Iris Recognition Market Size, Share, Statistics, Industry Growth Analysis Report by Component (Hardware, and Software), Product (Smartphones, Scanners), Application (Identity Management and Access Control, Time Monitoring, E-payment), Vertical and Region - Global Forecast to 2027

Updated on : October 22, 2024

The Iris Recognition Market is witnessing significant growth, driven by the escalating demand for secure and efficient biometric solutions across various sectors, including banking, healthcare, and security. As organizations prioritize robust identity verification methods, the adoption of iris recognition technology is gaining traction due to its accuracy and speed compared to traditional biometric systems. Key trends influencing this market include advancements in artificial intelligence and machine learning, which enhance the capabilities of iris recognition systems, allowing for faster processing and improved user experience. Additionally, the growing focus on privacy and data security is pushing organizations to adopt more sophisticated biometric solutions.

Iris Recognition Market Size & Share

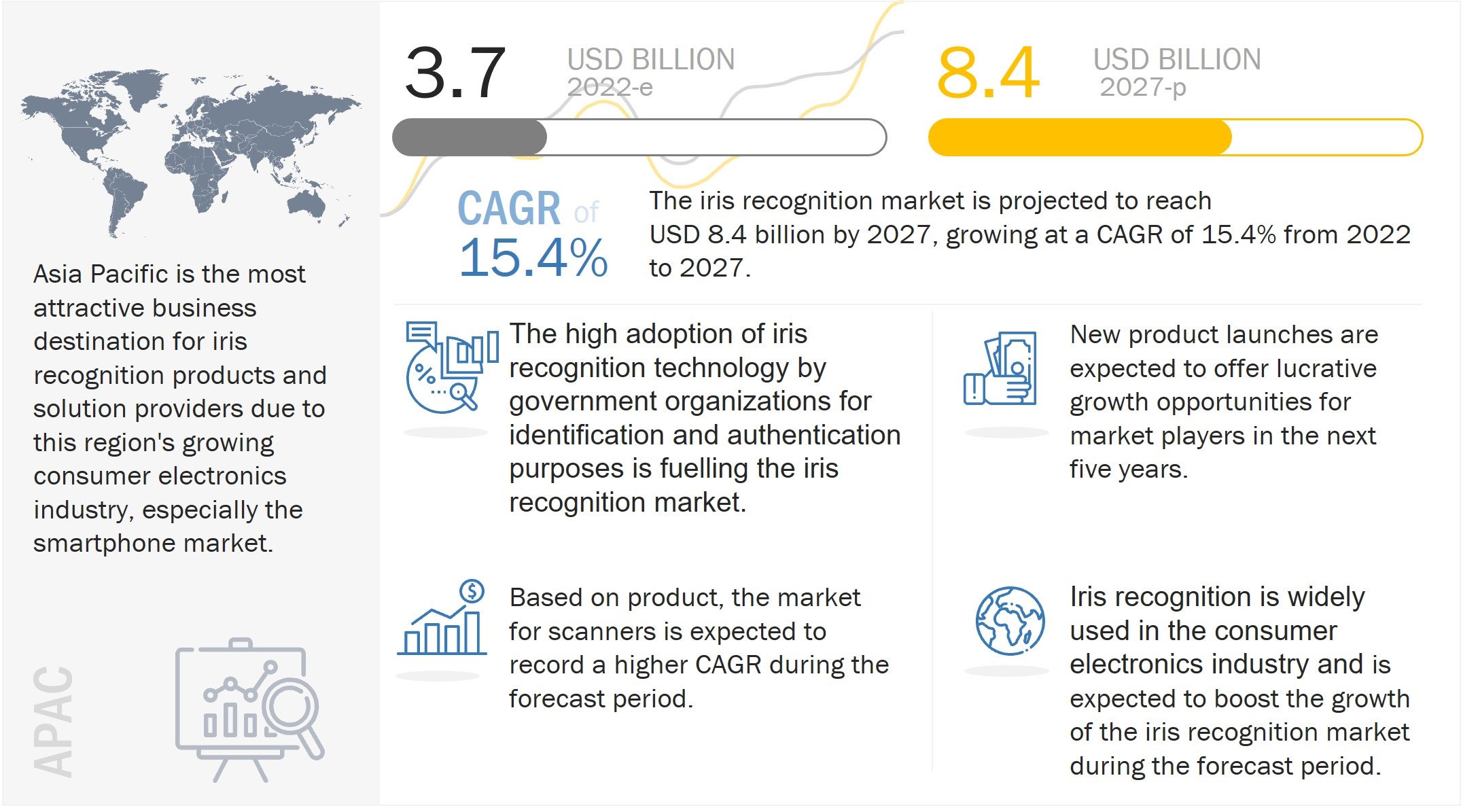

Global iris recognition market size is projected to reach USD 8.4 billion by 2027, growing at a CAGR of 17.7% from 2022 to 2027 .Cloud computing is a well-researched domain for various computational means. The use of iris recognition technology in cloud computing ensures high-level security, contrary to the conventional methods of securing data. Key factors driving the iris recognition market include the integration of cloud computing with iris recognition technology, increased adoption of iris recognition in the banking & finance industry to avoid fraudulent activities, and use of iris recognition technology for identification and authentication purposes by government organizations. Players in the iris recognition industry adopted growth strategies such as product launches, partnerships, collaborations, and strategic alliances to cater to the growing demand for iris recognition systems and expand their global footprint to all the major regions.

The objective of the report is to define, describe, and forecast the iris recognition market based on component, product, application, vertical, and region.

Iris Recognition Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Iris Recognition Market Dynamics :

Driver : Increased adoption of iris recognition technology for identification and authentication by government organizations

The government sector is one of the early adopters of iris recognition technology, generating high demand for its products and solutions. This is among the major factors fueling the growth of the iris recognition market. Government organizations/agencies/departments worldwide utilize iris recognition technology for identification and authentication purposes. For instance, the Federal Bureau of Investigation (FBI) worked with local, state, tribal, and federal agencies to build the National Crime Information Center (NCIC) and the Next Generation Identification (NGI) systems. These systems make use of iris recognition as a reliable means of identification.

Furthermore, the market is expected to expand through new agreements and contracts with governmental bodies and other end users. For instance, in April 2021, EyeLock LLC, a provider of iris identity authentication solutions and a subsidiary of VOXX International Corporation, was awarded a contract to control individual access to the four data center facilities in charge of monitoring and controlling all governmental buildings, streets, and service providers for Egypt's New Capital City.

Restraint: Presence of competing biometric technologies

Various biometric technologies, such as face recognition, fingerprint recognition, iris recognition, voice recognition, and vascular recognition, are available in the market. Based on the advantages and disadvantages of these technologies, their acceptability in the market varies. Iris recognition technology faces high competition from face and fingerprint recognition technologies. One of the primary reasons for this is its high cost. The prices of iris scanners are higher than their substitutes, such as face and fingerprint detection systems. Consequently, the increased adoption of fingerprint and face recognition biometric systems in many industries, such as travel, commercial offices, and others, impedes market growth.

Opportunities : Penetration of biometric technologies in automotive and military & defense sectors

In the automotive sector, touchless biometric products are expected to witness high demand in the coming years. The scanning of the vein, face, iris, or finger can be used for various applications, including user/driver authentication, in-car payment, in-cabin personalization, and intra-vehicle network encryption. Many automobile giants, such as Ford Motor Company (US), Audi AG (Germany), and BMW AG (Germany), are working on deploying touchless biometric systems in their cars. Iris-recognition-based biometric systems are becoming popular in the automotive sector due to their ability to work in dark environments, high accuracy, and non-contact features.

The increased adoption of iris recognition in the military & defense sector also propels market demand. The American military has used iris-scanning technology to identify prisoners in Afghanistan and Iraq. For instance, even in remote locations with poor internet, military troops can quickly transfer iris, fingerprint, and face scan data to a West Virginia FBI database using the portable biometrics recorder SEEK II.

Challenges : Complexity of integrating iris recognition technology into conventional identification solutions

One major challenge in deploying iris recognition technology is integrating it with existing systems to enable security, surveillance, and access control. Since iris biometrics technology is undergoing various advancements, such as the deployment of high-definition camera technology, algorithms, and other analytics solutions, the integration of this technology with other biometric devices has become more complex.

Government to acquire significant share by vertical in iris recognition market

The government holds a significant share in the iris recognition vertical segment. Many companies operating in the iris recognition market are offering iris recognition systems to organizations from the government sector. For instance, IriTech (UK) offers the IriShield series of iris recognition products to various government organizations, including the United Nations High Commissioner for Refugees (UNHCR), the Indian government, and the Kenyan government. Additionally, in 2021, a new partnership between Iris ID Systems Inc. and Aware Inc. was announced. This company supplies iris recognition and identity identification technologies for state and local governments to utilize the FBI's Next Generation Identification (NGI) Iris Service.

Scanner to own maximum share by product in iris recognition market

The government, banking & finance, military & defense, and travel & immigration are the major demand-generating verticals for iris scanners. The spike in cybercrime cases is one of the primary reasons for the market expansion of iris scanners. Companies in the iris recognition market are developing new iris scanners to meet the demands of their customers. For instance, Princeton Identity (US) launched the new IOM Access600e iris and face biometric capture device.

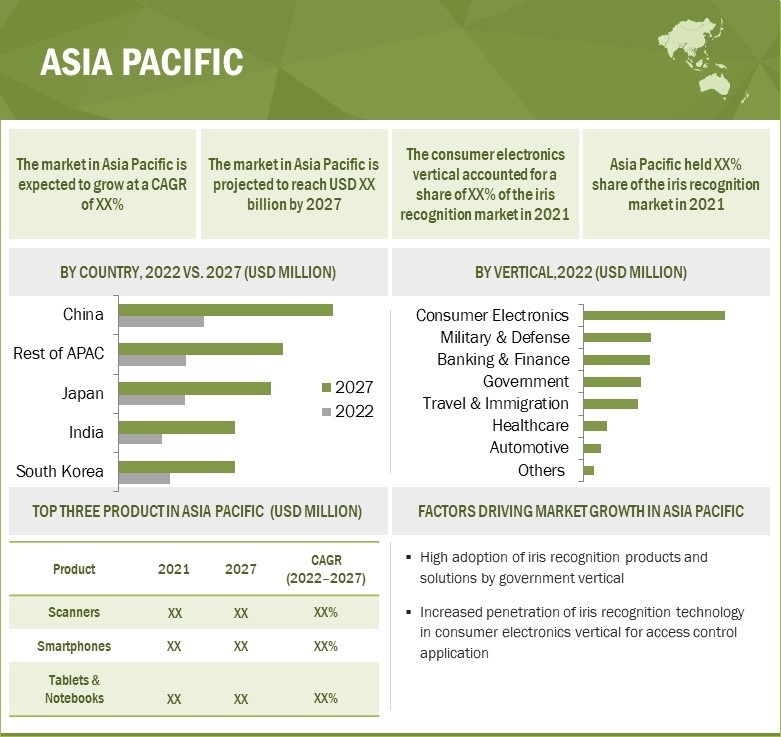

Iris recognition market to witness highest demand from Asia Pacific

The dominant position of China in the Asia Pacific iris recognition market can be attributed to the deployment of iris recognition technology in consumer electronics, government, and travel & immigration verticals. Manufacturing plants of leading consumer electronics providers boost the demand for iris recognition products and solutions in this country. Low labor costs and the easy availability of raw materials are a few key factors that have made China a favorable destination for consumer electronics manufacturers, especially mobile phone manufacturers. For instance, in smartphone manufacturing, 16 rare-earth metals, such as scandium and yttrium, are used, and China has vast reserves of most of these metals. The demand for advanced security systems is also expected to rise in China.

The country is currently involved in transportation infrastructure projects, including railways, airports, ports, and highways. This is likely to generate demand for advanced security systems, such as biometric systems, accelerating the growth of the iris recognition market in China. In May 2021, the South Korean government announced a USD 451 billion expenditure on the domestic production of semiconductors. The government shall assist the companies through tax incentives, lower interest rates, favorable regulations, corporate investments, and support packages. Such advancements are expected to upscale the deployment of biometric systems in the South Korean iris recognition market. The initiatives by the government to provide advanced and upgraded services to citizens, along with developing smart cities, are expected to offer growth opportunities for the iris recognition market in Asia Pacific.

Iris Recognition Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Iris Recognition Companies - Key Market Players:

The iris recognition companies such asThales (France), IDEMIA (France), HID Global Corporation (US), Iris ID, Inc. (US), IriTech, Inc. (US), IrisGuard Ltd. (UK), EyeLock LLC (US), NEC Corporation (Japan), Princeton Identity (US), and CMITech Company, Ltd. (Korea), among others.

Iris Recognition Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 3.7 Billion |

| Projected Market Size | USD 8.4 Billion |

| Growth Rate | 15.4% At a CAGR |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/USD Billion) |

|

Segments Covered |

|

|

Regions Covered |

|

|

Companies Covered |

|

| Top Companies in North America |

|

| Key Market Driver | Increased adoption of iris recognition technology for identification and authentication by government |

| Key Market Opportunity | Penetration of biometric technologies in automotive and military & defense sectors |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Scanner to own maximum |

| Largest Application Market Share | Identity management & access control |

Iris Recognition Market Highlights

This report categorizes the iris recognition market based on component, product, application, vertical, and region.

|

Aspect |

Details |

|

By Component |

|

|

By Product |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent developments in iris recognition market :

- In March 2022, IriTech, Inc stepped up its iris recognition products by releasing IriShield Binocular (BK2121) and cloud-based iris recognition service (IriSecureID). IriTech offers a more convenient way to access iris recognition functions, including enrollment, identification, verification, and de-duplication through a web service interface that can be easily integrated into any enterprise application.

- In February 2022, IriTech, Inc. entered a co-promotion agreement with Egis Technology Inc. (Egistec), a leading global provider of fingerprint sensors. The co-promotion with Egistec, which is already providing fingerprint solutions to top-tier smartphone manufacturers, is expected to create more opportunities for IriTech and Egistec in consumer technology while focusing on the mobile industry.

- In February 2021, EyeLock LLC entered into an agreement with Iris Scanners Technologies Pvt. Ltd. ("IrisScanners") of India. This new partnership leverages IrisScanners' extensive distribution network in India for biometric access control solutions. It also strategically targets emerging technology-based companies that strongly desire to add user-friendly, touchless, and cost-effective iris biometric products to their systems.

- In September 2021, BNCTL (Banco Nacional de Comércio de Timor-Leste) signed an agreement with IrisGuard and EyeTrust LDA to deploy IrisGuard's EyePay® Network payment platform, powered by their award-winning iris recognition technology. It is the youngest sovereign nation in Southeast Asia. This authentication and payment authorization platform, featuring the recently launched EyePay® Phone, will be utilized to verify and secure the last mile of financial transactions in counters/branches and ATMs.

Frequently Asked Questions (FAQ’s)

Which are the major companies in the iris recognition market? What are their primary strategies to strengthen their market presence?

Thales (France), IDEMIA (France), HID Global Corporation (US), eyeLock LLC (US), and NEC Corporation (Japan) are the leading players in the market. These companies have adopted organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to gain a competitive advantage in the market.

Which is the potential market for the government vertical in terms of application?

E-payment is an application with high growth opportunities owing to advancements in the government vertical. Major companies that provide government applications are Thales (France), IDEMIA (France), eyeLock LLC (US), and NEC Corporation (Japan), among others.

What are the factors creating opportunities for new market entrants?

Factors such as the adoption of iris recognition in the banking & finance industry to avoid fraudulent activities and penetration of biometric technologies in automotive and military & defense sectors are creating opportunities for the players in the market.

Which application is expected to drive market growth in the next six years?

Identity management and access control are expected to remain the major applications driving iris recognition demand. These applications held the largest share of the iris recognition market in 2021 due to high demand from government, military & defense, and banking & finance verticals.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 IRIS RECOGNITION MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 IRIS RECOGNITION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Methodology to arrive at market size using bottom-up approach

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE)— REVENUE GENERATED BY COMPANIES IN IRIS RECOGNITION MARKET

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Methodology to arrive at market size using top-down approach

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION FOR ONE COMPANY IN MARKET

FIGURE 6 IRIS RECOGNITION MARKET: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 SOFTWARE TO HOLD LARGER SHARE OF IRIS RECOGNITION MARKET THROUGHOUT FORECAST PERIOD

FIGURE 9 SCANNERS TO HOLD LARGEST SHARE OF MARKET IN 2027

FIGURE 10 IDENTITY MANAGEMENT AND ACCESS CONTROL APPLICATION TO HOLD LARGEST SHARE OF MARKET IN 2027

FIGURE 11 MARKET FOR HEALTHCARE VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN IRIS RECOGNITION MARKET

FIGURE 13 INCREASING ADOPTION OF IRIS RECOGNITION TECHNOLOGY IN ASIA PACIFIC TO DRIVE MARKET GROWTH

4.2 MARKET, BY COMPONENT

FIGURE 14 SOFTWARE TO HOLD LARGER MARKET SHARE IN 2022

4.3 IRIS RECOGNITION MARKET, BY APPLICATION

FIGURE 15 IDENTITY MANAGEMENT AND ACCESS CONTROL APPLICATION TO CAPTURE LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.4 MARKET IN ASIA PACIFIC, BY VERTICAL AND COUNTRY

FIGURE 16 CHINA AND CONSUMER ELECTRONICS TO BE LARGEST SHAREHOLDERS IN MARKET IN ASIA PACIFIC, BY COUNTRY AND VERTICAL, RESPECTIVELY, IN 2021

4.5 IRIS RECOGNITION MARKET, BY VERTICAL

FIGURE 17 BANKING & FINANCE VERTICAL TO HOLD LARGEST MARKET SHARE IN MARKET IN 2022

4.6 MARKET, BY COUNTRY

FIGURE 18 INDIA TO HOLD LARGEST SHARE OF GLOBAL MARKET IN 2022

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 IRIS RECOGNITION MARKET : DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

FIGURE 20 MARKET: DRIVERS AND THEIR IMPACT

5.2.1.1 Rising adoption of iris recognition technology by government organizations for identification and authentication purposes

5.2.1.2 Increasing penetration of iris recognition technology into consumer electronics industry

FIGURE 21 GLOBAL SMARTPHONE SHIPMENTS, 2019–2021 (BILLION UNITS)

5.2.1.3 Rising use of iris recognition technology in travel and immigration industry

5.2.2 RESTRAINTS

FIGURE 22 MARKET: RESTRAINTS AND THEIR IMPACT

5.2.2.1 Risk of privacy breach and identity theft

5.2.2.2 Presence of different competitive biometric technologies

TABLE 1 COMPARISON BETWEEN VARIOUS BIOMETRIC TECHNOLOGIES

5.2.3 OPPORTUNITIES

FIGURE 23 IRIS RECOGNITION MARKET: OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Growing demand for iris recognition technology from healthcare industry

5.2.3.2 Rising penetration of biometric technologies into automotive and aerospace & defense verticals

5.2.3.3 Increasing use of iris recognition systems in banking & finance sector to prevent fraud

5.2.3.4 Integration of cloud computing with iris recognition technology

5.2.4 CHALLENGES

FIGURE 24 MARKET : CHALLENGES AND THEIR IMPACT

5.2.4.1 Complexities in integrating iris recognition technology into conventional identification solutions

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 IRIS RECOGNITION MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM ANALYSIS

FIGURE 26 MARKET : ECOSYSTEM ANALYSIS

TABLE 2 COMPANIES AND THEIR ROLES IN IRIS RECOGNITION ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE (ASP) OF VARIOUS IRIS RECOGNITION TECHNOLOGIES

TABLE 3 AVERAGE SELLING PRICE OF VARIOUS IRIS RECOGNITION HARDWARE COMPONENTS

FIGURE 27 AVERAGE SELLING PRICE OF IRIS SCANNERS OFFERED BY THREE KEY PLAYERS

TABLE 4 AVERAGE SELLING PRICE OF IRIS SCANNERS OFFERED BY THREE KEY PLAYERS (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR IRIS RECOGNITION TECHNOLOGY PROVIDERS

FIGURE 28 REVENUE SHIFT FOR MARKET PLAYERS

5.7 TECHNOLOGY ANALYSIS

5.7.1 KEY TECHNOLOGY TRENDS

5.7.2 CLOUD-BASED IRIS RECOGNITION SYSTEM

5.7.3 3D IRIS RECOGNITION

5.7.4 COMPLEMENTARY TECHNOLOGIES

5.7.4.1 Payment with iris recognition

5.7.5 ADJACENT TECHNOLOGIES

5.7.5.1 Integration of computer vision in iris recognition systems

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IRIS RECOGNITION MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 INTENSITY OF COMPETITIVE RIVALRY

5.8.2 BARGAINING POWER OF SUPPLIERS

5.8.3 BARGAINING POWER OF BUYERS

5.8.4 THREAT OF SUBSTITUTES

5.8.5 THREAT OF NEW ENTRANTS

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES (%)

5.9.2 BUYING CRITERIA

FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

5.10 CASE STUDY ANALYSIS

TABLE 8 USE OF BIOMETRICS FOR FOOD DISTRIBUTION

TABLE 9 USE OF IRIS RECOGNITION FOR AUTO MALL SECURITY

TABLE 10 USE OF IRIS RECOGNITION FOR VERIFICATION OF UNIQUE IDENTIFICATION NUMBERS (UID) ISSUED TO ALL INDIAN CITIZENS

TABLE 11 USE OF MULTI-BIOMETRIC ENROLLMENT SYSTEM BY MEXICO TAX AGENCY

5.11 TRADE AND TARIFF ANALYSIS

5.11.1 TRADE ANALYSIS

5.11.1.1 Trade data for HS code 847160

FIGURE 32 IMPORT DATA, BY COUNTRY, 2017−2021 (USD MILLION)

FIGURE 33 EXPORT DATA, BY COUNTRY, 2017−2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 34 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 12 TOP 20 PATENT OWNERS IN LAST 10 YEARS

FIGURE 35 NUMBER OF PATENTS GRANTED, 2011−2022

5.12.1 PATENT ANALYSIS

TABLE 13 MAJOR PATENTS RELATED TO IRIS RECOGNITION MARKET

5.13 KEY CONFERENCES AND EVENTS, 2022–2023

TABLE 14 IRIS RECOGNITION MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS

5.14 REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO MARKET

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 STANDARDS AND REGULATIONS RELATED TO MARKET

TABLE 19 NORTH AMERICA: SAFETY STANDARDS FOR MARKET

TABLE 20 EUROPE: SAFETY STANDARDS FOR IRIS RECOGNITION MARKET

TABLE 21 ASIA PACIFIC: SAFETY STANDARDS FOR MARKET

TABLE 22 ROW: SAFETY STANDARDS FOR IRIS RECOGNITION MARKET

6 IRIS RECOGNITION MARKET, BY COMPONENT (Page No. - 85)

6.1 INTRODUCTION

FIGURE 36 IRIS RECOGNITION MARKET, BY COMPONENT

FIGURE 37 SOFTWARE SEGMENT TO CONTINUE TO HOLD LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 23 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 24 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 HARDWARE

TABLE 25 HARDWARE: IRIS RECOGNITION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 26 HARDWARE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 27 MARKET, BY HARDWARE TYPE, 2018–2021 (USD MILLION)

TABLE 28 MARKET, BY HARDWARE TYPE, 2022–2027 (USD MILLION)

TABLE 29 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 30 MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.1 CAMERAS

6.2.1.1 Rising demand for identity management and access control

6.2.2 SENSORS

6.2.2.1 Growing development of new technology-based sensors for biometric applications in consumer electronics devices

6.2.3 IMAGE PROCESSORS

6.2.3.1 Surging demand in high-volume server applications that run on server hardware

6.2.4 INTEGRATED DEVICES

6.2.4.1 Increasing demand for Wi-Fi-enabled iris devices for various applications

6.3 SOFTWARE

TABLE 31 SOFTWARE: IRIS RECOGNITION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 32 SOFTWARE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 33 SOFTWARE: MARKET, BY SOFTWARE TYPE, 2018–2021 (USD MILLION)

TABLE 34 SOFTWARE: MARKET, BY SOFTWARE TYPE, 2022–2027 (USD MILLION)

TABLE 35 SOFTWARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 36 SOFTWARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 IRIS RECOGNITION SOFTWARE & SDK

6.3.1.1 Prominent presence of various major players

6.3.2 DATABASE

6.3.2.1 Surging demand for databases in various verticals

6.3.3 ANALYTICS SOLUTION

6.3.3.1 Growing deployment of combinations of business analytics software

6.3.4 OTHERS

7 IRIS RECOGNITION MARKET, BY PRODUCT (Page No. - 95)

7.1 INTRODUCTION

FIGURE 38 IRIS RECOGNITION MARKET, BY PRODUCT

FIGURE 39 SCANNERS TO CONTINUE TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 37 MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 38 MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.2 SMARTPHONES

7.2.1 RISING PENETRATION OF BIOMETRIC TECHNOLOGIES IN SMARTPHONES TO BOOST MARKET

TABLE 39 SMARTPHONES: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 40 SMARTPHONES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 41 SMARTPHONES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 42 SMARTPHONES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 WEARABLES

7.3.1 INCREASING USE OF IRIS RECOGNITION IN SMARTWATCHES TO DRIVE MARKET

TABLE 43 WEARABLES: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 44 WEARABLES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 45 WEARABLES: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 46 WEARABLES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.4 TABLETS & NOTEBOOKS

7.4.1 DEVELOPMENTS OF TABLETS WITH IRIS SCANNER TO POSITIVELY IMPACT MARKET FOR TABLETS & NOTEBOOKS

TABLE 47 TABLETS & NOTEBOOKS: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 48 TABLETS & NOTEBOOKS: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 49 TABLETS & NOTEBOOKS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 50 TABLETS & NOTEBOOKS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.5 PERSONAL COMPUTERS/LAPTOPS

7.5.1 SURGING ADOPTION OF IDENTITY MANAGEMENT SOLUTIONS BY GOVERNMENT AND TRAVEL AGENCIES TO PROPEL MARKET GROWTH

TABLE 51 PERSONAL COMPUTERS/LAPTOPS: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 52 PERSONAL COMPUTERS/LAPTOPS: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 53 PERSONAL COMPUTERS/LAPTOPS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 54 PERSONAL COMPUTERS/LAPTOPS: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.6 SCANNERS

7.6.1 INCREASING DEMAND FOR IRIS RECOGNITION SCANNERS IN GOVERNMENT VERTICAL TO DRIVE MARKET

TABLE 55 SCANNERS: MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 56 SCANNERS: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 57 SCANNERS: IRIS RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 58 SCANNERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 IRIS RECOGNITION MARKET, BY APPLICATION (Page No. - 106)

8.1 INTRODUCTION

FIGURE 40 IRIS RECOGNITION MARKET, BY APPLICATION

FIGURE 41 IDENTITY MANAGEMENT AND ACCESS CONTROL APPLICATIONS TO CONTINUE TO DOMINATE IRIS RECOGNITION MARKET, IN TERMS OF SIZE, DURING FORECAST PERIOD

TABLE 59 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 60 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

8.2 IDENTITY MANAGEMENT AND ACCESS CONTROL

TABLE 61 IDENTITY MANAGEMENT AND ACCESS CONTROL: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 62 IDENTITY MANAGEMENT AND ACCESS CONTROL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 63 IDENTITY MANAGEMENT AND ACCESS CONTROL: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 64 IDENTITY MANAGEMENT AND ACCESS CONTROL: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 TIME MONITORING

8.3.1 INTEGRATION OF IRIS RECOGNITION TECHNOLOGY INTO TIME AND ATTENDANCE MANAGEMENT SYSTEMS TO SUPPORT MARKET GROWTH

TABLE 65 TIME MONITORING APPLICATION: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 66 TIME MONITORING: IRIS RECOGNITION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 67 TIME MONITORING: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 68 TIME MONITORING: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 E-PAYMENT

8.4.1 RISING CONSUMER PREFERENCE FOR CASHLESS PAYMENTS TO DRIVE MARKET

TABLE 69 E-PAYMENT: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 70 E-PAYMENT: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 71 E-PAYMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 E-PAYMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 IRIS RECOGNITION MARKET, BY VERTICAL (Page No. - 115)

9.1 INTRODUCTION

FIGURE 42 IRIS RECOGNITION MARKET, BY VERTICAL

FIGURE 43 HEALTHCARE VERTICAL TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 73 MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 74 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 GOVERNMENT

9.2.1 INCREASING GOVERNMENT INITIATIVES FOR PUBLIC SAFETY TO BOOST DEMAND FOR BIOMETRICS SOLUTIONS

FIGURE 44 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET FOR GOVERNMENT VERTICAL THROUGHOUT FORECAST PERIOD

TABLE 75 GOVERNMENT: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 76 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 77 GOVERNMENT: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 78 GOVERNMENT: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.3 MILITARY & DEFENSE

9.3.1 CONCERNS REGARDING NATIONAL SECURITY, SECURITY OF ARMED FORCES, AND MONITORING OF INDIVIDUALS TO FUEL DEMAND FOR IRIS RECOGNITION TECHNOLOGY

FIGURE 45 MILITARY & DEFENSE VERTICAL IN NORTH AMERICA TO MAINTAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 79 MILITARY & DEFENSE: IRIS RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 80 MILITARY & DEFENSE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 81 MILITARY & DEFENSE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 82 MILITARY & DEFENSE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.4 HEALTHCARE

9.4.1 RISING ADOPTION OF BIOMETRICS IN PATIENT IDENTIFICATION, PATIENT SECURITY, AND STAFF ATTENDANCE TRACKING APPLICATIONS TO PUSH MARKET GROWTH

FIGURE 46 HEALTHCARE VERTICAL IN NORTH AMERICA TO MAINTAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 83 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 HEALTHCARE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 86 HEALTHCARE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.5 BANKING & FINANCE

9.5.1 UTILIZATION OF IRIS RECOGNITION SYSTEMS TO ADDRESS SECURITY CHALLENGES TO FOSTER MARKET GROWTH

FIGURE 47 BANKING & FINANCE VERTICAL IN NORTH AMERICA TO MAINTAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 87 BANKING & FINANCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 88 BANKING & FINANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 89 BANKING & FINANCE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 90 BANKING & FINANCE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.6 CONSUMER ELECTRONICS

9.6.1 INCREASING DEPLOYMENT OF IRIS RECOGNITION TECHNOLOGY IN LAPTOPS TO ACCELERATE MARKET GROWTH

FIGURE 48 CONSUMER ELECTRONICS VERTICAL IN ASIA PACIFIC TO MAINTAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 91 CONSUMER ELECTRONICS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 92 CONSUMER ELECTRONICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 93 CONSUMER ELECTRONICS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 94 CONSUMER ELECTRONICS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.7 TRAVEL & IMMIGRATION

9.7.1 INCREASING PENETRATION OF E-PASSPORT PROGRAMS WORLDWIDE TO WIDEN SCOPE OF IRIS RECOGNITION TECHNOLOGY

FIGURE 49 TRAVEL AND IMMIGRATION VERTICAL IN NORTH AMERICA TO MAINTAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 95 TRAVEL AND IMMIGRATION: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 96 TRAVEL AND IMMIGRATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 97 TRAVEL AND IMMIGRATION: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 98 TRAVEL AND IMMIGRATION: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.8 AUTOMOTIVE

9.8.1 EUROPE TO CONTINUE TO HOLD LARGEST SIZE OF MARKET FOR AUTOMOTIVE VERTICAL DURING FORECAST PERIOD

FIGURE 50 AUTOMOTIVE VERTICAL IN EUROPE TO MAINTAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 99 AUTOMOTIVE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 100 AUTOMOTIVE: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 101 AUTOMOTIVE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 102 AUTOMOTIVE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

9.9 OTHERS

FIGURE 51 OTHER VERTICALS IN NORTH AMERICA TO MAINTAIN LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 103 OTHERS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 104 OTHERS: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 105 OTHERS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 106 OTHERS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 137)

10.1 INTRODUCTION

FIGURE 52 IRIS RECOGNITION MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 53 MARKET, BY REGION

TABLE 107 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 108 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 54 NORTH AMERICA: IRIS RECOGNITION MARKET SNAPSHOT

FIGURE 55 US TO HOLD LARGEST SHARE OF MARKET IN NORTH AMERICA IN 2027

TABLE 109 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Increasing concerns regarding national security, crime, and terrorism to augment demand for iris recognition

10.2.2 CANADA

10.2.2.1 Rising demand for iris recognition systems in government, and travel and immigration verticals to drive market

10.2.3 MEXICO

10.2.3.1 Growing need for safety and security in various verticals to boost market growth

10.3 EUROPE

FIGURE 56 EUROPE: IRIS RECOGNITION MARKET SNAPSHOT

FIGURE 57 GERMANY TO HOLD LARGEST SHARE OF MARKET IN EUROPE IN 2027

TABLE 115 EUROPE: IRIS RECOGNITION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 116 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 117 EUROPE: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 118 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 119 EUROPE: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing adoption of biometric technology by government and travel and immigration

10.3.2 ITALY

10.3.2.1 Rapid deployment of iris recognition by government vertical

10.3.3 FRANCE

10.3.3.1 Rising inter-country political disputes to boost demand

10.3.4 UK

10.3.4.1 Growing initiatives by government such as Iris Recognition Immigration System

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 58 ASIA PACIFIC: IRIS RECOGNITION MARKET SNAPSHOT

FIGURE 59 CHINA TO HOLD LARGEST SHARE OF MARKET IN ASIA PACIFIC IN 2027

TABLE 121 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Presence of manufacturing plants of several leading providers of consumer electronics to drive market

10.4.2 SOUTH KOREA

10.4.2.1 Thriving consumer electronics industry to propel market growth

10.4.3 JAPAN

10.4.3.1 Increasing security concerns to drive market growth

10.4.4 INDIA

10.4.4.1 Growing focus of government to provide advanced and upgraded services to citizens to accelerate market growth

10.4.5 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 60 ROW: IRIS RECOGNITION MARKET SNAPSHOT

FIGURE 61 MIDDLE EAST TO HOLD LARGEST SHARE OF MARKET IN ROW IN 2027

TABLE 127 ROW: IRIS RECOGNITION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 128 ROW: MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 129 ROW: MARKET, BY VERTICAL, 2018–2021 (USD MILLION)

TABLE 130 ROW: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 131 ROW: MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 132 ROW: MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Increasing government support to automate border-crossing processes

10.5.2 AFRICA

10.5.2.1 Growing investments in automation and AI technologies

10.5.3 SOUTH AMERICA

10.5.3.1 Rising security spending, cybercrimes, and face & iris recognition adoption in airports

11 COMPETITIVE LANDSCAPE (Page No. - 162)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

TABLE 133 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MARKET

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 MARKET SHARE ANALYSIS, 2021

TABLE 134 IRIS RECOGNITION MARKET: DEGREE OF COMPETITION

11.4 REVENUE ANALYSIS OF TOP PLAYERS IN IRIS RECOGNITION MARKET

FIGURE 62 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN MARKET

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 PERVASIVE PLAYERS

11.5.3 EMERGING LEADERS

11.5.4 PARTICIPANTS

FIGURE 63 MARKET : COMPANY EVALUATION QUADRANT, 2021

11.6 STARTUP/SME EVALUATION QUADRANT

11.6.1 PROGRESSIVE COMPANIES

11.6.2 RESPONSIVE COMPANIES

11.6.3 DYNAMIC COMPANIES

11.6.4 STARTING BLOCKS

FIGURE 64 IRIS RECOGNITION MARKET (GLOBAL): STARTUP/SME EVALUATION QUADRANT, 2021

11.7 COMPANY FOOTPRINT

TABLE 135 COMPANY FOOTPRINT

TABLE 136 COMPONENT FOOTPRINT OF COMPANIES

TABLE 137 APPLICATION FOOTPRINT OF COMPANIES

TABLE 138 PRODUCT FOOTPRINT OF COMPANIES

TABLE 139 VERTICAL FOOTPRINT OF COMPANIES

TABLE 140 REGIONAL FOOTPRINT OF COMPANIES

11.8 COMPETITIVE BENCHMARKING

TABLE 141 IRIS RECOGNITION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 142 MARKET : COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.9 COMPETITIVE SCENARIOS AND TRENDS

11.9.1 PRODUCT LAUNCHES

TABLE 143 MARKET: PRODUCT LAUNCHES, JANUARY 2018–MAY 2022

11.9.2 DEALS

TABLE 144 MARKET: DEALS, JANUARY 2018–MAY 2022

12 COMPANY PROFILES (Page No. - 179)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 THALES

TABLE 145 THALES: COMPANY OVERVIEW

FIGURE 65 THALES: COMPANY SNAPSHOT

12.1.2 IDEMIA

TABLE 146 IDEMIA: BUSINESS OVERVIEW

FIGURE 66 IDEMIA: COMPANY SNAPSHOT

12.1.3 HID GLOBAL CORPORATION

TABLE 147 HID GLOBAL CORPORATION: BUSINESS OVERVIEW

12.1.4 EYELOCK LLC

TABLE 148 EYELOCK LLC: BUSINESS OVERVIEW

12.1.5 NEC CORPORATION

TABLE 149 NEC CORPORATION: BUSINESS OVERVIEW

FIGURE 67 NEC CORPORATION: COMPANY SNAPSHOT

12.1.6 IRITECH, INC.

TABLE 150 IRITECH, INC.: BUSINESS OVERVIEW

12.1.7 IRISGUARD LTD.

TABLE 151 IRISGUARD LTD: BUSINESS OVERVIEW

12.1.8 IRIS ID, INC.

TABLE 152 IRIS ID, INC.: BUSINESS OVERVIEW

12.1.9 PRINCETON IDENTITY

TABLE 153 PRINCETON IDENTITY: BUSINESS OVERVIEW

TABLE 154 PRINCETON IDENTITY: PRODUCT LAUNCHES

12.1.10 CMI TECH

TABLE 155 CMI TECH: BUSINESS OVERVIEW

12.1.11 UNISYS CORPORATION

TABLE 156 UNISYS CORPORATION: BUSINESS OVERVIEW

TABLE 157 UNISYS CORPORATION: PRODUCT LAUNCHES

12.2 OTHER PLAYERS

12.2.1 BIOENABLE TECHNOLOGIES

12.2.2 4G IDENTITY SOLUTIONS

12.2.3 BI² TECHNOLOGIES

12.2.4 MANTRA SOFTECH

12.2.5 AWARE, INC.

12.2.6 NEUROTECHNOLOGY

12.2.7 DERMALOG IDENTIFICATION SYSTEMS

12.2.8 BIOID

12.2.9 SRI INTERNATIONAL

12.2.10 M2SYS TECHNOLOGY

12.2.11 TASCENT

12.2.12 ADITECH LTD

12.2.13 BIOLINK SOLUTIONS

12.2.14 SHANGHAI PIXSUR SMART TECHNOLOGY CO., LTD.

12.2.15 ANVIZ GLOBAL INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 224)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The research process for this study included systematic gathering, recording, and analysis of data about customers and companies operating in the iris recognition market. This process involved the extensive use of secondary sources, directories, and databases (Factiva, Oanda, and OneSource) for identifying and collecting valuable information for the comprehensive, technical, market-oriented, and commercial study of the iris recognition market. In-depth interviews were conducted with primary respondents, including experts from core and related industries and preferred manufacturers, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects. Key players in the iris recognition market were identified through secondary research, and their market rankings were determined through primary and secondary research. This research included studying annual reports of top players and interviewing key industry experts such as CEOs, directors, and marketing executives.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. Secondary sources included corporate filings, such as annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, iris recognition products related journals, and certified publications; articles by recognized authors; directories; and databases.

Secondary research was conducted to obtain key information about the industry supply chain, market value chain, key players, market classification and segmentation as per industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives. Data from secondary research was collected and analyzed to determine the overall market size, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and key executives from major companies in the iris recognition market.

After going through market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers obtained. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by players operating in the market.

To know about the assumptions considered for the study, download the pdf brochure

Market size Estimation

In the complete market engineering process, both top-down and bottom-up approaches were used, along with several data triangulation methods, to estimate and forecast the size of the market and its segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were carried out on the complete market engineering process to list the key information/insights pertaining to the iris recognition market.

The key players in the market were identified through secondary research, and their rankings in the respective regions were determined through primary and secondary research. This entire procedure involved the study of the annual and financial reports of top players, as well as interviews with industry experts such as chief executive officers, vice presidents, directors, and marketing executives for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Iris recognition market: Bottom-up Approach

Data triangulation

After arriving at the overall size of the iris recognition market from the market size estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the market breakdown and data triangulation procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using top-down and bottom-up approaches.

Report objectives

- To describe and forecast the iris recognition market, in terms of value, based on component, product, application, and vertical

- To describe and forecast the iris recognition market size, in terms of value, with respect to four regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To provide detailed information about the drivers, restraints, opportunities, and challenges influencing the growth of the iris recognition market

- To provide a detailed overview of the supply chain of the iris recognition ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2, along with a detailed competitive landscape of the market

- To analyze competitive developments in the iris recognition market, such as acquisitions, product launches, partnerships, expansions, and collaborations

Available customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies.

Product analysis

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Iris Recognition Market