Food Texture Market by Type (Cellulose Derivatives, Gums, Pectin, Gelatin, Starch, Inulin, Dextrin), Source, Form (Dry, Liquid), Application (Bakery & Confectionery Products, Dairy & Frozen Foods), Functionality and Region - Global Forecast to 2028

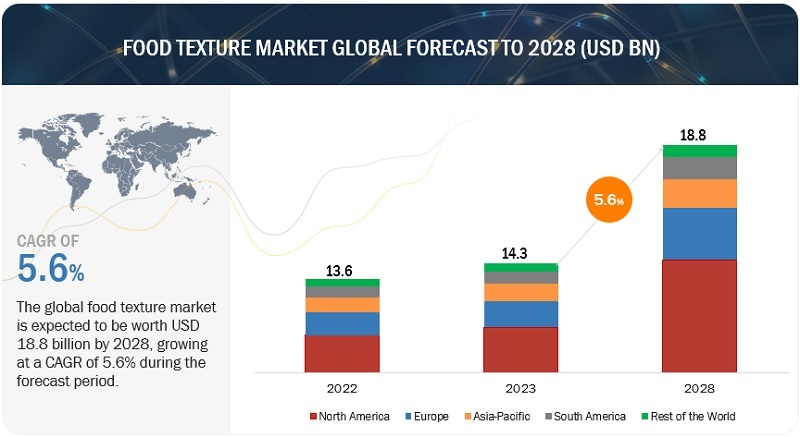

The global food texture market size was valued at USD 13.6 billion in 2022 and is poised to grow from USD 14.3 billion in 2023 to USD 18.8 billion by 2028, growing at a CAGR of 5.6% in the forecast period (2023-2028).This growth is primarily attributed to increasing consumer demand for diverse food experiences and textures. As consumers seek novel taste sensations and unique mouthfeel, food manufacturers are innovating to meet these preferences, thus driving the market's expansion as it responds to evolving consumer trends and demands. The food texture market refers to the industry that deals with the production and sale of food ingredients and additives that enhance or modify the texture of various food products.

The expanding business has offered lucrative business opportunities to the players who are operating in the market segments. For instance, in October 2022, Ajinomoto launched NIKUPLUS a meat texture stabilizer, which enhances its presence in the market. This innovative product improves meat texture, catering to the growing demand for high-quality meat products. It expands Ajinomoto's portfolio; meeting market needs efficiently. Other key players like Nexira have capitalized on this by making strategic acquisitions. For instance, Nexira's acquisition of UNIPEKTIN Ingredients Inc. showcases the industry's dynamism. This move allows Nexira to expand its product offerings, particularly in the field of locust bean gum, addressing the rising demand for diverse and innovative food texturizers. Such strategic maneuvers among players demonstrate their commitment to meeting evolving market needs and strengthening their positions in the competitive food texture market.

The overall market is classified as a competitive market, with the key players, namely ADM (US), International Flavors & Fragrances Inc. (US), Kerry Group PLC (Ireland), Ingredion (US), and Tate & Lyle (UK) occupying 40-45% of the market share.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Food Texture Market Dynamics

Drivers: Expansion of Convenience and Ready-to-Eat Food Products to Catalyze the Demand

The proliferation of convenience and ready-to-eat food products is a significant driver of the market. Busy lifestyles and changing consumer preferences have fueled the demand for easily accessible, time-saving meal options. Food texture additives play a crucial role in maintaining the quality, taste, and texture of these products. They ensure that convenience foods remain visually appealing and palatable, meeting consumer expectations. As the demand for such products continues to rise globally, the market is poised to grow substantially.

Restraints: Regulatory Complexities

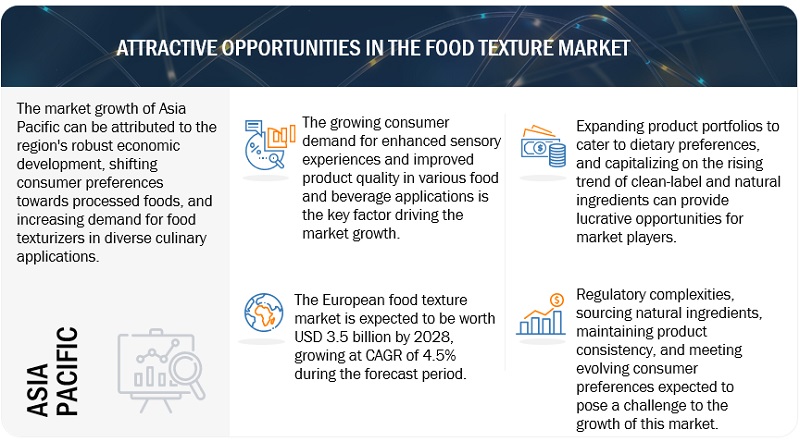

Regulatory complexities pose a substantial restraint in the food texture market. Different countries have varying regulations and standards for food additives, which can make it challenging for manufacturers to navigate international markets. Adhering to these regulations demands significant resources for testing and compliance. Additionally, the need to clearly label food products with texture-modifying additives presents a challenge, as consumers are becoming more cautious about what they consume, leading to greater scrutiny of ingredient lists.

Opportunities: Consumer Shift Towards Artisanal and Aesthetically Pleasing Cuisines

Consumers increasingly seek unique and visually appealing food presentations, especially in the context of fine dining and gourmet foods. Food texture additives can be leveraged to create innovative textures and appearances, enhancing the visual and tactile appeal of dishes. For example, in high-end gastronomy, chefs are exploring the use of texturizers to craft intricate textures that surprise and delight diners. This aligns with the trend of "molecular gastronomy," where texturizers like agar-agar or sodium alginate are employed to create artistic and memorable dining experiences. As more consumers embrace these culinary trends, there is a growing opportunity for food texture additives to play a crucial role in elevating the aesthetics of dishes and attracting discerning consumers seeking unique sensory experiences.

Challenges: Possible Unpleasant Impact of Food Texturizers on Taste and Other Sensory Attributes

Consumers often associate naturalness, taste, and overall sensory quality with food products. Introducing texturizers in formulations must be carefully balanced to avoid negatively impacting these attributes. Overuse or inappropriate selection of texturizers can lead to an undesirable aftertaste, altered flavor, or a perception of artificiality. Manufacturers face the challenge of maintaining a delicate equilibrium between achieving the desired texture and preserving the sensory characteristics that consumers value. Striking this balance is vital to ensure that food products with added texturizers not only meet functional requirements but also satisfy consumers' sensory expectations.

The Food Texture Market Ecosystem

By type, the dextrin segment is projected to grow with the second-highest CAGR in the food texture market during the forecast period.

Dextrins are carbohydrate-based additives known for their ability to modify the texture of various food products. They are utilized in a multitude of applications, including as thickening agents, stabilizers, and binding agents. Dextrins offer several advantages, such as improving the viscosity and texture of food items, making them highly sought after by manufacturers looking to enhance the mouthfeel and overall quality of their products. This versatility and effectiveness across different food categories are driving the growth of the Dextrin segment in the food texture market.

By source, the synthetic segment is projected to grow with the second-highest CAGR in the food texture market during the forecast period.

Synthetic food texture modifiers offer a cost-effective and readily available solution for manufacturers. They can be precisely formulated to achieve specific texture attributes, providing consistency in texture across various batches of products. Synthetic additives often have a longer shelf life, ensuring product stability and reducing waste. Some synthetic texture-modifying ingredients offer unique properties that are difficult to replicate with natural sources, making them indispensable for certain applications in the food industry. These factors collectively contribute to the anticipated growth of the synthetic segment in the food texture market.

By form, the liquid segment accounts second-highest market share in the food texture market.

Consumers are increasingly drawn to liquid or beverage-based products that offer convenience and functionality, such as meal replacement shakes, smoothies, and functional beverages. These liquid products often require specific texture modifications to enhance mouthfeel, viscosity, and overall sensory appeal. Moreover, the rising demand for plant-based and dairy alternatives has driven innovation in liquid food textures, leading to developments like creamy non-dairy milk alternatives and protein-rich liquid meal replacements.

By application, the beverages segment accounts significant market share in the food texture market.

Consumers are increasingly looking for unique sensory experiences in their beverages. Texture plays a pivotal role in enhancing the overall drinking experience, from smooth and creamy textures in dairy-based beverages to the satisfying crunch in fruit juices with added pulp. Manufacturers are responding to this demand by incorporating various texture-modifying ingredients to create novel and appealing sensations. The growing market for functional beverages, such as protein shakes and meal replacement drinks, necessitates specific textures to maintain product integrity and provide a pleasant mouthfeel. These factors are driving the adoption of texture-enhancing solutions in the beverage industry, contributing to the projected growth in this segment.

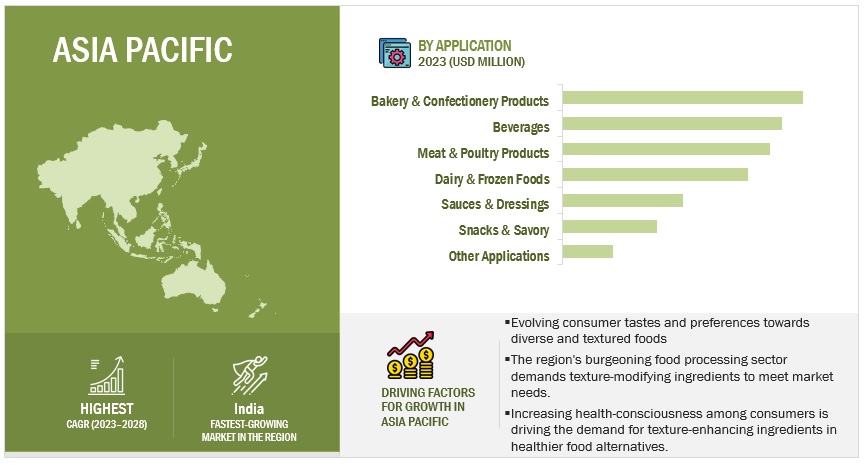

Asia Pacific is poised to experience the highest CAGR in the food texture market during the forecast period.

The region's robust economic growth has led to an increase in disposable income, enabling consumers to explore a wider range of food options, including those with diverse textures. The burgeoning food processing industry in the Asia Pacific demands texture-modifying ingredients to meet the diverse tastes and preferences of consumers. Additionally, the region's rich culinary heritage encourages experimentation with food textures, contributing to market growth. Lastly, the growing awareness of health and wellness has prompted consumers to seek out healthier food alternatives, driving the demand for texture-enhancing ingredients in the region's food products.

Asia Pacific: Food Texture Market Snapshot

Key Market Players

Key players in this market include Ajinomoto Co Inc. (Japan), ADM (US), Ashland (US), IFF (US), Cargill (US), Tate & Lyle (UK), Avebe (Netherlands), CP Kelco (US), Kerry Group plc (Ireland), DSM (Netherlands), Ingredion (US), Estelle Chemicals Pvt. Ltd (India), Fiberstar, Inc. (US), Riken Vitamin Co., Ltd. (Japan), and Levapan S.A. (Colombia).

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (Kilo Ton) |

|

Segments Covered |

Type, Source, Form, Application, Functionality, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Rest of the World |

|

Companies studied |

|

Report Scope:

By Type

- Cellulose Derivatives

- Gums

- Pectin

- Gelatin

- Starch

- Inulin

- Dextrin

- Other Types

By Source

- Natural

- Synthetic

By Form

- Dry

- Liquid

By Application

- Bakery & Confectionery Products

- Dairy & Frozen Foods

- Meat & Poultry Products

- Beverages

- Snacks & Savory

- Sauces & Dressings

- Other Applications

By Functionality

- Thickening

- Gelling

- Emulsifying

- Stabilizing

- Other Functionalities

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World

Recent Developments

- In September 2023, Tate & Lyle partnered with IMCD in Finland and the Baltic region, expanding their ingredient distribution. This collaboration will help Tate & Lyle expand the geographical reach of its food textures to Finland and the Baltic region thereby expanding its market share.

- In May 2023, Ajinomoto Co., Inc. entered a strategic alliance with Solar Foods to utilize Solein, a CO2-fed microbial protein, and conduct market feasibility studies in Singapore from fiscal 2024.

- In January 2023, ADM's acquisition of Kansas Protein Foods strengthened its position in the food texture market. This strategic move brings flexibility and capacity to unflavored textured soy protein, flavored alternatives, and non-GMO proteins.

Frequently Asked Questions (FAQ):

How big is the food texture market?

The global food texture market size is expected to increase from a predicted USD 14.3 billion in 2023 to USD 18.8 billion by 2028 at a CAGR of 5.6%.

Which players are involved in the manufacturing of food texture market?

Major Players Profiled: Ajinomoto Co Inc. (Japan), ADM (US), Ashland (US), IFF (US), Cargill (US), Tate & Lyle (UK), Avebe (Netherlands), CP Kelco (US), Kerry Group plc (Ireland), DSM (Netherlands), Ingredion (US), Estelle Chemicals Pvt. Ltd (India), Fiberstar, Inc. (US), Riken Vitamin Co., Ltd. (Japan), and Levapan S.A. (Colombia).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for food texture market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of food texture market?

Factors that can influence the growth potential of the food texture market may include changing consumer preferences, technological advancements in food processing, innovations in texture-modifying ingredients, and global trends in the food and beverage industry.

Why is food texture important?

Food texture is important because it influences our overall dining experience, affecting factors such as enjoyment, satisfaction, and even digestion. Texture adds variety to the sensory aspects of food, enhancing flavor perception and creating a more pleasurable eating experience.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASE IN RETAIL SALESGROWTH OPPORTUNITIES IN ASIA PACIFIC AND SOUTH AMERICA

-

5.3 MARKET DYNAMICSDRIVERS- Expansion of convenience and ready-to-eat food products to catalyze demand- Rise in demand for clean-label products and consumer health & wellness trends- Multifunctionality of food texturizers to lead to wide range of applicationsRESTRAINTS- Limited raw material availability and price fluctuations- Cultural restriction on gelatin consumptionOPPORTUNITIES- Consumer shift toward artisanal and aesthetically pleasing cuisines- Increase in R&D investments for alternate sources of food texturizersCHALLENGES- Lack of regulatory harmonization- Possible unpleasant impacts of food texturizers on taste and other sensory attributes

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGDISTRIBUTIONMARKETING & SALES

-

6.3 TECHNOLOGY ANALYSISBREWER’S SPENT YEAST CELL WALL POLYSACCHARIDES AS POTENTIAL SOURCECROSSLINKING OF POLYSACCHARIDES

-

6.4 PRICING ANALYSIS: FOOD TEXTURE MARKETAVERAGE SELLING PRICE TREND, BY TYPE

-

6.5 MARKET MAP AND ECOSYSTEM OF FOOD TEXTURIZERSDEMAND SIDESUPPLY SIDE

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.7 FOOD TEXTURE MARKET: PATENT ANALYSIS

-

6.8 TRADE ANALYSISCELLULOSE AND ITS CHEMICAL DERIVATIVESPECTIN, PECTINATES, AGAR AGAR, AND OTHER MUCILAGES AND THICKENERS DERIVED FROM VEGETABLE PRODUCTSGELATIN, 2022STARCHES AND INULIN, 2022DEXTRINS AND OTHER MODIFIED STARCHES, 2022

- 6.9 KEY CONFERENCES AND EVENTS

-

6.10 TARIFF AND REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPEAN UNIONASIA PACIFIC- China- Japan- India- South KoreaSOUTH AMERICA- Brazil- Colombia

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.13 CASE STUDIESTATE & LYLE: ACQUISITION OF NUTRIATIINTERNATIONAL FLAVORS & FRAGRANCES INC.: LAUNCH OF SEAFLOUR

- 7.1 INTRODUCTION

-

7.2 CELLULOSE DERIVATIVESMULTIPLE PROPERTIES OF CELLULOSE DERIVATIVES TO MAKE THEM POPULAR TEXTURIZERS

-

7.3 GUMSENHANCED TEXTURE ALONG WITH LOWER CALORIE VALUE OFFERED BY GUMS TO DRIVE MARKET

-

7.4 PECTINDISTINCT CHARACTERISTICS, SUCH AS NATURAL VEGAN HYDROCOLLOID AND POTENTIAL TO GENERATE DIVERSE VISCOELASTIC SOLUTIONS, TO DRIVE DEMAND

-

7.5 GELATINWIDE USE OF GELATIN IN VARIOUS FOOD APPLICATIONS TO DRIVE MARKET GROWTH

-

7.6 STARCHADAPTABILITY AND TEXTURIZING PROPERTIES OF STARCH TO DRIVE MARKET

-

7.7 INULINRISE IN CHEESE CONSUMPTION TO DRIVE DEMAND FOR INULIN

-

7.8 DEXTRINDUAL ROLE OF DEXTRIN TO MAKE IT VALUABLE TEXTURIZER IN FOOD INDUSTRY

- 7.9 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 NATURALGROWING CLEAN LABEL TRENDS IN DEVELOPED MARKETS TO DRIVE DEMAND FOR FOOD TEXTURIZING AGENTS

-

8.3 SYNTHETICBETTER POTENCY, RESISTANCE TO MICROBIAL DEGRADATION, AND SOLUTION CLARITY TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 DRYENHANCING CULINARY DELIGHTS WITH DRY FORM FOOD TEXTURIZERS TO DRIVE MARKET

-

9.3 LIQUIDELEVATING TEXTURE AND CONSISTENCY IN LIQUID DELIGHTS WITH WET FOOD TEXTURIZERS TO DRIVE DEMAND

- 10.1 INTRODUCTION

-

10.2 BAKERY & CONFECTIONERY PRODUCTSIMPROVED QUALITY AND ENHANCED FUNCTIONALITIES OF CONFECTIONERY ITEMS AND BAKED FOODS TO HELP SUSTAIN MARKET

-

10.3 DAIRY & FROZEN FOODSRISING TREND OF PROVIDING CUSTOMIZED SOLUTIONS FOR DAIRY FOODS TO DRIVE MARKET GROWTH

-

10.4 MEAT & POULTRY PRODUCTSNOVEL APPLICATIONS FOR TEXTURIZING AGENTS IN MEAT & POULTRY PRODUCTS TO DRIVE MARKET GROWTH

-

10.5 BEVERAGESGROWTH OF ENERGY DRINKS MARKET TO DRIVE DEMAND FOR TEXTURIZING AGENTS IN BEVERAGE APPLICATIONS

-

10.6 SNACKS & SAVORYBUSY CONSUMER LIFESTYLES TO DRIVE MARKET FOR FOOD TEXTURIZERS FOR SNACKS AND SAVORY APPLICATIONS

-

10.7 SAUCES & DRESSINGSCHANGING CONSUMERS’ FOOD CHOICES TO DRIVE MARKET GROWTH FOR SAUCES & DRESSINGS

- 10.8 OTHER APPLICATIONS

- 11.1 INTRODUCTION

-

11.2 STABILIZINGHIGH USAGE OF FOOD TEXTURIZERS AS STABILIZING AGENTS IN SALAD DRESSINGS AND SAUCES TO DRIVE MARKET

-

11.3 THICKENINGRISING CONSUMPTION OF MEAT AND MEAT ALTERNATIVES TO DRIVE DEMAND FOR FOOD TEXTURIZERS AS THICKENERS

-

11.4 GELLINGRISING CONSUMPTION OF DAIRY PRODUCTS AND INSTANCES OF CHRONIC DISEASE TO DRIVE DEMAND FOR GELLING PROPERTIES OF FOOD TEXTURIZERS

-

11.5 EMULSIFYINGUSAGE OF FOOD TEXTURIZERS WITH EMULSIFYING FUNCTIONALITY TO BE DRIVEN BY PROPERTIES SUCH AS OVERALL DURABILITY, QUALITY, AND TEXTURE APPEAL

- 11.6 OTHER FUNCTIONALITIES

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Prominent presence of key playersCANADA- Demand for starch and agar with shift toward natural ingredientsMEXICO- Rise in consumption of dairy products

-

12.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISTURKEY- High production and consumption of gelatin, coupled with fast-growing bakery & confectionery industryUK- Leading manufacturer in food & drink sectorGERMANY- Increase in consumer demand for diverse and premium bakery productsFRANCE- Growth in consumer preference for natural, clean label productsITALY- Rise in awareness of balanced nutrition and healthier Italian food optionsSPAIN- Demand for natural, healthier processed food with growth in economyREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Consumer demand for innovative textures with rise in affluence and digitalizationINDIA- Increase in demand for healthy processed food productsSOUTH KOREA- Continued adapting to changing lifestyles and health prioritiesAUSTRALIA & NEW ZEALAND- Consumption of beverages to increase demand from different preservative manufacturersJAPAN- Popularity of ready-to-eat and convenience foodsREST OF ASIA PACIFIC

-

12.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Increase in preference for healthier, low-fat, and low-sugar alternatives, aligning with global food trendsARGENTINA- Demand for plant-based alternatives and healthier food optionsCOLOMBIA- Increase in demand for processed cheese and plant-based alternativesREST OF SOUTH AMERICA

-

12.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISMIDDLE EAST- Rise in demand for nutritional labelingAFRICA- Evolving consumer preferences, increasing demand for processed foods, health consciousness, and rich biodiversity

-

13.1 INTRODUCTIONOVERVIEW

- 13.2 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- 13.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.4 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS

- 13.5 ANNUAL REVENUE VS. REVENUE GROWTH

- 13.6 EBITDA OF KEY PLAYERS

- 13.7 GLOBAL SNAPSHOT OF KEY PARTICIPANTS

-

13.8 COMPANY EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 13.9 COMPANY FOOTPRINT

-

13.10 COMPANY EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.11 COMPETITIVE BENCHMARKING

-

13.12 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY PLAYERSAJINOMOTO CO., INC.- Business overview- Products offered- Recent developments- MnM viewADM- Business overview- Products offered- Recent developments- MnM viewTATE & LYLE- Business overview- Products offered- Recent developments- MnM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products offered- Recent developments- MnM viewCARGILL, INCORPORATED- Business overview- Products offered- Recent developments- MnM viewASHLAND- Business overview- Products offered- Recent developments- MnM viewAVEBE- Business overview- Products offered- Recent developments- MnM viewCP KELCO U.S., INC.- Business overview- Products offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products offered- Recent developments- MnM viewDSM- Business overview- Products offered- Recent developments- MnM viewINGREDION- Business overview- Products offered- Recent developments- MnM viewESTELLE CHEMICALS PVT. LTD.- Business overview- Products offered- Recent developments- MnM viewFIBERSTAR, INC.- Business overview- Products Offered- Recent developments- MnM viewRIKEN VITAMIN CO., LTD.- Business overview- Products offered- Recent developments- MnM viewLEVAPAN S.A.- Business overview- Products offered- Recent developments- MnM view

-

14.2 STARTUPS/SMESNEXIRA- Business overview- Products offered- Recent Developments- MnM viewPALSGAARD- Business overview- Products offered- Recent developments- MnM viewPURATOS- Business overview- Products offered- Recent developments- MnM viewNATUREX- Business overview- Products offered- Recent developments- MnM viewROQUETTE FRÈRES- Business overview- Products offered- Recent developments- MnM viewBHANSALI INTERNATIONALB & V SRLALTRAFINE GUMSAGARMEXAGAR DEL PACIFICO S.A.

- 15.1 INTRODUCTION

- 15.2 RESEARCH LIMITATIONS

-

15.3 GLOBAL HYDROCOLLOIDS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 SPECIALTY INGREDIENTS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 FOOD TEXTURE MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 APPLICATIONS AND FUNCTIONALITIES OF FOOD TEXTURIZERS

- TABLE 4 FOOD TEXTURE MARKET: AVERAGE SELLING PRICE TREND, BY TYPE, 2020–2022 (USD/TON)

- TABLE 5 CELLULOSE DERIVATIVES: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 6 GUMS: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 7 PECTIN: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 8 GELATIN: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 9 STARCH: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 10 INULIN: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 11 DEXTRIN: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 12 OTHER TYPES: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 13 FOOD TEXTURE MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 14 PATENTS PERTAINING TO FOOD TEXTURIZERS, 2022–2023

- TABLE 15 TOP 10 IMPORTERS AND EXPORTERS OF CELLULOSE AND ITS CHEMICAL DERIVATIVES, 2022 (USD THOUSAND)

- TABLE 16 TOP 10 IMPORTERS AND EXPORTERS OF PECTIN, PECTINATES, AGAR AGAR, AND OTHER MUCILAGES AND THICKENERS DERIVED FROM VEGETABLE PRODUCTS, 2022 (USD THOUSAND)

- TABLE 17 TOP 10 IMPORTERS AND EXPORTERS OF GELATIN AND ITS DERIVATIVES, 2022 (USD THOUSAND)

- TABLE 18 TOP 10 IMPORTERS AND EXPORTERS OF STARCHES AND INULIN, 2022 (USD THOUSAND)

- TABLE 19 TOP 10 IMPORTERS AND EXPORTERS OF DEXTRINS AND OTHER MODIFIED STARCHES, 2022 (USD THOUSAND)

- TABLE 20 KEY CONFERENCES AND EVENTS IN FOOD TEXTURE MARKET, 2023–2024

- TABLE 21 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 FOOD TEXTURE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SOURCES OF FOOD TEXTURIZERS (%)

- TABLE 26 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 27 FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 28 FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 29 FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 30 FOOD TEXTURE MARKET SIZE, BY TYPE, 2023–2028 (KT)

- TABLE 31 CELLULOSE DERIVATIVES: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 32 CELLULOSE DERIVATIVES: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 CELLULOSE DERIVATIVES: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 34 CELLULOSE DERIVATIVES: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 35 GUMS: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 GUMS: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 GUMS: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 38 GUMS: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 39 PECTIN: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 40 PECTIN: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 PECTIN: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 42 PECTIN: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 43 GELATIN: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 44 GELATIN: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 GELATIN: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 46 GELATIN: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 47 STARCH: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 48 STARCH: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 STARCH: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 50 STARCH: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 51 INULIN: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 52 INULIN: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 INULIN: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 54 INULIN: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 55 DEXTRIN: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 56 DEXTRIN: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 DEXTRIN: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 58 DEXTRIN: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 59 OTHER TYPES: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 60 OTHER TYPES: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 OTHER TYPES: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 62 OTHER TYPES: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 63 FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 64 FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 65 NATURAL: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 66 NATURAL: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 SYNTHETIC: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 68 SYNTHETIC: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 70 FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 71 DRY: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 72 DRY: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 LIQUID: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 74 LIQUID: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 76 FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 77 BAKERY & CONFECTIONERY PRODUCTS: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 78 BAKERY & CONFECTIONERY PRODUCTS: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 DAIRY & FROZEN FOODS: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 80 DAIRY & FROZEN FOODS: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 MEAT & POULTRY PRODUCTS: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 82 MEAT & POULTRY PRODUCTS: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 BEVERAGES: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 BEVERAGES: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 SNACKS & SAVORY: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 86 SNACKS & SAVORY: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 SAUCES & DRESSINGS: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 SAUCES & DRESSINGS: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 OTHER APPLICATIONS: FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 OTHER APPLICATIONS: FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 FOOD TEXTURE MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 FOOD TEXTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 FOOD TEXTURE MARKET, BY REGION, 2019–2022 (KT)

- TABLE 94 FOOD TEXTURE MARKET, BY REGION, 2023–2028 (KT)

- TABLE 95 NORTH AMERICA: FOOD TEXTURE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: FOOD TEXTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 100 NORTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 101 NORTH AMERICA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 US: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 108 US: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 109 US: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 110 US: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 111 US: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 112 US: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 113 US: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 US: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 CANADA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 116 CANADA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 117 CANADA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 118 CANADA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 119 CANADA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 120 CANADA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 121 CANADA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 CANADA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 MEXICO: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 124 MEXICO: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 MEXICO: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 126 MEXICO: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 127 MEXICO: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 128 MEXICO: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 129 MEXICO: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 MEXICO: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 EUROPE: FOOD TEXTURE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 132 EUROPE: FOOD TEXTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 133 EUROPE: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 134 EUROPE: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 EUROPE: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 136 EUROPE: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 137 EUROPE: FOOD TEXTURE MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 138 EUROPE: FOOD TEXTURE MARKET, BY INGREDIENT TYPE, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 140 EUROPE: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 142 EUROPE: FOOD TEXTURE MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 143 TURKEY: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 144 TURKEY: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 145 TURKEY: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 146 TURKEY: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 147 TURKEY: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 148 TURKEY: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 149 TURKEY: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 150 TURKEY: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 UK: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 152 UK: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 153 UK: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 154 UK: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 155 UK: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 156 UK: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 157 UK: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 158 UK: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 GERMANY: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 160 GERMANY: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 GERMANY: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 162 GERMANY: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 163 GERMANY: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 164 GERMANY: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 165 GERMANY: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 166 GERMANY: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 167 FRANCE: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 168 FRANCE: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 169 FRANCE: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 170 FRANCE: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 171 FRANCE: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 172 FRANCE: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 173 FRANCE: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 174 FRANCE: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 175 ITALY: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 176 ITALY: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 177 ITALY: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 178 ITALY: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 179 ITALY: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 180 ITALY: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 181 ITALY: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 182 ITALY: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 183 SPAIN: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 184 SPAIN: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 SPAIN: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 186 SPAIN: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 187 SPAIN: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 188 SPAIN: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 189 SPAIN: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 190 SPAIN: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 192 REST OF EUROPE: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 193 REST OF EUROPE: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 194 REST OF EUROPE: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 195 REST OF EUROPE: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 196 REST OF EUROPE: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 197 REST OF EUROPE: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 198 REST OF EUROPE: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: FOOD TEXTURE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 200 ASIA PACIFIC: FOOD TEXTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 201 ASIA PACIFIC: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 202 ASIA PACIFIC: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 ASIA PACIFIC: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 204 ASIA PACIFIC: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 205 ASIA PACIFIC: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 206 ASIA PACIFIC: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 207 ASIA PACIFIC: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 208 ASIA PACIFIC: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 209 ASIA PACIFIC: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 210 ASIA PACIFIC: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 211 CHINA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 212 CHINA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 213 CHINA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 214 CHINA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 215 CHINA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 216 CHINA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 217 CHINA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 218 CHINA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 219 INDIA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 220 INDIA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 221 INDIA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 222 INDIA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 223 INDIA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 224 INDIA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 225 INDIA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 226 INDIA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 227 SOUTH KOREA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 228 SOUTH KOREA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 229 SOUTH KOREA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 230 SOUTH KOREA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 231 SOUTH KOREA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 232 SOUTH KOREA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 233 SOUTH KOREA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 234 SOUTH KOREA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 235 AUSTRALIA & NEW ZEALAND: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 236 AUSTRALIA & NEW ZEALAND: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 237 AUSTRALIA & NEW ZEALAND: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 238 AUSTRALIA & NEW ZEALAND: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 239 AUSTRALIA & NEW ZEALAND: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 240 AUSTRALIA & NEW ZEALAND: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 241 AUSTRALIA & NEW ZEALAND: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 242 AUSTRALIA & NEW ZEALAND: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 243 JAPAN: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 244 JAPAN: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 245 JAPAN: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 246 JAPAN: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 247 JAPAN: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 248 JAPAN: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 249 JAPAN: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 250 JAPAN: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 251 REST OF ASIA PACIFIC: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 252 REST OF ASIA PACIFIC: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 253 REST OF ASIA PACIFIC: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 254 REST OF ASIA PACIFIC: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 259 SOUTH AMERICA: FOOD TEXTURE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 260 SOUTH AMERICA: FOOD TEXTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 261 SOUTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 262 SOUTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 263 SOUTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 264 SOUTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 265 SOUTH AMERICA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 266 SOUTH AMERICA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 267 SOUTH AMERICA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 268 SOUTH AMERICA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 269 SOUTH AMERICA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 270 SOUTH AMERICA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 271 BRAZIL: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 272 BRAZIL: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 273 BRAZIL: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 274 BRAZIL: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 275 BRAZIL: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 276 BRAZIL: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 277 BRAZIL: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 278 BRAZIL: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 279 ARGENTINA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 280 ARGENTINA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 281 ARGENTINA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 282 ARGENTINA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 283 ARGENTINA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 284 ARGENTINA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 285 ARGENTINA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 286 ARGENTINA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 287 COLOMBIA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 288 COLOMBIA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 289 COLOMBIA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 290 COLOMBIA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 291 COLOMBIA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 292 COLOMBIA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 293 COLOMBIA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 294 COLOMBIA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 295 REST OF SOUTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 296 REST OF SOUTH AMERICA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 297 REST OF SOUTH AMERICA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 298 REST OF SOUTH AMERICA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 299 REST OF SOUTH AMERICA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 300 REST OF SOUTH AMERICA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 301 REST OF SOUTH AMERICA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 302 REST OF SOUTH AMERICA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 303 ROW: FOOD TEXTURE MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 304 ROW: FOOD TEXTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 305 ROW: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 306 ROW: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 307 ROW: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 308 ROW: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 309 ROW: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 310 ROW: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 311 ROW: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 312 ROW: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 313 ROW: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 314 ROW: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 315 MIDDLE EAST: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 316 MIDDLE EAST: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 317 MIDDLE EAST: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 318 MIDDLE EAST: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 319 MIDDLE EAST: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 320 MIDDLE EAST: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 321 MIDDLE EAST: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 322 MIDDLE EAST: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 323 AFRICA: FOOD TEXTURE MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 324 AFRICA: FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 325 AFRICA: FOOD TEXTURE MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 326 AFRICA: FOOD TEXTURE MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 327 AFRICA: FOOD TEXTURE MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 328 AFRICA: FOOD TEXTURE MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 329 AFRICA: FOOD TEXTURE MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 330 AFRICA: FOOD TEXTURE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 331 FOOD TEXTURE MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 332 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 333 COMPANY FOOTPRINT, BY TYPE

- TABLE 334 COMPANY FOOTPRINT, BY SOURCE

- TABLE 335 COMPANY FOOTPRINT, BY FORM

- TABLE 336 COMPANY FOOTPRINT, BY FUNCTIONALITY

- TABLE 337 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 338 COMPANY FOOTPRINT, BY REGION

- TABLE 339 OVERALL COMPANY FOOTPRINT

- TABLE 340 LIST OF STARTUPS/SMES

- TABLE 341 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 342 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 343 FOOD TEXTURE MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 344 FOOD TEXTURE MARKET: DEALS, 2019–2023

- TABLE 345 FOOD TEXTURE MARKET: OTHERS, 2019–2023

- TABLE 346 AJINOMOTO CO., INC.: BUSINESS OVERVIEW

- TABLE 347 AJINOMOTO CO., INC.: PRODUCTS OFFERED

- TABLE 348 AJINOMOTO CO. INC.: PRODUCT LAUNCHES

- TABLE 349 AJINOMOTO CO., INC.: DEALS

- TABLE 350 AJINOMOTO CO., INC.: OTHERS

- TABLE 351 ADM: BUSINESS OVERVIEW

- TABLE 352 ADM: PRODUCTS OFFERED

- TABLE 353 ADM: PRODUCT LAUNCHES

- TABLE 354 ADM: DEALS

- TABLE 355 ADM: OTHERS

- TABLE 356 TATE & LYLE: BUSINESS OVERVIEW

- TABLE 357 TATE & LYLE: PRODUCTS OFFERED

- TABLE 358 TATE & LYLE: DEALS

- TABLE 359 TATE & LYLE: OTHERS

- TABLE 360 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- TABLE 361 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS OFFERED

- TABLE 362 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCT LAUNCHES

- TABLE 363 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 364 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- TABLE 365 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 366 CARGILL, INCORPORATED: PRODUCTS OFFERED

- TABLE 367 CARGILL, INCORPORATED: DEALS

- TABLE 368 CARGILL, INCORPORATED.: OTHERS

- TABLE 369 ASHLAND: BUSINESS OVERVIEW

- TABLE 370 ASHLAND: PRODUCTS OFFERED

- TABLE 371 ASHLAND: PRODUCT LAUNCHES

- TABLE 372 AVEBE: BUSINESS OVERVIEW

- TABLE 373 AVEBE: PRODUCTS OFFERED

- TABLE 374 AVEBE: PRODUCT LAUNCHES

- TABLE 375 AVEBE: DEALS

- TABLE 376 AVEBE: OTHERS

- TABLE 377 CP KELCO U.S., INC.: BUSINESS OVERVIEW

- TABLE 378 CP KELCO U.S., INC.: PRODUCTS OFFERED

- TABLE 379 CP KELCO U.S., INC.: PRODUCT LAUNCHES

- TABLE 380 CP KELCO U.S., INC.: DEALS

- TABLE 381 CP KELCO U.S., INC.: OTHERS

- TABLE 382 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 383 KERRY GROUP PLC: PRODUCTS OFFERED

- TABLE 384 KERRY GROUP PLC: PRODUCT LAUNCHES

- TABLE 385 KERRY GROUP PLC: DEALS

- TABLE 386 KERRY GROUP PLC.: OTHERS

- TABLE 387 DSM: BUSINESS OVERVIEW

- TABLE 388 DSM: PRODUCTS OFFERED

- TABLE 389 DSM: PRODUCT LAUNCHES

- TABLE 390 DSM: OTHERS

- TABLE 391 INGREDION: BUSINESS OVERVIEW

- TABLE 392 INGREDION: PRODUCTS OFFERED

- TABLE 393 INGREDION: PRODUCT LAUNCHES

- TABLE 394 INGREDION.: DEALS

- TABLE 395 INGREDION.: OTHERS

- TABLE 396 ESTELLE CHEMICALS PVT. LTD.: BUSINESS OVERVIEW

- TABLE 397 ESTELLE CHEMICALS PVT. LTD.: PRODUCTS OFFERED

- TABLE 398 FIBERSTAR, INC.: BUSINESS OVERVIEW

- TABLE 399 FIBERSTAR, INC.: PRODUCTS OFFERED

- TABLE 400 FIBERSTAR, INC.: PRODUCT LAUNCHES

- TABLE 401 FIBERSTAR, INC.: DEALS

- TABLE 402 RIKEN VITAMIN CO., LTD.: BUSINESS OVERVIEW

- TABLE 403 RIKEN VITAMIN CO., LTD.: PRODUCTS OFFERED

- TABLE 404 LEVAPAN S.A.: BUSINESS OVERVIEW

- TABLE 405 LEVAPAN S.A.: PRODUCTS OFFERED

- TABLE 406 NEXIRA: BUSINESS OVERVIEW

- TABLE 407 NEXIRA: PRODUCTS OFFERED

- TABLE 408 NEXIRA: PRODUCT LAUNCHES

- TABLE 409 NEXIRA: DEALS

- TABLE 410 PALSGAARD: BUSINESS OVERVIEW

- TABLE 411 PALSGAARD: PRODUCTS OFFERED

- TABLE 412 PURATOS: BUSINESS OVERVIEW

- TABLE 413 PURATOS: PRODUCTS OFFERED

- TABLE 414 NATUREX: BUSINESS OVERVIEW

- TABLE 415 NATUREX: PRODUCTS OFFERED

- TABLE 416 ROQUETTE FRÈRES: BUSINESS OVERVIEW

- TABLE 417 ROQUETTE FRÈRES: PRODUCTS OFFERED

- TABLE 418 ADJACENT MARKETS

- TABLE 419 HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 420 SPECIALTY FOOD INGREDIENTS: EMULSIFIERS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- FIGURE 1 FOOD TEXTURE MARKET: RESEARCH DESIGN

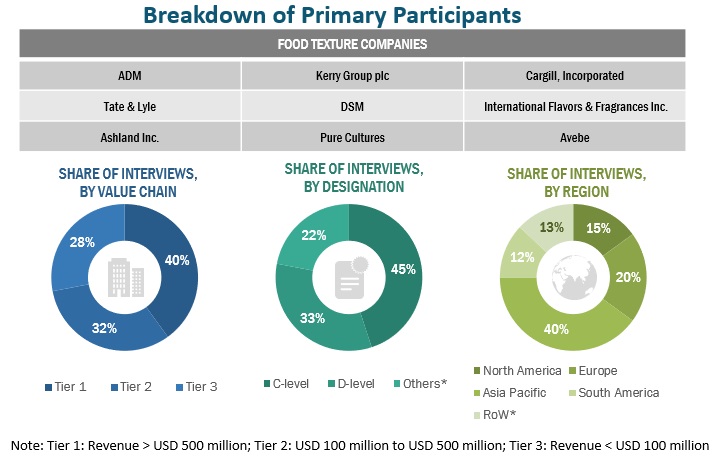

- FIGURE 2 BREAKDOWN OF PRIMARY PROFILES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 FOOD TEXTURE MARKET: DEMAND SIDE CALCULATION

- FIGURE 4 FOOD TEXTURE MARKET SIZE CALCULATION – SUPPLY SIDE

- FIGURE 5 SUPPLY SIDE ANALYSIS: FOOD TEXTURE MARKET

- FIGURE 6 DATA TRIANGULATION AND MARKET BREAKUP

- FIGURE 7 INDICATORS OF RECESSION

- FIGURE 8 WORLD INFLATION RATE: 2011–2021

- FIGURE 9 GLOBAL GDP: 2011–2021 (USD TRILLION)

- FIGURE 10 RECESSION INDICATORS AND THEIR IMPACT ON FOOD TEXTURE MARKET

- FIGURE 11 FOOD TEXTURE MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 12 FOOD TEXTURE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 FOOD TEXTURE MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 FOOD TEXTURE MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 FOOD TEXTURE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 FOOD TEXTURE MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 17 INCREASING DEMAND FOR NATURAL, CLEAN-LABEL PRODUCTS TO PROPEL MARKET FOR FOOD TEXTURE

- FIGURE 18 US TO ACCOUNT FOR LARGEST MARKET IN 2023

- FIGURE 19 NATURAL SEGMENT AND US TO ACCOUNT FOR LARGEST MARKET SHARES IN 2022

- FIGURE 20 CELLULOSE DERIVATIVES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 NATURAL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 22 DRY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 BAKERY & CONFECTIONERY PRODUCTS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 24 RETAIL AND FOOD SERVICE SALES IN US, 2016–2021 (USD BILLION)

- FIGURE 25 ANNUAL GDP GROWTH RATE IN ASIAN COUNTRIES, 2022

- FIGURE 26 MARKET DYNAMICS

- FIGURE 27 VALUE CHAIN ANALYSIS OF FOOD TEXTURE MARKET

- FIGURE 28 GLOBAL AVERAGE SELLING PRICE TREND, BY TYPE (USD/TON)

- FIGURE 29 FOOD TEXTURE MARKET: MARKET MAP

- FIGURE 30 FOOD TEXTURE: ECOSYSTEM MAPPING

- FIGURE 31 REVENUE SHIFT FOR FOOD TEXTURE MARKET

- FIGURE 32 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 33 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 34 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SOURCES

- FIGURE 36 CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 37 FOOD TEXTURE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 FOOD TEXTURE MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 39 FOOD TEXTURE MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 40 FOOD TEXTURE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 41 FOOD TEXTURE MARKET, BY FUNCTIONALITY, 2022 (%)

- FIGURE 42 FOOD TEXTURE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 43 NORTH AMERICA: INFLATION DATA, BY COUNTRY, 2018–2021

- FIGURE 44 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 45 NORTH AMERICA: FOOD TEXTURE MARKET SNAPSHOT

- FIGURE 46 EUROPE: INFLATION DATA, BY COUNTRY, 2018–2021

- FIGURE 47 EUROPE: FOOD TEXTURE MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 48 ASIA PACIFIC: INFLATION DATA, BY COUNTRY, 2018–2021

- FIGURE 49 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 50 ASIA PACIFIC: FOOD TEXTURE MARKET SNAPSHOT

- FIGURE 51 SOUTH AMERICA: INFLATION DATA, BY COUNTRY, 2018–2021

- FIGURE 52 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 53 ROW: INFLATION DATA, BY COUNTRY, 2018–2021

- FIGURE 54 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 55 SEGMENTAL REVENUE ANALYSIS FOR KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 56 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022

- FIGURE 57 EBITDA OF KEY PLAYERS, 2022 (USD BILLION)

- FIGURE 58 GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 59 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 60 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 61 AJINOMOTO CO., INC.: COMPANY SNAPSHOT

- FIGURE 62 ADM: COMPANY SNAPSHOT

- FIGURE 63 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 64 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 65 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 66 ASHLAND: COMPANY SNAPSHOT

- FIGURE 67 AVEBE: COMPANY SNAPSHOT

- FIGURE 68 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 69 DSM: COMPANY SNAPSHOT

- FIGURE 70 INGREDION: COMPANY SNAPSHOT

- FIGURE 71 RIKEN VITAMIN CO., LTD.: COMPANY SNAPSHOT

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the Food texture market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), Consumer Healthcare Products Association (CHPA), European Federation of Associations of Health Product Manufacturers (EHPM), Canadian Health Food Association (CHFA), and Health Food Manufacturers' Association (HFMA), associations were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The Food texture market encompasses various stakeholders involved in the supply chain, raw material manufacturers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of Precision fermentation. On the demand side, key opinion leaders, executives, and CEOs of companies in the Food texture industry were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the Food texture market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

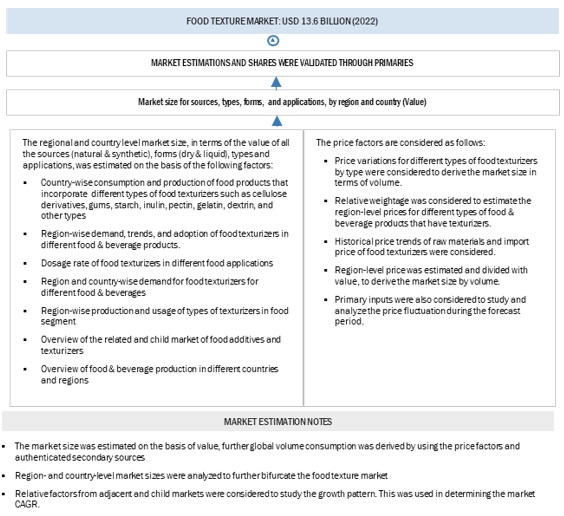

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Food Texture Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Food Texture Market Size: Top-Down Approach

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Food Texturizers, also known as food texturizing agents, are food ingredients/additives. They are sourced naturally and synthetically and are then used to achieve specific texture characteristics such as thickness, creaminess, smoothness, viscosity, and others.

Hydrocolloid is a major category that covers many food texturizers. According to the Journal of Food Science and Technology, 2020, “Hydrocolloids are all the polysaccharides extracted from plants, seaweeds, and microbial sources, as well as gums derived from plant exudates and modified biopolymers made by the chemical treatment of cellulose.”

Stakeholders

- Raw material suppliers of food texturizers

- Intermediate stakeholders, including distributors, retailers, associations, and regulatory bodies

- Manufacturers and traders of food texturizers

- Manufacturers of food products and restaurant owners

- Trade associations and industry bodies

- Government organizations, research organizations, and consulting firms

- Importers and exporters of food texturizers

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- Institute of Food and Agricultural Sciences (IFAS)

- Global Food & Beverage Association (GFBA)

- Food Export Association

- European Union (EU)

- The European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Organization for Economic Co-operation and Development (OECD)

Report Objectives

- To define, segment, and project the global market for Food texture on the basis of type, source, form, application, functionality, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze competitive developments in the Food texture market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European Food texture market, by key country

- Further breakdown of the Rest of the Asia Pacific Food texture market, by key country

- Further breakdown of the Rest of South America Food texture market, by key country

Company Information

- Detailed analyses and profiling of additional market players

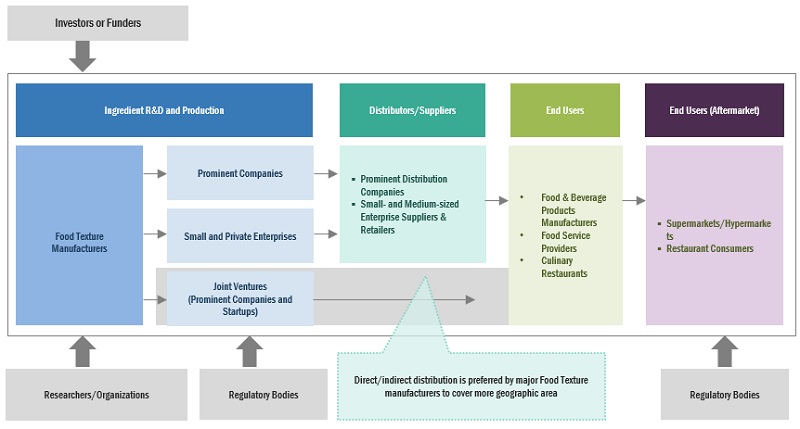

Growth opportunities and latent adjacency in Food Texture Market