Tag Management System Market by Component (Tools and Services), Application (User Experience Management, Risk & Compliance Management, Content Management, Campaign Management), Deployment Type, Organization Size, Vertical - Global Forecast to 2023

The overall tag management system market is expected to grow from USD 569.5 million in 2017 to USD 1.28 billion by 2023, at a CAGR of 14.2% from 2018 to 2023. Tag management tools usually provide graphical user interfaces (GUIs) that marketing, or business professionals can manage. Tag management system tools can also help companies comply with ‘do-not-track’ preferences and other privacy standards in their data collection. An increasing need for established data governance policies, delivering better customer experience, and ability to create a cohesive ecosystem are expected to drive the growth of tag management system tools and services. The base year considered for the study is 2017, and the forecast has been provided for the period between 2018 and 2023.

Market Dynamics

Drivers

- Rising need for established data governance policies

- Delivering better customer experience

- Ability to create a cohesive ecosystem

Restraints

- Proliferation of digital and web-based marketing technologies

Opportunities

- Real-time mobile app marketing opportunity

- Leveraging customized tag management systems

Challenges

- Issues related to ownership of tags

- Lack of advanced technological expertise and knowledge among marketers

Real-time marketing app strategies and leveraging new advanced breed of tag management solutions are expected to drive the growth tag management system tools.

Tag management tools usually provide graphical user interfaces (GUIs) that marketing, or business professionals can manage. Tag management system tools can also help companies comply with ‘do-not-track’ preferences and other privacy standards in their data collection. An increasing need for established data governance policies, delivering better customer experience, and ability to create a cohesive ecosystem are expected to drive the growth of tag management system tools and services. Proliferation of digital and web-based technologies, ownership of tags, and advanced technical knowledge and expertise are expected to limit the growth of global tag management system market. In addition, the retail and eCommerce deals with a large amount of customer data, through which it provides personalized experiences to its customers. The growth in mobile data consumption and in the usage of smartphones and tablets is expected to spur the demand for mobility solutions in the retail sector. This data is used for digital marketing by predicting the customers’ behaviors and patterns. Therefore, the ever-growing retail and eCommerce industry drives the growth of tag mamnagement systems market.

To know about the assumptions considered for the study, download the pdf brochure

The following are the major objectives of the study.

- To define, describe, and forecast the global tag management system market on the basis of components, applications, organization sizes, deployment types, verticals, and regions

- To provide a detailed information regarding the major factors influencing the growth of the tag management system market (drivers, restraints, opportunities, and challenges)

- To strategically analyze each subsegment with respect to individual growth trends, future prospects, and contribution to the total tag management system market

- To forecast the market size of the segments with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the tag management system market

- To strategically profile the key players of the tag management system market and comprehensively analyze their core competencies1 in the market

- To track and analyze competitive developments, such as new product launches, mergers and acquisitions, venture capital investments, partnerships, agreements, and collaborations in the global tag management system market

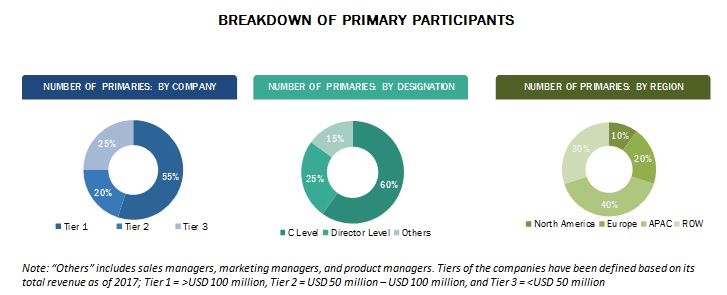

During this research study, major players operating in the tag management systems market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

The major Tag management system technology market vendors include Google (US), IBM (US), Adobe (US), Tealium (US), Ensighten (US), Adform (Denmark), AT Internet (France), Commanders Act (France), Datalicious (Australia), Matomo (US), Mezzobit (US), Qubit (UK), Relay 42 (Netherlands), Segment (US), Signal (US), Sizmek (US), Piwik Pro (US), and Innocraft (New Zealand). These players have majorly adopted partnerships, agreements and collaborations, and new product launches as their key growth strategies to offer feature-rich blockchain technology solutions to customers and further penetrate into untapped regions.

Major Market Developments

- In April 2018, Segment launched new GDPR tools that enable companies to make a single delete or suppression request, rather than having to submit multiple requests with the different marketing and advertising firms handling their data. With these tools, businesses can manage their end-users’ requests via a simple user interface or through an API, and these requests would be forwarded to support Segment integrations.

- In May 2018, Tealium partnered with major cloud computing platforms, including Amazon, Google, and Microsoft. The integration enabled clients to collect customer interaction data and stream it in the real time to cloud-based infrastructure for analysis.

- In September 2017, Sizmek acquired Rocket Fuel, a marketing and advertising technology provider based in California, US. This acquisition enabled Sizmek to combine Rocket Fuel’s AI-powered predictive marketing software, Demand-Side Platform (DSP), and Data Management Platform (DMP) with Sizmek’s Dynamic Creative Optimization (DCO) and SaaS capabilities.

Target Audience:

- Advertising and media agencies

- Tag management system technology vendors

- Network solution providers

- Independent software vendors

- Consulting firms

- Customer analytics providers

- Value-Added Resellers (VARs)

- Data governance providers

- Communication service providers

- Web analytics providers

- Web content management providers

- Digital marketing providers

Report Scope:

By Component:

- Tools

- Services

By Application:

- Campaign Management

- User Experience Management

- Content Management

- Risk and Compliance Management

- Others

By Organization Size:

- Large Enterprises

- SMBs

By Deployment Type:

- Cloud

- On-premises

By Vertical:

- BFSI

- Telecommunication and IT

- Retail and eCommerce

- Healthcare

- Manufacturing

- Media and Entertainment

- Others

By Geography:

- North America

- Europe

- Asia Pacific (APAC)

-

Rest of the World (RoW)

Critical questions which the report answers

- What are new application areas which the tag management system companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall tag management system market is expected to grow from USD 661.9 million in 2018 to USD 1.28 billion by 2023 at a CAGR of 14.2%. The rising need for established data governance policies, delivering better customer experience and ability to create a cohesive ecosystem are the key factors driving the growth of this market.

Tags are code snippets placed on a web page to track visitor activity and integrate third-party elements, such as social media updates and ads, on the webpage. Tag management system helps manage these multiple tags on a page through one single container tag, which prioritizes and fires individual tags when appropriate. The tag management system increases a website’s speed and performance by loading details faster, thereby enhancing customer experience. The Tag management system provides organizations a competitive edge by allowing marketing or other professionals to deploy new digital marketing technologies that require tags with less dependence on IT processes, thus accelerating the speed to market.

The tag management system market has been segmented, on the basis of application, into campaign management, user experience management, content management, risk and compliance management and others. The campaign management market is expected to grow at the highest CAGR between 2018 and 2023. As the marketers increase the number of marketing channels, the number of tags for these also increases, requiring significant resources to manage and execute these tags efficiently and effectively to track and sync customer data to third-party tools. Tag management tools help reduce the complexity for both marketing and IT teams enabling them to launch their marketing campaigns faster. The high adoption of tag management systems for campaign management application contribute to the rapid growth of the market.

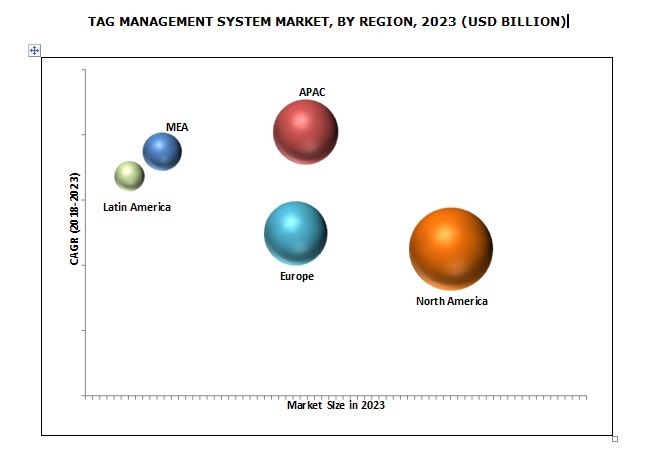

The tag management system market in APAC is expected to grow at the highest CAGR during the forecast period. APAC is the fastest-growing market for tag management system. The tag management market in Asia Pacific is expected to be driven by the presence of half of the world’s smartphone users, the highest number of social media users, also the rising trend of online shopping, and the evolving internet connectivity. All these factors are expected to contribute to the growth of the digital marketing tools in this region. As a result, APAC holds a significant share of the overall tag management system market.

Tag management system applications in campaign management, user experience management and risk and compliance management drive the growth of the market

Retail and eCommerce

For retail and eCommerce companies, detailed insights about their visitors and prospective customers are priceless. Hence, these companies are deploying and formulating many marketing strategies to an increase in revenue with in conversion rates. Retail sector is expected to be one of the fastest-growing sectors, due to the rising consumers’ purchasing power. Thus, the retail sector is attracting major companies around the world. The retail and eCommerce deals with a large amount of customer data, through which it provides personalized experiences to its customers.

Media and Entertainment

The media and entertainment vertical has undergone numerous transformations over the last couple for decades, with regards to the generation, management, and distribution of content. A substantial need for managing the web content among publishers, broadcasters, and media portal providers to offer online audience with contextual experiences, has been prominent lately. Proper marketing helps in routing these contents in a client desired manner without leading to the loss of sensitive digital content.

BFSI

The BFSI organizations are focusing on web-based digital technologies to offer customers easy-to-use and customer friendly banking services. The BFSI vertical has witnessed high growth due to the globalization of financial services. Financial institutions are focusing on building enhanced customer relationships by reaching out maximum possible customers through multiple channels, such as internet, email, applications, and smartphones. Thus, the rise in digital marketing across BFSI organizations is expected to be a noteworthy contributor to the growth of tag management market.

Healthcare

Healthcare and life sciences organizations are focusing on delivering better outcomes. Data security while meeting the important standards to safeguard individual’s data is a major challenge for them. Despite the bottlenecks, digital marketing is said to be rapidly gaining traction in the healthcare and life sciences vertical, with an increasing demand for organizing and streamlining the marketing tasks and the shifting interest of online users and mobile users. Hence, the tools integrated with social platforms are highly leveraged in the vertical to form healthcare communities, share their opinions, and win competitions, and for data analysis and interpretation.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for tag management system?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The proliferation of digital and web-based marketing technologies is a major factor restraining the growth of the market. The number of web-based and digital technologies delivering customer experience has significantly grown from about 150 in 2011 to nearly 2,000 by 2015, and it is expected to be 5,000 in the current year. As the number of marketing technologies rises, the adoption rate of such new technologies across enterprises also increases, due to which brands are under pressure to have maximum flexibility to both deploy and get value from new technologies in real time to maintain the needed competitive edge. Integrating tag management system on mobile apps provides tag management system providers with huge opportunity to prosper in this market. Tag management systems assist companies and marketers in removing extra code for creating intelligent rules for tag loading and for providing a high-speed architecture for tag delivery. This enhances site performance by loading pages faster and making the launch of key solutions and campaigns easier than ever before. This accelerates the time to market.

The major Tag management system technology market vendors include Google (US), IBM (US), Adobe (US), Tealium (US), Ensighten (US), Adform (Denmark), AT Internet (France), Commanders Act (France), Datalicious (Australia), Matomo (US), Mezzobit (US), Qubit (UK), Relay 42 (Netherlands), Segment (US), Signal (US), Sizmek (US), Piwik Pro (US), and Innocraft (New Zealand). These players have majorly adopted partnerships, agreements and collaborations, and new product launches as their key growth strategies to offer feature-rich blockchain technology solutions to customers and further penetrate into untapped regions.

Frequently Asked Questions (FAQ):

How big is the Tag Management System Market?

What is growth rate of the Tag Management System Market?

What are the top trends in Tag Management System Market?

Who are the key players in Tag Management System Market?

Who will be the leading hub for Tag Management System Market?

What are the top opportunities in Tag Management System Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primary Interviews

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Market Opportunities in the Tag Management System Market

4.2 Market By Component

4.3 Market By Application

4.4 Market By Vertical

4.5 Market By Organization Size

4.6 Market By Region

4.7 Market By Deployment Type

5 Market Overview and Industry Trends (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Need for Established Data Governance Policies

5.2.1.2 Delivering Better Customer Experience

5.2.1.3 Ability to Create A Cohesive Ecosystem

5.2.2 Restraints

5.2.2.1 Proliferation of Digital and Web-Based Marketing Technologies

5.2.3 Opportunities

5.2.3.1 Real-Time Mobile App Marketing Opportunity

5.2.3.2 Leveraging Customized Tag Management Systems

5.2.4 Challenges

5.2.4.1 Issues Related to Ownership of Tags

5.2.4.2 Lack of Advanced Technological Expertise and Knowledge Among Marketers

5.3 Tag Management System Technologies

5.3.1 Data Quality

5.3.2 Data Governance

5.3.3 Customer Analytics

5.3.4 Web Analytics

5.3.5 Artificial Intelligence

5.4 Regulatory Implications

5.4.1 General Data Protection Regulation (GDPR)

5.4.2 Can-Spam

5.4.3 EPRivacy Directive (EPR)

5.4.4 Governance, Risk, and Compliance (GRC)

6 Tag Management System Market, By Component (Page No. - 40)

6.1 Introduction

6.1.1 Tools

6.1.2 Services

6.1.3 Managed Services

6.1.4 Professional Services

6.1.5 Consulting Services

6.1.6 Support and Maintenance Services

7 Market By Application (Page No. - 47)

7.1 Introduction

7.1.1 Campaign Management

7.1.2 User Experience Management

7.1.3 Content Management

7.1.4 Risk and Compliance Management

7.1.5 Others

8 Tag Management System Market, By Organization Size (Page No. - 53)

8.1 Introduction

8.1.1 Large Enterprises

8.1.2 Small and Medium-Sized Enterprises

9 Market By Deployment Type (Page No. - 57)

9.1 Introduction

9.1.1 Cloud

9.1.2 On-Premises

10 Market By Vertical (Page No. - 61)

10.1 Introduction

10.2 Banking, Financial Services, and Insurance

10.3 Telecommunication and It

10.4 Retail and Ecommerce

10.5 Healthcare

10.6 Manufacturing

10.7 Media and Entertainment

10.8 Others

11 Tag Management System Market, By Region (Page No. - 69)

11.1 Introduction

11.2 North America

11.2.1 North America, By Country

11.2.1.1 United States

11.2.1.2 Canada

11.2.2 North America, By Component

11.2.3 North America, By Service

11.2.4 North America, By Professional Service

11.2.5 North America, By Application

11.2.6 North America, By Deployment Type

11.2.7 North America, By Organization Size

11.2.8 North America, By Vertical

11.3 Europe

11.3.1 Europe, By Country

11.3.1.1 United Kingdom

11.3.1.2 Germany

11.3.1.3 France

11.3.1.4 Rest of Europe

11.3.2 Europe, By Component

11.3.3 Europe, By Service

11.3.4 Europe, By Professional Service

11.3.5 Europe, By Application

11.3.6 Europe, By Deployment Type

11.3.7 Europe, By Organization Size

11.3.8 Europe, By Vertical

11.4 Asia Pacific

11.4.1 Asia Pacific, By Country

11.4.1.1 Japan

11.4.1.2 India

11.4.1.3 Singapore

11.4.1.4 Rest of Asia Pacific

11.4.2 Asia Pacific, By Component

11.4.3 Asia Pacific, By Service

11.4.4 Asia Pacific, By Professional Service

11.4.5 Asia Pacific, By Application

11.4.6 Asia Pacific, By Deployment Type

11.4.7 Asia Pacific, By Organization Size

11.4.8 Asia Pacific, By Vertical

11.5 Latin America

11.5.1 Latin America, By Country

11.5.1.1 Mexico

11.5.1.2 Brazil

11.5.1.3 Rest of Latin America

11.5.2 Latin America, By Component

11.5.3 Latin America, By Service

11.5.4 Latin America, By Professional Service

11.5.5 Latin America, By Application

11.5.6 Latin America, By Deployment Type

11.5.7 Latin America, By Organization Size

11.5.8 Latin America, By Vertical

11.5.9 Middle East and Africa

11.5.9.1 Middle East

11.5.9.2 Africa

11.5.10 Middle East and Africa, By Component

11.5.11 Middle East and Africa, By Service

11.5.12 Middle East and Africa, By Professional Service

11.5.13 Middle East and Africa, By Application

11.5.14 Middle East and Africa, By Deployment Type

11.5.15 Middle East and Africa, By Organization Size

11.5.16 Middle East and Africa, By Vertical

12 Competitive Landscape (Page No. - 98)

12.1 Overview

12.2 Tag Management System Market: Prominent Players

12.3 Key Players in the Market

12.4 Competitive Scenario

12.4.1 New Product Launches and Product Upgradations

12.4.2 Partnerships and Collaborations

12.4.3 Acquisitions

12.4.4 Business Expansions

13 Company Profiles (Page No. - 103)

(Business Overview, Tools Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Google

13.2 IBM

13.3 Adobe

13.4 Tealium

13.5 Ensighten

13.6 Adform

13.7 AT Internet

13.8 Commanders Act

13.9 Piwik Pro

13.10 Datalicious

13.11 Innocraft

13.12 Mezzobit

13.13 Oracle

13.14 Qubit

13.15 Relay42

13.16 Segment

13.17 Signal

*Business Overview, Tools Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 135)

14.1 Key Insights of Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.4 Introducing RT: Real-Time Market Intelligence

14.5 Available Customization

14.6 Related Reports

14.7 Author Details

List of Tables (76 Tables)

Table 1 Tag Management System Market Size and Growth Rate, 2016–2023 (USD Million, Y-O-Y %)

Table 2 Market Size By Type, 2016–2023 (USD Million)

Table 3 Tools: Market Size By Region, 2016–2023 (USD Million)

Table 4 Services: Market Size By Region, 2016–2023 (USD Million)

Table 5 Services: Market Size By Type, 2016–2023 (USD Million)

Table 6 Managed Services: Market Size By Region, 2016–2023 (USD Million)

Table 7 Professional Services: Market Size By Region, 2016–2023 (USD Million)

Table 8 Tag Management System Market Size, By Professional Service, 2016–2023 (USD Million)

Table 9 Professional Services: Market Size By Region, 2016–2023 (USD Million)

Table 10 Consulting Services: Market Size By Region, 2016–2023 (USD Million)

Table 11 Support and Maintenance Services: Market Size By Region, 2016–2023 (USD Million)

Table 12 Tag Management System Market Size, By Application, 2016–2023 (USD Million)

Table 13 Campaign Management: Market Size By Region, 2016–2023 (USD Million)

Table 14 User Experience Management: Market Size By Region, 2016–2023 (USD Million)

Table 15 Content Management: Market Size By Region, 2016–2023 (USD Million)

Table 16 Risk and Compliance Management: Market Size By Region, 2016–2023 (USD Million)

Table 17 Others: Market Size By Region, 2016–2023 (USD Million)

Table 18 Tag Management System Market Size, By Organization Size, 2016–2023 (USD Million)

Table 19 Large Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 20 Small and Medium-Sized Enterprises: Market Size By Region, 2016–2023 (USD Million)

Table 21 Market Size By Deployment Type, 2016–2023 (USD Million)

Table 22 Cloud: Market Size By Region, 2016–2023 (USD Million)

Table 23 on Premises: Market Size By Region, 2016–2023 (USD Million)

Table 24 Tag Management System Market Size, By Vertical, 2016–2023 (USD Million)

Table 25 Banking, Financial Services, and Insurance: Market Size By Region, 2018–2023 (USD Million)

Table 26 Telecommunication and It: Market Size By Region, 2016–2023 (USD Million)

Table 27 Retail and Ecommerce: Market Size By Region, 2016–2023 (USD Million)

Table 28 Healthcare and Life Sciences: Market Size By Region, 2016–2023 (USD Million)

Table 29 Manufacturing: Market Size By Region, 2016–2023 (USD Million)

Table 30 Media and Entertainment: Market Size By Region, 2016–2023 (USD Million)

Table 31 Others: Market Size By Region, 2016–2023 (USD Million)

Table 32 Market Size By Region, 2016–2023 (USD Million)

Table 33 North America: Tag Management System Market Size, By Country, 2016–2023 (USD Million)

Table 34 North America: Market Size By Component, 2016–2023 (USD Million)

Table 35 North America: Market Size By Service, 2016–2023 (USD Million)

Table 36 North America: Market Size By Professional Service, 2016–2023 (USD Million)

Table 37 North America: Market Size By Application, 2016–2023 (USD Million)

Table 38 North America: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 39 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 40 North America: Market Size By Vertical, 2016–2023 (USD Million)

Table 41 Europe: Tag Management System Market Size, By Country, 2016–2023 (USD Million)

Table 42 Europe: Market Size By Component, 2016–2023 (USD Million)

Table 43 Europe: Market Size By Service, 2016–2023 (USD Million)

Table 44 Europe: Market Size By Professional Service, 2016–2023 (USD Million)

Table 45 Europe: Market Size By Application, 2016–2023 (USD Million)

Table 46 Europe: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 47 Europe: Market Size By Organization Size, 2016–2023 (USD Million)

Table 48 Europe: Market Size By Vertical, 2016–2023 (USD Million)

Table 49 Asia Pacific: Tag Management System Market Size, By Country, 2016–2023 (USD Million)

Table 50 Asia Pacific: Market Size By Component, 2016–2023 (USD Million)

Table 51 Asia Pacific: Market Size By Service, 2016–2023 (USD Million)

Table 52 Asia Pacific: Market Size By Professional Service, 2016–2023 (USD Million)

Table 53 Asia Pacific: Market Size By Application, 2016–2023 (USD Million)

Table 54 Asia Pacific: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 55 Asia Pacific: Market Size By Organization Size, 2016–2023 (USD Million)

Table 56 Asia Pacific: Market Size By Vertical, 2016–2023 (USD Million)

Table 57 Latin America: Tag Management System Market Size, By Country, 2016–2023 (USD Million)

Table 58 Latin America: Market Size By Component, 2016–2023 (USD Million)

Table 59 Latin America: Market Size By Service, 2016–2023 (USD Million)

Table 60 Latin America: Market Size By Professional Service, 2016–2023 (USD Million)

Table 61 Latin America: Market Size By Application, 2016–2023 (USD Million)

Table 62 Latin America: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 63 Latin America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 64 Latin America: Market Size By Vertical, 2016–2023 (USD Million)

Table 65 Middle East and Africa: Tag Management System Market Size, By Subregion, 2016–2023 (USD Million)

Table 66 Middle East and Africa: Market Size By Component, 2016–2023 (USD Million)

Table 67 Middle East and Africa: Market Size By Service, 2016–2023 (USD Million)

Table 68 Middle East and Africa: Market Size By Professional Service, 2016–2023 (USD Million)

Table 69 Middle East and Africa: Market Size By Application, 2016–2023 (USD Million)

Table 70 Middle East and Africa: Market Size By Deployment Type, 2016–2023 (USD Million)

Table 71 Middle East and Africa: Market Size By Organization Size, 2016–2023 (USD Million)

Table 72 Middle East and Africa: Market Size By Vertical, 2016–2023 (USD Million)

Table 73 New Product Launches and Product Upgradations, 2015–2018

Table 74 Partnerships and Collaborations, 2016–2018

Table 75 Acquisitions, 2014–2017

Table 76 Business Expansions, 2017

List of Figures (39 Figures)

Figure 1 Tag Management System Market Segmentation

Figure 2 Market Regional Segmentation

Figure 3 Market Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Data Triangulation

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Tag Management System Market: Assumption

Figure 9 User Experience Management Application and North America are Estimated to Hold the Largest Market Shares in 2018

Figure 10 Tag Management System Market Share, By Component, 2018

Figure 11 North America is Estimated to Hold the Largest Market Share in 2018

Figure 12 Increasing Adoption in Various Application Areas is Expected to Drive the Tag Management System Market During the Forecast Period

Figure 13 Services Segment is Expected to Grow at A Higher CAGR and Hold A Larger Market Share During the Forecast Period

Figure 14 User Experience Management is Expected to Hold the Largest Market Size During the Forecast Period

Figure 15 Retail and Ecommerce Vertical is Expected to Hold the Largest Market Size During the Forecast Period

Figure 16 Large Enterprises Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 17 North America Region is Estimated to Hold the Largest Market Share in 2018

Figure 18 Cloud Deployment Type is Estimated to Witness A Higher Adoption Rate in 2018

Figure 19 Tag Management System Market: Drivers, Restraints, Opportunities, and Challenges

Figure 20 Services Component is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 21 Managed Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 22 Consulting Services Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 23 Campaign Management Application is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 24 Small and Medium-Sized Enterprises Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 25 Cloud Deployment Type is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 26 Healthcare Vertical is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 28 North America: Market Snapshot

Figure 29 Asia Pacific: Market Snapshot

Figure 30 Key Developments By the Leading Players in the Tag Management System Market, 2015–2018

Figure 31 Google: Company Snapshot

Figure 32 Google: SWOT Analysis

Figure 33 IBM: Company Snapshot

Figure 34 IBM: SWOT Analysis

Figure 35 Adobe: Company Snapshot

Figure 36 Adobe: SWOT Analysis

Figure 37 Tealium: SWOT Analysis

Figure 38 Ensighten: SWOT Analysis

Figure 39 Oracle: Company Snapshot

Growth opportunities and latent adjacency in Tag Management System Market