE FOR COMMERCIAL APPLICATION, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 200 MARKET IN EUROPE FOR COMMERCIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 201 MARKET IN EUROPE FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 202 MARKET IN EUROPE FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 203 MARKET IN UK, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 204 MARKET IN UK, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 205 BUILDING AUTOMATION SYSTEM MARKET IN GERMANY, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 206 MARKET IN GERMANY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 207 MARKET IN FRANCE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 208 MARKET IN FRANCE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 209 MARKET IN ITALY, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 210 MARKET IN ITALY, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 211 MARKET IN REST OF EUROPE, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 212 BUILDING AUTOMATION SYSTEM MARKET IN REST OF EUROPE, BY APPLICATION, 2021–2026 (USD MILLION)

15.3.3.3 APAC

TABLE 213 BUILDING AUTOMATION SYSTEM MARKET IN APAC, BY COUNTRY, 2015–2020 (USD BILLION)

TABLE 214 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD BILLION)

TABLE 215 MARKET IN APAC, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 216 MARKET IN APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 217 MARKET IN APAC, BY APPLICATION, 2015–2020 (USD BILLION)

TABLE 218 MARKET IN APAC, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 219 MARKET IN APAC FOR RESIDENTIAL APPLICATION, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 220 BUILDING AUTOMATION SYSTEM MARKET IN APAC FOR RESIDENTIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 221 MARKET IN APAC FOR COMMERCIAL APPLICATION, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 222 MARKET IN APAC FOR COMMERCIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 223 MARKET IN APAC FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2015–2020 (USD MILLION)

TABLE 224 BUILDING AUTOMATION SYSTEM MARKET IN APAC FOR INDUSTRIAL APPLICATION, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 225 MARKET IN CHINA, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 226 MARKET IN CHINA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 227 MARKET IN JAPAN, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 228 MARKET IN JAPAN, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 229 MARKET IN INDIA, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 230 MARKET IN INDIA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 231 MARKET IN SOUTH KOREA, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 232 MARKET IN SOUTH KOREA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 233 MARKET IN REST OF APAC, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 234 BUILDING AUTOMATION SYSTEM MARKET IN REST OF APAC, BY APPLICATION, 2021–2026 (USD MILLION)

15.3.3.4 ROW

TABLE 235 BUILDING AUTOMATION SYSTEM MARKET IN ROW, BY REGION, 2015–2020 (USD BILLION)

TABLE 236 SMART THERMOSTAT MARKET IN ROW, BY REGION, 2021–2026 (USD BILLION)

TABLE 237 MARKET IN ROW, BY OFFERING, 2015–2020 (USD MILLION)

TABLE 238 MARKET IN ROW, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 239 MARKET IN ROW, BY APPLICATION, 2015–2020 (USD BILLION)

TABLE 240 MARKET IN ROW, BY APPLICATION, 2021–2026 (USD BILLION)

TABLE 241 MARKET IN ROW FOR RESIDENTIAL APPLICATION, BY REGION, 2015–2020 (USD MILLION)

TABLE 242 BUILDING AUTOMATION SYSTEM MARKET IN ROW FOR RESIDENTIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 243 MARKET IN ROW FOR COMMERCIAL APPLICATION, BY REGION, 2015–2020 (USD MILLION)

TABLE 244 MARKET IN ROW FOR COMMERCIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 245 MARKET IN ROW FOR INDUSTRIAL APPLICATION, BY REGION, 2015–2020 (USD MILLION)

TABLE 246 MARKET IN ROW FOR INDUSTRIAL APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 247 MARKET IN SOUTH AMERICA, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 248 MARKET IN SOUTH AMERICA, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 249 MARKET IN MIDDLE EAST AND AFRICA, BY APPLICATION, 2015–2020 (USD MILLION)

TABLE 250 BUILDING AUTOMATION SYSTEM MARKET IN MIDDLE EAST AND AFRICA, BY APPLICATION, 2021–2026 (USD MILLION)

16 APPENDIX (Page No. - 243)

16.1 INSIGHTS OF INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Smart Thermostat Market

The Smart Thermostat Market report provides a holistic view of the market with market dynamics, competitive landscape, key players in the market, estimated growth of the Smart Thermostat sector based on product, connectivity technology, vertical, and geography, and the impact of COVID-19 on the market, which will help easily spot business opportunities with high growth prospects and lower risks, and channelize strategies to maximize business outputs.

This study includes the Smart Thermostat Market analysis, trends, and future estimations to determine the imminent investment pockets.* The report presents information related to key drivers, restraints, and Smart Thermostat Market opportunity.* The Smart Thermostat Market size is quantitatively analyzed from 2019 to 2026 to highlight the financial competency of the industry.* Extensive analysis of the market is conducted by following key product positioning and monitoring the top competitors within the market framework.* Key players are profiled and their strategies are analyzed thoroughly to understand the competitive outlook of the Smart Thermostat Market.