This study employed a comprehensive approach to determine the current size of the ring main unitmarket. The process began with an in-depth phase of secondary research, gathering extensive data from the market, related sectors, and the broader industry context. This initial data collection was then rigorously validated through primary research, involving discussions with industry experts across the value chain. Subsequently, market size assessments were performed for each country through tailored analyses, resulting in a detailed market breakdown. These analyses were cross-verified to estimate the sizes of various segments and sub-segments accurately. By integrating both secondary and primary research methods, the study ensures that its findings are accurate and reliable.

Secondary Research

In this research study, a wide array of secondary sources was employed to gather crucial data for a detailed analysis of the global ring main unitmarket. These sources included directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, the World Bank, the US Department of Energy (DOE), and the International Energy Agency (IEA). These resources were instrumental in covering technical, market-oriented, and commercial aspects of the market, significantly enriching the study's depth and scope. Additional sources utilized in the research comprised annual reports, press releases, investor presentations, white papers, authoritative publications, articles by esteemed experts, information from industry associations, trade directories, and various database resources. The extensive and diverse secondary sources provided a robust and comprehensive foundation for the research study.

Primary Research

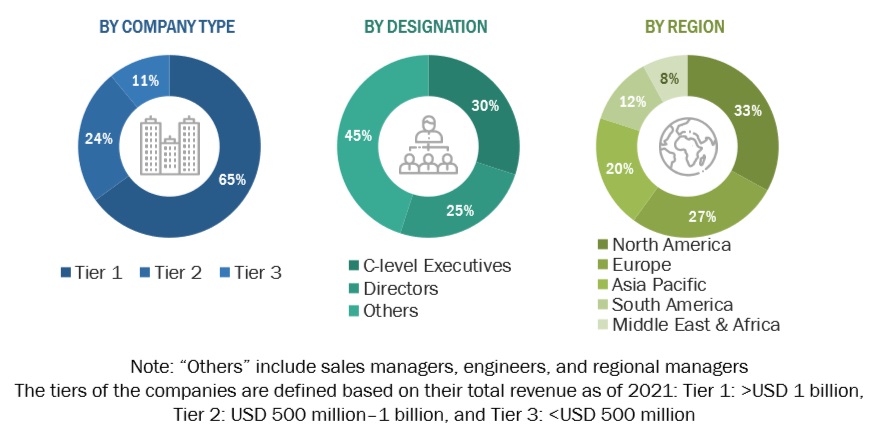

The ring main unit (RMU) market involves a diverse range of stakeholders, including RMU manufacturers, boiler manufacturers, subcomponent manufacturers, manufacturing technology providers, and technology support providers within the supply chain. On the demand side, the market is driven by the increasing need for RMUs in electrical distribution networks. On the supply side, the market is characterized by a growing demand for contracts from distribution utilities, as well as mergers and acquisitions among major industry players. To gather both qualitative and quantitative data, numerous primary sources from both the supply and demand sides of the market were interviewed. Below is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

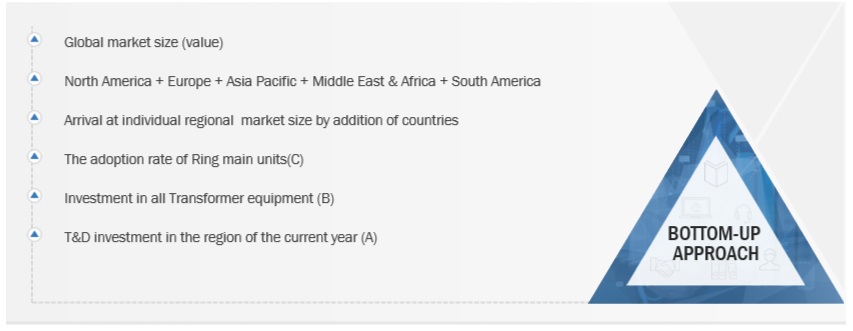

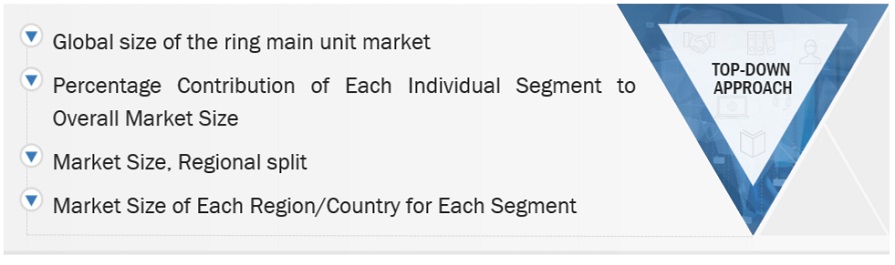

The ring main unit market size has been meticulously estimated and verified through the application of both bottom-up and top-down methodology. Numerous market subsegments were estimated using this method in great detail. The research process includes the following important stages.

-

This approach has looked at regional and national manufacturing data for all kinds of ring main units.

-

A substantial amount of primary and secondary research has been carried out in order to completely comprehend the state of the global market for different types of ring main units.

-

Several primary interviews have been conducted with eminent ring main unit system development specialists, including major OEMs and Tier I suppliers.

-

Qualitative aspects like market drivers, constraints, opportunities, and challenges have been considered when assessing and projecting the market size.

Global Ring Main Unit Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Ring Main Unit Market Size: Top-Down Approach

Data Triangulation

To determine the overall market size, the study divided the market into various segments and subsegments. Techniques such as data triangulation and market segmentation were used to finalize the comprehensive market analysis and obtain precise statistics for each segment and subsegment. Data triangulation involved a detailed analysis of various factors and trends from both the demand and supply sides within the ring main unit market ecosystem.

Market Definition

A ring main unit (RMU) serves as a vital component in the transmission and distribution of electrical energy, tasked with adjusting voltage levels between circuits within the power grid. Its principal role involves either increasing (stepping up) or decreasing (stepping down) voltage as electricity traverses from power generation plants to end-users, ensuring efficient transmission over extended distances while minimizing energy loss. Power transformers play a pivotal role in linking disparate power networks and upholding the stability and reliability of the electrical supply system. Comprising a magnetic core typically crafted from materials like silicon steel and insulated wire coils or windings, power transformers operate through electromagnetic induction. As alternating current flows through the primary winding, it generates a magnetic field that induces voltage in the secondary winding. The magnitude of the induced voltage is contingent upon the turns ratio between the primary and secondary windings. For example, if the secondary winding has fewer turns than the primary, the resultant output voltage will be lower, thus functioning as a step-down transformer.

Key Stakeholders

-

Government Utility Providers

-

Independent Power Producers

-

Transformer manufacturers

-

Power equipment and garden tool manufacturers

-

Consulting companies in the energy & power sector

-

Distribution utilities

-

Government and research organizations

-

Organizations, forums, and associations

-

Raw material suppliers

-

State and national regulatory authorities

-

RMU manufacturers, distributors, and suppliers

-

RMU original equipment manufacturers (OEMs)

Objectives of the Study

-

Based on variables including insulation type, installation, voltage rating, structure, application, the ring main unit market will be defined, categorized, segmented, and projected.

-

To estimate market sizes for the major nations in each of these five regions, along with those for Africa, the Middle East, Asia Pacific, North America, and South America.

-

To offer comprehensive examinations of the factors influencing market dynamics, as well as industry-specific prospects, limitations, and challenges.

-

To methodically evaluate each subsegment's market share, growth patterns, and future prospects.

-

To assess market prospects for interested parties and the competitive environment facing industry leaders.

-

To develop strategic profiles of the leading companies by carefully analyzing their market shares and key differentiators.

-

To keep an eye on and evaluate developments pertaining to competition in the ring main unit market, including partnerships, agreements, sales contracts, joint ventures, product launches, contracts, expansions, and investments.

-

This study provides an analysis of the market for ring main units.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

-

Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

-

Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Ring Main Unit Market