Sustainable Pharmaceutical Packaging Market by Raw Material (Plastics, Paper & paperboard, Glass, Metal), Product Type, Process (Recyclable, Reusable, and Biodegradable), Packaging Type(Primary Packaging), and Region - Global Forecast to 2027

Updated on : November 11, 2025

Sustainable Pharmaceutical Packaging Market

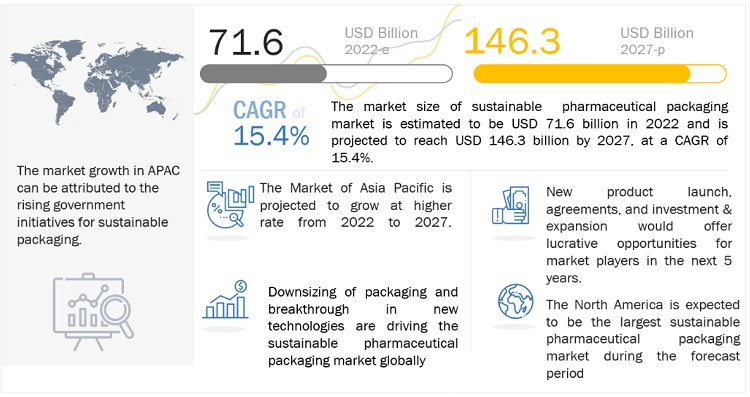

The global sustainable pharmaceutical packaging market was valued at USD 71.6 billion in 2022 and is projected to reach USD 146.3 billion by 2027, growing at 15.4% cagr from 2022 to 2027. The global market is growing due to the to stringent laws and regulations levied by governments and governing bodies, as well as a shift in consumer preferences towards recyclable and eco-friendly packaging materials.

Attractive Opportunities in Sustainable Pharmaceutical Packaging Market

Note:e-estimated,p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Sustainable Pharmaceutical Packaging Market Dynamics

Driver: Consumer preference towards recyclable and eco-friendly materials

In recent years, there has been a shift in consumer preference toward more sustainable and eco-friendly materials in the packaging industry. This trend is driven by concerns about environmental pollution and the depletion of natural resources, as well as a growing awareness of the impacts of packaging waste on the planet. Consumers are increasingly looking for packaging made from recycled materials, such as paper, cardboard, and plastic. They are also interested in biodegradable and compostable options.

Restraint: Increase in packaging cost

Sustainability policies aimed at reducing waste and increasing recycling can lead to an increase in overall packaging costs. This is because sustainable packaging materials, such as biodegradable plastics or recycled materials, are often more expensive than traditional materials. The cost of packaging design, testing, and certification to meet sustainability standards can also add to the overall cost. Implementing recycling and recovery systems for used packaging materials can also be costly. These increased costs can be passed on to consumers through higher prices for products packaged in sustainable materials.

Opportunity: Growing demand for primary pharmaceutical packaging.

Primary pharmaceutical packaging products such as plastic bottles, glass bottles, prefilled syringes, prefilled inhalers, medication tubes, and blister packaging, among others, come in direct contact with the medicine or drug. There is a surge in demand for sustainability in primary pharmaceutical packaging due to increasing consumer awareness of environmental issues, government regulations, and industry initiatives on environmentally friendly packaging. Industry initiatives have also played a role in promoting sustainable practices in primary pharmaceutical packaging.

Challenge: Fluctuation in prices of raw material

Fluctuations in raw material prices can have a significant impact on the sustainable pharmaceutical packaging industry. Sustainability in packaging often requires using alternative materials that are less common, more complex, or more expensive than traditional options. These materials are often more sensitive to price fluctuations.The cost of producing sustainable packaging increases when raw material prices increase, which can make it less competitive with traditional packaging options. This can make it difficult for sustainable packaging manufacturers to remain profitable and make sustainable packaging more expensive for consumers. This can cause a decrease in the demand for sustainable packaging and could lead to a slowdown in the growth of the industry.

Plastics segment amongst other raw material projected to grow at a highest CAGR from 2022 to 2027, in terms of volume

Plastics can be easily formed, possess high quality, are cost-effective, and provide excellent barrier properties and freedom of design. Plastic molded containers provide superior resistance to breakage and offer safety to consumers. The use of recyclable plastics in the sustainable pharmaceutical packaging industry is becoming increasingly important as companies and consumers become more aware of the impact of packaging materials. Recyclable plastics, such as PET and HDPE, can be used to create packaging that is not only environmentally friendly but also cost-effective and safe for the storage and transportation of pharmaceutical products

Biodegradable segment projected to grow at highest cagr from 2022 to 2027, in terms of value

The use of biodegradable packaging in the pharmaceutical industry has the potential to reduce the environmental impact of packaging materials and conserve resources. Biodegradable plastics can be composed of bioplastics manufactured from renewable raw materials. There are usually two forms of biodegradable plastic, injection molded and solid. The solid forms are generally used for food containers, leaf collection bags, and water bottles. Such plastics do not decompose unless disposed of properly, meaning that biodegradable plastics must be treated to compost.

Asia Pacific is projected to grow the fastest in the sustainable pharmaceutical packaging market during the forecast period.

The Asia Pacific region has emerged as the fastest growing market for sustainable pharmaceutical packaging. This is due to the increasing focus on sustainability and environmental protection, coupled with the rapid growth of the pharmaceutical industry in the region. The pharmaceutical industry in Asia Pacific is growing rapidly due to the large population and increasing healthcare spending, and this has increased the demand for sustainable packaging solutions. Companies in the region are investing heavily in research and development to create new and innovative sustainable packaging solutions to meet the growing demand from consumers and healthcare providers. Additionally, governments in the region are implementing policies and regulations to promote sustainable packaging and reduce environmental impact, further driving the growth of the market.

To know about the assumptions considered for the study, download the pdf brochure

Sustainable Pharmaceutical Packaging Market Players

The key players in the sustaianble pharmaceutical packaging market include Schott AG (Germany), Amcor PLC (Switzerland), AptarGroup,Inc (US), West Pharmaceutical Services, Inc. (US), Berry Global (US), Gerresheimer AG (Germany), Catalent,Inc (US), and WestRock (US). The pharmaceutical packaging market report analyzes the key growth strategies, such as new product launches, investments & expansions, joint ventures, agreements, partnerships, and mergers & acquisitions adopted by the leading market players between 2019 and 2022.

Sustainable Pharmaceutical Packaging Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Kiloton) and Value (USD) |

|

Segments |

Raw Material, Product Type, Packaging Type, Process and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Schott AG (Germany), Amcor PLC (Switzerland), AptarGroup,Inc (US), West Pharmaceutical Services, Inc. (US), Berry Global (US), Gerresheimer AG (Germany), Catalent,Inc (US), and WestRock (US) |

This research report categorizes the sustaianble pharmaceutical packaging market based on raw material, types, drug delivery modes, and region.

By Material:

- Plastics

- Paper & paperboard

- Glass

- Metal

- Others

By Packaging Type:

- Primary Packaging

- Secondary Packaging

By Product Type

- Plastic bottles

- Blister

- Labels & accessories

- Caps & closures

- Pre-filled syringes

- Medical specialty bags

- Temp controlled packaging

- Pouches & strip packs

- Pre-filled inhalers

- Vials

- Ampoules

- Medication tubes

- Jars & Canisters

- Cartriges

- Others

By Process:

- Recyclable

- Reusable

- Biodegradable

By Region:

- North America

- Aisa Pacific

- Europe

- Middle East & Africa

- South America

The pharmaceutical packaging market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In September 2022, Aptar Pharma launched an innovative dispensing solution that is mono-material and fully recyclable when paired with a PE or PET bottle. It is suitable for a range of viscosities, customizable with two dosage options and two neck size options, and is available in a variety of colors with its unique, three-part design.

- In September 2022, Berry Global Group, Inc. announced a collaboration with Mars Inc. to launch its popular pantry-sized treats in polyethylene terephthalate (PET) jars that have been optimized by including 15% recycled plastic content, i.e., post-consumer resin (PCR).

- In November 2022, Aptar Pharma announced its collaboration with TFF Pharmaceuticals. This collaboration is aimed at developing and testing the administration of dry powder vaccines utilizing TFF Pharmaceutical’s Thin Film Freezing technology and Aptar Pharma’s proprietary intranasal Unidose (UDS) powder nasal spray system.

- In June 2022, WestRock Company announced a partnership with Recipe Unlimited to introduce a line of recyclable paperboard packaging, with the goal of keeping 31 million plastic bottles out of Canada's landfills annually.

Frequently Asked Questions (FAQ):

What is the current size of the global sustainable pharmaceutical packaging market?

The global Sustainable pharmaceutical packaging market size is projected to grow from USD 71.6 billion in 2022 to USD 146.3 billion by 2027, at a CAGR of 15.4%.

Are there any regulations for sustainable pharmaceutical packaging?

Several countries in Europe and North America have introduced regulations for this market. For e.g Governments all over the world are encouraging the use of sustainable packaging in order to minimize waste. In March 2020, the European Commission adopted the new circular economy action plan (CEAP). The European Commission transitioned to a circular economy that would reduce pressure on natural resources and create sustainable growth and jobs.

Who are the winners in the global sustainable pharmaceutical packaging market?

Companies such as Schott AG, Amcor PLC, AptarGroup,Inc, West Pharmaceutical Services, Berry Global, Gerresheimer AG, Catalent,Inc, Nolato, SGD Pharma, Origin Pharma, and WestRock under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What are some of the drivers in the sustainable pharmaceutical packaging market?

Consumer preference towards recyclable and eco-friendly materials and government intitative for sustainable packaging are some of the major drivers for sustainable pharmaceutical packaging. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Government initiatives for sustainable packaging- Consumer preference toward recyclable and eco-friendly materials- Downsizing of packaging- Breakthrough in new technologies and innovations- High growth in generics and biopharmaceuticals marketsRESTRAINTS- Poor infrastructure facilities for recycling- Lack of awareness of sustainability- High packaging costsOPPORTUNITIES- Growing demand for primary pharmaceutical packagingCHALLENGES- Volatile raw material prices

-

5.3 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSR&D OF PRODUCTSMANUFACTURERSDISTRIBUTORSEND USERSPOST-DISPOSAL PROCESS

-

5.4 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 REGULATORY LANDSCAPEREGULATIONS- Europe- US- Others

-

5.6 TECHNOLOGY ANALYSISAUTOMATED RECYCLINGEMERGENCE OF TECHNOLOGICALLY ADVANCED RAW MATERIALSNANOTECHNOLOGYPACKAGING FOR BIOLOGICSSMART PACKAGINGANTI-COUNTERFEIT PACKAGINGOTHER SMART TRENDS AND TECHNOLOGIES

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY RAW MATERIALAVERAGE SELLING PRICE, BY COMPANY

-

5.8 ECOSYSTEM MAPPING

-

5.9 IMPACT OF COVID-19 ON PHARMACEUTICAL PACKAGING MARKETIMPACT ON HEALTHCARE INDUSTRY

- 5.10 IMPACT OF RECESSION ON PHARMACEUTICAL PACKAGING MARKET

-

5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.12 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDS DURING 2011–2021INSIGHTSJURISDICTION ANALYSISTOP PATENT APPLICANTS

- 5.13 TRADE ANALYSIS

- 5.14 OPERATIONAL DATA

- 5.15 KEY CONFERENCES AND EVENTS IN 2022–2023

-

5.16 CASE STUDY ANALYSISOPTHALMIC SQUEEZE DISPENSER BY APTAR PHARMA TO CONTRIBUTE TO OVERALL ESG COMMITMENTSMOISTURE BARRIER TECHNOLOGY FOR BETTER DRUG DELIVERYCUSTOM TECHNOLOGY FOR BETTER BREATHING

- 6.1 INTRODUCTION

-

6.2 PLASTICSCOST-EFFECTIVENESS AND EXCELLENT BARRIER PROPERTIES OF PLASTICS TO DRIVE MARKETHIGH-DENSITY POLYETHYLENE (HDPE)POLYPROPYLENE (PP)LOW-DENSITY POLYETHYLENE (LDPE)POLYVINYL CHLORIDE (PVC)POLYETHYLENE TEREPHTHALATE (PET)BIO-BASED PLASTICS (BBP)BIODEGRADABLE PLASTICS

-

6.3 PAPER & PAPERBOARDINNOVATIONS IN SECONDARY PACKAGING TO BOOST MARKET

-

6.4 GLASSEXCELLENT CHEMICAL RESISTANCE AND RECYCLABILITY OF GLASS TO PROPEL MARKET

-

6.5 METALINCREASING USE OF ALUMINUM FOR BLISTER PACKAGING TO DRIVE MARKET

- 6.6 OTHER RAW MATERIALS

- 7.1 INTRODUCTION

-

7.2 PLASTIC BOTTLESEASY OPERABILITY AND SHATTER RESISTANCE OF PLASTIC BOTTLES TO SUPPORT MARKETSTANDARD PLASTIC BOTTLESPLASTIC DISPENSING BOTTLESPLASTIC JARS

-

7.3 LABELS & ACCESSORIESPATIENT-DRUG COMMUNICATION COMPLIANCE TO DRIVE MARKETSELF-ADHESIVE LABELSDIE-CUT LABELSTAMPER-PROOF LABELSHOLOGRAPHIC STRIP LABELS

-

7.4 CAPS & CLOSURESPREFERENCE FOR POLYPROPYLENE AND POLYETHYLENE-BASED CAPS & CLOSURES TO FAVOR MARKET GROWTH

-

7.5 MEDICAL SPECIALTY BAGSWIDE USE OF LLDPE AND PE TO CONTRIBUTE TO MARKET GROWTH

-

7.6 PREFILLED SYRINGESHIGH DEMAND IN DEVELOPED AND EMERGING ECONOMIES TO DRIVE MARKET

-

7.7 TEMPERATURE-CONTROLLED PACKAGINGINCREASING PRODUCTION OF SPECIALIZED DRUGS TO INFLUENCE MARKET GROWTH POSITIVELY

-

7.8 POUCHES & STRIP PACKSGROWING DEMAND FOR STANDUP POUCHES TO DRIVE MARKET

-

7.9 AMPOULESHIGH DEMAND FROM EMERGING ECONOMIES TO SPUR MARKET GROWTH

-

7.10 VIALSDEMAND FOR VACCINE PACKAGING TO DRIVE MARKET

-

7.11 MEDICATION TUBESGROWTH OF FLEXIBLE PACKAGING IN EMERGING ECONOMIES TO BOOST MARKETCOMPOSITE TUBESALL-PLASTIC TUBESCOLLAPSIBLE METAL TUBES

-

7.12 JARS & CANISTERSINCREASING DEMAND FOR PROTECTIVE PACKAGING TO FUEL MARKET

-

7.13 CARTRIDGESBALANCED PACKAGING OFFERED BY CARTRIDGES TO DRIVE MARKET

- 7.14 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 PRIMARY PACKAGINGUSE OF ALUMINUM OR GLASS TO REDUCE ENVIRONMENTAL IMPACT OF PRIMARY PACKAGING

-

8.3 SECONDARY PACKAGINGUSE OF PLANT-BASED MATERIALS IN SECONDARY PACKAGING TO GAIN MOMENTUM

- 9.1 INTRODUCTION

-

9.2 RECYCLABLEFOCUS OF PACKAGING COMPANIES TO IMPROVE RECYCLING INFRASTRUCTURE TO DRIVE MARKET

-

9.3 REUSABLEDURABILITY OF TERTIARY PACKAGING TO FUEL MARKET

-

9.4 BIODEGRADABLEINNOVATION TO PLAY KEY ROLE IN BIODEGRADABLE PLASTIC PACKAGING

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACTUS- Environmental responsibility to drive marketCANADA- Government initiative to reduce overall quantity of packaging waste to boost marketMEXICO- Gradual economic recovery to support market

-

10.3 ASIA PACIFICRECESSION IMPACTCHINA- Increasing awareness of eco-friendly, sustainable, and renewable packaging to drive marketJAPAN- Increasing demand for generic drugs to propel marketSOUTH KOREA- Well-developed healthcare industry and presence of major pharmaceutical manufacturers to drive marketINDIA- Increasing domestic consumption and export of generic drugs to fuel marketAUSTRALIA- PBS schemes to strengthen pharmaceutical industryREST OF ASIA PACIFIC

-

10.4 EUROPERECESSION IMPACTGERMANY- Government initiatives for boosting recycling rate to drive marketFRANCE- High demand for generic drugs to drive marketITALY- Growing exports of pharmaceuticals to boost marketUK- Innovations in drug manufacturing to increase demandSPAIN- Macroeconomic factors to have positive impact on marketRUSSIA- Government initiatives for domestic production of pharmaceuticals to fuel marketREST OF EUROPE

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Wider access to healthcare services to increase demand for pharmaceuticalsSOUTH AFRICA- Gradual rise in generic drug use to fuel marketUAE- Increasing initiatives for domestic pharmaceutical production to drive marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Free and universal healthcare services to support pharmaceutical industryARGENTINA- Increasing awareness and development of recycling facilities to drive marketREST OF SOUTH AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET EVALUATION MATRIX

- 11.4 REVENUE ANALYSIS

-

11.5 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2021BERRY GLOBAL INC.AMCOR PLCAPTARGROUP, INC.GERRESHEIMER AGSCHOTT AG

- 11.6 MARKET SHARE ANALYSIS

-

11.7 COMPANY EVALUATION MATRIX (TIER-1 PLAYERS)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

- 11.8 STRENGTH OF PRODUCT PORTFOLIO (TIER-1 PLAYERS)

- 11.9 BUSINESS STRATEGY EXCELLENCE (TIER-1 PLAYERS)

-

11.10 START-UP AND SME MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 11.11 STRENGTH OF PRODUCT PORTFOLIO (START-UPS AND SMES)

- 11.12 BUSINESS STRATEGY EXCELLENCE (START-UPS AND SMES)

-

11.13 COMPETITIVE BENCHMARKINGCOMPANY TYPE FOOTPRINTCOMPANY REGION FOOTPRINTCOMPANY FOOTPRINT

-

11.14 COMPETITIVE SITUATION AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSBERRY GLOBAL INC.- Business overview- Products offered- Recent developments- Sustainability goals- MnM viewGERRESHEIMER AG- Business overview- Products offered- Recent developments- Sustainability goals- MnM viewAMCOR PLC- Business overview- Products offered- Recent developments- Sustainability goals- MnM viewSCHOTT AG- Business overview- Products offered- Recent developments- Sustainability goals- MnM viewAPTARGROUP, INC.- Business overview- Products offered- Recent developments- Sustainability goals- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offered- Recent developments- Sustainability goalsWESTROCK COMPANY- Business overview- Products offered- Recent developments- Sustainability goals- MnM viewNIPRO CORPORATION- Business overview- Products offered- Recent developments- Sustainability goalsCATALENT, INC.- Business overview- Products offered- Recent developments- Sustainability goalsSEALED AIR CORPORATION- Business overview- Products offered- Recent developments- Sustainability goalsWEST PHARMACEUTICAL SERVICES, INC.- Business overview- Products offered- Recent developments- Sustainability goals

-

12.2 OTHER PLAYERSALPLA WERKE ALWIN LEHNER GMBH & CO KGARDAGH GROUP S.A.CCL INDUSTRIES INC.FRANK NOE EGYPT LTD.GAPLAST GMBHLONZA GROUP LTD.MONDI GROUPNOLATO ABORIGIN PHARMA PACKAGINGCOMARBILCARE LIMITEDSGD PHARMASILGAN HOLDINGS INC.VETTER PHARMA INTERNATIONAL GMBH

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS

- TABLE 1 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKETING: VALUE CHAIN STAKEHOLDERS

- TABLE 3 IMPACT OF PORTER'S FIVE FORCES ON SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET

- TABLE 4 AVERAGE SELLING PRICE, BY RAW MATERIAL (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE, BY COMPANY (USD/KG)

- TABLE 6 LIST OF PATENTS BY SANOFI AVENTIS DEUTSCHLAND

- TABLE 7 LIST OF PATENTS BY SCHOTT AG

- TABLE 8 LIST OF PATENTS BY TERUMO CORP

- TABLE 9 LIST OF PATENTS BY BECTON, DICKINSON AND COMPANY

- TABLE 10 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 11 KEY CONFERENCES AND EVENTS IN 2022–2023

- TABLE 12 BASIC PACKAGING RAW MATERIALS USED IN PHARMACEUTICAL PACKAGING

- TABLE 13 RAW MATERIAL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 14 RAW MATERIAL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 15 RAW MATERIAL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (KILOTON)

- TABLE 16 RAW MATERIAL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 17 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (USD MILLION)

- TABLE 18 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (USD MILLION)

- TABLE 19 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (KILOTON)

- TABLE 20 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (KILOTON)

- TABLE 21 PLASTICS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 22 PLASTICS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 23 PLASTICS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (KILOTON)

- TABLE 24 PLASTICS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 25 PAPER & PAPERBOARD: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 26 PAPER & PAPERBOARD: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 27 PAPER & PAPERBOARD: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (KILOTON)

- TABLE 28 PAPER & PAPERBOARD: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 29 GLASS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 30 GLASS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 31 GLASS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (KILOTON)

- TABLE 32 GLASS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 33 TYPES OF GLASS USED IN PACKAGING

- TABLE 34 METAL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 35 METAL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 36 METAL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (KILOTON)

- TABLE 37 METAL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 38 OTHER RAW MATERIALS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 39 OTHER RAW MATERIALS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 40 OTHER RAW MATERIALS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (KILOTON)

- TABLE 41 OTHER RAW MATERIALS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (KILOTON)

- TABLE 42 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2016–2019 (USD MILLION)

- TABLE 43 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2020–2027 (USD MILLION)

- TABLE 44 PRIMARY PACKAGING: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 45 PRIMARY PACKAGING: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 46 SECONDARY PACKAGING: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 47 SECONDARY PACKAGING: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 48 PROCESS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 49 PROCESS: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 50 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 51 SUSTAINABLE PLASTIC PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 52 RECYCLABLE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 53 RECYCLABLE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 54 REUSABLE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 55 REUSABLE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 56 BIODEGRADABLE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 57 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2016–2019 (USD MILLION)

- TABLE 58 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 60 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2016–2019 (USD MILLION)

- TABLE 62 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2020–2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 64 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (USD MILLION)

- TABLE 66 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (USD MILLION)

- TABLE 67 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (KILOTON)

- TABLE 68 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (KILOTON)

- TABLE 69 US: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 70 US: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 71 CANADA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 72 CANADA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 73 MEXICO: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 74 MEXICO: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 75 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 76 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 77 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2016–2019 (USD MILLION)

- TABLE 78 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2020–2027 (USD MILLION)

- TABLE 79 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 80 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (USD MILLION)

- TABLE 82 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (KILOTON)

- TABLE 84 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (KILOTON)

- TABLE 85 CHINA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 86 CHINA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 87 JAPAN: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 88 JAPAN: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 89 SOUTH KOREA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 90 SOUTH KOREA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 91 INDIA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 92 INDIA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 93 AUSTRALIA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 94 AUSTRALIA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 97 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 98 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 99 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2016–2019 (USD MILLION)

- TABLE 100 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2020–2027 (USD MILLION)

- TABLE 101 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 102 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 103 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (USD MILLION)

- TABLE 104 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (USD MILLION)

- TABLE 105 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (KILOTON)

- TABLE 106 EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (KILOTON)

- TABLE 107 GERMANY: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 108 GERMANY: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 109 FRANCE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 110 FRANCE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 111 ITALY: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 112 ITALY: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 113 UK: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 114 UK: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 115 SPAIN: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 116 SPAIN: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 117 RUSSIA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 118 RUSSIA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 119 REST OF EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 120 REST OF EUROPE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2016–2019 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2020–2027 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (KILOTON)

- TABLE 130 MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (KILOTON)

- TABLE 131 SAUDI ARABIA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 132 SAUDI ARABIA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 133 SOUTH AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 134 SOUTH AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 135 UAE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 136 UAE: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 137 REST OF MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 138 REST OF MIDDLE EAST & AFRICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 139 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

- TABLE 140 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 141 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2016–2019 (USD MILLION)

- TABLE 142 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PACKAGING TYPE, 2020–2027 (USD MILLION)

- TABLE 143 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 144 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 145 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (USD MILLION)

- TABLE 146 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (USD MILLION)

- TABLE 147 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2016–2019 (KILOTON)

- TABLE 148 SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY RAW MATERIAL, 2020–2027 (KILOTON)

- TABLE 149 BRAZIL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 150 BRAZIL: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 151 ARGENTINA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 152 ARGENTINA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 153 REST OF SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2016–2019 (USD MILLION)

- TABLE 154 REST OF SOUTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, BY PROCESS, 2020–2027 (USD MILLION)

- TABLE 155 COMPANIES ADOPTED INVESTMENT & EXPANSION AND PRODUCT LAUNCH AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2022

- TABLE 156 MARKET EVALUATION MATRIX

- TABLE 157 REVENUE OF KEY COMPANIES DURING 2019–2021

- TABLE 158 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: DEGREE OF COMPETITION

- TABLE 159 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: LIST OF COMPANIES

- TABLE 160 OVERALL TYPE FOOTPRINT

- TABLE 161 OVERALL REGION FOOTPRINT

- TABLE 162 OVERALL COMPANY FOOTPRINT

- TABLE 163 PHARMACEUTICAL PACKAGING MARKET: PRODUCT LAUNCHES, 2019–2022

- TABLE 164 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: DEALS, 2019–2022

- TABLE 165 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: OTHER DEVELOPMENTS, 2019–2021

- TABLE 166 BERRY GLOBAL INC.: COMPANY OVERVIEW

- TABLE 167 BERRY GLOBAL INC.: PRODUCTS OFFERED

- TABLE 168 BERRY GLOBAL INC.: PRODUCT LAUNCHES

- TABLE 169 BERRY GLOBAL INC.: DEALS

- TABLE 170 BERRY GLOBAL INC.: OTHER DEVELOPMENTS

- TABLE 171 GERRESHEIMER AG: COMPANY OVERVIEW

- TABLE 172 GERRESHEIMER AG: PRODUCTS OFFERED

- TABLE 173 GERRESHEIMER AG: PRODUCT LAUNCHES

- TABLE 174 GERRESHEIMER AG: DEALS

- TABLE 175 GERRESHEIMER AG: OTHER DEVELOPMENTS

- TABLE 176 AMCOR PLC: COMPANY OVERVIEW

- TABLE 177 AMCOR PLC: PRODUCTS OFFERED

- TABLE 178 AMCOR PLC: PRODUCT LAUNCHES

- TABLE 179 AMCOR PLC: DEALS

- TABLE 180 AMCOR PLC: OTHER DEVELOPMENTS

- TABLE 181 SCHOTT AG: COMPANY OVERVIEW

- TABLE 182 SCHOTT AG: PRODUCTS OFFERED

- TABLE 183 SCHOTT AG: PRODUCT LAUNCHES

- TABLE 184 SCHOTT AG: DEALS

- TABLE 185 SCHOTT AG: OTHER DEVELOPMENTS

- TABLE 186 APTARGROUP, INC.: COMPANY OVERVIEW

- TABLE 187 APTARGROUP, INC.: PRODUCTS OFFERED

- TABLE 188 APTARGROUP, INC.: PRODUCT LAUNCHES

- TABLE 189 APTARGROUP, INC.: DEALS

- TABLE 190 APTARGROUP, INC.: OTHER DEVELOPMENTS

- TABLE 191 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 192 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 193 BECTON, DICKINSON AND COMPANY: PRODUCT LAUNCHES

- TABLE 194 BECTON, DICKINSON AND COMPANY: DEALS

- TABLE 195 WESTROCK COMPANY: COMPANY OVERVIEW

- TABLE 196 WESTROCK COMPANY: PRODUCTS OFFERED

- TABLE 197 WESTROCK COMPANY: DEALS

- TABLE 198 NIPRO CORPORATION: COMPANY OVERVIEW

- TABLE 199 NIPRO CORPORATION: PRODUCTS OFFERED

- TABLE 200 NIPRO CORPORATION: DEALS

- TABLE 201 CATALENT, INC.: COMPANY OVERVIEW

- TABLE 202 CATALENT, INC.: PRODUCTS OFFERED

- TABLE 203 CATALENT, INC.: DEALS

- TABLE 204 CATALENT, INC.: OTHER DEVELOPMENTS

- TABLE 205 SEALED AIR CORPORATION: COMPANY OVERVIEW

- TABLE 206 SEALED AIR CORPORATION: PRODUCTS OFFERED

- TABLE 207 SEALED AIR CORPORATION: PRODUCT LAUNCHES

- TABLE 208 SEALED AIR CORPORATION: DEALS

- TABLE 209 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY OVERVIEW

- TABLE 210 WEST PHARMACEUTICAL SERVICES, INC.: PRODUCTS OFFERED

- TABLE 211 WEST PHARMACEUTICAL SERVICES, INC.: PRODUCT LAUNCHES

- TABLE 212 WEST PHARMACEUTICAL SERVICES, INC.: DEALS

- TABLE 213 WEST PHARMACEUTICAL SERVICES, INC.: OTHER DEVELOPMENTS

- TABLE 214 ALPLA WERKE ALWIN LEHNER GMBH & CO KG: COMPANY OVERVIEW

- TABLE 215 ARDAGH GROUP S.A.: COMPANY OVERVIEW

- TABLE 216 CCL INDUSTRIES INC.: COMPANY OVERVIEW

- TABLE 217 FRANK NOE EGYPT LTD.: COMPANY OVERVIEW

- TABLE 218 GAPLAST GMBH: COMPANY OVERVIEW

- TABLE 219 LONZA GROUP LTD.: COMPANY OVERVIEW

- TABLE 220 MONDI GROUP: COMPANY OVERVIEW

- TABLE 221 NOLATO AB: COMPANY OVERVIEW

- TABLE 222 ORIGIN PHARMA PACKAGING: COMPANY OVERVIEW

- TABLE 223 COMAR: COMPANY OVERVIEW

- TABLE 224 BILCARE LIMITED: COMPANY OVERVIEW

- TABLE 225 SGD PHARMA: COMPANY OVERVIEW

- TABLE 226 SILGAN HOLDINGS INC.: COMPANY OVERVIEW

- TABLE 227 VETTER PHARMA INTERNATIONAL GMBH: COMPANY OVERVIEW

- FIGURE 1 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: RESEARCH DESIGN

- FIGURE 2 LIST OF STAKEHOLDERS AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 6 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: DATA TRIANGULATION

- FIGURE 7 PLASTICS TO HOLD LARGEST SHARE IN SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET

- FIGURE 8 PRIMARY PACKAGING TO BE FASTER-GROWING SEGMENT OF SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET

- FIGURE 9 BIODEGRADABLE SEGMENT TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING PHARMACEUTICAL PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 11 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET

- FIGURE 12 PLASTICS SEGMENT TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- FIGURE 13 NORTH AMERICA AND PLASTICS SEGMENT ACCOUNTED FOR LARGEST SHARES

- FIGURE 14 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET IN INDIA TO WITNESS HIGHEST CAGR

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET

- FIGURE 16 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS OF SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET

- FIGURE 18 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 19 PHARMACEUTICAL PACKAGING MARKET: ECOSYSTEM MAPPING

- FIGURE 20 SMART PACKAGING, IOT, AND NANOTECHNOLOGY TO DRIVE MARKET

- FIGURE 21 GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

- FIGURE 22 NUMBER OF PATENTS DURING 2011–2021

- FIGURE 23 TOP JURISDICTIONS

- FIGURE 24 TOP 10 PATENT APPLICANTS

- FIGURE 25 PLASTICS TO DOMINATE SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET

- FIGURE 26 PRIMARY PACKAGING FORMAT TO BE LARGER SEGMENT

- FIGURE 27 RECYCLABLE PROCESS SEGMENT TO BE LARGER SEGMENT

- FIGURE 28 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET IN INDIA TO REGISTER HIGHEST CAGR

- FIGURE 29 NORTH AMERICA: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET SNAPSHOT

- FIGURE 31 RANKING OF TOP 5 PLAYERS IN SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET, 2021

- FIGURE 32 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET SHARE, BY COMPANY (2021)

- FIGURE 33 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: COMPANY EVALUATION MATRIX FOR TIER-1 COMPANIES, 2021

- FIGURE 34 SUSTAINABLE PHARMACEUTICAL PACKAGING MARKET: COMPANY EVALUATION MATRIX FOR START-UPS AND SMES, 2021

- FIGURE 35 BERRY GLOBAL INC.: COMPANY SNAPSHOT

- FIGURE 36 GERRESHEIMER AG: COMPANY SNAPSHOT

- FIGURE 37 AMCOR PLC: COMPANY SNAPSHOT

- FIGURE 38 SCHOTT AG: COMPANY SNAPSHOT

- FIGURE 39 APTARGROUP, INC.: COMPANY SNAPSHOT

- FIGURE 40 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

- FIGURE 41 WESTROCK COMPANY: COMPANY SNAPSHOT

- FIGURE 42 NIPRO CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 CATALENT, INC.: COMPANY SNAPSHOT

- FIGURE 44 SEALED AIR CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 WEST PHARMACEUTICAL SERVICES, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size for pharmaceutical packaging. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Bloomberg, World Bank, Statista, Packaging Industry Associations, Trademap, Zauba, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulations form agencies such as the Food & Drug Administration (FDA), World Health organization (WHO), The European Federation of Pharmaceutical Industries and Associations (EFPIA), Pharmaceuticals Export Promotion Council of India, regulatory bodies, and databases.

Primary Research

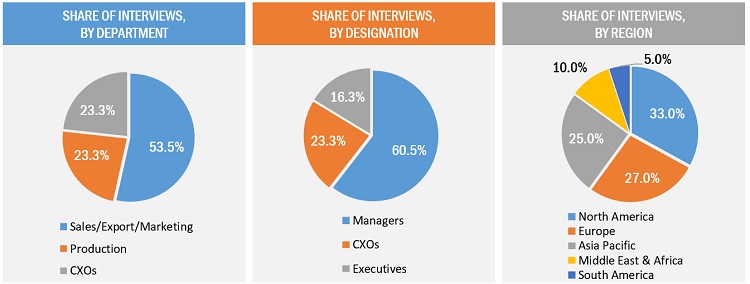

Extensive primary research has been conducted after acquiring an understanding of the sustainable pharmaceutical packaging market scenario through secondary research The pharmaceutical packaging market comprises several stakeholders such as raw material suppliers, distributors of pharmaceutical packaging, end-users, and regulatory organizations in the supply chain. The demand side of this market consists of pharmaceutical drug manufacturers, medical drug filling contractors, hospitals, labs, research institutes, and other healthcare institutions. Several primary interviews have been conducted with market experts from both the demand- (pharmaceutical packaging manufacturers) and supply-side (end-product manufacturers, buyers, and distributors) players across six major regions, namely, North America, Western Europe, Eastern & Central Europe, Asia Pacific, Middle East & Africa, and South America.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the sustainable pharmaceutical packaging market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, raw material, product type, process, and packaging type in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of sustainable pharmaceutical packaging and their applications.

Report Objective:

- To analyze and forecast size of thesustainable pharmaceutical packaging market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market by type, by raw material, product type, process, packaging type and region.

- To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micro markets with respect to individual trends, future prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To analyze competitive developments such as mergers & acquisitions, new product developments, investments & expansions, and agreements & partnerships in the market

- Strategically profile key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the pharmaceutical packaging market report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Regional Analysis

- A further breakdown of the pharmaceutical packaging market, by segments

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sustainable Pharmaceutical Packaging Market