Software-Defined Wide Area Network (SD-WAN) Market by Component (Solutions and Services), Deployment Mode (On-Premises and Cloud), Organization Size, End User (Service Providers and Verticals) and Region - Global Forecast to 2027

Updated on : March 19, 2024

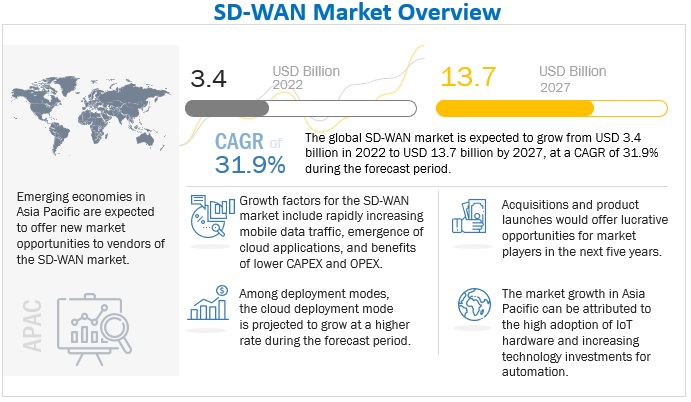

The software-defined wide area network (SD-WAN) market share is expected to grow from USD 3.4 billion in 2021 to USD 13.7 billion by 2026 with a compound annual growth rate (CAGR) of 31.9%. Benefits of SD-WAN such as WAN simplification, lower costs, bandwidth efficiency is driving the SD-WAN market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing number of cloud-based solutions

The number of cloud-based solutions has increased significantly over the past few years, as connectivity and cloud storage prices have fallen. Many businesses now use cloud-based applications. Many prominent IT companies are now providing many cloud-based services and cloud platforms. As SD-WAN provides better cloud connectivity than MPLS, enterprises will likely go for SD-WAN. The increasing number of cloud-based applications also increases traffic in the network. According to Cisco, the global cloud IP traffic will increase from 499 Exabytes (EB) per month in 2016 to 1.6 Zettabytes (ZB) per month in 2021, at a CAGR of 27%. Enterprises need to move toward more advanced technologies, such as SD-WAN, to handle increased traffic. Thus, an increasing number of cloud-based solutions is expected to boost the global software-defined wide area network market during the forecast period.

Restraint: Reliability issues in SD-WAN

SD-WAN is an advanced technology, but some networking experts suggest another form of transmission is still needed for reliable quality of service. They advise the enterprises to keep MPLS link parallel to the broadband link to avail quality service in real-time traffic. Though SD-WAN is used to improve QoS, it alone cannot guarantee QoS. SD-WAN can detect packet loss and jitter and choose the best path for the packet, however, if all paths are bad, SD-WAN cannot guarantee the quality of service. Effective implementation of SD-WAN can significantly reduce the company’s dependence on MPLS; however, SD-WAN is unlikely to replace MPLS completely soon. As many SD-WAN vendors promise that their solutions will increase network reliability, customers’ concerns over the reliability of the SD-WAN network are not expected to last for long.

Opportunity: Digital transformation across organizations

Cost-saving is not the only objective of the SD-WAN implementation. With the implantation of SD-WAN, networks become easier to operate, manage, and maintain. SD-WAN is often implemented as part of digital transformation process of the company. For many organizations, one of the key objectives of digital transformation is to increase the effectiveness of platforms and applications used by enterprises for social, marketing, or e-commerce efforts. SD-WAN plays a key role in the digital transformation not only by saving cost on network infrastructure but by improving the performance of the applications. Being able to use multiple links for data transmission, using SD-WAN increases application performance over the WAN infrastructure. As companies are planning big-budget digital transformations, the global SD-WAN market is expected to grow significantly during the forecast period.

Challenge: Concerns over SD-WAN security

Businesses are concerned about the network security as cyber-attacks are threat for the sensitive data. of SD-WAN appliances used by the businesses might be with highly sensitive data traffic. Security devices must be placed at each remote location to protect the network from internet-based threats. Businesses are confused about what kind of setup is needed for optimal security. This can be the challenge for businesses while adopting the SD-WAN technology.

SMEs segment is projected to grow at the fastest rate during the forecast period.

SMEs are adopting SD-WAN technology due to the increasing usage of cloud technology. SD-WAN lets even small businesses combine multiple Internet and MPLS lines to enhance the performance of voice, video, and cloud-based applications across single or multiple sites. Even if the workforce is smaller than these, they often have employees in multiple locations. In this case, SD-WAN provides numerous added benefits such as enhanced centralized control, WAN performance, network agility, and network scalability at less cost. By using cloud-based applications, the bandwidth requirements and operating costs increases for SMEs and therefore with SD-WAN, SMEs can decrease those costs while making use of multiple low-cost local Internet lines.

Vertical segment is set to account for the largest market share during the forecast period

The vertical customers have been classified into industries, such as BFSI, manufacturing, retail, healthcare, education, transportation and logistics, energy and utilities, and others. Enterprises across various verticals markets are increasingly deploying SD-WAN solutions as the benefits attained by them during the COVID-19 pandemic, such as remote work culture across the globe, also supporting cloud-first strategy and advancement in application performance.

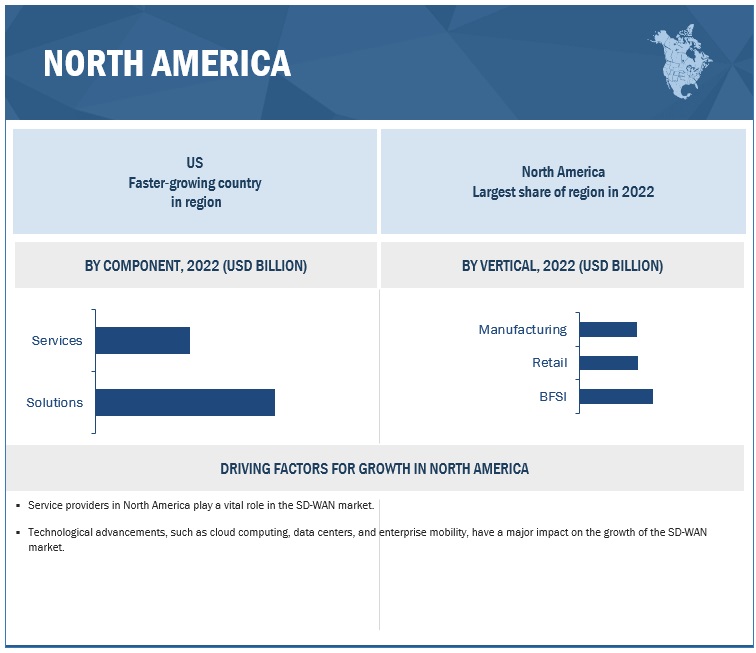

North America to account for the largest market share during the forecast period

North America comprises developed countries with well-established infrastructures in the US and Canada. It is expected to hold the largest global software-defined wide area network (SD-WAN) market share. These countries have well-established economies that empower them to invest strongly in innovation and R&D activities, thereby contributing to the evolution of new technologies. The region is technologically developed and has been adopting several government initiatives such as 5G, RAN, cyber security, network security, and secure access, including smart cities and Industrial IoT (IIoT). Due to the increasing adoption of trending technologies, such as edge computing, IoT, cloud, ZTNA, AI, big data, hybrid cloud, and mobility, North American organizations are keen to integrate advanced technologies into their processes. The advent of SMEs and the adoption of digitalization in all sectors among large enterprises are expected to drive market growth in North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The software-defined wide area network market market vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global SD-WAN market are Cisco (US), Oracle (US), Hewlett Packard Enterprise (US), Nokia (Finland), VMware (US), Huawei (China), Juniper Networks (US), Fortinet (US), Citrix US), Ciena (US), Epsilon Telecommunications (Singapore), Palo Alto Networks (US), Riverbed Technology (US), Ericsson (Sweden), BT (UK), Colt Technology Services (UK), NEC Corporation (Japan), Tata Communications (India), Extreme Networks (US), Martello Technologies (Canada), Arelion (Sweden), Aryaka (US), Flexiwan (Israel), Cato Networks (Israel), Nour Global (UAE), Sencinet (Brazil), MCM Telecom (Mexico), InterNexa (Colombia), FatPipe Networks (US), Bigleaf Networks (US), Lavelle Networks (India). The study includes an in-depth competitive analysis of these key players in the SD-WAN market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Market value in 2027 | USD 13.7 Billion |

| Market value in 2022 | USD 3.4 Billion |

| Largest Market | North America |

| Market growth rate | 31.9% CAGR 2022 to 2027 |

| Market size available for years | 2016–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Segments covered | By component, deployment mode, organization size, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

| Companies covered | Cisco (US), Oracle (US), Hewlett Packard Enterprise (US), Nokia (Finland), VMware (US), Huawei (China), Juniper Networks (US), Fortinet (US), Citrix US), Ciena (US), Epsilon Telecommunications (Singapore), Palo Alto Networks (US), Riverbed Technology (US), Ericsson (Sweden), BT (UK), Colt Technology Services (UK), NEC Corporation (Japan), Tata Communications (India), Extreme Networks (US), Martello Technologies (Canada), Arelion (Sweden), Aryaka (US), Flexiwan (Israel), Cato Networks (Israel), Nour Global (UAE), Sencinet (Brazil), MCM Telecom (Mexico), InterNexa (Colombia), FatPipe Networks (US), Bigleaf Networks (US), Lavelle Networks (India). |

This research report categorizes the software-defined wide area network market to forecast revenues and analyze trends in each of the following subsegments:

By Component

-

Solution

- Software

- Appliances

-

Services

- Consulting

- Implementation

- Training and support

By Deployment Mode

- Cloud

- On-premises

By Organization Size

- SMEs

- Large Enterprises

By End User

- Service Providers

-

Verticals

- Banking, Financial Services, and Insurance

- Manufacturing

- Retail

- Healthcare

- Government

- Transport and Logistics

- Energy and Utilities

- Other Verticals

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

- UAE

- KSA

- Rest of Middle East

-

Africa

- South Africa

- Egypt

- Nigeria

- Rest of Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In July 2022, Nokia has announced a five-year agreement with Ice to provide high-capacity equipment such as 5G Massive MIMO to support all spectrum bands. In this agreement, the company will modernize approximately 3,200 base stations and will deploy 3900 new base stations.

- In June 2022, Telefónica Tech and Cisco teamed together on SD-WAN, security, and SASE solutions. This new service would provide a comprehensive connectivity and safety package to link firms across data centers, local branches, and distant worker locations. It was supposed to meet the demands of both major startups and local businesses.

- In September 2021, Hewlett Packard Enterprise acquired Zerto, an industry leader in cloud data management and protection. This acquisition positions the HPE GreenLake edge-to-cloud platform in the high-growth market with a proven solution and propels HPE’s storage business into a cloud-native and software-defined data service.

Frequently Asked Questions (FAQ):

What is SD-WAN?

As defined by Cisco, SD-WAN is a software-defined approach to managing the WAN. It enables reducing costs with transport independence across MPLS, 4G/5G LTE, and other connection types, improves application performance, increases agility, optimizes user experience and efficiency for software-as-a-service (SaaS) and public-cloud applications, and simplifies operations with automation and cloud-based management.

Which countries are considered in Europe?

The report includes an analysis of the UK, France, Germany, Italy, Spain and Nordics in Europe.

Which are the key drivers supporting the growth of the SD-WAN market?

The key driver supporting the growth of the SD-WAN market includes an increasing number of cloud-based solutions, a rising need for mobility services, and enterprises’ focus on reducing OPEX with SD-WAN.

Who are the key vendors in the SD-WAN market?

The key vendors operating in the SD-WAN market include Cisco (US), Oracle (US), Hewlett Packard Enterprise (US), Nokia (Finland), VMware (US), Huawei (China), Juniper Networks (US), Fortinet (US), Citrix US), Ciena (US), Epsilon Telecommunications (Singapore), Palo Alto Networks (US), Riverbed Technology (US), Ericsson (Sweden), BT (UK), Colt Technology Services (UK), NEC Corporation (Japan), Tata Communications (India), Extreme Networks (US), Martello Technologies (Canada), Arelion (Sweden), Aryaka (US), Flexiwan (Israel), Cato Networks (Israel), Nour Global (UAE), Sencinet (Brazil), MCM Telecom (Mexico), InterNexa (Colombia), FatPipe Networks (US), Bigleaf Networks (US), Lavelle Networks (India). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

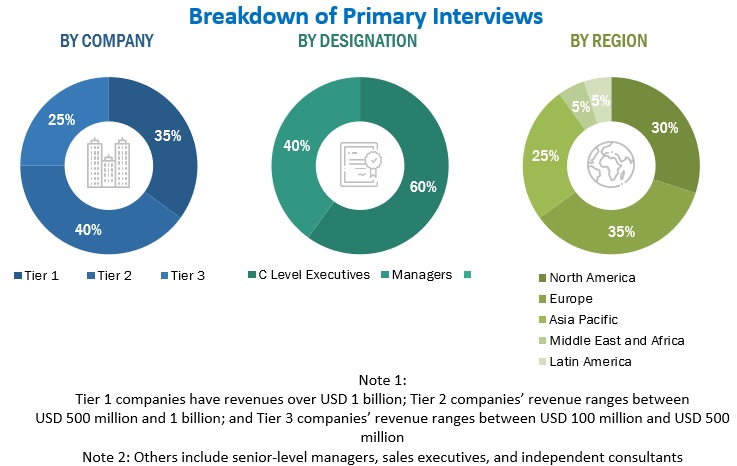

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the SD-WAN market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information, as well as to assess the market’s prospects. These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants.

Secondary Research

In the secondary research process, various secondary sources were referred to, for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals and various associations were also referred to, such as the IEEE Communications Society (ComSoc) and Information Theory Society (IT). Secondary research was used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives. Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides of the SD-WAN market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology, and innovation directors, related key executives from various vendors providing SD-WAN solutions, associated service providers, and system integrators operating in the targeted regions. All parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data

After the complete market engineering process (including calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

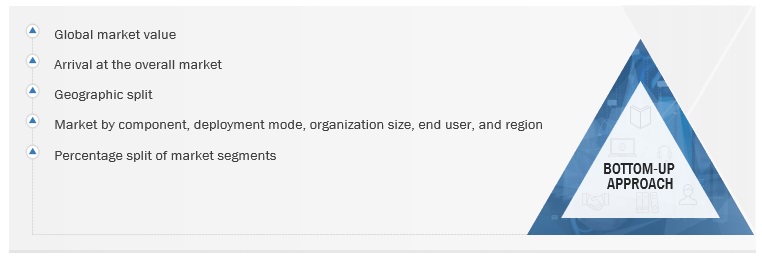

In the complete market engineering process, both top-down and bottom-up approaches were extensively used and several data triangulation methods to perform the market estimation and forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the market size of the SD-WAN market. The first approach involves the estimation of the market size by summing up revenues of the companies generated through the sale of solution and services.

SD-WAN Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The bottom-up approach was employed to arrive at the overall size of the SD-WAN market from the revenue of the key players and their share in this market. The revenue of the key players was analyzed to determine the overall size of the SD-WAN market.

Report Objectives

- To determine, segment, and forecast the global SD-WAN market by component, deployment mode, organization size, end user, and region in terms of value

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Latin America, and Middle East and Africa

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze macro and micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze industry trends, pricing data, and patents and innovations related to the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the SD-WAN market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches and developments, partnerships, agreements, collaborations, business expansions, and Research and Development (R&D) activities

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Further breakdown of the France SD-WAN market

- Further breakdown of South Korean SD-WAN market

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Software-Defined Wide Area Network (SD-WAN) Market