Synthetic Data Generation Market by Offering (Solution/Platform and Services), Data Type (Tabular, Text, Image, and Video), Application (AI/ML Training & Development, Test Data Management), Vertical and Region - Global Forecast to 2028

Synthetic Data Generation Market Overview

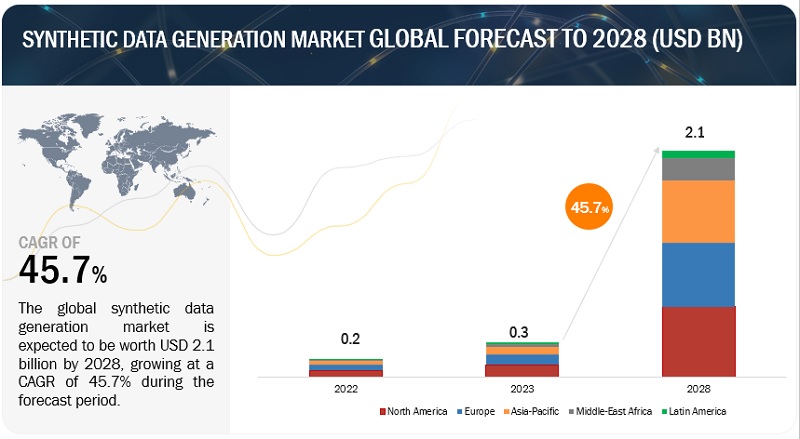

The Synthetic Data Generation Market size is expected to reach USD 2.1 billion by 2028 from USD 0.3 billion in 2023, to grow at a CAGR of 45.7%. Synthetic data generation involves creating artificial datasets that mimic real-world data's characteristics and statistical properties. It offers numerous benefits and is driven by various factors. Synthetic data generation provides organizations a cost-effective and time-efficient solution, eliminating the need to collect and label large volumes of real-world data. It enables businesses to overcome privacy and security concerns by generating data that does not contain sensitive information. Synthetic data also enhances data diversity, scalability, and customization, allowing organizations to simulate various scenarios and edge cases. Furthermore, it supports the training and validation of machine learning models, facilitates data sharing and collaboration, and accelerates innovation in healthcare, finance, and cybersecurity sectors. The increasing concerns about data privacy, the need for diverse and representative data, and the demand for efficient model training are some drivers propelling the growth of the synthetic data generation market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Synthetic Data Generation Market Dynamics

Driver: Increasing Demand for Data Privacy and Compliance

The rising importance of data privacy and compliance regulations, such as GDPR and CCPA, is driving the need for organizations to handle personal data with utmost caution. Synthetic data generation offers a solution by allowing organizations to generate realistic data while preserving privacy and adhering to regulatory requirements. The growing demand for data privacy and compliance is fueling the synthetic data generation market. Organizations are seeking ways to protect personal data and adhere to stringent privacy regulations. Synthetic data generation provides a solution by allowing the use of artificially generated data that mimics real data while preserving privacy. It helps organizations mitigate risks, ensure compliance, and maintain ethical and transparent data practices. Additionally, synthetic data generation enables access to restricted or scarce data, allowing industries to drive advancements while adhering to privacy regulations and data availability constraints. Overall, the demand for data privacy and compliance is driving the adoption of synthetic data generation as a privacy-preserving solution for various data-intensive activities.

Restraint: Regulatory and Ethical Considerations

While synthetic data can help address privacy concerns, regulatory and ethical considerations still apply. Different jurisdictions have varying regulations regarding the use of synthetic data, and organizations must ensure compliance with relevant data protection and privacy laws. Moreover, ethical considerations, such as potential biases introduced during the generation process or the potential impact on individuals or groups, need to be carefully addressed to maintain ethical standards and avoid unintended consequences.

Opportunity: Increasing deployment of large language models

Advances in large language models, or LLMs, and other generative ML tooling are streamlining content creation. LLMs are complex neural networks that can generate text. They underpin systems like OpenAI's GPT-3 (text) and Google's LaMDA (conversational dialogue) and helped inspire OpenAI's DALL-E and Midjourney (text-to-image). LLMs have been increasing an average of 10x per year in size and sophistication. The result: Modern AI can autonomously generate content—be it text, visual, audio, code, data, or multimedia—on par with human benchmarks.

As large language models improve, the AI industry is witnessing the advances flow to downstream tasks and multi-modal models. These models can take multiple input modalities (e.g., image, text, audio), and produce outputs of different modalities. This is not unlike human cognition; a child reading a picture book uses both the text and illustrations to visualize the story. Language models are progressively becoming the cognitive structure of real-world AI, and enterprises are set for a promising network effect—improvements in large language models tend to flow into downstream tasks and multi-modal models that span text, video, audio, image, code, and beyond.

Challenge: Lack of Maturity in the Market

The synthetic data generation market is still in its early stages of development and is expected to grow significantly in the coming years. This is due to the advantages of synthetic data over real data, which include privacy, cost, accuracy, and flexibility. However, a number of challenges need to be addressed before the market can reach its full potential, such as the lack of standards, trust, and awareness. Some steps that can be taken to address these challenges include developing standards for synthetic data generation, building trust in synthetic data, and increasing awareness of the benefits of synthetic data

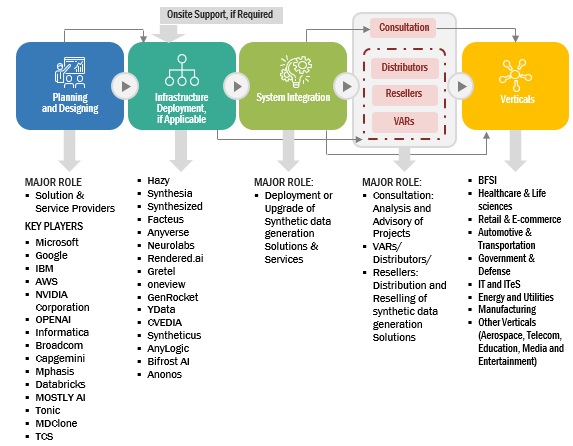

Synthetic Data Generation Market Ecosystem

By data type, text data to segment to record the highest growth rate during the forecast period

By data type, text data segment is expected to have the highest growth rate during the forecast period. The increasing demand for artificial intelligence (AI) and machine learning (ML) applications requires large amounts of data to train and develop models, further driving the text data segment.

Among applications, the Test data management segment has the highest market share during the forecast period.

Under the applications segment, Test data management segment is expected to have the highest market share during the forecast period. The need for high-quality, diverse, and representative data for testing and validation purposes will drive the segment. Businesses can enhance the effectiveness and efficiency of their testing processes using synthetic data leading to improved product quality, faster time-to-market, and reduced costs associated with traditional test data management approaches.

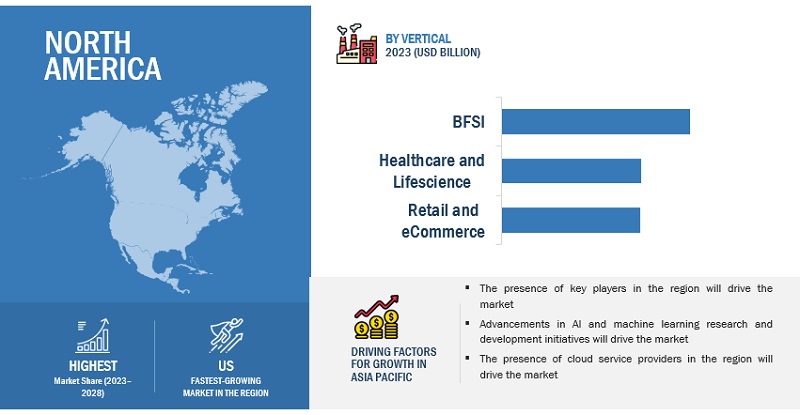

Among regions, North America to hold the highest market share during the forecast period

North America is a hub for technological advancements, focusing strongly on AI, machine learning, and data-driven innovations. This region boasts a rich ecosystem of research institutions, tech companies, and startups, driving the demand for high-quality synthetic data for training AI models and conducting experiments. Additionally, the presence of key players in the region further drives the synthetic data generation market in this region.

Synthetic Data Generation Market Players

The report includes the study of key players offering synthetic data generation solutions and services. It profiles major vendors in the global synthetic data generation market. The major vendors Microsoft (US), Google (US), IBM (US), AWS (US), NVIDIA (US), OpenAI (US), Informatica (US), Broadcom (US), Sogeti (France), Mphasis (India), Databricks (US), MOSTLY AI (Austria), Tonic (US), MDClone (Israel), TCS (India), Hazy (UK), Synthesia (UK), Synthesized (UK), Facteus (US), Anyverse (Spain), Neurolabs (Scotland), Rendered.ai (US), Gretel (US), OneView (Israel), GenRocket (US), YData (US), CVEDIA (UK), Syntheticus (Switzerland), AnyLogic (US), Bifrost AI (US), Anonos (US). These players have adopted various strategies to grow in the global market.

The study includes an in-depth competitive analysis of these key players in the synthetic data generation market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2023 |

USD 0.3 billion |

|

Revenue forecast for 2028 |

USD 2.1 billion |

|

Growth Rate |

45.7% CAGR |

|

Market size available for years |

2019 – 2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

Offering (Solution/ Platform and Services), Data Type (Tabular, Text, Image and Video, Others), Application ( AI/ML Training and Development, Test Data Management, Data analytics & visualization, Enterprise Data Sharing, Others), Vertical (Banking, Financial Services, and Insurance, Healthcare & Life sciences, Automotive & Transportation, Government & Defense, IT and ITeS, Manufacturing, Other Verticals) and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), Google (US), IBM (US), AWS (US), NVIDIA (US), OpenAI (US), Informatica (US), Broadcom (US), Sogeti (France), Mphasis (India), Databricks (US), MOSTLY AI (Austria), Tonic (US), MDClone (Israel) TCS (India), Hazy (UK), Synthesia (UK), Synthesized (UK), Facteus (US), Anyverse (Spain), Neurolabs (Scotland), Rendered.ai (US), Gretel (US), OneView (Israel), GenRocket (US), YData (US), CVEDIA (UK), Syntheticus (Switzerland), AnyLogic (US), Bifrost AI (US), Anonos (US) |

This research report categorizes the synthetic data generation market to forecast revenue and analyze trends in each of the following submarkets:

Based on Offering:

- Solution/Platform

- Services

Based on Data Type:

- Tabular Data

- Text data

- Image and Video Data

- Others

Based on Application:

- AI/ML Training and Development

- Test Data Management

- Data analytics and visualization

- Enterprise Data Sharing

- Others

Based on Vertical:

- BFSI

- Healthcare & Life sciences

- Retail & E-commerce

- Automotive & Transportation

- Government & Defense

- IT and ITeS

- Manufacturing

- Other Verticals

Based on Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Italy

- Spain

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- ANZ

- Rest of APAC

-

Middle East & Africa

- UAE

- KSA

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2023, Databricks acquired Okera, a data governance platform with a focus on AI. the acquisition will enable Databricks to expose additional APIs that its own data governance partners will be able to use to provide solutions to their customers.

- In January 2023, Microsoft entered into a multi-billion-dollar partnership with OpenAI to accelerate the development of AI technology. The partnership aims to democratize AI and make it accessible to everyone. The partnership has already yielded impressive results, including the development of GPT-3

- In December 2022, AWS and Stability AI collaborated to make its open-source tools and models. Stability AI, a community-driven, open-source artificial intelligence (AI) company, selected AWS as its preferred cloud provider to build and scale its AI models for image, language, audio, video, and 3D content generation. Stability AI will use Amazon SageMaker (AWS's end-to-end machine learning service), as well as AWS's proven computing infrastructure and storage, to accelerate its work on open-source generative AI models.

- In October 2022, Microsoft partnered with Informatica, an enterprise cloud data management leader, announcing its inclusion as an initial partner of the Microsoft Intelligent Data Platform Partner Ecosystem. Microsoft announced the launch of this ecosystem during its Microsoft Ignite 2022. This initiative represents both companies' investment toward helping enterprises truly operationalize AI with trusted and governed data.

- In June 2022, Tonic announced an integration with Snowflake, the Data Cloud company. The new integration will enable joint Tonic and Snowflake customers to build applications with realistic, de-identified data in the Snowflake Data Cloud. Joint customers can also tokenize data at scale and ensure regulatory compliance.

Frequently Asked Questions (FAQ):

What is the projected market value of the global synthetic data generation market?

The global synthetic data generation market size to grow from USD 0.3 billion in 2023 to USD 2.1 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 45.7% during the forecast period.

Which region has the largest synthetic data generation market share?

North America is estimated to hold the largest market share in synthetic data generation in 2023.

Which application is expected to hold a larger market size during the forecast period?

Among applications, AI/ML training and development is expected to hold a larger market size during the forecast period.

Which data type is expected to have the highest growth rate during the forecast period?

Text data segment is expected to have the highest growth rate during the forecast period.

Who are the major vendors in the synthetic data generation market?

Major vendors in the synthetic data generation market are Microsoft (US), Google (US), IBM (US), AWS (US), NVIDIA (US), OpenAI (US), Informatica (US), Broadcom (US), Sogeti (France), Mphasis (India), Databricks (US), MOSTLY AI (Austria), Tonic (US), MDClone (Israel) TCS (India), Hazy (UK), Synthesia (UK), Synthesized (UK), Facteus (US), Anyverse (Spain), Neurolabs (Scotland), Rendered.ai (US), Gretel (US), OneView (Israel), GenRocket (US), YData (US), CVEDIA (UK), Syntheticus (Switzerland), AnyLogic (US), Bifrost AI (US), Anonos (US)

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising adoption of AI and machine learning technologies- Increasing need for data privacy and compliance- Rise in investments in AI- Increase in content creationRESTRAINTS- Regulatory and ethical considerations- Issues related to achieving quality data and realismOPPORTUNITIES- Increasing deployment of large language models- Growing interest of enterprises in commercializing synthetic images- Robust advancements in machine learning and computing innovationCHALLENGES- Market immaturity- Lack of skilled workforce- High costs associated with high-end generative models

-

5.3 ETHICS AND IMPLICATIONS OF SYNTHETIC DATA GENERATIONPRIVACY PROTECTIONFAIRNESSDATA OWNERSHIP AND CONSENTUNINTENDED CONSEQUENCESACCOUNTABILITY AND TRANSPARENCYFAIR REPRESENTATIONREGULATORY COMPLIANCE

- 5.4 ADVENT OF SYNTHETIC DATA GENERATION

- 5.5 HISTORY OF SYNTHETIC DATA GENERATION

- 5.6 TIMELINE OF ADVANCEMENTS IN SYNTHETIC DATA GENERATION MARKET

-

5.7 ECOSYSTEM ANALYSISSYNTHETIC DATA GENERATION TECHNOLOGY PROVIDERSSYNTHETIC DATA GENERATION CLOUD PLATFORM PROVIDERSSYNTHETIC DATA GENERATION CLOUD END USERSSYNTHETIC DATA GENERATION CLOUD REGULATORS

-

5.8 SYNTHETIC DATA GENERATION TECHNIQUES AND METHODS BASED ON DATA TYPESTABULAR- Rule-based Methods- Data Augmentation- Generative Adversarial Networks (GANs)- Variational Autoencoders (VAEs)- Bayesian NetworksTEXT- Markov Chains- Neural Networks (RNNs)- Transformer Models- Language Models- Variational AutoencodersIMAGES AND VIDEOS- Generative Adversarial Networks (GANs)- Variational Autoencoders (VAEs)- Conditional GANs- Image and Video Synthesis with Neural Networks- Style Transfer and Data AugmentationTIME SERIES & TRANSACTIONAL DATA- Autoregressive Integrated Moving Average (ARIMA)- Long Short-Term Memory (LSTM) Networks- Hidden Markov Models (HMMs)- Sequence Generative Adversarial Networks (SeqGANs)- Gaussian Mixture Models (GMMs)- Synthetic Oversampling and Undersampling

-

5.9 CASE STUDY ANALYSISCASE STUDY 1: MOSTLY AI HELPED RETAIL BANK SHORTEN DEVELOPMENT OF SPRINTS BY SEVERAL DAYSCASE STUDY 2: SWEDISH GOVERNMENT INCORPORATED ARTIFICIAL INTELLIGENCE INTO DAILY OPERATIONSCASE STUDY 3: EVERLYWELL GAINED 5X DEPLOYMENT VELOCITY WITH SUPPORT FROM TONIC APICASE STUDY 4: VODAFONE ADOPTED HAZY SYNTHETIC DATA TO QUICKLY AND ACCURATELY PREDICT CHURNCASE STUDY 5: SCALE AI HELPED KALEIDO AI’S ML TEAM TO IMPROVE MODEL PERFORMANCE ON BUSINESS-CRITICAL EDGE CASES

- 5.10 SUPPLY CHAIN ANALYSIS

-

5.11 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSPAYMENT CARD INDUSTRY DATA SECURITY STANDARDGRAMM-LEACH-BLILEY ACTHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTGENERAL DATA PROTECTION REGULATIONPERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACTINFORMATION SECURITY TECHNOLOGY: PERSONAL INFORMATION SECURITY SPECIFICATION GB/T 35273-2017SECURE INDIA NATIONAL DIGITAL COMMUNICATIONS POLICY, 2018GENERAL DATA PROTECTION LAWLAW NO 13 OF 2016 ON PROTECTING PERSONAL DATANIST SPECIAL PUBLICATION 800-144, GUIDELINES ON SECURITY AND PRIVACY IN PUBLIC CLOUD COMPUTING

-

5.12 PATENT ANALYSISMETHODOLOGYPATENT APPLICATIONSTOP 15 PATENT APPLICANTS IN LAST 10 YEARSTOP 15 PATENT OWNERS IN LAST 10 YEARS

- 5.13 KEY CONFERENCES & EVENTS

- 5.14 PRICING ANALYSIS

-

5.15 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.16 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.17 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF MARKETBUSINESS MODELS IN SYNTHETIC DATA GENERATION MARKET- Software licensing- Data-as-a-Service (DaaS)- Custom development- Consulting and professional services- Partnerships and collaborations- Data monetization- Integration with existing platforms- Research and development- Freemium model- Open source

-

6.1 INTRODUCTIONOFFERINGS: MARKET DRIVERS

- 6.2 SOLUTIONS

-

6.3 SERVICESPROFESSIONAL SERVICES- Rising demand for specialized expertise in synthetic data generation to boost market growthMANAGED SERVICES- Need for end-to-end management of synthetic data generation to drive market for managed services

-

7.1 INTRODUCTIONDATA TYPES: MARKET DRIVERS

-

7.2 TABULARDEMAND FOR PRIVACY PRESERVATION TO DRIVE GENERATION OF TABULAR DATA

-

7.3 TEXTNEED TO CREATE LABELED TRAINING DATASETS FOR NATURAL LANGUAGE PROCESSING TASKS TO DRIVE MARKET GROWTH

-

7.4 IMAGES AND VIDEOSDEMAND FOR COMPUTER VISION TRAINING, IMAGE RECOGNITION, AND VIDEO ANALYSIS MODELS TO DRIVE MARKET GROWTH

- 7.5 OTHER DATA TYPES

-

8.1 INTRODUCTIONAPPLICATIONS: MARKET DRIVERS

-

8.2 AI/ML TRAINING AND DEVELOPMENTNEED FOR SCALABLE AND DIVERSE DATASETS FOR TRAINING MODELS TO DRIVE ADOPTION OF SYNTHETIC DATA GENERATION

-

8.3 TEST DATA MANAGEMENTNEED TO ENHANCE EFFICIENCY OF SOFTWARE TESTING APPLICATIONS TO PROPEL SYNTHETIC DATA GENERATION MARKET

-

8.4 DATA ANALYTICS AND VISUALIZATIONGROWING NEED TO SAFEGUARD DATA PRIVACY TO BOOST SYNTHETIC DATA GENERATION FOR DATA ANALYTICS AND VISUALIZATION

-

8.5 ENTERPRISE DATA SHARINGNEED TO LEVERAGE POWER OF SHARED DATA TO ENCOURAGE PLAYERS TO ADOPT ENTERPRISE DATA SHARING AND DETECTION

- 8.6 OTHER APPLICATIONS

-

9.1 INTRODUCTIONVERTICALS: MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)NEED FOR REGULATED LANDSCAPE WITH STRINGENT DATA PRIVACY REQUIREMENTS TO DRIVE MARKET GROWTHBFSI: MARKET USE CASES

-

9.3 HEALTHCARE AND LIFE SCIENCESDEMAND FOR PRIVACY IN HEALTHCARE SECTOR TO BOOST ADOPTION OF SYNTHETIC DATA GENERATIONHEALTHCARE AND LIFE SCIENCES: MARKET USE CASES

-

9.4 RETAIL AND E-COMMERCESYNTHETIC DATA GENERATION TO ENABLE RETAIL AND E-COMMERCE COMPANIES TO CREATE REPRESENTATIVE DATASETSRETAIL AND E-COMMERCE: MARKET USE CASES

-

9.5 AUTOMOTIVE AND TRANSPORTATIONDEMAND FOR OPTIMIZED VEHICLE PERFORMANCE TO PROPEL ADOPTION OF SYNTHETIC DATA GENERATIONAUTOMOTIVE AND TRANSPORTATION: MARKET USE CASES

-

9.6 GOVERNMENT AND DEFENSERISING NEED TO PROTECT SENSITIVE INFORMATION TO DRIVE USE OF SYNTHETIC DATA GENERATION IN GOVERNMENT AND DEFENSE SEGMENTGOVERNMENT AND DEFENSE: MARKET USE CASES

-

9.7 IT AND ITESNEED FOR DATA PRIVACY AND SECURITY IN IT AND ITES SECTOR TO ENABLE PLAYERS TO UNDERSTAND VALUE OF SYNTHETIC DATA GENERATIONIT AND ITES: SYNTHETIC DATA GENERATION MARKET USE CASES

-

9.8 MANUFACTURINGGROWING NEED TO IMPROVE PRODUCT DESIGN AND OPTIMIZATION TO PROPEL MARKET GROWTHMANUFACTURING: MARKET USE CASES

- 9.9 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Technological advancements and widespread application of synthetic data generation to drive marketCANADA- Need to enhance productivity and improve customer satisfaction to drive market growth

-

10.3 EUROPEEUROPE: SYNTHETIC DATA GENERATION MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Government initiatives to drive demand for synthetic data generationGERMANY- Surge in adoption of artificial intelligence to drive demand for synthetic data generation tools in research and developmentFRANCE- Growing demand for research and educational excellence to drive demand for AI-enabled technologiesITALY- Demand for deep learning model to perform source separation and music generation to drive market growthSPAIN- Need to develop AI solutions and language models to drive market for synthetic data generationFINLAND- Growing demand for AI applications in education sector to drive market growthREST OF EUROPE

-

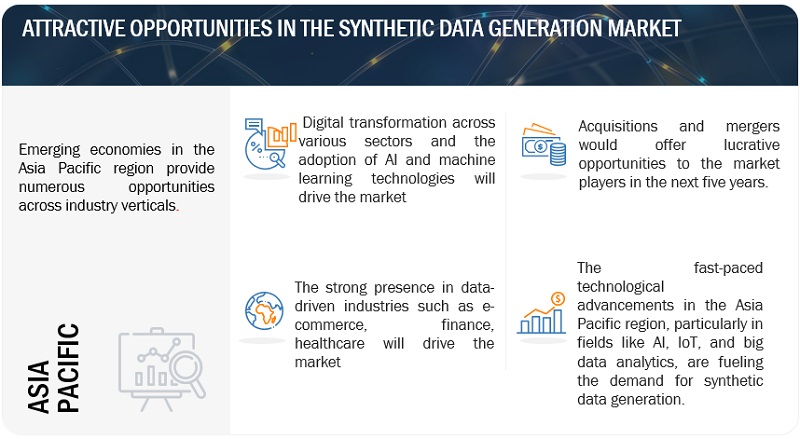

10.4 ASIA PACIFICASIA PACIFIC: SYNTHETIC DATA GENERATION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Growth in technology sector to boost popularity of synthetic data generation solutionsINDIA- Rise in digital transformation across industry verticals to drive market growthJAPAN- Need to digitalize pharma industry to drive adoption of synthetic data generation solutionsSOUTH KOREA- Rise in initiatives by government to boost adoption of synthetic data generation toolsSINGAPORE- Steady progress made in AI advancements to drive market for synthetic data generation solutionsAUSTRALIA & NEW ZEALAND- Popularity of ChatGPT and large language models to propel popularity of synthetic data generation solutionsREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTSAUDI ARABIA- Major investments by tech giants to drive demand for synthetic data generation solutionsUAE- Adoption of trailblazing technologies for advanced education system to boost market growthSOUTH AFRICA- Demand for advancements in healthcare sector to drive market for synthetic data generation solutionsISRAEL- Strong cluster of synthetic data generation and AI startups to lead to market growthREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: SYNTHETIC DATA GENERATION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Establishment of cloud region to propel market growth of synthetic data generation solutionsMEXICO- Demand for digitalizing banking sector to boost adoption of marketARGENTINA- Use of synthetic data generation solutions by government to address economic and political instability to drive market growthREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

11.3 REVENUE ANALYSISHISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 EVALUATION QUADRANT MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPETITIVE BENCHMARKING FOR KEY PLAYERS

-

11.7 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 11.8 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

-

11.9 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 12.1 INTRODUCTION

-

12.2 KEY PLAYERSMICROSOFT- Business overview- Solutions/Services offered- Recent developments- MnM viewGOOGLE- Business overview- Solutions/Services offered- Recent developments- MnM viewIBM- Business overview- Solutions/Services offered- Recent developments- MnM viewAWS- Business overview- Solutions/Services offered- Recent developments- MnM viewNVIDIA CORPORATION- Business overview- Solutions/Services offeredOPENAI- Business overview- Solutions/Services offered- Recent developments- MnM viewINFORMATICA- Business overview- Solutions/Services offered- Recent developmentsBROADCOM- Business overview- Solutions offeredCAPGEMINI- Business overview- Solutions/Services offeredMPHASIS- Business overview- Solutions/Services offeredDATABRICS- Business overview- Solutions/Services offered- Recent developmentsMOSTLY AI- Business overview- Solutions/Services offered- Recent developmentsTONIC- Business overview- Solutions/Services offered- Recent developmentsMD CLONE- Business overview- Solutions/Services offered- Recent developmentsTCS

-

12.3 STARTUPS/SMESHAZYSYNTHESIASYNTHESIZEDFACTEUSANYVERSENEUROLABSRENDERED AIGRETELONEVIEWGENROCKETY DATACVEDIASYNTHETICUSANYLOGICBIFROST AIANONOS

-

13.1 NATURAL LANGUAGE PROCESSING MARKETMARKET DEFINITIONMARKET OVERVIEWNATURAL LANGUAGE PROCESSING MARKET, BY COMPONENTNATURAL LANGUAGE PROCESSING MARKET, BY TYPENATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODENATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZENATURAL LANGUAGE PROCESSING MARKET, BY APPLICATIONNATURAL LANGUAGE PROCESSING MARKET, BY TECHNOLOGYNATURAL LANGUAGE PROCESSING MARKET, BY VERTICALNATURAL LANGUAGE PROCESSING MARKET, BY REGION

-

13.2 ARTIFICIAL INTELLIGENCE MARKETMARKET DEFINITIONMARKET OVERVIEWARTIFICIAL INTELLIGENCE MARKET, BY OFFERINGARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGYARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODEARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZEARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTIONARTIFICIAL INTELLIGENCE MARKET, BY VERTICALARTIFICIAL INTELLIGENCE MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATE, 2019–2022

- TABLE 2 KEY PARTICIPANTS OF PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 10 AVERAGE SELLING PRICE ANALYSIS

- TABLE 11 IMPACT OF PORTER’S FORCES ON MARKET

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 14 SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 15 MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 16 SOLUTIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 17 SOLUTIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 21 MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 22 MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 23 MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 24 PROFESSIONAL SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 PROFESSIONAL SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 TRAINING AND CONSULTING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 TRAINING AND CONSULTING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 SYSTEM INTEGRATION AND IMPLEMENTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 31 SUPPORT AND MAINTENANCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 MANAGED SERVICES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 MANAGED SERVICES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 SYNTHETIC DATA GENERATION MARKET, BY DATA TYPE, 2019–2022 (USD MILLION)

- TABLE 35 MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 36 TABULAR: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 TABULAR: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 TEXT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 39 TEXT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 IMAGES AND VIDEOS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 IMAGES AND VIDEOS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 OTHER DATA TYPES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 OTHER DATA TYPES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 SYNTHETIC DATA GENERATION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 AI/ML TRAINING AND DEVELOPMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 AI/ML TRAINING AND DEVELOPMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 TEST DATA MANAGEMENT: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 TEST DATA MANAGEMENT: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 DATA ANALYTICS AND VISUALIZATION: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 51 DATA ANALYTICS AND VISUALIZATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 ENTERPRISE DATA SHARING AND RETENTION: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 ENTERPRISE DATA SHARING AND RETENTION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 OTHER APPLICATIONS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 OTHER APPLICATIONS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 57 MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 58 BFSI: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 BFSI: SYNTHETIC DATA GENERATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 RETAIL AND E-COMMERCE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 RETAIL AND E-COMMERCE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 AUTOMOTIVE AND TRANSPORTATION: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 AUTOMOTIVE AND TRANSPORTATION: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 GOVERNMENT AND DEFENSE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 IT AND ITES: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 IT AND ITES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 MANUFACTURING: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 MANUFACTURING: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 OTHER VERTICALS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 OTHER VERTICALS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY DATA TYPE, 2019–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 90 US: SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 91 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 92 CANADA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 93 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 95 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: MARKET, BY DATA TYPE, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: SYNTHETIC DATA GENERATION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 102 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 103 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 105 EUROPE: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 106 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 108 UK: SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 109 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 110 GERMANY: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 111 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 112 FRANCE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 113 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 114 ITALY: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 115 ITALY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 116 SPAIN: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 117 SPAIN: SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 119 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: SYNTHETIC DATA GENERATION MARKET, BY DATA TYPE, 2019–2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 134 CHINA: SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 135 CHINA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 136 INDIA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 137 INDIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 138 JAPAN: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 139 JAPAN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 140 SOUTH KOREA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 141 SOUTH KOREA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 142 SINGAPORE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 143 SINGAPORE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 144 AUSTRALIA & NEW ZEALAND: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 145 AUSTRALIA & NEW ZEALAND: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: MARKET, BY DATA TYPE, 2019–2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: SYNTHETIC DATA GENERATION MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 162 SAUDI ARABIA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 163 SAUDI ARABIA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 164 UAE: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 165 UAE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 166 SOUTH AFRICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 167 SOUTH AFRICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 168 ISRAEL: SYNTHETIC DATA GENERATION MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 169 ISRAEL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 171 LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: MARKET, BY DATA TYPE, 2019–2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: MARKET, BY DATA TYPE, 2023–2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2019–2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2023–2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: SYNTHETIC DATA GENERATION MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: MARKET, BY VERTICAL, 2019–2022 (USD MILLION)

- TABLE 181 LATIN AMERICA: MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 183 LATIN AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 184 BRAZIL: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 185 BRAZIL: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 186 MEXICO: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 187 MEXICO: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 188 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2019–2022 (USD MILLION)

- TABLE 189 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 190 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 191 MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 192 PRODUCT FOOTPRINT ANALYSIS FOR KEY PLAYERS, 2022

- TABLE 193 SYNTHETIC DATA GENERATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 194 PRODUCT FOOTPRINT ANALYSIS FOR STARTUPS/SMES, 2022

- TABLE 195 PRODUCT LAUNCHES AND ENHANCEMENTS, 2020–2023

- TABLE 196 DEALS, 2020–2023

- TABLE 197 MICROSOFT: BUSINESS OVERVIEW

- TABLE 198 MICROSOFT: SOLUTIONS/SERVICES OFFERED

- TABLE 199 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 200 MICROSOFT: DEALS

- TABLE 201 GOOGLE: BUSINESS OVERVIEW

- TABLE 202 GOOGLE: SOLUTIONS/SERVICES OFFERED

- TABLE 203 GOOGLE: DEALS

- TABLE 204 IBM: BUSINESS OVERVIEW

- TABLE 205 IBM: SOLUTIONS/SERVICES OFFERED

- TABLE 206 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 207 IBM: DEALS

- TABLE 208 AWS: BUSINESS OVERVIEW

- TABLE 209 AWS: SOLUTIONS/SERVICES OFFERED

- TABLE 210 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 211 AWS: DEALS

- TABLE 212 NVIDIA CORPORATION: BUSINESS OVERVIEW

- TABLE 213 NVIDIA CORPORATION: SOLUTIONS/SERVICES OFFERED

- TABLE 214 OPENAI: BUSINESS OVERVIEW

- TABLE 215 OPENAI: SOLUTIONS/SERVICES OFFERED

- TABLE 216 OPENAI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 217 OPENAI: DEALS

- TABLE 218 INFORMATICA: BUSINESS OVERVIEW

- TABLE 219 INFORMATICA: SOLUTIONS/SERVICES OFFERED

- TABLE 220 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 221 INFORMATICA: DEALS

- TABLE 222 BROADCOM: BUSINESS OVERVIEW

- TABLE 223 BROADCOM: SOLUTIONS/SERVICES OFFERED

- TABLE 224 CAPGEMINI: BUSINESS OVERVIEW

- TABLE 225 CAPGEMINI: SOLUTIONS/SERVICES OFFERED

- TABLE 226 MPHASIS: BUSINESS OVERVIEW

- TABLE 227 MPHASIS: SOLUTIONS/SERVICES OFFERED

- TABLE 228 DATABRICS: BUSINESS OVERVIEW

- TABLE 229 DATABRICS: SOLUTIONS/SERVICES OFFERED

- TABLE 230 DATABRICS: DEALS

- TABLE 231 MOSTLY AI: BUSINESS OVERVIEW

- TABLE 232 MOSTLY AI: SOLUTIONS/SERVICES OFFERED

- TABLE 233 MOSTLY AI: DEALS

- TABLE 234 TONIC: BUSINESS OVERVIEW

- TABLE 235 TONIC: SOLUTIONS/SERVICES OFFERED

- TABLE 236 TONIC: DEALS

- TABLE 237 MD CLONE: BUSINESS OVERVIEW

- TABLE 238 MD CLONE: SOLUTIONS/SERVICES OFFERED

- TABLE 239 MD CLONE: DEALS

- TABLE 240 NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 241 NATURAL LANGUAGE PROCESSING MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 242 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 243 NATURAL LANGUAGE PROCESSING MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 244 NATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 245 NATURAL LANGUAGE PROCESSING MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 246 NATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 247 NATURAL LANGUAGE PROCESSING MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 248 NATURAL LANGUAGE PROCESSING MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 249 NATURAL LANGUAGE PROCESSING MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 250 NATURAL LANGUAGE PROCESSING MARKET, BY TECHNOLOGY, 2016–2021 (USD MILLION)

- TABLE 251 NATURAL LANGUAGE PROCESSING MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 252 NATURAL LANGUAGE PROCESSING MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 253 NATURAL LANGUAGE PROCESSING MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 254 NATURAL LANGUAGE PROCESSING MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 255 NATURAL LANGUAGE PROCESSING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 256 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2016–2021 (USD BILLION)

- TABLE 257 ARTIFICIAL INTELLIGENCE MARKET, BY OFFERING, 2022–2027 (USD BILLION)

- TABLE 258 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2016–2021 (USD BILLION)

- TABLE 259 ARTIFICIAL INTELLIGENCE MARKET, BY TECHNOLOGY, 2022–2027 (USD BILLION)

- TABLE 260 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD BILLION)

- TABLE 261 ARTIFICIAL INTELLIGENCE MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD BILLION)

- TABLE 262 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD BILLION)

- TABLE 263 ARTIFICIAL INTELLIGENCE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 264 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD BILLION)

- TABLE 265 ARTIFICIAL INTELLIGENCE MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD BILLION)

- TABLE 266 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2016–2021 (USD BILLION)

- TABLE 267 ARTIFICIAL INTELLIGENCE MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 268 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2016–2021 (USD BILLION)

- TABLE 269 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2022–2027 (USD BILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF SYNTHETIC DATA GENERATION THROUGH OVERALL MARKET SPENDING

- FIGURE 8 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 INCREASING INVESTMENTS IN AI TO DRIVE MARKET GROWTH

- FIGURE 10 BFSI SEGMENT AND NORTH AMERICA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 11 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 13 SYNTHETIC DATA GENERATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 SYNTHETIC DATA TO ACCOUNT FOR LARGER DATA VOLUME BY 2030

- FIGURE 15 HISTORY OF SYNTHETIC DATA GENERATION

- FIGURE 16 ECOSYSTEM ANALYSIS

- FIGURE 17 SUPPLY CHAIN ANALYSIS

- FIGURE 18 NUMBER OF PATENTS GRANTED ANNUALLY, 2019–2022

- FIGURE 19 TOP 15 PATENT APPLICANTS IN LAST 10 YEARS

- FIGURE 20 TOP 15 PATENT OWNERS IN LAST 10 YEARS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 24 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 25 MANAGED SERVICES SEGMENT TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 26 SYSTEM INTEGRATION AND IMPLEMENTATION SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 27 TEXT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 AI/ML TRAINING AND DEVELOPMENT SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 29 HEALTHCARE AND LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA: SYNTHETIC DATA GENERATION MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 34 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- FIGURE 35 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2022

- FIGURE 36 EVALUATION QUADRANT MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 37 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 38 GOOGLE: COMPANY SNAPSHOT

- FIGURE 39 IBM: COMPANY SNAPSHOT

- FIGURE 40 AWS: COMPANY SNAPSHOT

- FIGURE 41 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 INFORMATICA: COMPANY SNAPSHOT

- FIGURE 43 BROADCOM: COMPANY SNAPSHOT

- FIGURE 44 CAPGEMINI: COMPANY SNAPSHOT

- FIGURE 45 MPHASIS: COMPANY SNAPSHOT

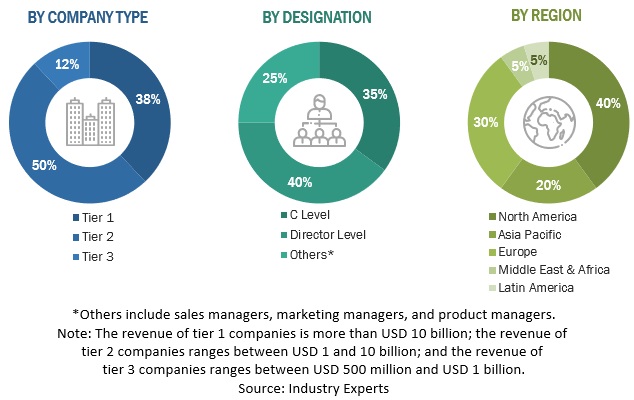

The synthetic data generation market research study involved extensive secondary sources, directories, journals, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred Synthetic data generation providers, third-party service providers, consulting service providers, end-users, and other commercial enterprises. In-depth interviews with primary respondents, including key industry participants and subject matter experts, were conducted to obtain and verify critical qualitative and quantitative information and assess the market's prospects.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, the spending of various countries on synthetic data generation was extracted from the respective sources. Secondary research was mainly used to obtain the key information related to the industry's value chain and supply chain to identify the key players based on solutions, services, market classification, and segmentation according to offerings of the major players, industry trends related to solutions/platforms, services, application, data types, verticals, and regions, and the key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including chief experience officers (CXOs); vice presidents (VPs); directors from business development, marketing, and synthetic data generation expertise; related key executives from synthetic data generation solution vendors, SIs, professional service providers, and industry associations; and the key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as chief information officers (CIOs), chief technology officers (CTOs), chief strategy officers (CSOs), and end-users using synthetic data generation solutions, were interviewed to understand the buyer's perspective on suppliers, products, service providers, and their current usage of synthetic data generation solutions and services, which would impact the overall synthetic data generation market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

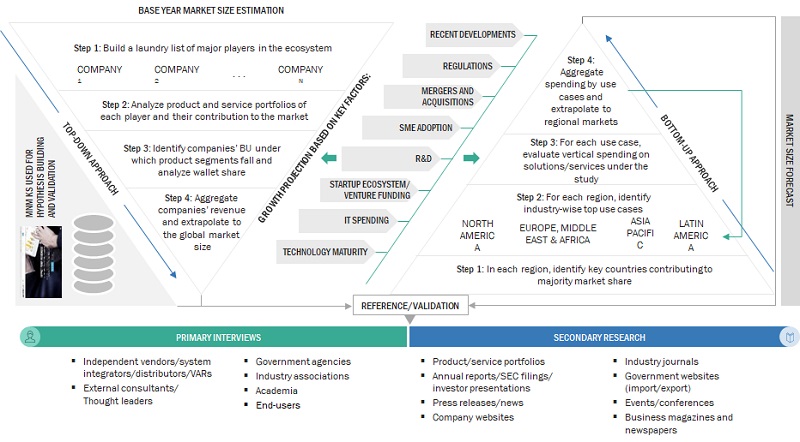

Multiple approaches were adopted for estimating and forecasting the synthetic data generation market. The first approach involves estimating the market size by the summation of the revenue companies generate through the sale of solutions and services.

Bottom-Up Approach

the bottom-up approach, the adoption rate of synthetic data generation market solutions and services among different end-users in the key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of synthetic data generation solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included the analysis of the synthetic data generation market's regional penetration. Based on secondary research, the regional spending on information and communications technology (ICT), socio-economic analysis of each country, strategic vendor analysis of major synthetic data generation providers, and organic and inorganic business development activities of regional and global players were estimated. With the data triangulation procedure and data validation through primaries, the exact values of the overall synthetic data generation market size and segments' size were determined and confirmed using the study.

Top-Down Approach

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the synthetic data generation market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies' revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

The list of vendors considered for estimating the market size is not limited to those profiled in the report. However, MarketsandMarkets prepared a list of vendors offering synthetic data generation solutions and services. They mapped their products related to the synthetic data generation market to identify major vendors operating in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes as explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The synthetic data generation market includes software, tools, and platforms provided by synthetic data vendors to design or create artificial data sets that mimic real-world data. It also includes managed and professional services provided by synthetic data service providers. Synthetic data is any information manufactured artificially which does not represent events or objects in the real world. Algorithms create synthetic data used in model datasets for testing or training purposes. Synthetic data can mimic operational or production data and help train machine learning (ML) models or test out mathematical models.

Key Stakeholders

- Synthetic data generation vendors

- Synthetic data generation service vendors

- Managed service providers

- Support and maintenance service providers

- System integrators (SIs)/Migration service providers

- Value-added resellers (VARs) and distributors

- Independent software vendors (ISVs)

- Third-party providers

- Technology providers

- Compliance regulatory authorities

- Government authorities

Report Objectives

- To define, describe, and forecast the synthetic data generation market by offering (solutions/platforms and services), data type, application, and vertical.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth.

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the synthetic data generation market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders.

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies.

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the synthetic data generation market

- To analyze the impact of recession in the synthetic data generation market across all the regions

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company's specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic Analysis:

- Further breakup of the North American synthetic data generation market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle East & Africa market

Growth opportunities and latent adjacency in Synthetic Data Generation Market