Supply Chain Security Market by Component (Hardware, Software, Services), Security Type (Data Locality & Protection, Data Visibility & Governance), Organization Size, Application (Healthcare & Pharmaceuticals, FMCG) and Region - Global Forecast to 2027

Supply Chain Security Market Size, Share, Statistics

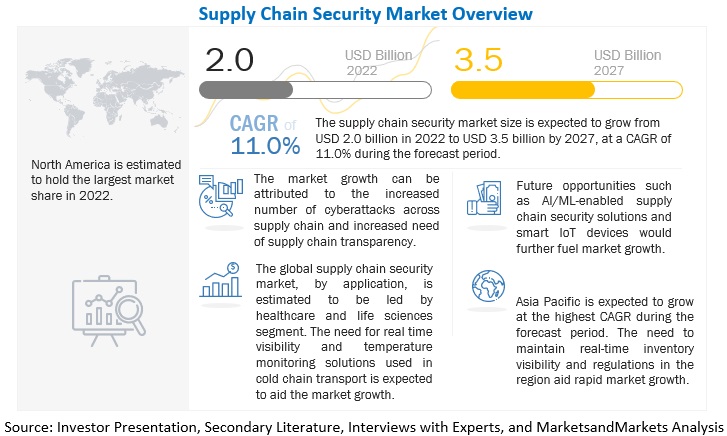

MarketsandMarkets forecasts that the global supply chain security market will grow from an estimated USD 2.0 billion in 2022 to USD 3.5 billion by 2027, at a compound annual growth rate (CAGR) of 11.0%. The rise in incidents of cyberattacks across the supply chain is expected to fuel market growth. Moreover, a lack of awareness about supply chain security among organizations may hinder the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Supply Chain Security Market Dynamics

Driver: Rising incidences of cyberattacks across supply chains

Due to rising incidents of cyberattacks across the supply chain, organizations are seeking solutions to safeguard their supply chains from cyberattacks, check data accuracy, and increase supply chain visibility. According to cybersecurity services provider BlueVoyant, an indirect data breach due to flaws in their supply chains has been experienced by 93% of global enterprises in the last 2 years. In 2022 itself, supply chain data breaches have increased by nearly 37%. These numbers are alarming and indicate that organizations need to focus on their supply chain security. According to Yahoo Business, many entities admit that they have no means of detecting a data breach in their supply chain, and the number of such entities is on the rise.

Restraint: Budgetary constraints among small and emerging startups in developing economies

Cybersecurity requirements grow at a higher rate than budgets planned to address them. Most smaller firms lack the budget and IT security expertise to adopt enhanced cybersecurity solutions to safeguard their networks and IT infrastructures from various cyberattacks. Limited capital funding can be a major restraining factor for small and medium-sized companies embracing the supply chain security model. Emerging startups in developing countries across the Middle East & Africa, Latin America, and Asia Pacific often face a challenge to acquire finance and appropriate funding to adopt supply chain security solutions for their business. The capital funding in these firms is majorly obtained for safeguarding business-critical operations, at times leaving less or no funding for enhancing advanced supply chain security solutions.

Opportunity: Improving risk prediction and management

Risk mitigation will continue to be paramount for procurement leaders through 2025, but the approach to deliver this on priority is changing. Legal requirements and stakeholder expectations for risk screening and due diligence are increasing, and procurement leaders will need to leverage more sophisticated tools, triangulate information and data from more sources, and scan for risks in deeper parts of the supply chain than ever before. In the last few years, there has been tremendous growth in the number of tools and technologies available to support supply chain risk prediction, and several include sustainability dimensions, such as environmental, ethical, and human rights risk monitoring. Procurement leaders are working to understand and test the capabilities of these tools and consider integration into and interoperability with the existing systems across the business.

Challenge: Awareness about supply chain security among organization

From automation of tasks to streamlining operations of the Internet of Things, the supply chain sector is in the midst of a digital transformation. This has made the industry more susceptible to attacks. It is, therefore, necessary for organizations in the supply chain sector to invest in cybersecurity training and scenario-based tabletop tests of incident response plans. Companies often realize that many cyberattacks are the result of human behavior. Thus, educating employees should be at the top of any company’s list of supply chain security priorities. Organizations mostly admit that they provide employees with cybersecurity awareness training after a ransomware attack. Employees are the first line of defense in organizations; however, many organizations do not have a well-trained staff or adequate cybersecurity infrastructure to help protect the organization from supply chain attacks. If employees learn how to identify and prevent supply chain cyberattacks, it will help keep the company safe and also help the entire economy to avoid the calamitous disruptions experienced over the last few years.

By applications, healthcare and pharmaceutical segment to account for largest market share during forecast period

The healthcare industry possesses invaluable data. This data includes patient health information, personal identification, and card payment. The risk of losing this information increases when third-party vendors with whom information is shared are included in the risk matrix. The consequences of a disruption in a hospital supply chain can be more dire than just a delayed shipment when patient life is at stake. A missed delivery can cost lives as supply chains in healthcare bring life-saving medicines and treatments to the patients that need them. Hence, security is crucial in the healthcare supply chain. Tracking medications through the pharmaceutical supply chain enables healthcare supply chains to deliver legitimate medications to their patients. Hospital supply chain regulations have been implemented by many countries and regions to ensure the safety of medical and pharmaceutical products. For example, the Falsified Medicines Directive (FMD) in the European Union and the Drug Supply Chain Security Act (DSCSA) in the US require verification and transparency of pharmaceuticals imported and sold within the respective regions.

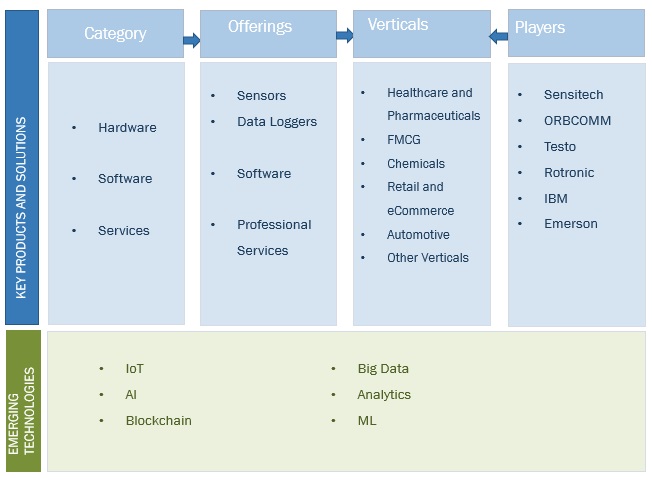

Supply Chain Security Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

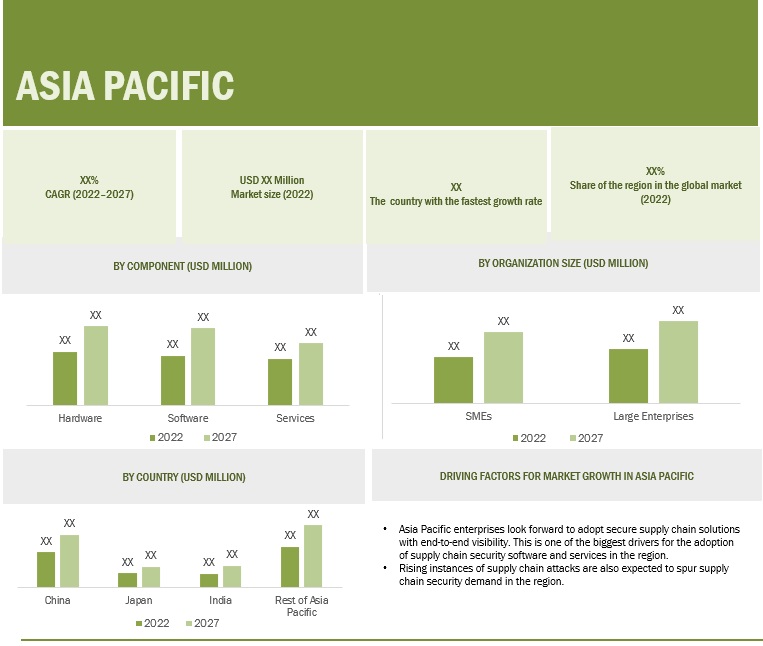

By Region, Asia Pacific Is Expected to Grow at Highest CAGR During Forecast Period

Asia Pacific includes big developing economies, such as China, Japan, India, and the rest of Asia Pacific. With the increasing technological innovations and the growing presence of numerous organizations, economies in the Asia Pacific are witnessing high growth. The Asia Pacific region is strategically, geographically, economically, and demographically important in the global supply chain. Hence, this region has become a potential market for supply chain security vendors. Businesses are finding new ways to optimize their supply chain solutions and gearing up digitally for growth. The region has witnessed a surge in delivery after the pandemic, and Southeast Asia now boasts some of the world’s large local eCommerce players and super app providers. This results in supply chain security becoming an important aspect.

Secure data exchange platforms for the logistics sector have been implemented by the governments of India and Singapore as part of larger logistics policy investments. The emissions calculator for supply chains has been launched by the Indian government, and it announced a national logistics award program to improve security.

Key Market Players:

The key players in the global supply chain security market include IBM (US), Emerson (US), Oracle (US), NXP Semiconductors (the Netherlands), Testo (Germany), ORBCOMM (US), Sensitech (US), ELPRO (Switzerland), Rotronic (Switzerland), Monnit (US), Cold Chain Technologies (US), LogTag Recorders (New Zealand), Dickson (US), Signatrol (UK), Hanwell Solutions (UK), Controlant (Iceland), Roambee (US), Omega Compliance (Hong Kong), Tagbox Solutions (India), C2A Security (Israel), SafeTraces (US), Tive (US), Altana (US), FourKites (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Period for Which Market Size Has Been Studied | 2018–2027 |

| Base Year Considered | 2021 |

| Forecast Period | 2022–2027 |

| Forecast Units | Value (USD Million/USD Billion) |

| Segments Covered | By Component, Organization Size, Security Type, Application, Region |

| Geographies Covered | North America, Europe, Asia Pacific, Middle East & Africa (MEA), and Latin America |

| Major Companies Covered | IBM (US), Emerson (US), Oracle (US), NXP Semiconductors (the Netherlands), Testo (Germany), ORBCOMM (US), Sensitech (US), ELPRO (Switzerland), Rotronic (Switzerland), Monnit (US), Cold Chain Technologies (US), LogTag Recorders (New Zealand), Dickson (US), Signatrol (UK), Hanwell Solutions (UK), Controlant (Iceland), Roambee (US), Omega Compliance (Hong Kong), Tagbox Solutions (India), C2A Security (Israel), SafeTraces (US), Tive (US), Altana (US), FourKites (US) |

Market Segmentation

Recent Developments:

- In February 2022, Oracle upgraded its Oracle Supply Chain & Manufacturing (SCM) with new logistics management capabilities. These capabilities will help organizations increase efficiency and value across their global supply chains

- In August 2021, Cloudleaf announced its strategic partnership with ELPRO. This partnership will help to bring enhanced solutions to the supply chains. To ensure global visibility and help provide safe and effective delivery of medications to patients, Cloudleaf and ELPRO together are providing qualified, real-time cold chain monitoring solutions.

- In May 2021, Grassmid Transport, a provider of truckload carrier services, chose ORBCOMM’s comprehensive solutions, including integrated in-cab and asset tracking solutions to monitor Grassmid Transport’s fleet of trucks, dry vans, and refrigerated trailers.

- In April 2021, Carrier teamed up with Sensitech (Both Carrier and Sensitech are a part of Carrier Global Corporation, a provider of HVAC, refrigeration, fire, security, and building automation technologies) to support effective vaccine distribution in North Carolina. Carrier leverages Sensitech’s next-generation IoT supply chain monitoring devices for real-time tracking of vaccine shipments throughout the state. Stationary temperature monitoring systems are used to track vaccines stored at Bank of America Stadium.

- In January 2021, IBM partnered with Covalent. Covalent, a fashion brand by Newlight Technologies, adopted IBM Blockchain technology on IBM LinuxONE to enable consumers to track the carbon footprint and supply chain of its sustainable, AirCarbon-based fashion accessories, from eyewear to handbags.

Frequently Asked Questions (FAQ):

What is supply chain security?

A Supply chain security system combines traditional supply chain management practices with security measures and focuses on the risk management of external suppliers, vendors, logistics, and transportation. Supply chain security activities aim to protect the supply chain from terrorism, piracy, and theft. These solutions help businesses identify, analyze, and mitigate risks that arise in the supply chain with real-time supply chain visibility and transparency, thereby helping businesses make faster, more accurate, and informed decisions.

What is the projected market value of the global supply chain security market?

The global supply chain security market would grow from an estimated USD 2.0 billion in 2022 to USD 3.5 billion by 2027, at a CAGR of 11.0% during the forecast period.

What are the key trends affecting the global supply chain security market?

Cloud deployment type is expected to witness the highest adoption over the forecast period due to increasing demand for professional and cloud-native developer tools that support native architectures, cross-platform app architectures, and web-based app architectures.

Which key players influence the market growth of supply chain security?

IBM (US), Emerson (US), Oracle (US), NXP Semiconductors (Netherlands), and Testo (Germany) are the leaders in the supply chain security market, recognized as star players. These companies account for a major share of the supply chain security market. The vendors offer solutions based on user requirements and adopt growth strategies to consistently achieve the desired growth to mark their market presence.

Which emerging SMEs support market growth?

Tagbox Solutions (India), C2A Security (Israel), SafeTraces (US), Tive (US), Altana (US), and FourKites (US) are a few of the emerging SMEs nurturing market growth with their technical skills and expertise. These startups focus on developing product/service portfolios and bringing innovations to the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

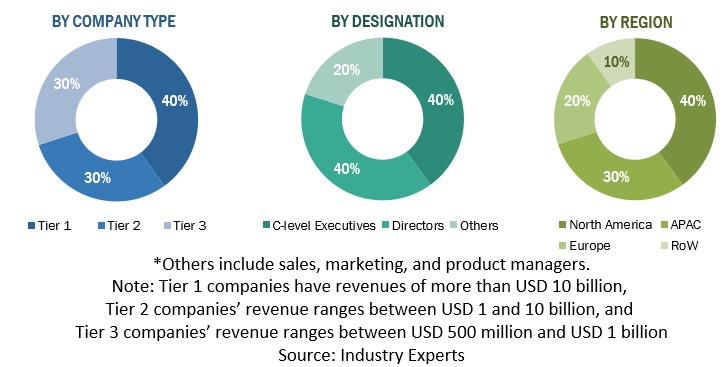

The study involved major activities to estimate the current market size for the supply chain security market. Exhaustive secondary research was done to collect information on the Supply chain security industry and validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. Thereafter, the market breakup and data triangulation procedures were used to calculate the market size of the segments and subsegments of the supply chain security market.

Secondary Research

The market size of companies offering supply chain security solutions and services was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. These sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including chief executive officers (CEOs), vice presidents (VPs), marketing directors, product development/innovation teams, and related key executives from various key companies and organizations operating in the supply chain security market.

The top-down and bottom-up approaches were extensively used in the market engineering process and several data triangulation methods to estimate and forecast the market growth for segments and subsegments listed in this report. The complete market engineering process included extensive qualitative and quantitative analysis listing key information/insights throughout the report.

After the complete market engineering process (calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers. The primary research was conducted to identify the segmentation types; industry trends; the competitive landscape of the supply chain security market players; and the key market dynamics, such as drivers, restraints, opportunities, challenges, and key strategies.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

In this market estimation approach, the key companies offering the supply chain security solutions and services, such as IBM, Emerson, Oracle, NXP Semiconductors and Testo, which contribute a major part of the supply chain security market, were identified. After finalizing these companies, data was validated by industry experts through primary interviews related to the leading market vendors. Furthermore, their total revenue through annual reports, US Securities and Exchange Commission (SEC) filings, and paid databases was identified.

Data Triangulation

After completing the market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of supply chain security market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Report Objectives

- To describe and forecast the global supply chain security market by component, security type, application, organization size, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing market growth

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the supply chain security market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Supply Chain Security Market