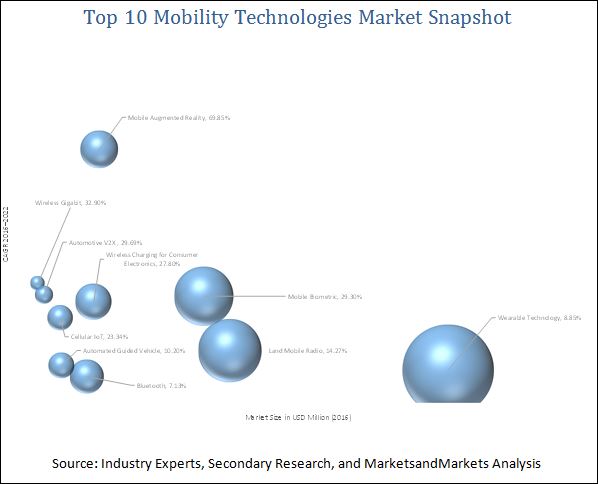

Top 10 Mobility Technologies Market by Technology (Bluetooth, Wearable Technology, Mobile Augmented Reality, Wireless Gigabit, Cellular IoT, Mobile Biometric, Automotive V2X, Wireless Charging For Consumer Electronics) & Geography - Global Forecast to 2022

[257 Pages Report] The Top 10 mobility technologies market is expected to grow at a significant rate during the forecast period. The base year used for this study is 2015, and the forecast period considered is between 2016 and 2022.

The objectives of the study are as follows:

- To define, describe, and forecast the market for Top 10 mobility technologies cellular IoT, wireless gigabit, mobile augmented reality, wireless charging for consumer electronics, Bluetooth, mobile biometrics, automotive vehicle-to-everything, automated guided vehicle, land mobile radio, and wearable technology on the basis of various parameters

- To forecast the market size for various technologies with respect to four main regions—North America , Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically profile the key players and comprehensively analyze their market shares and core competencies, along with detailing the competitive landscape for market leaders

- To analyze the competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers and acquisitions, new product developments, and research and developments (R&D) carried out in the Top 10 mobility technologies market

The Top 10 mobility technologies market is expected to grow at a significant rate during the forecast period. The growth of this market is being propelled by the rapid technological advancements and increased need for wireless connectivity. The scope of this report covers the top mobility technologies market on the basis of diverse segments such as, product, industry, application, geography, and others.

The application areas of the wearable technology range from consumer durables and healthcare to enterprise, industrial, and so on. The overall wearable technology market holds prominent growth potential between 2016 and 2022. The growth of this market can be attributed to the consumer preferences for sophisticated gadgets, increasing growth prospects of next-generation displays and integrated consumer wearable devices, and increasing popularity of wearable fitness and medical devices.

Mobile augmented reality (MAR) allows computer-generated data to precisely overlay physical objects in real-time through handheld devices such as smartphones cameras, tablets, personal digital assistants (PDAs), game consoles, smart glasses, and wearable devices. The increasing adoption of mobile augmented reality in the e-commerce and retail, gaming, and entertainment sectors is driving the market growth. Also, the growing demand for smartphones and tablets incorporated with augmented reality apps would fuel the market growth during the forecast period.

The wireless gigabit technology allows users to build faster and more efficient communication network. WiGig has the ability to transfer data at 60 GHz. The technology was specifically developed for low-range wireless communication for the home entertainment industry, majorly connecting to devices such as PCs, laptops, tablets, routers, smartphones, adapters, and so on. The growth of this technology has instilled the need for faster data transfer and wireless connectivity, thereby enabling instantaneous transfer, display, sharing, and streaming of files across various computing or multimedia devices.

Mobile biometrics is a technology used for identification and authentication purposes by measuring and analyzing characteristics such as DNA, fingerprints, retinas, and others. The rising instances of security breaches and terrorist activities, increasing crime rates, and growing threats to public and private property and educational institutions have intensified the awareness about security. The growth of the mobile biometrics market is primarily driven by the factors such as government initiatives to adopt biometrics in various fields, increasing use of biometrics in smartphones, introduction of e-passports, increased use of biometric technology in numerous segments, and adoption of biometric technology in election administration.

Cellular IoT consists of seven technologies 2G, 3G, 4G, LTE–M, NB–IoT, NB–LTE–M, and 5G. These technologies operate on the licensed spectrum and are used for high-quality data and voice services. The growing demand for low-power consumption devices for machine-to-machine communication, along with the low deployment costs, is driving the growth of the market for cellular IoT technology. Other LPWA technologies have less battery life compared to cellular IoT technology and have less coverage area compared to cellular networks. Thus, cellular IoT has an added advantage of transferring data at a lower rate, thereby offering a larger battery life to connected objects.

This report describes the drivers, restraints, opportunities, and challenges pertaining to the Top 10 mobility technologies market. In addition, it analyzes the current scenario and forecasts the market size till 2022.

The key players in the Top 10 mobility technologies market include Qualcomm Inc. (U.S.), Sierra Wireless (Canada), Apple Inc. (U.S.), Samsung Electronics Corporation Ltd. (South Korea), Nuance Communication Inc. (U.S.), Intel Corporation (U.S.), Texas Instruments (U.S.), Atmel Corporation (U.S.),, STMicroelectronics N.V. (Switzerland), Autotalks Limited (Israel), Harris Corporation (U.S.), Motorola Solutions, Inc. (U.S.), Daifuku Co., Ltd. (Japan), and Dematic GmbH & Co., KG. (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 24)

1.1 Objectives of the Study

1.2 Report Description

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for This Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 27)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 38)

4.1 Attractive Market Opportunities in Mobile Augmented Reality Market

4.2 Display Devices Expected to Dominate the Wireless Gigabit Market Between 2016 and 2022

4.3 Voice Recognition Expected to Grow at Highest Rate in Mobile Biometric Market

4.4 Application and Region Snapshot of Automotive V2X Market

4.5 Market in China Expected to Grow at the Highest Rate in Cellular IoT Market Between 2016 and 2022

5 Mobile Augmented Reality Market (Page No. - 42)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Decline in Prices of Hardware Components

5.2.1.2 Growing Interest of Large Tech Companies in Augmented Reality

5.2.2 Restraints

5.2.2.1 Development of Ar Technology Dependent on Advancements in Computing and Digital Networks

5.2.3 Opportunities

5.2.3.1 Increasing Adoption of 3D Cameras for the Generation of 3D Models of Real Objects

5.2.4 Challenges

5.2.4.1 Low Adoption Rate Due to Privacy Issues and Complexities Associated With the Design

5.3 Mobile Augmented Reality Market, By Component

5.3.1 Hardware

5.3.2 Software

5.4 Mobile Augmented Reality Market, By Application

5.4.1 Smartphones

5.4.2 Tablets

5.4.3 Personal Digital Assistant and Gaming Console

5.4.4 Smart Glasses

5.4.5 Wearable

5.5 Mobile Augmented Reality Market, By Vertical

5.5.1 Consumer

5.5.2 Aerospace and Defense

5.5.3 Medical

5.5.4 Commercial

5.5.5 Industrial

5.6 Geographic Analysis

5.6.1 North America

5.6.2 Europe

5.6.3 APAC

5.6.4 RoW

5.7 Competitive Landscape

5.7.1 Ranking of Players

6 Wireless Gigabit Market (Page No. - 56)

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.1.1 Constant Innovations and Advancements in the Technology

6.2.1.2 Launch of New Spectrums (Frequency Bands) and Increasing Penetration Into Emerging Economies

6.2.2 Restraints

6.2.2.1 Short Operating Range of Wigig Products

6.2.3 Opportunities

6.2.3.1 Rapid Growth of Next-Generation Computing Devices

6.2.4 Challenges

6.2.4.1 High Frequency of Internal Substitution

6.3 Wireless Gigabit Market, By Product

6.3.1 Display Devices

6.3.2 Network Infrastructure Devices

6.4 Wireless Gigabit Market, By Module

6.4.1 System-On-Chip

6.4.2 Integrated Circuit Chip

6.5 Wireless Gigabit Market, By Application

6.5.1 Consumer Electronics

6.5.2 Networking

6.5.3 Commercial

6.6 Geographic Analysis

6.6.1 North America

6.6.2 Europe

6.6.3 APAC

6.6.4 RoW

6.7 Competitive Landscape

6.7.1 Ranking of Players

7 Automotive Vehicle–To–Everything Market (Page No. - 70)

7.1 Introduction

7.2 Market Dynamics

7.2.1 Drivers

7.2.1.1 Demand for Real-Time Traffic and Incident Alerts for Increasing Public Safety

7.2.1.2 Increasing Financial Aid From Various Governments for Better Traffic Management

7.2.1.3 Increasing Environmental Concerns to Lead to the Adoption of Connected Vehicles

7.2.2 Restraints

7.2.2.1 Lack of Cellular Connectivity Coverage in Developing Countries

7.2.2.2 Cost Burden on Consumers

7.2.2.3 Lack of Infrastructure

7.2.3 Opportunities

7.2.3.1 Autonomous Cars to Transform Automotive Industry

7.2.3.2 Predictive Maintenance Using Real-Time Monitoring

7.2.4 Challenges

7.2.4.1 Lack of Standardization

7.2.4.2 Lack of Willingness to Adopt New Technology

7.2.4.3 Security of Data Generated By Vehicles

7.3 Automotive Vehicle–To–Everything (V2X) Market, By Offering

7.3.1 Hardware

7.3.2 Software

7.3.2.1 Device Management

7.3.2.2 Application Management

7.3.2.3 Network Management

7.4 Automotive Vehicle-To-Everything Market, By Communication Type

7.4.1 Vehicle-To-Vehicle (V2v)

7.4.2 Vehicle-To-Infrastructure (V2I)

7.4.3 Vehicle-To-Pedestrian (V2P)

7.4.4 Vehicle-To-Home (V2H)

7.4.5 Vehicle-To-Grid (V2G)

7.4.6 Vehicle-To-Network (V2N)

7.5 Automotive Vehicle-To-Everything Market, By Vehicle Type

7.5.1 Passenger Vehicles

7.5.2 Commercial Vehicles

7.6 Automotive Vehicle-To-Everything Market, By Connectivity Type

7.6.1 Dedicated Short Range Communication (DSRC) Connectivity

7.6.2 Cellular Connectivity

7.7 Automotive Vehicle-To-Everything Market, By Application

7.7.1 Automated Driver Assistance

7.7.2 Intelligent Traffic Systems

7.7.3 Emergency Vehicle Notification

7.7.4 Passenger Information System

7.7.5 Fleet & Asset Management

7.7.6 Parking Management System

7.7.7 Remote Monitoring & Diagnostics

7.7.8 Predictive Maintenance

7.8 Geographic Analysis

7.8.1 North America

7.8.2 Europe

7.8.3 APAC

7.8.4 RoW

7.9 Competitive Landscape

7.9.1 Ranking of Players

8 Mobile Biometric Market (Page No. - 92)

8.1 Introduction

8.2 Market Dynamics

8.2.1 Drivers

8.2.1.1 Government Initiatives to Promote the Adoption of Biometric Technology

8.2.1.2 Large-Scale Adoption of Electronic Verification Systems

8.2.2 Restraints

8.2.2.1 Concerns Regarding Privacy and Data Breach

8.2.3 Opportunities

8.2.3.1 Application of Mobile Biometrics in E-Commerce and Online Gaming

8.2.4 Challenges

8.2.4.1 Protection of Biometric Data

8.3 Mobile Biometric Market, By Component

8.3.1 Hardware Components

8.3.1.1 Fingerprint Readers

8.3.1.2 Scanners

8.3.1.3 Cameras

8.3.1.4 Others

8.3.2 Software

8.4 Mobile Biometrics Market, By Authentication Mode

8.4.1 Single-Factor Authentication Mode

8.4.1.1 Fingerprint Recognition

8.4.1.2 Voice Recognition

8.4.1.3 Facial Recognition

8.4.1.4 Iris Recognition

8.4.1.5 Vein Recognition

8.4.1.6 Retina Scan System

8.4.1.7 Others

8.4.2 Multi-Factor Authentication Mode

8.5 Mobile Biometric Market, By Industry

8.5.1 Consumer Electronics

8.5.2 Healthcare

8.5.3 Finance & Banking

8.5.4 Travel & Immigration

8.5.5 Government/Law Enforcement & Forensics

8.5.6 Military & Defense

8.5.7 Others

8.6 Geographic Analysis

8.6.1 North America

8.6.2 Europe

8.6.3 APAC

8.6.4 RoW

8.7 Competitive Landscape

8.7.1 Ranking of Players

9 Wireless Charging Market for Consumer Electronics (Page No. - 107)

9.1 Introduction

9.2 Market Dynamics

9.2.1 Drivers

9.2.1.1 User Friendliness of the Wireless Charging Technology

9.2.1.2 Huge Demand Expected for Wireless Charging-Enabled Smartphones

9.2.1.3 Ability to Charge Multiple Devices Simultaneously

9.2.1.4 Consumer Inclination Toward Wireless Connectivity

9.2.2 Restraints

9.2.2.1 Interference With Other Electronic Devices Likely to Create A Hurdle for the Market Growth

9.2.3 Opportunities

9.2.3.1 Growth Prospects for New Applications Leading to the Development of New Products

9.2.4 Challenges

9.2.4.1 Compatibility Issues Restricting the Adoption of Wireless Charging Devices

9.2.4.2 Inadequate Government Regulations for the Wireless Charging Market

9.3 Wireless Charging Market in Consumer Electronics, By Device

9.3.1 Smartphones

9.3.2 Computing Devices

9.3.3 Wearable Devices

9.3.4 Others

9.4 Wireless Charging Market for Consumer Electronics, By Technology

9.4.1 Inductive Technology

9.4.2 Radiation Technology

9.4.3 Other Technologies

9.4.3.1 Radio Frequency (RF) Technology

9.4.3.2 Laser Beam Technology

9.5 Wireless Charging Market for Consumer Electronics, By Range

9.5.1 Short Range

9.5.2 Medium Range

9.5.3 Long Range

9.6 Geographic Analysis

9.6.1 North America

9.6.2 Europe

9.6.3 APAC

9.6.4 RoW

9.7 Competitive Landscape

9.7.1 Ranking of Players

10 Cellular IoT Market (Page No. - 122)

10.1 Introduction

10.2 Market Dynamics

10.2.1 Drivers

10.2.1.1 Rising Demand for Extended Network Coverage

10.2.1.2 Rising Demand for Cellular Connectivity in the Automotive Sector

10.2.2 Restraints

10.2.2.1 Technology Fragmentation

10.2.3 Opportunities

10.2.3.1 Growing Adoption of Smart Technologies and Distributed Applications

10.2.4 Challenges

10.2.4.1 Developing Common Protocols and Standards Across the IoT Platform

10.3 Cellular IoT Market, By Offering

10.3.1 Hardware

10.3.2 Software

10.4 Cellular IoT Market, By Type

10.4.1 2G

10.4.2 3G

10.4.3 4G

10.4.4 LTE-M

10.4.5 NB-LTE-M

10.4.6 NB-IoT

10.4.7 5G

10.5 Cellular IoT Market, By End-Use Application

10.5.1 Agriculture

10.5.2 Environmental Monitoring

10.5.3 Automotive and Transportation

10.5.4 Energy

10.5.5 Healthcare

10.5.6 Retail

10.5.7 Smart City

10.5.8 Consumer Electronics

10.5.9 Building Automation

10.5.10 Manufacturing

10.6 Geographic Analysis

10.6.1 North America

10.6.2 Europe

10.6.3 APAC

10.6.4 RoW

10.7 Competitive Landscape

10.7.1 Ranking of Players

11 Land Mobile Radio Market (Page No. - 140)

11.1 Introduction

11.2 Market Dynamics

11.2.1 Drivers

11.2.1.1 Growing Significance of Efficient Critical Communication Operations

11.2.1.2 Rising Demand for Inexpensive and Reliable Land Mobile Radios

11.2.1.3 Application of Land Mobile Radios Into Diverse Industries, Majorly in Military & Defense, Law Enforcement, and Aviation

11.2.1.4 Transition of Land Mobile Radios From Analog to Digital

11.2.2 Restraints

11.2.2.1 Spectrum Shortages Limiting Industry Expansion and Limited Channel Capacity

11.2.2.2 High Costs for Building LMRs

11.2.3 Opportunities

11.2.3.1 Requirement of Voice Encryption for Secure Communication

11.2.3.2 Dynamic Spectrum Access Opportunities for LMRs

11.2.4 Challenges

11.2.4.1 Narrowbanding Public Safety Communication Channels

11.2.4.2 Growth of IoT (Internet of Things) Devices

11.3 Land Mobile Radio Market, By Type

11.4 Land Mobile Radio Market, By Technology

11.4.1 Digital Land Mobile Radio

11.4.2 Analog Land Mobile Radio

11.5 Land Mobile Radio Market, By Application

11.5.1 Public Safety

11.5.2 Commercial

11.6 Geographic Analysis

11.6.1 North America

11.6.2 Europe

11.6.3 APAC

11.6.4 RoW

11.7 Competitive Landscape

11.7.1 Ranking of Players

12 Automated Guided Vehicles (Page No. - 153)

12.1 Introduction

12.2 Market Dynamics

12.2.1 Drivers

12.2.1.1 Growing Demand for Automation and Material Handling Equipment in Various Process Industries

12.2.1.2 Rising Demand for Automation is Leading to New Avenues for AGVS

12.2.1.3 Replacement of Conventional Batteries With Lithium-Ion Based Batteries

12.2.1.4 High Labor Cost, Owing to Scarcity of Labor

12.2.1.5 Growing Emphasis on Workplace Safety and Increased Productivity By Industries

12.2.2 Restraints

12.2.2.1 High Capital Investments

12.2.2.2 High Switching Cost

12.2.3 Opportunities

12.2.3.1 Emergence of Flexible Manufacturing Systems (FMS)

12.2.3.2 Increased Demand for Intelligent and Customized Automated Guided Vehicles

12.2.4 Challenges

12.2.4.1 Need to Reduce Market Delivery Time

12.3 Automated Guided Vehicle Market, By Type

12.3.1 Unit Load Carrier

12.3.2 Tow Vehicle

12.3.3 Pallet Truck

12.3.4 Assembly Line Vehicle

12.3.5 Others

12.4 Automated Guided Vehicle Market, By Navigation Technology

12.4.1 Laser Guidance

12.4.2 Magnetic Guidance

12.4.3 Inductive Guidance

12.4.4 Optical Tape Guidance

12.4.5 Others

12.5 Automated Guided Vehicle Market, By Battery Type

12.5.1 Lead

12.5.2 Nickel-Based

12.5.3 Lithium-Ion

12.6 Automated Guided Vehicle Market, By Industry

12.6.1 Automotive

12.6.2 Manufacturing

12.6.3 Food & Beverages

12.6.4 Aerospace

12.6.5 Healthcare

12.6.6 Logistics

12.6.7 Retail

12.6.8 Others

12.7 Automated Guided Vehicle Market , By Application

12.7.1 Transportation

12.7.2 Distribution

12.7.3 Storage

12.7.4 Assembly

12.7.5 Packaging

12.7.6 Others

12.8 Geographic Analysis

12.8.1 North America

12.8.2 Europe

12.8.3 APAC

12.8.4 RoW

12.9 Competitive Landscape

12.9.1 Ranking of Players

13 Wearable Technology Market (Page No. - 181)

13.1 Introduction

13.2 Market Dynamics

13.2.1 Drivers

13.2.1.1 Consumer Preference for Sophisticated Gadgets

13.2.1.2 Increasing Growth Prospects of Next-Generation Displays in Wearable Devices

13.2.1.3 Growing Popularity of Internet of Things and Connected Devices

13.2.1.4 Increase in Demand of Wearables in Fitness and Medical Devices

13.2.1.5 Development of Key Enabling Technologies

13.2.2 Restraints

13.2.2.1 Power Consumption and Limited Battery Life

13.2.2.2 Shorter Life Cycle of the Consumer Electronics Sector

13.2.3 Opportunities

13.2.3.1 Adoption of Wearables in Multiple Application Areas

13.2.3.2 Multi-Featured and Hybrid Application Mobile Devices

13.2.4 Challenges

13.2.4.1 High Initial Costs

13.2.4.2 Unaddressed Regulatory Issues & Vulnerability of Healthcare Information

13.3 Wearable Technology Market, By Type

13.3.1 Wearable Smart Textile

13.3.1.1 Active Smart Textiles

13.3.1.2 Passive Smart Textiles

13.3.1.3 Ultra-Smart Textiles

13.3.2 Wearable Products & Devices (Non-Textiles)

13.4 Wearable Technology Market, By Product

13.4.1 Wrist Wear

13.4.1.1 Smartwatches

13.4.1.2 Wristbands

13.4.2 Headwear & Eyewear

13.4.2.1 Augmented Reality Headsets

13.4.2.2 Virtual Reality Headsets

13.4.2.3 Others

13.4.3 Footwear

13.4.3.1 Casual Footwear

13.4.3.2 Special-Purpose Footwear

13.4.4 Neckwear

13.4.4.1 Fashion and Jewelry

13.4.4.2 Ties and Collars

13.4.5 Bodywear

13.4.5.1 Inner Wear

13.4.5.2 Fashion & Apparel

13.4.5.3 Armwear & Legwear

13.4.6 Other Wearable Technologies

13.4.6.1 Ring Scanners

13.4.6.2 Bodyworn Cameras

13.4.6.3 Internables/Implantables

13.5 Wearable Technology Market, By Application

13.5.1 Consumer Electronics

13.5.1.1 Infotainment & Multimedia

13.5.1.2 Garments & Fashion

13.5.1.3 Multifunction

13.5.2 Healthcare

13.5.2.1 Clinical Applications

13.5.2.2 Nonclinical Applications

13.5.3 Enterprise & Industrial Application

13.5.3.1 Logistics, Packaging, & Warehouse

13.5.3.2 Other Industrial Applications

13.5.4 Other Applications

13.6 Geographic Analysis

13.6.1 Americas

13.6.2 Europe

13.6.3 APAC

13.6.4 RoW

13.7 Competitive Landscape

13.7.1 Ranking of Players

14 Bluetooth (Page No. - 205)

14.1 Introduction

14.2 Market Dynamics

14.2.1 Drivers

14.2.1.1 Growing Demand for Smartphones and Other Wireless Connectivity Devices

14.2.1.2 Increasing Market for Cloud Computing and IoT

14.2.1.3 Increasing Demand for Low-Power Wide-Area (LPWA) Networks

14.2.2 Restraints

14.2.2.1 Lack of Uniform Communication Standards

14.2.2.2 Interference With Other Electromagnetic Sources, Physical Objects, and Layered Structure

14.2.3 Opportunities

14.2.3.1 Increased Government Funding for Fast Evolution of Internet of Things

14.2.3.2 Emerging Need for Cross-Domain Applications

14.2.4 Challenges

14.2.4.1 Need for Better Security of Information

14.2.4.2 Trade-Off Between Features Such as Data Rates, Power Consumption, and Range for Various Wireless Technologies

14.3 Bluetooth Market, By Type

14.3.1 Bluetooth 2.0 and 3.0

14.3.2 Bluetooth Smart

14.3.3 Bluetooth Smart/Wi-Fi

14.3.4 Bluetooth Smart/Ant+

14.4 Bluetooth Market, By Application

14.4.1 Automotive and Transportation

14.4.2 Consumer Electronics

14.4.3 Healthcare

14.4.4 Building Automation

14.4.5 Industrial

14.4.6 Wearable Devices

14.5 Geographic Analysis

14.5.1 North America

14.5.2 Europe

14.5.3 APAC

14.5.4 RoW

14.6 Competitive Landscape

14.6.1 Ranking of Players

15 Company Profiles (Page No. - 219)

15.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

15.2 Qualcomm, Inc.

15.3 Sierra Wireless

15.4 Apple, Inc.

15.5 Samsung Electronics Co., Ltd.

15.6 Nuance Communication, Inc.

15.7 Intel Corporation

15.8 Texas Instruments

15.9 Atmel Corporation

15.10 Stmicroelectronics N.V.

15.11 Autotalks Ltd

15.12 Harris Corporation

15.13 Motorola Solutions, Inc.

15.14 Daifuku Co., Ltd.

15.15 Dematic GmbH & Co. Kg

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 253)

16.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.2 Introducing RT: Real-Time Market Intelligence

16.3 Available Customizations

16.4 Author Details

List of Tables (66 Tables)

Table 1 Mobile Augmented Reality Market, By Component, 2014–2022, (USD Billion)

Table 2 Mobile Augmented Reality Market, By Application, 2014–2022 (USD Billion)

Table 3 Mobile Augmented Reality Market, By Vertical, 2014–2022 (USD Billion)

Table 4 Mobile Augmented Reality Market, By Region, 2014–2022 (USD Billion)

Table 5 Ranking Analysis of Top 5 Players in Mobile Augmented Reality Market

Table 6 Wireless Gigabit Market, By Product, 2014–2022 (USD Million)

Table 7 Wireless Gigabit Market, By Module, 2014–2022 (USD Million)

Table 8 Wireless Gigabit Market, By Application, 2014–2022 (USD Million)

Table 9 Wireless Gigabit Market, By Region, 2014–2022 (USD Million)

Table 10 Ranking Analysis of Top 5 Players in Wireless Gigabit Market, 2015

Table 11 Government Initiatives in the V2X Technology Market, 2014–2016

Table 12 Automotive V2X Market, By Offering, 2017–2022 (USD Million)

Table 13 Automotive V2X Market, By Communication Type, 2017–2022 (USD Million)

Table 14 Automotive V2X Market, By Vehicle Type, 2017–2022 (USD Million)

Table 15 Automotive V2X Market, By Connectivity Type, 2017–2022 (USD Million)

Table 16 Automotive V2X Market, By Connectivity Type, 2017–2022 (Thousand Units)

Table 17 Automotive V2X Market, By Application, 2017–2022 (USD Million)

Table 18 Automotive V2X Market, By Region, 2017–2022 (USD Million)

Table 19 Automotive V2X Market, By Region, 2017–2022 (Thousand Units)

Table 20 Qualcomm Inc. Expected to Lead the Semiconductor Market for Automotive Vehicle-To-Everything Market, 2015

Table 21 Mobile Biometrics Market, By Component, 2014–2022 (USD Million)

Table 22 Mobile Biometrics Market, By Authentication Mode, 2014–2022 (USD Million)

Table 23 Mobile Biometrics Market, By Industry, 2014–2022 (USD Million)

Table 24 Mobile Biometrics Market, By Region, 2014–2022 (USD Million)

Table 25 Ranking Analysis of Top 5 Players in Mobile Biometrics Market, 2015

Table 26 Wireless Charging Market for Consumer Electronics, By Device, 2014–2022 (USD Million)

Table 27 Developments: Wireless Charging in Smartphones

Table 28 Wireless Charging Market for Consumer Electronics, By Technology, 2014–2022 (USD Million)

Table 29 Wireless Charging Market for Consumer Electronics, By Range, 2014–2022 (USD Million)

Table 30 Wireless Charging Market for Consumer Electronics, By Region, 2014–2022 (USD Million)

Table 31 Ranking Analysis of Top 5 Players in Wireless Charging Market for Consumer Electronics, 2015

Table 32 Cellular IoT Market, By Offering, 2014–2022 (USD Million)

Table 33 Cellular IoT Market, By Type, 2014–2022 (USD Million)

Table 34 Cellular IoT Market, By End-Use Application, 2014–2022 (USD Million)

Table 35 Cellular IoT Market, By Region, 2014–2022 (USD Million)

Table 36 Ranking Analysis of Top 5 Players in Cellular IoT Market, 2015

Table 37 Land Mobile Radio Market, By Type, 2014–2022 (USD Billion)

Table 38 Land Mobile Radio Market, By Technology, 2014–2022 (USD Billion)

Table 39 Land Mobile Radio Market, Technology Comparison Chart

Table 40 Land Mobile Radio Market, By Industry, 2014–2022 (USD Billion)

Table 41 Land Mobile Radio Market, By Geography, 2014–2022 (USD Billion)

Table 42 Ranking Analysis of Top 5 Players in Land Mobile Radio Market, 2015

Table 43 Country Wise Ranking of Manufacturing Output, 2001 & 2013

Table 44 Automated Guided Vehicle Market, By Type, 2014–2022 (USD Million)

Table 45 Automated Guided Vehicle Market, By Type, 2014–2022 (Thousand Units)

Table 46 Automated Guided Vehicle Market, By Navigation Technology, 2014-2022 (USD Million)

Table 47 Automated Guided Vehicle Market, By Battery Type, 2014-2022 (USD Million)

Table 48 Automated Guided Vehicle Market, By Industry, 2014–2022 (USD Million)

Table 49 Automated Guided Vehicle Market, By Application, 2014-2022 (USD Million)

Table 50 Automated Guided Vehicle Market, By Region, 2014-2022 (USD Million)

Table 51 Ranking Analysis of Top 5 Players in Automated Guided Vehicle Market, 2015

Table 52 The Need for Sophisticated Devices Propels the Growth of the Wearable Technology Market

Table 53 Need of Self-Powering Devices Restrains the Growth of the Wearable Technology Market

Table 54 Increasing Opportunities in Multiple Applications and Technological Growth Pave the Growth Avenue for Players in the Wearables Market

Table 55 Unaddressed Regulatory Issues and Vulnerability of Healthcare Information

Table 56 Wearable Technology Market, By Type, 2014–2022 (USD Billion)

Table 57 Wearable Technology Market, By Type, 2014–2022 (Million Units)

Table 58 Wearable Technology Market, By Product, 2014–2022 (USD Billion)

Table 59 Wearable Technology Market, By Product, 2014–2022 (Million Units)

Table 60 Wearable Technology Market, By Application, 2014–2022 (USD Million)

Table 61 Wearable Technology Market, By Geography, 2014–2022 (USD Billion)

Table 62 Ranking Analysis of Top 5 Players in Wearable Technology Market, 2015

Table 63 Bluetooth Market, By Type, 2014–2022 (USD Million)

Table 64 Bluetooth Market, By Application, 2014–2022 (USD Million)

Table 65 Bluetooth Market, By Region, 2014–2022 (USD Million)

Table 66 Ranking Analysis of Top 5 Players in Bluetooth Market

List of Figures (76 Figures)

Figure 1 Top 10 Mobility Technologies Market

Figure 2 Process Flow of Market Size Estimation

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Mobile Augmented Reality Expected to Witness the Highest Growth Rate Between 2016 and 2022

Figure 6 Commercial Vertical Expected to Witness Highest Growth Between 2016 and 2022

Figure 7 Network Infrastructure Devices Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 8 Fingerprint Recognition Method is Expected to Dominate the Single Factor Authentication Method Between 2016 and 2022

Figure 9 Automated Driver Assistance to Hold the Largest Share of the Automotive V2X Market for Applications in 2017

Figure 10 U.S. Likely to Hold the Largest Share of the Cellular IoT Market Between 2016 and 2022

Figure 11 Decline in Cost of Hardware Components Would Drive the Mobile Augmented Reality Market

Figure 12 Mobile Augmented Reality Market for Hardware Components Expected to Grow at A Higher CAGR Between 2016 and 2022

Figure 13 Mobile Augmented Reality Market for Smartphones Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 14 Commercial Vertical Expected to Hold the Largest Share of the Mobile Augmented Reality Market By 2022

Figure 15 Geographic Snapshot: the Market in APAC to Grow With the Highest CAGR Between 2016 and 2022

Figure 16 Rising Need for Faster Data Transfer Driving the Growth of the Wireless Gigabit Market

Figure 17 Display Devices Expected to Hold A Larger Share of the Global Wireless Gigabit Market Based on Product Between 2016 and 2022

Figure 18 System on Chip Expected to Dominate the Global Wireless Gigabit Market Between 2015 and 2022

Figure 19 Consumer Electronics Application Expected to Hold the Largest Share of the Global Wireless Gigabit Market Between 2016 and 2022

Figure 20 APAC Expected to Hold the Largest Share of the Global Wireless Gigabit Market By 2022 (USD Million)

Figure 21 Automotive Vehicle-To-Everything Market Dynamics

Figure 22 Number of Road Traffic Deaths, Worldwide

Figure 23 Automotive V2X Market for Software Expected to Grow at A Higher Rate Between 2017 and 2022

Figure 24 V2v Communication Expected to Hold the Largest Share of the Automotive V2X Market Between 2017 and 2022

Figure 25 Passenger Vehicles Expected to Dominate the Automotive Vehicle-To-Everything Market Between 2017 and 2022

Figure 26 Cellular Connectivity Expected to Grow at A Higher Rate in the Automotive V2X Market Between 2017 and 2022

Figure 27 Automated Driver Assistance Application Expected to Hold the Largest Share of the Automotive V2X Market Between 2017 and 2022

Figure 28 Automotive V2X Market in China Expected to Grow at the Highest Rate Between 2017 and 2022

Figure 29 Government Initiatives to Adopt Biometrics and Rising Mobile Transactions are the Key Drivers for the Mobile Biometrics Market

Figure 30 Mobile Biometrics Market for the Software Segment Expected to Grow at A Higher Rate Compared to the Hardware Segment Between 2016 and 2022

Figure 31 Mobile Biometrics Market for Single-Factor Authentication Expected to Hold the Largest Market Share in 2016

Figure 32 Consumer Electronics Expected to Hold the Largest Share of the Mobile Biometrics Market in 2016

Figure 33 Market in Asia-Pacific to Grow at the Highest Rate Between 2016 and 2022

Figure 34 Increasing Efficiency of Wireless Charging-Enabled Devices Expected to Drive the Market

Figure 35 Wearable Device Expected to Witness the Highest Growth Rate in the Wireless Charging Market for Consumer Electronics Between 2016 and 2022

Figure 36 Induction Technology Expected to Dominate the Wireless Charging Market Between 2016 and 2022

Figure 37 APAC Expected to Dominate the Wireless Charging Market Between 2016 and 2022

Figure 38 Rising Demand for Cellular Connectivity in the Automotive Sector and Extended Network Coverage Contributes to the Cellular IoT Market Growth

Figure 39 Rising Demand for Embedded Connectivity in Automobiles

Figure 40 Cellular IoT Market for Software Segment Expected to Grow at A Higher Rate Between 2016 and 2022

Figure 41 2G Expected to Hold the Largest Share of the Cellular IoT Market Between 2016 and 2022

Figure 42 Cellular IoT Market for Building Automation Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 43 Cellular IoT Market in China Expected to Grow at the Highest Rate Between 2016 and 2022

Figure 44 Growing Significance of Efficient Critical Communication Operations Drive the Market

Figure 45 Digital LMR Expected to Grow at Highest Rate for Land Mobile Radio Market During the Forecast Period

Figure 46 Digital Technology Expected to Grow at Highest Rate for Land Mobile Radio Market During the Forecast Period

Figure 47 Public Safety Application Expected to Hold the Largest Share of Land Mobile Radio Market in 2016

Figure 48 APAC Expected to Register the Highest Growth Rate Between 2016 and 2022

Figure 49 Growing Material Handling Equipment Sector is the Key Factor Driving the Global Automated Guided Vehicle Market

Figure 50 Material Handling Equipment Market, 2011-2014 (Thousand Units)

Figure 51 Projected Share of Lithium-Ion Based Batteries in Various Industrial Segments By 2020

Figure 52 The Tow Vehicles Segment is Expected to Lead the Global Automated Guided Vehicle Market Between 2016 and 2022

Figure 53 The Laser Guidance Technology is Expected to Dominate the AGV Market in Terms of Market Share

Figure 54 AGV Market for Lithium-Ion Battery is Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 55 The Automotive Segment is Expected to Lead the Global Automated Guided Vehicle Market Between 2016 and 2022

Figure 56 The Transportation Application Segment is Expected to Account for the Largest Share in the AGV Market By 2022

Figure 57 Growing Popularity of Internet of Things and Connected Devices and Consumer Preference for Sophisticated Gadgets are the Driving Factors for the Growth of Wearable Technology Market

Figure 58 Wearable Products (Non-Textiles) Expected to Grow at Highest Rate in Wearable Technology Market Between 2016 and 2022

Figure 59 Headwear Segment of Wearable Technology Market Expected to Witness the Highest Growth Rate Between 2016 and 2022

Figure 60 Consumer Electronics Application Expected to Dominate the Wearable Technology Market Between 2016 and 2022

Figure 61 Americas Wearable Technology Market Expected to Grow at the Highest Rate During Forecast Period

Figure 62 Growing Demand for Internet of Things and Increasing Internet Connectivity are Driving the Bluetooth Market

Figure 63 Consumer Electronics Application Expected to Dominate the Bluetooth Market Between 2016 and 2022

Figure 64 APAC Expected to Dominate the Bluetooth Market Between 2016 and 2022

Figure 65 Qualcomm, Inc.: Company Snapshot

Figure 66 Sierra Wireless: Company Snapshot

Figure 67 Apple Inc.: Company Snapshot

Figure 68 Samsung Electronics Co., Ltd.: Company Snapshot

Figure 69 Nuance Communications Inc.: Company Snapshot

Figure 70 Intel Corporation: Company Snapshot

Figure 71 Texas Instruments: Company Snapshot

Figure 72 Microchip Technology (Atmel Corporation): Company Snapshot

Figure 73 Stmicroelectronics N.V.: Company Snapshot

Figure 74 Harris Corporation : Company Snapshot

Figure 75 Motorola Solutions, Inc. : Company Snapshot

Figure 76 Daifuku Co., Ltd.: Company Snapshot

The research methodology used to estimate and forecast the Top 10 mobility technologies market begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources referred to for this research study include information from various journals and databases such as IEEE journals, Factiva, Hoover’s, and OneSource. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure has been employed to arrive at the overall size of the Top 10 mobility technologies market from the revenues of the key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews of people holding key positions in the industry such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

The major players in the market for Top 10 mobility technologies include Qualcomm Inc. (U.S.), Sierra Wireless (Canada), Apple Inc. (U.S.), Samsung Electronics Corporation Ltd. (South Korea), Nuance Communication, Inc. (U.S.), Intel Corporation (U.S.), Texas Instruments (U.S.), Atmel Corporation (U.S.), STMicroelectronics N.V. (Switzerland), Autotalks Limited (Israel), Harris Corporation (U.S.), Motorola Solutions, Inc. (U.S.), Daifuku Co., Ltd. (Japan), and Dematic GmbH & Co., KG. (Germany). The end users of these mobility technologies are from the consumer, entertainment, industrial, automotive, military, defense, and aviation, and other sectors.

The Target Audience:

- Wireless gigabit chip manufacturers

- WiGig end product OEMs

- Wireless power associations

- Wireless power-enabled device manufacturers and suppliers

- Companies operating in the wearable technology market

- Biometric technology providers

- Software vendors

- Semiconductor foundries

- Original equipment manufacturers (OEMs) and electronic product manufacturers

- IoT security companies

- Automation and control system providers

“The study answers several questions for the target audiences, primarily which market segments to focus on in the next two to five years for prioritizing their efforts and investments.”

To know about the assumptions considered for the study, download the pdf brochure

Report Scope:

In this report, the Top 10 mobility technologies market has been segmented on the basis of the following categories:

-

Bluetooth Market

- By Type

- By Application

- By Geography

-

Cellular IoT Market

- By Offering

- By Type

- By Application

- By Geography

-

Automotive Vehicle–to–Everything Market

- By Offering

- By Communication Type

- By Vehicle Type

- By Connectivity Type

- By Application

- By Geography

-

Mobile Augmented Reality Market

- By Component

- By Application

- By Vertical

- By Geography

-

Wireless Gigabit Market

- By Product

- By Module

- By Application

- By Geography

-

Wireless Charging Market

- By Device

- By Technology

- By Range

- By Geography

-

Wearable Technology Market

- By Type

- By Product

- By Application

- By Geography

-

Mobile Biometric Market

- By Component

- By Authentication Mode

- By Industry

- By Geography

-

Automated Guided Vehicle Market

- By Type

- By Navigation Technology

- By Battery Type

- By Industry

- By Application

- By Geography

-

Land Mobile Radio Market

- By Type

- By Technology

- By Application

- By Geography

Competitive Landscape: Market ranking analysis

Company Profiles: Detailed analysis of the major companies present in the Top 10 mobility technologies market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Top 10 Mobility Technologies Market