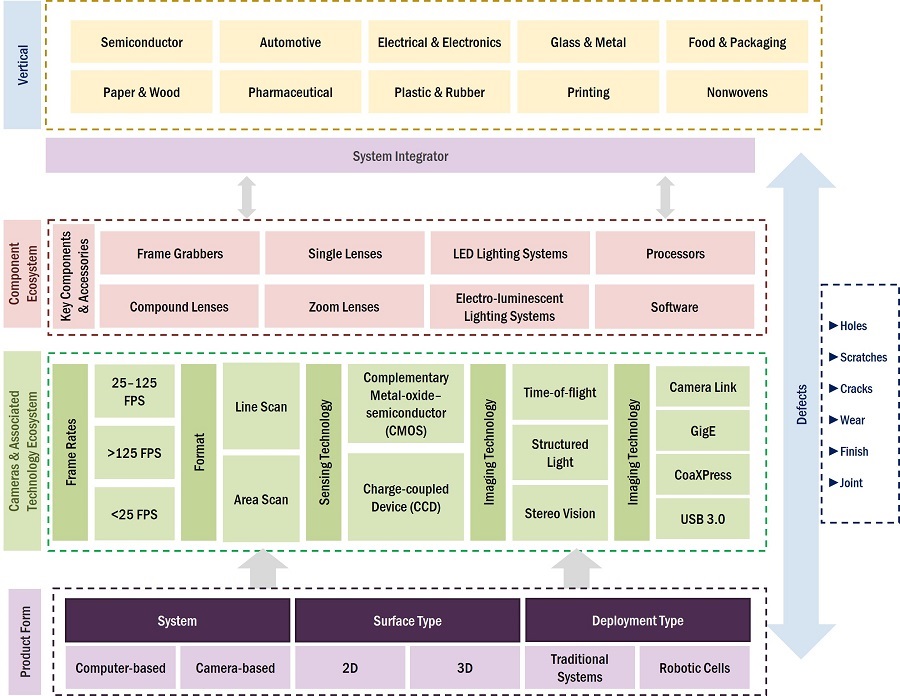

Surface Inspection Market Size, Share, Trends, Statistics and Industry Growth Analysis by Component (Cameras, Frame Grabbers, Processors, Software), Surface Type (2D, 3D), System (Computer-based, Camera-based), Deployment Type (Traditional Systems, Robotic Cells), Vertical - Global Forecast to 2028

Updated on : October 22, 2024

Surface Inspection Market Size & Share

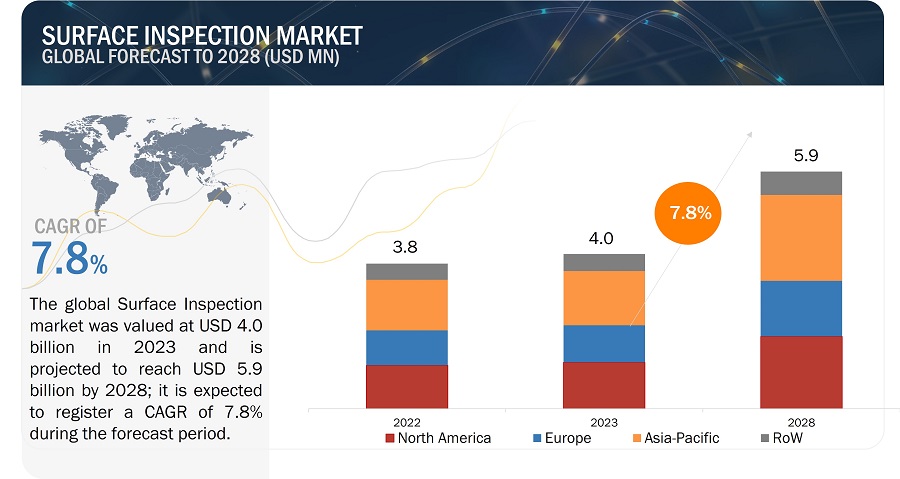

The global Surface Inspection market was worth USD 4.0 billion in 2023 and is anticipated to reach USD 5.9 billion by 2028. The market is estimated to grow at a CAGR of 7.8% during the forecast period from2023 to 2028. Surface inspection technology has recently moved towards the non-contact method using laser triangulation and structured light scanning for accurate 3D surface profiling. Such technologies are considered very important in finding defects within complex geometries.

In surface inspection, other popular methods are hyperspectral and multispectral imaging, which helps show material defects that are not visible to the naked human eye. Integrating surface inspection with industrial automation and the IIoT will enable more effective real-time monitoring and predictive maintenance, thereby leading to an increase in productivity with minimum chances of downtime. The above improvements have been vital for industries like automotive, aerospace, electronics, and pharmaceutical, where the integrity and quality control of the surface have been highly essential.

Surface Inspection Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

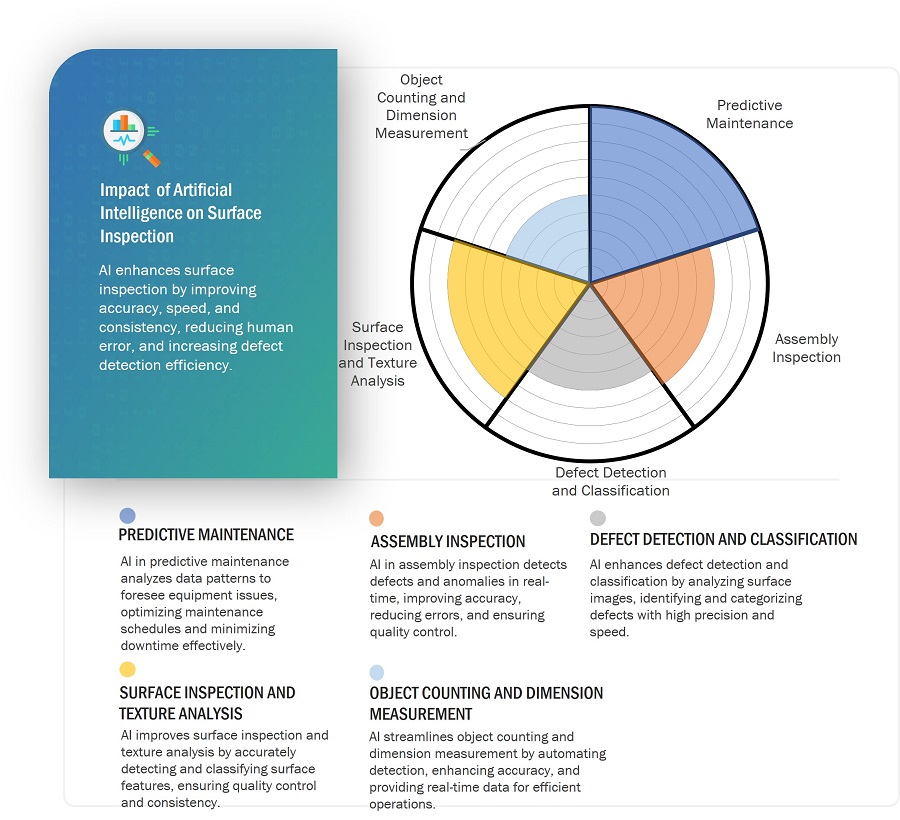

Impact of Artificial Intelligence on the Surface Inspection Market

Artificial intelligence (AI) contributes to surface inspection by improving accuracy, speed, and efficiency. Using computer vision and machine learning, AI detects defects in great detail, even subtle variations commonly missed by human inspectors. This reduces reliance on human inspectors, minimizing error possibilities and increasing quality control. AI systems rapidly process large volumes of data to realize real-time inspections with immediate feedback, which is essential in defect-sensitive industries manufacturing critical components. They also learn and improve over time as newer data are available. As AI evolves, more enhanced and reliable surface inspection solutions are foreseen.

Surface Inspection Market Trends & Dynamics:

Driver: Integration of smart cameras, sophisticated software, and powerful image processors in surface inspection systems.

The features of different components of a given surface inspection system industry determine the performance of cameras, optics, image sensors, processors, illumination equipment, and software. Advancements in embedded processors have extended the functionalities of smart cameras to run inspection activities independently. In April 2020, Cognex introduced the In-Sight D900, touted as the first deep learning-powered industrial smart camera. These self-contained systems are meant for a range of challenging in-line inspection applications, such as optical character recognition, defect detection, and verification of assemblies. Smart cameras contain image sensors from VGA to 2MP. These cameras will inspect large-sized automotive parts and detect even more minor defects within images. Companies are producing smart cameras with resolutions of image sensors up to 36MP and more. For instance, the series of FH-S and FZ-S cameras by OMRON, Japan, provide an image resolution of 21 MP with 2 to 8 camera ports.

Restraint: Lack of technical know-how about the integration of surface inspection systems with robots and 3D models

Surface inspection systems require a technically skilled labor force to understand machine signals and integrate collaborative robots with surface inspection systems. More advanced surface vision systems that can be integrated with robots and carry out 3D inspection are being introduced in the technologically advancing markets. The customers' needs are constantly changing in this market, and workers must be trained to operate the new systems. Economic growth depends so much on the productivity of labor. Today, the major challenge facing encouragement toward lifelong learning, especially among elderly but economically active, faces deterrents. For example, China and Japan will witness a rapid population aging in the coming decades, necessitating the maintenance and upgrading of a growing pool of mature and older workers and making further progress in formal education. In several regions, the growing number of young people entering the labor force will continue to strain education, training capacity, and job creation rates. International migrant workers are still bound to increase, bringing new challenges concerning equal access to training and bridging the skills gap in some countries.

Opportunity: Rapid Adoption due to Feature Upgradation of Collaborative Robots.

Using existing surface inspection systems integrated with robots increases process speed, lowers costs, and reduces human errors. These systems, also known as VGR systems, are used in the automotive, electronics, and food processing industries. The demand for surface inspection systems also increases with increasing demand for robots. Collaborative robots are becoming more popular because they enable humans and robots to perform assigned tasks efficiently together in open or uncaged environments. It has found wide acceptability not only in small and medium-sized businesses but also in complex traditional industries such as automobiles, which need the support of collaborative vision systems. The speed of change is because industries are fast-changing in nature. This scenario has been observed in the consumer goods industry, particularly in packaging, where any package's shape, size, surface, or weight constantly changes.

Challenge: Intricacies in product designing and manufacturing

Surface inspection systems are used in the automotive, food, metal, paper, semiconductor, and electrical & electronics industries. Each industry has requirements, and technological advancements add daily complexity to manufacturing. Surface inspection systems face the challenge of meeting various industries' diverse and ever-changing needs. Metal industry surface inspection systems should be able to analyze metal surfaces that could have been cut, shaped, rolled, or coated. It has been reported that surface defects are widespread in various kinds of steel products.

Surface Inspection Market Ecosystem

Prominent companies in this market include well-established, financially stable Surface Inspection providers such as KEYENCE Corporation (Japan), Cognex Corporation (US), OMRON Corporation (Japan), Teledyne Technologies (US), Panasonic Corporation (Japan), ISRA VISION (Germany), Cognex Corporation(US), OMRON Corporation (Japan), Teledyne Technologies (US), and AMETEK (US). These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Along with the well-established companies, many small and medium companies operate in this market, such as Moritex (Japan) and Pixargus (Germany).

Camera to hold largest market share among valve type of Surface Inspection market in 2023

Cameras held the largest share of the surface inspection market in 2023. This is because many applications, such as the inspection of packaging for proper lids and labels, and objects, such as doors of automobiles, can require multiple cameras to cover large areas. Cameras are also being regularly upgraded in terms of resolution and frame rate. Software is expected to grow at the highest CAGR during the forecast period. Recent advancements in software for surface inspection systems have fueled its market with enhanced big data analytics, artificial intelligence, and self-learning capabilities. The demand for standalone processors is expected to reduce owing to the availability of camera-based systems equipped with onboard processors. Optics can be replaced using robotic cells, which offer flexibility in the distance between the camera and the work item. With the advent of high-resolution cameras, frame grabbers are not required for low-end applications.

3D Surface Type will likely grow at the highest CAGR in the Forecast Period.

The 3D surface type accounted for a share of nearly the overall surface inspection market in terms of value in 2022. A 3D camera can capture both 3D and 2D images simultaneously. 3D systems provide greater statistical certainty due to more extensive data set sizes and can give nanometer (nm) resolution. Unlike 2D systems, they can be integrated with industrial robots, which work in a three-dimensional world. 3D scanning is beneficial for inspecting automobiles with contoured exteriors and interiors, turbine and impeller blades (airfoil shapes), archaeological artifacts, and any complicated non-prismatic geometry, with or without variable curvature.

Semiconductor Industry to hold largest market share in 2023

The semiconductor industry is expected to account for the largest share of the market in 2023. In the semiconductor industry, miniaturization has already reached nanometer scales, and PCBs are highly integrated, which demands a high value for surface inspection systems. On the other hand, wafer inspection contributes significantly to the growth prospects for the surface inspection market in the semiconductor and electrical & electronics industries.

Surface Inspection Market Regional Analysis

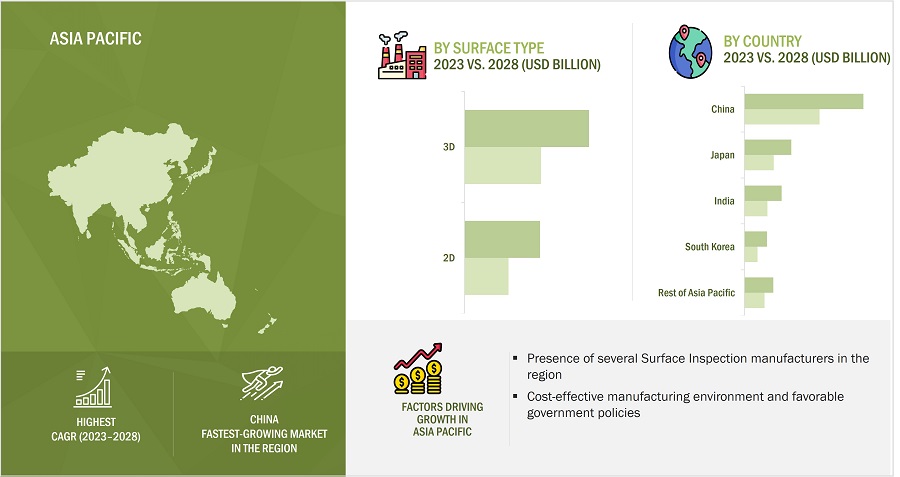

In 2023, Asia Pacific will grow at the highest CAGR in the Surface Inspection market.

Surface Inspection Market by Region

To know about the assumptions considered for the study, download the pdf brochure

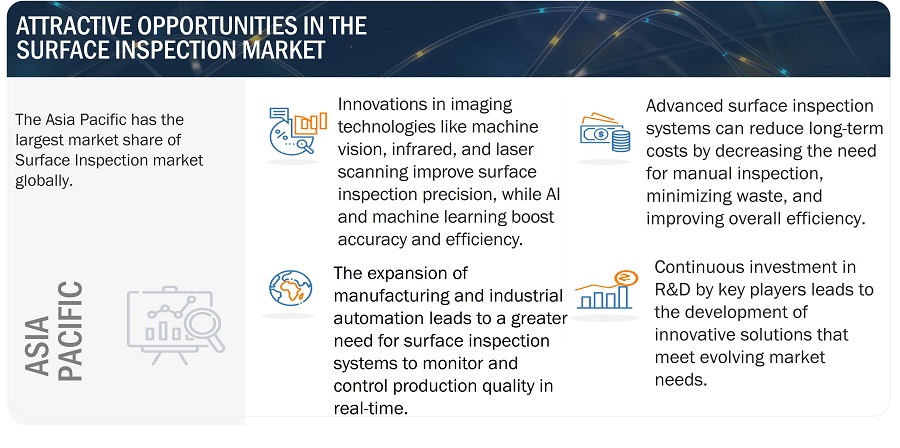

The surface inspection market in Asia Pacific is projected to record the highest CAGR during the forecast period. Increasing investments in automation by automotive and electrical & electronics companies, especially in China, South Korea, and India, are expected to be the key driver for the market in Asia Pacific. Hence, with automation, the growing demand from automotive, semiconductor, electrical & electronics, and food & packaging industries in Asia Pacific is expected to drive the surface inspection market during the forecast period. Also, the increasing adoption of collaborative robot-based vision inspection systems in sectors such as wood & furniture and automotive is another key trend that has fueled the demand for robotic cell-based surface inspection systems in the region. Many companies are shifting their base to Asia Pacific due to low labor costs in the region; this may impact the surface inspection market. Asia Pacific has emerged as a major manufacturing hub, boosting the demand for surface inspection systems in this region.

Top Surface Inspection Companies: Key players

- KEYENCE Corporation (Japan),

- Cognex Corporation (US),

- OMRON Corporation (Japan),

- ISRA VISION (Germany), and

- Teledyne Technologies (US),

- Panasonic Corporation (Japan) . are some of the key players in the Surface Inspection companies.

Surface Inspection Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 4.0 billion in 2023 |

| Projected Market Size | USD 5.9 billion by 2028 |

| Growth Rate | CAGR of 7.8% |

|

Years Considered |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Companies Covered |

|

Surface Inspection Market Highlights

This report has segmented the overall surface inspection market based on component, surface type, system, deployment type, vertical, and region.

|

Aspect |

Details |

|

By Component |

|

|

By Surface Type |

|

|

By System |

|

|

By Deployment Type |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Surface Inspection Industry

- In May 2024, Hitachi High-Tech Corporation announces the LS9300AD, a system for non-patterned wafer surface particles and defect inspection on both sides. With its Differential Interference Contrast function, this system significantly enhances dark-field laser scattering detection, allowing the detection of abnormal defects, including shallow and low-aspect ones. The LS9300AD uses the conventional product's wafer edge grip method and rotating stage, offering complete front and backside wafer inspection.

- In November 2022, Cognex introduced a series of modular vision tunnels for the logistics industry. DataMan image-based barcode reading platform accurately reads codes on packages at high speed with short gaps to increase sortation throughout and decrease processing time for the logistics industry.

- In August 2022, IMS Messsysteme developed a unique camera cluster system that guarantees the highest accuracy for flatness measurement, even on high-gloss materials. High-performance cameras are used to detect and record the topography of the individual measuring material.

Frequently Asked Questions (FAQ):

Which are the major companies in the Surface Inspection market? What are their major strategies to strengthen their market presence?

The major companies in the Surface Inspection market are – KEYENCE Corporation (Japan), Cognex Corporation (US), OMRON Corporation (Japan), Teledyne Technologies (US), Panasonic Corporation (Japan), ISRA VISION (Germany), Cognex (US), OMRON (Japan), Teledyne Technologies (US), and AMETEK (US) and the major strategies adopted by these players are product launches and developments.

What is a Surface Inspection?

Surface inspection refers to the process of examining the outermost layer of a material or object to detect defects, inconsistencies, or contaminants. This involves using various techniques and technologies, such as visual inspection, optical imaging, or sensors, to assess surface quality and integrity. The goal is to identify and evaluate imperfections, such as scratches, cracks, or foreign particles, that could affect the inspected item's functionality, safety, or aesthetic value.

Who are the winners in the global Surface Inspection market?

Companies such – as KEYENCE Corporation (Japan), Cognex Corporation (US), OMRON Corporation (Japan), ISRA VISION (Germany), and Teledyne Technologies (US), Panasonic Corporation (Japan) fall under the winner’s category. These companies cater to their customers' requirements by providing various Surface Inspections.

What are the drivers and opportunities for the Surface Inspection market market?

Integration of smart cameras, advanced software, and powerful image processors into surface inspection systems, Rise in demand for electrical and electronic devices, Surging adoption of collaborative robots (cobots) owing to their progressive features, Rising integration of surface inspection systems with IIoT, AI, and cloud.

What are the restraints and challenges for the Surface Inspection market?

Lack of technical know-how regarding the integration of surface inspection systems with robots and 3D models, Interoperability issues in surface inspection systems and robotic framework in existing facilities, Intricacies in product designing and manufacturing, Functional and operational challenges with respect to surface inspection systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Integration of smart cameras, advanced software, and powerful image processors into surface inspection systems- Increase in remuneration across various countries- Rise in demand for electrical and electronic devicesRESTRAINTS- Lack of technical know-how regarding integration of surface inspection systems with robots and 3D models- Interoperability issues in surface inspection systems and robotic framework in existing facilitiesOPPORTUNITIES- Surging adoption of collaborative robots (cobots) owing to their progressive features- Rising integration of surface inspection systems with IIoT, AI, and cloud- Substantial demand for surface inspection systems from food & beverage companiesCHALLENGES- Intricacies in product designing and manufacturing- Functional and operational challenges with respect to surface inspection systems

-

5.3 SUPPLY CHAIN ANALYSISPLANNING & REVISING FUNDRESEARCH & DEVELOPMENTMANUFACTURINGASSEMBLY, DISTRIBUTION, & AFTER-SALES SERVICES

-

5.4 ECOSYSTEM MAPPING

- 5.5 TRENDS IMPACTING CUSTOMER BUSINESS

-

5.6 CASE STUDIESAUTOMOTIVE- STEMMER IMAGING (Germany) integrated vision camera, processors, and software from Teledyne DALSA (Canada) into lighting equipment from Smart Vision Lights (US) to create vision solution for automotive assembly processSEMICONDUCTOR- Detection of quality issues in low-volume PCB assemblies using FH series of vision-integrated cobot systems by OMRON (Japan)- Use of Allied Vision’s Mako and Manta cameras in hard disk drives for quality control and inspection applicationsFOOD & PACKAGING- Newbaze Ireland Nutrition employed vision solutions provided by Datalogic (Italy) and AIS (Spain) to ensure product quality and safety- Suntory PepsiCo (Vietnam) deployed Imaging OCR software and vision controller offered by Matrox Electronic Systems (Canada) for accurate identification and verification of manufacturing and expiration dates

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.8 TECHNOLOGY TRENDSKEY TECHNOLOGIES- Advancements in CMOS technology make it increasingly appealing for industrial machines- Emergence of mobile/portable vision systemsCOMPLEMENTARY TECHNOLOGY- Rapid advancements in AI and deep learning enable new capabilities in vision systemsADJACENT TECHNOLOGY- Modular smart camera designs offer flexibility in selecting lenses and lighting equipment for multipurpose applications

- 5.9 AVERAGE SELLING PRICE ANALYSIS

-

5.10 TRADE ANALYSISIMPORT SCENARIO- Import scenario for surface inspection systemsEXPORT SCENARIO- Export scenario for surface inspection systems

-

5.11 PATENT ANALYSIS

-

5.12 TARIFF AND REGULATORY LANDSCAPETARIFF- Positive impact of tariff on surface inspection systems- Negative impact of tariff on surface inspection systemsREGULATIONS AND STANDARDS- Leading associations for machine vision-based inspection systems

- 6.1 INTRODUCTION

- 6.2 HOLES

- 6.3 SCRATCHES

- 6.4 CRACKS

- 6.5 WEAR

- 6.6 FINISH

- 6.7 JOINTS

- 6.8 OTHERS

- 7.1 INTRODUCTION

-

7.2 CAMERASFRAME RATES- Automobile industry to witness strong demand for cameras with higher frame ratesFORMATS- Area scan cameras- Line scan camerasSENSING TECHNOLOGY- CCD- CMOS- CCD and CMOSINTERFACE STANDARDS- Camera link- GigE- USB 3.0- CoaXPress- Others- Comparison between various interface standardsIMAGING TECHNOLOGY- Structured light- Time-of-flight- Stereo vision- Comparison between various imaging technologies

-

7.3 FRAME GRABBERSABILITY OF FRAME GRABBERS TO PROCESS, STORE, AND VISUALIZE MULTIPLE IMAGES AT ONCE AND PERFORM REAL-TIME COMPRESSION TO DRIVE DEMAND

-

7.4 OPTICSUSE OF LIQUID LENSES TO ENHANCE VISION CAMERA VIEW AND ADJUST FOCAL LENGTHS TO BOOST DEMAND

-

7.5 LIGHTING EQUIPMENTLIGHTING EQUIPMENT HELP CAMERAS TO FUNCTION PROPERLY AND PRECISELY AND IMPROVE QUALITY OF IMAGES CAPTURED

-

7.6 PROCESSORSPROCESSORS PERFORM ARITHMETIC ALGORITHMS TO GAIN HIGHEST PERFORMANCE IN SURFACE INSPECTION SYSTEMS

-

7.7 SOFTWARESOFTWARE DRIVES IMAGE ACQUISITION, PROCESSING, AND ANALYSIS FUNCTIONS THAT SIGNIFICANTLY INCREASE SYSTEM COST

- 7.8 OTHERS

- 8.1 INTRODUCTION

-

8.2 2DUSE OF 2D SYSTEMS TO INCREASE PRODUCTIVITY AND ACCURACY BY DIMINISHING EFFECTS OF REFLECTIONS

-

8.3 3DIMPLEMENTATION OF 3D SYSTEMS FOR QUALITY AND PRECISE INSPECTION APPLICATIONS IN VARIOUS INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 COMPUTER-BASEDHIGH PROCESSING POWER OF COMPUTER-BASED SYSTEMS TO HANDLE COMPLEX ALGORITHMS TO DRIVE DEMAND

-

9.3 CAMERA-BASEDQUICKER SETUP AND UTILIZATION OF INTELLIGENT PROCESSORS IN CAMERA-BASED SYSTEMS TO BOOST DEMAND

- 10.1 INTRODUCTION

-

10.2 TRADITIONAL SYSTEMSLOWER MAINTENANCE AND IMPLEMENTATION COSTS AND REQUIREMENT FOR LESS SPACE TO BOOST DEMAND

-

10.3 ROBOTIC CELLSINCREASING DEMAND FOR COBOTS WORLDWIDE TO DRIVE MARKET GROWTH

- 11.1 INTRODUCTION

-

11.2 SEMICONDUCTORIR VISION-BASED INSPECTION- Ability of IR cameras to identify cracks and broken traces in assembly line productsMACRO-DEFECT INSPECTION- Adoption of brightfield and darkfield inspection technologies to maximize all macro defectsROBOT VISION-BASED INSPECTION- Implementation of robotic cells in manufacturing industry to handle complex assemblies and tiny partsPRINTED CIRCUIT BOARD (PCB) INSPECTION- Use of bar code reading technology to inspect appropriate placement of PCB componentsSEMICONDUCTOR FABRICATION INSPECTION- Deployment of semiconductor fabrication inspection systems for high-speed wafer inspection

-

11.3 AUTOMOTIVEASSEMBLY VERIFICATION- Necessity to inspect assembly line to ensure proper functioning of complex configuration of componentsFLAW DETECTION- Deployment of vision-based surface inspection systems to detect flaws and inspect surface quality of objectsPRINT VERIFICATION- Need to detect pre-printing errors such as missing content, color variation, and text/print errorsINSPECTION OF PAINTED SURFACES- Requirement to detect defect dents, scratches, and flaking on painted surfacesINSPECTION OF CFRP AND GFRP CAR MATS- Necessity to inspect surface structure of carbon-fiber websINSPECTION OF WELD AND BRAZED SEAMS- Necessity of welded seam inspection of axle carriers, vehicle body, steel wheels, and seats in car body

-

11.4 ELECTRICAL & ELECTRONICSSUITABILITY OF ROBOT-BASED SURFACE INSPECTION SYSTEMS TO DETECT BENT PINS ON PORTS AND CONNECTORS, LOOSE SCREWS, AND MISSING COMPONENTS

-

11.5 GLASS & METALCUT PLATE INSPECTION- Need for automatic inspection and rejection of glasses according to user-defined tolerance with minimum operator interventionsMIRRORED GLASS INSPECTION- Use of mirrored glass inspection for verification of glass identity, pinhole detection, and paint defect detectionFLOAT GLASS INSPECTION- Adoption of float glass inspection to detect inclusion, tin, and ream defectsCOATED GLASS INSPECTION- Deployment of coated glass inspection systems in architectural and automotive industriesLAMINATED GLASS INSPECTION- Implementation of laminated glass inspection systems to detect bubbles, cracks, and scratchesPRISTINE GLASS INSPECTION- Employment of pristine glass inspection systems to detect strains, scratches, cracks, and fingerprints and provide crystal-clear imagesSTRUCTURED SOLAR GLASS INSPECTION- Adoption of structured solar glass inspection technique to detect round bubble and glass chip defectsCOATING- Application of coating to prevent metal from rusting, as well as for cosmetic appealCOLD ROLLING- Use of cold rolling to attain thinner sheets with roll speeds up to 7,000 ft per minuteCONVERTING- Adoption of conversion technique to convert metal sheets into smaller sizes for easy transportationHOT ROLLING- Implementation of hot rolling technique to reduce metal thickness

-

11.6 FOOD & PACKAGINGQUALITY ASSURANCE- Consistent quality assurance to encourage customer loyalty and maintain brand imageGRADING- Need to check quality grades based on size, shape, and colorLABEL VALIDATION- Adoption of label validation technique to detect tears, double labels, wrinkles, and incorrect dates on packages and containersSAFETY INSPECTION- Utilization of safety inspection systems to check quality and safety of packages and containersGLASS CONTAINERS INSPECTION- Deployment of surface inspection technique to check quality of bottles at faster rateMETAL CONTAINERS INSPECTION- Necessity to check correct usage of graphics and colors on metal containersPLASTIC BOTTLE INSPECTION- Inspection of plastic bottles to check appropriate fill height, labels, registration details, and bottle caps

-

11.7 PAPER & WOODDEPLOYMENT OF SURFACE INSPECTION SYSTEMS IN PRINTING, SHEETING, WRAPPING, AND PULP DRYING PROCESSES IN PAPER MANUFACTURING

-

11.8 PHARMACEUTICALVIAL INSPECTION- Necessity to inspect fill levels, stoppers, and containers and verify barcodesBLISTER PACK INSPECTION- Use of blister pack inspection technique to remove defective capsules and tablets before reaching consumersTRANSDERMAL PATCHES INSPECTION- Necessity to inspect transdermal patches for presence of active ingredients in medicineINSULIN PEN INSPECTION- Importance of inspecting plastic sleeves, grease, dosage knobs, and angle of rotation of insulin pens

-

11.9 PLASTIC & RUBBERADOPTION OF SURFACE INSPECTION SYSTEMS IN RUBBER INDUSTRY FOR INSPECTING GELS, CARBON SPECS, HOLES, CONTAMINANTS, EDGE CRACKS, WRINKLES, AND SCRATCHES IN RUBBER PARTS

-

11.10 PRINTINGIMPLEMENTATION OF VISION-BASED SURFACE INSPECTION SYSTEMS TO CAPTURE DEFECTS RELATED TO CURRENCIES, BANKNOTES, STAMPS, LABELS, AND PACKAGING MATERIALS

-

11.11 NONWOVENSNEED FOR ACCURATE SURFACE INSPECTION OF NONWOVEN FABRICS LAMINATED BY CHEMICALS, SOLVENTS, AND HOT GLUES

-

11.12 POSTAL & LOGISTICSUTILIZATION OF SURFACE INSPECTION SYSTEMS IN POSTAL & LOGISTICS FOR CHECKING PACKAGING ESTHETICS AND PRINT QUALITY AND VERIFYING ADDRESS AND BARCODES

- 12.1 INTRODUCTION

-

12.2 AMERICASUS- Open investment policy, highly skilled workforce, and infrastructure to boost marketCANADA- Skilled workforce and low labor cost to propel growthMEXICO- Increased use of automation and digitalization to drive growthBRAZIL- Growing industrialization, low manufacturing costs, and availability of economical workforce to stimulate growthREST OF AMERICAS

-

12.3 EUROPEGERMANY- Increasing use of surface inspection systems by several manufacturing firms to boost marketUK- Rising demand from food & packaging and pharmaceutical industries to boost marketFRANCE- Rapid industrial modernization with government incentives and funding to create opportunities for market playersITALY- Surging adoption of surface inspection systems by small and medium-sized players to accelerate growthSPAIN- Increasing focus of process industries on automation to boost marketREST OF EUROPE

-

12.4 ASIA PACIFICCHINA- Rising adoption from automotive and electrical & electronics industries to drive marketJAPAN- Early adoption of robot-based 3D surface inspection systems to contribute to market growthSOUTH KOREA- Rising inclination toward automation to create opportunities for vision-based surface inspection system providersINDIA- Increasing requirement for surface inspection systems from warehousing and packaging industries to accelerate growthREST OF ASIA PACIFIC

-

12.5 ROWMIDDLE EAST- Increasing investment in manufacturing and automation sectors to fuel market growthAFRICA- Thriving food & beverage and automotive industries to drive growth

- 13.1 OVERVIEW

-

13.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC PLAY

- 13.3 FIVE-YEAR COMPANY REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS, 2022

-

13.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.6 STARTUPS/SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.7 COMPANY FOOTPRINT (40 COMPANIES)

-

13.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSISRA VISION- Business overview- Products/Solutions offered- Recent developments- MnM viewCOGNEX- Business overview- Products/Solutions offered- Recent developments- MnM viewOMRON- Business overview- Products/Solutions offered- Recent developments- MnM viewTELEDYNE TECHNOLOGIES- Business overview- Products/Solutions offered- Recent developments- MnM viewVITRONIC- Business overview- Products/Solutions offered- Recent developments- MnM viewPANASONIC- Business overview- Products/Solutions offered- Recent developmentsMATROX ELECTRONIC SYSTEMS- Business overview- Products/Solutions offered- Recent developmentsIMS MESSSYSTEME- Business overview- Products/Solutions offered- Recent developmentsKEYENCE- Business overview- Products/Solutions offered- Recent developmentsDATALOGIC- Business overview- Products/Solutions offered- Recent developments

-

14.2 OTHER KEY PLAYERSAMETEK SURFACE VISIONKITOVTELEDYNE FLIRSONYNATIONAL INSTRUMENTSSICKBASLERINDUSTRIAL VISION SYSTEMSALLIED VISION TECHNOLOGIESBAUMERIN-CORE SYSTÈMESDARK FIELD TECHNOLOGIESSIPOTEKMORITEXPIXARGUS

- 15.1 MACHINE VISION MARKET

- 15.2 INTRODUCTION

-

15.3 PC-BASED MACHINE VISION SYSTEMSPC-BASED MACHINE VISION SYSTEMS CAN DETECT UNEXPECTED VARIATIONS IN CERTAIN TASKS

-

15.4 SMART CAMERA-BASED MACHINE VISION SYSTEMSSMART CAMERA-BASED MACHINE VISION SYSTEMS CONSIST OF EMBEDDED CONTROLLERS WITH INTEGRATED VISION SOFTWARE

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS

- TABLE 1 LIST OF COMPANIES AND THEIR ROLES IN SURFACE INSPECTION ECOSYSTEM

- TABLE 2 SURFACE INSPECTION MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE OF KEY COMPONENTS OF SURFACE INSPECTION SYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF SURFACE INSPECTION SYSTEMS OFFERED BY ISRA VISION AND VITRONIC BASED ON NUMBER OF CAMERAS ADOPTED

- TABLE 5 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 903180 (INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING OR CHECKING), 2011–2020 (USD MILLION)

- TABLE 6 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 903180 (INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING OR CHECKING), 2011–2020 (USD MILLION)

- TABLE 7 PATENTS FILED FOR VARIOUS TYPES OF SURFACE INSPECTION SYSTEMS, 2018–2020

- TABLE 8 US: MFN TARIFF FOR INSTRUMENTS, APPLIANCES, AND MACHINES DESIGNED FOR MEASURING OR CHECKING (INCLUDING SURFACE INSPECTION SYSTEMS) EXPORTED, BY KEY COUNTRY

- TABLE 9 CHINA: MFN TARIFF FOR INSTRUMENTS, APPLIANCES, AND MACHINES DESIGNED FOR MEASURING OR CHECKING (INCLUDING SURFACE INSPECTION SYSTEMS) EXPORTED, BY KEY COUNTRY

- TABLE 10 SURFACE INSPECTION MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 11 SURFACE INSPECTION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 12 CAMERAS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 13 CAMERAS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 14 CAMERAS: SURFACE INSPECTION MARKET, BY FRAME RATE, 2019–2022 (USD MILLION)

- TABLE 15 CAMERAS: SURFACE INSPECTION MARKET, BY FRAME RATE, 2023–2028 (USD MILLION)

- TABLE 16 CAMERAS: SURFACE INSPECTION MARKET, BY FORMAT, 2019–2022 (USD MILLION)

- TABLE 17 CAMERAS: SURFACE INSPECTION MARKET, BY FORMAT, 2023–2028 (USD MILLION)

- TABLE 18 CAMERAS: SURFACE INSPECTION MARKET, BY SENSING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 19 CAMERAS: SURFACE INSPECTION MARKET, BY SENSING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 20 CCD VS. CMOS CAMERAS

- TABLE 21 CAMERAS: SURFACE INSPECTION MARKET, BY INTERFACE STANDARD, 2019–2022 (USD MILLION)

- TABLE 22 CAMERAS: SURFACE INSPECTION MARKET, BY INTERFACE STANDARD, 2023–2028 (USD MILLION)

- TABLE 23 COMPARISON BETWEEN INTERFACE STANDARDS

- TABLE 24 CAMERAS: SURFACE INSPECTION MARKET, BY IMAGING TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 25 CAMERAS: SURFACE INSPECTION MARKET, BY IMAGING TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 26 COMPARISON BETWEEN VARIOUS IMAGING TECHNOLOGIES

- TABLE 27 FRAME GRABBERS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 28 FRAME GRABBERS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 29 OPTICS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 30 OPTICS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 31 LIGHTING EQUIPMENT: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 32 LIGHTING EQUIPMENT: SURFACE INSPECTION MARKETS, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 33 PROCESSORS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 34 PROCESSORS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 35 SOFTWARE: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 36 SOFTWARE: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 37 OTHERS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 38 OTHERS: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 39 COMPARISON BETWEEN 3D AND 2D SURFACE INSPECTION SYSTEMS

- TABLE 40 SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 41 SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 42 COMPANIES MANUFACTURING 2D SURFACE INSPECTION SYSTEMS

- TABLE 43 2D: SURFACE INSPECTION MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 44 2D: SURFACE INSPECTION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 45 2D: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 46 2D: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 47 2D: SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 48 2D: SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 49 COMPANIES MANUFACTURING 3D SURFACE INSPECTION SYSTEMS

- TABLE 50 3D: SURFACE INSPECTION MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 51 3D: SURFACE INSPECTION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 52 3D: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 53 3D: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 54 3D: SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 55 3D: SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 56 SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 57 SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 58 COMPUTER-BASED: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 59 COMPUTER-BASED: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 60 COMPUTER-BASED: SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 61 COMPUTER-BASED: SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 62 CAMERA-BASED: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2019–2022 (USD MILLION)

- TABLE 63 CAMERA-BASED: SURFACE INSPECTION MARKET, BY SURFACE TYPE, 2023–2028 (USD MILLION)

- TABLE 64 CAMERA-BASED: SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 65 CAMERA-BASED: SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 66 SURFACE INSPECTION MARKET, BY DEPLOYMENT TYPE, 2019–2022 (USD MILLION)

- TABLE 67 SURFACE INSPECTION MARKET, BY DEPLOYMENT TYPE, 2023–2028 (USD MILLION)

- TABLE 68 SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 69 SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 70 SEMICONDUCTOR: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 71 SEMICONDUCTOR: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 72 SEMICONDUCTOR: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 SEMICONDUCTOR: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 AUTOMOTIVE: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 75 AUTOMOTIVE: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 76 AUTOMOTIVE: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 AUTOMOTIVE: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 ELECTRICAL & ELECTRONICS: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 79 ELECTRICAL & ELECTRONICS: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 80 ELECTRICAL & ELECTRONICS: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 ELECTRICAL & ELECTRONICS: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 GLASS & METAL: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 83 GLASS & METAL: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 84 GLASS & METAL: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 GLASS & METAL: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 86 FOOD & PACKAGING: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 87 FOOD & PACKAGING: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 88 FOOD & PACKAGING: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 FOOD & PACKAGING: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 90 PAPER & WOOD: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 91 PAPER & WOOD: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 92 PAPER & WOOD: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 PAPER & WOOD: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 94 PHARMACEUTICAL: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 95 PHARMACEUTICAL: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 96 PHARMACEUTICAL: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 97 PHARMACEUTICAL: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 98 PLASTIC & RUBBER: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 99 PLASTIC & RUBBER: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 100 PLASTIC & RUBBER: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 101 PLASTIC & RUBBER: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 102 PRINTING: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 103 PRINTING: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 104 PRINTING: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 105 PRINTING: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 106 NONWOVENS: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 107 NONWOVENS: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 108 NONWOVENS: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 109 NONWOVENS: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 110 POSTAL & LOGISTICS: SURFACE INSPECTION MARKET, BY SYSTEM, 2019–2022 (USD MILLION)

- TABLE 111 POSTAL & LOGISTICS: SURFACE INSPECTION MARKET, BY SYSTEM, 2023–2028 (USD MILLION)

- TABLE 112 POSTAL & LOGISTICS: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 113 POSTAL & LOGISTICS: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 114 SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 115 SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 116 AMERICAS: SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 117 AMERICAS: SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 118 AMERICAS: SURFACE INSPECTION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 119 AMERICAS: SURFACE INSPECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 121 EUROPE: SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 122 EUROPE: SURFACE INSPECTION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 123 EUROPE: SURFACE INSPECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: SURFACE INSPECTION MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: SURFACE INSPECTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 128 ROW: SURFACE INSPECTION MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 129 ROW: SURFACE INSPECTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 130 ROW: SURFACE INSPECTION MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 131 ROW: SURFACE INSPECTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 132 OVERVIEW OF STRATEGIES DEPLOYED BY SURFACE INSPECTION COMPANIES

- TABLE 133 DEGREE OF COMPETITION, SURFACE INSPECTION MARKET (2022)

- TABLE 134 STARTUPS/SMES IN SURFACE INSPECTION MARKET

- TABLE 135 COMPANY FOOTPRINT

- TABLE 136 COMPANY COMPONENT FOOTPRINT (40 COMPANIES)

- TABLE 137 COMPANY VERTICAL FOOTPRINT (40 COMPANIES)

- TABLE 138 COMPANY REGION FOOTPRINT (40 COMPANIES)

- TABLE 139 PRODUCT LAUNCHES, SEPTEMBER 2021–DECEMBER 2022

- TABLE 140 DEALS, FEBRUARY 2020–SEPTEMBER 2022

- TABLE 141 EXPANSIONS, JANUARY 2020–OCTOBER 2022

- TABLE 142 ISRA VISION: BUSINESS OVERVIEW

- TABLE 143 ISRA VISION: PRODUCT OFFERINGS

- TABLE 144 ISRA VISION: PRODUCT LAUNCHES

- TABLE 145 ISRA VISION: DEALS

- TABLE 146 COGNEX: BUSINESS OVERVIEW

- TABLE 147 COGNEX: PRODUCT OFFERINGS

- TABLE 148 COGNEX: PRODUCT LAUNCHES

- TABLE 149 OMRON: BUSINESS OVERVIEW

- TABLE 150 OMRON: PRODUCT OFFERINGS

- TABLE 151 OMRON: PRODUCT LAUNCHES

- TABLE 152 OMRON: DEALS

- TABLE 153 OMRON: OTHERS

- TABLE 154 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 155 TELEDYNE TECHNOLOGIES: PRODUCT OFFERINGS

- TABLE 156 TELEDYNE TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 157 TELEDYNE TECHNOLOGIES: DEALS

- TABLE 158 VITRONIC: BUSINESS OVERVIEW

- TABLE 159 VITRONIC: PRODUCT OFFERINGS

- TABLE 160 VITRONIC: PRODUCT LAUNCHES

- TABLE 161 VITRONIC: DEALS

- TABLE 162 VITRONIC: OTHERS

- TABLE 163 PANASONIC: BUSINESS OVERVIEW

- TABLE 164 PANASONIC: PRODUCT OFFERINGS

- TABLE 165 PANASONIC: DEALS

- TABLE 166 MATROX ELECTRONIC SYSTEMS: BUSINESS OVERVIEW

- TABLE 167 MATROX ELECTRONIC SYSTEMS: PRODUCT OFFERINGS

- TABLE 168 MATROX ELECTRONIC SYSTEMS: PRODUCT LAUNCHES

- TABLE 169 MATROX ELECTRONIC SYSTEMS: OTHERS

- TABLE 170 IMS MESSSYSTEME: BUSINESS OVERVIEW

- TABLE 171 IMS MESSSYSTEME: PRODUCT OFFERINGS

- TABLE 172 IMS MESSSYSTEME: OTHERS

- TABLE 173 KEYENCE: BUSINESS OVERVIEW

- TABLE 174 KEYENCE: PRODUCT OFFERINGS

- TABLE 175 KEYENCE: PRODUCT LAUNCHES

- TABLE 176 DATALOGIC: BUSINESS OVERVIEW

- TABLE 177 DATALOGIC: PRODUCT OFFERINGS

- TABLE 178 DATALOGIC: PRODUCT LAUNCHES

- TABLE 179 DATALOGIC: DEALS

- TABLE 180 MACHINE VISION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

- TABLE 181 MACHINE VISION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- FIGURE 1 SURFACE INSPECTION MARKET SEGMENTATION

- FIGURE 2 SURFACE INSPECTION MARKET: RESEARCH DESIGN

- FIGURE 3 SURFACE INSPECTION MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED FROM COMPANIES IN SURFACE INSPECTION MARKET

- FIGURE 5 SURFACE INSPECTION MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 CAMERAS ACCOUNTED FOR LARGEST SHARE OF SURFACE INSPECTION MARKET IN 2022

- FIGURE 8 COMPUTER-BASED SYSTEMS TO ACCOUNT FOR LARGER SHARE OF SURFACE INSPECTION MARKET THAN CAMERA-BASED SYSTEMS THROUGHOUT FORECAST PERIOD

- FIGURE 9 2D SYSTEMS HELD LARGER SHARE OF SURFACE INSPECTION MARKET THAN 3D SYSTEMS IN 2022

- FIGURE 10 TRADITIONAL SYSTEMS TO DOMINATE SURFACE INSPECTION MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 11 SURFACE INSPECTION MARKET FOR AUTOMOTIVE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO RECORD HIGHEST CAGR IN GLOBAL SURFACE INSPECTION MARKET FROM 2022 TO 2027

- FIGURE 13 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES (PERCENTAGE CHANGE)

- FIGURE 14 SURFACE INSPECTION MARKET: PRE- AND POST-RECESSION SCENARIO

- FIGURE 15 ASIA PACIFIC TO PROVIDE LUCRATIVE OPPORTUNITIES TO MARKET PLAYERS

- FIGURE 16 COMPUTER-BASED SURFACE INSPECTION SYSTEMS HELD LARGER MARKET SHARE IN 2022

- FIGURE 17 2D SURFACE INSPECTION SYSTEMS TO CAPTURE LARGER MARKET SHARE IN 2023

- FIGURE 18 AUTOMOTIVE VERTICAL TO CAPTURE LARGEST MARKET SHARE DURING 2023−2028

- FIGURE 19 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL SURFACE INSPECTION MARKET DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, & CHALLENGES

- FIGURE 21 IMPACT OF DRIVERS ON SURFACE INSPECTION MARKET

- FIGURE 22 IMPACT OF RESTRAINTS ON SURFACE INSPECTION MARKET

- FIGURE 23 IMPACT OF OPPORTUNITIES ON SURFACE INSPECTION MARKET

- FIGURE 24 IMPACT OF CHALLENGES ON SURFACE INSPECTION MARKET

- FIGURE 25 SUPPLY CHAIN ANALYSIS OF SURFACE INSPECTION ECOSYSTEM: R&D AND MANUFACTURING PHASES ADD MAXIMUM VALUE

- FIGURE 26 SURFACE INSPECTION ECOSYSTEM

- FIGURE 27 SHIFT IN CLIENT’S REVENUE: LENS ON AUTOMOTIVE, ELECTRICAL & ELECTRONICS, SEMICONDUCTOR, AND MEDICAL & PHARMACEUTICAL INDUSTRIES

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 29 ASP TREND FOR SURFACE INSPECTION SYSTEMS BASED ON NUMBER OF CAMERAS

- FIGURE 30 ASP TREND FOR SURFACE INSPECTION SYSTEMS BASED ON SYSTEM

- FIGURE 31 ASP TREND FOR SURFACE INSPECTION SYSTEMS BASED ON SURFACE TYPE

- FIGURE 32 IMPORT DATA FOR INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING OR CHECKING (INCLUDING SURFACE INSPECTION SYSTEMS), 2016–2020

- FIGURE 33 EXPORT DATA FOR INSTRUMENTS, APPLIANCES, AND MACHINES FOR MEASURING OR CHECKING (INCLUDING SURFACE INSPECTION SYSTEMS), 2016–2020

- FIGURE 34 FILED PATENTS FOR SURFACE INSPECTION SYSTEMS, 2010–2020

- FIGURE 35 TOP 10 COMPANIES WITH HIGHEST NO. OF PATENT APPLICATIONS, 2010–2020

- FIGURE 36 SOFTWARE SEGMENT TO REGISTER HIGHEST CAGR IN SURFACE INSPECTION MARKET, BY COMPONENT, FROM 2023 TO 2028

- FIGURE 37 CAMERAS WITH FRAME RATE OF >125 FPS TO EXHIBIT HIGHEST CAGR IN SURFACE INSPECTION MARKET DURING FORECAST PERIOD

- FIGURE 38 CMOS SENSORS PROJECTED TO LEAD MARKET FOR CAMERAS THROUGHOUT FORECAST PERIOD

- FIGURE 39 MARKET FOR TIME-OF-FLIGHT CAMERAS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 40 3D FRAME GRABBERS TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 2D LIGHTING EQUIPMENT TO WITNESS HIGHER CAGR IN SURFACE INSPECTION MARKET DURING FORECAST PERIOD

- FIGURE 42 3D SEGMENT TO REGISTER HIGHER CAGR IN SURFACE INSPECTION MARKET FOR SOFTWARE DURING FORECAST PERIOD

- FIGURE 43 MARKET FOR 3D SYSTEMS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 2D SURFACE INSPECTION MARKET FOR CAMERA-BASED SYSTEMS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 MARKET FOR CAMERA-BASED 3D SURFACE INSPECTION SYSTEMS TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 46 CAMERA-BASED SURFACE INSPECTION SYSTEMS TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 47 3D CAMERA-BASED SYSTEMS TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 48 ROBOTIC CELL SEGMENT TO REGISTER HIGHER CAGR IN SURFACE INSPECTION MARKET DURING FORECAST PERIOD

- FIGURE 49 AUTOMOTIVE VERTICAL TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 COMPUTER-BASED SYSTEMS TO ACCOUNT FOR LARGER MARKET SHARE FOR PHARMACEUTICAL VERTICAL THROUGHOUT FORECAST PERIOD

- FIGURE 51 CAMERA-BASED SYSTEMS TO REGISTER HIGHER CAGR IN SURFACE INSPECTION MARKET FOR PRINTING VERTICAL DURING FORECAST PERIOD

- FIGURE 52 COMPUTER-BASED SYSTEMS TO RECORD HIGHER CAGR IN SURFACE INSPECTION MARKET FOR POSTAL & LOGISTICS VERTICAL DURING FORECAST PERIOD

- FIGURE 53 CHINA TO EXHIBIT HIGHEST CAGR IN SURFACE INSPECTION MARKET DURING 2023–2028

- FIGURE 54 AMERICAS: SNAPSHOT OF SURFACE INSPECTION MARKET

- FIGURE 55 EUROPE: SNAPSHOT OF SURFACE INSPECTION MARKET

- FIGURE 56 ASIA PACIFIC: SNAPSHOT OF SURFACE INSPECTION MARKET

- FIGURE 57 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN SURFACE INSPECTION MARKET

- FIGURE 58 SURFACE INSPECTION MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 59 SURFACE INSPECTION MARKET, STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 60 ISRA VISION: COMPANY SNAPSHOT

- FIGURE 61 COGNEX: COMPANY SNAPSHOT

- FIGURE 62 OMRON: COMPANY SNAPSHOT

- FIGURE 63 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 64 PANASONIC: COMPANY SNAPSHOT

- FIGURE 65 KEYENCE: COMPANY SNAPSHOT

- FIGURE 66 DATALOGIC: COMPANY SNAPSHOT

- FIGURE 67 SMART CAMERA-BASED MACHINE VISION SYSTEMS TO WITNESS HIGHER CAGR FROM 2022 TO 2027

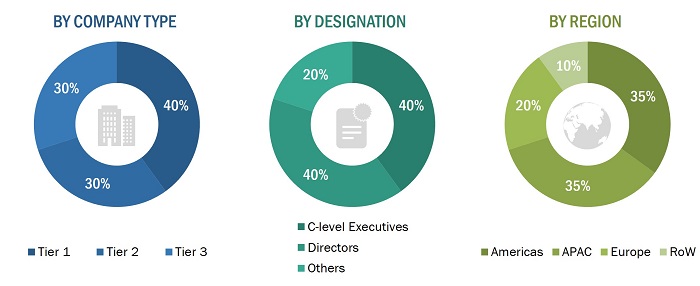

The study involves four major activities for estimating the size of the surface inspection market. Exhaustive secondary research has been conducted to collect information related to the market. The next step is to validate these findings and assumptions related to the market size with industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the overall size of the surface inspection market. After that, market breakdown and data triangulation procedures have been used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources referred to for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

Extensive primary research has been conducted after gaining knowledge about the current scenario of the surface inspection market through secondary research. Several primary interviews have been conducted with experts from the demand and supply sides across four major regions—Americas, Europe, Asia Pacific, and RoW. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the surface inspection market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The supply chain of the industry and the market size, in terms of value, have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, the total market has been split into several segments. The market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments. The data has then been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Study Objectives:

- To describe and forecast the surface inspection market, in terms of value, based on surface type, system, deployment type, component, and vertical

- To describe and forecast the surface inspection market, in terms of value with regard to four main regions: the Americas, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing market growth

- To provide a detailed overview of the supply chain pertaining to the surface inspection ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the surface inspection market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments in the surface inspection market, such as acquisitions, product launches and developments, and research and developments

Customization Options

With the given market data, MarketsandMarkets offers customizations according to the company's specific needs. The following customization options are available for this report:

Company Information:

- Detailed analysis and profiling of additional five market players

Outlook and Growth of Surface Inspection and Frame grabbers Market

Frame grabbers are devices that capture individual frames of digital video signals and convert them into digital images that can be processed by a computer. They are often used in conjunction with imaging sensors, such as cameras or sensors used for surface inspection, to capture high-quality images at high speeds.

In the context of surface inspection, frame grabbers are used to capture and process images of the surface being inspected, allowing defects and anomalies to be identified and analyzed. The high-speed processing capabilities of frame grabbers make them particularly useful in applications where real-time detection and analysis is necessary.

Surface inspection is a process that involves using various types of sensors and imaging technologies to detect and inspect the surface of an object for defects or anomalies. This process is commonly used in manufacturing and quality control applications, where it is necessary to ensure that products meet certain standards and specifications.

Niche Threats for the Frame grabbers Market:

The frame grabbers market may face several niche threats, including:

Advancements in camera technology: As camera technology continues to advance, manufacturers may opt for cameras with built-in image processing capabilities, reducing the need for separate frame grabbers.

Emergence of alternative technologies: Alternative technologies, such as field-programmable gate arrays (FPGAs) and system-on-chip (SoC) solutions, may offer similar functionality to frame grabbers and could potentially replace them in certain applications.

Economic downturns: The frame grabbers market is highly dependent on the manufacturing sector, which can be adversely affected by economic downturns. During periods of economic instability, manufacturers may reduce their investments in technology and equipment.

Increasing adoption of wireless systems: As wireless technology becomes more prevalent, there may be a shift towards wireless image transfer systems, reducing the need for physical connections and potentially impacting the demand for frame grabbers.

Intellectual property issues: There may be intellectual property issues surrounding the development and manufacture of frame grabbers, such as patent disputes, which could potentially impact the market.

Market Scope of Frame Grabbers Market

The frame grabbers market is expected to grow significantly in the coming years, driven by the increasing demand for high-quality image capture and processing in various industries. Frame grabbers are widely used in applications such as industrial automation, medical imaging, surveillance, and scientific research.

The growing adoption of machine vision systems in manufacturing and quality control is also driving the demand for frame grabbers. These systems use cameras and imaging sensors to detect defects and anomalies in products, and frame grabbers play a critical role in capturing and processing the images for analysis.

Furthermore, the increasing use of digital imaging in medical applications, such as X-ray and ultrasound imaging, is also fueling the demand for frame grabbers. These devices help to capture and process high-quality images for diagnosis and treatment planning.

Geographically, the Asia-Pacific region is expected to experience the highest growth rate in the frame grabbers market, driven by the increasing adoption of automation and digital imaging technologies in industries such as automotive, electronics, and healthcare. North America and Europe are also significant markets for frame grabbers, with strong demand from industries such as aerospace, defense, and scientific research.

How is Frame Grabbers going to impact the surface inspection market?

Frame grabbers are already having a significant impact on the surface inspection market and are expected to continue to play a critical role in this field. The use of frame grabbers enables high-quality images of the surface being inspected to be captured and processed quickly and accurately, which is essential in ensuring that defects and anomalies are identified and corrected in real-time.

One of the key benefits of frame grabbers is their ability to process large amounts of data at high speeds, which is essential in surface inspection applications. With advances in imaging and automation technologies, the amount of data generated during surface inspection is increasing rapidly, making it more important than ever to have fast and efficient processing capabilities. Frame grabbers provide the speed and efficiency necessary to handle this growing amount of data and enable real-time analysis of the surface being inspected.

Another advantage of frame grabbers is their flexibility and compatibility with a wide range of imaging sensors and cameras. This allows for the integration of the latest imaging technologies into surface inspection systems, enabling high-quality images to be captured with greater precision and accuracy.

Overall, the use of frame grabbers in surface inspection is expected to continue to grow, driven by the increasing demand for high-quality standards and greater efficiency in manufacturing processes. The impact of frame grabbers in this field is already significant, and as new imaging and automation technologies continue to emerge, the adoption of frame grabbers is likely to increase even further. By enabling real-time detection and analysis of surface defects and anomalies, frame grabbers are playing a critical role in improving product quality and customer satisfaction in various industries.

What will be future use cases of Frame Grabbers along with commentary of adaption, market potential, risk

The future use cases of frame grabbers are likely to be diverse and varied, with increasing demand in various industries for high-quality image capture and processing. Some potential use cases of frame grabbers are:

Autonomous vehicles: Frame grabbers can be used to capture and process high-quality images in autonomous vehicles, enabling real-time analysis of the environment for safe and efficient navigation.

Virtual and augmented reality: Frame grabbers can be used to capture high-quality images for use in virtual and augmented reality applications, providing a more immersive and realistic experience.

3D printing: Frame grabbers can be used to capture and process high-quality images for 3D printing, enabling accurate and precise printing of complex objects.

Agriculture: Frame grabbers can be used in agriculture to capture and process images of crops, enabling real-time analysis of plant health and growth.

The adaptation of frame grabbers in these and other industries is likely to be driven by the increasing demand for high-quality image capture and processing. With the continuous advancements in imaging and automation technologies, the market potential for frame grabbers is significant, and the adoption of these devices is likely to continue to grow.

However, there are also potential risks associated with the future use cases of frame grabbers. These include the emergence of alternative technologies, such as FPGAs and SoC solutions, that could potentially replace frame grabbers in certain applications. Additionally, economic downturns could impact the demand for frame grabbers, and intellectual property issues, such as patent disputes, could potentially impact the frame grabbers market.

Key challenges for growing frame grabbers market in the future:

While the market potential for frame grabbers is significant, there are several key challenges that may impact the growth of this market in the future. Some of the key challenges are:

Competition from alternative technologies: As technology continues to evolve, there is always the possibility that alternative imaging and automation technologies could emerge that could potentially replace frame grabbers in certain applications. For example, FPGAs and SoC solutions are becoming increasingly popular, and these alternatives could potentially challenge the dominance of frame grabbers in certain markets.

Cost: The cost of frame grabbers can be relatively high, which may make it difficult for smaller businesses and organizations to adopt these devices. This could potentially limit the growth of the frame grabbers market in certain sectors.

Complexity: Frame grabbers can be relatively complex devices that require specialized knowledge and expertise to operate and integrate into existing systems. This could potentially limit the adoption of frame grabbers in certain industries, where the necessary expertise may not be readily available.

Intellectual property issues: There is always the potential for patent disputes and other intellectual property issues to arise, which could impact the growth of the frame grabbers market. This could potentially lead to legal battles and increased costs for manufacturers and customers.

Top Companies in frame grabbers market:

The frame grabbers market is dominated by several top companies that are driving innovation and growth in the field. Teledyne DALSA, National Instruments, Matrox Imaging, Baumer, and ADLINK Technology are among the key players in the market, offering a wide range of frame grabbers for various applications. These companies are known for their high-performance and reliable products, which are used in industries ranging from industrial automation and machine vision to scientific research and medical imaging. Despite the competitive market, these companies and others are continuing to innovate, driving improvements in speed, accuracy, and efficiency for imaging and automation applications.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Surface Inspection Market