Gesture Recognition and Touchless Sensing Market Size, Share & Growth

Gesture Recognition and Touchless Sensing Market, by Technology (Touch-based, Touchless), Touchless Sensing Product (Touchless Biometric Equipment, Touchless Sanitary Equipment), Gesture Recognition, Industry, and Region - Global Forecast to 2032

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

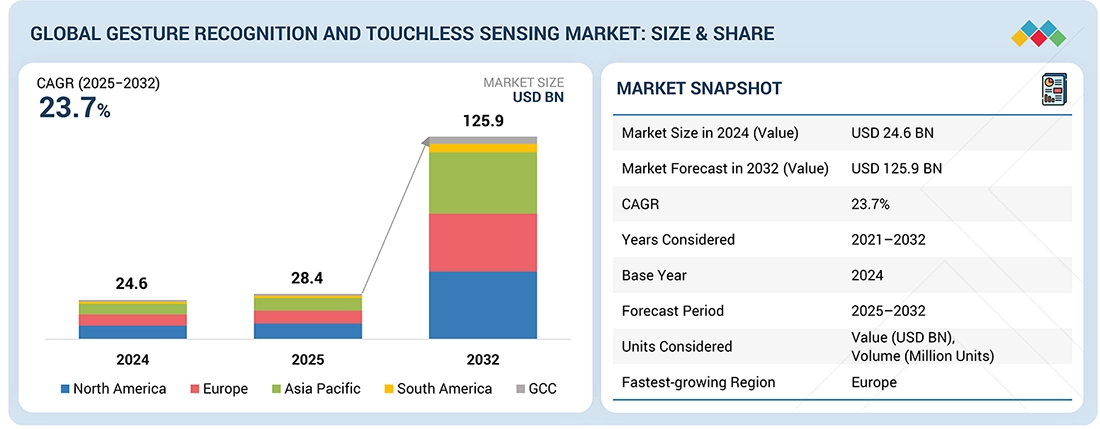

The global gesture recognition and touchless sensing market size is projected to reach USD 125.9 billion by 2032 from USD 28.4 billion in 2025, at a CAGR of 23.7% from 2025 to 2032. Growth in digitalization, technological advancements across industries, and an increase in the use of touchless sensing in the automotive and healthcare industries are major factors driving market growth. Further, increasing use of gesture recognition in VR and video games is likely to create new growth opportunities during the forecast period.

The gesture sensing control market is growing rapidly as industries adopt touchless technologies that allow users to control devices through simple hand or body movements. Gesture sensing systems use technologies such as motion sensors, infrared sensors, depth cameras, and AI-based algorithms to detect and interpret human gestures, enabling natural human–machine interaction. The market is expanding across sectors including consumer electronics, automotive, healthcare, gaming, and smart home automation, where gesture control improves convenience, safety, and user experience.

The GCC gesture recognition market is experiencing strong growth as governments and industries across countries such as Saudi Arabia, the UAE, Qatar, Kuwait, and Oman increasingly adopt touchless and AI-enabled technologies.Investments in smart cities, connected homes, automotive infotainment systems, and healthcare technologies are accelerating adoption, while advancements in AI, sensors, and 3D gesture recognition are further improving system accuracy and expanding applications across the region.

The touchless sensing market is gaining strong momentum as industries shift toward safer, more intuitive, and hygienic human–machine interactions. Powered by advances in AI, computer vision, radar, infrared, and ultrasonic technologies, touchless sensing enables gesture recognition, motion tracking, and presence detection without physical contact. Demand is rising across consumer electronics, automotive, healthcare, smart homes, and industrial automation, especially after the pandemic accelerated the need for contact-free interfaces. In vehicles, touchless controls improve driver safety, while in healthcare and public infrastructure they reduce contamination risks. As sensors become more accurate, energy-efficient, and cost-effective, touchless sensing is evolving from a convenience feature into a core component of next-generation smart and connected systems.

The 3D gesture sensing control market is expanding rapidly as industries adopt advanced touchless interaction technologies that allow users to control devices through natural hand movements in three-dimensional space. These systems use technologies such as infrared sensors, depth cameras, radar, ultrasonic sensing, and AI-based computer vision to accurately detect and interpret gestures, enabling intuitive human–machine interaction across devices. The market is witnessing strong adoption in consumer electronics, automotive infotainment systems, healthcare equipment, gaming, and smart home applications, where hands-free control improves convenience and safety.

KEY TAKEAWAYS

-

GESTURE RECOGNITION AND TOUCHLESS SENSING MARKET, BY REGIONBy region, North America is expected to dominate the market and is projected to grow at a CAGR of 23.1% during the forecast period.

-

GESTURE RECOGNITION AND TOUCHLESS SENSING MARKET, BY TECHNOLOGYBy technology, the touch-less technology segment is expected to dominate the market during the forecast period.

-

GESTURE RECOGNITION MARKET, BY TYPEBy gesture recognition type, the online segment is expected to grow at the fastest CAGR during the forecast period.

-

GESTURE RECOGNITION MARKET, BY INDUSTRYBy gesture recognition, the consumer electronics segment is expected to dominate the market.

-

TOUCHLESS SENSING MARKET, BY PRODUCTBy touchless sensing product, the touchless sanitary equipment is expected to register the fastest CAGR during the forecast period.

-

TOUCHLESS SENSING MARKET, BY INDUSTRYBy touchless sensing industry, the automotive segment is expected to register the highest CAGR during the forecast period.

-

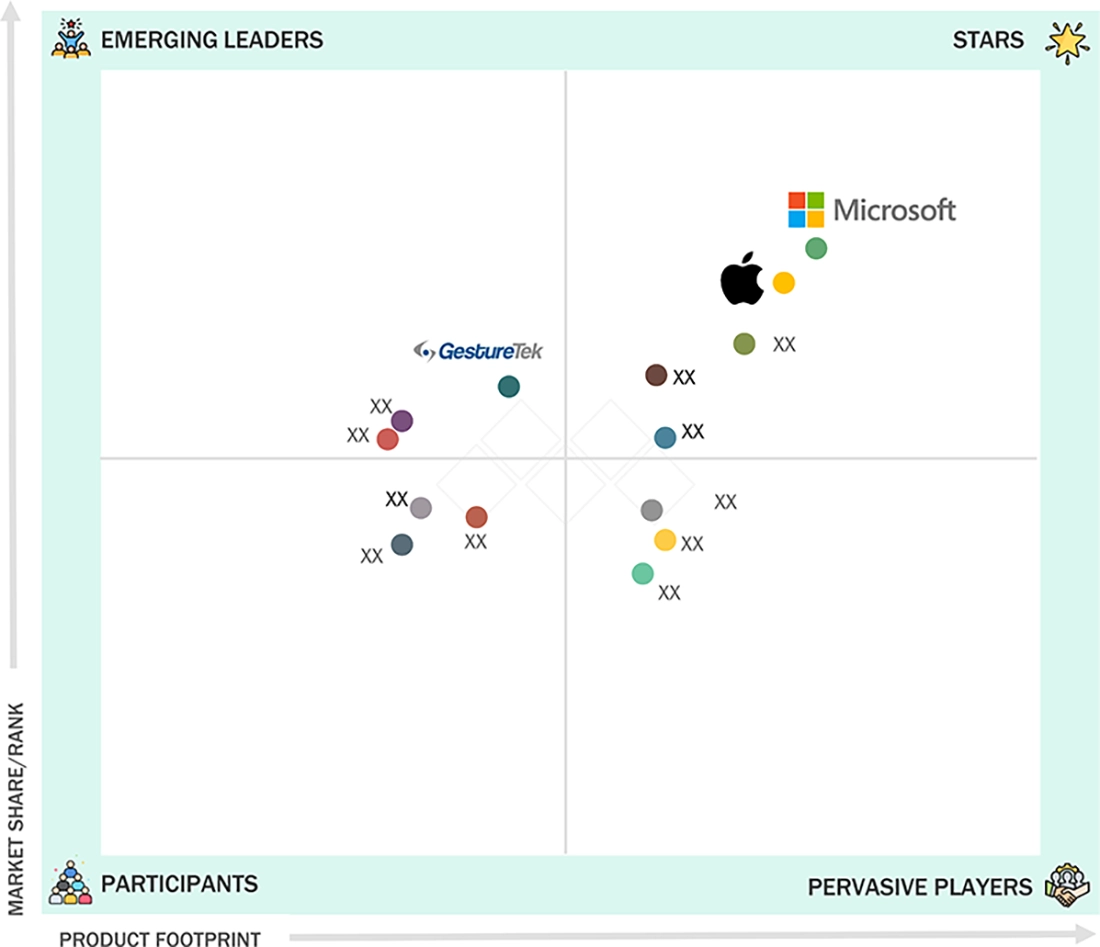

COMPETITIVE LANDSCAPE - KEY PLAYERSApple Inc. (US), Microsoft Corporation (US), Microchip Technology Inc. (US), Google LLC (US), and Infineon Technologies (Germany) were identified as some of the star players in the global gesture recognition and touchless sensing market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - STARTUPS/SMESHID Global Corporation (US), OMRON Corporation (Japan), and ESPROS, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders. These vendors have been marking their market presence by offering solutions as per end-user requirements and adopting growth strategies to achieve their targets.

Major automobile manufacturers, including Volkswagen AG (Germany), BMW AG (Germany), and Mercedes-Benz, a division of Daimler AG (Germany), have integrated gesture control technology into their vehicles, creating a platform for gesture recognition technology to enhance control interfaces. In 2024, Harman launched Ready Connect 5G Telematics Control Unit (TCU), which uses new Snapdragon Digital Chassis connected car technologies from Qualcomm Technologies, Inc., to push connectivity boundaries and democratize the automotive connectivity landscape.

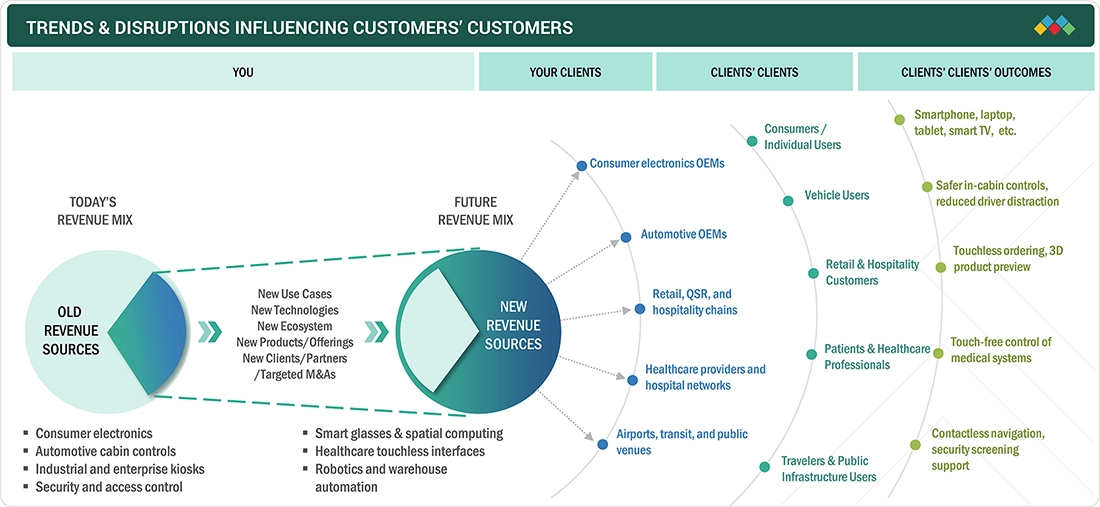

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The gesture recognition and touchless sensing market share is shifting toward AI-driven, sensor-based interfaces across multiple industries. Adoption is expanding from consumer electronics into automotive, healthcare, retail, and public infrastructure. Touchless systems are improving safety, hygiene, and user convenience through accurate, context-aware interactions. These trends are creating new revenue opportunities and reshaping traditional interface models.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in digitalization and rise in technological advancements across industries

-

Increasing demand for connectivity in automotive industry

Level

-

High replacement expenses and user resistance to new products

-

Integration challenges with existing systems

Level

-

Tracking and controlling functionality upgrades in touchless biometric solutions

-

Higher use of gesture recognition in VR and video games

Level

-

High costs and complex framework of product technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in digitalization and rise in technological advancements across industries

Growth in digitalization and rapid technological advancements across industries is increasing the adoption of gesture recognition and touchless sensing solutions. These technologies enable enhanced user interaction, automation, and hygiene-focused operations across the automotive, consumer electronics, healthcare, and smart infrastructure sectors.

Restraint: High replacement expenses and user resistance to new products

High replacement expenses and user resistance to adopting new technologies continue to limit market penetration. Concerns related to integration complexity, compatibility with existing systems, and cost justification slow large-scale deployment.

Opportunity: Tracking and controlling functionality upgrades in touchless biometric solutions

Advancements in tracking and controlling functionalities within touchless biometric solutions are creating new growth opportunities. Enhanced accuracy and real-time responsiveness are expanding use cases in security systems, smart homes, and immersive digital environments.

Challenge: High costs and complex framework of product technologies

High development costs and the complex technological framework required for gesture recognition and touchless sensing solutions remain key challenges. Ensuring reliability, precision, and scalability while managing costs impacts adoption, particularly among small and mid-sized enterprises.

GESTURE RECOGNITION AND TOUCHLESS SENSING MARKET SIZE: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Apple deployed gesture recognition and touchless sensing in its consumer electronics ecosystem, including Face ID facial recognition for iPhone and iPad devices, touchless gesture controls in watchOS, and spatial computing interactions in Vision Pro headset for immersive AR/VR experiences. | The technology enabled seamless biometric authentication, improved user privacy and security, enhanced accessibility for users with mobility limitations, reduced physical contact with devices, and created intuitive spatial computing experiences with natural hand tracking and eye-gaze interactions. |

|

Microsoft implemented gesture recognition and touchless sensing through Azure Kinect DK and HoloLens mixed reality platform for enterprise applications, including hands-free surgical guidance in healthcare, touchless industrial equipment control in manufacturing, and gesture-based collaboration tools in corporate environments. | The deployment improved workplace hygiene and safety by eliminating physical touch requirements, enhanced productivity through natural gesture-based interactions, enabled innovative mixed reality training and simulation programs, and supported social distancing requirements in healthcare and manufacturing facilities. |

|

Microchip Technology deployed GestIC 3D gesture recognition controllers and touchless sensor solutions for automotive human-machine interfaces, smart home devices, and consumer electronics, enabling mid-air gesture control for infotainment systems, touchless light switches, and proximity sensing for appliances. | The technology reduced driver distraction through intuitive gesture controls in vehicles, improved hygiene in public spaces and high-traffic environments, extended product lifespan by minimizing mechanical wear from physical buttons, and enhanced user convenience with contactless operation of everyday devices. |

|

Google implemented gesture recognition and touchless sensing through Project Soli, a radar-based motion sensing technology, in Pixel smartphones and Nest smart home devices. This enabled touchless music control, call management, alarm snoozing, and presence detection for automated lighting and security systems. | The system enabled hands-free device control for improved accessibility and convenience, reduced unnecessary device interactions to extend battery life, enhanced privacy through on-device processing without cameras, and created more intuitive smart home automation with presence and motion-based triggers. |

|

Infineon Technologies deployed 60GHz radar sensors and Time-of-Flight (ToF) solutions for gesture recognition and touchless sensing in automotive cabin monitoring systems, smart retail displays with gesture-based navigation, and industrial robotics with touchless human-machine collaboration interfaces. | The deployment improved automotive safety through driver attention monitoring and child presence detection. It enhanced retail customer engagement with interactive touchless displays, enabled safer human-robot collaboration in industrial settings, and provided reliable performance in challenging environmental conditions, including varying lighting and temperature ranges. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The gesture recognition and touchless sensing ecosystem comprises technology developers, sensor and hardware suppliers, and semiconductor providers collaborating to enable reliable contactless interaction solutions. The ecosystem supports the development of integrated systems that combine software intelligence with advanced sensing and processing capabilities. Growing demand from consumer electronics, automotive, and smart infrastructure applications is driving investments in performance optimization, scalability, and system-level integration.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Gesture Recognition and Touchless Sensing Market, By Technology

The touchless technology segment is expected to dominate the market during the forecast period. Increasing preference for contact-free interfaces in public and private environments is driving adoption. Advancements in sensor accuracy and system integration are improving performance and reliability.

Gesture Recognition Market, By Type

The online gesture recognition segment is expected to grow at the fastest CAGR during the forecast period. Real-time data processing enables faster response and improved interaction accuracy. This capability supports adoption in applications requiring immediate and dynamic user control.

Gesture Recognition Market, By Industry

The consumer electronics segment is expected to dominate the gesture recognition market trends. High usage in smartphones, wearables, gaming devices, and smart home systems continues to drive demand. Manufacturers are focusing on intuitive user experiences to maintain market growth.

Touchless Sensing Market, By Product

The touchless sanitary equipment segment is expected to register the fastest CAGR during the forecast period. Rising awareness of hygiene and safety is driving the deployment of solutions in commercial buildings and public infrastructure. Regulatory focus on cleanliness standards further supports adoption.

Touchless Sensing Market, By Industry

The automotive segment is expected to register the fastest CAGR in the touchless sensing market. The integration of gesture-based controls in vehicle cabins is enhancing safety and driver convenience. The growing demand for smart and connected vehicles is accelerating market expansion.

REGION

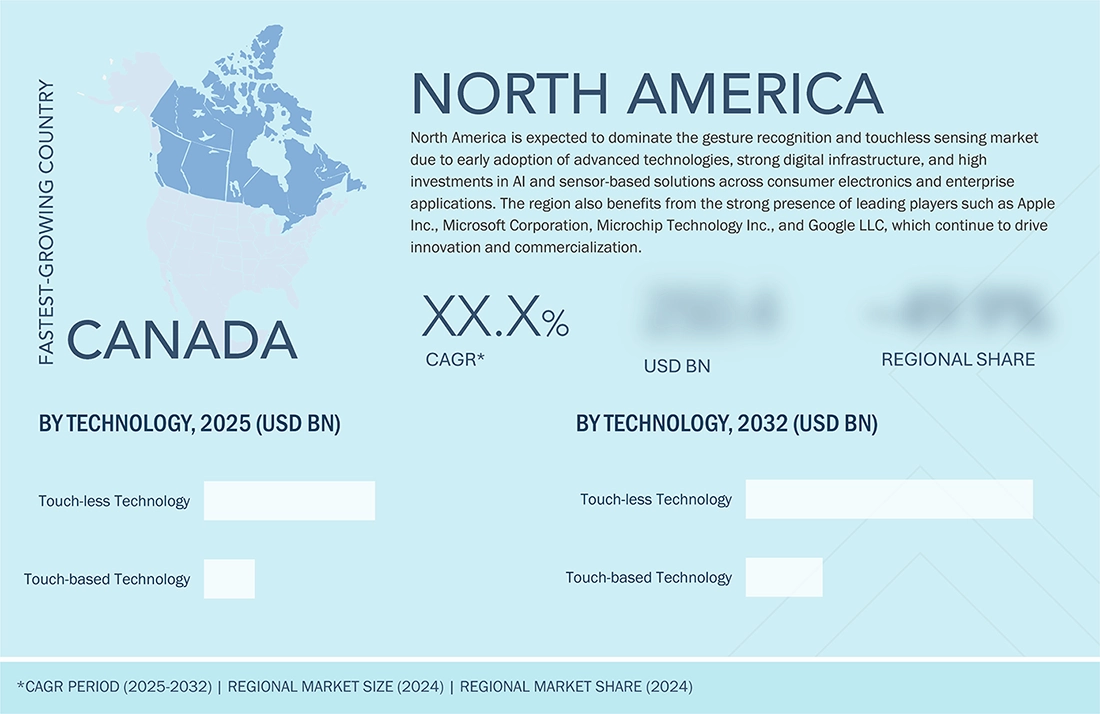

Canada to be fastest-growing country in North America gesture recognition and touchless sensing market during forecast period

North America is expected to dominate the touchless sensing market size during the forecast period. The region benefits from early adoption of advanced technologies and strong demand across consumer electronics, automotive, and healthcare applications. Continuous investments in AI, sensor technologies, and smart infrastructure are supporting market growth. The presence of key players such as Apple Inc. (US), Microsoft Corporation (US), Microchip Technology Inc. (US), Google LLC (US), OMNIVISION (US), and GestureTek (Canada) further strengthens the regional ecosystem. Strong innovation capabilities and a mature technology landscape position North America as a leading market.

GESTURE RECOGNITION AND TOUCHLESS SENSING MARKET SIZE: COMPANY EVALUATION MATRIX

In the global touchless sensing market share matrix, Apple Inc. and Microsoft Corporation (Star) lead with a strong market presence and a wide product portfolio, driving large-scale adoption across various verticals, including consumer electronics, healthcare, and automotive. GestureTek (Emerging Leader) is strengthening its position by offering specialized gesture-based interaction solutions for smart spaces, healthcare environments, and interactive installations, supporting growing adoption in targeted applications.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 24.6 Billion |

| Market Forecast in 2032 (Value) | USD 125.9 Billion |

| Growth Rate | CAGR of 23.7% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD BN), Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

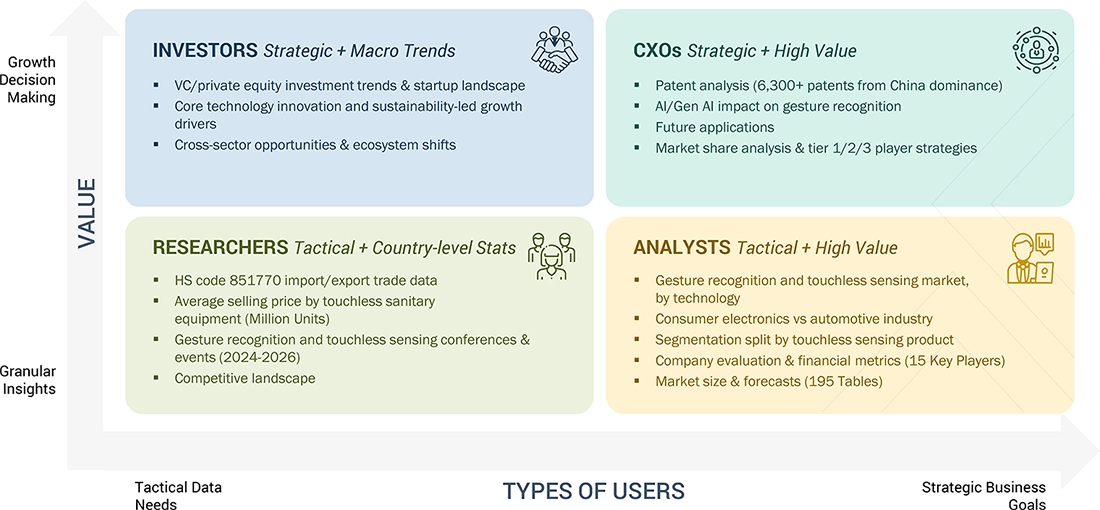

WHAT IS IN IT FOR YOU: GESTURE RECOGNITION AND TOUCHLESS SENSING MARKET SIZE REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Automotive Gesture Control Manufacturer |

|

|

| Healthcare Touchless Interface Provider |

|

|

| Smart Building Technology Integrator |

|

|

| Retail Touchless Payment System Vendor |

|

|

| Consumer Electronics Gesture Interface Developer |

|

|

RECENT DEVELOPMENTS

- April 2024 : Microchip Technology Inc. acquired Seoul-based VSI Co. Ltd., a provider of high-speed asymmetric camera, sensor, and display connectivity technologies. The acquisition strengthens Microchip’s portfolio in Automotive SerDes Alliance (ASA)–based products, supporting advanced in-vehicle networking (IVN) applications.

- March 2024 : OMNIVISION launched its new OV50K40 smartphone image sensor based on TheiaCel technology. The OV50K40 is a 50-megapixel sensor with 1.2-micron pixel size and a 1/1.3-inch optical format, offering high gain and correlated multiple sampling (CMS) to improve performance in low-light conditions.

- September 2023 : Apple Inc. introduced the Apple Watch Series 9, powered by watchOS 10, featuring redesigned apps, a new Smart Stack, updated watch faces, and enhanced cycling and hiking capabilities. The launch also included double-tap gesture support, improved performance, and expanded access to health data and Precision Finding.

- January 2023 : Cognitec Systems GmbH upgraded its FaceVACS-Entry technology to enable comparison of facial images retrieved from ID documents or databases. The update also incorporated presentation attack detection to ensure live user interaction with the device.

FAQ

1. What is the current size and projected growth of the gesture recognition market?

The global gesture recognition market has been experiencing significant growth due to rising adoption of touchless interfaces across consumer electronics, automotive, healthcare, and smart home sectors. Market estimates suggest the industry was valued at several billion USD in the early 2020s and is expected to grow at a healthy CAGR (often projected between 15–25 % through the latter half of the decade) as technology improves and demand for more natural human–machine interfaces increases.

2. Which regions hold the largest market share in gesture recognition?

North America and Asia Pacific are generally leading regions in the touchless sensing market growth. North America holds a substantial share due to strong technology adoption, presence of major tech companies, and uptake in sectors such as automotive and consumer electronics. Meanwhile, Asia Pacific—particularly countries like China, Japan, South Korea, and India—is witnessing rapid growth driven by manufacturing, smart devices, and expanding demand for advanced user interface technologies.

3. What technologies are commonly used in gesture recognition systems?

Gesture recognition systems use a variety of technologies, including:

-

Camera-based optical sensors (2D/3D imaging) for detecting and interpreting hand and body movements

-

Infrared (IR) sensors that recognize motion and proximity

-

Radar and ultrasonic sensing technologies for non-line-of-sight gesture detection

-

Machine learning and AI algorithms that improve accuracy and interpretation of gesture patterns

Each technology offers unique benefits depending on application needs, such as precision, cost, and environmental conditions.

4. What are the key application areas for gesture recognition technology?

Gesture recognition is used across multiple industries, including:

-

Consumer electronics such as smartphones, tablets, and gaming systems (e.g., gesture control cameras)

-

Automotive interfaces enabling touchless controls for infotainment and vehicle systems

-

Healthcare and assistive technologies supporting sterile interaction in surgical settings or accessibility tools

-

Smart home and IoT devices for controlling lights, appliances, and entertainment systems via gestures

These applications highlight how gesture controls enhance user experience by providing intuitive, contactless interaction methods.

5. Which companies are leading the gesture recognition market?

Key players in the touchless sensing market Trends include a mix of technology vendors, semiconductor developers, and software innovators. Some prominent companies and brands are:

-

Microsoft, with its Kinect sensor and body-tracking technologies

-

Google / Alphabet, integrating gesture and motion sensing in platforms and AI research

-

Apple, advancing gesture controls through devices like iPhones, iPads, and MacBooks

-

Ultraleap (formerly Leap Motion), focusing on high-precision hand-tracking systems

-

Samsung Electronics, deploying gesture interfaces in consumer products and smart appliances

These companies invest in R&D to refine gesture algorithms, sensor fusion, and real-time interaction capabilities, often collaborating with OEMs and platform developers to extend touchless sensing market analysis into new markets.

Table of Contents

Methodology

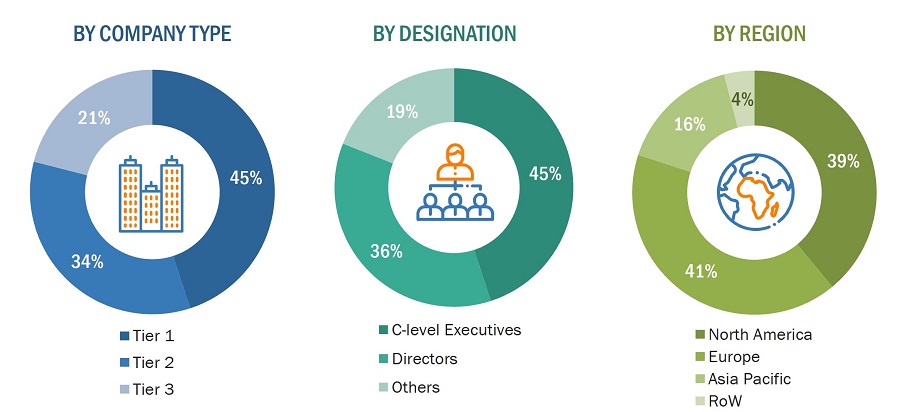

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the gesture recognition and touchless sensing market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the gesture recognition and touchless sensing market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the gesture recognition and touchless sensing market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers; gesture recognition and touchless sensing market products-related journals; certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the gesture recognition and touchless sensing market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

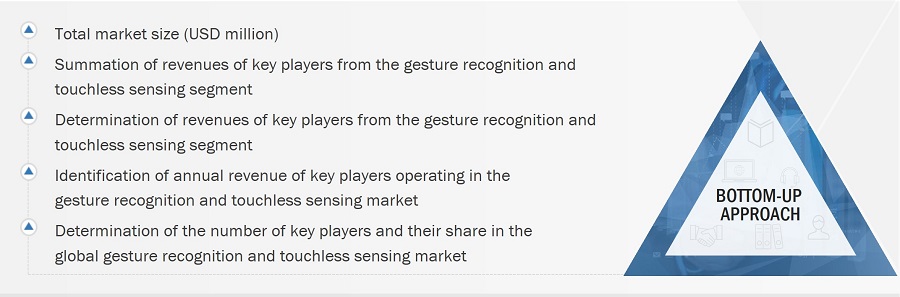

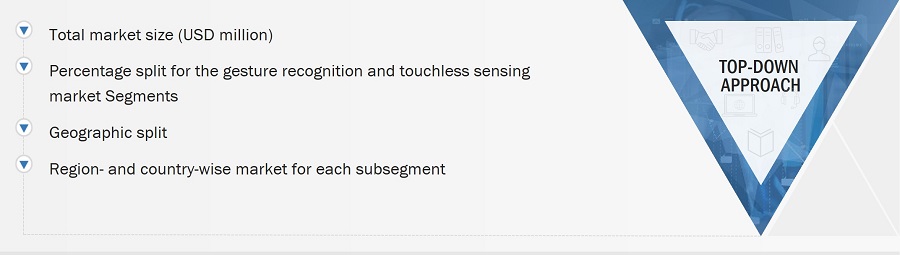

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the gesture recognition and touchless sensing market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Gesture Recognition and Touchless Sensing Market : Bottom-up Approach

Gesture Recognition and Touchless Sensing Market : Top-Down Approach

Data Triangulation

After arriving at the overall size of the gesture recognition and touchless sensing market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Market Definition

Gesture recognition and touchless sensing are two radical technologies that facilitate users by getting rid of physical connections in order to operate any smart device. The idea of gesture recognition and touchless sensing underwent a sea change in the last decade. Intelligence in electronic devices is very technology-oriented, efficient, and assures high HMI. The growth in the market can be attributed to the easy adoption of gesture recognition and touchless sensing due to low technical complexity and increased digitalization. Gesture recognition and touchless sensing use various mathematical algorithms in computing devices to translate human gestures or movements. These systems help humans interact with machines without using any mechanical devices. Gesture recognition and touchless sensing technology use human gestures, such as the movement of the head, fingers, arms, hands, and the entire body. The gesture recognition market is segmented into technology, type, industry, and geography, whereas the touchless sensing market is segmented into technology, product, industry, and geography.

Key Stakeholders

- Gesture recognition and touchless sensing hardware and software providers

- Analysts and strategic business planners

- Venture capitalists and startups

- Research laboratories and intellectual property (IP) companies

- Technology standards organizations, forums, alliances, and associations

- Government bodies such as regulatory authorities and policymakers

- Raw material suppliers and manufacturers of gesture recognition and touchless sensing products

- Installation & maintenance service providers

- End customers from the consumer electronics, automotive, healthcare, and banking & finance sectors

Report Objectives

- To define, describe, and forecast the gesture recognition and touchless sensing market based on technologies, product, type, industry, and region.

-

To forecast the sizes of various segments with respect to four major regions—

North America, Europe, Asia Pacific, and Rest of the World (RoW) - To provide a detailed analysis of the gesture recognition and touchless sensing market supply chain.

- To analyze the impact of the recession on gesture recognition and touchless sensing market market

- To strategically analyze the micromarkets1 with respect to individual growth trends and prospects and their contributions to the total market

- To analyze competitive developments such as expansions, agreements, partnerships, acquisitions, product developments, and research and development (R&D) in the gesture recognition and touchless sensing market

- To analyze the opportunities for market players and provide details of the competitive landscape of the market.

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios.

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market.

Available customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

The following customization options are available for the report:

- Market sizing and forecast for additional countries

- Additional five companies profiling

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Gesture Recognition

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Gesture Recognition